BAF-5-FOF Fundamentals of Finance: Investment Appraisal and Analysis

VerifiedAdded on 2023/06/13

|18

|4421

|51

Report

AI Summary

This report provides a comprehensive analysis of investment appraisal techniques, focusing on the financial viability of a project proposal for Hoodoo Inc. It identifies sensitive variables such as selling price, initial capital investment, and cost of capital, and calculates the weighted average cost of capital (WACC). The report amends the initial investment appraisal, correcting errors made by a trainee, and recalculates the Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period. The analysis highlights the advantages and limitations of the financial techniques used, ultimately providing recommendations for the drafted project. The corrected calculations reveal a positive NPV, indicating the project's financial viability. Desklib offers a wealth of similar solved assignments and study resources for students.

Running head: FUNDAMENTAL OF FINANCE

Fundamental of Finance

Name of the Student:

Name of the University:

Authors Note:

Fundamental of Finance

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FUNDAMENTAL OF FINANCE

1

Table of Contents

Introduction:...............................................................................................................................2

Analytical comments on variable of the project’s viability that could be sensitive:.................2

Calculating the appropriate cost of capital and discussing that appropriate cost of capital,

which could be used in the calculation:.....................................................................................4

Amendment of the investment appraisal techniques, which are used in the assessment with

clear explanation:.......................................................................................................................6

Discussing the relevant advantage, problems and limitations of the financial techniques used

in the assessment of the project:...............................................................................................10

Providing appropriate recommendation for the drafted project:..............................................13

Conclusion:..............................................................................................................................14

References and Bibliography:..................................................................................................15

1

Table of Contents

Introduction:...............................................................................................................................2

Analytical comments on variable of the project’s viability that could be sensitive:.................2

Calculating the appropriate cost of capital and discussing that appropriate cost of capital,

which could be used in the calculation:.....................................................................................4

Amendment of the investment appraisal techniques, which are used in the assessment with

clear explanation:.......................................................................................................................6

Discussing the relevant advantage, problems and limitations of the financial techniques used

in the assessment of the project:...............................................................................................10

Providing appropriate recommendation for the drafted project:..............................................13

Conclusion:..............................................................................................................................14

References and Bibliography:..................................................................................................15

FUNDAMENTAL OF FINANCE

2

Introduction:

The overall assessment mainly aims in understanding the significance of investment

appraisal techniques and how it might help in detecting the financial viability of an

investment opportunity. In addition, the assessment also evaluates the proposal made by the

trainee of Hoodoo Inc, where the mistakes made by the young trainees is checked and new

project valuation is conducted. In addition, the valuation of the cost of capital is also

discussed in the assessment, which helps in depicted the discounting rate, which is taken into

consideration in the investment appraisal techniques. Moreover, the amendments on the

assumption of the project is relevantly evaluated in the assessment, which could help in

depicting the level expenses that might incur during 5-year time span. In addition, different

level of appraisal techniques such as Net Present Value, Internal Rate of Return and Payback

Period is relevantly calculated in the assessment to understand the financial viability of the

project proposed and amended for Hoodoo Inc.

Analytical comments on variable of the project’s viability that could be sensitive:

The relevant analytical comments are mainly conducted on variable assessment of the

project, which helps in detecting the sensitive valuation of different components. The major

sensitive component of the project is mainly considered as selling price of the machine, initial

capital investment required by the project and cost of capital of the organisation. The

estimation of the selling price is relevantly different, as the anticipation of the selling price

for the machine after 5 years. The salvage value of the machine is mainly anticipated at the

levels of $6 million, which can only alter slightly from the anticipation, as resale value of the

machine is relevantly high. Therefore, the change in the current valuation of the machine can

alter the overall cash inflow of the company during the ending period but cannot anticipate

the actual value. On the other hand, Lerer and McGarrigle (2018) criticises that the valuation

2

Introduction:

The overall assessment mainly aims in understanding the significance of investment

appraisal techniques and how it might help in detecting the financial viability of an

investment opportunity. In addition, the assessment also evaluates the proposal made by the

trainee of Hoodoo Inc, where the mistakes made by the young trainees is checked and new

project valuation is conducted. In addition, the valuation of the cost of capital is also

discussed in the assessment, which helps in depicted the discounting rate, which is taken into

consideration in the investment appraisal techniques. Moreover, the amendments on the

assumption of the project is relevantly evaluated in the assessment, which could help in

depicting the level expenses that might incur during 5-year time span. In addition, different

level of appraisal techniques such as Net Present Value, Internal Rate of Return and Payback

Period is relevantly calculated in the assessment to understand the financial viability of the

project proposed and amended for Hoodoo Inc.

Analytical comments on variable of the project’s viability that could be sensitive:

The relevant analytical comments are mainly conducted on variable assessment of the

project, which helps in detecting the sensitive valuation of different components. The major

sensitive component of the project is mainly considered as selling price of the machine, initial

capital investment required by the project and cost of capital of the organisation. The

estimation of the selling price is relevantly different, as the anticipation of the selling price

for the machine after 5 years. The salvage value of the machine is mainly anticipated at the

levels of $6 million, which can only alter slightly from the anticipation, as resale value of the

machine is relevantly high. Therefore, the change in the current valuation of the machine can

alter the overall cash inflow of the company during the ending period but cannot anticipate

the actual value. On the other hand, Lerer and McGarrigle (2018) criticises that the valuation

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FUNDAMENTAL OF FINANCE

3

of the asset might reduce due to the market value and the actual demand for the used

machines in the current market.

The second sensitive information that could be identified from the evaluation is the

initial capital investment required by the project, as the working capital is conducted to a be

percentage of the sales conducted by the company over the period of 1 year. This anticipation

of the demand is a variable factor for the project, which significantly changes with the

alternation in demand for the project. In this context, Shehu (2015) stated that anticipation of

the demand is relevantly essential for the organisation to understand the level of production

that is needed during the fiscal year for reducing the blockage of essential capital and

increasing their cash position. The last components that is considered to be sensitive is the

cost of capital anticipated for the project, which helps in deriving the net present value of the

project. However, cost of capital for the project is not sensitive, as the data is calculated on

the basis of the current WACC of the company. Hence, slight alternation in the cost of capital

value is conducted due to the changes in the current share price of the organisation.

After the evaluation of the overall variables of the project intimal investment capital is

considered to be most sensitive, as changes in demand for the project will directly alter the

working capital requirements and the initial investment that will be conducted by the

company over the period of time. The changes in value of demand will directly affect cash

flow of the project and spike the initiation of adequate decision that needs to be conducted by

the company. According to Baum and Crosby (2014), demand for particular project is an

essential measurement factor, which allows organisation to understand the significance of the

project in generating higher returns from investment.

3

of the asset might reduce due to the market value and the actual demand for the used

machines in the current market.

The second sensitive information that could be identified from the evaluation is the

initial capital investment required by the project, as the working capital is conducted to a be

percentage of the sales conducted by the company over the period of 1 year. This anticipation

of the demand is a variable factor for the project, which significantly changes with the

alternation in demand for the project. In this context, Shehu (2015) stated that anticipation of

the demand is relevantly essential for the organisation to understand the level of production

that is needed during the fiscal year for reducing the blockage of essential capital and

increasing their cash position. The last components that is considered to be sensitive is the

cost of capital anticipated for the project, which helps in deriving the net present value of the

project. However, cost of capital for the project is not sensitive, as the data is calculated on

the basis of the current WACC of the company. Hence, slight alternation in the cost of capital

value is conducted due to the changes in the current share price of the organisation.

After the evaluation of the overall variables of the project intimal investment capital is

considered to be most sensitive, as changes in demand for the project will directly alter the

working capital requirements and the initial investment that will be conducted by the

company over the period of time. The changes in value of demand will directly affect cash

flow of the project and spike the initiation of adequate decision that needs to be conducted by

the company. According to Baum and Crosby (2014), demand for particular project is an

essential measurement factor, which allows organisation to understand the significance of the

project in generating higher returns from investment.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FUNDAMENTAL OF FINANCE

4

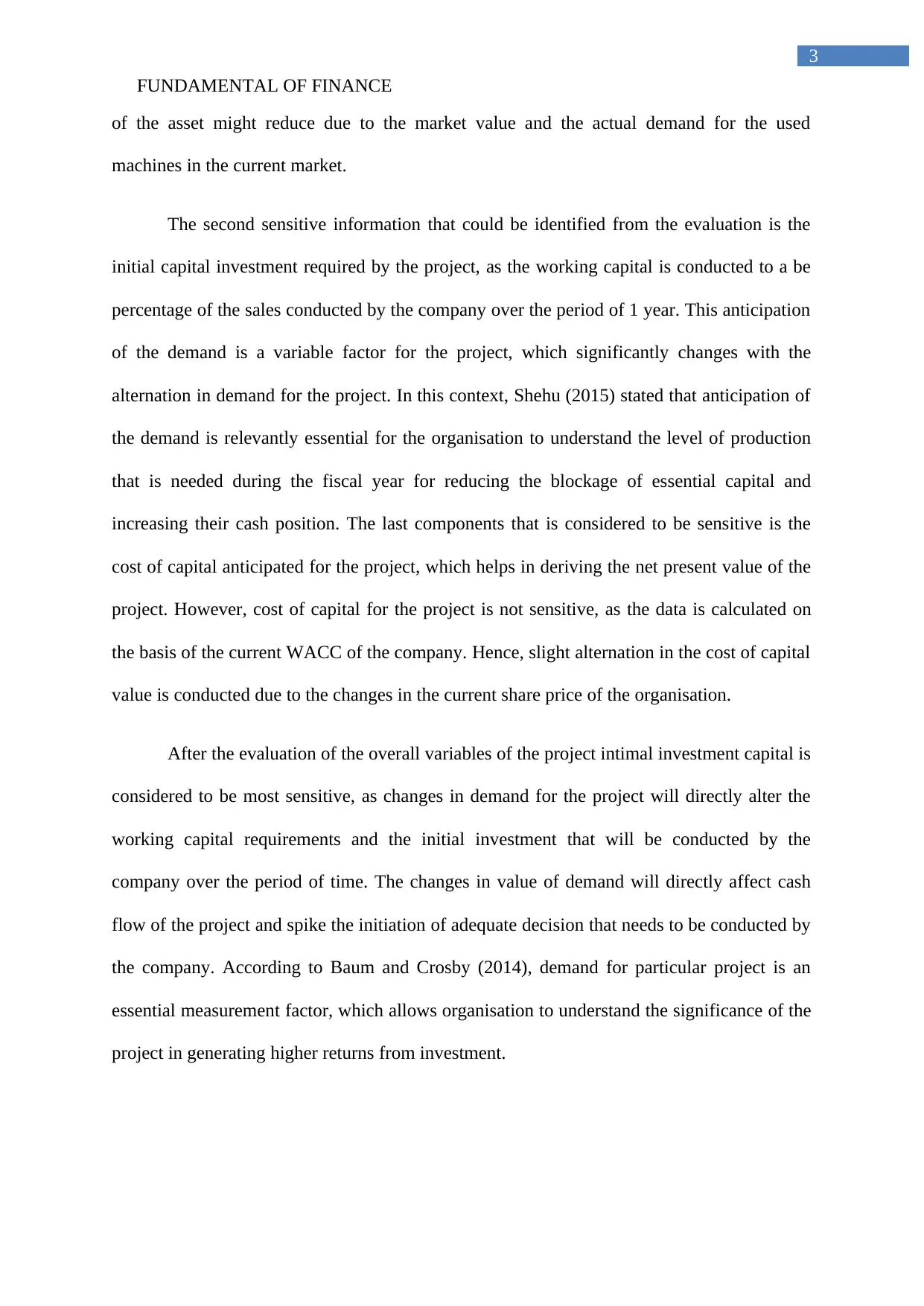

Calculating the appropriate cost of capital and discussing that appropriate cost of

capital, which could be used in the calculation:

Particulars Amount

Dividend $ 9,000,000

Number of shares 5,000,000

Common stock value $ 2,500,000

Par value $ 54.0

Share value $ 135,000,000

Cost of capital 8.33%

Bond interest rate 6.50%

Bond value $ 173,850,000

Market bond value $ 169,677,600

Tax 30%

Total value $ 304,677,600

WACC 6.23%

The above table mainly helps in depicting the level of WACC, which could be used

during the calculation of the Net Present Value. The calculation of WACC mainly indicates

the minimum return that is needed by the investors from the operations of the company.

Hence, the project that is selected by the company needs to have return higher than the

WACC value, as it will increase firm value in future. The above calculated cost of capital is

relatively adequate, as it is delivered from the information presented about the company.

Using the appropriate cost of capital is essential for the organisation, as it helps in depicting

the accurate level of net present value calculated for the project. The alteration in the

calculation of WACC has changed the cost of capital value for the project, which helped the

4

Calculating the appropriate cost of capital and discussing that appropriate cost of

capital, which could be used in the calculation:

Particulars Amount

Dividend $ 9,000,000

Number of shares 5,000,000

Common stock value $ 2,500,000

Par value $ 54.0

Share value $ 135,000,000

Cost of capital 8.33%

Bond interest rate 6.50%

Bond value $ 173,850,000

Market bond value $ 169,677,600

Tax 30%

Total value $ 304,677,600

WACC 6.23%

The above table mainly helps in depicting the level of WACC, which could be used

during the calculation of the Net Present Value. The calculation of WACC mainly indicates

the minimum return that is needed by the investors from the operations of the company.

Hence, the project that is selected by the company needs to have return higher than the

WACC value, as it will increase firm value in future. The above calculated cost of capital is

relatively adequate, as it is delivered from the information presented about the company.

Using the appropriate cost of capital is essential for the organisation, as it helps in depicting

the accurate level of net present value calculated for the project. The alteration in the

calculation of WACC has changed the cost of capital value for the project, which helped the

FUNDAMENTAL OF FINANCE

5

company to unravel the significance and opportunities of the project that could generate high

level of returns from investment.

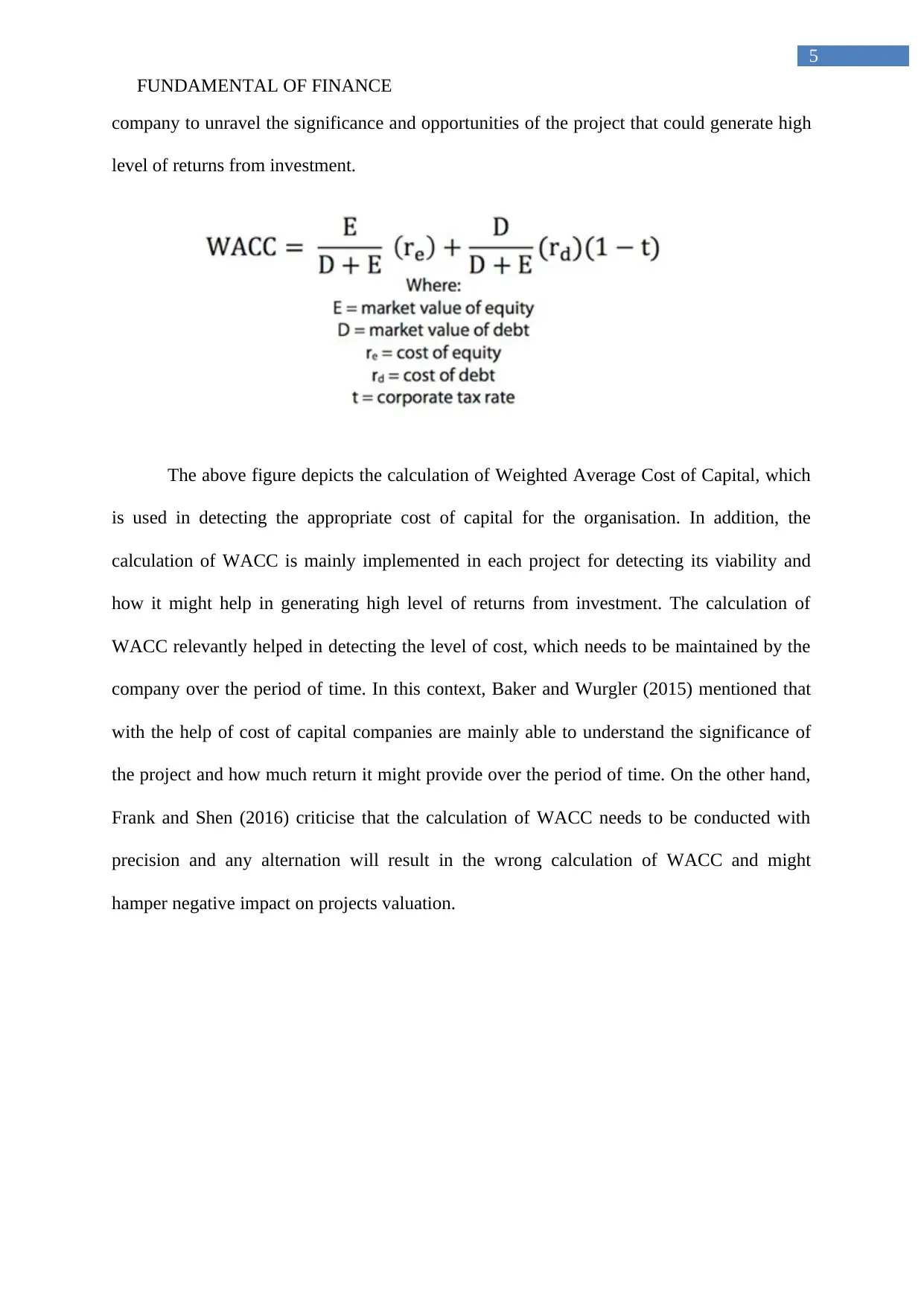

The above figure depicts the calculation of Weighted Average Cost of Capital, which

is used in detecting the appropriate cost of capital for the organisation. In addition, the

calculation of WACC is mainly implemented in each project for detecting its viability and

how it might help in generating high level of returns from investment. The calculation of

WACC relevantly helped in detecting the level of cost, which needs to be maintained by the

company over the period of time. In this context, Baker and Wurgler (2015) mentioned that

with the help of cost of capital companies are mainly able to understand the significance of

the project and how much return it might provide over the period of time. On the other hand,

Frank and Shen (2016) criticise that the calculation of WACC needs to be conducted with

precision and any alternation will result in the wrong calculation of WACC and might

hamper negative impact on projects valuation.

5

company to unravel the significance and opportunities of the project that could generate high

level of returns from investment.

The above figure depicts the calculation of Weighted Average Cost of Capital, which

is used in detecting the appropriate cost of capital for the organisation. In addition, the

calculation of WACC is mainly implemented in each project for detecting its viability and

how it might help in generating high level of returns from investment. The calculation of

WACC relevantly helped in detecting the level of cost, which needs to be maintained by the

company over the period of time. In this context, Baker and Wurgler (2015) mentioned that

with the help of cost of capital companies are mainly able to understand the significance of

the project and how much return it might provide over the period of time. On the other hand,

Frank and Shen (2016) criticise that the calculation of WACC needs to be conducted with

precision and any alternation will result in the wrong calculation of WACC and might

hamper negative impact on projects valuation.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FUNDAMENTAL OF FINANCE

6

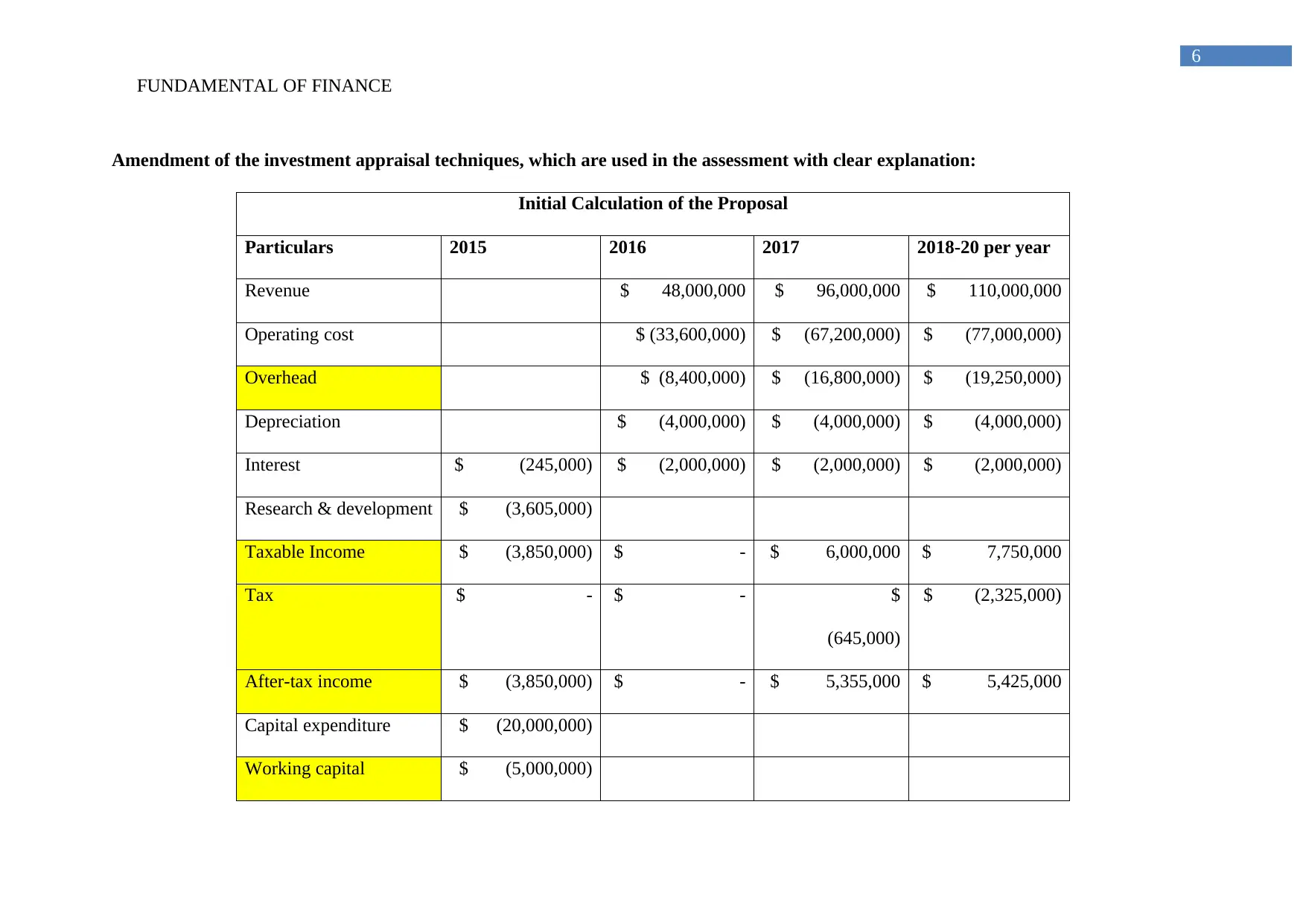

Amendment of the investment appraisal techniques, which are used in the assessment with clear explanation:

Initial Calculation of the Proposal

Particulars 2015 2016 2017 2018-20 per year

Revenue $ 48,000,000 $ 96,000,000 $ 110,000,000

Operating cost $ (33,600,000) $ (67,200,000) $ (77,000,000)

Overhead $ (8,400,000) $ (16,800,000) $ (19,250,000)

Depreciation $ (4,000,000) $ (4,000,000) $ (4,000,000)

Interest $ (245,000) $ (2,000,000) $ (2,000,000) $ (2,000,000)

Research & development $ (3,605,000)

Taxable Income $ (3,850,000) $ - $ 6,000,000 $ 7,750,000

Tax $ - $ - $

(645,000)

$ (2,325,000)

After-tax income $ (3,850,000) $ - $ 5,355,000 $ 5,425,000

Capital expenditure $ (20,000,000)

Working capital $ (5,000,000)

6

Amendment of the investment appraisal techniques, which are used in the assessment with clear explanation:

Initial Calculation of the Proposal

Particulars 2015 2016 2017 2018-20 per year

Revenue $ 48,000,000 $ 96,000,000 $ 110,000,000

Operating cost $ (33,600,000) $ (67,200,000) $ (77,000,000)

Overhead $ (8,400,000) $ (16,800,000) $ (19,250,000)

Depreciation $ (4,000,000) $ (4,000,000) $ (4,000,000)

Interest $ (245,000) $ (2,000,000) $ (2,000,000) $ (2,000,000)

Research & development $ (3,605,000)

Taxable Income $ (3,850,000) $ - $ 6,000,000 $ 7,750,000

Tax $ - $ - $

(645,000)

$ (2,325,000)

After-tax income $ (3,850,000) $ - $ 5,355,000 $ 5,425,000

Capital expenditure $ (20,000,000)

Working capital $ (5,000,000)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FUNDAMENTAL OF FINANCE

7

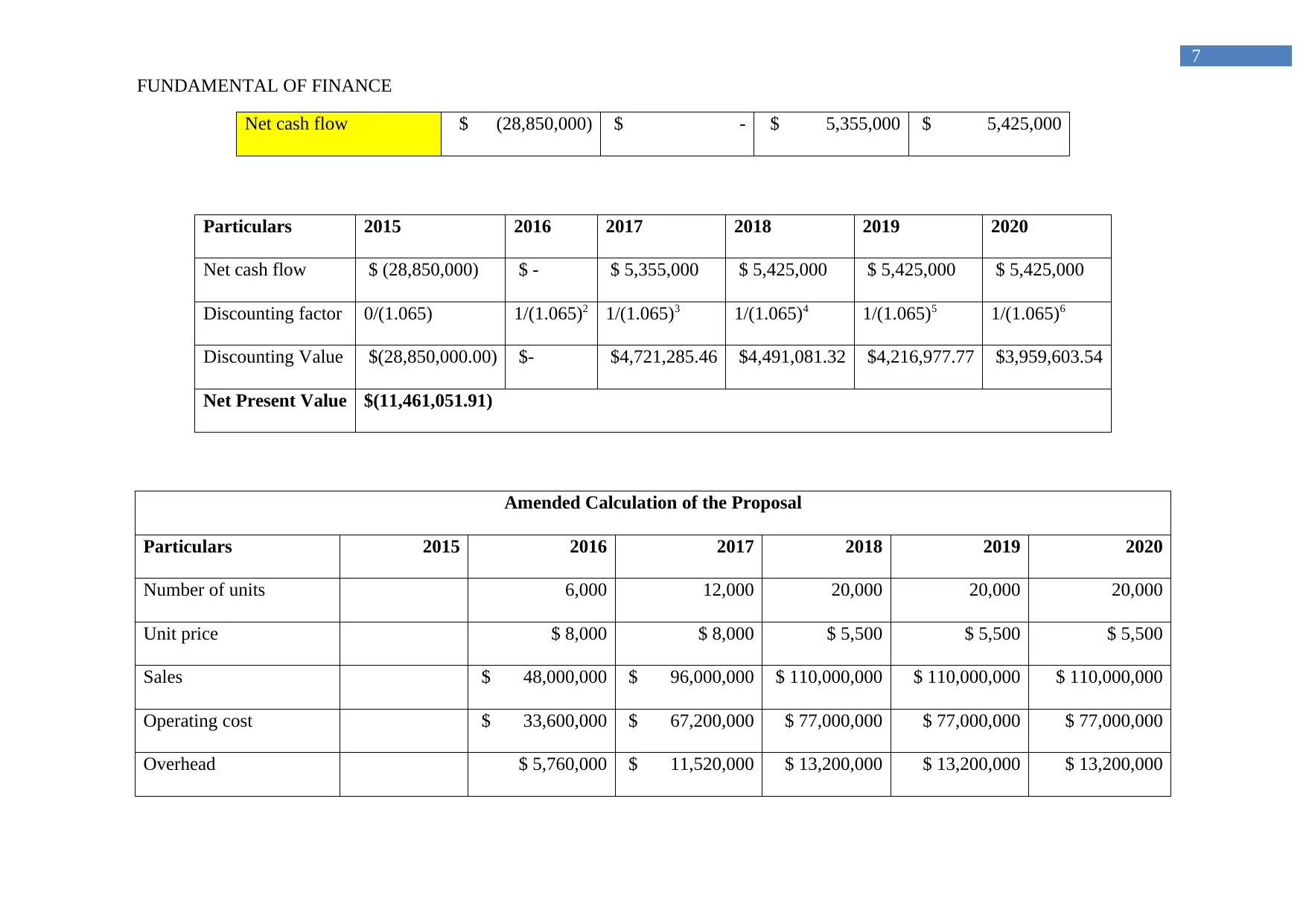

Net cash flow $ (28,850,000) $ - $ 5,355,000 $ 5,425,000

Particulars 2015 2016 2017 2018 2019 2020

Net cash flow $ (28,850,000) $ - $ 5,355,000 $ 5,425,000 $ 5,425,000 $ 5,425,000

Discounting factor 0/(1.065) 1/(1.065)2 1/(1.065)3 1/(1.065)4 1/(1.065)5 1/(1.065)6

Discounting Value $(28,850,000.00) $- $4,721,285.46 $4,491,081.32 $4,216,977.77 $3,959,603.54

Net Present Value $(11,461,051.91)

Amended Calculation of the Proposal

Particulars 2015 2016 2017 2018 2019 2020

Number of units 6,000 12,000 20,000 20,000 20,000

Unit price $ 8,000 $ 8,000 $ 5,500 $ 5,500 $ 5,500

Sales $ 48,000,000 $ 96,000,000 $ 110,000,000 $ 110,000,000 $ 110,000,000

Operating cost $ 33,600,000 $ 67,200,000 $ 77,000,000 $ 77,000,000 $ 77,000,000

Overhead $ 5,760,000 $ 11,520,000 $ 13,200,000 $ 13,200,000 $ 13,200,000

7

Net cash flow $ (28,850,000) $ - $ 5,355,000 $ 5,425,000

Particulars 2015 2016 2017 2018 2019 2020

Net cash flow $ (28,850,000) $ - $ 5,355,000 $ 5,425,000 $ 5,425,000 $ 5,425,000

Discounting factor 0/(1.065) 1/(1.065)2 1/(1.065)3 1/(1.065)4 1/(1.065)5 1/(1.065)6

Discounting Value $(28,850,000.00) $- $4,721,285.46 $4,491,081.32 $4,216,977.77 $3,959,603.54

Net Present Value $(11,461,051.91)

Amended Calculation of the Proposal

Particulars 2015 2016 2017 2018 2019 2020

Number of units 6,000 12,000 20,000 20,000 20,000

Unit price $ 8,000 $ 8,000 $ 5,500 $ 5,500 $ 5,500

Sales $ 48,000,000 $ 96,000,000 $ 110,000,000 $ 110,000,000 $ 110,000,000

Operating cost $ 33,600,000 $ 67,200,000 $ 77,000,000 $ 77,000,000 $ 77,000,000

Overhead $ 5,760,000 $ 11,520,000 $ 13,200,000 $ 13,200,000 $ 13,200,000

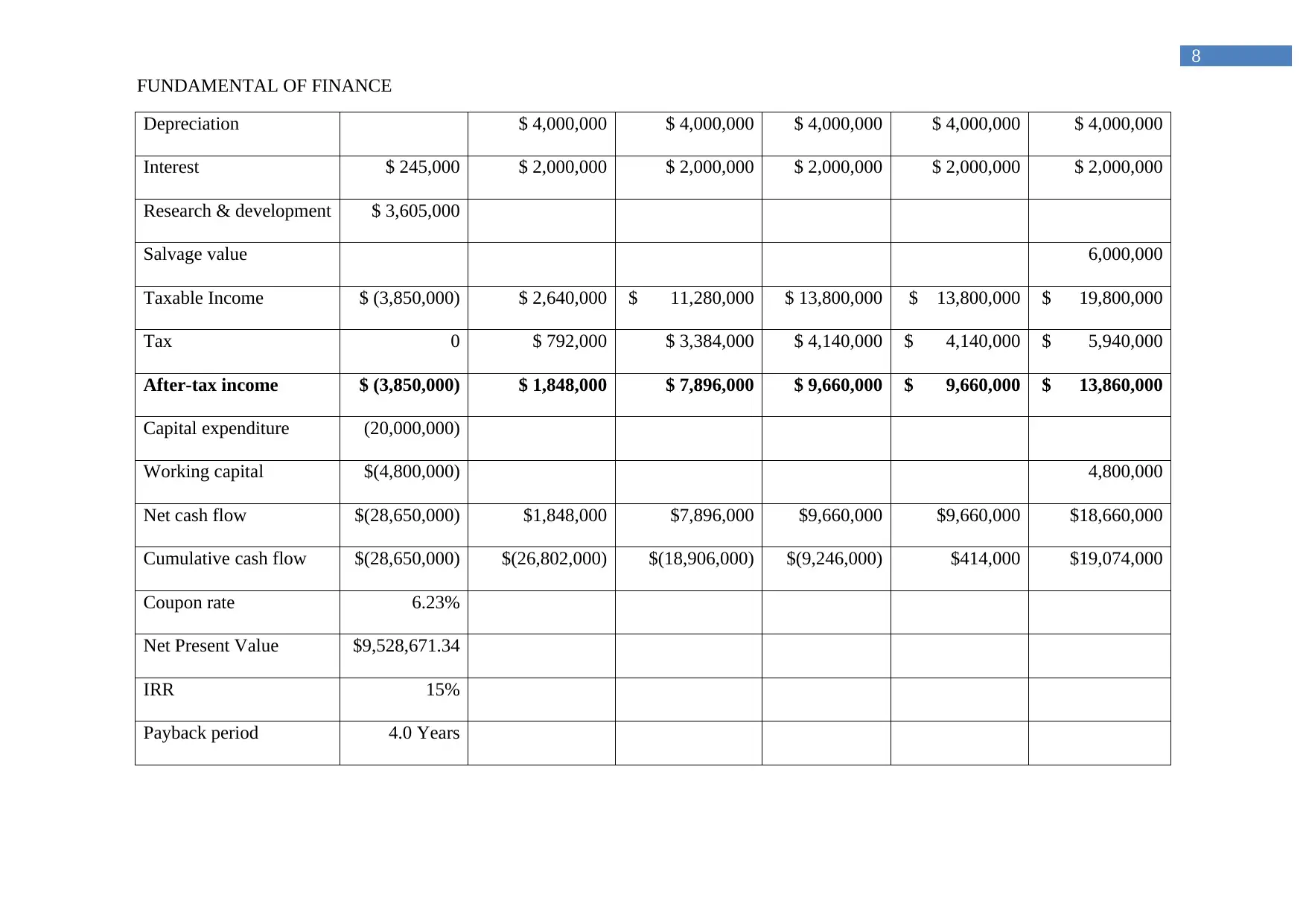

FUNDAMENTAL OF FINANCE

8

Depreciation $ 4,000,000 $ 4,000,000 $ 4,000,000 $ 4,000,000 $ 4,000,000

Interest $ 245,000 $ 2,000,000 $ 2,000,000 $ 2,000,000 $ 2,000,000 $ 2,000,000

Research & development $ 3,605,000

Salvage value 6,000,000

Taxable Income $ (3,850,000) $ 2,640,000 $ 11,280,000 $ 13,800,000 $ 13,800,000 $ 19,800,000

Tax 0 $ 792,000 $ 3,384,000 $ 4,140,000 $ 4,140,000 $ 5,940,000

After-tax income $ (3,850,000) $ 1,848,000 $ 7,896,000 $ 9,660,000 $ 9,660,000 $ 13,860,000

Capital expenditure (20,000,000)

Working capital $(4,800,000) 4,800,000

Net cash flow $(28,650,000) $1,848,000 $7,896,000 $9,660,000 $9,660,000 $18,660,000

Cumulative cash flow $(28,650,000) $(26,802,000) $(18,906,000) $(9,246,000) $414,000 $19,074,000

Coupon rate 6.23%

Net Present Value $9,528,671.34

IRR 15%

Payback period 4.0 Years

8

Depreciation $ 4,000,000 $ 4,000,000 $ 4,000,000 $ 4,000,000 $ 4,000,000

Interest $ 245,000 $ 2,000,000 $ 2,000,000 $ 2,000,000 $ 2,000,000 $ 2,000,000

Research & development $ 3,605,000

Salvage value 6,000,000

Taxable Income $ (3,850,000) $ 2,640,000 $ 11,280,000 $ 13,800,000 $ 13,800,000 $ 19,800,000

Tax 0 $ 792,000 $ 3,384,000 $ 4,140,000 $ 4,140,000 $ 5,940,000

After-tax income $ (3,850,000) $ 1,848,000 $ 7,896,000 $ 9,660,000 $ 9,660,000 $ 13,860,000

Capital expenditure (20,000,000)

Working capital $(4,800,000) 4,800,000

Net cash flow $(28,650,000) $1,848,000 $7,896,000 $9,660,000 $9,660,000 $18,660,000

Cumulative cash flow $(28,650,000) $(26,802,000) $(18,906,000) $(9,246,000) $414,000 $19,074,000

Coupon rate 6.23%

Net Present Value $9,528,671.34

IRR 15%

Payback period 4.0 Years

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FUNDAMENTAL OF FINANCE

9

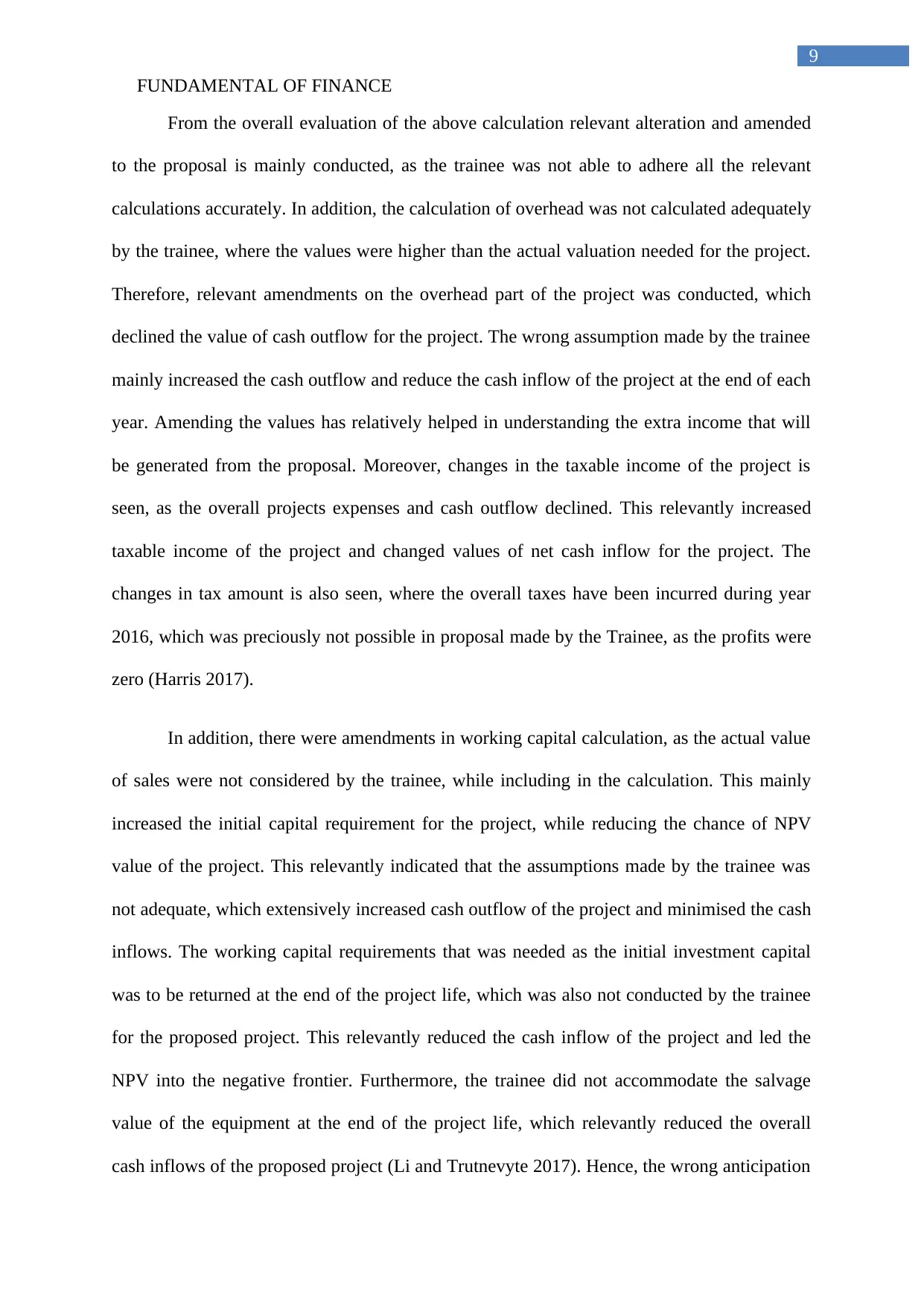

From the overall evaluation of the above calculation relevant alteration and amended

to the proposal is mainly conducted, as the trainee was not able to adhere all the relevant

calculations accurately. In addition, the calculation of overhead was not calculated adequately

by the trainee, where the values were higher than the actual valuation needed for the project.

Therefore, relevant amendments on the overhead part of the project was conducted, which

declined the value of cash outflow for the project. The wrong assumption made by the trainee

mainly increased the cash outflow and reduce the cash inflow of the project at the end of each

year. Amending the values has relatively helped in understanding the extra income that will

be generated from the proposal. Moreover, changes in the taxable income of the project is

seen, as the overall projects expenses and cash outflow declined. This relevantly increased

taxable income of the project and changed values of net cash inflow for the project. The

changes in tax amount is also seen, where the overall taxes have been incurred during year

2016, which was preciously not possible in proposal made by the Trainee, as the profits were

zero (Harris 2017).

In addition, there were amendments in working capital calculation, as the actual value

of sales were not considered by the trainee, while including in the calculation. This mainly

increased the initial capital requirement for the project, while reducing the chance of NPV

value of the project. This relevantly indicated that the assumptions made by the trainee was

not adequate, which extensively increased cash outflow of the project and minimised the cash

inflows. The working capital requirements that was needed as the initial investment capital

was to be returned at the end of the project life, which was also not conducted by the trainee

for the proposed project. This relevantly reduced the cash inflow of the project and led the

NPV into the negative frontier. Furthermore, the trainee did not accommodate the salvage

value of the equipment at the end of the project life, which relevantly reduced the overall

cash inflows of the proposed project (Li and Trutnevyte 2017). Hence, the wrong anticipation

9

From the overall evaluation of the above calculation relevant alteration and amended

to the proposal is mainly conducted, as the trainee was not able to adhere all the relevant

calculations accurately. In addition, the calculation of overhead was not calculated adequately

by the trainee, where the values were higher than the actual valuation needed for the project.

Therefore, relevant amendments on the overhead part of the project was conducted, which

declined the value of cash outflow for the project. The wrong assumption made by the trainee

mainly increased the cash outflow and reduce the cash inflow of the project at the end of each

year. Amending the values has relatively helped in understanding the extra income that will

be generated from the proposal. Moreover, changes in the taxable income of the project is

seen, as the overall projects expenses and cash outflow declined. This relevantly increased

taxable income of the project and changed values of net cash inflow for the project. The

changes in tax amount is also seen, where the overall taxes have been incurred during year

2016, which was preciously not possible in proposal made by the Trainee, as the profits were

zero (Harris 2017).

In addition, there were amendments in working capital calculation, as the actual value

of sales were not considered by the trainee, while including in the calculation. This mainly

increased the initial capital requirement for the project, while reducing the chance of NPV

value of the project. This relevantly indicated that the assumptions made by the trainee was

not adequate, which extensively increased cash outflow of the project and minimised the cash

inflows. The working capital requirements that was needed as the initial investment capital

was to be returned at the end of the project life, which was also not conducted by the trainee

for the proposed project. This relevantly reduced the cash inflow of the project and led the

NPV into the negative frontier. Furthermore, the trainee did not accommodate the salvage

value of the equipment at the end of the project life, which relevantly reduced the overall

cash inflows of the proposed project (Li and Trutnevyte 2017). Hence, the wrong anticipation

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FUNDAMENTAL OF FINANCE

10

of the cash outflows conducted by the proposed project was the main reason behind the

negative NPV calculation conducted by the Trainee.

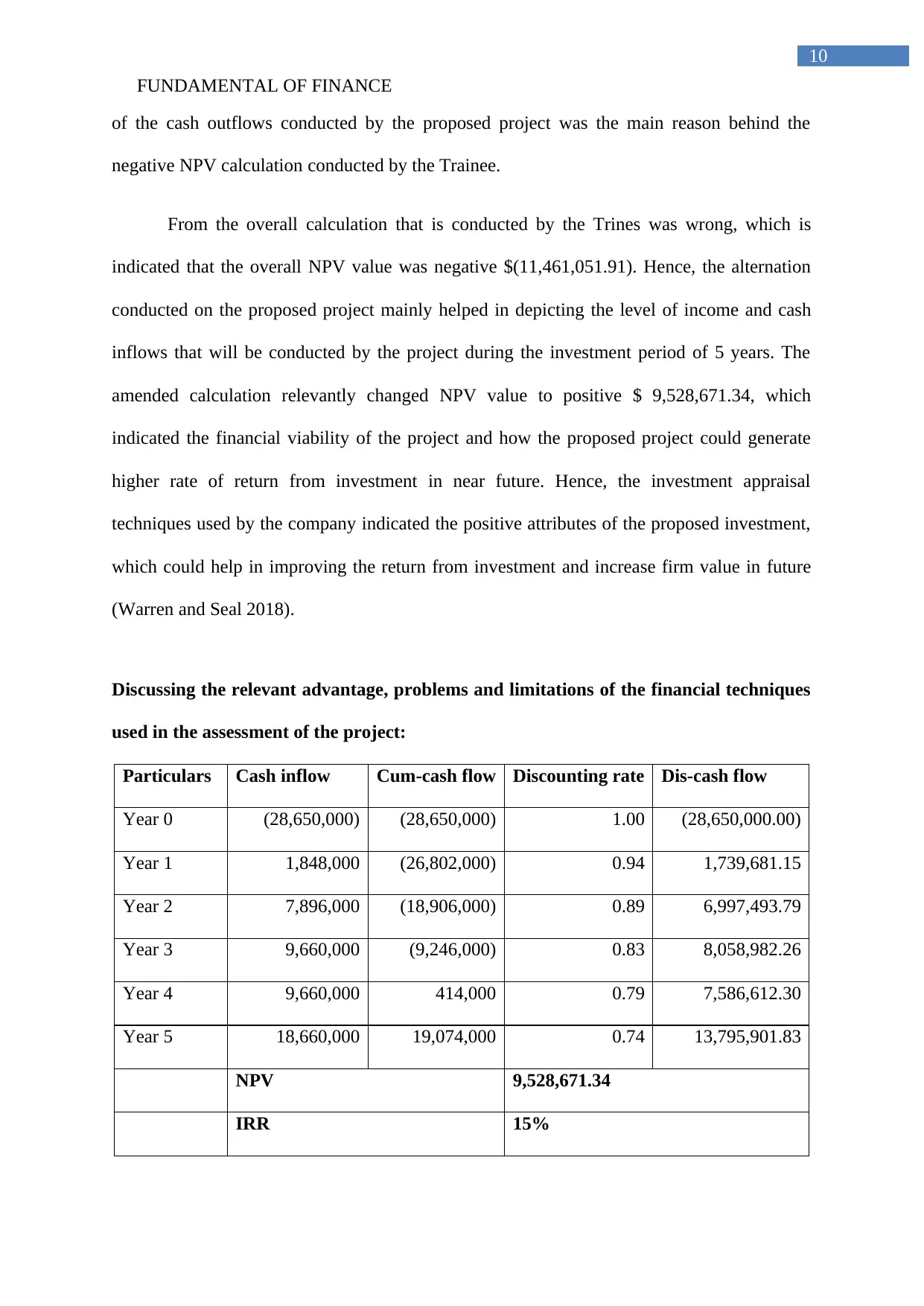

From the overall calculation that is conducted by the Trines was wrong, which is

indicated that the overall NPV value was negative $(11,461,051.91). Hence, the alternation

conducted on the proposed project mainly helped in depicting the level of income and cash

inflows that will be conducted by the project during the investment period of 5 years. The

amended calculation relevantly changed NPV value to positive $ 9,528,671.34, which

indicated the financial viability of the project and how the proposed project could generate

higher rate of return from investment in near future. Hence, the investment appraisal

techniques used by the company indicated the positive attributes of the proposed investment,

which could help in improving the return from investment and increase firm value in future

(Warren and Seal 2018).

Discussing the relevant advantage, problems and limitations of the financial techniques

used in the assessment of the project:

Particulars Cash inflow Cum-cash flow Discounting rate Dis-cash flow

Year 0 (28,650,000) (28,650,000) 1.00 (28,650,000.00)

Year 1 1,848,000 (26,802,000) 0.94 1,739,681.15

Year 2 7,896,000 (18,906,000) 0.89 6,997,493.79

Year 3 9,660,000 (9,246,000) 0.83 8,058,982.26

Year 4 9,660,000 414,000 0.79 7,586,612.30

Year 5 18,660,000 19,074,000 0.74 13,795,901.83

NPV 9,528,671.34

IRR 15%

10

of the cash outflows conducted by the proposed project was the main reason behind the

negative NPV calculation conducted by the Trainee.

From the overall calculation that is conducted by the Trines was wrong, which is

indicated that the overall NPV value was negative $(11,461,051.91). Hence, the alternation

conducted on the proposed project mainly helped in depicting the level of income and cash

inflows that will be conducted by the project during the investment period of 5 years. The

amended calculation relevantly changed NPV value to positive $ 9,528,671.34, which

indicated the financial viability of the project and how the proposed project could generate

higher rate of return from investment in near future. Hence, the investment appraisal

techniques used by the company indicated the positive attributes of the proposed investment,

which could help in improving the return from investment and increase firm value in future

(Warren and Seal 2018).

Discussing the relevant advantage, problems and limitations of the financial techniques

used in the assessment of the project:

Particulars Cash inflow Cum-cash flow Discounting rate Dis-cash flow

Year 0 (28,650,000) (28,650,000) 1.00 (28,650,000.00)

Year 1 1,848,000 (26,802,000) 0.94 1,739,681.15

Year 2 7,896,000 (18,906,000) 0.89 6,997,493.79

Year 3 9,660,000 (9,246,000) 0.83 8,058,982.26

Year 4 9,660,000 414,000 0.79 7,586,612.30

Year 5 18,660,000 19,074,000 0.74 13,795,901.83

NPV 9,528,671.34

IRR 15%

FUNDAMENTAL OF FINANCE

11

Payback period 4.0 Years

The above table indicates the overall investment appraisal techniques, which has been

used by the company in detecting the financial viability of the project. In addition, the

financial terms mainly help in understanding the significance of the project and how it could

improve the returns from investment over the period of investment. the investment appraisal

techniques used in the valuation of the project have certain advantages and disadvantages,

which needs to be evaluated to understand the significance of the techniques delivering the

accurate value of and assumptions of the project. This first appraisal techniques used in the

assessment is the calculation of Net present value, which needs certain assumptions from the

project for deriving the accurate financial viability of the project (Bader, Al-Nawaiseh and

Nawaiseh 2018).

The Net Present Valuation relevantly has significance and limitation, which can

indicated the use of investment appraisal techniques in maximising the level of returns from

investments. The relevant limitations of the Net Present Value technique are that it cannot

accommodate or compare projects with different timeline. This limitation does not allow the

organisation to understand the actual significance of the project with different level of tenure.

Moreover, NPV also uses discounting rate, which needs to be evaluated to understand the

significance and return generation capability of the project. Furthermore, NPV is also not

able to compare projects with different sizes to understand the investment opportunity, which

could generate higher rate of return from investment. Hence, the above identified

disadvantage might not allow the organisation to detect the significance of the investment

appraisal technique (Lokman et al. 2017).

11

Payback period 4.0 Years

The above table indicates the overall investment appraisal techniques, which has been

used by the company in detecting the financial viability of the project. In addition, the

financial terms mainly help in understanding the significance of the project and how it could

improve the returns from investment over the period of investment. the investment appraisal

techniques used in the valuation of the project have certain advantages and disadvantages,

which needs to be evaluated to understand the significance of the techniques delivering the

accurate value of and assumptions of the project. This first appraisal techniques used in the

assessment is the calculation of Net present value, which needs certain assumptions from the

project for deriving the accurate financial viability of the project (Bader, Al-Nawaiseh and

Nawaiseh 2018).

The Net Present Valuation relevantly has significance and limitation, which can

indicated the use of investment appraisal techniques in maximising the level of returns from

investments. The relevant limitations of the Net Present Value technique are that it cannot

accommodate or compare projects with different timeline. This limitation does not allow the

organisation to understand the actual significance of the project with different level of tenure.

Moreover, NPV also uses discounting rate, which needs to be evaluated to understand the

significance and return generation capability of the project. Furthermore, NPV is also not

able to compare projects with different sizes to understand the investment opportunity, which

could generate higher rate of return from investment. Hence, the above identified

disadvantage might not allow the organisation to detect the significance of the investment

appraisal technique (Lokman et al. 2017).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.