Financial Analysis of Leadall's FP17 Capital Budgeting Opportunity

VerifiedAdded on 2020/05/08

|11

|1939

|65

Report

AI Summary

This report provides a financial analysis of Leadall's FP17 project, evaluating its capital budgeting opportunity. The analysis utilizes quantitative methods such as Net Present Value (NPV) and discounted payback period to assess the project's profitability and investment recovery timeline. The report includes detailed calculations of cash flows, considering initial investments, operating transactions, and expenses like depreciation and income tax. Furthermore, the report considers qualitative factors such as fund availability, working capital requirements, government regulations, return on capital, and the use of assumptions. The impact of research and development expenses is also assessed. The report concludes with a recommendation to accept the project based on positive NPV and the fulfillment of the required payback period, while acknowledging the importance of considering both quantitative and qualitative aspects in making a sound investment decision. The report also references several academic sources related to capital budgeting and financial management.

1

FINANCIAL MANAGEMENT

FINANCIAL MANAGEMENT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

CONTENT

1. INTRODUCTION 3

2. QUALITATIVE FACTORS 4-6

3. QUANTITATIVE FACTORS 7

4. RECOMMENDATION AND JUSTIFICATION 8-9

6. CONCLUSION 10

CONTENT

1. INTRODUCTION 3

2. QUALITATIVE FACTORS 4-6

3. QUANTITATIVE FACTORS 7

4. RECOMMENDATION AND JUSTIFICATION 8-9

6. CONCLUSION 10

3

INTRODUCTION

A company has to take various decisions in its day to day operation. These decisions must be taken correctly and promptly so that there is a

positive impact on the company. In order to take such decisions there is a common tool used by various companies known as capital budgeting.

Using this tool the company is able to take certain important decisions relating to the capital investment of the company. As there is a huge

capital involved in the project it is necessary to first analyse its impact.

We have been provided with the case study of Leadall, in which we are required to evaluate the opportunity of making FP17. We need to analyse

whether the company will have enough profits or not (Dayananda, 2008). The net present value and discounted payback period will help us to

take decision better.

INTRODUCTION

A company has to take various decisions in its day to day operation. These decisions must be taken correctly and promptly so that there is a

positive impact on the company. In order to take such decisions there is a common tool used by various companies known as capital budgeting.

Using this tool the company is able to take certain important decisions relating to the capital investment of the company. As there is a huge

capital involved in the project it is necessary to first analyse its impact.

We have been provided with the case study of Leadall, in which we are required to evaluate the opportunity of making FP17. We need to analyse

whether the company will have enough profits or not (Dayananda, 2008). The net present value and discounted payback period will help us to

take decision better.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

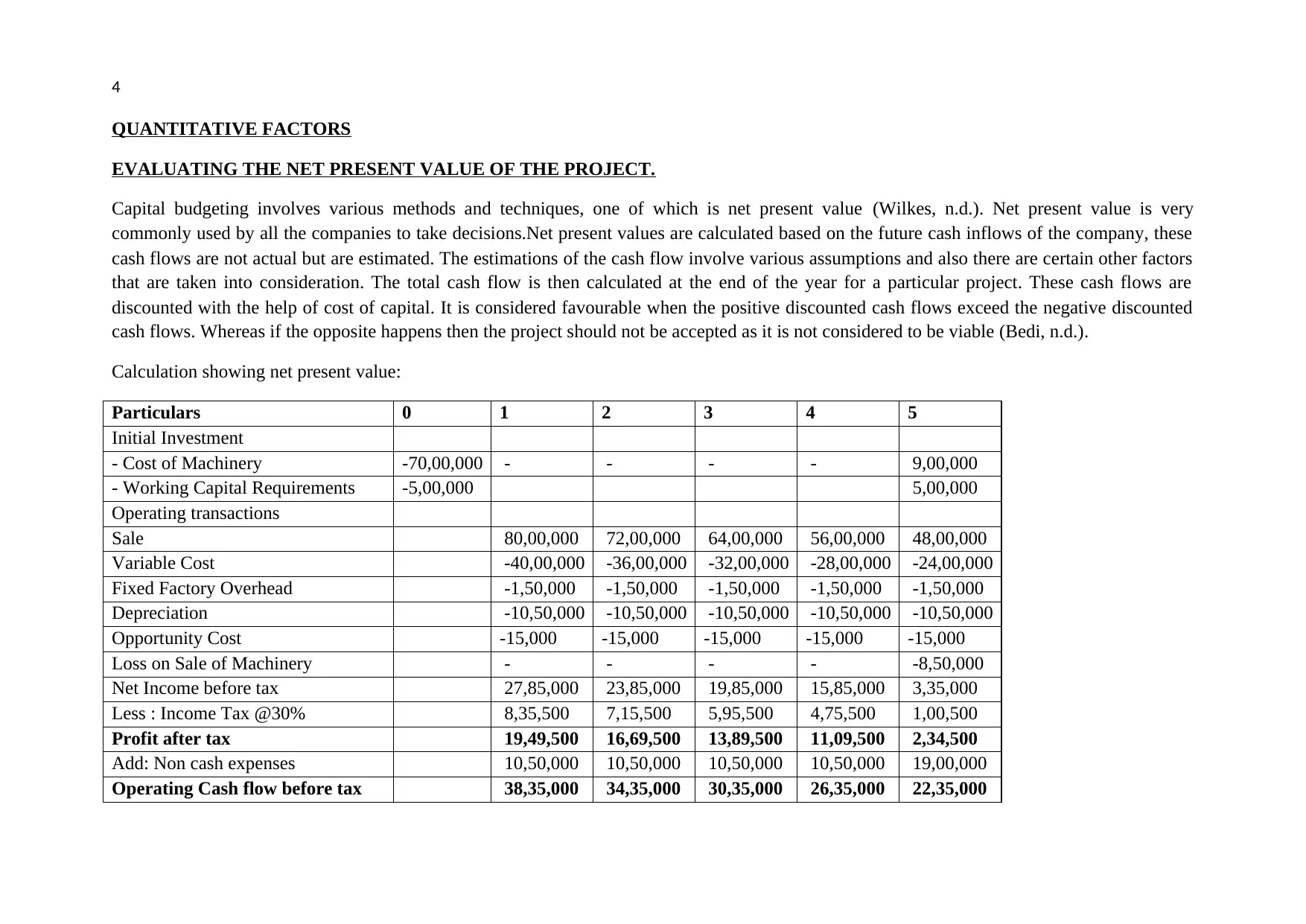

QUANTITATIVE FACTORS

EVALUATING THE NET PRESENT VALUE OF THE PROJECT.

Capital budgeting involves various methods and techniques, one of which is net present value (Wilkes, n.d.). Net present value is very

commonly used by all the companies to take decisions.Net present values are calculated based on the future cash inflows of the company, these

cash flows are not actual but are estimated. The estimations of the cash flow involve various assumptions and also there are certain other factors

that are taken into consideration. The total cash flow is then calculated at the end of the year for a particular project. These cash flows are

discounted with the help of cost of capital. It is considered favourable when the positive discounted cash flows exceed the negative discounted

cash flows. Whereas if the opposite happens then the project should not be accepted as it is not considered to be viable (Bedi, n.d.).

Calculation showing net present value:

Particulars 0 1 2 3 4 5

Initial Investment

- Cost of Machinery -70,00,000 - - - - 9,00,000

- Working Capital Requirements -5,00,000 5,00,000

Operating transactions

Sale 80,00,000 72,00,000 64,00,000 56,00,000 48,00,000

Variable Cost -40,00,000 -36,00,000 -32,00,000 -28,00,000 -24,00,000

Fixed Factory Overhead -1,50,000 -1,50,000 -1,50,000 -1,50,000 -1,50,000

Depreciation -10,50,000 -10,50,000 -10,50,000 -10,50,000 -10,50,000

Opportunity Cost -15,000 -15,000 -15,000 -15,000 -15,000

Loss on Sale of Machinery - - - - -8,50,000

Net Income before tax 27,85,000 23,85,000 19,85,000 15,85,000 3,35,000

Less : Income Tax @30% 8,35,500 7,15,500 5,95,500 4,75,500 1,00,500

Profit after tax 19,49,500 16,69,500 13,89,500 11,09,500 2,34,500

Add: Non cash expenses 10,50,000 10,50,000 10,50,000 10,50,000 19,00,000

Operating Cash flow before tax 38,35,000 34,35,000 30,35,000 26,35,000 22,35,000

QUANTITATIVE FACTORS

EVALUATING THE NET PRESENT VALUE OF THE PROJECT.

Capital budgeting involves various methods and techniques, one of which is net present value (Wilkes, n.d.). Net present value is very

commonly used by all the companies to take decisions.Net present values are calculated based on the future cash inflows of the company, these

cash flows are not actual but are estimated. The estimations of the cash flow involve various assumptions and also there are certain other factors

that are taken into consideration. The total cash flow is then calculated at the end of the year for a particular project. These cash flows are

discounted with the help of cost of capital. It is considered favourable when the positive discounted cash flows exceed the negative discounted

cash flows. Whereas if the opposite happens then the project should not be accepted as it is not considered to be viable (Bedi, n.d.).

Calculation showing net present value:

Particulars 0 1 2 3 4 5

Initial Investment

- Cost of Machinery -70,00,000 - - - - 9,00,000

- Working Capital Requirements -5,00,000 5,00,000

Operating transactions

Sale 80,00,000 72,00,000 64,00,000 56,00,000 48,00,000

Variable Cost -40,00,000 -36,00,000 -32,00,000 -28,00,000 -24,00,000

Fixed Factory Overhead -1,50,000 -1,50,000 -1,50,000 -1,50,000 -1,50,000

Depreciation -10,50,000 -10,50,000 -10,50,000 -10,50,000 -10,50,000

Opportunity Cost -15,000 -15,000 -15,000 -15,000 -15,000

Loss on Sale of Machinery - - - - -8,50,000

Net Income before tax 27,85,000 23,85,000 19,85,000 15,85,000 3,35,000

Less : Income Tax @30% 8,35,500 7,15,500 5,95,500 4,75,500 1,00,500

Profit after tax 19,49,500 16,69,500 13,89,500 11,09,500 2,34,500

Add: Non cash expenses 10,50,000 10,50,000 10,50,000 10,50,000 19,00,000

Operating Cash flow before tax 38,35,000 34,35,000 30,35,000 26,35,000 22,35,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

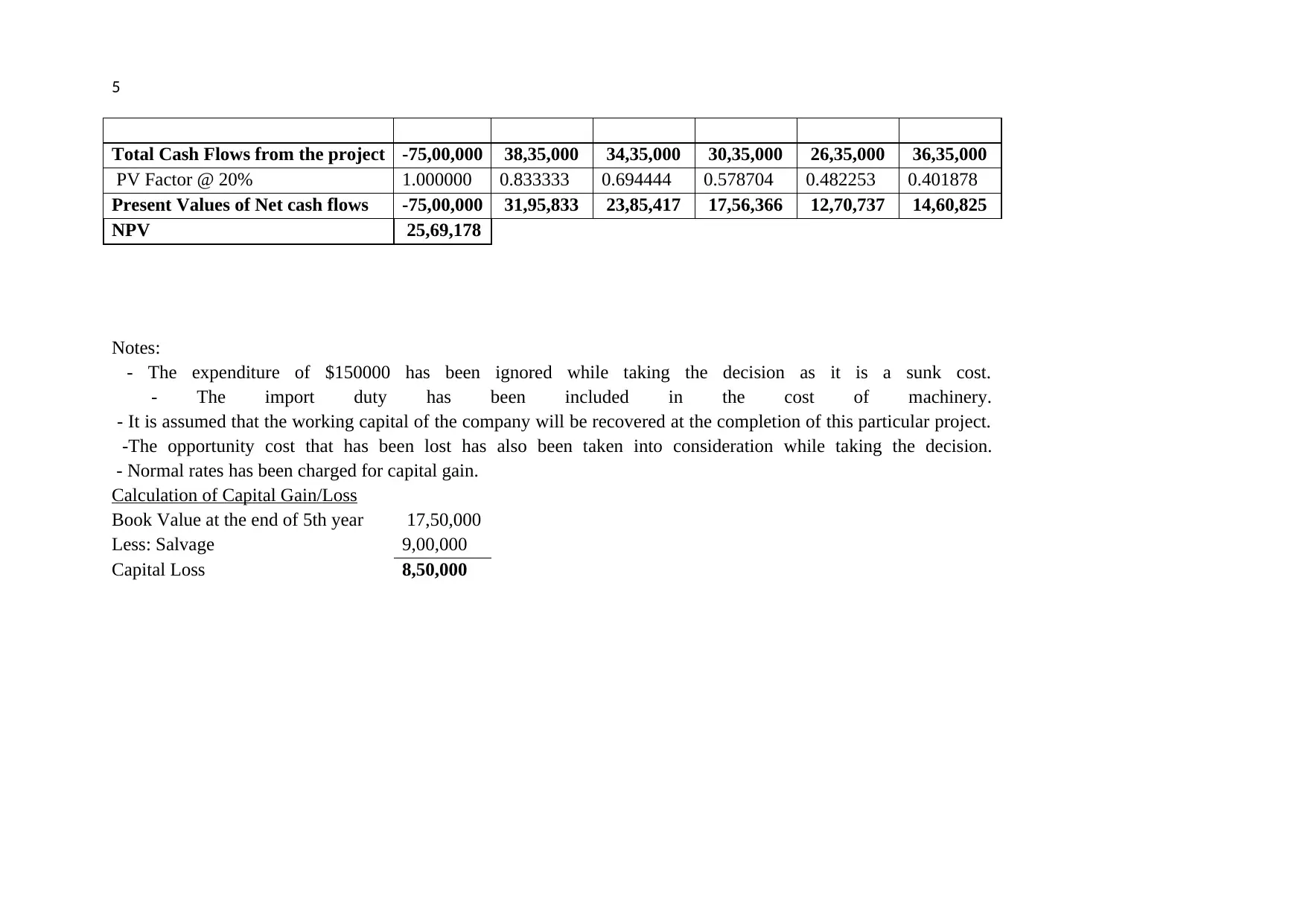

5

Total Cash Flows from the project -75,00,000 38,35,000 34,35,000 30,35,000 26,35,000 36,35,000

PV Factor @ 20% 1.000000 0.833333 0.694444 0.578704 0.482253 0.401878

Present Values of Net cash flows -75,00,000 31,95,833 23,85,417 17,56,366 12,70,737 14,60,825

NPV 25,69,178

Notes:

- The expenditure of $150000 has been ignored while taking the decision as it is a sunk cost.

- The import duty has been included in the cost of machinery.

- It is assumed that the working capital of the company will be recovered at the completion of this particular project.

-The opportunity cost that has been lost has also been taken into consideration while taking the decision.

- Normal rates has been charged for capital gain.

Calculation of Capital Gain/Loss

Book Value at the end of 5th year 17,50,000

Less: Salvage 9,00,000

Capital Loss 8,50,000

Total Cash Flows from the project -75,00,000 38,35,000 34,35,000 30,35,000 26,35,000 36,35,000

PV Factor @ 20% 1.000000 0.833333 0.694444 0.578704 0.482253 0.401878

Present Values of Net cash flows -75,00,000 31,95,833 23,85,417 17,56,366 12,70,737 14,60,825

NPV 25,69,178

Notes:

- The expenditure of $150000 has been ignored while taking the decision as it is a sunk cost.

- The import duty has been included in the cost of machinery.

- It is assumed that the working capital of the company will be recovered at the completion of this particular project.

-The opportunity cost that has been lost has also been taken into consideration while taking the decision.

- Normal rates has been charged for capital gain.

Calculation of Capital Gain/Loss

Book Value at the end of 5th year 17,50,000

Less: Salvage 9,00,000

Capital Loss 8,50,000

6

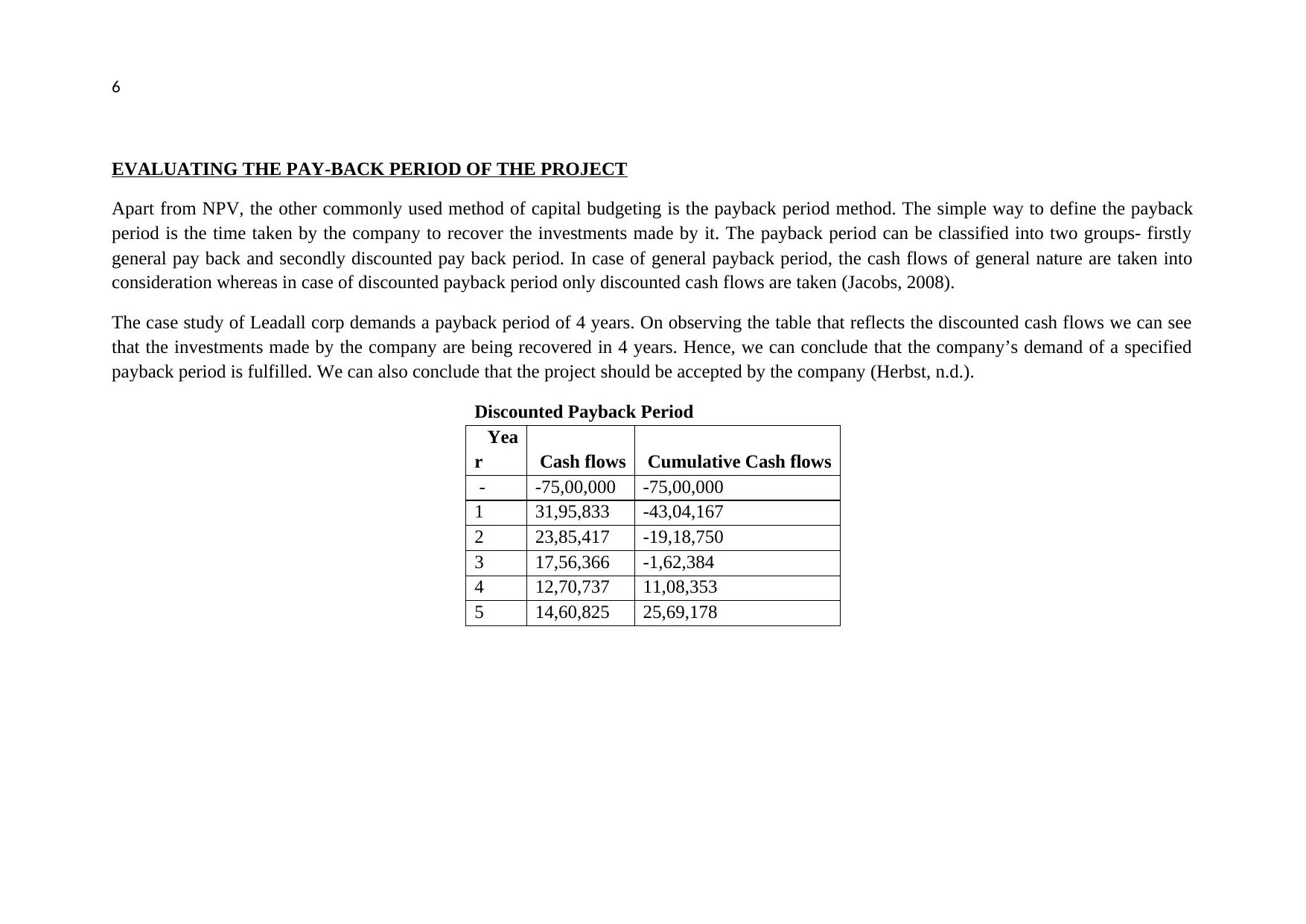

EVALUATING THE PAY-BACK PERIOD OF THE PROJECT

Apart from NPV, the other commonly used method of capital budgeting is the payback period method. The simple way to define the payback

period is the time taken by the company to recover the investments made by it. The payback period can be classified into two groups- firstly

general pay back and secondly discounted pay back period. In case of general payback period, the cash flows of general nature are taken into

consideration whereas in case of discounted payback period only discounted cash flows are taken (Jacobs, 2008).

The case study of Leadall corp demands a payback period of 4 years. On observing the table that reflects the discounted cash flows we can see

that the investments made by the company are being recovered in 4 years. Hence, we can conclude that the company’s demand of a specified

payback period is fulfilled. We can also conclude that the project should be accepted by the company (Herbst, n.d.).

Discounted Payback Period

Yea

r Cash flows Cumulative Cash flows

- -75,00,000 -75,00,000

1 31,95,833 -43,04,167

2 23,85,417 -19,18,750

3 17,56,366 -1,62,384

4 12,70,737 11,08,353

5 14,60,825 25,69,178

EVALUATING THE PAY-BACK PERIOD OF THE PROJECT

Apart from NPV, the other commonly used method of capital budgeting is the payback period method. The simple way to define the payback

period is the time taken by the company to recover the investments made by it. The payback period can be classified into two groups- firstly

general pay back and secondly discounted pay back period. In case of general payback period, the cash flows of general nature are taken into

consideration whereas in case of discounted payback period only discounted cash flows are taken (Jacobs, 2008).

The case study of Leadall corp demands a payback period of 4 years. On observing the table that reflects the discounted cash flows we can see

that the investments made by the company are being recovered in 4 years. Hence, we can conclude that the company’s demand of a specified

payback period is fulfilled. We can also conclude that the project should be accepted by the company (Herbst, n.d.).

Discounted Payback Period

Yea

r Cash flows Cumulative Cash flows

- -75,00,000 -75,00,000

1 31,95,833 -43,04,167

2 23,85,417 -19,18,750

3 17,56,366 -1,62,384

4 12,70,737 11,08,353

5 14,60,825 25,69,178

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7

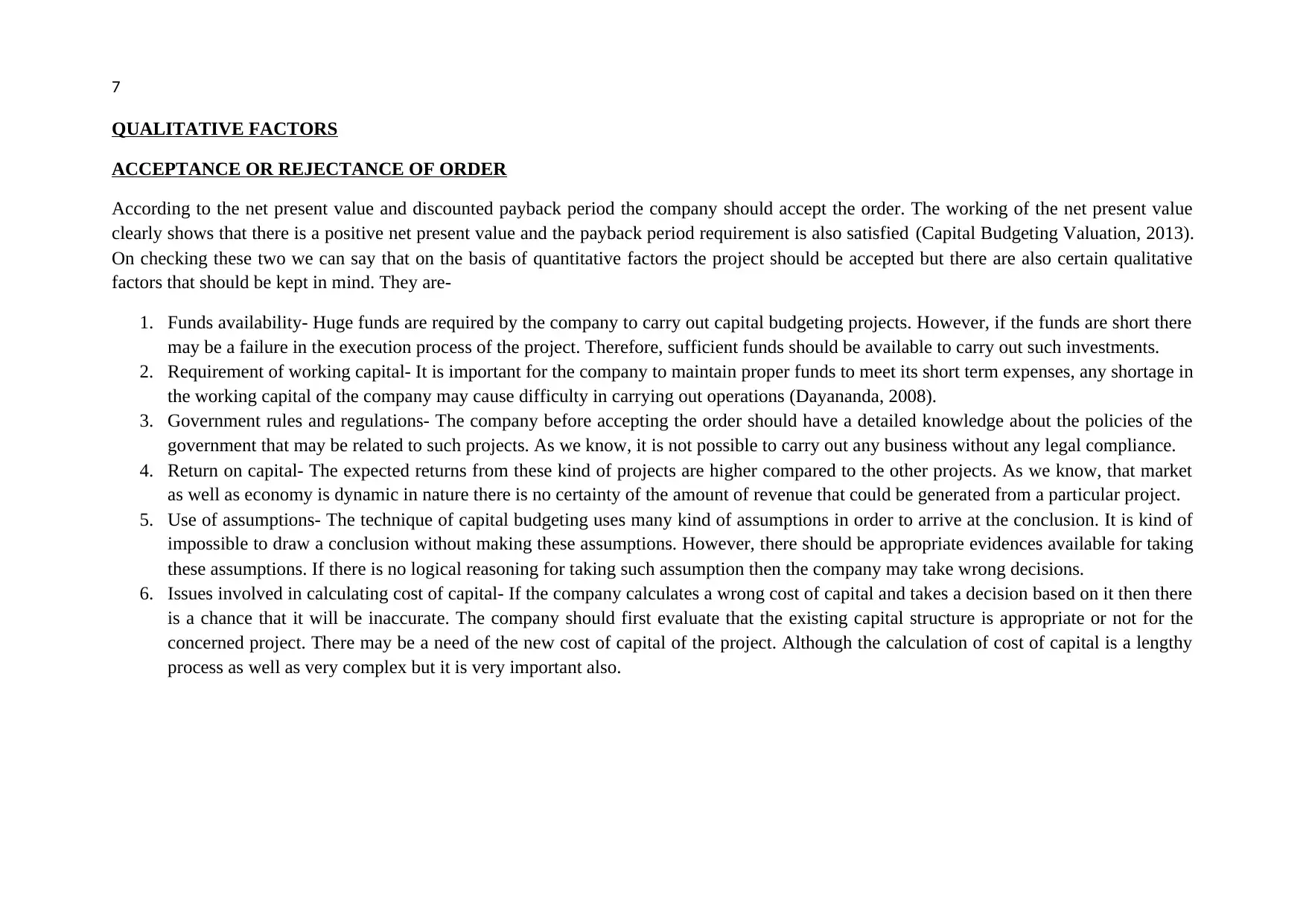

QUALITATIVE FACTORS

ACCEPTANCE OR REJECTANCE OF ORDER

According to the net present value and discounted payback period the company should accept the order. The working of the net present value

clearly shows that there is a positive net present value and the payback period requirement is also satisfied (Capital Budgeting Valuation, 2013).

On checking these two we can say that on the basis of quantitative factors the project should be accepted but there are also certain qualitative

factors that should be kept in mind. They are-

1. Funds availability- Huge funds are required by the company to carry out capital budgeting projects. However, if the funds are short there

may be a failure in the execution process of the project. Therefore, sufficient funds should be available to carry out such investments.

2. Requirement of working capital- It is important for the company to maintain proper funds to meet its short term expenses, any shortage in

the working capital of the company may cause difficulty in carrying out operations (Dayananda, 2008).

3. Government rules and regulations- The company before accepting the order should have a detailed knowledge about the policies of the

government that may be related to such projects. As we know, it is not possible to carry out any business without any legal compliance.

4. Return on capital- The expected returns from these kind of projects are higher compared to the other projects. As we know, that market

as well as economy is dynamic in nature there is no certainty of the amount of revenue that could be generated from a particular project.

5. Use of assumptions- The technique of capital budgeting uses many kind of assumptions in order to arrive at the conclusion. It is kind of

impossible to draw a conclusion without making these assumptions. However, there should be appropriate evidences available for taking

these assumptions. If there is no logical reasoning for taking such assumption then the company may take wrong decisions.

6. Issues involved in calculating cost of capital- If the company calculates a wrong cost of capital and takes a decision based on it then there

is a chance that it will be inaccurate. The company should first evaluate that the existing capital structure is appropriate or not for the

concerned project. There may be a need of the new cost of capital of the project. Although the calculation of cost of capital is a lengthy

process as well as very complex but it is very important also.

QUALITATIVE FACTORS

ACCEPTANCE OR REJECTANCE OF ORDER

According to the net present value and discounted payback period the company should accept the order. The working of the net present value

clearly shows that there is a positive net present value and the payback period requirement is also satisfied (Capital Budgeting Valuation, 2013).

On checking these two we can say that on the basis of quantitative factors the project should be accepted but there are also certain qualitative

factors that should be kept in mind. They are-

1. Funds availability- Huge funds are required by the company to carry out capital budgeting projects. However, if the funds are short there

may be a failure in the execution process of the project. Therefore, sufficient funds should be available to carry out such investments.

2. Requirement of working capital- It is important for the company to maintain proper funds to meet its short term expenses, any shortage in

the working capital of the company may cause difficulty in carrying out operations (Dayananda, 2008).

3. Government rules and regulations- The company before accepting the order should have a detailed knowledge about the policies of the

government that may be related to such projects. As we know, it is not possible to carry out any business without any legal compliance.

4. Return on capital- The expected returns from these kind of projects are higher compared to the other projects. As we know, that market

as well as economy is dynamic in nature there is no certainty of the amount of revenue that could be generated from a particular project.

5. Use of assumptions- The technique of capital budgeting uses many kind of assumptions in order to arrive at the conclusion. It is kind of

impossible to draw a conclusion without making these assumptions. However, there should be appropriate evidences available for taking

these assumptions. If there is no logical reasoning for taking such assumption then the company may take wrong decisions.

6. Issues involved in calculating cost of capital- If the company calculates a wrong cost of capital and takes a decision based on it then there

is a chance that it will be inaccurate. The company should first evaluate that the existing capital structure is appropriate or not for the

concerned project. There may be a need of the new cost of capital of the project. Although the calculation of cost of capital is a lengthy

process as well as very complex but it is very important also.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

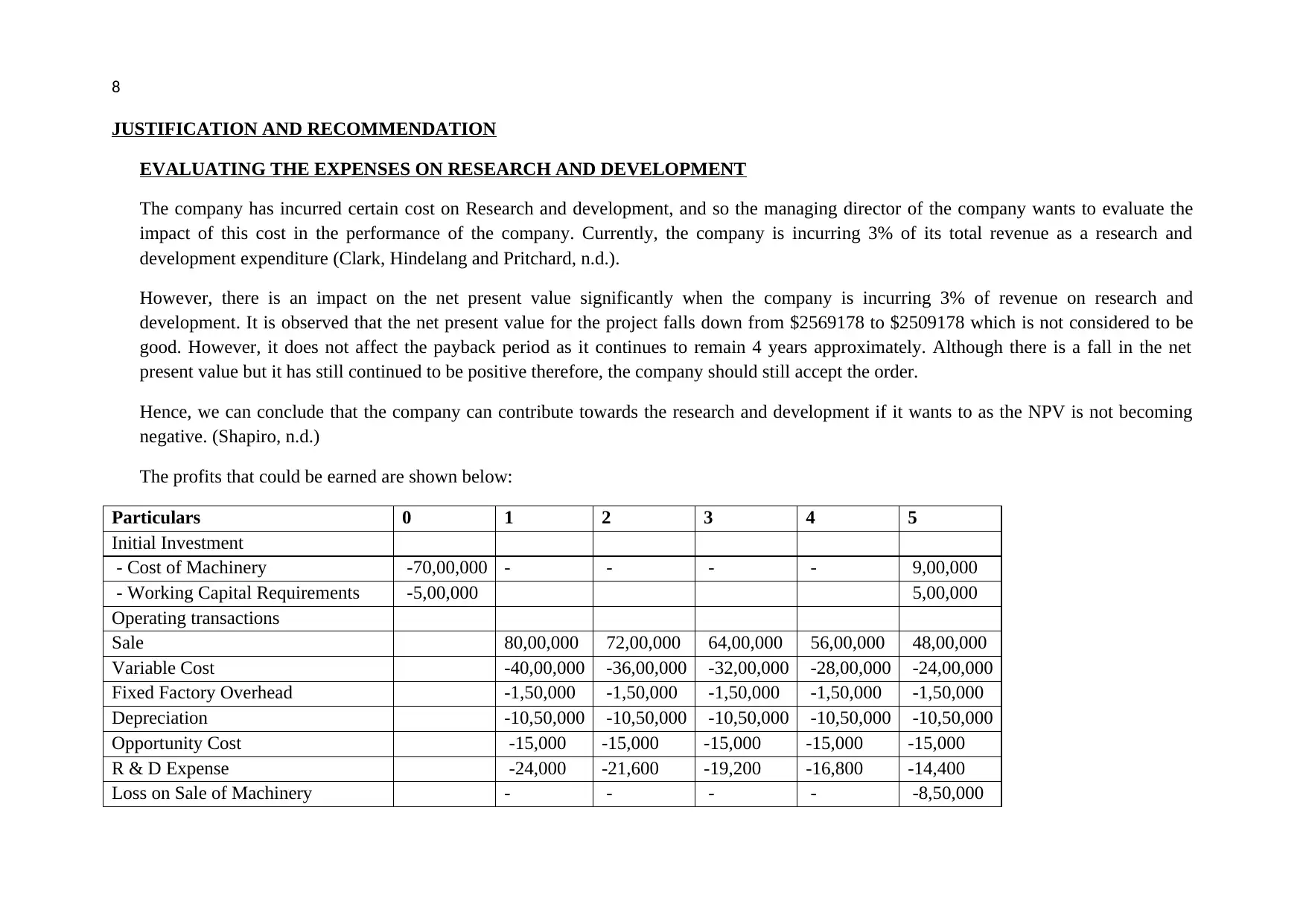

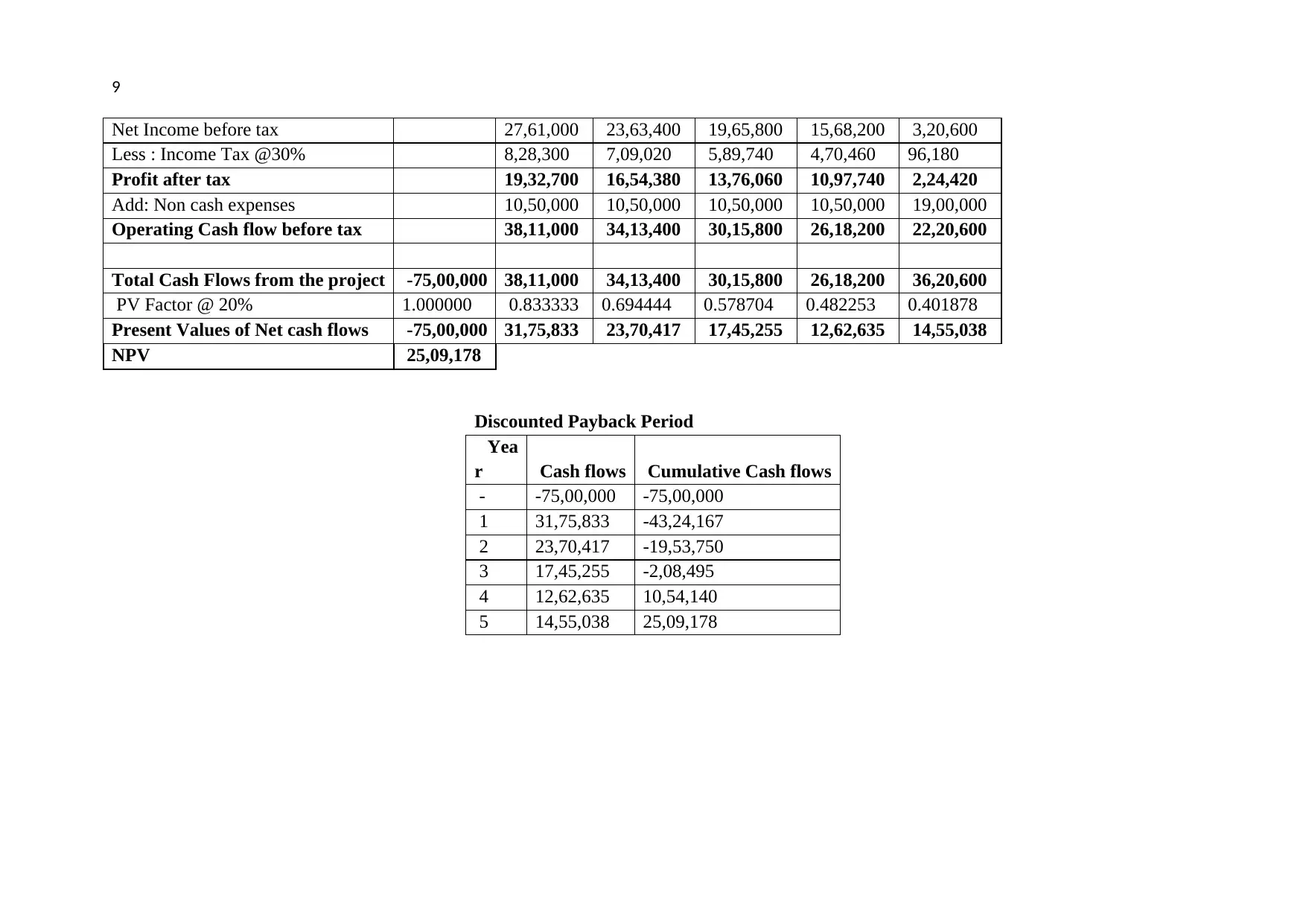

JUSTIFICATION AND RECOMMENDATION

EVALUATING THE EXPENSES ON RESEARCH AND DEVELOPMENT

The company has incurred certain cost on Research and development, and so the managing director of the company wants to evaluate the

impact of this cost in the performance of the company. Currently, the company is incurring 3% of its total revenue as a research and

development expenditure (Clark, Hindelang and Pritchard, n.d.).

However, there is an impact on the net present value significantly when the company is incurring 3% of revenue on research and

development. It is observed that the net present value for the project falls down from $2569178 to $2509178 which is not considered to be

good. However, it does not affect the payback period as it continues to remain 4 years approximately. Although there is a fall in the net

present value but it has still continued to be positive therefore, the company should still accept the order.

Hence, we can conclude that the company can contribute towards the research and development if it wants to as the NPV is not becoming

negative. (Shapiro, n.d.)

The profits that could be earned are shown below:

Particulars 0 1 2 3 4 5

Initial Investment

- Cost of Machinery -70,00,000 - - - - 9,00,000

- Working Capital Requirements -5,00,000 5,00,000

Operating transactions

Sale 80,00,000 72,00,000 64,00,000 56,00,000 48,00,000

Variable Cost -40,00,000 -36,00,000 -32,00,000 -28,00,000 -24,00,000

Fixed Factory Overhead -1,50,000 -1,50,000 -1,50,000 -1,50,000 -1,50,000

Depreciation -10,50,000 -10,50,000 -10,50,000 -10,50,000 -10,50,000

Opportunity Cost -15,000 -15,000 -15,000 -15,000 -15,000

R & D Expense -24,000 -21,600 -19,200 -16,800 -14,400

Loss on Sale of Machinery - - - - -8,50,000

JUSTIFICATION AND RECOMMENDATION

EVALUATING THE EXPENSES ON RESEARCH AND DEVELOPMENT

The company has incurred certain cost on Research and development, and so the managing director of the company wants to evaluate the

impact of this cost in the performance of the company. Currently, the company is incurring 3% of its total revenue as a research and

development expenditure (Clark, Hindelang and Pritchard, n.d.).

However, there is an impact on the net present value significantly when the company is incurring 3% of revenue on research and

development. It is observed that the net present value for the project falls down from $2569178 to $2509178 which is not considered to be

good. However, it does not affect the payback period as it continues to remain 4 years approximately. Although there is a fall in the net

present value but it has still continued to be positive therefore, the company should still accept the order.

Hence, we can conclude that the company can contribute towards the research and development if it wants to as the NPV is not becoming

negative. (Shapiro, n.d.)

The profits that could be earned are shown below:

Particulars 0 1 2 3 4 5

Initial Investment

- Cost of Machinery -70,00,000 - - - - 9,00,000

- Working Capital Requirements -5,00,000 5,00,000

Operating transactions

Sale 80,00,000 72,00,000 64,00,000 56,00,000 48,00,000

Variable Cost -40,00,000 -36,00,000 -32,00,000 -28,00,000 -24,00,000

Fixed Factory Overhead -1,50,000 -1,50,000 -1,50,000 -1,50,000 -1,50,000

Depreciation -10,50,000 -10,50,000 -10,50,000 -10,50,000 -10,50,000

Opportunity Cost -15,000 -15,000 -15,000 -15,000 -15,000

R & D Expense -24,000 -21,600 -19,200 -16,800 -14,400

Loss on Sale of Machinery - - - - -8,50,000

9

Net Income before tax 27,61,000 23,63,400 19,65,800 15,68,200 3,20,600

Less : Income Tax @30% 8,28,300 7,09,020 5,89,740 4,70,460 96,180

Profit after tax 19,32,700 16,54,380 13,76,060 10,97,740 2,24,420

Add: Non cash expenses 10,50,000 10,50,000 10,50,000 10,50,000 19,00,000

Operating Cash flow before tax 38,11,000 34,13,400 30,15,800 26,18,200 22,20,600

Total Cash Flows from the project -75,00,000 38,11,000 34,13,400 30,15,800 26,18,200 36,20,600

PV Factor @ 20% 1.000000 0.833333 0.694444 0.578704 0.482253 0.401878

Present Values of Net cash flows -75,00,000 31,75,833 23,70,417 17,45,255 12,62,635 14,55,038

NPV 25,09,178

Discounted Payback Period

Yea

r Cash flows Cumulative Cash flows

- -75,00,000 -75,00,000

1 31,75,833 -43,24,167

2 23,70,417 -19,53,750

3 17,45,255 -2,08,495

4 12,62,635 10,54,140

5 14,55,038 25,09,178

Net Income before tax 27,61,000 23,63,400 19,65,800 15,68,200 3,20,600

Less : Income Tax @30% 8,28,300 7,09,020 5,89,740 4,70,460 96,180

Profit after tax 19,32,700 16,54,380 13,76,060 10,97,740 2,24,420

Add: Non cash expenses 10,50,000 10,50,000 10,50,000 10,50,000 19,00,000

Operating Cash flow before tax 38,11,000 34,13,400 30,15,800 26,18,200 22,20,600

Total Cash Flows from the project -75,00,000 38,11,000 34,13,400 30,15,800 26,18,200 36,20,600

PV Factor @ 20% 1.000000 0.833333 0.694444 0.578704 0.482253 0.401878

Present Values of Net cash flows -75,00,000 31,75,833 23,70,417 17,45,255 12,62,635 14,55,038

NPV 25,09,178

Discounted Payback Period

Yea

r Cash flows Cumulative Cash flows

- -75,00,000 -75,00,000

1 31,75,833 -43,24,167

2 23,70,417 -19,53,750

3 17,45,255 -2,08,495

4 12,62,635 10,54,140

5 14,55,038 25,09,178

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10

CONCLUSION

Capital budgeting technique is widely used by many companies as it has proved itself to be useful for decision making. We could help in

evaluating and analysing the outcome of the acceptance of this project only because of its application. After a detailed study, now we could

conclude that the company should accept the project on the basis of quantitative factors (Goel, 2015).

CONCLUSION

Capital budgeting technique is widely used by many companies as it has proved itself to be useful for decision making. We could help in

evaluating and analysing the outcome of the acceptance of this project only because of its application. After a detailed study, now we could

conclude that the company should accept the project on the basis of quantitative factors (Goel, 2015).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11

REFERENCES:

Bedi, A. (n.d.). Capital budgeting. New Delhi: Deep & Deep Publications.

Capital Budgeting Valuation. (2013). Hoboken, N.J.: Wiley.

Clark, J., Hindelang, T. and Pritchard, R. (n.d.). Capital budgeting. Englewood Cliffs, N.J.: Prentice-Hall.

Dayananda, D. (2008). Capital budgeting. New York: Cambridge University Press.

Goel, S. (2015). Capital Budgeting. Business Expert Press.

Herbst, A. (n.d.). Capital budgeting. Cambridge, Angleterre: Harper & Row.

Jacobs, D. (2008). A review of capital budgeting practices. Washington, D.C.: International Monetary Fund, Fiscal Affairs Dept.

Peterson, P. and Fabozzi, F. (n.d.). Capital budgeting. New York: Wiley & Sons.

Shapiro, A. (n.d.). Capital budgeting and investment analysis. Upper Saddle River, NJ: Pearson/Prentice Hall.

Wilkes, F. (n.d.). Capital budgeting techniques. Chichester: John Wiley & Sons.

REFERENCES:

Bedi, A. (n.d.). Capital budgeting. New Delhi: Deep & Deep Publications.

Capital Budgeting Valuation. (2013). Hoboken, N.J.: Wiley.

Clark, J., Hindelang, T. and Pritchard, R. (n.d.). Capital budgeting. Englewood Cliffs, N.J.: Prentice-Hall.

Dayananda, D. (2008). Capital budgeting. New York: Cambridge University Press.

Goel, S. (2015). Capital Budgeting. Business Expert Press.

Herbst, A. (n.d.). Capital budgeting. Cambridge, Angleterre: Harper & Row.

Jacobs, D. (2008). A review of capital budgeting practices. Washington, D.C.: International Monetary Fund, Fiscal Affairs Dept.

Peterson, P. and Fabozzi, F. (n.d.). Capital budgeting. New York: Wiley & Sons.

Shapiro, A. (n.d.). Capital budgeting and investment analysis. Upper Saddle River, NJ: Pearson/Prentice Hall.

Wilkes, F. (n.d.). Capital budgeting techniques. Chichester: John Wiley & Sons.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.