MAN7MFI - Investment Analysis: Bovis Plc & Carillion Plc - UK Stock

VerifiedAdded on 2023/04/10

|25

|3442

|255

Report

AI Summary

This report provides an investment analysis of Bovis Plc and Carillion Plc, two UK construction firms, using financial ratios to inform portfolio restructuring decisions. The analysis includes current ratio, quick ratio, operating cash flow, net and gross profit margins, operating profit margin, working capital cycle, return on capital employed, return on total assets, debt to equity ratio, and return on equity. The report justifies the divestment decision based on these ratios, conducts a SWOT analysis, and examines the reasons for Carillion Plc's liquidation in 2018. Ultimately, the analysis suggests that Bovis Plc is a more suitable investment compared to Carillion Plc, indicating that Carillion Plc’s shares should be considered for divestment due to its relatively lower profitability and higher risk.

Running head: INVESTMENT ANALYSIS

INVESTMENT ANALYSIS

Name of the student:

Name of the university:

Author Note:

INVESTMENT ANALYSIS

Name of the student:

Name of the university:

Author Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INVESTMENT ANALYSIS 1

Executive Summary:

The project is about the investment analysis of the Bovis Plc. and Carillion Plc. through use

of financial ratios. In this assignment, deep appraisal has been made for the investing decision

that the investor will take into consideration for investment purpose. The assignment is

prepared to show the finding of financial performance analysis based on which portfolio

restructuring consisting of shares of both the company is made. The assignment is also

evaluated reasons for the collapse of the Carillion Plc., which was one of the major

liquidation in UK in the year 2018.

The finding of the collapse has been interpreted in such a way that it will help the strategy of

portfolio restructuring. The major collapse has singled major insights and failure of financial

statement to report financial distress.

Executive Summary:

The project is about the investment analysis of the Bovis Plc. and Carillion Plc. through use

of financial ratios. In this assignment, deep appraisal has been made for the investing decision

that the investor will take into consideration for investment purpose. The assignment is

prepared to show the finding of financial performance analysis based on which portfolio

restructuring consisting of shares of both the company is made. The assignment is also

evaluated reasons for the collapse of the Carillion Plc., which was one of the major

liquidation in UK in the year 2018.

The finding of the collapse has been interpreted in such a way that it will help the strategy of

portfolio restructuring. The major collapse has singled major insights and failure of financial

statement to report financial distress.

INVESTMENT ANALYSIS 2

Table of Contents

1. Introduction:...........................................................................................................................4

2. Analysis of financial data for investment purpose:................................................................5

2.1 Current ratio:....................................................................................................................5

2.2 Quick Ratio:.....................................................................................................................6

2.3 Operating cash flow:........................................................................................................6

2.4 Net profit margin:.............................................................................................................6

2.5 Gross profit margin:.........................................................................................................6

2.6 Operating Profit Margin...................................................................................................7

2.7 Working Capital Cycle.....................................................................................................7

2.7 Return on Capital Employed............................................................................................8

2.8 Return on Total Assets.....................................................................................................8

2.9 Debt to equity ratio:.........................................................................................................8

2.11 Return on equity:............................................................................................................9

3. Justification of decision taken above:..................................................................................10

4. SWOT Analysis...............................................................................................................11

5. Liquidation of Carillion Plc. :..............................................................................................12

6. Conclusion:..........................................................................................................................13

7. References:...........................................................................................................................14

7. Appendix:.............................................................................................................................17

Table of Contents

1. Introduction:...........................................................................................................................4

2. Analysis of financial data for investment purpose:................................................................5

2.1 Current ratio:....................................................................................................................5

2.2 Quick Ratio:.....................................................................................................................6

2.3 Operating cash flow:........................................................................................................6

2.4 Net profit margin:.............................................................................................................6

2.5 Gross profit margin:.........................................................................................................6

2.6 Operating Profit Margin...................................................................................................7

2.7 Working Capital Cycle.....................................................................................................7

2.7 Return on Capital Employed............................................................................................8

2.8 Return on Total Assets.....................................................................................................8

2.9 Debt to equity ratio:.........................................................................................................8

2.11 Return on equity:............................................................................................................9

3. Justification of decision taken above:..................................................................................10

4. SWOT Analysis...............................................................................................................11

5. Liquidation of Carillion Plc. :..............................................................................................12

6. Conclusion:..........................................................................................................................13

7. References:...........................................................................................................................14

7. Appendix:.............................................................................................................................17

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INVESTMENT ANALYSIS 3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INVESTMENT ANALYSIS 4

1. Introduction:

The whole assignment is prepared to show the strategic portfolio management

consisting of shares of two companies namely Bovis Plc. and Carillion Plc. with the

calculation of ratios from the data derived from the financial statements of both the company.

Portfolio restructuring plays a vital role in mitigating risk and assuring optimal rate of return

to the portfolio. The portfolio restructuring involves continuous analysis of performance of

the company whether from financial point of view or market perception point of view. Both

the company namely Bovis Plc. and Carillion Plc. is engaged in the business of construction

and the person has acquired shares of both the company. The Bovis Plc. is the one of the

largest company of the United Kingdom whereas the Carillion Plc. is ranked 2nd in terms of

market share holding. Since, the investor has made investment in both the companies. Now

the investor is considering to divestment from one of the company. The divestment process

can be done with the deep analysis of key financial ratios such as Gross profit margin, Net

profit margin and Return on equity. (Brown, and Panibratov 2016.)

1. Introduction:

The whole assignment is prepared to show the strategic portfolio management

consisting of shares of two companies namely Bovis Plc. and Carillion Plc. with the

calculation of ratios from the data derived from the financial statements of both the company.

Portfolio restructuring plays a vital role in mitigating risk and assuring optimal rate of return

to the portfolio. The portfolio restructuring involves continuous analysis of performance of

the company whether from financial point of view or market perception point of view. Both

the company namely Bovis Plc. and Carillion Plc. is engaged in the business of construction

and the person has acquired shares of both the company. The Bovis Plc. is the one of the

largest company of the United Kingdom whereas the Carillion Plc. is ranked 2nd in terms of

market share holding. Since, the investor has made investment in both the companies. Now

the investor is considering to divestment from one of the company. The divestment process

can be done with the deep analysis of key financial ratios such as Gross profit margin, Net

profit margin and Return on equity. (Brown, and Panibratov 2016.)

INVESTMENT ANALYSIS 5

2. Analysis of financial data for investment purpose:

The reliability of investment decision is the result of deep analysis of the financial

statement using different techniques such as ratio analysis, growth factors and dividend

policy adopted by the company. The more efficient the analysis is the more effective decision

can be made. These all factors are more dependent on the company performance and effected

by the relevant market forces, which leads investor to restructure their portfolio as to

maximize return (Acosta-González, Fernández-Rodríguez, and Ganga 2019). The decision to

choose any company for divestment purpose is mainly dependent on the ratios of the

company. The following ratios are the main indicator of financial health of the company

based on which portfolio restructuring decision can be made:

2.1 Current ratio:

It shows the capacity of the company to pay its debt obligation within a short span of

time i.e. within an accounting period. It is the major indicator of the debt paying capacity of

the company. Through use of current ratio, investor analyze whether the company has healthy

cash operating cycle or not. A low ratio indicates company’s inability to pay its short-term

debt obligation unless there is appropriate additional cash flow. A high ratio indicates that the

company has more cash & cash equivalent holdings but it fails to invest the same in

innovation and growth.

The current ratio of Bovis Plc. is 3.54 and Carillion Plc. is 0.82, which shows that the

Bovis Plc. has enough funds to pay its short-term obligations whereas the Carillion Plc. has

running short of fund. Based on current ratio, it is advisable to sell the shares of Carillion Plc.

(See Appendix)

2. Analysis of financial data for investment purpose:

The reliability of investment decision is the result of deep analysis of the financial

statement using different techniques such as ratio analysis, growth factors and dividend

policy adopted by the company. The more efficient the analysis is the more effective decision

can be made. These all factors are more dependent on the company performance and effected

by the relevant market forces, which leads investor to restructure their portfolio as to

maximize return (Acosta-González, Fernández-Rodríguez, and Ganga 2019). The decision to

choose any company for divestment purpose is mainly dependent on the ratios of the

company. The following ratios are the main indicator of financial health of the company

based on which portfolio restructuring decision can be made:

2.1 Current ratio:

It shows the capacity of the company to pay its debt obligation within a short span of

time i.e. within an accounting period. It is the major indicator of the debt paying capacity of

the company. Through use of current ratio, investor analyze whether the company has healthy

cash operating cycle or not. A low ratio indicates company’s inability to pay its short-term

debt obligation unless there is appropriate additional cash flow. A high ratio indicates that the

company has more cash & cash equivalent holdings but it fails to invest the same in

innovation and growth.

The current ratio of Bovis Plc. is 3.54 and Carillion Plc. is 0.82, which shows that the

Bovis Plc. has enough funds to pay its short-term obligations whereas the Carillion Plc. has

running short of fund. Based on current ratio, it is advisable to sell the shares of Carillion Plc.

(See Appendix)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INVESTMENT ANALYSIS 6

2.2 Quick Ratio:

The quick ratio helps the company in understanding the ability of the company to pay

its immediate liabilities. It indicates the ability of the company to meet the short term

obligations by using the most liquid assets. The ideal quick ratio is 1:1 whereas the quick

ratio of Bovis Plc. and Carillion Plc. 0.28 and 0.79. This indicates that the quick ratio of

Carillion Plc. is better than Bovis Plc. and Carillion Plc. is better in handling short term

obligations.

2.3 Operating cash flow:

It shows that how the company is generating cash from its day-to-day activities. The

financial experts generally analyze operating cash flow to find whether the company is

paying its expenses through operating cash flows or it needs external financing to cope with

the expenses. The Bovis Plc. has operating cash flow of £ 61.80 million whereas Carillion

Plc. has operating cash flow of £ 73.30 million, which shows that the Carillion Plc. has

generated more operating cash flow as compared to the later. Therefore, based on above the

shares of the Bovis Plc. can be sold but decision cannot be based on above only.

2.4 Net profit margin:

It shows the capacity of the company to convert revenue into profit. A higher

percentage indicates that the company is more profitable and vice-versa. It is the major

indicator of the performance in terms of profitability to predict the growth perspective of the

company in long-term prospect. The Net profit margin of the Bovis Plc. is 14.67% whereas

the Carillion Plc. has 3.34%. So, Carillion Plc. is less profitable as compared to the Bovis Plc.

Based on above, the shares of Carillion Plc. can be sold.

2.2 Quick Ratio:

The quick ratio helps the company in understanding the ability of the company to pay

its immediate liabilities. It indicates the ability of the company to meet the short term

obligations by using the most liquid assets. The ideal quick ratio is 1:1 whereas the quick

ratio of Bovis Plc. and Carillion Plc. 0.28 and 0.79. This indicates that the quick ratio of

Carillion Plc. is better than Bovis Plc. and Carillion Plc. is better in handling short term

obligations.

2.3 Operating cash flow:

It shows that how the company is generating cash from its day-to-day activities. The

financial experts generally analyze operating cash flow to find whether the company is

paying its expenses through operating cash flows or it needs external financing to cope with

the expenses. The Bovis Plc. has operating cash flow of £ 61.80 million whereas Carillion

Plc. has operating cash flow of £ 73.30 million, which shows that the Carillion Plc. has

generated more operating cash flow as compared to the later. Therefore, based on above the

shares of the Bovis Plc. can be sold but decision cannot be based on above only.

2.4 Net profit margin:

It shows the capacity of the company to convert revenue into profit. A higher

percentage indicates that the company is more profitable and vice-versa. It is the major

indicator of the performance in terms of profitability to predict the growth perspective of the

company in long-term prospect. The Net profit margin of the Bovis Plc. is 14.67% whereas

the Carillion Plc. has 3.34%. So, Carillion Plc. is less profitable as compared to the Bovis Plc.

Based on above, the shares of Carillion Plc. can be sold.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INVESTMENT ANALYSIS 7

2.5 Gross profit margin:

It shows that how much profit the company has earned through sales before expenses.

It is not the true indicator of profitability of the company. Gross profit margin is generally

arrived by dividing gross profit by net sales of the company. Gross profit is the result of

deducting cost of goods sold from the sales revenue. So that the company is able to analyze

the ratio to formulate policies to widen, the gap between cost of goods sold and sales revenue

to the extent it is feasible to that. The higher percentage of gross profit margin indicates that

the company has sufficient amount to pay its overheads.

Through calculation of Gross profit margin of both the companies, the Bovis Plc. has

77.66% and Carillion Plc. has 92.02% of Gross profit margin. So, from both the ratio the

Carillion Plc. is seemed to be more profitable but the argument is not yet over because the net

margin of Bovis Plc. is greater as compared to the Carillion Plc. The reason of such change

might be increased salary expenses, high production cost, depreciation and higher debt

burden on the company. Standalone decision based on this will not provide, will not provide

expected outcome or will provide outcome that is not expected to have. (See appendix)

2.6 Operating Profit Margin

Operating profit margin is the performance ratio of an organization that measures

profit percentage that the company earns from its operations before the deduction of the taxes

and the interest payments. It is obtained by dividing the operating profit by total revenue. The

company can measure the efficiency of itself in managing the operating costs. The operating

profit margin of Bovis Plc. is better than Carillion Plc. It can be rather said that Bovis Plc. is

very efficient in managing the operating expenses as they are having the operating profit

margin of 15.17% whereas the operating profit margin of Carillion Plc. is 3.31%.

2.5 Gross profit margin:

It shows that how much profit the company has earned through sales before expenses.

It is not the true indicator of profitability of the company. Gross profit margin is generally

arrived by dividing gross profit by net sales of the company. Gross profit is the result of

deducting cost of goods sold from the sales revenue. So that the company is able to analyze

the ratio to formulate policies to widen, the gap between cost of goods sold and sales revenue

to the extent it is feasible to that. The higher percentage of gross profit margin indicates that

the company has sufficient amount to pay its overheads.

Through calculation of Gross profit margin of both the companies, the Bovis Plc. has

77.66% and Carillion Plc. has 92.02% of Gross profit margin. So, from both the ratio the

Carillion Plc. is seemed to be more profitable but the argument is not yet over because the net

margin of Bovis Plc. is greater as compared to the Carillion Plc. The reason of such change

might be increased salary expenses, high production cost, depreciation and higher debt

burden on the company. Standalone decision based on this will not provide, will not provide

expected outcome or will provide outcome that is not expected to have. (See appendix)

2.6 Operating Profit Margin

Operating profit margin is the performance ratio of an organization that measures

profit percentage that the company earns from its operations before the deduction of the taxes

and the interest payments. It is obtained by dividing the operating profit by total revenue. The

company can measure the efficiency of itself in managing the operating costs. The operating

profit margin of Bovis Plc. is better than Carillion Plc. It can be rather said that Bovis Plc. is

very efficient in managing the operating expenses as they are having the operating profit

margin of 15.17% whereas the operating profit margin of Carillion Plc. is 3.31%.

INVESTMENT ANALYSIS 8

2.7 Working Capital Cycle

The calculation shows that the accounts receivable turn days of Bovis Plc. is better

than Carillion Plc. that is 2 days against 120 days. The average payment period is 72 days for

Bovis Plc. whereas for Carillion Plc. is 180 days. This means in this regard also Bovis Plc. is

performing better. Therefore any investor would prefer Bovis Plc. than Carillion Plc.

2.7 Return on Capital Employed

It shows efficiency of the company to generate profits from its capital employed. It

shows how effectively Company’s asset is performing. From the calculations done for this

purpose, Bovis Plc. has ROCE of 13.77% and Carillion Plc. has ROCE of 9.34%. Therefore,

Bovis Plc. is generating more values from its assets in terms of EBIT. So, it is considered

better for further investment purpose as compared to Carillion Plc.

2.8 Return on Total Assets

It measure the earnings of the company before its tax and interest payments with respect to

the value of the total assets. It refers to the fact that how efficiently the company uses its

assets efficiently in order to earn the maximum revenue. The return on total assets of Bovis

Plc. is 10% whereas the return on the total assets of Carillion Plc. is 4%. This states that

Bovis Plc. is very much efficient in utilizing the assets that helps them in earning the

maximum revenue. So Bovis Plc. is at a better off position than Carillion Plc.

2.9 Debt to equity ratio:

The debt equity ratio of the company is calculated by the formula Total Liabilities /

Shareholder Equity. It helps in determining the financial leverage of the company. It helps in

the understanding of how the company is financing its operations by using its debts funds.

More precisely it helps in understanding the ability of the equity of the shareholder to cover

its outstanding debts. Higher debt equity ratios are associated with higher risks and lower

2.7 Working Capital Cycle

The calculation shows that the accounts receivable turn days of Bovis Plc. is better

than Carillion Plc. that is 2 days against 120 days. The average payment period is 72 days for

Bovis Plc. whereas for Carillion Plc. is 180 days. This means in this regard also Bovis Plc. is

performing better. Therefore any investor would prefer Bovis Plc. than Carillion Plc.

2.7 Return on Capital Employed

It shows efficiency of the company to generate profits from its capital employed. It

shows how effectively Company’s asset is performing. From the calculations done for this

purpose, Bovis Plc. has ROCE of 13.77% and Carillion Plc. has ROCE of 9.34%. Therefore,

Bovis Plc. is generating more values from its assets in terms of EBIT. So, it is considered

better for further investment purpose as compared to Carillion Plc.

2.8 Return on Total Assets

It measure the earnings of the company before its tax and interest payments with respect to

the value of the total assets. It refers to the fact that how efficiently the company uses its

assets efficiently in order to earn the maximum revenue. The return on total assets of Bovis

Plc. is 10% whereas the return on the total assets of Carillion Plc. is 4%. This states that

Bovis Plc. is very much efficient in utilizing the assets that helps them in earning the

maximum revenue. So Bovis Plc. is at a better off position than Carillion Plc.

2.9 Debt to equity ratio:

The debt equity ratio of the company is calculated by the formula Total Liabilities /

Shareholder Equity. It helps in determining the financial leverage of the company. It helps in

the understanding of how the company is financing its operations by using its debts funds.

More precisely it helps in understanding the ability of the equity of the shareholder to cover

its outstanding debts. Higher debt equity ratios are associated with higher risks and lower

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INVESTMENT ANALYSIS 9

debt equity ratios are associated with lower risks. The debt to equity ratio of Carillion is very

high around 17.22 with respect to the debt equity ratio of Bovis Plc. that is 9.13, whcih

indicates Carillion has high risks associated with it.

2.11 Return on equity:

Return on equity is the most important profitability metrics that generally reveals that

how much profit company is generating for its equity shareholders. Many analyst uses this

tool to analyze the overall performance of the company as well as managerial efficiency in

terms of capacity to earn profit for the shareholders of the company. A higher ratio indicates

that the company is managing its state of affairs in such a way that the overall profit and

growth opportunity of the company has been increased with the substantial gain in the trust of

the investors. Return on equity directly affects the price of the shares, the higher return on

equity, the higher intrinsic value of the stock will be. This tells that why the companies

having higher Return on equity (ROE) has higher valuation as compared to other companies

having lower return on equity. (Easton, and Sommers, 2018.)

From the calculation, the Bovis Plc. has Return on equity of 179.67% whereas the

Carillion Plc. has Return on equity of 60.20%. Therefore, from above it can be seen that the

Bovis Plc. is more profitable and suitable for further investment purpose. The Carillion Plc. is

having comparatively less Return on equity, which means that it is not generating sufficient

profit to the shareholders. (See appendix)

Bovis Plc. has outperformed whereas Carillion Plc. has performed well but less

performed as compare to Bovis Plc. Therefore, the Carillion Plc.’s share should be sold for

divestment purpose.

Based on above analysis, it can be observed that the Bovis Plc. has more optimum for

decisions related to investment as compared to the Carillion Plc. As the ratios are the major

debt equity ratios are associated with lower risks. The debt to equity ratio of Carillion is very

high around 17.22 with respect to the debt equity ratio of Bovis Plc. that is 9.13, whcih

indicates Carillion has high risks associated with it.

2.11 Return on equity:

Return on equity is the most important profitability metrics that generally reveals that

how much profit company is generating for its equity shareholders. Many analyst uses this

tool to analyze the overall performance of the company as well as managerial efficiency in

terms of capacity to earn profit for the shareholders of the company. A higher ratio indicates

that the company is managing its state of affairs in such a way that the overall profit and

growth opportunity of the company has been increased with the substantial gain in the trust of

the investors. Return on equity directly affects the price of the shares, the higher return on

equity, the higher intrinsic value of the stock will be. This tells that why the companies

having higher Return on equity (ROE) has higher valuation as compared to other companies

having lower return on equity. (Easton, and Sommers, 2018.)

From the calculation, the Bovis Plc. has Return on equity of 179.67% whereas the

Carillion Plc. has Return on equity of 60.20%. Therefore, from above it can be seen that the

Bovis Plc. is more profitable and suitable for further investment purpose. The Carillion Plc. is

having comparatively less Return on equity, which means that it is not generating sufficient

profit to the shareholders. (See appendix)

Bovis Plc. has outperformed whereas Carillion Plc. has performed well but less

performed as compare to Bovis Plc. Therefore, the Carillion Plc.’s share should be sold for

divestment purpose.

Based on above analysis, it can be observed that the Bovis Plc. has more optimum for

decisions related to investment as compared to the Carillion Plc. As the ratios are the major

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INVESTMENT ANALYSIS 10

indicator of financial health of any company. However, if go through each ratio the choice

will investment will be different for different ratios. For example, Gross profit margin

indicates that the Carillion Plc. is more profitable but Net profit margin shows that The Bovis

Plc. is more profitable. The net profit margin ratio is preferred over the gross profit margin.

The Bovis Plc. would be preferred over the Carillion Plc. because the overall financial ratios

indicates financial soundness of the Bovis Plc. is better in comparison with the Carillion Plc.

(Williams, and Dobelman, 2017.)

3. Justification of decision taken above:

The decision related to investment or divestment is mainly based on the analysis done

for this purpose. The main basis of analysis is the financial statement of both companies

relying wholly on which is not feasible for investment purpose because the expectation of

investor is more of return from the investment with equal importance have been provided to

the security to the investment made. The Bovis Plc. has more financial strengths as compared

to the Carillion Plc. whether it is a Debt equity ratio or any other ratio based on which the

investment can be diluted from Bovis Plc. from Carillion Plc. However if a company has

strong financial ratios that does not mean the company is more favorable for investment

purpose, other factors should be taken into consideration such as growth opportunity of the

company, government regulations covering the activities of the company, and micro-

economic conditions affecting the affairs of the company. As both the company is engaged in

the business of construction, the performance of the project they have completed is also

another factor to consider. If any of the company have defaulted in any of the project it has

taken then it will have major impact on the investment decision of the investor. The analysis

of financial statement has some assumptions and limitations, which may be analyzed and

disclosed properly to investor for insuring safety of investment made. Relying only on

indicator of financial health of any company. However, if go through each ratio the choice

will investment will be different for different ratios. For example, Gross profit margin

indicates that the Carillion Plc. is more profitable but Net profit margin shows that The Bovis

Plc. is more profitable. The net profit margin ratio is preferred over the gross profit margin.

The Bovis Plc. would be preferred over the Carillion Plc. because the overall financial ratios

indicates financial soundness of the Bovis Plc. is better in comparison with the Carillion Plc.

(Williams, and Dobelman, 2017.)

3. Justification of decision taken above:

The decision related to investment or divestment is mainly based on the analysis done

for this purpose. The main basis of analysis is the financial statement of both companies

relying wholly on which is not feasible for investment purpose because the expectation of

investor is more of return from the investment with equal importance have been provided to

the security to the investment made. The Bovis Plc. has more financial strengths as compared

to the Carillion Plc. whether it is a Debt equity ratio or any other ratio based on which the

investment can be diluted from Bovis Plc. from Carillion Plc. However if a company has

strong financial ratios that does not mean the company is more favorable for investment

purpose, other factors should be taken into consideration such as growth opportunity of the

company, government regulations covering the activities of the company, and micro-

economic conditions affecting the affairs of the company. As both the company is engaged in

the business of construction, the performance of the project they have completed is also

another factor to consider. If any of the company have defaulted in any of the project it has

taken then it will have major impact on the investment decision of the investor. The analysis

of financial statement has some assumptions and limitations, which may be analyzed and

disclosed properly to investor for insuring safety of investment made. Relying only on

INVESTMENT ANALYSIS 11

investment will affect the overall investment and expected return from the investment. The

source of information and the data used in calculations are usually taken from the financial

statements of both the companies. (Brown, and Panibratov, 2016.)

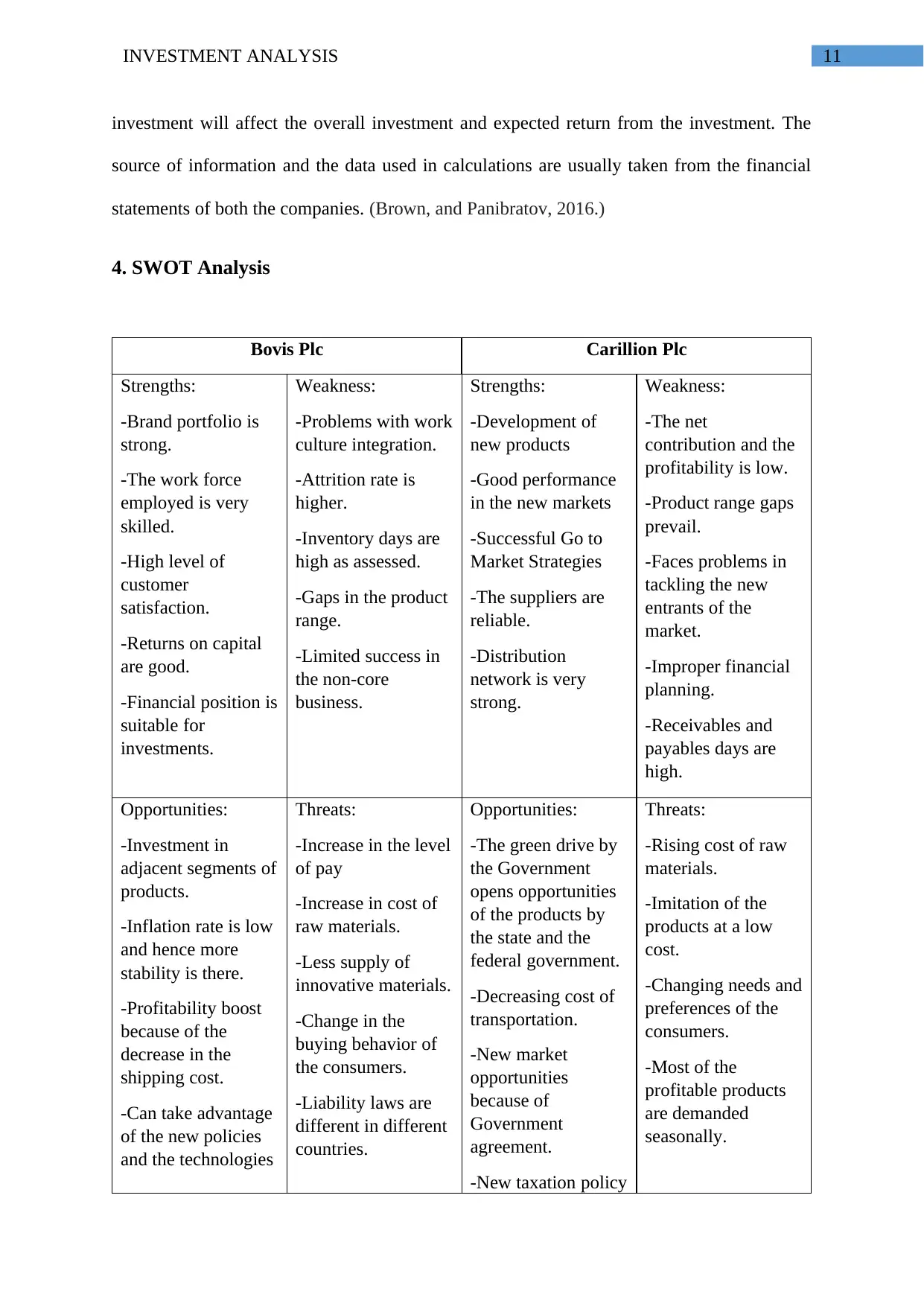

4. SWOT Analysis

Bovis Plc Carillion Plc

Strengths:

-Brand portfolio is

strong.

-The work force

employed is very

skilled.

-High level of

customer

satisfaction.

-Returns on capital

are good.

-Financial position is

suitable for

investments.

Weakness:

-Problems with work

culture integration.

-Attrition rate is

higher.

-Inventory days are

high as assessed.

-Gaps in the product

range.

-Limited success in

the non-core

business.

Strengths:

-Development of

new products

-Good performance

in the new markets

-Successful Go to

Market Strategies

-The suppliers are

reliable.

-Distribution

network is very

strong.

Weakness:

-The net

contribution and the

profitability is low.

-Product range gaps

prevail.

-Faces problems in

tackling the new

entrants of the

market.

-Improper financial

planning.

-Receivables and

payables days are

high.

Opportunities:

-Investment in

adjacent segments of

products.

-Inflation rate is low

and hence more

stability is there.

-Profitability boost

because of the

decrease in the

shipping cost.

-Can take advantage

of the new policies

and the technologies

Threats:

-Increase in the level

of pay

-Increase in cost of

raw materials.

-Less supply of

innovative materials.

-Change in the

buying behavior of

the consumers.

-Liability laws are

different in different

countries.

Opportunities:

-The green drive by

the Government

opens opportunities

of the products by

the state and the

federal government.

-Decreasing cost of

transportation.

-New market

opportunities

because of

Government

agreement.

-New taxation policy

Threats:

-Rising cost of raw

materials.

-Imitation of the

products at a low

cost.

-Changing needs and

preferences of the

consumers.

-Most of the

profitable products

are demanded

seasonally.

investment will affect the overall investment and expected return from the investment. The

source of information and the data used in calculations are usually taken from the financial

statements of both the companies. (Brown, and Panibratov, 2016.)

4. SWOT Analysis

Bovis Plc Carillion Plc

Strengths:

-Brand portfolio is

strong.

-The work force

employed is very

skilled.

-High level of

customer

satisfaction.

-Returns on capital

are good.

-Financial position is

suitable for

investments.

Weakness:

-Problems with work

culture integration.

-Attrition rate is

higher.

-Inventory days are

high as assessed.

-Gaps in the product

range.

-Limited success in

the non-core

business.

Strengths:

-Development of

new products

-Good performance

in the new markets

-Successful Go to

Market Strategies

-The suppliers are

reliable.

-Distribution

network is very

strong.

Weakness:

-The net

contribution and the

profitability is low.

-Product range gaps

prevail.

-Faces problems in

tackling the new

entrants of the

market.

-Improper financial

planning.

-Receivables and

payables days are

high.

Opportunities:

-Investment in

adjacent segments of

products.

-Inflation rate is low

and hence more

stability is there.

-Profitability boost

because of the

decrease in the

shipping cost.

-Can take advantage

of the new policies

and the technologies

Threats:

-Increase in the level

of pay

-Increase in cost of

raw materials.

-Less supply of

innovative materials.

-Change in the

buying behavior of

the consumers.

-Liability laws are

different in different

countries.

Opportunities:

-The green drive by

the Government

opens opportunities

of the products by

the state and the

federal government.

-Decreasing cost of

transportation.

-New market

opportunities

because of

Government

agreement.

-New taxation policy

Threats:

-Rising cost of raw

materials.

-Imitation of the

products at a low

cost.

-Changing needs and

preferences of the

consumers.

-Most of the

profitable products

are demanded

seasonally.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 25

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.