Finance in Hospitality: Financial Analysis and Strategy Report

VerifiedAdded on 2020/01/21

|19

|5301

|51

Report

AI Summary

This report offers a comprehensive analysis of financial management within the hospitality industry. It begins by evaluating internal and external finance sources available to businesses, including owner's funds, bank loans, and government grants, while also examining methods for generating income, such as providing event spaces and renegotiating contracts. The report then delves into cost elements (direct and indirect) and explores methods for controlling stock and cash through techniques like EOQ, ROP, and JIT. Budgetary control processes, including forecasting and variance analysis, are discussed. The report also covers the source and structure of trial balances, along with ratio analysis to assess financial performance, and concludes with a break-even analysis, cost-volume relationships, and short-term management decisions. The report includes tables for adjustments and financial statements, offering insights into strategic recommendations for improving future performance. This report is contributed by a student to Desklib, a platform providing AI-based study tools.

FINANCE IN HOSPITALITY

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION......................................................................................................................3

TASK 1......................................................................................................................................3

AC 1.1 Available finance sources for business and service industries.............................3

AC 1.2 Ranges of method of generating income for a large chain restaurant..................4

TASK 2......................................................................................................................................5

AC 2.1 Elements of cost, gross profit percentage and selling price.................................5

AC 2.2 Evaluate method of controlling stock and cash in business and service

environment......................................................................................................................7

TASK 3......................................................................................................................................8

AC 3.1 Budgetary control, process and purpose...............................................................8

AC 3.2 Variance analysis and corrective actions..............................................................9

TASK 4....................................................................................................................................10

AC 3.1 Source and structure of trial balance..................................................................10

AC 3.2 Evaluation of business accounts with necessary adjustments and required notes11

AC 4.1 computation of ratios for R. Riggs.....................................................................14

AC 4.2 Memorandum report about appropriate future strategies...................................14

TASK 5....................................................................................................................................15

AC 5.1 Categories of costs behaviour.............................................................................15

AC 5.2, 5.3 BEP, contribution per product, cost-volume relationship and short-term...15

management decisions....................................................................................................15

(1) Break-even point in units and value terms................................................................15

(2) Number of units required to be sold to meet target profits.......................................17

(c) Reasons for the best proposal with justifications......................................................17

CONCLUSION........................................................................................................................17

REFERENCES.........................................................................................................................18

INDEX OF TABLES

Table 1: Adjustment entries for R. Riggs.................................................................................13

Table 2: Profitability statement of R. Riggs for the year ended 31st December, 2012............13

Table 3: Balance sheet of R. Riggs as on 31st december, 2012...............................................13

2

INTRODUCTION......................................................................................................................3

TASK 1......................................................................................................................................3

AC 1.1 Available finance sources for business and service industries.............................3

AC 1.2 Ranges of method of generating income for a large chain restaurant..................4

TASK 2......................................................................................................................................5

AC 2.1 Elements of cost, gross profit percentage and selling price.................................5

AC 2.2 Evaluate method of controlling stock and cash in business and service

environment......................................................................................................................7

TASK 3......................................................................................................................................8

AC 3.1 Budgetary control, process and purpose...............................................................8

AC 3.2 Variance analysis and corrective actions..............................................................9

TASK 4....................................................................................................................................10

AC 3.1 Source and structure of trial balance..................................................................10

AC 3.2 Evaluation of business accounts with necessary adjustments and required notes11

AC 4.1 computation of ratios for R. Riggs.....................................................................14

AC 4.2 Memorandum report about appropriate future strategies...................................14

TASK 5....................................................................................................................................15

AC 5.1 Categories of costs behaviour.............................................................................15

AC 5.2, 5.3 BEP, contribution per product, cost-volume relationship and short-term...15

management decisions....................................................................................................15

(1) Break-even point in units and value terms................................................................15

(2) Number of units required to be sold to meet target profits.......................................17

(c) Reasons for the best proposal with justifications......................................................17

CONCLUSION........................................................................................................................17

REFERENCES.........................................................................................................................18

INDEX OF TABLES

Table 1: Adjustment entries for R. Riggs.................................................................................13

Table 2: Profitability statement of R. Riggs for the year ended 31st December, 2012............13

Table 3: Balance sheet of R. Riggs as on 31st december, 2012...............................................13

2

INTRODUCTION

Successful business operations are greatly depends upon availability of sufficient

quantum of funds. Every firm need funds for their operational activities and capital

expenditures. Hence, financial requirement can be arise for short, medium and long term

period. In the present report, various internal as well as external finance sources will be

evaluated that assist users in identifying most appropriate source to meet out their financial

need. Along with this, the report explain that how financial information are recorded in the

company's accounts. This will help to determine business performance and take strategic and

qualified decisions. Another, various managerial tools for controlling inventory, cash and

budgetary tool will be discuss. Lastly, ratio analysis technique will be used for evaluating

financial performance of the business.

TASK 1

AC 1.1 Available finance sources for business and service industries

There are two types of finance source, internal and external. Internal are available

inside the organization whilst external sources are available outside the business, explained

hereunder:

Owner’s funds and retained earnings: Owner may invest their personal savings into

the firm. However, retained earnings are the balance of profits that are not distributed

as shareholders dividend and kept as reserves or reinvested in the business (Romani

and Stern, 2013). Its advantage is firm do not need to pay any interest and repayment

of the investment. However, its disadvantage is high risk is associated with the

owner's funds.

Bank Loans: It is most frequently used source. Bank provides funds in the way of

loans to all the organizations (Khan, 2015). Its good aspect is it do not dilute control

rights hence, negative aspect is bank charges some interest over the loans.

Bank overdraft: It facilitates short-term financial need, in which firms are allowed to

withdraw some extent amount than their available account balance. It will help to

eliminate urgent financial need but still bank charges some high interest rates on this

facility.

Hire purchase: It allow users to purchase assets at some down payment and balance

can be repaid in fixed instalment (Peirson and et.al., 2014). Thus, it mitigate large

3

Successful business operations are greatly depends upon availability of sufficient

quantum of funds. Every firm need funds for their operational activities and capital

expenditures. Hence, financial requirement can be arise for short, medium and long term

period. In the present report, various internal as well as external finance sources will be

evaluated that assist users in identifying most appropriate source to meet out their financial

need. Along with this, the report explain that how financial information are recorded in the

company's accounts. This will help to determine business performance and take strategic and

qualified decisions. Another, various managerial tools for controlling inventory, cash and

budgetary tool will be discuss. Lastly, ratio analysis technique will be used for evaluating

financial performance of the business.

TASK 1

AC 1.1 Available finance sources for business and service industries

There are two types of finance source, internal and external. Internal are available

inside the organization whilst external sources are available outside the business, explained

hereunder:

Owner’s funds and retained earnings: Owner may invest their personal savings into

the firm. However, retained earnings are the balance of profits that are not distributed

as shareholders dividend and kept as reserves or reinvested in the business (Romani

and Stern, 2013). Its advantage is firm do not need to pay any interest and repayment

of the investment. However, its disadvantage is high risk is associated with the

owner's funds.

Bank Loans: It is most frequently used source. Bank provides funds in the way of

loans to all the organizations (Khan, 2015). Its good aspect is it do not dilute control

rights hence, negative aspect is bank charges some interest over the loans.

Bank overdraft: It facilitates short-term financial need, in which firms are allowed to

withdraw some extent amount than their available account balance. It will help to

eliminate urgent financial need but still bank charges some high interest rates on this

facility.

Hire purchase: It allow users to purchase assets at some down payment and balance

can be repaid in fixed instalment (Peirson and et.al., 2014). Thus, it mitigate large

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

amount of expenditures at the time of purchase whereas disadvantage is instalment

contain some interest charges.

Trade credit: It facilitate businesses to make payment after a short duration of 30

days so that they can sell their products first and pay later to creditors. Cash discount

is not available in trade credit.

Government grants: Government provide funds in the form of grants that can be use

for specific purpose. Business do not need to repay it with no interest obligations

while it is available only for the specific objectives and may be time-consuming also.

Family, friends and relatives: They provide financial support without any extra cost.

However, it will available up to a limited extent hence, can not be use for longer

duration.

Share capital: Funds can be generated through issuing preference and ordinary shares

(Růčková, 2015). Advantage is it diversify business control to the shareholders while

negative aspect is firms has to pay return in the form of dividend to them.

Personal savings and hire purchase are the best source to acquire machinery costing

worth £50000. Through this, owner will be able to make down payment from personal

savings and balance amount of hire purchase can be paid in equal instalment.

AC 1.2 Ranges of method of generating income for a large chain restaurant

There are ample ways of generating money for large units of restaurants. Some of the

exciting and unique ideas to create more income to achieve a worldwide growth are

mentioned below Providing rent facility- Restaurants serves the facility of providing the space for

numerous events such as party,business events,product launching,seminars and the

like. Conducting seminars and workshops- Simultaneously,conducting demonstration

lessons on cooking in the said restaurant will help to grab the attention of localities.

This will result in growth of the restaurant along with brand building. Renegotiating the contracts- Alternatively, the company should put its efforts to

renegotiate all of its contracts such as the contracts with its vendors,suppliers,credit

card provider,landlord etc. As a result of this, the company surprisingly gets a huge

amount of saving.

4

contain some interest charges.

Trade credit: It facilitate businesses to make payment after a short duration of 30

days so that they can sell their products first and pay later to creditors. Cash discount

is not available in trade credit.

Government grants: Government provide funds in the form of grants that can be use

for specific purpose. Business do not need to repay it with no interest obligations

while it is available only for the specific objectives and may be time-consuming also.

Family, friends and relatives: They provide financial support without any extra cost.

However, it will available up to a limited extent hence, can not be use for longer

duration.

Share capital: Funds can be generated through issuing preference and ordinary shares

(Růčková, 2015). Advantage is it diversify business control to the shareholders while

negative aspect is firms has to pay return in the form of dividend to them.

Personal savings and hire purchase are the best source to acquire machinery costing

worth £50000. Through this, owner will be able to make down payment from personal

savings and balance amount of hire purchase can be paid in equal instalment.

AC 1.2 Ranges of method of generating income for a large chain restaurant

There are ample ways of generating money for large units of restaurants. Some of the

exciting and unique ideas to create more income to achieve a worldwide growth are

mentioned below Providing rent facility- Restaurants serves the facility of providing the space for

numerous events such as party,business events,product launching,seminars and the

like. Conducting seminars and workshops- Simultaneously,conducting demonstration

lessons on cooking in the said restaurant will help to grab the attention of localities.

This will result in growth of the restaurant along with brand building. Renegotiating the contracts- Alternatively, the company should put its efforts to

renegotiate all of its contracts such as the contracts with its vendors,suppliers,credit

card provider,landlord etc. As a result of this, the company surprisingly gets a huge

amount of saving.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Publicity- A well executed advertisement and promotion will help the company to get

a huge exposure. This will provide a positive aspect in the mind set of people. Sampling- This is the most effective measure of generating income and promoting a

restaurant . As compared to advertising,this factor is less expensive and provides an

opportunity to render samples to its core customers. Items which can be easily and

fairly transported should be picked upon along with a strong representative to greet

the products.

Marketing-The marketing strategy which offers loyalty and integrity of its services

are the best for the company because of its achieving top grade results in the market

and costing it low to the company.

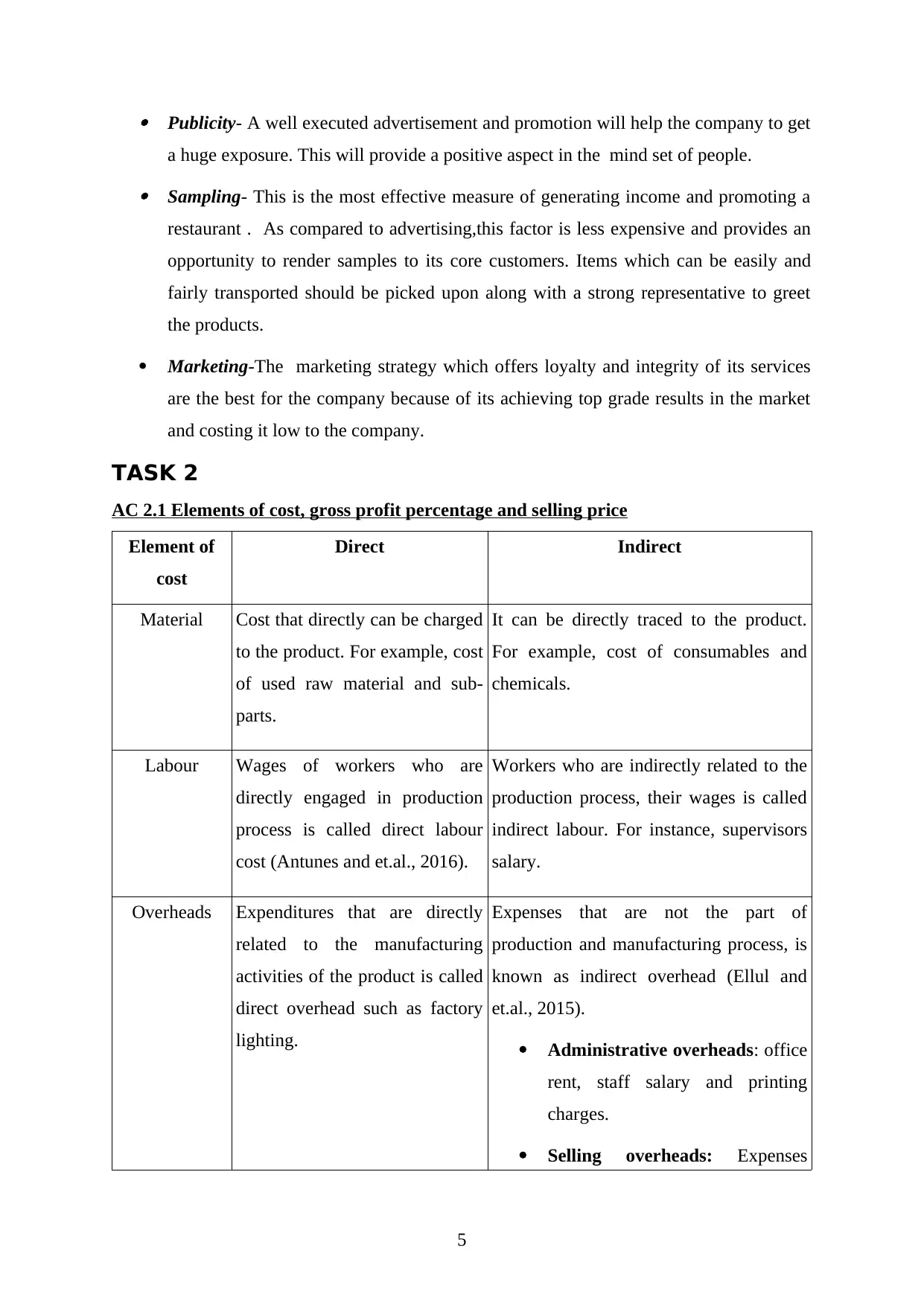

TASK 2

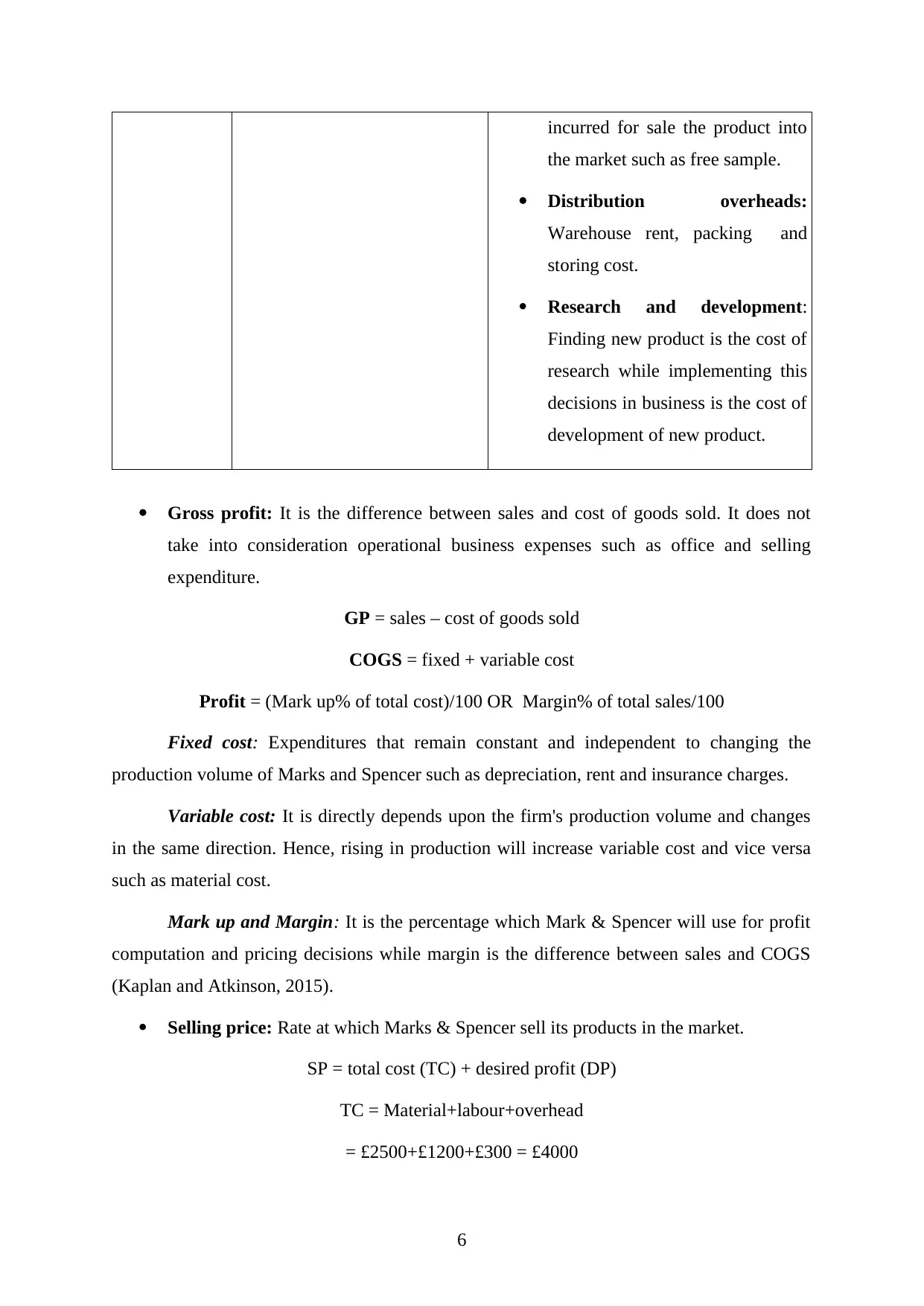

AC 2.1 Elements of cost, gross profit percentage and selling price

Element of

cost

Direct Indirect

Material Cost that directly can be charged

to the product. For example, cost

of used raw material and sub-

parts.

It can be directly traced to the product.

For example, cost of consumables and

chemicals.

Labour Wages of workers who are

directly engaged in production

process is called direct labour

cost (Antunes and et.al., 2016).

Workers who are indirectly related to the

production process, their wages is called

indirect labour. For instance, supervisors

salary.

Overheads Expenditures that are directly

related to the manufacturing

activities of the product is called

direct overhead such as factory

lighting.

Expenses that are not the part of

production and manufacturing process, is

known as indirect overhead (Ellul and

et.al., 2015).

Administrative overheads: office

rent, staff salary and printing

charges.

Selling overheads: Expenses

5

a huge exposure. This will provide a positive aspect in the mind set of people. Sampling- This is the most effective measure of generating income and promoting a

restaurant . As compared to advertising,this factor is less expensive and provides an

opportunity to render samples to its core customers. Items which can be easily and

fairly transported should be picked upon along with a strong representative to greet

the products.

Marketing-The marketing strategy which offers loyalty and integrity of its services

are the best for the company because of its achieving top grade results in the market

and costing it low to the company.

TASK 2

AC 2.1 Elements of cost, gross profit percentage and selling price

Element of

cost

Direct Indirect

Material Cost that directly can be charged

to the product. For example, cost

of used raw material and sub-

parts.

It can be directly traced to the product.

For example, cost of consumables and

chemicals.

Labour Wages of workers who are

directly engaged in production

process is called direct labour

cost (Antunes and et.al., 2016).

Workers who are indirectly related to the

production process, their wages is called

indirect labour. For instance, supervisors

salary.

Overheads Expenditures that are directly

related to the manufacturing

activities of the product is called

direct overhead such as factory

lighting.

Expenses that are not the part of

production and manufacturing process, is

known as indirect overhead (Ellul and

et.al., 2015).

Administrative overheads: office

rent, staff salary and printing

charges.

Selling overheads: Expenses

5

incurred for sale the product into

the market such as free sample.

Distribution overheads:

Warehouse rent, packing and

storing cost.

Research and development:

Finding new product is the cost of

research while implementing this

decisions in business is the cost of

development of new product.

Gross profit: It is the difference between sales and cost of goods sold. It does not

take into consideration operational business expenses such as office and selling

expenditure.

GP = sales – cost of goods sold

COGS = fixed + variable cost

Profit = (Mark up% of total cost)/100 OR Margin% of total sales/100

Fixed cost: Expenditures that remain constant and independent to changing the

production volume of Marks and Spencer such as depreciation, rent and insurance charges.

Variable cost: It is directly depends upon the firm's production volume and changes

in the same direction. Hence, rising in production will increase variable cost and vice versa

such as material cost.

Mark up and Margin: It is the percentage which Mark & Spencer will use for profit

computation and pricing decisions while margin is the difference between sales and COGS

(Kaplan and Atkinson, 2015).

Selling price: Rate at which Marks & Spencer sell its products in the market.

SP = total cost (TC) + desired profit (DP)

TC = Material+labour+overhead

= £2500+£1200+£300 = £4000

6

the market such as free sample.

Distribution overheads:

Warehouse rent, packing and

storing cost.

Research and development:

Finding new product is the cost of

research while implementing this

decisions in business is the cost of

development of new product.

Gross profit: It is the difference between sales and cost of goods sold. It does not

take into consideration operational business expenses such as office and selling

expenditure.

GP = sales – cost of goods sold

COGS = fixed + variable cost

Profit = (Mark up% of total cost)/100 OR Margin% of total sales/100

Fixed cost: Expenditures that remain constant and independent to changing the

production volume of Marks and Spencer such as depreciation, rent and insurance charges.

Variable cost: It is directly depends upon the firm's production volume and changes

in the same direction. Hence, rising in production will increase variable cost and vice versa

such as material cost.

Mark up and Margin: It is the percentage which Mark & Spencer will use for profit

computation and pricing decisions while margin is the difference between sales and COGS

(Kaplan and Atkinson, 2015).

Selling price: Rate at which Marks & Spencer sell its products in the market.

SP = total cost (TC) + desired profit (DP)

TC = Material+labour+overhead

= £2500+£1200+£300 = £4000

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CPU = £4000/400 = £10

DP = 25%

SP = £10 + (25/100*£10)

=£10 + £2.5 = £12.5

AC 2.2 Evaluate method of controlling stock and cash in business and service environment

Inventory or stock are the physical assets of a firm which it holds for the purpose of

future selling or generating it into a more valued asset for the organization.

In manufacturing companies, the process of inventory control includes four major stages.

These are raw materials,WIP,finished goods and COGS.

Stock control methods -

The decision as to what,when and how much to order is a very important criteria to

look upon in M&S. The company accordingly adopts various methods to efficiently control

its stock. This helps it in assessing correct amount of stock in correct place and at correct

time.

M&S broadly works on the following methods of controlling and managing the inventory-

EOQ –Here the company orders the units as per its requirements thereby reducing

the overall stock ordering and holding cost (Cash, receivables and inventory

management, n.d.).

EOQ=√2DCₒ/Cʜ

D= quantity of demand annually

C ₒ= cost per order of the quantity

Cʜ=annual holding cost per unit of stock.

The applicability of EOQ is as follows-

The product demand should be constant over the year.

Delivery of new order in case the stock is zero.

Irrespective of the units ordered , there applies a fixed cost for each order which is

placed.

Relevance of storage cost as a percentage of the purchase cost.

7

DP = 25%

SP = £10 + (25/100*£10)

=£10 + £2.5 = £12.5

AC 2.2 Evaluate method of controlling stock and cash in business and service environment

Inventory or stock are the physical assets of a firm which it holds for the purpose of

future selling or generating it into a more valued asset for the organization.

In manufacturing companies, the process of inventory control includes four major stages.

These are raw materials,WIP,finished goods and COGS.

Stock control methods -

The decision as to what,when and how much to order is a very important criteria to

look upon in M&S. The company accordingly adopts various methods to efficiently control

its stock. This helps it in assessing correct amount of stock in correct place and at correct

time.

M&S broadly works on the following methods of controlling and managing the inventory-

EOQ –Here the company orders the units as per its requirements thereby reducing

the overall stock ordering and holding cost (Cash, receivables and inventory

management, n.d.).

EOQ=√2DCₒ/Cʜ

D= quantity of demand annually

C ₒ= cost per order of the quantity

Cʜ=annual holding cost per unit of stock.

The applicability of EOQ is as follows-

The product demand should be constant over the year.

Delivery of new order in case the stock is zero.

Irrespective of the units ordered , there applies a fixed cost for each order which is

placed.

Relevance of storage cost as a percentage of the purchase cost.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ROP- It is that minimum level of inventory which a firm holds so that in the event of

shortage of stocks , the units can be reordered.

ROP=D*LT

D= rate of demand per period of time. LT= lead time period Just in time (JIT)-This method helps to increase the overall stock turnover and

simultaneously minimizes the holding cost of inventory (Inventory management and

control, n.d.). Stock-taking-This method represents the physical verification of the inventory stored

in the warehouse. This provides the company with an appropriate idea of its stock

units that it holds. First-In,First-Out (FIFO)- This method generally calculates the COGS during the

entire period and the value of stock at the end of financial period. This method works

on the assumption that inventory purchased first will be sold first.

Last -In,First-Out(LIFO)- This method works on the assumption that the asset

acquired last are disposed and sold of first. Wit addition to it , the tax liability of the

company gets increased.

TASK 3

AC 3.1 Budgetary control, process and purpose

Process of budgetary control: Budget entails managers to anticipate potential

earnings and expenditures that can be arise in future years. It consists of four stages,

described below:

At the initial stage, management has to forecast business revenues and expenditures

for the upcoming period. They analyse customer demand to predict future sales.

However, under the expenditures sides, they estimate purchase, rent, insurance, rent

and rates and others utilities payments.

At this stage, managers determine actual revenues and spendings through prepared

financial statements (Thompson and et.al., 2013).

8

shortage of stocks , the units can be reordered.

ROP=D*LT

D= rate of demand per period of time. LT= lead time period Just in time (JIT)-This method helps to increase the overall stock turnover and

simultaneously minimizes the holding cost of inventory (Inventory management and

control, n.d.). Stock-taking-This method represents the physical verification of the inventory stored

in the warehouse. This provides the company with an appropriate idea of its stock

units that it holds. First-In,First-Out (FIFO)- This method generally calculates the COGS during the

entire period and the value of stock at the end of financial period. This method works

on the assumption that inventory purchased first will be sold first.

Last -In,First-Out(LIFO)- This method works on the assumption that the asset

acquired last are disposed and sold of first. Wit addition to it , the tax liability of the

company gets increased.

TASK 3

AC 3.1 Budgetary control, process and purpose

Process of budgetary control: Budget entails managers to anticipate potential

earnings and expenditures that can be arise in future years. It consists of four stages,

described below:

At the initial stage, management has to forecast business revenues and expenditures

for the upcoming period. They analyse customer demand to predict future sales.

However, under the expenditures sides, they estimate purchase, rent, insurance, rent

and rates and others utilities payments.

At this stage, managers determine actual revenues and spendings through prepared

financial statements (Thompson and et.al., 2013).

8

There after, managers compare set targets with the actual output. It will assist users to

determine favourable or adverse variances and its causes. At last stage, corrective actions will be framed so that negative or adverse variances

can be eliminated and targets can be achieved (Moore and et.al., 2015).

Purpose of budgetary control: It aims at forecasting potential firms performance

through determining future revenues and spendings. Another purpose is to determine variance

and remove it to accomplish set targets. Moreover, it focuses in maximum utilization of

business resources through efficient allocation of incomes (Chen, Weikart and Williams,

2014). So that, expenses can be control and profits can be improve. Establishing coordination

and monitoring workers performance are the another purpose of budgetary planning.

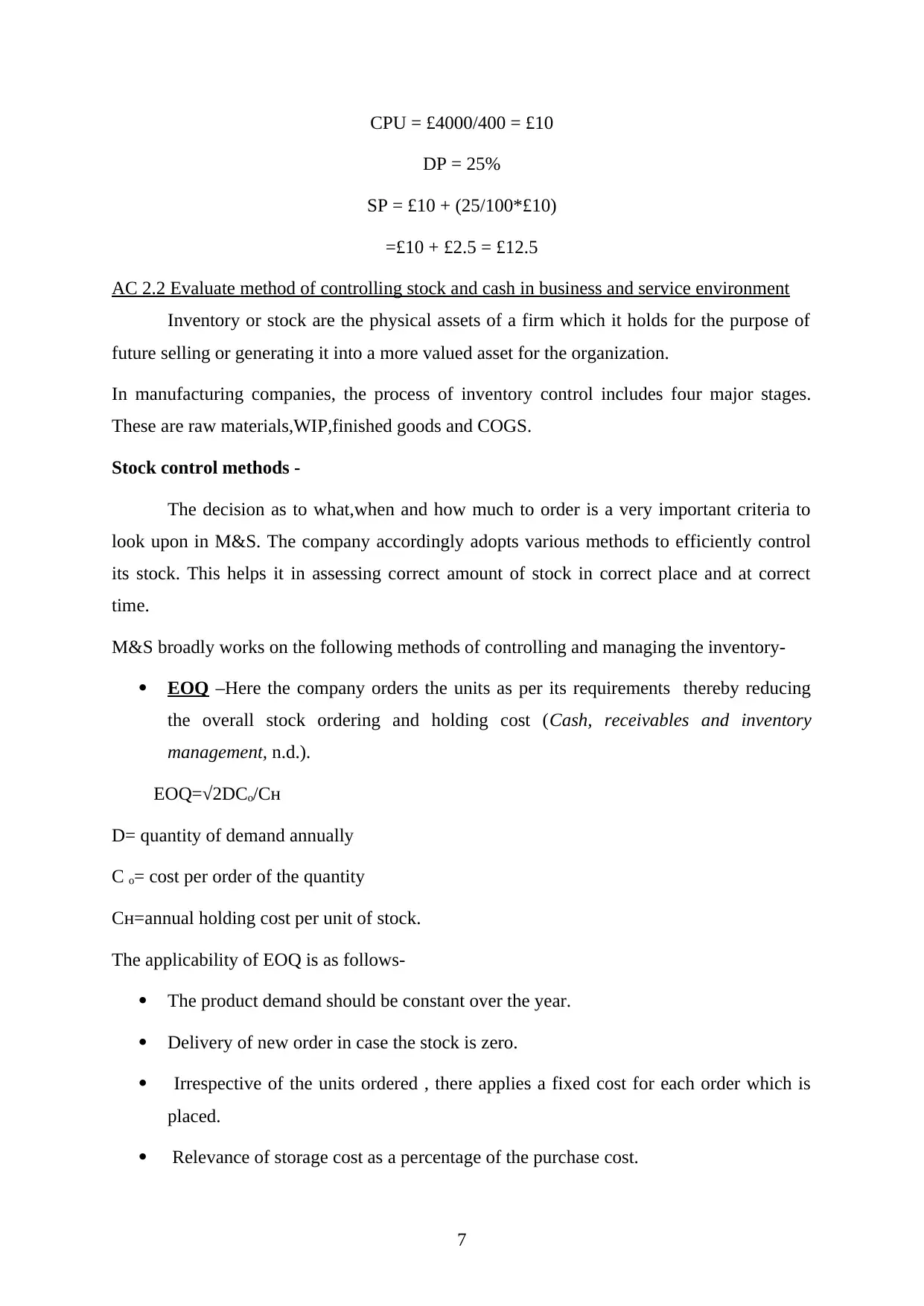

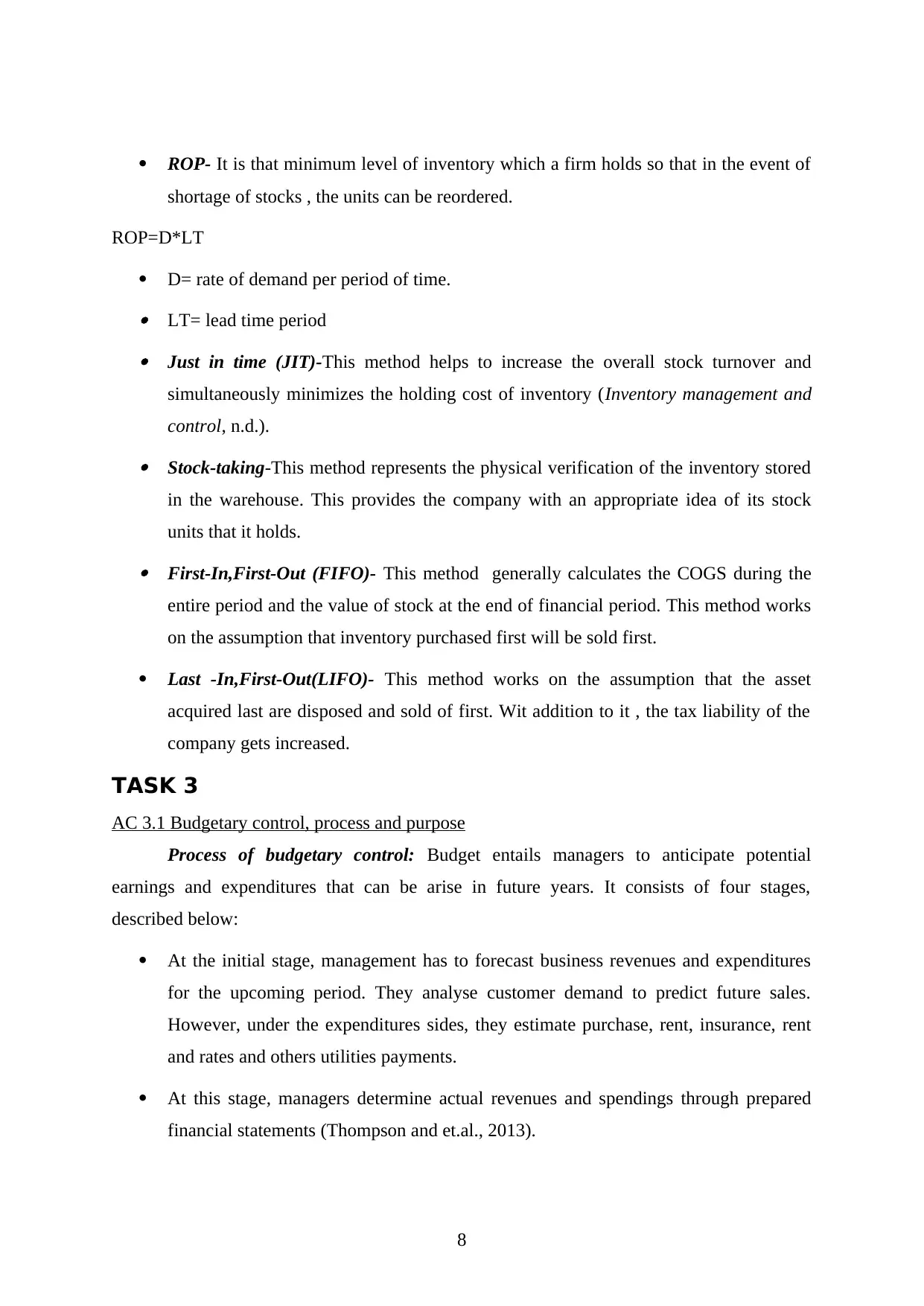

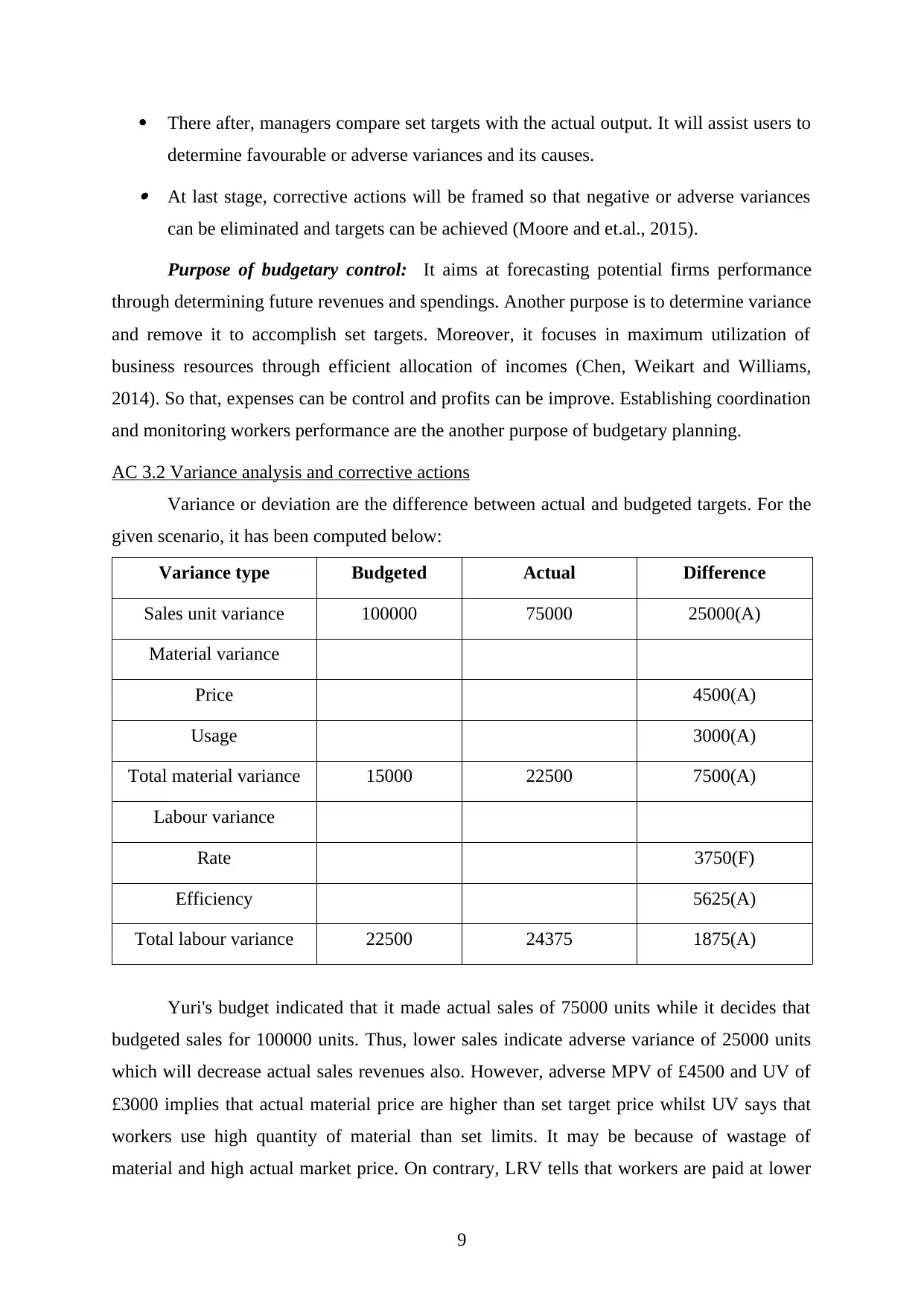

AC 3.2 Variance analysis and corrective actions

Variance or deviation are the difference between actual and budgeted targets. For the

given scenario, it has been computed below:

Variance type Budgeted Actual Difference

Sales unit variance 100000 75000 25000(A)

Material variance

Price 4500(A)

Usage 3000(A)

Total material variance 15000 22500 7500(A)

Labour variance

Rate 3750(F)

Efficiency 5625(A)

Total labour variance 22500 24375 1875(A)

Yuri's budget indicated that it made actual sales of 75000 units while it decides that

budgeted sales for 100000 units. Thus, lower sales indicate adverse variance of 25000 units

which will decrease actual sales revenues also. However, adverse MPV of £4500 and UV of

£3000 implies that actual material price are higher than set target price whilst UV says that

workers use high quantity of material than set limits. It may be because of wastage of

material and high actual market price. On contrary, LRV tells that workers are paid at lower

9

determine favourable or adverse variances and its causes. At last stage, corrective actions will be framed so that negative or adverse variances

can be eliminated and targets can be achieved (Moore and et.al., 2015).

Purpose of budgetary control: It aims at forecasting potential firms performance

through determining future revenues and spendings. Another purpose is to determine variance

and remove it to accomplish set targets. Moreover, it focuses in maximum utilization of

business resources through efficient allocation of incomes (Chen, Weikart and Williams,

2014). So that, expenses can be control and profits can be improve. Establishing coordination

and monitoring workers performance are the another purpose of budgetary planning.

AC 3.2 Variance analysis and corrective actions

Variance or deviation are the difference between actual and budgeted targets. For the

given scenario, it has been computed below:

Variance type Budgeted Actual Difference

Sales unit variance 100000 75000 25000(A)

Material variance

Price 4500(A)

Usage 3000(A)

Total material variance 15000 22500 7500(A)

Labour variance

Rate 3750(F)

Efficiency 5625(A)

Total labour variance 22500 24375 1875(A)

Yuri's budget indicated that it made actual sales of 75000 units while it decides that

budgeted sales for 100000 units. Thus, lower sales indicate adverse variance of 25000 units

which will decrease actual sales revenues also. However, adverse MPV of £4500 and UV of

£3000 implies that actual material price are higher than set target price whilst UV says that

workers use high quantity of material than set limits. It may be because of wastage of

material and high actual market price. On contrary, LRV tells that workers are paid at lower

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

rates whilst target piece rate is high. It will affect operations in a favourable manner.

However, LEV says that employees use high actual hours whereas budgeted hours are some

lower. This in turn, adverse variance arise for £5625. It may be because of high idle time,

machinery breakdowns, wastage of time and inefficient labour.

Thus, it can be recommended that Yuri has to find new suppliers whose price is some

lower than current prices. However, MUV can be removed through efficient material

management and reduce scrap or wastage. On contrary, LEV can be eliminated through

continuous monitoring and controlling, proper training and time management.

TASK 4

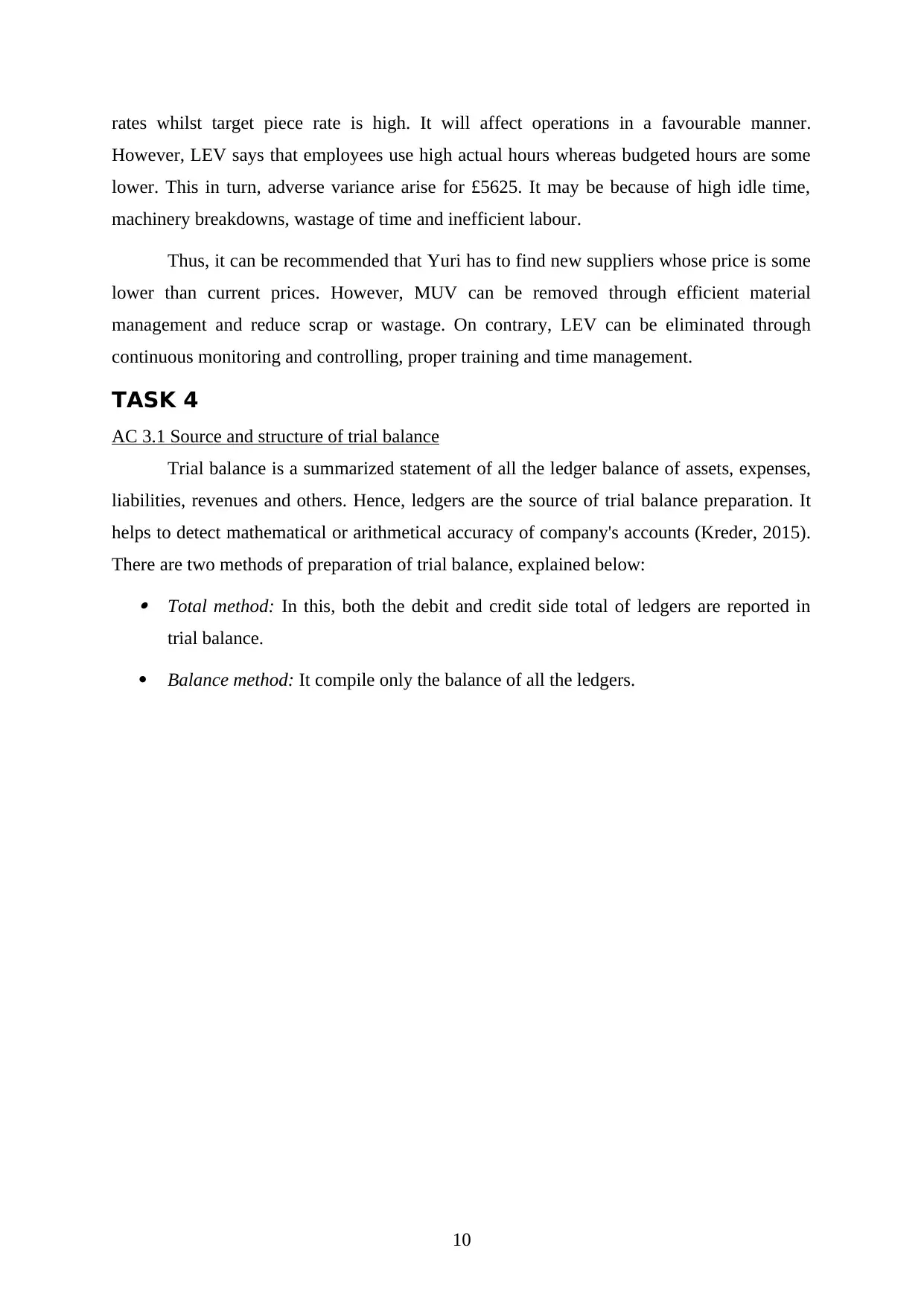

AC 3.1 Source and structure of trial balance

Trial balance is a summarized statement of all the ledger balance of assets, expenses,

liabilities, revenues and others. Hence, ledgers are the source of trial balance preparation. It

helps to detect mathematical or arithmetical accuracy of company's accounts (Kreder, 2015).

There are two methods of preparation of trial balance, explained below: Total method: In this, both the debit and credit side total of ledgers are reported in

trial balance.

Balance method: It compile only the balance of all the ledgers.

10

However, LEV says that employees use high actual hours whereas budgeted hours are some

lower. This in turn, adverse variance arise for £5625. It may be because of high idle time,

machinery breakdowns, wastage of time and inefficient labour.

Thus, it can be recommended that Yuri has to find new suppliers whose price is some

lower than current prices. However, MUV can be removed through efficient material

management and reduce scrap or wastage. On contrary, LEV can be eliminated through

continuous monitoring and controlling, proper training and time management.

TASK 4

AC 3.1 Source and structure of trial balance

Trial balance is a summarized statement of all the ledger balance of assets, expenses,

liabilities, revenues and others. Hence, ledgers are the source of trial balance preparation. It

helps to detect mathematical or arithmetical accuracy of company's accounts (Kreder, 2015).

There are two methods of preparation of trial balance, explained below: Total method: In this, both the debit and credit side total of ledgers are reported in

trial balance.

Balance method: It compile only the balance of all the ledgers.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

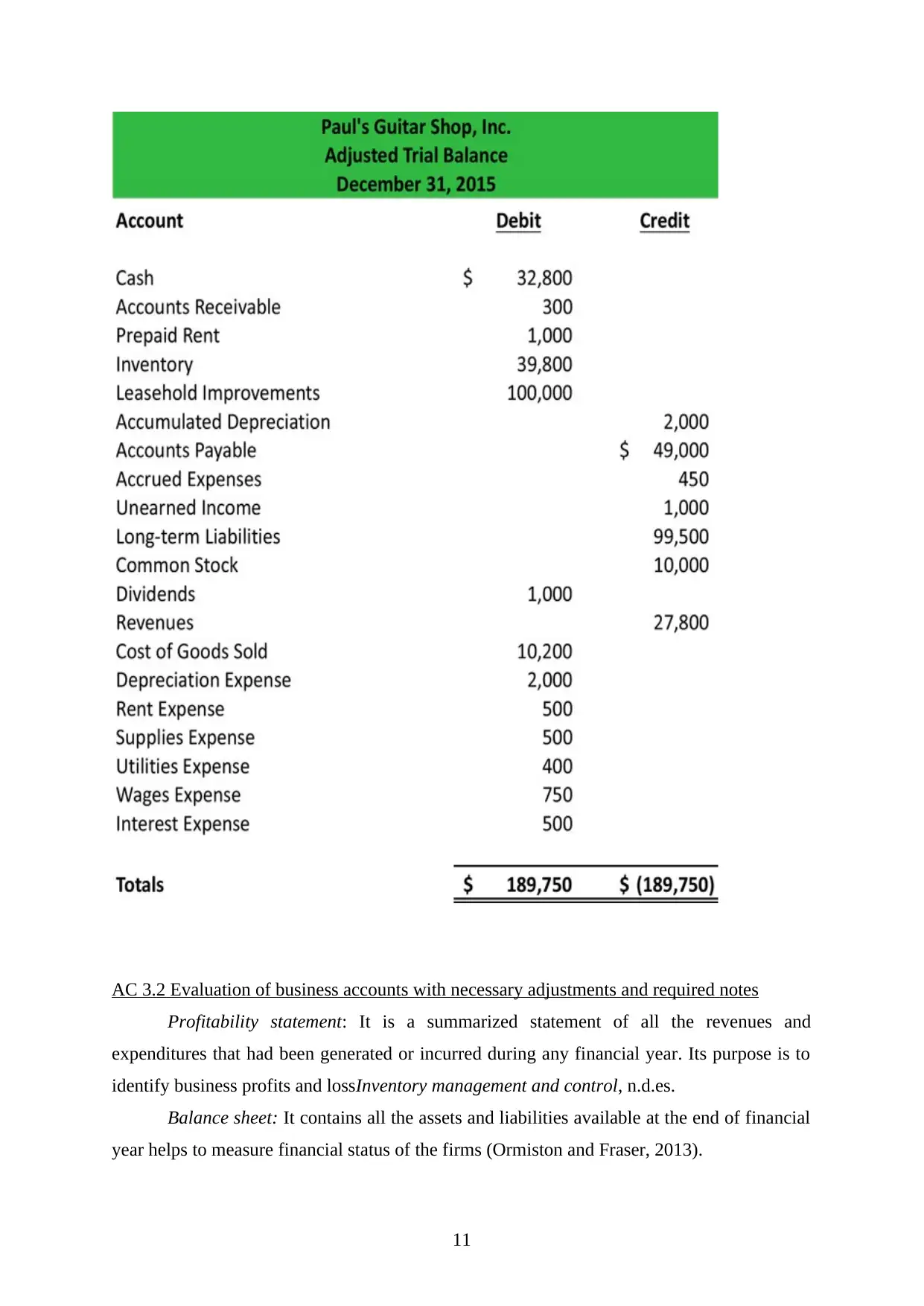

AC 3.2 Evaluation of business accounts with necessary adjustments and required notes

Profitability statement: It is a summarized statement of all the revenues and

expenditures that had been generated or incurred during any financial year. Its purpose is to

identify business profits and lossInventory management and control, n.d.es.

Balance sheet: It contains all the assets and liabilities available at the end of financial

year helps to measure financial status of the firms (Ormiston and Fraser, 2013).

11

Profitability statement: It is a summarized statement of all the revenues and

expenditures that had been generated or incurred during any financial year. Its purpose is to

identify business profits and lossInventory management and control, n.d.es.

Balance sheet: It contains all the assets and liabilities available at the end of financial

year helps to measure financial status of the firms (Ormiston and Fraser, 2013).

11

Table 1: Adjustment entries for R. Riggs

Date Particular L.F. Debit (In £) Credit (In £)

March, 3

2012

Furniture a/c Dr.

To creditors

(Purchase additional furniture

costing £525 on credit)

525

525

December, 30

2012

Bank a/c Dr.

To Interest received

(Interest recipts on bank deposits)

50

50

June, 4

2012

Accrued expenses a/c Dr.

To Bank a/c

(Unrecorded payment of

outstanding expenses)

200

200

Total 775 775

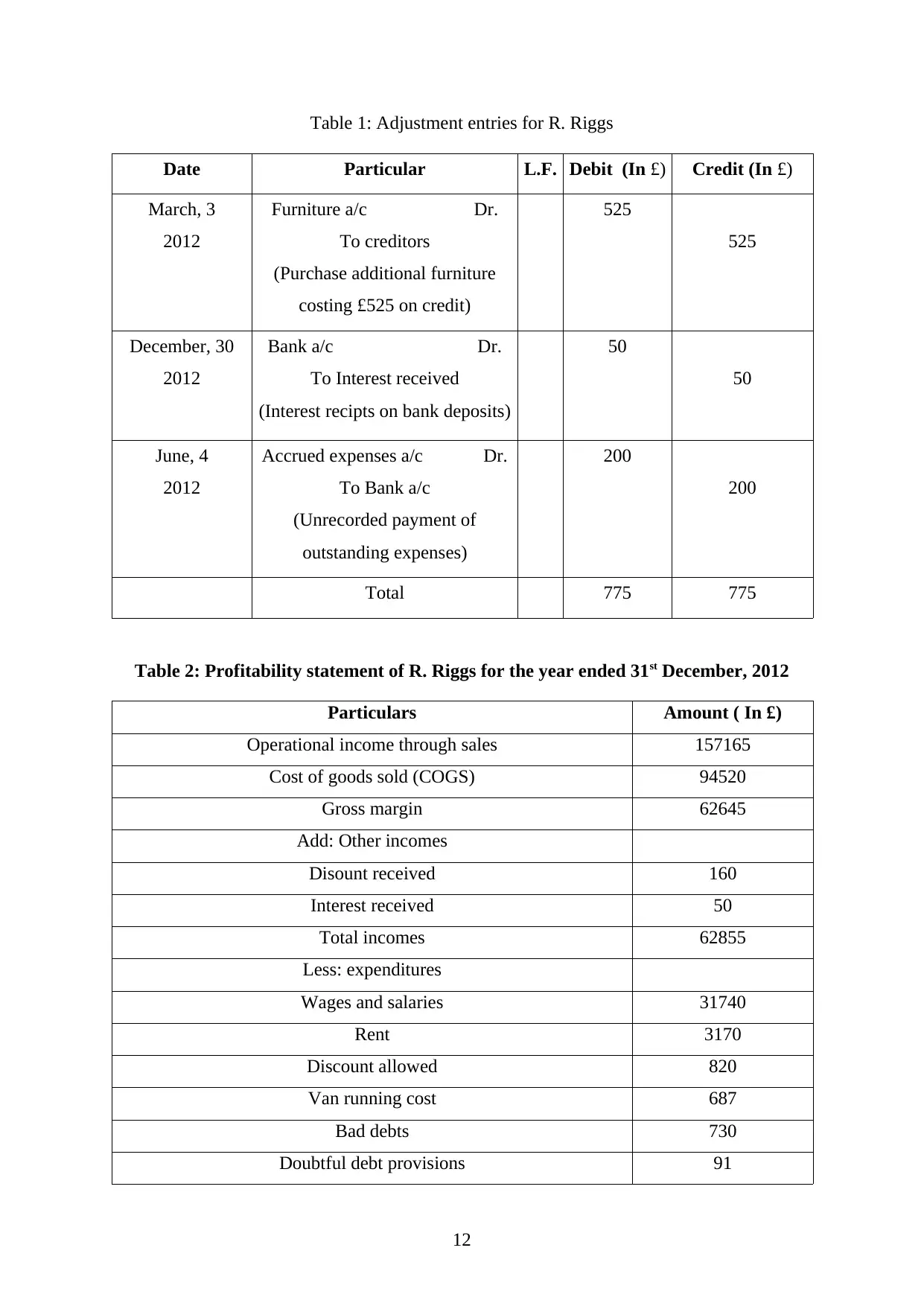

Table 2: Profitability statement of R. Riggs for the year ended 31st December, 2012

Particulars Amount ( In £)

Operational income through sales 157165

Cost of goods sold (COGS) 94520

Gross margin 62645

Add: Other incomes

Disount received 160

Interest received 50

Total incomes 62855

Less: expenditures

Wages and salaries 31740

Rent 3170

Discount allowed 820

Van running cost 687

Bad debts 730

Doubtful debt provisions 91

12

Date Particular L.F. Debit (In £) Credit (In £)

March, 3

2012

Furniture a/c Dr.

To creditors

(Purchase additional furniture

costing £525 on credit)

525

525

December, 30

2012

Bank a/c Dr.

To Interest received

(Interest recipts on bank deposits)

50

50

June, 4

2012

Accrued expenses a/c Dr.

To Bank a/c

(Unrecorded payment of

outstanding expenses)

200

200

Total 775 775

Table 2: Profitability statement of R. Riggs for the year ended 31st December, 2012

Particulars Amount ( In £)

Operational income through sales 157165

Cost of goods sold (COGS) 94520

Gross margin 62645

Add: Other incomes

Disount received 160

Interest received 50

Total incomes 62855

Less: expenditures

Wages and salaries 31740

Rent 3170

Discount allowed 820

Van running cost 687

Bad debts 730

Doubtful debt provisions 91

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19