ACC621 Assignment: Comprehensive Analysis of Auditing Procedures

VerifiedAdded on 2023/06/03

|13

|2311

|242

Report

AI Summary

This report delves into the critical aspects of auditing, beginning with a preliminary assessment of materiality based on AASB 108 and ISA 320, calculating materiality levels for Feldsper Enterprise, and discussing the impact of materiality on audit budgets. It includes an analytical review using trend analysis of the income statement, followed by the identification of key accounts susceptible to material misstatement, such as sales, cost of goods sold (COGS), miscellaneous expenses, and wages, along with relevant assertions. The report outlines specific audit procedures for each identified account to detect potential misstatements. Finally, it addresses the auditor's role in fraud detection, emphasizing the importance of maintaining professional skepticism throughout the audit process. Desklib provides access to this document and a wealth of other solved assignments and study resources for students.

Running head: ISSUES IN AUDITING

Issues in auditing

Name of the student

Name of the university

Author note

Issues in auditing

Name of the student

Name of the university

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ISSUES IN AUDITING 1

Table of Contents

1.0 Preliminary assessment for materiality...........................................................................2

2.0 Analytical review through trend analysis of income statement......................................3

3.0 Accounts considered for material misstatement..............................................................4

3.1.1 First account selected – Sales........................................................................................4

3.1.2 Rational for selection....................................................................................................4

3.1.3 Assertion and explanation.............................................................................................4

3.2 Second account selected – Cost of goods sold............................................................5

3.2.1 Rational for selection...............................................................................................5

3.2.2 Assertion and explanation........................................................................................5

3.3 Third account selected – Miscellaneous expenses...........................................................5

3.3.1 Rational for selection....................................................................................................5

3.3.2 Assertion and explanation.............................................................................................6

3.4 Fourth account selected – Wages.....................................................................................6

3.4.1 Rational for selection....................................................................................................6

3.4.2 Assertion and explanation.............................................................................................6

4.0 Audit procedure....................................................................................................................7

4.1 Sales.................................................................................................................................7

4.2 Cost of goods sold............................................................................................................7

4.3 Miscellaneous expenses...................................................................................................7

Table of Contents

1.0 Preliminary assessment for materiality...........................................................................2

2.0 Analytical review through trend analysis of income statement......................................3

3.0 Accounts considered for material misstatement..............................................................4

3.1.1 First account selected – Sales........................................................................................4

3.1.2 Rational for selection....................................................................................................4

3.1.3 Assertion and explanation.............................................................................................4

3.2 Second account selected – Cost of goods sold............................................................5

3.2.1 Rational for selection...............................................................................................5

3.2.2 Assertion and explanation........................................................................................5

3.3 Third account selected – Miscellaneous expenses...........................................................5

3.3.1 Rational for selection....................................................................................................5

3.3.2 Assertion and explanation.............................................................................................6

3.4 Fourth account selected – Wages.....................................................................................6

3.4.1 Rational for selection....................................................................................................6

3.4.2 Assertion and explanation.............................................................................................6

4.0 Audit procedure....................................................................................................................7

4.1 Sales.................................................................................................................................7

4.2 Cost of goods sold............................................................................................................7

4.3 Miscellaneous expenses...................................................................................................7

ISSUES IN AUDITING 2

4.4 Wages...............................................................................................................................8

5.0 Fraud....................................................................................................................................8

Reference....................................................................................................................................9

4.4 Wages...............................................................................................................................8

5.0 Fraud....................................................................................................................................8

Reference....................................................................................................................................9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ISSUES IN AUDITING 3

1.0 Preliminary assessment for materiality

Preliminary assessment regarding materiality is computed at the initial level of audit

and it is used for planning the nature and extent of audit to be carried out. AASB 108 defined

material misstatement as omission of any account that can have an impact on the decision of

the users of financial statement. The materiality is set at higher level if the risk of the client

that is the control risk as well as the inherent risk is at lower level. Conversely, it is set at

lower level if the risk of the client is lower (Eilifsen and Messier 2014). However, materiality

level of each company differs on the basis of the type of business and industry nature of the

company. These factors shall be considered as per ISA 320 requirements. Various bases those

can be taken for ascertaining the materiality levels are net profit, revenue, fixes asset and

gross profit (Icaew.com 2018). If revenues are taken as the base for ascertaining materiality it

is assumed that the materiality will be 1% to 5% of revenues. Therefore, materiality level will

be ($ 194,525 * 1%) = $ 1,945 to ($ 194,525 * 5%) = $ 9,726 for Feldsper Enterprise.

However, the auditor can set up the level of tolerable misstatement at lower than the

materiality level as it is unlikely that all the accounts will be material at the same time

(Moroney and Trotman 2016). Hence, it is assumed that the tolerable misstatement can be

ascertained at 75% of materiality that is ($ 9,726 *75%) = $ 7,295.

Audit budget determines the item numbers from the financial statement of the

company requires to be selected. When the materiality level is low the auditors will be

required to analyse more items from the financial reports and in case of high amount of

materiality the number of items will be less (Ruhnke, Pronobis and Michel 2014). Here, in

the given case if the materiality level is to be revised from $ 15,000 to $ 7,295 the auditor

will be required to analyse more number of items and therefore the audit budget will be

increased.

1.0 Preliminary assessment for materiality

Preliminary assessment regarding materiality is computed at the initial level of audit

and it is used for planning the nature and extent of audit to be carried out. AASB 108 defined

material misstatement as omission of any account that can have an impact on the decision of

the users of financial statement. The materiality is set at higher level if the risk of the client

that is the control risk as well as the inherent risk is at lower level. Conversely, it is set at

lower level if the risk of the client is lower (Eilifsen and Messier 2014). However, materiality

level of each company differs on the basis of the type of business and industry nature of the

company. These factors shall be considered as per ISA 320 requirements. Various bases those

can be taken for ascertaining the materiality levels are net profit, revenue, fixes asset and

gross profit (Icaew.com 2018). If revenues are taken as the base for ascertaining materiality it

is assumed that the materiality will be 1% to 5% of revenues. Therefore, materiality level will

be ($ 194,525 * 1%) = $ 1,945 to ($ 194,525 * 5%) = $ 9,726 for Feldsper Enterprise.

However, the auditor can set up the level of tolerable misstatement at lower than the

materiality level as it is unlikely that all the accounts will be material at the same time

(Moroney and Trotman 2016). Hence, it is assumed that the tolerable misstatement can be

ascertained at 75% of materiality that is ($ 9,726 *75%) = $ 7,295.

Audit budget determines the item numbers from the financial statement of the

company requires to be selected. When the materiality level is low the auditors will be

required to analyse more items from the financial reports and in case of high amount of

materiality the number of items will be less (Ruhnke, Pronobis and Michel 2014). Here, in

the given case if the materiality level is to be revised from $ 15,000 to $ 7,295 the auditor

will be required to analyse more number of items and therefore the audit budget will be

increased.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ISSUES IN AUDITING 4

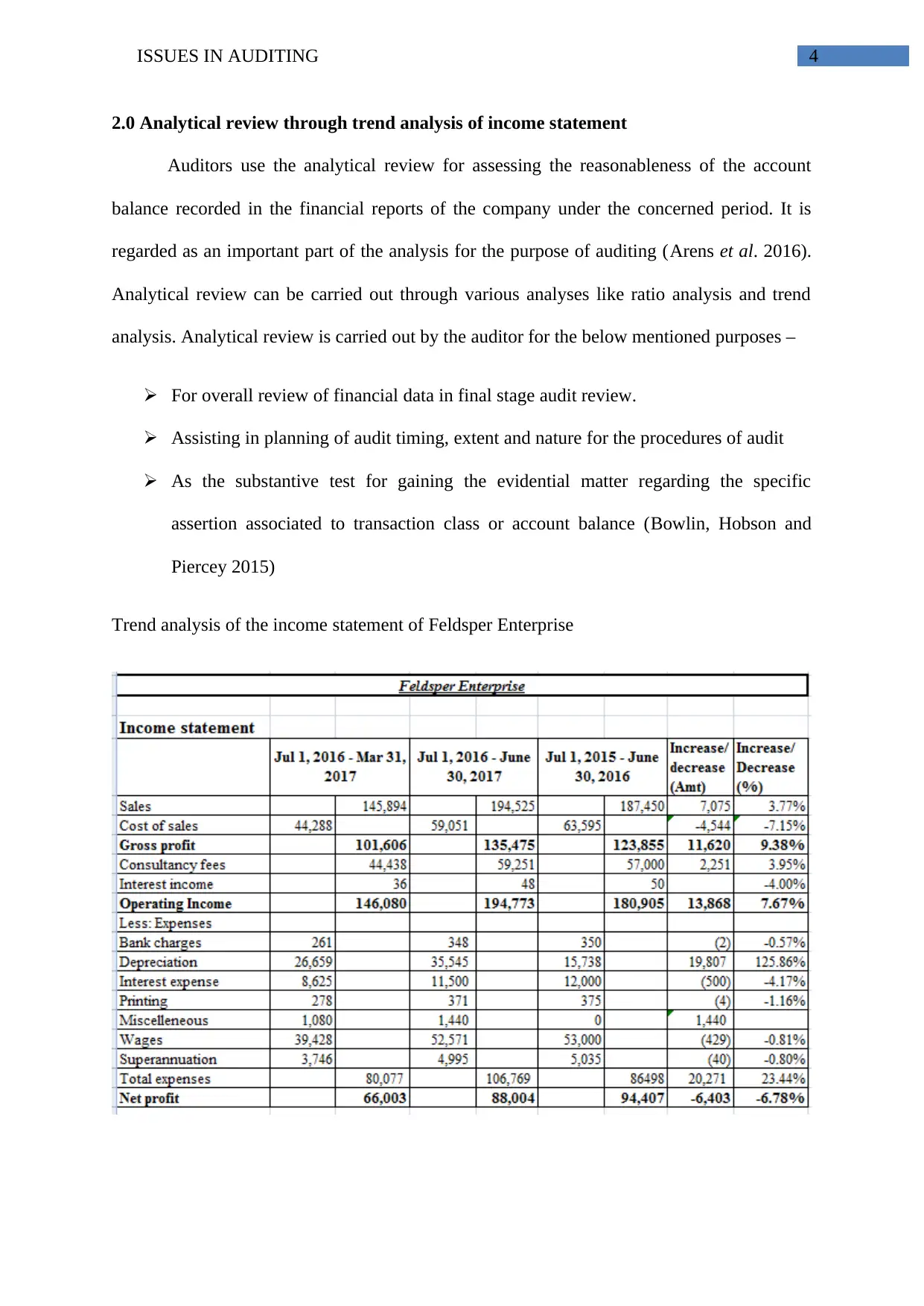

2.0 Analytical review through trend analysis of income statement

Auditors use the analytical review for assessing the reasonableness of the account

balance recorded in the financial reports of the company under the concerned period. It is

regarded as an important part of the analysis for the purpose of auditing (Arens et al. 2016).

Analytical review can be carried out through various analyses like ratio analysis and trend

analysis. Analytical review is carried out by the auditor for the below mentioned purposes –

For overall review of financial data in final stage audit review.

Assisting in planning of audit timing, extent and nature for the procedures of audit

As the substantive test for gaining the evidential matter regarding the specific

assertion associated to transaction class or account balance (Bowlin, Hobson and

Piercey 2015)

Trend analysis of the income statement of Feldsper Enterprise

2.0 Analytical review through trend analysis of income statement

Auditors use the analytical review for assessing the reasonableness of the account

balance recorded in the financial reports of the company under the concerned period. It is

regarded as an important part of the analysis for the purpose of auditing (Arens et al. 2016).

Analytical review can be carried out through various analyses like ratio analysis and trend

analysis. Analytical review is carried out by the auditor for the below mentioned purposes –

For overall review of financial data in final stage audit review.

Assisting in planning of audit timing, extent and nature for the procedures of audit

As the substantive test for gaining the evidential matter regarding the specific

assertion associated to transaction class or account balance (Bowlin, Hobson and

Piercey 2015)

Trend analysis of the income statement of Feldsper Enterprise

ISSUES IN AUDITING 5

3.0 Accounts considered for material misstatement

3.1.1 First account selected – Sales

3.1.2 Rational for selection

Sales revenue is considered as one of the major item in the financial reports of the

company as it states the ability of the entity to meet its daily operational expenses. Hence the

item is considered as a material item owing to its nature. Hence, irrespective of the amount

of changes in sales revenue as compared to last year it shall be considered for analysis as

materially misstated item.

3.1.3 Assertion and explanation

Though the changes in sales revenue has been increased by only 3.77% as compared

to previous year, owing to its nature it can be associated with various assertions like –

Occurrence – it determines the assertion that the sales transactions recorded by the

entity have been occurred during the period under concern.

Accuracy – amounts for sales transaction is recorded by the entity for proper amount

Classification - sales transaction is recorded by the entity under appropriate

accounting heads (Mao 2014).

Further, the presentation and disclosures can also be asserted in different ways like –

Occurrence – all the disclosures associated with the sales transactions related to

entity’s business and occurred in the concerned period actually

Classification – sales transactions have been segregated as per appropriate

accounting heads and recognised as per the recognition criteria followed by the

entity.

3.0 Accounts considered for material misstatement

3.1.1 First account selected – Sales

3.1.2 Rational for selection

Sales revenue is considered as one of the major item in the financial reports of the

company as it states the ability of the entity to meet its daily operational expenses. Hence the

item is considered as a material item owing to its nature. Hence, irrespective of the amount

of changes in sales revenue as compared to last year it shall be considered for analysis as

materially misstated item.

3.1.3 Assertion and explanation

Though the changes in sales revenue has been increased by only 3.77% as compared

to previous year, owing to its nature it can be associated with various assertions like –

Occurrence – it determines the assertion that the sales transactions recorded by the

entity have been occurred during the period under concern.

Accuracy – amounts for sales transaction is recorded by the entity for proper amount

Classification - sales transaction is recorded by the entity under appropriate

accounting heads (Mao 2014).

Further, the presentation and disclosures can also be asserted in different ways like –

Occurrence – all the disclosures associated with the sales transactions related to

entity’s business and occurred in the concerned period actually

Classification – sales transactions have been segregated as per appropriate

accounting heads and recognised as per the recognition criteria followed by the

entity.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ISSUES IN AUDITING 6

3.2 Second account selected – Cost of goods sold

3.2.1 Rational for selection

As large amount of saes revenue is eaten up by COGS this item shall be considered as

material owing to its nature. As COGS includes the expenses for various heads like labour

expenses, cost of material purchases and overhead expenses, it leaves wide scope to the

management to misstate it if it prefers to show that the company is left with sufficient amount

for paying off its operational expenses.

3.2.2 Assertion and explanation

The changes in COGS have been noticed that it reduced by 7.15% as compared to

previous year that states the entity was able to reduce the costs. However, at the same time it

may point out that the management may has misstated the amount to show that the company

sufficient amount for paying off its operational expenses. Different assertions linked with the

item may be as follows –

Accuracy – amounts for COGS is recorded by the entity for proper amount

Occurrence – it determines the assertion that the COGS recorded by the entity have

been occurred during the period under concern (Louwers et al. 2015).

Classification - COGS is recorded by the entity under appropriate accounting heads.

3.3 Third account selected – Miscellaneous expenses

3.3.1 Rational for selection

From the provided trial balance of Feldsper Enterprise it can be identified that the

miscellaneous expenses of the entity for the current year amounted to 1,440. However, there

were no such expenses recorded for the previous accounting year. It is likely that the

3.2 Second account selected – Cost of goods sold

3.2.1 Rational for selection

As large amount of saes revenue is eaten up by COGS this item shall be considered as

material owing to its nature. As COGS includes the expenses for various heads like labour

expenses, cost of material purchases and overhead expenses, it leaves wide scope to the

management to misstate it if it prefers to show that the company is left with sufficient amount

for paying off its operational expenses.

3.2.2 Assertion and explanation

The changes in COGS have been noticed that it reduced by 7.15% as compared to

previous year that states the entity was able to reduce the costs. However, at the same time it

may point out that the management may has misstated the amount to show that the company

sufficient amount for paying off its operational expenses. Different assertions linked with the

item may be as follows –

Accuracy – amounts for COGS is recorded by the entity for proper amount

Occurrence – it determines the assertion that the COGS recorded by the entity have

been occurred during the period under concern (Louwers et al. 2015).

Classification - COGS is recorded by the entity under appropriate accounting heads.

3.3 Third account selected – Miscellaneous expenses

3.3.1 Rational for selection

From the provided trial balance of Feldsper Enterprise it can be identified that the

miscellaneous expenses of the entity for the current year amounted to 1,440. However, there

were no such expenses recorded for the previous accounting year. It is likely that the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ISSUES IN AUDITING 7

management has included some expenses under this head to suppress any misstatement with

regard to expenses.

3.3.2 Assertion and explanation

Various assertions related to the miscellaneous expenses are as follows –

Occurrence – it determines the assertion that the miscellaneous expenses recorded by

the entity have been occurred during the concerned accounting period

Accuracy – appropriate amounts is recorded by the entity under miscellaneous

expenses (Coetzee and Lubbe 2014)

Further, the presentation and disclosures can also be asserted as follows –

Occurrence – all the disclosures associated with the miscellaneous expenses related

to entity’s business and occurred in the concerned period

3.4 Fourth account selected – Wages

3.4.1 Rational for selection

Wage payment is a major expense for Feldsper Enterprise as among the recorded

expenses under income statement wage expenses consumed the largest amount of operating

income. Hence, though the changes are only reduction of 0.81% as compared to previous

year owing to the amount involved it will be considered as material item.

3.4.2 Assertion and explanation

Wage expenses is the accounting head where the management has the scope of

misstating the amount as per their target as the head consist payment to number of employees

with different pay scales. Assertions related to wage payments are as follows –

management has included some expenses under this head to suppress any misstatement with

regard to expenses.

3.3.2 Assertion and explanation

Various assertions related to the miscellaneous expenses are as follows –

Occurrence – it determines the assertion that the miscellaneous expenses recorded by

the entity have been occurred during the concerned accounting period

Accuracy – appropriate amounts is recorded by the entity under miscellaneous

expenses (Coetzee and Lubbe 2014)

Further, the presentation and disclosures can also be asserted as follows –

Occurrence – all the disclosures associated with the miscellaneous expenses related

to entity’s business and occurred in the concerned period

3.4 Fourth account selected – Wages

3.4.1 Rational for selection

Wage payment is a major expense for Feldsper Enterprise as among the recorded

expenses under income statement wage expenses consumed the largest amount of operating

income. Hence, though the changes are only reduction of 0.81% as compared to previous

year owing to the amount involved it will be considered as material item.

3.4.2 Assertion and explanation

Wage expenses is the accounting head where the management has the scope of

misstating the amount as per their target as the head consist payment to number of employees

with different pay scales. Assertions related to wage payments are as follows –

ISSUES IN AUDITING 8

Occurrence – payments made to the employees who are actually employed by the

company

Cut-off – payment of wages are recorded under appropriate accounting words. In

other words, it does not include payment made in previous year (Leung et al. 2014).

4.0 Audit procedure

4.1 Sales

The auditor shall verify the recognition criteria applied by the company for

recognizing the sales revenue and the authored recognition method is applied on consistent

basis while recording the revenues. Further, the sales register shall be verified for big amount

of transaction with regard to number of unit sold, name of the customer to whom sales being

made and unit price charged (Griffin 2014).

4.2 Cost of goods sold

It shall be verified with regard to each accounting head like labour expenses, purchase

of material and overhead expenses. Each of the heads shall be matched with proper records

like purchase register for material purchased, labour register with respective basis for

payment and associated vouchers and bills associated to overhead expenses.

4.3 Miscellaneous expenses

Which are the expenses recorded as miscellaneous expenses shall be verified with

proper bills and vouchers. Further, the reason why the expenses are recorded as

miscellaneous instead of inclusion under respective heads must be identified (Moeller 2013).

Occurrence – payments made to the employees who are actually employed by the

company

Cut-off – payment of wages are recorded under appropriate accounting words. In

other words, it does not include payment made in previous year (Leung et al. 2014).

4.0 Audit procedure

4.1 Sales

The auditor shall verify the recognition criteria applied by the company for

recognizing the sales revenue and the authored recognition method is applied on consistent

basis while recording the revenues. Further, the sales register shall be verified for big amount

of transaction with regard to number of unit sold, name of the customer to whom sales being

made and unit price charged (Griffin 2014).

4.2 Cost of goods sold

It shall be verified with regard to each accounting head like labour expenses, purchase

of material and overhead expenses. Each of the heads shall be matched with proper records

like purchase register for material purchased, labour register with respective basis for

payment and associated vouchers and bills associated to overhead expenses.

4.3 Miscellaneous expenses

Which are the expenses recorded as miscellaneous expenses shall be verified with

proper bills and vouchers. Further, the reason why the expenses are recorded as

miscellaneous instead of inclusion under respective heads must be identified (Moeller 2013).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ISSUES IN AUDITING 9

4.4 Wages

Payment made to each category of employees with respective payment slip shall be

verified. In case of new engagement or retirement it shall be verified that the wage payment

account has been amended accordingly.

5.0 Fraud

Fraud is considered as the intentional error committed by the management for

fulfilling its own target. However, the primary job of the auditor is to detect fraud, if any,

while auditing the financial reports of the company. Therefore, irrespective of the fact that the

employees of the company are faithful, the auditor must carry out the audit with the objective

of detecting fraud (Glover and Prawitt 2014). No fraud likelihood is found as per analytical

reviews, however due to the nature and amount involved some accounts like saes, COGS,

miscellaneous expenses and wages shall be verified for the purpose of material misstatement.

4.4 Wages

Payment made to each category of employees with respective payment slip shall be

verified. In case of new engagement or retirement it shall be verified that the wage payment

account has been amended accordingly.

5.0 Fraud

Fraud is considered as the intentional error committed by the management for

fulfilling its own target. However, the primary job of the auditor is to detect fraud, if any,

while auditing the financial reports of the company. Therefore, irrespective of the fact that the

employees of the company are faithful, the auditor must carry out the audit with the objective

of detecting fraud (Glover and Prawitt 2014). No fraud likelihood is found as per analytical

reviews, however due to the nature and amount involved some accounts like saes, COGS,

miscellaneous expenses and wages shall be verified for the purpose of material misstatement.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ISSUES IN AUDITING 10

Reference

Arens, A.A., Elder, R.J., Beasley, M.S. and Hogan, C.E., 2016. Auditing and assurance

services. Pearson.

Bowlin, K.O., Hobson, J.L. and Piercey, M.D., 2015. The effects of auditor rotation,

professional skepticism, and interactions with managers on audit quality. The Accounting

Review, 90(4), pp.1363-1393.

Coetzee, P. and Lubbe, D., 2014. Improving the efficiency and effectiveness of risk‐based

internal audit engagements. International Journal of Auditing, 18(2), pp.115-125.

Eilifsen, A. and Messier Jr, W.F., 2014. Materiality guidance of the major public accounting

firms. Auditing: A Journal of Practice & Theory, 34(2), pp.3-26.

Glover, S.M. and Prawitt, D.F., 2014. Enhancing auditor professional skepticism: The

professional skepticism continuum. Current Issues in Auditing, 8(2), pp.P1-P10.

Griffin, J.B., 2014. The effects of uncertainty and disclosure on auditors' fair value

materiality decisions. Journal of Accounting Research, 52(5), pp.1165-1193.

Icaew.com., 2018. [online] Available at:

https://www.icaew.com/-/media/corporate/files/technical/iaa/materiality-in-the-audit-of-

financial-statements.ashx [Accessed 10 Oct. 2018].

Leung, P., Coram, P., Cooper, B.J. and Richardson, P., 2014. Modern Auditing and

Assurance Services 6e. Wiley.

Louwers, T.J., Ramsay, R.J., Sinason, D.H., Strawser, J.R. and Thibodeau, J.C., 2015.

Auditing & assurance services. McGraw-Hill Education.

Reference

Arens, A.A., Elder, R.J., Beasley, M.S. and Hogan, C.E., 2016. Auditing and assurance

services. Pearson.

Bowlin, K.O., Hobson, J.L. and Piercey, M.D., 2015. The effects of auditor rotation,

professional skepticism, and interactions with managers on audit quality. The Accounting

Review, 90(4), pp.1363-1393.

Coetzee, P. and Lubbe, D., 2014. Improving the efficiency and effectiveness of risk‐based

internal audit engagements. International Journal of Auditing, 18(2), pp.115-125.

Eilifsen, A. and Messier Jr, W.F., 2014. Materiality guidance of the major public accounting

firms. Auditing: A Journal of Practice & Theory, 34(2), pp.3-26.

Glover, S.M. and Prawitt, D.F., 2014. Enhancing auditor professional skepticism: The

professional skepticism continuum. Current Issues in Auditing, 8(2), pp.P1-P10.

Griffin, J.B., 2014. The effects of uncertainty and disclosure on auditors' fair value

materiality decisions. Journal of Accounting Research, 52(5), pp.1165-1193.

Icaew.com., 2018. [online] Available at:

https://www.icaew.com/-/media/corporate/files/technical/iaa/materiality-in-the-audit-of-

financial-statements.ashx [Accessed 10 Oct. 2018].

Leung, P., Coram, P., Cooper, B.J. and Richardson, P., 2014. Modern Auditing and

Assurance Services 6e. Wiley.

Louwers, T.J., Ramsay, R.J., Sinason, D.H., Strawser, J.R. and Thibodeau, J.C., 2015.

Auditing & assurance services. McGraw-Hill Education.

ISSUES IN AUDITING 11

Mao, M., 2014, June. Experimental Methods of Materiality Judgment on Auditor’s

Experience and Performance. In 3rd International Conference on Science and Social

Research (ICSSR 2014). Atlantis Press.

Moeller, R.R., 2013. Role of Internal Audit in Enterprise Risk Management. COSO

Enterprise Risk Management: Establishing Effective Governance, Risk, and Compliance

Processes, Second Edition, pp.247-266.

Moroney, R. and Trotman, K.T., 2016. Differences in Auditors' Materiality Assessments

When Auditing Financial Statements and Sustainability Reports. Contemporary Accounting

Research, 33(2), pp.551-575.

Ruhnke, K., Pronobis, P. and Michel, M., 2014. Audit materiality disclosures and credit

lending decisions.

Mao, M., 2014, June. Experimental Methods of Materiality Judgment on Auditor’s

Experience and Performance. In 3rd International Conference on Science and Social

Research (ICSSR 2014). Atlantis Press.

Moeller, R.R., 2013. Role of Internal Audit in Enterprise Risk Management. COSO

Enterprise Risk Management: Establishing Effective Governance, Risk, and Compliance

Processes, Second Edition, pp.247-266.

Moroney, R. and Trotman, K.T., 2016. Differences in Auditors' Materiality Assessments

When Auditing Financial Statements and Sustainability Reports. Contemporary Accounting

Research, 33(2), pp.551-575.

Ruhnke, K., Pronobis, P. and Michel, M., 2014. Audit materiality disclosures and credit

lending decisions.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.