Introduction to Multinational Finance: USD/CHF Exchange Rate Analysis

VerifiedAdded on 2022/08/14

|11

|3093

|223

Report

AI Summary

This report provides an in-depth analysis of the USD/CHF exchange rate, focusing on its movement from January 1, 2019, to December 31, 2019. The analysis centers on the application of Purchasing Power Parity (PPP) to understand and predict currency fluctuations. The report begins with an introduction to bilateral exchange rates and then delves into the movement of the USD/CHF exchange rate during the specified period, highlighting the appreciation of the CHF and the depreciation of the USD. The core of the analysis involves the application of PPP, using inflation data from both the US and Switzerland to explain currency movements. The report also discusses the prediction of currency exchange rates based on inflation differentials and provides a detailed examination of how PPP can be applied to forecast changes in the USD/CHF exchange rate. The report concludes with a forecast of future currency movements based on the analysis and provides recommendations for further study.

Running head: INTRODUCTION TO MULTINATIONAL FINANCE

Finance

Name of the Student:

Name of the University:

Author’s Note:

(USD/CHF Currency Pair Analysis).

Finance

Name of the Student:

Name of the University:

Author’s Note:

(USD/CHF Currency Pair Analysis).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCE

Table of Contents

Introduction......................................................................................................................................2

Discussion and Analysis..................................................................................................................2

Movement in USD/CHF Exchange Rate.....................................................................................2

Purchasing Power Parity..............................................................................................................2

Prediction of Changes in Currency Exchange Rates...................................................................3

Application of Purchasing Power Parity......................................................................................4

USD/CHF Movement..................................................................................................................4

Forecasting of USD/CHF............................................................................................................7

Conclusion and Recommendations..................................................................................................7

References........................................................................................................................................9

Table of Contents

Introduction......................................................................................................................................2

Discussion and Analysis..................................................................................................................2

Movement in USD/CHF Exchange Rate.....................................................................................2

Purchasing Power Parity..............................................................................................................2

Prediction of Changes in Currency Exchange Rates...................................................................3

Application of Purchasing Power Parity......................................................................................4

USD/CHF Movement..................................................................................................................4

Forecasting of USD/CHF............................................................................................................7

Conclusion and Recommendations..................................................................................................7

References........................................................................................................................................9

2FINANCE

Introduction

A Bilateral Exchange Rate is a common way for quoting a currency which well involves

two common pair of currencies. The Bilateral Exchange Rates are typically quoted in response to

the US Dollar that is USD $ as the currency is the most traded currency on a global scale. In

majority of the time period the central bank or the federal bank would be in one side of the

relationship and they would be usually displaying numbers using the three letter symbols. The

currency base which has been for example we have well considered the changes in the

USD/CHF for a trend period of one year and relevant changes from 1st January 2019 to 31st

December 2019 would be considered for analysis purpose (Yahoo Finance 2020).

Discussion and Analysis

Movement in USD/CHF Exchange Rate

The USD/CHF Exchange rate in the trend period from 1st January 2019 to 31st December

2019 had shown a fall in the value of USD Currency and in turn rise in the value of the CHF

Currency. This get to clearly show that the CHF Currency in turn has appreciated and in relative

terms the USD Currency has degraded (Theories of Exchange Rate Determination |

International Economics 2018). The currency exchange rate for the USD/CHF Currency was

around 0.99 on 1st January 2019 which ended up to around 0.97 on 31st December 2019. The

change in the currency will be well highlighted with the help of the Purchasing Power Parity

whereby changes in the inflation rate has been well considered for analyzing the movement in

the USD/CHF Currency Exchange Rate (USD to CHF Forecast: up to 0.966! Dollar to Franc

Analysis, Converter, Live Exchange Rates and Prediction, Long-Term & Short-Term Forex (FX)

Prognosis 2020).

Purchasing Power Parity

The purchasing power parity is the most common and popular technique that is widely

used for the purpose of valuation of exchange rate in terms of changing price that has been well

referred with the help of inflation data point for both the economies. The PPP is a key

macroeconomic term which is well used as a metric for comparing the economic productivity

Introduction

A Bilateral Exchange Rate is a common way for quoting a currency which well involves

two common pair of currencies. The Bilateral Exchange Rates are typically quoted in response to

the US Dollar that is USD $ as the currency is the most traded currency on a global scale. In

majority of the time period the central bank or the federal bank would be in one side of the

relationship and they would be usually displaying numbers using the three letter symbols. The

currency base which has been for example we have well considered the changes in the

USD/CHF for a trend period of one year and relevant changes from 1st January 2019 to 31st

December 2019 would be considered for analysis purpose (Yahoo Finance 2020).

Discussion and Analysis

Movement in USD/CHF Exchange Rate

The USD/CHF Exchange rate in the trend period from 1st January 2019 to 31st December

2019 had shown a fall in the value of USD Currency and in turn rise in the value of the CHF

Currency. This get to clearly show that the CHF Currency in turn has appreciated and in relative

terms the USD Currency has degraded (Theories of Exchange Rate Determination |

International Economics 2018). The currency exchange rate for the USD/CHF Currency was

around 0.99 on 1st January 2019 which ended up to around 0.97 on 31st December 2019. The

change in the currency will be well highlighted with the help of the Purchasing Power Parity

whereby changes in the inflation rate has been well considered for analyzing the movement in

the USD/CHF Currency Exchange Rate (USD to CHF Forecast: up to 0.966! Dollar to Franc

Analysis, Converter, Live Exchange Rates and Prediction, Long-Term & Short-Term Forex (FX)

Prognosis 2020).

Purchasing Power Parity

The purchasing power parity is the most common and popular technique that is widely

used for the purpose of valuation of exchange rate in terms of changing price that has been well

referred with the help of inflation data point for both the economies. The PPP is a key

macroeconomic term which is well used as a metric for comparing the economic productivity

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCE

and the standards of living between countries (Gilboa and Mitchell 2020). The PPP as a key

economic theory well compares different set of currencies with the help of common basket value

in both the economy. When considered through this concept both the currency are or should be

in an state of equilibrium that is well known as currency value at par, when the given set of

basket of goods is well priced at the same value in both the country, when considered into their

exchange rates. The PPP is a key popular metric that is well used by macro-economic analysts

for the purpose of well comparing the various currencies with the help of a basket of goods

approach (McKinnon and Ohno 2016). The concept of PPP well allows the economist for

comparing the productivity levels and standard of living between the two set of countries that are

considered (Arize 2020).

In order to well calculate the relative version of the PPP we can still do the same with the help of

the following formula:

S: P1/P2

Whereby;

S: The exchange rate of currency 1 with respect to currency 2

P1: Cost of Good of X in Price Currency 1

P2: Cost of Good of X in Price Currency 2

It is important to note that in every three years of time period the world releases a set of report

that well compares the productivity and growth of the various countries in relation to PPP and

US Dollar. In relation both the International Monetary Fund (IMF) and the Organizations for

Economic Cooperation and Development uses the weights based on the metric of PPP for well

making various predictions and recommendations to the economic policies. Now these

recommended economic policies can have an immediate or short term impact on the financial

markets. Forex traders in general uses the PPP for well identifying currencies which are

potentially undervalued or overvalued in terms of currency.

Prediction of Changes in Currency Exchange Rates

The currency exchange rate forecasted for the exchange pair can be well linked with a set

of theories whereby we can well relate the movement of the currency with the movement or

changes that have been observed in the inflation data for the US Economy and Switzerland

Economy (Chinn 2019). The historical changes in the exchange rate would be well observed and

and the standards of living between countries (Gilboa and Mitchell 2020). The PPP as a key

economic theory well compares different set of currencies with the help of common basket value

in both the economy. When considered through this concept both the currency are or should be

in an state of equilibrium that is well known as currency value at par, when the given set of

basket of goods is well priced at the same value in both the country, when considered into their

exchange rates. The PPP is a key popular metric that is well used by macro-economic analysts

for the purpose of well comparing the various currencies with the help of a basket of goods

approach (McKinnon and Ohno 2016). The concept of PPP well allows the economist for

comparing the productivity levels and standard of living between the two set of countries that are

considered (Arize 2020).

In order to well calculate the relative version of the PPP we can still do the same with the help of

the following formula:

S: P1/P2

Whereby;

S: The exchange rate of currency 1 with respect to currency 2

P1: Cost of Good of X in Price Currency 1

P2: Cost of Good of X in Price Currency 2

It is important to note that in every three years of time period the world releases a set of report

that well compares the productivity and growth of the various countries in relation to PPP and

US Dollar. In relation both the International Monetary Fund (IMF) and the Organizations for

Economic Cooperation and Development uses the weights based on the metric of PPP for well

making various predictions and recommendations to the economic policies. Now these

recommended economic policies can have an immediate or short term impact on the financial

markets. Forex traders in general uses the PPP for well identifying currencies which are

potentially undervalued or overvalued in terms of currency.

Prediction of Changes in Currency Exchange Rates

The currency exchange rate forecasted for the exchange pair can be well linked with a set

of theories whereby we can well relate the movement of the currency with the movement or

changes that have been observed in the inflation data for the US Economy and Switzerland

Economy (Chinn 2019). The historical changes in the exchange rate would be well observed and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCE

changes in the currency for the trend period would be well related with the Internal Parity

Condition that is Purchase Power Parity. Now as evaluated in the historical set of data that has

been collected for the currency pair of USD/CHF that the USD has depreciated and CHF has

appreciated in value terms. The same would be well linked with the changes that has been

observed in the inflation data points in this periods.

Application of Purchasing Power Parity

The Purchasing Power Parity would be well looking at prices of the goods in various

different countries and is regarded as one of the widely techniques for forecasting the exchange

rates. In accordance with the underlying principles of the PPP it is clearly stated that a pencil in

Switzerland, should be well equal to the same price in the United States of America after well

accounting various factors like the current exchange rate and excluding external costs like

transactions and shipping costs that would be influencing the cost (Bahmani-Oskooee et al.,

2017). In other words or simple terms the principle well states that there should be no arbitrage

opportunity for someone who is well willing to buy inexpensive set of pencils in one set of

country and then sell the some in another country in order to book profits. The approach of PPP

well forecast that the exchange rate would be well changing to offset the changes in the price

level that is well caused due to inflation in accordance with the underlying theory explained. In

order to well materialize the above contents and theory we can well refer to the data point

collected, where we have well make the key set of assumptions as follows:

The changes in the currency value or the currency pair analysed that is USD/CHF is

affected primarily due to a number or a range of multifactorial factors which includes

changes in interest rate, inflation rate and other business and economy conditions. Out of

which we have well considered that inflation data plays a key role in well explaining the

changes observed in currency pairs (Iyke and Odhiambo 2017).

There are other factors which one can well explain the changes in the exchange rate but

considering a single theory that is Purchase Power Parity has been well considered for

analysis purpose.

USD/CHF Movement

The underlying principle and approach for the PPP well forecast that the analysed pair of

exchange rate is expected to well change for offsetting the price level change that would be due

changes in the currency for the trend period would be well related with the Internal Parity

Condition that is Purchase Power Parity. Now as evaluated in the historical set of data that has

been collected for the currency pair of USD/CHF that the USD has depreciated and CHF has

appreciated in value terms. The same would be well linked with the changes that has been

observed in the inflation data points in this periods.

Application of Purchasing Power Parity

The Purchasing Power Parity would be well looking at prices of the goods in various

different countries and is regarded as one of the widely techniques for forecasting the exchange

rates. In accordance with the underlying principles of the PPP it is clearly stated that a pencil in

Switzerland, should be well equal to the same price in the United States of America after well

accounting various factors like the current exchange rate and excluding external costs like

transactions and shipping costs that would be influencing the cost (Bahmani-Oskooee et al.,

2017). In other words or simple terms the principle well states that there should be no arbitrage

opportunity for someone who is well willing to buy inexpensive set of pencils in one set of

country and then sell the some in another country in order to book profits. The approach of PPP

well forecast that the exchange rate would be well changing to offset the changes in the price

level that is well caused due to inflation in accordance with the underlying theory explained. In

order to well materialize the above contents and theory we can well refer to the data point

collected, where we have well make the key set of assumptions as follows:

The changes in the currency value or the currency pair analysed that is USD/CHF is

affected primarily due to a number or a range of multifactorial factors which includes

changes in interest rate, inflation rate and other business and economy conditions. Out of

which we have well considered that inflation data plays a key role in well explaining the

changes observed in currency pairs (Iyke and Odhiambo 2017).

There are other factors which one can well explain the changes in the exchange rate but

considering a single theory that is Purchase Power Parity has been well considered for

analysis purpose.

USD/CHF Movement

The underlying principle and approach for the PPP well forecast that the analysed pair of

exchange rate is expected to well change for offsetting the price level change that would be due

5FINANCE

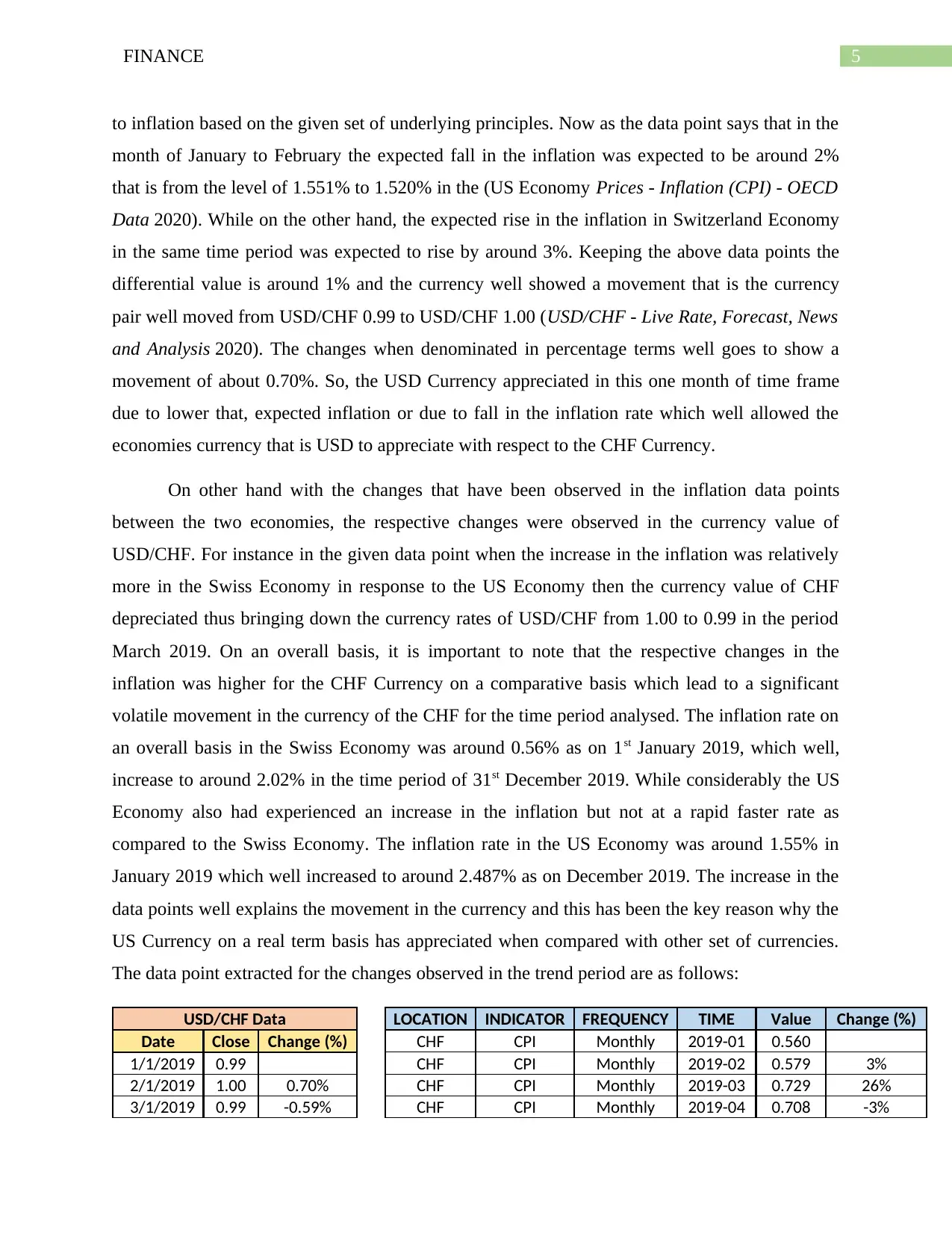

to inflation based on the given set of underlying principles. Now as the data point says that in the

month of January to February the expected fall in the inflation was expected to be around 2%

that is from the level of 1.551% to 1.520% in the (US Economy Prices - Inflation (CPI) - OECD

Data 2020). While on the other hand, the expected rise in the inflation in Switzerland Economy

in the same time period was expected to rise by around 3%. Keeping the above data points the

differential value is around 1% and the currency well showed a movement that is the currency

pair well moved from USD/CHF 0.99 to USD/CHF 1.00 (USD/CHF - Live Rate, Forecast, News

and Analysis 2020). The changes when denominated in percentage terms well goes to show a

movement of about 0.70%. So, the USD Currency appreciated in this one month of time frame

due to lower that, expected inflation or due to fall in the inflation rate which well allowed the

economies currency that is USD to appreciate with respect to the CHF Currency.

On other hand with the changes that have been observed in the inflation data points

between the two economies, the respective changes were observed in the currency value of

USD/CHF. For instance in the given data point when the increase in the inflation was relatively

more in the Swiss Economy in response to the US Economy then the currency value of CHF

depreciated thus bringing down the currency rates of USD/CHF from 1.00 to 0.99 in the period

March 2019. On an overall basis, it is important to note that the respective changes in the

inflation was higher for the CHF Currency on a comparative basis which lead to a significant

volatile movement in the currency of the CHF for the time period analysed. The inflation rate on

an overall basis in the Swiss Economy was around 0.56% as on 1st January 2019, which well,

increase to around 2.02% in the time period of 31st December 2019. While considerably the US

Economy also had experienced an increase in the inflation but not at a rapid faster rate as

compared to the Swiss Economy. The inflation rate in the US Economy was around 1.55% in

January 2019 which well increased to around 2.487% as on December 2019. The increase in the

data points well explains the movement in the currency and this has been the key reason why the

US Currency on a real term basis has appreciated when compared with other set of currencies.

The data point extracted for the changes observed in the trend period are as follows:

USD/CHF Data LOCATION INDICATOR FREQUENCY TIME Value Change (%)

Date Close Change (%) CHF CPI Monthly 2019-01 0.560

1/1/2019 0.99 CHF CPI Monthly 2019-02 0.579 3%

2/1/2019 1.00 0.70% CHF CPI Monthly 2019-03 0.729 26%

3/1/2019 0.99 -0.59% CHF CPI Monthly 2019-04 0.708 -3%

to inflation based on the given set of underlying principles. Now as the data point says that in the

month of January to February the expected fall in the inflation was expected to be around 2%

that is from the level of 1.551% to 1.520% in the (US Economy Prices - Inflation (CPI) - OECD

Data 2020). While on the other hand, the expected rise in the inflation in Switzerland Economy

in the same time period was expected to rise by around 3%. Keeping the above data points the

differential value is around 1% and the currency well showed a movement that is the currency

pair well moved from USD/CHF 0.99 to USD/CHF 1.00 (USD/CHF - Live Rate, Forecast, News

and Analysis 2020). The changes when denominated in percentage terms well goes to show a

movement of about 0.70%. So, the USD Currency appreciated in this one month of time frame

due to lower that, expected inflation or due to fall in the inflation rate which well allowed the

economies currency that is USD to appreciate with respect to the CHF Currency.

On other hand with the changes that have been observed in the inflation data points

between the two economies, the respective changes were observed in the currency value of

USD/CHF. For instance in the given data point when the increase in the inflation was relatively

more in the Swiss Economy in response to the US Economy then the currency value of CHF

depreciated thus bringing down the currency rates of USD/CHF from 1.00 to 0.99 in the period

March 2019. On an overall basis, it is important to note that the respective changes in the

inflation was higher for the CHF Currency on a comparative basis which lead to a significant

volatile movement in the currency of the CHF for the time period analysed. The inflation rate on

an overall basis in the Swiss Economy was around 0.56% as on 1st January 2019, which well,

increase to around 2.02% in the time period of 31st December 2019. While considerably the US

Economy also had experienced an increase in the inflation but not at a rapid faster rate as

compared to the Swiss Economy. The inflation rate in the US Economy was around 1.55% in

January 2019 which well increased to around 2.487% as on December 2019. The increase in the

data points well explains the movement in the currency and this has been the key reason why the

US Currency on a real term basis has appreciated when compared with other set of currencies.

The data point extracted for the changes observed in the trend period are as follows:

USD/CHF Data LOCATION INDICATOR FREQUENCY TIME Value Change (%)

Date Close Change (%) CHF CPI Monthly 2019-01 0.560

1/1/2019 0.99 CHF CPI Monthly 2019-02 0.579 3%

2/1/2019 1.00 0.70% CHF CPI Monthly 2019-03 0.729 26%

3/1/2019 0.99 -0.59% CHF CPI Monthly 2019-04 0.708 -3%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCE

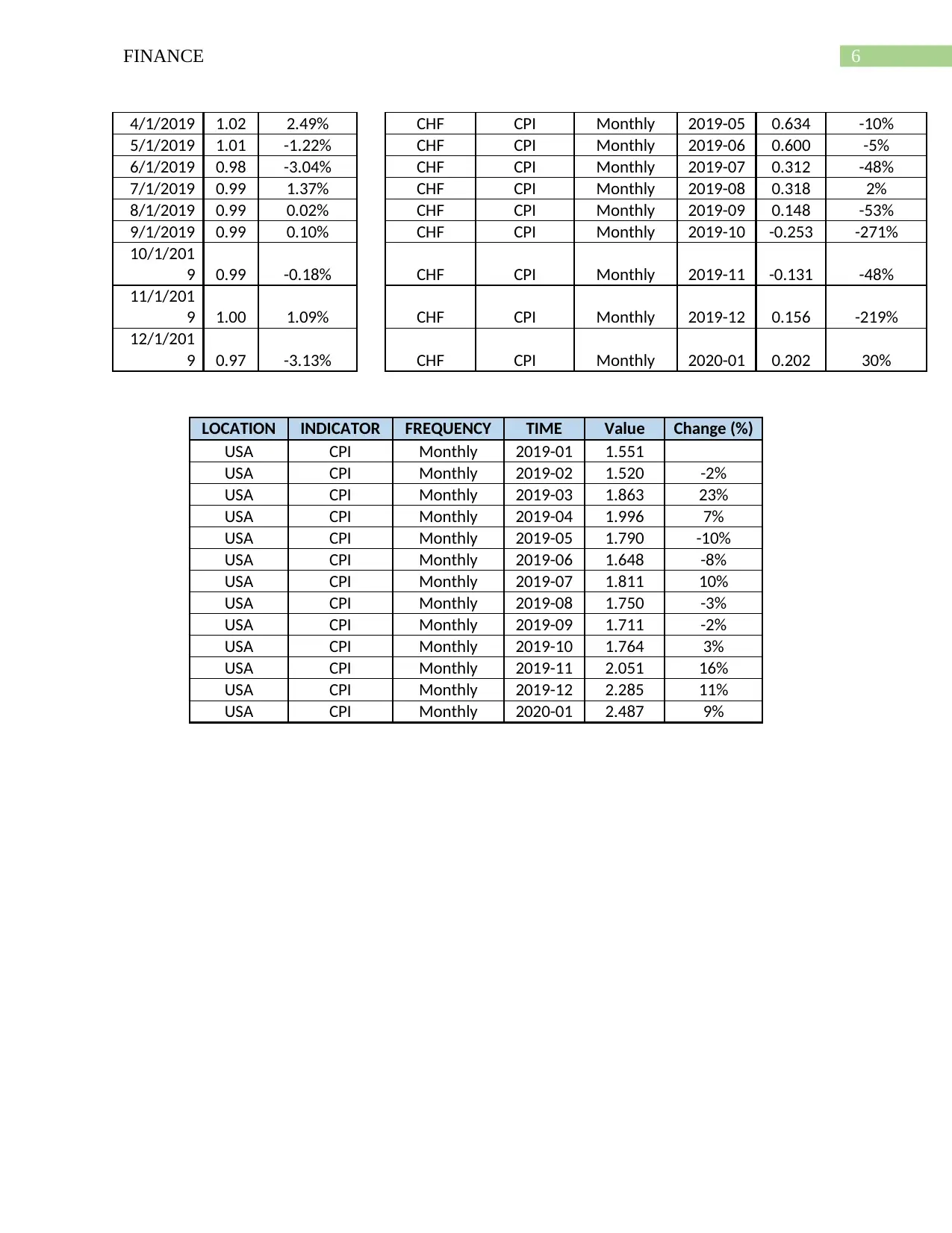

4/1/2019 1.02 2.49% CHF CPI Monthly 2019-05 0.634 -10%

5/1/2019 1.01 -1.22% CHF CPI Monthly 2019-06 0.600 -5%

6/1/2019 0.98 -3.04% CHF CPI Monthly 2019-07 0.312 -48%

7/1/2019 0.99 1.37% CHF CPI Monthly 2019-08 0.318 2%

8/1/2019 0.99 0.02% CHF CPI Monthly 2019-09 0.148 -53%

9/1/2019 0.99 0.10% CHF CPI Monthly 2019-10 -0.253 -271%

10/1/201

9 0.99 -0.18% CHF CPI Monthly 2019-11 -0.131 -48%

11/1/201

9 1.00 1.09% CHF CPI Monthly 2019-12 0.156 -219%

12/1/201

9 0.97 -3.13% CHF CPI Monthly 2020-01 0.202 30%

LOCATION INDICATOR FREQUENCY TIME Value Change (%)

USA CPI Monthly 2019-01 1.551

USA CPI Monthly 2019-02 1.520 -2%

USA CPI Monthly 2019-03 1.863 23%

USA CPI Monthly 2019-04 1.996 7%

USA CPI Monthly 2019-05 1.790 -10%

USA CPI Monthly 2019-06 1.648 -8%

USA CPI Monthly 2019-07 1.811 10%

USA CPI Monthly 2019-08 1.750 -3%

USA CPI Monthly 2019-09 1.711 -2%

USA CPI Monthly 2019-10 1.764 3%

USA CPI Monthly 2019-11 2.051 16%

USA CPI Monthly 2019-12 2.285 11%

USA CPI Monthly 2020-01 2.487 9%

4/1/2019 1.02 2.49% CHF CPI Monthly 2019-05 0.634 -10%

5/1/2019 1.01 -1.22% CHF CPI Monthly 2019-06 0.600 -5%

6/1/2019 0.98 -3.04% CHF CPI Monthly 2019-07 0.312 -48%

7/1/2019 0.99 1.37% CHF CPI Monthly 2019-08 0.318 2%

8/1/2019 0.99 0.02% CHF CPI Monthly 2019-09 0.148 -53%

9/1/2019 0.99 0.10% CHF CPI Monthly 2019-10 -0.253 -271%

10/1/201

9 0.99 -0.18% CHF CPI Monthly 2019-11 -0.131 -48%

11/1/201

9 1.00 1.09% CHF CPI Monthly 2019-12 0.156 -219%

12/1/201

9 0.97 -3.13% CHF CPI Monthly 2020-01 0.202 30%

LOCATION INDICATOR FREQUENCY TIME Value Change (%)

USA CPI Monthly 2019-01 1.551

USA CPI Monthly 2019-02 1.520 -2%

USA CPI Monthly 2019-03 1.863 23%

USA CPI Monthly 2019-04 1.996 7%

USA CPI Monthly 2019-05 1.790 -10%

USA CPI Monthly 2019-06 1.648 -8%

USA CPI Monthly 2019-07 1.811 10%

USA CPI Monthly 2019-08 1.750 -3%

USA CPI Monthly 2019-09 1.711 -2%

USA CPI Monthly 2019-10 1.764 3%

USA CPI Monthly 2019-11 2.051 16%

USA CPI Monthly 2019-12 2.285 11%

USA CPI Monthly 2020-01 2.487 9%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCE

10/27/2018 12/16/2018 2/4/2019 3/26/2019 5/15/2019 7/4/2019 8/23/2019 10/12/2019 12/1/2019 1/20/2020

0.94

0.95

0.96

0.97

0.98

0.99

1.00

1.01

1.02

1.03

0.99

1.00

0.99

1.02

1.01

0.98

0.99 0.99 0.99 0.99

1.00

0.97

USD/CHF Data

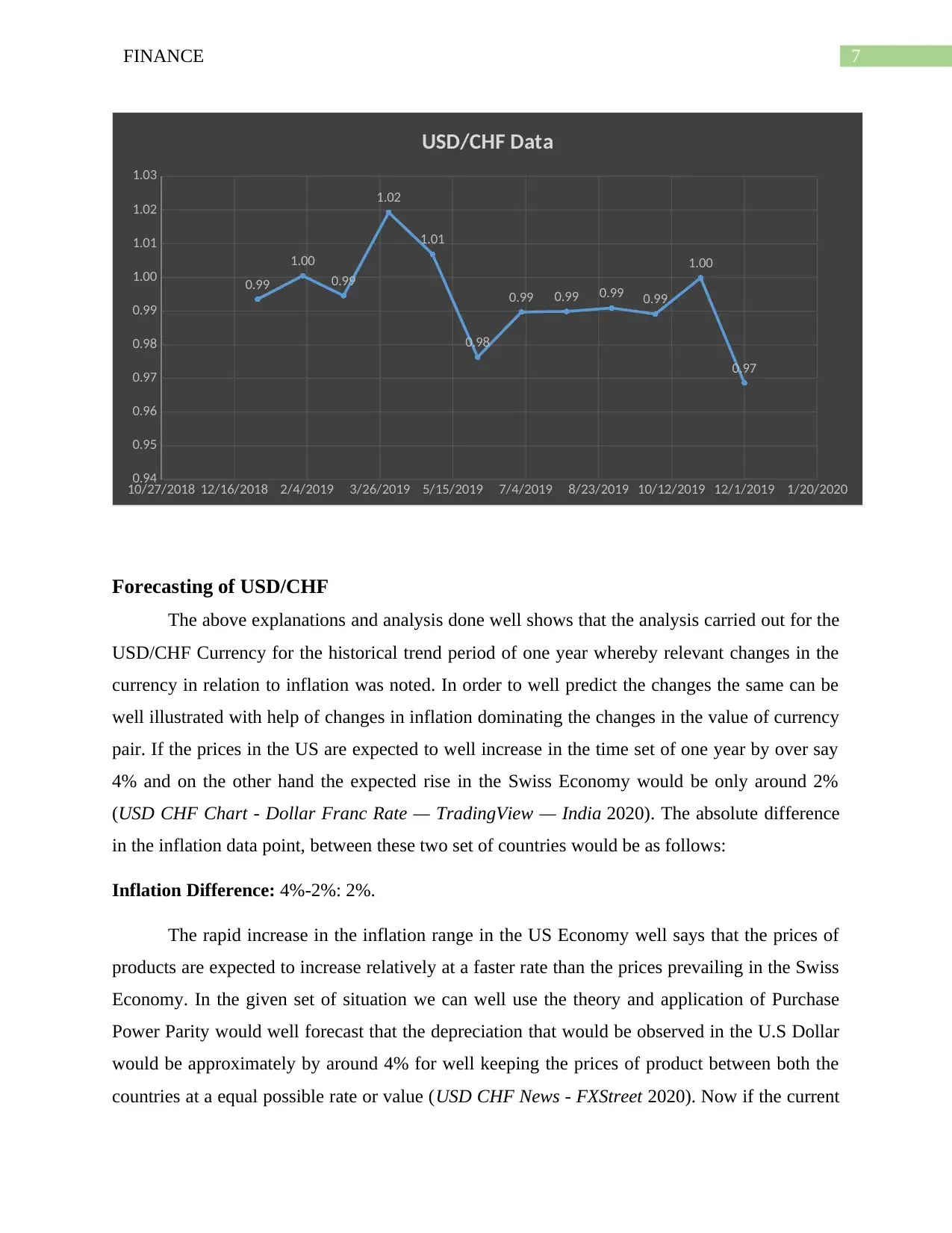

Forecasting of USD/CHF

The above explanations and analysis done well shows that the analysis carried out for the

USD/CHF Currency for the historical trend period of one year whereby relevant changes in the

currency in relation to inflation was noted. In order to well predict the changes the same can be

well illustrated with help of changes in inflation dominating the changes in the value of currency

pair. If the prices in the US are expected to well increase in the time set of one year by over say

4% and on the other hand the expected rise in the Swiss Economy would be only around 2%

(USD CHF Chart - Dollar Franc Rate — TradingView — India 2020). The absolute difference

in the inflation data point, between these two set of countries would be as follows:

Inflation Difference: 4%-2%: 2%.

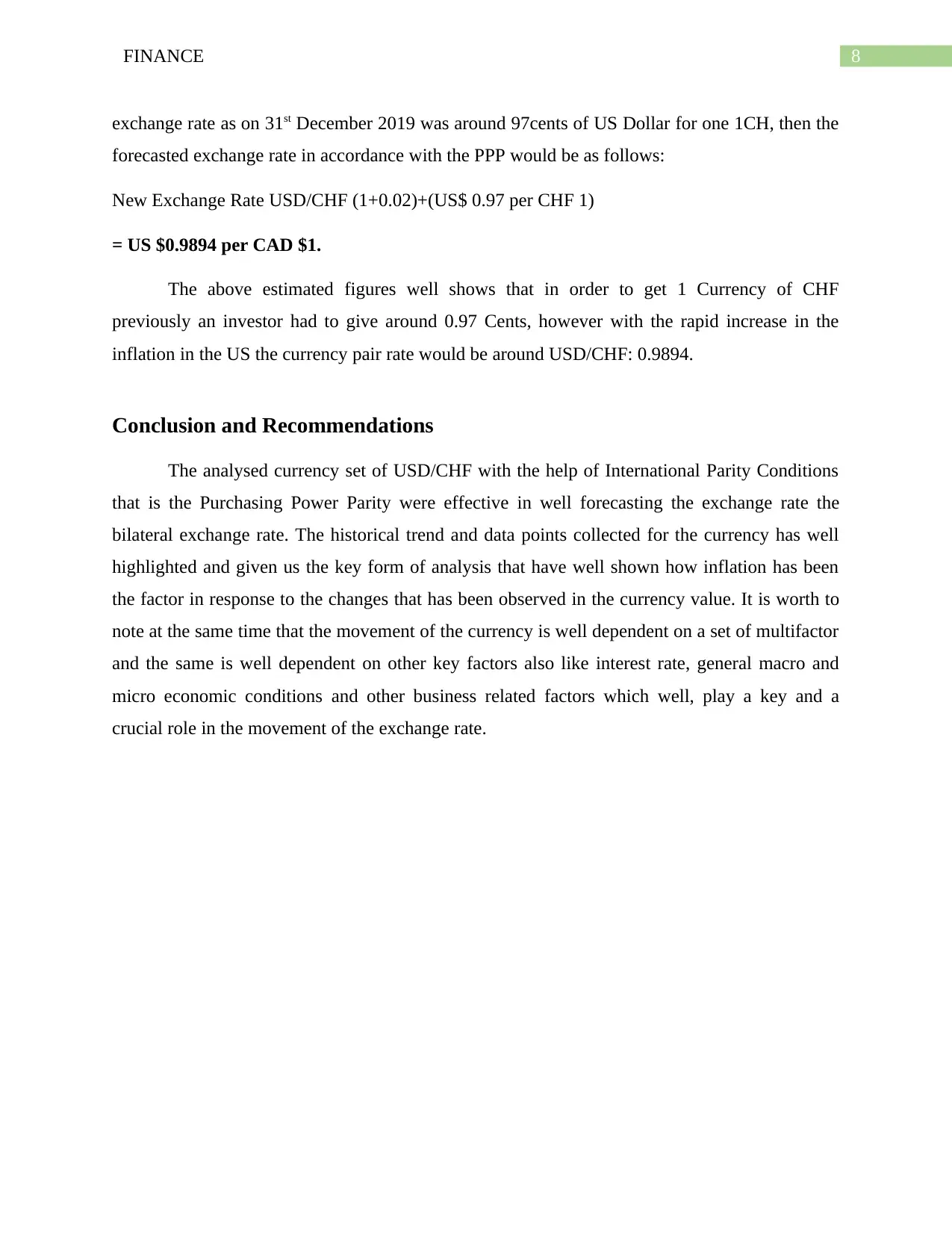

The rapid increase in the inflation range in the US Economy well says that the prices of

products are expected to increase relatively at a faster rate than the prices prevailing in the Swiss

Economy. In the given set of situation we can well use the theory and application of Purchase

Power Parity would well forecast that the depreciation that would be observed in the U.S Dollar

would be approximately by around 4% for well keeping the prices of product between both the

countries at a equal possible rate or value (USD CHF News - FXStreet 2020). Now if the current

10/27/2018 12/16/2018 2/4/2019 3/26/2019 5/15/2019 7/4/2019 8/23/2019 10/12/2019 12/1/2019 1/20/2020

0.94

0.95

0.96

0.97

0.98

0.99

1.00

1.01

1.02

1.03

0.99

1.00

0.99

1.02

1.01

0.98

0.99 0.99 0.99 0.99

1.00

0.97

USD/CHF Data

Forecasting of USD/CHF

The above explanations and analysis done well shows that the analysis carried out for the

USD/CHF Currency for the historical trend period of one year whereby relevant changes in the

currency in relation to inflation was noted. In order to well predict the changes the same can be

well illustrated with help of changes in inflation dominating the changes in the value of currency

pair. If the prices in the US are expected to well increase in the time set of one year by over say

4% and on the other hand the expected rise in the Swiss Economy would be only around 2%

(USD CHF Chart - Dollar Franc Rate — TradingView — India 2020). The absolute difference

in the inflation data point, between these two set of countries would be as follows:

Inflation Difference: 4%-2%: 2%.

The rapid increase in the inflation range in the US Economy well says that the prices of

products are expected to increase relatively at a faster rate than the prices prevailing in the Swiss

Economy. In the given set of situation we can well use the theory and application of Purchase

Power Parity would well forecast that the depreciation that would be observed in the U.S Dollar

would be approximately by around 4% for well keeping the prices of product between both the

countries at a equal possible rate or value (USD CHF News - FXStreet 2020). Now if the current

8FINANCE

exchange rate as on 31st December 2019 was around 97cents of US Dollar for one 1CH, then the

forecasted exchange rate in accordance with the PPP would be as follows:

New Exchange Rate USD/CHF (1+0.02)+(US$ 0.97 per CHF 1)

= US $0.9894 per CAD $1.

The above estimated figures well shows that in order to get 1 Currency of CHF

previously an investor had to give around 0.97 Cents, however with the rapid increase in the

inflation in the US the currency pair rate would be around USD/CHF: 0.9894.

Conclusion and Recommendations

The analysed currency set of USD/CHF with the help of International Parity Conditions

that is the Purchasing Power Parity were effective in well forecasting the exchange rate the

bilateral exchange rate. The historical trend and data points collected for the currency has well

highlighted and given us the key form of analysis that have well shown how inflation has been

the factor in response to the changes that has been observed in the currency value. It is worth to

note at the same time that the movement of the currency is well dependent on a set of multifactor

and the same is well dependent on other key factors also like interest rate, general macro and

micro economic conditions and other business related factors which well, play a key and a

crucial role in the movement of the exchange rate.

exchange rate as on 31st December 2019 was around 97cents of US Dollar for one 1CH, then the

forecasted exchange rate in accordance with the PPP would be as follows:

New Exchange Rate USD/CHF (1+0.02)+(US$ 0.97 per CHF 1)

= US $0.9894 per CAD $1.

The above estimated figures well shows that in order to get 1 Currency of CHF

previously an investor had to give around 0.97 Cents, however with the rapid increase in the

inflation in the US the currency pair rate would be around USD/CHF: 0.9894.

Conclusion and Recommendations

The analysed currency set of USD/CHF with the help of International Parity Conditions

that is the Purchasing Power Parity were effective in well forecasting the exchange rate the

bilateral exchange rate. The historical trend and data points collected for the currency has well

highlighted and given us the key form of analysis that have well shown how inflation has been

the factor in response to the changes that has been observed in the currency value. It is worth to

note at the same time that the movement of the currency is well dependent on a set of multifactor

and the same is well dependent on other key factors also like interest rate, general macro and

micro economic conditions and other business related factors which well, play a key and a

crucial role in the movement of the exchange rate.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCE

References

Arize, A.C., 2020. Purchasing power parity in developing countries: Evidence from conventional

and fractional cointegration tests. International Journal of Banking and Finance, 2(1), pp.29-43.

Bahmani-Oskooee, M., Chang, T., Chen, T.H. and Tzeng, H.W., 2017. Revisiting purchasing

power parity in Eastern European countries: quantile unit root tests. Empirical Economics, 52(2),

pp.463-483.

Chinn, M.D., 2019. Purchasing Power Parity and Real Exchange Rates. In Oxford Research

Encyclopedia of Economics and Finance.

Gilboa, S. and Mitchell, V., 2020. The role of culture and purchasing power parity in shaping

mall-shoppers’ profiles. Journal of Retailing and Consumer Services, 52, p.101951.

Iyke, B.N. and Odhiambo, N.M., 2017. Foreign exchange markets and the purchasing power

parity theory: Evidence from two Southern African countries. African Journal of Economic and

Management Studies, 8(1), pp.89-102.

Kuck, K., Maderitsch, R. and Schweikert, K., 2015. Asymmetric over-and undershooting of

major exchange rates: evidence from quantile regressions. Economics Letters, 126, pp.114-118.

Manahov, V., Hudson, R. and Gebka, B., 2014. Does high frequency trading affect technical

analysis and market efficiency? And if so, how?. Journal of International Financial Markets,

Institutions and Money, 28, pp.131-157.

Manzur, M., 2020. Exchange rate volatility and purchasing power parity: does euro make any

difference?. International Journal of Banking and Finance, 7(1), pp.99-118.

McKinnon, R.I. and Ohno, K., 2016. 7 Purchasing power parity as a monetary. The Future of the

International Monetary System: Change, Coordination of Instability?: Change, Coordination of

Instability?, p.42.

Prices - Inflation (CPI) - OECD Data 2020. Available at: https://data.oecd.org/price/inflation-

cpi.htm (Accessed: 6 March 2020).

References

Arize, A.C., 2020. Purchasing power parity in developing countries: Evidence from conventional

and fractional cointegration tests. International Journal of Banking and Finance, 2(1), pp.29-43.

Bahmani-Oskooee, M., Chang, T., Chen, T.H. and Tzeng, H.W., 2017. Revisiting purchasing

power parity in Eastern European countries: quantile unit root tests. Empirical Economics, 52(2),

pp.463-483.

Chinn, M.D., 2019. Purchasing Power Parity and Real Exchange Rates. In Oxford Research

Encyclopedia of Economics and Finance.

Gilboa, S. and Mitchell, V., 2020. The role of culture and purchasing power parity in shaping

mall-shoppers’ profiles. Journal of Retailing and Consumer Services, 52, p.101951.

Iyke, B.N. and Odhiambo, N.M., 2017. Foreign exchange markets and the purchasing power

parity theory: Evidence from two Southern African countries. African Journal of Economic and

Management Studies, 8(1), pp.89-102.

Kuck, K., Maderitsch, R. and Schweikert, K., 2015. Asymmetric over-and undershooting of

major exchange rates: evidence from quantile regressions. Economics Letters, 126, pp.114-118.

Manahov, V., Hudson, R. and Gebka, B., 2014. Does high frequency trading affect technical

analysis and market efficiency? And if so, how?. Journal of International Financial Markets,

Institutions and Money, 28, pp.131-157.

Manzur, M., 2020. Exchange rate volatility and purchasing power parity: does euro make any

difference?. International Journal of Banking and Finance, 7(1), pp.99-118.

McKinnon, R.I. and Ohno, K., 2016. 7 Purchasing power parity as a monetary. The Future of the

International Monetary System: Change, Coordination of Instability?: Change, Coordination of

Instability?, p.42.

Prices - Inflation (CPI) - OECD Data 2020. Available at: https://data.oecd.org/price/inflation-

cpi.htm (Accessed: 6 March 2020).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCE

Theories of Exchange Rate Determination | International Economics 2018. Available at:

http://www.economicsdiscussion.net/foreign-exchange/theories-foreign-exchange/theories-of-

exchange-rate-determination-international-economics/30637 (Accessed: 6 March 2020).

USD CHF Chart - Dollar Franc Rate — TradingView — India 2020. Available at:

https://in.tradingview.com/symbols/USDCHF/ (Accessed: 6 March 2020).

USD CHF News - FXStreet 2020. Available at: https://www.fxstreet.com/currencies/usdchf

(Accessed: 6 March 2020).

USD to CHF Forecast: up to 0.966! Dollar to Franc Analysis, Converter, Live Exchange Rates

and Prediction, Long-Term & Short-Term Forex (FX) Prognosis 2020. Available at:

https://walletinvestor.com/forex-forecast/usd-chf-prediction (Accessed: 6 March 2020).

USD/CHF - Live Rate, Forecast, News and Analysis 2020. Available at:

https://www.dailyfx.com/usd-chf (Accessed: 6 March 2020).

Yahoo Finance 2020. Available at: https://finance.yahoo.com/quote/CHF%3DX/history?

period1=1546300800&period2=1577750400&interval=1mo&filter=history&frequency=1mo

(Accessed: 6 March 2020).

Theories of Exchange Rate Determination | International Economics 2018. Available at:

http://www.economicsdiscussion.net/foreign-exchange/theories-foreign-exchange/theories-of-

exchange-rate-determination-international-economics/30637 (Accessed: 6 March 2020).

USD CHF Chart - Dollar Franc Rate — TradingView — India 2020. Available at:

https://in.tradingview.com/symbols/USDCHF/ (Accessed: 6 March 2020).

USD CHF News - FXStreet 2020. Available at: https://www.fxstreet.com/currencies/usdchf

(Accessed: 6 March 2020).

USD to CHF Forecast: up to 0.966! Dollar to Franc Analysis, Converter, Live Exchange Rates

and Prediction, Long-Term & Short-Term Forex (FX) Prognosis 2020. Available at:

https://walletinvestor.com/forex-forecast/usd-chf-prediction (Accessed: 6 March 2020).

USD/CHF - Live Rate, Forecast, News and Analysis 2020. Available at:

https://www.dailyfx.com/usd-chf (Accessed: 6 March 2020).

Yahoo Finance 2020. Available at: https://finance.yahoo.com/quote/CHF%3DX/history?

period1=1546300800&period2=1577750400&interval=1mo&filter=history&frequency=1mo

(Accessed: 6 March 2020).

1 out of 11