Australian Banking Industry Analysis

VerifiedAdded on 2020/02/24

|10

|1522

|36

AI Summary

This assignment analyzes the structure and functioning of the Australian banking industry. It examines the concentration of market power among the four major banks and its implications for consumers, including issues like higher costs and reduced choice. The analysis also explores potential regulatory solutions to mitigate these problems and promote a more competitive and equitable banking sector.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: AUSTRALIAN BANKING SECTOR: AN OLIGOPOLISTIC MARKET

Australian Banking Sector: An Oligopolistic Market

Name of the Student

Name of the University

Author Note

Australian Banking Sector: An Oligopolistic Market

Name of the Student

Name of the University

Author Note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1AUSTRALIAN BANKING SECTOR: AN OLIGOPOLISTIC MARKET

Table of Contents

Introduction:....................................................................................................................................2

Story’s Essence:...............................................................................................................................2

Economic Analysis of the Situation:...............................................................................................4

Recommendations:..........................................................................................................................7

Conclusion:......................................................................................................................................7

References........................................................................................................................................9

Table of Contents

Introduction:....................................................................................................................................2

Story’s Essence:...............................................................................................................................2

Economic Analysis of the Situation:...............................................................................................4

Recommendations:..........................................................................................................................7

Conclusion:......................................................................................................................................7

References........................................................................................................................................9

2AUSTRALIAN BANKING SECTOR: AN OLIGOPOLISTIC MARKET

Introduction:

In economics, the term “market” signifies a place of interaction for the two types of

economic agents, the buyers and the sellers. In other words, a market is the place where the

demand and the supply forces, in terms of their inter-dynamics, determine the price and quantity

aspects of a particular commodity or service. Type of market prevailing for a product, depends

on factors like number of buyers and sellers, the entry exit conditions for economic agents,

market power dynamics and others1. Based on these influencing factors, markets can be

competitive (perfectly competitive being the hypothetical extreme) of imperfectly competitive,

like monopoly, monopolistic competition and oligopoly (monopoly being the opposite of perfect

competition). The assignment tries to analyze the type of market structure prevailing in the

Australian banking industry. For research purposes it takes the article named, “Flush and

Dominant, Australia’s Banks Come Under Pressure”, written by A. Odysseus Patrick, as

reference2.

Story’s Essence:

The article finds that the Australian banking market, four major players in the supply side

categorically rule though having many players, both in the supply side and the demand side. In

1 Rios, Manuel C., Campbell R. McConnell, and Stanley L. Brue. Economics: Principles, problems, and policies.

McGraw-Hill, 2013.

2 A. Nytimes.com, 'Flush And Dominant, Australia’S Banks Come Under Pressure' (Nytimes.com, 2017)

<https://www.nytimes.com/2016/10/15/business/dealbook/australia-banks-under-pressure.html?mcubz=1> accessed

29 August 2017.

Introduction:

In economics, the term “market” signifies a place of interaction for the two types of

economic agents, the buyers and the sellers. In other words, a market is the place where the

demand and the supply forces, in terms of their inter-dynamics, determine the price and quantity

aspects of a particular commodity or service. Type of market prevailing for a product, depends

on factors like number of buyers and sellers, the entry exit conditions for economic agents,

market power dynamics and others1. Based on these influencing factors, markets can be

competitive (perfectly competitive being the hypothetical extreme) of imperfectly competitive,

like monopoly, monopolistic competition and oligopoly (monopoly being the opposite of perfect

competition). The assignment tries to analyze the type of market structure prevailing in the

Australian banking industry. For research purposes it takes the article named, “Flush and

Dominant, Australia’s Banks Come Under Pressure”, written by A. Odysseus Patrick, as

reference2.

Story’s Essence:

The article finds that the Australian banking market, four major players in the supply side

categorically rule though having many players, both in the supply side and the demand side. In

1 Rios, Manuel C., Campbell R. McConnell, and Stanley L. Brue. Economics: Principles, problems, and policies.

McGraw-Hill, 2013.

2 A. Nytimes.com, 'Flush And Dominant, Australia’S Banks Come Under Pressure' (Nytimes.com, 2017)

<https://www.nytimes.com/2016/10/15/business/dealbook/australia-banks-under-pressure.html?mcubz=1> accessed

29 August 2017.

3AUSTRALIAN BANKING SECTOR: AN OLIGOPOLISTIC MARKET

fact, these four politically supported and immensely influential banks majorly shadow all other

banks. These four players are the Westpac Bank, the Commonwealth Bank, the Australia and

New Zealand Banking Group and the Australia’s National Bank. Among them, two banks, the

Westpac Corporation and the Commonwealth Bank, especially its CommInsure wing, are worthy

of special mention when it comes to the consolidation of market power in the hands of the

players in the Australian banking industry3.

The high concentration of the market power in the hands of these four big banks in the

Australian banking market, indicates the presence of a clear oligopolistic structure in the

concerned market. These players have been enjoying tremendous control over the banking sector

and its pricing and other decisions for a long time and this, according to the article, has given rise

to many unfavorable and unfair issues, specially affecting those on the demand side4.

The four banks tend to work apparently in a cartel construct in the recent times and do

pose as a credible threat to the distribution of market power as they have the potential to join

hands together and work as a collusive monopolistic unit in the market. The article puts forward

the negative side of this oligopolistic construct in the banking industry of the country. Due to the

presence of immense market power and substantial political support, most of these big players

have been found to misuse their power to fulfill their vested interest of personal profit

maximization even if that comes at the costs of sufferings of their clientele5. The article puts

3 Maine, Bob. "The relentless pursuit of bank profits." Green Left Weekly 1120 (2016): 2.

4 Allen, David E., and Robert Powell. "The fluctuating default risk of Australian banks." Australian Journal of

Management 37.2 (2012): 297-325.

5 Maine, Bob. "The relentless pursuit of bank profits." Green Left Weekly 1120 (2016): 2.

fact, these four politically supported and immensely influential banks majorly shadow all other

banks. These four players are the Westpac Bank, the Commonwealth Bank, the Australia and

New Zealand Banking Group and the Australia’s National Bank. Among them, two banks, the

Westpac Corporation and the Commonwealth Bank, especially its CommInsure wing, are worthy

of special mention when it comes to the consolidation of market power in the hands of the

players in the Australian banking industry3.

The high concentration of the market power in the hands of these four big banks in the

Australian banking market, indicates the presence of a clear oligopolistic structure in the

concerned market. These players have been enjoying tremendous control over the banking sector

and its pricing and other decisions for a long time and this, according to the article, has given rise

to many unfavorable and unfair issues, specially affecting those on the demand side4.

The four banks tend to work apparently in a cartel construct in the recent times and do

pose as a credible threat to the distribution of market power as they have the potential to join

hands together and work as a collusive monopolistic unit in the market. The article puts forward

the negative side of this oligopolistic construct in the banking industry of the country. Due to the

presence of immense market power and substantial political support, most of these big players

have been found to misuse their power to fulfill their vested interest of personal profit

maximization even if that comes at the costs of sufferings of their clientele5. The article puts

3 Maine, Bob. "The relentless pursuit of bank profits." Green Left Weekly 1120 (2016): 2.

4 Allen, David E., and Robert Powell. "The fluctuating default risk of Australian banks." Australian Journal of

Management 37.2 (2012): 297-325.

5 Maine, Bob. "The relentless pursuit of bank profits." Green Left Weekly 1120 (2016): 2.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4AUSTRALIAN BANKING SECTOR: AN OLIGOPOLISTIC MARKET

forward as an example of this misusing of power, the instances of CommInsure, where the unit

avoided claims of insurances by deleting medical evidences, unfairly influencing the doctors and

other fraudulent activities. Other banks like the Westpac, has also evidences of manipulating

their interest rates and claims design according to situations, to benefit monetarily, putting their

customers in financial crisis. The banks have also behaved strikingly rudely and unfairly with

terminally ill people to get away without paying their medical claims as were previously

promised by the banks6. All these have given rise to tremendous dissatisfaction among the

demand side agents and has become a primary concern of the government of the country as

customers are losing confidence over the banking sector of Australia. The government has

undertaken several strict vigilance reforms, regulations and punishing steps, while many more

reforms are required to bring back the welfare quotient and confidence of the customers on this

concerned industry7.

Economic Analysis of the Situation:

The oligopoly market can be distinguished with the help of its inherent characteristic of

many buyers and a few sellers, the sellers experiencing strategic interdependence on each other.

This implies the strategies and outcomes of one seller in this market highly depend on the

6 Tyers, Rod. "Service Oligopolies and Australia's Economy‐Wide Performance." Australian Economic Review 48.4

(2015): 333-356.

7 Kavurmacioglu, Emir. Oligopolies in private spectrum commons: analysis and regulatory implications. Diss.

Boston University, 2016.

forward as an example of this misusing of power, the instances of CommInsure, where the unit

avoided claims of insurances by deleting medical evidences, unfairly influencing the doctors and

other fraudulent activities. Other banks like the Westpac, has also evidences of manipulating

their interest rates and claims design according to situations, to benefit monetarily, putting their

customers in financial crisis. The banks have also behaved strikingly rudely and unfairly with

terminally ill people to get away without paying their medical claims as were previously

promised by the banks6. All these have given rise to tremendous dissatisfaction among the

demand side agents and has become a primary concern of the government of the country as

customers are losing confidence over the banking sector of Australia. The government has

undertaken several strict vigilance reforms, regulations and punishing steps, while many more

reforms are required to bring back the welfare quotient and confidence of the customers on this

concerned industry7.

Economic Analysis of the Situation:

The oligopoly market can be distinguished with the help of its inherent characteristic of

many buyers and a few sellers, the sellers experiencing strategic interdependence on each other.

This implies the strategies and outcomes of one seller in this market highly depend on the

6 Tyers, Rod. "Service Oligopolies and Australia's Economy‐Wide Performance." Australian Economic Review 48.4

(2015): 333-356.

7 Kavurmacioglu, Emir. Oligopolies in private spectrum commons: analysis and regulatory implications. Diss.

Boston University, 2016.

5AUSTRALIAN BANKING SECTOR: AN OLIGOPOLISTIC MARKET

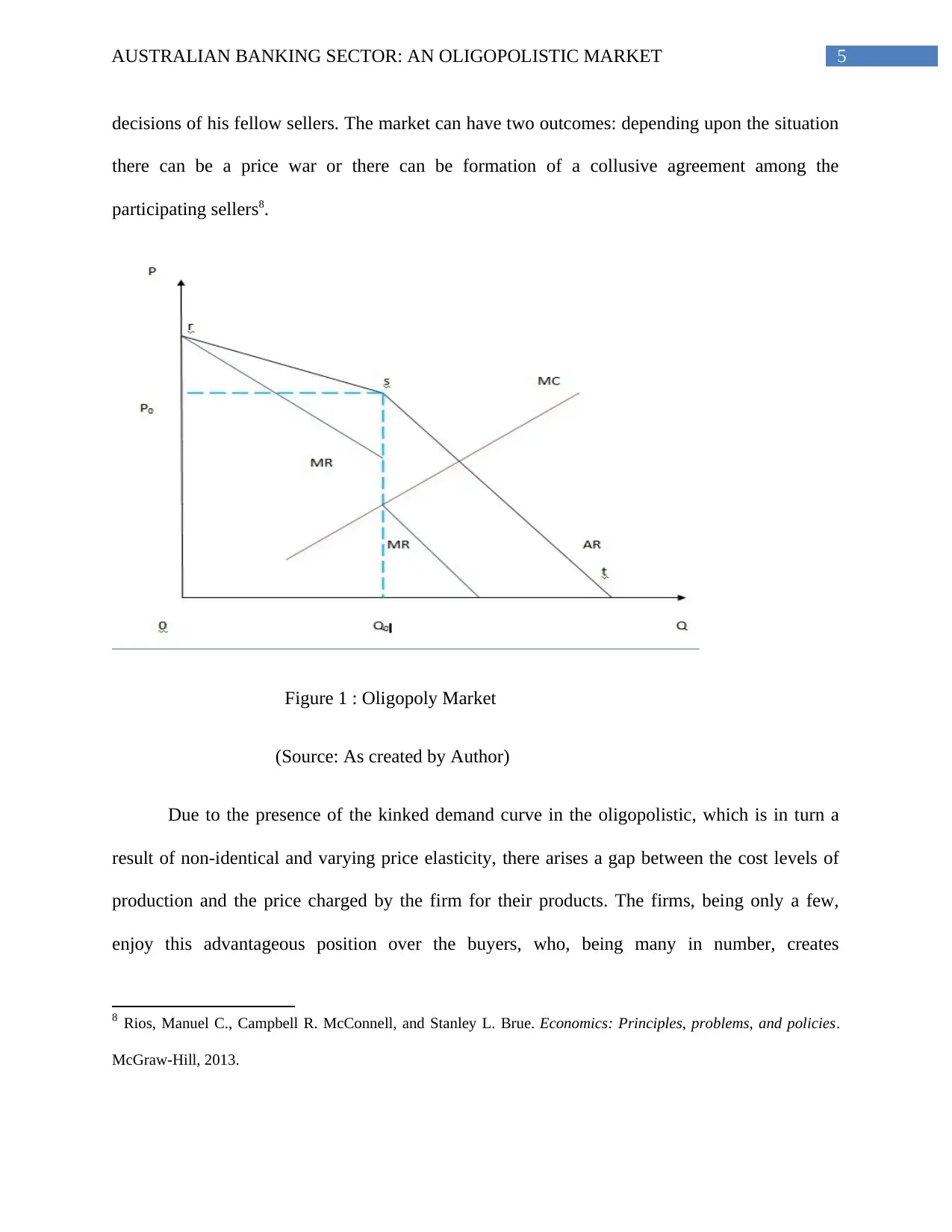

decisions of his fellow sellers. The market can have two outcomes: depending upon the situation

there can be a price war or there can be formation of a collusive agreement among the

participating sellers8.

Figure 1 : Oligopoly Market

(Source: As created by Author)

Due to the presence of the kinked demand curve in the oligopolistic, which is in turn a

result of non-identical and varying price elasticity, there arises a gap between the cost levels of

production and the price charged by the firm for their products. The firms, being only a few,

enjoy this advantageous position over the buyers, who, being many in number, creates

8 Rios, Manuel C., Campbell R. McConnell, and Stanley L. Brue. Economics: Principles, problems, and policies.

McGraw-Hill, 2013.

decisions of his fellow sellers. The market can have two outcomes: depending upon the situation

there can be a price war or there can be formation of a collusive agreement among the

participating sellers8.

Figure 1 : Oligopoly Market

(Source: As created by Author)

Due to the presence of the kinked demand curve in the oligopolistic, which is in turn a

result of non-identical and varying price elasticity, there arises a gap between the cost levels of

production and the price charged by the firm for their products. The firms, being only a few,

enjoy this advantageous position over the buyers, who, being many in number, creates

8 Rios, Manuel C., Campbell R. McConnell, and Stanley L. Brue. Economics: Principles, problems, and policies.

McGraw-Hill, 2013.

6AUSTRALIAN BANKING SECTOR: AN OLIGOPOLISTIC MARKET

substantial demand for the product, thereby helping the firm to charge a higher price for their

product than that would have been charged in the competitive situation.

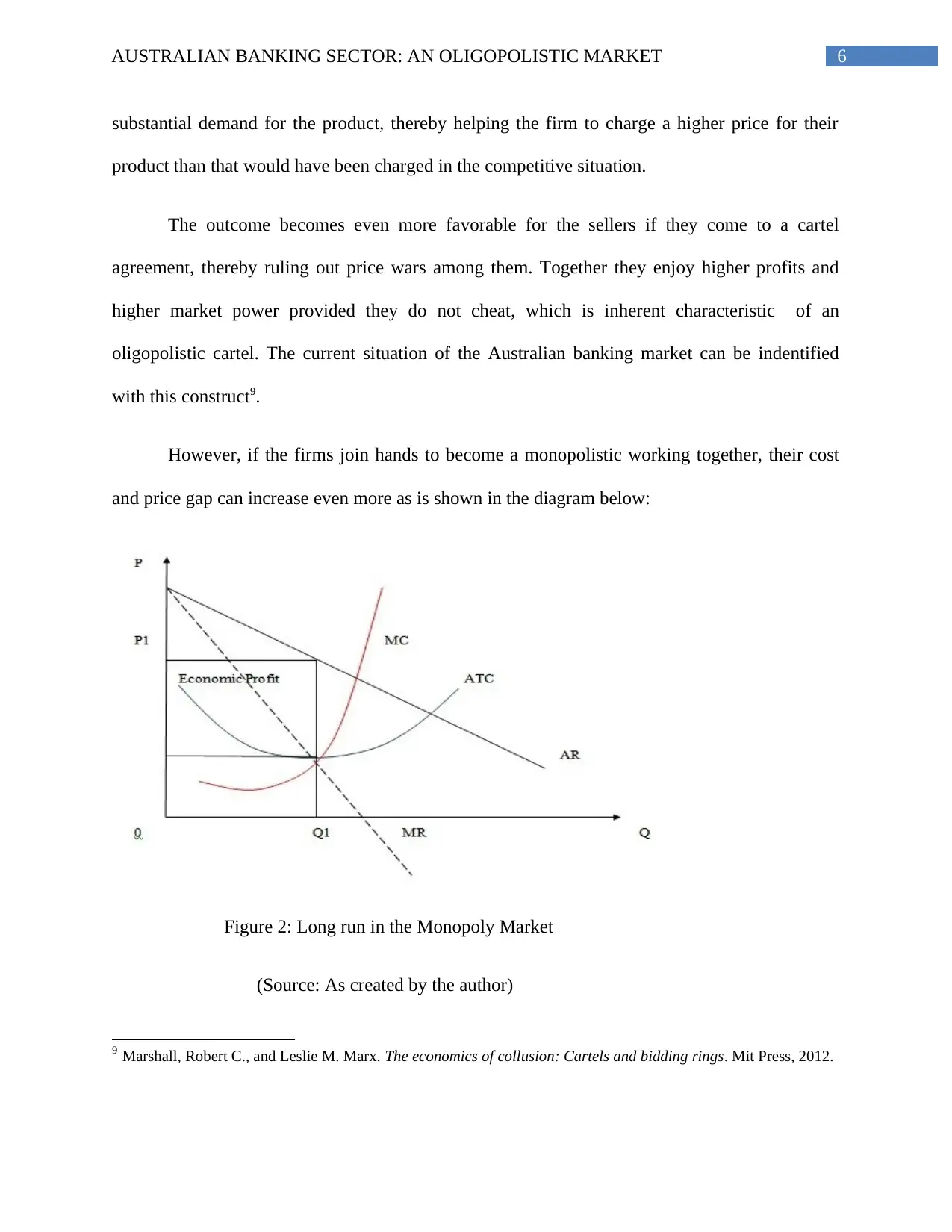

The outcome becomes even more favorable for the sellers if they come to a cartel

agreement, thereby ruling out price wars among them. Together they enjoy higher profits and

higher market power provided they do not cheat, which is inherent characteristic of an

oligopolistic cartel. The current situation of the Australian banking market can be indentified

with this construct9.

However, if the firms join hands to become a monopolistic working together, their cost

and price gap can increase even more as is shown in the diagram below:

Figure 2: Long run in the Monopoly Market

(Source: As created by the author)

9 Marshall, Robert C., and Leslie M. Marx. The economics of collusion: Cartels and bidding rings. Mit Press, 2012.

substantial demand for the product, thereby helping the firm to charge a higher price for their

product than that would have been charged in the competitive situation.

The outcome becomes even more favorable for the sellers if they come to a cartel

agreement, thereby ruling out price wars among them. Together they enjoy higher profits and

higher market power provided they do not cheat, which is inherent characteristic of an

oligopolistic cartel. The current situation of the Australian banking market can be indentified

with this construct9.

However, if the firms join hands to become a monopolistic working together, their cost

and price gap can increase even more as is shown in the diagram below:

Figure 2: Long run in the Monopoly Market

(Source: As created by the author)

9 Marshall, Robert C., and Leslie M. Marx. The economics of collusion: Cartels and bidding rings. Mit Press, 2012.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7AUSTRALIAN BANKING SECTOR: AN OLIGOPOLISTIC MARKET

In the monopoly market, due to the presence of the aggravated cost-price gap, in the long

run also the firm enjoys economic profit. This can be a potential threat for the buyers in the

banking market of Australia if the four big player join hands for a monopolistic construct.

Recommendations:

To rule out the problems faced by the consumers in the Australian banking industry and

to prevent any other future threats of consolidation and misuse of market power to substantial

extent by any of the participating agents, a stricter and regulatory environment has to be set up

by the governing authorities of the country. This should incorporate unbiased vigilance and

actions in case of defaulting by any of the players. New players should also be encouraged and

provided with sufficient securities in face of the competition they will face from the big ones10.

Conclusion:

In presence of market imperfections and asymmetric information structure, the party with

lack of information is bound to suffer. This makes free market condition more desirable.

However, in absence of free markets, proper reform, regulations, restrictions and unbiased

governance of a market can help in proper distribution of market power and welfare of the

participating agents, thereby making the market more equitable. The Australian banking industry

10 Feng, Yuan, Baochun Li, and Bo Li. "Price competition in an oligopoly market with multiple iaas cloud

providers." IEEE Transactions on Computers 63.1 (2014): 59-73.

In the monopoly market, due to the presence of the aggravated cost-price gap, in the long

run also the firm enjoys economic profit. This can be a potential threat for the buyers in the

banking market of Australia if the four big player join hands for a monopolistic construct.

Recommendations:

To rule out the problems faced by the consumers in the Australian banking industry and

to prevent any other future threats of consolidation and misuse of market power to substantial

extent by any of the participating agents, a stricter and regulatory environment has to be set up

by the governing authorities of the country. This should incorporate unbiased vigilance and

actions in case of defaulting by any of the players. New players should also be encouraged and

provided with sufficient securities in face of the competition they will face from the big ones10.

Conclusion:

In presence of market imperfections and asymmetric information structure, the party with

lack of information is bound to suffer. This makes free market condition more desirable.

However, in absence of free markets, proper reform, regulations, restrictions and unbiased

governance of a market can help in proper distribution of market power and welfare of the

participating agents, thereby making the market more equitable. The Australian banking industry

10 Feng, Yuan, Baochun Li, and Bo Li. "Price competition in an oligopoly market with multiple iaas cloud

providers." IEEE Transactions on Computers 63.1 (2014): 59-73.

8AUSTRALIAN BANKING SECTOR: AN OLIGOPOLISTIC MARKET

can also incorporate the above mentioned reforms to make the situation better for the buyer

group.

can also incorporate the above mentioned reforms to make the situation better for the buyer

group.

9AUSTRALIAN BANKING SECTOR: AN OLIGOPOLISTIC MARKET

References

Allen, David E., and Robert Powell. "The fluctuating default risk of Australian

banks." Australian Journal of Management 37.2 (2012): 297-325.

Feng, Yuan, Baochun Li, and Bo Li. "Price competition in an oligopoly market with multiple

iaas cloud providers." IEEE Transactions on Computers 63.1 (2014): 59-73.

Kavurmacioglu, Emir. Oligopolies in private spectrum commons: analysis and regulatory

implications. Diss. Boston University, 2016.

Maine, Bob. "The relentless pursuit of bank profits." Green Left Weekly 1120 (2016): 2.

Marshall, Robert C., and Leslie M. Marx. The economics of collusion: Cartels and bidding rings.

Mit Press, 2012.

Nytimes.com A, 'Flush And Dominant, Australia’S Banks Come Under Pressure' (Nytimes.com,

2017) <https://www.nytimes.com/2016/10/15/business/dealbook/australia-banks-under-

pressure.html?mcubz=1> accessed 29 August 2017

Rios, Manuel C., Campbell R. McConnell, and Stanley L. Brue. Economics: Principles,

problems, and policies. McGraw-Hill, 2013.

Tyers, Rod. "Service Oligopolies and Australia's Economy‐Wide Performance." Australian

Economic Review 48.4 (2015): 333-356.

References

Allen, David E., and Robert Powell. "The fluctuating default risk of Australian

banks." Australian Journal of Management 37.2 (2012): 297-325.

Feng, Yuan, Baochun Li, and Bo Li. "Price competition in an oligopoly market with multiple

iaas cloud providers." IEEE Transactions on Computers 63.1 (2014): 59-73.

Kavurmacioglu, Emir. Oligopolies in private spectrum commons: analysis and regulatory

implications. Diss. Boston University, 2016.

Maine, Bob. "The relentless pursuit of bank profits." Green Left Weekly 1120 (2016): 2.

Marshall, Robert C., and Leslie M. Marx. The economics of collusion: Cartels and bidding rings.

Mit Press, 2012.

Nytimes.com A, 'Flush And Dominant, Australia’S Banks Come Under Pressure' (Nytimes.com,

2017) <https://www.nytimes.com/2016/10/15/business/dealbook/australia-banks-under-

pressure.html?mcubz=1> accessed 29 August 2017

Rios, Manuel C., Campbell R. McConnell, and Stanley L. Brue. Economics: Principles,

problems, and policies. McGraw-Hill, 2013.

Tyers, Rod. "Service Oligopolies and Australia's Economy‐Wide Performance." Australian

Economic Review 48.4 (2015): 333-356.

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.