Financial Accounting Assignment: Conga, Sole Trader Financials

VerifiedAdded on 2020/10/22

|17

|3813

|269

Homework Assignment

AI Summary

This assignment focuses on financial accounting principles and their application in a real-world scenario. It involves preparing accounting records, including journal entries for purchases, sales, expenses, and other transactions for Conga, a sole trader engaged in the retail toy business. The solution presents the creation of ledger accounts, a trial balance, and the preparation of financial statements. The assignment covers crucial accounting concepts such as accruals and prudence, and it emphasizes the importance of VAT. The provided solution demonstrates the step-by-step process of recording transactions, summarizing data, and creating financial statements, providing a comprehensive understanding of the accounting cycle.

Introduction

To

Financial Accounting

To

Financial Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

TASK 2..........................................................................................................................................11

TASK 3..........................................................................................................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

TASK 2..........................................................................................................................................11

TASK 3..........................................................................................................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Financial accounting is core and essential aspect of a business organisation. It is an on

going and continuous process in which accountants records transactions, summarise and post

them to ledgers, and prepare statement of financial position, income statement and cash flow

statement. It assist in defining actual performance and position of business organisation (Samkin,

Low and Taylor, 2012). It also provide comparative analysis of data of one or more period.

Financial records are prepared by accountants while considering accounting concepts under

financial accounting which enhance the reliability of financial data. Ultimate objective of

financial accounting is reporting of financial and profitability position of business organisation to

various stakeholder like investors, creditors, suppliers etc. This report exhibits various

accounting concepts such as prudence and accruals and their application in annual accounts

along with practical knowledge of preparation of accounting records and financial statements in

the context of Conga, a sole trader engaged in retail business of toys. This report also describes

importance and requirement of value added tax for Conga.

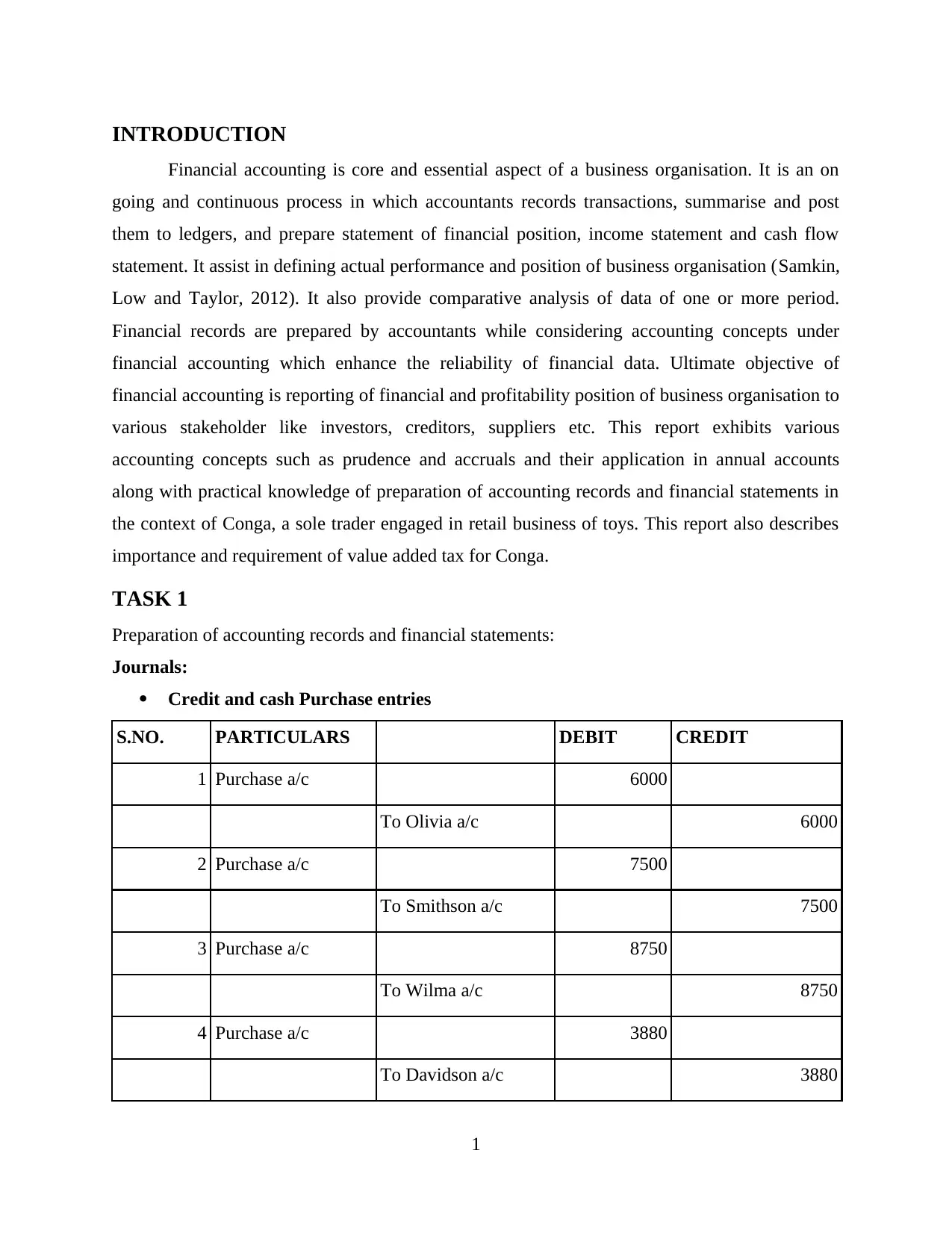

TASK 1

Preparation of accounting records and financial statements:

Journals:

Credit and cash Purchase entries

S.NO. PARTICULARS DEBIT CREDIT

1 Purchase a/c 6000

To Olivia a/c 6000

2 Purchase a/c 7500

To Smithson a/c 7500

3 Purchase a/c 8750

To Wilma a/c 8750

4 Purchase a/c 3880

To Davidson a/c 3880

1

Financial accounting is core and essential aspect of a business organisation. It is an on

going and continuous process in which accountants records transactions, summarise and post

them to ledgers, and prepare statement of financial position, income statement and cash flow

statement. It assist in defining actual performance and position of business organisation (Samkin,

Low and Taylor, 2012). It also provide comparative analysis of data of one or more period.

Financial records are prepared by accountants while considering accounting concepts under

financial accounting which enhance the reliability of financial data. Ultimate objective of

financial accounting is reporting of financial and profitability position of business organisation to

various stakeholder like investors, creditors, suppliers etc. This report exhibits various

accounting concepts such as prudence and accruals and their application in annual accounts

along with practical knowledge of preparation of accounting records and financial statements in

the context of Conga, a sole trader engaged in retail business of toys. This report also describes

importance and requirement of value added tax for Conga.

TASK 1

Preparation of accounting records and financial statements:

Journals:

Credit and cash Purchase entries

S.NO. PARTICULARS DEBIT CREDIT

1 Purchase a/c 6000

To Olivia a/c 6000

2 Purchase a/c 7500

To Smithson a/c 7500

3 Purchase a/c 8750

To Wilma a/c 8750

4 Purchase a/c 3880

To Davidson a/c 3880

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

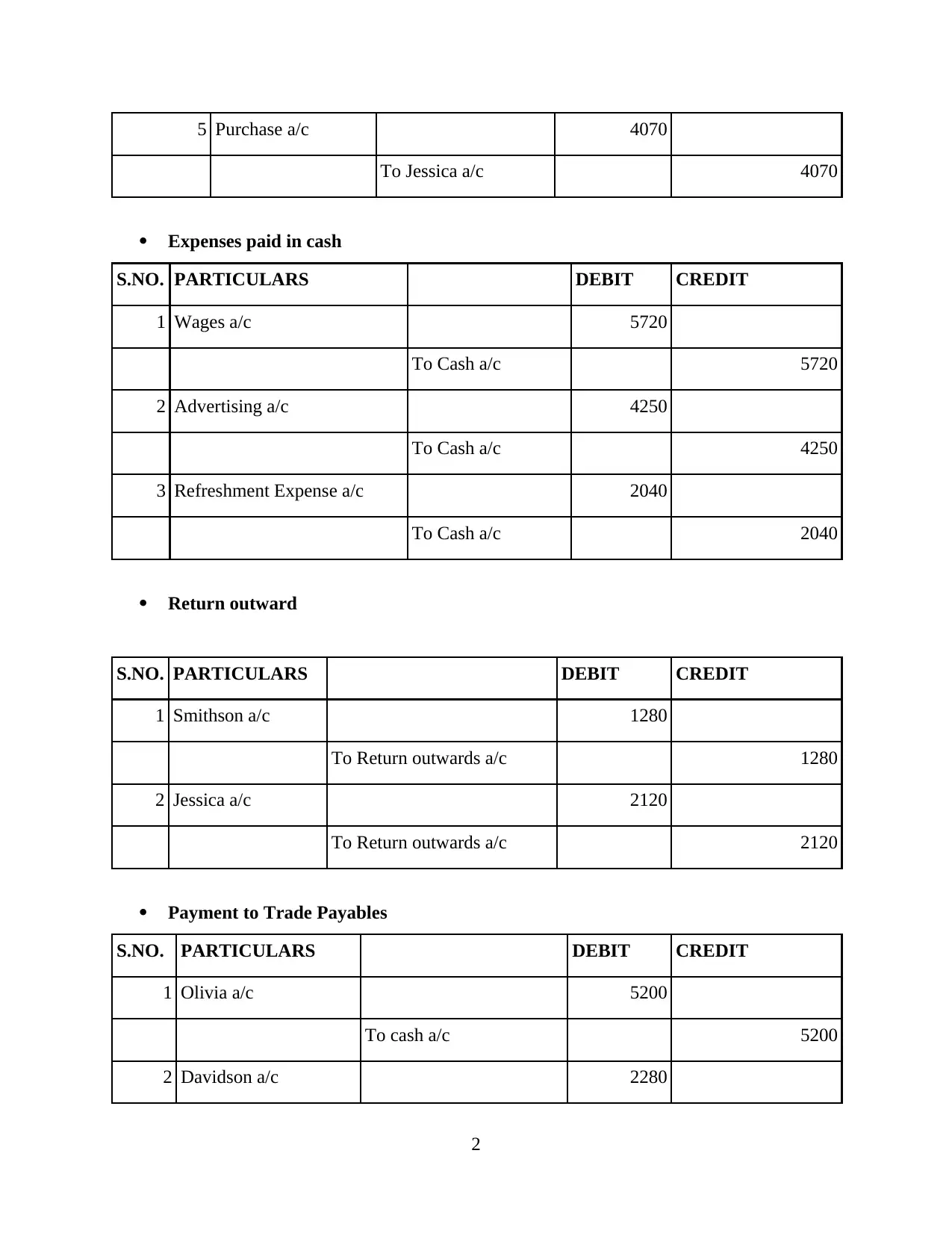

5 Purchase a/c 4070

To Jessica a/c 4070

Expenses paid in cash

S.NO. PARTICULARS DEBIT CREDIT

1 Wages a/c 5720

To Cash a/c 5720

2 Advertising a/c 4250

To Cash a/c 4250

3 Refreshment Expense a/c 2040

To Cash a/c 2040

Return outward

S.NO. PARTICULARS DEBIT CREDIT

1 Smithson a/c 1280

To Return outwards a/c 1280

2 Jessica a/c 2120

To Return outwards a/c 2120

Payment to Trade Payables

S.NO. PARTICULARS DEBIT CREDIT

1 Olivia a/c 5200

To cash a/c 5200

2 Davidson a/c 2280

2

To Jessica a/c 4070

Expenses paid in cash

S.NO. PARTICULARS DEBIT CREDIT

1 Wages a/c 5720

To Cash a/c 5720

2 Advertising a/c 4250

To Cash a/c 4250

3 Refreshment Expense a/c 2040

To Cash a/c 2040

Return outward

S.NO. PARTICULARS DEBIT CREDIT

1 Smithson a/c 1280

To Return outwards a/c 1280

2 Jessica a/c 2120

To Return outwards a/c 2120

Payment to Trade Payables

S.NO. PARTICULARS DEBIT CREDIT

1 Olivia a/c 5200

To cash a/c 5200

2 Davidson a/c 2280

2

To cash a/c 2280

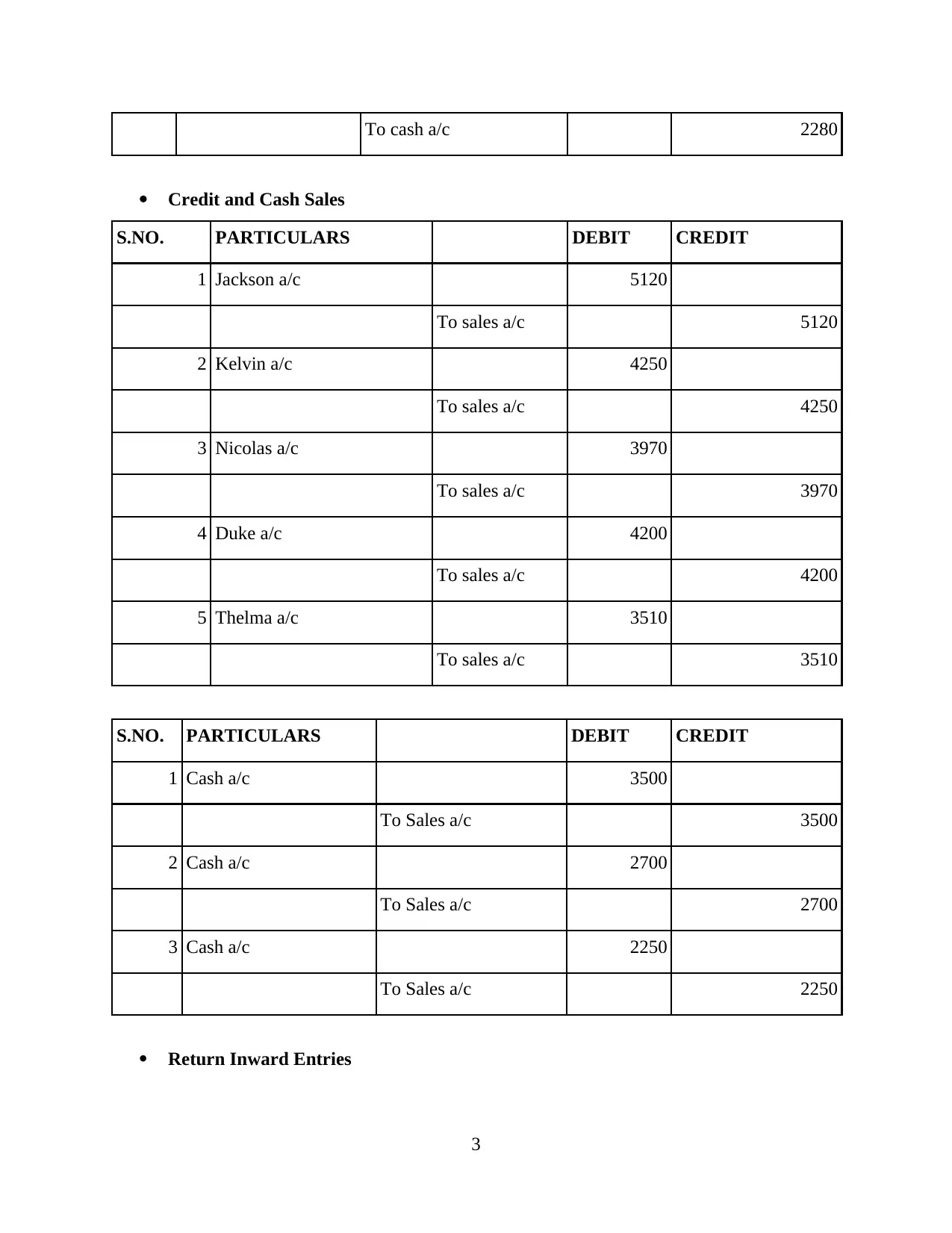

Credit and Cash Sales

S.NO. PARTICULARS DEBIT CREDIT

1 Jackson a/c 5120

To sales a/c 5120

2 Kelvin a/c 4250

To sales a/c 4250

3 Nicolas a/c 3970

To sales a/c 3970

4 Duke a/c 4200

To sales a/c 4200

5 Thelma a/c 3510

To sales a/c 3510

S.NO. PARTICULARS DEBIT CREDIT

1 Cash a/c 3500

To Sales a/c 3500

2 Cash a/c 2700

To Sales a/c 2700

3 Cash a/c 2250

To Sales a/c 2250

Return Inward Entries

3

Credit and Cash Sales

S.NO. PARTICULARS DEBIT CREDIT

1 Jackson a/c 5120

To sales a/c 5120

2 Kelvin a/c 4250

To sales a/c 4250

3 Nicolas a/c 3970

To sales a/c 3970

4 Duke a/c 4200

To sales a/c 4200

5 Thelma a/c 3510

To sales a/c 3510

S.NO. PARTICULARS DEBIT CREDIT

1 Cash a/c 3500

To Sales a/c 3500

2 Cash a/c 2700

To Sales a/c 2700

3 Cash a/c 2250

To Sales a/c 2250

Return Inward Entries

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

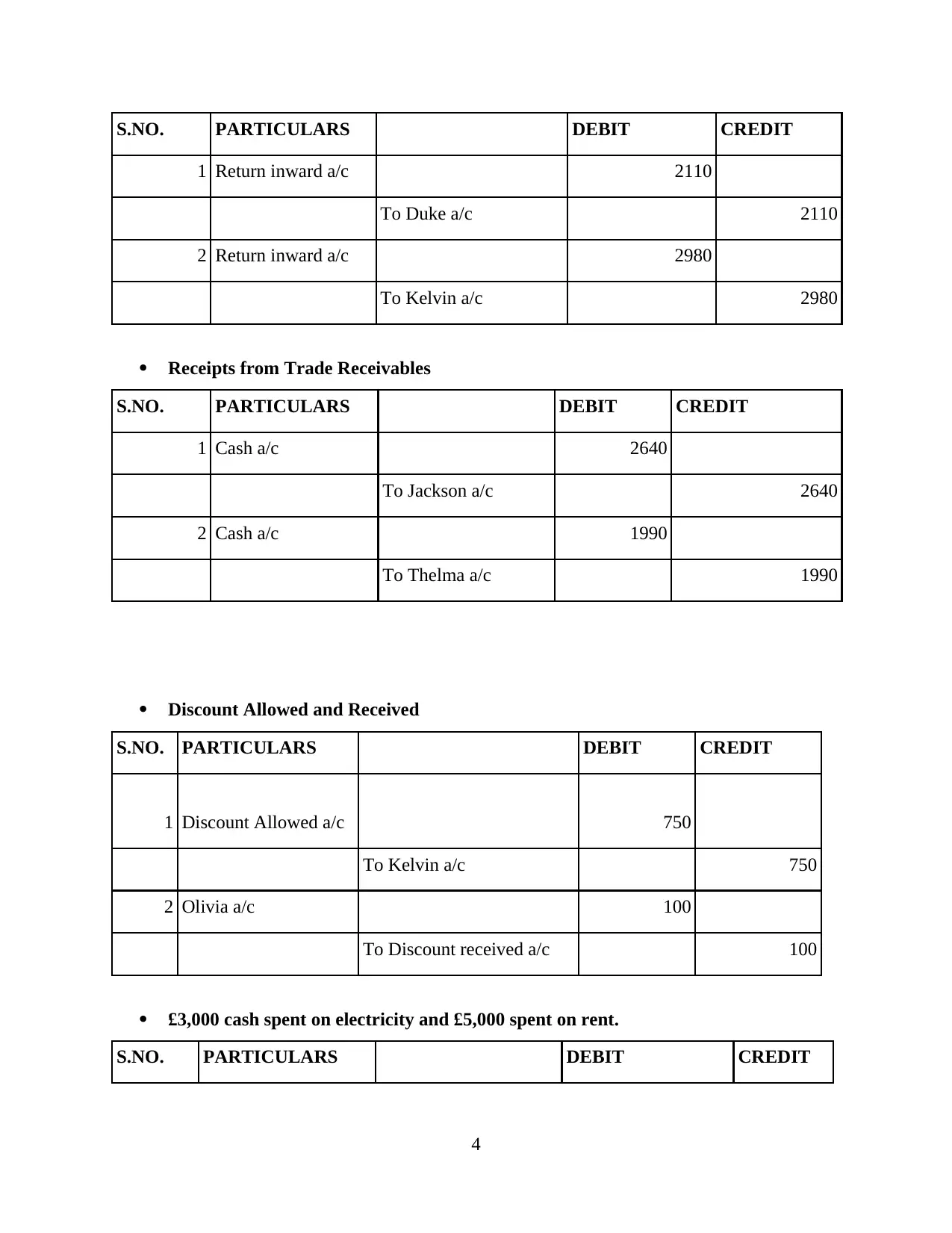

S.NO. PARTICULARS DEBIT CREDIT

1 Return inward a/c 2110

To Duke a/c 2110

2 Return inward a/c 2980

To Kelvin a/c 2980

Receipts from Trade Receivables

S.NO. PARTICULARS DEBIT CREDIT

1 Cash a/c 2640

To Jackson a/c 2640

2 Cash a/c 1990

To Thelma a/c 1990

Discount Allowed and Received

S.NO. PARTICULARS DEBIT CREDIT

1 Discount Allowed a/c 750

To Kelvin a/c 750

2 Olivia a/c 100

To Discount received a/c 100

£3,000 cash spent on electricity and £5,000 spent on rent.

S.NO. PARTICULARS DEBIT CREDIT

4

1 Return inward a/c 2110

To Duke a/c 2110

2 Return inward a/c 2980

To Kelvin a/c 2980

Receipts from Trade Receivables

S.NO. PARTICULARS DEBIT CREDIT

1 Cash a/c 2640

To Jackson a/c 2640

2 Cash a/c 1990

To Thelma a/c 1990

Discount Allowed and Received

S.NO. PARTICULARS DEBIT CREDIT

1 Discount Allowed a/c 750

To Kelvin a/c 750

2 Olivia a/c 100

To Discount received a/c 100

£3,000 cash spent on electricity and £5,000 spent on rent.

S.NO. PARTICULARS DEBIT CREDIT

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

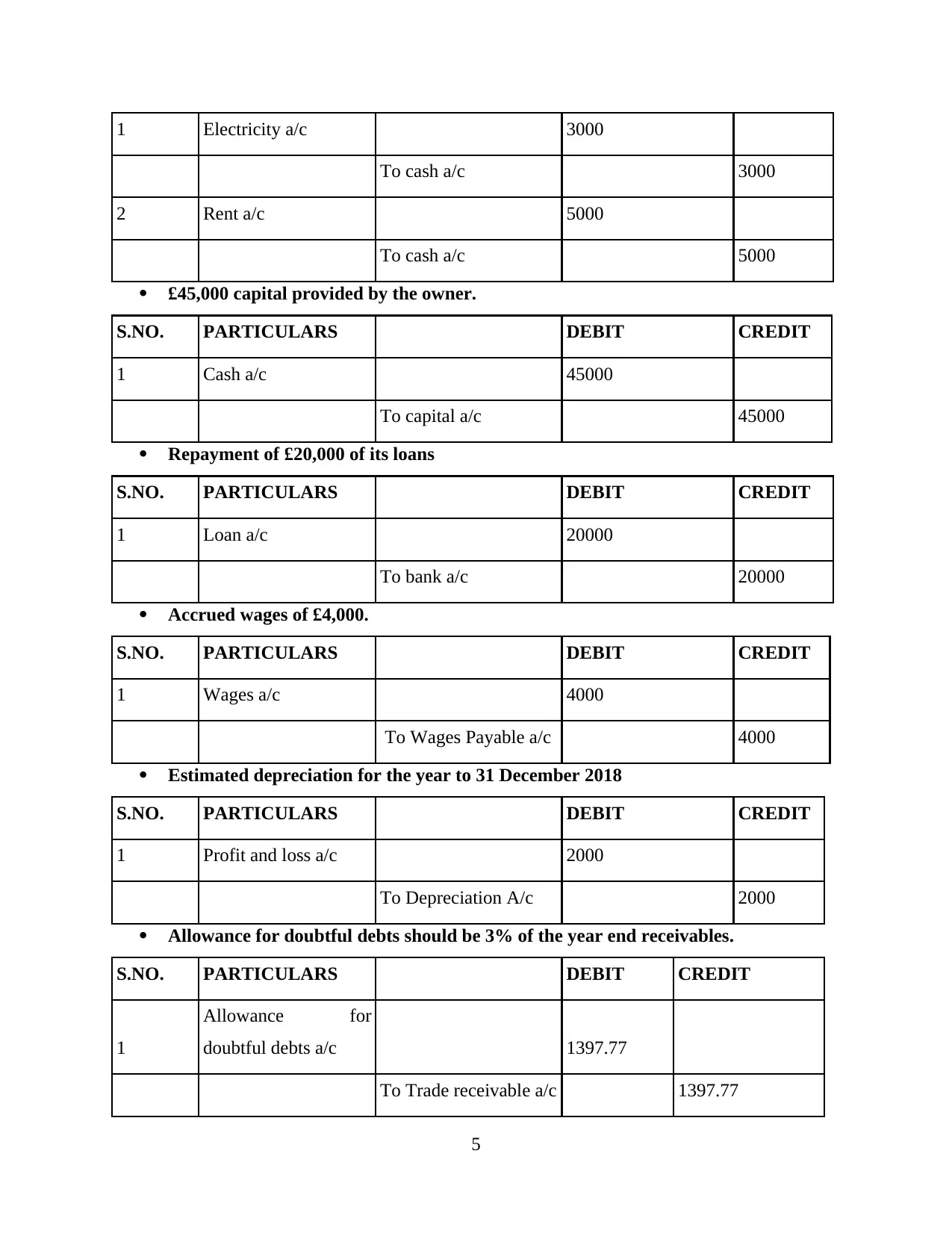

1 Electricity a/c 3000

To cash a/c 3000

2 Rent a/c 5000

To cash a/c 5000

£45,000 capital provided by the owner.

S.NO. PARTICULARS DEBIT CREDIT

1 Cash a/c 45000

To capital a/c 45000

Repayment of £20,000 of its loans

S.NO. PARTICULARS DEBIT CREDIT

1 Loan a/c 20000

To bank a/c 20000

Accrued wages of £4,000.

S.NO. PARTICULARS DEBIT CREDIT

1 Wages a/c 4000

To Wages Payable a/c 4000

Estimated depreciation for the year to 31 December 2018

S.NO. PARTICULARS DEBIT CREDIT

1 Profit and loss a/c 2000

To Depreciation A/c 2000

Allowance for doubtful debts should be 3% of the year end receivables.

S.NO. PARTICULARS DEBIT CREDIT

1

Allowance for

doubtful debts a/c 1397.77

To Trade receivable a/c 1397.77

5

To cash a/c 3000

2 Rent a/c 5000

To cash a/c 5000

£45,000 capital provided by the owner.

S.NO. PARTICULARS DEBIT CREDIT

1 Cash a/c 45000

To capital a/c 45000

Repayment of £20,000 of its loans

S.NO. PARTICULARS DEBIT CREDIT

1 Loan a/c 20000

To bank a/c 20000

Accrued wages of £4,000.

S.NO. PARTICULARS DEBIT CREDIT

1 Wages a/c 4000

To Wages Payable a/c 4000

Estimated depreciation for the year to 31 December 2018

S.NO. PARTICULARS DEBIT CREDIT

1 Profit and loss a/c 2000

To Depreciation A/c 2000

Allowance for doubtful debts should be 3% of the year end receivables.

S.NO. PARTICULARS DEBIT CREDIT

1

Allowance for

doubtful debts a/c 1397.77

To Trade receivable a/c 1397.77

5

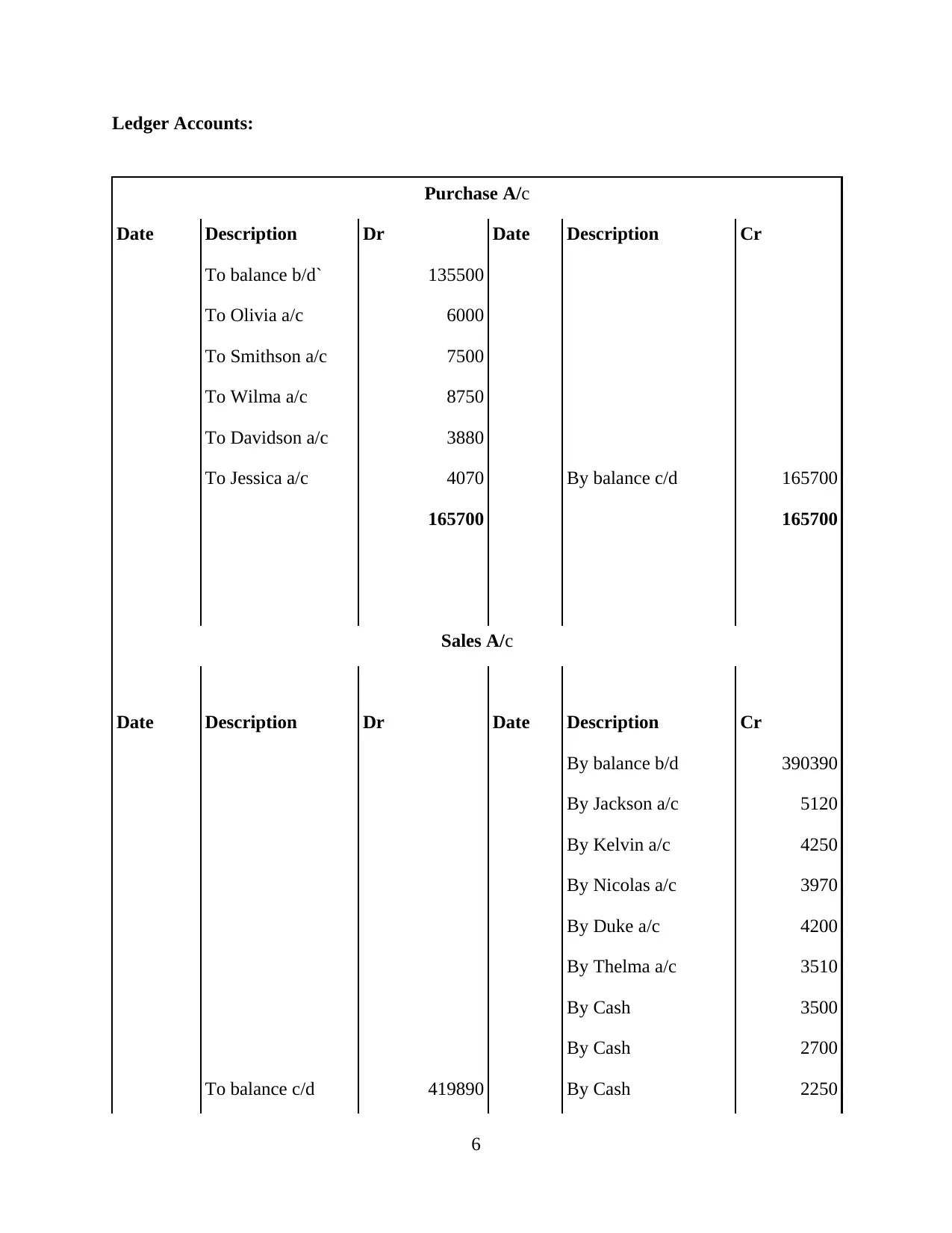

Ledger Accounts:

Purchase A/c

Date Description Dr Date Description Cr

To balance b/d` 135500

To Olivia a/c 6000

To Smithson a/c 7500

To Wilma a/c 8750

To Davidson a/c 3880

To Jessica a/c 4070 By balance c/d 165700

165700 165700

Sales A/c

Date Description Dr Date Description Cr

By balance b/d 390390

By Jackson a/c 5120

By Kelvin a/c 4250

By Nicolas a/c 3970

By Duke a/c 4200

By Thelma a/c 3510

By Cash 3500

By Cash 2700

To balance c/d 419890 By Cash 2250

6

Purchase A/c

Date Description Dr Date Description Cr

To balance b/d` 135500

To Olivia a/c 6000

To Smithson a/c 7500

To Wilma a/c 8750

To Davidson a/c 3880

To Jessica a/c 4070 By balance c/d 165700

165700 165700

Sales A/c

Date Description Dr Date Description Cr

By balance b/d 390390

By Jackson a/c 5120

By Kelvin a/c 4250

By Nicolas a/c 3970

By Duke a/c 4200

By Thelma a/c 3510

By Cash 3500

By Cash 2700

To balance c/d 419890 By Cash 2250

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

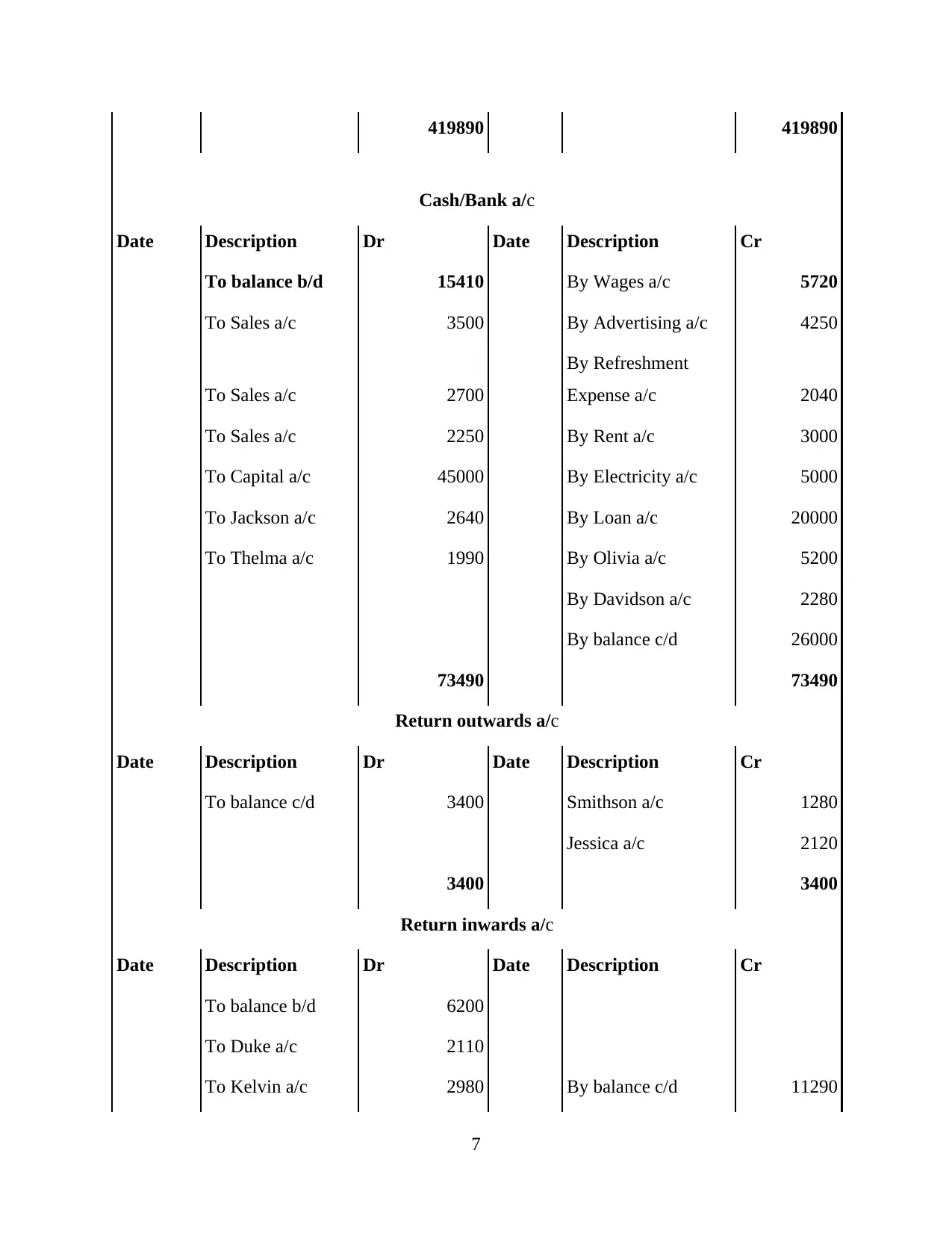

419890 419890

Cash/Bank a/c

Date Description Dr Date Description Cr

To balance b/d 15410 By Wages a/c 5720

To Sales a/c 3500 By Advertising a/c 4250

To Sales a/c 2700

By Refreshment

Expense a/c 2040

To Sales a/c 2250 By Rent a/c 3000

To Capital a/c 45000 By Electricity a/c 5000

To Jackson a/c 2640 By Loan a/c 20000

To Thelma a/c 1990 By Olivia a/c 5200

By Davidson a/c 2280

By balance c/d 26000

73490 73490

Return outwards a/c

Date Description Dr Date Description Cr

To balance c/d 3400 Smithson a/c 1280

Jessica a/c 2120

3400 3400

Return inwards a/c

Date Description Dr Date Description Cr

To balance b/d 6200

To Duke a/c 2110

To Kelvin a/c 2980 By balance c/d 11290

7

Cash/Bank a/c

Date Description Dr Date Description Cr

To balance b/d 15410 By Wages a/c 5720

To Sales a/c 3500 By Advertising a/c 4250

To Sales a/c 2700

By Refreshment

Expense a/c 2040

To Sales a/c 2250 By Rent a/c 3000

To Capital a/c 45000 By Electricity a/c 5000

To Jackson a/c 2640 By Loan a/c 20000

To Thelma a/c 1990 By Olivia a/c 5200

By Davidson a/c 2280

By balance c/d 26000

73490 73490

Return outwards a/c

Date Description Dr Date Description Cr

To balance c/d 3400 Smithson a/c 1280

Jessica a/c 2120

3400 3400

Return inwards a/c

Date Description Dr Date Description Cr

To balance b/d 6200

To Duke a/c 2110

To Kelvin a/c 2980 By balance c/d 11290

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

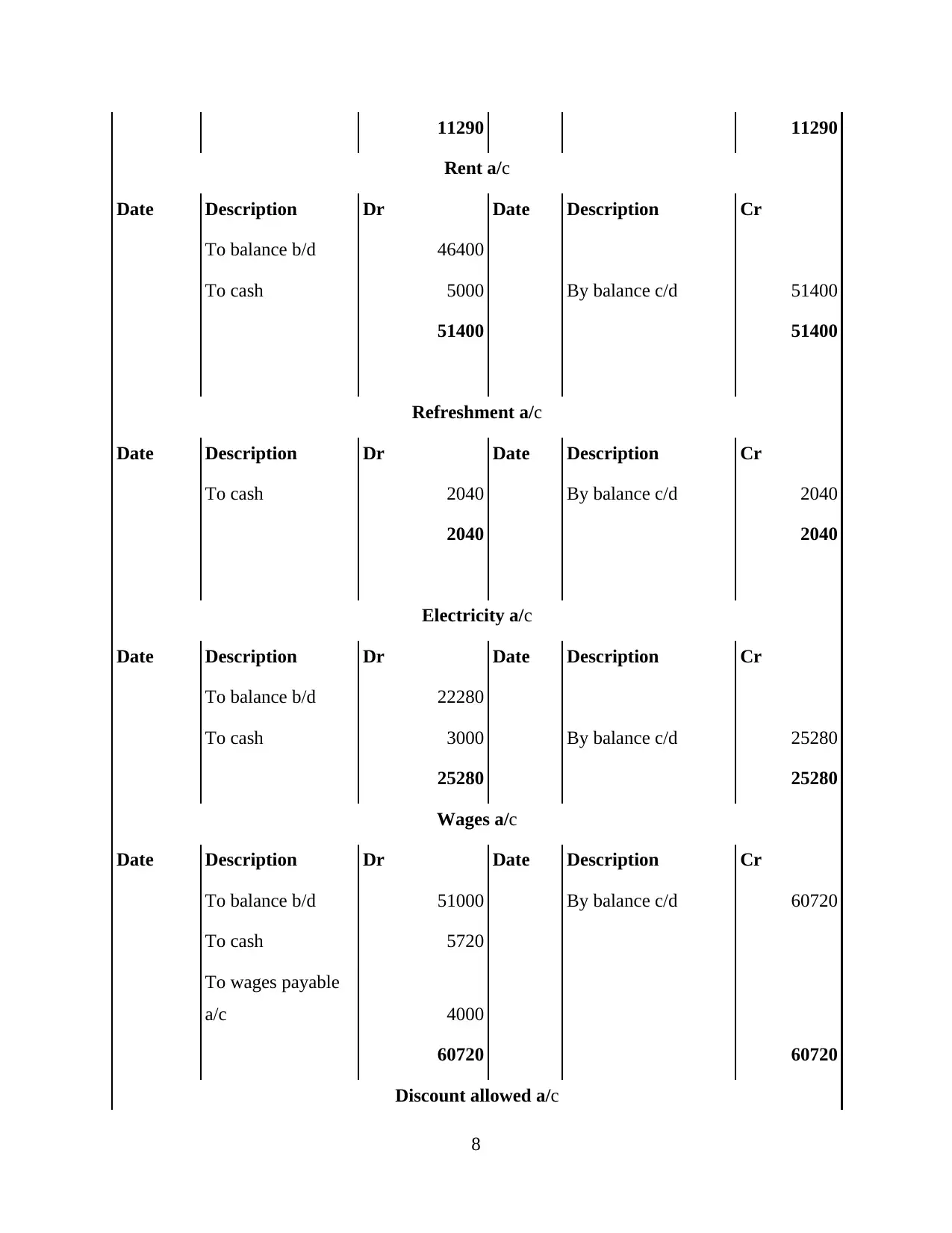

11290 11290

Rent a/c

Date Description Dr Date Description Cr

To balance b/d 46400

To cash 5000 By balance c/d 51400

51400 51400

Refreshment a/c

Date Description Dr Date Description Cr

To cash 2040 By balance c/d 2040

2040 2040

Electricity a/c

Date Description Dr Date Description Cr

To balance b/d 22280

To cash 3000 By balance c/d 25280

25280 25280

Wages a/c

Date Description Dr Date Description Cr

To balance b/d 51000 By balance c/d 60720

To cash 5720

To wages payable

a/c 4000

60720 60720

Discount allowed a/c

8

Rent a/c

Date Description Dr Date Description Cr

To balance b/d 46400

To cash 5000 By balance c/d 51400

51400 51400

Refreshment a/c

Date Description Dr Date Description Cr

To cash 2040 By balance c/d 2040

2040 2040

Electricity a/c

Date Description Dr Date Description Cr

To balance b/d 22280

To cash 3000 By balance c/d 25280

25280 25280

Wages a/c

Date Description Dr Date Description Cr

To balance b/d 51000 By balance c/d 60720

To cash 5720

To wages payable

a/c 4000

60720 60720

Discount allowed a/c

8

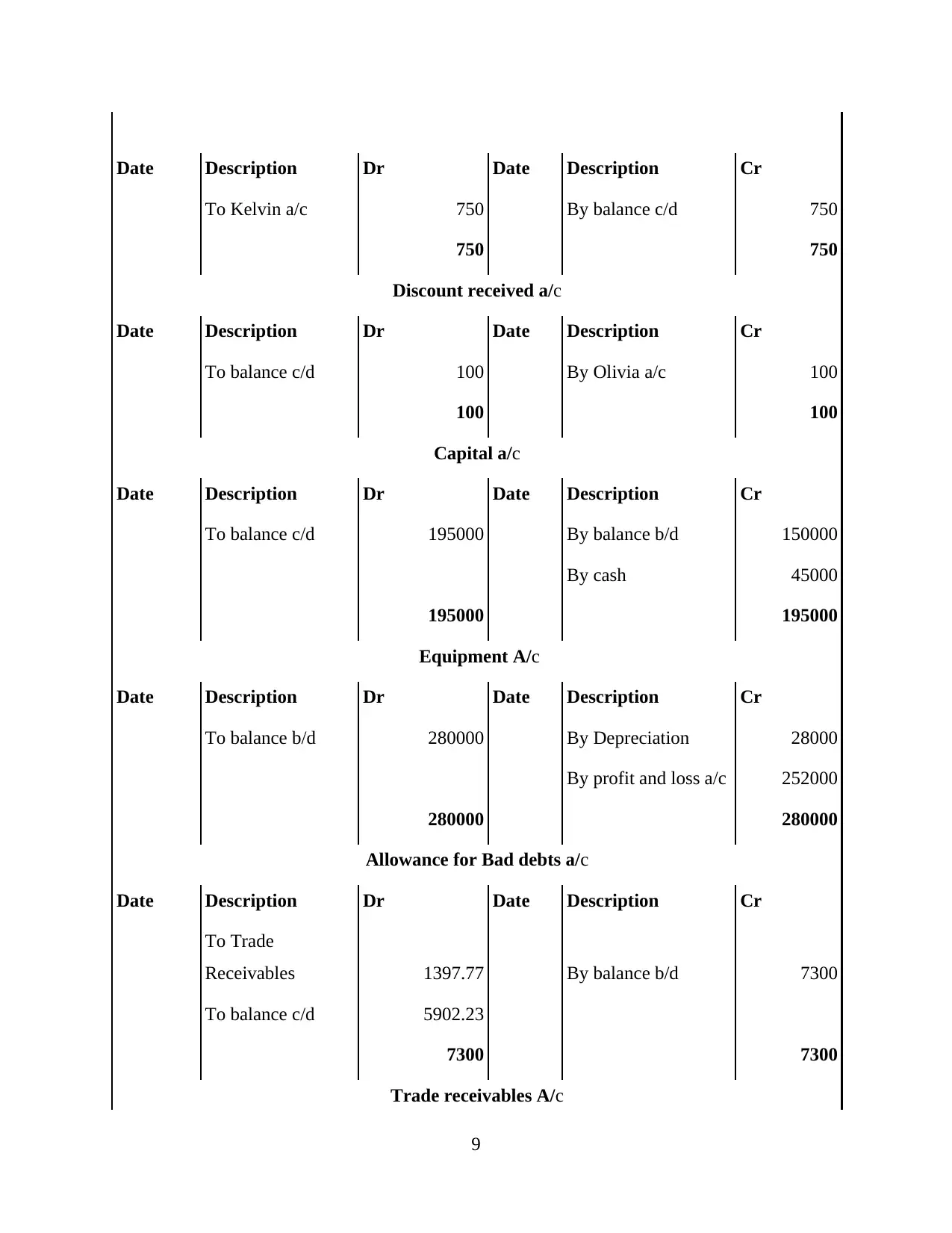

Date Description Dr Date Description Cr

To Kelvin a/c 750 By balance c/d 750

750 750

Discount received a/c

Date Description Dr Date Description Cr

To balance c/d 100 By Olivia a/c 100

100 100

Capital a/c

Date Description Dr Date Description Cr

To balance c/d 195000 By balance b/d 150000

By cash 45000

195000 195000

Equipment A/c

Date Description Dr Date Description Cr

To balance b/d 280000 By Depreciation 28000

By profit and loss a/c 252000

280000 280000

Allowance for Bad debts a/c

Date Description Dr Date Description Cr

To Trade

Receivables 1397.77 By balance b/d 7300

To balance c/d 5902.23

7300 7300

Trade receivables A/c

9

To Kelvin a/c 750 By balance c/d 750

750 750

Discount received a/c

Date Description Dr Date Description Cr

To balance c/d 100 By Olivia a/c 100

100 100

Capital a/c

Date Description Dr Date Description Cr

To balance c/d 195000 By balance b/d 150000

By cash 45000

195000 195000

Equipment A/c

Date Description Dr Date Description Cr

To balance b/d 280000 By Depreciation 28000

By profit and loss a/c 252000

280000 280000

Allowance for Bad debts a/c

Date Description Dr Date Description Cr

To Trade

Receivables 1397.77 By balance b/d 7300

To balance c/d 5902.23

7300 7300

Trade receivables A/c

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.