Finance Report: EOQ, Payback Period, Financial Statement Analysis

VerifiedAdded on 2023/01/05

|15

|4387

|63

Report

AI Summary

This report provides a comprehensive overview of key financial concepts, including Economic Order Quantity (EOQ) calculations for hard plastic, total annual cost analysis, and a critical evaluation of EOQ as an inventory management technique. It also explores payback period calculations and accounting rate of return, offering a critical assessment of the ARR method and recommendations to a senior team. Furthermore, the report delves into financial statement analysis, examining various financial ratios and emphasizing the importance of such analysis. It concludes with a discussion on the role of organizations in managing accounting standards and the function of audit committees in corporate governance. The report uses Touchdown Sports Inc. as a case study to apply the concepts discussed.

introduction to finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

Question 1........................................................................................................................................3

Economic order quantity for hard plastic....................................................................................3

Annual cost of hard plastic..........................................................................................................3

Critical evaluation of using EOQ as inventory management technique.....................................4

Advice for inventory management in respect to opinion of Grace Rodriquez and Maria

Cousins........................................................................................................................................5

Question 2........................................................................................................................................6

Pay back period...........................................................................................................................6

Accounting rate of return............................................................................................................8

Critical evaluation of accounting rate of return method.............................................................9

Advice to senior team..................................................................................................................9

Question 3......................................................................................................................................10

Financial calculations................................................................................................................10

Importance of financial statement analysis...............................................................................11

Question 4......................................................................................................................................12

Organisation role in managing accounting standards...............................................................12

Role of audit committee in corporate governance....................................................................13

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION...........................................................................................................................3

Question 1........................................................................................................................................3

Economic order quantity for hard plastic....................................................................................3

Annual cost of hard plastic..........................................................................................................3

Critical evaluation of using EOQ as inventory management technique.....................................4

Advice for inventory management in respect to opinion of Grace Rodriquez and Maria

Cousins........................................................................................................................................5

Question 2........................................................................................................................................6

Pay back period...........................................................................................................................6

Accounting rate of return............................................................................................................8

Critical evaluation of accounting rate of return method.............................................................9

Advice to senior team..................................................................................................................9

Question 3......................................................................................................................................10

Financial calculations................................................................................................................10

Importance of financial statement analysis...............................................................................11

Question 4......................................................................................................................................12

Organisation role in managing accounting standards...............................................................12

Role of audit committee in corporate governance....................................................................13

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION

Finance management is defined as managing and controlling financial resources of

company (Nagib and et.al., 2016). This report will emphasis over different principles and

concepts associated with the finance. Henceforth, this report will emphasis over the calculation

of economic order quantity. Calculation in respect to total annual cost of plastic will also project

in this report. Critical evaluation will also be conducted in respect to company's approach for

utilising EOQ model for managing company's inventory. Total annual cost of plastic will also

calculate in this project. Company’s approach to manage its inventory would also be evaluated

critically in this report. How effective the EOQ method to manage organization inventory would

be analysed critically in this project. Advice will also be given over company’s technique to

manage its inventory. Calculation related to payback period will also be analysed in this report.

Evaluation related to accounting rate of return will also be a part of this project. Critical analysis

of internal rate of return technique would also project in this project. Furthermore, this project

will provide details about various ratios like gross profit ratio, asset usage ratio, current ratio,

acid test, inventories holding period and debt to equity ratio. Importance of financial statements

will also project in this report.

Question 1

Economic order quantity for hard plastic

Economic Order Quantity (EOQ) = √ 2 * D * S / H

D (Demand in Unit) = 27000 Units

S (Order cost per purchase order) = $14

H (Holding cost per unit) = $1.75

= √ 2 * 27000 * $14 / $1.75

= 657 Units

Annual cost of hard plastic

Annual cost of plastic = Cost of material + Annual holding cost + Annual ordering cost

Demand in unit (D)= 27000 Unit

Finance management is defined as managing and controlling financial resources of

company (Nagib and et.al., 2016). This report will emphasis over different principles and

concepts associated with the finance. Henceforth, this report will emphasis over the calculation

of economic order quantity. Calculation in respect to total annual cost of plastic will also project

in this report. Critical evaluation will also be conducted in respect to company's approach for

utilising EOQ model for managing company's inventory. Total annual cost of plastic will also

calculate in this project. Company’s approach to manage its inventory would also be evaluated

critically in this report. How effective the EOQ method to manage organization inventory would

be analysed critically in this project. Advice will also be given over company’s technique to

manage its inventory. Calculation related to payback period will also be analysed in this report.

Evaluation related to accounting rate of return will also be a part of this project. Critical analysis

of internal rate of return technique would also project in this project. Furthermore, this project

will provide details about various ratios like gross profit ratio, asset usage ratio, current ratio,

acid test, inventories holding period and debt to equity ratio. Importance of financial statements

will also project in this report.

Question 1

Economic order quantity for hard plastic

Economic Order Quantity (EOQ) = √ 2 * D * S / H

D (Demand in Unit) = 27000 Units

S (Order cost per purchase order) = $14

H (Holding cost per unit) = $1.75

= √ 2 * 27000 * $14 / $1.75

= 657 Units

Annual cost of hard plastic

Annual cost of plastic = Cost of material + Annual holding cost + Annual ordering cost

Demand in unit (D)= 27000 Unit

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Volume per order (Q)= 657

(It would be estimated as EOQ)

Ordering cost per purchase order (S) = $14

Holding cost per unit (H)= $1.75

Annual ordering cost = D /Q * S

= 27000 / 657 * $14

= $ 575

Annual holding cost = Q/2 * H

= 657 / 2 * 1.75

= $ 575

Total cost = $ 24300 + $ 575 + $ 575

= $ 25450

Critical evaluation of using EOQ as inventory management technique

Economic order quantity is denoted as the quantity of material that company should order

every year to contain the least ordering cost and holding cost. This is the quantity that will allow

company to control the cost incurred to produce the final product (Vanauken, Ascigil and

Carraher, 2017). It takes time to convert material into finished good. Economic order quantity

allow the organisation to control the extra cost needed to convert material into finished good.

The time taken to convert the raw material into finished good also takes time which further

consumer extra cost of holding the material and equipment. The formula consume to evaluate

economic order quantity contain elements like annual consumption, holding cost and ordering

cost (Ventura and Samuel, 2016). ON the basis of the annual expected consumption appropriate

quantity calculated that consider the least amount of holding and ordering cost. This is the

standard quantity company should order in process to keep the ordering and holding cost

minimum. If the company order more than the requires amount of inventory than it needs to

consume more holding cost to protect such extra inventory company has ordered for future use.

IN case the organisation orders less than required inventory than it needs to suffer extra ordering

cost as number of order will be more than required which will consume extra ordering cost for

company. The concept of economic order quantity protect organisation from suffering such extra

(It would be estimated as EOQ)

Ordering cost per purchase order (S) = $14

Holding cost per unit (H)= $1.75

Annual ordering cost = D /Q * S

= 27000 / 657 * $14

= $ 575

Annual holding cost = Q/2 * H

= 657 / 2 * 1.75

= $ 575

Total cost = $ 24300 + $ 575 + $ 575

= $ 25450

Critical evaluation of using EOQ as inventory management technique

Economic order quantity is denoted as the quantity of material that company should order

every year to contain the least ordering cost and holding cost. This is the quantity that will allow

company to control the cost incurred to produce the final product (Vanauken, Ascigil and

Carraher, 2017). It takes time to convert material into finished good. Economic order quantity

allow the organisation to control the extra cost needed to convert material into finished good.

The time taken to convert the raw material into finished good also takes time which further

consumer extra cost of holding the material and equipment. The formula consume to evaluate

economic order quantity contain elements like annual consumption, holding cost and ordering

cost (Ventura and Samuel, 2016). ON the basis of the annual expected consumption appropriate

quantity calculated that consider the least amount of holding and ordering cost. This is the

standard quantity company should order in process to keep the ordering and holding cost

minimum. If the company order more than the requires amount of inventory than it needs to

consume more holding cost to protect such extra inventory company has ordered for future use.

IN case the organisation orders less than required inventory than it needs to suffer extra ordering

cost as number of order will be more than required which will consume extra ordering cost for

company. The concept of economic order quantity protect organisation from suffering such extra

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

cost incurred for consuming the inventory in order to convert such into finished good. The cost

advantages associated with the economic order quantity drive companies to consume the raw

material into the best way possible that will consume the minimum holding and ordering cost

incurred in converting raw material into finished. Only the minimum amount of inventory

company will be required to protect in the store. The biggest advantages of economic order

quantity is in respect to company need to suffer from the minimum ordering and holding cost

possible. This further reduces the overall cost of producing the unit or finished good (Di Nardo

and et.al., 2020). The use of economic order quantity method is further contain a certain

limitation as annual consumption of material are more hypothetical as any organisation do not

carry any specific idea about how much the units organization will consume in an year. The

hypothetical figure in respect to overall consumption of raw material evaluate the hypothetical

information about the quantity of raw material company should order in organisation.

Economic order quantity method also usage the past figures of total raw material

consumed to evaluate the economic order quantity. This tactic of identifying economic order

quanmity does not involve other elements like increased market demand, situation of business

environment and many other elements that can project wrong interpretations in respect to the

organisation. This method contain several limitations which also create a negative impact in

respect to using this method of calculate economic order quantity (Jackson and Orr, 2019). It is

not forecast to calculate the exact demand of raw material needed to convert into finished good.

This method assume that raw material will be immediately available by suppliers which in

practical context not become convenient as many times suppliers also not carry the quantity

needed to organisation at the time of order. This method also needed monitoring at continuous

level. All these are certain disadvantages or challenges associated with the method of inventory

management.

Touchdown Sports Inc's decision of utilising the economic order quantity method to

manage inventory is the most prominent technique to manage the inventory in organisation. This

technique allows the company to control cost and unusual holding of inventory in company's

stock (Maxwell, 2016). This method will allow better management of company’s inventory. So

the company's decision to use this technique is more beneficial in favour of the organisation.

advantages associated with the economic order quantity drive companies to consume the raw

material into the best way possible that will consume the minimum holding and ordering cost

incurred in converting raw material into finished. Only the minimum amount of inventory

company will be required to protect in the store. The biggest advantages of economic order

quantity is in respect to company need to suffer from the minimum ordering and holding cost

possible. This further reduces the overall cost of producing the unit or finished good (Di Nardo

and et.al., 2020). The use of economic order quantity method is further contain a certain

limitation as annual consumption of material are more hypothetical as any organisation do not

carry any specific idea about how much the units organization will consume in an year. The

hypothetical figure in respect to overall consumption of raw material evaluate the hypothetical

information about the quantity of raw material company should order in organisation.

Economic order quantity method also usage the past figures of total raw material

consumed to evaluate the economic order quantity. This tactic of identifying economic order

quanmity does not involve other elements like increased market demand, situation of business

environment and many other elements that can project wrong interpretations in respect to the

organisation. This method contain several limitations which also create a negative impact in

respect to using this method of calculate economic order quantity (Jackson and Orr, 2019). It is

not forecast to calculate the exact demand of raw material needed to convert into finished good.

This method assume that raw material will be immediately available by suppliers which in

practical context not become convenient as many times suppliers also not carry the quantity

needed to organisation at the time of order. This method also needed monitoring at continuous

level. All these are certain disadvantages or challenges associated with the method of inventory

management.

Touchdown Sports Inc's decision of utilising the economic order quantity method to

manage inventory is the most prominent technique to manage the inventory in organisation. This

technique allows the company to control cost and unusual holding of inventory in company's

stock (Maxwell, 2016). This method will allow better management of company’s inventory. So

the company's decision to use this technique is more beneficial in favour of the organisation.

Advice for inventory management in respect to opinion of Grace Rodriquez and Maria Cousins

Inventory management is a critical aspect of business. On the basis of the annual

consumption of raw material company conduct its inventory management practices. Grace

Rodriquez and Maria Cousins suggested the just in time method of managing inventory in

organisation. This method of inventory management guides the company to order inventory only

the time when raw material are needed to organisation. The prior order of inventory are not a part

of practice if company. This method follows the practice that raw material should be ordered

only the time when it is needed in factory. This method is directed towards cost control as

keeping material in stock will occur holding cost and ordering cost. Just in time inventory

method would directly allow the company to avoid holding cost. Ordering cost will be same in

this method of inventory management. Once the stock reached the re order level inventory are

ordered in this method so at the time of actual requirement of such stock raw material is

available in stock for company (Park, Ramesh and Cao, 2016). Ordering cost can also be more

than the EOQ method of inventory management. This method would directly control or restricts

the holding cost of inventory but it will generate more ordering cost for company. This method

also contains a limitation that it is not necessary that raw material would be immediately

available with the supplier. In case due top any abnormal reason supplier could not deliver raw

material company will face a trouble in producing the finished good. This method contains extra

risk of shortage of inventory in company's stock. Economic order quantity contain both the cost

holding cost and ordering cost but in limit (Bolomope and et.al., 2020). Economic order method

also ensures the proper availability of company's stock at all the time of production even in

abnormal circumstances. All these advantages associated with the economic order quantity make

this method more beneficial in respect to the organisation. Use of economic order quantity

method is more beneficial for the organisation. This method will allow the organisation to

control both cost and time related to the management of inventory.

Question 2

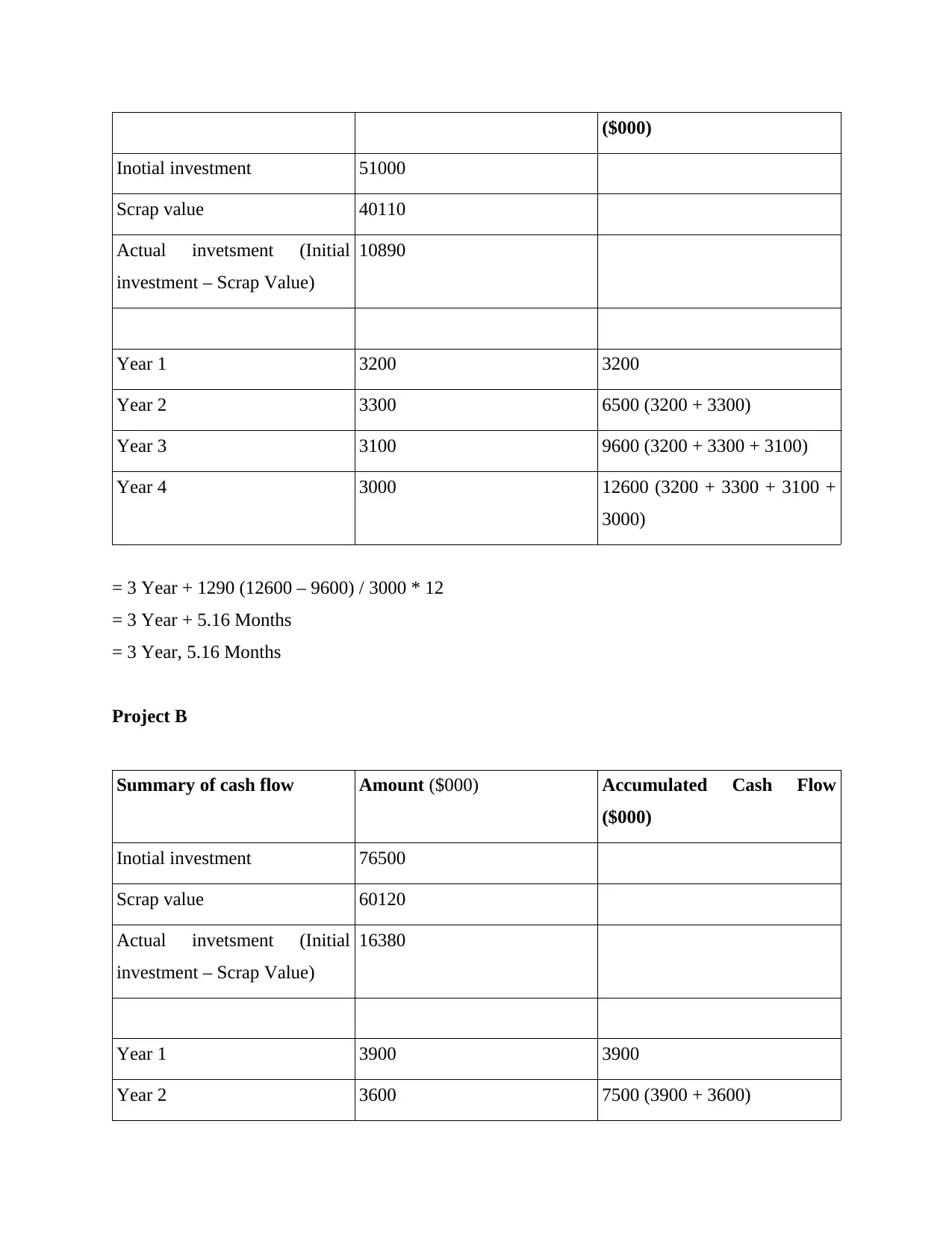

Pay back period

Pay back period is defined as time taken to recover the original investment amount.

Project A

Summary of cash flow Amount ($000) Accumulated Cash Flow

Inventory management is a critical aspect of business. On the basis of the annual

consumption of raw material company conduct its inventory management practices. Grace

Rodriquez and Maria Cousins suggested the just in time method of managing inventory in

organisation. This method of inventory management guides the company to order inventory only

the time when raw material are needed to organisation. The prior order of inventory are not a part

of practice if company. This method follows the practice that raw material should be ordered

only the time when it is needed in factory. This method is directed towards cost control as

keeping material in stock will occur holding cost and ordering cost. Just in time inventory

method would directly allow the company to avoid holding cost. Ordering cost will be same in

this method of inventory management. Once the stock reached the re order level inventory are

ordered in this method so at the time of actual requirement of such stock raw material is

available in stock for company (Park, Ramesh and Cao, 2016). Ordering cost can also be more

than the EOQ method of inventory management. This method would directly control or restricts

the holding cost of inventory but it will generate more ordering cost for company. This method

also contains a limitation that it is not necessary that raw material would be immediately

available with the supplier. In case due top any abnormal reason supplier could not deliver raw

material company will face a trouble in producing the finished good. This method contains extra

risk of shortage of inventory in company's stock. Economic order quantity contain both the cost

holding cost and ordering cost but in limit (Bolomope and et.al., 2020). Economic order method

also ensures the proper availability of company's stock at all the time of production even in

abnormal circumstances. All these advantages associated with the economic order quantity make

this method more beneficial in respect to the organisation. Use of economic order quantity

method is more beneficial for the organisation. This method will allow the organisation to

control both cost and time related to the management of inventory.

Question 2

Pay back period

Pay back period is defined as time taken to recover the original investment amount.

Project A

Summary of cash flow Amount ($000) Accumulated Cash Flow

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

($000)

Inotial investment 51000

Scrap value 40110

Actual invetsment (Initial

investment – Scrap Value)

10890

Year 1 3200 3200

Year 2 3300 6500 (3200 + 3300)

Year 3 3100 9600 (3200 + 3300 + 3100)

Year 4 3000 12600 (3200 + 3300 + 3100 +

3000)

= 3 Year + 1290 (12600 – 9600) / 3000 * 12

= 3 Year + 5.16 Months

= 3 Year, 5.16 Months

Project B

Summary of cash flow Amount ($000) Accumulated Cash Flow

($000)

Inotial investment 76500

Scrap value 60120

Actual invetsment (Initial

investment – Scrap Value)

16380

Year 1 3900 3900

Year 2 3600 7500 (3900 + 3600)

Inotial investment 51000

Scrap value 40110

Actual invetsment (Initial

investment – Scrap Value)

10890

Year 1 3200 3200

Year 2 3300 6500 (3200 + 3300)

Year 3 3100 9600 (3200 + 3300 + 3100)

Year 4 3000 12600 (3200 + 3300 + 3100 +

3000)

= 3 Year + 1290 (12600 – 9600) / 3000 * 12

= 3 Year + 5.16 Months

= 3 Year, 5.16 Months

Project B

Summary of cash flow Amount ($000) Accumulated Cash Flow

($000)

Inotial investment 76500

Scrap value 60120

Actual invetsment (Initial

investment – Scrap Value)

16380

Year 1 3900 3900

Year 2 3600 7500 (3900 + 3600)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

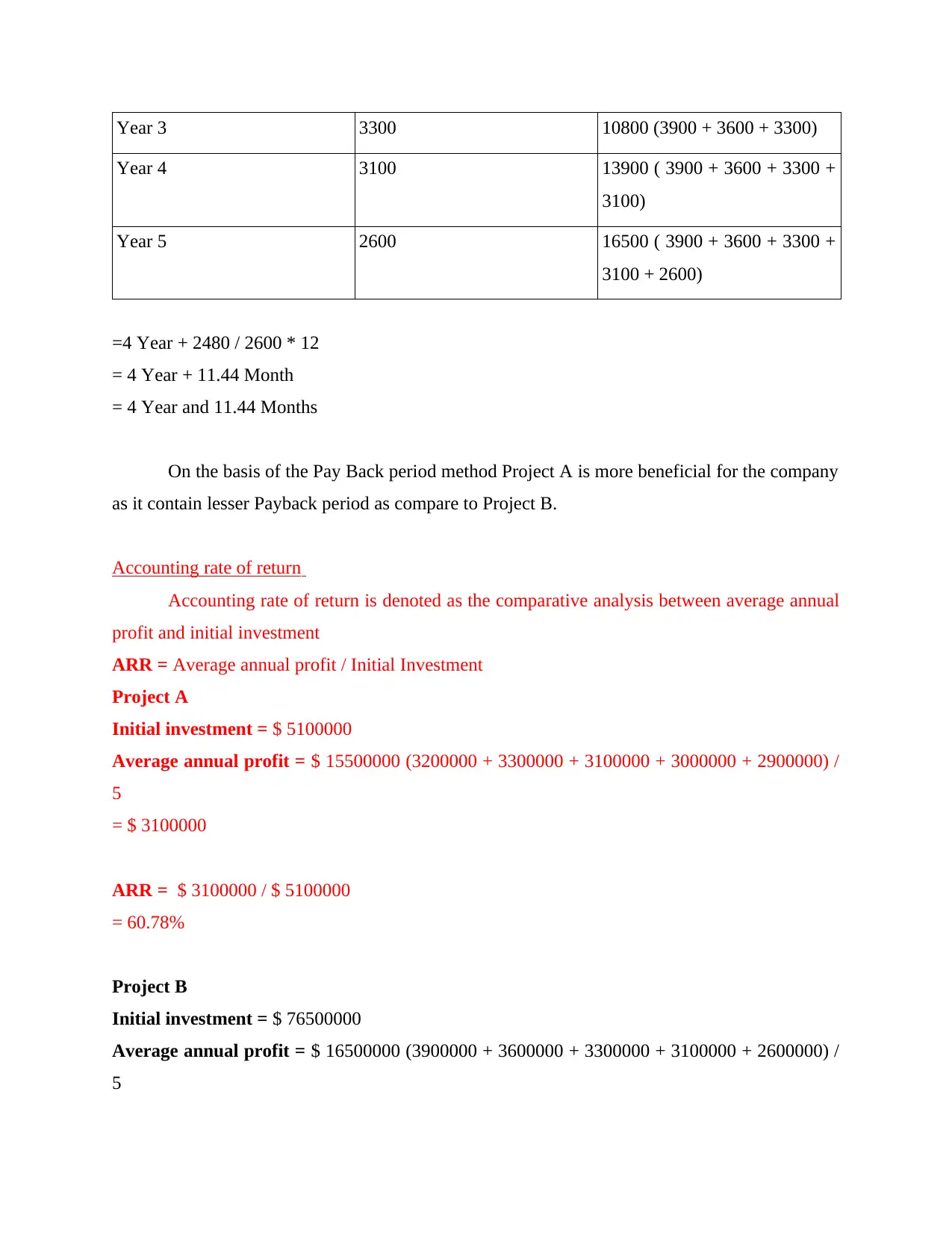

Year 3 3300 10800 (3900 + 3600 + 3300)

Year 4 3100 13900 ( 3900 + 3600 + 3300 +

3100)

Year 5 2600 16500 ( 3900 + 3600 + 3300 +

3100 + 2600)

=4 Year + 2480 / 2600 * 12

= 4 Year + 11.44 Month

= 4 Year and 11.44 Months

On the basis of the Pay Back period method Project A is more beneficial for the company

as it contain lesser Payback period as compare to Project B.

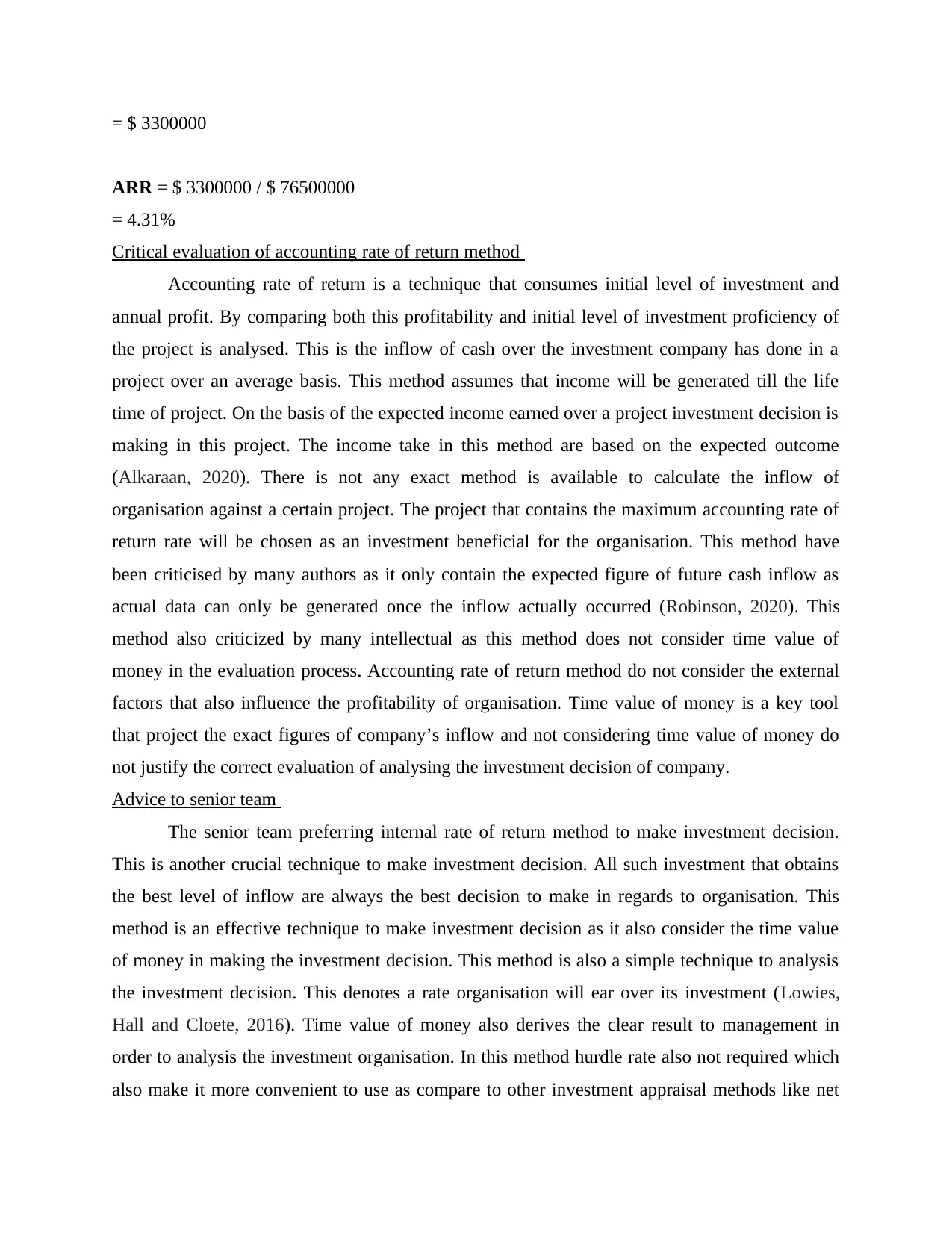

Accounting rate of return

Accounting rate of return is denoted as the comparative analysis between average annual

profit and initial investment

ARR = Average annual profit / Initial Investment

Project A

Initial investment = $ 5100000

Average annual profit = $ 15500000 (3200000 + 3300000 + 3100000 + 3000000 + 2900000) /

5

= $ 3100000

ARR = $ 3100000 / $ 5100000

= 60.78%

Project B

Initial investment = $ 76500000

Average annual profit = $ 16500000 (3900000 + 3600000 + 3300000 + 3100000 + 2600000) /

5

Year 4 3100 13900 ( 3900 + 3600 + 3300 +

3100)

Year 5 2600 16500 ( 3900 + 3600 + 3300 +

3100 + 2600)

=4 Year + 2480 / 2600 * 12

= 4 Year + 11.44 Month

= 4 Year and 11.44 Months

On the basis of the Pay Back period method Project A is more beneficial for the company

as it contain lesser Payback period as compare to Project B.

Accounting rate of return

Accounting rate of return is denoted as the comparative analysis between average annual

profit and initial investment

ARR = Average annual profit / Initial Investment

Project A

Initial investment = $ 5100000

Average annual profit = $ 15500000 (3200000 + 3300000 + 3100000 + 3000000 + 2900000) /

5

= $ 3100000

ARR = $ 3100000 / $ 5100000

= 60.78%

Project B

Initial investment = $ 76500000

Average annual profit = $ 16500000 (3900000 + 3600000 + 3300000 + 3100000 + 2600000) /

5

= $ 3300000

ARR = $ 3300000 / $ 76500000

= 4.31%

Critical evaluation of accounting rate of return method

Accounting rate of return is a technique that consumes initial level of investment and

annual profit. By comparing both this profitability and initial level of investment proficiency of

the project is analysed. This is the inflow of cash over the investment company has done in a

project over an average basis. This method assumes that income will be generated till the life

time of project. On the basis of the expected income earned over a project investment decision is

making in this project. The income take in this method are based on the expected outcome

(Alkaraan, 2020). There is not any exact method is available to calculate the inflow of

organisation against a certain project. The project that contains the maximum accounting rate of

return rate will be chosen as an investment beneficial for the organisation. This method have

been criticised by many authors as it only contain the expected figure of future cash inflow as

actual data can only be generated once the inflow actually occurred (Robinson, 2020). This

method also criticized by many intellectual as this method does not consider time value of

money in the evaluation process. Accounting rate of return method do not consider the external

factors that also influence the profitability of organisation. Time value of money is a key tool

that project the exact figures of company’s inflow and not considering time value of money do

not justify the correct evaluation of analysing the investment decision of company.

Advice to senior team

The senior team preferring internal rate of return method to make investment decision.

This is another crucial technique to make investment decision. All such investment that obtains

the best level of inflow are always the best decision to make in regards to organisation. This

method is an effective technique to make investment decision as it also consider the time value

of money in making the investment decision. This method is also a simple technique to analysis

the investment decision. This denotes a rate organisation will ear over its investment (Lowies,

Hall and Cloete, 2016). Time value of money also derives the clear result to management in

order to analysis the investment organisation. In this method hurdle rate also not required which

also make it more convenient to use as compare to other investment appraisal methods like net

ARR = $ 3300000 / $ 76500000

= 4.31%

Critical evaluation of accounting rate of return method

Accounting rate of return is a technique that consumes initial level of investment and

annual profit. By comparing both this profitability and initial level of investment proficiency of

the project is analysed. This is the inflow of cash over the investment company has done in a

project over an average basis. This method assumes that income will be generated till the life

time of project. On the basis of the expected income earned over a project investment decision is

making in this project. The income take in this method are based on the expected outcome

(Alkaraan, 2020). There is not any exact method is available to calculate the inflow of

organisation against a certain project. The project that contains the maximum accounting rate of

return rate will be chosen as an investment beneficial for the organisation. This method have

been criticised by many authors as it only contain the expected figure of future cash inflow as

actual data can only be generated once the inflow actually occurred (Robinson, 2020). This

method also criticized by many intellectual as this method does not consider time value of

money in the evaluation process. Accounting rate of return method do not consider the external

factors that also influence the profitability of organisation. Time value of money is a key tool

that project the exact figures of company’s inflow and not considering time value of money do

not justify the correct evaluation of analysing the investment decision of company.

Advice to senior team

The senior team preferring internal rate of return method to make investment decision.

This is another crucial technique to make investment decision. All such investment that obtains

the best level of inflow are always the best decision to make in regards to organisation. This

method is an effective technique to make investment decision as it also consider the time value

of money in making the investment decision. This method is also a simple technique to analysis

the investment decision. This denotes a rate organisation will ear over its investment (Lowies,

Hall and Cloete, 2016). Time value of money also derives the clear result to management in

order to analysis the investment organisation. In this method hurdle rate also not required which

also make it more convenient to use as compare to other investment appraisal methods like net

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

present value and other methods. As compare to accounting rate of return technique this method

is more reliable technique to analysis the investment decision of organisation. Accounting rate of

return do not involve time value of money which this method also involve so the preference of

this method over accounting rate of return method is more reliable. This method further contains

some limitations such as it ignores the size of investment completely. It also ignores future cost

company need to incur in order to sustain the investment. This technique of investment decision

maiking also ignores the reinvestment rate (Hanafi, 2018). Apart from the few mentioned

disadvantages this method suggests the most optimum level of results when it comes to making

investment decision in regards to the organisation. This method denote the most optimum rate an

organisation will derive from its investment which further indicate the bets result in favour to the

organisation. The decision of management to analysis investment decision based on internal rate

of return method is beneficial in favour of the organisation. As it will allow the company to

analysis all areas of the investment decision making.

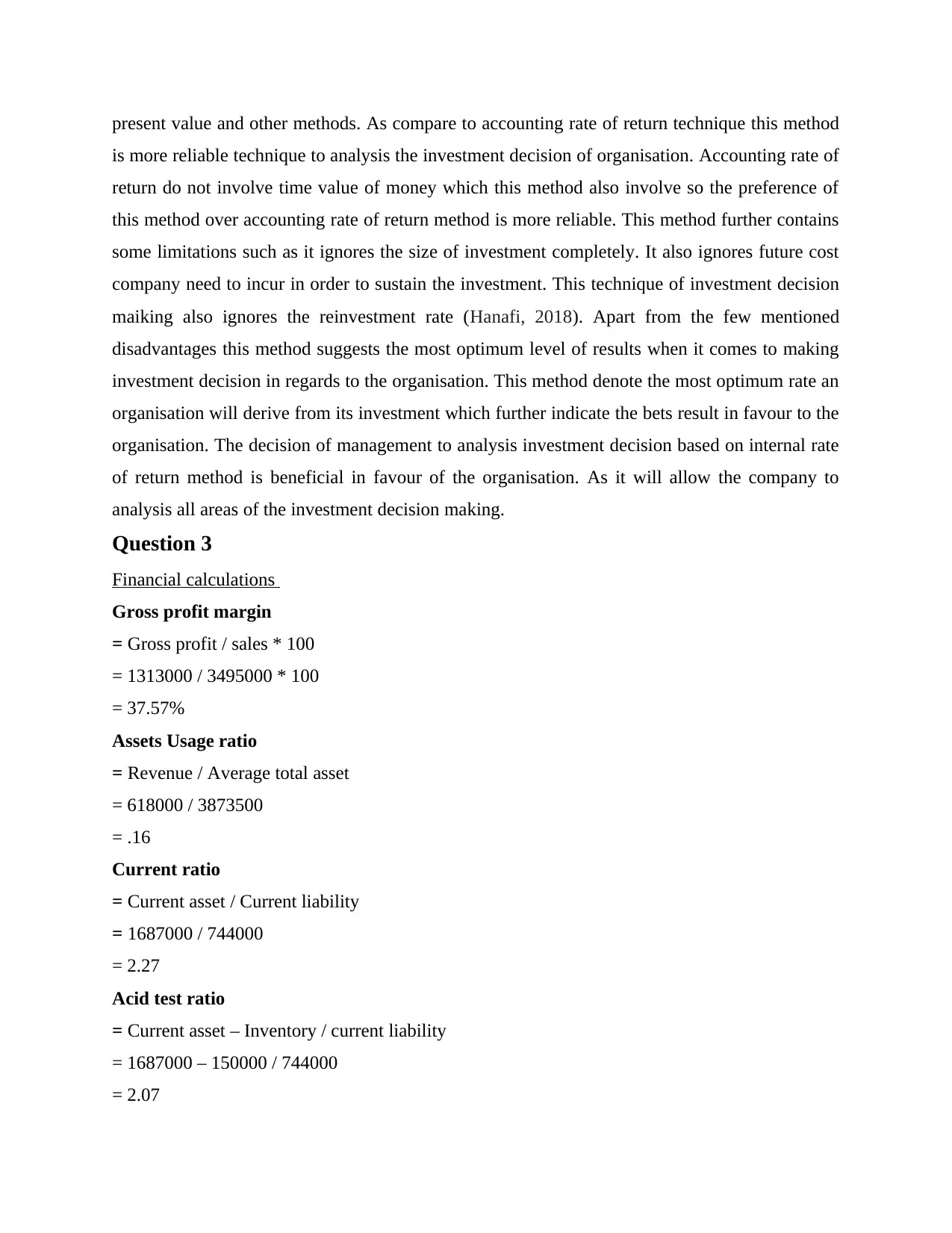

Question 3

Financial calculations

Gross profit margin

= Gross profit / sales * 100

= 1313000 / 3495000 * 100

= 37.57%

Assets Usage ratio

= Revenue / Average total asset

= 618000 / 3873500

= .16

Current ratio

= Current asset / Current liability

= 1687000 / 744000

= 2.27

Acid test ratio

= Current asset – Inventory / current liability

= 1687000 – 150000 / 744000

= 2.07

is more reliable technique to analysis the investment decision of organisation. Accounting rate of

return do not involve time value of money which this method also involve so the preference of

this method over accounting rate of return method is more reliable. This method further contains

some limitations such as it ignores the size of investment completely. It also ignores future cost

company need to incur in order to sustain the investment. This technique of investment decision

maiking also ignores the reinvestment rate (Hanafi, 2018). Apart from the few mentioned

disadvantages this method suggests the most optimum level of results when it comes to making

investment decision in regards to the organisation. This method denote the most optimum rate an

organisation will derive from its investment which further indicate the bets result in favour to the

organisation. The decision of management to analysis investment decision based on internal rate

of return method is beneficial in favour of the organisation. As it will allow the company to

analysis all areas of the investment decision making.

Question 3

Financial calculations

Gross profit margin

= Gross profit / sales * 100

= 1313000 / 3495000 * 100

= 37.57%

Assets Usage ratio

= Revenue / Average total asset

= 618000 / 3873500

= .16

Current ratio

= Current asset / Current liability

= 1687000 / 744000

= 2.27

Acid test ratio

= Current asset – Inventory / current liability

= 1687000 – 150000 / 744000

= 2.07

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Inventories holding period

= Avg Inventory / cost of good sold * 365

= 126000 (150000 + 102000 / 2) / 3495000 * 12

= .43 days

Debt to equity ratio

= Total liabilities / Total shareholder equity

= 914000 / 2210000

= .41

Importance of financial statement analysis

Financial statements are the financial records of company’s performance in a respective

financial year. All affairs entertained by organisation in a respective year are recorded in the

financial statement of company. Financial statement contains the significant information in

respect to organisation financial health and wealth. They are the exact knowledge about how

company has performed in a respective financial year so that further decisions can be taken in

respect to business operations. It involve sales of company in a respective financial year that can

also be analysed with previous year records to understand weather the organisation has

performed more effectively this year or not. Growth rate of company also evaluated with the

support of turnover of organisation (Ogunlusi and Obademi, 2019). Balance sheet guides the

management to understand the business performance and drive towards making the best decision

for business operations. Balance sheet project the exact detail where the organisation stated today

in respect to its assets, profitability, liabilities, ownership, funds and many such relative

information which further guides to company towards the right direction when it comes to

making decisions in business. Income statements project how much the sales company has

entertained, incomes associated with the organisation and expenses related to the respective

financial year and other such information. All this information further involved in evaluating

ration for assessing business presence in the market. Ratio such as liquidity ratio, current ratio,

asset to turnover ratio and all other respective ratios are also calculated based on the information

represent in financial records of organisation.

Financial statements also play an important role for all different stakeholders of

organisation. Stakeholders make decisions based on the information represent in the financial

records of organisation. They make investment decision in organisation on the basis of the

= Avg Inventory / cost of good sold * 365

= 126000 (150000 + 102000 / 2) / 3495000 * 12

= .43 days

Debt to equity ratio

= Total liabilities / Total shareholder equity

= 914000 / 2210000

= .41

Importance of financial statement analysis

Financial statements are the financial records of company’s performance in a respective

financial year. All affairs entertained by organisation in a respective year are recorded in the

financial statement of company. Financial statement contains the significant information in

respect to organisation financial health and wealth. They are the exact knowledge about how

company has performed in a respective financial year so that further decisions can be taken in

respect to business operations. It involve sales of company in a respective financial year that can

also be analysed with previous year records to understand weather the organisation has

performed more effectively this year or not. Growth rate of company also evaluated with the

support of turnover of organisation (Ogunlusi and Obademi, 2019). Balance sheet guides the

management to understand the business performance and drive towards making the best decision

for business operations. Balance sheet project the exact detail where the organisation stated today

in respect to its assets, profitability, liabilities, ownership, funds and many such relative

information which further guides to company towards the right direction when it comes to

making decisions in business. Income statements project how much the sales company has

entertained, incomes associated with the organisation and expenses related to the respective

financial year and other such information. All this information further involved in evaluating

ration for assessing business presence in the market. Ratio such as liquidity ratio, current ratio,

asset to turnover ratio and all other respective ratios are also calculated based on the information

represent in financial records of organisation.

Financial statements also play an important role for all different stakeholders of

organisation. Stakeholders make decisions based on the information represent in the financial

records of organisation. They make investment decision in organisation on the basis of the

information projected in the financial records of organisation. How much profitability company

generate, growth rate and various other information are all evaluated and identified on the basis

of the financial records of organisation. Financial statements such as balance sheet also reflect

the reserve company has contained for its future investment plains. This information is related to

the company’s share holders who are also claimed as the owner of the organisation (Xu and

et.al., 2019). All these aspects of the financial statements of organisation like income statement,

balance sheet guide the management to make the best decision in respect to the business

operations of organisation. Cash flow statement is another crucial financial record which

company prepare. This statement is helpful only for management. This statement reflects

information about the liquidity position of organisation. Company also need to analyse the

liquidity so that no extra blockage in company’s operations can create.

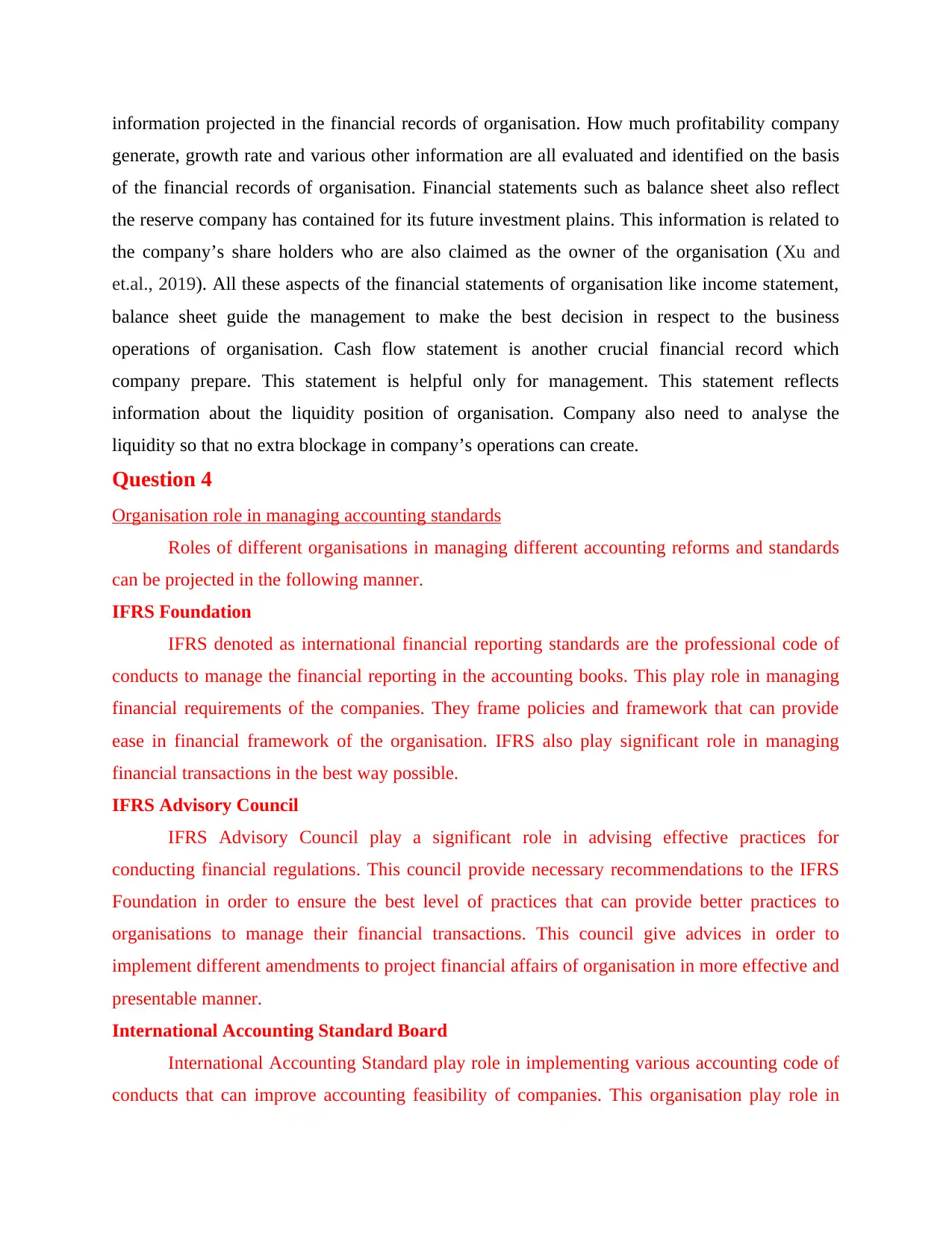

Question 4

Organisation role in managing accounting standards

Roles of different organisations in managing different accounting reforms and standards

can be projected in the following manner.

IFRS Foundation

IFRS denoted as international financial reporting standards are the professional code of

conducts to manage the financial reporting in the accounting books. This play role in managing

financial requirements of the companies. They frame policies and framework that can provide

ease in financial framework of the organisation. IFRS also play significant role in managing

financial transactions in the best way possible.

IFRS Advisory Council

IFRS Advisory Council play a significant role in advising effective practices for

conducting financial regulations. This council provide necessary recommendations to the IFRS

Foundation in order to ensure the best level of practices that can provide better practices to

organisations to manage their financial transactions. This council give advices in order to

implement different amendments to project financial affairs of organisation in more effective and

presentable manner.

International Accounting Standard Board

International Accounting Standard play role in implementing various accounting code of

conducts that can improve accounting feasibility of companies. This organisation play role in

generate, growth rate and various other information are all evaluated and identified on the basis

of the financial records of organisation. Financial statements such as balance sheet also reflect

the reserve company has contained for its future investment plains. This information is related to

the company’s share holders who are also claimed as the owner of the organisation (Xu and

et.al., 2019). All these aspects of the financial statements of organisation like income statement,

balance sheet guide the management to make the best decision in respect to the business

operations of organisation. Cash flow statement is another crucial financial record which

company prepare. This statement is helpful only for management. This statement reflects

information about the liquidity position of organisation. Company also need to analyse the

liquidity so that no extra blockage in company’s operations can create.

Question 4

Organisation role in managing accounting standards

Roles of different organisations in managing different accounting reforms and standards

can be projected in the following manner.

IFRS Foundation

IFRS denoted as international financial reporting standards are the professional code of

conducts to manage the financial reporting in the accounting books. This play role in managing

financial requirements of the companies. They frame policies and framework that can provide

ease in financial framework of the organisation. IFRS also play significant role in managing

financial transactions in the best way possible.

IFRS Advisory Council

IFRS Advisory Council play a significant role in advising effective practices for

conducting financial regulations. This council provide necessary recommendations to the IFRS

Foundation in order to ensure the best level of practices that can provide better practices to

organisations to manage their financial transactions. This council give advices in order to

implement different amendments to project financial affairs of organisation in more effective and

presentable manner.

International Accounting Standard Board

International Accounting Standard play role in implementing various accounting code of

conducts that can improve accounting feasibility of companies. This organisation play role in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

advancing the code of conducts to report accounting transactions in the books of accounts and

also to implement new codes that can improve the accounting practices.

IFRS Interpretations Committee

IFRS Interpretation Committee play role in interpreting all the modern needs and

requirements of the accounting practices. On the basis of the critical assessment of the existing

practices and codes of conducts use in accounting this committee play role in guiding fair

modifications that can sup[port better and effective projection of company’s financial and

accounting transactions.

Role of audit committee in corporate governance

Audit committee assess that a specific organisation has followed all the regulatory

requirements of accounting. This organisation ensures that organisation has reported the

transaction on the basis of the code of conducts and principles and policies of accounts. Audit

committee play significant role in dealing effectively against the corporate governance. The

governance is about to cope up with all the necessary requirements associated with the

accounting code of conducts. Audit is also to ensure that organisation could deal with all the

accounting practices and policies comprises with code of conducts. Audit can give assurance to

the stakeholders that company’s financial reporting is fair and they can make all the decisions on

the basis of the company’s accounting books.

CONCLUSION

Economic order quantity is a key technique to manage company’s inventory. This

technique involve annual consumption of company’s inventory, holding cost and ordering cost in

valuation of inventory of company (Luypaert, Van Caneghem and Van Uytbergen, 2016). This is

the quantity of inventory which contains the same holding cost and ordering cost. This method of

managing inventory also allows the company to control overall cost in managing inventory of

organisation. Accounting rate of return method is a key technique of analysing company’s

investment decision. This method involves investment decision based on the average annual

returns and initial level of investment. This method does not consider time value of money in

respect to analysing investment decision of organisation. Internal rate of return technique is an

effective technique to make the investment decision. This technique involves time value of

money in making the investment decision for the organisation. Financial statements and records

provide the clear information in respect to company’s performance in the respective financial

also to implement new codes that can improve the accounting practices.

IFRS Interpretations Committee

IFRS Interpretation Committee play role in interpreting all the modern needs and

requirements of the accounting practices. On the basis of the critical assessment of the existing

practices and codes of conducts use in accounting this committee play role in guiding fair

modifications that can sup[port better and effective projection of company’s financial and

accounting transactions.

Role of audit committee in corporate governance

Audit committee assess that a specific organisation has followed all the regulatory

requirements of accounting. This organisation ensures that organisation has reported the

transaction on the basis of the code of conducts and principles and policies of accounts. Audit

committee play significant role in dealing effectively against the corporate governance. The

governance is about to cope up with all the necessary requirements associated with the

accounting code of conducts. Audit is also to ensure that organisation could deal with all the

accounting practices and policies comprises with code of conducts. Audit can give assurance to

the stakeholders that company’s financial reporting is fair and they can make all the decisions on

the basis of the company’s accounting books.

CONCLUSION

Economic order quantity is a key technique to manage company’s inventory. This

technique involve annual consumption of company’s inventory, holding cost and ordering cost in

valuation of inventory of company (Luypaert, Van Caneghem and Van Uytbergen, 2016). This is

the quantity of inventory which contains the same holding cost and ordering cost. This method of

managing inventory also allows the company to control overall cost in managing inventory of

organisation. Accounting rate of return method is a key technique of analysing company’s

investment decision. This method involves investment decision based on the average annual

returns and initial level of investment. This method does not consider time value of money in

respect to analysing investment decision of organisation. Internal rate of return technique is an

effective technique to make the investment decision. This technique involves time value of

money in making the investment decision for the organisation. Financial statements and records

provide the clear information in respect to company’s performance in the respective financial

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

year. All decisions related to business company and stakeholders take are based on the financial

records of organisation.

REFERENCES

Books and Journals

Alkaraan, F., 2020. Strategic investment decision-making practices in large manufacturing

companies. Meditari Accountancy Research.

Bolomope, M. and et.al., 2020. Property investment decision-making behaviour amidst market

disruptions: an institutional perspective. Property Management.

Di Nardo, M. and et.al., 2020. An Economic Order Quantity Stochastic Dynamic Optimization

Model in a Logistic 4.0 Environment. Sustainability. 12(10). p.4075.

Hanafi, T., 2018. The testing of belief-adjustment model and framing effect on non-professional

investor’s investment decision-making. The Indonesian Accounting Review. 7(1). pp.1-

14.

Jackson, C. and Orr, A., 2019. Investment decision-making under economic policy

uncertainty. Journal of Property Research. 36(2). pp.153-185.

Lowies, G. A., Hall, J. H. and Cloete, C. E., 2016. Heuristic-driven bias in property investment

decision-making in South Africa. Journal of Property Investment & Finance.

Luypaert, M., Van Caneghem, T. and Van Uytbergen, S., 2016. Financial statement filing lags:

An empirical analysis among small firms. International Small Business Journal. 34(4).

pp.506-531.

Maxwell, A., 2016. Investment decision-making by business angels. In Handbook of Research

on Business Angels. Edward Elgar Publishing.

Nagib, A. N. M and et.al., 2016, November. The Role of Hybrid Make-to-Stock (MTS)-Make-

to-Order (MTO) and Economic Order Quantity (EOQ) Inventory Control Models in

Food and Beverage Processing Industry. In IOP Conference Series: Materials Science

and Engineering (Vol. 160, No. 1, p. 012003). IOP Publishing.

Ogunlusi, O. E. and Obademi, O., 2019. The Impact of Behavioural Finance on Investment

Decision-making: A Study of Selected Investment Banks in Nigeria. Global Business

Review. p.0972150919851388.

records of organisation.

REFERENCES

Books and Journals

Alkaraan, F., 2020. Strategic investment decision-making practices in large manufacturing

companies. Meditari Accountancy Research.

Bolomope, M. and et.al., 2020. Property investment decision-making behaviour amidst market

disruptions: an institutional perspective. Property Management.

Di Nardo, M. and et.al., 2020. An Economic Order Quantity Stochastic Dynamic Optimization

Model in a Logistic 4.0 Environment. Sustainability. 12(10). p.4075.

Hanafi, T., 2018. The testing of belief-adjustment model and framing effect on non-professional

investor’s investment decision-making. The Indonesian Accounting Review. 7(1). pp.1-

14.

Jackson, C. and Orr, A., 2019. Investment decision-making under economic policy

uncertainty. Journal of Property Research. 36(2). pp.153-185.

Lowies, G. A., Hall, J. H. and Cloete, C. E., 2016. Heuristic-driven bias in property investment

decision-making in South Africa. Journal of Property Investment & Finance.

Luypaert, M., Van Caneghem, T. and Van Uytbergen, S., 2016. Financial statement filing lags:

An empirical analysis among small firms. International Small Business Journal. 34(4).

pp.506-531.

Maxwell, A., 2016. Investment decision-making by business angels. In Handbook of Research

on Business Angels. Edward Elgar Publishing.

Nagib, A. N. M and et.al., 2016, November. The Role of Hybrid Make-to-Stock (MTS)-Make-

to-Order (MTO) and Economic Order Quantity (EOQ) Inventory Control Models in

Food and Beverage Processing Industry. In IOP Conference Series: Materials Science

and Engineering (Vol. 160, No. 1, p. 012003). IOP Publishing.

Ogunlusi, O. E. and Obademi, O., 2019. The Impact of Behavioural Finance on Investment

Decision-making: A Study of Selected Investment Banks in Nigeria. Global Business

Review. p.0972150919851388.

Park, E. H., Ramesh, B. and Cao, L., 2016. Emotion in IT investment decision making with a

real options perspective: The intertwining of cognition and regret. Journal of

Management Information Systems. 33(3). pp.652-683.

Robinson, T. R., 2020. International financial statement analysis. John Wiley & Sons.

Vanauken, H. E., Ascigil, S. and Carraher, S., 2017. Turkish SMEs' use of financial statements

for decision making. The Journal of Entrepreneurial Finance (JEF). 19(1).

Ventura, R. and Samuel, S., 2016. Optimization of fuel injection in GDI engine using economic

order quantity and Lambert W function. Applied Thermal Engineering. 101. pp.112-

120.

Xu, L. and et.al., 2019. To be or not to be? Big data business investment decision-making in the

supply chain. Sustainability. 11(8). p.2298.

Online:

Financial ratios, 2020 [Online]. Available Through:

< https://corporatefinanceinstitute.com/resources/knowledge/finance/financial-ratios/>.

real options perspective: The intertwining of cognition and regret. Journal of

Management Information Systems. 33(3). pp.652-683.

Robinson, T. R., 2020. International financial statement analysis. John Wiley & Sons.

Vanauken, H. E., Ascigil, S. and Carraher, S., 2017. Turkish SMEs' use of financial statements

for decision making. The Journal of Entrepreneurial Finance (JEF). 19(1).

Ventura, R. and Samuel, S., 2016. Optimization of fuel injection in GDI engine using economic

order quantity and Lambert W function. Applied Thermal Engineering. 101. pp.112-

120.

Xu, L. and et.al., 2019. To be or not to be? Big data business investment decision-making in the

supply chain. Sustainability. 11(8). p.2298.

Online:

Financial ratios, 2020 [Online]. Available Through:

< https://corporatefinanceinstitute.com/resources/knowledge/finance/financial-ratios/>.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.