Investment Appraisal and Shareholder Wealth for Anilana Hotels Project

VerifiedAdded on 2023/04/21

|23

|4451

|437

Report

AI Summary

This report provides a comprehensive analysis of investment appraisal techniques and their implications for shareholder wealth, using the case of Anilana Hotels' expansion project in Sri Lanka. The analysis begins with a justification of the project's viability, considering factors such as customer satisfaction and competitive advantage. It then introduces the company, identifies relevant cash inflows and outflows, and calculates the weighted average cost of capital (WACC). The project is evaluated using net present value (NPV) and internal rate of return (IRR), demonstrating the financial feasibility of the expansion. The report further examines the impact of the project on share price at various stages, including announcement, capital raising, and completion. It also discusses potential sources of finance, shareholders' wealth valuation methods, and the signalling effect of dividends. The findings indicate that the hotel expansion is financially sound and beneficial for shareholders. The report provides detailed calculations in the appendices, supporting the conclusions drawn.

Running head: INVESTMENT APPRAISAL AND SHAREHOLDERS’ WEALTH

Investment Appraisal and Shareholders’ Wealth

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Investment Appraisal and Shareholders’ Wealth

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1INVESTMENT APPRAISAL AND SHAREHOLDERS’ WEALTH

Table of Contents

1.0 Justification of the viability of the project:................................................................................2

2.0 Introduction of the company and identification of cash inflows and outflows related to the

project:.............................................................................................................................................3

3.0 Calculation of the weighted average cost of capital:.................................................................4

4.0 Evaluation of the project using investment appraisal:...............................................................5

5.0 Impact of share price by announcing the new project:..............................................................6

6.0 Impact of share price by raising capital for the new project:....................................................6

7.0 Impact of share price by the completion of the new project:....................................................7

8.0 Discussion of three potential sources of finance:......................................................................7

9.0 Discussion of three shareholders’ wealth valuation methods:...................................................8

10.0 Discussion about the signalling effect of dividend:.................................................................9

References:....................................................................................................................................10

Appendices:...................................................................................................................................12

Table of Contents

1.0 Justification of the viability of the project:................................................................................2

2.0 Introduction of the company and identification of cash inflows and outflows related to the

project:.............................................................................................................................................3

3.0 Calculation of the weighted average cost of capital:.................................................................4

4.0 Evaluation of the project using investment appraisal:...............................................................5

5.0 Impact of share price by announcing the new project:..............................................................6

6.0 Impact of share price by raising capital for the new project:....................................................6

7.0 Impact of share price by the completion of the new project:....................................................7

8.0 Discussion of three potential sources of finance:......................................................................7

9.0 Discussion of three shareholders’ wealth valuation methods:...................................................8

10.0 Discussion about the signalling effect of dividend:.................................................................9

References:....................................................................................................................................10

Appendices:...................................................................................................................................12

2INVESTMENT APPRAISAL AND SHAREHOLDERS’ WEALTH

1.0 Justification of the viability of the project:

The organisation chosen is Anilana Hotels, which is operating in Sri Lanka and it is

planning to open a new hotel in Tangalle, Sri Lanka. The project is deemed to be viable on

certain non-financial grounds, which are enumerated briefly as follows:

Customer satisfaction:

An organisation could not conduct its business operations in the absence of customers.

This is because the existing financial measures carry limited value to future profitability, as it has

with customer satisfaction (Damodaran 2016). It has been observed that there is relationship

between the stock price of an organisation and customer satisfaction. Hence, before undertaking

the project of opening a new hotel, Anilana Hotels could use customer perception as a primary

basis for ascertaining the viability of the project. This could be carried with the help of market

research like questionnaire and surveys. One of the significant financial measures, which could

be used for linking with customer satisfaction, is staff turnover (Daunfeldt and Hartwig 2014).

Staff turnover is associated with the productivity of the hotel in terms of providing services and

increased productivity would increase the satisfaction level of the customers, since their needs

are fulfilled. As a result, increased customer satisfaction would lead to more revenue generation

of Anilana Hotels.

Competitive edge:

In the recent times, Sri Lanka has attracted 2.1 million global visitors in 2018 with

tourists expressing interest to visit Tangalle (Sundaytimes.lk 2019). This denotes the presence of

sound market potential for the new project. Hence, opening a new hotel in this area would

1.0 Justification of the viability of the project:

The organisation chosen is Anilana Hotels, which is operating in Sri Lanka and it is

planning to open a new hotel in Tangalle, Sri Lanka. The project is deemed to be viable on

certain non-financial grounds, which are enumerated briefly as follows:

Customer satisfaction:

An organisation could not conduct its business operations in the absence of customers.

This is because the existing financial measures carry limited value to future profitability, as it has

with customer satisfaction (Damodaran 2016). It has been observed that there is relationship

between the stock price of an organisation and customer satisfaction. Hence, before undertaking

the project of opening a new hotel, Anilana Hotels could use customer perception as a primary

basis for ascertaining the viability of the project. This could be carried with the help of market

research like questionnaire and surveys. One of the significant financial measures, which could

be used for linking with customer satisfaction, is staff turnover (Daunfeldt and Hartwig 2014).

Staff turnover is associated with the productivity of the hotel in terms of providing services and

increased productivity would increase the satisfaction level of the customers, since their needs

are fulfilled. As a result, increased customer satisfaction would lead to more revenue generation

of Anilana Hotels.

Competitive edge:

In the recent times, Sri Lanka has attracted 2.1 million global visitors in 2018 with

tourists expressing interest to visit Tangalle (Sundaytimes.lk 2019). This denotes the presence of

sound market potential for the new project. Hence, opening a new hotel in this area would

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3INVESTMENT APPRAISAL AND SHAREHOLDERS’ WEALTH

provide competitive advantage to Anilana Hotels in the long-run, as it would generate positive

cash flows for a number of years.

2.0 Introduction of the company and identification of cash inflows and outflows related to

the project:

Company overview:

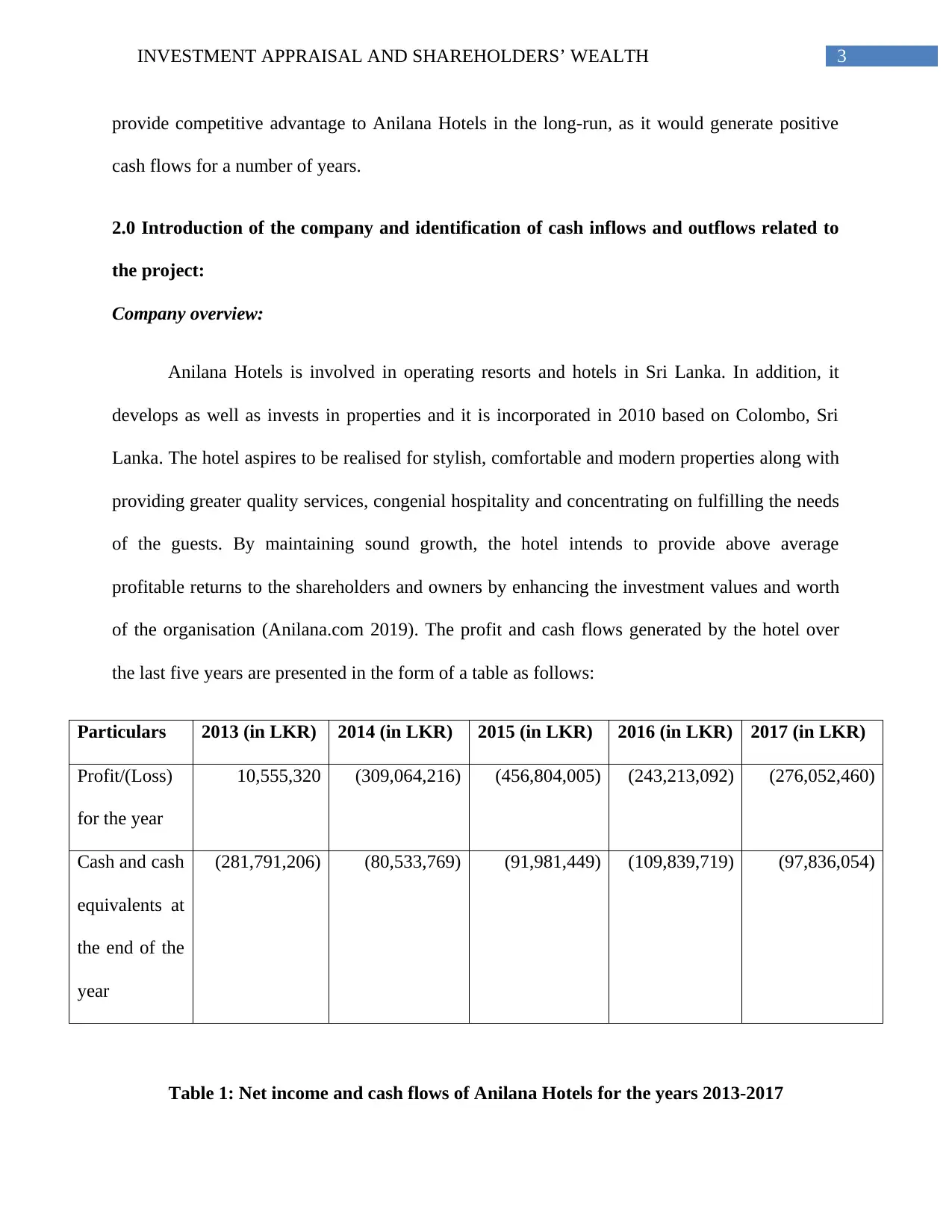

Anilana Hotels is involved in operating resorts and hotels in Sri Lanka. In addition, it

develops as well as invests in properties and it is incorporated in 2010 based on Colombo, Sri

Lanka. The hotel aspires to be realised for stylish, comfortable and modern properties along with

providing greater quality services, congenial hospitality and concentrating on fulfilling the needs

of the guests. By maintaining sound growth, the hotel intends to provide above average

profitable returns to the shareholders and owners by enhancing the investment values and worth

of the organisation (Anilana.com 2019). The profit and cash flows generated by the hotel over

the last five years are presented in the form of a table as follows:

Particulars 2013 (in LKR) 2014 (in LKR) 2015 (in LKR) 2016 (in LKR) 2017 (in LKR)

Profit/(Loss)

for the year

10,555,320 (309,064,216) (456,804,005) (243,213,092) (276,052,460)

Cash and cash

equivalents at

the end of the

year

(281,791,206) (80,533,769) (91,981,449) (109,839,719) (97,836,054)

Table 1: Net income and cash flows of Anilana Hotels for the years 2013-2017

provide competitive advantage to Anilana Hotels in the long-run, as it would generate positive

cash flows for a number of years.

2.0 Introduction of the company and identification of cash inflows and outflows related to

the project:

Company overview:

Anilana Hotels is involved in operating resorts and hotels in Sri Lanka. In addition, it

develops as well as invests in properties and it is incorporated in 2010 based on Colombo, Sri

Lanka. The hotel aspires to be realised for stylish, comfortable and modern properties along with

providing greater quality services, congenial hospitality and concentrating on fulfilling the needs

of the guests. By maintaining sound growth, the hotel intends to provide above average

profitable returns to the shareholders and owners by enhancing the investment values and worth

of the organisation (Anilana.com 2019). The profit and cash flows generated by the hotel over

the last five years are presented in the form of a table as follows:

Particulars 2013 (in LKR) 2014 (in LKR) 2015 (in LKR) 2016 (in LKR) 2017 (in LKR)

Profit/(Loss)

for the year

10,555,320 (309,064,216) (456,804,005) (243,213,092) (276,052,460)

Cash and cash

equivalents at

the end of the

year

(281,791,206) (80,533,769) (91,981,449) (109,839,719) (97,836,054)

Table 1: Net income and cash flows of Anilana Hotels for the years 2013-2017

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4INVESTMENT APPRAISAL AND SHAREHOLDERS’ WEALTH

(Source: Anilana.com 2019)

Identification of cash inflows and outflows:

In order to initiate this project, Anilana Hotels has to incur LKR 35,750,000, out of which

35,000,000 would be needed for purchasing the building, in which the new hotel would be

opened. The remaining outflows would be required for initial market research, legal and

secretarial fees and staff training. Anilana Hotels would offer three types of hotel rooms for the

guests, which include standard, deluxe rooms. The number of standard rooms, deluxe rooms and

superior rooms would be 125, 85 and 70 respectively. The occupancy rate is expected increase

after every four months in each year and in the final year, it is projected that the hotel would

have full occupancy rate. This would help the hotel in maximising their overall profit margin

(Fracassi 2016).

The relevant expenses that would be incurred every year include staff salaries, material

costs, marketing expenses and depreciation on building. It is projected that the hotel would not

employ above 30 staffs in the hotel in the five-year period in order to keep control of its expenses

owing to the net loss it suffered in the previous years. It is assumed that the building would

depreciate by 8% each year by following the straight-line method. The corporate tax rate of 28%

is applied on operating income to calculate the net income after which depreciation amount has

been added back to each of the respective years in order to arrive at the net cash inflows (Refer

to Appendices, Appendix 2 for detailed calculations).

3.0 Calculation of the weighted average cost of capital:

In order to calculate the weighted average cost of capital for the new hotel initiation in

Tangelle, Sri Lanka, certain assumptions have been made. After evaluating the latest annual

(Source: Anilana.com 2019)

Identification of cash inflows and outflows:

In order to initiate this project, Anilana Hotels has to incur LKR 35,750,000, out of which

35,000,000 would be needed for purchasing the building, in which the new hotel would be

opened. The remaining outflows would be required for initial market research, legal and

secretarial fees and staff training. Anilana Hotels would offer three types of hotel rooms for the

guests, which include standard, deluxe rooms. The number of standard rooms, deluxe rooms and

superior rooms would be 125, 85 and 70 respectively. The occupancy rate is expected increase

after every four months in each year and in the final year, it is projected that the hotel would

have full occupancy rate. This would help the hotel in maximising their overall profit margin

(Fracassi 2016).

The relevant expenses that would be incurred every year include staff salaries, material

costs, marketing expenses and depreciation on building. It is projected that the hotel would not

employ above 30 staffs in the hotel in the five-year period in order to keep control of its expenses

owing to the net loss it suffered in the previous years. It is assumed that the building would

depreciate by 8% each year by following the straight-line method. The corporate tax rate of 28%

is applied on operating income to calculate the net income after which depreciation amount has

been added back to each of the respective years in order to arrive at the net cash inflows (Refer

to Appendices, Appendix 2 for detailed calculations).

3.0 Calculation of the weighted average cost of capital:

In order to calculate the weighted average cost of capital for the new hotel initiation in

Tangelle, Sri Lanka, certain assumptions have been made. After evaluating the latest annual

5INVESTMENT APPRAISAL AND SHAREHOLDERS’ WEALTH

report of Anilana Hotels in 2017, it has been found that the hotel has not paid any dividend to its

shareholders in the mentioned year owing to the net loss it has incurred over the years. However,

it is assumed that the opening of the new hotel would help in covering the loss to a large extent

by generating increased revenue and the hotel is expected to minimise its operating expenses

significantly by 50% in its current business operations. This would create the ability of the hotel

to pay out dividends to its shareholders (Ferran and Ho 2014).

Due to no payment of dividend, the dividend per share of a competitor hotel has been

used, which is $0.10 per share and the growth rate of dividend is expected at 4% over the next

five years. Similar, the yield to maturity is taken as 16.08%. The intention here is to maintain the

cost of capital at 10%. Moreover, it is assumed that in order to fund the necessary plant and

equipment, the hotel would raise 50% of the funds through debt and the remaining 50% by

equity. By considering all this data, the WACC of the desired project has been computed (Refer

to Appendices, Appendix 2 for WACC calculation).

4.0 Evaluation of the project using investment appraisal:

For evaluating the new expansion project of Anilana Hotels, the two investment appraisal

techniques used include net present value (NPV) and internal rate of return (IRR) (Refer to

Appendices, Appendix 3 for detailed calculations). From the table, it could be observed that the

NPV of the expansion project is computed as LKR 6,520,780, while the internal rate of return is

calculated as 17.19%. With the help of NPV, it becomes possible to determine the profitability of

a proposed investment based on which final decision could be undertaken (Andor, Mohanty and

Toth 2015). A higher and positive NPV is always desirable and in this case, the NPV is found to

be positive, which states the project would be viable for the hotel in order to maximise its overall

profit margin.

report of Anilana Hotels in 2017, it has been found that the hotel has not paid any dividend to its

shareholders in the mentioned year owing to the net loss it has incurred over the years. However,

it is assumed that the opening of the new hotel would help in covering the loss to a large extent

by generating increased revenue and the hotel is expected to minimise its operating expenses

significantly by 50% in its current business operations. This would create the ability of the hotel

to pay out dividends to its shareholders (Ferran and Ho 2014).

Due to no payment of dividend, the dividend per share of a competitor hotel has been

used, which is $0.10 per share and the growth rate of dividend is expected at 4% over the next

five years. Similar, the yield to maturity is taken as 16.08%. The intention here is to maintain the

cost of capital at 10%. Moreover, it is assumed that in order to fund the necessary plant and

equipment, the hotel would raise 50% of the funds through debt and the remaining 50% by

equity. By considering all this data, the WACC of the desired project has been computed (Refer

to Appendices, Appendix 2 for WACC calculation).

4.0 Evaluation of the project using investment appraisal:

For evaluating the new expansion project of Anilana Hotels, the two investment appraisal

techniques used include net present value (NPV) and internal rate of return (IRR) (Refer to

Appendices, Appendix 3 for detailed calculations). From the table, it could be observed that the

NPV of the expansion project is computed as LKR 6,520,780, while the internal rate of return is

calculated as 17.19%. With the help of NPV, it becomes possible to determine the profitability of

a proposed investment based on which final decision could be undertaken (Andor, Mohanty and

Toth 2015). A higher and positive NPV is always desirable and in this case, the NPV is found to

be positive, which states the project would be viable for the hotel in order to maximise its overall

profit margin.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6INVESTMENT APPRAISAL AND SHAREHOLDERS’ WEALTH

On the other hand, IRR denotes the rate at which an investment project promises in

generating a return during its economic life. If the value of IRR is higher than the cost of capital,

the project would be profitable for the organisation and vice-versa (Clancy and Collins 2014). In

this case, IRR is higher than the required rate of return of 10%, which implies the feasibility of

the project. Hence, undertaking the hotel expansion project would help Anilana Hotels in

offsetting the net losses to a certain extent that it has encountered in the past four years.

5.0 Impact of share price by announcing the new project:

By critically analysing the annual reports of Anilana Hotels for the past five years, it has

been found that the hotel has suffered significant losses in the last four years. Moreover, there

has been no dividend payment made by the hotel in these years as well. Thus, it clearly states the

market sentiment about the hotel would not be positive among its shareholders. In this situation,

when the hotel announces a new project, the investors might have concerns regarding the project

viability. However, as the project is expected to yield long-term benefits in future, the

perceptions of the investors might change in future as well (De Andrés, De Fuente and San

Martín 2015). Therefore, the share price is expected to decline in the initial stage, which would

increase in future, as soon as it starts to generate benefits.

6.0 Impact of share price by raising capital for the new project:

For the new hotel project, Anilana Hotels is planning to raise 50% of its funds through

debt and 50% of its funds through equity. Since the hotel is planning to raise funds for opening a

new hotel in Tangalle, Sri Lanka and the concerned expansion would result in increased profit

margin for the hotel, the share price is expected to rise in future. However, there would be

decline in earnings per share in the short-term because of additional shares in circulation, which

tend to minimise the overall market value (Gullifer and Payne 2015).

On the other hand, IRR denotes the rate at which an investment project promises in

generating a return during its economic life. If the value of IRR is higher than the cost of capital,

the project would be profitable for the organisation and vice-versa (Clancy and Collins 2014). In

this case, IRR is higher than the required rate of return of 10%, which implies the feasibility of

the project. Hence, undertaking the hotel expansion project would help Anilana Hotels in

offsetting the net losses to a certain extent that it has encountered in the past four years.

5.0 Impact of share price by announcing the new project:

By critically analysing the annual reports of Anilana Hotels for the past five years, it has

been found that the hotel has suffered significant losses in the last four years. Moreover, there

has been no dividend payment made by the hotel in these years as well. Thus, it clearly states the

market sentiment about the hotel would not be positive among its shareholders. In this situation,

when the hotel announces a new project, the investors might have concerns regarding the project

viability. However, as the project is expected to yield long-term benefits in future, the

perceptions of the investors might change in future as well (De Andrés, De Fuente and San

Martín 2015). Therefore, the share price is expected to decline in the initial stage, which would

increase in future, as soon as it starts to generate benefits.

6.0 Impact of share price by raising capital for the new project:

For the new hotel project, Anilana Hotels is planning to raise 50% of its funds through

debt and 50% of its funds through equity. Since the hotel is planning to raise funds for opening a

new hotel in Tangalle, Sri Lanka and the concerned expansion would result in increased profit

margin for the hotel, the share price is expected to rise in future. However, there would be

decline in earnings per share in the short-term because of additional shares in circulation, which

tend to minimise the overall market value (Gullifer and Payne 2015).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7INVESTMENT APPRAISAL AND SHAREHOLDERS’ WEALTH

7.0 Impact of share price by the completion of the new project:

After the completion of the hotel expansion project of Anilana Hotels, it is already

projected that the hotel would provide dividend payments to its shareholders, since the same is

expected to grow by 4% throughout the entire project life. Moreover, the net losses would be

offset largely by the expansion project, which would be a favourable indication to the market

(Kengatharan 2016). Such increase in dividend and profit margin would boost the share price of

the hotel in the market in the long-run.

8.0 Discussion of three potential sources of finance:

The three potential sources of finance for funding the hotel expansion project are listed as

follows:

Equity finance:

Equity finance is the technique of obtaining funds by issuing new equity shares and

selling them in the market for funding new projects and business expansions. By using financing,

Anilana Hotels would have no loan to repay, which would provide the freedom of channelling

additional money for business growth. Moreover, even if there is absence of creditworthiness

like net losses suffered by Anilana Hotels, equity is preferable over debt finance. However, the

hotel would have loss of control, since they need to involve the shareholders in management

decision-making process. This might result in some conflict of interest, if differences could be

found in management style, vision and methods of running hotel operations (Nurullah and

Kengatharan 2015).

Debt finance:

7.0 Impact of share price by the completion of the new project:

After the completion of the hotel expansion project of Anilana Hotels, it is already

projected that the hotel would provide dividend payments to its shareholders, since the same is

expected to grow by 4% throughout the entire project life. Moreover, the net losses would be

offset largely by the expansion project, which would be a favourable indication to the market

(Kengatharan 2016). Such increase in dividend and profit margin would boost the share price of

the hotel in the market in the long-run.

8.0 Discussion of three potential sources of finance:

The three potential sources of finance for funding the hotel expansion project are listed as

follows:

Equity finance:

Equity finance is the technique of obtaining funds by issuing new equity shares and

selling them in the market for funding new projects and business expansions. By using financing,

Anilana Hotels would have no loan to repay, which would provide the freedom of channelling

additional money for business growth. Moreover, even if there is absence of creditworthiness

like net losses suffered by Anilana Hotels, equity is preferable over debt finance. However, the

hotel would have loss of control, since they need to involve the shareholders in management

decision-making process. This might result in some conflict of interest, if differences could be

found in management style, vision and methods of running hotel operations (Nurullah and

Kengatharan 2015).

Debt finance:

8INVESTMENT APPRAISAL AND SHAREHOLDERS’ WEALTH

Debt finance is the amount borrowed to be repaid with interest within a stipulated period.

With the help of this financing, Anilana Hotels could maintain complete control of ownership

without answering to the investors and the amount to be paid as interest is tax deductible.

However, the disadvantages include maintenance of sound credit history, financial discipline to

make timely repayments and placing assets at risk by providing collateral to the lender.

Government grants:

Although Anilana Hotels would use an equal proportion of debt and equity for funding its

hotel expansion, it could use government grants for funding future projects. The main advantage

of this funding is that the organisation does not have to repay any amount and thus, it could

increase its focus on improving its existing services. However, the amount obtained from

government grants has to be used by staying in line with the initial plan provided along with

tracking progress and submitting reports regularly to the particular agency (Rossi 2014).

9.0 Discussion of three shareholders’ wealth valuation methods:

Shareholder wealth value is a business term, which states that the final measure of the

success of an organisation is the degree to which it enriches the shareholders by providing

increased dividends and return on invested capital. The three methods of valuing shareholders’

wealth include the following:

Earnings per share valuation method:

When decisions are undertaken to increase net profit every year, the organisation could

either increase its retained earnings base or pay increased dividends to the shareholders. Earnings

per share are a key indicator related to shareholders’ wealth and with the rise in earnings, there is

increase in this ratio as well. This would make the investors to view the organisation as valuable.

Debt finance is the amount borrowed to be repaid with interest within a stipulated period.

With the help of this financing, Anilana Hotels could maintain complete control of ownership

without answering to the investors and the amount to be paid as interest is tax deductible.

However, the disadvantages include maintenance of sound credit history, financial discipline to

make timely repayments and placing assets at risk by providing collateral to the lender.

Government grants:

Although Anilana Hotels would use an equal proportion of debt and equity for funding its

hotel expansion, it could use government grants for funding future projects. The main advantage

of this funding is that the organisation does not have to repay any amount and thus, it could

increase its focus on improving its existing services. However, the amount obtained from

government grants has to be used by staying in line with the initial plan provided along with

tracking progress and submitting reports regularly to the particular agency (Rossi 2014).

9.0 Discussion of three shareholders’ wealth valuation methods:

Shareholder wealth value is a business term, which states that the final measure of the

success of an organisation is the degree to which it enriches the shareholders by providing

increased dividends and return on invested capital. The three methods of valuing shareholders’

wealth include the following:

Earnings per share valuation method:

When decisions are undertaken to increase net profit every year, the organisation could

either increase its retained earnings base or pay increased dividends to the shareholders. Earnings

per share are a key indicator related to shareholders’ wealth and with the rise in earnings, there is

increase in this ratio as well. This would make the investors to view the organisation as valuable.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9INVESTMENT APPRAISAL AND SHAREHOLDERS’ WEALTH

Asset-based valuation method:

The main reason that an organisation obtains funds is to purchase assets so that the same

could be used for revenue generation or investment in new projects with a positive return. An

effectively-managed organisation increases the utilisation of its assets in order to operate within

a smaller asset investment (Rossi 2015).

Cash flow-based valuation method:

It is possible for an organisation to increase cash flows by conversion of inventory and

trade receivables quickly into cash collections. With an increased rate of receivables turnover

and inventory turnover, shareholder value could be increased.

10.0 Discussion about the signalling effect of dividend:

According to the theory of asymmetric dividend, asymmetry could be observed in

financial information and the managers have additional information than the shareholders

regarding the financial prospects of an organisation (Vernimmen et al. 2014). Due to this, the

shareholders would find signals regarding the dividend decision that the managers attempt for

obtaining additional knowledge. Thus, asymmetric information mainly takes place at the time the

management possesses additional information of the organisation in contrast to its shareholders.

Asset-based valuation method:

The main reason that an organisation obtains funds is to purchase assets so that the same

could be used for revenue generation or investment in new projects with a positive return. An

effectively-managed organisation increases the utilisation of its assets in order to operate within

a smaller asset investment (Rossi 2015).

Cash flow-based valuation method:

It is possible for an organisation to increase cash flows by conversion of inventory and

trade receivables quickly into cash collections. With an increased rate of receivables turnover

and inventory turnover, shareholder value could be increased.

10.0 Discussion about the signalling effect of dividend:

According to the theory of asymmetric dividend, asymmetry could be observed in

financial information and the managers have additional information than the shareholders

regarding the financial prospects of an organisation (Vernimmen et al. 2014). Due to this, the

shareholders would find signals regarding the dividend decision that the managers attempt for

obtaining additional knowledge. Thus, asymmetric information mainly takes place at the time the

management possesses additional information of the organisation in contrast to its shareholders.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10INVESTMENT APPRAISAL AND SHAREHOLDERS’ WEALTH

References:

Andor, G., Mohanty, S.K. and Toth, T., 2015. Capital budgeting practices: A survey of Central

and Eastern European firms. Emerging Markets Review, 23, pp.148-172.

Anilana.com., 2019. Anilana | a touch of paradise | Passikudah Nilaveli Nuwara Eliya

Dambulla. [online] Available at: http://www.anilana.com/index.html#about [Accessed 12 Feb.

2019].

Anilana.com., 2019. Anilana | Investor Information. [online] Available at:

http://www.anilana.com/investors.html [Accessed 12 Feb. 2019].

Clancy, D.K. and Collins, D., 2014. Capital budgeting research and practice: The state of the art.

In Advances in Management Accounting (pp. 117-161). Emerald Group Publishing Limited.

Damodaran, A., 2016. Damodaran on valuation: security analysis for investment and corporate

finance (Vol. 324). John Wiley & Sons.

Daunfeldt, S.O. and Hartwig, F., 2014. What determines the use of capital budgeting methods?:

Evidence from Swedish listed companies. Journal of Finance and Economics, 2(4), pp.101-112.

De Andrés, P., De Fuente, G. and San Martín, P., 2015. Capital budgeting practices in

Spain. BRQ Business Research Quarterly, 18(1), pp.37-56.

Ferran, E. and Ho, L.C., 2014. Principles of corporate finance law. Oxford University Press.

Fracassi, C., 2016. Corporate finance policies and social networks. Management Science, 63(8),

pp.2420-2438.

References:

Andor, G., Mohanty, S.K. and Toth, T., 2015. Capital budgeting practices: A survey of Central

and Eastern European firms. Emerging Markets Review, 23, pp.148-172.

Anilana.com., 2019. Anilana | a touch of paradise | Passikudah Nilaveli Nuwara Eliya

Dambulla. [online] Available at: http://www.anilana.com/index.html#about [Accessed 12 Feb.

2019].

Anilana.com., 2019. Anilana | Investor Information. [online] Available at:

http://www.anilana.com/investors.html [Accessed 12 Feb. 2019].

Clancy, D.K. and Collins, D., 2014. Capital budgeting research and practice: The state of the art.

In Advances in Management Accounting (pp. 117-161). Emerald Group Publishing Limited.

Damodaran, A., 2016. Damodaran on valuation: security analysis for investment and corporate

finance (Vol. 324). John Wiley & Sons.

Daunfeldt, S.O. and Hartwig, F., 2014. What determines the use of capital budgeting methods?:

Evidence from Swedish listed companies. Journal of Finance and Economics, 2(4), pp.101-112.

De Andrés, P., De Fuente, G. and San Martín, P., 2015. Capital budgeting practices in

Spain. BRQ Business Research Quarterly, 18(1), pp.37-56.

Ferran, E. and Ho, L.C., 2014. Principles of corporate finance law. Oxford University Press.

Fracassi, C., 2016. Corporate finance policies and social networks. Management Science, 63(8),

pp.2420-2438.

11INVESTMENT APPRAISAL AND SHAREHOLDERS’ WEALTH

Gullifer, L. and Payne, J., 2015. Corporate finance law: principles and policy. Bloomsbury

Publishing.

Kengatharan, L., 2016. Capital budgeting theory and practice: a review and agenda for future

research. Applied Economics and Finance, 3(2), pp.15-38.

Nurullah, M. and Kengatharan, L., 2015. Capital budgeting practices: evidence from Sri

Lanka. Journal of Advances in Management Research, 12(1), pp.55-82.

Rossi, M., 2014. Capital budgeting in Europe: confronting theory with practice. International

Journal of Managerial and Financial Accounting, 6(4), pp.341-356.

Rossi, M., 2015. The use of capital budgeting techniques: an outlook from Italy. International

Journal of Management Practice, 8(1), pp.43-56.

Sundaytimes.lk., 2019. Tangalle: Paradise lost . [online] Available at:

http://www.sundaytimes.lk/120101/News/nws_22.html [Accessed 12 Feb. 2019].

Vernimmen, P., Quiry, P., Dallocchio, M., Le Fur, Y. and Salvi, A., 2014. Corporate finance:

theory and practice. John Wiley & Sons.

Gullifer, L. and Payne, J., 2015. Corporate finance law: principles and policy. Bloomsbury

Publishing.

Kengatharan, L., 2016. Capital budgeting theory and practice: a review and agenda for future

research. Applied Economics and Finance, 3(2), pp.15-38.

Nurullah, M. and Kengatharan, L., 2015. Capital budgeting practices: evidence from Sri

Lanka. Journal of Advances in Management Research, 12(1), pp.55-82.

Rossi, M., 2014. Capital budgeting in Europe: confronting theory with practice. International

Journal of Managerial and Financial Accounting, 6(4), pp.341-356.

Rossi, M., 2015. The use of capital budgeting techniques: an outlook from Italy. International

Journal of Management Practice, 8(1), pp.43-56.

Sundaytimes.lk., 2019. Tangalle: Paradise lost . [online] Available at:

http://www.sundaytimes.lk/120101/News/nws_22.html [Accessed 12 Feb. 2019].

Vernimmen, P., Quiry, P., Dallocchio, M., Le Fur, Y. and Salvi, A., 2014. Corporate finance:

theory and practice. John Wiley & Sons.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.