Inventory Management and Control: Decision Analysis & Valuation

VerifiedAdded on 2023/01/23

|15

|2750

|83

Homework Assignment

AI Summary

This assignment solution covers key aspects of inventory management and control, including decision analysis, economic order quantity (EOQ) calculations, and inventory control strategies. It delves into inventory valuation methods such as FIFO, LIFO, and weighted average cost, providing detailed calculations and profit analyses for each. Furthermore, the solution incorporates linear regression analysis to forecast sales based on historical data, examining the relationship between sales and both year and market spending. The document includes tables and figures to illustrate the analysis and calculations, offering a comprehensive understanding of the concepts and their practical applications. The solution provides a detailed step-by-step guide to each section of the assignment, including the formulas and calculations used to arrive at the results.

Inventory Management and Control

Course Name:

University:

Student Name:

Student Number:

Section:

Submission Date:

Course Name:

University:

Student Name:

Student Number:

Section:

Submission Date:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

1. Decision analysis...........................................................................................................3

2. Economic order quantity................................................................................................3

3. Inventory control............................................................................................................5

4. Inventory valuation.........................................................................................................7

5. Linear Regression........................................................................................................10

5.a Y (sales) versus X (year).......................................................................................10

5.b Y (sales) versus X (market$).................................................................................12

List of Figures

Figure 1: Scatter plot of Y (sales) versus X (year)..........................................................11

Figure 2: Scatter plot of Y (sales) versus X (market$)....................................................13

List of Tables

Table 1: Payoff table for decision analysis........................................................................4

Table 2: Inventory valuation (FIFO) and profit calculation................................................8

Table 3: Inventory valuation (LIFO) and profit calculation.................................................9

Table 4: Inventory valuation (Weighted Cost) and profit calculation...............................10

Table 5: least square point estimates for Y (sales) versus X (year)...............................12

Table 6: least square point estimates for Y (sales) versus X (market$).........................14

1. Decision analysis...........................................................................................................3

2. Economic order quantity................................................................................................3

3. Inventory control............................................................................................................5

4. Inventory valuation.........................................................................................................7

5. Linear Regression........................................................................................................10

5.a Y (sales) versus X (year).......................................................................................10

5.b Y (sales) versus X (market$).................................................................................12

List of Figures

Figure 1: Scatter plot of Y (sales) versus X (year)..........................................................11

Figure 2: Scatter plot of Y (sales) versus X (market$)....................................................13

List of Tables

Table 1: Payoff table for decision analysis........................................................................4

Table 2: Inventory valuation (FIFO) and profit calculation................................................8

Table 3: Inventory valuation (LIFO) and profit calculation.................................................9

Table 4: Inventory valuation (Weighted Cost) and profit calculation...............................10

Table 5: least square point estimates for Y (sales) versus X (year)...............................12

Table 6: least square point estimates for Y (sales) versus X (market$).........................14

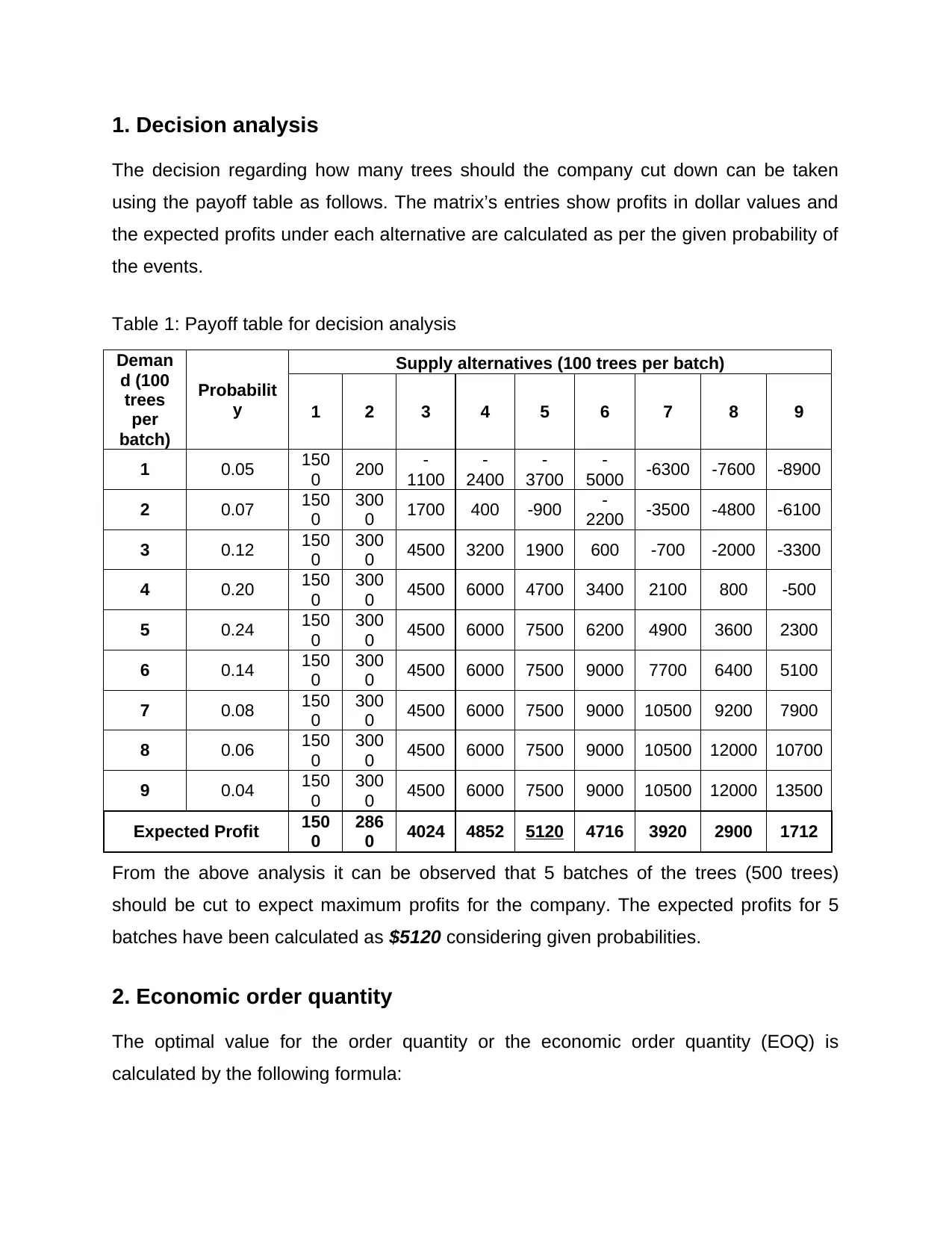

1. Decision analysis

The decision regarding how many trees should the company cut down can be taken

using the payoff table as follows. The matrix’s entries show profits in dollar values and

the expected profits under each alternative are calculated as per the given probability of

the events.

Table 1: Payoff table for decision analysis

Deman

d (100

trees

per

batch)

Probabilit

y

Supply alternatives (100 trees per batch)

1 2 3 4 5 6 7 8 9

1 0.05 150

0 200 -

1100

-

2400

-

3700

-

5000 -6300 -7600 -8900

2 0.07 150

0

300

0 1700 400 -900 -

2200 -3500 -4800 -6100

3 0.12 150

0

300

0 4500 3200 1900 600 -700 -2000 -3300

4 0.20 150

0

300

0 4500 6000 4700 3400 2100 800 -500

5 0.24 150

0

300

0 4500 6000 7500 6200 4900 3600 2300

6 0.14 150

0

300

0 4500 6000 7500 9000 7700 6400 5100

7 0.08 150

0

300

0 4500 6000 7500 9000 10500 9200 7900

8 0.06 150

0

300

0 4500 6000 7500 9000 10500 12000 10700

9 0.04 150

0

300

0 4500 6000 7500 9000 10500 12000 13500

Expected Profit 150

0

286

0 4024 4852 5120 4716 3920 2900 1712

From the above analysis it can be observed that 5 batches of the trees (500 trees)

should be cut to expect maximum profits for the company. The expected profits for 5

batches have been calculated as $5120 considering given probabilities.

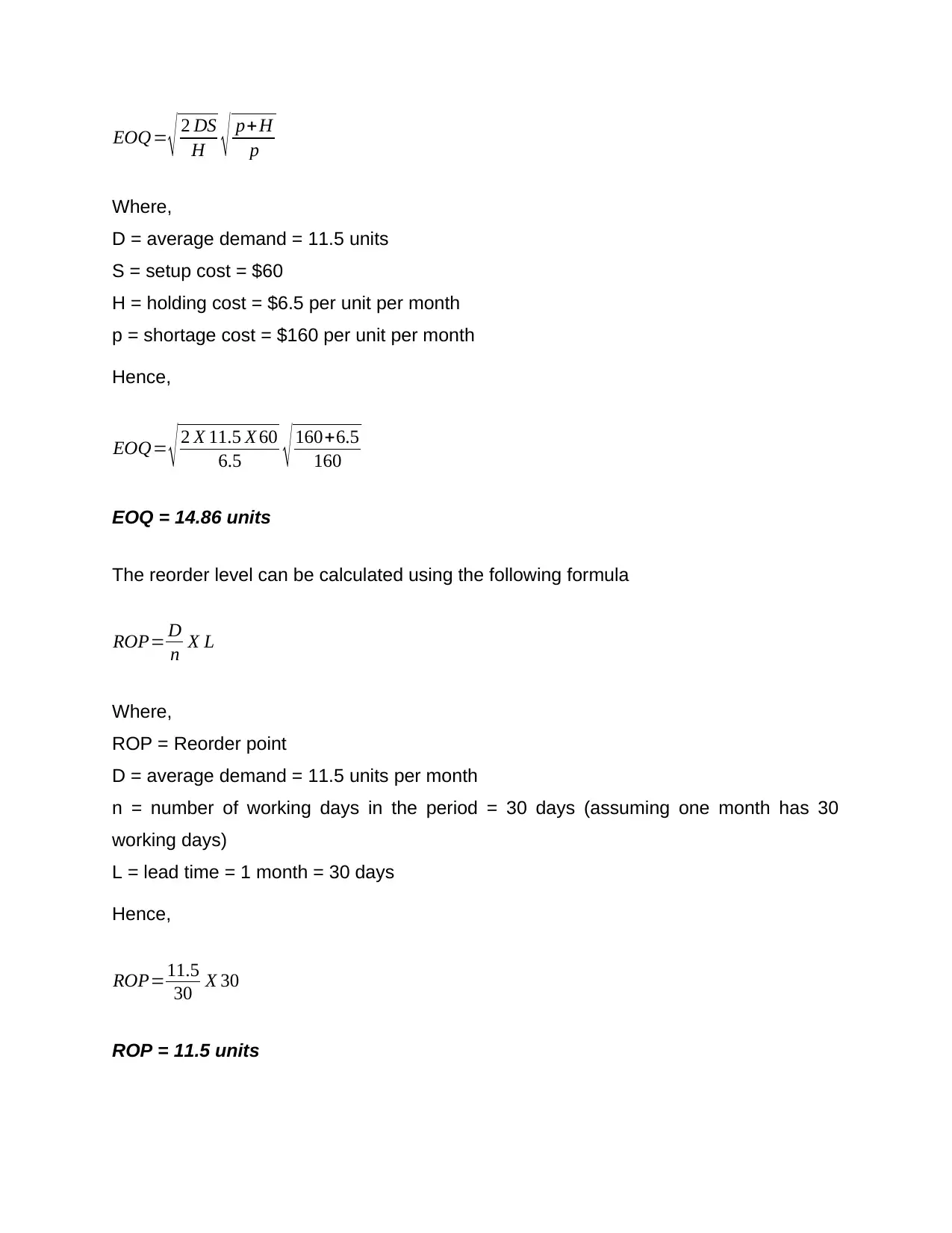

2. Economic order quantity

The optimal value for the order quantity or the economic order quantity (EOQ) is

calculated by the following formula:

The decision regarding how many trees should the company cut down can be taken

using the payoff table as follows. The matrix’s entries show profits in dollar values and

the expected profits under each alternative are calculated as per the given probability of

the events.

Table 1: Payoff table for decision analysis

Deman

d (100

trees

per

batch)

Probabilit

y

Supply alternatives (100 trees per batch)

1 2 3 4 5 6 7 8 9

1 0.05 150

0 200 -

1100

-

2400

-

3700

-

5000 -6300 -7600 -8900

2 0.07 150

0

300

0 1700 400 -900 -

2200 -3500 -4800 -6100

3 0.12 150

0

300

0 4500 3200 1900 600 -700 -2000 -3300

4 0.20 150

0

300

0 4500 6000 4700 3400 2100 800 -500

5 0.24 150

0

300

0 4500 6000 7500 6200 4900 3600 2300

6 0.14 150

0

300

0 4500 6000 7500 9000 7700 6400 5100

7 0.08 150

0

300

0 4500 6000 7500 9000 10500 9200 7900

8 0.06 150

0

300

0 4500 6000 7500 9000 10500 12000 10700

9 0.04 150

0

300

0 4500 6000 7500 9000 10500 12000 13500

Expected Profit 150

0

286

0 4024 4852 5120 4716 3920 2900 1712

From the above analysis it can be observed that 5 batches of the trees (500 trees)

should be cut to expect maximum profits for the company. The expected profits for 5

batches have been calculated as $5120 considering given probabilities.

2. Economic order quantity

The optimal value for the order quantity or the economic order quantity (EOQ) is

calculated by the following formula:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

EOQ= √ 2 DS

H √ p+H

p

Where,

D = average demand = 11.5 units

S = setup cost = $60

H = holding cost = $6.5 per unit per month

p = shortage cost = $160 per unit per month

Hence,

EOQ= √ 2 X 11.5 X 60

6.5 √ 160+6.5

160

EOQ = 14.86 units

The reorder level can be calculated using the following formula

ROP= D

n X L

Where,

ROP = Reorder point

D = average demand = 11.5 units per month

n = number of working days in the period = 30 days (assuming one month has 30

working days)

L = lead time = 1 month = 30 days

Hence,

ROP=11.5

30 X 30

ROP = 11.5 units

H √ p+H

p

Where,

D = average demand = 11.5 units

S = setup cost = $60

H = holding cost = $6.5 per unit per month

p = shortage cost = $160 per unit per month

Hence,

EOQ= √ 2 X 11.5 X 60

6.5 √ 160+6.5

160

EOQ = 14.86 units

The reorder level can be calculated using the following formula

ROP= D

n X L

Where,

ROP = Reorder point

D = average demand = 11.5 units per month

n = number of working days in the period = 30 days (assuming one month has 30

working days)

L = lead time = 1 month = 30 days

Hence,

ROP=11.5

30 X 30

ROP = 11.5 units

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

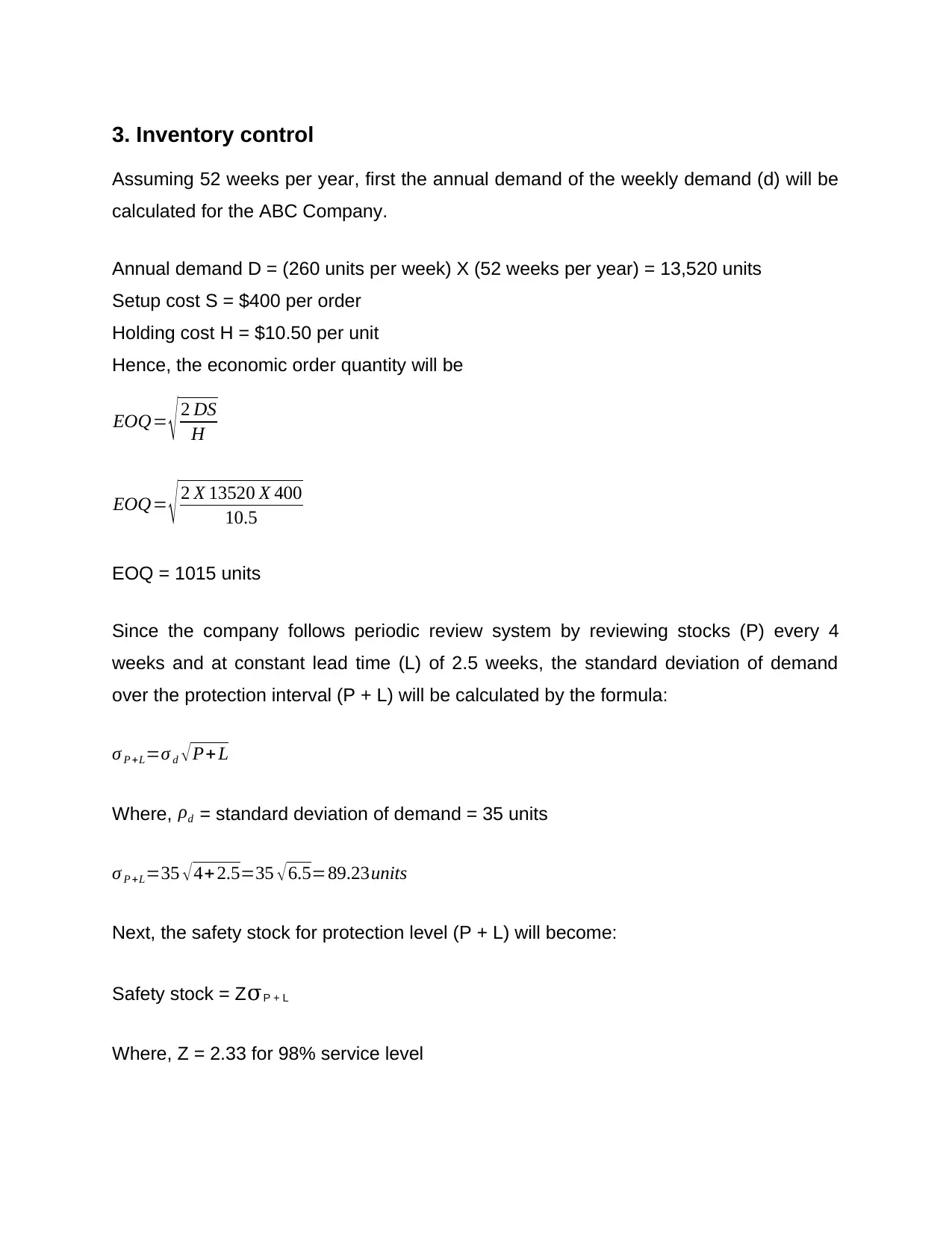

3. Inventory control

Assuming 52 weeks per year, first the annual demand of the weekly demand (d) will be

calculated for the ABC Company.

Annual demand D = (260 units per week) X (52 weeks per year) = 13,520 units

Setup cost S = $400 per order

Holding cost H = $10.50 per unit

Hence, the economic order quantity will be

EOQ= √ 2 DS

H

EOQ= √ 2 X 13520 X 400

10.5

EOQ = 1015 units

Since the company follows periodic review system by reviewing stocks (P) every 4

weeks and at constant lead time (L) of 2.5 weeks, the standard deviation of demand

over the protection interval (P + L) will be calculated by the formula:

σ P +L=σ d √ P+ L

Where, ρd = standard deviation of demand = 35 units

σ P +L=35 √ 4+ 2.5=35 √ 6.5=89.23units

Next, the safety stock for protection level (P + L) will become:

Safety stock = ZσP + L

Where, Z = 2.33 for 98% service level

Assuming 52 weeks per year, first the annual demand of the weekly demand (d) will be

calculated for the ABC Company.

Annual demand D = (260 units per week) X (52 weeks per year) = 13,520 units

Setup cost S = $400 per order

Holding cost H = $10.50 per unit

Hence, the economic order quantity will be

EOQ= √ 2 DS

H

EOQ= √ 2 X 13520 X 400

10.5

EOQ = 1015 units

Since the company follows periodic review system by reviewing stocks (P) every 4

weeks and at constant lead time (L) of 2.5 weeks, the standard deviation of demand

over the protection interval (P + L) will be calculated by the formula:

σ P +L=σ d √ P+ L

Where, ρd = standard deviation of demand = 35 units

σ P +L=35 √ 4+ 2.5=35 √ 6.5=89.23units

Next, the safety stock for protection level (P + L) will become:

Safety stock = ZσP + L

Where, Z = 2.33 for 98% service level

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Hence, Safety stock = 2.33 X 89.23 = 207.9 units = 208 units

Now the target inventory (T) or order quantity can be calculated using following formula:

T = d (P+L) + Safety stock = 260 (4 + 2.5) + 208

T = 1898 units

Total annual cost (C) will be the sum of all three costs as follows:

C= dP

2 ( H ) + D

dP ( S )+ Hz σ p+ L

C= 260 X 4

2 ( 10.5 ) + 13520

260 X 4 ( 400 ) +10.5 X 208

C = $12844

If the service level is changed to 99%, following changes to target inventory and total

costs would be observed.

New Z value at 99% = 2.575

Hence new T = d (P + L) + ZσP + L = 260 (4 + 2.5) + 2.575 X 35 √(4+2.5) = 1780 units

And new costs C= dP

2 ( H ) + D

dP ( S )+ Hz σ p+ L

¿ 260 X 4

2 ( 10.5 ) + 13520

260 X 4 ( 400 ) +10.5 X 2.575 X 35 √ 4 +2.5

C = $13072

Now the target inventory (T) or order quantity can be calculated using following formula:

T = d (P+L) + Safety stock = 260 (4 + 2.5) + 208

T = 1898 units

Total annual cost (C) will be the sum of all three costs as follows:

C= dP

2 ( H ) + D

dP ( S )+ Hz σ p+ L

C= 260 X 4

2 ( 10.5 ) + 13520

260 X 4 ( 400 ) +10.5 X 208

C = $12844

If the service level is changed to 99%, following changes to target inventory and total

costs would be observed.

New Z value at 99% = 2.575

Hence new T = d (P + L) + ZσP + L = 260 (4 + 2.5) + 2.575 X 35 √(4+2.5) = 1780 units

And new costs C= dP

2 ( H ) + D

dP ( S )+ Hz σ p+ L

¿ 260 X 4

2 ( 10.5 ) + 13520

260 X 4 ( 400 ) +10.5 X 2.575 X 35 √ 4 +2.5

C = $13072

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

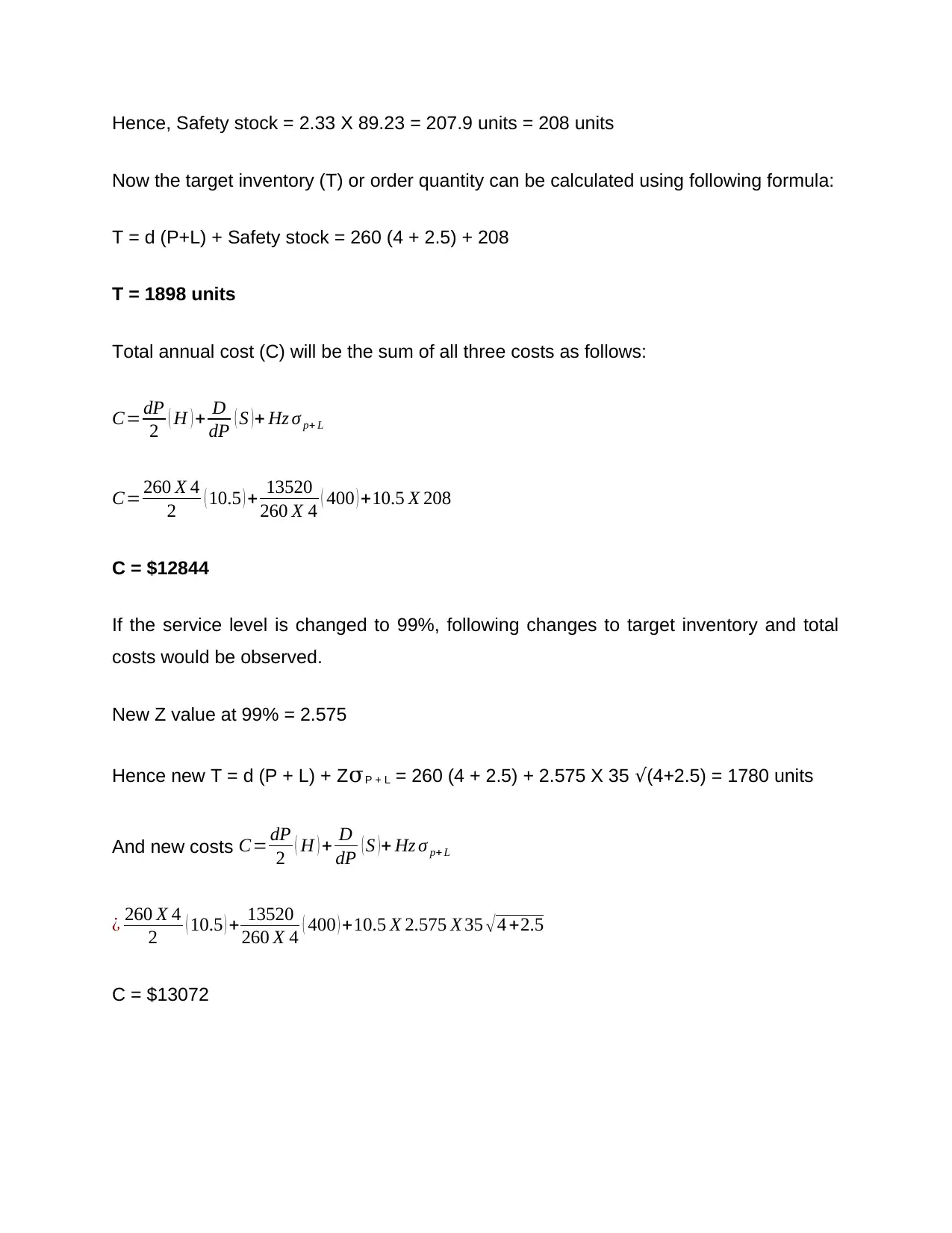

4. Inventory valuation

Calculation of profits for the company, if it follows FIFO (first-in-first-out) method of inventory valuation, is summarised in

below table.

Table 2: Inventory valuation (FIFO) and profit calculation

Purchase Sales Balance

COGS Profit

Month

Quantit

y

Unit

price

Total

Cost

Quantit

y

Unit

price

Total

revenue

Quantit

y

Unit

price

Total

cost

1 125 $28 $3,500 98 $40 $3,920 27 $28 $756 $2,744 $1,176

2 100 $26 $2,600 84 $40 $3,360 43 $26 $1,118 $756 $1,122

$1,482

3 150 $24 $3,600 128 $40 $5,120 65 $24 $1,560 $1,118 $1,962

$2,040

4 100 $25 $2,500 114 $40 $4,560 51 $25 $1,275 $1,560 $1,775

$1,225

5 75 $28 $2,100 82 $40 $3,280 44 $28 $1,232 $1,275 $1,137

$868

6 150 $30 $4,500 96 $40 $3,840 98 $30 $2,940 $1,232 $1,048

$1,560

Total : $18,800 $24,080 $2,940 $15,860 $8,220

Calculation of profits for the company, if it follows FIFO (first-in-first-out) method of inventory valuation, is summarised in

below table.

Table 2: Inventory valuation (FIFO) and profit calculation

Purchase Sales Balance

COGS Profit

Month

Quantit

y

Unit

price

Total

Cost

Quantit

y

Unit

price

Total

revenue

Quantit

y

Unit

price

Total

cost

1 125 $28 $3,500 98 $40 $3,920 27 $28 $756 $2,744 $1,176

2 100 $26 $2,600 84 $40 $3,360 43 $26 $1,118 $756 $1,122

$1,482

3 150 $24 $3,600 128 $40 $5,120 65 $24 $1,560 $1,118 $1,962

$2,040

4 100 $25 $2,500 114 $40 $4,560 51 $25 $1,275 $1,560 $1,775

$1,225

5 75 $28 $2,100 82 $40 $3,280 44 $28 $1,232 $1,275 $1,137

$868

6 150 $30 $4,500 96 $40 $3,840 98 $30 $2,940 $1,232 $1,048

$1,560

Total : $18,800 $24,080 $2,940 $15,860 $8,220

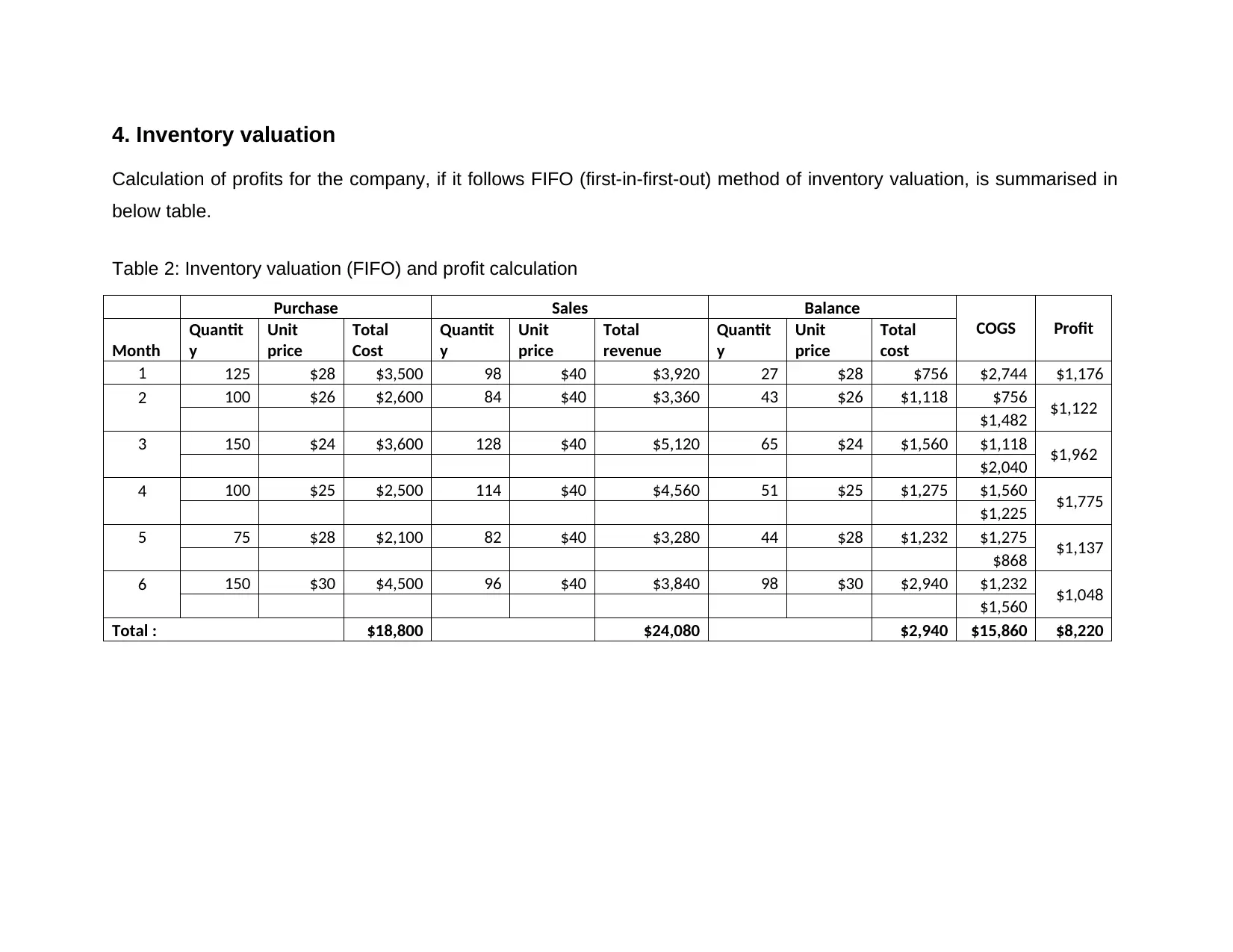

If the company follows LIFO (last-in-first-out) method, the inventory valuation and calculation of profit can be carried out

as follows:

Table 3: Inventory valuation (LIFO) and profit calculation

Purchase Sales Balance

COGS Profit

Month

Quantit

y

Unit

price

Total

cost

Quantit

y

Unit

price

Total

revenue

Quantit

y

Unit

price

Total

cost

1 125 $28 $3,500 98 $40 $3,920 27 $28 $756 $2,744 $1,176

2 100 $26 $2,600 84 $40 $3,360 27 $28 $756 $1,176

16 $26 $416 $2,184

3 150 $24 $3,600 128 $40 $5,120 27 $28 $756

$2,04816 $26 $416

22 $24 $528 $3,072

4 100 $25 $2,500 114 $40 $4,560 27 $28 $756

$1,72416 $26 $416 $336

8 $24 $192 $2,500

5 75 $28 $2,100 82 $40 $3,280 27 $28 $756

$1,01216 $26 $416 $168

1 $24 $24 $2,100

6 150 $30 $4,500 96 $40 $3,840 27 $28 $756

$960

16 $26 $416

1 $24 $24

54 $30 $1,620 $2,880

Total : $18,800 $24,080 $2,816 $15,984 $8,096

as follows:

Table 3: Inventory valuation (LIFO) and profit calculation

Purchase Sales Balance

COGS Profit

Month

Quantit

y

Unit

price

Total

cost

Quantit

y

Unit

price

Total

revenue

Quantit

y

Unit

price

Total

cost

1 125 $28 $3,500 98 $40 $3,920 27 $28 $756 $2,744 $1,176

2 100 $26 $2,600 84 $40 $3,360 27 $28 $756 $1,176

16 $26 $416 $2,184

3 150 $24 $3,600 128 $40 $5,120 27 $28 $756

$2,04816 $26 $416

22 $24 $528 $3,072

4 100 $25 $2,500 114 $40 $4,560 27 $28 $756

$1,72416 $26 $416 $336

8 $24 $192 $2,500

5 75 $28 $2,100 82 $40 $3,280 27 $28 $756

$1,01216 $26 $416 $168

1 $24 $24 $2,100

6 150 $30 $4,500 96 $40 $3,840 27 $28 $756

$960

16 $26 $416

1 $24 $24

54 $30 $1,620 $2,880

Total : $18,800 $24,080 $2,816 $15,984 $8,096

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

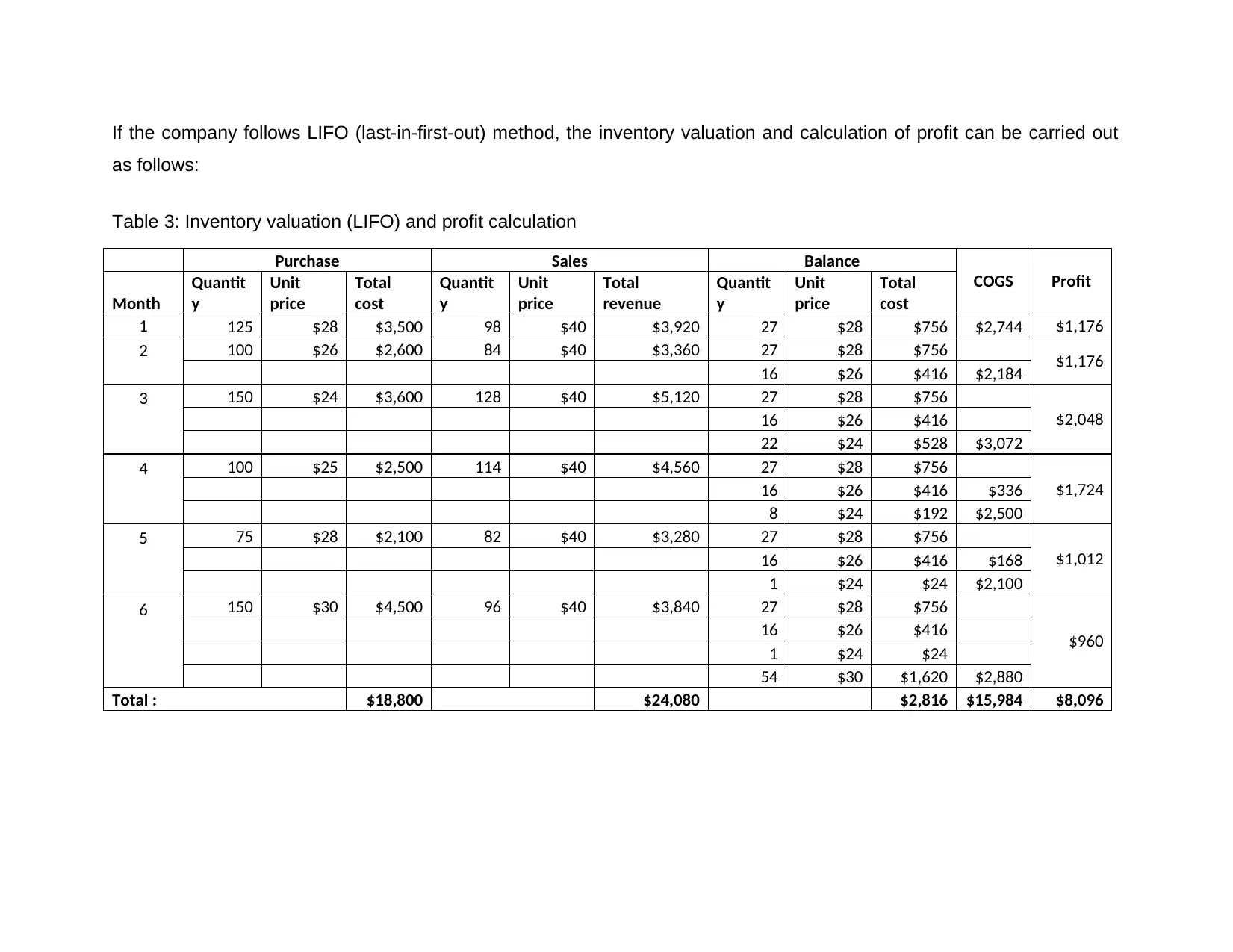

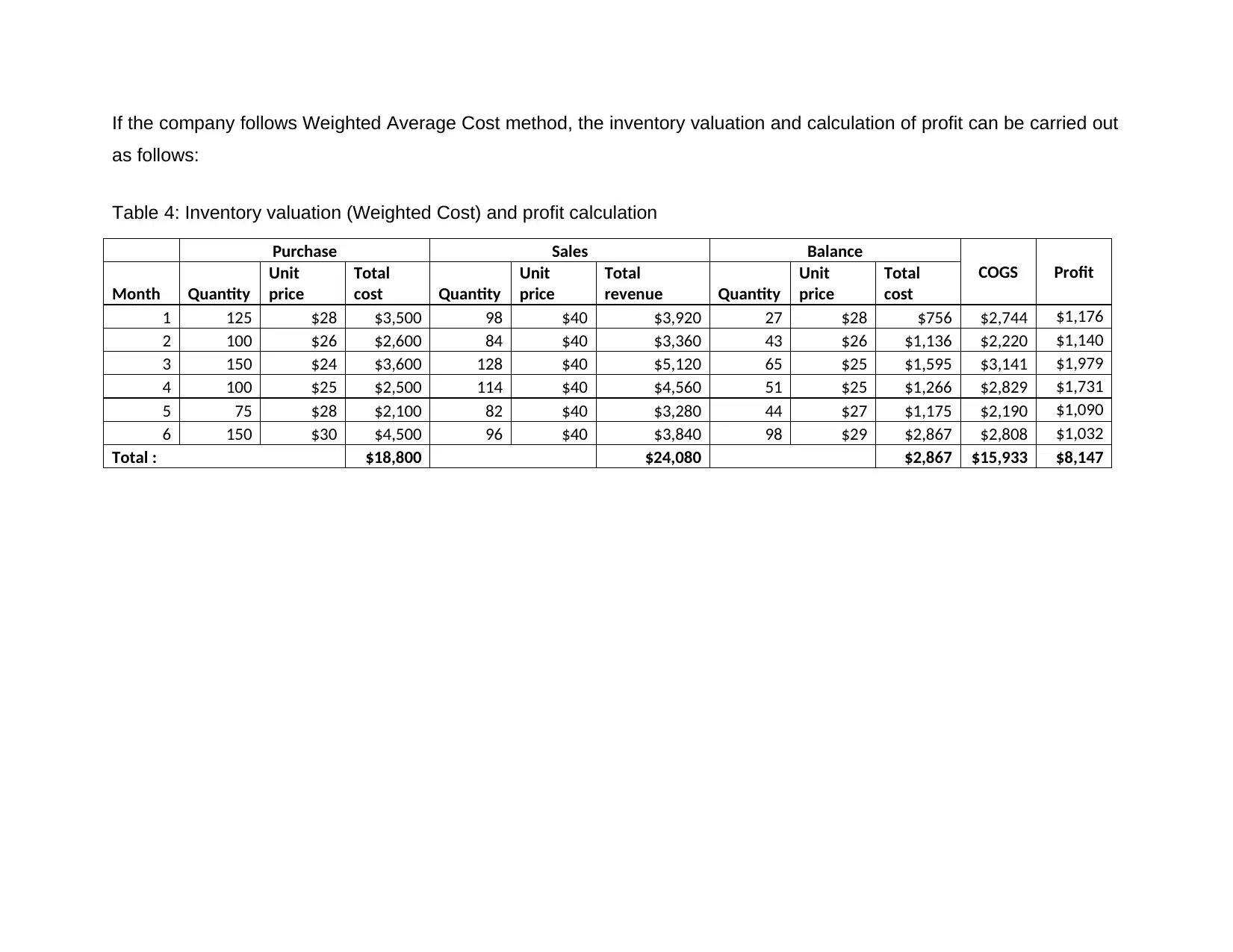

If the company follows Weighted Average Cost method, the inventory valuation and calculation of profit can be carried out

as follows:

Table 4: Inventory valuation (Weighted Cost) and profit calculation

Purchase Sales Balance

COGS Profit

Month Quantity

Unit

price

Total

cost Quantity

Unit

price

Total

revenue Quantity

Unit

price

Total

cost

1 125 $28 $3,500 98 $40 $3,920 27 $28 $756 $2,744 $1,176

2 100 $26 $2,600 84 $40 $3,360 43 $26 $1,136 $2,220 $1,140

3 150 $24 $3,600 128 $40 $5,120 65 $25 $1,595 $3,141 $1,979

4 100 $25 $2,500 114 $40 $4,560 51 $25 $1,266 $2,829 $1,731

5 75 $28 $2,100 82 $40 $3,280 44 $27 $1,175 $2,190 $1,090

6 150 $30 $4,500 96 $40 $3,840 98 $29 $2,867 $2,808 $1,032

Total : $18,800 $24,080 $2,867 $15,933 $8,147

as follows:

Table 4: Inventory valuation (Weighted Cost) and profit calculation

Purchase Sales Balance

COGS Profit

Month Quantity

Unit

price

Total

cost Quantity

Unit

price

Total

revenue Quantity

Unit

price

Total

cost

1 125 $28 $3,500 98 $40 $3,920 27 $28 $756 $2,744 $1,176

2 100 $26 $2,600 84 $40 $3,360 43 $26 $1,136 $2,220 $1,140

3 150 $24 $3,600 128 $40 $5,120 65 $25 $1,595 $3,141 $1,979

4 100 $25 $2,500 114 $40 $4,560 51 $25 $1,266 $2,829 $1,731

5 75 $28 $2,100 82 $40 $3,280 44 $27 $1,175 $2,190 $1,090

6 150 $30 $4,500 96 $40 $3,840 98 $29 $2,867 $2,808 $1,032

Total : $18,800 $24,080 $2,867 $15,933 $8,147

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

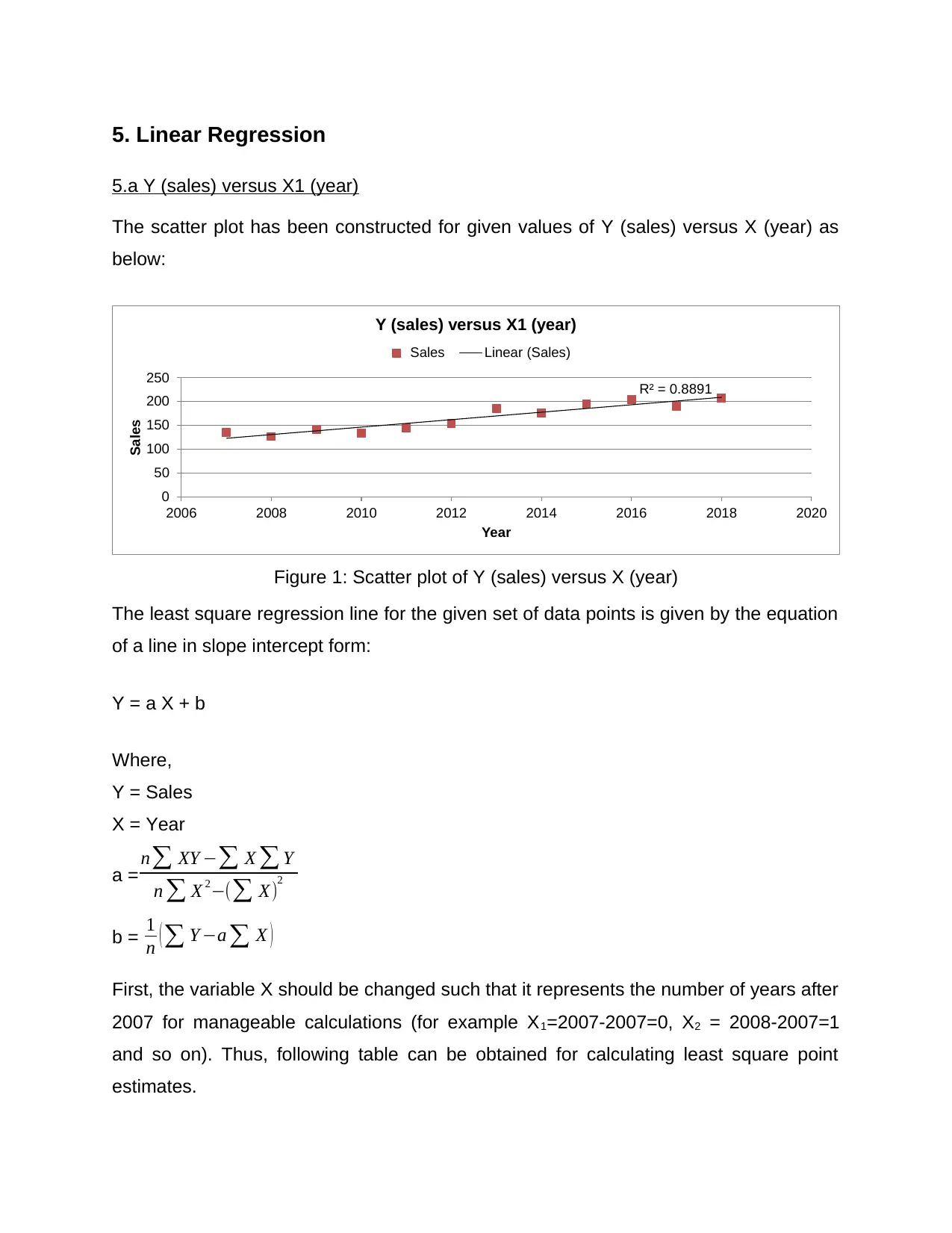

5. Linear Regression

5.a Y (sales) versus X1 (year)

The scatter plot has been constructed for given values of Y (sales) versus X (year) as

below:

R² = 0.8891

0

50

100

150

200

250

2006 2008 2010 2012 2014 2016 2018 2020

Sales

Year

Y (sales) versus X1 (year)

Sales Linear (Sales)

Figure 1: Scatter plot of Y (sales) versus X (year)

The least square regression line for the given set of data points is given by the equation

of a line in slope intercept form:

Y = a X + b

Where,

Y = Sales

X = Year

a = n∑ XY −∑ X ∑ Y

n ∑ X 2−(∑ X)2

b = 1

n (∑ Y −a ∑ X )

First, the variable X should be changed such that it represents the number of years after

2007 for manageable calculations (for example X1=2007-2007=0, X2 = 2008-2007=1

and so on). Thus, following table can be obtained for calculating least square point

estimates.

5.a Y (sales) versus X1 (year)

The scatter plot has been constructed for given values of Y (sales) versus X (year) as

below:

R² = 0.8891

0

50

100

150

200

250

2006 2008 2010 2012 2014 2016 2018 2020

Sales

Year

Y (sales) versus X1 (year)

Sales Linear (Sales)

Figure 1: Scatter plot of Y (sales) versus X (year)

The least square regression line for the given set of data points is given by the equation

of a line in slope intercept form:

Y = a X + b

Where,

Y = Sales

X = Year

a = n∑ XY −∑ X ∑ Y

n ∑ X 2−(∑ X)2

b = 1

n (∑ Y −a ∑ X )

First, the variable X should be changed such that it represents the number of years after

2007 for manageable calculations (for example X1=2007-2007=0, X2 = 2008-2007=1

and so on). Thus, following table can be obtained for calculating least square point

estimates.

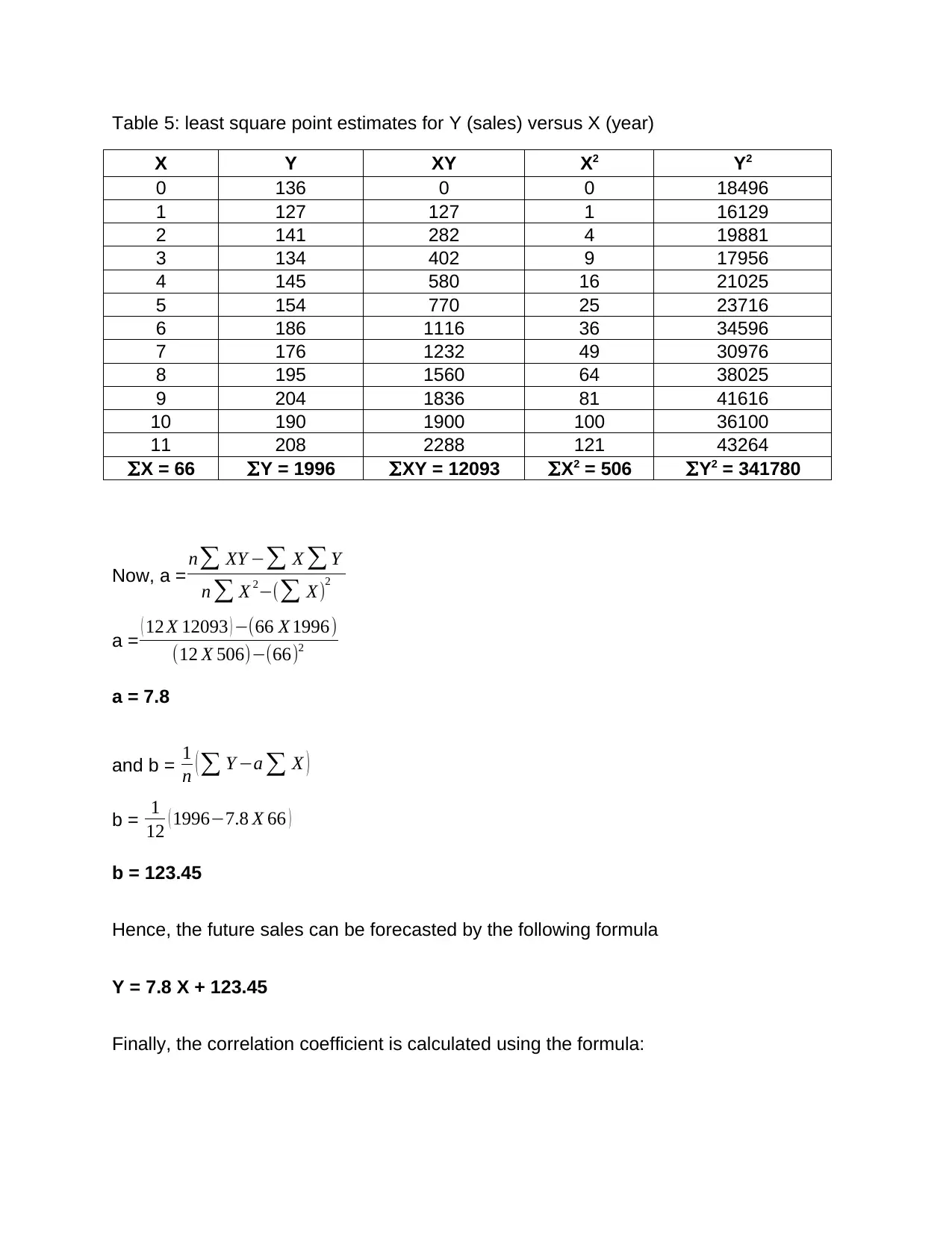

Table 5: least square point estimates for Y (sales) versus X (year)

X Y XY X2 Y2

0 136 0 0 18496

1 127 127 1 16129

2 141 282 4 19881

3 134 402 9 17956

4 145 580 16 21025

5 154 770 25 23716

6 186 1116 36 34596

7 176 1232 49 30976

8 195 1560 64 38025

9 204 1836 81 41616

10 190 1900 100 36100

11 208 2288 121 43264

ΣX = 66 ΣY = 1996 ΣXY = 12093 ΣX2 = 506 ΣY2 = 341780

Now, a = n∑ XY −∑ X ∑ Y

n ∑ X 2−(∑ X)2

a = ( 12 X 12093 ) −(66 X 1996)

(12 X 506)−(66)2

a = 7.8

and b = 1

n ( ∑ Y −a ∑ X )

b = 1

12 ( 1996−7.8 X 66 )

b = 123.45

Hence, the future sales can be forecasted by the following formula

Y = 7.8 X + 123.45

Finally, the correlation coefficient is calculated using the formula:

X Y XY X2 Y2

0 136 0 0 18496

1 127 127 1 16129

2 141 282 4 19881

3 134 402 9 17956

4 145 580 16 21025

5 154 770 25 23716

6 186 1116 36 34596

7 176 1232 49 30976

8 195 1560 64 38025

9 204 1836 81 41616

10 190 1900 100 36100

11 208 2288 121 43264

ΣX = 66 ΣY = 1996 ΣXY = 12093 ΣX2 = 506 ΣY2 = 341780

Now, a = n∑ XY −∑ X ∑ Y

n ∑ X 2−(∑ X)2

a = ( 12 X 12093 ) −(66 X 1996)

(12 X 506)−(66)2

a = 7.8

and b = 1

n ( ∑ Y −a ∑ X )

b = 1

12 ( 1996−7.8 X 66 )

b = 123.45

Hence, the future sales can be forecasted by the following formula

Y = 7.8 X + 123.45

Finally, the correlation coefficient is calculated using the formula:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.