International Trade, Finance & Investment: UK Economy Analysis Report

VerifiedAdded on 2022/12/28

|15

|3938

|27

Report

AI Summary

This report provides a comprehensive analysis of international trade, finance, and investment, focusing on their impact on the UK economy. It begins by defining key terms and exploring the role of financial markets in allocating capital domestically and internationally. The report delves into the different types of financial markets, including stock, bond, commodities, and derivatives markets, and their significance in economic growth. It examines the UK's financial market, its global standing, and the factors influencing its GDP. The report further investigates capital allocation within the UK economy and its relationship with international trade, including import and export dynamics, and the impact of foreign direct investment. The second part of the report evaluates the Italian economy, its key sectors, economic freedom, and government policies, providing a comparative analysis. The report concludes by summarizing the key findings and highlighting the interconnectedness of international trade, finance, and investment in shaping economic landscapes. The report also presents various charts and interpretations to support the analysis.

International Trade,

Finance & Investment

Finance & Investment

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

Financial markets work to allocate capital within a domestic economy and internationally for

trade, investment, and development purposes.............................................................................1

TASK 2............................................................................................................................................7

Evaluation of economy...............................................................................................................7

CONCLUSION .............................................................................................................................10

REFERENCES..............................................................................................................................12

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

Financial markets work to allocate capital within a domestic economy and internationally for

trade, investment, and development purposes.............................................................................1

TASK 2............................................................................................................................................7

Evaluation of economy...............................................................................................................7

CONCLUSION .............................................................................................................................10

REFERENCES..............................................................................................................................12

INTRODUCTION

International trade is an exchange of goods and services across international borders

because there is requirement or need of goods and services. It is a method of economic

interaction between foreign organizations and link with economic activities. International finance

for monetary transactions that transpire between two or more organisations. It is focusing on the

particular areas like foreign direct investment and currency exchange rates (Alexander and

Eberly, 2018). International investment is investment strategy use by different investors to

purchase different things. These terms are based on each other and important for economy. The

main aim of the report to understand the concept of the international trade, finance & investment

in depth manner that helps to understand UK economy to target future clients. In this assignment

consist of financial market work to allocate capital within a domestic economy. Along with

critically analysis of UK economy to analysis key challenges faced by a nation because of

industrialization and trade policies.

TASK 1

Financial markets work to allocate capital within a domestic economy and internationally for

trade, investment, and development purposes

Financial market defined as a marketplace where creation and trading of financial assets

like shares, derivatives, bonds and many others. It presents as a mediator in between investors

and savers by mobilising funds between them. At this market provides a platform to purchaser

and sellers to meet and trading of assets as per the demand and supply.

There are identified various types of financial market that operated by country as per their

economy. These market plays crucial role in economy that are explained below:

Stock market: It refers to the collection of exchanges and markets where conducting

regular activities like buying, selling and issue of share of public organisations. These

financial activities are operated by over the counter (OTC) marketplaces that conduct

under a set regulations.

Bond market: In this market people get various opportunities where investors purchase

debt securities that are carried out to the market by government institutions. Different

organisations issue their bond in this market to enhance their capital and maintain growth

in product lines (Alstadsæter, Jacob and Michael, 2017).

1

International trade is an exchange of goods and services across international borders

because there is requirement or need of goods and services. It is a method of economic

interaction between foreign organizations and link with economic activities. International finance

for monetary transactions that transpire between two or more organisations. It is focusing on the

particular areas like foreign direct investment and currency exchange rates (Alexander and

Eberly, 2018). International investment is investment strategy use by different investors to

purchase different things. These terms are based on each other and important for economy. The

main aim of the report to understand the concept of the international trade, finance & investment

in depth manner that helps to understand UK economy to target future clients. In this assignment

consist of financial market work to allocate capital within a domestic economy. Along with

critically analysis of UK economy to analysis key challenges faced by a nation because of

industrialization and trade policies.

TASK 1

Financial markets work to allocate capital within a domestic economy and internationally for

trade, investment, and development purposes

Financial market defined as a marketplace where creation and trading of financial assets

like shares, derivatives, bonds and many others. It presents as a mediator in between investors

and savers by mobilising funds between them. At this market provides a platform to purchaser

and sellers to meet and trading of assets as per the demand and supply.

There are identified various types of financial market that operated by country as per their

economy. These market plays crucial role in economy that are explained below:

Stock market: It refers to the collection of exchanges and markets where conducting

regular activities like buying, selling and issue of share of public organisations. These

financial activities are operated by over the counter (OTC) marketplaces that conduct

under a set regulations.

Bond market: In this market people get various opportunities where investors purchase

debt securities that are carried out to the market by government institutions. Different

organisations issue their bond in this market to enhance their capital and maintain growth

in product lines (Alstadsæter, Jacob and Michael, 2017).

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Commodities market: This marketplace exists in physical and virtual manner for

purchasing and selling and trading of raw and primary items. In present time about 50

major commodity markets operated by different countries at worldwide level that

facilitate trade in approx 100 primary commodities.

Derivative market: It is a part of financial market where financial instrument conduct

different underlying assets and financial derivatives. In this market prepare agreement

that based on market value assessed by company.

Background of financial market:

The financial market is that place where dealing in money and other financial activity

takes place. Therefore, it is most essential for business entity to focus on investment at the

market. As a result it will help to achieve their financial goals and objectives effectively.

Different financial institutions are part of financial market like Banks, financial companies and

many others. Banks, capital and money work in effective way and effective allocation of money

within an economy. These terms are essential for economy because it helps to select right way to

do work in smooth way.

Forms of money: There are identified different forms of money such as, Fiat, commodity and

fiduciary money. These forms of money is essential for economy to understand right way for

different activities.

Purpose of money: The main reason of money to fulfil the requirement of economy and conduct

various types of activities that depend on the money. Therefore, all the desires based on money

that supports to assure about demand generations works effectively (Beeson and Li, 2016) (Boot

and Ratnovski, 2016).

The UK is one of the biggest financial market in the world for fund management along

with US and Japan. As per the measurement UK assets under management about $11.8 trillion in

the year of 2017 and has strong international atmosphere. The financial market of United

Kingdom plays leader role in a different financial services.

The presence of financial market in economy provide various opportunities of growth and

investors get success for longer period of time. In this way the economy become witness for long

term growth when different kinds of financial market are performing effectively. Therefore, it is

essential that all the activities and functions are conducting properly in financial market that

2

purchasing and selling and trading of raw and primary items. In present time about 50

major commodity markets operated by different countries at worldwide level that

facilitate trade in approx 100 primary commodities.

Derivative market: It is a part of financial market where financial instrument conduct

different underlying assets and financial derivatives. In this market prepare agreement

that based on market value assessed by company.

Background of financial market:

The financial market is that place where dealing in money and other financial activity

takes place. Therefore, it is most essential for business entity to focus on investment at the

market. As a result it will help to achieve their financial goals and objectives effectively.

Different financial institutions are part of financial market like Banks, financial companies and

many others. Banks, capital and money work in effective way and effective allocation of money

within an economy. These terms are essential for economy because it helps to select right way to

do work in smooth way.

Forms of money: There are identified different forms of money such as, Fiat, commodity and

fiduciary money. These forms of money is essential for economy to understand right way for

different activities.

Purpose of money: The main reason of money to fulfil the requirement of economy and conduct

various types of activities that depend on the money. Therefore, all the desires based on money

that supports to assure about demand generations works effectively (Beeson and Li, 2016) (Boot

and Ratnovski, 2016).

The UK is one of the biggest financial market in the world for fund management along

with US and Japan. As per the measurement UK assets under management about $11.8 trillion in

the year of 2017 and has strong international atmosphere. The financial market of United

Kingdom plays leader role in a different financial services.

The presence of financial market in economy provide various opportunities of growth and

investors get success for longer period of time. In this way the economy become witness for long

term growth when different kinds of financial market are performing effectively. Therefore, it is

essential that all the activities and functions are conducting properly in financial market that

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

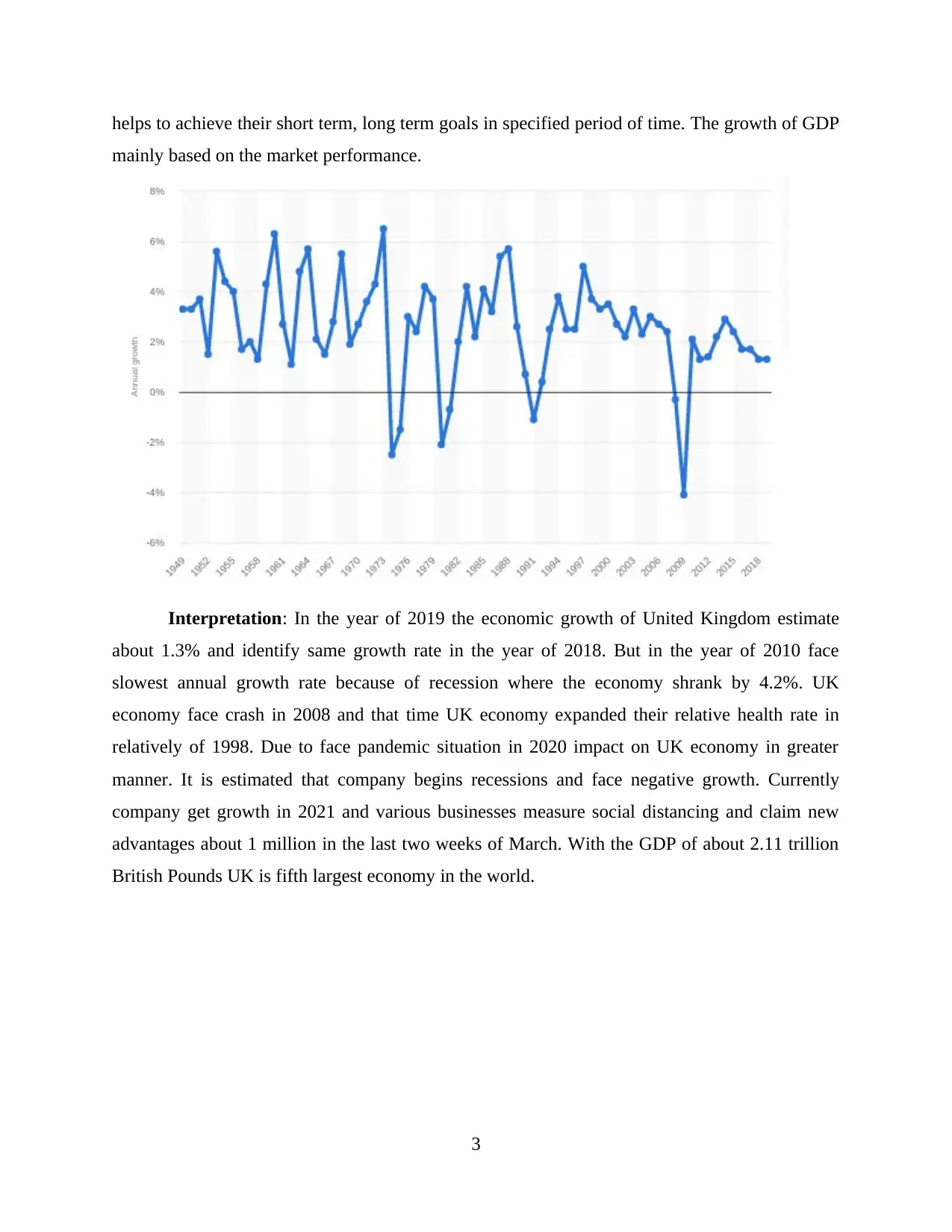

helps to achieve their short term, long term goals in specified period of time. The growth of GDP

mainly based on the market performance.

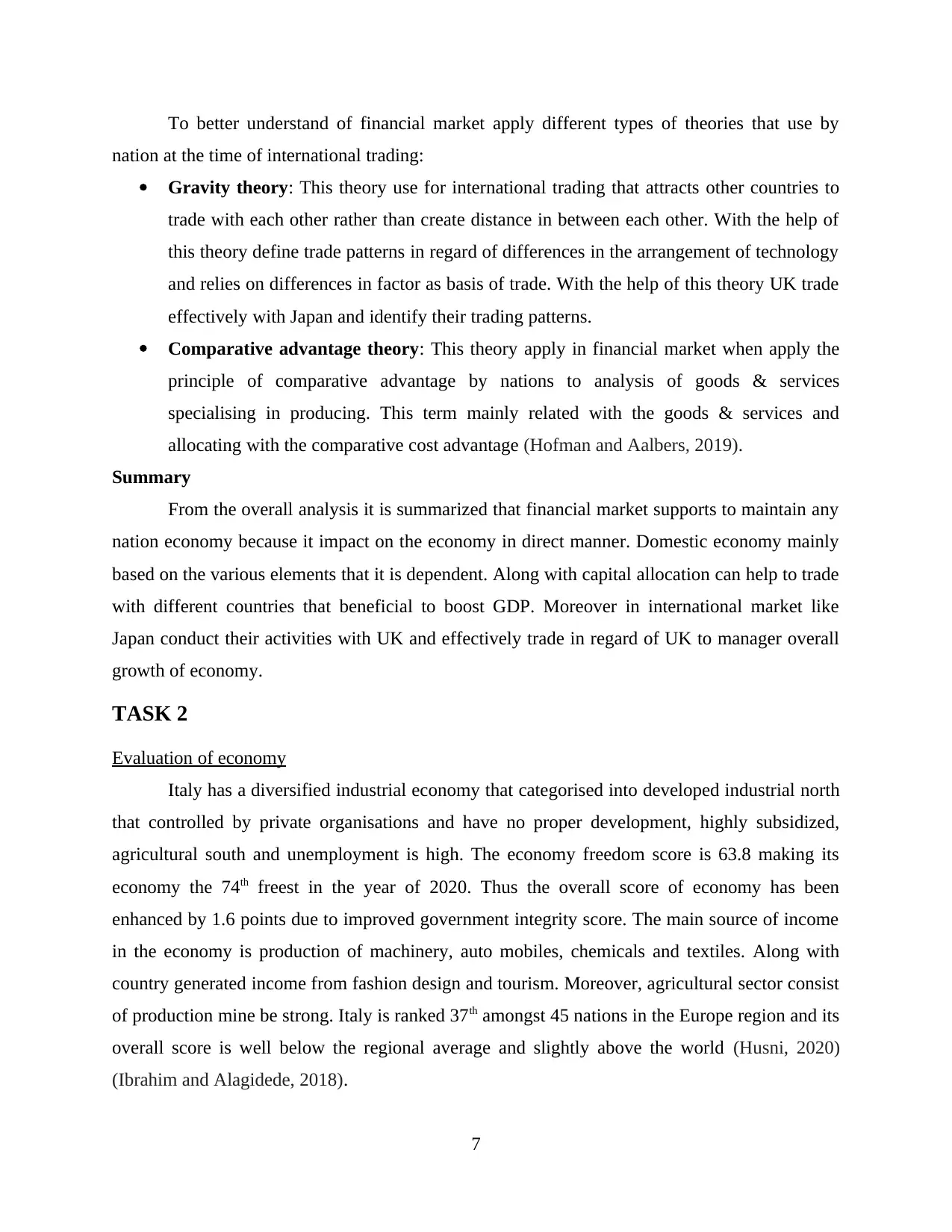

Interpretation: In the year of 2019 the economic growth of United Kingdom estimate

about 1.3% and identify same growth rate in the year of 2018. But in the year of 2010 face

slowest annual growth rate because of recession where the economy shrank by 4.2%. UK

economy face crash in 2008 and that time UK economy expanded their relative health rate in

relatively of 1998. Due to face pandemic situation in 2020 impact on UK economy in greater

manner. It is estimated that company begins recessions and face negative growth. Currently

company get growth in 2021 and various businesses measure social distancing and claim new

advantages about 1 million in the last two weeks of March. With the GDP of about 2.11 trillion

British Pounds UK is fifth largest economy in the world.

3

mainly based on the market performance.

Interpretation: In the year of 2019 the economic growth of United Kingdom estimate

about 1.3% and identify same growth rate in the year of 2018. But in the year of 2010 face

slowest annual growth rate because of recession where the economy shrank by 4.2%. UK

economy face crash in 2008 and that time UK economy expanded their relative health rate in

relatively of 1998. Due to face pandemic situation in 2020 impact on UK economy in greater

manner. It is estimated that company begins recessions and face negative growth. Currently

company get growth in 2021 and various businesses measure social distancing and claim new

advantages about 1 million in the last two weeks of March. With the GDP of about 2.11 trillion

British Pounds UK is fifth largest economy in the world.

3

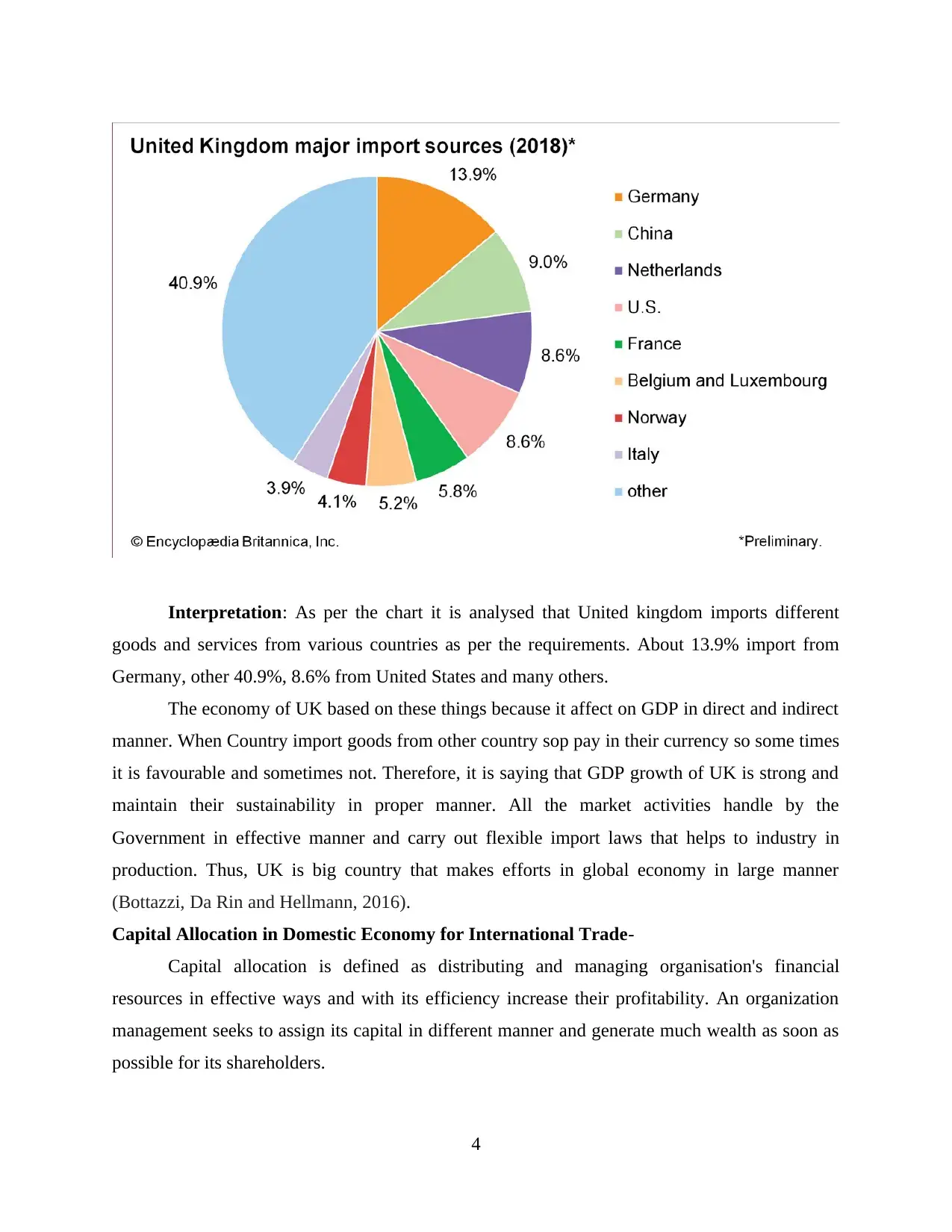

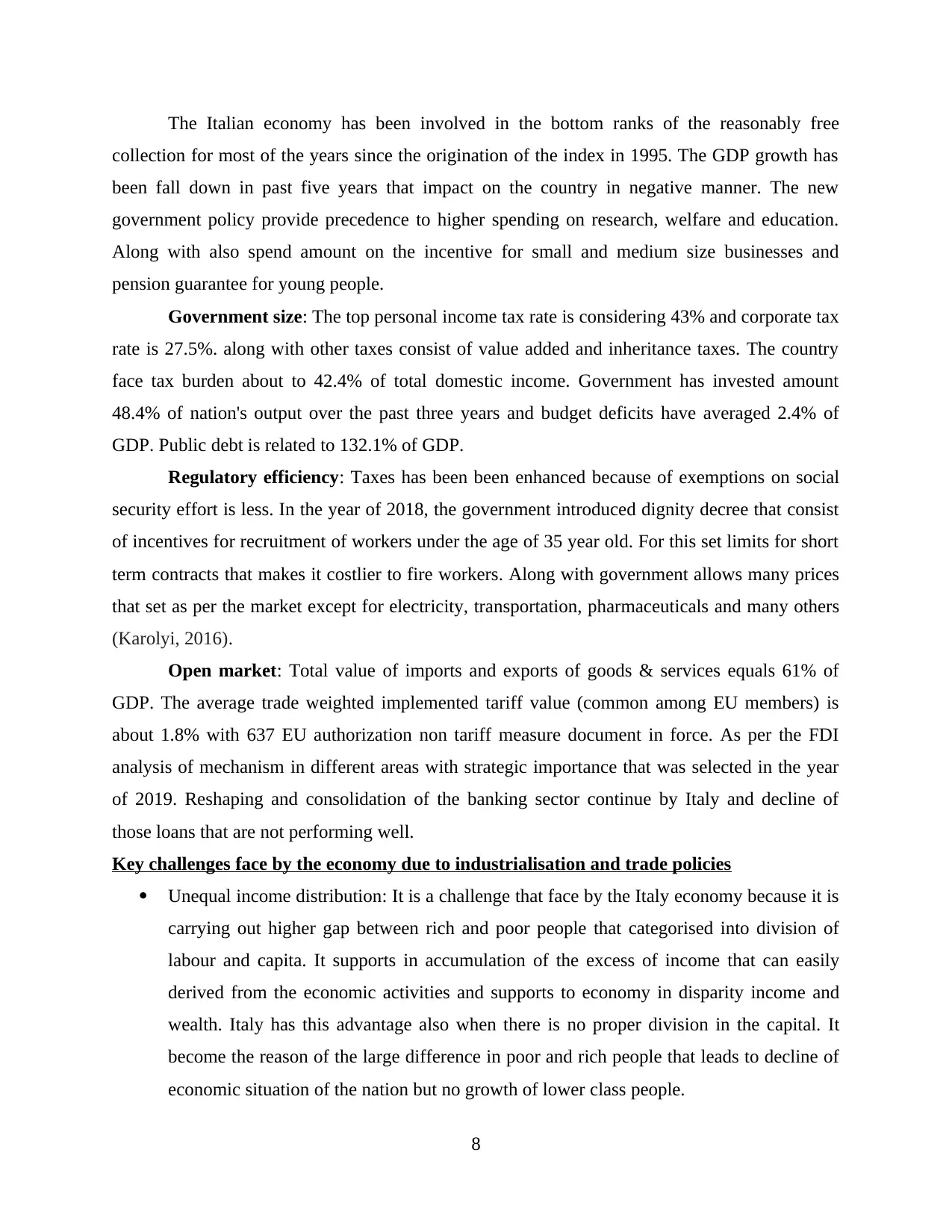

Interpretation: As per the chart it is analysed that United kingdom imports different

goods and services from various countries as per the requirements. About 13.9% import from

Germany, other 40.9%, 8.6% from United States and many others.

The economy of UK based on these things because it affect on GDP in direct and indirect

manner. When Country import goods from other country sop pay in their currency so some times

it is favourable and sometimes not. Therefore, it is saying that GDP growth of UK is strong and

maintain their sustainability in proper manner. All the market activities handle by the

Government in effective manner and carry out flexible import laws that helps to industry in

production. Thus, UK is big country that makes efforts in global economy in large manner

(Bottazzi, Da Rin and Hellmann, 2016).

Capital Allocation in Domestic Economy for International Trade-

Capital allocation is defined as distributing and managing organisation's financial

resources in effective ways and with its efficiency increase their profitability. An organization

management seeks to assign its capital in different manner and generate much wealth as soon as

possible for its shareholders.

4

goods and services from various countries as per the requirements. About 13.9% import from

Germany, other 40.9%, 8.6% from United States and many others.

The economy of UK based on these things because it affect on GDP in direct and indirect

manner. When Country import goods from other country sop pay in their currency so some times

it is favourable and sometimes not. Therefore, it is saying that GDP growth of UK is strong and

maintain their sustainability in proper manner. All the market activities handle by the

Government in effective manner and carry out flexible import laws that helps to industry in

production. Thus, UK is big country that makes efforts in global economy in large manner

(Bottazzi, Da Rin and Hellmann, 2016).

Capital Allocation in Domestic Economy for International Trade-

Capital allocation is defined as distributing and managing organisation's financial

resources in effective ways and with its efficiency increase their profitability. An organization

management seeks to assign its capital in different manner and generate much wealth as soon as

possible for its shareholders.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

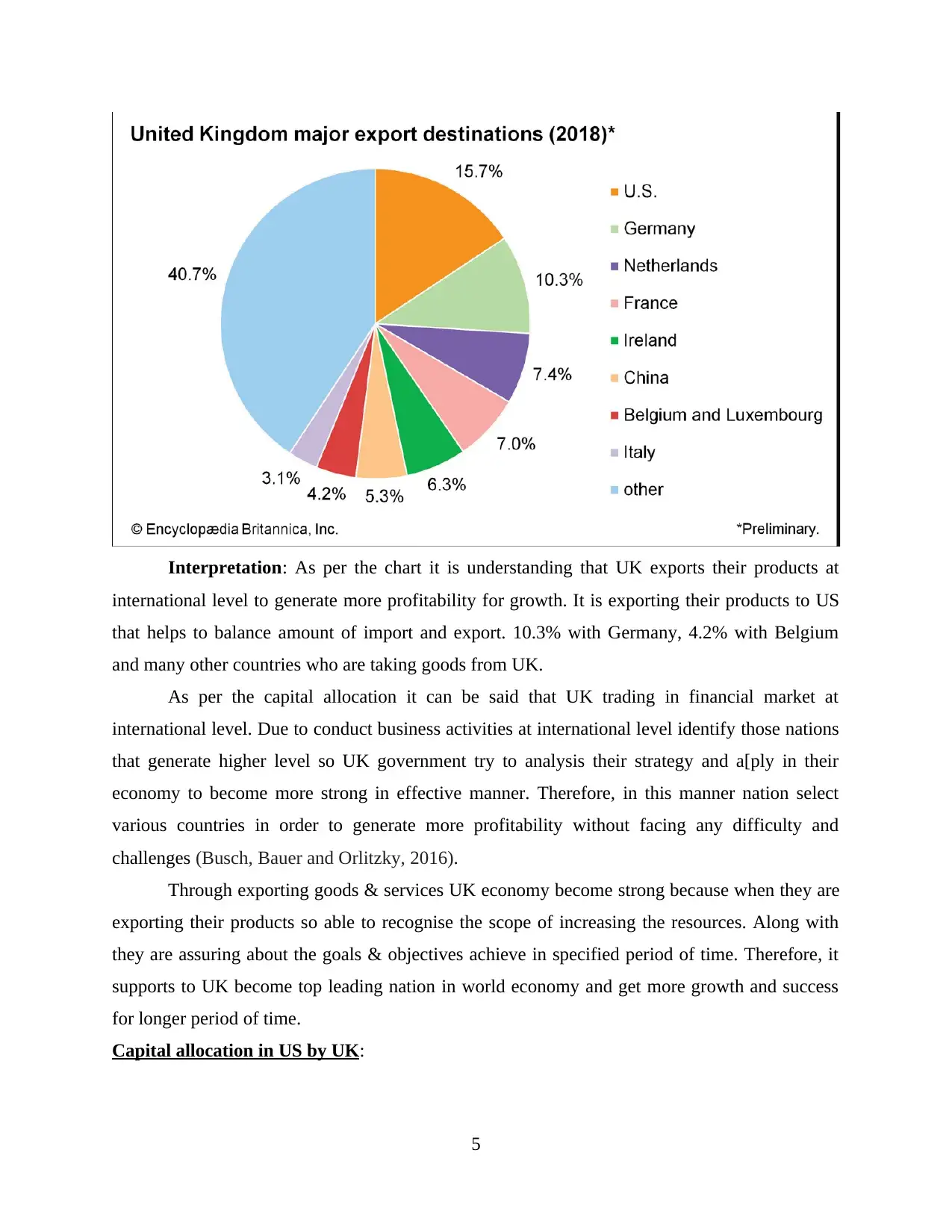

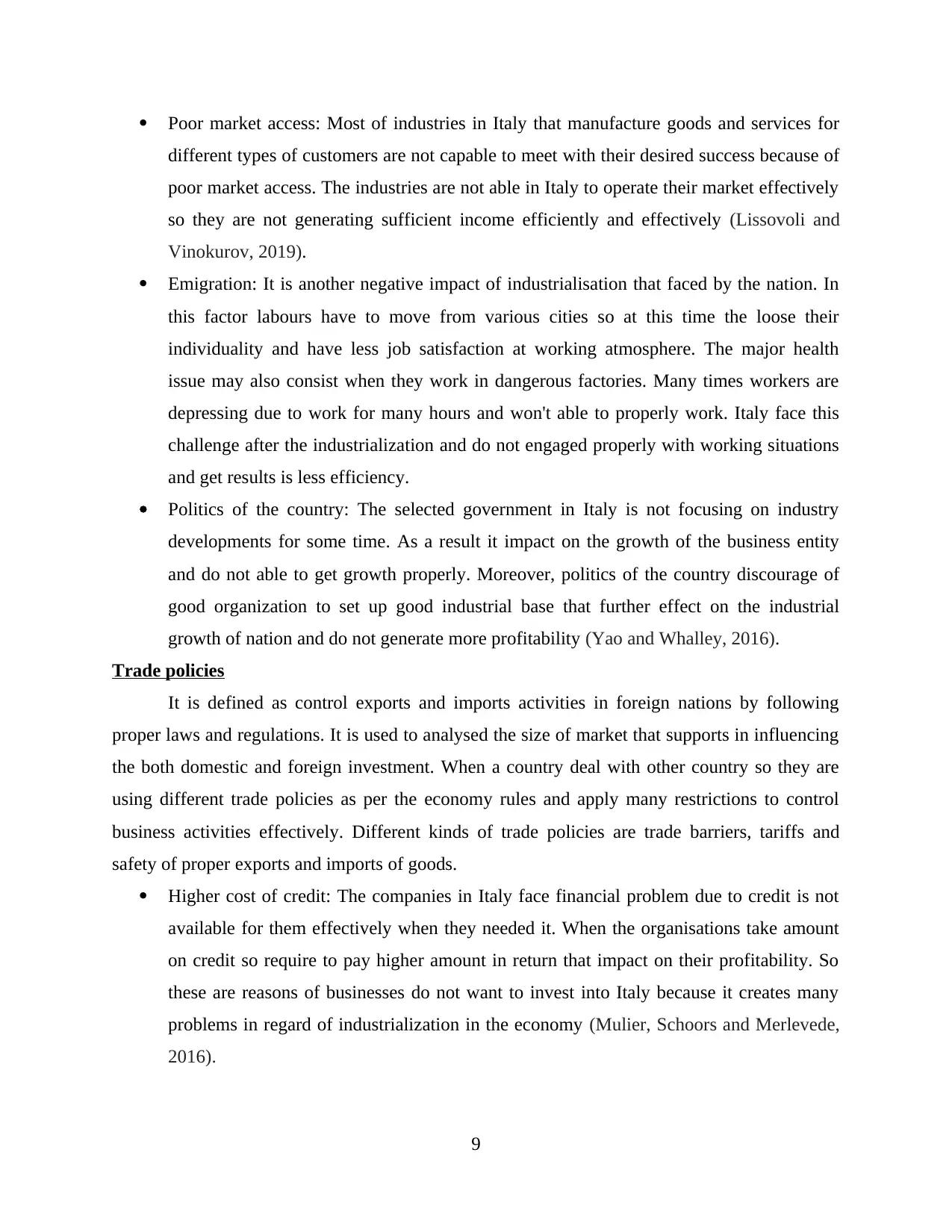

Interpretation: As per the chart it is understanding that UK exports their products at

international level to generate more profitability for growth. It is exporting their products to US

that helps to balance amount of import and export. 10.3% with Germany, 4.2% with Belgium

and many other countries who are taking goods from UK.

As per the capital allocation it can be said that UK trading in financial market at

international level. Due to conduct business activities at international level identify those nations

that generate higher level so UK government try to analysis their strategy and a[ply in their

economy to become more strong in effective manner. Therefore, in this manner nation select

various countries in order to generate more profitability without facing any difficulty and

challenges (Busch, Bauer and Orlitzky, 2016).

Through exporting goods & services UK economy become strong because when they are

exporting their products so able to recognise the scope of increasing the resources. Along with

they are assuring about the goals & objectives achieve in specified period of time. Therefore, it

supports to UK become top leading nation in world economy and get more growth and success

for longer period of time.

Capital allocation in US by UK:

5

international level to generate more profitability for growth. It is exporting their products to US

that helps to balance amount of import and export. 10.3% with Germany, 4.2% with Belgium

and many other countries who are taking goods from UK.

As per the capital allocation it can be said that UK trading in financial market at

international level. Due to conduct business activities at international level identify those nations

that generate higher level so UK government try to analysis their strategy and a[ply in their

economy to become more strong in effective manner. Therefore, in this manner nation select

various countries in order to generate more profitability without facing any difficulty and

challenges (Busch, Bauer and Orlitzky, 2016).

Through exporting goods & services UK economy become strong because when they are

exporting their products so able to recognise the scope of increasing the resources. Along with

they are assuring about the goals & objectives achieve in specified period of time. Therefore, it

supports to UK become top leading nation in world economy and get more growth and success

for longer period of time.

Capital allocation in US by UK:

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

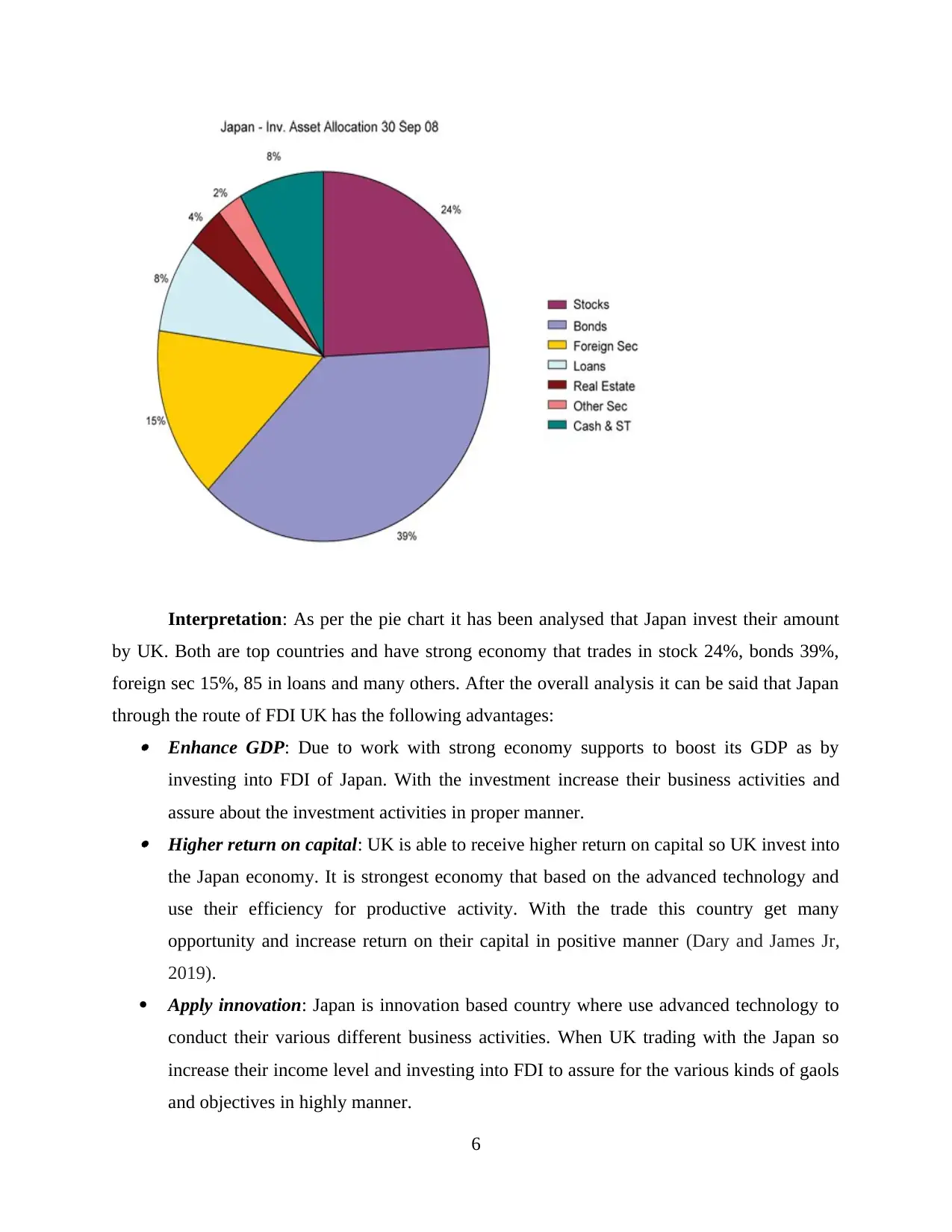

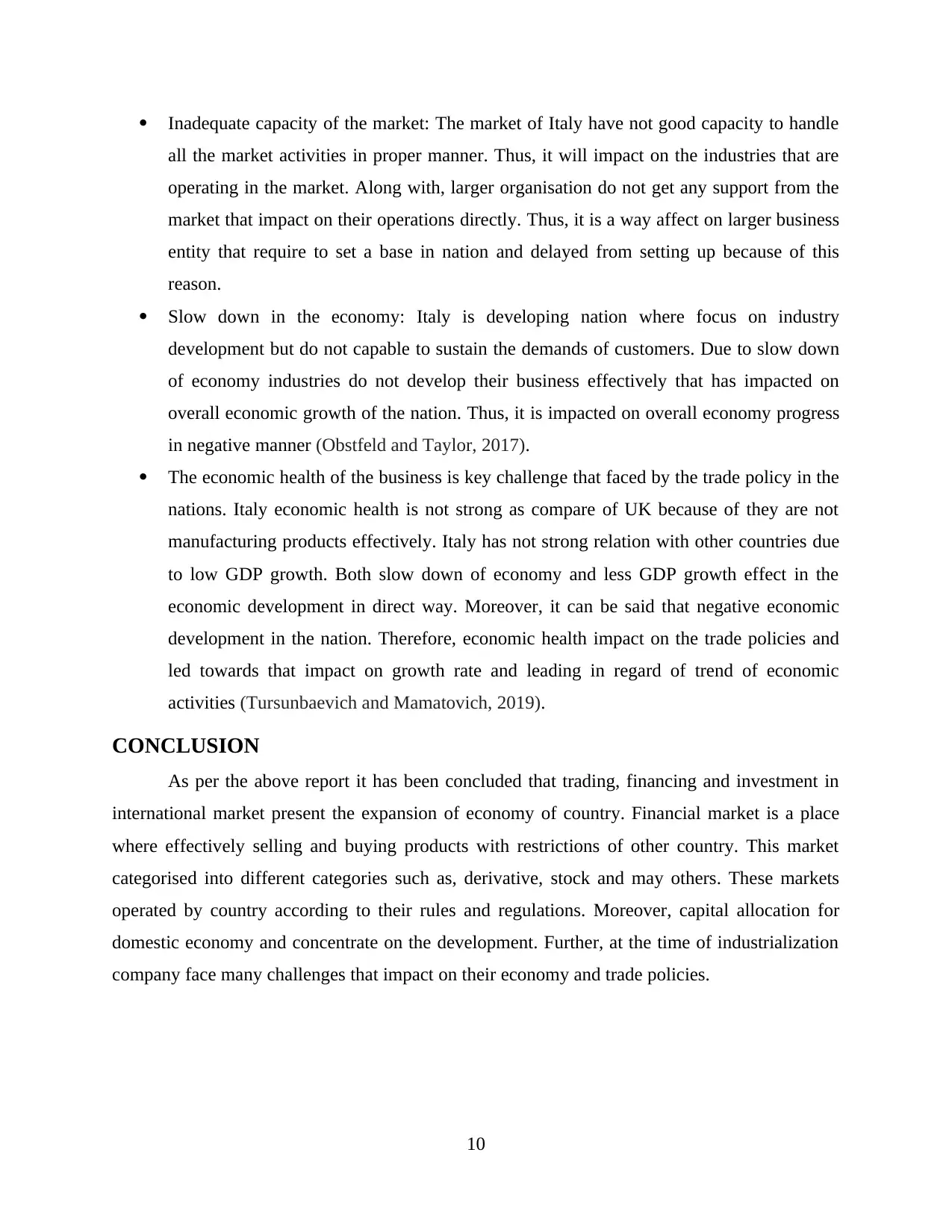

Interpretation: As per the pie chart it has been analysed that Japan invest their amount

by UK. Both are top countries and have strong economy that trades in stock 24%, bonds 39%,

foreign sec 15%, 85 in loans and many others. After the overall analysis it can be said that Japan

through the route of FDI UK has the following advantages: Enhance GDP: Due to work with strong economy supports to boost its GDP as by

investing into FDI of Japan. With the investment increase their business activities and

assure about the investment activities in proper manner. Higher return on capital: UK is able to receive higher return on capital so UK invest into

the Japan economy. It is strongest economy that based on the advanced technology and

use their efficiency for productive activity. With the trade this country get many

opportunity and increase return on their capital in positive manner (Dary and James Jr,

2019).

Apply innovation: Japan is innovation based country where use advanced technology to

conduct their various different business activities. When UK trading with the Japan so

increase their income level and investing into FDI to assure for the various kinds of gaols

and objectives in highly manner.

6

by UK. Both are top countries and have strong economy that trades in stock 24%, bonds 39%,

foreign sec 15%, 85 in loans and many others. After the overall analysis it can be said that Japan

through the route of FDI UK has the following advantages: Enhance GDP: Due to work with strong economy supports to boost its GDP as by

investing into FDI of Japan. With the investment increase their business activities and

assure about the investment activities in proper manner. Higher return on capital: UK is able to receive higher return on capital so UK invest into

the Japan economy. It is strongest economy that based on the advanced technology and

use their efficiency for productive activity. With the trade this country get many

opportunity and increase return on their capital in positive manner (Dary and James Jr,

2019).

Apply innovation: Japan is innovation based country where use advanced technology to

conduct their various different business activities. When UK trading with the Japan so

increase their income level and investing into FDI to assure for the various kinds of gaols

and objectives in highly manner.

6

To better understand of financial market apply different types of theories that use by

nation at the time of international trading:

Gravity theory: This theory use for international trading that attracts other countries to

trade with each other rather than create distance in between each other. With the help of

this theory define trade patterns in regard of differences in the arrangement of technology

and relies on differences in factor as basis of trade. With the help of this theory UK trade

effectively with Japan and identify their trading patterns.

Comparative advantage theory: This theory apply in financial market when apply the

principle of comparative advantage by nations to analysis of goods & services

specialising in producing. This term mainly related with the goods & services and

allocating with the comparative cost advantage (Hofman and Aalbers, 2019).

Summary

From the overall analysis it is summarized that financial market supports to maintain any

nation economy because it impact on the economy in direct manner. Domestic economy mainly

based on the various elements that it is dependent. Along with capital allocation can help to trade

with different countries that beneficial to boost GDP. Moreover in international market like

Japan conduct their activities with UK and effectively trade in regard of UK to manager overall

growth of economy.

TASK 2

Evaluation of economy

Italy has a diversified industrial economy that categorised into developed industrial north

that controlled by private organisations and have no proper development, highly subsidized,

agricultural south and unemployment is high. The economy freedom score is 63.8 making its

economy the 74th freest in the year of 2020. Thus the overall score of economy has been

enhanced by 1.6 points due to improved government integrity score. The main source of income

in the economy is production of machinery, auto mobiles, chemicals and textiles. Along with

country generated income from fashion design and tourism. Moreover, agricultural sector consist

of production mine be strong. Italy is ranked 37th amongst 45 nations in the Europe region and its

overall score is well below the regional average and slightly above the world (Husni, 2020)

(Ibrahim and Alagidede, 2018).

7

nation at the time of international trading:

Gravity theory: This theory use for international trading that attracts other countries to

trade with each other rather than create distance in between each other. With the help of

this theory define trade patterns in regard of differences in the arrangement of technology

and relies on differences in factor as basis of trade. With the help of this theory UK trade

effectively with Japan and identify their trading patterns.

Comparative advantage theory: This theory apply in financial market when apply the

principle of comparative advantage by nations to analysis of goods & services

specialising in producing. This term mainly related with the goods & services and

allocating with the comparative cost advantage (Hofman and Aalbers, 2019).

Summary

From the overall analysis it is summarized that financial market supports to maintain any

nation economy because it impact on the economy in direct manner. Domestic economy mainly

based on the various elements that it is dependent. Along with capital allocation can help to trade

with different countries that beneficial to boost GDP. Moreover in international market like

Japan conduct their activities with UK and effectively trade in regard of UK to manager overall

growth of economy.

TASK 2

Evaluation of economy

Italy has a diversified industrial economy that categorised into developed industrial north

that controlled by private organisations and have no proper development, highly subsidized,

agricultural south and unemployment is high. The economy freedom score is 63.8 making its

economy the 74th freest in the year of 2020. Thus the overall score of economy has been

enhanced by 1.6 points due to improved government integrity score. The main source of income

in the economy is production of machinery, auto mobiles, chemicals and textiles. Along with

country generated income from fashion design and tourism. Moreover, agricultural sector consist

of production mine be strong. Italy is ranked 37th amongst 45 nations in the Europe region and its

overall score is well below the regional average and slightly above the world (Husni, 2020)

(Ibrahim and Alagidede, 2018).

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The Italian economy has been involved in the bottom ranks of the reasonably free

collection for most of the years since the origination of the index in 1995. The GDP growth has

been fall down in past five years that impact on the country in negative manner. The new

government policy provide precedence to higher spending on research, welfare and education.

Along with also spend amount on the incentive for small and medium size businesses and

pension guarantee for young people.

Government size: The top personal income tax rate is considering 43% and corporate tax

rate is 27.5%. along with other taxes consist of value added and inheritance taxes. The country

face tax burden about to 42.4% of total domestic income. Government has invested amount

48.4% of nation's output over the past three years and budget deficits have averaged 2.4% of

GDP. Public debt is related to 132.1% of GDP.

Regulatory efficiency: Taxes has been been enhanced because of exemptions on social

security effort is less. In the year of 2018, the government introduced dignity decree that consist

of incentives for recruitment of workers under the age of 35 year old. For this set limits for short

term contracts that makes it costlier to fire workers. Along with government allows many prices

that set as per the market except for electricity, transportation, pharmaceuticals and many others

(Karolyi, 2016).

Open market: Total value of imports and exports of goods & services equals 61% of

GDP. The average trade weighted implemented tariff value (common among EU members) is

about 1.8% with 637 EU authorization non tariff measure document in force. As per the FDI

analysis of mechanism in different areas with strategic importance that was selected in the year

of 2019. Reshaping and consolidation of the banking sector continue by Italy and decline of

those loans that are not performing well.

Key challenges face by the economy due to industrialisation and trade policies

Unequal income distribution: It is a challenge that face by the Italy economy because it is

carrying out higher gap between rich and poor people that categorised into division of

labour and capita. It supports in accumulation of the excess of income that can easily

derived from the economic activities and supports to economy in disparity income and

wealth. Italy has this advantage also when there is no proper division in the capital. It

become the reason of the large difference in poor and rich people that leads to decline of

economic situation of the nation but no growth of lower class people.

8

collection for most of the years since the origination of the index in 1995. The GDP growth has

been fall down in past five years that impact on the country in negative manner. The new

government policy provide precedence to higher spending on research, welfare and education.

Along with also spend amount on the incentive for small and medium size businesses and

pension guarantee for young people.

Government size: The top personal income tax rate is considering 43% and corporate tax

rate is 27.5%. along with other taxes consist of value added and inheritance taxes. The country

face tax burden about to 42.4% of total domestic income. Government has invested amount

48.4% of nation's output over the past three years and budget deficits have averaged 2.4% of

GDP. Public debt is related to 132.1% of GDP.

Regulatory efficiency: Taxes has been been enhanced because of exemptions on social

security effort is less. In the year of 2018, the government introduced dignity decree that consist

of incentives for recruitment of workers under the age of 35 year old. For this set limits for short

term contracts that makes it costlier to fire workers. Along with government allows many prices

that set as per the market except for electricity, transportation, pharmaceuticals and many others

(Karolyi, 2016).

Open market: Total value of imports and exports of goods & services equals 61% of

GDP. The average trade weighted implemented tariff value (common among EU members) is

about 1.8% with 637 EU authorization non tariff measure document in force. As per the FDI

analysis of mechanism in different areas with strategic importance that was selected in the year

of 2019. Reshaping and consolidation of the banking sector continue by Italy and decline of

those loans that are not performing well.

Key challenges face by the economy due to industrialisation and trade policies

Unequal income distribution: It is a challenge that face by the Italy economy because it is

carrying out higher gap between rich and poor people that categorised into division of

labour and capita. It supports in accumulation of the excess of income that can easily

derived from the economic activities and supports to economy in disparity income and

wealth. Italy has this advantage also when there is no proper division in the capital. It

become the reason of the large difference in poor and rich people that leads to decline of

economic situation of the nation but no growth of lower class people.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Poor market access: Most of industries in Italy that manufacture goods and services for

different types of customers are not capable to meet with their desired success because of

poor market access. The industries are not able in Italy to operate their market effectively

so they are not generating sufficient income efficiently and effectively (Lissovoli and

Vinokurov, 2019).

Emigration: It is another negative impact of industrialisation that faced by the nation. In

this factor labours have to move from various cities so at this time the loose their

individuality and have less job satisfaction at working atmosphere. The major health

issue may also consist when they work in dangerous factories. Many times workers are

depressing due to work for many hours and won't able to properly work. Italy face this

challenge after the industrialization and do not engaged properly with working situations

and get results is less efficiency.

Politics of the country: The selected government in Italy is not focusing on industry

developments for some time. As a result it impact on the growth of the business entity

and do not able to get growth properly. Moreover, politics of the country discourage of

good organization to set up good industrial base that further effect on the industrial

growth of nation and do not generate more profitability (Yao and Whalley, 2016).

Trade policies

It is defined as control exports and imports activities in foreign nations by following

proper laws and regulations. It is used to analysed the size of market that supports in influencing

the both domestic and foreign investment. When a country deal with other country so they are

using different trade policies as per the economy rules and apply many restrictions to control

business activities effectively. Different kinds of trade policies are trade barriers, tariffs and

safety of proper exports and imports of goods.

Higher cost of credit: The companies in Italy face financial problem due to credit is not

available for them effectively when they needed it. When the organisations take amount

on credit so require to pay higher amount in return that impact on their profitability. So

these are reasons of businesses do not want to invest into Italy because it creates many

problems in regard of industrialization in the economy (Mulier, Schoors and Merlevede,

2016).

9

different types of customers are not capable to meet with their desired success because of

poor market access. The industries are not able in Italy to operate their market effectively

so they are not generating sufficient income efficiently and effectively (Lissovoli and

Vinokurov, 2019).

Emigration: It is another negative impact of industrialisation that faced by the nation. In

this factor labours have to move from various cities so at this time the loose their

individuality and have less job satisfaction at working atmosphere. The major health

issue may also consist when they work in dangerous factories. Many times workers are

depressing due to work for many hours and won't able to properly work. Italy face this

challenge after the industrialization and do not engaged properly with working situations

and get results is less efficiency.

Politics of the country: The selected government in Italy is not focusing on industry

developments for some time. As a result it impact on the growth of the business entity

and do not able to get growth properly. Moreover, politics of the country discourage of

good organization to set up good industrial base that further effect on the industrial

growth of nation and do not generate more profitability (Yao and Whalley, 2016).

Trade policies

It is defined as control exports and imports activities in foreign nations by following

proper laws and regulations. It is used to analysed the size of market that supports in influencing

the both domestic and foreign investment. When a country deal with other country so they are

using different trade policies as per the economy rules and apply many restrictions to control

business activities effectively. Different kinds of trade policies are trade barriers, tariffs and

safety of proper exports and imports of goods.

Higher cost of credit: The companies in Italy face financial problem due to credit is not

available for them effectively when they needed it. When the organisations take amount

on credit so require to pay higher amount in return that impact on their profitability. So

these are reasons of businesses do not want to invest into Italy because it creates many

problems in regard of industrialization in the economy (Mulier, Schoors and Merlevede,

2016).

9

Inadequate capacity of the market: The market of Italy have not good capacity to handle

all the market activities in proper manner. Thus, it will impact on the industries that are

operating in the market. Along with, larger organisation do not get any support from the

market that impact on their operations directly. Thus, it is a way affect on larger business

entity that require to set a base in nation and delayed from setting up because of this

reason.

Slow down in the economy: Italy is developing nation where focus on industry

development but do not capable to sustain the demands of customers. Due to slow down

of economy industries do not develop their business effectively that has impacted on

overall economic growth of the nation. Thus, it is impacted on overall economy progress

in negative manner (Obstfeld and Taylor, 2017).

The economic health of the business is key challenge that faced by the trade policy in the

nations. Italy economic health is not strong as compare of UK because of they are not

manufacturing products effectively. Italy has not strong relation with other countries due

to low GDP growth. Both slow down of economy and less GDP growth effect in the

economic development in direct way. Moreover, it can be said that negative economic

development in the nation. Therefore, economic health impact on the trade policies and

led towards that impact on growth rate and leading in regard of trend of economic

activities (Tursunbaevich and Mamatovich, 2019).

CONCLUSION

As per the above report it has been concluded that trading, financing and investment in

international market present the expansion of economy of country. Financial market is a place

where effectively selling and buying products with restrictions of other country. This market

categorised into different categories such as, derivative, stock and may others. These markets

operated by country according to their rules and regulations. Moreover, capital allocation for

domestic economy and concentrate on the development. Further, at the time of industrialization

company face many challenges that impact on their economy and trade policies.

10

all the market activities in proper manner. Thus, it will impact on the industries that are

operating in the market. Along with, larger organisation do not get any support from the

market that impact on their operations directly. Thus, it is a way affect on larger business

entity that require to set a base in nation and delayed from setting up because of this

reason.

Slow down in the economy: Italy is developing nation where focus on industry

development but do not capable to sustain the demands of customers. Due to slow down

of economy industries do not develop their business effectively that has impacted on

overall economic growth of the nation. Thus, it is impacted on overall economy progress

in negative manner (Obstfeld and Taylor, 2017).

The economic health of the business is key challenge that faced by the trade policy in the

nations. Italy economic health is not strong as compare of UK because of they are not

manufacturing products effectively. Italy has not strong relation with other countries due

to low GDP growth. Both slow down of economy and less GDP growth effect in the

economic development in direct way. Moreover, it can be said that negative economic

development in the nation. Therefore, economic health impact on the trade policies and

led towards that impact on growth rate and leading in regard of trend of economic

activities (Tursunbaevich and Mamatovich, 2019).

CONCLUSION

As per the above report it has been concluded that trading, financing and investment in

international market present the expansion of economy of country. Financial market is a place

where effectively selling and buying products with restrictions of other country. This market

categorised into different categories such as, derivative, stock and may others. These markets

operated by country according to their rules and regulations. Moreover, capital allocation for

domestic economy and concentrate on the development. Further, at the time of industrialization

company face many challenges that impact on their economy and trade policies.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.