Comprehensive Report on Accounting and Finance Principles

VerifiedAdded on 2020/11/23

|16

|3672

|316

Report

AI Summary

This report provides a comprehensive overview of accounting and finance principles, covering various fundamental models and techniques relevant to financial and management accounting. It includes an income statement and statement of financial position. The report delves into break-even analysis, calculating the break-even point and margin of safety. It assesses the impact of a marketing strategy on profitability, and explains the underpinning assumptions of the break-even model. Furthermore, the report calculates the payback period, accounting rate of return, and net present value, discussing investment appraisal techniques and the role of budgets in strategic planning. The analysis includes calculations and interpretations, evaluating the financial health and strategic decisions of Clarkenpark Ltd.

INTRODUCTION TO

ACCOUNTING AND

FINANCE

ACCOUNTING AND

FINANCE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

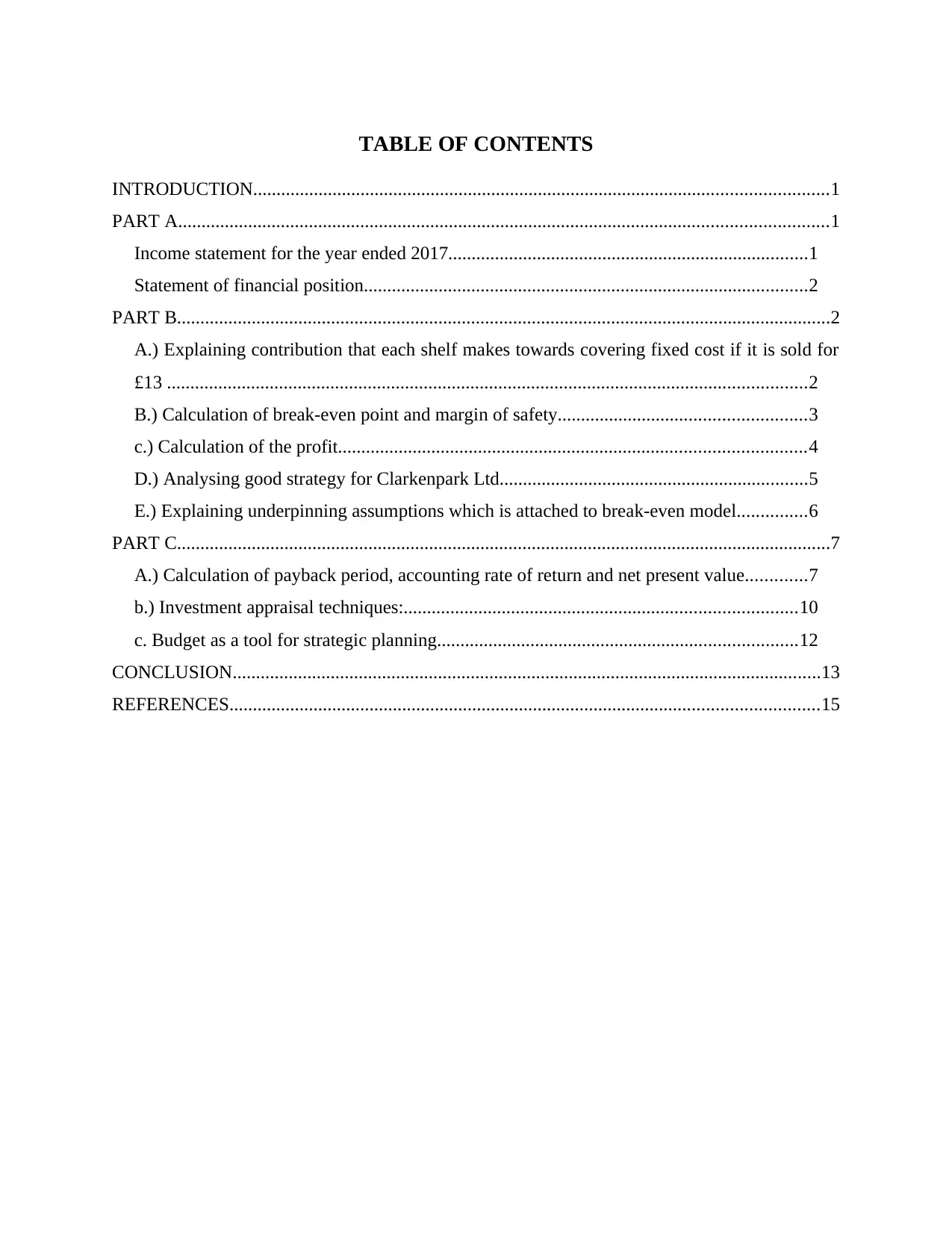

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

PART A...........................................................................................................................................1

Income statement for the year ended 2017.............................................................................1

Statement of financial position...............................................................................................2

PART B............................................................................................................................................2

A.) Explaining contribution that each shelf makes towards covering fixed cost if it is sold for

£13 .........................................................................................................................................2

B.) Calculation of break-even point and margin of safety.....................................................3

c.) Calculation of the profit....................................................................................................4

D.) Analysing good strategy for Clarkenpark Ltd..................................................................5

E.) Explaining underpinning assumptions which is attached to break-even model...............6

PART C............................................................................................................................................7

A.) Calculation of payback period, accounting rate of return and net present value.............7

b.) Investment appraisal techniques:....................................................................................10

c. Budget as a tool for strategic planning.............................................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................1

PART A...........................................................................................................................................1

Income statement for the year ended 2017.............................................................................1

Statement of financial position...............................................................................................2

PART B............................................................................................................................................2

A.) Explaining contribution that each shelf makes towards covering fixed cost if it is sold for

£13 .........................................................................................................................................2

B.) Calculation of break-even point and margin of safety.....................................................3

c.) Calculation of the profit....................................................................................................4

D.) Analysing good strategy for Clarkenpark Ltd..................................................................5

E.) Explaining underpinning assumptions which is attached to break-even model...............6

PART C............................................................................................................................................7

A.) Calculation of payback period, accounting rate of return and net present value.............7

b.) Investment appraisal techniques:....................................................................................10

c. Budget as a tool for strategic planning.............................................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................15

INTRODUCTION

Accounting can be defined as a system with the help of which accountant delivers all the

financial informations of the company. On the other hand, finance refers to a system which is

concerned with dealing with cost, assets, and liabilities of the company as to enable the company

in having better management of them. The present report provides a brief information about

various fundamental models and techniques of financial accounting and management accounting

that need to be comply by a business. The report provides a detailed explanation of the

advantages and limitations of the various investment appraisal techniques. Further, it also

provides key merits and demerits of budgets being a tool of the strategic planning. In addition,

the study also shows some calculations relating to the NRR and NPV methods of financial

accounting system.

PART A

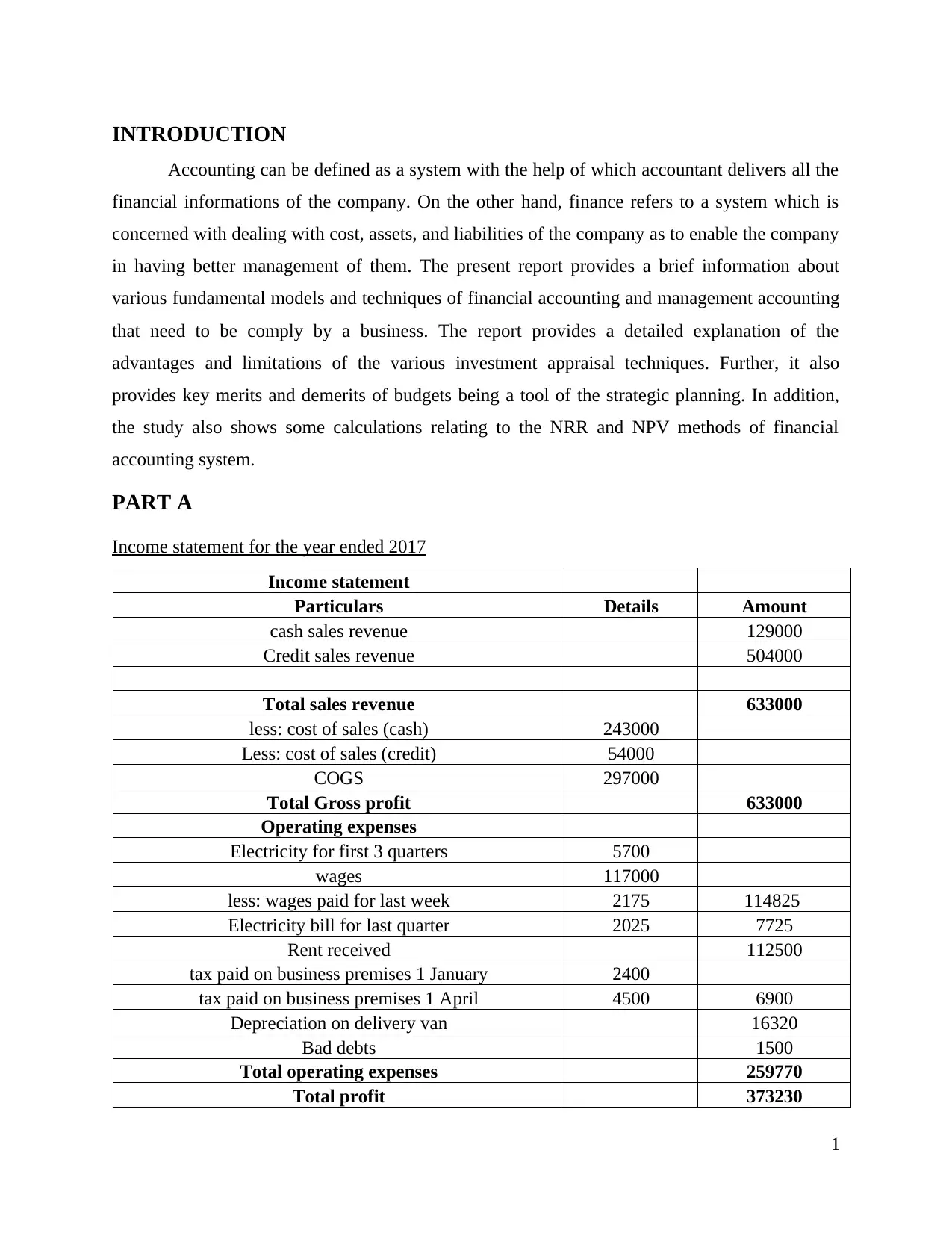

Income statement for the year ended 2017

Income statement

Particulars Details Amount

cash sales revenue 129000

Credit sales revenue 504000

Total sales revenue 633000

less: cost of sales (cash) 243000

Less: cost of sales (credit) 54000

COGS 297000

Total Gross profit 633000

Operating expenses

Electricity for first 3 quarters 5700

wages 117000

less: wages paid for last week 2175 114825

Electricity bill for last quarter 2025 7725

Rent received 112500

tax paid on business premises 1 January 2400

tax paid on business premises 1 April 4500 6900

Depreciation on delivery van 16320

Bad debts 1500

Total operating expenses 259770

Total profit 373230

1

Accounting can be defined as a system with the help of which accountant delivers all the

financial informations of the company. On the other hand, finance refers to a system which is

concerned with dealing with cost, assets, and liabilities of the company as to enable the company

in having better management of them. The present report provides a brief information about

various fundamental models and techniques of financial accounting and management accounting

that need to be comply by a business. The report provides a detailed explanation of the

advantages and limitations of the various investment appraisal techniques. Further, it also

provides key merits and demerits of budgets being a tool of the strategic planning. In addition,

the study also shows some calculations relating to the NRR and NPV methods of financial

accounting system.

PART A

Income statement for the year ended 2017

Income statement

Particulars Details Amount

cash sales revenue 129000

Credit sales revenue 504000

Total sales revenue 633000

less: cost of sales (cash) 243000

Less: cost of sales (credit) 54000

COGS 297000

Total Gross profit 633000

Operating expenses

Electricity for first 3 quarters 5700

wages 117000

less: wages paid for last week 2175 114825

Electricity bill for last quarter 2025 7725

Rent received 112500

tax paid on business premises 1 January 2400

tax paid on business premises 1 April 4500 6900

Depreciation on delivery van 16320

Bad debts 1500

Total operating expenses 259770

Total profit 373230

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

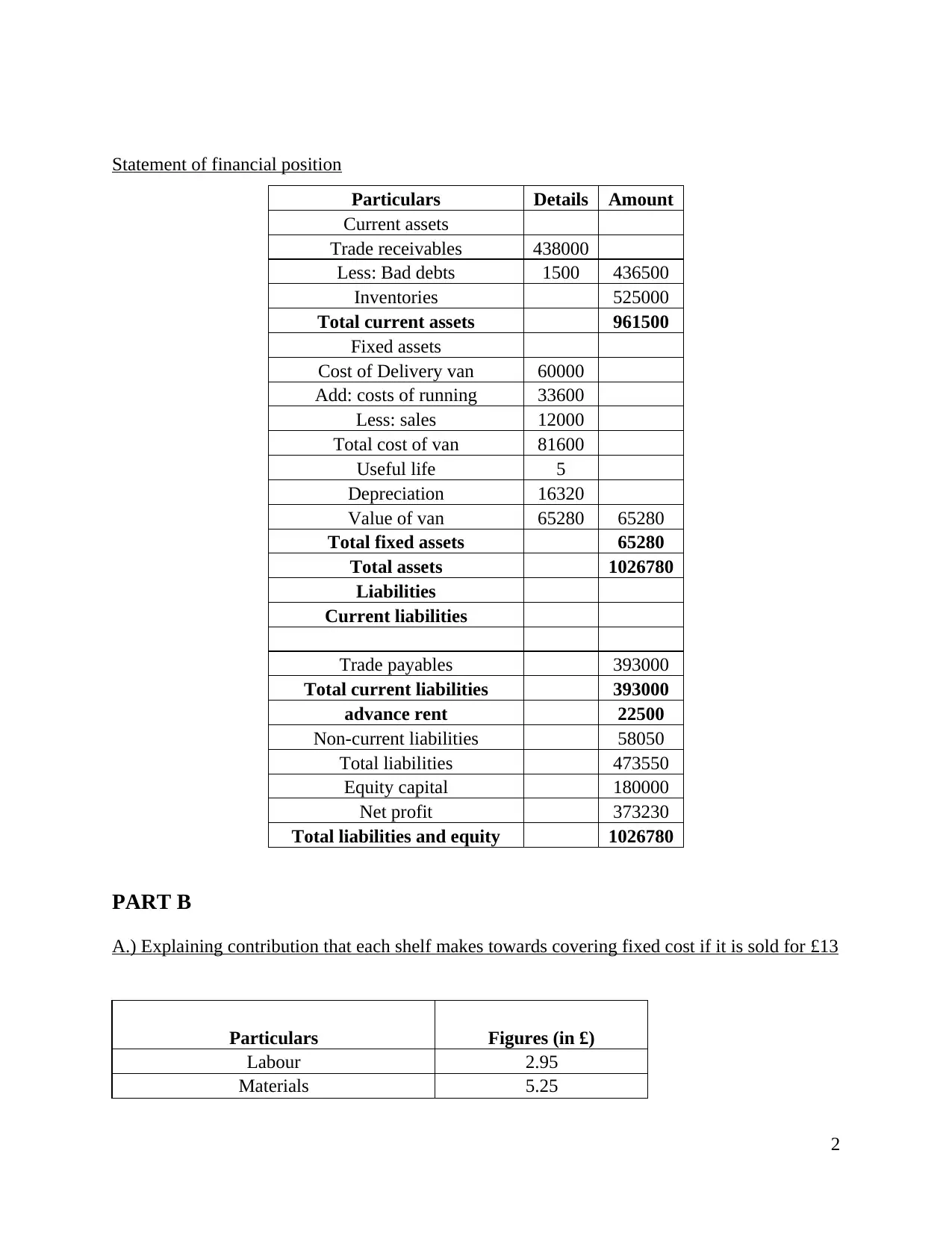

Statement of financial position

Particulars Details Amount

Current assets

Trade receivables 438000

Less: Bad debts 1500 436500

Inventories 525000

Total current assets 961500

Fixed assets

Cost of Delivery van 60000

Add: costs of running 33600

Less: sales 12000

Total cost of van 81600

Useful life 5

Depreciation 16320

Value of van 65280 65280

Total fixed assets 65280

Total assets 1026780

Liabilities

Current liabilities

Trade payables 393000

Total current liabilities 393000

advance rent 22500

Non-current liabilities 58050

Total liabilities 473550

Equity capital 180000

Net profit 373230

Total liabilities and equity 1026780

PART B

A.) Explaining contribution that each shelf makes towards covering fixed cost if it is sold for £13

Particulars Figures (in £)

Labour 2.95

Materials 5.25

2

Particulars Details Amount

Current assets

Trade receivables 438000

Less: Bad debts 1500 436500

Inventories 525000

Total current assets 961500

Fixed assets

Cost of Delivery van 60000

Add: costs of running 33600

Less: sales 12000

Total cost of van 81600

Useful life 5

Depreciation 16320

Value of van 65280 65280

Total fixed assets 65280

Total assets 1026780

Liabilities

Current liabilities

Trade payables 393000

Total current liabilities 393000

advance rent 22500

Non-current liabilities 58050

Total liabilities 473550

Equity capital 180000

Net profit 373230

Total liabilities and equity 1026780

PART B

A.) Explaining contribution that each shelf makes towards covering fixed cost if it is sold for £13

Particulars Figures (in £)

Labour 2.95

Materials 5.25

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

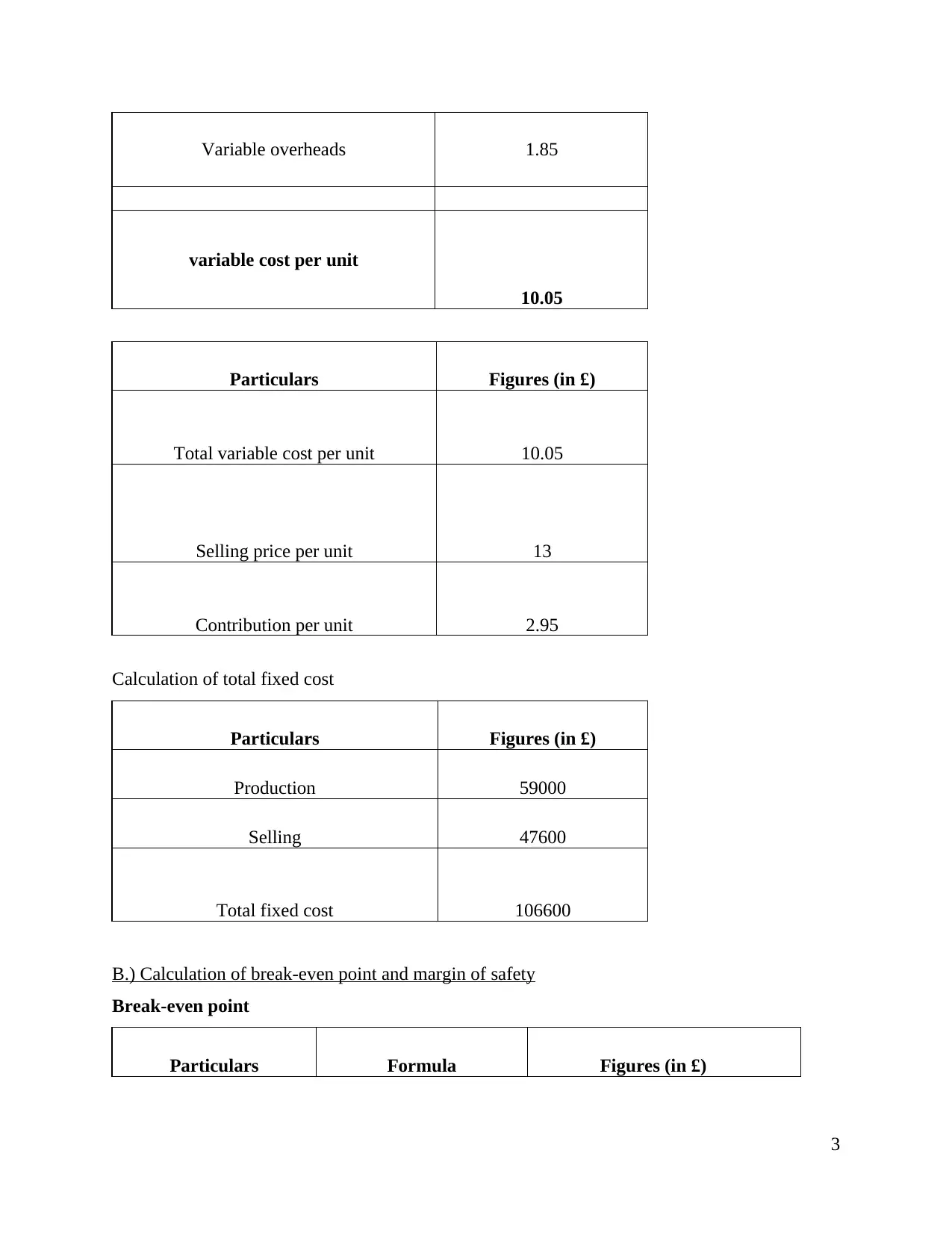

Variable overheads 1.85

variable cost per unit

10.05

Particulars Figures (in £)

Total variable cost per unit 10.05

Selling price per unit 13

Contribution per unit 2.95

Calculation of total fixed cost

Particulars Figures (in £)

Production 59000

Selling 47600

Total fixed cost 106600

B.) Calculation of break-even point and margin of safety

Break-even point

Particulars Formula Figures (in £)

3

variable cost per unit

10.05

Particulars Figures (in £)

Total variable cost per unit 10.05

Selling price per unit 13

Contribution per unit 2.95

Calculation of total fixed cost

Particulars Figures (in £)

Production 59000

Selling 47600

Total fixed cost 106600

B.) Calculation of break-even point and margin of safety

Break-even point

Particulars Formula Figures (in £)

3

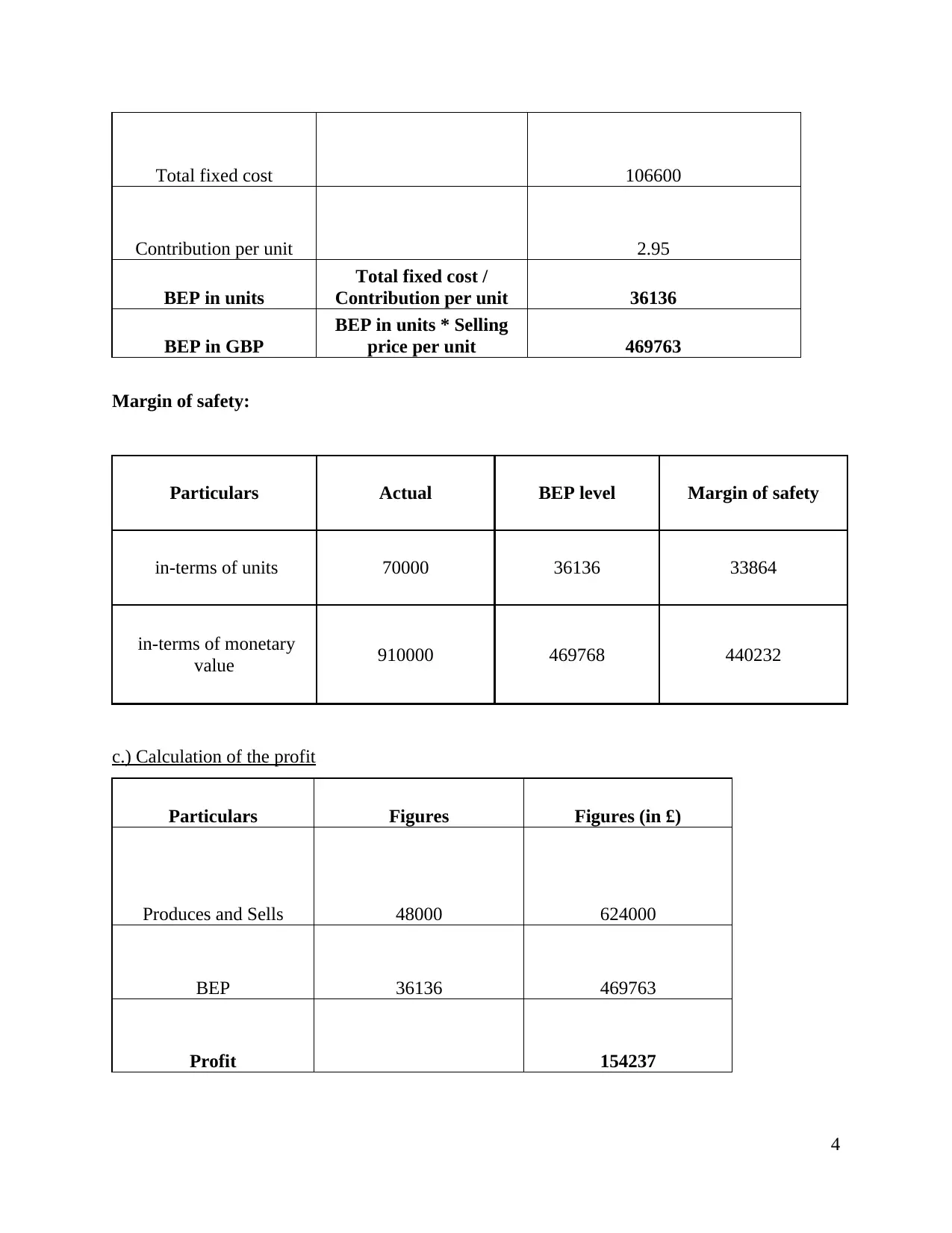

Total fixed cost 106600

Contribution per unit 2.95

BEP in units

Total fixed cost /

Contribution per unit 36136

BEP in GBP

BEP in units * Selling

price per unit 469763

Margin of safety:

Particulars Actual BEP level Margin of safety

in-terms of units 70000 36136 33864

in-terms of monetary

value 910000 469768 440232

c.) Calculation of the profit

Particulars Figures Figures (in £)

Produces and Sells 48000 624000

BEP 36136 469763

Profit 154237

4

Contribution per unit 2.95

BEP in units

Total fixed cost /

Contribution per unit 36136

BEP in GBP

BEP in units * Selling

price per unit 469763

Margin of safety:

Particulars Actual BEP level Margin of safety

in-terms of units 70000 36136 33864

in-terms of monetary

value 910000 469768 440232

c.) Calculation of the profit

Particulars Figures Figures (in £)

Produces and Sells 48000 624000

BEP 36136 469763

Profit 154237

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

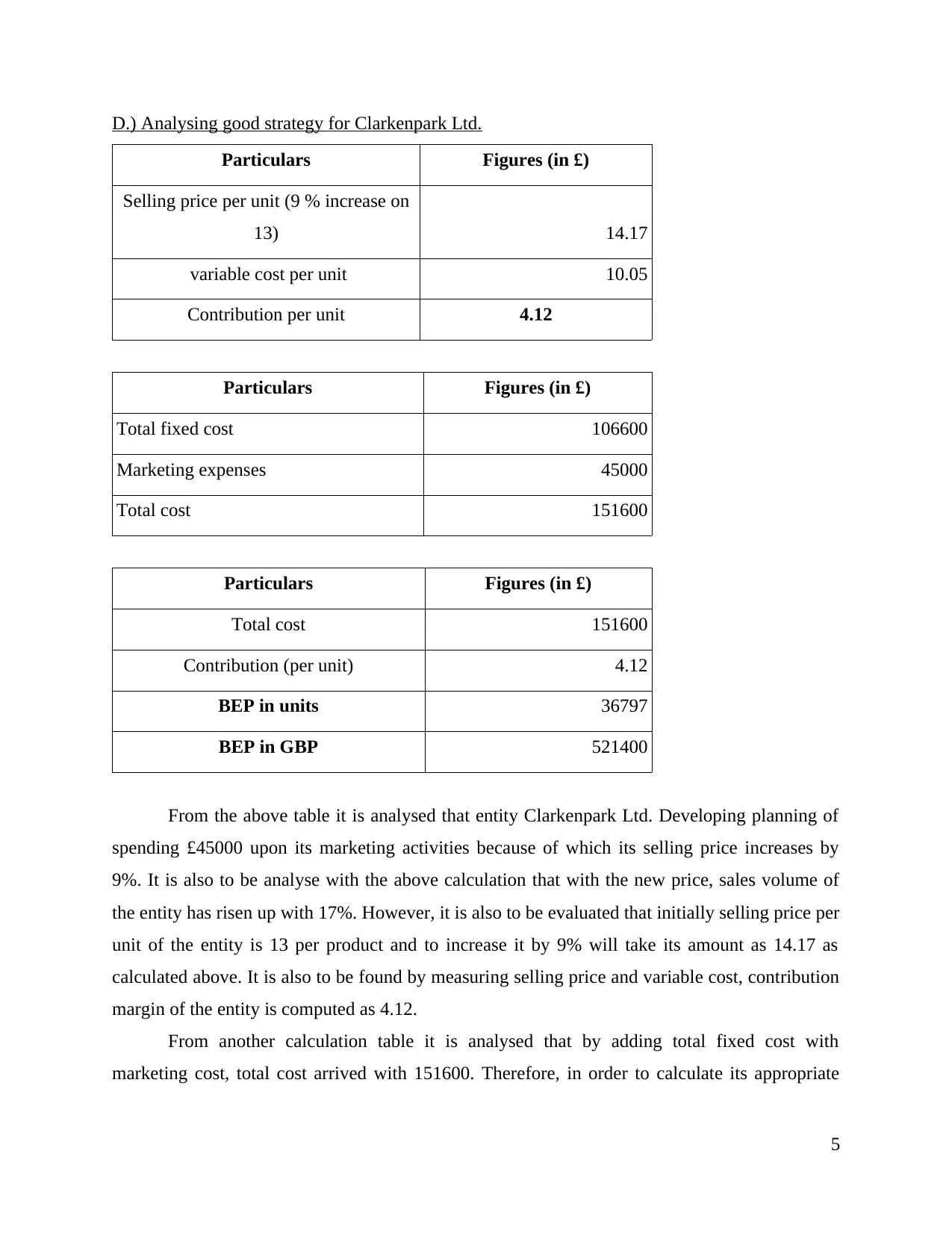

D.) Analysing good strategy for Clarkenpark Ltd.

Particulars Figures (in £)

Selling price per unit (9 % increase on

13) 14.17

variable cost per unit 10.05

Contribution per unit 4.12

Particulars Figures (in £)

Total fixed cost 106600

Marketing expenses 45000

Total cost 151600

Particulars Figures (in £)

Total cost 151600

Contribution (per unit) 4.12

BEP in units 36797

BEP in GBP 521400

From the above table it is analysed that entity Clarkenpark Ltd. Developing planning of

spending £45000 upon its marketing activities because of which its selling price increases by

9%. It is also to be analyse with the above calculation that with the new price, sales volume of

the entity has risen up with 17%. However, it is also to be evaluated that initially selling price per

unit of the entity is 13 per product and to increase it by 9% will take its amount as 14.17 as

calculated above. It is also to be found by measuring selling price and variable cost, contribution

margin of the entity is computed as 4.12.

From another calculation table it is analysed that by adding total fixed cost with

marketing cost, total cost arrived with 151600. Therefore, in order to calculate its appropriate

5

Particulars Figures (in £)

Selling price per unit (9 % increase on

13) 14.17

variable cost per unit 10.05

Contribution per unit 4.12

Particulars Figures (in £)

Total fixed cost 106600

Marketing expenses 45000

Total cost 151600

Particulars Figures (in £)

Total cost 151600

Contribution (per unit) 4.12

BEP in units 36797

BEP in GBP 521400

From the above table it is analysed that entity Clarkenpark Ltd. Developing planning of

spending £45000 upon its marketing activities because of which its selling price increases by

9%. It is also to be analyse with the above calculation that with the new price, sales volume of

the entity has risen up with 17%. However, it is also to be evaluated that initially selling price per

unit of the entity is 13 per product and to increase it by 9% will take its amount as 14.17 as

calculated above. It is also to be found by measuring selling price and variable cost, contribution

margin of the entity is computed as 4.12.

From another calculation table it is analysed that by adding total fixed cost with

marketing cost, total cost arrived with 151600. Therefore, in order to calculate its appropriate

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

formula will get used which include total cost divided by contribution per unit. The result which

has arrived is £36797 and its GDP comes up with £521400.

Thus, it is clearly measured that company has the capability of earning profit but it is not

at the level of 17% which indicates that Clarkenpark Ltd entity did not have sound strategy in

order to achieve profit. Hence, it is analysed that with the increase in price, its expenses will also

get increases but outcomes of profitability will not be achieved by the company.

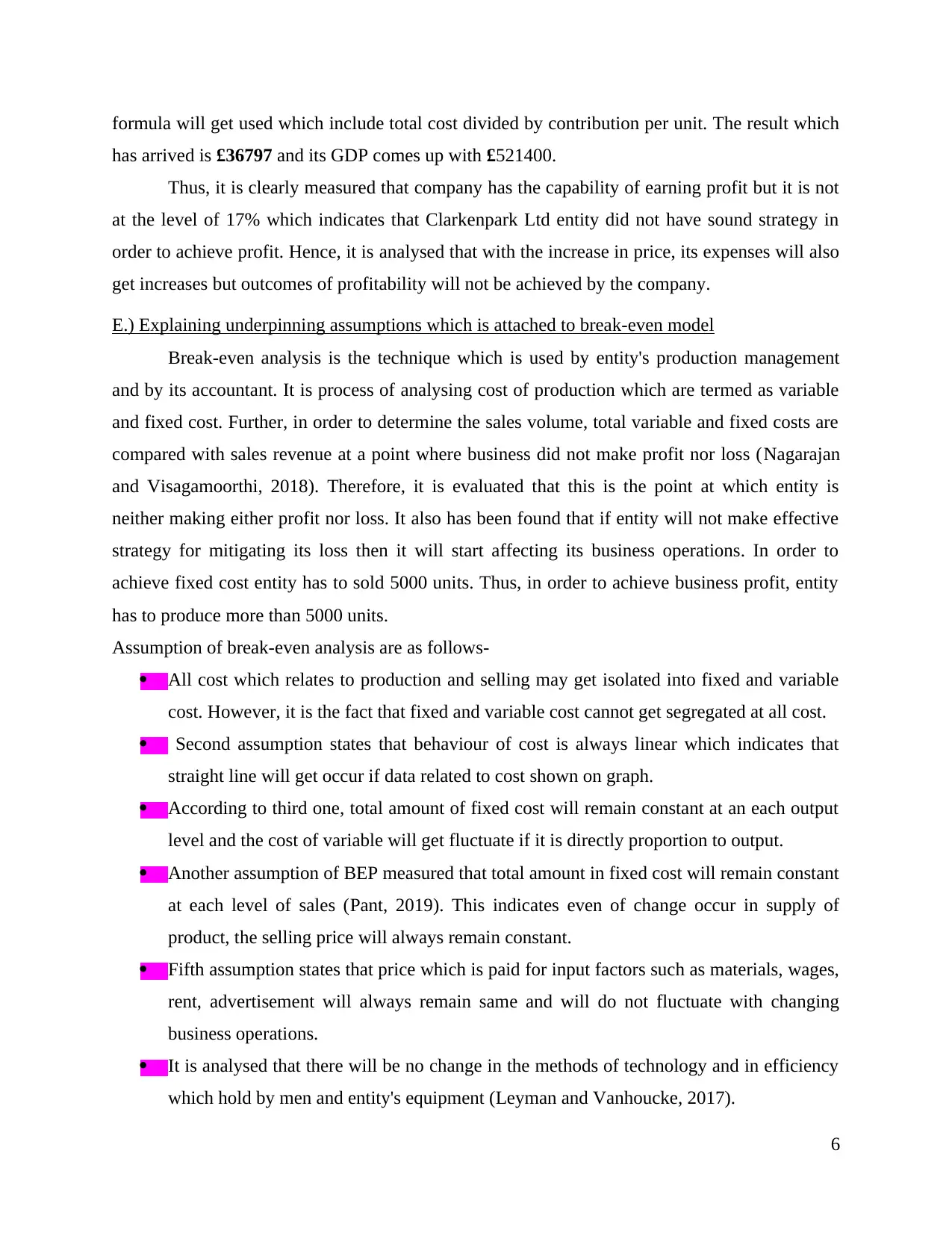

E.) Explaining underpinning assumptions which is attached to break-even model

Break-even analysis is the technique which is used by entity's production management

and by its accountant. It is process of analysing cost of production which are termed as variable

and fixed cost. Further, in order to determine the sales volume, total variable and fixed costs are

compared with sales revenue at a point where business did not make profit nor loss (Nagarajan

and Visagamoorthi, 2018). Therefore, it is evaluated that this is the point at which entity is

neither making either profit nor loss. It also has been found that if entity will not make effective

strategy for mitigating its loss then it will start affecting its business operations. In order to

achieve fixed cost entity has to sold 5000 units. Thus, in order to achieve business profit, entity

has to produce more than 5000 units.

Assumption of break-even analysis are as follows-

All cost which relates to production and selling may get isolated into fixed and variable

cost. However, it is the fact that fixed and variable cost cannot get segregated at all cost.

Second assumption states that behaviour of cost is always linear which indicates that

straight line will get occur if data related to cost shown on graph.

According to third one, total amount of fixed cost will remain constant at an each output

level and the cost of variable will get fluctuate if it is directly proportion to output.

Another assumption of BEP measured that total amount in fixed cost will remain constant

at each level of sales (Pant, 2019). This indicates even of change occur in supply of

product, the selling price will always remain constant.

Fifth assumption states that price which is paid for input factors such as materials, wages,

rent, advertisement will always remain same and will do not fluctuate with changing

business operations.

It is analysed that there will be no change in the methods of technology and in efficiency

which hold by men and entity's equipment (Leyman and Vanhoucke, 2017).

6

has arrived is £36797 and its GDP comes up with £521400.

Thus, it is clearly measured that company has the capability of earning profit but it is not

at the level of 17% which indicates that Clarkenpark Ltd entity did not have sound strategy in

order to achieve profit. Hence, it is analysed that with the increase in price, its expenses will also

get increases but outcomes of profitability will not be achieved by the company.

E.) Explaining underpinning assumptions which is attached to break-even model

Break-even analysis is the technique which is used by entity's production management

and by its accountant. It is process of analysing cost of production which are termed as variable

and fixed cost. Further, in order to determine the sales volume, total variable and fixed costs are

compared with sales revenue at a point where business did not make profit nor loss (Nagarajan

and Visagamoorthi, 2018). Therefore, it is evaluated that this is the point at which entity is

neither making either profit nor loss. It also has been found that if entity will not make effective

strategy for mitigating its loss then it will start affecting its business operations. In order to

achieve fixed cost entity has to sold 5000 units. Thus, in order to achieve business profit, entity

has to produce more than 5000 units.

Assumption of break-even analysis are as follows-

All cost which relates to production and selling may get isolated into fixed and variable

cost. However, it is the fact that fixed and variable cost cannot get segregated at all cost.

Second assumption states that behaviour of cost is always linear which indicates that

straight line will get occur if data related to cost shown on graph.

According to third one, total amount of fixed cost will remain constant at an each output

level and the cost of variable will get fluctuate if it is directly proportion to output.

Another assumption of BEP measured that total amount in fixed cost will remain constant

at each level of sales (Pant, 2019). This indicates even of change occur in supply of

product, the selling price will always remain constant.

Fifth assumption states that price which is paid for input factors such as materials, wages,

rent, advertisement will always remain same and will do not fluctuate with changing

business operations.

It is analysed that there will be no change in the methods of technology and in efficiency

which hold by men and entity's equipment (Leyman and Vanhoucke, 2017).

6

Another assumption of BEP states that revenue and costs will always get compared with

common activity base such as sales value of products and number of units which gets

produced.

Last assumption in BEP assumed that any output and sales volume will only be assumed

with relevant factor which mainly affect the entity's cost.

These are the universal assumption which get applicable in businesses. However, it is also been

true that this assumption may get derive from the real world calculation as some will not get

applied in order to generate the profitability and to reach at break-even analysis.

PART C

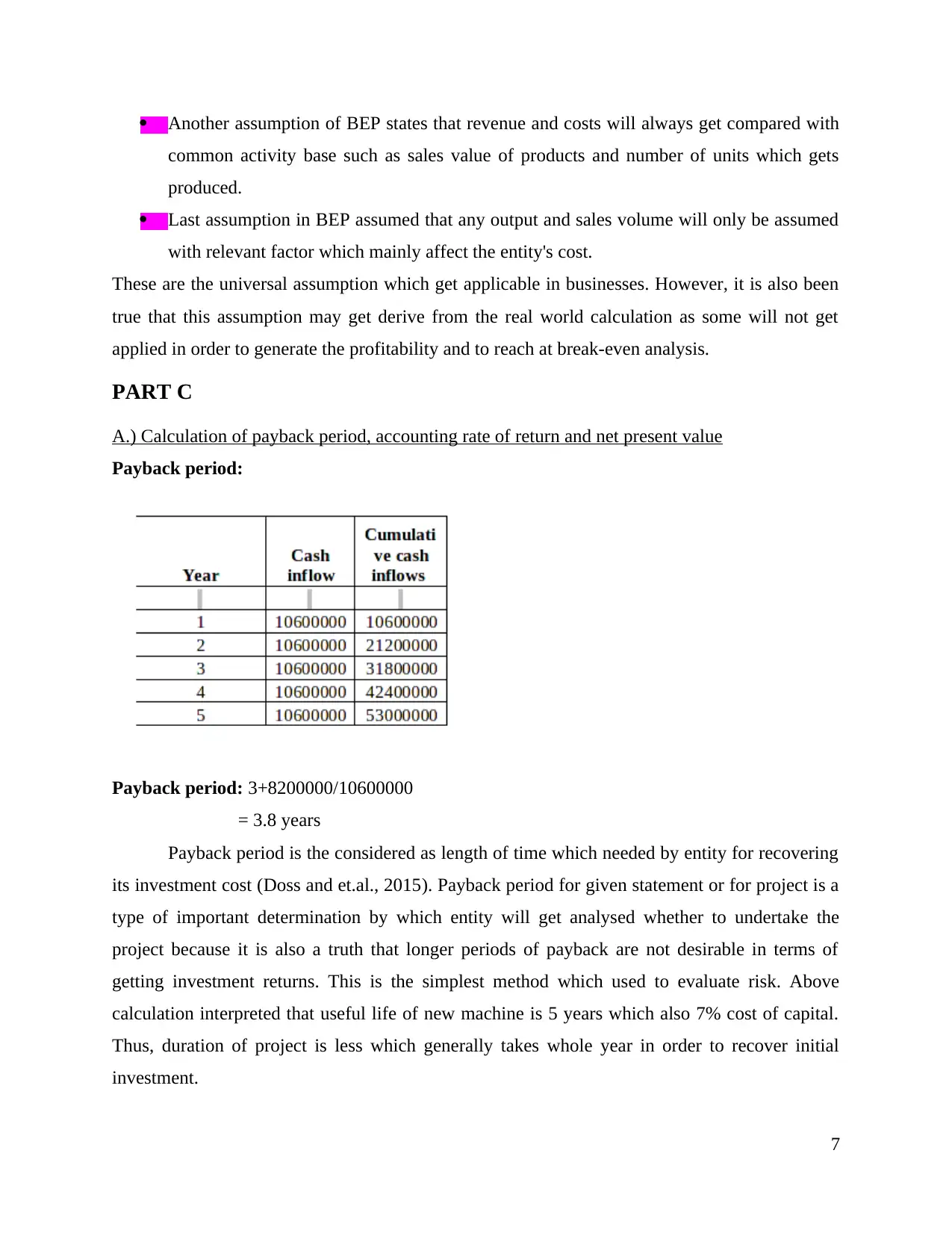

A.) Calculation of payback period, accounting rate of return and net present value

Payback period:

Payback period: 3+8200000/10600000

= 3.8 years

Payback period is the considered as length of time which needed by entity for recovering

its investment cost (Doss and et.al., 2015). Payback period for given statement or for project is a

type of important determination by which entity will get analysed whether to undertake the

project because it is also a truth that longer periods of payback are not desirable in terms of

getting investment returns. This is the simplest method which used to evaluate risk. Above

calculation interpreted that useful life of new machine is 5 years which also 7% cost of capital.

Thus, duration of project is less which generally takes whole year in order to recover initial

investment.

7

common activity base such as sales value of products and number of units which gets

produced.

Last assumption in BEP assumed that any output and sales volume will only be assumed

with relevant factor which mainly affect the entity's cost.

These are the universal assumption which get applicable in businesses. However, it is also been

true that this assumption may get derive from the real world calculation as some will not get

applied in order to generate the profitability and to reach at break-even analysis.

PART C

A.) Calculation of payback period, accounting rate of return and net present value

Payback period:

Payback period: 3+8200000/10600000

= 3.8 years

Payback period is the considered as length of time which needed by entity for recovering

its investment cost (Doss and et.al., 2015). Payback period for given statement or for project is a

type of important determination by which entity will get analysed whether to undertake the

project because it is also a truth that longer periods of payback are not desirable in terms of

getting investment returns. This is the simplest method which used to evaluate risk. Above

calculation interpreted that useful life of new machine is 5 years which also 7% cost of capital.

Thus, duration of project is less which generally takes whole year in order to recover initial

investment.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

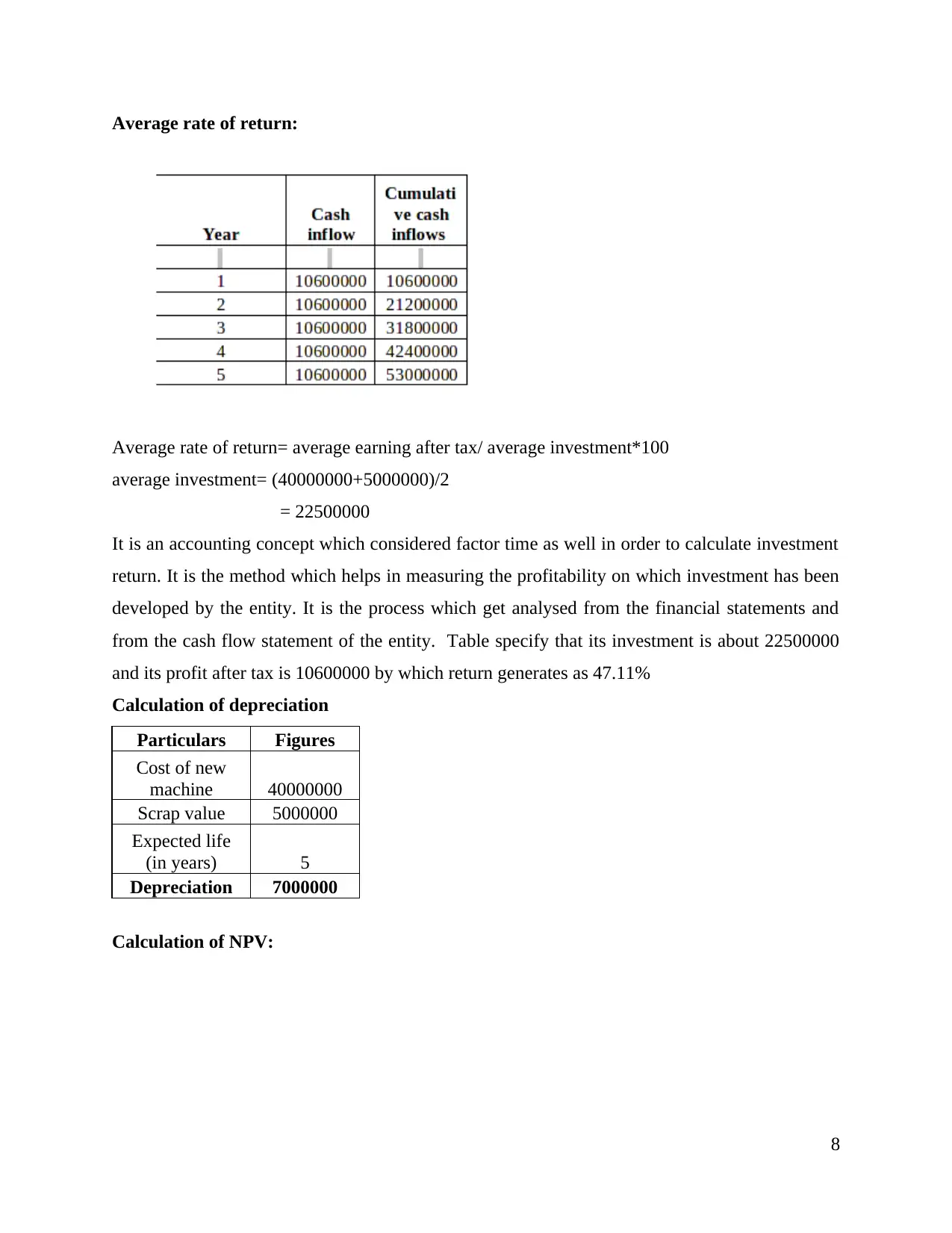

Average rate of return:

Average rate of return= average earning after tax/ average investment*100

average investment= (40000000+5000000)/2

= 22500000

It is an accounting concept which considered factor time as well in order to calculate investment

return. It is the method which helps in measuring the profitability on which investment has been

developed by the entity. It is the process which get analysed from the financial statements and

from the cash flow statement of the entity. Table specify that its investment is about 22500000

and its profit after tax is 10600000 by which return generates as 47.11%

Calculation of depreciation

Particulars Figures

Cost of new

machine 40000000

Scrap value 5000000

Expected life

(in years) 5

Depreciation 7000000

Calculation of NPV:

8

Average rate of return= average earning after tax/ average investment*100

average investment= (40000000+5000000)/2

= 22500000

It is an accounting concept which considered factor time as well in order to calculate investment

return. It is the method which helps in measuring the profitability on which investment has been

developed by the entity. It is the process which get analysed from the financial statements and

from the cash flow statement of the entity. Table specify that its investment is about 22500000

and its profit after tax is 10600000 by which return generates as 47.11%

Calculation of depreciation

Particulars Figures

Cost of new

machine 40000000

Scrap value 5000000

Expected life

(in years) 5

Depreciation 7000000

Calculation of NPV:

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

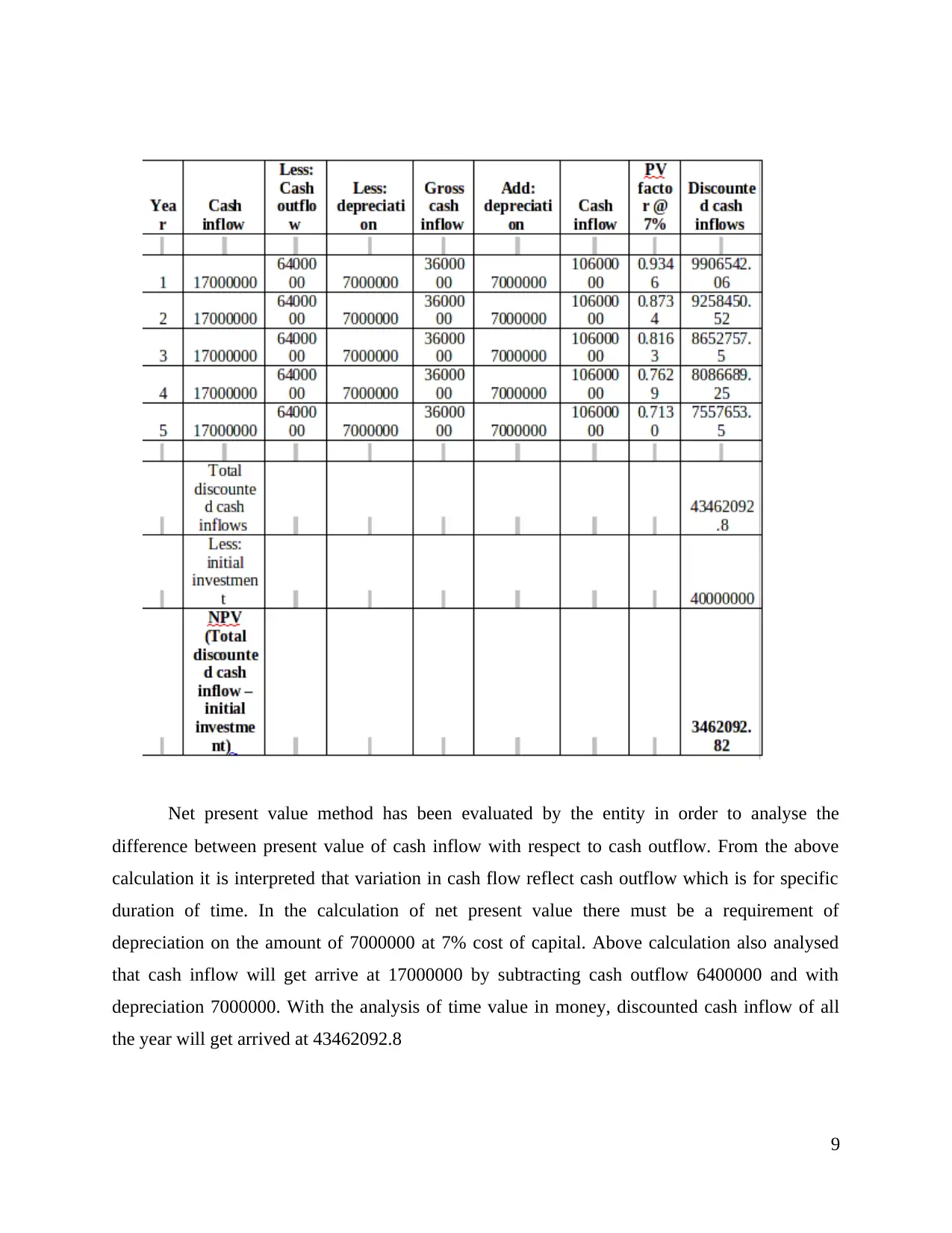

Net present value method has been evaluated by the entity in order to analyse the

difference between present value of cash inflow with respect to cash outflow. From the above

calculation it is interpreted that variation in cash flow reflect cash outflow which is for specific

duration of time. In the calculation of net present value there must be a requirement of

depreciation on the amount of 7000000 at 7% cost of capital. Above calculation also analysed

that cash inflow will get arrive at 17000000 by subtracting cash outflow 6400000 and with

depreciation 7000000. With the analysis of time value in money, discounted cash inflow of all

the year will get arrived at 43462092.8

9

difference between present value of cash inflow with respect to cash outflow. From the above

calculation it is interpreted that variation in cash flow reflect cash outflow which is for specific

duration of time. In the calculation of net present value there must be a requirement of

depreciation on the amount of 7000000 at 7% cost of capital. Above calculation also analysed

that cash inflow will get arrive at 17000000 by subtracting cash outflow 6400000 and with

depreciation 7000000. With the analysis of time value in money, discounted cash inflow of all

the year will get arrived at 43462092.8

9

Thus, it is evaluated that initial cost will get covered within 3 years with its average rate of return

of 47.11% and with positive vale of net present that is 3462092.82. Hence, project will not get

accepted according to investment appraisal technique.

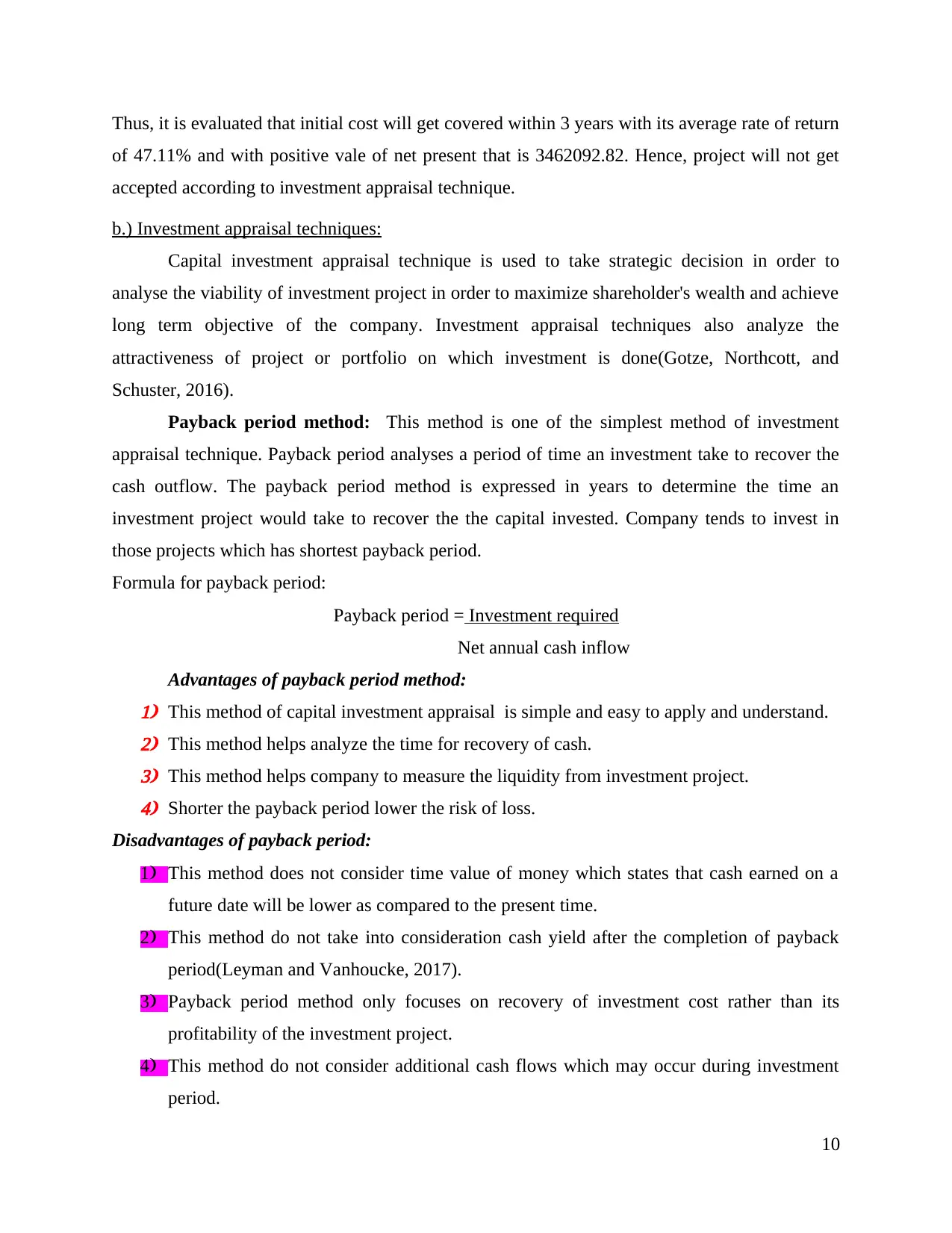

b.) Investment appraisal techniques:

Capital investment appraisal technique is used to take strategic decision in order to

analyse the viability of investment project in order to maximize shareholder's wealth and achieve

long term objective of the company. Investment appraisal techniques also analyze the

attractiveness of project or portfolio on which investment is done(Gotze, Northcott, and

Schuster, 2016).

Payback period method: This method is one of the simplest method of investment

appraisal technique. Payback period analyses a period of time an investment take to recover the

cash outflow. The payback period method is expressed in years to determine the time an

investment project would take to recover the the capital invested. Company tends to invest in

those projects which has shortest payback period.

Formula for payback period:

Payback period = Investment required

Net annual cash inflow

Advantages of payback period method:1) This method of capital investment appraisal is simple and easy to apply and understand.2) This method helps analyze the time for recovery of cash.3) This method helps company to measure the liquidity from investment project.4) Shorter the payback period lower the risk of loss.

Disadvantages of payback period:

1) This method does not consider time value of money which states that cash earned on a

future date will be lower as compared to the present time.

2) This method do not take into consideration cash yield after the completion of payback

period(Leyman and Vanhoucke, 2017).

3) Payback period method only focuses on recovery of investment cost rather than its

profitability of the investment project.

4) This method do not consider additional cash flows which may occur during investment

period.

10

of 47.11% and with positive vale of net present that is 3462092.82. Hence, project will not get

accepted according to investment appraisal technique.

b.) Investment appraisal techniques:

Capital investment appraisal technique is used to take strategic decision in order to

analyse the viability of investment project in order to maximize shareholder's wealth and achieve

long term objective of the company. Investment appraisal techniques also analyze the

attractiveness of project or portfolio on which investment is done(Gotze, Northcott, and

Schuster, 2016).

Payback period method: This method is one of the simplest method of investment

appraisal technique. Payback period analyses a period of time an investment take to recover the

cash outflow. The payback period method is expressed in years to determine the time an

investment project would take to recover the the capital invested. Company tends to invest in

those projects which has shortest payback period.

Formula for payback period:

Payback period = Investment required

Net annual cash inflow

Advantages of payback period method:1) This method of capital investment appraisal is simple and easy to apply and understand.2) This method helps analyze the time for recovery of cash.3) This method helps company to measure the liquidity from investment project.4) Shorter the payback period lower the risk of loss.

Disadvantages of payback period:

1) This method does not consider time value of money which states that cash earned on a

future date will be lower as compared to the present time.

2) This method do not take into consideration cash yield after the completion of payback

period(Leyman and Vanhoucke, 2017).

3) Payback period method only focuses on recovery of investment cost rather than its

profitability of the investment project.

4) This method do not consider additional cash flows which may occur during investment

period.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.