Investment Appraisal, Funding Methods & Variance Analysis Report

VerifiedAdded on 2023/06/14

|16

|4093

|165

Report

AI Summary

This report delves into key aspects of business finance, including investment appraisal techniques, funding methods, and variance analysis. It begins by applying payback period and net present value (NPV) methods to rank various investment projects, providing recommendations for the most profitable options and discussing the strengths and weaknesses of each method. Qualitative factors that directors should consider before making final investment decisions are also highlighted. The report then critically evaluates different funding methods, such as debt financing, retained earnings, and bank loans, exploring the link between investment and financing decisions, particularly in the context of company acquisitions. Furthermore, a variance analysis statement is prepared to assess the variable costs associated with chemical product production, explaining the causes of identified variances. Finally, the report differentiates between centralized and decentralized procurement, outlining their respective benefits, offering a comprehensive overview of financial decision-making and control within a business context. Desklib provides access to this and similar documents along with AI powered tools to help students.

Business Finance - Business

Report

Report

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

TASK...............................................................................................................................................3

(A)....................................................................................................................................................3

(a) Computation of Pay Back period for all projects..................................................................3

(b) Computation of Net present Value for all projects................................................................4

(c) Ranking of project using both payback and net present value method.................................5

(d) Recommendation on best and profitable projects.................................................................6

(e) Strength and Weaknesses of payback and net present value method....................................6

(f) Five qualitative factors which directors need to be considered before making final decision

.....................................................................................................................................................7

(B)....................................................................................................................................................8

(a)................................................................................................................................................8

(b)................................................................................................................................................8

C.......................................................................................................................................................9

a. Variance analysis statement for the variable cost element......................................................9

b. Explanations of identified variance in the above statement..................................................10

D.....................................................................................................................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................3

TASK...............................................................................................................................................3

(A)....................................................................................................................................................3

(a) Computation of Pay Back period for all projects..................................................................3

(b) Computation of Net present Value for all projects................................................................4

(c) Ranking of project using both payback and net present value method.................................5

(d) Recommendation on best and profitable projects.................................................................6

(e) Strength and Weaknesses of payback and net present value method....................................6

(f) Five qualitative factors which directors need to be considered before making final decision

.....................................................................................................................................................7

(B)....................................................................................................................................................8

(a)................................................................................................................................................8

(b)................................................................................................................................................8

C.......................................................................................................................................................9

a. Variance analysis statement for the variable cost element......................................................9

b. Explanations of identified variance in the above statement..................................................10

D.....................................................................................................................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................15

INTRODUCTION

The present report is based on various tools and techniques associated with business

finance will be discussed that are useful in making decisions and establishing control. First of all,

investment appraisal techniques will be applied to a number of projects in order to provide

ranking and making decisions in case of mutually exclusive projects (Fandel Hofmann and

Schreck, 2020). Secondly, various funding methods will be critically evaluated along with

discussing the link between investment and financing decision made for the acquisition of a

company. Further, a variance analysis statement will be prepared with reference to the

production of chemical product along with explaining the causes of variances occurred. At last,

centralized and decentralized procurement will be differentiated on different bases along with

highlighting their respective benefits.

TASK

(A)

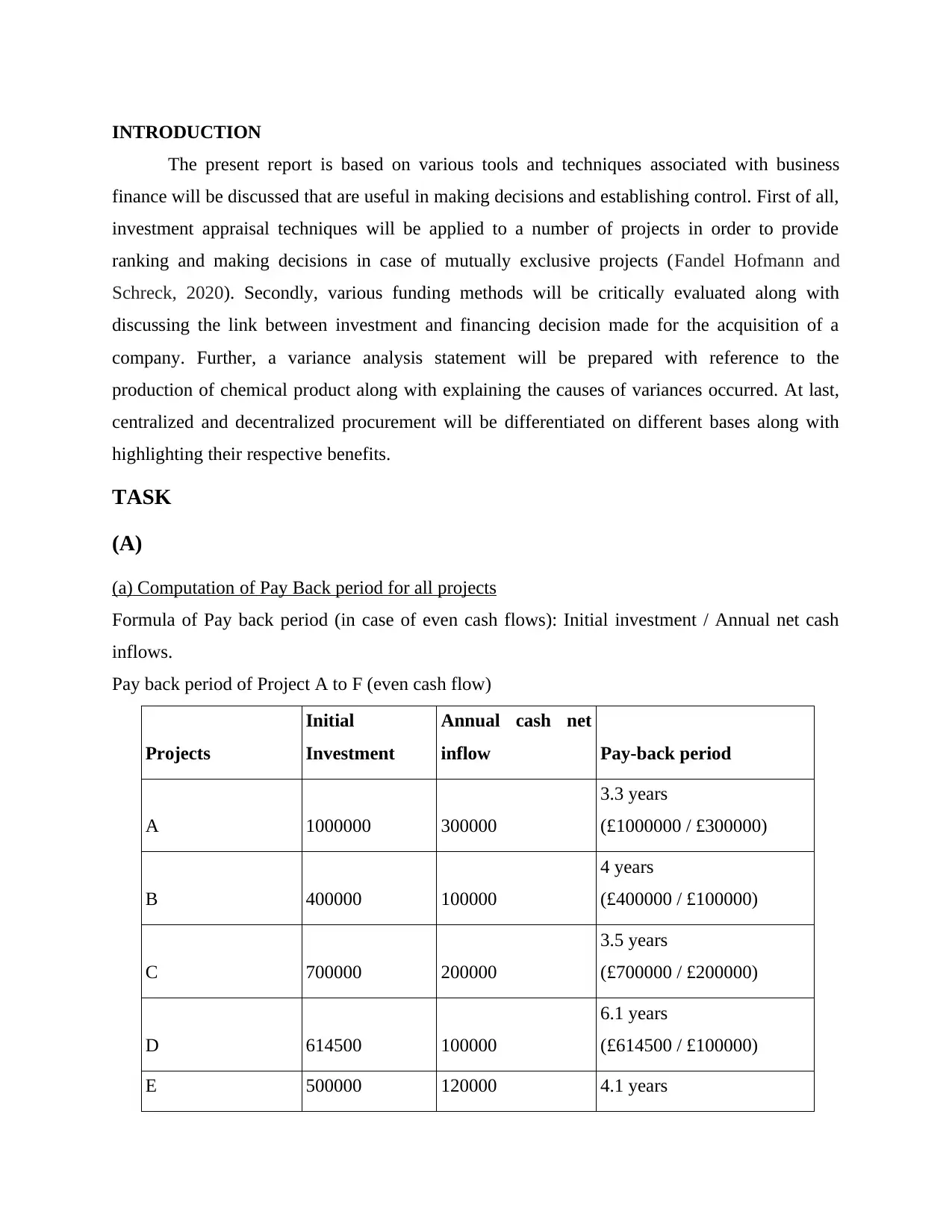

(a) Computation of Pay Back period for all projects

Formula of Pay back period (in case of even cash flows): Initial investment / Annual net cash

inflows.

Pay back period of Project A to F (even cash flow)

Projects

Initial

Investment

Annual cash net

inflow Pay-back period

A 1000000 300000

3.3 years

(£1000000 / £300000)

B 400000 100000

4 years

(£400000 / £100000)

C 700000 200000

3.5 years

(£700000 / £200000)

D 614500 100000

6.1 years

(£614500 / £100000)

E 500000 120000 4.1 years

The present report is based on various tools and techniques associated with business

finance will be discussed that are useful in making decisions and establishing control. First of all,

investment appraisal techniques will be applied to a number of projects in order to provide

ranking and making decisions in case of mutually exclusive projects (Fandel Hofmann and

Schreck, 2020). Secondly, various funding methods will be critically evaluated along with

discussing the link between investment and financing decision made for the acquisition of a

company. Further, a variance analysis statement will be prepared with reference to the

production of chemical product along with explaining the causes of variances occurred. At last,

centralized and decentralized procurement will be differentiated on different bases along with

highlighting their respective benefits.

TASK

(A)

(a) Computation of Pay Back period for all projects

Formula of Pay back period (in case of even cash flows): Initial investment / Annual net cash

inflows.

Pay back period of Project A to F (even cash flow)

Projects

Initial

Investment

Annual cash net

inflow Pay-back period

A 1000000 300000

3.3 years

(£1000000 / £300000)

B 400000 100000

4 years

(£400000 / £100000)

C 700000 200000

3.5 years

(£700000 / £200000)

D 614500 100000

6.1 years

(£614500 / £100000)

E 500000 120000 4.1 years

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

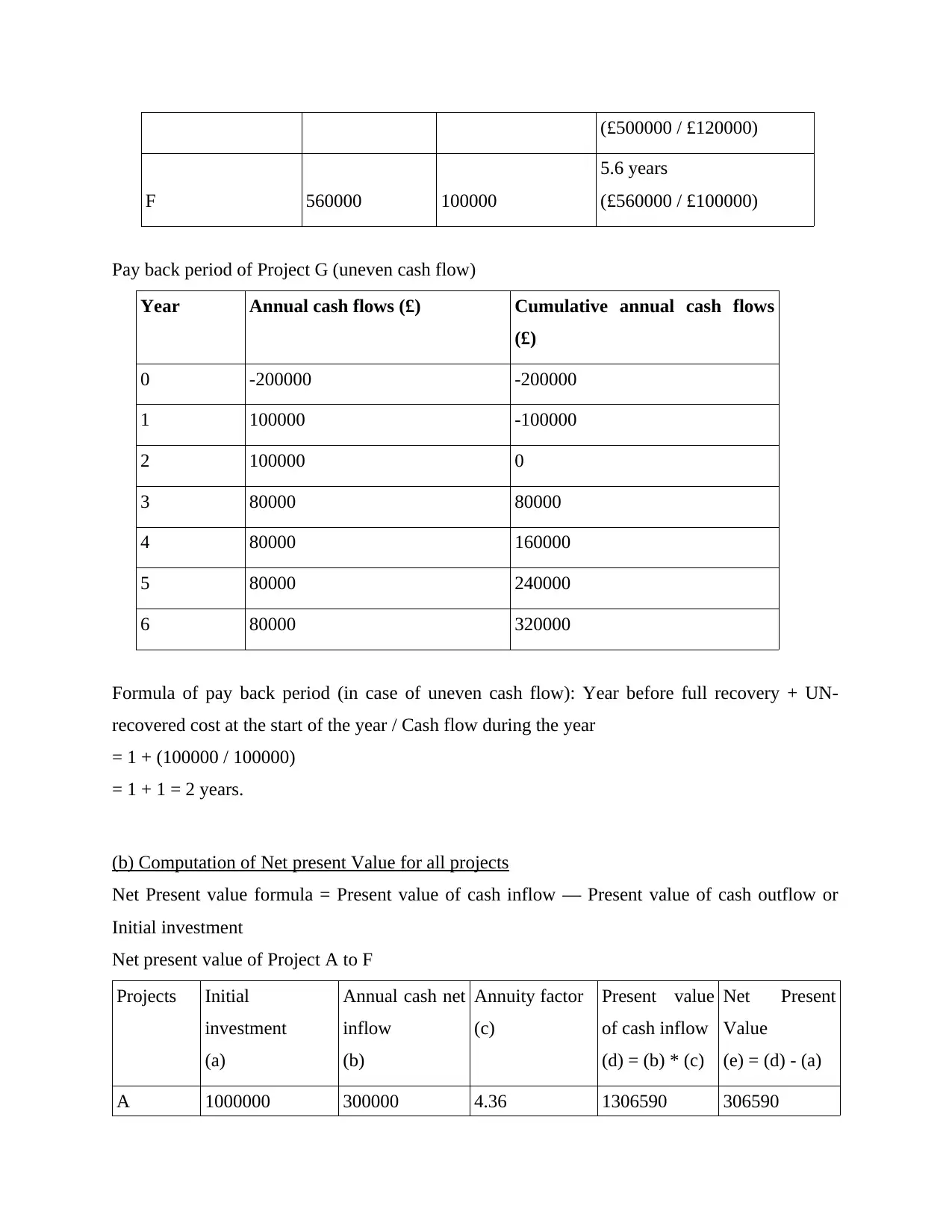

(£500000 / £120000)

F 560000 100000

5.6 years

(£560000 / £100000)

Pay back period of Project G (uneven cash flow)

Year Annual cash flows (£) Cumulative annual cash flows

(£)

0 -200000 -200000

1 100000 -100000

2 100000 0

3 80000 80000

4 80000 160000

5 80000 240000

6 80000 320000

Formula of pay back period (in case of uneven cash flow): Year before full recovery + UN-

recovered cost at the start of the year / Cash flow during the year

= 1 + (100000 / 100000)

= 1 + 1 = 2 years.

(b) Computation of Net present Value for all projects

Net Present value formula = Present value of cash inflow — Present value of cash outflow or

Initial investment

Net present value of Project A to F

Projects Initial

investment

(a)

Annual cash net

inflow

(b)

Annuity factor

(c)

Present value

of cash inflow

(d) = (b) * (c)

Net Present

Value

(e) = (d) - (a)

A 1000000 300000 4.36 1306590 306590

F 560000 100000

5.6 years

(£560000 / £100000)

Pay back period of Project G (uneven cash flow)

Year Annual cash flows (£) Cumulative annual cash flows

(£)

0 -200000 -200000

1 100000 -100000

2 100000 0

3 80000 80000

4 80000 160000

5 80000 240000

6 80000 320000

Formula of pay back period (in case of uneven cash flow): Year before full recovery + UN-

recovered cost at the start of the year / Cash flow during the year

= 1 + (100000 / 100000)

= 1 + 1 = 2 years.

(b) Computation of Net present Value for all projects

Net Present value formula = Present value of cash inflow — Present value of cash outflow or

Initial investment

Net present value of Project A to F

Projects Initial

investment

(a)

Annual cash net

inflow

(b)

Annuity factor

(c)

Present value

of cash inflow

(d) = (b) * (c)

Net Present

Value

(e) = (d) - (a)

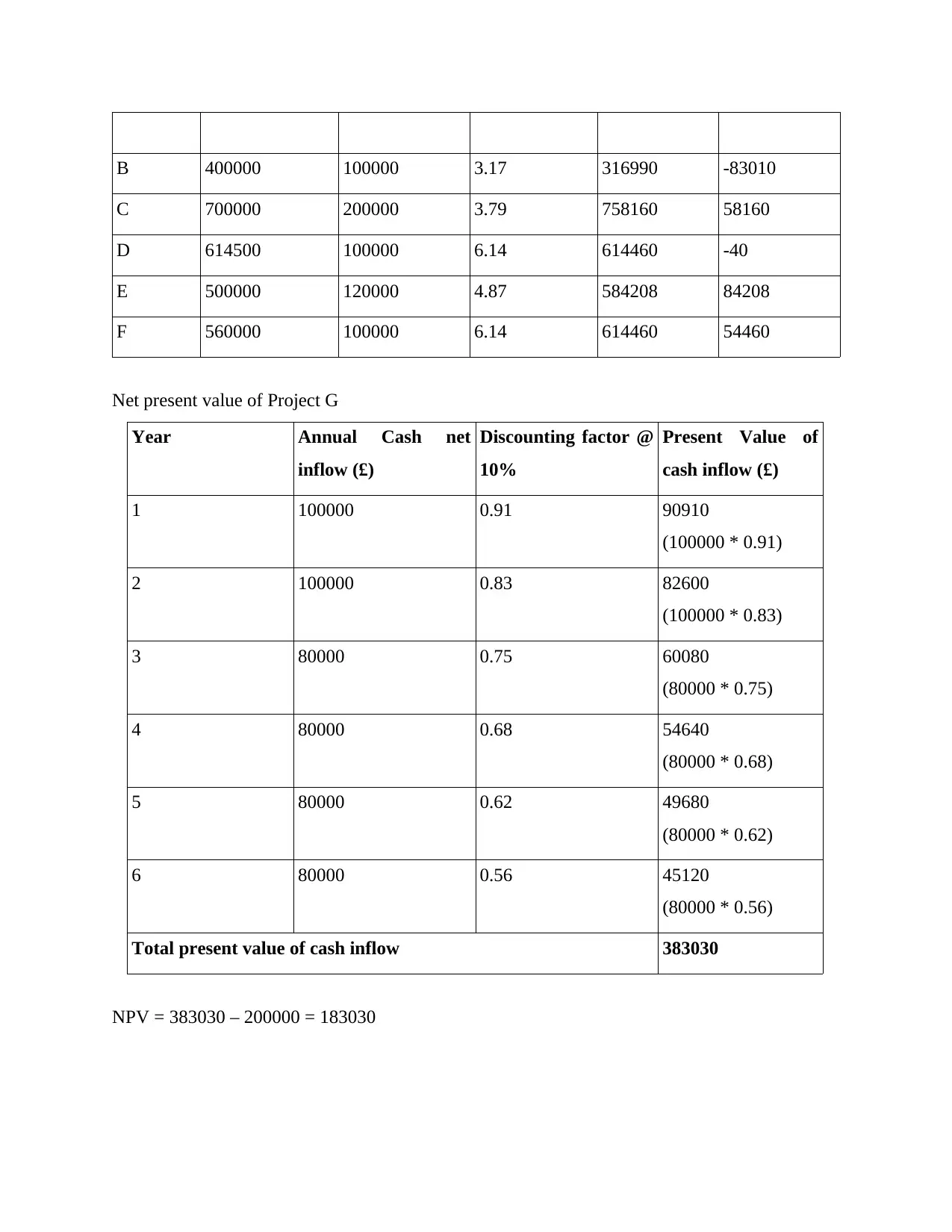

A 1000000 300000 4.36 1306590 306590

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

B 400000 100000 3.17 316990 -83010

C 700000 200000 3.79 758160 58160

D 614500 100000 6.14 614460 -40

E 500000 120000 4.87 584208 84208

F 560000 100000 6.14 614460 54460

Net present value of Project G

Year Annual Cash net

inflow (£)

Discounting factor @

10%

Present Value of

cash inflow (£)

1 100000 0.91 90910

(100000 * 0.91)

2 100000 0.83 82600

(100000 * 0.83)

3 80000 0.75 60080

(80000 * 0.75)

4 80000 0.68 54640

(80000 * 0.68)

5 80000 0.62 49680

(80000 * 0.62)

6 80000 0.56 45120

(80000 * 0.56)

Total present value of cash inflow 383030

NPV = 383030 – 200000 = 183030

C 700000 200000 3.79 758160 58160

D 614500 100000 6.14 614460 -40

E 500000 120000 4.87 584208 84208

F 560000 100000 6.14 614460 54460

Net present value of Project G

Year Annual Cash net

inflow (£)

Discounting factor @

10%

Present Value of

cash inflow (£)

1 100000 0.91 90910

(100000 * 0.91)

2 100000 0.83 82600

(100000 * 0.83)

3 80000 0.75 60080

(80000 * 0.75)

4 80000 0.68 54640

(80000 * 0.68)

5 80000 0.62 49680

(80000 * 0.62)

6 80000 0.56 45120

(80000 * 0.56)

Total present value of cash inflow 383030

NPV = 383030 – 200000 = 183030

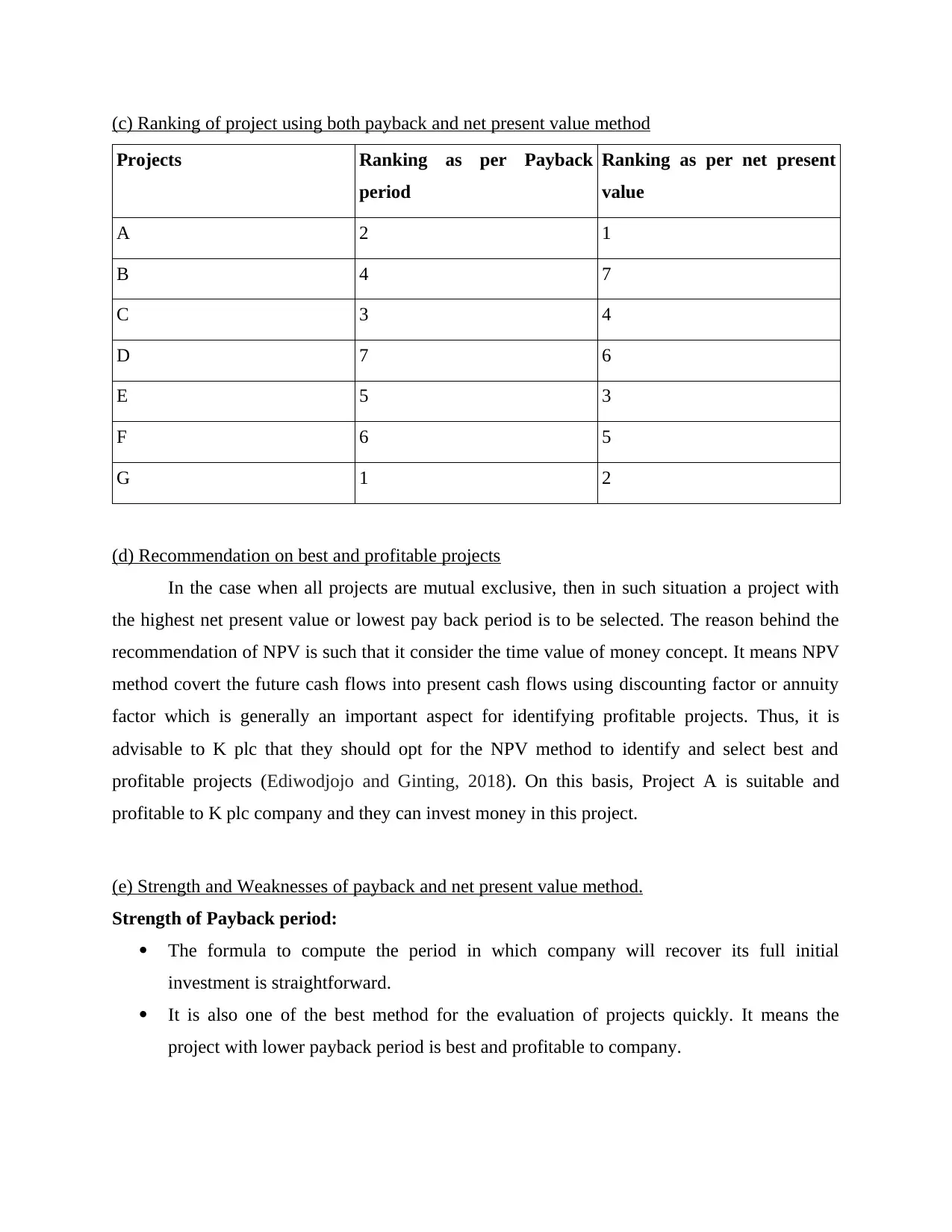

(c) Ranking of project using both payback and net present value method

Projects Ranking as per Payback

period

Ranking as per net present

value

A 2 1

B 4 7

C 3 4

D 7 6

E 5 3

F 6 5

G 1 2

(d) Recommendation on best and profitable projects

In the case when all projects are mutual exclusive, then in such situation a project with

the highest net present value or lowest pay back period is to be selected. The reason behind the

recommendation of NPV is such that it consider the time value of money concept. It means NPV

method covert the future cash flows into present cash flows using discounting factor or annuity

factor which is generally an important aspect for identifying profitable projects. Thus, it is

advisable to K plc that they should opt for the NPV method to identify and select best and

profitable projects (Ediwodjojo and Ginting, 2018). On this basis, Project A is suitable and

profitable to K plc company and they can invest money in this project.

(e) Strength and Weaknesses of payback and net present value method.

Strength of Payback period:

The formula to compute the period in which company will recover its full initial

investment is straightforward.

It is also one of the best method for the evaluation of projects quickly. It means the

project with lower payback period is best and profitable to company.

Projects Ranking as per Payback

period

Ranking as per net present

value

A 2 1

B 4 7

C 3 4

D 7 6

E 5 3

F 6 5

G 1 2

(d) Recommendation on best and profitable projects

In the case when all projects are mutual exclusive, then in such situation a project with

the highest net present value or lowest pay back period is to be selected. The reason behind the

recommendation of NPV is such that it consider the time value of money concept. It means NPV

method covert the future cash flows into present cash flows using discounting factor or annuity

factor which is generally an important aspect for identifying profitable projects. Thus, it is

advisable to K plc that they should opt for the NPV method to identify and select best and

profitable projects (Ediwodjojo and Ginting, 2018). On this basis, Project A is suitable and

profitable to K plc company and they can invest money in this project.

(e) Strength and Weaknesses of payback and net present value method.

Strength of Payback period:

The formula to compute the period in which company will recover its full initial

investment is straightforward.

It is also one of the best method for the evaluation of projects quickly. It means the

project with lower payback period is best and profitable to company.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

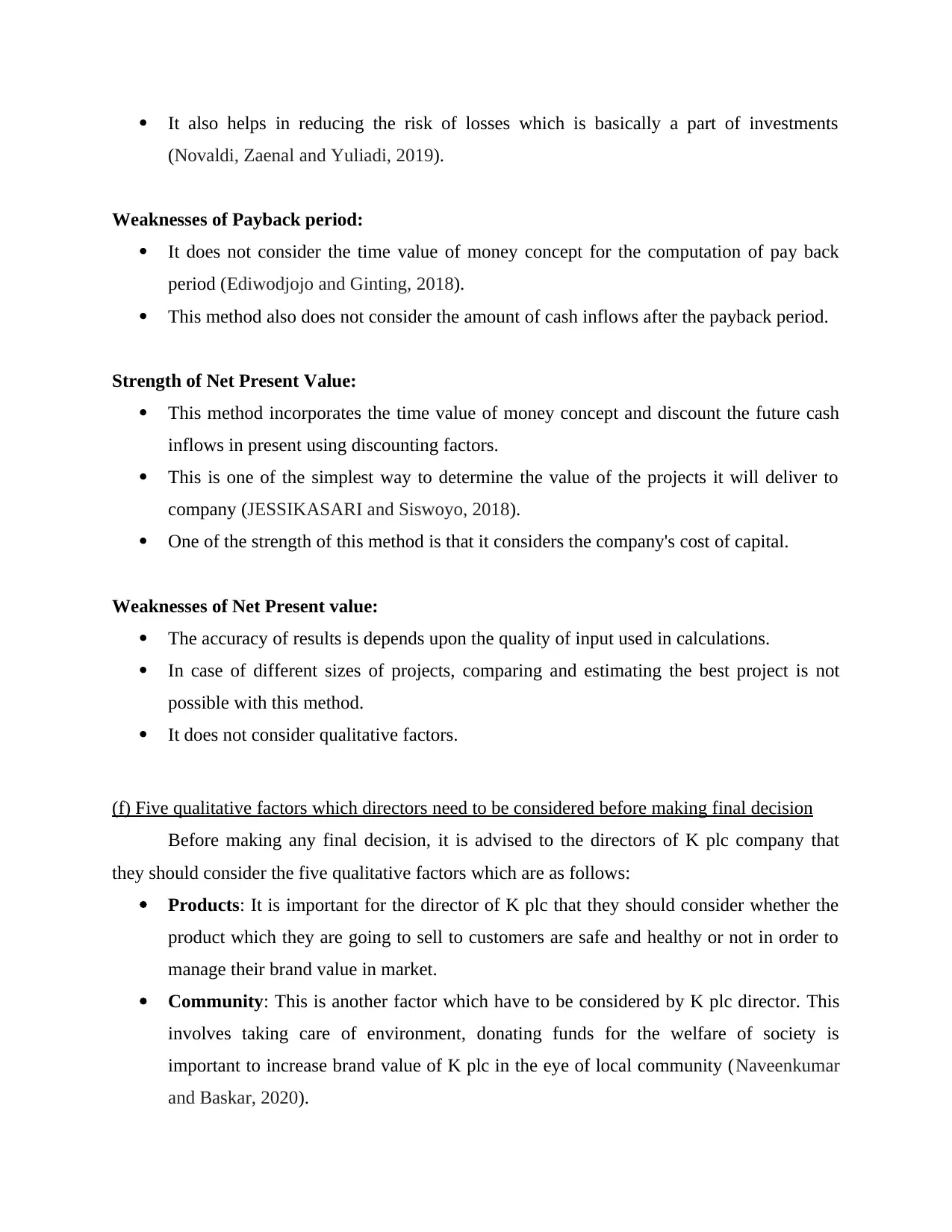

It also helps in reducing the risk of losses which is basically a part of investments

(Novaldi, Zaenal and Yuliadi, 2019).

Weaknesses of Payback period:

It does not consider the time value of money concept for the computation of pay back

period (Ediwodjojo and Ginting, 2018).

This method also does not consider the amount of cash inflows after the payback period.

Strength of Net Present Value:

This method incorporates the time value of money concept and discount the future cash

inflows in present using discounting factors.

This is one of the simplest way to determine the value of the projects it will deliver to

company (JESSIKASARI and Siswoyo, 2018).

One of the strength of this method is that it considers the company's cost of capital.

Weaknesses of Net Present value:

The accuracy of results is depends upon the quality of input used in calculations.

In case of different sizes of projects, comparing and estimating the best project is not

possible with this method.

It does not consider qualitative factors.

(f) Five qualitative factors which directors need to be considered before making final decision

Before making any final decision, it is advised to the directors of K plc company that

they should consider the five qualitative factors which are as follows:

Products: It is important for the director of K plc that they should consider whether the

product which they are going to sell to customers are safe and healthy or not in order to

manage their brand value in market.

Community: This is another factor which have to be considered by K plc director. This

involves taking care of environment, donating funds for the welfare of society is

important to increase brand value of K plc in the eye of local community (Naveenkumar

and Baskar, 2020).

(Novaldi, Zaenal and Yuliadi, 2019).

Weaknesses of Payback period:

It does not consider the time value of money concept for the computation of pay back

period (Ediwodjojo and Ginting, 2018).

This method also does not consider the amount of cash inflows after the payback period.

Strength of Net Present Value:

This method incorporates the time value of money concept and discount the future cash

inflows in present using discounting factors.

This is one of the simplest way to determine the value of the projects it will deliver to

company (JESSIKASARI and Siswoyo, 2018).

One of the strength of this method is that it considers the company's cost of capital.

Weaknesses of Net Present value:

The accuracy of results is depends upon the quality of input used in calculations.

In case of different sizes of projects, comparing and estimating the best project is not

possible with this method.

It does not consider qualitative factors.

(f) Five qualitative factors which directors need to be considered before making final decision

Before making any final decision, it is advised to the directors of K plc company that

they should consider the five qualitative factors which are as follows:

Products: It is important for the director of K plc that they should consider whether the

product which they are going to sell to customers are safe and healthy or not in order to

manage their brand value in market.

Community: This is another factor which have to be considered by K plc director. This

involves taking care of environment, donating funds for the welfare of society is

important to increase brand value of K plc in the eye of local community (Naveenkumar

and Baskar, 2020).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

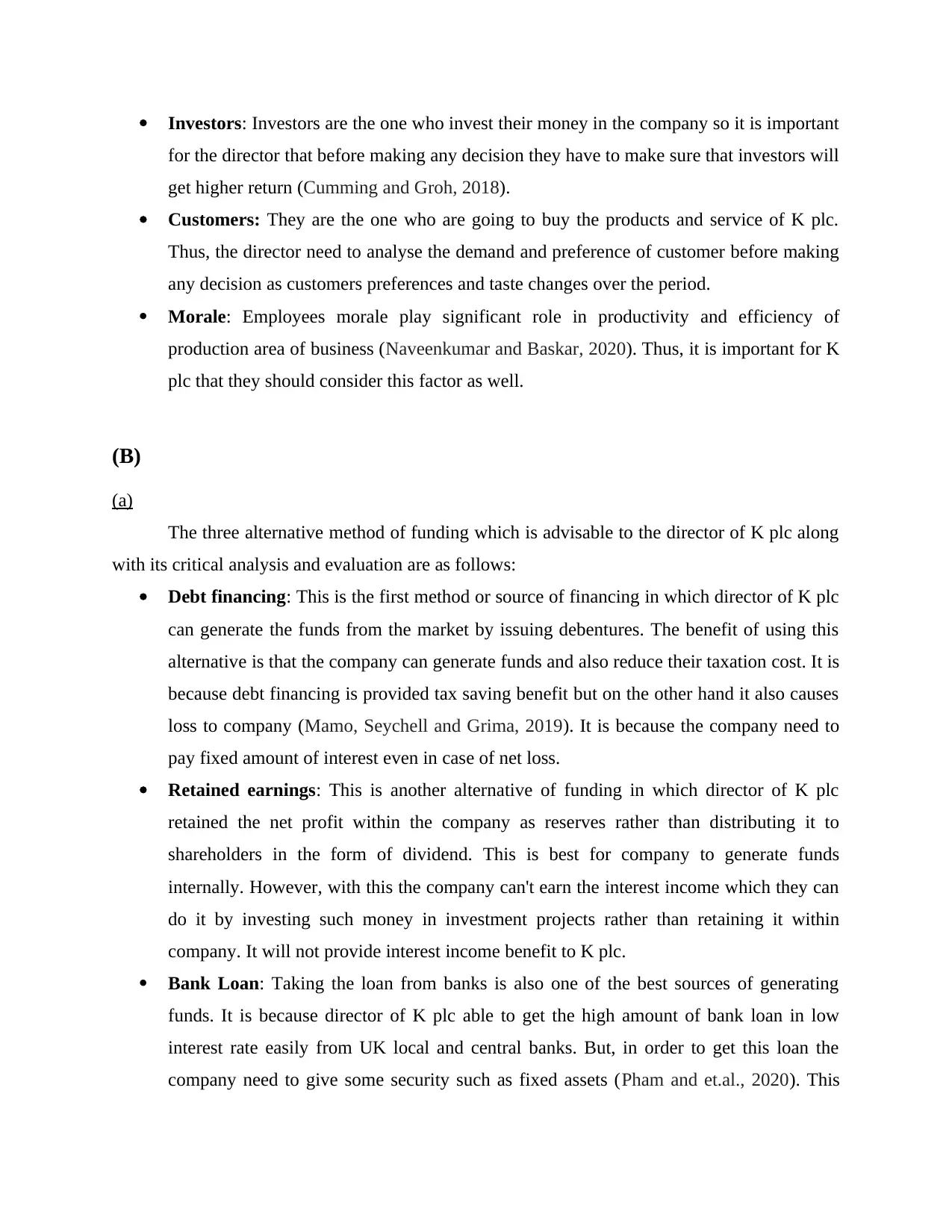

Investors: Investors are the one who invest their money in the company so it is important

for the director that before making any decision they have to make sure that investors will

get higher return (Cumming and Groh, 2018).

Customers: They are the one who are going to buy the products and service of K plc.

Thus, the director need to analyse the demand and preference of customer before making

any decision as customers preferences and taste changes over the period.

Morale: Employees morale play significant role in productivity and efficiency of

production area of business (Naveenkumar and Baskar, 2020). Thus, it is important for K

plc that they should consider this factor as well.

(B)

(a)

The three alternative method of funding which is advisable to the director of K plc along

with its critical analysis and evaluation are as follows:

Debt financing: This is the first method or source of financing in which director of K plc

can generate the funds from the market by issuing debentures. The benefit of using this

alternative is that the company can generate funds and also reduce their taxation cost. It is

because debt financing is provided tax saving benefit but on the other hand it also causes

loss to company (Mamo, Seychell and Grima, 2019). It is because the company need to

pay fixed amount of interest even in case of net loss.

Retained earnings: This is another alternative of funding in which director of K plc

retained the net profit within the company as reserves rather than distributing it to

shareholders in the form of dividend. This is best for company to generate funds

internally. However, with this the company can't earn the interest income which they can

do it by investing such money in investment projects rather than retaining it within

company. It will not provide interest income benefit to K plc.

Bank Loan: Taking the loan from banks is also one of the best sources of generating

funds. It is because director of K plc able to get the high amount of bank loan in low

interest rate easily from UK local and central banks. But, in order to get this loan the

company need to give some security such as fixed assets (Pham and et.al., 2020). This

for the director that before making any decision they have to make sure that investors will

get higher return (Cumming and Groh, 2018).

Customers: They are the one who are going to buy the products and service of K plc.

Thus, the director need to analyse the demand and preference of customer before making

any decision as customers preferences and taste changes over the period.

Morale: Employees morale play significant role in productivity and efficiency of

production area of business (Naveenkumar and Baskar, 2020). Thus, it is important for K

plc that they should consider this factor as well.

(B)

(a)

The three alternative method of funding which is advisable to the director of K plc along

with its critical analysis and evaluation are as follows:

Debt financing: This is the first method or source of financing in which director of K plc

can generate the funds from the market by issuing debentures. The benefit of using this

alternative is that the company can generate funds and also reduce their taxation cost. It is

because debt financing is provided tax saving benefit but on the other hand it also causes

loss to company (Mamo, Seychell and Grima, 2019). It is because the company need to

pay fixed amount of interest even in case of net loss.

Retained earnings: This is another alternative of funding in which director of K plc

retained the net profit within the company as reserves rather than distributing it to

shareholders in the form of dividend. This is best for company to generate funds

internally. However, with this the company can't earn the interest income which they can

do it by investing such money in investment projects rather than retaining it within

company. It will not provide interest income benefit to K plc.

Bank Loan: Taking the loan from banks is also one of the best sources of generating

funds. It is because director of K plc able to get the high amount of bank loan in low

interest rate easily from UK local and central banks. But, in order to get this loan the

company need to give some security such as fixed assets (Pham and et.al., 2020). This

also increase the chance of losing their assets in case if the company fails to repay the

loan to the company.

(b)

There is huge link between the company funds raising from above mentioned sources and

acquisition of unlisted company. It is because in order to acquire the unlisted company, K plc

need to pay purchase consideration to the acquiree company. So, at that time, acquirer company

can use the funds generate from debt capital, retained earnings and bank loan to pay amount of

purchase consideration to acquiree company. In this way, it can be said that finance and

investment decision are always linked with the acquisition of another company or unlisted

company. The unlisted company are those companies which are not listed on London stock

exchange or any other stock exchange (Paulet, 2018). Generating funds from various sources

helps the company to expand its business to the next geographical region or area. Also, the

company can also use this money to invest in new projects such as new plant and machinery the

impact of which they can increase their production level.

C.

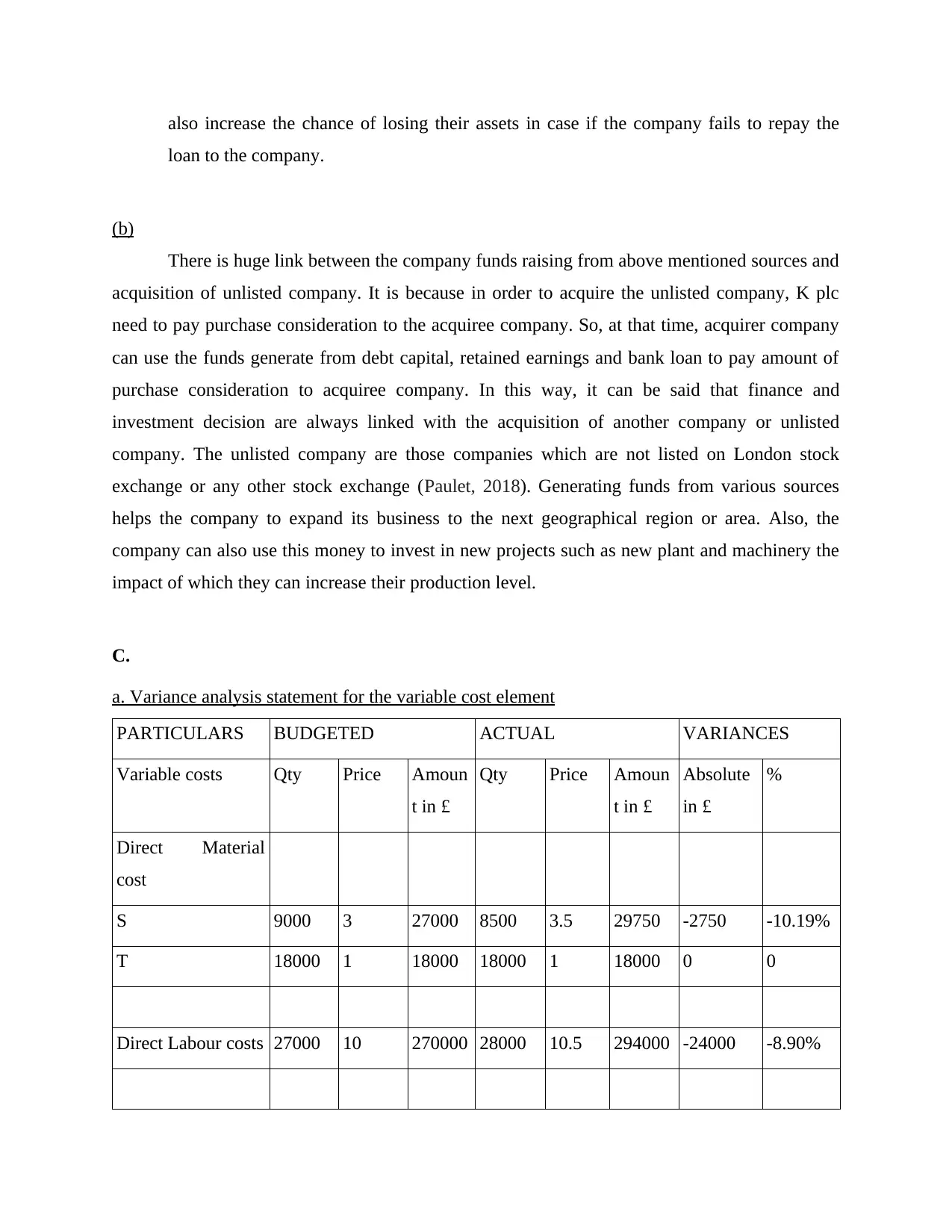

a. Variance analysis statement for the variable cost element

PARTICULARS BUDGETED ACTUAL VARIANCES

Variable costs Qty Price Amoun

t in £

Qty Price Amoun

t in £

Absolute

in £

%

Direct Material

cost

S 9000 3 27000 8500 3.5 29750 -2750 -10.19%

T 18000 1 18000 18000 1 18000 0 0

Direct Labour costs 27000 10 270000 28000 10.5 294000 -24000 -8.90%

loan to the company.

(b)

There is huge link between the company funds raising from above mentioned sources and

acquisition of unlisted company. It is because in order to acquire the unlisted company, K plc

need to pay purchase consideration to the acquiree company. So, at that time, acquirer company

can use the funds generate from debt capital, retained earnings and bank loan to pay amount of

purchase consideration to acquiree company. In this way, it can be said that finance and

investment decision are always linked with the acquisition of another company or unlisted

company. The unlisted company are those companies which are not listed on London stock

exchange or any other stock exchange (Paulet, 2018). Generating funds from various sources

helps the company to expand its business to the next geographical region or area. Also, the

company can also use this money to invest in new projects such as new plant and machinery the

impact of which they can increase their production level.

C.

a. Variance analysis statement for the variable cost element

PARTICULARS BUDGETED ACTUAL VARIANCES

Variable costs Qty Price Amoun

t in £

Qty Price Amoun

t in £

Absolute

in £

%

Direct Material

cost

S 9000 3 27000 8500 3.5 29750 -2750 -10.19%

T 18000 1 18000 18000 1 18000 0 0

Direct Labour costs 27000 10 270000 28000 10.5 294000 -24000 -8.90%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Variable overheads 27000 6 162000 - - 165000 -3000 -1.85%

Working notes:

Calculation of budgeted direct material costs = Actual production units * budgeted per unit cost

For S

Budgeted per unit cost of S= 1 kg * £3 = £3

Budgeted quantity for 9000 units of S = 1 kg per unit * 9000 units = 9000 kg

Budgeted direct material costs of S = 9000 * £3 = £27000

For T

Budgeted per unit cost of T= 2 kg * £1 = £2 or £1 per kg

Budgeted quantity needed for 9000 units of T = 2 kg per unit * 9000 units = 18000 kg

Budgeted direct material costs of T = 18000 * £1 = £18000

Budgeted Labour hours

Budgeted per unit labour cost = 3 Hours * £10 = £30

Budgeted labours for 9000 units = 3 Hours * 9000 Units = 27000 Hours

Budgeted direct labour costs = 27000 Hours * £10 = £270000

Budgeted variable overheads

Budgeted per unit variable overheads = 3 Hours * £6 per hour = £18 per unit

Budgeted variable overheads for 9000 units in terms of hours = 3 Hours * 9000 units = 27000

hours

Budgeted variable overheads in terms of £ = £6 * 27000 hours = £162000

b. Explanations of identified variance in the above statement

From the above statement, it has been identified that majorly there are unfavourable variances

for K Plc. in the areas such as direct material costs of S, direct labour costs and variable

overheads. However, the direct material costs associated with T is 0 which indicates that the

what has been budgeted was accurate and useful for the management as their performance in this

area is according to the budgeted one. For the other three unfavourable variances, the

explanations are as follows:

Direct material cost variance: This variance has been calculated for material S where the

difference has been obtained between actual cost incurred towards buying material S and the

Working notes:

Calculation of budgeted direct material costs = Actual production units * budgeted per unit cost

For S

Budgeted per unit cost of S= 1 kg * £3 = £3

Budgeted quantity for 9000 units of S = 1 kg per unit * 9000 units = 9000 kg

Budgeted direct material costs of S = 9000 * £3 = £27000

For T

Budgeted per unit cost of T= 2 kg * £1 = £2 or £1 per kg

Budgeted quantity needed for 9000 units of T = 2 kg per unit * 9000 units = 18000 kg

Budgeted direct material costs of T = 18000 * £1 = £18000

Budgeted Labour hours

Budgeted per unit labour cost = 3 Hours * £10 = £30

Budgeted labours for 9000 units = 3 Hours * 9000 Units = 27000 Hours

Budgeted direct labour costs = 27000 Hours * £10 = £270000

Budgeted variable overheads

Budgeted per unit variable overheads = 3 Hours * £6 per hour = £18 per unit

Budgeted variable overheads for 9000 units in terms of hours = 3 Hours * 9000 units = 27000

hours

Budgeted variable overheads in terms of £ = £6 * 27000 hours = £162000

b. Explanations of identified variance in the above statement

From the above statement, it has been identified that majorly there are unfavourable variances

for K Plc. in the areas such as direct material costs of S, direct labour costs and variable

overheads. However, the direct material costs associated with T is 0 which indicates that the

what has been budgeted was accurate and useful for the management as their performance in this

area is according to the budgeted one. For the other three unfavourable variances, the

explanations are as follows:

Direct material cost variance: This variance has been calculated for material S where the

difference has been obtained between actual cost incurred towards buying material S and the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

standard cost associated with this material on the basis of actual production activities (in terms of

units). The cause of variance could be any like the difference between budgeted and actual

quantity of material used in the production of actual units. Here the quantity of material used is

favourable as the actual quantity of 8500 Kg is less than the budgeted quantity of 9000 Kg but

still there are unfavourable variance obtained for the cost of material S due to the variation in

actual and budgeted price per Kg of material S that is £3.5 and £3 respectively (Lueg, 2018). The

variation occurred in the price of direct material S is known as unfavourable direct material price

variance while the variation that take place between the actual and budgeted quantity of material

used in production of 9000 units is known as favourable direct material usage variance.

The reason for the variance occurred in price of direct material (S) could be the size of

order placed. As the consumption of S material has reduced in actual production activities and

accordingly there would be less quantity needed for which there may be less discount available

from supplier. This lead to paying more for the purchase of direct material (S) and accordingly,

there are unfavourable direct material price variances (Marzuki, Abdul Rahim and Ismail, 2019).

Another cause of this variance is the increase in inflation in the market due to which the general

price level has increased and resulted in higher costs of inputs like direct material. The last

reason of such unfavourable variances is that the usage of high or premium quality materials in

the production activities for which higher rates are paid. The reason for favourable direct

material usage variance could be the use of better technology and higher efficiency of labours

involved in the production process.

Due to all these reasons mentioned above, there is an unfavourable direct material price

variance of £2750 in absolute terms or -10.19% in relative terms.

Direct labour cost variance: There are unfavourable variance obtained for the costs associated

with the direct labour involved in the production of chemical product. From the above statement

it can been seen that both labour efficiency and labour rate variance are unfavourable for K plc in

producing chemical product which leads to unfavourable direct labour cost variance. Labour

efficiency variance can be identified through the difference in actual hours works against the

budgeted hours on the basis of actual quantity produced (OLADEJI, 2018). Here the budgeted

hours are 27000 while the actual hours worked is 28000 which indicates that the efficiency of

labour has reduced. The causes of reduction in labour efficiency are breakdowns or use of faulty

units). The cause of variance could be any like the difference between budgeted and actual

quantity of material used in the production of actual units. Here the quantity of material used is

favourable as the actual quantity of 8500 Kg is less than the budgeted quantity of 9000 Kg but

still there are unfavourable variance obtained for the cost of material S due to the variation in

actual and budgeted price per Kg of material S that is £3.5 and £3 respectively (Lueg, 2018). The

variation occurred in the price of direct material S is known as unfavourable direct material price

variance while the variation that take place between the actual and budgeted quantity of material

used in production of 9000 units is known as favourable direct material usage variance.

The reason for the variance occurred in price of direct material (S) could be the size of

order placed. As the consumption of S material has reduced in actual production activities and

accordingly there would be less quantity needed for which there may be less discount available

from supplier. This lead to paying more for the purchase of direct material (S) and accordingly,

there are unfavourable direct material price variances (Marzuki, Abdul Rahim and Ismail, 2019).

Another cause of this variance is the increase in inflation in the market due to which the general

price level has increased and resulted in higher costs of inputs like direct material. The last

reason of such unfavourable variances is that the usage of high or premium quality materials in

the production activities for which higher rates are paid. The reason for favourable direct

material usage variance could be the use of better technology and higher efficiency of labours

involved in the production process.

Due to all these reasons mentioned above, there is an unfavourable direct material price

variance of £2750 in absolute terms or -10.19% in relative terms.

Direct labour cost variance: There are unfavourable variance obtained for the costs associated

with the direct labour involved in the production of chemical product. From the above statement

it can been seen that both labour efficiency and labour rate variance are unfavourable for K plc in

producing chemical product which leads to unfavourable direct labour cost variance. Labour

efficiency variance can be identified through the difference in actual hours works against the

budgeted hours on the basis of actual quantity produced (OLADEJI, 2018). Here the budgeted

hours are 27000 while the actual hours worked is 28000 which indicates that the efficiency of

labour has reduced. The causes of reduction in labour efficiency are breakdowns or use of faulty

equipment, poor supervision and motivation and inclusion of inexperienced workers in the

process of production. In addition to this, there are also variances that can be seen through the

variation in labour rates paid per hour which has also contributed towards unfavourable direct

labour cost variance. The cause of this variance could be hiring more skilled and experienced

workers and effective negotiation carried out by labour unions which leads to paying more per

hour to the labourers.

Direct variable overhead variances: There is again unfavourable variance obtained for variable

overheads amounted to 3000 in absolute terms and -1.89% in relative terms. This variance in

variable overhead are related to the use of indirect labour in the production process and costs

associated with the same. The cause could be both higher actual hours worked and higher rates

paid to labourers involved (Legaspi, 2019). The reasons due to which the variance in hours and

rates occurred are use of inefficient technology, poorly motivated or unskilled workers which

leads to reduced efficiency of indirect labours. Also, the increase in labour rate may be resulting

from increase in industrial wage rate or effective negotiation from unions.

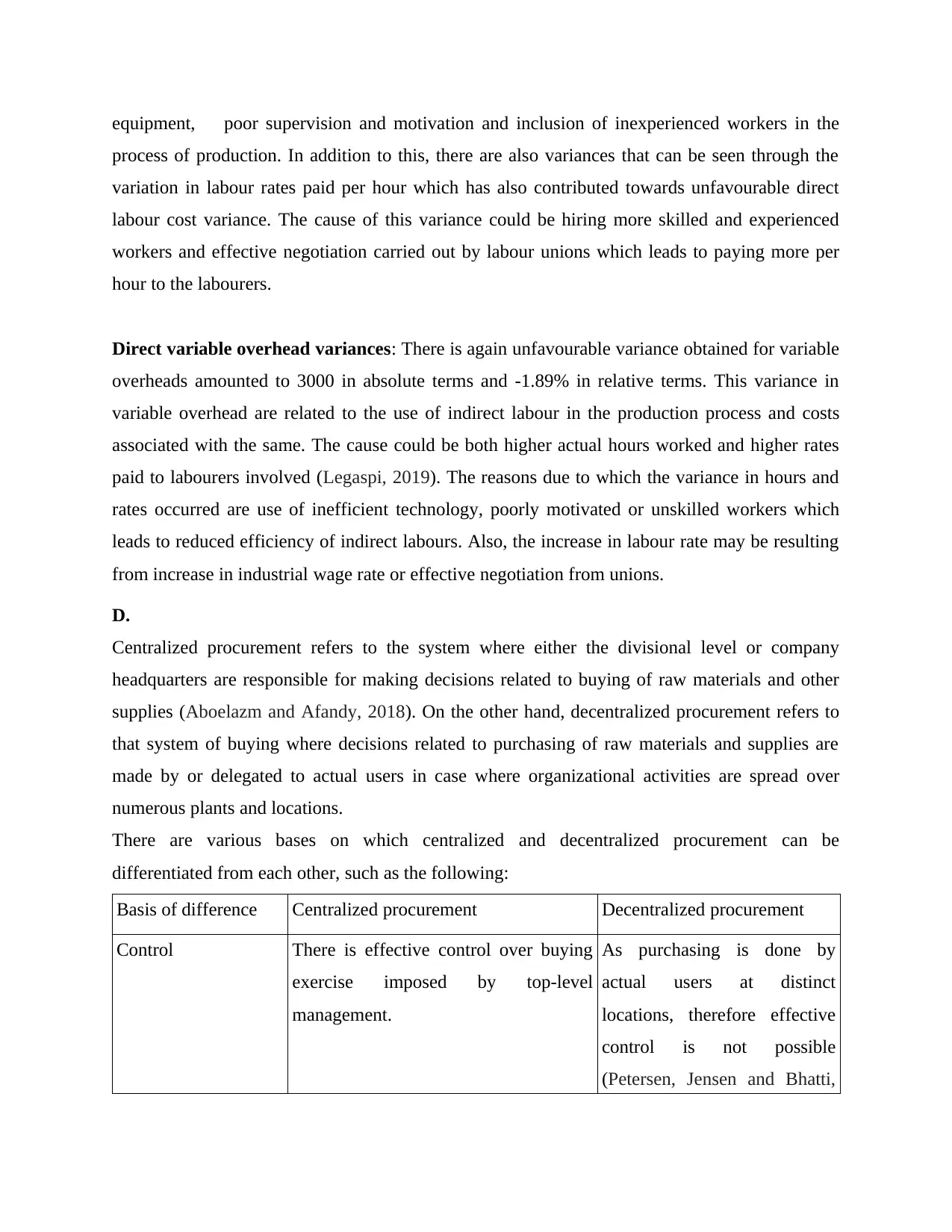

D.

Centralized procurement refers to the system where either the divisional level or company

headquarters are responsible for making decisions related to buying of raw materials and other

supplies (Aboelazm and Afandy, 2018). On the other hand, decentralized procurement refers to

that system of buying where decisions related to purchasing of raw materials and supplies are

made by or delegated to actual users in case where organizational activities are spread over

numerous plants and locations.

There are various bases on which centralized and decentralized procurement can be

differentiated from each other, such as the following:

Basis of difference Centralized procurement Decentralized procurement

Control There is effective control over buying

exercise imposed by top-level

management.

As purchasing is done by

actual users at distinct

locations, therefore effective

control is not possible

(Petersen, Jensen and Bhatti,

process of production. In addition to this, there are also variances that can be seen through the

variation in labour rates paid per hour which has also contributed towards unfavourable direct

labour cost variance. The cause of this variance could be hiring more skilled and experienced

workers and effective negotiation carried out by labour unions which leads to paying more per

hour to the labourers.

Direct variable overhead variances: There is again unfavourable variance obtained for variable

overheads amounted to 3000 in absolute terms and -1.89% in relative terms. This variance in

variable overhead are related to the use of indirect labour in the production process and costs

associated with the same. The cause could be both higher actual hours worked and higher rates

paid to labourers involved (Legaspi, 2019). The reasons due to which the variance in hours and

rates occurred are use of inefficient technology, poorly motivated or unskilled workers which

leads to reduced efficiency of indirect labours. Also, the increase in labour rate may be resulting

from increase in industrial wage rate or effective negotiation from unions.

D.

Centralized procurement refers to the system where either the divisional level or company

headquarters are responsible for making decisions related to buying of raw materials and other

supplies (Aboelazm and Afandy, 2018). On the other hand, decentralized procurement refers to

that system of buying where decisions related to purchasing of raw materials and supplies are

made by or delegated to actual users in case where organizational activities are spread over

numerous plants and locations.

There are various bases on which centralized and decentralized procurement can be

differentiated from each other, such as the following:

Basis of difference Centralized procurement Decentralized procurement

Control There is effective control over buying

exercise imposed by top-level

management.

As purchasing is done by

actual users at distinct

locations, therefore effective

control is not possible

(Petersen, Jensen and Bhatti,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.