Economics of Trade Policy and Competition

VerifiedAdded on 2020/05/28

|15

|2478

|59

AI Summary

The assignment delves into the economic aspects of trade policy, exploring various theories and their practical implications. It examines arguments for protectionist measures, such as the infant industry argument, and analyzes the effects of policies like carbon taxes on emissions and trade patterns. The document also touches upon international trade regulation and the influence of government preferences on market competition.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: INTRODUCTION TO MICROECONOMICS

Introduction to microeconomics

Name of the student

Name of the University

Author note

Introduction to microeconomics

Name of the student

Name of the University

Author note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1INTRODUCTION TO MICROECONOMICS

Table of Contents

Answer 1:...................................................................................................................................2

a).............................................................................................................................................2

b)............................................................................................................................................3

c).............................................................................................................................................4

d)............................................................................................................................................5

Answer 2:...................................................................................................................................6

a).............................................................................................................................................6

b)............................................................................................................................................6

Answer 3:...................................................................................................................................7

a).............................................................................................................................................7

b)............................................................................................................................................7

c).............................................................................................................................................8

d)............................................................................................................................................9

Answer 4:.................................................................................................................................11

a)...........................................................................................................................................11

b)..........................................................................................................................................11

c)...........................................................................................................................................12

Reference:................................................................................................................................13

Table of Contents

Answer 1:...................................................................................................................................2

a).............................................................................................................................................2

b)............................................................................................................................................3

c).............................................................................................................................................4

d)............................................................................................................................................5

Answer 2:...................................................................................................................................6

a).............................................................................................................................................6

b)............................................................................................................................................6

Answer 3:...................................................................................................................................7

a).............................................................................................................................................7

b)............................................................................................................................................7

c).............................................................................................................................................8

d)............................................................................................................................................9

Answer 4:.................................................................................................................................11

a)...........................................................................................................................................11

b)..........................................................................................................................................11

c)...........................................................................................................................................12

Reference:................................................................................................................................13

2INTRODUCTION TO MICROECONOMICS

Output

Price

Q0

P0

Demand Curve

Canada

Supply Curve

Australia

PC

PA

Q1O

Answer 1:

Australia now can export beef to Canada due to free trade agreement (Sun 2015).

Under this scenario, answer the given question 1 are as follow:

a)

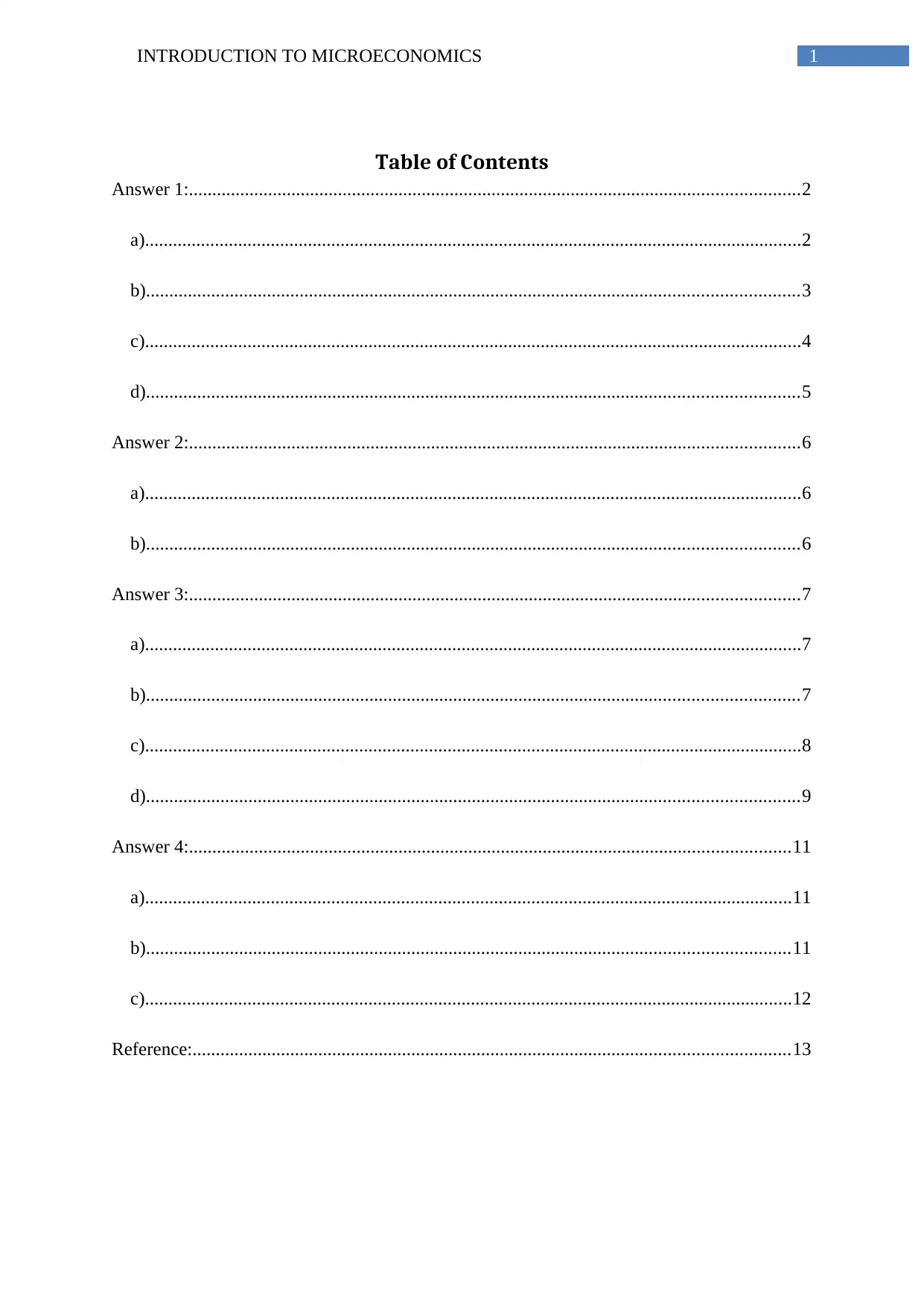

According to the question, if the government of Australia subsidise its beef supply,

then the cost of exporting beef will fall (Tebaldi 2017). It will enhance the demand of the

Australasian beef in Canada due to reduced price, which is the direct outcome of the export

subsidy provided by the Australian government. On the other hand, there will be scarcity of

beef in the domestic market of Australia, leading to a rise in price of the beef in the market

(Ding et L, 2014).

Figure1: Effect of export subsidy

Source: (created by author)

According to the figure 1, Q0 was the initial equilibrium quantity of Australian beef and P0

was the initial equilibrium price. With rise in export subsidy, Output will rise to Q1 and the

Output

Price

Q0

P0

Demand Curve

Canada

Supply Curve

Australia

PC

PA

Q1O

Answer 1:

Australia now can export beef to Canada due to free trade agreement (Sun 2015).

Under this scenario, answer the given question 1 are as follow:

a)

According to the question, if the government of Australia subsidise its beef supply,

then the cost of exporting beef will fall (Tebaldi 2017). It will enhance the demand of the

Australasian beef in Canada due to reduced price, which is the direct outcome of the export

subsidy provided by the Australian government. On the other hand, there will be scarcity of

beef in the domestic market of Australia, leading to a rise in price of the beef in the market

(Ding et L, 2014).

Figure1: Effect of export subsidy

Source: (created by author)

According to the figure 1, Q0 was the initial equilibrium quantity of Australian beef and P0

was the initial equilibrium price. With rise in export subsidy, Output will rise to Q1 and the

3INTRODUCTION TO MICROECONOMICS

Demand Curve

Supply Curve

Price

Output

O

A

C

D

E

F

G

H

PA

PC

P

SAExport

price for the Canadian market will fall to PC. However, the price for beef in the Australian

market will rise to PA, which is higher than the equilibrium price (McGovern 2017).

b)

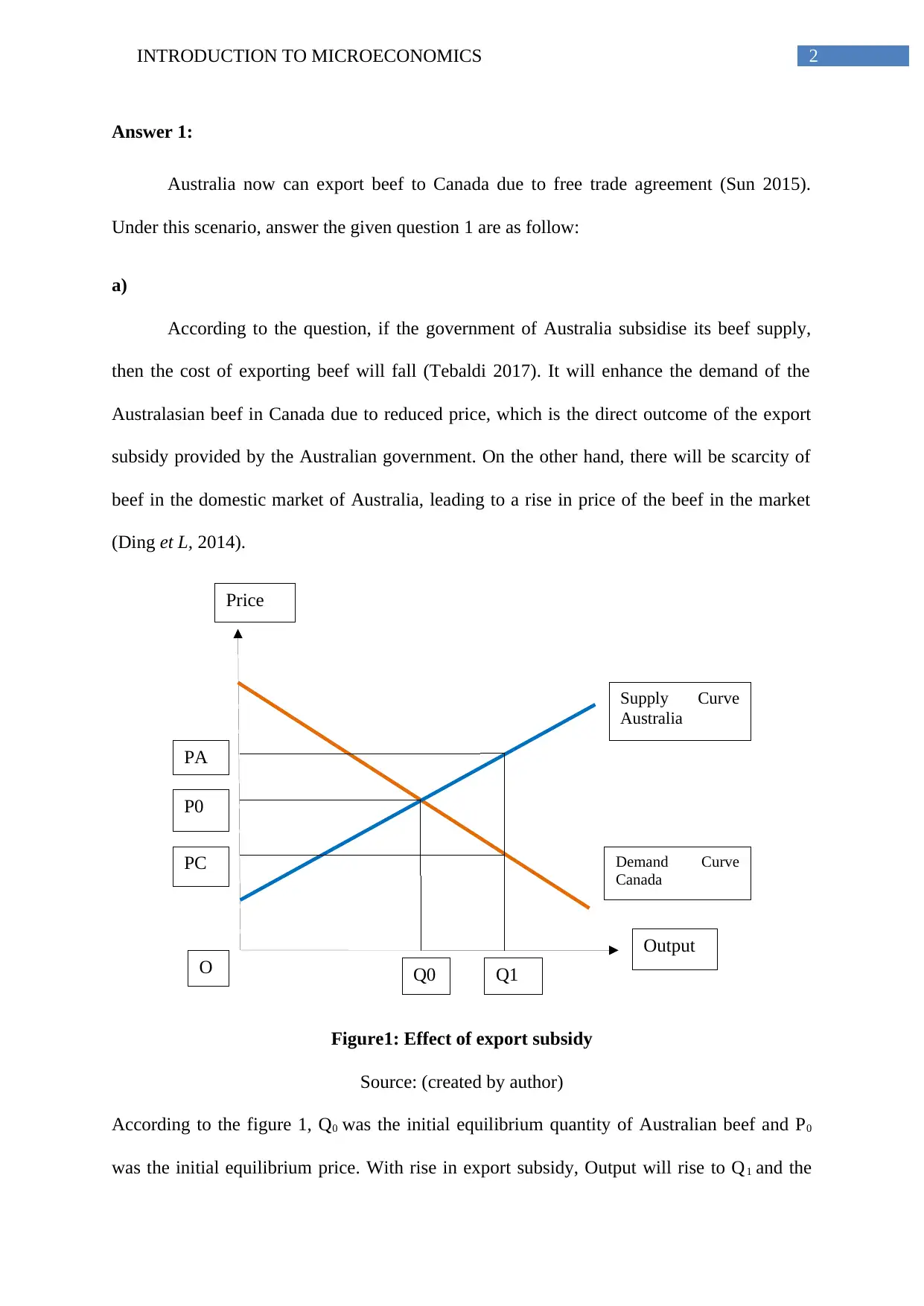

In order to find the consumer surplus, total surplus and government revenue we have

to consider the diagram 2. According to the diagram, P is the equilibrium price, if there is no

trade between the countries.

Figure 2: Change in surplus and revenue

Source: (Created by Author)

Post subsidy, price of the beef in the Australian market will hike up to the PA and the

price in Canadian market will be PC. This price rise in Australian market will lead to a fall in

Consumer Surplus by (A+D); whereas the producer surplus will increase up to the level of

(A+D+F) due to increased sell in the Canadian market. This entails that consumer surplus

during post subsidy will increase and it will affect the total surplus, which can be gained

through producer and consumer surplus. Combining this we can perceive that total surplus is

Demand Curve

Supply Curve

Price

Output

O

A

C

D

E

F

G

H

PA

PC

P

SAExport

price for the Canadian market will fall to PC. However, the price for beef in the Australian

market will rise to PA, which is higher than the equilibrium price (McGovern 2017).

b)

In order to find the consumer surplus, total surplus and government revenue we have

to consider the diagram 2. According to the diagram, P is the equilibrium price, if there is no

trade between the countries.

Figure 2: Change in surplus and revenue

Source: (Created by Author)

Post subsidy, price of the beef in the Australian market will hike up to the PA and the

price in Canadian market will be PC. This price rise in Australian market will lead to a fall in

Consumer Surplus by (A+D); whereas the producer surplus will increase up to the level of

(A+D+F) due to increased sell in the Canadian market. This entails that consumer surplus

during post subsidy will increase and it will affect the total surplus, which can be gained

through producer and consumer surplus. Combining this we can perceive that total surplus is

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4INTRODUCTION TO MICROECONOMICS

Supply Curve

Demand Curve

P1

P0

O

A

B C D

SC’ DC’

Price

Output

SC DC

[{(A+D+F) – (A+D)} = F]. On the other hand, government revenue from the beef export will

fall during post subsidy period due to excess expenditure as the form of subsidy (Stiglitz and

Rosengard 2015). Government revenue can be represented by (C+D+E+F+G+H), which is

lower than the pre subsidy period.

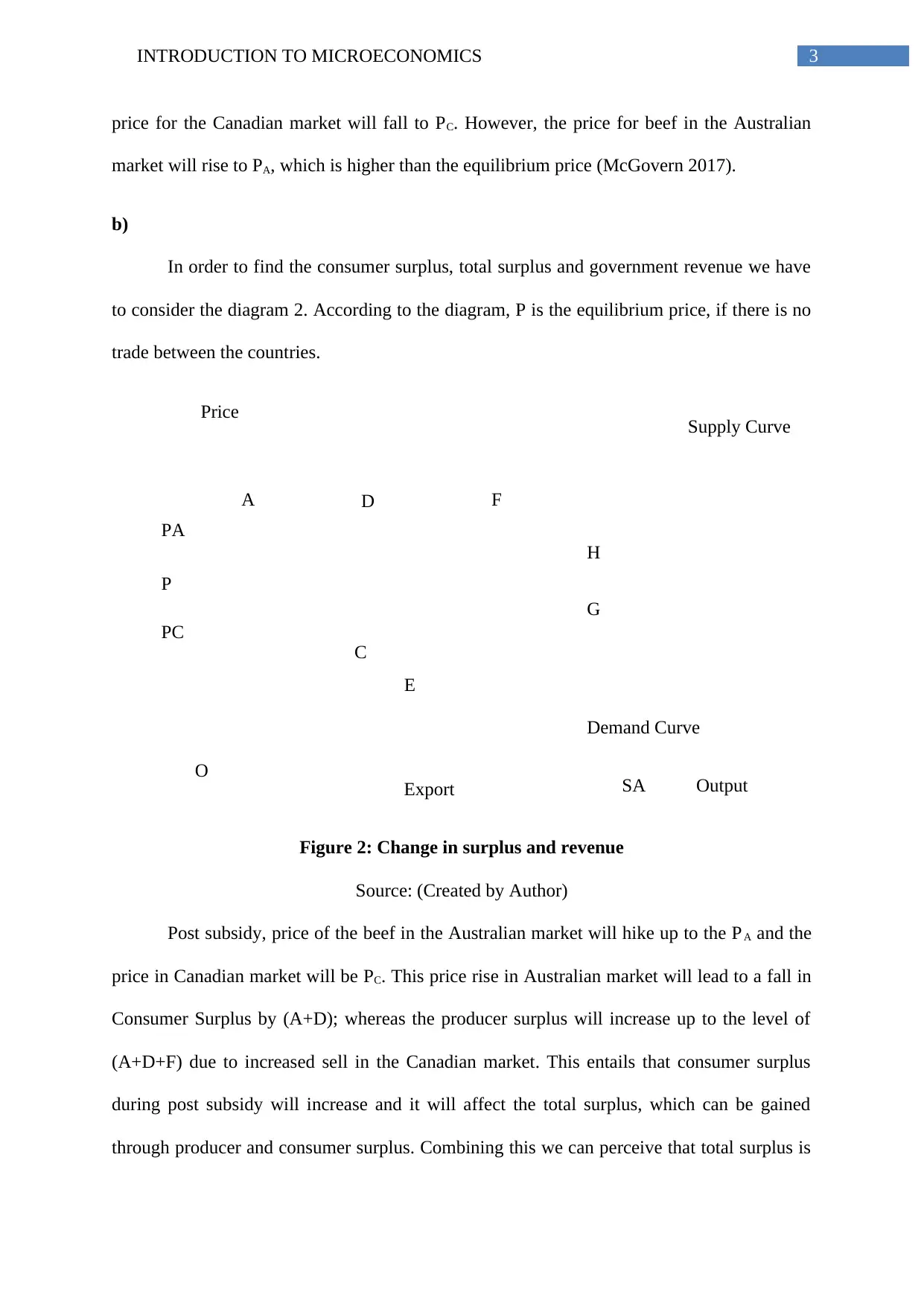

c)

Import quotas are one of the tools that aid the government to put restriction on the

import and enhance the production of the domestic suppliers.

Figure 3: Effect of import quota

Source: (Created by Author)

If the Canadian government put import quota on beef production, then it will restrict

beef export from Australia to Canada (Abbassi, Tamini and Dakhlaoui 2015). Considering

that pre quota price of beef in the Australian market is P0, we can envisage that post quota

price will rise to P1. It will lead to fall in demand and supply of beef as well and a loss of

Supply Curve

Demand Curve

P1

P0

O

A

B C D

SC’ DC’

Price

Output

SC DC

[{(A+D+F) – (A+D)} = F]. On the other hand, government revenue from the beef export will

fall during post subsidy period due to excess expenditure as the form of subsidy (Stiglitz and

Rosengard 2015). Government revenue can be represented by (C+D+E+F+G+H), which is

lower than the pre subsidy period.

c)

Import quotas are one of the tools that aid the government to put restriction on the

import and enhance the production of the domestic suppliers.

Figure 3: Effect of import quota

Source: (Created by Author)

If the Canadian government put import quota on beef production, then it will restrict

beef export from Australia to Canada (Abbassi, Tamini and Dakhlaoui 2015). Considering

that pre quota price of beef in the Australian market is P0, we can envisage that post quota

price will rise to P1. It will lead to fall in demand and supply of beef as well and a loss of

5INTRODUCTION TO MICROECONOMICS

consumer surplus by (A+B+C+D) amount. In this case, deadweight loss will be (A+B+C)

and the D section represents the foreign supplier’s profit.

d)

Trade protection is one of the tolls for the government that aids to protect the interest

of the domestic producers and enhance domestic output level (Shatz, Howard and David

2017). It provides the domestic producers competitive advantage in the domestic market with

favourable condition to compete with the international traders (Schuknecht 2017). Trade

protection increases government revenue and aids the foreign reserves of the country. Two

arguments in favour of the trade protection act are as follows:

Infant industry argument: It is aimed to safeguard the interest of the infant

industries by curtailing the stiff competition from the players of the world market.

Theoretically, it aids the firm to enhance their productivity and transform them to become

potent enough to compete with the foreign players (Charles 2017).

Business diversification: Country, which has immense specialization in production

of goods, and then they tends to be dependent on other nations for other products and

services. This hampers the country’s economic interest (Hill, Jones and Schilling 2014).

Thus, business diversification argument proposes that countries need to diversify their

business and transform them to become self-reliance in long run.

consumer surplus by (A+B+C+D) amount. In this case, deadweight loss will be (A+B+C)

and the D section represents the foreign supplier’s profit.

d)

Trade protection is one of the tolls for the government that aids to protect the interest

of the domestic producers and enhance domestic output level (Shatz, Howard and David

2017). It provides the domestic producers competitive advantage in the domestic market with

favourable condition to compete with the international traders (Schuknecht 2017). Trade

protection increases government revenue and aids the foreign reserves of the country. Two

arguments in favour of the trade protection act are as follows:

Infant industry argument: It is aimed to safeguard the interest of the infant

industries by curtailing the stiff competition from the players of the world market.

Theoretically, it aids the firm to enhance their productivity and transform them to become

potent enough to compete with the foreign players (Charles 2017).

Business diversification: Country, which has immense specialization in production

of goods, and then they tends to be dependent on other nations for other products and

services. This hampers the country’s economic interest (Hill, Jones and Schilling 2014).

Thus, business diversification argument proposes that countries need to diversify their

business and transform them to become self-reliance in long run.

6INTRODUCTION TO MICROECONOMICS

Answer 2:

a)

Given that market price for 2 unit of the product is 40; however, the Marginal Cost of

production is 30, which means the firm is willing to sell 2 units of their product at 30 unit of

price.

Thus the producer surplus is = 40 – 30 = 10 Units.

b)

The firm is willing to sell 3 units of their products at 50 unit of price. Given that, the

market price of the 3 units of the same product is 60.

Thus the producer surplus is = 60 – 50 = 10 Units.

Answer 2:

a)

Given that market price for 2 unit of the product is 40; however, the Marginal Cost of

production is 30, which means the firm is willing to sell 2 units of their product at 30 unit of

price.

Thus the producer surplus is = 40 – 30 = 10 Units.

b)

The firm is willing to sell 3 units of their products at 50 unit of price. Given that, the

market price of the 3 units of the same product is 60.

Thus the producer surplus is = 60 – 50 = 10 Units.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7INTRODUCTION TO MICROECONOMICS

Answer 3:

Given that:

Demand function is: QD = 200 -2P

Supply function is: QS = -10 + P

a)

Inverse demand function is the representation of the demand function, where quantity is

function of the price (Sun et al. 2017).

In this case Inverse demand function is:

QD = 200 -2P

QD + 2P = 200

2P= 200 – QD

P = 200/2 –QD/2

P = 100 – QD/2

Inverse supply function is the representation of the supply function, where quantity is the

function of price (Van et al. 2014).

In this case Inverse supply function is:

QS = -10 + P

P = QS + 10

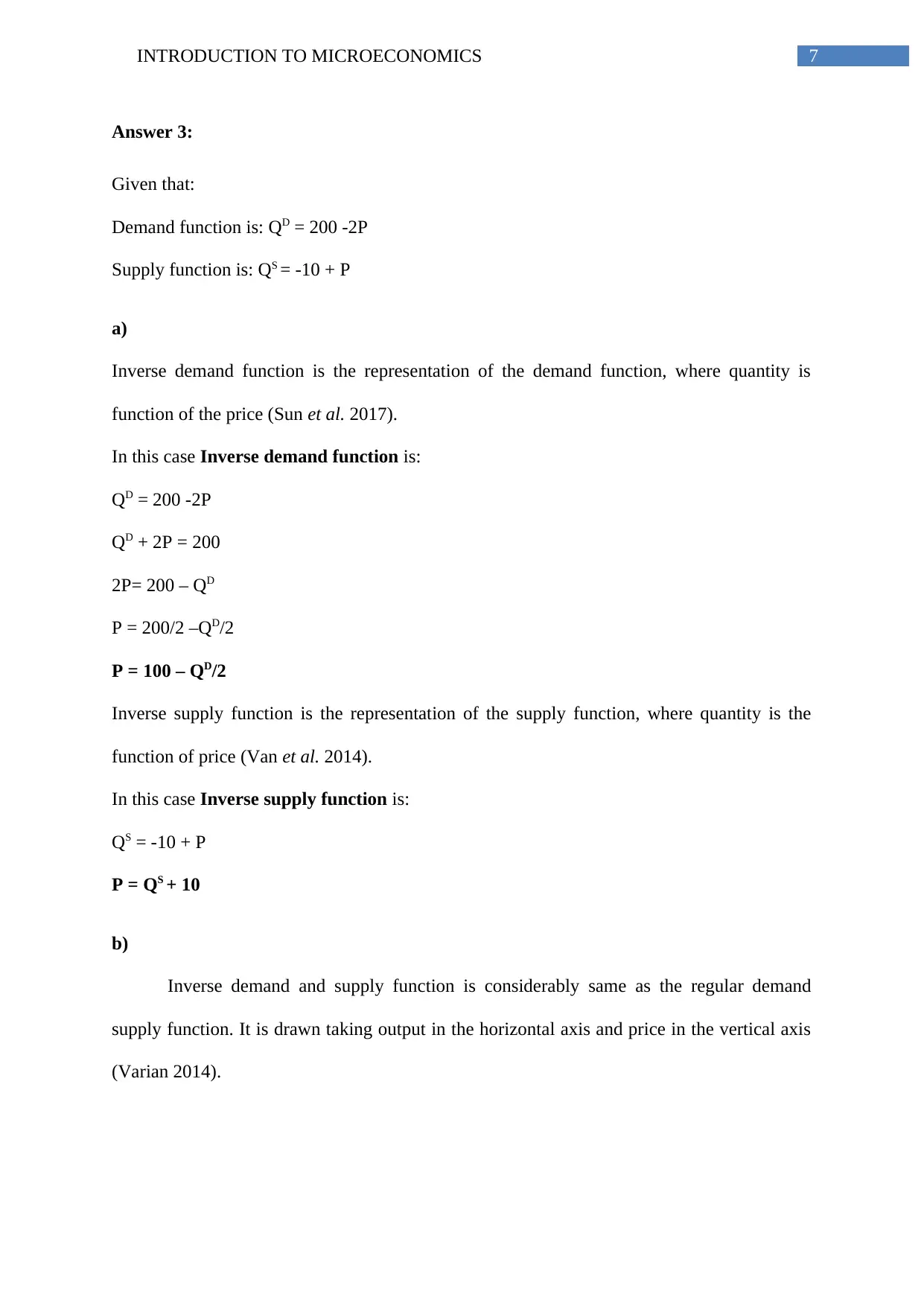

b)

Inverse demand and supply function is considerably same as the regular demand

supply function. It is drawn taking output in the horizontal axis and price in the vertical axis

(Varian 2014).

Answer 3:

Given that:

Demand function is: QD = 200 -2P

Supply function is: QS = -10 + P

a)

Inverse demand function is the representation of the demand function, where quantity is

function of the price (Sun et al. 2017).

In this case Inverse demand function is:

QD = 200 -2P

QD + 2P = 200

2P= 200 – QD

P = 200/2 –QD/2

P = 100 – QD/2

Inverse supply function is the representation of the supply function, where quantity is the

function of price (Van et al. 2014).

In this case Inverse supply function is:

QS = -10 + P

P = QS + 10

b)

Inverse demand and supply function is considerably same as the regular demand

supply function. It is drawn taking output in the horizontal axis and price in the vertical axis

(Varian 2014).

8INTRODUCTION TO MICROECONOMICS

60

70

Inverse Supply Curve

Inverse Demand Curve

Output

Price

Consumer Surplus

Producer Surplus

100

10

Figure 4: Inverse supply and demand curves

Source: (Created by Author)

Figure 4, depicts the inverse demand and supply function. Demand function is

negatively sloped and the inverse supply function is positively sloped.

c)

Calculation of equilibrium quantity, price can be done considering that, the market is

in equilibrium.

Therefore, QD = QS

200-2P = -10 + P [Putting the given equations of supply and demand]

2P+P= 200+10

3P=210

P=210/3

P=70

Therefore, the equilibrium price of orange is 70 for each unit.

60

70

Inverse Supply Curve

Inverse Demand Curve

Output

Price

Consumer Surplus

Producer Surplus

100

10

Figure 4: Inverse supply and demand curves

Source: (Created by Author)

Figure 4, depicts the inverse demand and supply function. Demand function is

negatively sloped and the inverse supply function is positively sloped.

c)

Calculation of equilibrium quantity, price can be done considering that, the market is

in equilibrium.

Therefore, QD = QS

200-2P = -10 + P [Putting the given equations of supply and demand]

2P+P= 200+10

3P=210

P=210/3

P=70

Therefore, the equilibrium price of orange is 70 for each unit.

9INTRODUCTION TO MICROECONOMICS

Now to trace the equilibrium quantity of orange, we have to put the equilibrium price in

demand equation.

QD = 200 -2P

QD= 200-2*70

QD= 200-140

QD= 60

Therefore, the equilibrium quantity of orange is 60 units.

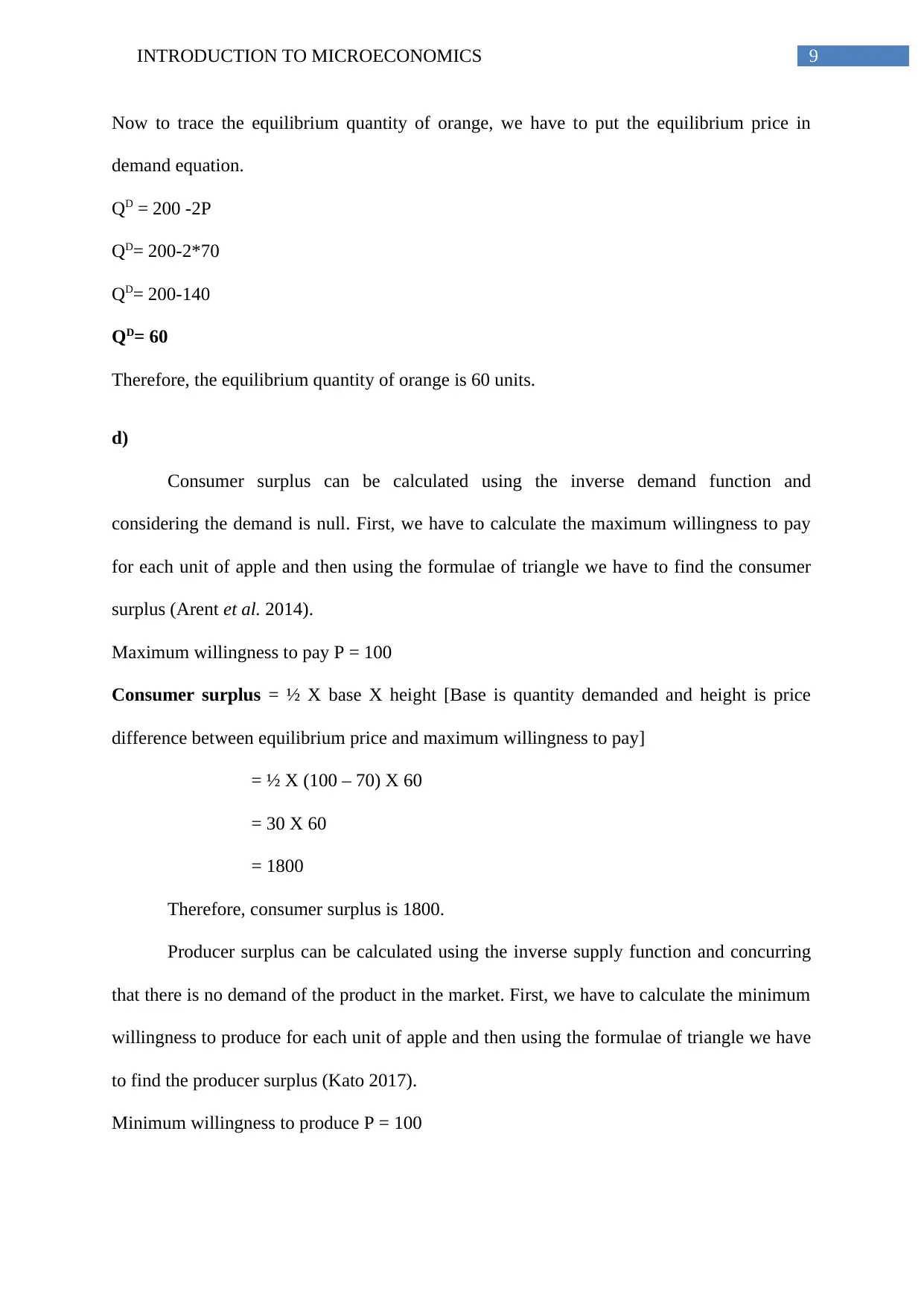

d)

Consumer surplus can be calculated using the inverse demand function and

considering the demand is null. First, we have to calculate the maximum willingness to pay

for each unit of apple and then using the formulae of triangle we have to find the consumer

surplus (Arent et al. 2014).

Maximum willingness to pay P = 100

Consumer surplus = ½ X base X height [Base is quantity demanded and height is price

difference between equilibrium price and maximum willingness to pay]

= ½ X (100 – 70) X 60

= 30 X 60

= 1800

Therefore, consumer surplus is 1800.

Producer surplus can be calculated using the inverse supply function and concurring

that there is no demand of the product in the market. First, we have to calculate the minimum

willingness to produce for each unit of apple and then using the formulae of triangle we have

to find the producer surplus (Kato 2017).

Minimum willingness to produce P = 100

Now to trace the equilibrium quantity of orange, we have to put the equilibrium price in

demand equation.

QD = 200 -2P

QD= 200-2*70

QD= 200-140

QD= 60

Therefore, the equilibrium quantity of orange is 60 units.

d)

Consumer surplus can be calculated using the inverse demand function and

considering the demand is null. First, we have to calculate the maximum willingness to pay

for each unit of apple and then using the formulae of triangle we have to find the consumer

surplus (Arent et al. 2014).

Maximum willingness to pay P = 100

Consumer surplus = ½ X base X height [Base is quantity demanded and height is price

difference between equilibrium price and maximum willingness to pay]

= ½ X (100 – 70) X 60

= 30 X 60

= 1800

Therefore, consumer surplus is 1800.

Producer surplus can be calculated using the inverse supply function and concurring

that there is no demand of the product in the market. First, we have to calculate the minimum

willingness to produce for each unit of apple and then using the formulae of triangle we have

to find the producer surplus (Kato 2017).

Minimum willingness to produce P = 100

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10INTRODUCTION TO MICROECONOMICS

Producer surplus = ½ X base X height [Base is quantity demanded and height is price

difference between equilibrium price and maximum willingness to pay]

= ½ X (70-10) X60

= 60 X 60

= 3600

Therefore, producer surplus is 3600.

Producer surplus = ½ X base X height [Base is quantity demanded and height is price

difference between equilibrium price and maximum willingness to pay]

= ½ X (70-10) X60

= 60 X 60

= 3600

Therefore, producer surplus is 3600.

11INTRODUCTION TO MICROECONOMICS

Price

O Output

Demand curve

Supply curve

Supply + Tax

Q1 Q0

P1

P0

Answer 4:

a)

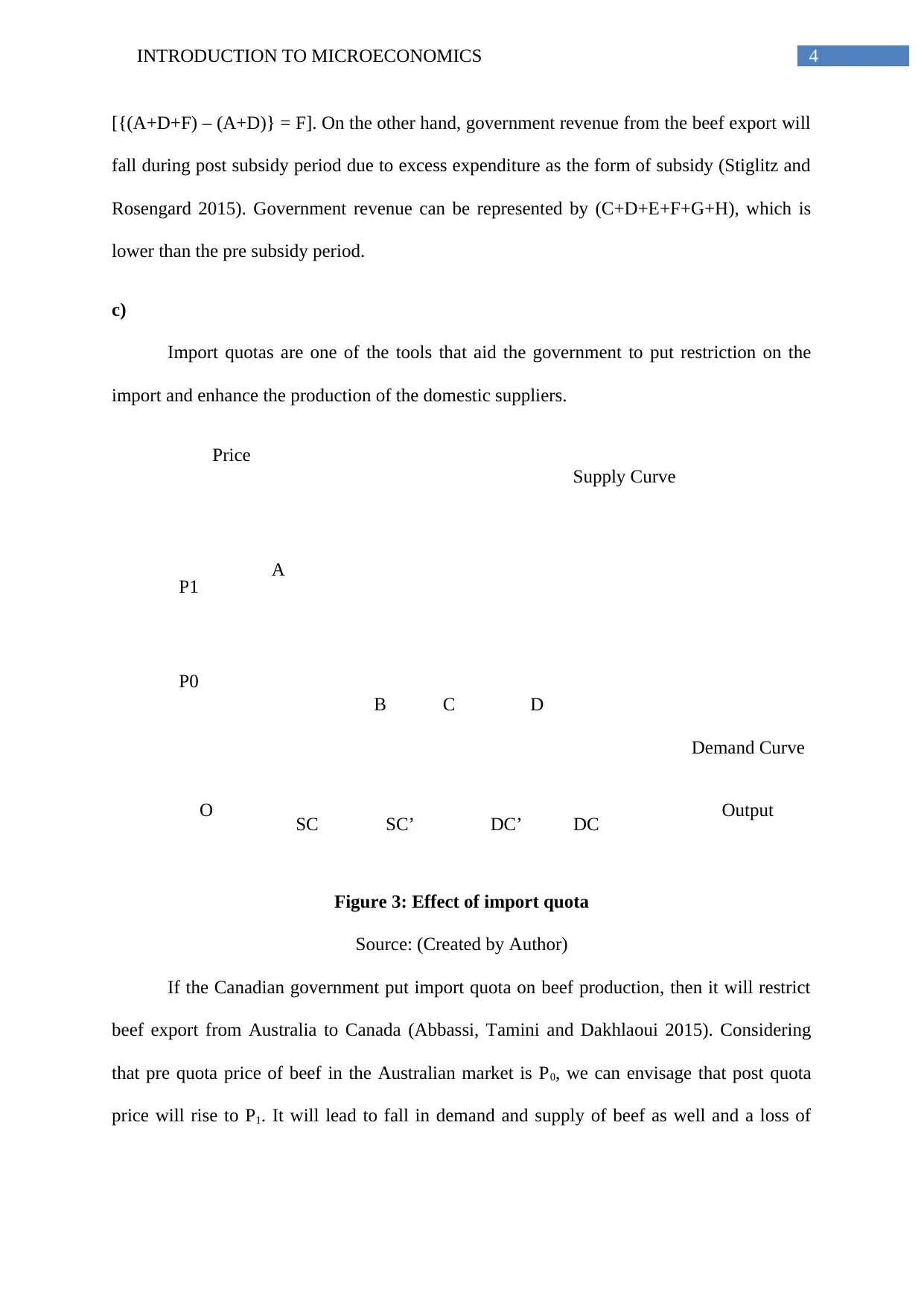

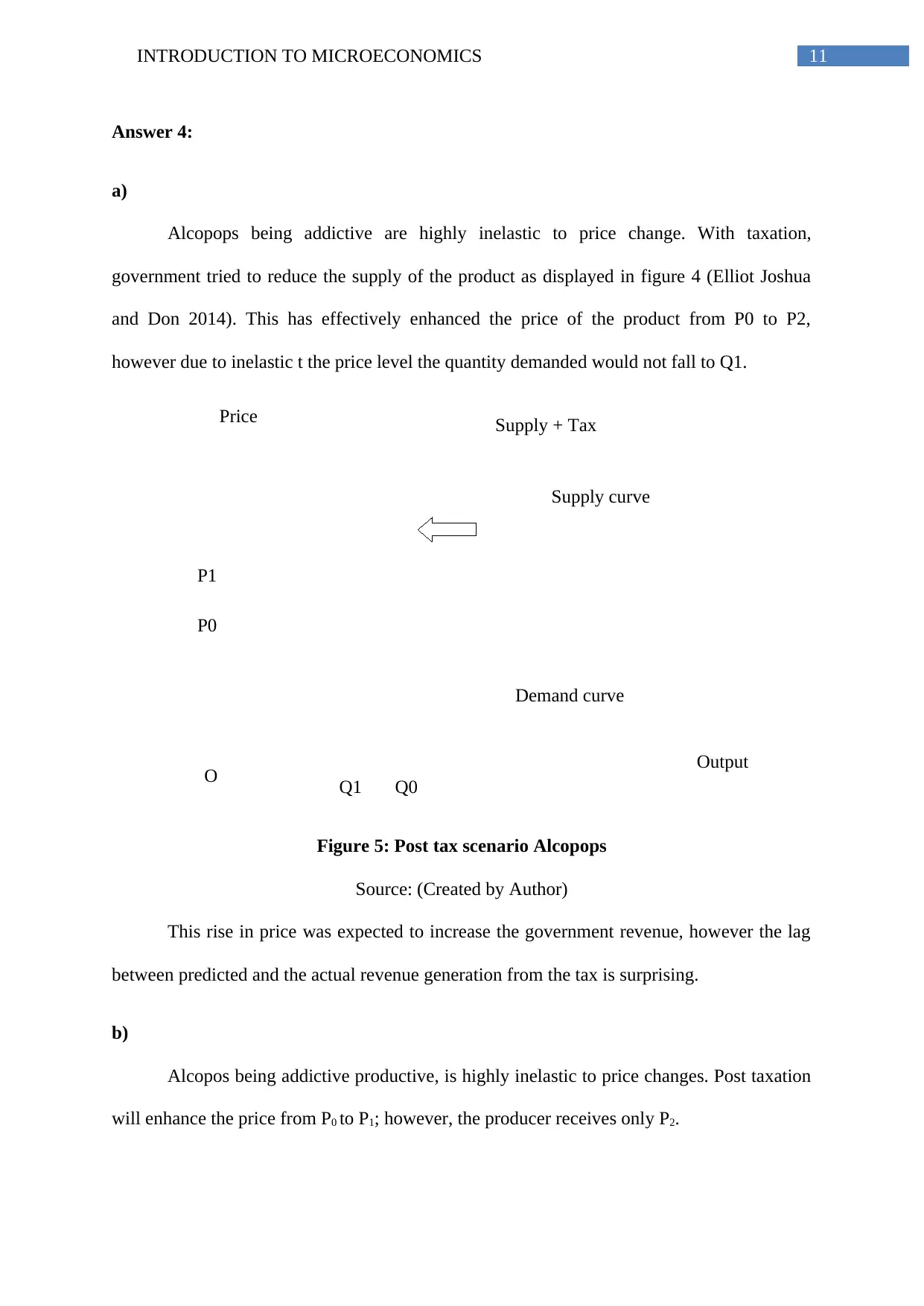

Alcopops being addictive are highly inelastic to price change. With taxation,

government tried to reduce the supply of the product as displayed in figure 4 (Elliot Joshua

and Don 2014). This has effectively enhanced the price of the product from P0 to P2,

however due to inelastic t the price level the quantity demanded would not fall to Q1.

Figure 5: Post tax scenario Alcopops

Source: (Created by Author)

This rise in price was expected to increase the government revenue, however the lag

between predicted and the actual revenue generation from the tax is surprising.

b)

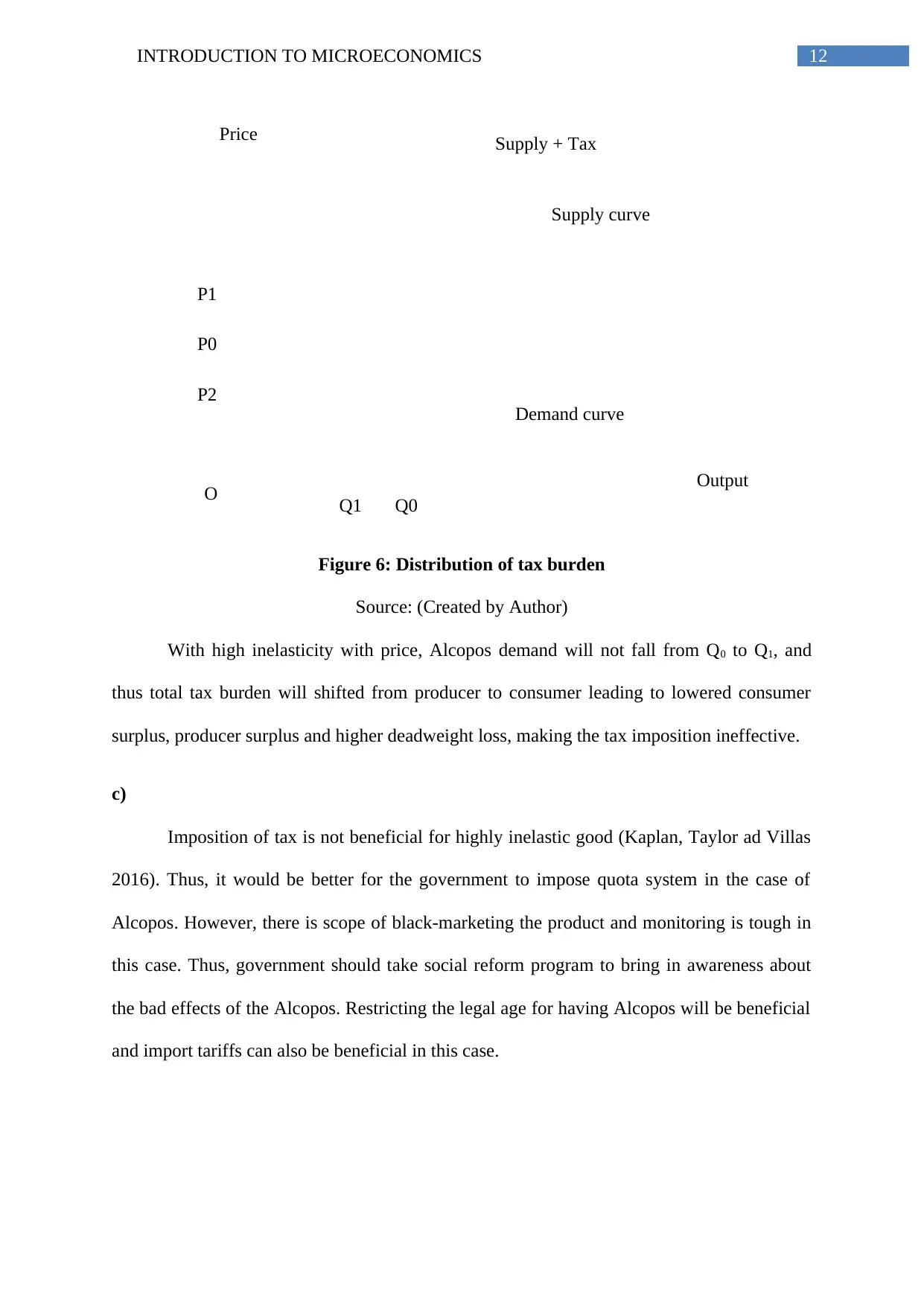

Alcopos being addictive productive, is highly inelastic to price changes. Post taxation

will enhance the price from P0 to P1; however, the producer receives only P2.

Price

O Output

Demand curve

Supply curve

Supply + Tax

Q1 Q0

P1

P0

Answer 4:

a)

Alcopops being addictive are highly inelastic to price change. With taxation,

government tried to reduce the supply of the product as displayed in figure 4 (Elliot Joshua

and Don 2014). This has effectively enhanced the price of the product from P0 to P2,

however due to inelastic t the price level the quantity demanded would not fall to Q1.

Figure 5: Post tax scenario Alcopops

Source: (Created by Author)

This rise in price was expected to increase the government revenue, however the lag

between predicted and the actual revenue generation from the tax is surprising.

b)

Alcopos being addictive productive, is highly inelastic to price changes. Post taxation

will enhance the price from P0 to P1; however, the producer receives only P2.

12INTRODUCTION TO MICROECONOMICS

Price

O Output

Demand curve

Supply curve

Supply + Tax

Q1 Q0

P1

P0

P2

Figure 6: Distribution of tax burden

Source: (Created by Author)

With high inelasticity with price, Alcopos demand will not fall from Q0 to Q1, and

thus total tax burden will shifted from producer to consumer leading to lowered consumer

surplus, producer surplus and higher deadweight loss, making the tax imposition ineffective.

c)

Imposition of tax is not beneficial for highly inelastic good (Kaplan, Taylor ad Villas

2016). Thus, it would be better for the government to impose quota system in the case of

Alcopos. However, there is scope of black-marketing the product and monitoring is tough in

this case. Thus, government should take social reform program to bring in awareness about

the bad effects of the Alcopos. Restricting the legal age for having Alcopos will be beneficial

and import tariffs can also be beneficial in this case.

Price

O Output

Demand curve

Supply curve

Supply + Tax

Q1 Q0

P1

P0

P2

Figure 6: Distribution of tax burden

Source: (Created by Author)

With high inelasticity with price, Alcopos demand will not fall from Q0 to Q1, and

thus total tax burden will shifted from producer to consumer leading to lowered consumer

surplus, producer surplus and higher deadweight loss, making the tax imposition ineffective.

c)

Imposition of tax is not beneficial for highly inelastic good (Kaplan, Taylor ad Villas

2016). Thus, it would be better for the government to impose quota system in the case of

Alcopos. However, there is scope of black-marketing the product and monitoring is tough in

this case. Thus, government should take social reform program to bring in awareness about

the bad effects of the Alcopos. Restricting the legal age for having Alcopos will be beneficial

and import tariffs can also be beneficial in this case.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13INTRODUCTION TO MICROECONOMICS

Reference:

Abbassi, A., Tamini, L.D. and Dakhlaoui, A., 2015. Import quota allocation between regions

under Cournot competition. Economic Modelling, 51, pp.484-490.

Arent, D.J., Tol, R.S., Faust, E., Hella, J.P., Kumar, S., Strzepek, K.M., Tóth, F.L., Yan, D.,

Abdulla, A., Kheshgi, H. and Xu, H., 2015. Key economic sectors and services. Climate

Change 2014 Impacts, Adaptation and Vulnerability: Part A: Global and Sectoral Aspects,

pp.659-708.

Charles, L., 2017. A new empirical test of the infant-industry argument: the case of

Switzerland protectionism during the 19th century (No. 2017-11). Groupe de Recherche en

Economie Théorique et Appliquée.

Ding, Z., Sarikprueck, P., Lee, L., Lee, W.J., Shi, J. and Lu, H., 2014, September. Financial

opportunities for LSE under scarcity price environment. In North American Power

Symposium (NAPS), 2014 (pp. 1-6). IEEE.

Elliott, J. and Fullerton, D., 2014. Can a unilateral carbon tax reduce emissions

elsewhere?. Resource and Energy Economics, 36(1), pp.6-21.

Hill, C.W., Jones, G.R. and Schilling, M.A., 2014. Strategic management: theory: an

integrated approach. Cengage Learning.

Kaplan, S., Taylor, R. and Villas-Boas, S.B., 2016. Soda Wars: Effect of a Soda Tax Election

on Soda Purchases.

Kato, H., 2017. Government Preference and Merger. In The Theory of Mixed Oligopoly (pp.

135-145). Springer Japan.

McGovern, E., 2017. International trade regulation (Vol. 2). Globefield Press

Schuknecht, L., 2017. Trade protection in the European Community (Vol. 29). Routledge.

Shatz, H.J. and Tarr, D.G., 2017. Exchange rate overvaluation and trade protection: lessons

from experience. In Trade Policies for Development and Transition (pp. 115-127).

Reference:

Abbassi, A., Tamini, L.D. and Dakhlaoui, A., 2015. Import quota allocation between regions

under Cournot competition. Economic Modelling, 51, pp.484-490.

Arent, D.J., Tol, R.S., Faust, E., Hella, J.P., Kumar, S., Strzepek, K.M., Tóth, F.L., Yan, D.,

Abdulla, A., Kheshgi, H. and Xu, H., 2015. Key economic sectors and services. Climate

Change 2014 Impacts, Adaptation and Vulnerability: Part A: Global and Sectoral Aspects,

pp.659-708.

Charles, L., 2017. A new empirical test of the infant-industry argument: the case of

Switzerland protectionism during the 19th century (No. 2017-11). Groupe de Recherche en

Economie Théorique et Appliquée.

Ding, Z., Sarikprueck, P., Lee, L., Lee, W.J., Shi, J. and Lu, H., 2014, September. Financial

opportunities for LSE under scarcity price environment. In North American Power

Symposium (NAPS), 2014 (pp. 1-6). IEEE.

Elliott, J. and Fullerton, D., 2014. Can a unilateral carbon tax reduce emissions

elsewhere?. Resource and Energy Economics, 36(1), pp.6-21.

Hill, C.W., Jones, G.R. and Schilling, M.A., 2014. Strategic management: theory: an

integrated approach. Cengage Learning.

Kaplan, S., Taylor, R. and Villas-Boas, S.B., 2016. Soda Wars: Effect of a Soda Tax Election

on Soda Purchases.

Kato, H., 2017. Government Preference and Merger. In The Theory of Mixed Oligopoly (pp.

135-145). Springer Japan.

McGovern, E., 2017. International trade regulation (Vol. 2). Globefield Press

Schuknecht, L., 2017. Trade protection in the European Community (Vol. 29). Routledge.

Shatz, H.J. and Tarr, D.G., 2017. Exchange rate overvaluation and trade protection: lessons

from experience. In Trade Policies for Development and Transition (pp. 115-127).

14INTRODUCTION TO MICROECONOMICS

Stiglitz, J.E. and Rosengard, J.K., 2015. Economics of the Public Sector: Fourth

International Student Edition. WW Norton & Company.

Sun, C.H.J., Chiang, F.S. and Squires, D., 2017. More Landings for Higher Profit? Inverse

Demand Analysis of the Bluefin Tuna Auction Price in Japan and Economic Incentives in

Global Bluefin Tuna Fisheries Management (No. 1701).

Sun, K., 2015. China-Australia Free Trade Agreement: Implications for Canada.

Tebaldi, P., 2017. Estimating equilibrium in health insurance exchanges: Price competition

and subsidy design under the aca.

Van Ommeren, J., de Groote, J. and Mingardo, G., 2014. Residential parking permits and

parking supply. Regional Science and Urban Economics, 45, pp.33-44.

Varian, H.R., 2014. Intermediate Microeconomics: A Modern Approach: Ninth International

Student Edition. WW Norton & Company.

Stiglitz, J.E. and Rosengard, J.K., 2015. Economics of the Public Sector: Fourth

International Student Edition. WW Norton & Company.

Sun, C.H.J., Chiang, F.S. and Squires, D., 2017. More Landings for Higher Profit? Inverse

Demand Analysis of the Bluefin Tuna Auction Price in Japan and Economic Incentives in

Global Bluefin Tuna Fisheries Management (No. 1701).

Sun, K., 2015. China-Australia Free Trade Agreement: Implications for Canada.

Tebaldi, P., 2017. Estimating equilibrium in health insurance exchanges: Price competition

and subsidy design under the aca.

Van Ommeren, J., de Groote, J. and Mingardo, G., 2014. Residential parking permits and

parking supply. Regional Science and Urban Economics, 45, pp.33-44.

Varian, H.R., 2014. Intermediate Microeconomics: A Modern Approach: Ninth International

Student Edition. WW Norton & Company.

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.