International Trade: Openness, GINI Index and Trade Theories

VerifiedAdded on 2020/03/23

|12

|1303

|39

Homework Assignment

AI Summary

This assignment solution delves into key concepts in international trade, beginning with an analysis of the correlation between a country's openness to trade and its GINI index, using Paraguay and Poland as examples. It then provides a detailed explanation of the Stolper-Samuelson theorem, exploring the relationship between factor rewards and output prices in the context of trade. The solution further applies the theorem, connecting it to the openness-GINI index correlation and discussing how trade impacts unskilled labor wages. The assignment also includes graphical representations and calculations to determine relative supply, demand, and equilibrium prices under free trade, including opportunity costs and comparative advantages. Finally, it analyzes the benefits of trade for both home and foreign countries, illustrating the advantages through consumer equilibrium analysis using budget lines and indifference curves. The assignment covers topics like Heckscher-Ohlin theorem, comparative advantage and trade effects on wages.

Running Head: INTERNATIONAL TRADE

International Trade

Name of the Student

Name of the University

Course ID

International Trade

Name of the Student

Name of the University

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1INTERNATIONAL TRADE

Table of Contents

Answer 1..........................................................................................................................................2

Correlation between Openness and GINI index..........................................................................2

Answer 2..........................................................................................................................................2

Stolper-Samuelson Theorem.......................................................................................................2

Answer 3..........................................................................................................................................5

Answer 4..........................................................................................................................................5

Answer a......................................................................................................................................5

Answer b......................................................................................................................................6

Answer c......................................................................................................................................8

Answer d......................................................................................................................................9

Answer e......................................................................................................................................9

Reference list.................................................................................................................................11

Table of Contents

Answer 1..........................................................................................................................................2

Correlation between Openness and GINI index..........................................................................2

Answer 2..........................................................................................................................................2

Stolper-Samuelson Theorem.......................................................................................................2

Answer 3..........................................................................................................................................5

Answer 4..........................................................................................................................................5

Answer a......................................................................................................................................5

Answer b......................................................................................................................................6

Answer c......................................................................................................................................8

Answer d......................................................................................................................................9

Answer e......................................................................................................................................9

Reference list.................................................................................................................................11

2INTERNATIONAL TRADE

Answer 1

Correlation between Openness and GINI index

Openness is a measure of countries’ engagement in trade. Openness represents sum of

export and import as a percentage of Gross Domestic Product in a nation. GINI index measures

the prevailing inequality in the nation. The GINI coefficient can be used as a proxy measure of

ratio of skilled to unskilled wage. For Paraguay, the estimated correlation coefficient between

openness and GINI index is -0.26. This implies an inverse relation exists between openness and

GINI index. As participation of the nation in trade, increase the inequality in the nation

decreases. The rising proportionate share of trade in GDP thus is positive contributor to income

equality and living standard. The value of correlation coefficient is small indicating a weak

relationship between openness and GINI for Paraguay. The correlation coefficient for between

the two variables in case of Poland is -0.61. For Poland, also increasing openness reduces the

GINI index. The effect of trade on inequality is however stronger for Paraguay than that for

Poland. That means, that means the increasing openness of Poland has a much stronger effect in

reducing inequality than that for Paraguay. Trade thus has a beneficial impact on economic

development in form of a reduced income inequality.

Answer 2

Stolper-Samuelson Theorem

The Stolper Samuelson theory one of the basic theorem obtained from Heckscher-Ohlin

trade theory. The theory explains relationship between rewards to factor inputs and relative price

for produced output. If relative price in the world market increases, then the factor that is used

intensively in production gains a higher reward (Feenstra, 2015). The theory can be explained

Answer 1

Correlation between Openness and GINI index

Openness is a measure of countries’ engagement in trade. Openness represents sum of

export and import as a percentage of Gross Domestic Product in a nation. GINI index measures

the prevailing inequality in the nation. The GINI coefficient can be used as a proxy measure of

ratio of skilled to unskilled wage. For Paraguay, the estimated correlation coefficient between

openness and GINI index is -0.26. This implies an inverse relation exists between openness and

GINI index. As participation of the nation in trade, increase the inequality in the nation

decreases. The rising proportionate share of trade in GDP thus is positive contributor to income

equality and living standard. The value of correlation coefficient is small indicating a weak

relationship between openness and GINI for Paraguay. The correlation coefficient for between

the two variables in case of Poland is -0.61. For Poland, also increasing openness reduces the

GINI index. The effect of trade on inequality is however stronger for Paraguay than that for

Poland. That means, that means the increasing openness of Poland has a much stronger effect in

reducing inequality than that for Paraguay. Trade thus has a beneficial impact on economic

development in form of a reduced income inequality.

Answer 2

Stolper-Samuelson Theorem

The Stolper Samuelson theory one of the basic theorem obtained from Heckscher-Ohlin

trade theory. The theory explains relationship between rewards to factor inputs and relative price

for produced output. If relative price in the world market increases, then the factor that is used

intensively in production gains a higher reward (Feenstra, 2015). The theory can be explained

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3INTERNATIONAL TRADE

with help of a hypothetical example. Suppose country A has two substitutable factor input skilled

and unskilled labor. WU/WS represents ratio of relative wages of unskilled labor to skilled labor.

Using the two inputs suppose the country can produce two goods X and Y. For any given WU/WS

, the nation faces a higher cost minimizing input ratio for good X as compared to good Y. This in

turn implies

aSX ( W U

W S )

aUX ( W U

WS )

>

aSY ( W U

W S )

aUY ( WU

W S )

Good X is therefore skill intensive while good Y is unskilled labor intensive. The Zero profit

conditions are obtained as

Zero profit for X

W U aUX

( W U

W S ) +W S aSX

( W U

W S )=PX

Zero profit for Y

W U aUY

( W U

W S )+W S aSY

( W U

W S )=PY

with help of a hypothetical example. Suppose country A has two substitutable factor input skilled

and unskilled labor. WU/WS represents ratio of relative wages of unskilled labor to skilled labor.

Using the two inputs suppose the country can produce two goods X and Y. For any given WU/WS

, the nation faces a higher cost minimizing input ratio for good X as compared to good Y. This in

turn implies

aSX ( W U

W S )

aUX ( W U

WS )

>

aSY ( W U

W S )

aUY ( WU

W S )

Good X is therefore skill intensive while good Y is unskilled labor intensive. The Zero profit

conditions are obtained as

Zero profit for X

W U aUX

( W U

W S ) +W S aSX

( W U

W S )=PX

Zero profit for Y

W U aUY

( W U

W S )+W S aSY

( W U

W S )=PY

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4INTERNATIONAL TRADE

Figure 1: Free trade and Stolper-Samuelson theory

(Source: as created by Author)

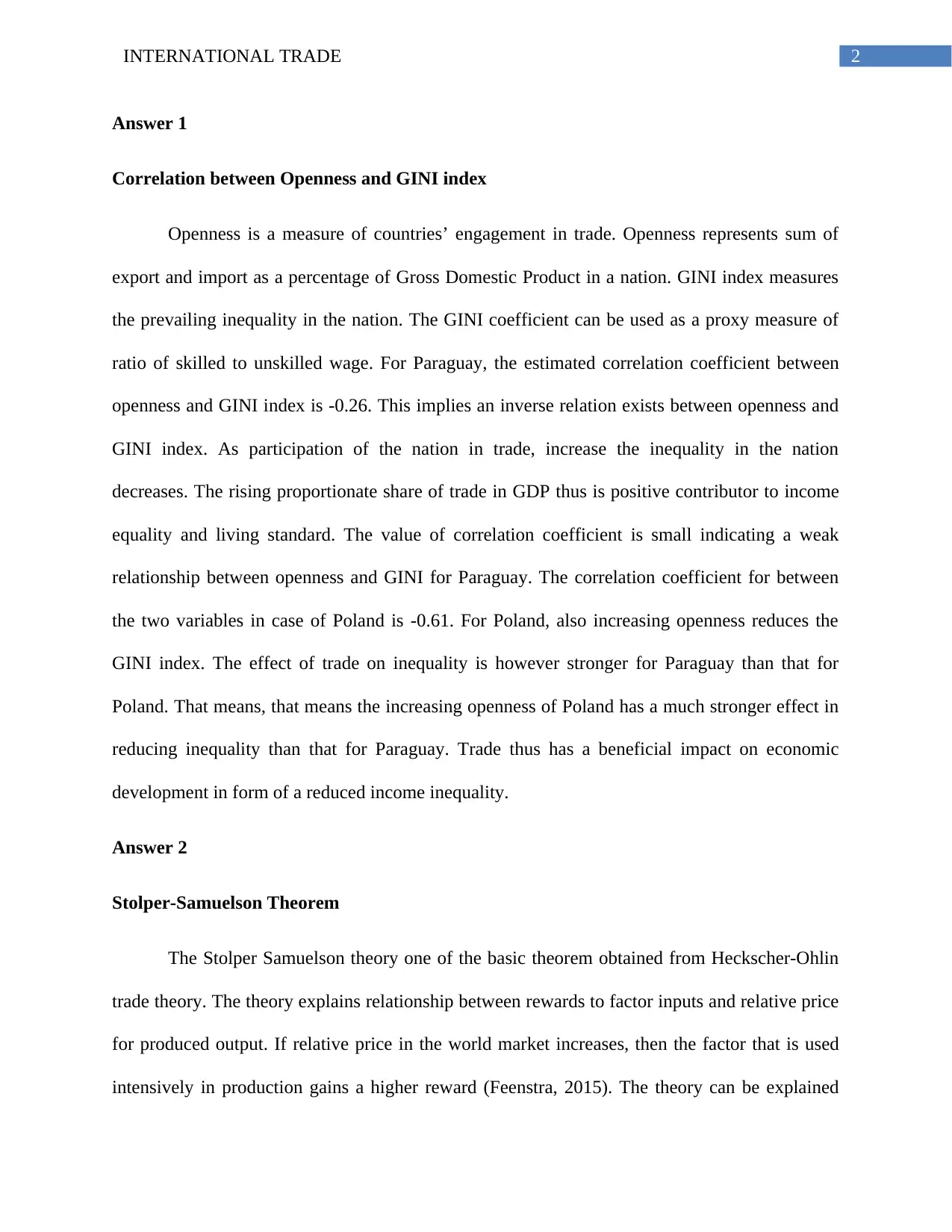

In the above figure the steeper line represents the zero profit line for Y as it in intensive in

unskilled labor. The relatively flatter line shows the same for X. Under autarky equilibrium is at

A. The dotted line shows zero profit line of X under free trade. The equilibrium now moves to

point B. Under free trade as (WS/PY ) increases representing a fall in PY, (WU/PX) falls indicating a

fall in wage of unskilled labors. In order words, a fall in PY/PX raises wage of skilled laborers in

terms of both X and Y. The decline in relative price of unskilled-intensive good hurts unskilled

labor while benefits skilled labors. This explains the Stolper Samuelson theorem.

Figure 1: Free trade and Stolper-Samuelson theory

(Source: as created by Author)

In the above figure the steeper line represents the zero profit line for Y as it in intensive in

unskilled labor. The relatively flatter line shows the same for X. Under autarky equilibrium is at

A. The dotted line shows zero profit line of X under free trade. The equilibrium now moves to

point B. Under free trade as (WS/PY ) increases representing a fall in PY, (WU/PX) falls indicating a

fall in wage of unskilled labors. In order words, a fall in PY/PX raises wage of skilled laborers in

terms of both X and Y. The decline in relative price of unskilled-intensive good hurts unskilled

labor while benefits skilled labors. This explains the Stolper Samuelson theorem.

5INTERNATIONAL TRADE

Answer 3

The Stolper Samuelson theorem states that an increase in relative price of a good

increases return to the factor that is most intensively used in the production process. Given that,

both the countries are unskilled labor abundant countries, following Heckscher Ohlin theorem

both the countries should specialize in unskilled labor-intensive goods. From Question 1, a

negative correlation is obtained between openness and GINI index. The GINI index can be used

to present ratio to skilled to unskilled wages. The negative correlation indicates that as countries

become more and more open the ratio of skilled to unskilled labor wages falls. In order words, as

the countries engage in trade the unskilled laborers receive a higher relative wage. Both the

countries being unskilled-labor abundant countries must be engaged in exporting unskilled labor-

intensive good. When countries engage in export it receives a higher price in the world market

than that in the home market (Chacholiades, 2017). Therefore, as the country’s export unskilled

labor intensive goods, with an increase in relative price the abundant factors (unskilled laborers)

receives a higher wage and hence GINI index falls. This supports the proposition of Stolper

Samuelson theorem which states that a higher relative price of output means a higher reward

intensive factor.

Answer 4

Answer a

Corn Demand :QD

C = I

3 PC

Radio Demand :QD

R = 2 I

3 PR

Answer 3

The Stolper Samuelson theorem states that an increase in relative price of a good

increases return to the factor that is most intensively used in the production process. Given that,

both the countries are unskilled labor abundant countries, following Heckscher Ohlin theorem

both the countries should specialize in unskilled labor-intensive goods. From Question 1, a

negative correlation is obtained between openness and GINI index. The GINI index can be used

to present ratio to skilled to unskilled wages. The negative correlation indicates that as countries

become more and more open the ratio of skilled to unskilled labor wages falls. In order words, as

the countries engage in trade the unskilled laborers receive a higher relative wage. Both the

countries being unskilled-labor abundant countries must be engaged in exporting unskilled labor-

intensive good. When countries engage in export it receives a higher price in the world market

than that in the home market (Chacholiades, 2017). Therefore, as the country’s export unskilled

labor intensive goods, with an increase in relative price the abundant factors (unskilled laborers)

receives a higher wage and hence GINI index falls. This supports the proposition of Stolper

Samuelson theorem which states that a higher relative price of output means a higher reward

intensive factor.

Answer 4

Answer a

Corn Demand :QD

C = I

3 PC

Radio Demand :QD

R = 2 I

3 PR

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6INTERNATIONAL TRADE

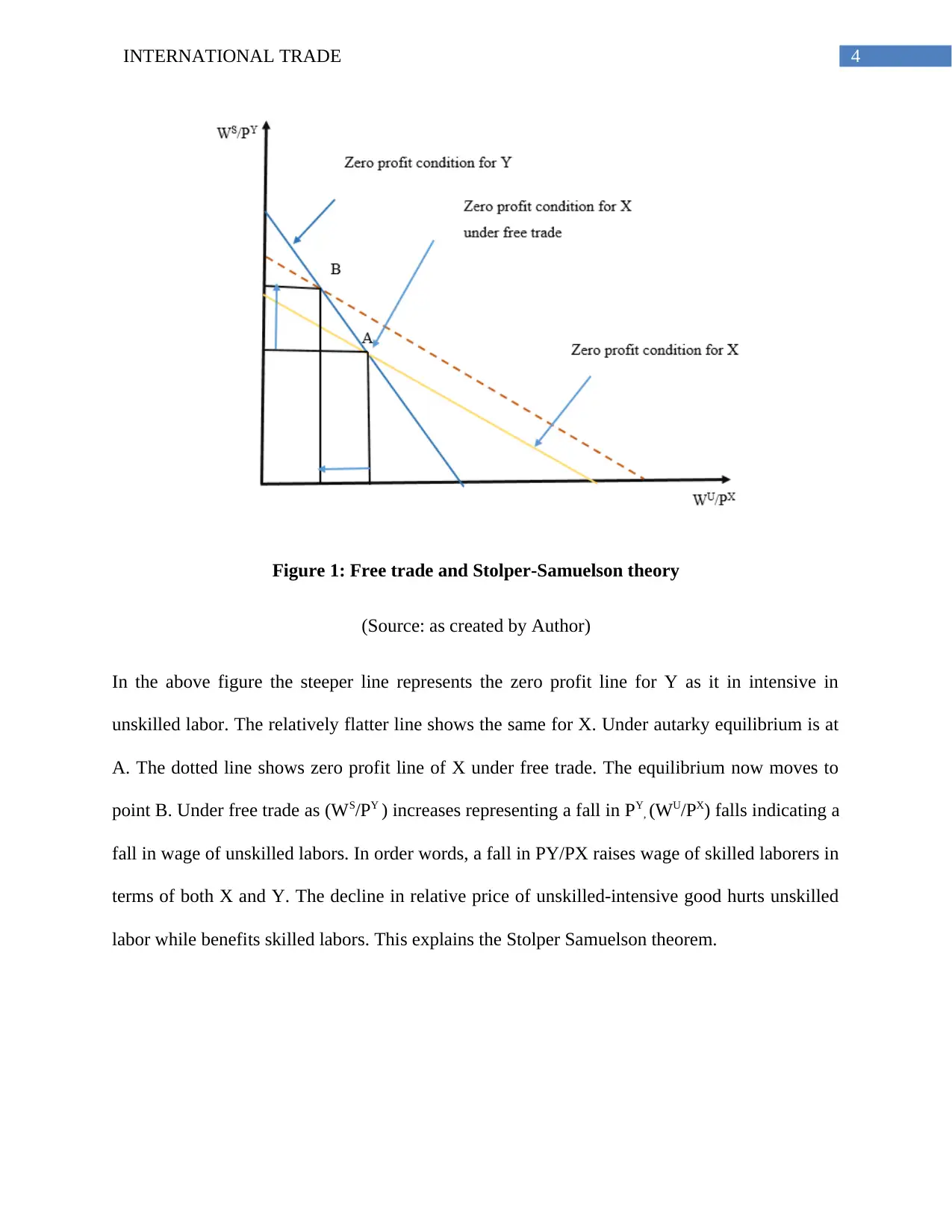

Relative demand for radio=QD

R

QD

C

¿

2 I

3 PR

I

3 PC

¿ 2 I

3 PR

× 3 PC

I

¿ 2

PR

PC

Figure 2: Relative demand curve for Radios

Answer b

Unit of goods produced with

1 unit of labor

Corn (C) Radio (R)

Home 2 3

Relative demand for radio=QD

R

QD

C

¿

2 I

3 PR

I

3 PC

¿ 2 I

3 PR

× 3 PC

I

¿ 2

PR

PC

Figure 2: Relative demand curve for Radios

Answer b

Unit of goods produced with

1 unit of labor

Corn (C) Radio (R)

Home 2 3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7INTERNATIONAL TRADE

Foreign 2 4

Opportunity cost Corn (C) Radio (R)

Home 1.5 0.66

Foreign 2 0.5

Feasible production using all

the factor input

Corn (C) Radio (R)

Home (2*30)= 60 (3*30)= 90

Foreign (2* 60) = 120 (4*60) = 240

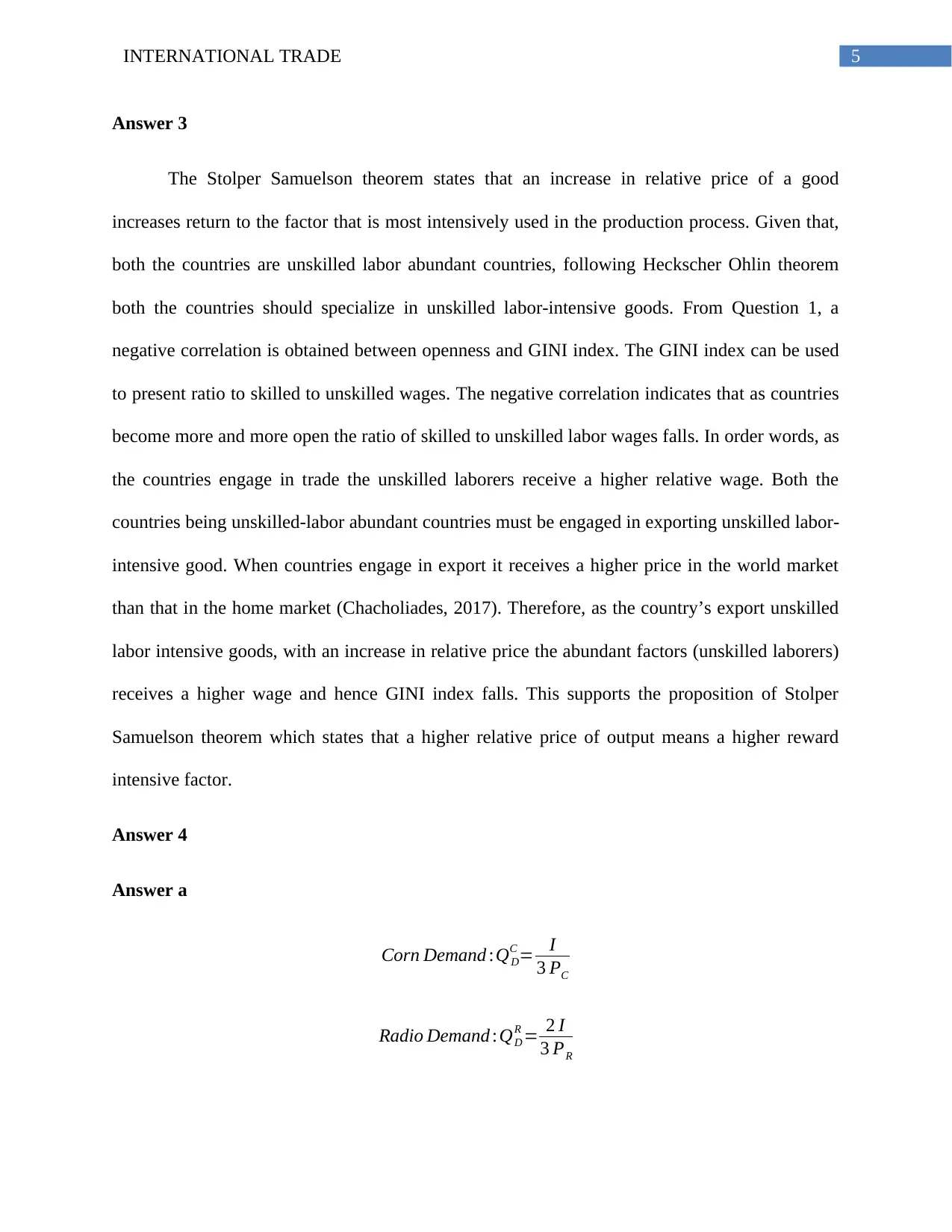

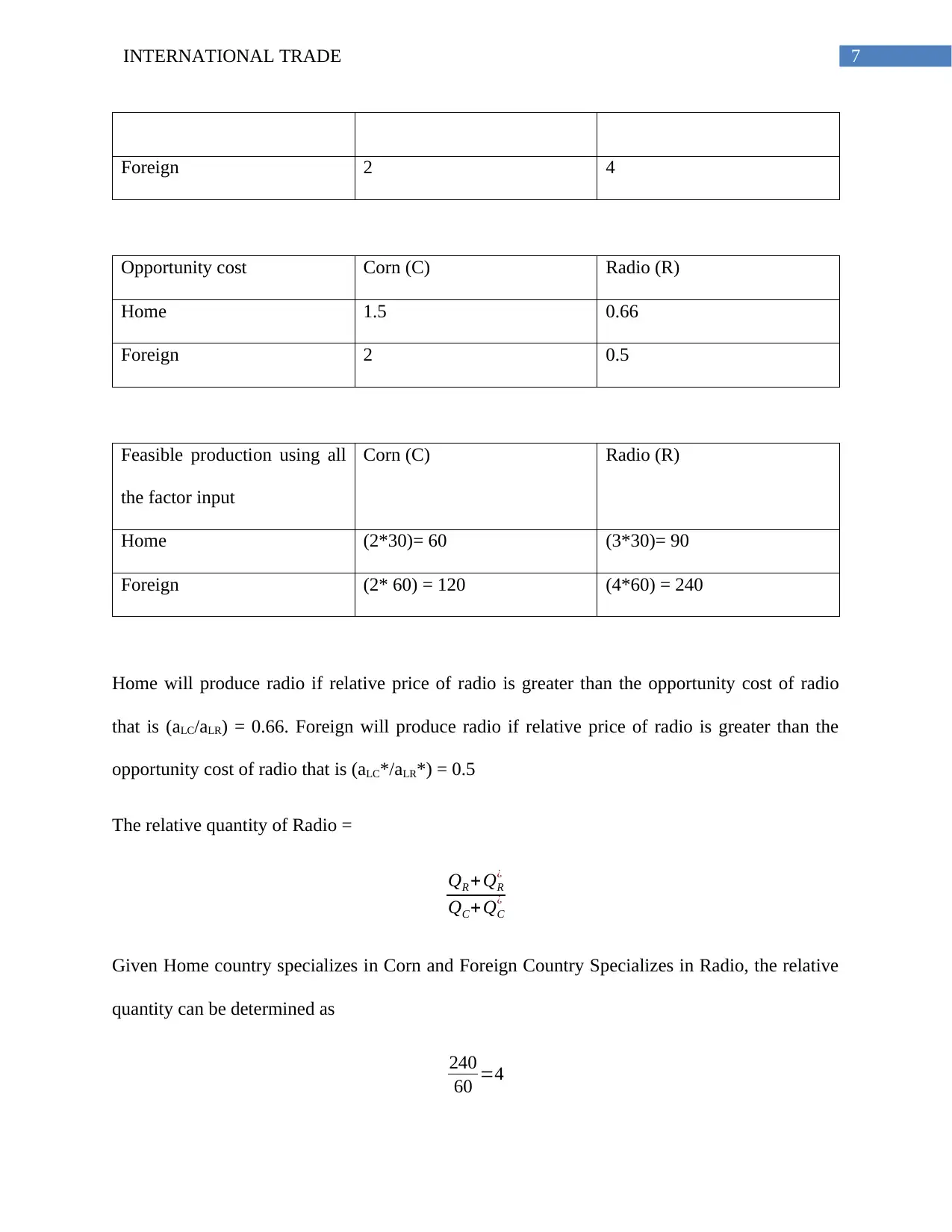

Home will produce radio if relative price of radio is greater than the opportunity cost of radio

that is (aLC/aLR) = 0.66. Foreign will produce radio if relative price of radio is greater than the

opportunity cost of radio that is (aLC*/aLR*) = 0.5

The relative quantity of Radio =

QR + QR

¿

QC+ QC

¿

Given Home country specializes in Corn and Foreign Country Specializes in Radio, the relative

quantity can be determined as

240

60 =4

Foreign 2 4

Opportunity cost Corn (C) Radio (R)

Home 1.5 0.66

Foreign 2 0.5

Feasible production using all

the factor input

Corn (C) Radio (R)

Home (2*30)= 60 (3*30)= 90

Foreign (2* 60) = 120 (4*60) = 240

Home will produce radio if relative price of radio is greater than the opportunity cost of radio

that is (aLC/aLR) = 0.66. Foreign will produce radio if relative price of radio is greater than the

opportunity cost of radio that is (aLC*/aLR*) = 0.5

The relative quantity of Radio =

QR + QR

¿

QC+ QC

¿

Given Home country specializes in Corn and Foreign Country Specializes in Radio, the relative

quantity can be determined as

240

60 =4

8INTERNATIONAL TRADE

Figure 3: World relative supply curve

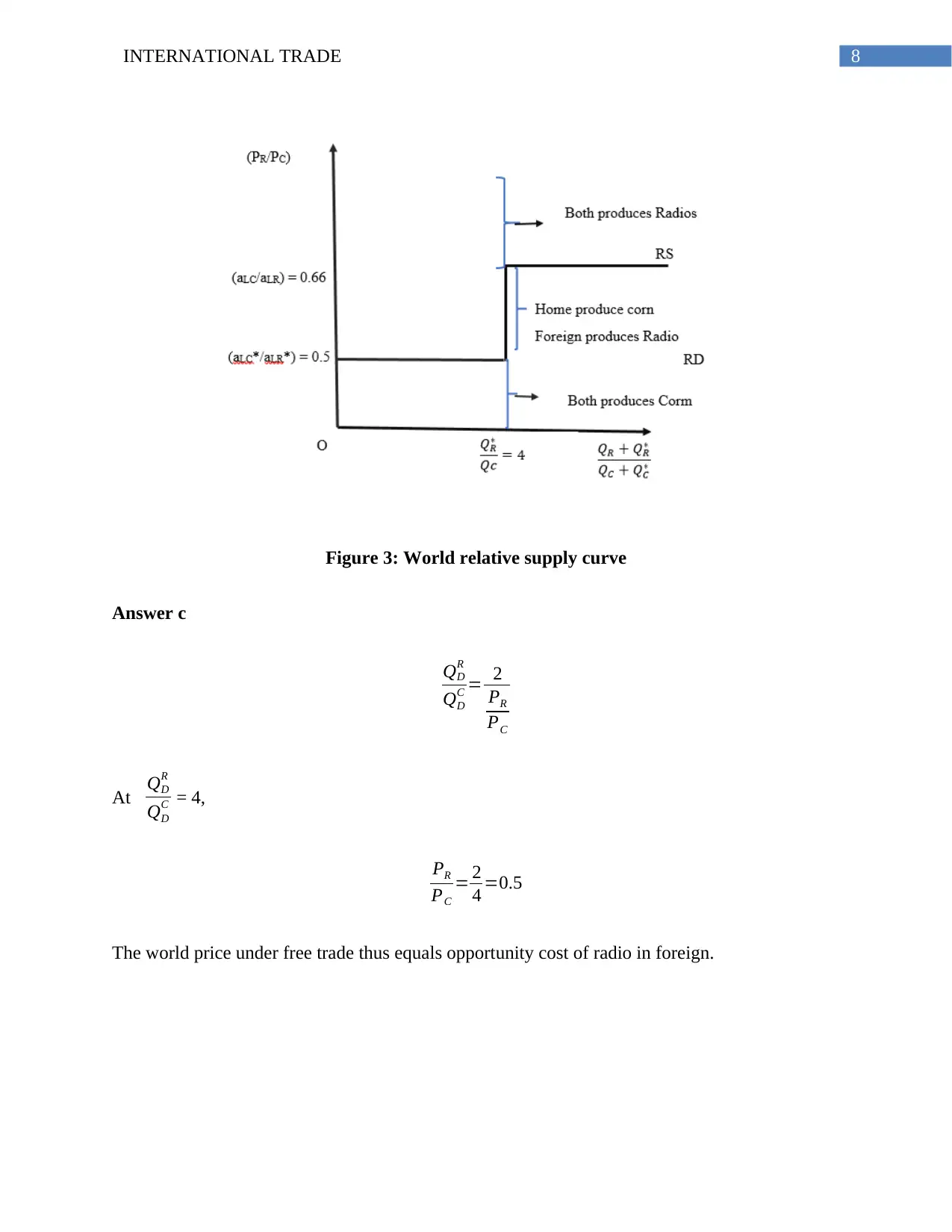

Answer c

QD

R

QD

C = 2

PR

PC

At QD

R

QD

C = 4,

PR

PC

= 2

4 =0.5

The world price under free trade thus equals opportunity cost of radio in foreign.

Figure 3: World relative supply curve

Answer c

QD

R

QD

C = 2

PR

PC

At QD

R

QD

C = 4,

PR

PC

= 2

4 =0.5

The world price under free trade thus equals opportunity cost of radio in foreign.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9INTERNATIONAL TRADE

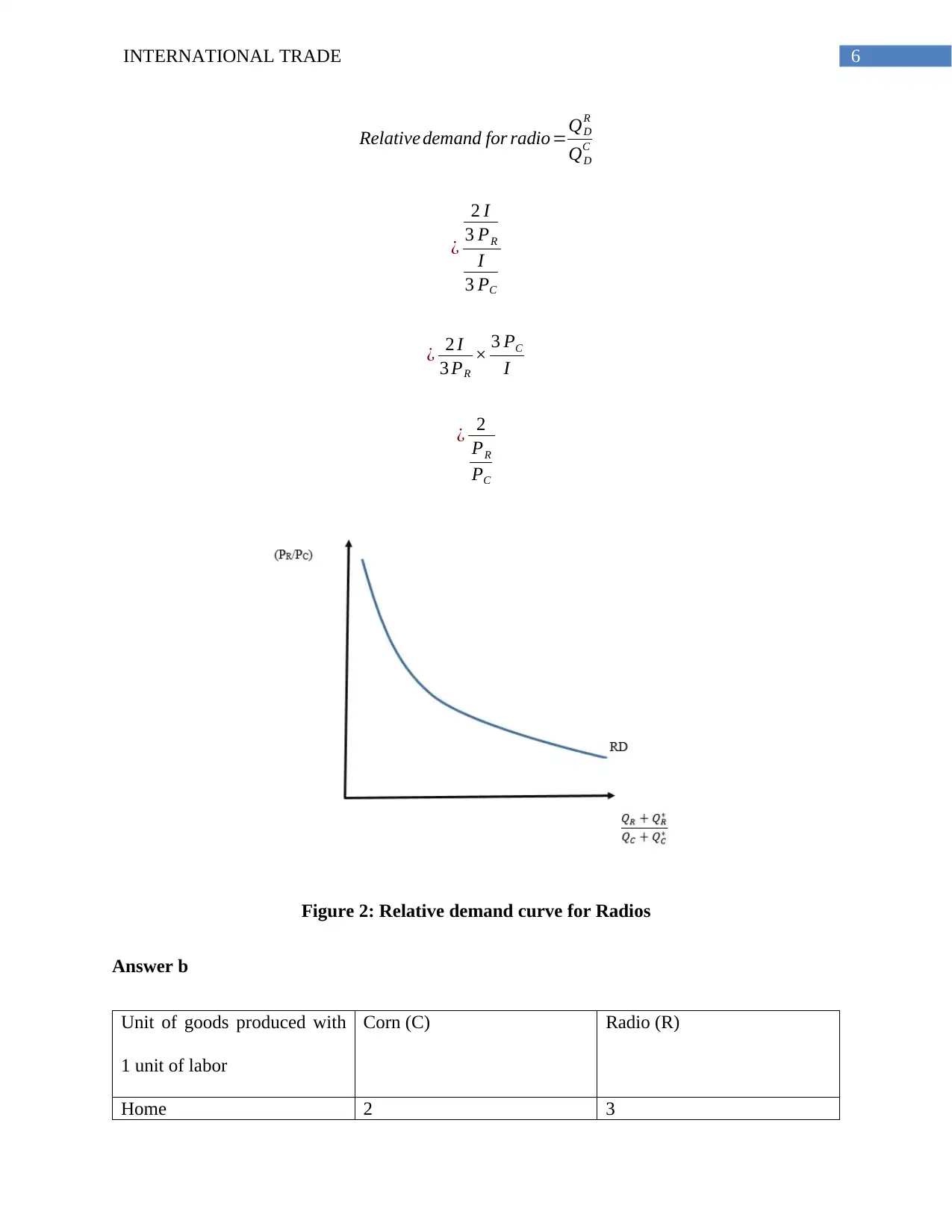

Figure 4: Equilibrium price and quantity under free trade

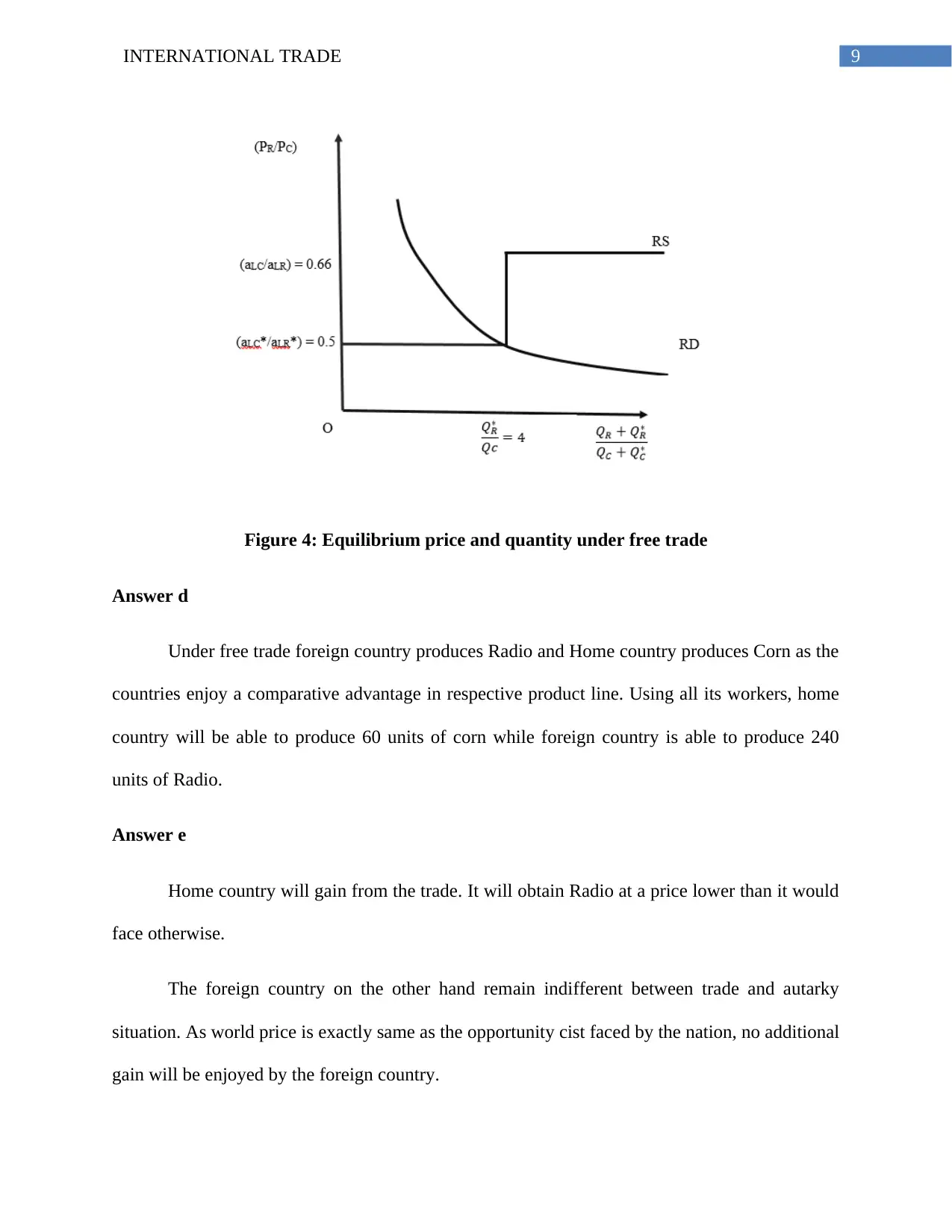

Answer d

Under free trade foreign country produces Radio and Home country produces Corn as the

countries enjoy a comparative advantage in respective product line. Using all its workers, home

country will be able to produce 60 units of corn while foreign country is able to produce 240

units of Radio.

Answer e

Home country will gain from the trade. It will obtain Radio at a price lower than it would

face otherwise.

The foreign country on the other hand remain indifferent between trade and autarky

situation. As world price is exactly same as the opportunity cist faced by the nation, no additional

gain will be enjoyed by the foreign country.

Figure 4: Equilibrium price and quantity under free trade

Answer d

Under free trade foreign country produces Radio and Home country produces Corn as the

countries enjoy a comparative advantage in respective product line. Using all its workers, home

country will be able to produce 60 units of corn while foreign country is able to produce 240

units of Radio.

Answer e

Home country will gain from the trade. It will obtain Radio at a price lower than it would

face otherwise.

The foreign country on the other hand remain indifferent between trade and autarky

situation. As world price is exactly same as the opportunity cist faced by the nation, no additional

gain will be enjoyed by the foreign country.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10INTERNATIONAL TRADE

Figure 5: Benefits to the workers in Home country

The benefit to the labor can be understood from evaluation of consumer equilibrium with

the help to budget line and indifference curve. Before trade, equilibrium for home country’s

worker is at E. After trade because of a lower price of radio the budget line will shift pivotally

towards radios. The new equilibrium is at E1. The workers in home country now consume a

higher radio given corn. The workers in home country also benefitted from a higher wage after

specialization in corn.

Figure 5: Benefits to the workers in Home country

The benefit to the labor can be understood from evaluation of consumer equilibrium with

the help to budget line and indifference curve. Before trade, equilibrium for home country’s

worker is at E. After trade because of a lower price of radio the budget line will shift pivotally

towards radios. The new equilibrium is at E1. The workers in home country now consume a

higher radio given corn. The workers in home country also benefitted from a higher wage after

specialization in corn.

11INTERNATIONAL TRADE

Reference list

Chacholiades, M. (2017). The pure theory of international trade. Routledge.

Feenstra, R. C. (2015). Advanced international trade: theory and evidence. Princeton university

press.

Reference list

Chacholiades, M. (2017). The pure theory of international trade. Routledge.

Feenstra, R. C. (2015). Advanced international trade: theory and evidence. Princeton university

press.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.