Analyzing Materiality and Fraud Risk in Auditing Practice Today

VerifiedAdded on 2023/06/05

|16

|2832

|182

Report

AI Summary

This report analyzes key issues in auditing practice, focusing on the appropriateness of materiality levels and the assessment of fraud risk within the context of auditing standards. It examines the case of Fuchsia Enterprises, highlighting discrepancies in preliminary materiality assessments and the potential oversight of fraud risk considerations. Through analytical review, the report identifies possible areas of misstatement in the income statement, including sales revenue, cost of sales, and depreciation, and suggests specific audit procedures for these accounts. The report emphasizes the importance of adhering to auditing standards like ASA 240 and Corporations Act, 2001, recommending a reduced materiality level and a comprehensive audit approach that considers fraud risk, irrespective of perceived client trustworthiness. Ultimately, it advocates for a rigorous and unbiased audit process to ensure the accurate reflection of an organization's financial performance and position.

Running head: ISSUES IN AUDITITNG PRACTICE

Issues in Auditing Practice

Name of the Student:

Name of the University:

Authors Note:

Issues in Auditing Practice

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

ISSUES IN AUDITITNG PRACTICE

Executive Summary:

Trial Balance of an entity contains information about account balances as on the date of

which the Trial Balance relates. An auditor will be able to access significant amount of

information from the Trial Balance. The preliminary assessment about the financial state and

performance of an entity can be made from the Trail Balance and accordingly an effective

strategy for the audit can be formulated from the same. The preliminary assessment about the

materiality levels for certain accounts and balances have been made in this document for the

audit purpose of Fuchsia Enterprises. Analytical review has also been conducted with an

objective of understanding the areas where misstatements may have occurred.

ISSUES IN AUDITITNG PRACTICE

Executive Summary:

Trial Balance of an entity contains information about account balances as on the date of

which the Trial Balance relates. An auditor will be able to access significant amount of

information from the Trial Balance. The preliminary assessment about the financial state and

performance of an entity can be made from the Trail Balance and accordingly an effective

strategy for the audit can be formulated from the same. The preliminary assessment about the

materiality levels for certain accounts and balances have been made in this document for the

audit purpose of Fuchsia Enterprises. Analytical review has also been conducted with an

objective of understanding the areas where misstatements may have occurred.

2

ISSUES IN AUDITITNG PRACTICE

Contents

Executive Summary:........................................................................................................................1

Introduction:....................................................................................................................................3

Appropriateness of Materiality level:..............................................................................................3

Analytical review:............................................................................................................................5

Possible areas of misstatement in income statement:......................................................................8

Audit procedures for identified accounts:......................................................................................10

Procedure for sales revenue:......................................................................................................10

Procedure for cost of sales:........................................................................................................10

Procedure for Depreciation:.......................................................................................................10

Fraud risk suggestion by audit partner:.........................................................................................11

Conclusion:....................................................................................................................................11

Recommendation:..........................................................................................................................12

References:....................................................................................................................................13

ISSUES IN AUDITITNG PRACTICE

Contents

Executive Summary:........................................................................................................................1

Introduction:....................................................................................................................................3

Appropriateness of Materiality level:..............................................................................................3

Analytical review:............................................................................................................................5

Possible areas of misstatement in income statement:......................................................................8

Audit procedures for identified accounts:......................................................................................10

Procedure for sales revenue:......................................................................................................10

Procedure for cost of sales:........................................................................................................10

Procedure for Depreciation:.......................................................................................................10

Fraud risk suggestion by audit partner:.........................................................................................11

Conclusion:....................................................................................................................................11

Recommendation:..........................................................................................................................12

References:....................................................................................................................................13

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

ISSUES IN AUDITITNG PRACTICE

Introduction:

The audits of entities operating in the country are subjected to the auditing and assurance

standards issued by the Auditing and Assurance Standards Board (AAUSB). ASA 320 provides

guidelines for the auditor to be followed for determination of materiality level. It is the amount

that an auditor considers material for the purpose of the audit.

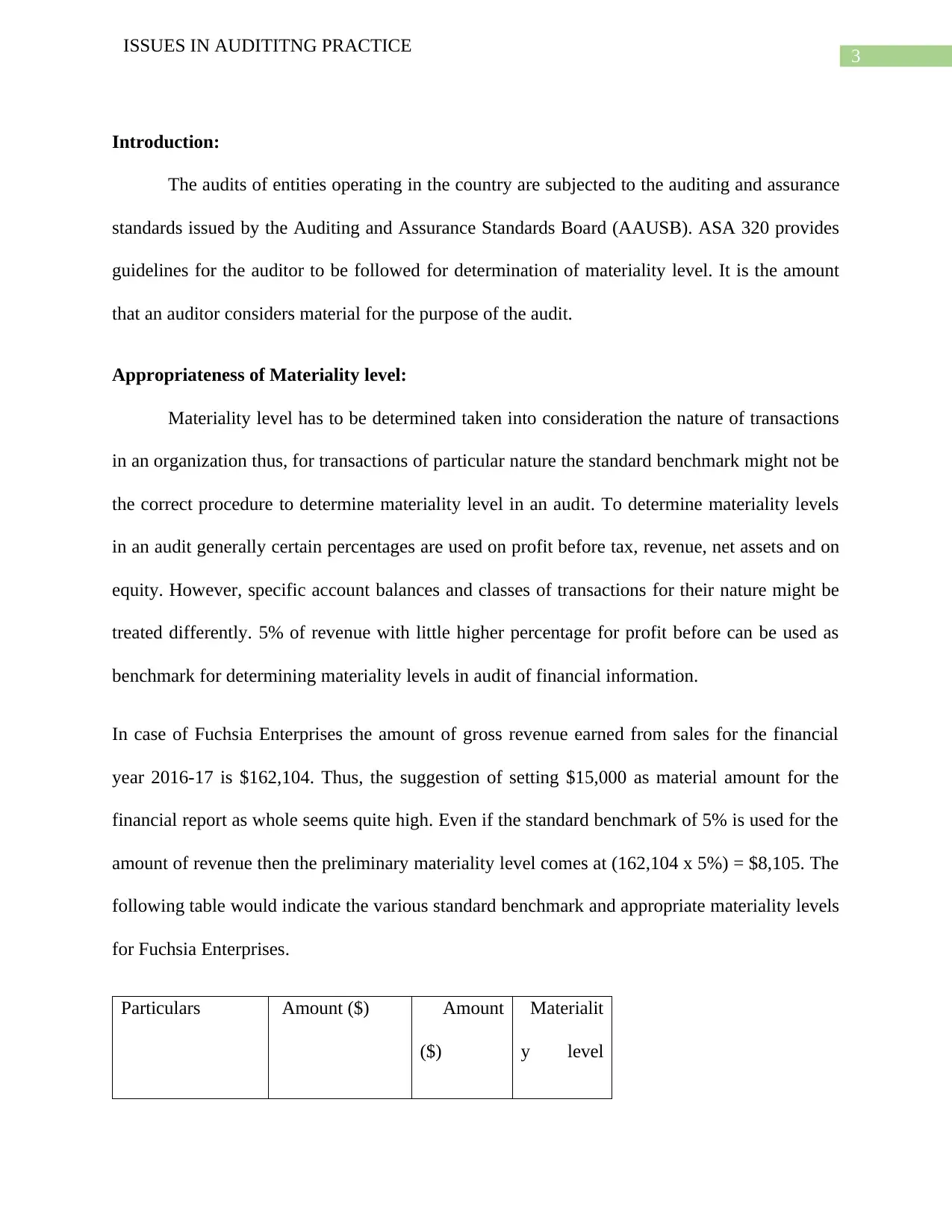

Appropriateness of Materiality level:

Materiality level has to be determined taken into consideration the nature of transactions

in an organization thus, for transactions of particular nature the standard benchmark might not be

the correct procedure to determine materiality level in an audit. To determine materiality levels

in an audit generally certain percentages are used on profit before tax, revenue, net assets and on

equity. However, specific account balances and classes of transactions for their nature might be

treated differently. 5% of revenue with little higher percentage for profit before can be used as

benchmark for determining materiality levels in audit of financial information.

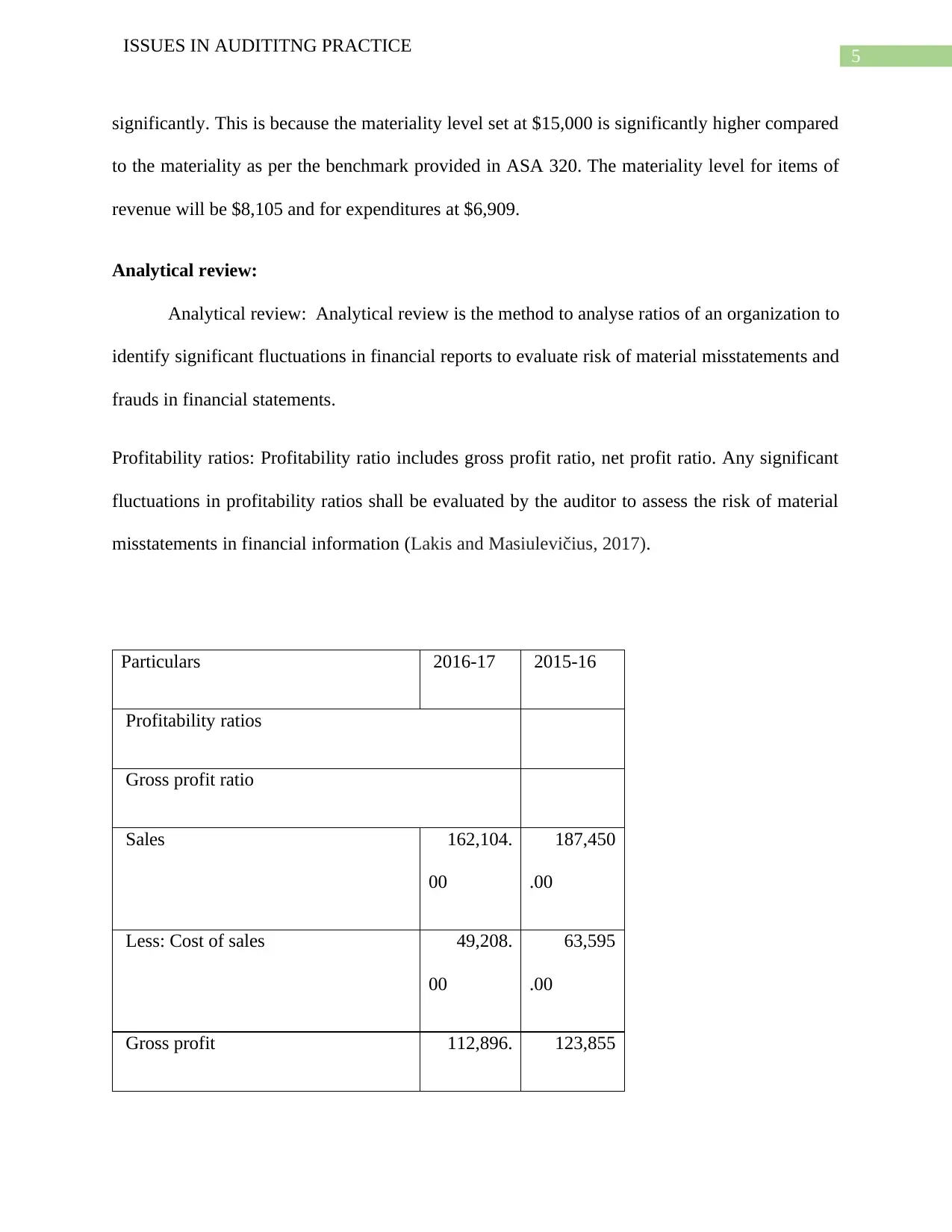

In case of Fuchsia Enterprises the amount of gross revenue earned from sales for the financial

year 2016-17 is $162,104. Thus, the suggestion of setting $15,000 as material amount for the

financial report as whole seems quite high. Even if the standard benchmark of 5% is used for the

amount of revenue then the preliminary materiality level comes at (162,104 x 5%) = $8,105. The

following table would indicate the various standard benchmark and appropriate materiality levels

for Fuchsia Enterprises.

Particulars Amount ($) Amount

($)

Materialit

y level

ISSUES IN AUDITITNG PRACTICE

Introduction:

The audits of entities operating in the country are subjected to the auditing and assurance

standards issued by the Auditing and Assurance Standards Board (AAUSB). ASA 320 provides

guidelines for the auditor to be followed for determination of materiality level. It is the amount

that an auditor considers material for the purpose of the audit.

Appropriateness of Materiality level:

Materiality level has to be determined taken into consideration the nature of transactions

in an organization thus, for transactions of particular nature the standard benchmark might not be

the correct procedure to determine materiality level in an audit. To determine materiality levels

in an audit generally certain percentages are used on profit before tax, revenue, net assets and on

equity. However, specific account balances and classes of transactions for their nature might be

treated differently. 5% of revenue with little higher percentage for profit before can be used as

benchmark for determining materiality levels in audit of financial information.

In case of Fuchsia Enterprises the amount of gross revenue earned from sales for the financial

year 2016-17 is $162,104. Thus, the suggestion of setting $15,000 as material amount for the

financial report as whole seems quite high. Even if the standard benchmark of 5% is used for the

amount of revenue then the preliminary materiality level comes at (162,104 x 5%) = $8,105. The

following table would indicate the various standard benchmark and appropriate materiality levels

for Fuchsia Enterprises.

Particulars Amount ($) Amount

($)

Materialit

y level

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

ISSUES IN AUDITITNG PRACTICE

@5%

Sales 162,104.

00

8,105.20

Total expenditure

Cost of sales 49,208.00

Bank charges 290.00

Depreciation 29,620.83

Interest expense 9,583.33

Printing 308.33

Miscellaneous 1,200.00

Wages 43,808.33

Superannuation 4,162.63

138,181.

46

6,909.07

Effects of changing preliminary assessment:

If the preliminary assessment is changed then the audit budget would increase as the

extent of checking and verification of account balances and transactions would increase

ISSUES IN AUDITITNG PRACTICE

@5%

Sales 162,104.

00

8,105.20

Total expenditure

Cost of sales 49,208.00

Bank charges 290.00

Depreciation 29,620.83

Interest expense 9,583.33

Printing 308.33

Miscellaneous 1,200.00

Wages 43,808.33

Superannuation 4,162.63

138,181.

46

6,909.07

Effects of changing preliminary assessment:

If the preliminary assessment is changed then the audit budget would increase as the

extent of checking and verification of account balances and transactions would increase

5

ISSUES IN AUDITITNG PRACTICE

significantly. This is because the materiality level set at $15,000 is significantly higher compared

to the materiality as per the benchmark provided in ASA 320. The materiality level for items of

revenue will be $8,105 and for expenditures at $6,909.

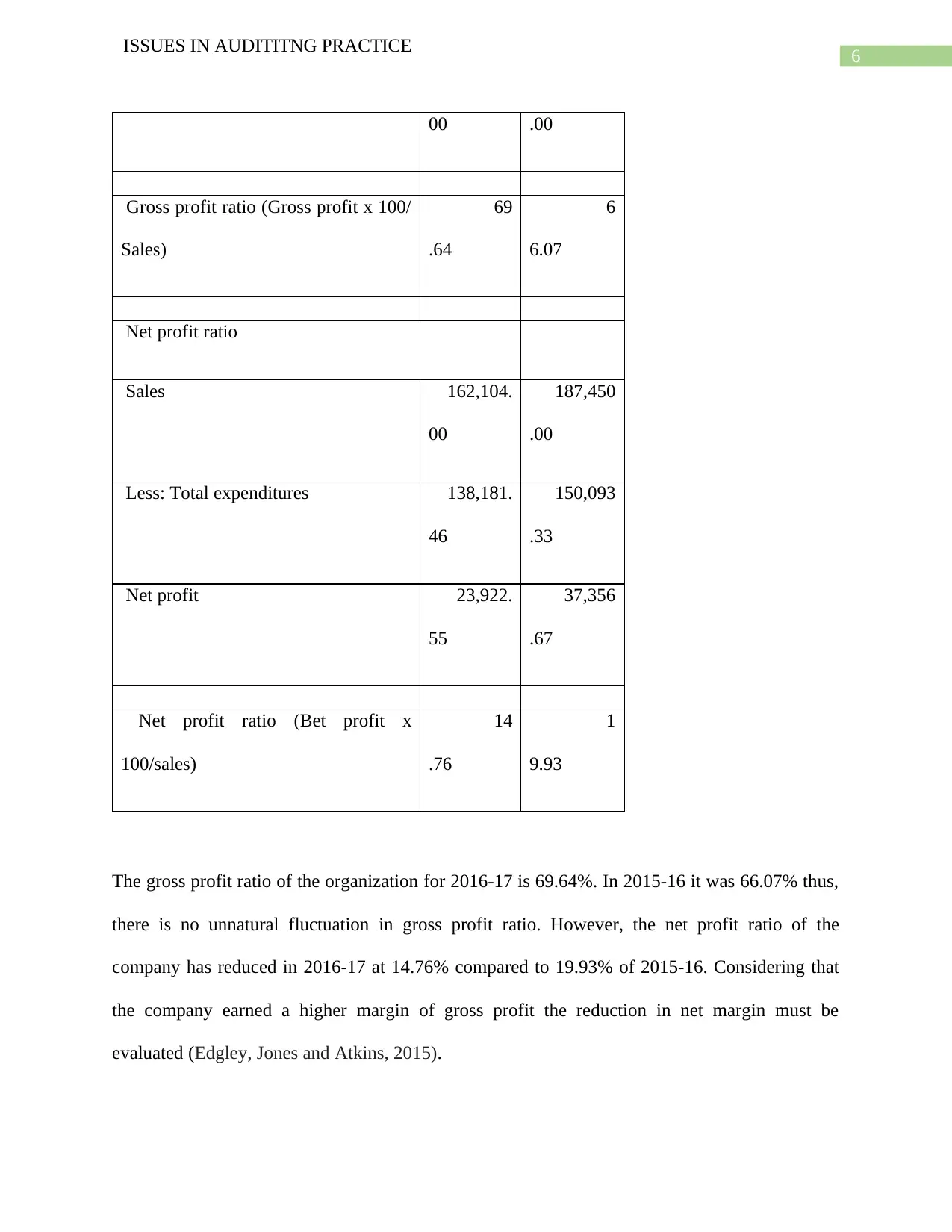

Analytical review:

Analytical review: Analytical review is the method to analyse ratios of an organization to

identify significant fluctuations in financial reports to evaluate risk of material misstatements and

frauds in financial statements.

Profitability ratios: Profitability ratio includes gross profit ratio, net profit ratio. Any significant

fluctuations in profitability ratios shall be evaluated by the auditor to assess the risk of material

misstatements in financial information (Lakis and Masiulevičius, 2017).

Particulars 2016-17 2015-16

Profitability ratios

Gross profit ratio

Sales 162,104.

00

187,450

.00

Less: Cost of sales 49,208.

00

63,595

.00

Gross profit 112,896. 123,855

ISSUES IN AUDITITNG PRACTICE

significantly. This is because the materiality level set at $15,000 is significantly higher compared

to the materiality as per the benchmark provided in ASA 320. The materiality level for items of

revenue will be $8,105 and for expenditures at $6,909.

Analytical review:

Analytical review: Analytical review is the method to analyse ratios of an organization to

identify significant fluctuations in financial reports to evaluate risk of material misstatements and

frauds in financial statements.

Profitability ratios: Profitability ratio includes gross profit ratio, net profit ratio. Any significant

fluctuations in profitability ratios shall be evaluated by the auditor to assess the risk of material

misstatements in financial information (Lakis and Masiulevičius, 2017).

Particulars 2016-17 2015-16

Profitability ratios

Gross profit ratio

Sales 162,104.

00

187,450

.00

Less: Cost of sales 49,208.

00

63,595

.00

Gross profit 112,896. 123,855

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

ISSUES IN AUDITITNG PRACTICE

00 .00

Gross profit ratio (Gross profit x 100/

Sales)

69

.64

6

6.07

Net profit ratio

Sales 162,104.

00

187,450

.00

Less: Total expenditures 138,181.

46

150,093

.33

Net profit 23,922.

55

37,356

.67

Net profit ratio (Bet profit x

100/sales)

14

.76

1

9.93

The gross profit ratio of the organization for 2016-17 is 69.64%. In 2015-16 it was 66.07% thus,

there is no unnatural fluctuation in gross profit ratio. However, the net profit ratio of the

company has reduced in 2016-17 at 14.76% compared to 19.93% of 2015-16. Considering that

the company earned a higher margin of gross profit the reduction in net margin must be

evaluated (Edgley, Jones and Atkins, 2015).

ISSUES IN AUDITITNG PRACTICE

00 .00

Gross profit ratio (Gross profit x 100/

Sales)

69

.64

6

6.07

Net profit ratio

Sales 162,104.

00

187,450

.00

Less: Total expenditures 138,181.

46

150,093

.33

Net profit 23,922.

55

37,356

.67

Net profit ratio (Bet profit x

100/sales)

14

.76

1

9.93

The gross profit ratio of the organization for 2016-17 is 69.64%. In 2015-16 it was 66.07% thus,

there is no unnatural fluctuation in gross profit ratio. However, the net profit ratio of the

company has reduced in 2016-17 at 14.76% compared to 19.93% of 2015-16. Considering that

the company earned a higher margin of gross profit the reduction in net margin must be

evaluated (Edgley, Jones and Atkins, 2015).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

ISSUES IN AUDITITNG PRACTICE

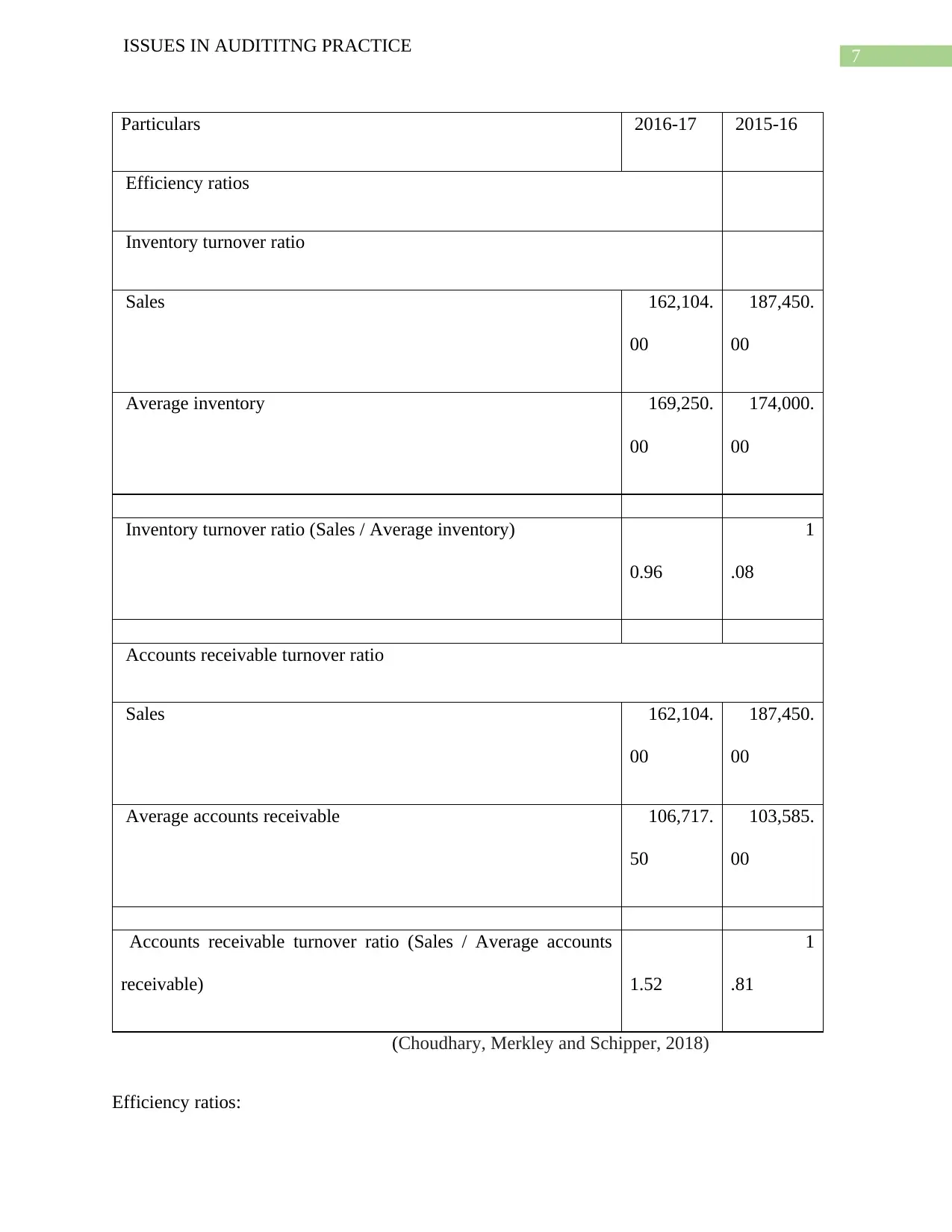

Particulars 2016-17 2015-16

Efficiency ratios

Inventory turnover ratio

Sales 162,104.

00

187,450.

00

Average inventory 169,250.

00

174,000.

00

Inventory turnover ratio (Sales / Average inventory)

0.96

1

.08

Accounts receivable turnover ratio

Sales 162,104.

00

187,450.

00

Average accounts receivable 106,717.

50

103,585.

00

Accounts receivable turnover ratio (Sales / Average accounts

receivable) 1.52

1

.81

(Choudhary, Merkley and Schipper, 2018)

Efficiency ratios:

ISSUES IN AUDITITNG PRACTICE

Particulars 2016-17 2015-16

Efficiency ratios

Inventory turnover ratio

Sales 162,104.

00

187,450.

00

Average inventory 169,250.

00

174,000.

00

Inventory turnover ratio (Sales / Average inventory)

0.96

1

.08

Accounts receivable turnover ratio

Sales 162,104.

00

187,450.

00

Average accounts receivable 106,717.

50

103,585.

00

Accounts receivable turnover ratio (Sales / Average accounts

receivable) 1.52

1

.81

(Choudhary, Merkley and Schipper, 2018)

Efficiency ratios:

8

ISSUES IN AUDITITNG PRACTICE

Efficiency ratios help an auditor to assess the ability of an organization to use its operating assets

in day to day to business operations. Both inventory and accounts receivable turnover ratios of

the company have reduced in 2017-18 compared to 2015-16. However, the reduction in

inventory and accounts receivable turnover ratios are quite insignificant for the audit (Moroney

and Trotman, 2016).

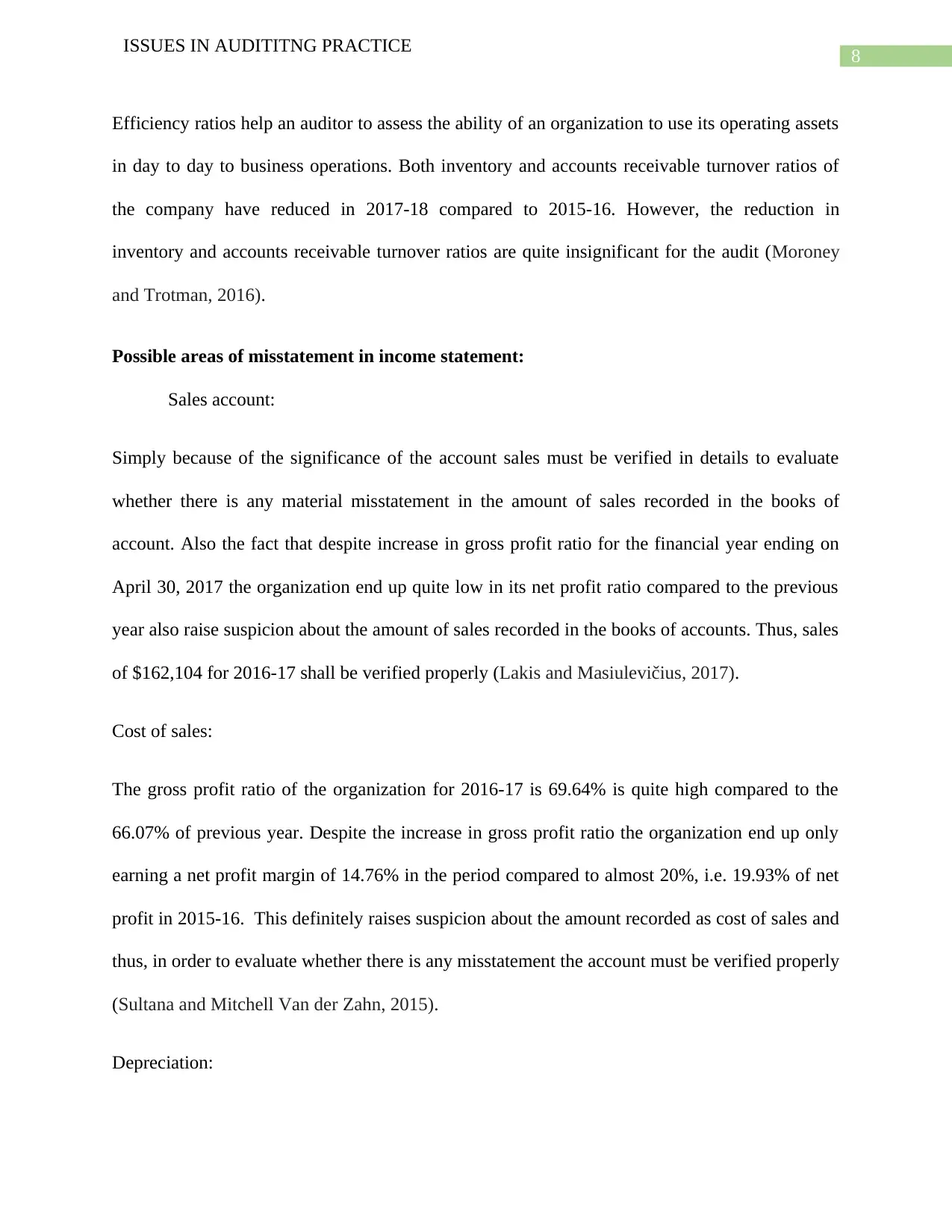

Possible areas of misstatement in income statement:

Sales account:

Simply because of the significance of the account sales must be verified in details to evaluate

whether there is any material misstatement in the amount of sales recorded in the books of

account. Also the fact that despite increase in gross profit ratio for the financial year ending on

April 30, 2017 the organization end up quite low in its net profit ratio compared to the previous

year also raise suspicion about the amount of sales recorded in the books of accounts. Thus, sales

of $162,104 for 2016-17 shall be verified properly (Lakis and Masiulevičius, 2017).

Cost of sales:

The gross profit ratio of the organization for 2016-17 is 69.64% is quite high compared to the

66.07% of previous year. Despite the increase in gross profit ratio the organization end up only

earning a net profit margin of 14.76% in the period compared to almost 20%, i.e. 19.93% of net

profit in 2015-16. This definitely raises suspicion about the amount recorded as cost of sales and

thus, in order to evaluate whether there is any misstatement the account must be verified properly

(Sultana and Mitchell Van der Zahn, 2015).

Depreciation:

ISSUES IN AUDITITNG PRACTICE

Efficiency ratios help an auditor to assess the ability of an organization to use its operating assets

in day to day to business operations. Both inventory and accounts receivable turnover ratios of

the company have reduced in 2017-18 compared to 2015-16. However, the reduction in

inventory and accounts receivable turnover ratios are quite insignificant for the audit (Moroney

and Trotman, 2016).

Possible areas of misstatement in income statement:

Sales account:

Simply because of the significance of the account sales must be verified in details to evaluate

whether there is any material misstatement in the amount of sales recorded in the books of

account. Also the fact that despite increase in gross profit ratio for the financial year ending on

April 30, 2017 the organization end up quite low in its net profit ratio compared to the previous

year also raise suspicion about the amount of sales recorded in the books of accounts. Thus, sales

of $162,104 for 2016-17 shall be verified properly (Lakis and Masiulevičius, 2017).

Cost of sales:

The gross profit ratio of the organization for 2016-17 is 69.64% is quite high compared to the

66.07% of previous year. Despite the increase in gross profit ratio the organization end up only

earning a net profit margin of 14.76% in the period compared to almost 20%, i.e. 19.93% of net

profit in 2015-16. This definitely raises suspicion about the amount recorded as cost of sales and

thus, in order to evaluate whether there is any misstatement the account must be verified properly

(Sultana and Mitchell Van der Zahn, 2015).

Depreciation:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

ISSUES IN AUDITITNG PRACTICE

The amount of depreciation for 2016-17 is $29,620 whereas in 2015-16 it was $15,738. Since the

organization has not made any addition to Machinery, Motor Vehicle and Furniture during the

course of 2016-17 thus, the reason for increase in amount of depreciation in the year has to be

evaluated. There could be misstatement in reporting the amount of depreciation in the profit and

loss account. Since the amount of difference between the depreciation amounts of two years is

quite significant thus, it has to be evaluated correctly (Gaynor et. al. 2016).

Consultancy fees:

The amount of consultancy fees earned by the organization in 2016-17 has reduced to $49,375

from $57,000 of previous period. The reason for the same has to be properly evaluated. Is it

mainly due to the difference in accounting period between two financial statements or due to

other reason? Evaluation by the auditor will be helpful in determining whether there is any

material misstatement in financial information (Knechel and Salterio, 2016).

Audit procedures for identified accounts:

Procedure for sales revenue:

The sales orders received has to be evaluated with the actual deliveries made in the

period. The accounting entries recorded subsequent to the credit and cash sales have to be

evaluated properly to check whether these have been correctly recorded in the books of accounts

of the organization. In case of any sales return whether the same has been accounted for and due

effects have been given to the relevant cash or accounts receivable accounts for such returns.

Procedure for cost of sales:

Verification of cost of sales requires the auditor to verify the inventory management

system, i.e. procurement and issue of materials and goods. The auditor would evaluate the

ISSUES IN AUDITITNG PRACTICE

The amount of depreciation for 2016-17 is $29,620 whereas in 2015-16 it was $15,738. Since the

organization has not made any addition to Machinery, Motor Vehicle and Furniture during the

course of 2016-17 thus, the reason for increase in amount of depreciation in the year has to be

evaluated. There could be misstatement in reporting the amount of depreciation in the profit and

loss account. Since the amount of difference between the depreciation amounts of two years is

quite significant thus, it has to be evaluated correctly (Gaynor et. al. 2016).

Consultancy fees:

The amount of consultancy fees earned by the organization in 2016-17 has reduced to $49,375

from $57,000 of previous period. The reason for the same has to be properly evaluated. Is it

mainly due to the difference in accounting period between two financial statements or due to

other reason? Evaluation by the auditor will be helpful in determining whether there is any

material misstatement in financial information (Knechel and Salterio, 2016).

Audit procedures for identified accounts:

Procedure for sales revenue:

The sales orders received has to be evaluated with the actual deliveries made in the

period. The accounting entries recorded subsequent to the credit and cash sales have to be

evaluated properly to check whether these have been correctly recorded in the books of accounts

of the organization. In case of any sales return whether the same has been accounted for and due

effects have been given to the relevant cash or accounts receivable accounts for such returns.

Procedure for cost of sales:

Verification of cost of sales requires the auditor to verify the inventory management

system, i.e. procurement and issue of materials and goods. The auditor would evaluate the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

ISSUES IN AUDITITNG PRACTICE

inventory valuation model used by the entity to determine cost of sales and closing inventory.

Whether the inventory has been correctly debited subsequent to the procurement and credited

subsequent to issue for sales has to be verified. Apart from that subsequent to sales return

whether inventory has been recorded in books of accounts as return shall be evaluated properly.

In case of any error in recording the procurement, issue and return of inventories then the amount

of cost of sales would be affected and so would be the profit and loss of the organization (Chan

and Vasarhelyi, 2018).

Procedure for Depreciation:

The amount of depreciation recorded in the books of accounts of the organization for the

period ending on 30th April, 2017 is $29,620.83 whereas in 2015-16 the amount of depreciation

charged in the profit and loss account was $15,783.00. A closer verification of the Trial Balance

of the organization reveals that there has been no acquisition of additional fixed assets such as

Machinery, Motor Vehicles and Furniture during the period between July 014, 2016 and April

30, 2017. Thus, the reason for such increase in the amount of depreciation must be evaluated to

determine whether there is any material misstatement in the books of accounts of the

organization during the period ending on April 30, 2017 (Badolato, Donelson and Ege, 2014).

Fraud risk suggestion by audit partner:

As per s307C of Corporations Act, 2001 an auditor must express his opinion on the

financial information of an organization. The auditor must state whether the financial

information is correctly reflects the performance and position of the organization as on a

particular date. In order to conduct an audit as per the requirements of Corporations Act, 2001 an

auditor must conduct an audit in accordance with the auditing standards applicable in the

country. ASA 240 guidelines the responsibilities of an auditor to consider fraud in an audit of

ISSUES IN AUDITITNG PRACTICE

inventory valuation model used by the entity to determine cost of sales and closing inventory.

Whether the inventory has been correctly debited subsequent to the procurement and credited

subsequent to issue for sales has to be verified. Apart from that subsequent to sales return

whether inventory has been recorded in books of accounts as return shall be evaluated properly.

In case of any error in recording the procurement, issue and return of inventories then the amount

of cost of sales would be affected and so would be the profit and loss of the organization (Chan

and Vasarhelyi, 2018).

Procedure for Depreciation:

The amount of depreciation recorded in the books of accounts of the organization for the

period ending on 30th April, 2017 is $29,620.83 whereas in 2015-16 the amount of depreciation

charged in the profit and loss account was $15,783.00. A closer verification of the Trial Balance

of the organization reveals that there has been no acquisition of additional fixed assets such as

Machinery, Motor Vehicles and Furniture during the period between July 014, 2016 and April

30, 2017. Thus, the reason for such increase in the amount of depreciation must be evaluated to

determine whether there is any material misstatement in the books of accounts of the

organization during the period ending on April 30, 2017 (Badolato, Donelson and Ege, 2014).

Fraud risk suggestion by audit partner:

As per s307C of Corporations Act, 2001 an auditor must express his opinion on the

financial information of an organization. The auditor must state whether the financial

information is correctly reflects the performance and position of the organization as on a

particular date. In order to conduct an audit as per the requirements of Corporations Act, 2001 an

auditor must conduct an audit in accordance with the auditing standards applicable in the

country. ASA 240 guidelines the responsibilities of an auditor to consider fraud in an audit of

11

ISSUES IN AUDITITNG PRACTICE

financial statements irrespective of the feeling of an auditor about the client and its staffs (Cao,

Chychyla and Stewart, 2015).

It is immaterial whether a senior partner feels that the staffs of the client are trustworthy or not.

Auditor must carry out his standard procedures to consider the risk of fraud in an audit of

financial statements to accumulate substantial evidence to come to a conclusion on the risk of

material misstatements due to fraud in financial information. Hence, in this case also the

suggestion of the audit partner to not consider fraud risk in the audit of Fuchsia Enterprises is

inappropriate and irrelevant. The audit must consider the aspect of fraud risk as per the

guidelines provided in ASA 240 issued by the AAUSB (Louwers et. al. 2015).

Conclusion:

Summarizing the above discussion it is easy to understand that the preliminary

assessment about the materiality level set by the audit partner at $15,000 is quite high

considering the amount of revenue and other items of Trial Balance. Similar the view of the audit

partner to not consider the fraud risks for the audit of the entity is also inappropriate. It would be

harsh to suggest that there had been any particular indication of fraud from analytical review.

However, the risk of material misstatement in the financial information is indicated from

analytical review. This is because despite significant increase in gross profit ratio the net margin

of the organization has deteriorated significantly.

Recommendation:

Thus, the auditor is recommended to reduce the materiality level for account balances and

should conduct the audit without any preconceived notion about the entity and its staffs. The

audit should be conducted in accordance with relevant standards on auditing to ensure that the

ISSUES IN AUDITITNG PRACTICE

financial statements irrespective of the feeling of an auditor about the client and its staffs (Cao,

Chychyla and Stewart, 2015).

It is immaterial whether a senior partner feels that the staffs of the client are trustworthy or not.

Auditor must carry out his standard procedures to consider the risk of fraud in an audit of

financial statements to accumulate substantial evidence to come to a conclusion on the risk of

material misstatements due to fraud in financial information. Hence, in this case also the

suggestion of the audit partner to not consider fraud risk in the audit of Fuchsia Enterprises is

inappropriate and irrelevant. The audit must consider the aspect of fraud risk as per the

guidelines provided in ASA 240 issued by the AAUSB (Louwers et. al. 2015).

Conclusion:

Summarizing the above discussion it is easy to understand that the preliminary

assessment about the materiality level set by the audit partner at $15,000 is quite high

considering the amount of revenue and other items of Trial Balance. Similar the view of the audit

partner to not consider the fraud risks for the audit of the entity is also inappropriate. It would be

harsh to suggest that there had been any particular indication of fraud from analytical review.

However, the risk of material misstatement in the financial information is indicated from

analytical review. This is because despite significant increase in gross profit ratio the net margin

of the organization has deteriorated significantly.

Recommendation:

Thus, the auditor is recommended to reduce the materiality level for account balances and

should conduct the audit without any preconceived notion about the entity and its staffs. The

audit should be conducted in accordance with relevant standards on auditing to ensure that the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.