Investment Psychology: Analyzing Stocks and Market Trends

VerifiedAdded on 2023/06/14

|9

|1633

|334

Report

AI Summary

This report delves into the investment psychology behind selecting stocks, focusing on Amazon, Coca-Cola Bottling, and Domino's Pizza. It examines their financial history, comparing them against competitors using metrics like operating margin, gross margin, and debt/equity ratios. The report analyzes the logical and emotional reasons for investment choices, predicting future performance based on past peaks and troughs. Ultimately, it aims to guide investors in making informed decisions to maximize returns, highlighting the importance of understanding both market trends and company-specific financial data. Desklib provides access to similar solved assignments and past papers for students.

Running head: INVESTMENT PSYCHOLOGY

Investment Psychology

Name of the Student:

Name of the University:

Authors Note:

Investment Psychology

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INVESTMENT PSYCHOLOGY

1

Table of Contents

Introduction:...............................................................................................................................2

Identifying the industry:.............................................................................................................2

Conducting research on financial History:.................................................................................2

Depicting how it fairs against the competition:.........................................................................4

Stating the reason behind buying the shares:.............................................................................5

Predicting future performance of the company by evaluating past peaks and troughs:.............6

Conclusion:................................................................................................................................6

Reference and Bibliography:......................................................................................................8

1

Table of Contents

Introduction:...............................................................................................................................2

Identifying the industry:.............................................................................................................2

Conducting research on financial History:.................................................................................2

Depicting how it fairs against the competition:.........................................................................4

Stating the reason behind buying the shares:.............................................................................5

Predicting future performance of the company by evaluating past peaks and troughs:.............6

Conclusion:................................................................................................................................6

Reference and Bibliography:......................................................................................................8

INVESTMENT PSYCHOLOGY

2

Introduction:

The overall aim of the assessment is to identify financial capability of three

diversified companies, which could increase return from investment for investors.

Furthermore, the assessment also focuses on detecting the performance of all the 3 selected

companies are relatively compared to its competitors by identifying different ratios and

current situation of the organization. The evaluation of past performance is relatively helpful

in depicting the future performance of the selected companies.

Identifying the industry:

Amazon.com Inc. is listed in consumer service industry, where it has become the

leader of the industry by capturing market share all over the world. Coca Cola Bottling Co.

Consolidation is under the beverage industry, where the organisation provides soft drinks to

its customers. Domino’s Pizza Inc mainly falls in food delivery industry, where the overall

income of the company has grown adequately over the period. The identified industry mainly

helps in understanding the competitions of the company, which could help in detecting their

performance.

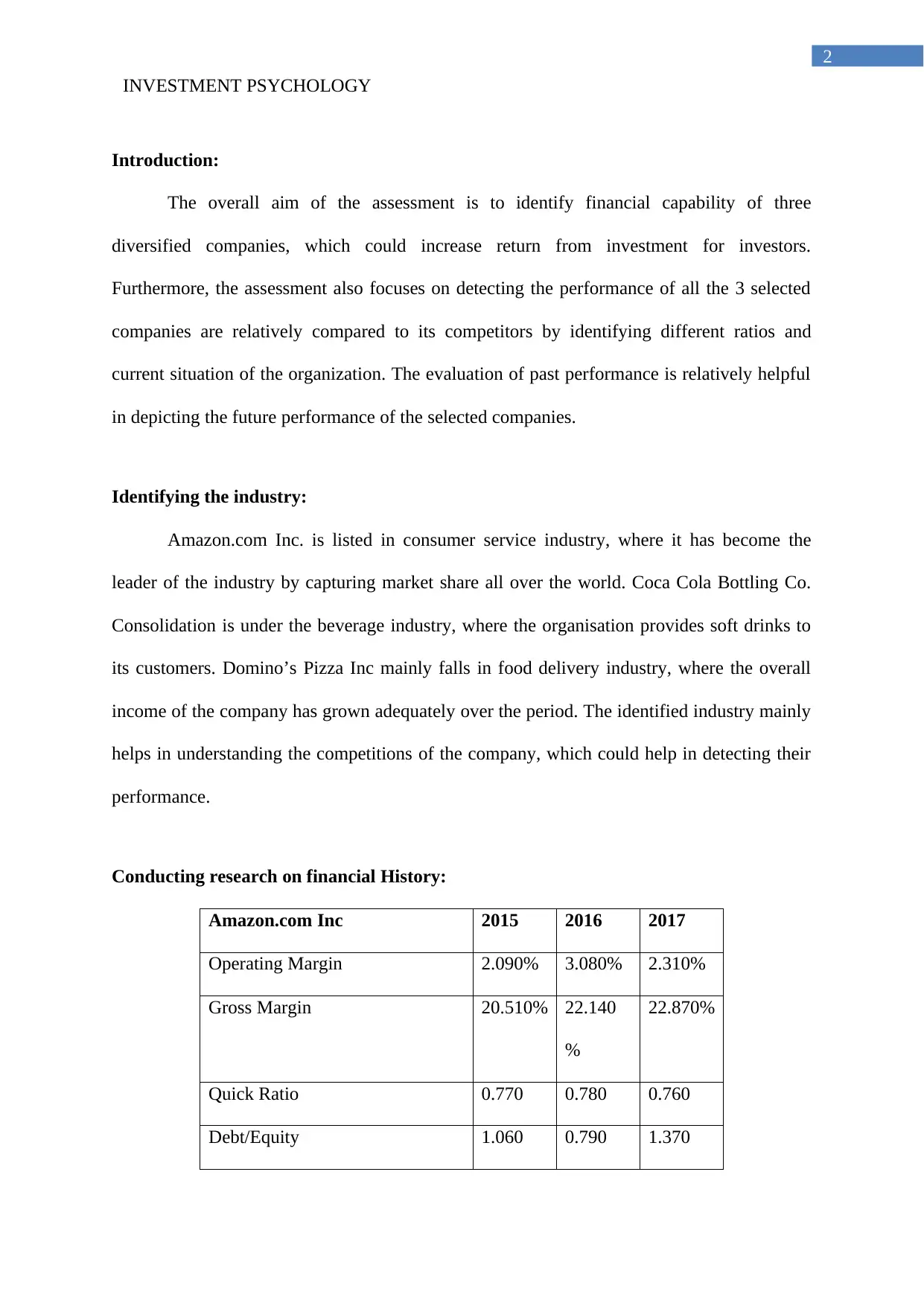

Conducting research on financial History:

Amazon.com Inc 2015 2016 2017

Operating Margin 2.090% 3.080% 2.310%

Gross Margin 20.510% 22.140

%

22.870%

Quick Ratio 0.770 0.780 0.760

Debt/Equity 1.060 0.790 1.370

2

Introduction:

The overall aim of the assessment is to identify financial capability of three

diversified companies, which could increase return from investment for investors.

Furthermore, the assessment also focuses on detecting the performance of all the 3 selected

companies are relatively compared to its competitors by identifying different ratios and

current situation of the organization. The evaluation of past performance is relatively helpful

in depicting the future performance of the selected companies.

Identifying the industry:

Amazon.com Inc. is listed in consumer service industry, where it has become the

leader of the industry by capturing market share all over the world. Coca Cola Bottling Co.

Consolidation is under the beverage industry, where the organisation provides soft drinks to

its customers. Domino’s Pizza Inc mainly falls in food delivery industry, where the overall

income of the company has grown adequately over the period. The identified industry mainly

helps in understanding the competitions of the company, which could help in detecting their

performance.

Conducting research on financial History:

Amazon.com Inc 2015 2016 2017

Operating Margin 2.090% 3.080% 2.310%

Gross Margin 20.510% 22.140

%

22.870%

Quick Ratio 0.770 0.780 0.760

Debt/Equity 1.060 0.790 1.370

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INVESTMENT PSYCHOLOGY

3

The above table depicts the overall financial performance of Amazon ink from 2015

to 2017 which has relatively improved over the period of 3 fiscal years. The overall operating

profit margin and gross margin of the company as a relatively increased over the period,

while it's quick ratio has declined due to the low accumulation of current assets. This

declining liquidity position is supported by the rising debt condition of the company, which

increases the relevant interest payments that needs to be conducted by the organization1.

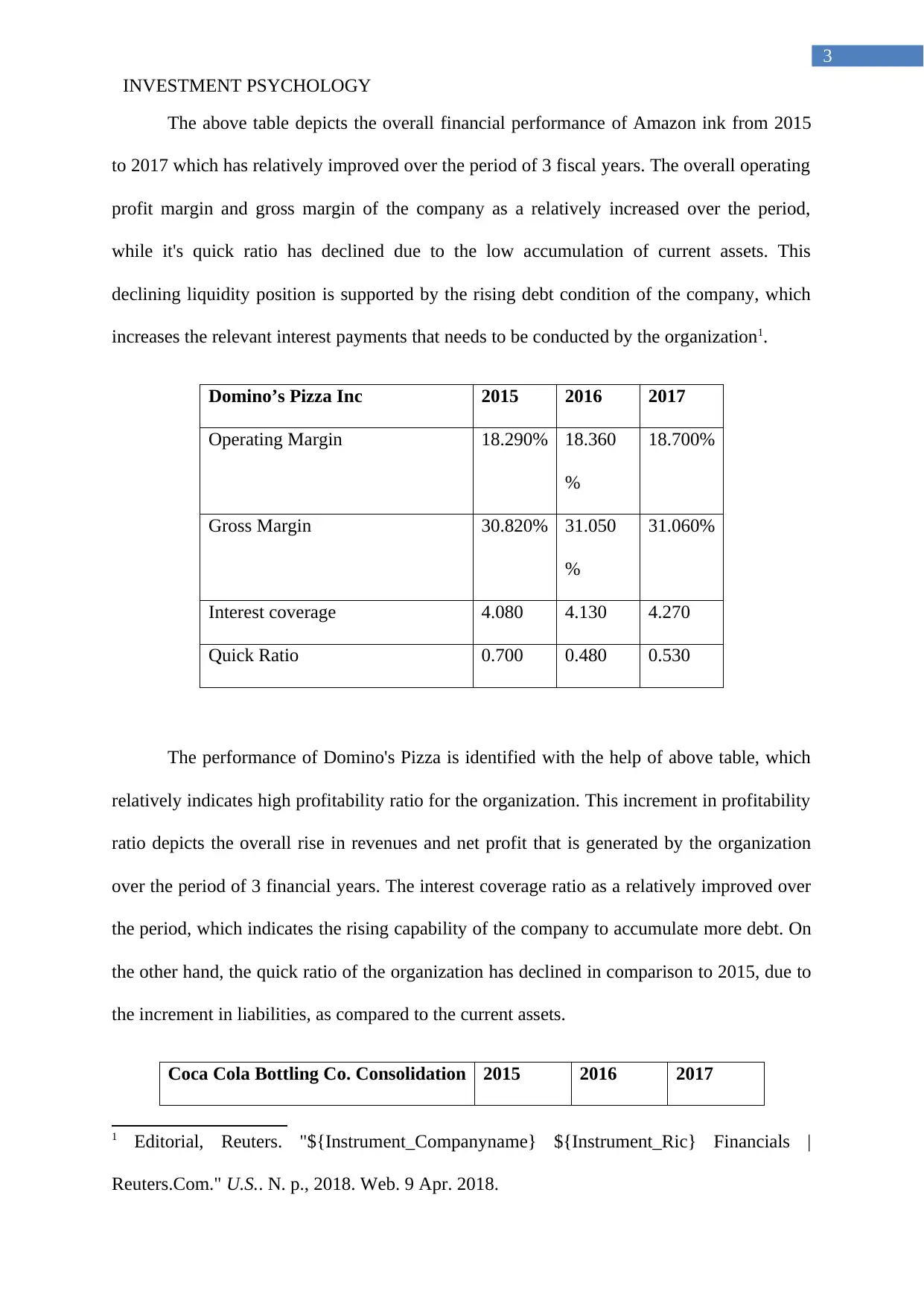

Domino’s Pizza Inc 2015 2016 2017

Operating Margin 18.290% 18.360

%

18.700%

Gross Margin 30.820% 31.050

%

31.060%

Interest coverage 4.080 4.130 4.270

Quick Ratio 0.700 0.480 0.530

The performance of Domino's Pizza is identified with the help of above table, which

relatively indicates high profitability ratio for the organization. This increment in profitability

ratio depicts the overall rise in revenues and net profit that is generated by the organization

over the period of 3 financial years. The interest coverage ratio as a relatively improved over

the period, which indicates the rising capability of the company to accumulate more debt. On

the other hand, the quick ratio of the organization has declined in comparison to 2015, due to

the increment in liabilities, as compared to the current assets.

Coca Cola Bottling Co. Consolidation 2015 2016 2017

1 Editorial, Reuters. "${Instrument_Companyname} ${Instrument_Ric} Financials |

Reuters.Com." U.S.. N. p., 2018. Web. 9 Apr. 2018.

3

The above table depicts the overall financial performance of Amazon ink from 2015

to 2017 which has relatively improved over the period of 3 fiscal years. The overall operating

profit margin and gross margin of the company as a relatively increased over the period,

while it's quick ratio has declined due to the low accumulation of current assets. This

declining liquidity position is supported by the rising debt condition of the company, which

increases the relevant interest payments that needs to be conducted by the organization1.

Domino’s Pizza Inc 2015 2016 2017

Operating Margin 18.290% 18.360

%

18.700%

Gross Margin 30.820% 31.050

%

31.060%

Interest coverage 4.080 4.130 4.270

Quick Ratio 0.700 0.480 0.530

The performance of Domino's Pizza is identified with the help of above table, which

relatively indicates high profitability ratio for the organization. This increment in profitability

ratio depicts the overall rise in revenues and net profit that is generated by the organization

over the period of 3 financial years. The interest coverage ratio as a relatively improved over

the period, which indicates the rising capability of the company to accumulate more debt. On

the other hand, the quick ratio of the organization has declined in comparison to 2015, due to

the increment in liabilities, as compared to the current assets.

Coca Cola Bottling Co. Consolidation 2015 2016 2017

1 Editorial, Reuters. "${Instrument_Companyname} ${Instrument_Ric} Financials |

Reuters.Com." U.S.. N. p., 2018. Web. 9 Apr. 2018.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INVESTMENT PSYCHOLOGY

4

Operating Margin 4.260% 4.050% 2.220%

Gross Margin 39.070% 38.520% 35.640%

Debt/Equity 2.770 3.420 3.060

Quick Ratio 0.890 0.840 0.800

The financial performance of Coca Cola bottling has the relatively declined for the

period of 3 years, which could be identified from the profitability ratios. Moreover, the

organization is supported by the reduction and quick ratio and increment in debt to conduct

their operations. Therefore, from the evaluation of the ratios the overall declining

performance of Coca Cola bottling can be identified.

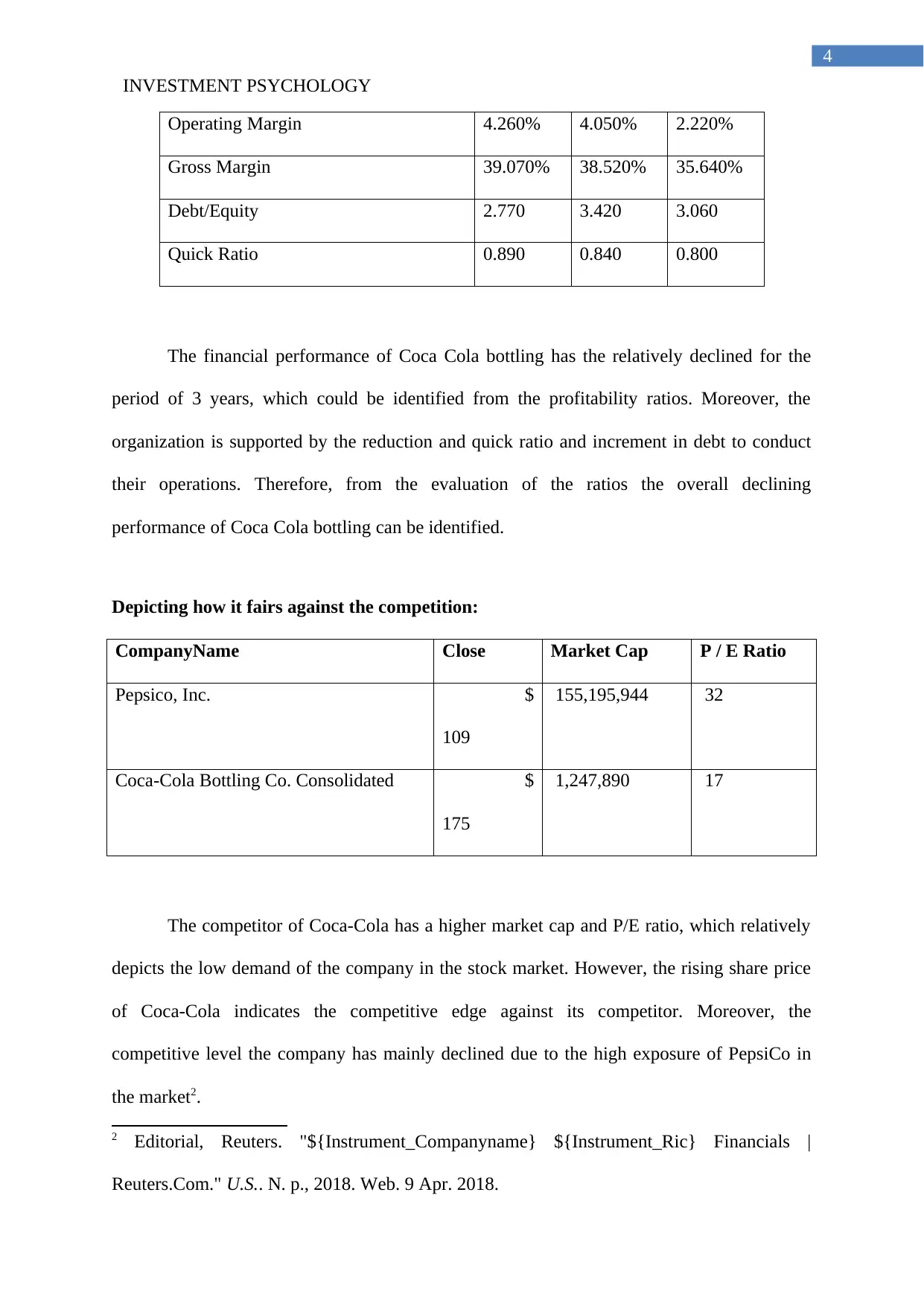

Depicting how it fairs against the competition:

CompanyName Close Market Cap P / E Ratio

Pepsico, Inc. $

109

155,195,944 32

Coca-Cola Bottling Co. Consolidated $

175

1,247,890 17

The competitor of Coca-Cola has a higher market cap and P/E ratio, which relatively

depicts the low demand of the company in the stock market. However, the rising share price

of Coca-Cola indicates the competitive edge against its competitor. Moreover, the

competitive level the company has mainly declined due to the high exposure of PepsiCo in

the market2.

2 Editorial, Reuters. "${Instrument_Companyname} ${Instrument_Ric} Financials |

Reuters.Com." U.S.. N. p., 2018. Web. 9 Apr. 2018.

4

Operating Margin 4.260% 4.050% 2.220%

Gross Margin 39.070% 38.520% 35.640%

Debt/Equity 2.770 3.420 3.060

Quick Ratio 0.890 0.840 0.800

The financial performance of Coca Cola bottling has the relatively declined for the

period of 3 years, which could be identified from the profitability ratios. Moreover, the

organization is supported by the reduction and quick ratio and increment in debt to conduct

their operations. Therefore, from the evaluation of the ratios the overall declining

performance of Coca Cola bottling can be identified.

Depicting how it fairs against the competition:

CompanyName Close Market Cap P / E Ratio

Pepsico, Inc. $

109

155,195,944 32

Coca-Cola Bottling Co. Consolidated $

175

1,247,890 17

The competitor of Coca-Cola has a higher market cap and P/E ratio, which relatively

depicts the low demand of the company in the stock market. However, the rising share price

of Coca-Cola indicates the competitive edge against its competitor. Moreover, the

competitive level the company has mainly declined due to the high exposure of PepsiCo in

the market2.

2 Editorial, Reuters. "${Instrument_Companyname} ${Instrument_Ric} Financials |

Reuters.Com." U.S.. N. p., 2018. Web. 9 Apr. 2018.

INVESTMENT PSYCHOLOGY

5

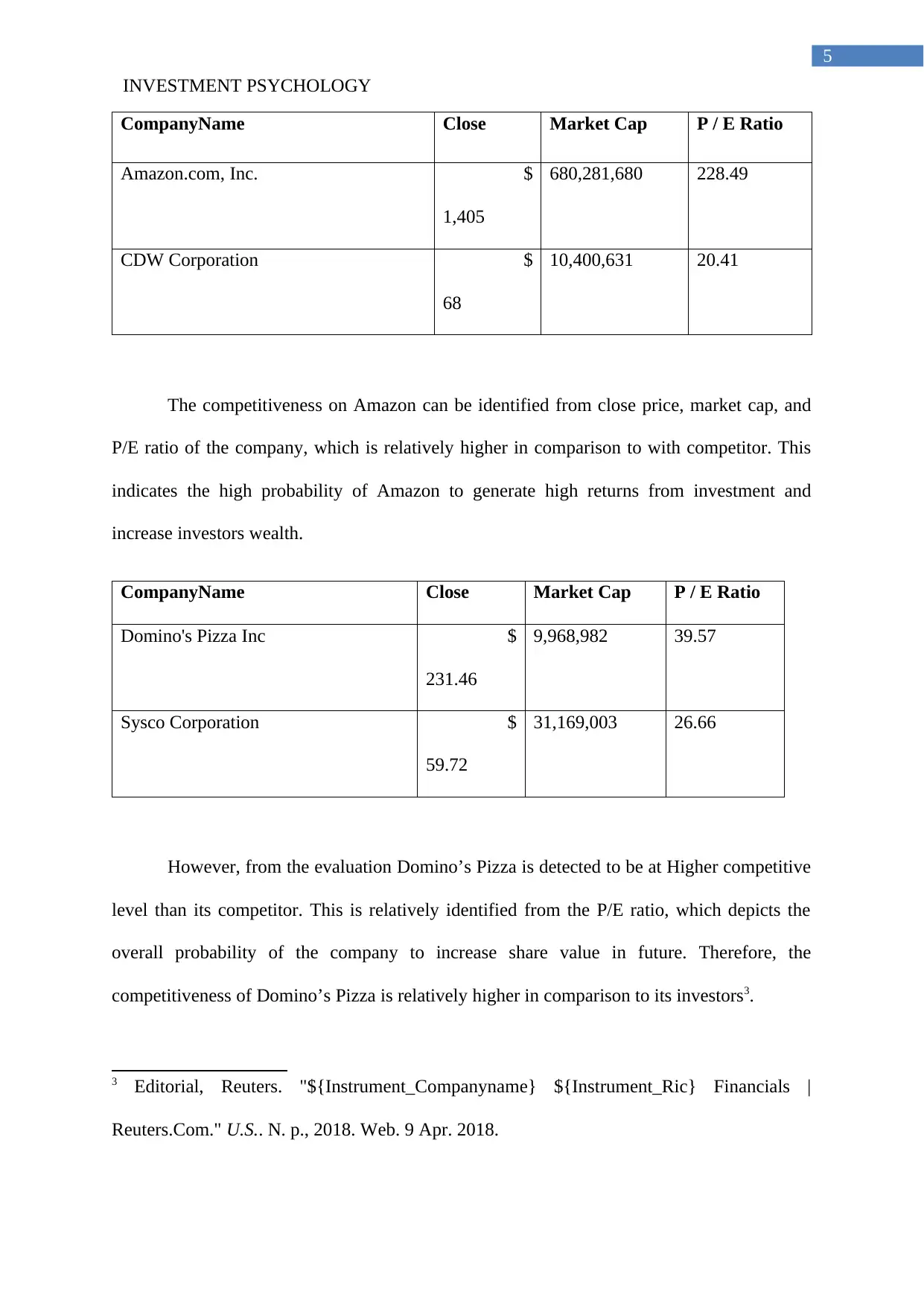

CompanyName Close Market Cap P / E Ratio

Amazon.com, Inc. $

1,405

680,281,680 228.49

CDW Corporation $

68

10,400,631 20.41

The competitiveness on Amazon can be identified from close price, market cap, and

P/E ratio of the company, which is relatively higher in comparison to with competitor. This

indicates the high probability of Amazon to generate high returns from investment and

increase investors wealth.

CompanyName Close Market Cap P / E Ratio

Domino's Pizza Inc $

231.46

9,968,982 39.57

Sysco Corporation $

59.72

31,169,003 26.66

However, from the evaluation Domino’s Pizza is detected to be at Higher competitive

level than its competitor. This is relatively identified from the P/E ratio, which depicts the

overall probability of the company to increase share value in future. Therefore, the

competitiveness of Domino’s Pizza is relatively higher in comparison to its investors3.

3 Editorial, Reuters. "${Instrument_Companyname} ${Instrument_Ric} Financials |

Reuters.Com." U.S.. N. p., 2018. Web. 9 Apr. 2018.

5

CompanyName Close Market Cap P / E Ratio

Amazon.com, Inc. $

1,405

680,281,680 228.49

CDW Corporation $

68

10,400,631 20.41

The competitiveness on Amazon can be identified from close price, market cap, and

P/E ratio of the company, which is relatively higher in comparison to with competitor. This

indicates the high probability of Amazon to generate high returns from investment and

increase investors wealth.

CompanyName Close Market Cap P / E Ratio

Domino's Pizza Inc $

231.46

9,968,982 39.57

Sysco Corporation $

59.72

31,169,003 26.66

However, from the evaluation Domino’s Pizza is detected to be at Higher competitive

level than its competitor. This is relatively identified from the P/E ratio, which depicts the

overall probability of the company to increase share value in future. Therefore, the

competitiveness of Domino’s Pizza is relatively higher in comparison to its investors3.

3 Editorial, Reuters. "${Instrument_Companyname} ${Instrument_Ric} Financials |

Reuters.Com." U.S.. N. p., 2018. Web. 9 Apr. 2018.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INVESTMENT PSYCHOLOGY

6

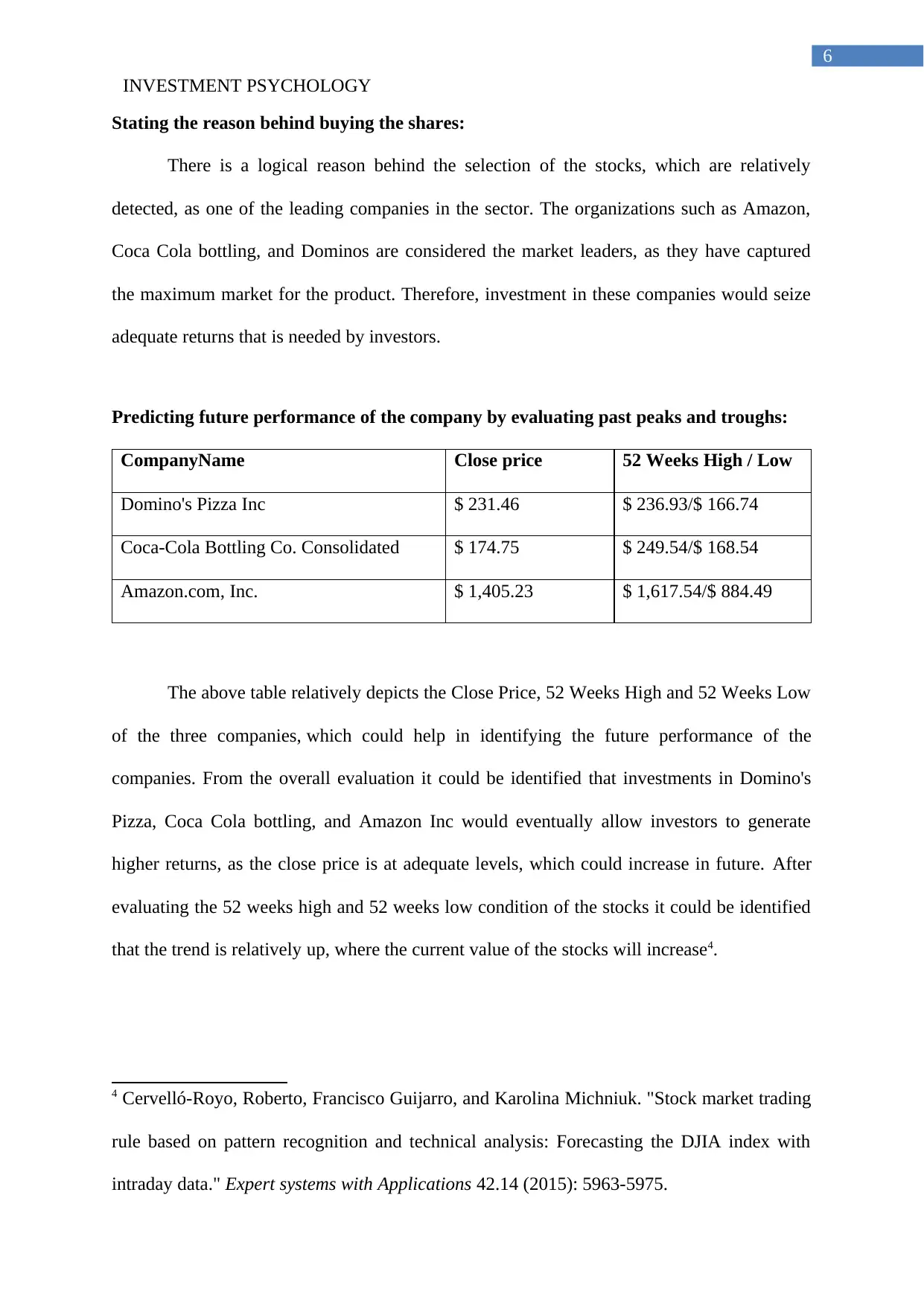

Stating the reason behind buying the shares:

There is a logical reason behind the selection of the stocks, which are relatively

detected, as one of the leading companies in the sector. The organizations such as Amazon,

Coca Cola bottling, and Dominos are considered the market leaders, as they have captured

the maximum market for the product. Therefore, investment in these companies would seize

adequate returns that is needed by investors.

Predicting future performance of the company by evaluating past peaks and troughs:

CompanyName Close price 52 Weeks High / Low

Domino's Pizza Inc $ 231.46 $ 236.93/$ 166.74

Coca-Cola Bottling Co. Consolidated $ 174.75 $ 249.54/$ 168.54

Amazon.com, Inc. $ 1,405.23 $ 1,617.54/$ 884.49

The above table relatively depicts the Close Price, 52 Weeks High and 52 Weeks Low

of the three companies, which could help in identifying the future performance of the

companies. From the overall evaluation it could be identified that investments in Domino's

Pizza, Coca Cola bottling, and Amazon Inc would eventually allow investors to generate

higher returns, as the close price is at adequate levels, which could increase in future. After

evaluating the 52 weeks high and 52 weeks low condition of the stocks it could be identified

that the trend is relatively up, where the current value of the stocks will increase4.

4 Cervelló-Royo, Roberto, Francisco Guijarro, and Karolina Michniuk. "Stock market trading

rule based on pattern recognition and technical analysis: Forecasting the DJIA index with

intraday data." Expert systems with Applications 42.14 (2015): 5963-5975.

6

Stating the reason behind buying the shares:

There is a logical reason behind the selection of the stocks, which are relatively

detected, as one of the leading companies in the sector. The organizations such as Amazon,

Coca Cola bottling, and Dominos are considered the market leaders, as they have captured

the maximum market for the product. Therefore, investment in these companies would seize

adequate returns that is needed by investors.

Predicting future performance of the company by evaluating past peaks and troughs:

CompanyName Close price 52 Weeks High / Low

Domino's Pizza Inc $ 231.46 $ 236.93/$ 166.74

Coca-Cola Bottling Co. Consolidated $ 174.75 $ 249.54/$ 168.54

Amazon.com, Inc. $ 1,405.23 $ 1,617.54/$ 884.49

The above table relatively depicts the Close Price, 52 Weeks High and 52 Weeks Low

of the three companies, which could help in identifying the future performance of the

companies. From the overall evaluation it could be identified that investments in Domino's

Pizza, Coca Cola bottling, and Amazon Inc would eventually allow investors to generate

higher returns, as the close price is at adequate levels, which could increase in future. After

evaluating the 52 weeks high and 52 weeks low condition of the stocks it could be identified

that the trend is relatively up, where the current value of the stocks will increase4.

4 Cervelló-Royo, Roberto, Francisco Guijarro, and Karolina Michniuk. "Stock market trading

rule based on pattern recognition and technical analysis: Forecasting the DJIA index with

intraday data." Expert systems with Applications 42.14 (2015): 5963-5975.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INVESTMENT PSYCHOLOGY

7

Conclusion:

The financial history of the companies is evaluated, while the statement regarding the

reason behind the purchase of shares are also conducted. Moreover, with the detection of

peaks and troughs the overall future performance of the companies is predicted, which might

allow investors to improve the returns from investment. Therefore, the investments conducted

in the selected stocks would eventually allow the investors to generate higher returns from

investment.

7

Conclusion:

The financial history of the companies is evaluated, while the statement regarding the

reason behind the purchase of shares are also conducted. Moreover, with the detection of

peaks and troughs the overall future performance of the companies is predicted, which might

allow investors to improve the returns from investment. Therefore, the investments conducted

in the selected stocks would eventually allow the investors to generate higher returns from

investment.

INVESTMENT PSYCHOLOGY

8

Reference and Bibliography:

Cervelló-Royo, Roberto, Francisco Guijarro, and Karolina Michniuk. "Stock market trading

rule based on pattern recognition and technical analysis: Forecasting the DJIA index with

intraday data." Expert systems with Applications 42.14 (2015): 5963-5975.

Chandra, Prasanna. Investment analysis and portfolio management. McGraw-Hill Education,

2017.

Editorial, Reuters. "${Instrument_Companyname} ${Instrument_Ric} Financials |

Reuters.Com." U.S.. N. p., 2018. Web. 9 Apr. 2018.

Editorial, Reuters. "${Instrument_Companyname} ${Instrument_Ric} Financials |

Reuters.Com." U.S.. N. p., 2018. Web. 9 Apr. 2018.

Editorial, Reuters. "${Instrument_Companyname} ${Instrument_Ric} Quote|

Reuters.Com." U.S.. N. p., 2018. Web. 9 Apr. 2018.

Kang, Yan-Qing, et al. "Environmental assessment and investment strategy for China's

manufacturing industry: A non-radial DEA based analysis." Journal of Cleaner

Production175 (2018): 501-511.

Mikesell, Raymond F., and John W. Whitney. The world mining industry: Investment

strategy and public policy. Routledge, 2017.

Stanković, Jelena, Ivana Marković, and Miloš Stojanović. "Investment Strategy Optimization

Using Technical Analysis and Predictive Modeling in Emerging Markets." Procedia

Economics and Finance 19 (2015): 51-62.

8

Reference and Bibliography:

Cervelló-Royo, Roberto, Francisco Guijarro, and Karolina Michniuk. "Stock market trading

rule based on pattern recognition and technical analysis: Forecasting the DJIA index with

intraday data." Expert systems with Applications 42.14 (2015): 5963-5975.

Chandra, Prasanna. Investment analysis and portfolio management. McGraw-Hill Education,

2017.

Editorial, Reuters. "${Instrument_Companyname} ${Instrument_Ric} Financials |

Reuters.Com." U.S.. N. p., 2018. Web. 9 Apr. 2018.

Editorial, Reuters. "${Instrument_Companyname} ${Instrument_Ric} Financials |

Reuters.Com." U.S.. N. p., 2018. Web. 9 Apr. 2018.

Editorial, Reuters. "${Instrument_Companyname} ${Instrument_Ric} Quote|

Reuters.Com." U.S.. N. p., 2018. Web. 9 Apr. 2018.

Kang, Yan-Qing, et al. "Environmental assessment and investment strategy for China's

manufacturing industry: A non-radial DEA based analysis." Journal of Cleaner

Production175 (2018): 501-511.

Mikesell, Raymond F., and John W. Whitney. The world mining industry: Investment

strategy and public policy. Routledge, 2017.

Stanković, Jelena, Ivana Marković, and Miloš Stojanović. "Investment Strategy Optimization

Using Technical Analysis and Predictive Modeling in Emerging Markets." Procedia

Economics and Finance 19 (2015): 51-62.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.