Financial Management Analysis of Clariton

VerifiedAdded on 2020/01/23

|20

|4444

|41

Report

AI Summary

This assignment delves into a comprehensive analysis of Clariton's financial health. It examines various financial ratios, including profitability, liquidity, efficiency, and solvency ratios, to assess the firm's performance over time. The analysis highlights trends in key financial metrics, identifies strengths and weaknesses, and suggests potential areas for improvement in financial management practices.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Managing Financial Resources

and Decisions

1

and Decisions

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2

INTRODUCTION

Finance is the vast field and in order to manage it better it is necessary to understand its

varied aspects. In the current report, an attempt is made to understand varied areas from where

finance can be raised and their cost. Implications of these funding sources are also explained in

the report. Apart from this, cash budget is presented in the report and comments are done on the

fluctuation of cash flow amount. Along with this, unit cost is also computed for Clariton

antiques. Best alternative is selected on the basis of results that are generated from project

evaluation methods. At end of study, financial statements are analyzed and profitability of the

organisation is judged.

TASK 1

1.1 Sources of finance accessible to the business firms

There are number of financing options that are available to the firms. Managers can select

any source of finance for the firm whichever they think is most suitable for the business firm.

The alternatives from where funds could be raised can be classified in to two categories namely

unincorporated and incorporated business (Lo, Wong and Firth, 2010). Unincorporated business

encompass venture that are operated by individual or by group of few people together. On other

hand, incorporated business encompass corporate that have separate entity from their owners.

Sources of finance for mentioned type of business are as follows.

Incorporate business

Venture capital: under this method funds are collected for long period of time. It helps

to attract majority of amount of fund from the institutional investors. Moreover, those

who cannot launch their IPO in the primary market also resort to VC firm in order to

collect relevant amount of fund for project finance. Equity: There are some important characteristics of equity and it must be noted that its

nature is highly similar to venture capital. However, there is some difference between

both. In case of equity there is a market regulator which look after entire share issue

process (Cochrane, 2011). Whereas, in case of venture capital there is no regulator and all

terms of conditions are determined by VC firm and company which intends to raised fund

from former entity.

3

Finance is the vast field and in order to manage it better it is necessary to understand its

varied aspects. In the current report, an attempt is made to understand varied areas from where

finance can be raised and their cost. Implications of these funding sources are also explained in

the report. Apart from this, cash budget is presented in the report and comments are done on the

fluctuation of cash flow amount. Along with this, unit cost is also computed for Clariton

antiques. Best alternative is selected on the basis of results that are generated from project

evaluation methods. At end of study, financial statements are analyzed and profitability of the

organisation is judged.

TASK 1

1.1 Sources of finance accessible to the business firms

There are number of financing options that are available to the firms. Managers can select

any source of finance for the firm whichever they think is most suitable for the business firm.

The alternatives from where funds could be raised can be classified in to two categories namely

unincorporated and incorporated business (Lo, Wong and Firth, 2010). Unincorporated business

encompass venture that are operated by individual or by group of few people together. On other

hand, incorporated business encompass corporate that have separate entity from their owners.

Sources of finance for mentioned type of business are as follows.

Incorporate business

Venture capital: under this method funds are collected for long period of time. It helps

to attract majority of amount of fund from the institutional investors. Moreover, those

who cannot launch their IPO in the primary market also resort to VC firm in order to

collect relevant amount of fund for project finance. Equity: There are some important characteristics of equity and it must be noted that its

nature is highly similar to venture capital. However, there is some difference between

both. In case of equity there is a market regulator which look after entire share issue

process (Cochrane, 2011). Whereas, in case of venture capital there is no regulator and all

terms of conditions are determined by VC firm and company which intends to raised fund

from former entity.

3

Debenture: It is another long term source of finance through which debt can be raised

from the general public. At specific interest rate usually debt is taken from the general

public and institutional investors (Sources of Finance,2017). This source of finance is

usually used by those firms who wants to take huge amount of debt in the business which

cannot be received from the single bank.

Unincorporated business

Bank loan: This source of finance is often used by small and medium sized business

firms because there is less amount of cash flow in their business. Hence, due to less

availability of cash in the business firms compelled to raise fund from banks.

Retained earnings: It refer to the inside source of finance and frequently used to meet

operative capital needs of the business (Diamond and Vartiainen, 2012). Retained

earnings is the moderate or small portion of earning and due to this reason not finance

cost is charged on same.

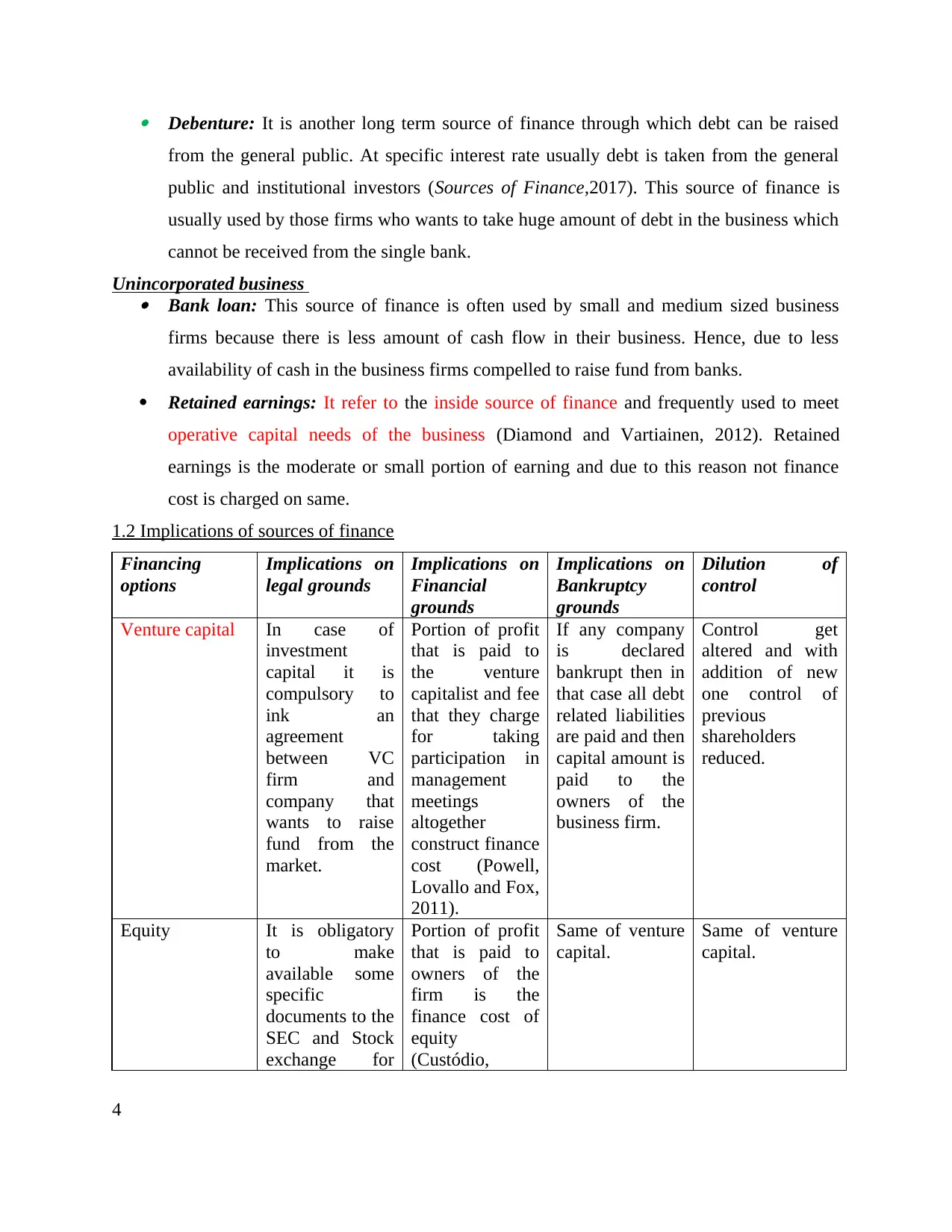

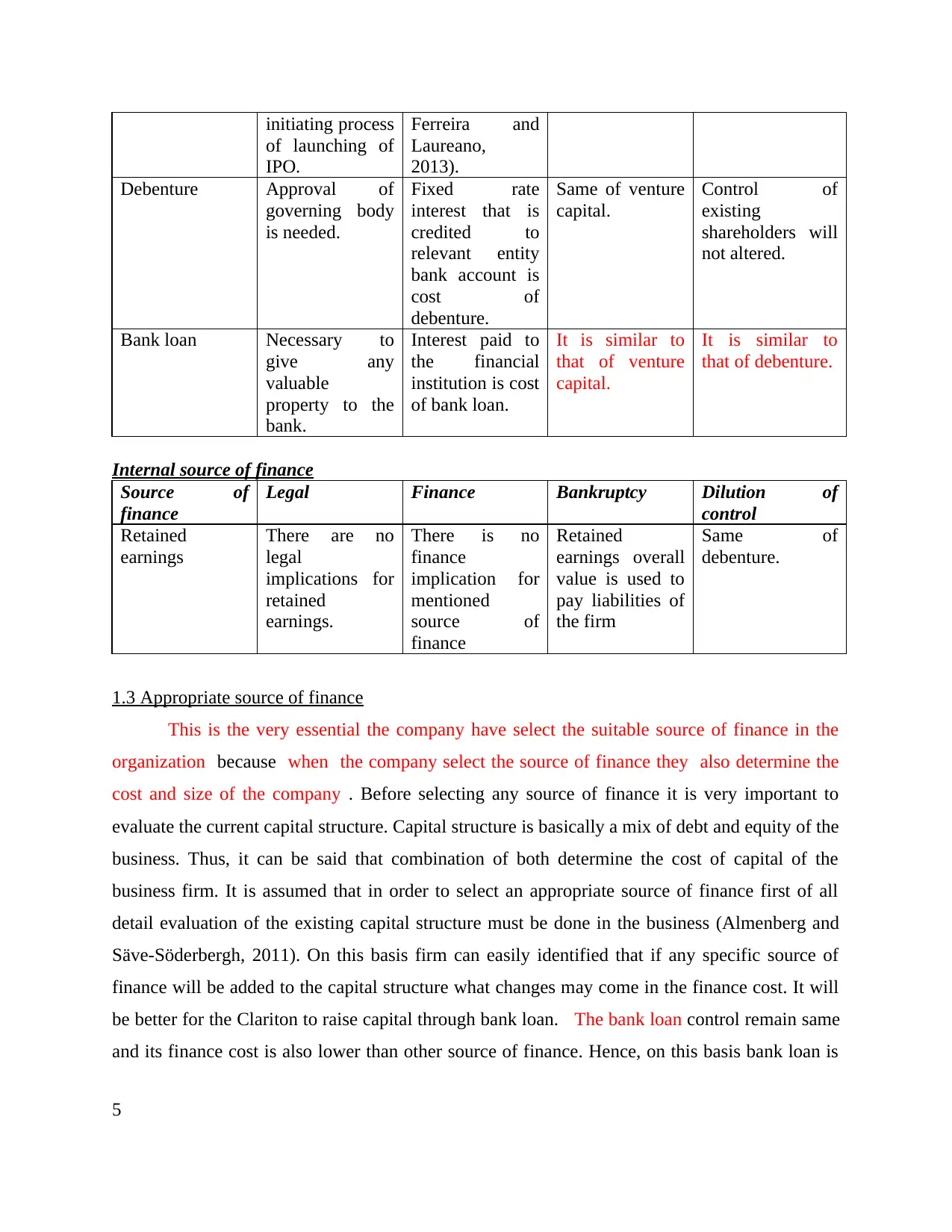

1.2 Implications of sources of finance

Financing

options

Implications on

legal grounds

Implications on

Financial

grounds

Implications on

Bankruptcy

grounds

Dilution of

control

Venture capital In case of

investment

capital it is

compulsory to

ink an

agreement

between VC

firm and

company that

wants to raise

fund from the

market.

Portion of profit

that is paid to

the venture

capitalist and fee

that they charge

for taking

participation in

management

meetings

altogether

construct finance

cost (Powell,

Lovallo and Fox,

2011).

If any company

is declared

bankrupt then in

that case all debt

related liabilities

are paid and then

capital amount is

paid to the

owners of the

business firm.

Control get

altered and with

addition of new

one control of

previous

shareholders

reduced.

Equity It is obligatory

to make

available some

specific

documents to the

SEC and Stock

exchange for

Portion of profit

that is paid to

owners of the

firm is the

finance cost of

equity

(Custódio,

Same of venture

capital.

Same of venture

capital.

4

from the general public. At specific interest rate usually debt is taken from the general

public and institutional investors (Sources of Finance,2017). This source of finance is

usually used by those firms who wants to take huge amount of debt in the business which

cannot be received from the single bank.

Unincorporated business

Bank loan: This source of finance is often used by small and medium sized business

firms because there is less amount of cash flow in their business. Hence, due to less

availability of cash in the business firms compelled to raise fund from banks.

Retained earnings: It refer to the inside source of finance and frequently used to meet

operative capital needs of the business (Diamond and Vartiainen, 2012). Retained

earnings is the moderate or small portion of earning and due to this reason not finance

cost is charged on same.

1.2 Implications of sources of finance

Financing

options

Implications on

legal grounds

Implications on

Financial

grounds

Implications on

Bankruptcy

grounds

Dilution of

control

Venture capital In case of

investment

capital it is

compulsory to

ink an

agreement

between VC

firm and

company that

wants to raise

fund from the

market.

Portion of profit

that is paid to

the venture

capitalist and fee

that they charge

for taking

participation in

management

meetings

altogether

construct finance

cost (Powell,

Lovallo and Fox,

2011).

If any company

is declared

bankrupt then in

that case all debt

related liabilities

are paid and then

capital amount is

paid to the

owners of the

business firm.

Control get

altered and with

addition of new

one control of

previous

shareholders

reduced.

Equity It is obligatory

to make

available some

specific

documents to the

SEC and Stock

exchange for

Portion of profit

that is paid to

owners of the

firm is the

finance cost of

equity

(Custódio,

Same of venture

capital.

Same of venture

capital.

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

initiating process

of launching of

IPO.

Ferreira and

Laureano,

2013).

Debenture Approval of

governing body

is needed.

Fixed rate

interest that is

credited to

relevant entity

bank account is

cost of

debenture.

Same of venture

capital.

Control of

existing

shareholders will

not altered.

Bank loan Necessary to

give any

valuable

property to the

bank.

Interest paid to

the financial

institution is cost

of bank loan.

It is similar to

that of venture

capital.

It is similar to

that of debenture.

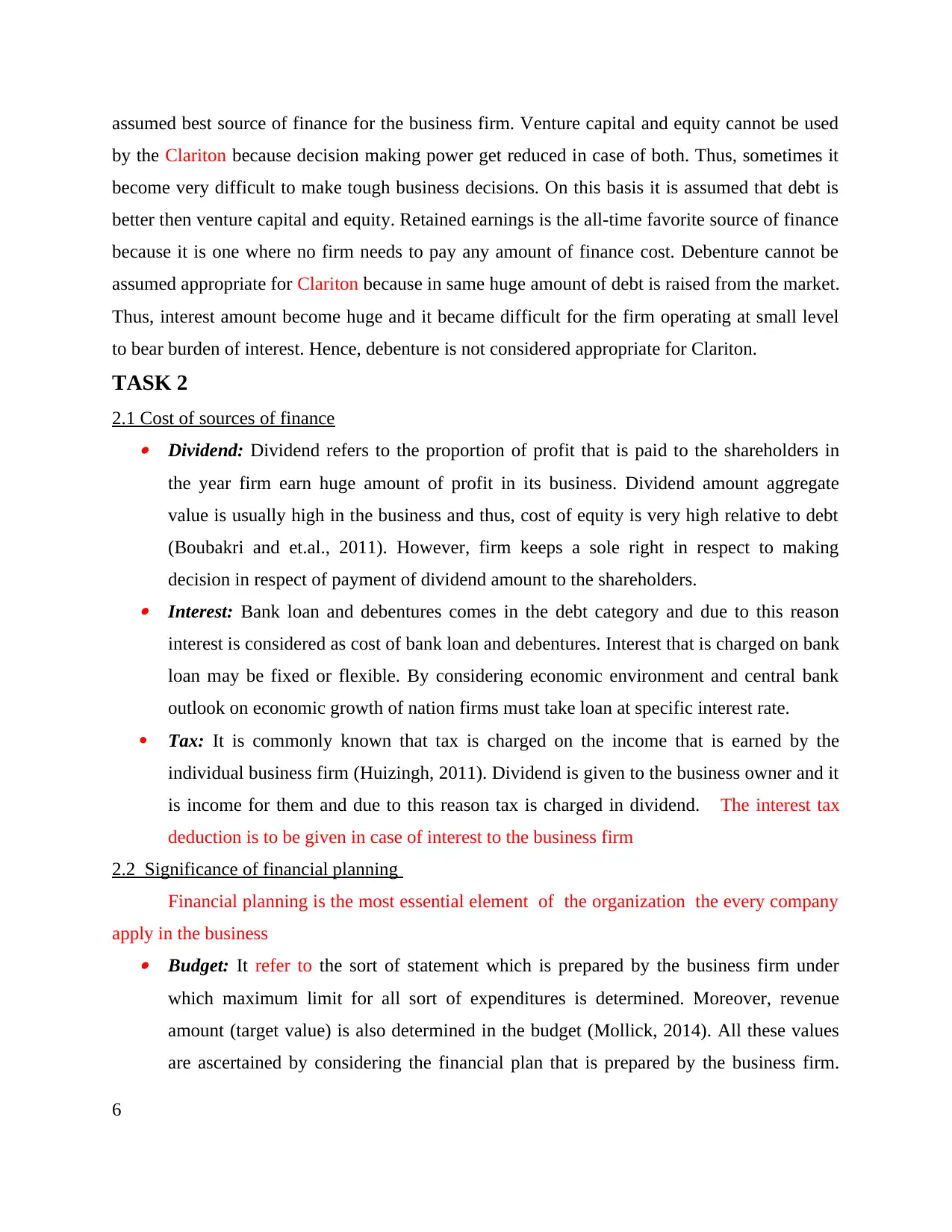

Internal source of finance

Source of

finance

Legal Finance Bankruptcy Dilution of

control

Retained

earnings

There are no

legal

implications for

retained

earnings.

There is no

finance

implication for

mentioned

source of

finance

Retained

earnings overall

value is used to

pay liabilities of

the firm

Same of

debenture.

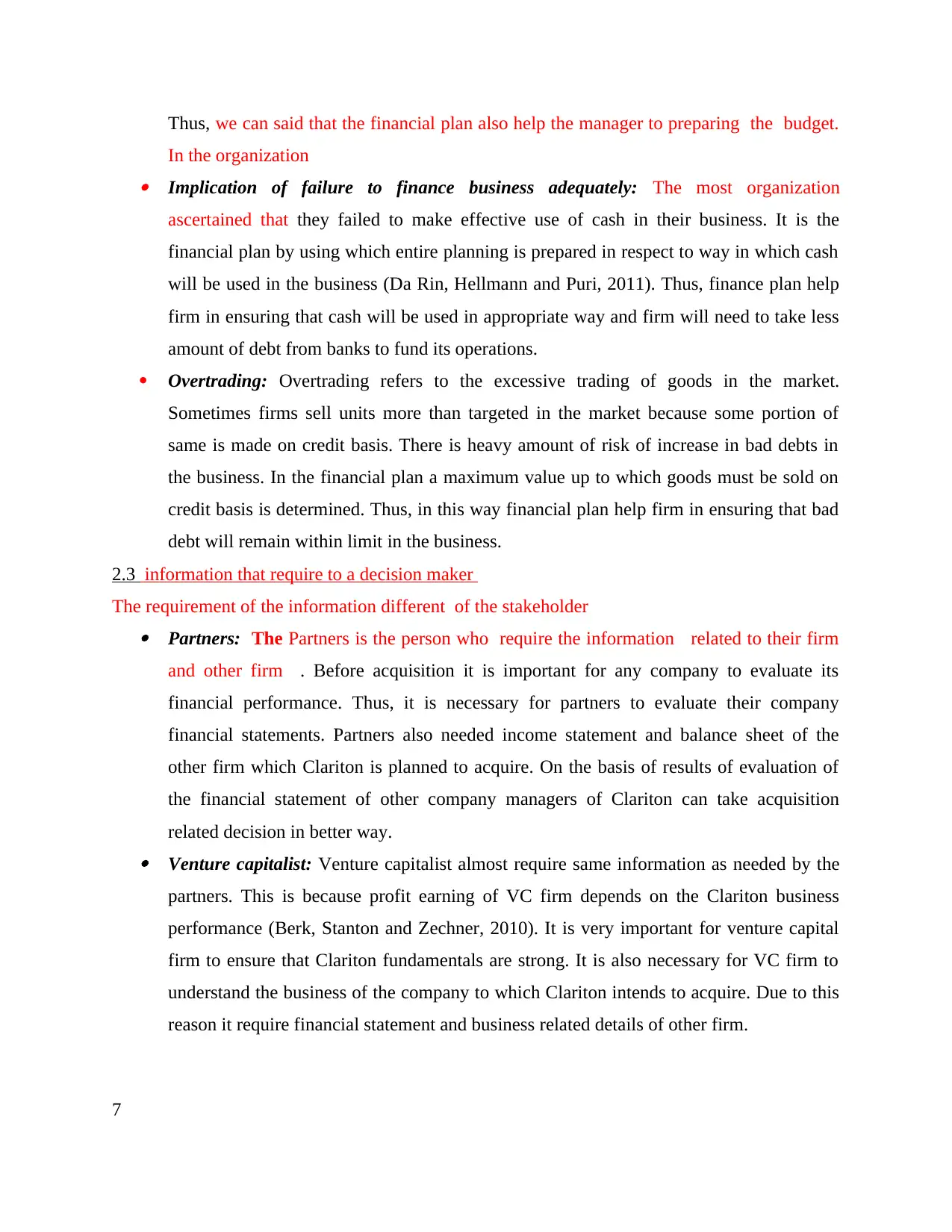

1.3 Appropriate source of finance

This is the very essential the company have select the suitable source of finance in the

organization because when the company select the source of finance they also determine the

cost and size of the company . Before selecting any source of finance it is very important to

evaluate the current capital structure. Capital structure is basically a mix of debt and equity of the

business. Thus, it can be said that combination of both determine the cost of capital of the

business firm. It is assumed that in order to select an appropriate source of finance first of all

detail evaluation of the existing capital structure must be done in the business (Almenberg and

Säve-Söderbergh, 2011). On this basis firm can easily identified that if any specific source of

finance will be added to the capital structure what changes may come in the finance cost. It will

be better for the Clariton to raise capital through bank loan. The bank loan control remain same

and its finance cost is also lower than other source of finance. Hence, on this basis bank loan is

5

of launching of

IPO.

Ferreira and

Laureano,

2013).

Debenture Approval of

governing body

is needed.

Fixed rate

interest that is

credited to

relevant entity

bank account is

cost of

debenture.

Same of venture

capital.

Control of

existing

shareholders will

not altered.

Bank loan Necessary to

give any

valuable

property to the

bank.

Interest paid to

the financial

institution is cost

of bank loan.

It is similar to

that of venture

capital.

It is similar to

that of debenture.

Internal source of finance

Source of

finance

Legal Finance Bankruptcy Dilution of

control

Retained

earnings

There are no

legal

implications for

retained

earnings.

There is no

finance

implication for

mentioned

source of

finance

Retained

earnings overall

value is used to

pay liabilities of

the firm

Same of

debenture.

1.3 Appropriate source of finance

This is the very essential the company have select the suitable source of finance in the

organization because when the company select the source of finance they also determine the

cost and size of the company . Before selecting any source of finance it is very important to

evaluate the current capital structure. Capital structure is basically a mix of debt and equity of the

business. Thus, it can be said that combination of both determine the cost of capital of the

business firm. It is assumed that in order to select an appropriate source of finance first of all

detail evaluation of the existing capital structure must be done in the business (Almenberg and

Säve-Söderbergh, 2011). On this basis firm can easily identified that if any specific source of

finance will be added to the capital structure what changes may come in the finance cost. It will

be better for the Clariton to raise capital through bank loan. The bank loan control remain same

and its finance cost is also lower than other source of finance. Hence, on this basis bank loan is

5

assumed best source of finance for the business firm. Venture capital and equity cannot be used

by the Clariton because decision making power get reduced in case of both. Thus, sometimes it

become very difficult to make tough business decisions. On this basis it is assumed that debt is

better then venture capital and equity. Retained earnings is the all-time favorite source of finance

because it is one where no firm needs to pay any amount of finance cost. Debenture cannot be

assumed appropriate for Clariton because in same huge amount of debt is raised from the market.

Thus, interest amount become huge and it became difficult for the firm operating at small level

to bear burden of interest. Hence, debenture is not considered appropriate for Clariton.

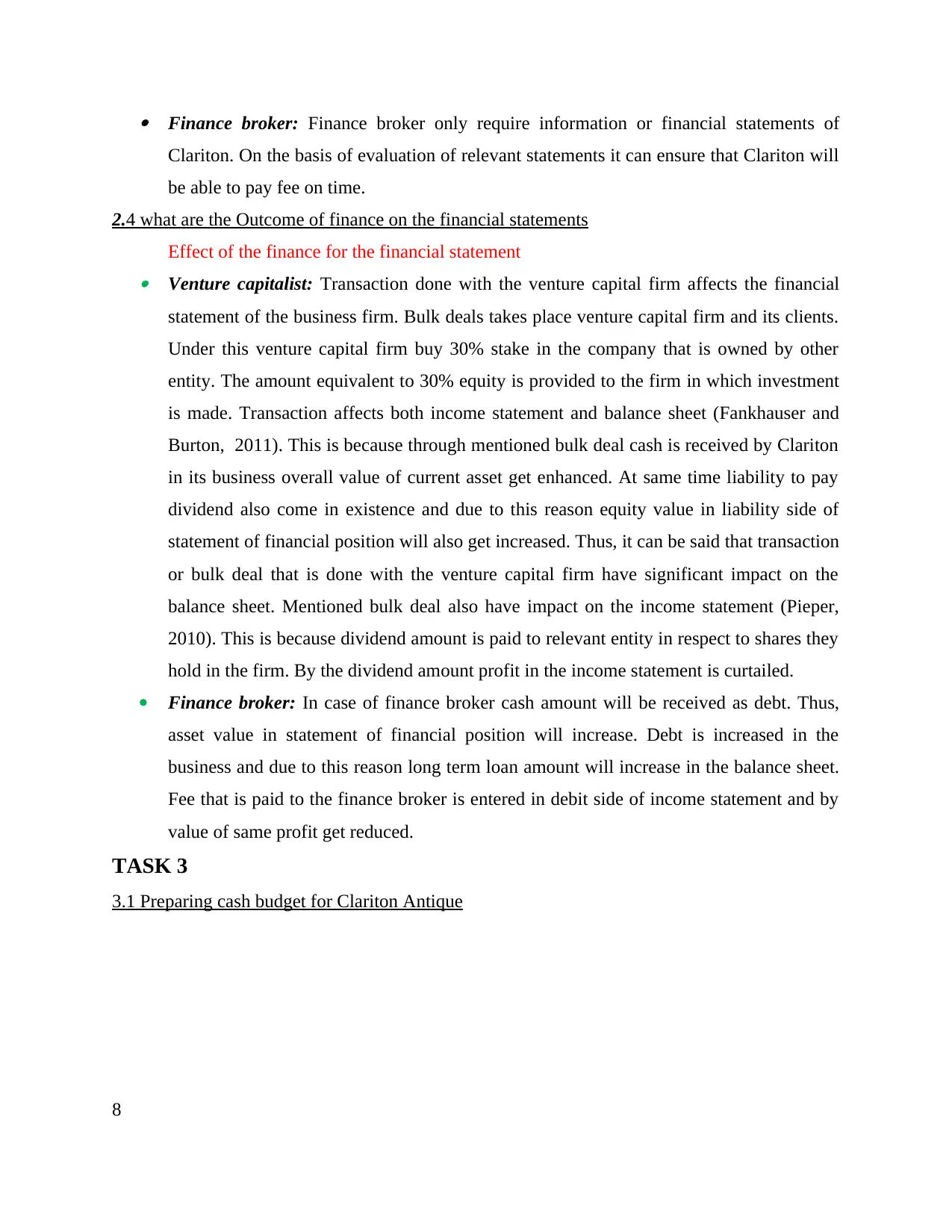

TASK 2

2.1 Cost of sources of finance Dividend: Dividend refers to the proportion of profit that is paid to the shareholders in

the year firm earn huge amount of profit in its business. Dividend amount aggregate

value is usually high in the business and thus, cost of equity is very high relative to debt

(Boubakri and et.al., 2011). However, firm keeps a sole right in respect to making

decision in respect of payment of dividend amount to the shareholders. Interest: Bank loan and debentures comes in the debt category and due to this reason

interest is considered as cost of bank loan and debentures. Interest that is charged on bank

loan may be fixed or flexible. By considering economic environment and central bank

outlook on economic growth of nation firms must take loan at specific interest rate.

Tax: It is commonly known that tax is charged on the income that is earned by the

individual business firm (Huizingh, 2011). Dividend is given to the business owner and it

is income for them and due to this reason tax is charged in dividend. The interest tax

deduction is to be given in case of interest to the business firm

2.2 Significance of financial planning

Financial planning is the most essential element of the organization the every company

apply in the business Budget: It refer to the sort of statement which is prepared by the business firm under

which maximum limit for all sort of expenditures is determined. Moreover, revenue

amount (target value) is also determined in the budget (Mollick, 2014). All these values

are ascertained by considering the financial plan that is prepared by the business firm.

6

by the Clariton because decision making power get reduced in case of both. Thus, sometimes it

become very difficult to make tough business decisions. On this basis it is assumed that debt is

better then venture capital and equity. Retained earnings is the all-time favorite source of finance

because it is one where no firm needs to pay any amount of finance cost. Debenture cannot be

assumed appropriate for Clariton because in same huge amount of debt is raised from the market.

Thus, interest amount become huge and it became difficult for the firm operating at small level

to bear burden of interest. Hence, debenture is not considered appropriate for Clariton.

TASK 2

2.1 Cost of sources of finance Dividend: Dividend refers to the proportion of profit that is paid to the shareholders in

the year firm earn huge amount of profit in its business. Dividend amount aggregate

value is usually high in the business and thus, cost of equity is very high relative to debt

(Boubakri and et.al., 2011). However, firm keeps a sole right in respect to making

decision in respect of payment of dividend amount to the shareholders. Interest: Bank loan and debentures comes in the debt category and due to this reason

interest is considered as cost of bank loan and debentures. Interest that is charged on bank

loan may be fixed or flexible. By considering economic environment and central bank

outlook on economic growth of nation firms must take loan at specific interest rate.

Tax: It is commonly known that tax is charged on the income that is earned by the

individual business firm (Huizingh, 2011). Dividend is given to the business owner and it

is income for them and due to this reason tax is charged in dividend. The interest tax

deduction is to be given in case of interest to the business firm

2.2 Significance of financial planning

Financial planning is the most essential element of the organization the every company

apply in the business Budget: It refer to the sort of statement which is prepared by the business firm under

which maximum limit for all sort of expenditures is determined. Moreover, revenue

amount (target value) is also determined in the budget (Mollick, 2014). All these values

are ascertained by considering the financial plan that is prepared by the business firm.

6

Thus, we can said that the financial plan also help the manager to preparing the budget.

In the organization Implication of failure to finance business adequately: The most organization

ascertained that they failed to make effective use of cash in their business. It is the

financial plan by using which entire planning is prepared in respect to way in which cash

will be used in the business (Da Rin, Hellmann and Puri, 2011). Thus, finance plan help

firm in ensuring that cash will be used in appropriate way and firm will need to take less

amount of debt from banks to fund its operations.

Overtrading: Overtrading refers to the excessive trading of goods in the market.

Sometimes firms sell units more than targeted in the market because some portion of

same is made on credit basis. There is heavy amount of risk of increase in bad debts in

the business. In the financial plan a maximum value up to which goods must be sold on

credit basis is determined. Thus, in this way financial plan help firm in ensuring that bad

debt will remain within limit in the business.

2.3 information that require to a decision maker

The requirement of the information different of the stakeholder Partners: The Partners is the person who require the information related to their firm

and other firm . Before acquisition it is important for any company to evaluate its

financial performance. Thus, it is necessary for partners to evaluate their company

financial statements. Partners also needed income statement and balance sheet of the

other firm which Clariton is planned to acquire. On the basis of results of evaluation of

the financial statement of other company managers of Clariton can take acquisition

related decision in better way. Venture capitalist: Venture capitalist almost require same information as needed by the

partners. This is because profit earning of VC firm depends on the Clariton business

performance (Berk, Stanton and Zechner, 2010). It is very important for venture capital

firm to ensure that Clariton fundamentals are strong. It is also necessary for VC firm to

understand the business of the company to which Clariton intends to acquire. Due to this

reason it require financial statement and business related details of other firm.

7

In the organization Implication of failure to finance business adequately: The most organization

ascertained that they failed to make effective use of cash in their business. It is the

financial plan by using which entire planning is prepared in respect to way in which cash

will be used in the business (Da Rin, Hellmann and Puri, 2011). Thus, finance plan help

firm in ensuring that cash will be used in appropriate way and firm will need to take less

amount of debt from banks to fund its operations.

Overtrading: Overtrading refers to the excessive trading of goods in the market.

Sometimes firms sell units more than targeted in the market because some portion of

same is made on credit basis. There is heavy amount of risk of increase in bad debts in

the business. In the financial plan a maximum value up to which goods must be sold on

credit basis is determined. Thus, in this way financial plan help firm in ensuring that bad

debt will remain within limit in the business.

2.3 information that require to a decision maker

The requirement of the information different of the stakeholder Partners: The Partners is the person who require the information related to their firm

and other firm . Before acquisition it is important for any company to evaluate its

financial performance. Thus, it is necessary for partners to evaluate their company

financial statements. Partners also needed income statement and balance sheet of the

other firm which Clariton is planned to acquire. On the basis of results of evaluation of

the financial statement of other company managers of Clariton can take acquisition

related decision in better way. Venture capitalist: Venture capitalist almost require same information as needed by the

partners. This is because profit earning of VC firm depends on the Clariton business

performance (Berk, Stanton and Zechner, 2010). It is very important for venture capital

firm to ensure that Clariton fundamentals are strong. It is also necessary for VC firm to

understand the business of the company to which Clariton intends to acquire. Due to this

reason it require financial statement and business related details of other firm.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance broker: Finance broker only require information or financial statements of

Clariton. On the basis of evaluation of relevant statements it can ensure that Clariton will

be able to pay fee on time.

2.4 what are the Outcome of finance on the financial statements

Effect of the finance for the financial statement Venture capitalist: Transaction done with the venture capital firm affects the financial

statement of the business firm. Bulk deals takes place venture capital firm and its clients.

Under this venture capital firm buy 30% stake in the company that is owned by other

entity. The amount equivalent to 30% equity is provided to the firm in which investment

is made. Transaction affects both income statement and balance sheet (Fankhauser and

Burton, 2011). This is because through mentioned bulk deal cash is received by Clariton

in its business overall value of current asset get enhanced. At same time liability to pay

dividend also come in existence and due to this reason equity value in liability side of

statement of financial position will also get increased. Thus, it can be said that transaction

or bulk deal that is done with the venture capital firm have significant impact on the

balance sheet. Mentioned bulk deal also have impact on the income statement (Pieper,

2010). This is because dividend amount is paid to relevant entity in respect to shares they

hold in the firm. By the dividend amount profit in the income statement is curtailed.

Finance broker: In case of finance broker cash amount will be received as debt. Thus,

asset value in statement of financial position will increase. Debt is increased in the

business and due to this reason long term loan amount will increase in the balance sheet.

Fee that is paid to the finance broker is entered in debit side of income statement and by

value of same profit get reduced.

TASK 3

3.1 Preparing cash budget for Clariton Antique

8

Clariton. On the basis of evaluation of relevant statements it can ensure that Clariton will

be able to pay fee on time.

2.4 what are the Outcome of finance on the financial statements

Effect of the finance for the financial statement Venture capitalist: Transaction done with the venture capital firm affects the financial

statement of the business firm. Bulk deals takes place venture capital firm and its clients.

Under this venture capital firm buy 30% stake in the company that is owned by other

entity. The amount equivalent to 30% equity is provided to the firm in which investment

is made. Transaction affects both income statement and balance sheet (Fankhauser and

Burton, 2011). This is because through mentioned bulk deal cash is received by Clariton

in its business overall value of current asset get enhanced. At same time liability to pay

dividend also come in existence and due to this reason equity value in liability side of

statement of financial position will also get increased. Thus, it can be said that transaction

or bulk deal that is done with the venture capital firm have significant impact on the

balance sheet. Mentioned bulk deal also have impact on the income statement (Pieper,

2010). This is because dividend amount is paid to relevant entity in respect to shares they

hold in the firm. By the dividend amount profit in the income statement is curtailed.

Finance broker: In case of finance broker cash amount will be received as debt. Thus,

asset value in statement of financial position will increase. Debt is increased in the

business and due to this reason long term loan amount will increase in the balance sheet.

Fee that is paid to the finance broker is entered in debit side of income statement and by

value of same profit get reduced.

TASK 3

3.1 Preparing cash budget for Clariton Antique

8

9

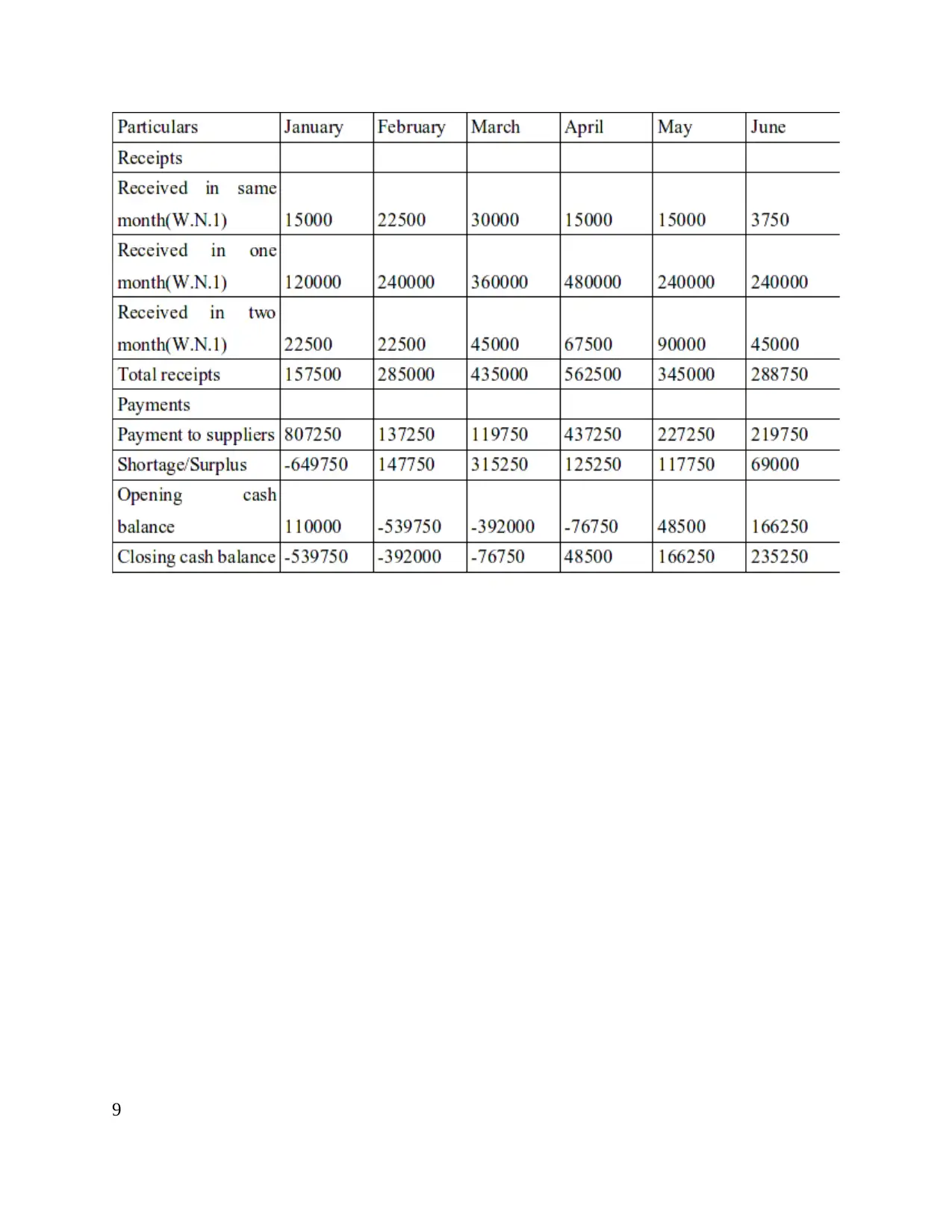

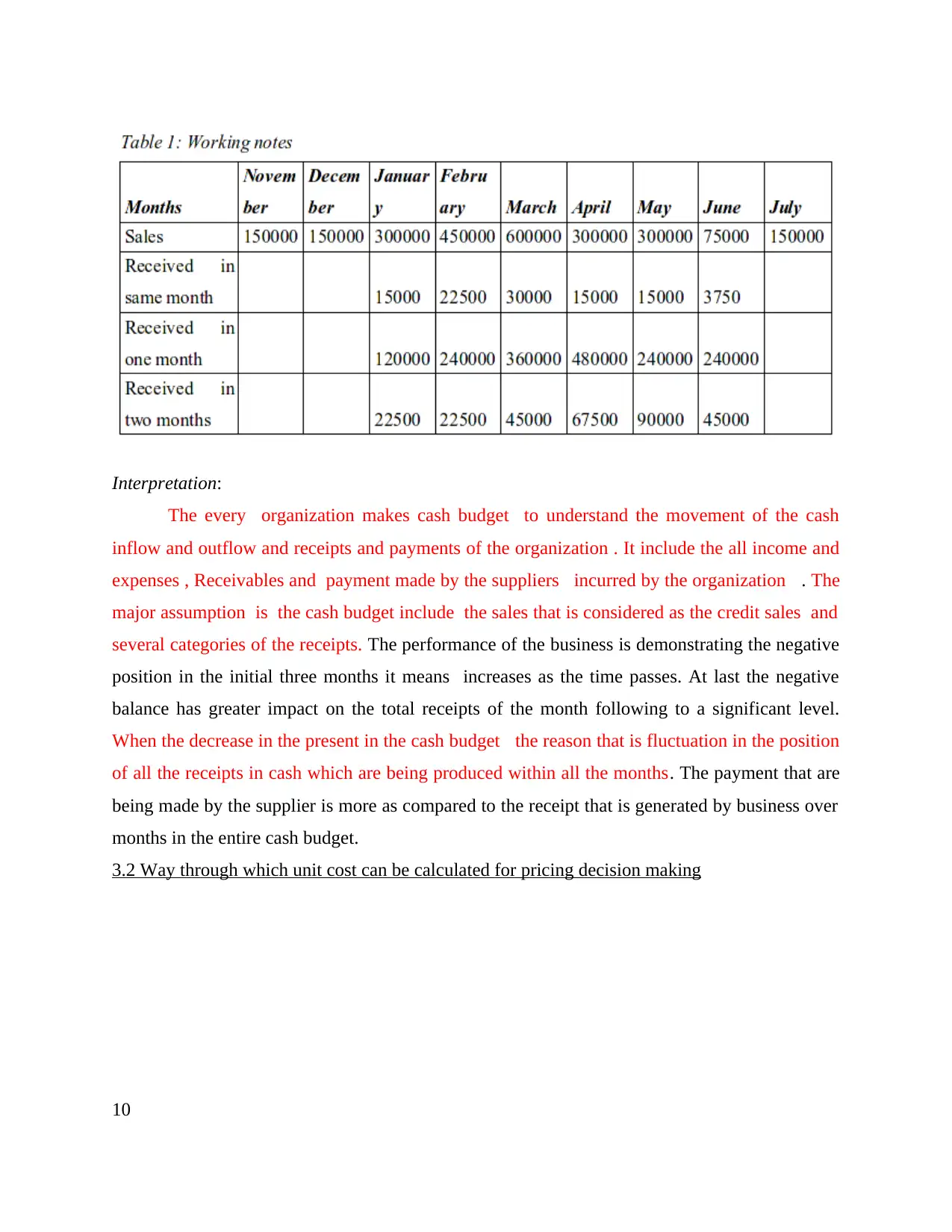

Interpretation:

The every organization makes cash budget to understand the movement of the cash

inflow and outflow and receipts and payments of the organization . It include the all income and

expenses , Receivables and payment made by the suppliers incurred by the organization . The

major assumption is the cash budget include the sales that is considered as the credit sales and

several categories of the receipts. The performance of the business is demonstrating the negative

position in the initial three months it means increases as the time passes. At last the negative

balance has greater impact on the total receipts of the month following to a significant level.

When the decrease in the present in the cash budget the reason that is fluctuation in the position

of all the receipts in cash which are being produced within all the months. The payment that are

being made by the supplier is more as compared to the receipt that is generated by business over

months in the entire cash budget.

3.2 Way through which unit cost can be calculated for pricing decision making

10

The every organization makes cash budget to understand the movement of the cash

inflow and outflow and receipts and payments of the organization . It include the all income and

expenses , Receivables and payment made by the suppliers incurred by the organization . The

major assumption is the cash budget include the sales that is considered as the credit sales and

several categories of the receipts. The performance of the business is demonstrating the negative

position in the initial three months it means increases as the time passes. At last the negative

balance has greater impact on the total receipts of the month following to a significant level.

When the decrease in the present in the cash budget the reason that is fluctuation in the position

of all the receipts in cash which are being produced within all the months. The payment that are

being made by the supplier is more as compared to the receipt that is generated by business over

months in the entire cash budget.

3.2 Way through which unit cost can be calculated for pricing decision making

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

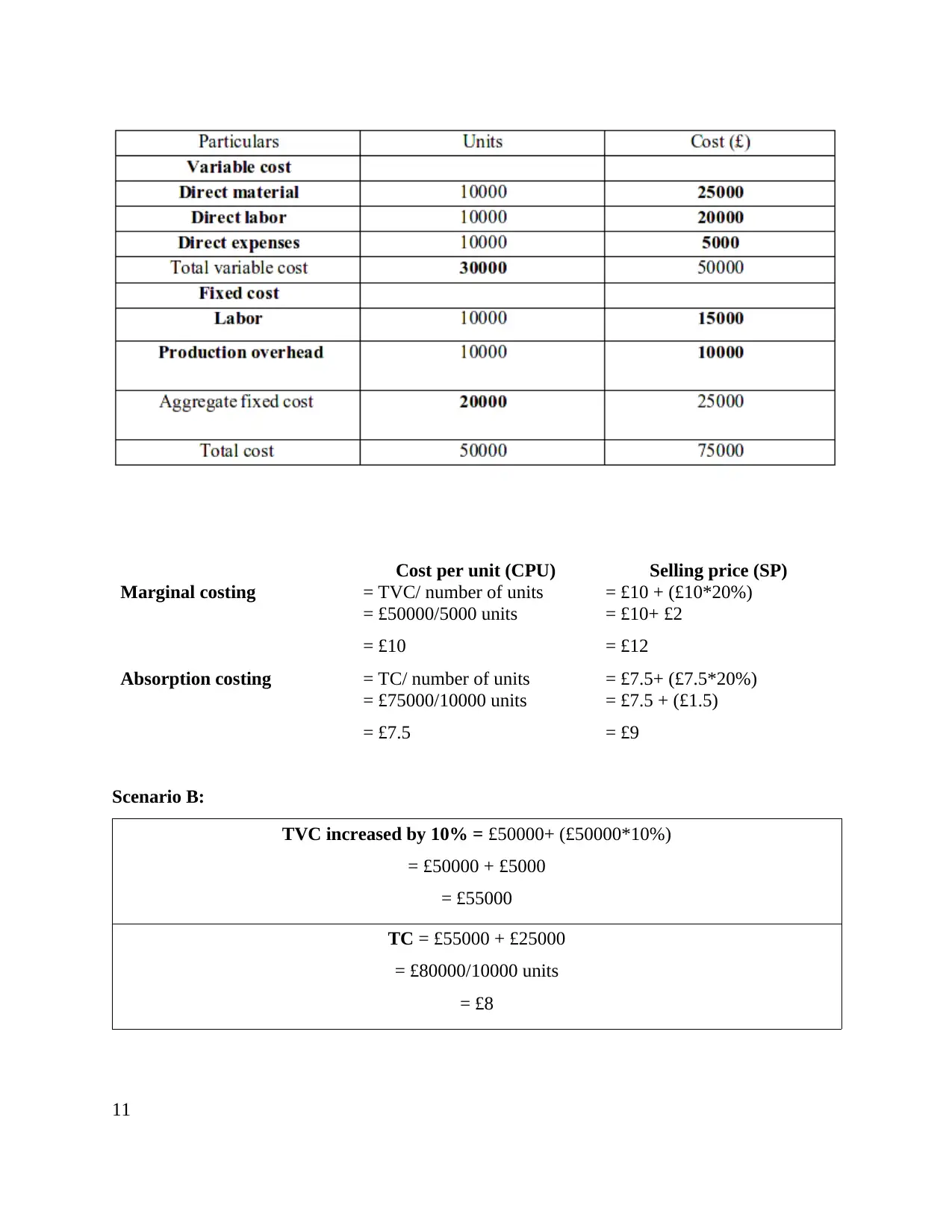

Cost per unit (CPU) Selling price (SP)

Marginal costing = TVC/ number of units

= £50000/5000 units

= £10

= £10 + (£10*20%)

= £10+ £2

= £12

Absorption costing = TC/ number of units

= £75000/10000 units

= £7.5

= £7.5+ (£7.5*20%)

= £7.5 + (£1.5)

= £9

Scenario B:

TVC increased by 10% = £50000+ (£50000*10%)

= £50000 + £5000

= £55000

TC = £55000 + £25000

= £80000/10000 units

= £8

11

Marginal costing = TVC/ number of units

= £50000/5000 units

= £10

= £10 + (£10*20%)

= £10+ £2

= £12

Absorption costing = TC/ number of units

= £75000/10000 units

= £7.5

= £7.5+ (£7.5*20%)

= £7.5 + (£1.5)

= £9

Scenario B:

TVC increased by 10% = £50000+ (£50000*10%)

= £50000 + £5000

= £55000

TC = £55000 + £25000

= £80000/10000 units

= £8

11

Cost per unit (CPU) Selling price (SP)

Marginal costing = TVC/ number of units

= £55000/10000 units

= £5.5

= £5.5 + (£5.5*20%)

= £5.5 + £1.1

= £6.6

Absorption costing = TC/ number of units

= £75000/10000 units

= £7.5

= £7.5 + (£7.5*20%)

= £7.5 + (£1.5)

= £8.6

On the basis of calculation above in relation with the unit cost of Clariton various

strategies in relation with pricing methods have been chosen in order to set the prices of the

products. These are stated in the manner as below: Cost plus pricing method: This method is followed in the several business in which the

rating of the product is developed by means of action into account all the kind of cost

elements along with the profit element as well (Davies and Drexler, 2010).

Differentiation: In this method the price offered to greater customer range on the basis

of present negotiating buyers ability. The development of competition will facilitates the

customers by means of offering products at lower prices in comparison with the rival of

the organization.

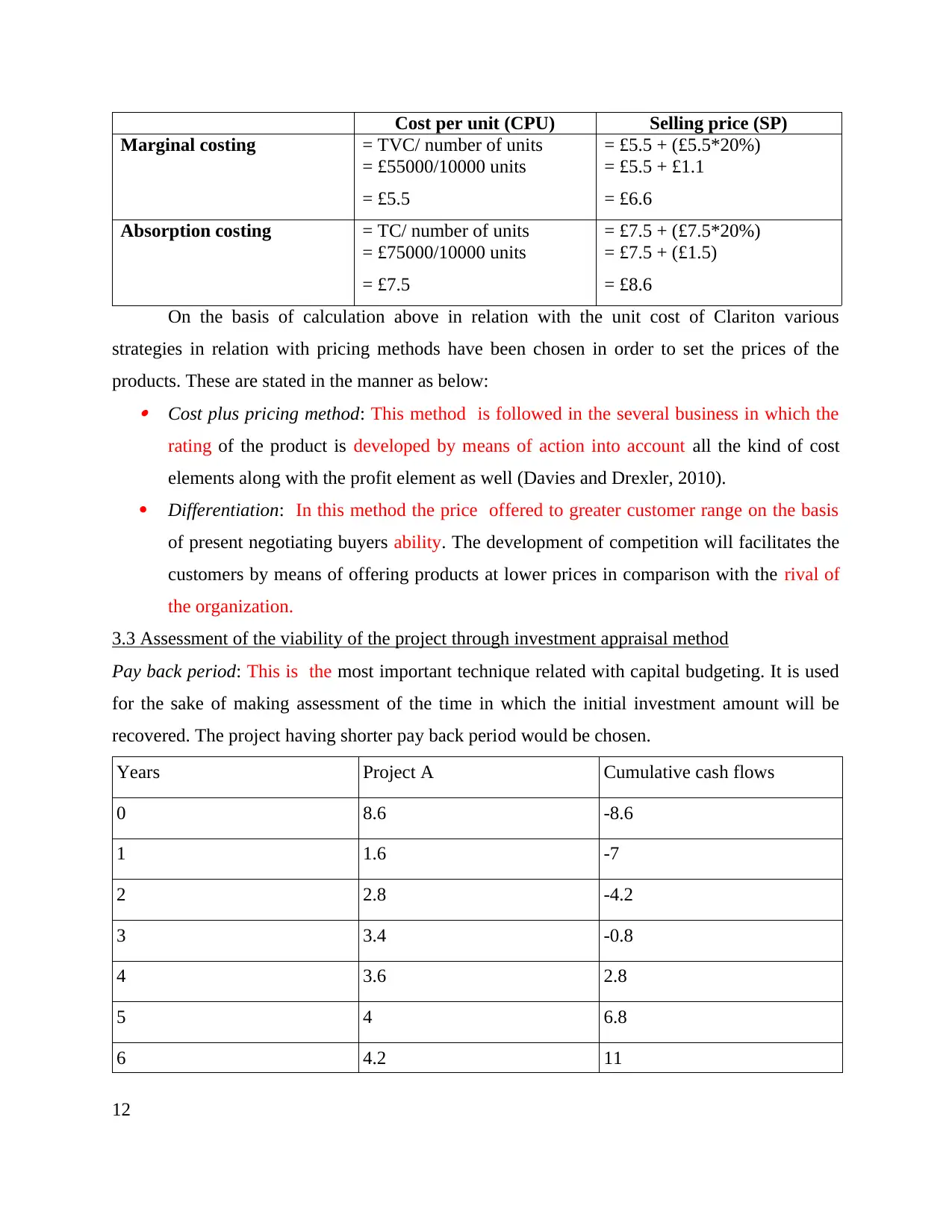

3.3 Assessment of the viability of the project through investment appraisal method

Pay back period: This is the most important technique related with capital budgeting. It is used

for the sake of making assessment of the time in which the initial investment amount will be

recovered. The project having shorter pay back period would be chosen.

Years Project A Cumulative cash flows

0 8.6 -8.6

1 1.6 -7

2 2.8 -4.2

3 3.4 -0.8

4 3.6 2.8

5 4 6.8

6 4.2 11

12

Marginal costing = TVC/ number of units

= £55000/10000 units

= £5.5

= £5.5 + (£5.5*20%)

= £5.5 + £1.1

= £6.6

Absorption costing = TC/ number of units

= £75000/10000 units

= £7.5

= £7.5 + (£7.5*20%)

= £7.5 + (£1.5)

= £8.6

On the basis of calculation above in relation with the unit cost of Clariton various

strategies in relation with pricing methods have been chosen in order to set the prices of the

products. These are stated in the manner as below: Cost plus pricing method: This method is followed in the several business in which the

rating of the product is developed by means of action into account all the kind of cost

elements along with the profit element as well (Davies and Drexler, 2010).

Differentiation: In this method the price offered to greater customer range on the basis

of present negotiating buyers ability. The development of competition will facilitates the

customers by means of offering products at lower prices in comparison with the rival of

the organization.

3.3 Assessment of the viability of the project through investment appraisal method

Pay back period: This is the most important technique related with capital budgeting. It is used

for the sake of making assessment of the time in which the initial investment amount will be

recovered. The project having shorter pay back period would be chosen.

Years Project A Cumulative cash flows

0 8.6 -8.6

1 1.6 -7

2 2.8 -4.2

3 3.4 -0.8

4 3.6 2.8

5 4 6.8

6 4.2 11

12

Calculation of payback period

= 3+0.8/3.6

=3+0.22

=3.22 years

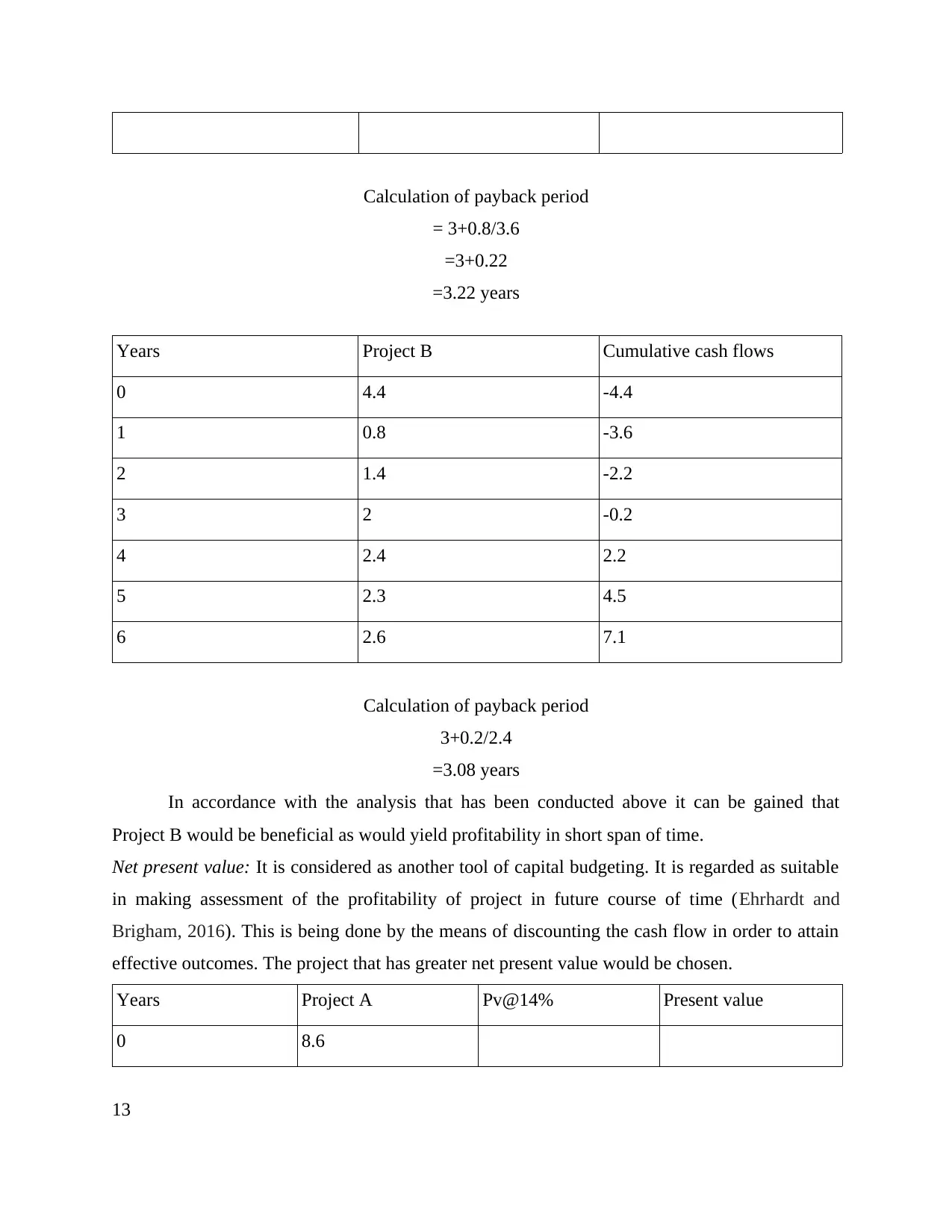

Years Project B Cumulative cash flows

0 4.4 -4.4

1 0.8 -3.6

2 1.4 -2.2

3 2 -0.2

4 2.4 2.2

5 2.3 4.5

6 2.6 7.1

Calculation of payback period

3+0.2/2.4

=3.08 years

In accordance with the analysis that has been conducted above it can be gained that

Project B would be beneficial as would yield profitability in short span of time.

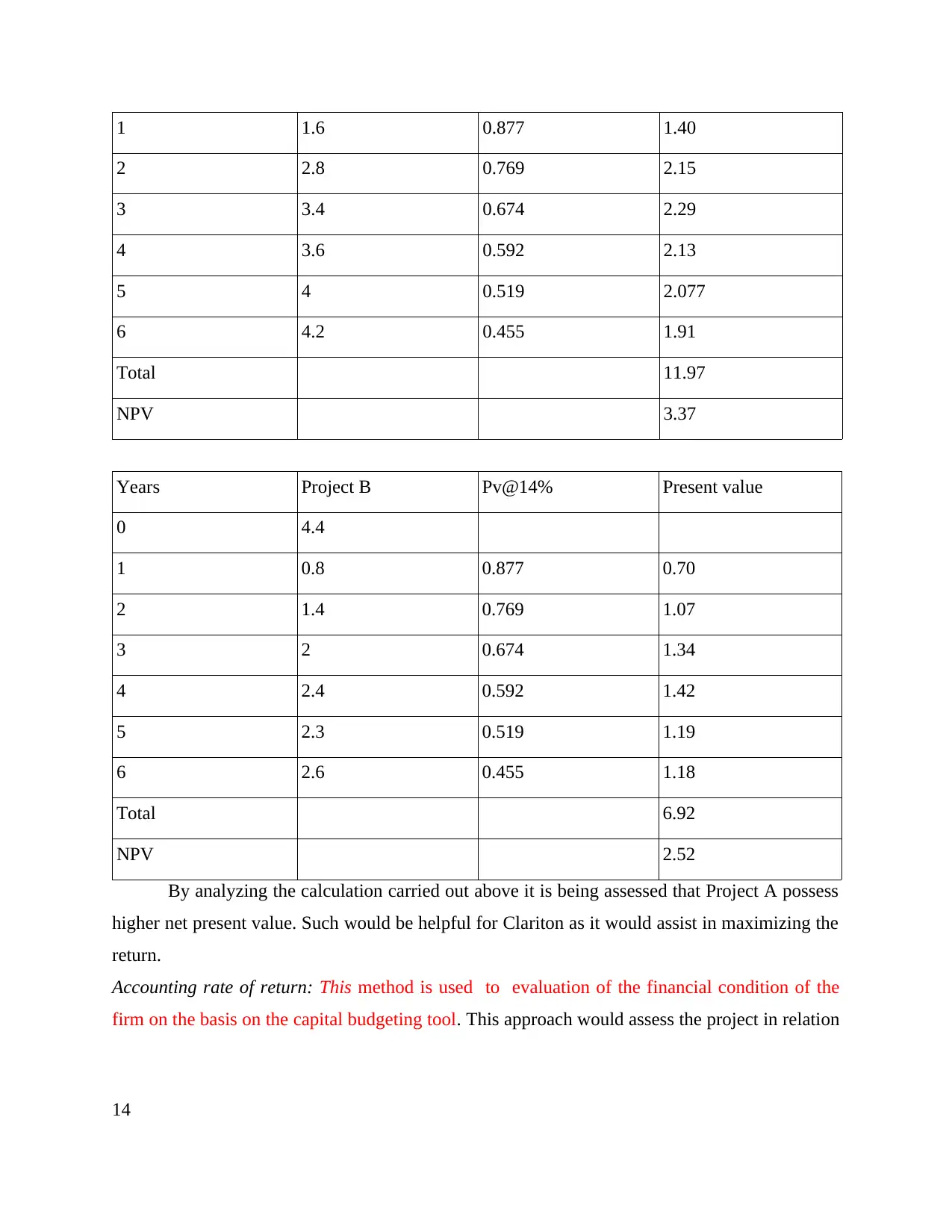

Net present value: It is considered as another tool of capital budgeting. It is regarded as suitable

in making assessment of the profitability of project in future course of time (Ehrhardt and

Brigham, 2016). This is being done by the means of discounting the cash flow in order to attain

effective outcomes. The project that has greater net present value would be chosen.

Years Project A Pv@14% Present value

0 8.6

13

= 3+0.8/3.6

=3+0.22

=3.22 years

Years Project B Cumulative cash flows

0 4.4 -4.4

1 0.8 -3.6

2 1.4 -2.2

3 2 -0.2

4 2.4 2.2

5 2.3 4.5

6 2.6 7.1

Calculation of payback period

3+0.2/2.4

=3.08 years

In accordance with the analysis that has been conducted above it can be gained that

Project B would be beneficial as would yield profitability in short span of time.

Net present value: It is considered as another tool of capital budgeting. It is regarded as suitable

in making assessment of the profitability of project in future course of time (Ehrhardt and

Brigham, 2016). This is being done by the means of discounting the cash flow in order to attain

effective outcomes. The project that has greater net present value would be chosen.

Years Project A Pv@14% Present value

0 8.6

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1 1.6 0.877 1.40

2 2.8 0.769 2.15

3 3.4 0.674 2.29

4 3.6 0.592 2.13

5 4 0.519 2.077

6 4.2 0.455 1.91

Total 11.97

NPV 3.37

Years Project B Pv@14% Present value

0 4.4

1 0.8 0.877 0.70

2 1.4 0.769 1.07

3 2 0.674 1.34

4 2.4 0.592 1.42

5 2.3 0.519 1.19

6 2.6 0.455 1.18

Total 6.92

NPV 2.52

By analyzing the calculation carried out above it is being assessed that Project A possess

higher net present value. Such would be helpful for Clariton as it would assist in maximizing the

return.

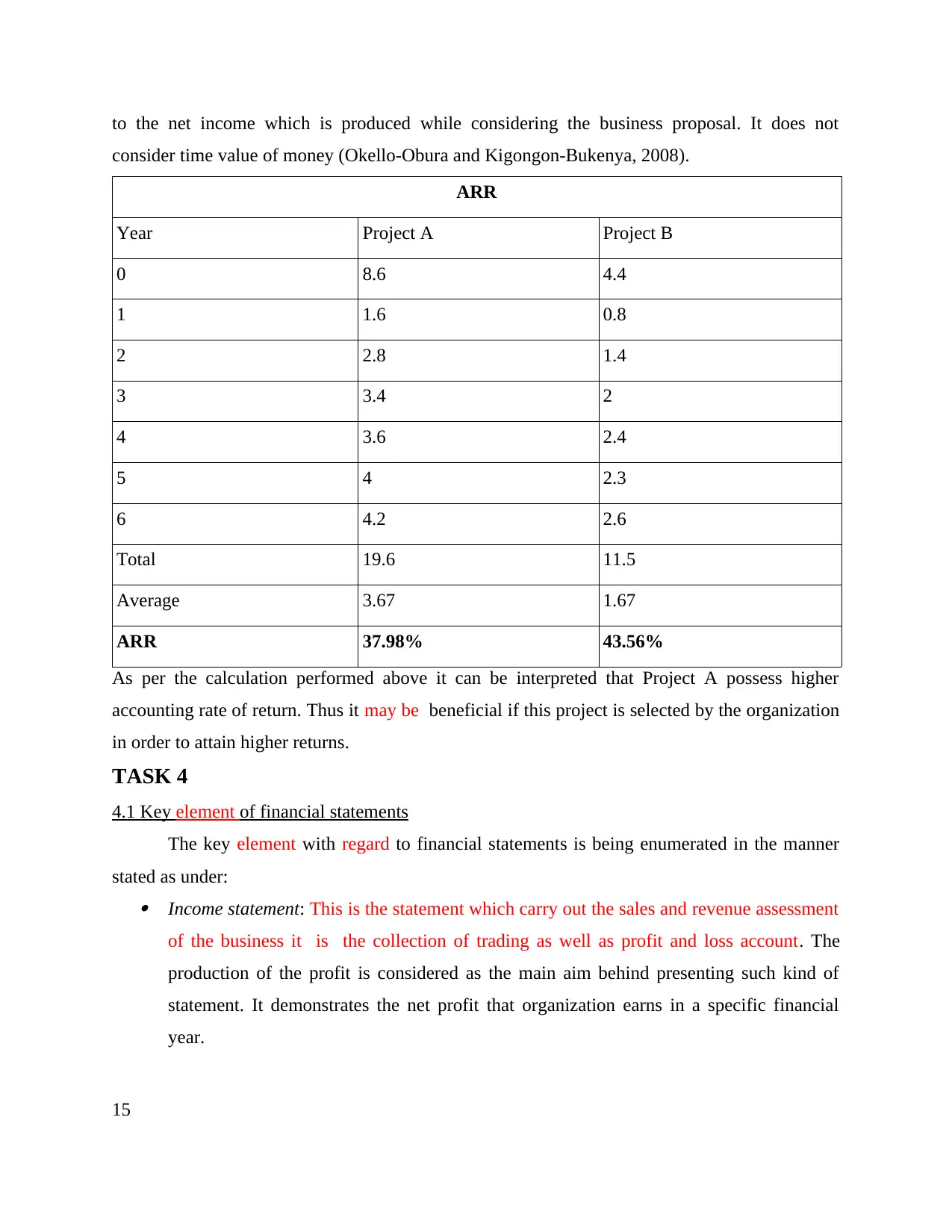

Accounting rate of return: This method is used to evaluation of the financial condition of the

firm on the basis on the capital budgeting tool. This approach would assess the project in relation

14

2 2.8 0.769 2.15

3 3.4 0.674 2.29

4 3.6 0.592 2.13

5 4 0.519 2.077

6 4.2 0.455 1.91

Total 11.97

NPV 3.37

Years Project B Pv@14% Present value

0 4.4

1 0.8 0.877 0.70

2 1.4 0.769 1.07

3 2 0.674 1.34

4 2.4 0.592 1.42

5 2.3 0.519 1.19

6 2.6 0.455 1.18

Total 6.92

NPV 2.52

By analyzing the calculation carried out above it is being assessed that Project A possess

higher net present value. Such would be helpful for Clariton as it would assist in maximizing the

return.

Accounting rate of return: This method is used to evaluation of the financial condition of the

firm on the basis on the capital budgeting tool. This approach would assess the project in relation

14

to the net income which is produced while considering the business proposal. It does not

consider time value of money (Okello-Obura and Kigongon-Bukenya, 2008).

ARR

Year Project A Project B

0 8.6 4.4

1 1.6 0.8

2 2.8 1.4

3 3.4 2

4 3.6 2.4

5 4 2.3

6 4.2 2.6

Total 19.6 11.5

Average 3.67 1.67

ARR 37.98% 43.56%

As per the calculation performed above it can be interpreted that Project A possess higher

accounting rate of return. Thus it may be beneficial if this project is selected by the organization

in order to attain higher returns.

TASK 4

4.1 Key element of financial statements

The key element with regard to financial statements is being enumerated in the manner

stated as under: Income statement: This is the statement which carry out the sales and revenue assessment

of the business it is the collection of trading as well as profit and loss account. The

production of the profit is considered as the main aim behind presenting such kind of

statement. It demonstrates the net profit that organization earns in a specific financial

year.

15

consider time value of money (Okello-Obura and Kigongon-Bukenya, 2008).

ARR

Year Project A Project B

0 8.6 4.4

1 1.6 0.8

2 2.8 1.4

3 3.4 2

4 3.6 2.4

5 4 2.3

6 4.2 2.6

Total 19.6 11.5

Average 3.67 1.67

ARR 37.98% 43.56%

As per the calculation performed above it can be interpreted that Project A possess higher

accounting rate of return. Thus it may be beneficial if this project is selected by the organization

in order to attain higher returns.

TASK 4

4.1 Key element of financial statements

The key element with regard to financial statements is being enumerated in the manner

stated as under: Income statement: This is the statement which carry out the sales and revenue assessment

of the business it is the collection of trading as well as profit and loss account. The

production of the profit is considered as the main aim behind presenting such kind of

statement. It demonstrates the net profit that organization earns in a specific financial

year.

15

Statement of cash flow: This is the statement prepare by means of monitoring the present

cash inflow and outflow in the business. The cash outflow can be reduced by means of

tracking the expenditure of organization. Statement of changes within equity: This is the important statement regarded as one of

the important part of the organization which results in enhancing the firm's capital in

order to fight against the competitors (Purce, 2014). The closing and opening equity

shares is considered by means of including the dividend amount. Statement of financial position: The financial position of the firm is assessed by the

means of determining the factors that includes assets and liabilities. This statement is

regarded as reflector of internal organizational performance along with estimation of

values of all kind of resources and attached financing.

Notes to financial statement: The accounts notes are refer to the notes in future period

time. This is detail as main advantage for the firm. The firm's owner may take into

account such notes through which alterations takes place in the values of several

components recorded in addition with the complete details (Winand and et.al., 2012). It

attains legal requirements through which changes are reflected over the years. This are

considered as the components of the financial statements.

4.2 differentiation the Claiton Antique and financial statement for other components

There are several formats of financial statements among the several business types. This

has been stated in the manner as below: Sole trader: Such type of firm is owned by the single Person. This type of firm makes

development of simple profit and loss account for the purpose of assessing the profits of

organization. Partnership: This type of the firm that which is run by two or more person. In this all

type of accounts like balance sheet, income statement and cash flow are developed

(Davies and Drexler, 2010). Along with this it prepares partner's capital account in terms

of capital contributes of each partner and their share of profit is assessed with

effectiveness.

16

cash inflow and outflow in the business. The cash outflow can be reduced by means of

tracking the expenditure of organization. Statement of changes within equity: This is the important statement regarded as one of

the important part of the organization which results in enhancing the firm's capital in

order to fight against the competitors (Purce, 2014). The closing and opening equity

shares is considered by means of including the dividend amount. Statement of financial position: The financial position of the firm is assessed by the

means of determining the factors that includes assets and liabilities. This statement is

regarded as reflector of internal organizational performance along with estimation of

values of all kind of resources and attached financing.

Notes to financial statement: The accounts notes are refer to the notes in future period

time. This is detail as main advantage for the firm. The firm's owner may take into

account such notes through which alterations takes place in the values of several

components recorded in addition with the complete details (Winand and et.al., 2012). It

attains legal requirements through which changes are reflected over the years. This are

considered as the components of the financial statements.

4.2 differentiation the Claiton Antique and financial statement for other components

There are several formats of financial statements among the several business types. This

has been stated in the manner as below: Sole trader: Such type of firm is owned by the single Person. This type of firm makes

development of simple profit and loss account for the purpose of assessing the profits of

organization. Partnership: This type of the firm that which is run by two or more person. In this all

type of accounts like balance sheet, income statement and cash flow are developed

(Davies and Drexler, 2010). Along with this it prepares partner's capital account in terms

of capital contributes of each partner and their share of profit is assessed with

effectiveness.

16

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Limited company: Clariton is considered as the limited company. Therefore it is required

to develop all account which involves cash flow, income statement and balance sheet.

Such is required to be in accordance with the international standards of accounting.

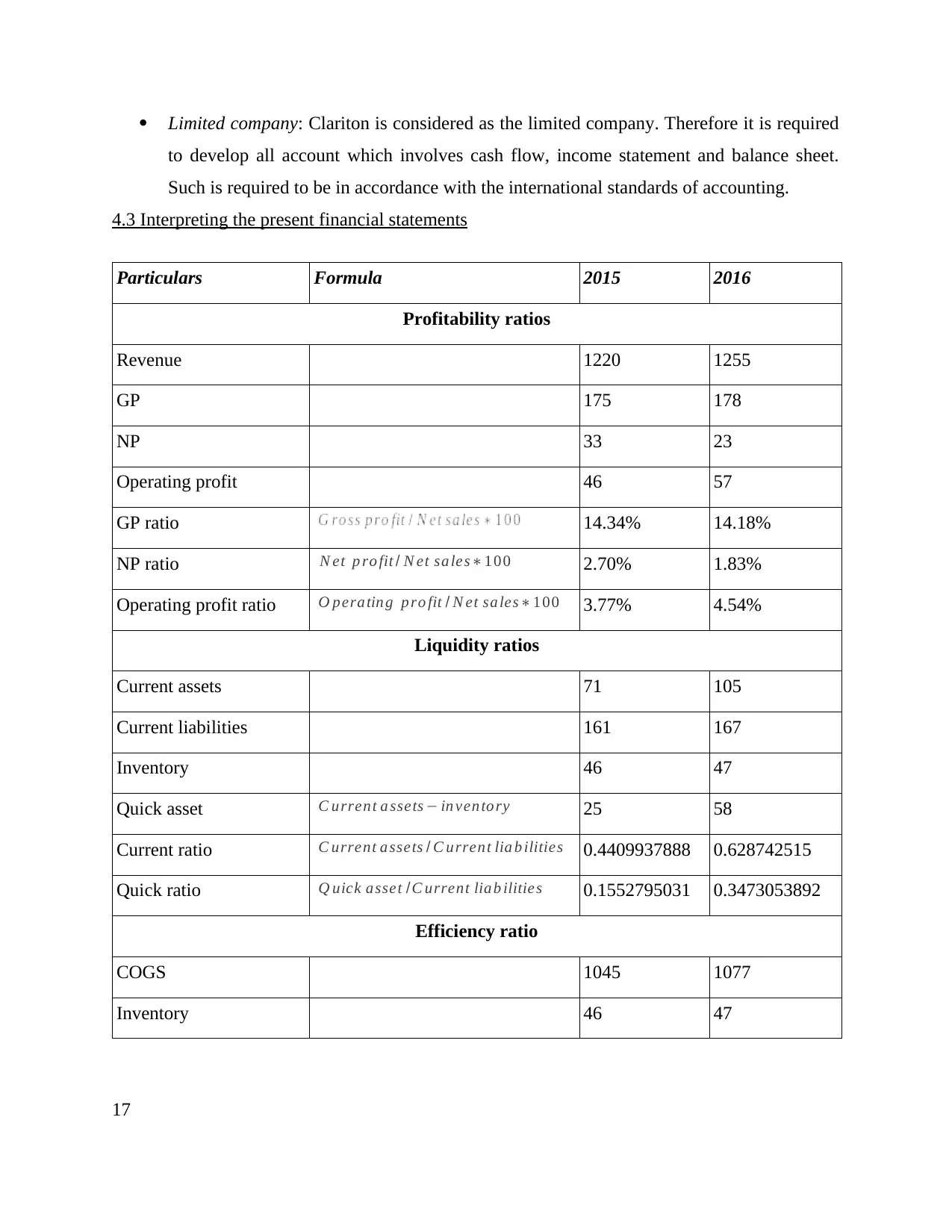

4.3 Interpreting the present financial statements

Particulars Formula 2015 2016

Profitability ratios

Revenue 1220 1255

GP 175 178

NP 33 23

Operating profit 46 57

GP ratio 14.34% 14.18%

NP ratio N et p ro fit / N et sa les∗100 2.70% 1.83%

Operating profit ratio O pera tin g p ro fit / N et sa les∗ 100 3.77% 4.54%

Liquidity ratios

Current assets 71 105

Current liabilities 161 167

Inventory 46 47

Quick asset C urrent a ssets − in ven tory 25 58

Current ratio C urrent a ssets / C urrent lia b ilitie s 0.4409937888 0.628742515

Quick ratio Q uick asset /C urrent lia b ilitie s 0.1552795031 0.3473053892

Efficiency ratio

COGS 1045 1077

Inventory 46 47

17

to develop all account which involves cash flow, income statement and balance sheet.

Such is required to be in accordance with the international standards of accounting.

4.3 Interpreting the present financial statements

Particulars Formula 2015 2016

Profitability ratios

Revenue 1220 1255

GP 175 178

NP 33 23

Operating profit 46 57

GP ratio 14.34% 14.18%

NP ratio N et p ro fit / N et sa les∗100 2.70% 1.83%

Operating profit ratio O pera tin g p ro fit / N et sa les∗ 100 3.77% 4.54%

Liquidity ratios

Current assets 71 105

Current liabilities 161 167

Inventory 46 47

Quick asset C urrent a ssets − in ven tory 25 58

Current ratio C urrent a ssets / C urrent lia b ilitie s 0.4409937888 0.628742515

Quick ratio Q uick asset /C urrent lia b ilitie s 0.1552795031 0.3473053892

Efficiency ratio

COGS 1045 1077

Inventory 46 47

17

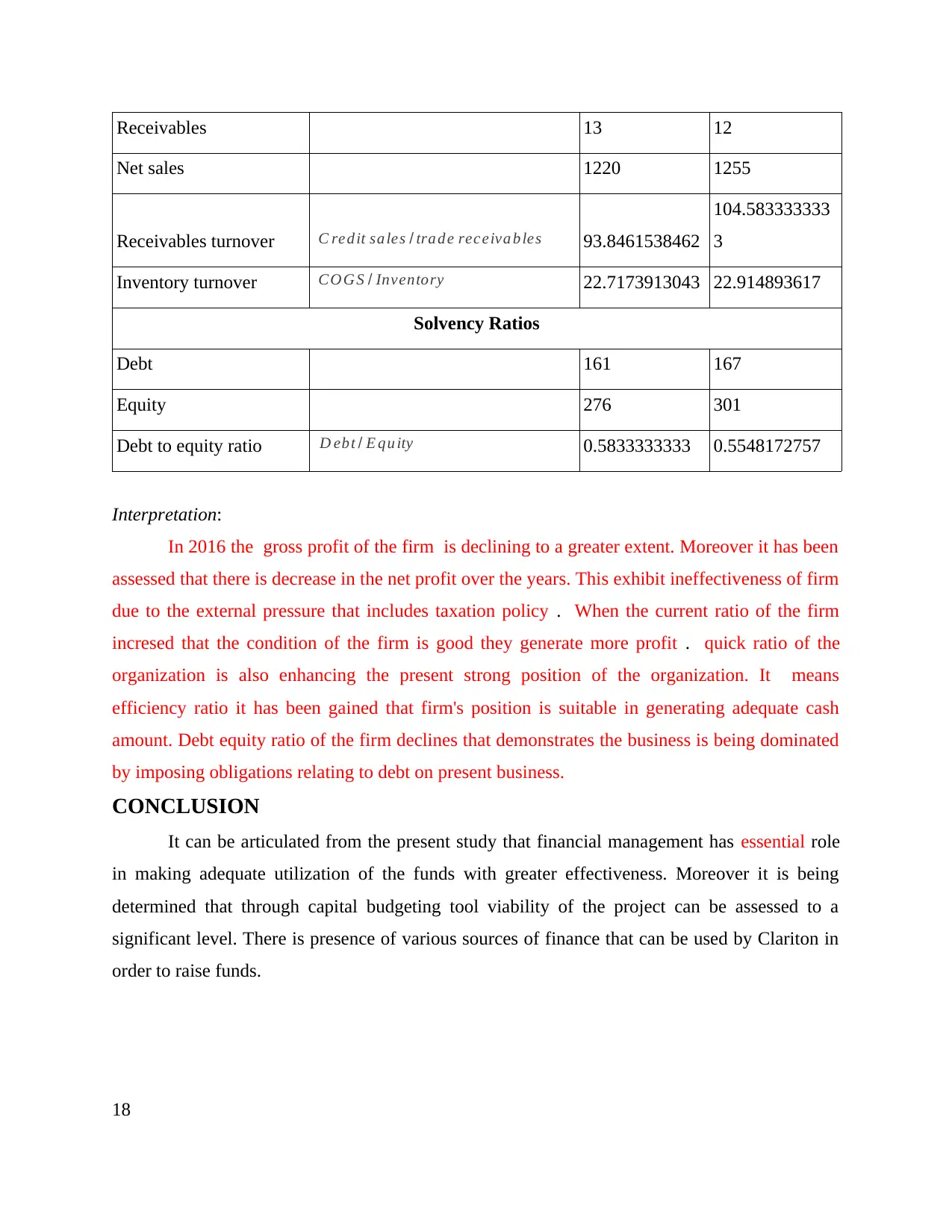

Receivables 13 12

Net sales 1220 1255

Receivables turnover C red it sa les / tra d e receiva b les 93.8461538462

104.583333333

3

Inventory turnover C O G S / Inventory 22.7173913043 22.914893617

Solvency Ratios

Debt 161 167

Equity 276 301

Debt to equity ratio D ebt / E qu ity 0.5833333333 0.5548172757

Interpretation:

In 2016 the gross profit of the firm is declining to a greater extent. Moreover it has been

assessed that there is decrease in the net profit over the years. This exhibit ineffectiveness of firm

due to the external pressure that includes taxation policy . When the current ratio of the firm

incresed that the condition of the firm is good they generate more profit . quick ratio of the

organization is also enhancing the present strong position of the organization. It means

efficiency ratio it has been gained that firm's position is suitable in generating adequate cash

amount. Debt equity ratio of the firm declines that demonstrates the business is being dominated

by imposing obligations relating to debt on present business.

CONCLUSION

It can be articulated from the present study that financial management has essential role

in making adequate utilization of the funds with greater effectiveness. Moreover it is being

determined that through capital budgeting tool viability of the project can be assessed to a

significant level. There is presence of various sources of finance that can be used by Clariton in

order to raise funds.

18

Net sales 1220 1255

Receivables turnover C red it sa les / tra d e receiva b les 93.8461538462

104.583333333

3

Inventory turnover C O G S / Inventory 22.7173913043 22.914893617

Solvency Ratios

Debt 161 167

Equity 276 301

Debt to equity ratio D ebt / E qu ity 0.5833333333 0.5548172757

Interpretation:

In 2016 the gross profit of the firm is declining to a greater extent. Moreover it has been

assessed that there is decrease in the net profit over the years. This exhibit ineffectiveness of firm

due to the external pressure that includes taxation policy . When the current ratio of the firm

incresed that the condition of the firm is good they generate more profit . quick ratio of the

organization is also enhancing the present strong position of the organization. It means

efficiency ratio it has been gained that firm's position is suitable in generating adequate cash

amount. Debt equity ratio of the firm declines that demonstrates the business is being dominated

by imposing obligations relating to debt on present business.

CONCLUSION

It can be articulated from the present study that financial management has essential role

in making adequate utilization of the funds with greater effectiveness. Moreover it is being

determined that through capital budgeting tool viability of the project can be assessed to a

significant level. There is presence of various sources of finance that can be used by Clariton in

order to raise funds.

18

19

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

20

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.