Report on Capital Allocation, Trade Finance, and Economic Evaluation

VerifiedAdded on 2022/12/30

|15

|3811

|4

Report

AI Summary

This report provides an in-depth analysis of international trade finance, focusing on capital allocation within both the UK domestic and international markets. It explores the functioning of financial markets, including capital markets, money markets, and bond markets, along with the effects of interest rates and exchange rates. The report also evaluates the Indian economy, examining its key sectors like agriculture, industry, and services, and discusses the challenges faced due to industrialization and trade policies. Furthermore, it delves into the application of theory models such as CAPM and investment decision-making models to understand capital allocation. The report concludes with recommendations and an executive summary highlighting key findings, offering a comprehensive overview of the subject matter.

International Trade Finance

& Investment

& Investment

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................4

MAIN BODY...................................................................................................................................4

Capital allocation within Domestic economy.............................................................................4

Evaluation of Indian economy....................................................................................................7

Evaluation of challenges faced by India due to industrialisation and trade policies...................9

CONCLUSION..............................................................................................................................10

RECOMMENDATIONS...............................................................................................................11

.......................................................................................................................................................11

REFERENCES..............................................................................................................................12

INTRODUCTION...........................................................................................................................4

MAIN BODY...................................................................................................................................4

Capital allocation within Domestic economy.............................................................................4

Evaluation of Indian economy....................................................................................................7

Evaluation of challenges faced by India due to industrialisation and trade policies...................9

CONCLUSION..............................................................................................................................10

RECOMMENDATIONS...............................................................................................................11

.......................................................................................................................................................11

REFERENCES..............................................................................................................................12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

EXECUTIVE SUMMARY

This report shows that the capital allocation within the UK domestic and international

market economy indicates that factors for the economy development and affected from the

different factors. For allocating UK domestic and international market it should be aware that

how financial market works and also discuss the interest rate, exchange rate, capital market,

money market, bond market and about the FDI and theory models by which they effect the

allocation of capital.

This report shows that the capital allocation within the UK domestic and international

market economy indicates that factors for the economy development and affected from the

different factors. For allocating UK domestic and international market it should be aware that

how financial market works and also discuss the interest rate, exchange rate, capital market,

money market, bond market and about the FDI and theory models by which they effect the

allocation of capital.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION

Financial market is the market place where trading of all the financial securities are done

including stock market, bond market, Forex market etc. for the smooth working of capital

economy (Johansson, and et.al, 2017). In this report we discuss the capital allocation of domestic

economy of UK and the international market and also evaluate the economy of India. This report

also shows the challenges of the country faced due to industrialization and trade policy and

difficulties faced by business due to these policies.

MAIN BODY

Capital allocation within Domestic economy.

Domestic capital market is an important role carrying in mobilizing financial domestic

development to private capital. This is done through giving loans to domestic companies in local

currencies where capital market reduces the mismatch for the borrowers companies while

reducing in systematic risk. Whereas, government bond help to manage and create the

macroeconomics and fiscal risk to maintain the pricing benchmark. The main allocation of

capital is federal and local government also with corporation where federal government issues

the long term bonds for the national debt, for financial capitals projects such as construction,

where corporation and local government issues both bond and stock of the country to grow

(Litavcova, Heckova, Chapcakova, 2017). For the explanation of capital market within the UK

country followings are the terms looking at:

Capital Market: Capital market is a market where capital market are the securities with

the time period of more than one year. They include the Bonds issued by government, stocks,

long term investment etc. which is purchased by the individual or the institution. Whereas, there

are two markets which are dealing by the UK country is primary market which issues the bond,

stocks for the very first time and secondary market where buying and selling of bonds and stocks

which are already issued by government in past and purchase or sell by other in the market.

Moreover, domestics market is market of short term transaction with the domestic currency

deposit or loans which issues in UK market. UK bank loan is the credit loan market where lender

provides the long term loans to the borrowers which will be repaid by the borrower at the time of

maturity date along with interest charge. Fixed payment loan is one of the credit market

Financial market is the market place where trading of all the financial securities are done

including stock market, bond market, Forex market etc. for the smooth working of capital

economy (Johansson, and et.al, 2017). In this report we discuss the capital allocation of domestic

economy of UK and the international market and also evaluate the economy of India. This report

also shows the challenges of the country faced due to industrialization and trade policy and

difficulties faced by business due to these policies.

MAIN BODY

Capital allocation within Domestic economy.

Domestic capital market is an important role carrying in mobilizing financial domestic

development to private capital. This is done through giving loans to domestic companies in local

currencies where capital market reduces the mismatch for the borrowers companies while

reducing in systematic risk. Whereas, government bond help to manage and create the

macroeconomics and fiscal risk to maintain the pricing benchmark. The main allocation of

capital is federal and local government also with corporation where federal government issues

the long term bonds for the national debt, for financial capitals projects such as construction,

where corporation and local government issues both bond and stock of the country to grow

(Litavcova, Heckova, Chapcakova, 2017). For the explanation of capital market within the UK

country followings are the terms looking at:

Capital Market: Capital market is a market where capital market are the securities with

the time period of more than one year. They include the Bonds issued by government, stocks,

long term investment etc. which is purchased by the individual or the institution. Whereas, there

are two markets which are dealing by the UK country is primary market which issues the bond,

stocks for the very first time and secondary market where buying and selling of bonds and stocks

which are already issued by government in past and purchase or sell by other in the market.

Moreover, domestics market is market of short term transaction with the domestic currency

deposit or loans which issues in UK market. UK bank loan is the credit loan market where lender

provides the long term loans to the borrowers which will be repaid by the borrower at the time of

maturity date along with interest charge. Fixed payment loan is one of the credit market

instrument that give borrower to make the payment on the period basis such as moths to the

lender. Hence, capital market is to provide the long term capital assets (Madura, 2020).

Money Market: it is the market that provide the short term loans and short terms deposit

for the borrowers provided by the lender through bank loan and government. It provides with the

large volume of trade between the traders and institutions. Money markets usually involved

mutual funds and commercial papers issued by government and purchases by individual or by

investor. This market is safe compared to the capital market and easily liquidate.

Bond Market: this market are the debt market or credit market own b y issuer to investor.

Bond restricts the borrower to pay the debt on a particular time period with the interest.

Government typically issue the bond to raise the funds and capitals for the purpose of

infrastructure of the country, government companies also issue these bond to expand their

business and projects and maintain the operations. When people of UK purchases the

government bond which means they are lending money to the government which is used for the

increasing in infrastructure and government provide the fix rate of interest specified in the bond

coupon and continue until the bonds get mature. These bonds are min 1 year to 30 years or more

of time periods.

The effects of interest rate on Capital market within the Domestic market of UK.

In 2017, UK domestic interest rate with all major cash saving products have been gone

downward path over the past five years. This Is due to low bank of interest by the Bank of

England, which drop from 0.5% to 0.25% in august 2016. access of saving by the country people

bring at the bottom and 2 year fixed cash ISA and 3 year of bonds has been issued by the

government which brings slight recovery to the economy. Report from Research in Mintel's

consumer, saving and investment — UK 2017 reveals that 32% of people who are saving or

investment are not interested to save when the rates are low, whereas 40% are interested to save

when the rates are high. As to get the better returns, 23% peoples are more interested in saving or

investment where low rate of interest made them more investment but it does not impact on cash

saving.

Theory models of Capital allocation within Domestic economy: Pricing Model: CAPM shows the relationship between systematic risk and return

expected for assets and stocks. Is widely used throughout finance generating expected

return and pricing security risk of assets. Investor uses this model or compensating risk

lender. Hence, capital market is to provide the long term capital assets (Madura, 2020).

Money Market: it is the market that provide the short term loans and short terms deposit

for the borrowers provided by the lender through bank loan and government. It provides with the

large volume of trade between the traders and institutions. Money markets usually involved

mutual funds and commercial papers issued by government and purchases by individual or by

investor. This market is safe compared to the capital market and easily liquidate.

Bond Market: this market are the debt market or credit market own b y issuer to investor.

Bond restricts the borrower to pay the debt on a particular time period with the interest.

Government typically issue the bond to raise the funds and capitals for the purpose of

infrastructure of the country, government companies also issue these bond to expand their

business and projects and maintain the operations. When people of UK purchases the

government bond which means they are lending money to the government which is used for the

increasing in infrastructure and government provide the fix rate of interest specified in the bond

coupon and continue until the bonds get mature. These bonds are min 1 year to 30 years or more

of time periods.

The effects of interest rate on Capital market within the Domestic market of UK.

In 2017, UK domestic interest rate with all major cash saving products have been gone

downward path over the past five years. This Is due to low bank of interest by the Bank of

England, which drop from 0.5% to 0.25% in august 2016. access of saving by the country people

bring at the bottom and 2 year fixed cash ISA and 3 year of bonds has been issued by the

government which brings slight recovery to the economy. Report from Research in Mintel's

consumer, saving and investment — UK 2017 reveals that 32% of people who are saving or

investment are not interested to save when the rates are low, whereas 40% are interested to save

when the rates are high. As to get the better returns, 23% peoples are more interested in saving or

investment where low rate of interest made them more investment but it does not impact on cash

saving.

Theory models of Capital allocation within Domestic economy: Pricing Model: CAPM shows the relationship between systematic risk and return

expected for assets and stocks. Is widely used throughout finance generating expected

return and pricing security risk of assets. Investor uses this model or compensating risk

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

and time value of money. This model is used to accurate predict the fair values of the

securities due to estimation of the expected return of the securities which are risky in

nature. This model help to know the relationship between the return, risk and value of an

efficient capital market (Maggiori, Neiman, Schreger, 2020). Investment decision-making Model: It refers to of using the information to access the

performance and prospects of the company for the use of investment or derive the

securities of the company. It is an important to know the decision-making process to

ensure that securities provides and adequate amount of returns.

Capital allocation within the International market.

International capital allocation allow the residents of different countries to increase their

portfolio by increasing trade risk assets, capital market in international market which are

diversified by selling of foreign bonds, exchange rates of other countries. Foreign direct

investment include minimum of 10% of foreign firms equity capital. FDI have the characteristics

of having physical investment in more than one country like investing in infrastructure in other

countries. Indirect investment are the investment which is made to create the building,

machineries and equipment which is not the direct portfolio investment. Whereas, FDI include

the direct acquisition of the international firm or investing in a joint venture with the local firms

which include the technology, licence or any intellectual properties. FDI offers other countries

with limited amount of capital and financed beyond the borders. For example FDI and exports

are the main two factors for the economic growth of India. FDI is the main element for

developing the private sector having low economic income and which reduce the poverty of the

country. Swap/ Hedge funds is referred to the contract to exchange two streams of future cash

flow or liabilities from two different financial statement. This is design to find the capital control

imposed by the government and for the efficient borrowing in global market (Nan, Kaizoji,

2019).

Theory models of Capital allocation within International Market:

Capital assets pricing model: This model is determined the appropriate required rate of

return on the assets and to make the decision on the additional assets. This shows into account on

the asset sensitivity to non diversified risk. This is also called systematic risk or market risk and

securities due to estimation of the expected return of the securities which are risky in

nature. This model help to know the relationship between the return, risk and value of an

efficient capital market (Maggiori, Neiman, Schreger, 2020). Investment decision-making Model: It refers to of using the information to access the

performance and prospects of the company for the use of investment or derive the

securities of the company. It is an important to know the decision-making process to

ensure that securities provides and adequate amount of returns.

Capital allocation within the International market.

International capital allocation allow the residents of different countries to increase their

portfolio by increasing trade risk assets, capital market in international market which are

diversified by selling of foreign bonds, exchange rates of other countries. Foreign direct

investment include minimum of 10% of foreign firms equity capital. FDI have the characteristics

of having physical investment in more than one country like investing in infrastructure in other

countries. Indirect investment are the investment which is made to create the building,

machineries and equipment which is not the direct portfolio investment. Whereas, FDI include

the direct acquisition of the international firm or investing in a joint venture with the local firms

which include the technology, licence or any intellectual properties. FDI offers other countries

with limited amount of capital and financed beyond the borders. For example FDI and exports

are the main two factors for the economic growth of India. FDI is the main element for

developing the private sector having low economic income and which reduce the poverty of the

country. Swap/ Hedge funds is referred to the contract to exchange two streams of future cash

flow or liabilities from two different financial statement. This is design to find the capital control

imposed by the government and for the efficient borrowing in global market (Nan, Kaizoji,

2019).

Theory models of Capital allocation within International Market:

Capital assets pricing model: This model is determined the appropriate required rate of

return on the assets and to make the decision on the additional assets. This shows into account on

the asset sensitivity to non diversified risk. This is also called systematic risk or market risk and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

also represent by quantity beta in financial institution and also expected return of the market and

risk free assets.

International Money Market includes the national currencies which are for short term

deposits in other countries expect the country of issue in international market where foreign

currencies are trade. They include the foreign exchange dealer which are employed by

commercial bank and foreign exchange broker. It is the market where transaction of international

currency between the central bank of countries. This transaction are mainly done in the form of

Gold and US Dollar. This is basically done by the government for borrowing or lending or by

large institutional corporation with help of banks like HSBC and JP Morgan(Vukovic, Prosin,

2018).

Foreign Bond Market is market where foreign market is issued by the foreign borrower.

This bond usually used local currency. The local market authorities supervisee the issuance of

foreign bond and sale of bonds where foreign bonds are carried out in the foreign bond market.

These bonds are normally issued by the government sector and private institutional. These bonds

are purchase by either buyer who is debtor issuer or by seller who are the institutions.

Foreign exchange: It refers to the trading of one currency to another and the value which

the exchange of currencies is made is knowns as the exchange rate. This rate is determined by

the rate of two currencies which is expressed in terms of one another (Habib, Bützer, Stracca,

2016). The impact of exchange rate in the international market is occurred on UK from the

fluctuation of exchange rates due to increasing in the spending power of the residents of UK in

2018.

Evaluation of Indian economy.

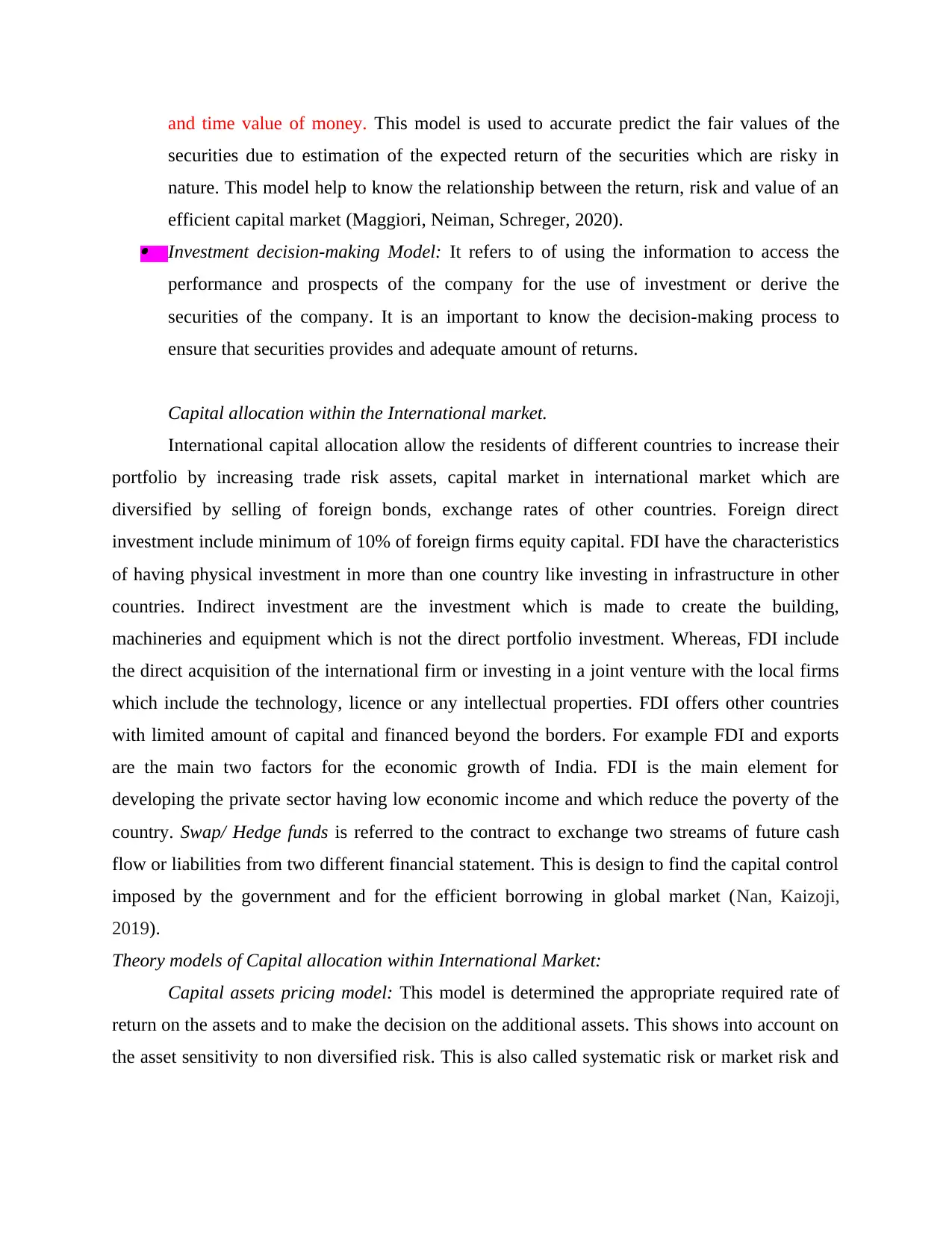

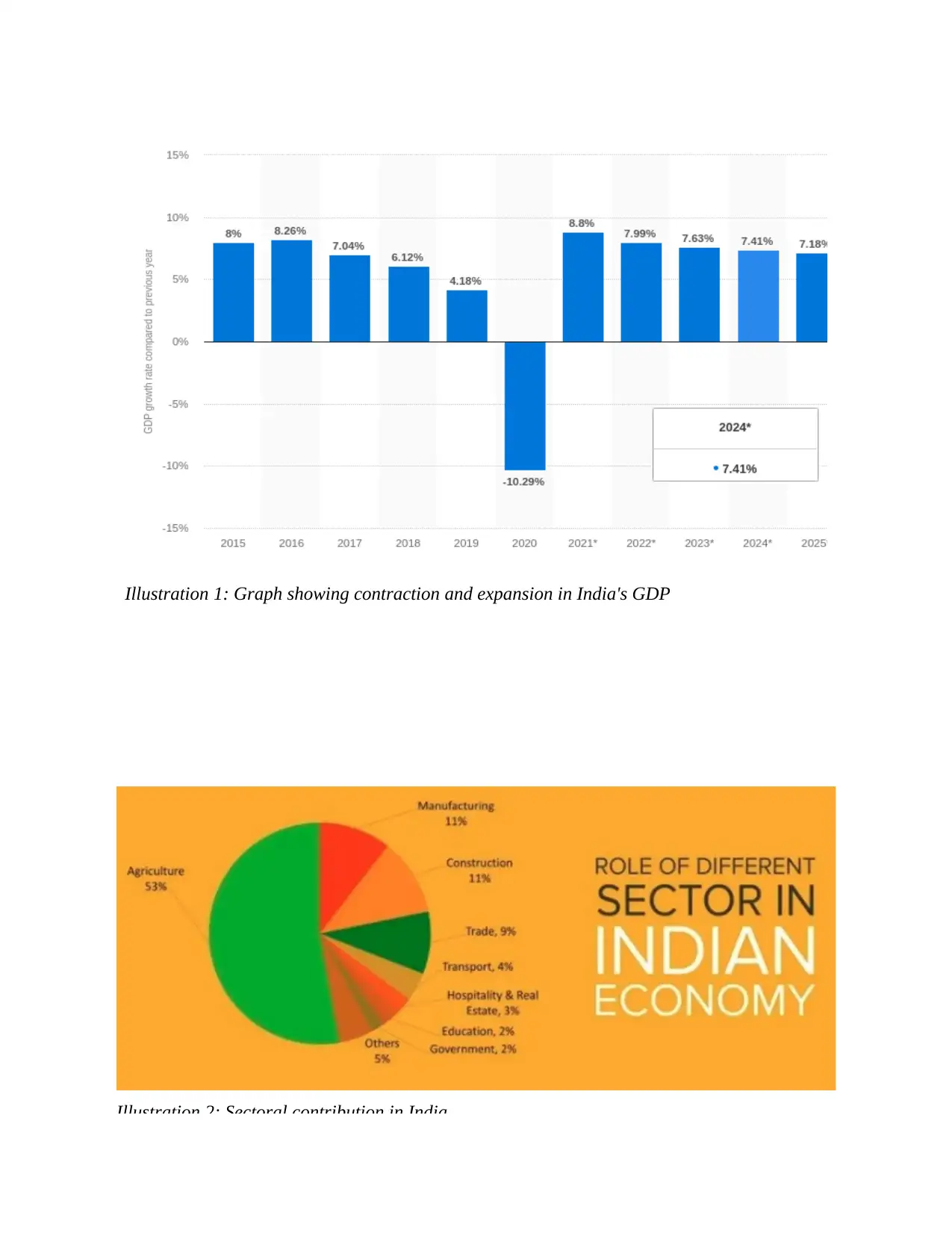

India is considered as one of the fastest growing economy and is likely to be in the top three

position of the world economy in the coming years. India's GDP growth had contracted

approximately 23% in the quarters of current year as against the quarters of previous year when

the same had been grown 5%. India has to work on creating employment in non farm sector

because it has low employment growth rate. After the pandemic Covid 19 India has witnessed a

fall in its export by 19% and imports by 38%. There is a fall in the purchasing managers index

which is an indicator of manufacturing goods from June to July 2020 (Puri and Misra, 2017).

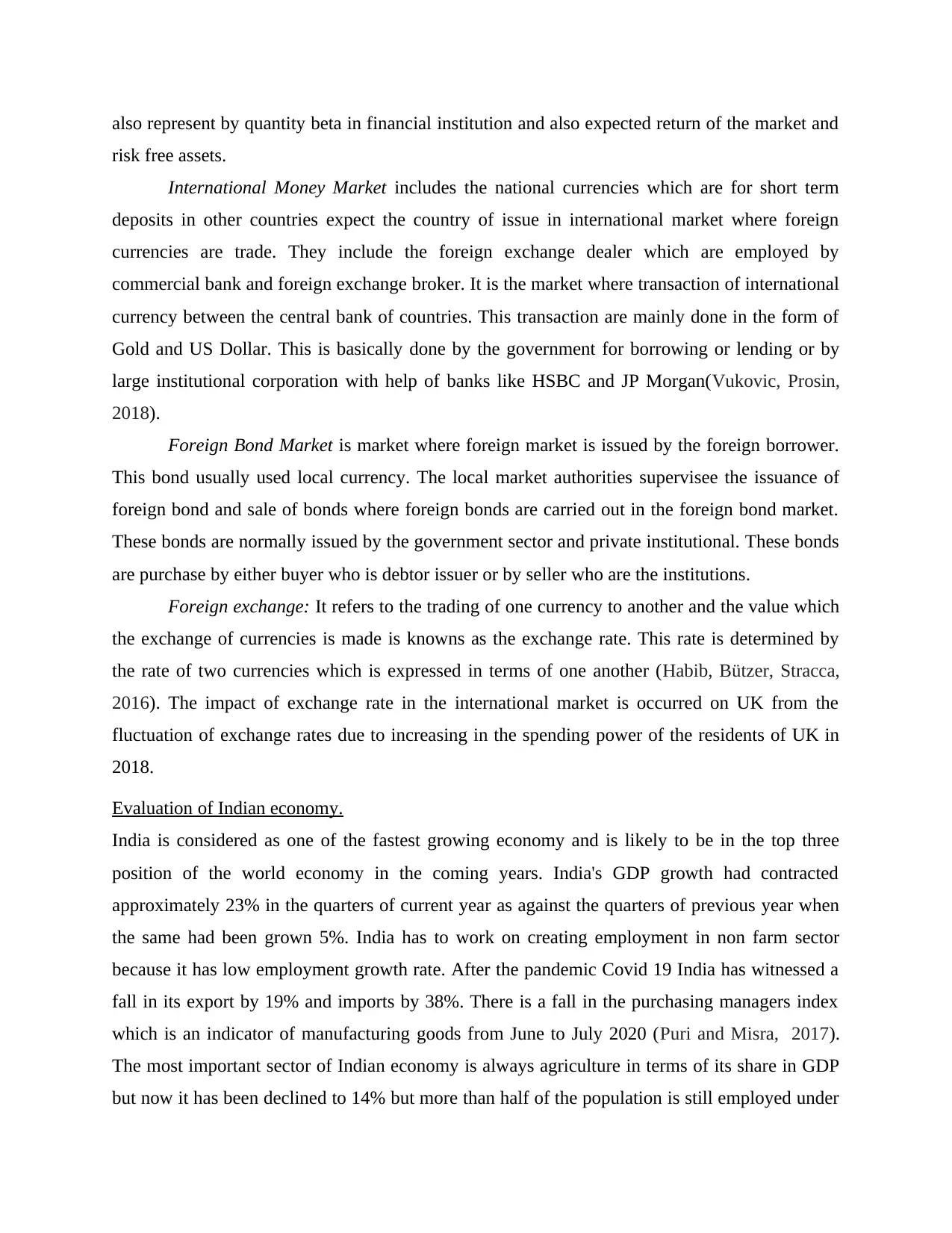

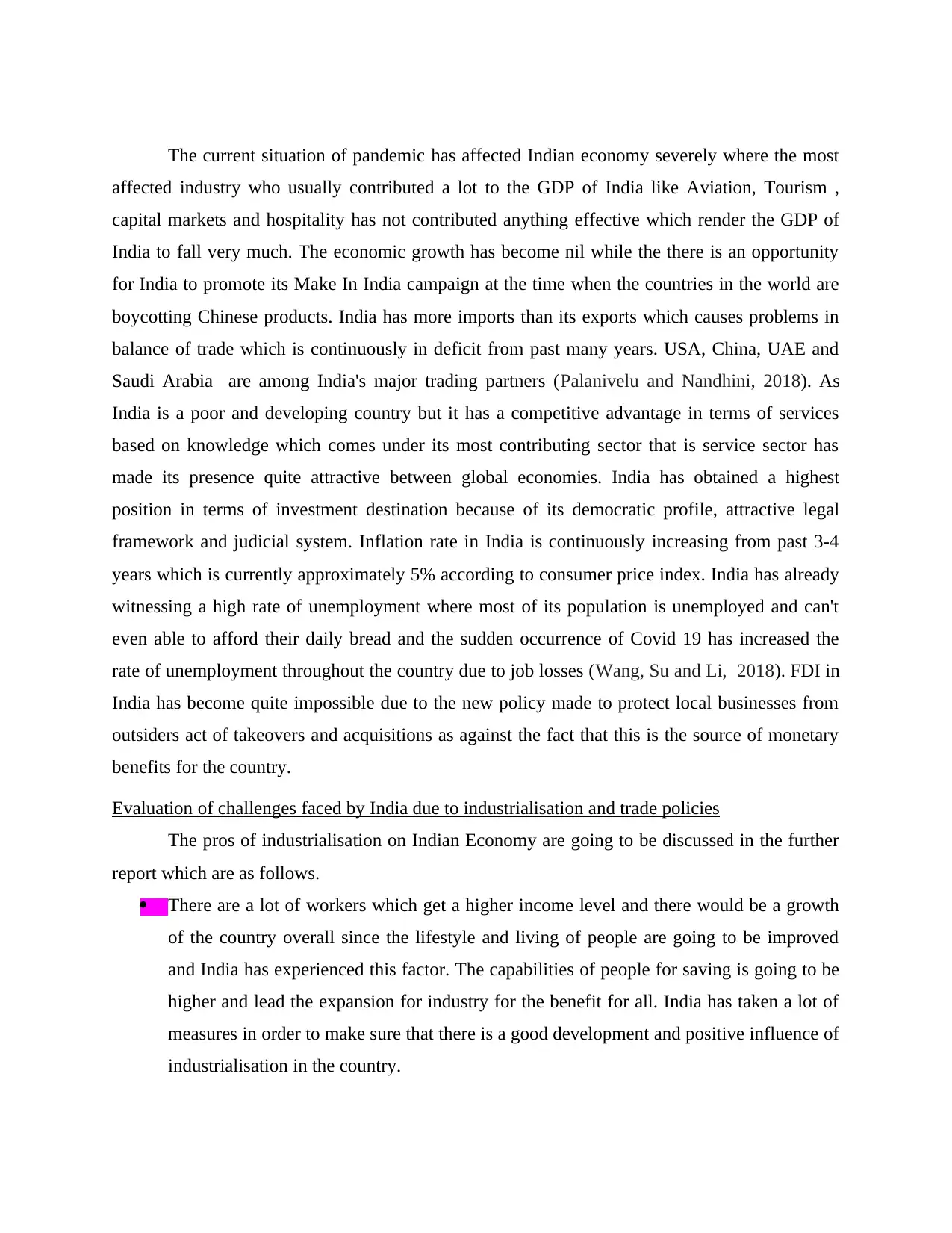

The most important sector of Indian economy is always agriculture in terms of its share in GDP

but now it has been declined to 14% but more than half of the population is still employed under

risk free assets.

International Money Market includes the national currencies which are for short term

deposits in other countries expect the country of issue in international market where foreign

currencies are trade. They include the foreign exchange dealer which are employed by

commercial bank and foreign exchange broker. It is the market where transaction of international

currency between the central bank of countries. This transaction are mainly done in the form of

Gold and US Dollar. This is basically done by the government for borrowing or lending or by

large institutional corporation with help of banks like HSBC and JP Morgan(Vukovic, Prosin,

2018).

Foreign Bond Market is market where foreign market is issued by the foreign borrower.

This bond usually used local currency. The local market authorities supervisee the issuance of

foreign bond and sale of bonds where foreign bonds are carried out in the foreign bond market.

These bonds are normally issued by the government sector and private institutional. These bonds

are purchase by either buyer who is debtor issuer or by seller who are the institutions.

Foreign exchange: It refers to the trading of one currency to another and the value which

the exchange of currencies is made is knowns as the exchange rate. This rate is determined by

the rate of two currencies which is expressed in terms of one another (Habib, Bützer, Stracca,

2016). The impact of exchange rate in the international market is occurred on UK from the

fluctuation of exchange rates due to increasing in the spending power of the residents of UK in

2018.

Evaluation of Indian economy.

India is considered as one of the fastest growing economy and is likely to be in the top three

position of the world economy in the coming years. India's GDP growth had contracted

approximately 23% in the quarters of current year as against the quarters of previous year when

the same had been grown 5%. India has to work on creating employment in non farm sector

because it has low employment growth rate. After the pandemic Covid 19 India has witnessed a

fall in its export by 19% and imports by 38%. There is a fall in the purchasing managers index

which is an indicator of manufacturing goods from June to July 2020 (Puri and Misra, 2017).

The most important sector of Indian economy is always agriculture in terms of its share in GDP

but now it has been declined to 14% but more than half of the population is still employed under

this sector. Government has initiated various steps to improve agricultural income and its share

in GDP where high subsidies has been granted to farmers, export promotion of agricultural

goods and growth of food processing industry. Another most important sector of Indian economy

is industrial sector which has a share of 25% in economy along with its good contribution

towards employment in the country. Its growth is quite impressive after the introduction of LPG

policy. A lot of investment for this sector is done by the government every year for technological

and research and development in this sector. The service sector is another most important sector

of Indian economy which has the largest contribution in GDP of India which is around 60%. Due

to this sector only India has been called as IT hub in the world and it has created a lot of

opportunity in terms of employment in the country (Dolli and Divya, 2020). Manufacturing

sector has been playing great role in India GDP growth and government of India is also taking

every possible steps towards this sector development through various initiatives and programs

like MUDRA and Make In India. In creating a bright future of Indian economy the aims and

objectives in this regard of the NITI aayog states that the farmers' income must be doubled from

the current one, Make In India campaign must deliver a better result with a great boost in the

manufacturing industry and aims to achieve a 36% rate of investment from the current rate of

29%.

in GDP where high subsidies has been granted to farmers, export promotion of agricultural

goods and growth of food processing industry. Another most important sector of Indian economy

is industrial sector which has a share of 25% in economy along with its good contribution

towards employment in the country. Its growth is quite impressive after the introduction of LPG

policy. A lot of investment for this sector is done by the government every year for technological

and research and development in this sector. The service sector is another most important sector

of Indian economy which has the largest contribution in GDP of India which is around 60%. Due

to this sector only India has been called as IT hub in the world and it has created a lot of

opportunity in terms of employment in the country (Dolli and Divya, 2020). Manufacturing

sector has been playing great role in India GDP growth and government of India is also taking

every possible steps towards this sector development through various initiatives and programs

like MUDRA and Make In India. In creating a bright future of Indian economy the aims and

objectives in this regard of the NITI aayog states that the farmers' income must be doubled from

the current one, Make In India campaign must deliver a better result with a great boost in the

manufacturing industry and aims to achieve a 36% rate of investment from the current rate of

29%.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Illustration 1: Graph showing contraction and expansion in India's GDP

Illustration 2: Sectoral contribution in India

Illustration 2: Sectoral contribution in India

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The current situation of pandemic has affected Indian economy severely where the most

affected industry who usually contributed a lot to the GDP of India like Aviation, Tourism ,

capital markets and hospitality has not contributed anything effective which render the GDP of

India to fall very much. The economic growth has become nil while the there is an opportunity

for India to promote its Make In India campaign at the time when the countries in the world are

boycotting Chinese products. India has more imports than its exports which causes problems in

balance of trade which is continuously in deficit from past many years. USA, China, UAE and

Saudi Arabia are among India's major trading partners (Palanivelu and Nandhini, 2018). As

India is a poor and developing country but it has a competitive advantage in terms of services

based on knowledge which comes under its most contributing sector that is service sector has

made its presence quite attractive between global economies. India has obtained a highest

position in terms of investment destination because of its democratic profile, attractive legal

framework and judicial system. Inflation rate in India is continuously increasing from past 3-4

years which is currently approximately 5% according to consumer price index. India has already

witnessing a high rate of unemployment where most of its population is unemployed and can't

even able to afford their daily bread and the sudden occurrence of Covid 19 has increased the

rate of unemployment throughout the country due to job losses (Wang, Su and Li, 2018). FDI in

India has become quite impossible due to the new policy made to protect local businesses from

outsiders act of takeovers and acquisitions as against the fact that this is the source of monetary

benefits for the country.

Evaluation of challenges faced by India due to industrialisation and trade policies

The pros of industrialisation on Indian Economy are going to be discussed in the further

report which are as follows.

There are a lot of workers which get a higher income level and there would be a growth

of the country overall since the lifestyle and living of people are going to be improved

and India has experienced this factor. The capabilities of people for saving is going to be

higher and lead the expansion for industry for the benefit for all. India has taken a lot of

measures in order to make sure that there is a good development and positive influence of

industrialisation in the country.

affected industry who usually contributed a lot to the GDP of India like Aviation, Tourism ,

capital markets and hospitality has not contributed anything effective which render the GDP of

India to fall very much. The economic growth has become nil while the there is an opportunity

for India to promote its Make In India campaign at the time when the countries in the world are

boycotting Chinese products. India has more imports than its exports which causes problems in

balance of trade which is continuously in deficit from past many years. USA, China, UAE and

Saudi Arabia are among India's major trading partners (Palanivelu and Nandhini, 2018). As

India is a poor and developing country but it has a competitive advantage in terms of services

based on knowledge which comes under its most contributing sector that is service sector has

made its presence quite attractive between global economies. India has obtained a highest

position in terms of investment destination because of its democratic profile, attractive legal

framework and judicial system. Inflation rate in India is continuously increasing from past 3-4

years which is currently approximately 5% according to consumer price index. India has already

witnessing a high rate of unemployment where most of its population is unemployed and can't

even able to afford their daily bread and the sudden occurrence of Covid 19 has increased the

rate of unemployment throughout the country due to job losses (Wang, Su and Li, 2018). FDI in

India has become quite impossible due to the new policy made to protect local businesses from

outsiders act of takeovers and acquisitions as against the fact that this is the source of monetary

benefits for the country.

Evaluation of challenges faced by India due to industrialisation and trade policies

The pros of industrialisation on Indian Economy are going to be discussed in the further

report which are as follows.

There are a lot of workers which get a higher income level and there would be a growth

of the country overall since the lifestyle and living of people are going to be improved

and India has experienced this factor. The capabilities of people for saving is going to be

higher and lead the expansion for industry for the benefit for all. India has taken a lot of

measures in order to make sure that there is a good development and positive influence of

industrialisation in the country.

Government are making the trading and policies for industrialisation to take place in the

country so that there would be better development and improvement which is going to be

present. The cash flow in the country is going to be higher and more development can be

done by the government for the people which is a great factor for the people to have

(Siddiqui, 2017). There is a lot of manufacturing for the products and services in this

industry which is going to be present and that is good for the overall development of the

people as well.

The local areas of the country are going to be provided with the basic improvement of

products and services by the government and the country will have better economic

factor. Productivity and educated unemployed people are going to be placed and made

sure that there are right decisions which are being taken as well. Problems in this industry

are going to have more ideas and creativity which is going to be present so that there is a

growth and proper training is going to be present so that the individuals in India are going

to get motivated to share their own businesses so that the economic growth is going to be

in the country.

There are many problems and challenges faced by the Indian economy due to the policies of

industrialisation and trades because of the following facts explained further in this report:

There was a lot of disadvantages faced by the citizens because industrialisation has been

resulted in a widespread environmental pollution, a lot of harmful impact to nature and

human health due to pollution and wastes created by the industries and these are not at all

bothered and compensated by the industrialists (Siddiqui, 2017).

The industrialisation caused disparity of income in the Indian economy in terms of

discrimination between labour and capital because an individual with more wealth can

easily afford to invest in capital and technology whereas the one with less capital and

wealth couldn't do so.

Industrialisation causes a widespread migrant throughout the country which allows

industrialists to hire them for their advantage without any considerations towards their

health and also provide them with low wages (Wang, Su, and Li, 2018).

Lack of infrastructural facilities has always been the challenge for Indian economy

because industrialisation demand high level of infrastructural set up without which the

development of the same is not at all possible. This include transportation and

country so that there would be better development and improvement which is going to be

present. The cash flow in the country is going to be higher and more development can be

done by the government for the people which is a great factor for the people to have

(Siddiqui, 2017). There is a lot of manufacturing for the products and services in this

industry which is going to be present and that is good for the overall development of the

people as well.

The local areas of the country are going to be provided with the basic improvement of

products and services by the government and the country will have better economic

factor. Productivity and educated unemployed people are going to be placed and made

sure that there are right decisions which are being taken as well. Problems in this industry

are going to have more ideas and creativity which is going to be present so that there is a

growth and proper training is going to be present so that the individuals in India are going

to get motivated to share their own businesses so that the economic growth is going to be

in the country.

There are many problems and challenges faced by the Indian economy due to the policies of

industrialisation and trades because of the following facts explained further in this report:

There was a lot of disadvantages faced by the citizens because industrialisation has been

resulted in a widespread environmental pollution, a lot of harmful impact to nature and

human health due to pollution and wastes created by the industries and these are not at all

bothered and compensated by the industrialists (Siddiqui, 2017).

The industrialisation caused disparity of income in the Indian economy in terms of

discrimination between labour and capital because an individual with more wealth can

easily afford to invest in capital and technology whereas the one with less capital and

wealth couldn't do so.

Industrialisation causes a widespread migrant throughout the country which allows

industrialists to hire them for their advantage without any considerations towards their

health and also provide them with low wages (Wang, Su, and Li, 2018).

Lack of infrastructural facilities has always been the challenge for Indian economy

because industrialisation demand high level of infrastructural set up without which the

development of the same is not at all possible. This include transportation and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.