Comprehensive Analysis: Investment and Portfolio Management Project

VerifiedAdded on 2023/04/24

|11

|2705

|483

Project

AI Summary

This project analyzes the investment potential of Apple Inc. and Exxon Mobil using five years of monthly stock data. The analysis includes calculating annualized mean returns, standard deviations, and correlations. The study constructs an investment opportunity set, determines the optimal risky portfolio, and calculates its risk and return. It also identifies the minimum variance portfolio, examining its risk and return profile, and explores the benefits of diversification. The project uses formulas to determine the optimal weights of each stock in different portfolio constructions, considering risk-free rates and Sharpe ratios. The report concludes with a comparison of the two portfolios, highlighting the importance of diversification in managing risk and maximizing returns. The results show that the optimal risky portfolio generates more return while the minimum variance portfolio minimizes risk.

Running head: INVESTMENT AND PORTFOLIO MANAGEMENT

Investment and Portfolio Management

Name of the Student:

Name of the University:

Author’s Note:

Investment and Portfolio Management

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1INVESTMENT AND PORTFOLIO MANAGEMENT

Table of Contents

Introduction................................................................................................................................2

Discussion..................................................................................................................................2

Annual Mean Return, Standard Deviation and Correlation...................................................2

Investment Opportunity Set...................................................................................................3

Optimal Risky Portfolio.........................................................................................................5

Risk and Return of Optimal Portfolio....................................................................................6

Minimum Variance Portfolio.................................................................................................7

Risk and Return of Minimum Variance Portfolio..................................................................7

Diversification........................................................................................................................8

Conclusion..................................................................................................................................9

Reference..................................................................................................................................11

Table of Contents

Introduction................................................................................................................................2

Discussion..................................................................................................................................2

Annual Mean Return, Standard Deviation and Correlation...................................................2

Investment Opportunity Set...................................................................................................3

Optimal Risky Portfolio.........................................................................................................5

Risk and Return of Optimal Portfolio....................................................................................6

Minimum Variance Portfolio.................................................................................................7

Risk and Return of Minimum Variance Portfolio..................................................................7

Diversification........................................................................................................................8

Conclusion..................................................................................................................................9

Reference..................................................................................................................................11

2INVESTMENT AND PORTFOLIO MANAGEMENT

Introduction

The stock price analysis for the Exon Mobil and Apple Stock Incorporation was taken

into consideration for the purpose of Investment Analysis and Portfolio Construction. Five-

years of monthly data was taken into consideration for the purpose of the analysis of the

stocks. Risk and return are some of the important characteristics of investment and the same

has been taken into consideration while deciding the optimum weights of each of the security

in the portfolio (Calvo, Ivorra and Liern 2016).

Discussion

Annual Mean Return, Standard Deviation and Correlation

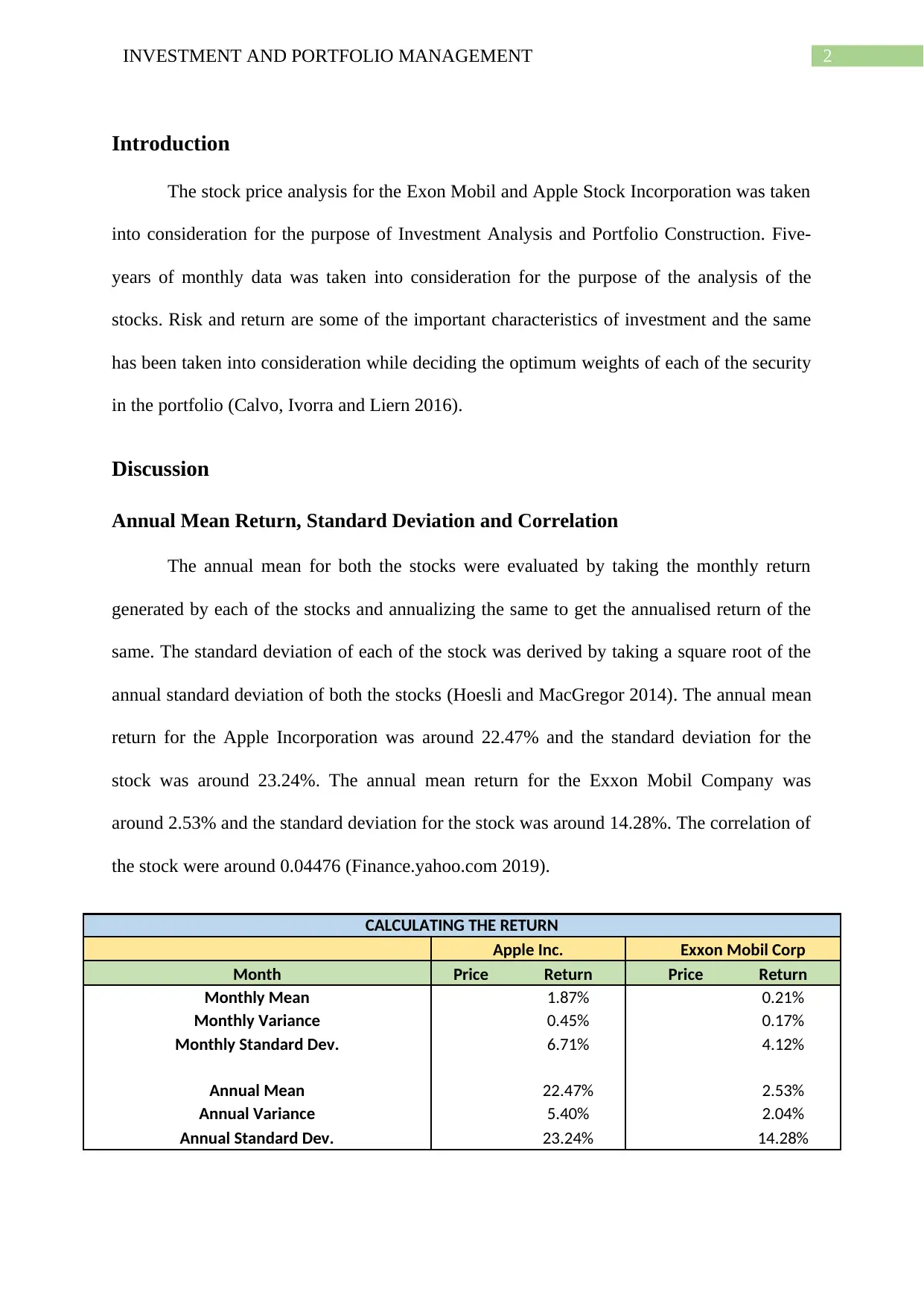

The annual mean for both the stocks were evaluated by taking the monthly return

generated by each of the stocks and annualizing the same to get the annualised return of the

same. The standard deviation of each of the stock was derived by taking a square root of the

annual standard deviation of both the stocks (Hoesli and MacGregor 2014). The annual mean

return for the Apple Incorporation was around 22.47% and the standard deviation for the

stock was around 23.24%. The annual mean return for the Exxon Mobil Company was

around 2.53% and the standard deviation for the stock was around 14.28%. The correlation of

the stock were around 0.04476 (Finance.yahoo.com 2019).

CALCULATING THE RETURN

Apple Inc. Exxon Mobil Corp

Month Price Return Price Return

Monthly Mean 1.87% 0.21%

Monthly Variance 0.45% 0.17%

Monthly Standard Dev. 6.71% 4.12%

Annual Mean 22.47% 2.53%

Annual Variance 5.40% 2.04%

Annual Standard Dev. 23.24% 14.28%

Introduction

The stock price analysis for the Exon Mobil and Apple Stock Incorporation was taken

into consideration for the purpose of Investment Analysis and Portfolio Construction. Five-

years of monthly data was taken into consideration for the purpose of the analysis of the

stocks. Risk and return are some of the important characteristics of investment and the same

has been taken into consideration while deciding the optimum weights of each of the security

in the portfolio (Calvo, Ivorra and Liern 2016).

Discussion

Annual Mean Return, Standard Deviation and Correlation

The annual mean for both the stocks were evaluated by taking the monthly return

generated by each of the stocks and annualizing the same to get the annualised return of the

same. The standard deviation of each of the stock was derived by taking a square root of the

annual standard deviation of both the stocks (Hoesli and MacGregor 2014). The annual mean

return for the Apple Incorporation was around 22.47% and the standard deviation for the

stock was around 23.24%. The annual mean return for the Exxon Mobil Company was

around 2.53% and the standard deviation for the stock was around 14.28%. The correlation of

the stock were around 0.04476 (Finance.yahoo.com 2019).

CALCULATING THE RETURN

Apple Inc. Exxon Mobil Corp

Month Price Return Price Return

Monthly Mean 1.87% 0.21%

Monthly Variance 0.45% 0.17%

Monthly Standard Dev. 6.71% 4.12%

Annual Mean 22.47% 2.53%

Annual Variance 5.40% 2.04%

Annual Standard Dev. 23.24% 14.28%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3INVESTMENT AND PORTFOLIO MANAGEMENT

Investment Opportunity Set

The investment proportions for the two stocks were prepared for the two stocks from

0% to 100% using interval of 5%. The investment opportunity set for the stocks could be well

prepared with the help of the stock giving the maximum return in contrast to the risk taken by

the stock. The investment opportunity curve was made where the optimum investment

opportunity in the stock could be found with the help of risk/return formula. While preparing

the investment opportunity set the Apple stock was denoted as “S” and Exon Mobil was

denoted as “B” (Chandra 2017).

E(Rs) E(Rʙ) σs σʙ ρsʙ Rƒ

22.47% 2.53% 23.24% 14.28% 4.48% 2.44%

Ws Wʙ

= 1-Ws

Expected return E(Rp)

=Ws*E(Rs)+Wʙ*E(Rʙ)

Variance

(σ^p)

Standard

Deviation

(σp)

Risk/Return

0% 100% 2.53% 0.0204 14.28% 0.17716

5% 95% 3.53% 0.0186 13.62% 0.25894

10% 90% 4.52% 0.0171 13.07% 0.34614

15% 85% 5.52% 0.0160 12.64% 0.43671

20% 80% 6.52% 0.0153 12.35% 0.52775

25% 75% 7.52% 0.0149 12.20% 0.61575

26% 74% 7.81% 0.0149 12.19% 0.64049

30% 70% 8.51% 0.0149 12.21% 0.69715

35% 65% 9.51% 0.0153 12.37% 0.76898

40% 60% 10.51% 0.0160 12.67% 0.82940

45% 55% 11.50% 0.0172 13.10% 0.87785

50% 50% 12.50% 0.0187 13.66% 0.91491

55% 45% 13.50% 0.0205 14.33% 0.94190

60% 40% 14.49% 0.0228 15.09% 0.96050

65% 35% 15.49% 0.0254 15.93% 0.97238

70% 30% 16.49% 0.0284 16.84% 0.97909

75% 25% 17.49% 0.0317 17.81% 0.98191

80% 20% 18.48% 0.0354 18.82% 0.98189

85% 15% 19.48% 0.0395 19.88% 0.97982

90% 10% 20.48% 0.0440 20.97% 0.97632

95% 5% 21.47% 0.0488 22.09% 0.97185

100% 0% 22.47% 0.0540 23.24% 0.96675

105.0% -5.0% 23.47% 0.0596 24.41% 0.96126

106.5% -6.5% 23.76% 0.0613 24.77%

Investment Opportunity Set

The investment proportions for the two stocks were prepared for the two stocks from

0% to 100% using interval of 5%. The investment opportunity set for the stocks could be well

prepared with the help of the stock giving the maximum return in contrast to the risk taken by

the stock. The investment opportunity curve was made where the optimum investment

opportunity in the stock could be found with the help of risk/return formula. While preparing

the investment opportunity set the Apple stock was denoted as “S” and Exon Mobil was

denoted as “B” (Chandra 2017).

E(Rs) E(Rʙ) σs σʙ ρsʙ Rƒ

22.47% 2.53% 23.24% 14.28% 4.48% 2.44%

Ws Wʙ

= 1-Ws

Expected return E(Rp)

=Ws*E(Rs)+Wʙ*E(Rʙ)

Variance

(σ^p)

Standard

Deviation

(σp)

Risk/Return

0% 100% 2.53% 0.0204 14.28% 0.17716

5% 95% 3.53% 0.0186 13.62% 0.25894

10% 90% 4.52% 0.0171 13.07% 0.34614

15% 85% 5.52% 0.0160 12.64% 0.43671

20% 80% 6.52% 0.0153 12.35% 0.52775

25% 75% 7.52% 0.0149 12.20% 0.61575

26% 74% 7.81% 0.0149 12.19% 0.64049

30% 70% 8.51% 0.0149 12.21% 0.69715

35% 65% 9.51% 0.0153 12.37% 0.76898

40% 60% 10.51% 0.0160 12.67% 0.82940

45% 55% 11.50% 0.0172 13.10% 0.87785

50% 50% 12.50% 0.0187 13.66% 0.91491

55% 45% 13.50% 0.0205 14.33% 0.94190

60% 40% 14.49% 0.0228 15.09% 0.96050

65% 35% 15.49% 0.0254 15.93% 0.97238

70% 30% 16.49% 0.0284 16.84% 0.97909

75% 25% 17.49% 0.0317 17.81% 0.98191

80% 20% 18.48% 0.0354 18.82% 0.98189

85% 15% 19.48% 0.0395 19.88% 0.97982

90% 10% 20.48% 0.0440 20.97% 0.97632

95% 5% 21.47% 0.0488 22.09% 0.97185

100% 0% 22.47% 0.0540 23.24% 0.96675

105.0% -5.0% 23.47% 0.0596 24.41% 0.96126

106.5% -6.5% 23.76% 0.0613 24.77%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4INVESTMENT AND PORTFOLIO MANAGEMENT

0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00%

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

2.53%

3.53%

4.52%

5.52%

6.52%

7.52%

7.81%

8.51%

9.51%

10.51%

11.50%

12.50%

13.50%

14.49%

15.49%

16.49%

17.49%

18.48%

19.48%

20.48%

21.47%

22.47%

23.47%23.76%

Series2

CML

Market

Optimal Risky Portfolio

The optimal risky portfolio could be calculated with the help of the return and risk of

each of the security is calculated for determining the optimal risky portfolio. The weight of

the Apple stock was denoted by Stock 1and the weight of the Exon Mobil Company was

denoted by Stock 2 (Klingebiel and Rammer 2014). The weight on optimal risky portfolio for

the stock were calculated with the formula:

Wʙ (Stock 2)

=

[E(Rʙ) - Rƒ] σs^2 - [E(Rs) - Rƒ] σʙσsρʙs

[E(Rʙ) - Rƒ] σs^2 + [E(Rs) - Rƒ] σʙ^2 - [E(Rʙ) - Rƒ + E (Rs) - Rƒ] σʙσsρʙs

The weight of Stock 2 (Exxon) was calculated to be around -6.49% and the weight of

the weight of Stock 1 (Apple Inc.) was taken to be around 106.49%. The risk free rate was

taken at 2.44% that was the five-years Treasury bill rate of the US which has been taken from

the Bloomberg Data (Bloomberg.com 2019).

Stocks Weights

Stock 1 (Apple Incorporation) 106.49%

0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00%

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

2.53%

3.53%

4.52%

5.52%

6.52%

7.52%

7.81%

8.51%

9.51%

10.51%

11.50%

12.50%

13.50%

14.49%

15.49%

16.49%

17.49%

18.48%

19.48%

20.48%

21.47%

22.47%

23.47%23.76%

Series2

CML

Market

Optimal Risky Portfolio

The optimal risky portfolio could be calculated with the help of the return and risk of

each of the security is calculated for determining the optimal risky portfolio. The weight of

the Apple stock was denoted by Stock 1and the weight of the Exon Mobil Company was

denoted by Stock 2 (Klingebiel and Rammer 2014). The weight on optimal risky portfolio for

the stock were calculated with the formula:

Wʙ (Stock 2)

=

[E(Rʙ) - Rƒ] σs^2 - [E(Rs) - Rƒ] σʙσsρʙs

[E(Rʙ) - Rƒ] σs^2 + [E(Rs) - Rƒ] σʙ^2 - [E(Rʙ) - Rƒ + E (Rs) - Rƒ] σʙσsρʙs

The weight of Stock 2 (Exxon) was calculated to be around -6.49% and the weight of

the weight of Stock 1 (Apple Inc.) was taken to be around 106.49%. The risk free rate was

taken at 2.44% that was the five-years Treasury bill rate of the US which has been taken from

the Bloomberg Data (Bloomberg.com 2019).

Stocks Weights

Stock 1 (Apple Incorporation) 106.49%

5INVESTMENT AND PORTFOLIO MANAGEMENT

Stock 2 (Exxon Mobil) -6.49%

Optimal Risky Portfolio =

Sp = (E(Rp) - Rƒ) / σp Sharp Ratio 0.862056101

Wʙ (Stock 2) = [E(Rʙ) - Rƒ] σs^2 - [E(Rs) - Rƒ] σʙσsρʙs

[E(Rʙ) - Rƒ] σs^2 + [E(Rs) - Rƒ] σʙ^2 - [E(Rʙ) - Rƒ + E (Rs) - Rƒ] σʙσsρʙs

Weight of B -6.49%

Weight of S (Stock 1) (1- Weight of B) 106.49%

E (Rp) 23.76%

σp= 24.74%

Risk and Return of Optimal Portfolio

The expected return from the portfolio was calculated with the help of the weights of

each of the security in the portfolio and the return generated by each of the stocks (Kevin

2015). The return for the optimal risky portfolio was calculated with the help of the formula:

Expected Return (E(Rp)) = Weight of Stock 1* Return of Stock 1+ Weight of Stock 2*

Return of Stock 2.

The return for the portfolio was calculated to be around 23.76%, which was derived

by taking the optimum weightage given to each of the security in the portfolio

(Finance.yahoo.com 2019). The risk or the standard deviation of the portfolio was derived to

be around 24.74% (Damodaran 2016).

Stock 2 (Exxon Mobil) -6.49%

Optimal Risky Portfolio =

Sp = (E(Rp) - Rƒ) / σp Sharp Ratio 0.862056101

Wʙ (Stock 2) = [E(Rʙ) - Rƒ] σs^2 - [E(Rs) - Rƒ] σʙσsρʙs

[E(Rʙ) - Rƒ] σs^2 + [E(Rs) - Rƒ] σʙ^2 - [E(Rʙ) - Rƒ + E (Rs) - Rƒ] σʙσsρʙs

Weight of B -6.49%

Weight of S (Stock 1) (1- Weight of B) 106.49%

E (Rp) 23.76%

σp= 24.74%

Risk and Return of Optimal Portfolio

The expected return from the portfolio was calculated with the help of the weights of

each of the security in the portfolio and the return generated by each of the stocks (Kevin

2015). The return for the optimal risky portfolio was calculated with the help of the formula:

Expected Return (E(Rp)) = Weight of Stock 1* Return of Stock 1+ Weight of Stock 2*

Return of Stock 2.

The return for the portfolio was calculated to be around 23.76%, which was derived

by taking the optimum weightage given to each of the security in the portfolio

(Finance.yahoo.com 2019). The risk or the standard deviation of the portfolio was derived to

be around 24.74% (Damodaran 2016).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6INVESTMENT AND PORTFOLIO MANAGEMENT

Minimum Variance Portfolio

The weights of each of the stock in the minimum variance portfolio could be

calculated with the help of the formula:

Ws (min) = (σʙ²- σʙ*σs*ρ) / ( σs²+ σʙ²- 2σʙ*σs*ρ)

The weight of apple stock was determined to be around 26.5% which is Stock 1 and

the weight of the stock 2 (Exxon Mobil) was taken at 73.5% (Bloomberg.com 2019). The

weightage of the stock was given at such a stage where the investor with a least amount of

risk can generate the highest amount of return for a stock (DeFusco et al. 2015).

Risk and Return of Minimum Variance Portfolio

The Minimum variance portfolio shows the diversified portfolio which consist of well

diversified portfolio which when hedged together results in lowest possible risk for the rate of

expected return. The return for the minimum variance portfolio was calculated with the help

of the optimum weights of the securities and the constituent risk. The expected return for the

stock could be calculated with the help of the formula:

Expected Return (E(Rp)) = Weight of Stock 1* Return of Stock 1+ Weight of Stock 2*

Return of Stock 2.

The return for the stock was calculated to be 7.81% for the minimum variance

portfolio stating that the portfolio can earn as high as 7.81% by taking the lowest amount of

risk (Bloomberg.com 2019). The standard deviation for the stock was calculated with the

formula:

Standard Deviation (S.D): The standard deviation for the portfolio could be calculated with

the help of the risk of each security in the portfolio and the weightage of each of the stock in

Minimum Variance Portfolio

The weights of each of the stock in the minimum variance portfolio could be

calculated with the help of the formula:

Ws (min) = (σʙ²- σʙ*σs*ρ) / ( σs²+ σʙ²- 2σʙ*σs*ρ)

The weight of apple stock was determined to be around 26.5% which is Stock 1 and

the weight of the stock 2 (Exxon Mobil) was taken at 73.5% (Bloomberg.com 2019). The

weightage of the stock was given at such a stage where the investor with a least amount of

risk can generate the highest amount of return for a stock (DeFusco et al. 2015).

Risk and Return of Minimum Variance Portfolio

The Minimum variance portfolio shows the diversified portfolio which consist of well

diversified portfolio which when hedged together results in lowest possible risk for the rate of

expected return. The return for the minimum variance portfolio was calculated with the help

of the optimum weights of the securities and the constituent risk. The expected return for the

stock could be calculated with the help of the formula:

Expected Return (E(Rp)) = Weight of Stock 1* Return of Stock 1+ Weight of Stock 2*

Return of Stock 2.

The return for the stock was calculated to be 7.81% for the minimum variance

portfolio stating that the portfolio can earn as high as 7.81% by taking the lowest amount of

risk (Bloomberg.com 2019). The standard deviation for the stock was calculated with the

formula:

Standard Deviation (S.D): The standard deviation for the portfolio could be calculated with

the help of the risk of each security in the portfolio and the weightage of each of the stock in

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7INVESTMENT AND PORTFOLIO MANAGEMENT

the portfolio. The correlation of the stock was to be taken at the 4.476% (Finance.yahoo.com

2019). The standrad deviation for the stocks were calculated with the help of weight of each

of the security and the risk of each of the security.

Portfolio Standard Deviation: w2A*σ2(RA) + w2B*σ2(RB) + 2*(wA)*(wB)*Cov(RA, RB)

The standard deviation for the stock was calculated to be around 12.40%, which states

that this is the minimum risk that can be taken by the stocks for getting the highest amount of

return. Thus, the investor can earn the best with the application of minimum variance

portfolio that is by investing around 73.5% of the total fund in the Apple Inc. Stock and

26.5% in the Exxon Mobil Company Stock (Finance.yahoo.com 2019).

Ws (min) = (σʙ²- σʙ*σs*ρ) / ( σs²+ σʙ²- 2σʙ*σs*ρ) 26.5%

WB = (1- Weight of Apple Stock) 73.5%

E (Rp)= Ws (min) * E(Rs) + (1-Ws (min))*E(Rʙ) 7.81%

σp= 12.40%

Minimum variance portfolio =

ݓᢿߪ ᢿ ଶ ݓ ߪ ଶ ʹ ݓᢿߪ ᢿ ݓ ߪ ʌࡰƐ

Diversification

Diversification plays an important role in the context of portfolio management where

taking two or more stocks in the portfolio would be helping the risk and return modification.

Diversification is important in modifying the return and risk of the portfolio thereby reducing

the concentration risk of the portfolio. In the above report both the stocks were analysed

based on the return and risk generated by each of the stock and the implication of each of the

stock in the portfolio. The inclusion of various stocks in a portfolio is a risk management

strategy to yield higher and better returns (Howard 2014).

The return generated from the Apple Incorporation via the optimal risky portfolio was

much more as the theory behind the same is that the return from the portfolio should be

maximized and that was the key reason for giving the Apple stock a weightage of 106.49%

the portfolio. The correlation of the stock was to be taken at the 4.476% (Finance.yahoo.com

2019). The standrad deviation for the stocks were calculated with the help of weight of each

of the security and the risk of each of the security.

Portfolio Standard Deviation: w2A*σ2(RA) + w2B*σ2(RB) + 2*(wA)*(wB)*Cov(RA, RB)

The standard deviation for the stock was calculated to be around 12.40%, which states

that this is the minimum risk that can be taken by the stocks for getting the highest amount of

return. Thus, the investor can earn the best with the application of minimum variance

portfolio that is by investing around 73.5% of the total fund in the Apple Inc. Stock and

26.5% in the Exxon Mobil Company Stock (Finance.yahoo.com 2019).

Ws (min) = (σʙ²- σʙ*σs*ρ) / ( σs²+ σʙ²- 2σʙ*σs*ρ) 26.5%

WB = (1- Weight of Apple Stock) 73.5%

E (Rp)= Ws (min) * E(Rs) + (1-Ws (min))*E(Rʙ) 7.81%

σp= 12.40%

Minimum variance portfolio =

ݓᢿߪ ᢿ ଶ ݓ ߪ ଶ ʹ ݓᢿߪ ᢿ ݓ ߪ ʌࡰƐ

Diversification

Diversification plays an important role in the context of portfolio management where

taking two or more stocks in the portfolio would be helping the risk and return modification.

Diversification is important in modifying the return and risk of the portfolio thereby reducing

the concentration risk of the portfolio. In the above report both the stocks were analysed

based on the return and risk generated by each of the stock and the implication of each of the

stock in the portfolio. The inclusion of various stocks in a portfolio is a risk management

strategy to yield higher and better returns (Howard 2014).

The return generated from the Apple Incorporation via the optimal risky portfolio was

much more as the theory behind the same is that the return from the portfolio should be

maximized and that was the key reason for giving the Apple stock a weightage of 106.49%

8INVESTMENT AND PORTFOLIO MANAGEMENT

and -6.49% to Exxon Mobil. The standard deviation of the portfolio was around 24.74%. The

reason behind the same can be given to the poor performance by the Exxon Mobil where the

company gave a return less than 2.44% ,which was the risk free rate of return. Return

generated by Exxon Mobil Company was just 2.53% which was found to be inconsistent

(Finance.yahoo.com 2019). The sharp ratio of the minimum variance portfolio was around

0.42 which shows the excess unit of return generated by the portfolio for a single unit of risk

taken.

It is crucial to note however on the other hand the minimum variance portfolio takes

the concept of the higher risk by taking a minimum amount of risk in the given set of

investment opportunity. The same was computed with the help of the various investment

intervals and the best interval class was selected which gave the highest amount of return by

taking the least amount of risk at the same time. The return generated by the minimum

variance portfolio was around 7.81% and the correspondence standard deviation of the

portfolio was taken at 12.19%. The sharp ratio of the portfolio was around 0.85 which

comparatively is far more better and efficient than the minimum variance portfolio.

Conclusion

In the above report both the stocks Apple Inc. and Exxon Mobil were analysed based

on the return and risk generated by each of the stock and the implication of each of the stock

in the portfolio. The optimal weights in a stock was determined based on the minimum

variance portfolio and the optimal risky portfolio where optimal risky portfolio was found to

generate more return for the investors. On the other hand side the minimum variance

portfolio considered the best allocation mix of securities according to the inherent risk and

return associated with the same.

and -6.49% to Exxon Mobil. The standard deviation of the portfolio was around 24.74%. The

reason behind the same can be given to the poor performance by the Exxon Mobil where the

company gave a return less than 2.44% ,which was the risk free rate of return. Return

generated by Exxon Mobil Company was just 2.53% which was found to be inconsistent

(Finance.yahoo.com 2019). The sharp ratio of the minimum variance portfolio was around

0.42 which shows the excess unit of return generated by the portfolio for a single unit of risk

taken.

It is crucial to note however on the other hand the minimum variance portfolio takes

the concept of the higher risk by taking a minimum amount of risk in the given set of

investment opportunity. The same was computed with the help of the various investment

intervals and the best interval class was selected which gave the highest amount of return by

taking the least amount of risk at the same time. The return generated by the minimum

variance portfolio was around 7.81% and the correspondence standard deviation of the

portfolio was taken at 12.19%. The sharp ratio of the portfolio was around 0.85 which

comparatively is far more better and efficient than the minimum variance portfolio.

Conclusion

In the above report both the stocks Apple Inc. and Exxon Mobil were analysed based

on the return and risk generated by each of the stock and the implication of each of the stock

in the portfolio. The optimal weights in a stock was determined based on the minimum

variance portfolio and the optimal risky portfolio where optimal risky portfolio was found to

generate more return for the investors. On the other hand side the minimum variance

portfolio considered the best allocation mix of securities according to the inherent risk and

return associated with the same.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9INVESTMENT AND PORTFOLIO MANAGEMENT

Reference

Bloomberg.com. (2019). Treasury Yield. [online] Available at:

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us [Accessed 12 Mar.

2019].

Calvo, C., Ivorra, C. and Liern, V., 2016. Fuzzy portfolio selection with non-financial goals:

exploring the efficient frontier. Annals of Operations Research, 245(1-2), pp.31-46.

Chandra, P., 2017. Investment analysis and portfolio management. McGraw-Hill Education.

Damodaran, A., 2016. Damodaran on valuation: security analysis for investment and

corporate finance (Vol. 324). John Wiley & Sons.

DeFusco, R.A., McLeavey, D.W., Pinto, J.E., Anson, M.J. and Runkle, D.E.,

2015. Quantitative investment analysis. John Wiley & Sons.

Finance.yahoo.com. (2019). Apple Share Price. [online] Available at:

https://finance.yahoo.com/quote/AAPL/history?p=AAPL [Accessed 12 Mar. 2019].

Finance.yahoo.com. (2019). Exxon Mobil Share Price. [online] Available at:

https://finance.yahoo.com/quote/XOM/history?p=XOM&.tsrc=fin-srch [Accessed 12 Mar.

2019].

Hoesli, M. and MacGregor, B.D., 2014. Property investment: principles and practice of

portfolio management. Routledge.

Howard, C.T., 2014. Behavioral portfolio management. Journal of Behavioral Finance &

Economics, Forthcoming.

Kevin, S., 2015. Security analysis and portfolio management. PHI Learning Pvt. Ltd..

Reference

Bloomberg.com. (2019). Treasury Yield. [online] Available at:

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us [Accessed 12 Mar.

2019].

Calvo, C., Ivorra, C. and Liern, V., 2016. Fuzzy portfolio selection with non-financial goals:

exploring the efficient frontier. Annals of Operations Research, 245(1-2), pp.31-46.

Chandra, P., 2017. Investment analysis and portfolio management. McGraw-Hill Education.

Damodaran, A., 2016. Damodaran on valuation: security analysis for investment and

corporate finance (Vol. 324). John Wiley & Sons.

DeFusco, R.A., McLeavey, D.W., Pinto, J.E., Anson, M.J. and Runkle, D.E.,

2015. Quantitative investment analysis. John Wiley & Sons.

Finance.yahoo.com. (2019). Apple Share Price. [online] Available at:

https://finance.yahoo.com/quote/AAPL/history?p=AAPL [Accessed 12 Mar. 2019].

Finance.yahoo.com. (2019). Exxon Mobil Share Price. [online] Available at:

https://finance.yahoo.com/quote/XOM/history?p=XOM&.tsrc=fin-srch [Accessed 12 Mar.

2019].

Hoesli, M. and MacGregor, B.D., 2014. Property investment: principles and practice of

portfolio management. Routledge.

Howard, C.T., 2014. Behavioral portfolio management. Journal of Behavioral Finance &

Economics, Forthcoming.

Kevin, S., 2015. Security analysis and portfolio management. PHI Learning Pvt. Ltd..

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10INVESTMENT AND PORTFOLIO MANAGEMENT

Klingebiel, R. and Rammer, C., 2014. Resource allocation strategy for innovation portfolio

management. Strategic Management Journal, 35(2), pp.246-268.

Klingebiel, R. and Rammer, C., 2014. Resource allocation strategy for innovation portfolio

management. Strategic Management Journal, 35(2), pp.246-268.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.