Investment Analysis: Portfolio Construction using Markowitz Model

VerifiedAdded on 2023/03/30

|14

|2431

|142

Report

AI Summary

This report provides an in-depth analysis of investment portfolio creation, focusing on identifying viable investment options for investors. It emphasizes the use of the Efficient Frontier to help investors select suitable investment strategies based on their criteria. The analysis covers various asset classes, including Australian shares, US shares, Brent oil, Australian bonds, and US Fed funds. Statistical calculations like covariance, correlation, and bordered covariance are employed to determine the optimal variable template for constructing the Efficient Frontier. The report highlights the importance of the minimum variance portfolio, which is particularly appealing to investors with a conservative investment approach, and discusses the implications of the five assets on the efficient frontier and capital allocation line. The Markowitz model is critically discussed, and the popularity of the minimum variance portfolio is explained in relation to modern portfolio theory.

Running head: INVESTMENT ANALYSIS AND PORTFOLIO MANAGEMENT

Investment Analysis and Portfolio Management

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Investment Analysis and Portfolio Management

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1INVESTMENT ANALYSIS AND PORTFOLIO MANAGEMENT

Executive Summary:

The report analyses all the relevant points regarding the investment portfolio creation, while

detecting the viable investment option presented to investors. Further analysis is mainly

conducted on Efficient Frontier, which allows the investors to detect the investment options, that

would suit their investment criteria. The investment asset that is analyzed are Australian shares,

US shares, Brent oil, Australian bonds and US fed funds. Moreover, adequate statistical

calculations such as covariance, correlation and bordered covariance are mainly used for

identifying the best variable template that is used for completing the overall Efficient Frontier.

Lastly, the significance of minimum variance portfolio is highlighted, which is currently

demanded by maximum of the investors who have conservative investment approach.

Executive Summary:

The report analyses all the relevant points regarding the investment portfolio creation, while

detecting the viable investment option presented to investors. Further analysis is mainly

conducted on Efficient Frontier, which allows the investors to detect the investment options, that

would suit their investment criteria. The investment asset that is analyzed are Australian shares,

US shares, Brent oil, Australian bonds and US fed funds. Moreover, adequate statistical

calculations such as covariance, correlation and bordered covariance are mainly used for

identifying the best variable template that is used for completing the overall Efficient Frontier.

Lastly, the significance of minimum variance portfolio is highlighted, which is currently

demanded by maximum of the investors who have conservative investment approach.

2INVESTMENT ANALYSIS AND PORTFOLIO MANAGEMENT

Table of Contents

Introduction:....................................................................................................................................3

1. Briefly discussing about the five asset class in context to AM, GM, and SD:............................3

2. Discussing the implications of the five assets on efficient frontier and CAL:............................7

3. Stating the reasons behind the popularity of Minimum variance portfolio, while synthesise

about the modern portfolio:...........................................................................................................10

Conclusion:....................................................................................................................................11

References:....................................................................................................................................12

Table of Contents

Introduction:....................................................................................................................................3

1. Briefly discussing about the five asset class in context to AM, GM, and SD:............................3

2. Discussing the implications of the five assets on efficient frontier and CAL:............................7

3. Stating the reasons behind the popularity of Minimum variance portfolio, while synthesise

about the modern portfolio:...........................................................................................................10

Conclusion:....................................................................................................................................11

References:....................................................................................................................................12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3INVESTMENT ANALYSIS AND PORTFOLIO MANAGEMENT

Introduction:

The main focus of the overall assessment is to identify and create an adequate level of

portfolio at could be utilized by investors for improving Britain from the capital exposure. The

portfolio created in the assessment directly focuses on the efficient Frontier and minimum

variance portfolio, as it allows the investors to identify and select the most viable investment

opportunity. Further analysis is based on the statistical calculations, which are used to identify

the return and risk contributions of each asset class. The major class that is used in the

assessment is Australian shares, US shares, Brent oil, Australian bonds and US fed funds.

Moreover, adequate statistical calculations such as covariance, correlation and bordered

covariance are mainly used for identifying the best variable template that is used for completing

the overall Efficient Frontier. Lastly, the significance of minimum variance portfolio is

highlighted, which is currently demanded by maximum of the investors who have conservative

investment approach.

Introduction:

The main focus of the overall assessment is to identify and create an adequate level of

portfolio at could be utilized by investors for improving Britain from the capital exposure. The

portfolio created in the assessment directly focuses on the efficient Frontier and minimum

variance portfolio, as it allows the investors to identify and select the most viable investment

opportunity. Further analysis is based on the statistical calculations, which are used to identify

the return and risk contributions of each asset class. The major class that is used in the

assessment is Australian shares, US shares, Brent oil, Australian bonds and US fed funds.

Moreover, adequate statistical calculations such as covariance, correlation and bordered

covariance are mainly used for identifying the best variable template that is used for completing

the overall Efficient Frontier. Lastly, the significance of minimum variance portfolio is

highlighted, which is currently demanded by maximum of the investors who have conservative

investment approach.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4INVESTMENT ANALYSIS AND PORTFOLIO MANAGEMENT

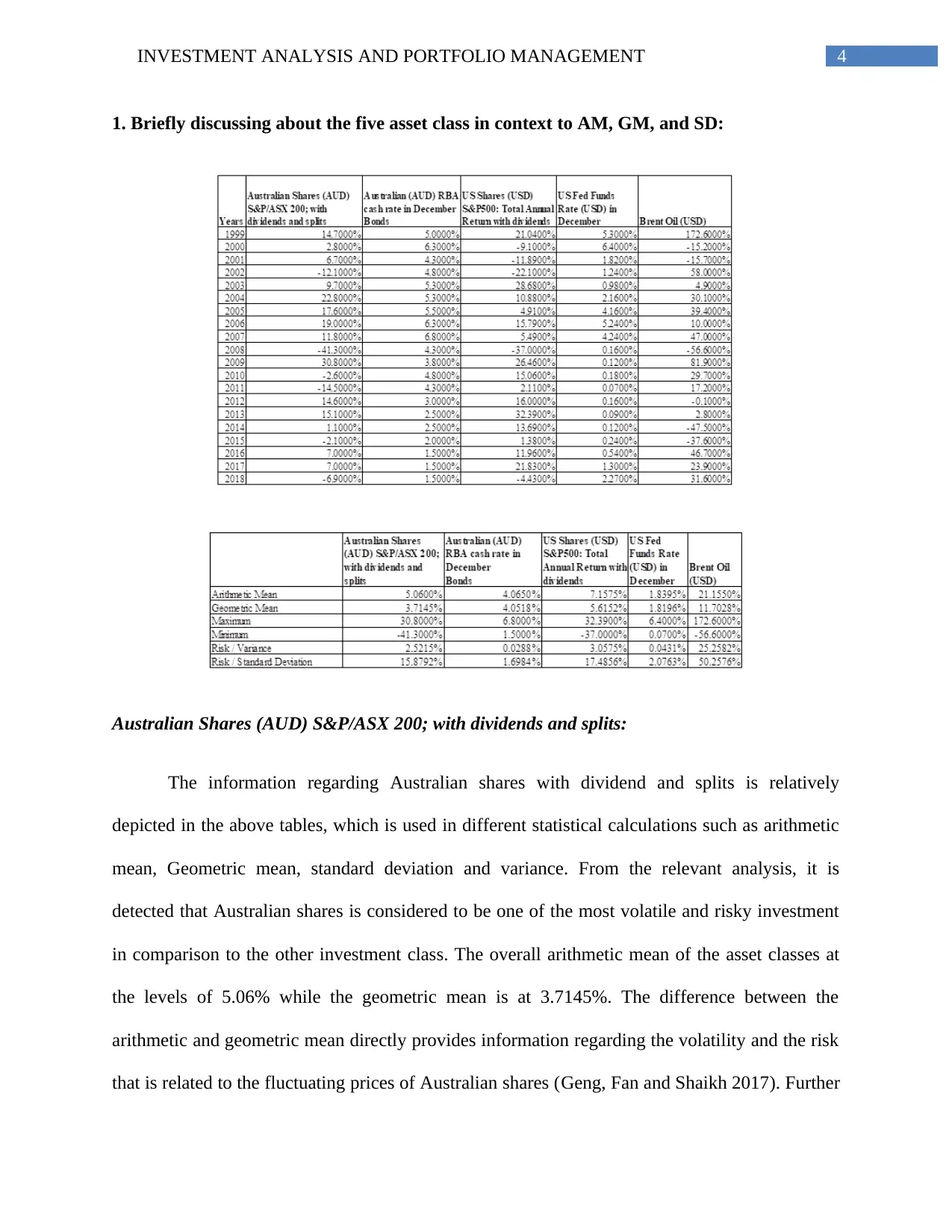

1. Briefly discussing about the five asset class in context to AM, GM, and SD:

Australian Shares (AUD) S&P/ASX 200; with dividends and splits:

The information regarding Australian shares with dividend and splits is relatively

depicted in the above tables, which is used in different statistical calculations such as arithmetic

mean, Geometric mean, standard deviation and variance. From the relevant analysis, it is

detected that Australian shares is considered to be one of the most volatile and risky investment

in comparison to the other investment class. The overall arithmetic mean of the asset classes at

the levels of 5.06% while the geometric mean is at 3.7145%. The difference between the

arithmetic and geometric mean directly provides information regarding the volatility and the risk

that is related to the fluctuating prices of Australian shares (Geng, Fan and Shaikh 2017). Further

1. Briefly discussing about the five asset class in context to AM, GM, and SD:

Australian Shares (AUD) S&P/ASX 200; with dividends and splits:

The information regarding Australian shares with dividend and splits is relatively

depicted in the above tables, which is used in different statistical calculations such as arithmetic

mean, Geometric mean, standard deviation and variance. From the relevant analysis, it is

detected that Australian shares is considered to be one of the most volatile and risky investment

in comparison to the other investment class. The overall arithmetic mean of the asset classes at

the levels of 5.06% while the geometric mean is at 3.7145%. The difference between the

arithmetic and geometric mean directly provides information regarding the volatility and the risk

that is related to the fluctuating prices of Australian shares (Geng, Fan and Shaikh 2017). Further

5INVESTMENT ANALYSIS AND PORTFOLIO MANAGEMENT

analysis has depicted that the conditions of the asset class is at the levels of 2.5215% for variance

and 15.8792% for standard deviation, which is considered to be higher. The maximum returns

that is provided from the Australian shares at the levels of 30.8%, while the minimum returns is -

41.3%. The drastic difference between the minimum and maximum returns of the Australian

shares directly state about the volatility that is present in the class, which might directly affect

the portfolio risk of an investor.

Australian Bonds (AUD) RBA cash rate in December:

Australian bonds directly provide information regarding the risk free asset, which is

mainly used by investors minimise risk from their investment. The calculation has directly

indicated that Australian bonds are considered to be one of the appropriate investment options

with an arithmetic mean of 4.065% and geometric mean of 4.0518%. The low difference

between the arithmetic and geometric mean directly states about the minimal situations that is

conducted on the return generation capability of the asset. Therefore, investors with the help of

the Australian bonds are able to minimise the level of risk involved in investment while

generating nominal returns in the process. Thus, the information in the above table directly state

about the risk criteria of the investment, which is at the levels of 1.694% for standard deviation

and 0.0288% for variance. Consequently, the risk contribution of the asset class is relatively low

in comparison to other asset class, which states that investment in the Australian bonds would

directly reduce the risk conditions of the portfolio (Chandra 2017). On the other hand, the asset

has a maximum return value of 6.8%, while the lowest return is at 1.5%.

US Shares (USD) S&P500: Total Annual Return with dividends:

The third class that is evaluated in the above table is the US shares with total annual

returns and dividends. The US shares is considered to be highly risky in comparison other

analysis has depicted that the conditions of the asset class is at the levels of 2.5215% for variance

and 15.8792% for standard deviation, which is considered to be higher. The maximum returns

that is provided from the Australian shares at the levels of 30.8%, while the minimum returns is -

41.3%. The drastic difference between the minimum and maximum returns of the Australian

shares directly state about the volatility that is present in the class, which might directly affect

the portfolio risk of an investor.

Australian Bonds (AUD) RBA cash rate in December:

Australian bonds directly provide information regarding the risk free asset, which is

mainly used by investors minimise risk from their investment. The calculation has directly

indicated that Australian bonds are considered to be one of the appropriate investment options

with an arithmetic mean of 4.065% and geometric mean of 4.0518%. The low difference

between the arithmetic and geometric mean directly states about the minimal situations that is

conducted on the return generation capability of the asset. Therefore, investors with the help of

the Australian bonds are able to minimise the level of risk involved in investment while

generating nominal returns in the process. Thus, the information in the above table directly state

about the risk criteria of the investment, which is at the levels of 1.694% for standard deviation

and 0.0288% for variance. Consequently, the risk contribution of the asset class is relatively low

in comparison to other asset class, which states that investment in the Australian bonds would

directly reduce the risk conditions of the portfolio (Chandra 2017). On the other hand, the asset

has a maximum return value of 6.8%, while the lowest return is at 1.5%.

US Shares (USD) S&P500: Total Annual Return with dividends:

The third class that is evaluated in the above table is the US shares with total annual

returns and dividends. The US shares is considered to be highly risky in comparison other

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6INVESTMENT ANALYSIS AND PORTFOLIO MANAGEMENT

investment class leaving Brent oil, as they have the variance at 3.057%, while the standard

deviation at 17.4856%. The high level of risk attributes of the asset class is considered to be most

risky for investors, as it would increase the investment risk. The arithmetic mean of the asset

classes is at the level of 7.1575% while geometric mean is at 5.6152%. The staggering difference

between the arithmetic and geometric mean provides insight on the volatility that is present on

the fluctuations of US shares return. The risk contribution of the asset class is mainly supported

by the maximum and minimum returns, which is at the levels of 32.39% and negative -37%. The

difference between the minimum and maximum returns provides insight on the uninterrupted

fluctuations that is conducted on the US shares. The investors can use the US shares in their

portfolio to generate higher returns while accommodating the high level of risk associated with

the asset class (Hammoudeh et al. 2014).

US Fed Funds Rate (USD) in December:

The US Fed fund rates are considered to be one of the risk free asset that is traded in the

United States, where investors can use the asset class to minimize the level of risk involved in

investment. The calculation has directly provided insight on the risk and return conditions of the

asset class, where the geometric mean is at the levels of 1.8196% while the arithmetic mean is at

1.8395%. In a similar instance, the risk and standard deviation of the asset is also considered to

be the second lowest in comparison to other asset. The variance is at the levels of 0.0431% while

the standard deviation is that 2.0760%, which makes the investment in US fund rate risk free in

comparison to other investment options. The difference between arithmetic and geometric mean

is minimal, which states about the lowest fluctuations that is present within the asset class.

Lastly, the maximum and minimum values of the US fed fund rate is at the levels of 6.4% and

investment class leaving Brent oil, as they have the variance at 3.057%, while the standard

deviation at 17.4856%. The high level of risk attributes of the asset class is considered to be most

risky for investors, as it would increase the investment risk. The arithmetic mean of the asset

classes is at the level of 7.1575% while geometric mean is at 5.6152%. The staggering difference

between the arithmetic and geometric mean provides insight on the volatility that is present on

the fluctuations of US shares return. The risk contribution of the asset class is mainly supported

by the maximum and minimum returns, which is at the levels of 32.39% and negative -37%. The

difference between the minimum and maximum returns provides insight on the uninterrupted

fluctuations that is conducted on the US shares. The investors can use the US shares in their

portfolio to generate higher returns while accommodating the high level of risk associated with

the asset class (Hammoudeh et al. 2014).

US Fed Funds Rate (USD) in December:

The US Fed fund rates are considered to be one of the risk free asset that is traded in the

United States, where investors can use the asset class to minimize the level of risk involved in

investment. The calculation has directly provided insight on the risk and return conditions of the

asset class, where the geometric mean is at the levels of 1.8196% while the arithmetic mean is at

1.8395%. In a similar instance, the risk and standard deviation of the asset is also considered to

be the second lowest in comparison to other asset. The variance is at the levels of 0.0431% while

the standard deviation is that 2.0760%, which makes the investment in US fund rate risk free in

comparison to other investment options. The difference between arithmetic and geometric mean

is minimal, which states about the lowest fluctuations that is present within the asset class.

Lastly, the maximum and minimum values of the US fed fund rate is at the levels of 6.4% and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7INVESTMENT ANALYSIS AND PORTFOLIO MANAGEMENT

0.07%, which does not speak about the high fluctuations that is present assets price

movement(Delfim and Hoesli 2018).

Brent Oil (USD):

One of the most risky investment options that are calculated in the above table is the

Brent oil. The Brent Oil asset class is considered to be one of the riskiest investment options, as

it has a standard deviation value of 50.2576%, while a variance value of 25.2580%. The high

levels of standard deviation and variance directly states about the volatility that is present in the

price fluctuations of Brent oil. In the similar process, the maximum return that is provided by

Brent oil is at the levels of 172.6% while the minimum returns is at -56.6%. Thus, investors to

generate high level of returns while accommodating high risk in that portfolio can conduct the

investment in Brent oil. The further analysis of the calculation has directly stated that Brent oil

has a arithmetic mean of 21.1550% while a geometric mean of 11.70280%. The major difference

between the geometric and arithmetic mean is due to the volatility and price fluctuations that are

present within the Brent oil asset class. Therefore, investors can use the investment class to

improve the returns from the portfolio while accommodating for the risk attributes of Brent oil

(McKay, Shaoiro and Thomas 2018).

0.07%, which does not speak about the high fluctuations that is present assets price

movement(Delfim and Hoesli 2018).

Brent Oil (USD):

One of the most risky investment options that are calculated in the above table is the

Brent oil. The Brent Oil asset class is considered to be one of the riskiest investment options, as

it has a standard deviation value of 50.2576%, while a variance value of 25.2580%. The high

levels of standard deviation and variance directly states about the volatility that is present in the

price fluctuations of Brent oil. In the similar process, the maximum return that is provided by

Brent oil is at the levels of 172.6% while the minimum returns is at -56.6%. Thus, investors to

generate high level of returns while accommodating high risk in that portfolio can conduct the

investment in Brent oil. The further analysis of the calculation has directly stated that Brent oil

has a arithmetic mean of 21.1550% while a geometric mean of 11.70280%. The major difference

between the geometric and arithmetic mean is due to the volatility and price fluctuations that are

present within the Brent oil asset class. Therefore, investors can use the investment class to

improve the returns from the portfolio while accommodating for the risk attributes of Brent oil

(McKay, Shaoiro and Thomas 2018).

8INVESTMENT ANALYSIS AND PORTFOLIO MANAGEMENT

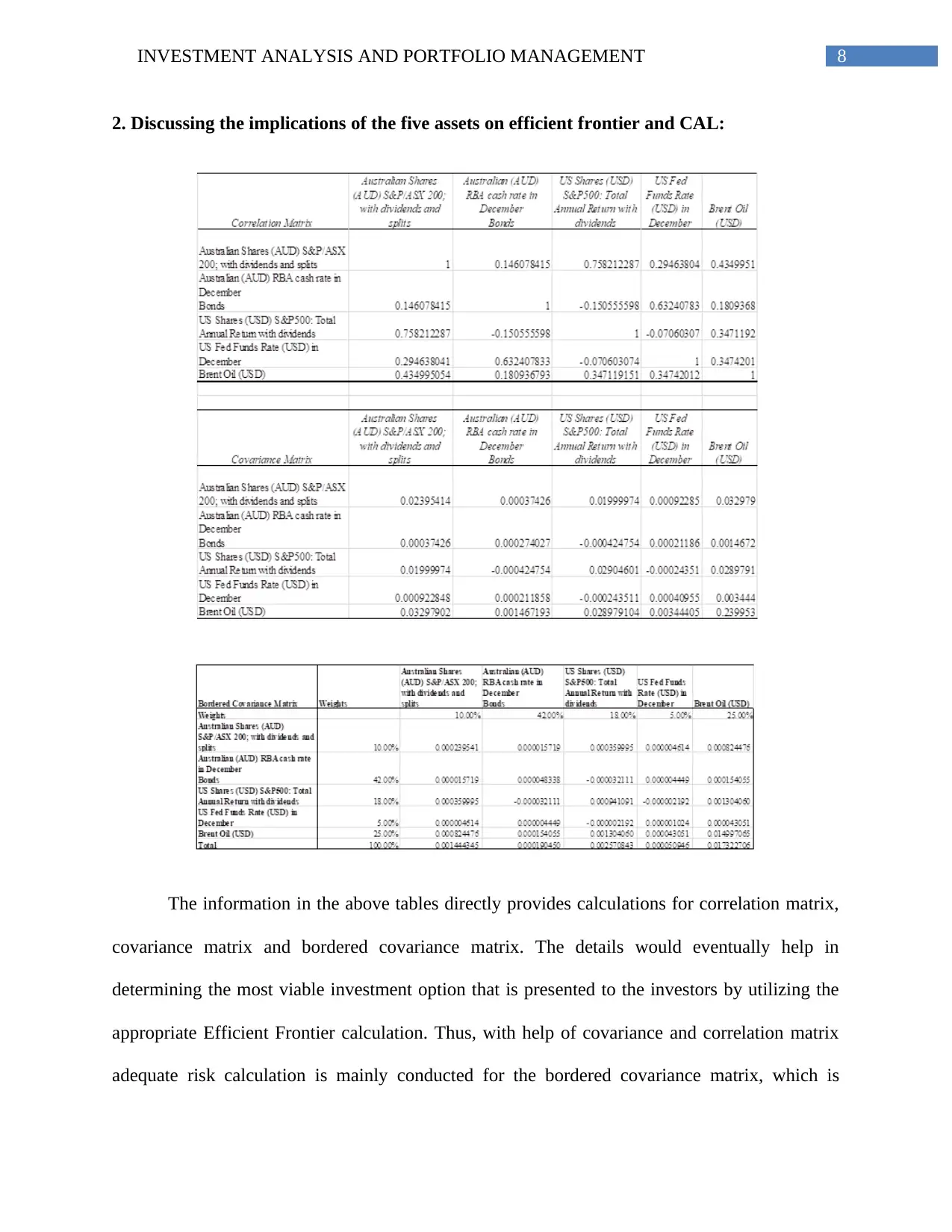

2. Discussing the implications of the five assets on efficient frontier and CAL:

The information in the above tables directly provides calculations for correlation matrix,

covariance matrix and bordered covariance matrix. The details would eventually help in

determining the most viable investment option that is presented to the investors by utilizing the

appropriate Efficient Frontier calculation. Thus, with help of covariance and correlation matrix

adequate risk calculation is mainly conducted for the bordered covariance matrix, which is

2. Discussing the implications of the five assets on efficient frontier and CAL:

The information in the above tables directly provides calculations for correlation matrix,

covariance matrix and bordered covariance matrix. The details would eventually help in

determining the most viable investment option that is presented to the investors by utilizing the

appropriate Efficient Frontier calculation. Thus, with help of covariance and correlation matrix

adequate risk calculation is mainly conducted for the bordered covariance matrix, which is

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9INVESTMENT ANALYSIS AND PORTFOLIO MANAGEMENT

utilized in identifying the different kind of weights certain asset class, should have to obtain the

targeted returns. Therefore, by utilizing, the appropriate data from the above table relevant

calculations has been conducted to present the best viable portfolio risk and portfolio returns for

different weights. The use of adequate calculation it is detected that bordered covariance Matrix

can be used to identify the best possible risk and return ratio for investors.

0.00% 10.00% 20.00% 30.00% 40.00% 50.00% 60.00%

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

30.00%

35.00%

40.00%

45.00%

50.00%

Efficient Frontier and Capital Allocation Line

Efficient frontier CAL

Portfolio risk

Portfolio return

utilized in identifying the different kind of weights certain asset class, should have to obtain the

targeted returns. Therefore, by utilizing, the appropriate data from the above table relevant

calculations has been conducted to present the best viable portfolio risk and portfolio returns for

different weights. The use of adequate calculation it is detected that bordered covariance Matrix

can be used to identify the best possible risk and return ratio for investors.

0.00% 10.00% 20.00% 30.00% 40.00% 50.00% 60.00%

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

30.00%

35.00%

40.00%

45.00%

50.00%

Efficient Frontier and Capital Allocation Line

Efficient frontier CAL

Portfolio risk

Portfolio return

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10INVESTMENT ANALYSIS AND PORTFOLIO MANAGEMENT

The graph directly presents information regarding the overall capital allocation line and

efficient Frontier, which can be used by investors to identify the viable investment options

presented to them. The table provides a list of portfolio risk and portfolio returns that can be used

by an investor to identify the viable risk and reward ratio that could allow them to generate the

targeted returns from their investment. The calculation of Sharpe ratio and capital asset line has

also been conducted to determine the best possible investment scenario for investor can use to

support its investment criteria and in return generate the maximum level of income from their

portfolio.

Efficient Frontier line directly projects a curve diagram tourist attributes of a particular

investment is a relatively lower in comparison to the return contribution. The minimum returns

generated from a portfolio are 2.5%, which is considered the risk free asset. Therefore, it is

understood that investors would rely on risk free assets to generate returns when the returns are

lower than 2.5%, as calculated from the efficient Frontier. Hence, the contribution of the

investors are mainly conducted when the returns of the investment is the higher than the rate.

This is the main reason why the curve of the overall efficient Frontier is not high in comparison

to the standard graphs. Investors with the help of above graph can identify the minimum variance

portfolio and the optimum portfolio, which could help them to support their investment needs.

The minimum variance portfolio and optimal portfolio method provides investors with the

information regarding the different segments of risk and return conditions (Hong, Juneja and Liu

2017).

The graph directly presents information regarding the overall capital allocation line and

efficient Frontier, which can be used by investors to identify the viable investment options

presented to them. The table provides a list of portfolio risk and portfolio returns that can be used

by an investor to identify the viable risk and reward ratio that could allow them to generate the

targeted returns from their investment. The calculation of Sharpe ratio and capital asset line has

also been conducted to determine the best possible investment scenario for investor can use to

support its investment criteria and in return generate the maximum level of income from their

portfolio.

Efficient Frontier line directly projects a curve diagram tourist attributes of a particular

investment is a relatively lower in comparison to the return contribution. The minimum returns

generated from a portfolio are 2.5%, which is considered the risk free asset. Therefore, it is

understood that investors would rely on risk free assets to generate returns when the returns are

lower than 2.5%, as calculated from the efficient Frontier. Hence, the contribution of the

investors are mainly conducted when the returns of the investment is the higher than the rate.

This is the main reason why the curve of the overall efficient Frontier is not high in comparison

to the standard graphs. Investors with the help of above graph can identify the minimum variance

portfolio and the optimum portfolio, which could help them to support their investment needs.

The minimum variance portfolio and optimal portfolio method provides investors with the

information regarding the different segments of risk and return conditions (Hong, Juneja and Liu

2017).

11INVESTMENT ANALYSIS AND PORTFOLIO MANAGEMENT

3. Stating the reasons behind the popularity of Minimum variance portfolio, while

synthesise about the modern portfolio:

The information presented in the above figure provides insight on the overall minimum

variance portfolio that has been created with the help of the efficient Frontier. The minimum

variance portfolio has been stated that with the conditions of 1.58% the portfolio could generate

a return of 3.94% by making adequate combinations of different asset class weights. Minimum

variance portfolio is considered to be one of the best viable investment options that allow

investors to minimize the risk exposure in the capital market. Normative theory is considered to

be a standard or norm of behavior that investors pursue in constructing a portfolio, which directly

indicates that modern portfolio theory, is normative. The comparison of minimum variance

portfolio and modern portfolio theory has mainly stated about the overall difference between the

perspectives of an investor. The minimum variance portfolio is considered to be the most

attractive and best possible option that is used by investors all around the world, as it allows

them to mitigate the risk from investment. Santacruz (2016) indicated that investors have

conservative investment approach uses the minimum variance portfolio, as it focuses on risk free

asset investment, while improving the benefits from the portfolio exposure.

Conclusion:

After analyzing all the relevant points regarding the investment portfolio creation, it has

been detected that the most viable investment option presented to investors is minimum variance

3. Stating the reasons behind the popularity of Minimum variance portfolio, while

synthesise about the modern portfolio:

The information presented in the above figure provides insight on the overall minimum

variance portfolio that has been created with the help of the efficient Frontier. The minimum

variance portfolio has been stated that with the conditions of 1.58% the portfolio could generate

a return of 3.94% by making adequate combinations of different asset class weights. Minimum

variance portfolio is considered to be one of the best viable investment options that allow

investors to minimize the risk exposure in the capital market. Normative theory is considered to

be a standard or norm of behavior that investors pursue in constructing a portfolio, which directly

indicates that modern portfolio theory, is normative. The comparison of minimum variance

portfolio and modern portfolio theory has mainly stated about the overall difference between the

perspectives of an investor. The minimum variance portfolio is considered to be the most

attractive and best possible option that is used by investors all around the world, as it allows

them to mitigate the risk from investment. Santacruz (2016) indicated that investors have

conservative investment approach uses the minimum variance portfolio, as it focuses on risk free

asset investment, while improving the benefits from the portfolio exposure.

Conclusion:

After analyzing all the relevant points regarding the investment portfolio creation, it has

been detected that the most viable investment option presented to investors is minimum variance

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.