ACC621 Report: Investigating Key Auditing Issues at Fawn Enterprise

VerifiedAdded on 2023/06/07

|12

|2410

|357

Report

AI Summary

This report delves into the auditing issues encountered in Fawn Enterprise, beginning with a critical evaluation of the preliminary materiality judgment, suggesting a more appropriate level based on sales and total assets. It discusses the importance of analytical reviews in identifying potential misstatements and presents a trend analysis. The report identifies consultancy fees, depreciation, sales, and wages as accounts susceptible to material misstatement, providing justifications and relevant assertions for each. Recommended audit procedures are outlined for each of these accounts, focusing on detailed testing, control reviews, and substantive procedures. Finally, the report addresses the assessment of fraud risk, emphasizing the need for special attention to accounts prone to misstatement and misappropriation, even in the absence of apparent fraud indicators. This student assignment is available on Desklib, a platform offering a wide range of study resources, including past papers and solved assignments.

Running head: ISSUES IN AUDITING

Issues in auditing

Name of the student

Name of the university

Author note

Issues in auditing

Name of the student

Name of the university

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ISSUES IN AUDITING 1

Table of Contents

1.0 Preliminary judgement for materiality.................................................................................3

2.0 Analytical review.................................................................................................................3

3.0 Analytical review through trend analysis.............................................................................4

4.0 accounts under material misstatement.................................................................................5

4.1.1 First account selected – Consultancy fees.....................................................................5

4.1.2 Rational for selection....................................................................................................5

4.1.3 Assertion and explanation.............................................................................................5

4.2 Second account selected – Depreciation.....................................................................5

4.2.1 Rational for selection....................................................................................................5

4.2.2 Assertion and explanation........................................................................................5

4.3 Third account selected – Sales.........................................................................................6

4.3.1 Rational for selection....................................................................................................6

4.3.2 Assertion and explanation.............................................................................................6

4.4 Fourth account selected – Wages.....................................................................................6

4.4.1 Rational for selection....................................................................................................6

4.4.2 Assertion and explanation.............................................................................................7

5.0 Recommended audit procedure............................................................................................7

5.1 Audit procedure – consultancy fees.................................................................................7

5.2 Audit procedure - depreciation.........................................................................................7

Table of Contents

1.0 Preliminary judgement for materiality.................................................................................3

2.0 Analytical review.................................................................................................................3

3.0 Analytical review through trend analysis.............................................................................4

4.0 accounts under material misstatement.................................................................................5

4.1.1 First account selected – Consultancy fees.....................................................................5

4.1.2 Rational for selection....................................................................................................5

4.1.3 Assertion and explanation.............................................................................................5

4.2 Second account selected – Depreciation.....................................................................5

4.2.1 Rational for selection....................................................................................................5

4.2.2 Assertion and explanation........................................................................................5

4.3 Third account selected – Sales.........................................................................................6

4.3.1 Rational for selection....................................................................................................6

4.3.2 Assertion and explanation.............................................................................................6

4.4 Fourth account selected – Wages.....................................................................................6

4.4.1 Rational for selection....................................................................................................6

4.4.2 Assertion and explanation.............................................................................................7

5.0 Recommended audit procedure............................................................................................7

5.1 Audit procedure – consultancy fees.................................................................................7

5.2 Audit procedure - depreciation.........................................................................................7

ISSUES IN AUDITING 2

5.3 Audit procedure - sales.....................................................................................................8

5.4 Audit procedure - wages..................................................................................................8

6.0 Fraud....................................................................................................................................9

Reference..................................................................................................................................10

5.3 Audit procedure - sales.....................................................................................................8

5.4 Audit procedure - wages..................................................................................................8

6.0 Fraud....................................................................................................................................9

Reference..................................................................................................................................10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ISSUES IN AUDITING 3

1.0 Preliminary judgement for materiality

Preliminary materiality judgement is based upon the financial statement of the

company. It is the maximum tolerable level for misstatement that will be regarded as material

for any particular account balance. However, the amount of tolerable misstatement is

depended upon the preliminary materiality judgement. Tolerable misstatement is always

lower than the preliminary judgement while considering materiality. Generally, 1% to 5% of

sales or 2% of total assets are considered for the amount of materiality (Eilifsen and Messier

2014). In the given case, 1% to 5% of sales are $ 1945.25 to $ 9,726.25 and 2% of total assets

is $ 10,650.59. Therefore, preliminary assessment amounting to $ 15,000 by the audit partner

is not appropriate. They shall set the amount at $ 10,000.

Preliminary assessment indicates the reliance that can be made on the function of the

internal auditor. It improves the objectivity and independence of the internal audit function.

While the audit budget is set the auditor takes into account the common and risk associated

items like wages, inventories, cash and other expenses into consideration for expressing audit

opinion (Byrnes et al. 2015). Therefore, when the preliminary assessment is changed, for

instance, planning materiality has been changed from $ 15,000 to $ 10,000 audit budget will

also increased. The auditor will have to increase the audit procedure for more number of

items.

2.0 Analytical review

It is used by the auditors for assessing reasonableness of the account balances. It is

done through comparing the changes in the account balances over the period of time or by

comparing with associated accounts. It is useful in highlighting the general areas where the

financial statements seem to be incorrect or where the transactions are misstated or

1.0 Preliminary judgement for materiality

Preliminary materiality judgement is based upon the financial statement of the

company. It is the maximum tolerable level for misstatement that will be regarded as material

for any particular account balance. However, the amount of tolerable misstatement is

depended upon the preliminary materiality judgement. Tolerable misstatement is always

lower than the preliminary judgement while considering materiality. Generally, 1% to 5% of

sales or 2% of total assets are considered for the amount of materiality (Eilifsen and Messier

2014). In the given case, 1% to 5% of sales are $ 1945.25 to $ 9,726.25 and 2% of total assets

is $ 10,650.59. Therefore, preliminary assessment amounting to $ 15,000 by the audit partner

is not appropriate. They shall set the amount at $ 10,000.

Preliminary assessment indicates the reliance that can be made on the function of the

internal auditor. It improves the objectivity and independence of the internal audit function.

While the audit budget is set the auditor takes into account the common and risk associated

items like wages, inventories, cash and other expenses into consideration for expressing audit

opinion (Byrnes et al. 2015). Therefore, when the preliminary assessment is changed, for

instance, planning materiality has been changed from $ 15,000 to $ 10,000 audit budget will

also increased. The auditor will have to increase the audit procedure for more number of

items.

2.0 Analytical review

It is used by the auditors for assessing reasonableness of the account balances. It is

done through comparing the changes in the account balances over the period of time or by

comparing with associated accounts. It is useful in highlighting the general areas where the

financial statements seem to be incorrect or where the transactions are misstated or

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ISSUES IN AUDITING 4

misclassified. Once the review identifies the concern areas, the auditor will start further

investigation for pinpointing the sources of underlying issues (Arens et al. 2016). Based on

the findings and knowledge the auditor develops the audit plan that sates the procedures to be

followed for effective and efficient audit. The main objectives of performing the analytical

review are as follows –

To assist the auditor in planning the nature, timing and extend of the audit procedure

It can be used as substantive procedure as the detailed tests for risk reduction is less

efficient as it is time consuming

For overall assessment of the financial statement through various measures like trend

analysis and ratio analysis (Christensen, Glover and Wood 2013).

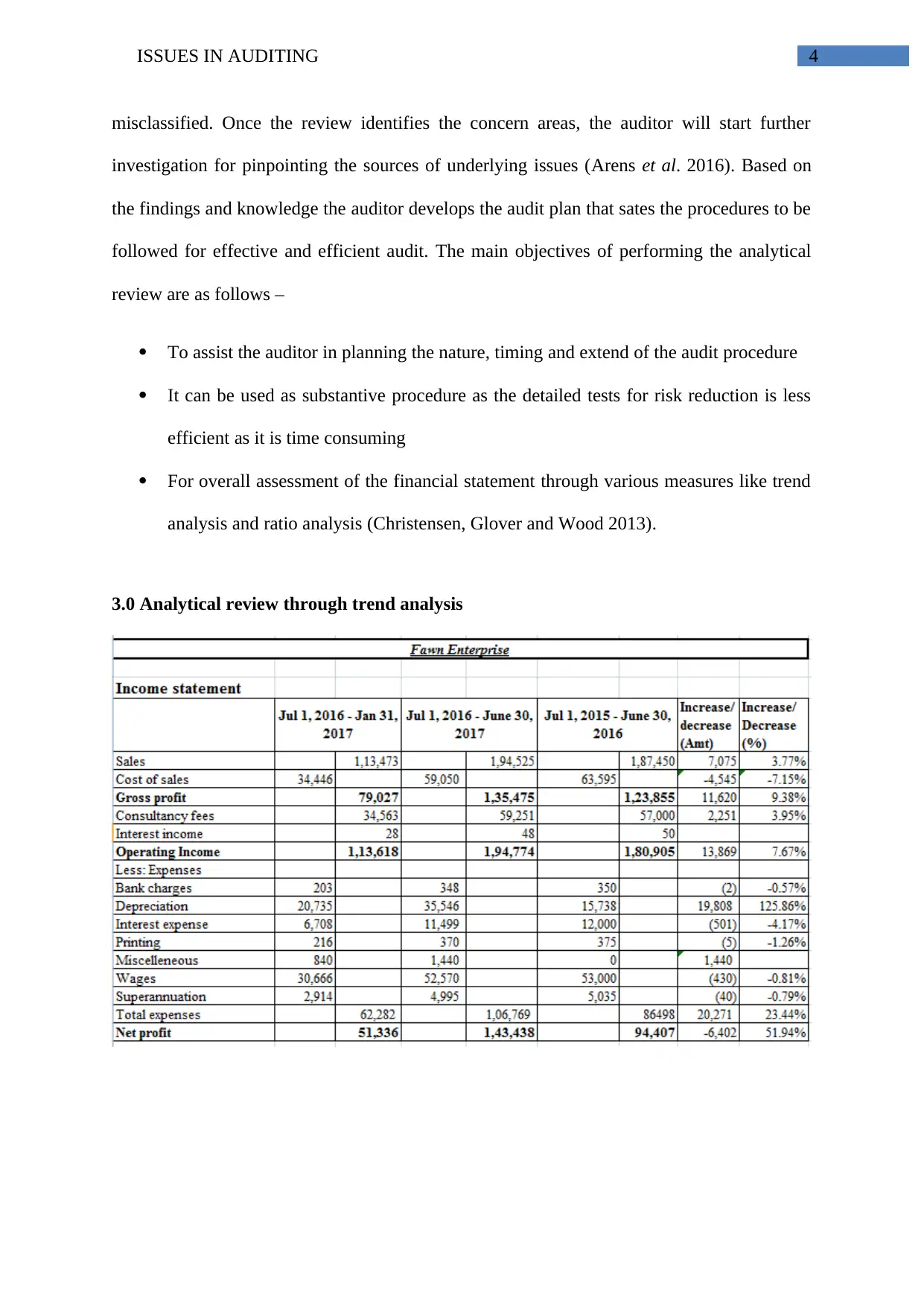

3.0 Analytical review through trend analysis

misclassified. Once the review identifies the concern areas, the auditor will start further

investigation for pinpointing the sources of underlying issues (Arens et al. 2016). Based on

the findings and knowledge the auditor develops the audit plan that sates the procedures to be

followed for effective and efficient audit. The main objectives of performing the analytical

review are as follows –

To assist the auditor in planning the nature, timing and extend of the audit procedure

It can be used as substantive procedure as the detailed tests for risk reduction is less

efficient as it is time consuming

For overall assessment of the financial statement through various measures like trend

analysis and ratio analysis (Christensen, Glover and Wood 2013).

3.0 Analytical review through trend analysis

ISSUES IN AUDITING 5

4.0 accounts under material misstatement

4.1.1 First account selected – Consultancy fees

4.1.2 Rational for selection

From the income statement of Fawn Enterprise it is found that the consultancy fees

have been increased by 3.95% over the year from 2016 to 2017.

4.1.3 Assertion and explanation

As the consultancy fees has been increased there may involve the chances of

manipulation for the fees. Generally the fees remain same unless the increase is approved

through an agreement or the company changed the consultancy service provider (Coetzee and

Lubbe 2014). The assertion here is the accuracy that is the amount has been recorded at

appropriate amount without any misstatement.

4.2 Second account selected – Depreciation

4.2.1 Rational for selection

Depreciation on non-current assets has been increased from $ 15,738 to $ 35,546 that

is by 125.86%.

4.2.2 Assertion and explanation

Generally, the depreciation is maintained at the same amount if straight line method is

applied or in reducing amount if the diminishing method is applied. However, the

depreciation is increased only when the company purchases any new asset and depreciation is

provided on that asset. It is found from the balance sheet of fawn Enterprise that the company

has not purchased any new asset over the past 2 years. Therefore the depreciation shall also

be provided at the same amount. The assertion involves here is cut-off that is the transactions

were recorded under the correct period of reporting (Kharisova and Kozlova 2014).

4.0 accounts under material misstatement

4.1.1 First account selected – Consultancy fees

4.1.2 Rational for selection

From the income statement of Fawn Enterprise it is found that the consultancy fees

have been increased by 3.95% over the year from 2016 to 2017.

4.1.3 Assertion and explanation

As the consultancy fees has been increased there may involve the chances of

manipulation for the fees. Generally the fees remain same unless the increase is approved

through an agreement or the company changed the consultancy service provider (Coetzee and

Lubbe 2014). The assertion here is the accuracy that is the amount has been recorded at

appropriate amount without any misstatement.

4.2 Second account selected – Depreciation

4.2.1 Rational for selection

Depreciation on non-current assets has been increased from $ 15,738 to $ 35,546 that

is by 125.86%.

4.2.2 Assertion and explanation

Generally, the depreciation is maintained at the same amount if straight line method is

applied or in reducing amount if the diminishing method is applied. However, the

depreciation is increased only when the company purchases any new asset and depreciation is

provided on that asset. It is found from the balance sheet of fawn Enterprise that the company

has not purchased any new asset over the past 2 years. Therefore the depreciation shall also

be provided at the same amount. The assertion involves here is cut-off that is the transactions

were recorded under the correct period of reporting (Kharisova and Kozlova 2014).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ISSUES IN AUDITING 6

4.3 Third account selected – Sales

4.3.1 Rational for selection

Sales revenue plays major role in any kind of business. It has been found that the sales

revenue for Fawn Enterprise is increased from $ 187,450 to $ 194,525 that is by 3.77% over

the years from 2016 to 2017. Further, sales revenue is always susceptible to misstatement,

error and misappropriation.

4.3.2 Assertion and explanation

Although the amount of increase is not big, as sales revenue are always subject to

misstatement, error and misappropriation. Further, as different entities use different methods

for recognising sales revenue and sells good on both cash as well as credit terms, there is

always involvement of risks with the sales revenue computation if the method is not applied

on consistent basis. The assertion involves here is the accuracy and classification that is the

account balance for sales revenue has been recorded at full amount without any error and

transactions are recorded under correct accounts (Legoria, Melendrez and Reynolds 2013).

4.4 Fourth account selected – Wages

4.4.1 Rational for selection

Wages plays major role in any kind of business as it involves large amount of

business expenses. It has been found that the cash at bank for Fawn Enterprise is reduced

from $ 53,000 to $ 52,570 that is by 0.81% over the years from 2016 to 2017. Further,

irrespective of the amount involved wages are always susceptible to misstatement and

misappropriation.

4.3 Third account selected – Sales

4.3.1 Rational for selection

Sales revenue plays major role in any kind of business. It has been found that the sales

revenue for Fawn Enterprise is increased from $ 187,450 to $ 194,525 that is by 3.77% over

the years from 2016 to 2017. Further, sales revenue is always susceptible to misstatement,

error and misappropriation.

4.3.2 Assertion and explanation

Although the amount of increase is not big, as sales revenue are always subject to

misstatement, error and misappropriation. Further, as different entities use different methods

for recognising sales revenue and sells good on both cash as well as credit terms, there is

always involvement of risks with the sales revenue computation if the method is not applied

on consistent basis. The assertion involves here is the accuracy and classification that is the

account balance for sales revenue has been recorded at full amount without any error and

transactions are recorded under correct accounts (Legoria, Melendrez and Reynolds 2013).

4.4 Fourth account selected – Wages

4.4.1 Rational for selection

Wages plays major role in any kind of business as it involves large amount of

business expenses. It has been found that the cash at bank for Fawn Enterprise is reduced

from $ 53,000 to $ 52,570 that is by 0.81% over the years from 2016 to 2017. Further,

irrespective of the amount involved wages are always susceptible to misstatement and

misappropriation.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ISSUES IN AUDITING 7

4.4.2 Assertion and explanation

As wages are always subject to misstatement and misappropriation, irrespective of the

involvement of amount wages shall always be regarded as a special item for auditing

purpose. The assertion involves here is the accuracy and cut-off that is the account balance

for wages has been recorded at full amount without any error and transactions are recorded

under correct accounting period (Glover and Prawitt 2014).

5.0 Recommended audit procedure

5.1 Audit procedure – consultancy fees

The auditor shall carry out the reasonable check procedures for checking the incomes

related to consultancy fees and determining whether the fees are in line with the ordinary

consideration. If the fees from any client are increased through any new agreement or the

company added any service for any particular client then the agreement of engagement or

enhancement of fees shall be checked properly (Titera 2013). The auditor shall also check the

whether the fees received were one time fees or paid on monthly basis. The associated

transactions and recording in the account books shall also be checked properly.

5.2 Audit procedure - depreciation

Before carrying out the detail testing of depreciation charges the auditors shall review

and assess the control over non-current assets and depreciation associated with those assets. It

will assist the auditor to test the depreciation expenses in more efficient manner. Key controls

that shall be looked upon by the auditor are purchase of assets, physical control over it,

methods used for charging depreciation and recording of these expenses under the financial

statement. While auditing for depreciation the auditor must review the rate of depreciation

and the auditor shall apply professional scepticism to analyse that the rate of depreciation will

not help the management to charge the expenses as per their desire. If required, the auditor

4.4.2 Assertion and explanation

As wages are always subject to misstatement and misappropriation, irrespective of the

involvement of amount wages shall always be regarded as a special item for auditing

purpose. The assertion involves here is the accuracy and cut-off that is the account balance

for wages has been recorded at full amount without any error and transactions are recorded

under correct accounting period (Glover and Prawitt 2014).

5.0 Recommended audit procedure

5.1 Audit procedure – consultancy fees

The auditor shall carry out the reasonable check procedures for checking the incomes

related to consultancy fees and determining whether the fees are in line with the ordinary

consideration. If the fees from any client are increased through any new agreement or the

company added any service for any particular client then the agreement of engagement or

enhancement of fees shall be checked properly (Titera 2013). The auditor shall also check the

whether the fees received were one time fees or paid on monthly basis. The associated

transactions and recording in the account books shall also be checked properly.

5.2 Audit procedure - depreciation

Before carrying out the detail testing of depreciation charges the auditors shall review

and assess the control over non-current assets and depreciation associated with those assets. It

will assist the auditor to test the depreciation expenses in more efficient manner. Key controls

that shall be looked upon by the auditor are purchase of assets, physical control over it,

methods used for charging depreciation and recording of these expenses under the financial

statement. While auditing for depreciation the auditor must review the rate of depreciation

and the auditor shall apply professional scepticism to analyse that the rate of depreciation will

not help the management to charge the expenses as per their desire. If required, the auditor

ISSUES IN AUDITING 8

shall recalculate the depreciation expenses taking into account the amount of accumulated

depreciation and reconcile the income statement with the balance sheet for analysing the

amount of depreciation (Wali 2015). Finally, the auditor shall perform the test for

reasonableness for evaluating that amount charged for depreciation was appropriate.

5.3 Audit procedure - sales

While carrying out the audit procedure for sales revenues the auditor shall use various

analytical procedures for analysing the recognition methods used by the entity. The auditor

shall further confirm the financial records for sales revenues with the transaction records. As

sales revenues can be used for paying of various expenses it is regarded as a key item for the

financial statement and therefore it is always exposed to misappropriation (Ruhnke, Pronobis

and Michel 2014). The auditor shall perform substantive procedure that is verification of

actual numbers under the financial statements. Further, for performing audit with regard to

sales revenues the auditor shall discuss recognition procedures and observe the method’s

application along with test for some of the transaction of sales.

5.4 Audit procedure - wages

While auditing for wages the auditor shall obtain the reasonable assurances that wages

expenses are reported accurately. Preliminary procedure for auditing wage balance is

confirmation from the wage register and employee register. The process of confirmation also

has the unintended advantage that is the auditor at the same time can confirm if the company

has any unpaid or arrear in wages or any wages is paid in advance. Further, all the payment

related vouchers and transactions shall be confirmed with the account balances. Further, for

the payments of big amounts proper authorization shall be checked with the authorised

person. The wage payments shall be matched with the employee register and their

entitlements (Leung et al. 2014). The auditor shall also verify the ledger account for each

shall recalculate the depreciation expenses taking into account the amount of accumulated

depreciation and reconcile the income statement with the balance sheet for analysing the

amount of depreciation (Wali 2015). Finally, the auditor shall perform the test for

reasonableness for evaluating that amount charged for depreciation was appropriate.

5.3 Audit procedure - sales

While carrying out the audit procedure for sales revenues the auditor shall use various

analytical procedures for analysing the recognition methods used by the entity. The auditor

shall further confirm the financial records for sales revenues with the transaction records. As

sales revenues can be used for paying of various expenses it is regarded as a key item for the

financial statement and therefore it is always exposed to misappropriation (Ruhnke, Pronobis

and Michel 2014). The auditor shall perform substantive procedure that is verification of

actual numbers under the financial statements. Further, for performing audit with regard to

sales revenues the auditor shall discuss recognition procedures and observe the method’s

application along with test for some of the transaction of sales.

5.4 Audit procedure - wages

While auditing for wages the auditor shall obtain the reasonable assurances that wages

expenses are reported accurately. Preliminary procedure for auditing wage balance is

confirmation from the wage register and employee register. The process of confirmation also

has the unintended advantage that is the auditor at the same time can confirm if the company

has any unpaid or arrear in wages or any wages is paid in advance. Further, all the payment

related vouchers and transactions shall be confirmed with the account balances. Further, for

the payments of big amounts proper authorization shall be checked with the authorised

person. The wage payments shall be matched with the employee register and their

entitlements (Leung et al. 2014). The auditor shall also verify the ledger account for each

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ISSUES IN AUDITING 9

wage payment transaction. Further, the auditor shall verify whether any new employee has

been engaged or retired and their payment details.

6.0 Fraud

Assessment of fraud risk is the tool used by the auditor to assess the risks of fraud

involved in internal control. Frauds are generally committed to get higher incentives or

rationalize any unjustified fraudulent activities. Therefore, even if the staffs of the company

are trustworthy there always exists the inherent risk of fraud with regard to some of the

accounts like cash, inventories and receivables. As these accounts are subject to

misstatement, theft, fraud and misappropriation the auditor shall check these accounts with

special attention (Louwers et al. 2015). Though no indication of fraud existed in case of

Fawn Enterprise, the auditor shall check for fraud risks.

wage payment transaction. Further, the auditor shall verify whether any new employee has

been engaged or retired and their payment details.

6.0 Fraud

Assessment of fraud risk is the tool used by the auditor to assess the risks of fraud

involved in internal control. Frauds are generally committed to get higher incentives or

rationalize any unjustified fraudulent activities. Therefore, even if the staffs of the company

are trustworthy there always exists the inherent risk of fraud with regard to some of the

accounts like cash, inventories and receivables. As these accounts are subject to

misstatement, theft, fraud and misappropriation the auditor shall check these accounts with

special attention (Louwers et al. 2015). Though no indication of fraud existed in case of

Fawn Enterprise, the auditor shall check for fraud risks.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ISSUES IN AUDITING 10

Reference

Arens, A.A., Elder, R.J., Beasley, M.S. and Hogan, C.E., 2016. Auditing and assurance

services. Pearson.

Byrnes, P.E., Al-Awadhi, C.A., Gullvist, B., Brown-Liburd, H., Teeter, C.R., Warren Jr, J.D.

and Vasarhelyi, M., 2015. Evolution of auditing: From the traditional approach to the future

audit. Audit Analytics, 71.

Christensen, B.E., Glover, S.M. and Wood, D.A., 2013. Extreme estimation uncertainty and

audit assurance. Current Issues in Auditing, 7(1), pp.P36-P42.

Coetzee, P. and Lubbe, D., 2014. Improving the efficiency and effectiveness of risk‐based

internal audit engagements. International Journal of Auditing, 18(2), pp.115-125.

Eilifsen, A. and Messier Jr, W.F., 2014. Materiality guidance of the major public accounting

firms. Auditing: A Journal of Practice & Theory, 34(2), pp.3-26.

Glover, S.M. and Prawitt, D.F., 2014. Enhancing auditor professional skepticism: The

professional skepticism continuum. Current Issues in Auditing, 8(2), pp.P1-P10.

Kharisova, F.I. and Kozlova, N.N., 2014. Applying the category of «Assertions (or

preconditions)» In audit of financial statement. Mediterranean Journal of Social

Sciences, 5(24), p.180.

Legoria, J., Melendrez, K.D. and Reynolds, J.K., 2013. Qualitative audit materiality and

earnings management. Review of Accounting Studies, 18(2), pp.414-442.

Leung, P., Coram, P., Cooper, B.J. and Richardson, P., 2014. Modern Auditing and

Assurance Services 6e. Wiley.

Reference

Arens, A.A., Elder, R.J., Beasley, M.S. and Hogan, C.E., 2016. Auditing and assurance

services. Pearson.

Byrnes, P.E., Al-Awadhi, C.A., Gullvist, B., Brown-Liburd, H., Teeter, C.R., Warren Jr, J.D.

and Vasarhelyi, M., 2015. Evolution of auditing: From the traditional approach to the future

audit. Audit Analytics, 71.

Christensen, B.E., Glover, S.M. and Wood, D.A., 2013. Extreme estimation uncertainty and

audit assurance. Current Issues in Auditing, 7(1), pp.P36-P42.

Coetzee, P. and Lubbe, D., 2014. Improving the efficiency and effectiveness of risk‐based

internal audit engagements. International Journal of Auditing, 18(2), pp.115-125.

Eilifsen, A. and Messier Jr, W.F., 2014. Materiality guidance of the major public accounting

firms. Auditing: A Journal of Practice & Theory, 34(2), pp.3-26.

Glover, S.M. and Prawitt, D.F., 2014. Enhancing auditor professional skepticism: The

professional skepticism continuum. Current Issues in Auditing, 8(2), pp.P1-P10.

Kharisova, F.I. and Kozlova, N.N., 2014. Applying the category of «Assertions (or

preconditions)» In audit of financial statement. Mediterranean Journal of Social

Sciences, 5(24), p.180.

Legoria, J., Melendrez, K.D. and Reynolds, J.K., 2013. Qualitative audit materiality and

earnings management. Review of Accounting Studies, 18(2), pp.414-442.

Leung, P., Coram, P., Cooper, B.J. and Richardson, P., 2014. Modern Auditing and

Assurance Services 6e. Wiley.

ISSUES IN AUDITING 11

Louwers, T.J., Ramsay, R.J., Sinason, D.H., Strawser, J.R. and Thibodeau, J.C., 2015.

Auditing & assurance services. McGraw-Hill Education.

Ruhnke, K., Pronobis, P. and Michel, M., 2014. Audit materiality disclosures and credit

lending decisions.

Titera, W.R., 2013. Updating audit standard—Enabling audit data analysis. Journal of

Information Systems, 27(1), pp.325-331.

Wali, S., 2015. Mechanisms of corporate governance and fixed asset

revaluation. International Journal of Accounting and Finance, 5(1), pp.82-97.

Louwers, T.J., Ramsay, R.J., Sinason, D.H., Strawser, J.R. and Thibodeau, J.C., 2015.

Auditing & assurance services. McGraw-Hill Education.

Ruhnke, K., Pronobis, P. and Michel, M., 2014. Audit materiality disclosures and credit

lending decisions.

Titera, W.R., 2013. Updating audit standard—Enabling audit data analysis. Journal of

Information Systems, 27(1), pp.325-331.

Wali, S., 2015. Mechanisms of corporate governance and fixed asset

revaluation. International Journal of Accounting and Finance, 5(1), pp.82-97.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.