Financial Accounting Report

VerifiedAdded on 2020/12/09

|14

|3603

|479

Report

AI Summary

This report analyzes the financial accounting practices of Conga, a small toy retailer, demonstrating the application of key concepts like prudence and accrual. It includes the preparation of accounting records, financial statements, and a discussion on the significance of VAT in business operations.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Introduction to

Financial Accounting

Financial Accounting

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

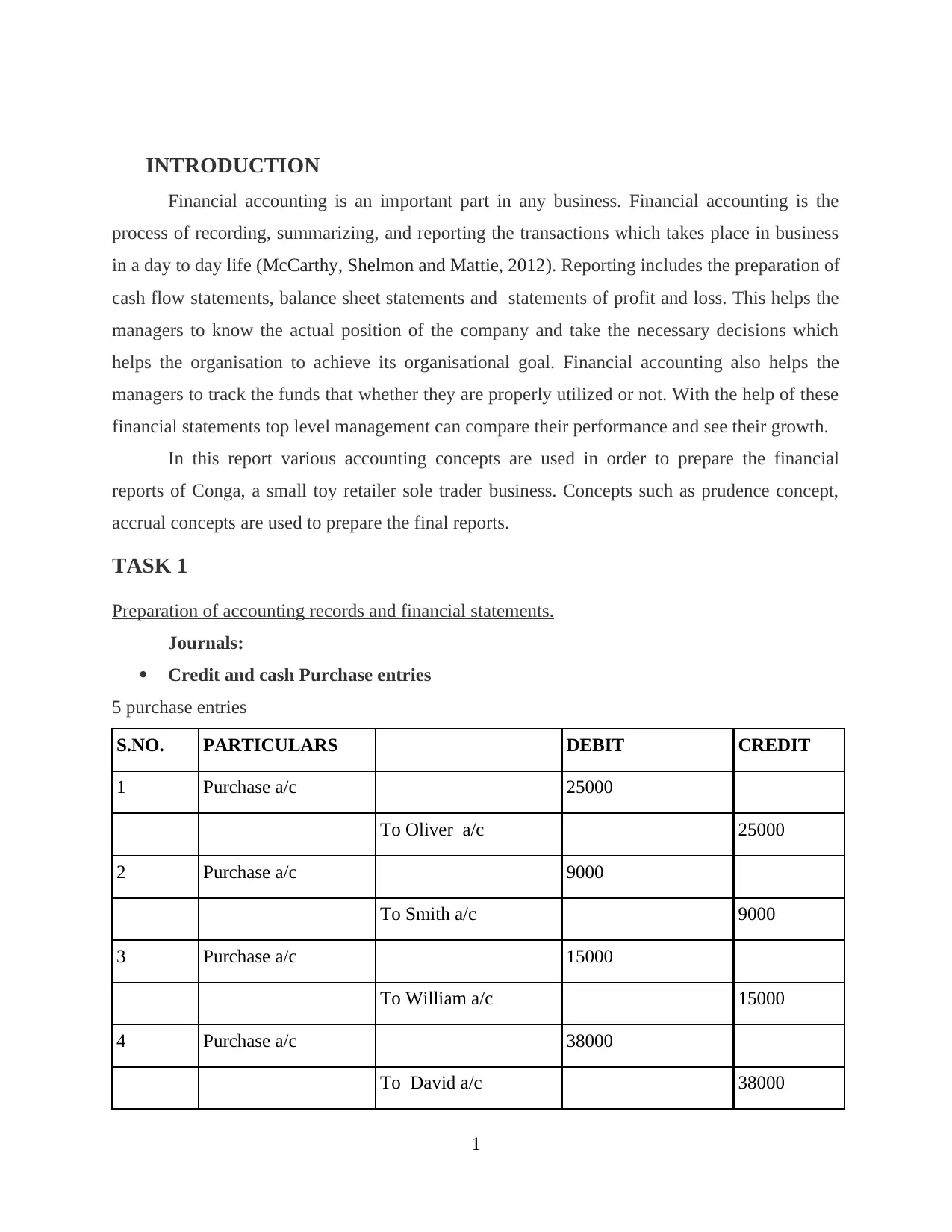

INTRODUCTION

Financial accounting is an important part in any business. Financial accounting is the

process of recording, summarizing, and reporting the transactions which takes place in business

in a day to day life (McCarthy, Shelmon and Mattie, 2012). Reporting includes the preparation of

cash flow statements, balance sheet statements and statements of profit and loss. This helps the

managers to know the actual position of the company and take the necessary decisions which

helps the organisation to achieve its organisational goal. Financial accounting also helps the

managers to track the funds that whether they are properly utilized or not. With the help of these

financial statements top level management can compare their performance and see their growth.

In this report various accounting concepts are used in order to prepare the financial

reports of Conga, a small toy retailer sole trader business. Concepts such as prudence concept,

accrual concepts are used to prepare the final reports.

TASK 1

Preparation of accounting records and financial statements.

Journals:

Credit and cash Purchase entries

5 purchase entries

S.NO. PARTICULARS DEBIT CREDIT

1 Purchase a/c 25000

To Oliver a/c 25000

2 Purchase a/c 9000

To Smith a/c 9000

3 Purchase a/c 15000

To William a/c 15000

4 Purchase a/c 38000

To David a/c 38000

1

Financial accounting is an important part in any business. Financial accounting is the

process of recording, summarizing, and reporting the transactions which takes place in business

in a day to day life (McCarthy, Shelmon and Mattie, 2012). Reporting includes the preparation of

cash flow statements, balance sheet statements and statements of profit and loss. This helps the

managers to know the actual position of the company and take the necessary decisions which

helps the organisation to achieve its organisational goal. Financial accounting also helps the

managers to track the funds that whether they are properly utilized or not. With the help of these

financial statements top level management can compare their performance and see their growth.

In this report various accounting concepts are used in order to prepare the financial

reports of Conga, a small toy retailer sole trader business. Concepts such as prudence concept,

accrual concepts are used to prepare the final reports.

TASK 1

Preparation of accounting records and financial statements.

Journals:

Credit and cash Purchase entries

5 purchase entries

S.NO. PARTICULARS DEBIT CREDIT

1 Purchase a/c 25000

To Oliver a/c 25000

2 Purchase a/c 9000

To Smith a/c 9000

3 Purchase a/c 15000

To William a/c 15000

4 Purchase a/c 38000

To David a/c 38000

1

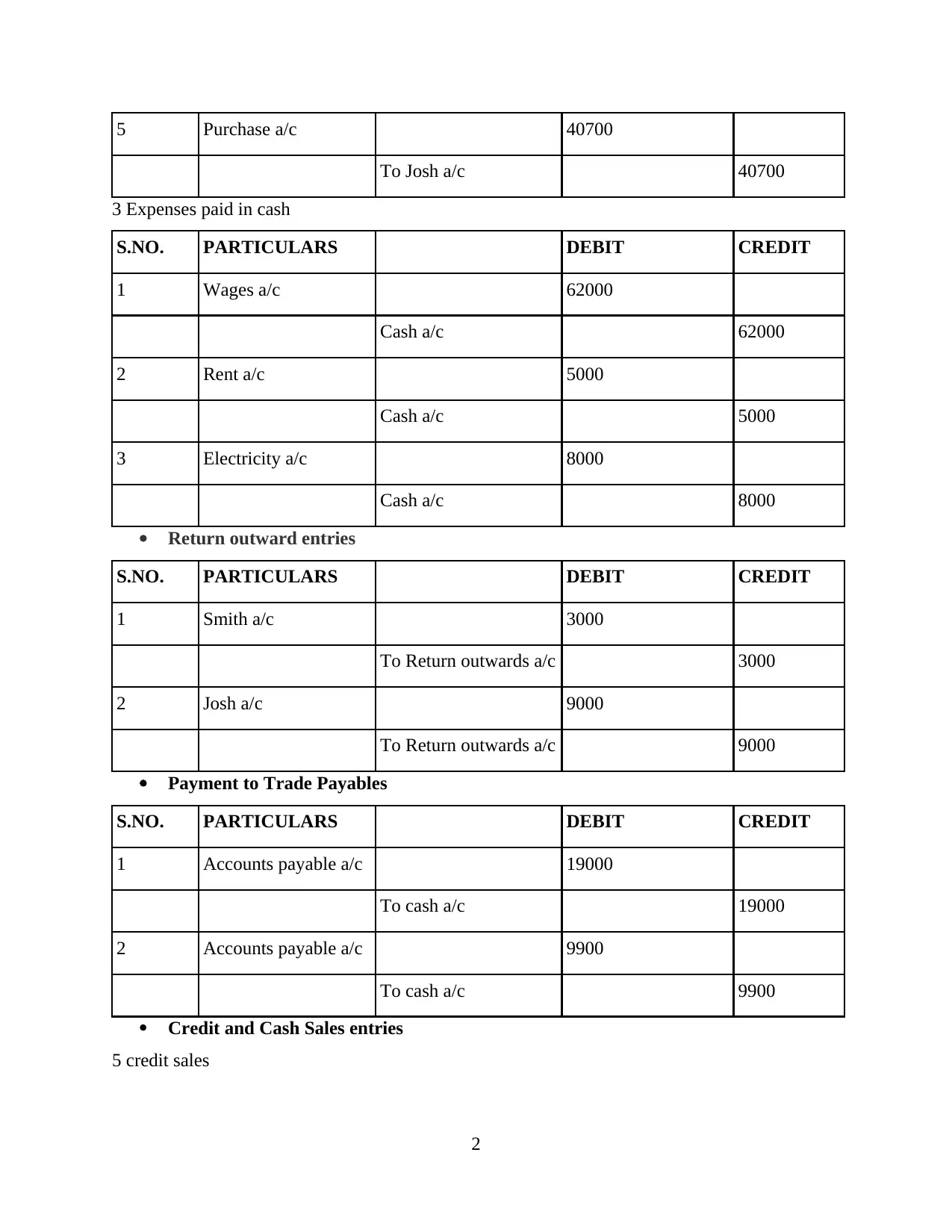

5 Purchase a/c 40700

To Josh a/c 40700

3 Expenses paid in cash

S.NO. PARTICULARS DEBIT CREDIT

1 Wages a/c 62000

Cash a/c 62000

2 Rent a/c 5000

Cash a/c 5000

3 Electricity a/c 8000

Cash a/c 8000

Return outward entries

S.NO. PARTICULARS DEBIT CREDIT

1 Smith a/c 3000

To Return outwards a/c 3000

2 Josh a/c 9000

To Return outwards a/c 9000

Payment to Trade Payables

S.NO. PARTICULARS DEBIT CREDIT

1 Accounts payable a/c 19000

To cash a/c 19000

2 Accounts payable a/c 9900

To cash a/c 9900

Credit and Cash Sales entries

5 credit sales

2

To Josh a/c 40700

3 Expenses paid in cash

S.NO. PARTICULARS DEBIT CREDIT

1 Wages a/c 62000

Cash a/c 62000

2 Rent a/c 5000

Cash a/c 5000

3 Electricity a/c 8000

Cash a/c 8000

Return outward entries

S.NO. PARTICULARS DEBIT CREDIT

1 Smith a/c 3000

To Return outwards a/c 3000

2 Josh a/c 9000

To Return outwards a/c 9000

Payment to Trade Payables

S.NO. PARTICULARS DEBIT CREDIT

1 Accounts payable a/c 19000

To cash a/c 19000

2 Accounts payable a/c 9900

To cash a/c 9900

Credit and Cash Sales entries

5 credit sales

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

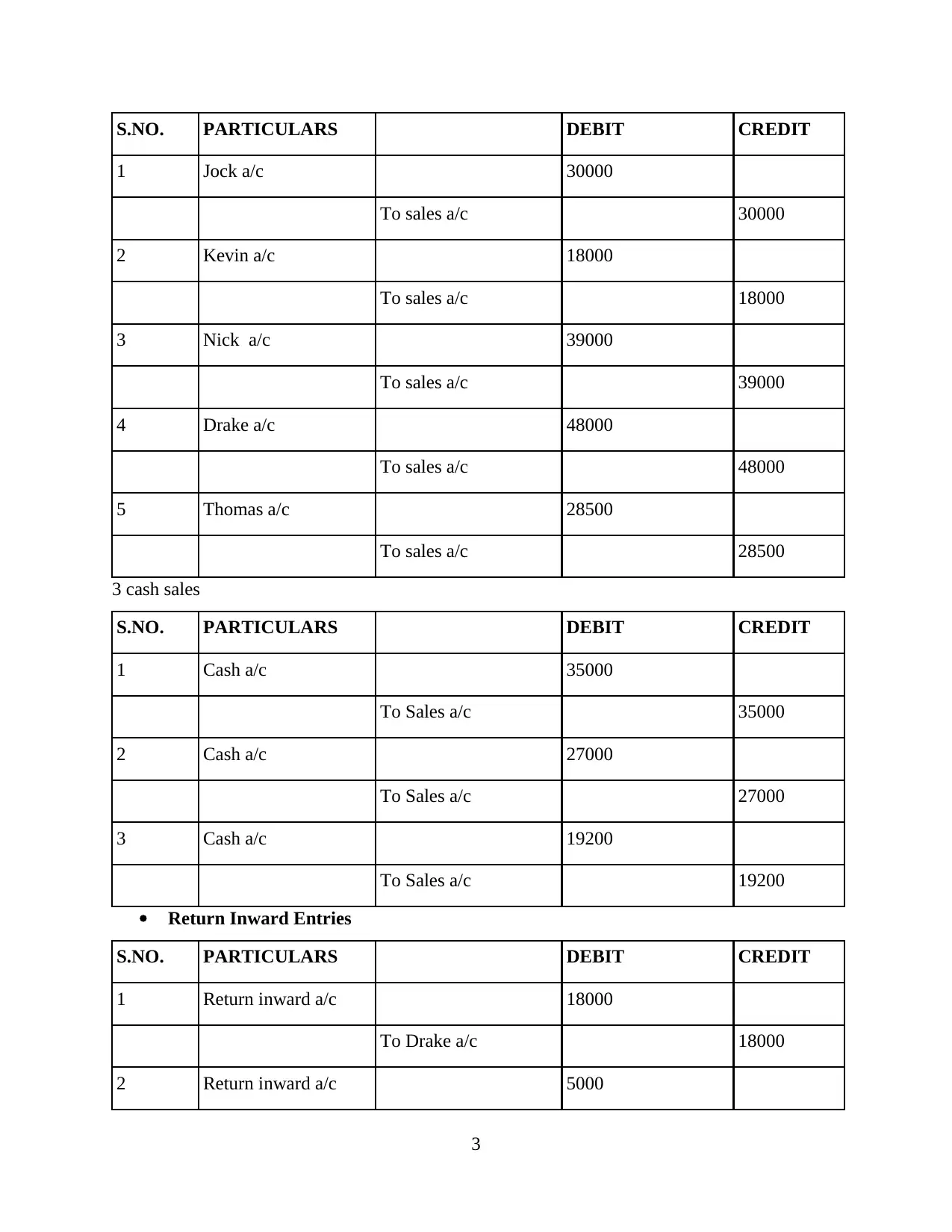

S.NO. PARTICULARS DEBIT CREDIT

1 Jock a/c 30000

To sales a/c 30000

2 Kevin a/c 18000

To sales a/c 18000

3 Nick a/c 39000

To sales a/c 39000

4 Drake a/c 48000

To sales a/c 48000

5 Thomas a/c 28500

To sales a/c 28500

3 cash sales

S.NO. PARTICULARS DEBIT CREDIT

1 Cash a/c 35000

To Sales a/c 35000

2 Cash a/c 27000

To Sales a/c 27000

3 Cash a/c 19200

To Sales a/c 19200

Return Inward Entries

S.NO. PARTICULARS DEBIT CREDIT

1 Return inward a/c 18000

To Drake a/c 18000

2 Return inward a/c 5000

3

1 Jock a/c 30000

To sales a/c 30000

2 Kevin a/c 18000

To sales a/c 18000

3 Nick a/c 39000

To sales a/c 39000

4 Drake a/c 48000

To sales a/c 48000

5 Thomas a/c 28500

To sales a/c 28500

3 cash sales

S.NO. PARTICULARS DEBIT CREDIT

1 Cash a/c 35000

To Sales a/c 35000

2 Cash a/c 27000

To Sales a/c 27000

3 Cash a/c 19200

To Sales a/c 19200

Return Inward Entries

S.NO. PARTICULARS DEBIT CREDIT

1 Return inward a/c 18000

To Drake a/c 18000

2 Return inward a/c 5000

3

To Kevin a/c 5000

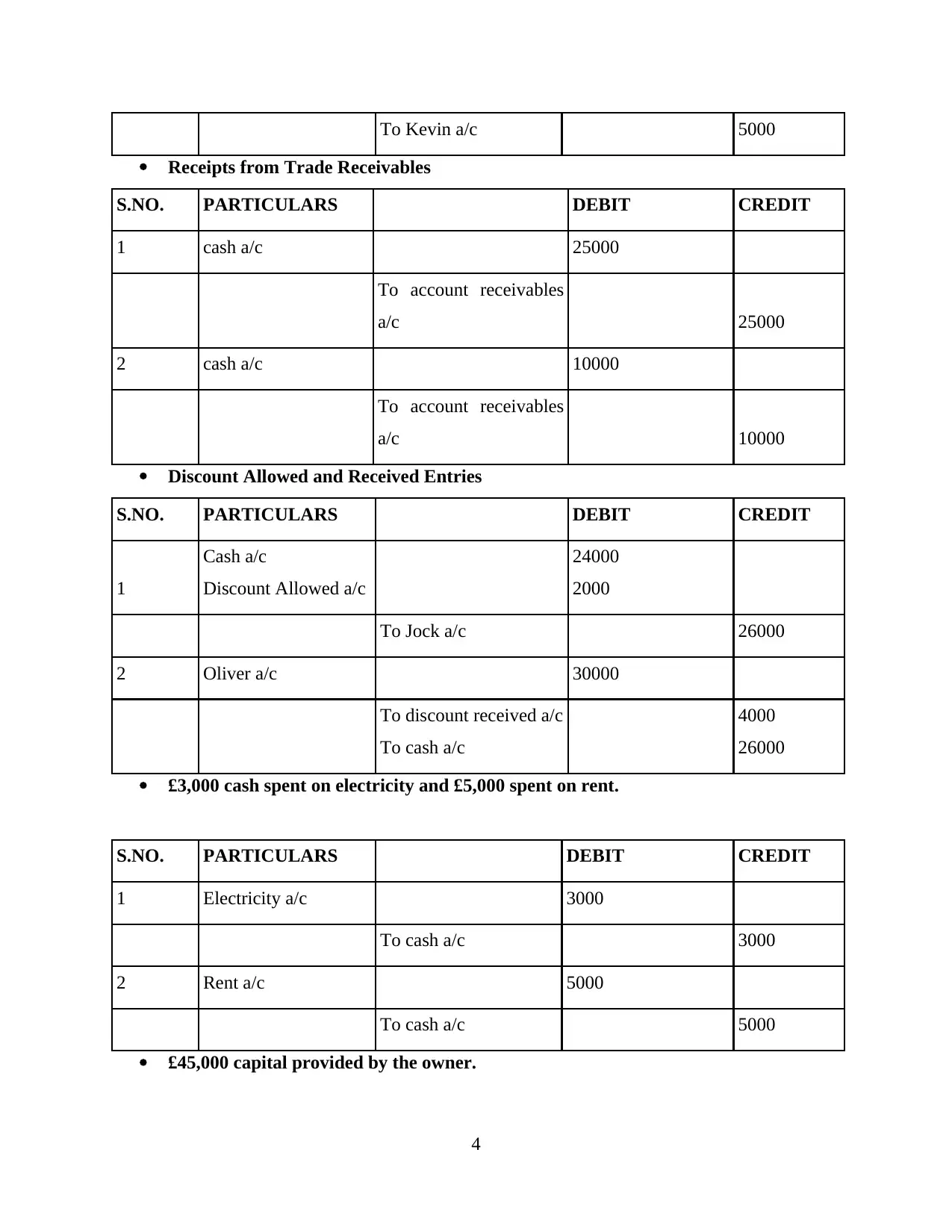

Receipts from Trade Receivables

S.NO. PARTICULARS DEBIT CREDIT

1 cash a/c 25000

To account receivables

a/c 25000

2 cash a/c 10000

To account receivables

a/c 10000

Discount Allowed and Received Entries

S.NO. PARTICULARS DEBIT CREDIT

1

Cash a/c

Discount Allowed a/c

24000

2000

To Jock a/c 26000

2 Oliver a/c 30000

To discount received a/c

To cash a/c

4000

26000

£3,000 cash spent on electricity and £5,000 spent on rent.

S.NO. PARTICULARS DEBIT CREDIT

1 Electricity a/c 3000

To cash a/c 3000

2 Rent a/c 5000

To cash a/c 5000

£45,000 capital provided by the owner.

4

Receipts from Trade Receivables

S.NO. PARTICULARS DEBIT CREDIT

1 cash a/c 25000

To account receivables

a/c 25000

2 cash a/c 10000

To account receivables

a/c 10000

Discount Allowed and Received Entries

S.NO. PARTICULARS DEBIT CREDIT

1

Cash a/c

Discount Allowed a/c

24000

2000

To Jock a/c 26000

2 Oliver a/c 30000

To discount received a/c

To cash a/c

4000

26000

£3,000 cash spent on electricity and £5,000 spent on rent.

S.NO. PARTICULARS DEBIT CREDIT

1 Electricity a/c 3000

To cash a/c 3000

2 Rent a/c 5000

To cash a/c 5000

£45,000 capital provided by the owner.

4

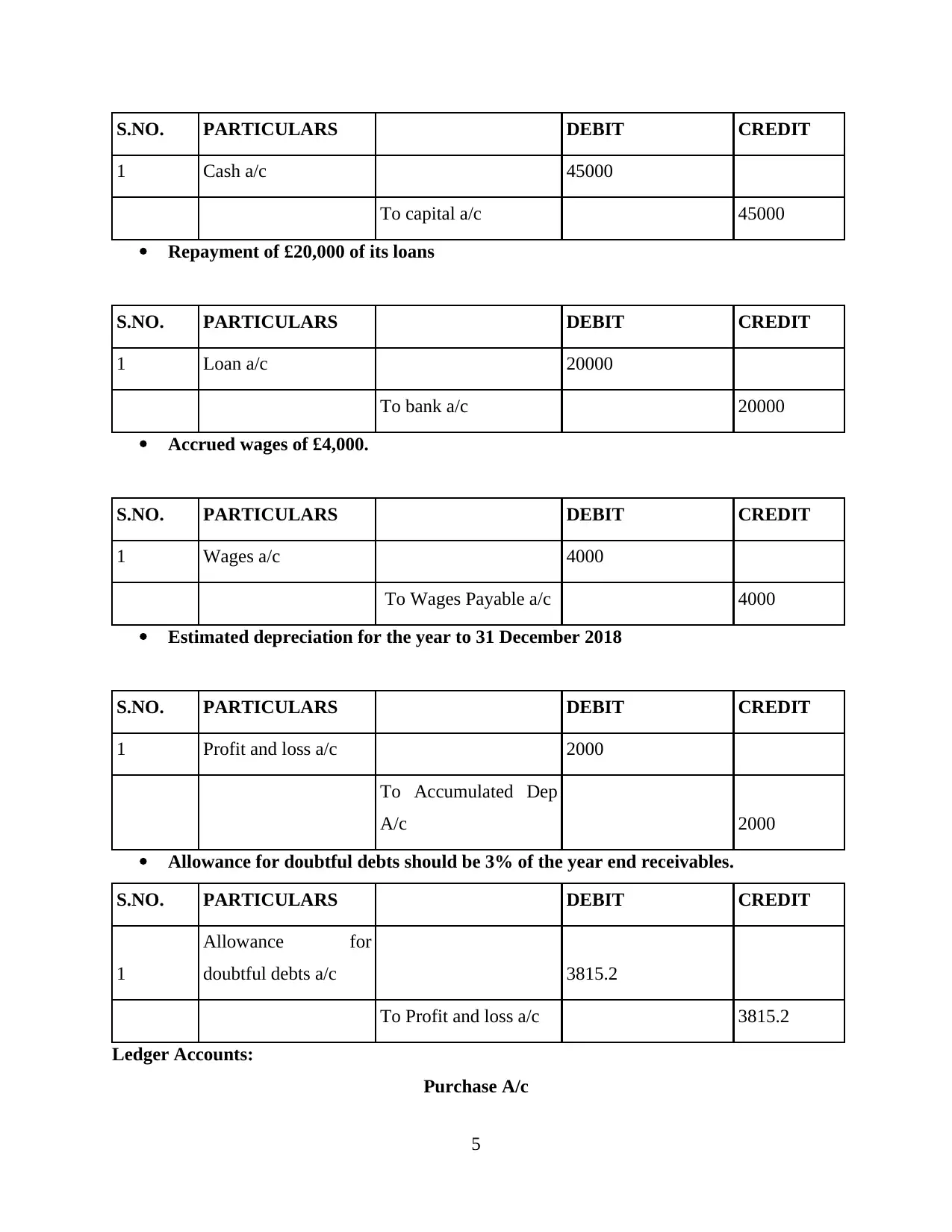

S.NO. PARTICULARS DEBIT CREDIT

1 Cash a/c 45000

To capital a/c 45000

Repayment of £20,000 of its loans

S.NO. PARTICULARS DEBIT CREDIT

1 Loan a/c 20000

To bank a/c 20000

Accrued wages of £4,000.

S.NO. PARTICULARS DEBIT CREDIT

1 Wages a/c 4000

To Wages Payable a/c 4000

Estimated depreciation for the year to 31 December 2018

S.NO. PARTICULARS DEBIT CREDIT

1 Profit and loss a/c 2000

To Accumulated Dep

A/c 2000

Allowance for doubtful debts should be 3% of the year end receivables.

S.NO. PARTICULARS DEBIT CREDIT

1

Allowance for

doubtful debts a/c 3815.2

To Profit and loss a/c 3815.2

Ledger Accounts:

Purchase A/c

5

1 Cash a/c 45000

To capital a/c 45000

Repayment of £20,000 of its loans

S.NO. PARTICULARS DEBIT CREDIT

1 Loan a/c 20000

To bank a/c 20000

Accrued wages of £4,000.

S.NO. PARTICULARS DEBIT CREDIT

1 Wages a/c 4000

To Wages Payable a/c 4000

Estimated depreciation for the year to 31 December 2018

S.NO. PARTICULARS DEBIT CREDIT

1 Profit and loss a/c 2000

To Accumulated Dep

A/c 2000

Allowance for doubtful debts should be 3% of the year end receivables.

S.NO. PARTICULARS DEBIT CREDIT

1

Allowance for

doubtful debts a/c 3815.2

To Profit and loss a/c 3815.2

Ledger Accounts:

Purchase A/c

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

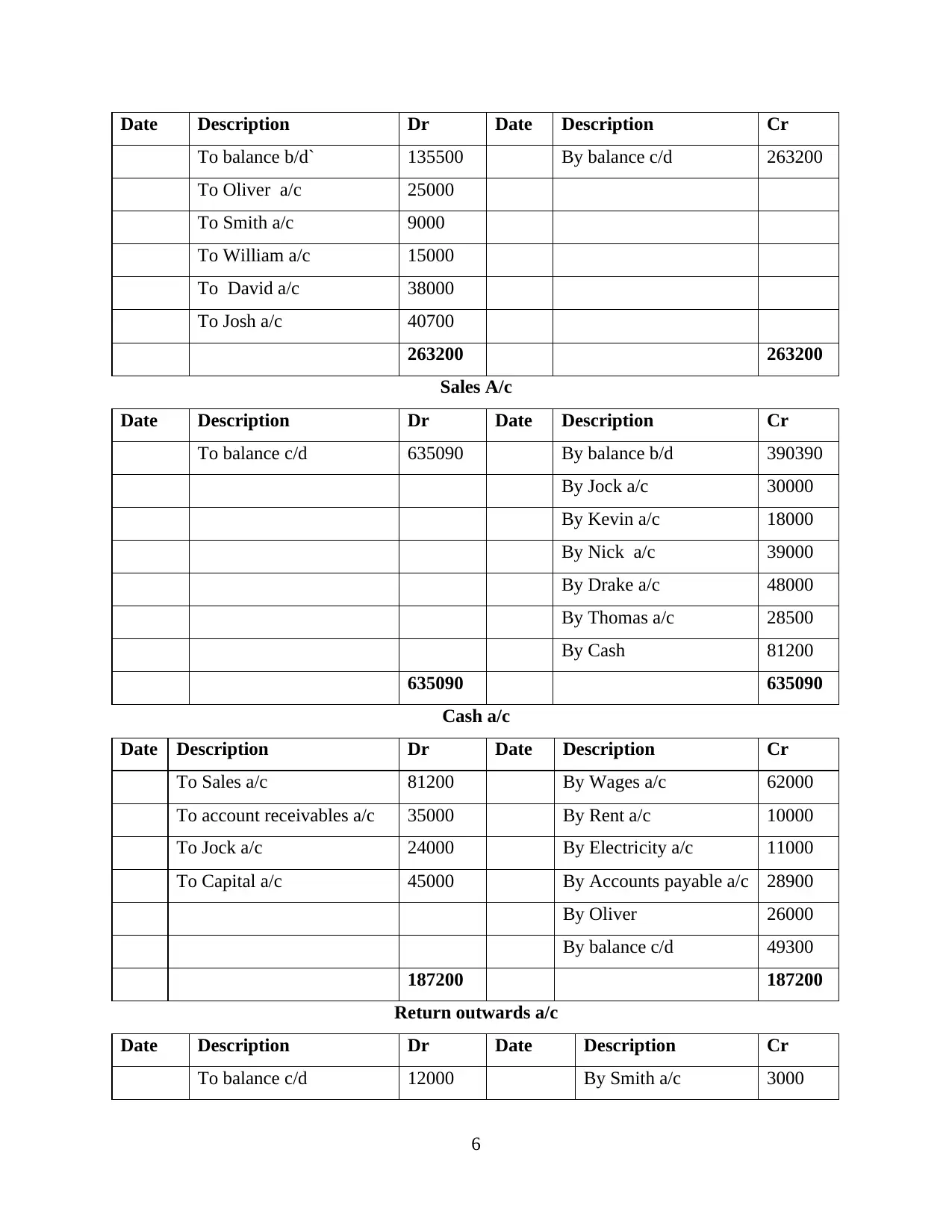

Date Description Dr Date Description Cr

To balance b/d` 135500 By balance c/d 263200

To Oliver a/c 25000

To Smith a/c 9000

To William a/c 15000

To David a/c 38000

To Josh a/c 40700

263200 263200

Sales A/c

Date Description Dr Date Description Cr

To balance c/d 635090 By balance b/d 390390

By Jock a/c 30000

By Kevin a/c 18000

By Nick a/c 39000

By Drake a/c 48000

By Thomas a/c 28500

By Cash 81200

635090 635090

Cash a/c

Date Description Dr Date Description Cr

To Sales a/c 81200 By Wages a/c 62000

To account receivables a/c 35000 By Rent a/c 10000

To Jock a/c 24000 By Electricity a/c 11000

To Capital a/c 45000 By Accounts payable a/c 28900

By Oliver 26000

By balance c/d 49300

187200 187200

Return outwards a/c

Date Description Dr Date Description Cr

To balance c/d 12000 By Smith a/c 3000

6

To balance b/d` 135500 By balance c/d 263200

To Oliver a/c 25000

To Smith a/c 9000

To William a/c 15000

To David a/c 38000

To Josh a/c 40700

263200 263200

Sales A/c

Date Description Dr Date Description Cr

To balance c/d 635090 By balance b/d 390390

By Jock a/c 30000

By Kevin a/c 18000

By Nick a/c 39000

By Drake a/c 48000

By Thomas a/c 28500

By Cash 81200

635090 635090

Cash a/c

Date Description Dr Date Description Cr

To Sales a/c 81200 By Wages a/c 62000

To account receivables a/c 35000 By Rent a/c 10000

To Jock a/c 24000 By Electricity a/c 11000

To Capital a/c 45000 By Accounts payable a/c 28900

By Oliver 26000

By balance c/d 49300

187200 187200

Return outwards a/c

Date Description Dr Date Description Cr

To balance c/d 12000 By Smith a/c 3000

6

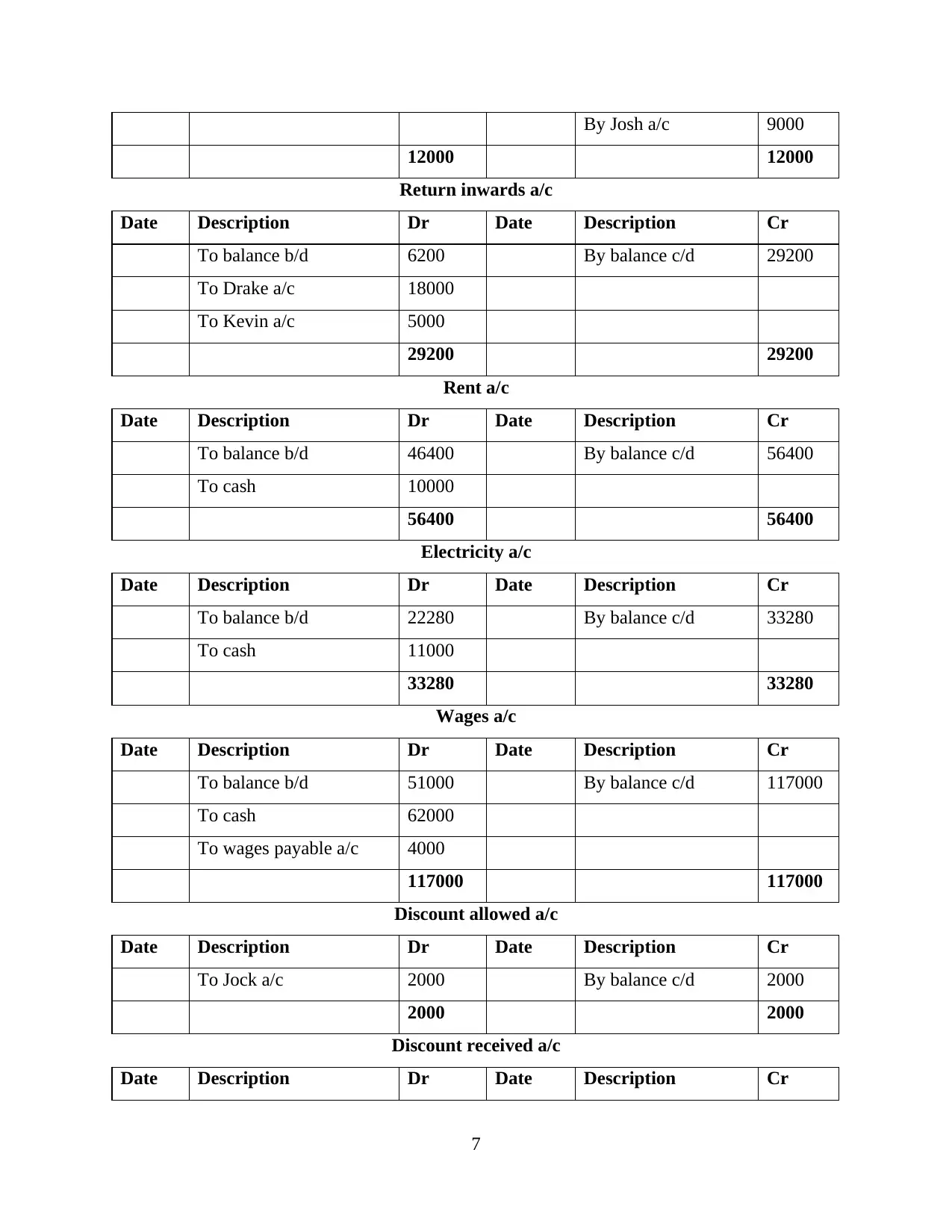

By Josh a/c 9000

12000 12000

Return inwards a/c

Date Description Dr Date Description Cr

To balance b/d 6200 By balance c/d 29200

To Drake a/c 18000

To Kevin a/c 5000

29200 29200

Rent a/c

Date Description Dr Date Description Cr

To balance b/d 46400 By balance c/d 56400

To cash 10000

56400 56400

Electricity a/c

Date Description Dr Date Description Cr

To balance b/d 22280 By balance c/d 33280

To cash 11000

33280 33280

Wages a/c

Date Description Dr Date Description Cr

To balance b/d 51000 By balance c/d 117000

To cash 62000

To wages payable a/c 4000

117000 117000

Discount allowed a/c

Date Description Dr Date Description Cr

To Jock a/c 2000 By balance c/d 2000

2000 2000

Discount received a/c

Date Description Dr Date Description Cr

7

12000 12000

Return inwards a/c

Date Description Dr Date Description Cr

To balance b/d 6200 By balance c/d 29200

To Drake a/c 18000

To Kevin a/c 5000

29200 29200

Rent a/c

Date Description Dr Date Description Cr

To balance b/d 46400 By balance c/d 56400

To cash 10000

56400 56400

Electricity a/c

Date Description Dr Date Description Cr

To balance b/d 22280 By balance c/d 33280

To cash 11000

33280 33280

Wages a/c

Date Description Dr Date Description Cr

To balance b/d 51000 By balance c/d 117000

To cash 62000

To wages payable a/c 4000

117000 117000

Discount allowed a/c

Date Description Dr Date Description Cr

To Jock a/c 2000 By balance c/d 2000

2000 2000

Discount received a/c

Date Description Dr Date Description Cr

7

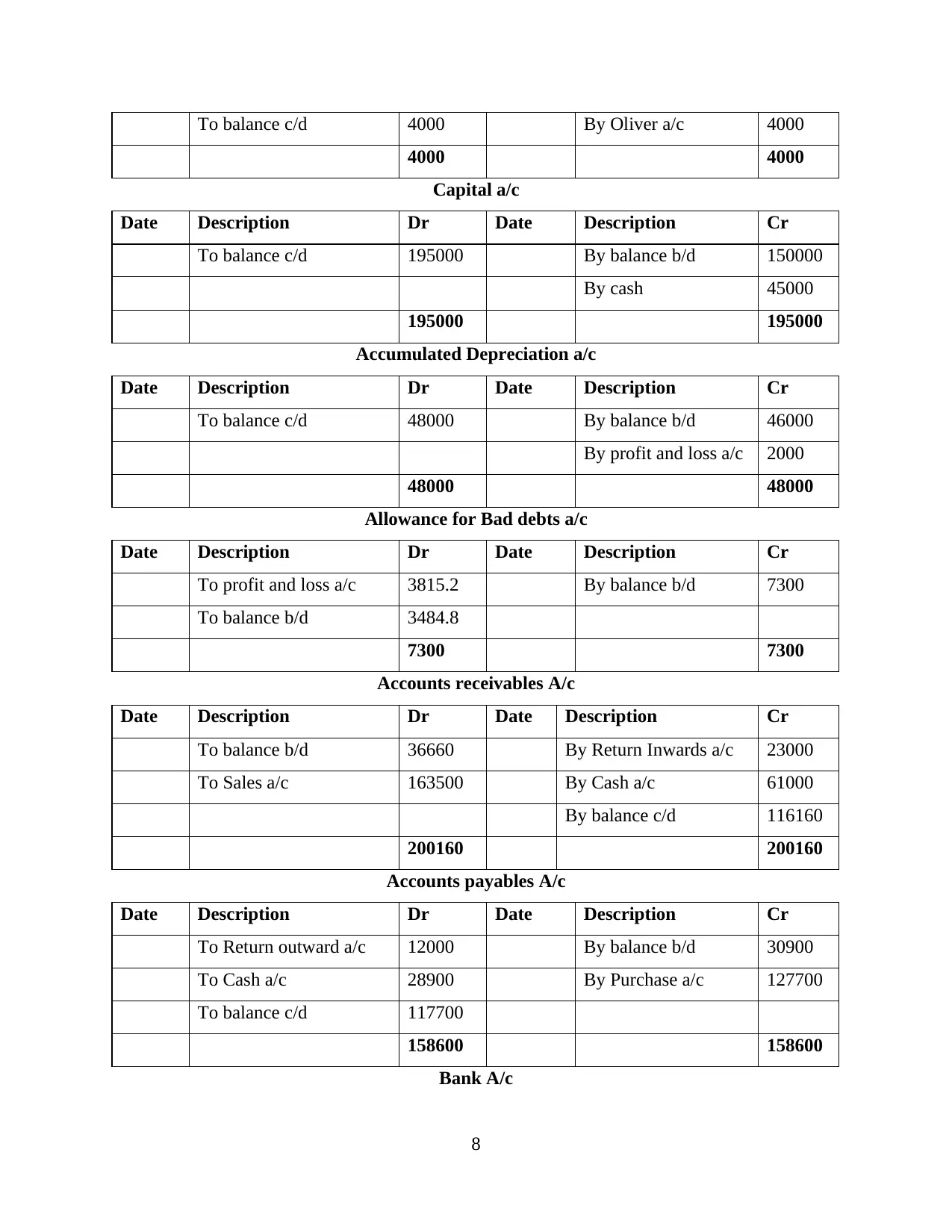

To balance c/d 4000 By Oliver a/c 4000

4000 4000

Capital a/c

Date Description Dr Date Description Cr

To balance c/d 195000 By balance b/d 150000

By cash 45000

195000 195000

Accumulated Depreciation a/c

Date Description Dr Date Description Cr

To balance c/d 48000 By balance b/d 46000

By profit and loss a/c 2000

48000 48000

Allowance for Bad debts a/c

Date Description Dr Date Description Cr

To profit and loss a/c 3815.2 By balance b/d 7300

To balance b/d 3484.8

7300 7300

Accounts receivables A/c

Date Description Dr Date Description Cr

To balance b/d 36660 By Return Inwards a/c 23000

To Sales a/c 163500 By Cash a/c 61000

By balance c/d 116160

200160 200160

Accounts payables A/c

Date Description Dr Date Description Cr

To Return outward a/c 12000 By balance b/d 30900

To Cash a/c 28900 By Purchase a/c 127700

To balance c/d 117700

158600 158600

Bank A/c

8

4000 4000

Capital a/c

Date Description Dr Date Description Cr

To balance c/d 195000 By balance b/d 150000

By cash 45000

195000 195000

Accumulated Depreciation a/c

Date Description Dr Date Description Cr

To balance c/d 48000 By balance b/d 46000

By profit and loss a/c 2000

48000 48000

Allowance for Bad debts a/c

Date Description Dr Date Description Cr

To profit and loss a/c 3815.2 By balance b/d 7300

To balance b/d 3484.8

7300 7300

Accounts receivables A/c

Date Description Dr Date Description Cr

To balance b/d 36660 By Return Inwards a/c 23000

To Sales a/c 163500 By Cash a/c 61000

By balance c/d 116160

200160 200160

Accounts payables A/c

Date Description Dr Date Description Cr

To Return outward a/c 12000 By balance b/d 30900

To Cash a/c 28900 By Purchase a/c 127700

To balance c/d 117700

158600 158600

Bank A/c

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

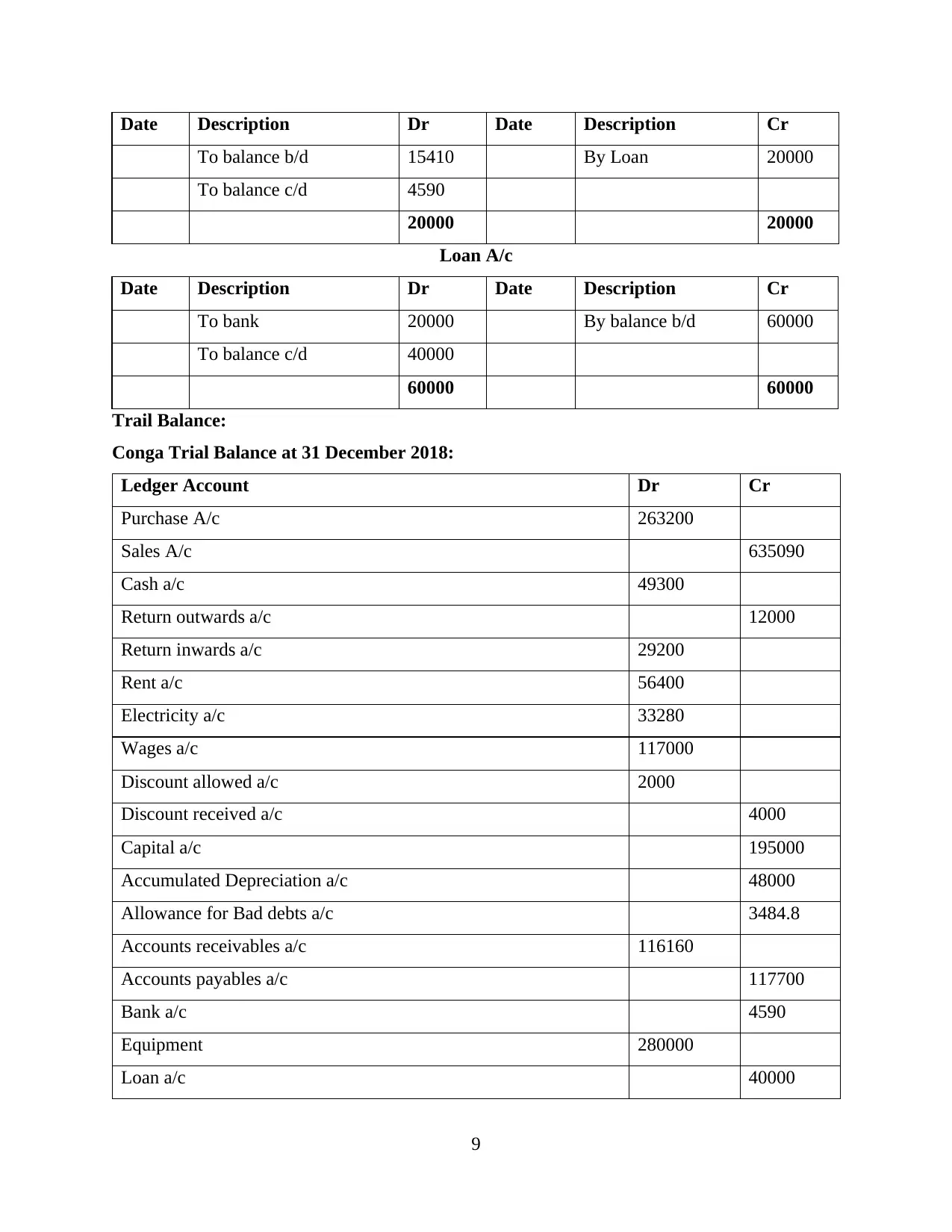

Date Description Dr Date Description Cr

To balance b/d 15410 By Loan 20000

To balance c/d 4590

20000 20000

Loan A/c

Date Description Dr Date Description Cr

To bank 20000 By balance b/d 60000

To balance c/d 40000

60000 60000

Trail Balance:

Conga Trial Balance at 31 December 2018:

Ledger Account Dr Cr

Purchase A/c 263200

Sales A/c 635090

Cash a/c 49300

Return outwards a/c 12000

Return inwards a/c 29200

Rent a/c 56400

Electricity a/c 33280

Wages a/c 117000

Discount allowed a/c 2000

Discount received a/c 4000

Capital a/c 195000

Accumulated Depreciation a/c 48000

Allowance for Bad debts a/c 3484.8

Accounts receivables a/c 116160

Accounts payables a/c 117700

Bank a/c 4590

Equipment 280000

Loan a/c 40000

9

To balance b/d 15410 By Loan 20000

To balance c/d 4590

20000 20000

Loan A/c

Date Description Dr Date Description Cr

To bank 20000 By balance b/d 60000

To balance c/d 40000

60000 60000

Trail Balance:

Conga Trial Balance at 31 December 2018:

Ledger Account Dr Cr

Purchase A/c 263200

Sales A/c 635090

Cash a/c 49300

Return outwards a/c 12000

Return inwards a/c 29200

Rent a/c 56400

Electricity a/c 33280

Wages a/c 117000

Discount allowed a/c 2000

Discount received a/c 4000

Capital a/c 195000

Accumulated Depreciation a/c 48000

Allowance for Bad debts a/c 3484.8

Accounts receivables a/c 116160

Accounts payables a/c 117700

Bank a/c 4590

Equipment 280000

Loan a/c 40000

9

Inventory 40000

Suspense a/c 73324.8

1059864.8 1059864.8

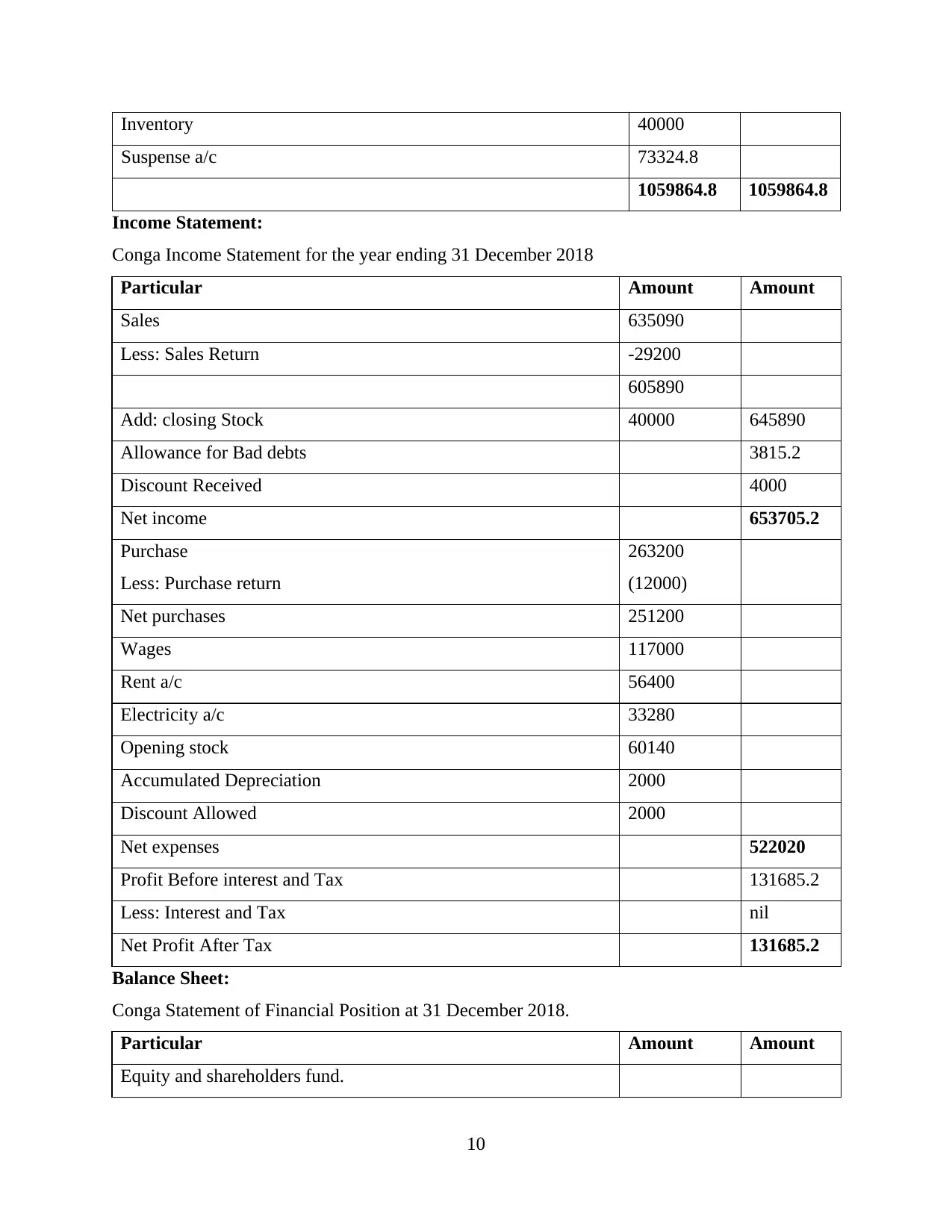

Income Statement:

Conga Income Statement for the year ending 31 December 2018

Particular Amount Amount

Sales 635090

Less: Sales Return -29200

605890

Add: closing Stock 40000 645890

Allowance for Bad debts 3815.2

Discount Received 4000

Net income 653705.2

Purchase

Less: Purchase return

263200

(12000)

Net purchases 251200

Wages 117000

Rent a/c 56400

Electricity a/c 33280

Opening stock 60140

Accumulated Depreciation 2000

Discount Allowed 2000

Net expenses 522020

Profit Before interest and Tax 131685.2

Less: Interest and Tax nil

Net Profit After Tax 131685.2

Balance Sheet:

Conga Statement of Financial Position at 31 December 2018.

Particular Amount Amount

Equity and shareholders fund.

10

Suspense a/c 73324.8

1059864.8 1059864.8

Income Statement:

Conga Income Statement for the year ending 31 December 2018

Particular Amount Amount

Sales 635090

Less: Sales Return -29200

605890

Add: closing Stock 40000 645890

Allowance for Bad debts 3815.2

Discount Received 4000

Net income 653705.2

Purchase

Less: Purchase return

263200

(12000)

Net purchases 251200

Wages 117000

Rent a/c 56400

Electricity a/c 33280

Opening stock 60140

Accumulated Depreciation 2000

Discount Allowed 2000

Net expenses 522020

Profit Before interest and Tax 131685.2

Less: Interest and Tax nil

Net Profit After Tax 131685.2

Balance Sheet:

Conga Statement of Financial Position at 31 December 2018.

Particular Amount Amount

Equity and shareholders fund.

10

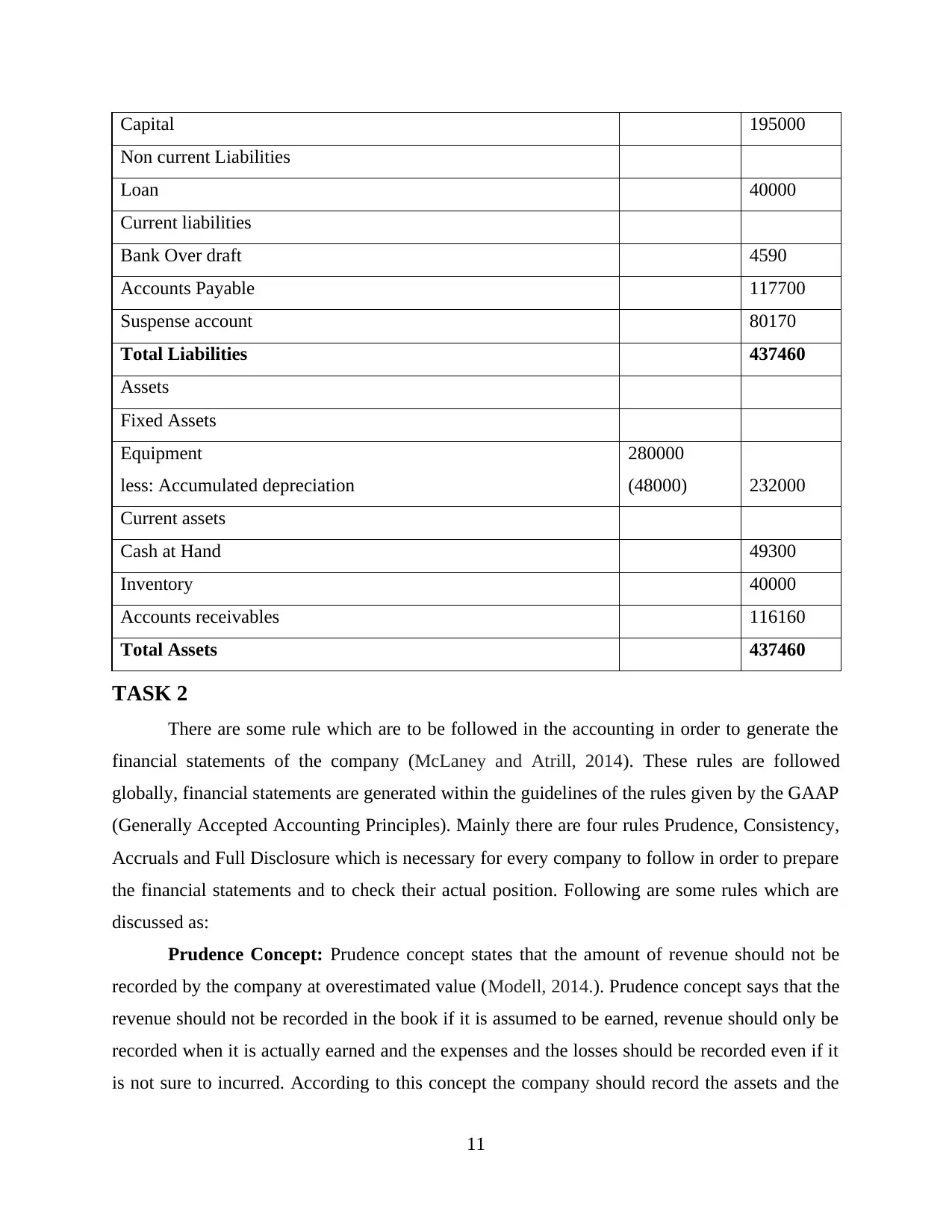

Capital 195000

Non current Liabilities

Loan 40000

Current liabilities

Bank Over draft 4590

Accounts Payable 117700

Suspense account 80170

Total Liabilities 437460

Assets

Fixed Assets

Equipment

less: Accumulated depreciation

280000

(48000) 232000

Current assets

Cash at Hand 49300

Inventory 40000

Accounts receivables 116160

Total Assets 437460

TASK 2

There are some rule which are to be followed in the accounting in order to generate the

financial statements of the company (McLaney and Atrill, 2014). These rules are followed

globally, financial statements are generated within the guidelines of the rules given by the GAAP

(Generally Accepted Accounting Principles). Mainly there are four rules Prudence, Consistency,

Accruals and Full Disclosure which is necessary for every company to follow in order to prepare

the financial statements and to check their actual position. Following are some rules which are

discussed as:

Prudence Concept: Prudence concept states that the amount of revenue should not be

recorded by the company at overestimated value (Modell, 2014.). Prudence concept says that the

revenue should not be recorded in the book if it is assumed to be earned, revenue should only be

recorded when it is actually earned and the expenses and the losses should be recorded even if it

is not sure to incurred. According to this concept the company should record the assets and the

11

Non current Liabilities

Loan 40000

Current liabilities

Bank Over draft 4590

Accounts Payable 117700

Suspense account 80170

Total Liabilities 437460

Assets

Fixed Assets

Equipment

less: Accumulated depreciation

280000

(48000) 232000

Current assets

Cash at Hand 49300

Inventory 40000

Accounts receivables 116160

Total Assets 437460

TASK 2

There are some rule which are to be followed in the accounting in order to generate the

financial statements of the company (McLaney and Atrill, 2014). These rules are followed

globally, financial statements are generated within the guidelines of the rules given by the GAAP

(Generally Accepted Accounting Principles). Mainly there are four rules Prudence, Consistency,

Accruals and Full Disclosure which is necessary for every company to follow in order to prepare

the financial statements and to check their actual position. Following are some rules which are

discussed as:

Prudence Concept: Prudence concept states that the amount of revenue should not be

recorded by the company at overestimated value (Modell, 2014.). Prudence concept says that the

revenue should not be recorded in the book if it is assumed to be earned, revenue should only be

recorded when it is actually earned and the expenses and the losses should be recorded even if it

is not sure to incurred. According to this concept the company should record the assets and the

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

revenue only if it is certain to be earned and the losses and expense should be recorded if it is

probable to incur. As per the GAAP (Generally Accepted Accounting Principles) the prudence

concept also states that the assets purchased by the company should be recorded on the on the

fair value if the fair value is less than the book value.

Accrual Concept (Matching concept): Accrual concept says that the company should

record it revenues and expenses in the same reporting period (Socea, 2012). It is used for the

journal entries to match both the sides of the trial balance. This concept is used to keep the

balance of the accounting equation i.e. Assets = Liabilities + Capital. As per this concept every

debit entry will have the credit entry with the same amount to balance the accounting equation

and vice versa. Accruals are treated as a key part for the closing process which is used to

generate the financial statements under the accrual concept. To record the accrued expenses

under the concept of double entry bookkeeping this expense is set off by the liability. Accrual

concept helps in the preparation of the financial statements as it requires to record the income

and expenses in the same accounting period in which they incurred rather than doing it on the

cash basis.

In order to create the annual reports Conga also needs to follow these accounting

concepts as they are mandatory for every business organisation irrespective of their size. In order

to create the financial statements the company must need to follow the prudence concept as it

shows the actual position of the company. Conga also used these concept in order to draw the

statements of financial positions and statements of profit and loss also known as the Income

Statements. The accrual concept helped the accountant of the conga to draw the financial

statements and balance sheet and also the management in taking the necessary decisions for a

specific accounting period.

TASK 3

Taxes are the main source of income for any country. As this is the way the government

of the country levies the tax on the individual income and the earning of the organisation (Weil,

Schipper and Francis, 2013.). For this purpose government uses different types of the taxation

system for individual it uses the direct tax system some of the direct tax are the income tax,

wealth tax, property tax and for the organisation it uses various types of indirect tax some of the

direct tax is the custom duty, exercise tax, Value added tax (VAT), Royalty etc. Proper

implementation of these taxes are necessary for the countries to increase their profitability.

12

probable to incur. As per the GAAP (Generally Accepted Accounting Principles) the prudence

concept also states that the assets purchased by the company should be recorded on the on the

fair value if the fair value is less than the book value.

Accrual Concept (Matching concept): Accrual concept says that the company should

record it revenues and expenses in the same reporting period (Socea, 2012). It is used for the

journal entries to match both the sides of the trial balance. This concept is used to keep the

balance of the accounting equation i.e. Assets = Liabilities + Capital. As per this concept every

debit entry will have the credit entry with the same amount to balance the accounting equation

and vice versa. Accruals are treated as a key part for the closing process which is used to

generate the financial statements under the accrual concept. To record the accrued expenses

under the concept of double entry bookkeeping this expense is set off by the liability. Accrual

concept helps in the preparation of the financial statements as it requires to record the income

and expenses in the same accounting period in which they incurred rather than doing it on the

cash basis.

In order to create the annual reports Conga also needs to follow these accounting

concepts as they are mandatory for every business organisation irrespective of their size. In order

to create the financial statements the company must need to follow the prudence concept as it

shows the actual position of the company. Conga also used these concept in order to draw the

statements of financial positions and statements of profit and loss also known as the Income

Statements. The accrual concept helped the accountant of the conga to draw the financial

statements and balance sheet and also the management in taking the necessary decisions for a

specific accounting period.

TASK 3

Taxes are the main source of income for any country. As this is the way the government

of the country levies the tax on the individual income and the earning of the organisation (Weil,

Schipper and Francis, 2013.). For this purpose government uses different types of the taxation

system for individual it uses the direct tax system some of the direct tax are the income tax,

wealth tax, property tax and for the organisation it uses various types of indirect tax some of the

direct tax is the custom duty, exercise tax, Value added tax (VAT), Royalty etc. Proper

implementation of these taxes are necessary for the countries to increase their profitability.

12

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.