Bond Pricing and Valuation

VerifiedAdded on 2020/03/16

|8

|1838

|229

AI Summary

This assignment delves into the concepts of bond pricing and stock valuation. It begins by analyzing how changes in interest rates affect bond prices, highlighting the role of interest rate elasticity. Subsequently, it applies the Dividend Discount Model to determine the value of a share based on expected dividends and growth rates. The assignment further explores the impact of varying growth rates on stock prices using a case study with specific dividend payments and return expectations.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Investments and Portfolio Management

[Type the abstract of the document here. The abstract is typically a short summary of the contents

of the document. Type the abstract of the document here. The abstract is typically a short

summary of the contents of the document.]

[Type the abstract of the document here. The abstract is typically a short summary of the contents

of the document. Type the abstract of the document here. The abstract is typically a short

summary of the contents of the document.]

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

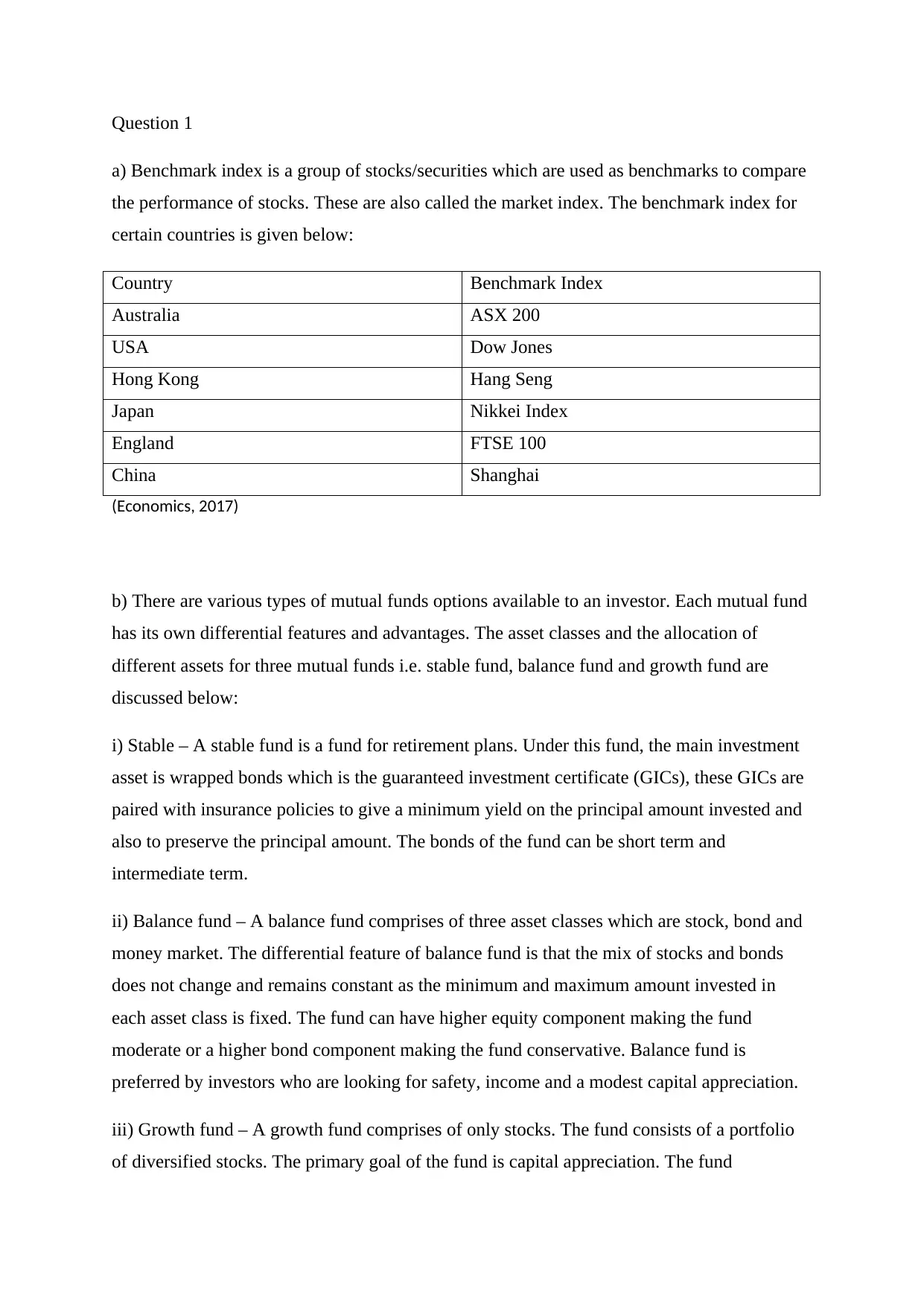

Question 1

a) Benchmark index is a group of stocks/securities which are used as benchmarks to compare

the performance of stocks. These are also called the market index. The benchmark index for

certain countries is given below:

Country Benchmark Index

Australia ASX 200

USA Dow Jones

Hong Kong Hang Seng

Japan Nikkei Index

England FTSE 100

China Shanghai

(Economics, 2017)

b) There are various types of mutual funds options available to an investor. Each mutual fund

has its own differential features and advantages. The asset classes and the allocation of

different assets for three mutual funds i.e. stable fund, balance fund and growth fund are

discussed below:

i) Stable – A stable fund is a fund for retirement plans. Under this fund, the main investment

asset is wrapped bonds which is the guaranteed investment certificate (GICs), these GICs are

paired with insurance policies to give a minimum yield on the principal amount invested and

also to preserve the principal amount. The bonds of the fund can be short term and

intermediate term.

ii) Balance fund – A balance fund comprises of three asset classes which are stock, bond and

money market. The differential feature of balance fund is that the mix of stocks and bonds

does not change and remains constant as the minimum and maximum amount invested in

each asset class is fixed. The fund can have higher equity component making the fund

moderate or a higher bond component making the fund conservative. Balance fund is

preferred by investors who are looking for safety, income and a modest capital appreciation.

iii) Growth fund – A growth fund comprises of only stocks. The fund consists of a portfolio

of diversified stocks. The primary goal of the fund is capital appreciation. The fund

a) Benchmark index is a group of stocks/securities which are used as benchmarks to compare

the performance of stocks. These are also called the market index. The benchmark index for

certain countries is given below:

Country Benchmark Index

Australia ASX 200

USA Dow Jones

Hong Kong Hang Seng

Japan Nikkei Index

England FTSE 100

China Shanghai

(Economics, 2017)

b) There are various types of mutual funds options available to an investor. Each mutual fund

has its own differential features and advantages. The asset classes and the allocation of

different assets for three mutual funds i.e. stable fund, balance fund and growth fund are

discussed below:

i) Stable – A stable fund is a fund for retirement plans. Under this fund, the main investment

asset is wrapped bonds which is the guaranteed investment certificate (GICs), these GICs are

paired with insurance policies to give a minimum yield on the principal amount invested and

also to preserve the principal amount. The bonds of the fund can be short term and

intermediate term.

ii) Balance fund – A balance fund comprises of three asset classes which are stock, bond and

money market. The differential feature of balance fund is that the mix of stocks and bonds

does not change and remains constant as the minimum and maximum amount invested in

each asset class is fixed. The fund can have higher equity component making the fund

moderate or a higher bond component making the fund conservative. Balance fund is

preferred by investors who are looking for safety, income and a modest capital appreciation.

iii) Growth fund – A growth fund comprises of only stocks. The fund consists of a portfolio

of diversified stocks. The primary goal of the fund is capital appreciation. The fund

comprises of stocks of companies which have above average growth and these companies

mostly reinvest their earning for expansion and acquisitions. Growth funds can be large cap,

mid cap and small cap.

Question 2

Interest elasticity is the sensitivity of the price of the fixed income securities to the interest

rates. Higher interest elasticity means that with a small change in the interest rates, the prices

of securities fluctuate by a higher amount. Duration of a fixed income security measures the

average life of a bond. Duration provides an estimate of the sensitivity of the bond prices to

the interest rates. Higher the duration, higher is the sensitivity of the interest rates to the bond

prices and vice versa (Bodie, Kane, & Marcus, 2016). Like if the interest rate increases by

1%, and the duration of a bond is 5 years, the prices of bond will decline by 5%.

Prices and duration of a bond or fixed income security are related from the point of view of

interest rates. Price and interest rates have an inverse relationship. The sensitivity of price and

interest rate is measured by duration. Duration determines the change in price as a result of a

change in interest rate.

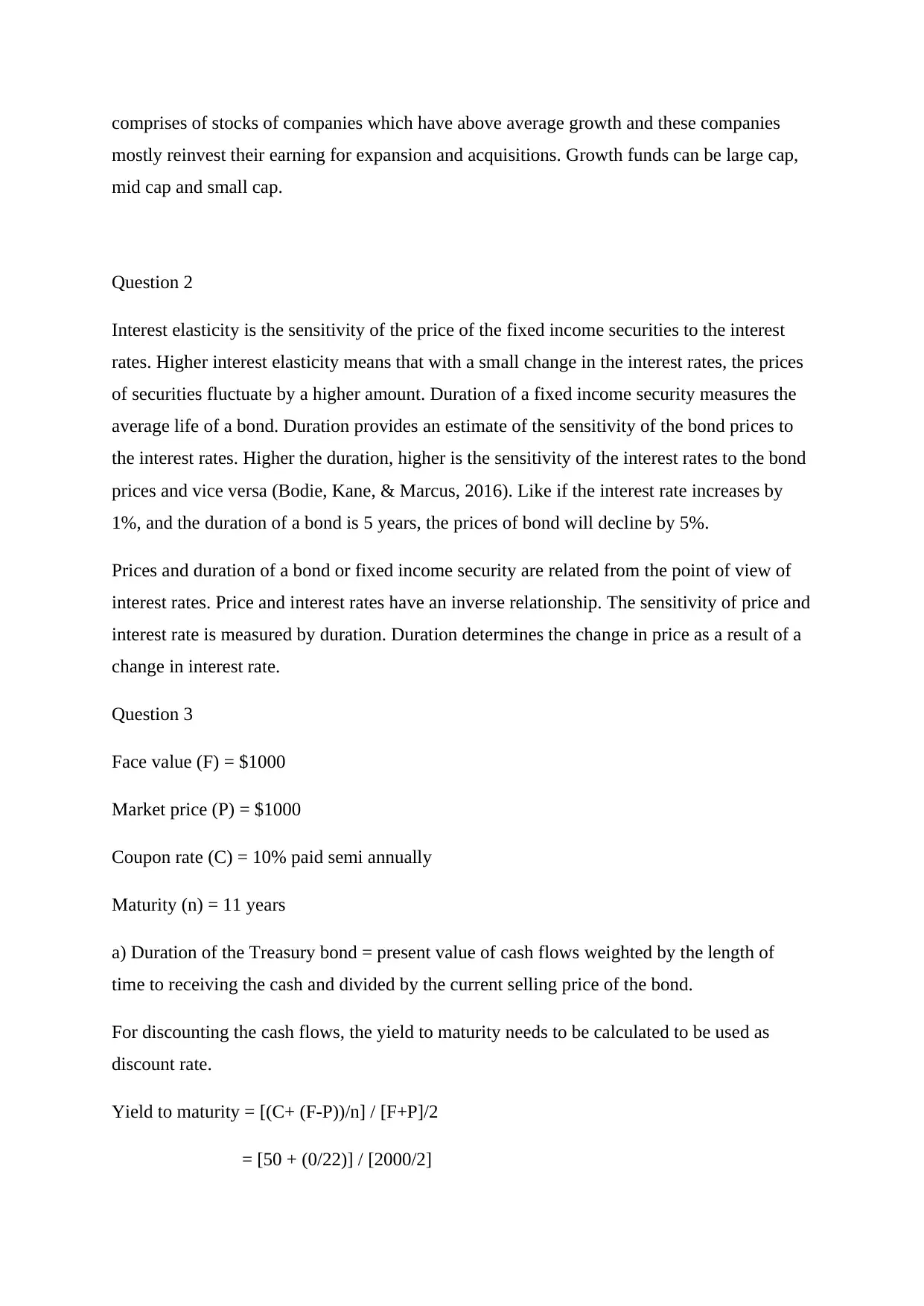

Question 3

Face value (F) = $1000

Market price (P) = $1000

Coupon rate (C) = 10% paid semi annually

Maturity (n) = 11 years

a) Duration of the Treasury bond = present value of cash flows weighted by the length of

time to receiving the cash and divided by the current selling price of the bond.

For discounting the cash flows, the yield to maturity needs to be calculated to be used as

discount rate.

Yield to maturity = [(C+ (F-P))/n] / [F+P]/2

= [50 + (0/22)] / [2000/2]

mostly reinvest their earning for expansion and acquisitions. Growth funds can be large cap,

mid cap and small cap.

Question 2

Interest elasticity is the sensitivity of the price of the fixed income securities to the interest

rates. Higher interest elasticity means that with a small change in the interest rates, the prices

of securities fluctuate by a higher amount. Duration of a fixed income security measures the

average life of a bond. Duration provides an estimate of the sensitivity of the bond prices to

the interest rates. Higher the duration, higher is the sensitivity of the interest rates to the bond

prices and vice versa (Bodie, Kane, & Marcus, 2016). Like if the interest rate increases by

1%, and the duration of a bond is 5 years, the prices of bond will decline by 5%.

Prices and duration of a bond or fixed income security are related from the point of view of

interest rates. Price and interest rates have an inverse relationship. The sensitivity of price and

interest rate is measured by duration. Duration determines the change in price as a result of a

change in interest rate.

Question 3

Face value (F) = $1000

Market price (P) = $1000

Coupon rate (C) = 10% paid semi annually

Maturity (n) = 11 years

a) Duration of the Treasury bond = present value of cash flows weighted by the length of

time to receiving the cash and divided by the current selling price of the bond.

For discounting the cash flows, the yield to maturity needs to be calculated to be used as

discount rate.

Yield to maturity = [(C+ (F-P))/n] / [F+P]/2

= [50 + (0/22)] / [2000/2]

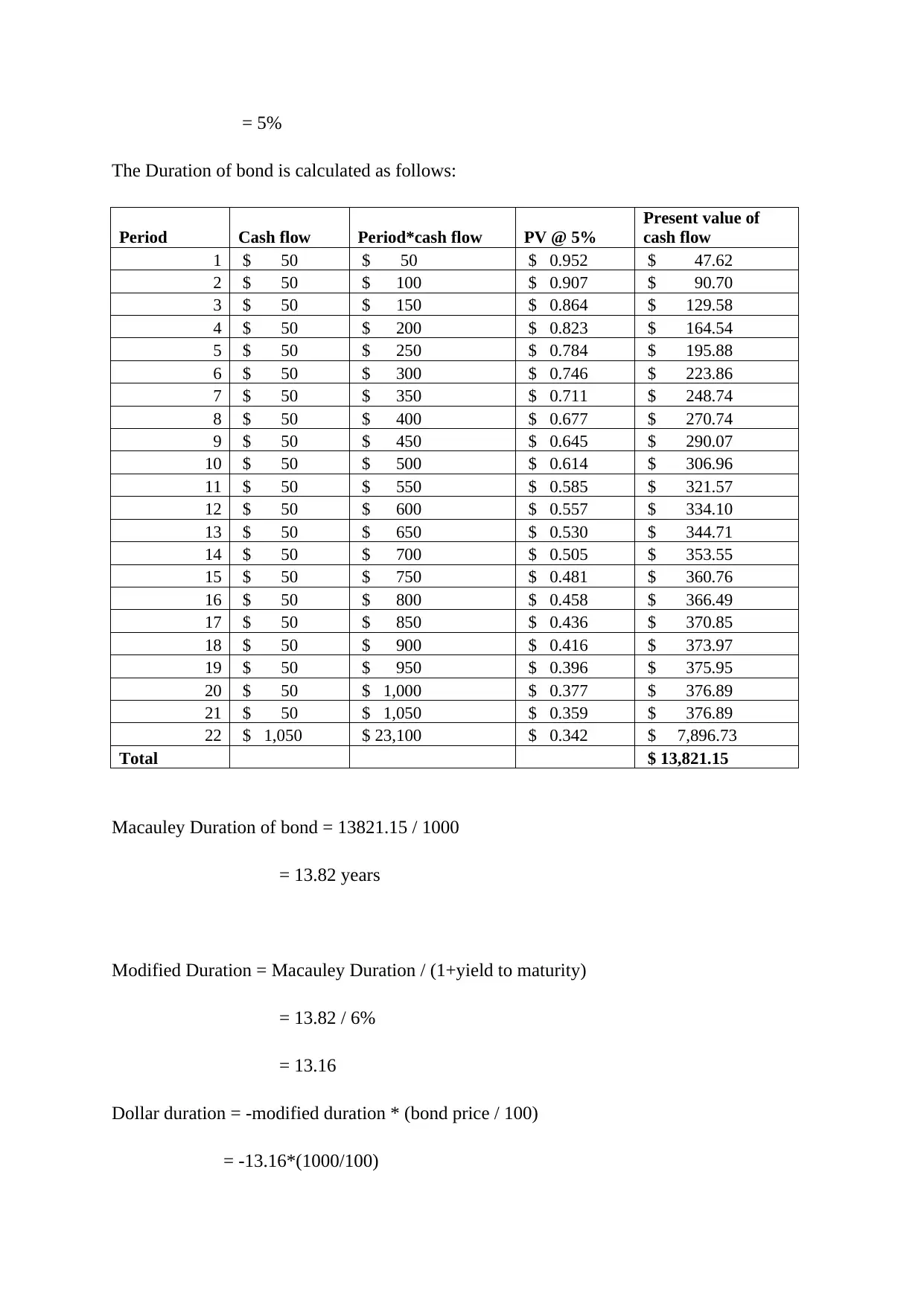

= 5%

The Duration of bond is calculated as follows:

Period Cash flow Period*cash flow PV @ 5%

Present value of

cash flow

1 $ 50 $ 50 $ 0.952 $ 47.62

2 $ 50 $ 100 $ 0.907 $ 90.70

3 $ 50 $ 150 $ 0.864 $ 129.58

4 $ 50 $ 200 $ 0.823 $ 164.54

5 $ 50 $ 250 $ 0.784 $ 195.88

6 $ 50 $ 300 $ 0.746 $ 223.86

7 $ 50 $ 350 $ 0.711 $ 248.74

8 $ 50 $ 400 $ 0.677 $ 270.74

9 $ 50 $ 450 $ 0.645 $ 290.07

10 $ 50 $ 500 $ 0.614 $ 306.96

11 $ 50 $ 550 $ 0.585 $ 321.57

12 $ 50 $ 600 $ 0.557 $ 334.10

13 $ 50 $ 650 $ 0.530 $ 344.71

14 $ 50 $ 700 $ 0.505 $ 353.55

15 $ 50 $ 750 $ 0.481 $ 360.76

16 $ 50 $ 800 $ 0.458 $ 366.49

17 $ 50 $ 850 $ 0.436 $ 370.85

18 $ 50 $ 900 $ 0.416 $ 373.97

19 $ 50 $ 950 $ 0.396 $ 375.95

20 $ 50 $ 1,000 $ 0.377 $ 376.89

21 $ 50 $ 1,050 $ 0.359 $ 376.89

22 $ 1,050 $ 23,100 $ 0.342 $ 7,896.73

Total $ 13,821.15

Macauley Duration of bond = 13821.15 / 1000

= 13.82 years

Modified Duration = Macauley Duration / (1+yield to maturity)

= 13.82 / 6%

= 13.16

Dollar duration = -modified duration * (bond price / 100)

= -13.16*(1000/100)

The Duration of bond is calculated as follows:

Period Cash flow Period*cash flow PV @ 5%

Present value of

cash flow

1 $ 50 $ 50 $ 0.952 $ 47.62

2 $ 50 $ 100 $ 0.907 $ 90.70

3 $ 50 $ 150 $ 0.864 $ 129.58

4 $ 50 $ 200 $ 0.823 $ 164.54

5 $ 50 $ 250 $ 0.784 $ 195.88

6 $ 50 $ 300 $ 0.746 $ 223.86

7 $ 50 $ 350 $ 0.711 $ 248.74

8 $ 50 $ 400 $ 0.677 $ 270.74

9 $ 50 $ 450 $ 0.645 $ 290.07

10 $ 50 $ 500 $ 0.614 $ 306.96

11 $ 50 $ 550 $ 0.585 $ 321.57

12 $ 50 $ 600 $ 0.557 $ 334.10

13 $ 50 $ 650 $ 0.530 $ 344.71

14 $ 50 $ 700 $ 0.505 $ 353.55

15 $ 50 $ 750 $ 0.481 $ 360.76

16 $ 50 $ 800 $ 0.458 $ 366.49

17 $ 50 $ 850 $ 0.436 $ 370.85

18 $ 50 $ 900 $ 0.416 $ 373.97

19 $ 50 $ 950 $ 0.396 $ 375.95

20 $ 50 $ 1,000 $ 0.377 $ 376.89

21 $ 50 $ 1,050 $ 0.359 $ 376.89

22 $ 1,050 $ 23,100 $ 0.342 $ 7,896.73

Total $ 13,821.15

Macauley Duration of bond = 13821.15 / 1000

= 13.82 years

Modified Duration = Macauley Duration / (1+yield to maturity)

= 13.82 / 6%

= 13.16

Dollar duration = -modified duration * (bond price / 100)

= -13.16*(1000/100)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

= $131.6

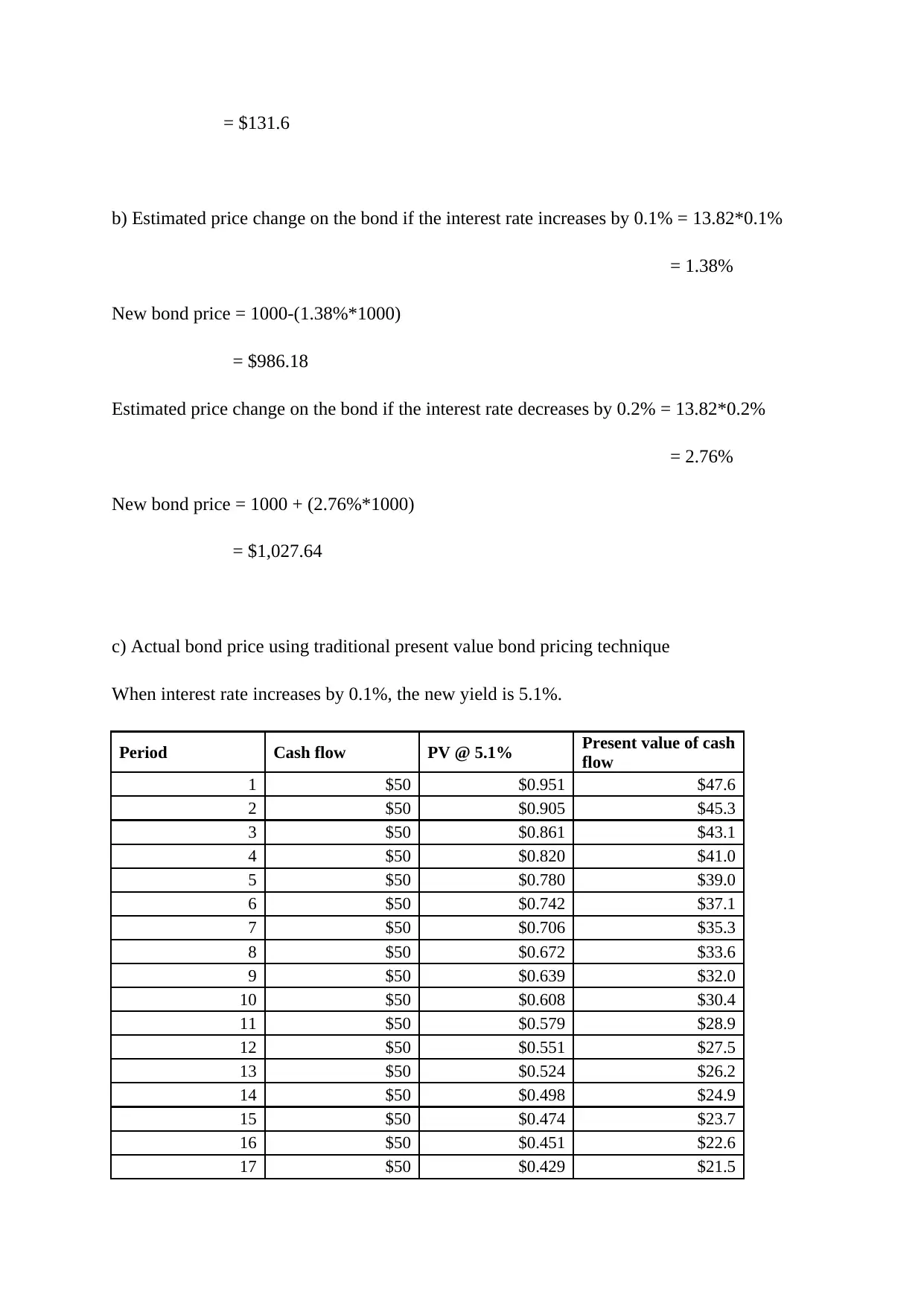

b) Estimated price change on the bond if the interest rate increases by 0.1% = 13.82*0.1%

= 1.38%

New bond price = 1000-(1.38%*1000)

= $986.18

Estimated price change on the bond if the interest rate decreases by 0.2% = 13.82*0.2%

= 2.76%

New bond price = 1000 + (2.76%*1000)

= $1,027.64

c) Actual bond price using traditional present value bond pricing technique

When interest rate increases by 0.1%, the new yield is 5.1%.

Period Cash flow PV @ 5.1% Present value of cash

flow

1 $50 $0.951 $47.6

2 $50 $0.905 $45.3

3 $50 $0.861 $43.1

4 $50 $0.820 $41.0

5 $50 $0.780 $39.0

6 $50 $0.742 $37.1

7 $50 $0.706 $35.3

8 $50 $0.672 $33.6

9 $50 $0.639 $32.0

10 $50 $0.608 $30.4

11 $50 $0.579 $28.9

12 $50 $0.551 $27.5

13 $50 $0.524 $26.2

14 $50 $0.498 $24.9

15 $50 $0.474 $23.7

16 $50 $0.451 $22.6

17 $50 $0.429 $21.5

b) Estimated price change on the bond if the interest rate increases by 0.1% = 13.82*0.1%

= 1.38%

New bond price = 1000-(1.38%*1000)

= $986.18

Estimated price change on the bond if the interest rate decreases by 0.2% = 13.82*0.2%

= 2.76%

New bond price = 1000 + (2.76%*1000)

= $1,027.64

c) Actual bond price using traditional present value bond pricing technique

When interest rate increases by 0.1%, the new yield is 5.1%.

Period Cash flow PV @ 5.1% Present value of cash

flow

1 $50 $0.951 $47.6

2 $50 $0.905 $45.3

3 $50 $0.861 $43.1

4 $50 $0.820 $41.0

5 $50 $0.780 $39.0

6 $50 $0.742 $37.1

7 $50 $0.706 $35.3

8 $50 $0.672 $33.6

9 $50 $0.639 $32.0

10 $50 $0.608 $30.4

11 $50 $0.579 $28.9

12 $50 $0.551 $27.5

13 $50 $0.524 $26.2

14 $50 $0.498 $24.9

15 $50 $0.474 $23.7

16 $50 $0.451 $22.6

17 $50 $0.429 $21.5

18 $50 $0.408 $20.4

19 $50 $0.389 $19.4

20 $50 $0.370 $18.5

21 $50 $0.352 $17.6

22 $1,050 $0.335 $351.5

Total $987.0

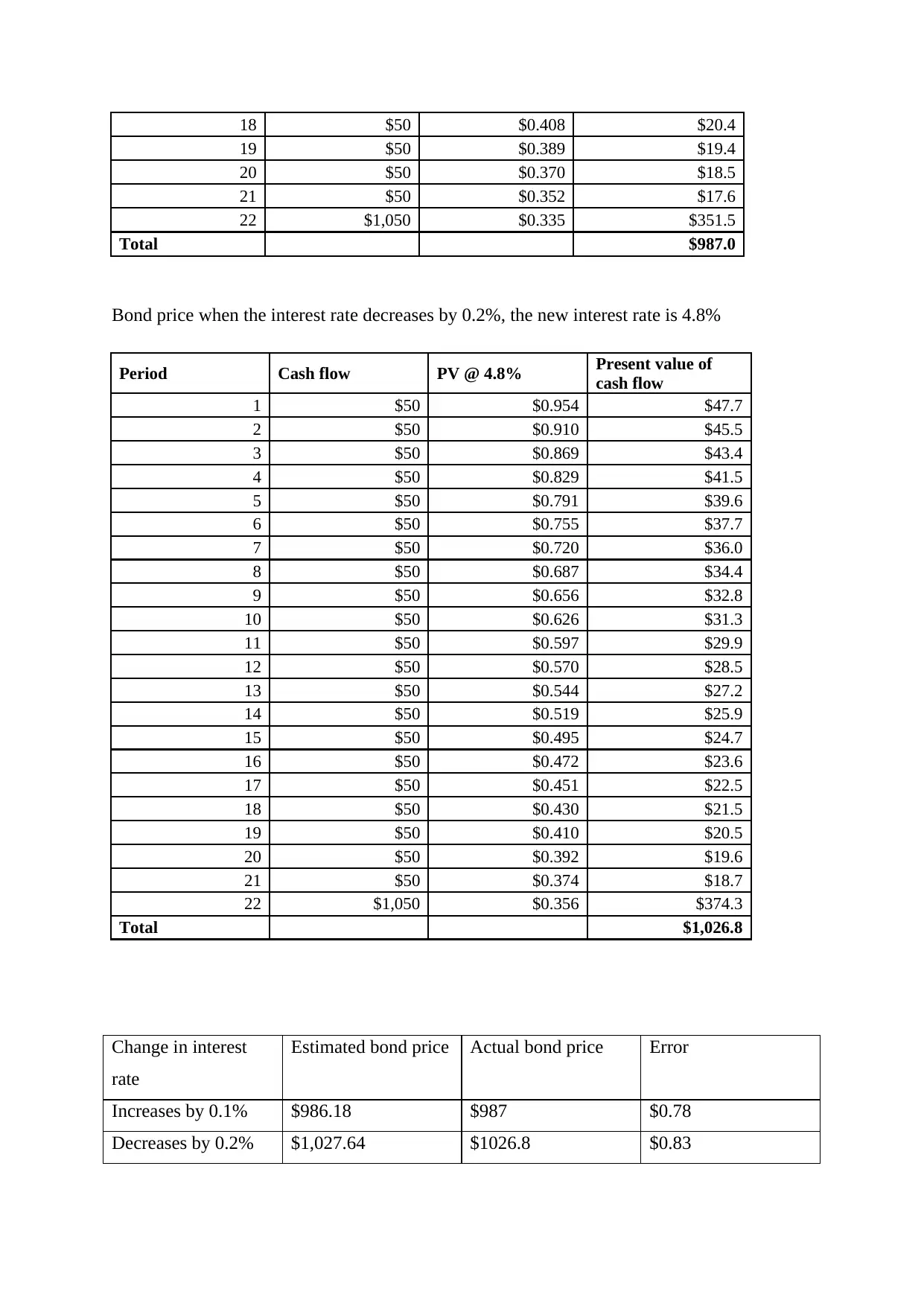

Bond price when the interest rate decreases by 0.2%, the new interest rate is 4.8%

Period Cash flow PV @ 4.8% Present value of

cash flow

1 $50 $0.954 $47.7

2 $50 $0.910 $45.5

3 $50 $0.869 $43.4

4 $50 $0.829 $41.5

5 $50 $0.791 $39.6

6 $50 $0.755 $37.7

7 $50 $0.720 $36.0

8 $50 $0.687 $34.4

9 $50 $0.656 $32.8

10 $50 $0.626 $31.3

11 $50 $0.597 $29.9

12 $50 $0.570 $28.5

13 $50 $0.544 $27.2

14 $50 $0.519 $25.9

15 $50 $0.495 $24.7

16 $50 $0.472 $23.6

17 $50 $0.451 $22.5

18 $50 $0.430 $21.5

19 $50 $0.410 $20.5

20 $50 $0.392 $19.6

21 $50 $0.374 $18.7

22 $1,050 $0.356 $374.3

Total $1,026.8

Change in interest

rate

Estimated bond price Actual bond price Error

Increases by 0.1% $986.18 $987 $0.78

Decreases by 0.2% $1,027.64 $1026.8 $0.83

19 $50 $0.389 $19.4

20 $50 $0.370 $18.5

21 $50 $0.352 $17.6

22 $1,050 $0.335 $351.5

Total $987.0

Bond price when the interest rate decreases by 0.2%, the new interest rate is 4.8%

Period Cash flow PV @ 4.8% Present value of

cash flow

1 $50 $0.954 $47.7

2 $50 $0.910 $45.5

3 $50 $0.869 $43.4

4 $50 $0.829 $41.5

5 $50 $0.791 $39.6

6 $50 $0.755 $37.7

7 $50 $0.720 $36.0

8 $50 $0.687 $34.4

9 $50 $0.656 $32.8

10 $50 $0.626 $31.3

11 $50 $0.597 $29.9

12 $50 $0.570 $28.5

13 $50 $0.544 $27.2

14 $50 $0.519 $25.9

15 $50 $0.495 $24.7

16 $50 $0.472 $23.6

17 $50 $0.451 $22.5

18 $50 $0.430 $21.5

19 $50 $0.410 $20.5

20 $50 $0.392 $19.6

21 $50 $0.374 $18.7

22 $1,050 $0.356 $374.3

Total $1,026.8

Change in interest

rate

Estimated bond price Actual bond price Error

Increases by 0.1% $986.18 $987 $0.78

Decreases by 0.2% $1,027.64 $1026.8 $0.83

From the above we see that the change in the estimated bond price is higher than the actual

bond price. This error occurs because the estimated price due to change in interest rate is due

to the interest rate elasticity of the bond.

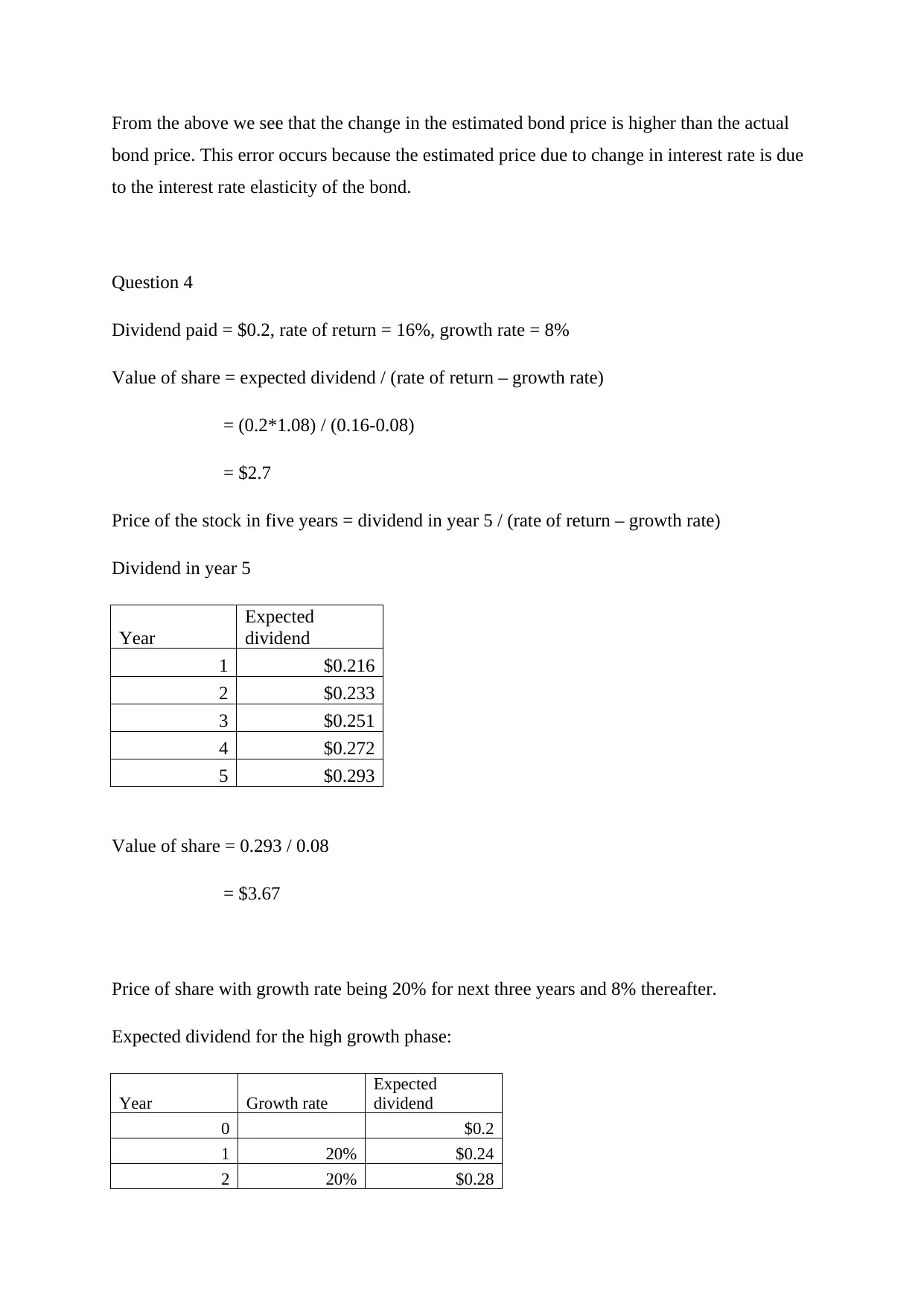

Question 4

Dividend paid = $0.2, rate of return = 16%, growth rate = 8%

Value of share = expected dividend / (rate of return – growth rate)

= (0.2*1.08) / (0.16-0.08)

= $2.7

Price of the stock in five years = dividend in year 5 / (rate of return – growth rate)

Dividend in year 5

Year

Expected

dividend

1 $0.216

2 $0.233

3 $0.251

4 $0.272

5 $0.293

Value of share = 0.293 / 0.08

= $3.67

Price of share with growth rate being 20% for next three years and 8% thereafter.

Expected dividend for the high growth phase:

Year Growth rate

Expected

dividend

0 $0.2

1 20% $0.24

2 20% $0.28

bond price. This error occurs because the estimated price due to change in interest rate is due

to the interest rate elasticity of the bond.

Question 4

Dividend paid = $0.2, rate of return = 16%, growth rate = 8%

Value of share = expected dividend / (rate of return – growth rate)

= (0.2*1.08) / (0.16-0.08)

= $2.7

Price of the stock in five years = dividend in year 5 / (rate of return – growth rate)

Dividend in year 5

Year

Expected

dividend

1 $0.216

2 $0.233

3 $0.251

4 $0.272

5 $0.293

Value of share = 0.293 / 0.08

= $3.67

Price of share with growth rate being 20% for next three years and 8% thereafter.

Expected dividend for the high growth phase:

Year Growth rate

Expected

dividend

0 $0.2

1 20% $0.24

2 20% $0.28

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

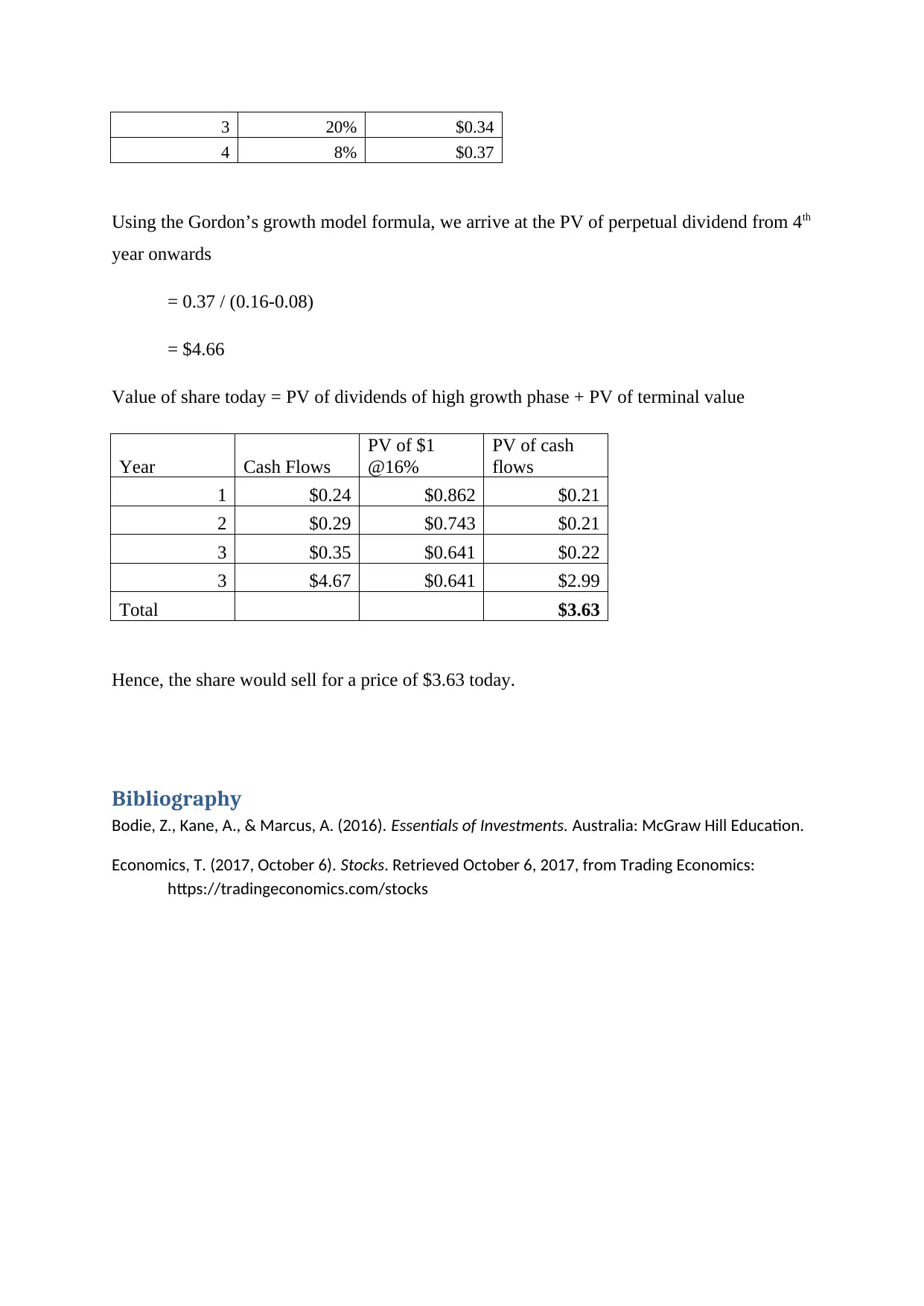

3 20% $0.34

4 8% $0.37

Using the Gordon’s growth model formula, we arrive at the PV of perpetual dividend from 4th

year onwards

= 0.37 / (0.16-0.08)

= $4.66

Value of share today = PV of dividends of high growth phase + PV of terminal value

Year Cash Flows

PV of $1

@16%

PV of cash

flows

1 $0.24 $0.862 $0.21

2 $0.29 $0.743 $0.21

3 $0.35 $0.641 $0.22

3 $4.67 $0.641 $2.99

Total $3.63

Hence, the share would sell for a price of $3.63 today.

Bibliography

Bodie, Z., Kane, A., & Marcus, A. (2016). Essentials of Investments. Australia: McGraw Hill Education.

Economics, T. (2017, October 6). Stocks. Retrieved October 6, 2017, from Trading Economics:

https://tradingeconomics.com/stocks

4 8% $0.37

Using the Gordon’s growth model formula, we arrive at the PV of perpetual dividend from 4th

year onwards

= 0.37 / (0.16-0.08)

= $4.66

Value of share today = PV of dividends of high growth phase + PV of terminal value

Year Cash Flows

PV of $1

@16%

PV of cash

flows

1 $0.24 $0.862 $0.21

2 $0.29 $0.743 $0.21

3 $0.35 $0.641 $0.22

3 $4.67 $0.641 $2.99

Total $3.63

Hence, the share would sell for a price of $3.63 today.

Bibliography

Bodie, Z., Kane, A., & Marcus, A. (2016). Essentials of Investments. Australia: McGraw Hill Education.

Economics, T. (2017, October 6). Stocks. Retrieved October 6, 2017, from Trading Economics:

https://tradingeconomics.com/stocks

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.