FIN 360 Investment Analysis: Cryptocurrency Markets Using CCI Model

VerifiedAdded on 2023/04/22

|13

|2756

|261

Report

AI Summary

This report provides an analysis of cryptocurrency markets using the Commodity Channel Index (CCI) model, in the context of investment analysis and portfolio management. It begins by explaining technical analysis and its growing importance, particularly in relation to cryptocurrency investments. The report discusses the role and trends of cryptocurrencies like Ripple (XRP), followed by the data collection process and an overview of the CCI background, including its formulas and computations. It evaluates the effectiveness of various CCI models in maximizing returns compared to traditional buy-and-hold strategies, recommending the monthly CCI model for long-term investors. The analysis emphasizes that the CCI model offers a more comprehensive approach to investment decisions by comparing current and historical prices to identify potential buying or selling opportunities.

qwertyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopasdfghj

klzxcvbnmqwertyuiopasdfghjklzxcvbn

mqwertyuiopasdfghjklzxcvbnmqwerty

uiopasdfghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmqwertyuiopasdfghjklzxcvb

nmqwertyuiopasdfghjklzxcvbnmqwert

yuiopasdfghjklzxcvbnmqwertyuiopasdf

ghjklzxcvbnmqwertyuiopasdfghjklzxcv

bnmqwertyuiopasdfghjklzxcvbnmqwer

tyuiopasdfghjklzxcvbnmqwertyuiopasd

fghjklzxcvbnmqwertyuiopasdfghjklzxcv

bnmqwertyuiopasdfghjklzxcvbnmqwer

tyuiopasdfghjklzxcvbnmrtyuiopasdfghj

klzxcvbnmqwertyuiopasdfghjklzxcvbn

mqwertyuiopasdfghjklzxcvbnmqwerty

Investment Analysis and

Portfolio Management

opasdfghjklzxcvbnmqwertyuiopasdfghj

klzxcvbnmqwertyuiopasdfghjklzxcvbn

mqwertyuiopasdfghjklzxcvbnmqwerty

uiopasdfghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmqwertyuiopasdfghjklzxcvb

nmqwertyuiopasdfghjklzxcvbnmqwert

yuiopasdfghjklzxcvbnmqwertyuiopasdf

ghjklzxcvbnmqwertyuiopasdfghjklzxcv

bnmqwertyuiopasdfghjklzxcvbnmqwer

tyuiopasdfghjklzxcvbnmqwertyuiopasd

fghjklzxcvbnmqwertyuiopasdfghjklzxcv

bnmqwertyuiopasdfghjklzxcvbnmqwer

tyuiopasdfghjklzxcvbnmrtyuiopasdfghj

klzxcvbnmqwertyuiopasdfghjklzxcvbn

mqwertyuiopasdfghjklzxcvbnmqwerty

Investment Analysis and

Portfolio Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Executive Summary

Efficient Market Hypothesis is vital as it provides strong support to the fundamental asset value.

However, the existence of noise traders leads to some disturbance in the fundamental value that

persists over time. This led to the concept of technical analysis that enables the decision making

of the investors. One of the priority tools that is used in this scenario is that of Commodity

Channel Index (CCI) that is discussed in the report.

2

Efficient Market Hypothesis is vital as it provides strong support to the fundamental asset value.

However, the existence of noise traders leads to some disturbance in the fundamental value that

persists over time. This led to the concept of technical analysis that enables the decision making

of the investors. One of the priority tools that is used in this scenario is that of Commodity

Channel Index (CCI) that is discussed in the report.

2

Contents

Introduction and Data Analysis....................................................................................................................3

1a. Technical Analysis..................................................................................................................................3

1b. Popularity in the last year......................................................................................................................4

1c. Role of crypto currencies in investments...............................................................................................5

1d. Trend of the crypto currency.................................................................................................................6

2. Data collection.........................................................................................................................................6

3. CCI background........................................................................................................................................7

Analysis and Evaluation:..............................................................................................................................8

Conclusion.................................................................................................................................................10

References.................................................................................................................................................11

3

Introduction and Data Analysis....................................................................................................................3

1a. Technical Analysis..................................................................................................................................3

1b. Popularity in the last year......................................................................................................................4

1c. Role of crypto currencies in investments...............................................................................................5

1d. Trend of the crypto currency.................................................................................................................6

2. Data collection.........................................................................................................................................6

3. CCI background........................................................................................................................................7

Analysis and Evaluation:..............................................................................................................................8

Conclusion.................................................................................................................................................10

References.................................................................................................................................................11

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Introduction and Data Analysis

1a. Technical Analysis

Using various market analysis tools to find out the reasons for the deviation of company

fundamentals and finding ways to eradicate the deviation is the job of technical analysis. It is in

nature a discipline of study, which employs the study of evaluation of investment options. It is

intrinsically a trading discipline. It uses past trends of an investment to decide investment options

on an investment. The nature of trends can vary from price movements to volume changes. All

these past trends act as statistics for investment decisions and calculations (Parrino, Kidwell &

Bates, 2012). Furthermore, in order to apply technical analysis, a past history of the trading is a

must. Hence technical analysis can be applied on shares, futures, bonds, commodities,

currencies, etc. to name a few. In short, all those investment options that trade, and have been

trading for quite some time, technical analysis can be applied to them.

For a layman to understand the concept, it can safely be said that any market financial

instrument, which is being traded on the exchange regularly or periodically, and has sufficient

trading history so as to use its past trends to analyze the performance of the stock and thereby

take investment decisions by predicting its future based on its past trends. So, this is what

technical analysis means.

The technical analysis concept is built upon assumptions. The key assumptions are as follows:

1. Artificial or non-natural price changes do not affect- dividend payouts, share repurchases

and/or share splits etc. result in artificial price changes. And the form of distribution of money

into the market also results in an artificial change in prices (Petty., Titman., Keown., Martin.,

Burrow. and Nguyen, 2012). This makes decision making using the market data difficult

because of an unnatural price change, however, the basic market value remains unaffected.

2. Liquidity- for accurate and efficient decision making, it is assumed that a share or security is

highly liquid. Stocks with high mobility in the market are easier to trade and result in less

deviation of prices because of the ready and steady demand and supply. This results in lesser

4

1a. Technical Analysis

Using various market analysis tools to find out the reasons for the deviation of company

fundamentals and finding ways to eradicate the deviation is the job of technical analysis. It is in

nature a discipline of study, which employs the study of evaluation of investment options. It is

intrinsically a trading discipline. It uses past trends of an investment to decide investment options

on an investment. The nature of trends can vary from price movements to volume changes. All

these past trends act as statistics for investment decisions and calculations (Parrino, Kidwell &

Bates, 2012). Furthermore, in order to apply technical analysis, a past history of the trading is a

must. Hence technical analysis can be applied on shares, futures, bonds, commodities,

currencies, etc. to name a few. In short, all those investment options that trade, and have been

trading for quite some time, technical analysis can be applied to them.

For a layman to understand the concept, it can safely be said that any market financial

instrument, which is being traded on the exchange regularly or periodically, and has sufficient

trading history so as to use its past trends to analyze the performance of the stock and thereby

take investment decisions by predicting its future based on its past trends. So, this is what

technical analysis means.

The technical analysis concept is built upon assumptions. The key assumptions are as follows:

1. Artificial or non-natural price changes do not affect- dividend payouts, share repurchases

and/or share splits etc. result in artificial price changes. And the form of distribution of money

into the market also results in an artificial change in prices (Petty., Titman., Keown., Martin.,

Burrow. and Nguyen, 2012). This makes decision making using the market data difficult

because of an unnatural price change, however, the basic market value remains unaffected.

2. Liquidity- for accurate and efficient decision making, it is assumed that a share or security is

highly liquid. Stocks with high mobility in the market are easier to trade and result in less

deviation of prices because of the ready and steady demand and supply. This results in lesser

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

fluctuations and hence, technical analysis and decision making become easier (Porter & Norton,

2014). However, for less mobile securities, prices have to be heavily negotiated upon in order to

strike a buy or sell deal, and hence, there are higher fluctuations. Hence, mobility here refers to

the ready market for sale and purchase, in short trading of stocks.

3. External extremities- any external extremity, political turmoil, sad or happy sudden news,

etc. can result in high price fluctuations.

These assumptions are fundamental in decision making. Technical analysis is an efficient tool for

making a financial decision because the market patterns form the basis for decision making using

technical analysis tools.

1b. Popularity in the last year

The erstwhile technique of analysis of a company’s performance was the fundamental analysis.

This technique required the evaluation of a company’s performance by using its financial

statements and thereby computing the intrinsic value of the company. This technique required

the use of analytical tools to compute the company’s earnings, overall and per share, the

company’s GDP, it's liquidity ratios and positioning, and the list is huge (Needles & Powers,

2013). However, this system had its drawbacks. The company’s intrinsic value was determinable

by the use of fundamental analysis but the real-time situation of the company and a ready

comparison can be drawn by using the technique of technical analysis (Laux, 2014).

The technical analysis helps in evaluating a company’s position and status on a real-time basis

since the information is readily available for a regularly trading stock or such other tradable

investment instrument (Lui & Chong, 2010). In the past two decades, with dematerialization of

stocks, the technique of technical analysis became very popular because of increasing

competition in the market amongst the companies, and because the information so derived is

comparable and there is a benefit of comparison amongst the companies belonging to the same

industry (Melville, 2013).

Another reason for the increased use of technical analysis in the past two decades is that trends

are an important tool when it comes to the principle of forecast. Financial instruments can be

used to analyze the past information and performance of a company but the efficiency of the

5

2014). However, for less mobile securities, prices have to be heavily negotiated upon in order to

strike a buy or sell deal, and hence, there are higher fluctuations. Hence, mobility here refers to

the ready market for sale and purchase, in short trading of stocks.

3. External extremities- any external extremity, political turmoil, sad or happy sudden news,

etc. can result in high price fluctuations.

These assumptions are fundamental in decision making. Technical analysis is an efficient tool for

making a financial decision because the market patterns form the basis for decision making using

technical analysis tools.

1b. Popularity in the last year

The erstwhile technique of analysis of a company’s performance was the fundamental analysis.

This technique required the evaluation of a company’s performance by using its financial

statements and thereby computing the intrinsic value of the company. This technique required

the use of analytical tools to compute the company’s earnings, overall and per share, the

company’s GDP, it's liquidity ratios and positioning, and the list is huge (Needles & Powers,

2013). However, this system had its drawbacks. The company’s intrinsic value was determinable

by the use of fundamental analysis but the real-time situation of the company and a ready

comparison can be drawn by using the technique of technical analysis (Laux, 2014).

The technical analysis helps in evaluating a company’s position and status on a real-time basis

since the information is readily available for a regularly trading stock or such other tradable

investment instrument (Lui & Chong, 2010). In the past two decades, with dematerialization of

stocks, the technique of technical analysis became very popular because of increasing

competition in the market amongst the companies, and because the information so derived is

comparable and there is a benefit of comparison amongst the companies belonging to the same

industry (Melville, 2013).

Another reason for the increased use of technical analysis in the past two decades is that trends

are an important tool when it comes to the principle of forecast. Financial instruments can be

used to analyze the past information and performance of a company but the efficiency of the

5

forecast of the company’s performance using the past financial data is difficult. However, using

the trends of performance, the forecast is easier (Power, 2017).

1c. Role of crypto currencies in investments

Before understanding the role of cryptocurrency in investment, it is important to understand the

basics of cryptocurrency because this is a newer and less known concept in the investment world.

In a layman’s view, cryptocurrency is the safest form of investment. Cryptocurrency is like a

digitalized form of money, which is used as a medium of exchange. It has strongly

cryptographed so as to provide maximum security on its transfer. The transfer of these assets is

verified and tracked and the generation of such money is regulated (Quiggin, 2013). This is

therefore considered the safest form of exchange. All of it, be it generation, creation, acquisition,

exchange or transfer, it is all tracked and regulated and registered by either a centralized or also

decentralized banking system.

Now coming to the topic of concern here, let us understand the Ripple protocol. Ripple control is

selected in this scenario. Ripple labs had come up with this unique concept of gross settlement,

exchange and remittance network, as is defined in the standard Wikipedia definition of ripple.

One of the modes of exchange of ripple includes cryptocurrencies along with others. Ripple

employs a decentralized cryptocurrency names XRP, which is the second largest cryptocurrency

in terms of market capitalization, bitcoin being the first (Quiggin, 2013).

1d. Trend of the crypto currency

With multiple views and perceptions regarding cryptocurrency, its usage and propaganda, it has

its share of acceptances and rejections in the international financial markets. It appears that the

world of cryptocurrency will see its share of bullish markets more often than the bearish market

(Ross., Christensen., Drew., Bianchi., Westerfield and Jordan, 2014). The trend which looks

more obvious is the bullish trend. There are multiple views against the invention of crypto. Many

consider it to be a malicious invention and hold it responsible for investment market foul play

and possibilities of scams are associated with crypto. However, there are many market players

who are playing big bets and propagating crypto as the best possible and safest newer form of

money. The big bulls are surely going to enter the market and sweep the market up to bullish

trends.

6

the trends of performance, the forecast is easier (Power, 2017).

1c. Role of crypto currencies in investments

Before understanding the role of cryptocurrency in investment, it is important to understand the

basics of cryptocurrency because this is a newer and less known concept in the investment world.

In a layman’s view, cryptocurrency is the safest form of investment. Cryptocurrency is like a

digitalized form of money, which is used as a medium of exchange. It has strongly

cryptographed so as to provide maximum security on its transfer. The transfer of these assets is

verified and tracked and the generation of such money is regulated (Quiggin, 2013). This is

therefore considered the safest form of exchange. All of it, be it generation, creation, acquisition,

exchange or transfer, it is all tracked and regulated and registered by either a centralized or also

decentralized banking system.

Now coming to the topic of concern here, let us understand the Ripple protocol. Ripple control is

selected in this scenario. Ripple labs had come up with this unique concept of gross settlement,

exchange and remittance network, as is defined in the standard Wikipedia definition of ripple.

One of the modes of exchange of ripple includes cryptocurrencies along with others. Ripple

employs a decentralized cryptocurrency names XRP, which is the second largest cryptocurrency

in terms of market capitalization, bitcoin being the first (Quiggin, 2013).

1d. Trend of the crypto currency

With multiple views and perceptions regarding cryptocurrency, its usage and propaganda, it has

its share of acceptances and rejections in the international financial markets. It appears that the

world of cryptocurrency will see its share of bullish markets more often than the bearish market

(Ross., Christensen., Drew., Bianchi., Westerfield and Jordan, 2014). The trend which looks

more obvious is the bullish trend. There are multiple views against the invention of crypto. Many

consider it to be a malicious invention and hold it responsible for investment market foul play

and possibilities of scams are associated with crypto. However, there are many market players

who are playing big bets and propagating crypto as the best possible and safest newer form of

money. The big bulls are surely going to enter the market and sweep the market up to bullish

trends.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2. Data collection

In excel sheet.

Refer excel workbook (Sheet- ‘Daily data 2014-2018’)

3. CCI background

7

In excel sheet.

Refer excel workbook (Sheet- ‘Daily data 2014-2018’)

3. CCI background

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

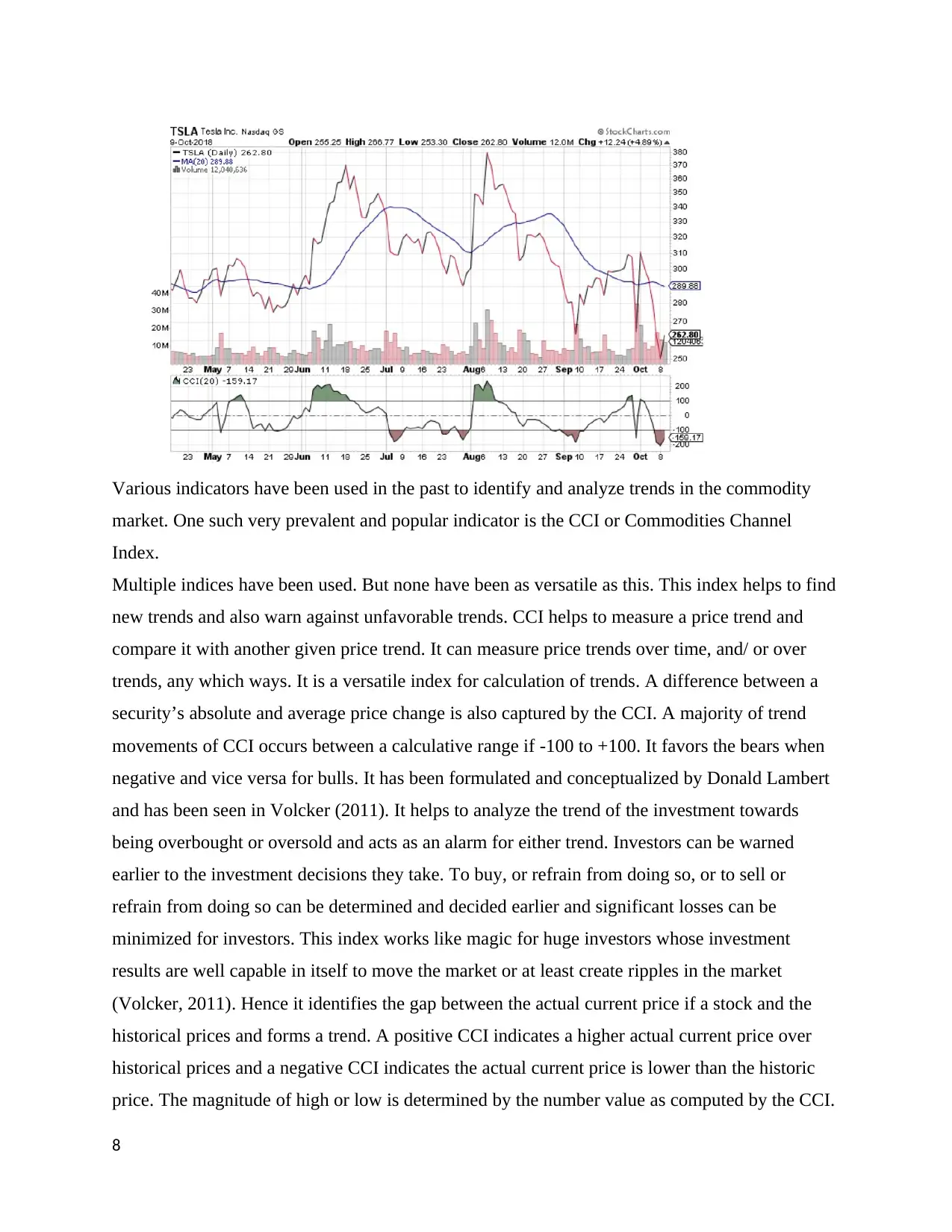

Various indicators have been used in the past to identify and analyze trends in the commodity

market. One such very prevalent and popular indicator is the CCI or Commodities Channel

Index.

Multiple indices have been used. But none have been as versatile as this. This index helps to find

new trends and also warn against unfavorable trends. CCI helps to measure a price trend and

compare it with another given price trend. It can measure price trends over time, and/ or over

trends, any which ways. It is a versatile index for calculation of trends. A difference between a

security’s absolute and average price change is also captured by the CCI. A majority of trend

movements of CCI occurs between a calculative range if -100 to +100. It favors the bears when

negative and vice versa for bulls. It has been formulated and conceptualized by Donald Lambert

and has been seen in Volcker (2011). It helps to analyze the trend of the investment towards

being overbought or oversold and acts as an alarm for either trend. Investors can be warned

earlier to the investment decisions they take. To buy, or refrain from doing so, or to sell or

refrain from doing so can be determined and decided earlier and significant losses can be

minimized for investors. This index works like magic for huge investors whose investment

results are well capable in itself to move the market or at least create ripples in the market

(Volcker, 2011). Hence it identifies the gap between the actual current price if a stock and the

historical prices and forms a trend. A positive CCI indicates a higher actual current price over

historical prices and a negative CCI indicates the actual current price is lower than the historic

price. The magnitude of high or low is determined by the number value as computed by the CCI.

8

market. One such very prevalent and popular indicator is the CCI or Commodities Channel

Index.

Multiple indices have been used. But none have been as versatile as this. This index helps to find

new trends and also warn against unfavorable trends. CCI helps to measure a price trend and

compare it with another given price trend. It can measure price trends over time, and/ or over

trends, any which ways. It is a versatile index for calculation of trends. A difference between a

security’s absolute and average price change is also captured by the CCI. A majority of trend

movements of CCI occurs between a calculative range if -100 to +100. It favors the bears when

negative and vice versa for bulls. It has been formulated and conceptualized by Donald Lambert

and has been seen in Volcker (2011). It helps to analyze the trend of the investment towards

being overbought or oversold and acts as an alarm for either trend. Investors can be warned

earlier to the investment decisions they take. To buy, or refrain from doing so, or to sell or

refrain from doing so can be determined and decided earlier and significant losses can be

minimized for investors. This index works like magic for huge investors whose investment

results are well capable in itself to move the market or at least create ripples in the market

(Volcker, 2011). Hence it identifies the gap between the actual current price if a stock and the

historical prices and forms a trend. A positive CCI indicates a higher actual current price over

historical prices and a negative CCI indicates the actual current price is lower than the historic

price. The magnitude of high or low is determined by the number value as computed by the CCI.

8

The higher the magnitude, the higher is the downside, and vice versa for a low side trend. The

index is unbound. The magnitude of the downside or high side is unpredictable. The index can

compute any magnitude of the same.

Mathematics must also be known. Let us understand the formulas, and computations of the CCI.

Commodity Chanel Index (CCI) = (typical price- moving average)/0.015*average deviation.

Typical price = (High+Low+Close)/3 for each period under computation and trend analysis.

Moving Average = (Sum of typical prices)/ Number of periods added together.

Mean Deviation = The Typical Price minus the moving average for the period.

Analysis and Evaluation:

1. CCI Model

Refer excel workbook

(Sheets- ‘Daily CCI’ and ‘Monthly CCI’)

2. Evaluation of the role of various CCI models

CCI models or Commodity Channel Index when compared with the traditional buy-and-hold

decisions are a lot more comprehensive. CCI model or Commodity channel index is the

difference between the historical prices and the current price. A positive Commodity Channel

Index (CCI) represents that the current price is above the historical average price. On the other

hand, a negative Commodity Channel Index (CCI) represents that the current price is below the

historic average price.

There can be two ways of buy-and-sell decision making under Commodity Channel Index (CCI),

+/- 100 levels and also +/-200 levels. In +/- 100 methods, readings of 100 or more indicate that

the current prices will exceed the historic prices and low readings of -100 or less, indicate that

the current prices are well below the historic prices. Whereas, in +/- 200 methods, readings of

200 or more indicate that the current prices will exceed the historic prices and low readings of -

200 or less, indicate that the current prices are well below the historic prices.

9

index is unbound. The magnitude of the downside or high side is unpredictable. The index can

compute any magnitude of the same.

Mathematics must also be known. Let us understand the formulas, and computations of the CCI.

Commodity Chanel Index (CCI) = (typical price- moving average)/0.015*average deviation.

Typical price = (High+Low+Close)/3 for each period under computation and trend analysis.

Moving Average = (Sum of typical prices)/ Number of periods added together.

Mean Deviation = The Typical Price minus the moving average for the period.

Analysis and Evaluation:

1. CCI Model

Refer excel workbook

(Sheets- ‘Daily CCI’ and ‘Monthly CCI’)

2. Evaluation of the role of various CCI models

CCI models or Commodity Channel Index when compared with the traditional buy-and-hold

decisions are a lot more comprehensive. CCI model or Commodity channel index is the

difference between the historical prices and the current price. A positive Commodity Channel

Index (CCI) represents that the current price is above the historical average price. On the other

hand, a negative Commodity Channel Index (CCI) represents that the current price is below the

historic average price.

There can be two ways of buy-and-sell decision making under Commodity Channel Index (CCI),

+/- 100 levels and also +/-200 levels. In +/- 100 methods, readings of 100 or more indicate that

the current prices will exceed the historic prices and low readings of -100 or less, indicate that

the current prices are well below the historic prices. Whereas, in +/- 200 methods, readings of

200 or more indicate that the current prices will exceed the historic prices and low readings of -

200 or less, indicate that the current prices are well below the historic prices.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

In both approaches, a move of the trend from – 100/200 to +100/200 indicates a strong upside

trend. On the other hand, a move of the trend from +100/200 to -100/200 indicates a strong

downside trend.

3. Recommendation

Monthly Commodity Channel Index (CCI) model can be recommended to a long term investor.

This is because for a long term investor, understanding the trends at the monthly level is more

beneficial rather than comparing trends on a daily basis as the investment is going to be for a

long period of time(months).

10

trend. On the other hand, a move of the trend from +100/200 to -100/200 indicates a strong

downside trend.

3. Recommendation

Monthly Commodity Channel Index (CCI) model can be recommended to a long term investor.

This is because for a long term investor, understanding the trends at the monthly level is more

beneficial rather than comparing trends on a daily basis as the investment is going to be for a

long period of time(months).

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Conclusion

To end, it can be reiterated the fact that the Commodity Channel Index (CCI) model of taking

investing decisions is a more comprehensive and holistic approach as compared to the traditional

buy-and-sell approach. It clearly, logically and analytically shows the trends in prices of the

commodity. It also makes it easier to take investing decisions. In the above research on XRP –

Cryptocurrency, the monthly CCI index clearly shows that the commodity was first at an upward

trend from 2014-mid 2017 and then at a downward trend till 2018. This will aid an investor in

taking sound investment decisions.

The future scope for research in this area should be to make the Commodity Channel Index

(CCI) even easier to understand and calculate while at the same time making it more holistic.

11

To end, it can be reiterated the fact that the Commodity Channel Index (CCI) model of taking

investing decisions is a more comprehensive and holistic approach as compared to the traditional

buy-and-sell approach. It clearly, logically and analytically shows the trends in prices of the

commodity. It also makes it easier to take investing decisions. In the above research on XRP –

Cryptocurrency, the monthly CCI index clearly shows that the commodity was first at an upward

trend from 2014-mid 2017 and then at a downward trend till 2018. This will aid an investor in

taking sound investment decisions.

The future scope for research in this area should be to make the Commodity Channel Index

(CCI) even easier to understand and calculate while at the same time making it more holistic.

11

References

Laux, B. (2014). Discussion of The role of revenue recognition in performance reporting, 44,

349-379. Retrieved from https://doi.org/10.1080/00014788.2014.897867

Lui, K.M. and Chong, T.T.L. (2010). Do Technical Analysts Outperform Novice Traders:

Experimental Evidence. Economics Bulletin, 33(4), 3080-3087. Retrieved from

http://www.accessecon.com/Pubs/EB/2013/Volume33/EB-13-V33-I4-P287.pdf

Melville, A. (2013). International Financial Reporting – A Practical Guide. 4th edition. Pearson,

Education Limited, UK

Needles, B.E., & Powers, M. (2013). Principles of Financial Accounting (12th Edition). Financial

Accounting Series: Cengage Learning.

Parrino, R, Kidwell, D. & Bates, T. (2012). Fundamentals of corporate finance (3rd edition).

Hoboken.

Petty, J. W, Titman, S., Keown, A. J., Martin, J. D., Burrow, M. and Nguyen, H. (2012)

Financial Management: Principles and Applications (6th ed). Australia: Pearson

Education Australia.

Porter, G. and Norton, C. (2014). Financial Accounting: The Impact on Decision Maker (10th

edition). Texas: Cengage Learning

Power, T. (2017) Fund choice: Comparing super funds in 8 steps [online]. Retrieved from:

https://www.superguide.com.au/boost-your-superannuation/comparing-super-funds-in-8-

steps

Quiggin, J (2013). The Bitcoin Bubble and a Bad Hypothesis. Retrieved from:

https://nationalinterest.org/commentary/the-bitcoin-bubble-bad-hypothesis-8353

Ross, S., Christensen, M., Drew, M., Bianchi, R., Westerfield, R. And Jordan, B.(2014).

Fundamentals of Corporate Finance, 7th ed. North Ryde: McGraw-Hill Australia Pty

Ltd.

12

Laux, B. (2014). Discussion of The role of revenue recognition in performance reporting, 44,

349-379. Retrieved from https://doi.org/10.1080/00014788.2014.897867

Lui, K.M. and Chong, T.T.L. (2010). Do Technical Analysts Outperform Novice Traders:

Experimental Evidence. Economics Bulletin, 33(4), 3080-3087. Retrieved from

http://www.accessecon.com/Pubs/EB/2013/Volume33/EB-13-V33-I4-P287.pdf

Melville, A. (2013). International Financial Reporting – A Practical Guide. 4th edition. Pearson,

Education Limited, UK

Needles, B.E., & Powers, M. (2013). Principles of Financial Accounting (12th Edition). Financial

Accounting Series: Cengage Learning.

Parrino, R, Kidwell, D. & Bates, T. (2012). Fundamentals of corporate finance (3rd edition).

Hoboken.

Petty, J. W, Titman, S., Keown, A. J., Martin, J. D., Burrow, M. and Nguyen, H. (2012)

Financial Management: Principles and Applications (6th ed). Australia: Pearson

Education Australia.

Porter, G. and Norton, C. (2014). Financial Accounting: The Impact on Decision Maker (10th

edition). Texas: Cengage Learning

Power, T. (2017) Fund choice: Comparing super funds in 8 steps [online]. Retrieved from:

https://www.superguide.com.au/boost-your-superannuation/comparing-super-funds-in-8-

steps

Quiggin, J (2013). The Bitcoin Bubble and a Bad Hypothesis. Retrieved from:

https://nationalinterest.org/commentary/the-bitcoin-bubble-bad-hypothesis-8353

Ross, S., Christensen, M., Drew, M., Bianchi, R., Westerfield, R. And Jordan, B.(2014).

Fundamentals of Corporate Finance, 7th ed. North Ryde: McGraw-Hill Australia Pty

Ltd.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.