Japan's Economy: Production Output, GDP, and Labor Market Analysis

VerifiedAdded on 2023/06/08

|10

|3438

|146

AI Summary

Japan is the third largest economy in the world with a strong work ethic and advanced technology. The country heavily relies on imported raw materials and fuels due to the lack of arable land. Japan's economy faced a severe recession during the global financial crisis, but the government's stimulus spending helped the recovery. The Abenomics policy aims to bring Japan out of deflationary recession through fiscal stimulus, unorthodox monetary policy, and structural reforms. Japan's unemployment rate has gradually declined, and the government provides job training courses and temporary job opportunities to counter unemployment caused by the recession.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Japan

Japan – the “Land of the Rising Sun” – a nation in East Asia formed by 6,852

islands in the Pacific Ocean. Japan got the third largest economy in the world

after the United States of America and China and the fifth largest importer and

exporter in the world. Due to the successes of the advanced car and consumer

electronics industries propelled Japan's rapid post-war expansion (Japan in brief,

n.d.). According to the report of Central Intelligence Agency, the GDP

composition per by sector is consists of Agriculture (1%), Industry (29.7%) and

Services (69.3%) (The World Factbook: JAPAN, 2018).

Main product produced by Japan (Workman, 2018):

1. Vehicles

2. Machinery

3. Electrical machinery

4. Chemical Product

5. Iron, steel

Major Export country (The World Factbook: JAPAN, 2018):

1. United State

2. China

3. South Korea

4. Hong Kong

5. Thailand

Example of Major Company:

1. Toyota Motor

2. Honda Moto

3. Nippon Telegraph & Tel

4. Canon

5. Softbank

Japan – the “Land of the Rising Sun” – a nation in East Asia formed by 6,852

islands in the Pacific Ocean. Japan got the third largest economy in the world

after the United States of America and China and the fifth largest importer and

exporter in the world. Due to the successes of the advanced car and consumer

electronics industries propelled Japan's rapid post-war expansion (Japan in brief,

n.d.). According to the report of Central Intelligence Agency, the GDP

composition per by sector is consists of Agriculture (1%), Industry (29.7%) and

Services (69.3%) (The World Factbook: JAPAN, 2018).

Main product produced by Japan (Workman, 2018):

1. Vehicles

2. Machinery

3. Electrical machinery

4. Chemical Product

5. Iron, steel

Major Export country (The World Factbook: JAPAN, 2018):

1. United State

2. China

3. South Korea

4. Hong Kong

5. Thailand

Example of Major Company:

1. Toyota Motor

2. Honda Moto

3. Nippon Telegraph & Tel

4. Canon

5. Softbank

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Overview

In the cooperation between government-industry, strong work ethic, mastery

develops in high-tech and smaller allocation in defense (1% of GDP) give Japan

an opportunity to develop a technologically advanced economy opportunity. Due

to the lack of arable land Japan's gradually reliant on imported raw material and

fuels, and highly subsidized and preserved on their limited agricultural industry.

They import around 60% of its food and self-sufficient in rice. Japan also had one

of the largest fishing fleets in the world and has about 15% of the global catch.

Although the financial sector wasn't severely imperiled to subprime mortgages

their derivative instruments and weathered the initial effect of the recent global

loan crisis, the acute decline on business investment and global need for Japan's

exportation during late 2008 bring Japan further into depression. The stimulus

spending by the government helped the recovery of the economy in late 2009

and 2010, but they also foresaw the GDP growth in 2011 would slow down.

Former Prime Minister Kan suggested to opening the agricultural and services

sector to strengthen the competitiveness to overseas and boost exporting

through free-trade agreements. The reasons cause the complexity of Japan's

economy are the massive government debts, which is about 200% of GDP,

persistent deflation and an aging and shrinking population (Japan’s Economy,

n.d.).

In the cooperation between government-industry, strong work ethic, mastery

develops in high-tech and smaller allocation in defense (1% of GDP) give Japan

an opportunity to develop a technologically advanced economy opportunity. Due

to the lack of arable land Japan's gradually reliant on imported raw material and

fuels, and highly subsidized and preserved on their limited agricultural industry.

They import around 60% of its food and self-sufficient in rice. Japan also had one

of the largest fishing fleets in the world and has about 15% of the global catch.

Although the financial sector wasn't severely imperiled to subprime mortgages

their derivative instruments and weathered the initial effect of the recent global

loan crisis, the acute decline on business investment and global need for Japan's

exportation during late 2008 bring Japan further into depression. The stimulus

spending by the government helped the recovery of the economy in late 2009

and 2010, but they also foresaw the GDP growth in 2011 would slow down.

Former Prime Minister Kan suggested to opening the agricultural and services

sector to strengthen the competitiveness to overseas and boost exporting

through free-trade agreements. The reasons cause the complexity of Japan's

economy are the massive government debts, which is about 200% of GDP,

persistent deflation and an aging and shrinking population (Japan’s Economy,

n.d.).

Production Output Performance Analysis

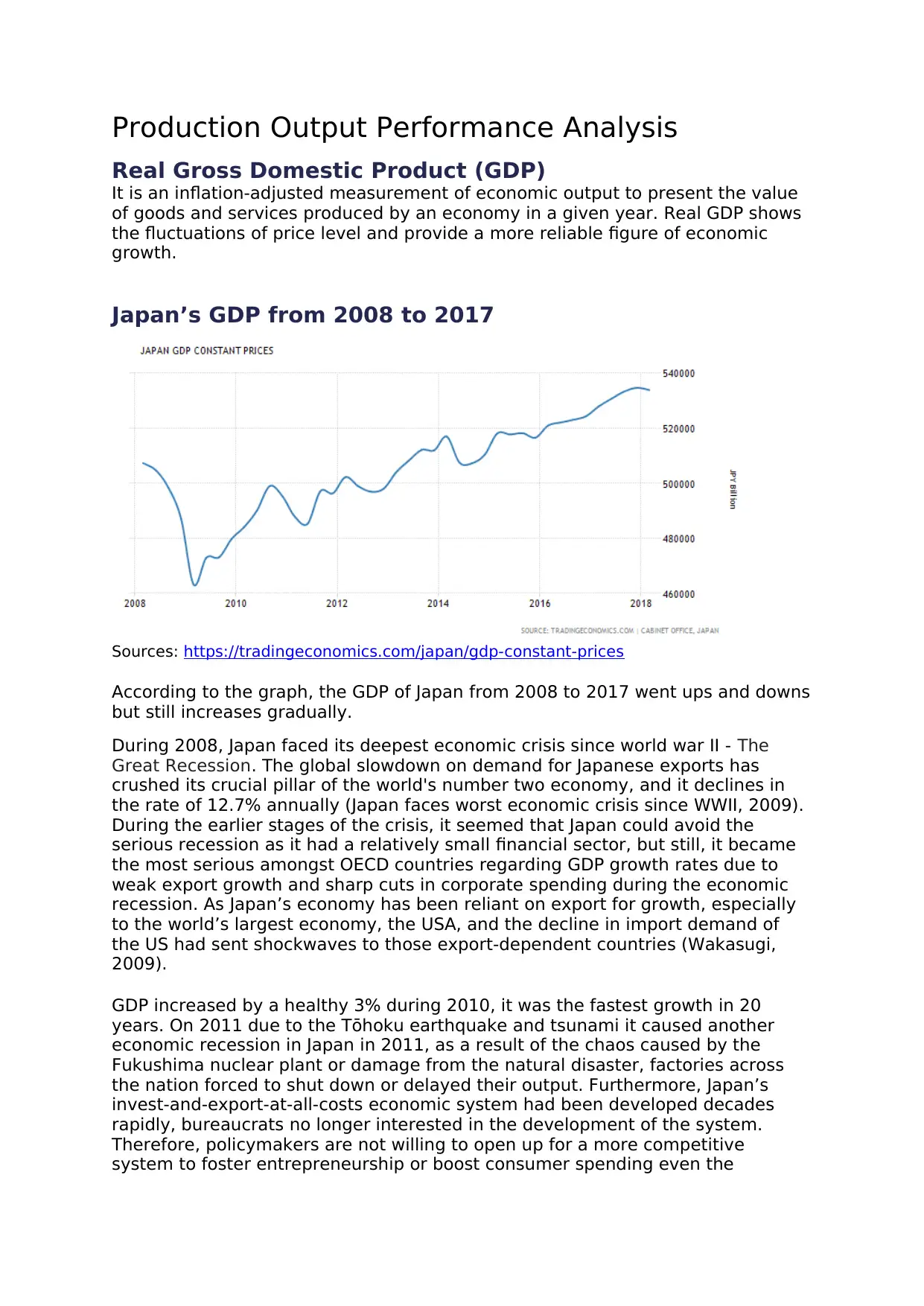

Real Gross Domestic Product (GDP)

It is an inflation-adjusted measurement of economic output to present the value

of goods and services produced by an economy in a given year. Real GDP shows

the fluctuations of price level and provide a more reliable figure of economic

growth.

Japan’s GDP from 2008 to 2017

Sources: https://tradingeconomics.com/japan/gdp-constant-prices

According to the graph, the GDP of Japan from 2008 to 2017 went ups and downs

but still increases gradually.

During 2008, Japan faced its deepest economic crisis since world war II - The

Great Recession. The global slowdown on demand for Japanese exports has

crushed its crucial pillar of the world's number two economy, and it declines in

the rate of 12.7% annually (Japan faces worst economic crisis since WWII, 2009).

During the earlier stages of the crisis, it seemed that Japan could avoid the

serious recession as it had a relatively small financial sector, but still, it became

the most serious amongst OECD countries regarding GDP growth rates due to

weak export growth and sharp cuts in corporate spending during the economic

recession. As Japan’s economy has been reliant on export for growth, especially

to the world’s largest economy, the USA, and the decline in import demand of

the US had sent shockwaves to those export-dependent countries (Wakasugi,

2009).

GDP increased by a healthy 3% during 2010, it was the fastest growth in 20

years. On 2011 due to the Tōhoku earthquake and tsunami it caused another

economic recession in Japan in 2011, as a result of the chaos caused by the

Fukushima nuclear plant or damage from the natural disaster, factories across

the nation forced to shut down or delayed their output. Furthermore, Japan’s

invest-and-export-at-all-costs economic system had been developed decades

rapidly, bureaucrats no longer interested in the development of the system.

Therefore, policymakers are not willing to open up for a more competitive

system to foster entrepreneurship or boost consumer spending even the

Real Gross Domestic Product (GDP)

It is an inflation-adjusted measurement of economic output to present the value

of goods and services produced by an economy in a given year. Real GDP shows

the fluctuations of price level and provide a more reliable figure of economic

growth.

Japan’s GDP from 2008 to 2017

Sources: https://tradingeconomics.com/japan/gdp-constant-prices

According to the graph, the GDP of Japan from 2008 to 2017 went ups and downs

but still increases gradually.

During 2008, Japan faced its deepest economic crisis since world war II - The

Great Recession. The global slowdown on demand for Japanese exports has

crushed its crucial pillar of the world's number two economy, and it declines in

the rate of 12.7% annually (Japan faces worst economic crisis since WWII, 2009).

During the earlier stages of the crisis, it seemed that Japan could avoid the

serious recession as it had a relatively small financial sector, but still, it became

the most serious amongst OECD countries regarding GDP growth rates due to

weak export growth and sharp cuts in corporate spending during the economic

recession. As Japan’s economy has been reliant on export for growth, especially

to the world’s largest economy, the USA, and the decline in import demand of

the US had sent shockwaves to those export-dependent countries (Wakasugi,

2009).

GDP increased by a healthy 3% during 2010, it was the fastest growth in 20

years. On 2011 due to the Tōhoku earthquake and tsunami it caused another

economic recession in Japan in 2011, as a result of the chaos caused by the

Fukushima nuclear plant or damage from the natural disaster, factories across

the nation forced to shut down or delayed their output. Furthermore, Japan’s

invest-and-export-at-all-costs economic system had been developed decades

rapidly, bureaucrats no longer interested in the development of the system.

Therefore, policymakers are not willing to open up for a more competitive

system to foster entrepreneurship or boost consumer spending even the

domestic economy is stunted, suffer from lack of investment, low standard

services, low productivity and high costs (Schuman, 2011).

Japan’s economy was rising, but due to the Senkaku Island dispute during 2012,

it slightly went down but still keep growing. After the ragged rise and fall from

2012 and 2013, on the mid-2013 Japan's economy finally went up slowly.

Unfortunately, it sank into recession again in the fourth quarter of 2015 due to

the sharp fall in inventories. Companies rather to building up shares and cutting

down their inventories (Harding, 2015).

The economic expansion during 2017 mostly came from aboard. The unusually

enthusiastic spending by Japanese consumers on April to June and the main

driver of growth from July to September was foreign trade. The central to Japan's

recovery has been exports part of it helped by the weak yen. The government’s

stimulus plan-Abenomics had requested the central bank to invest a massive

amount of money in the financial system, as a weaker yen make Japanese

products more attractive to overseas buyers. As for the domestic aspect, the

economy was weaker. According to the data, exports grew by 6% annually but

household consumption fell by 1.9%. On the other hand, business investment

had increased a healthy 1% it’s a sign that organization expects Japan's growth

streak will last longer (Soble, 2017).

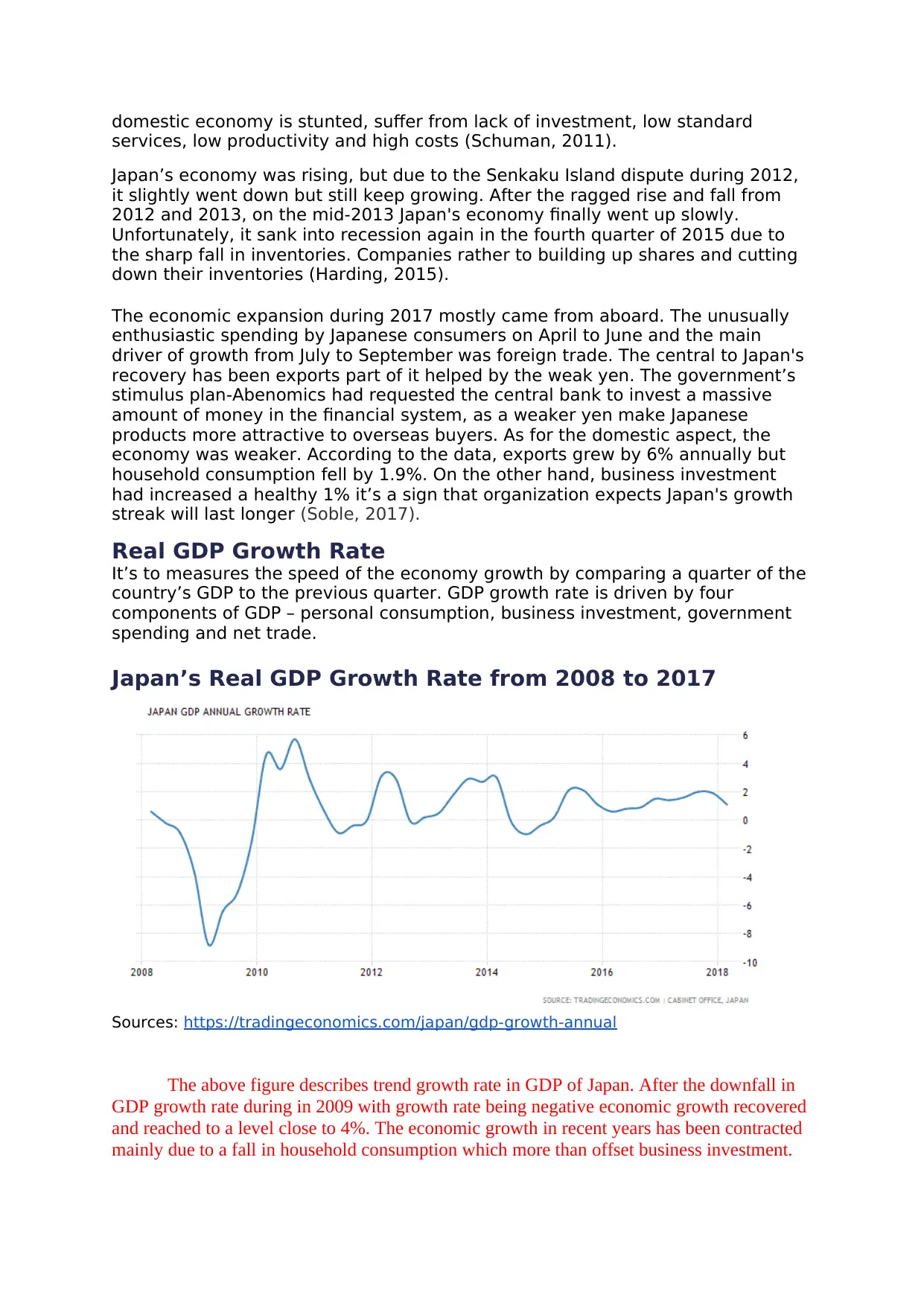

Real GDP Growth Rate

It’s to measures the speed of the economy growth by comparing a quarter of the

country’s GDP to the previous quarter. GDP growth rate is driven by four

components of GDP – personal consumption, business investment, government

spending and net trade.

Japan’s Real GDP Growth Rate from 2008 to 2017

Sources: https://tradingeconomics.com/japan/gdp-growth-annual

The above figure describes trend growth rate in GDP of Japan. After the downfall in

GDP growth rate during in 2009 with growth rate being negative economic growth recovered

and reached to a level close to 4%. The economic growth in recent years has been contracted

mainly due to a fall in household consumption which more than offset business investment.

services, low productivity and high costs (Schuman, 2011).

Japan’s economy was rising, but due to the Senkaku Island dispute during 2012,

it slightly went down but still keep growing. After the ragged rise and fall from

2012 and 2013, on the mid-2013 Japan's economy finally went up slowly.

Unfortunately, it sank into recession again in the fourth quarter of 2015 due to

the sharp fall in inventories. Companies rather to building up shares and cutting

down their inventories (Harding, 2015).

The economic expansion during 2017 mostly came from aboard. The unusually

enthusiastic spending by Japanese consumers on April to June and the main

driver of growth from July to September was foreign trade. The central to Japan's

recovery has been exports part of it helped by the weak yen. The government’s

stimulus plan-Abenomics had requested the central bank to invest a massive

amount of money in the financial system, as a weaker yen make Japanese

products more attractive to overseas buyers. As for the domestic aspect, the

economy was weaker. According to the data, exports grew by 6% annually but

household consumption fell by 1.9%. On the other hand, business investment

had increased a healthy 1% it’s a sign that organization expects Japan's growth

streak will last longer (Soble, 2017).

Real GDP Growth Rate

It’s to measures the speed of the economy growth by comparing a quarter of the

country’s GDP to the previous quarter. GDP growth rate is driven by four

components of GDP – personal consumption, business investment, government

spending and net trade.

Japan’s Real GDP Growth Rate from 2008 to 2017

Sources: https://tradingeconomics.com/japan/gdp-growth-annual

The above figure describes trend growth rate in GDP of Japan. After the downfall in

GDP growth rate during in 2009 with growth rate being negative economic growth recovered

and reached to a level close to 4%. The economic growth in recent years has been contracted

mainly due to a fall in household consumption which more than offset business investment.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

(tradingeconomics.com, 2018). In the last two years’ economic growth lies between 0 and 2

percent.

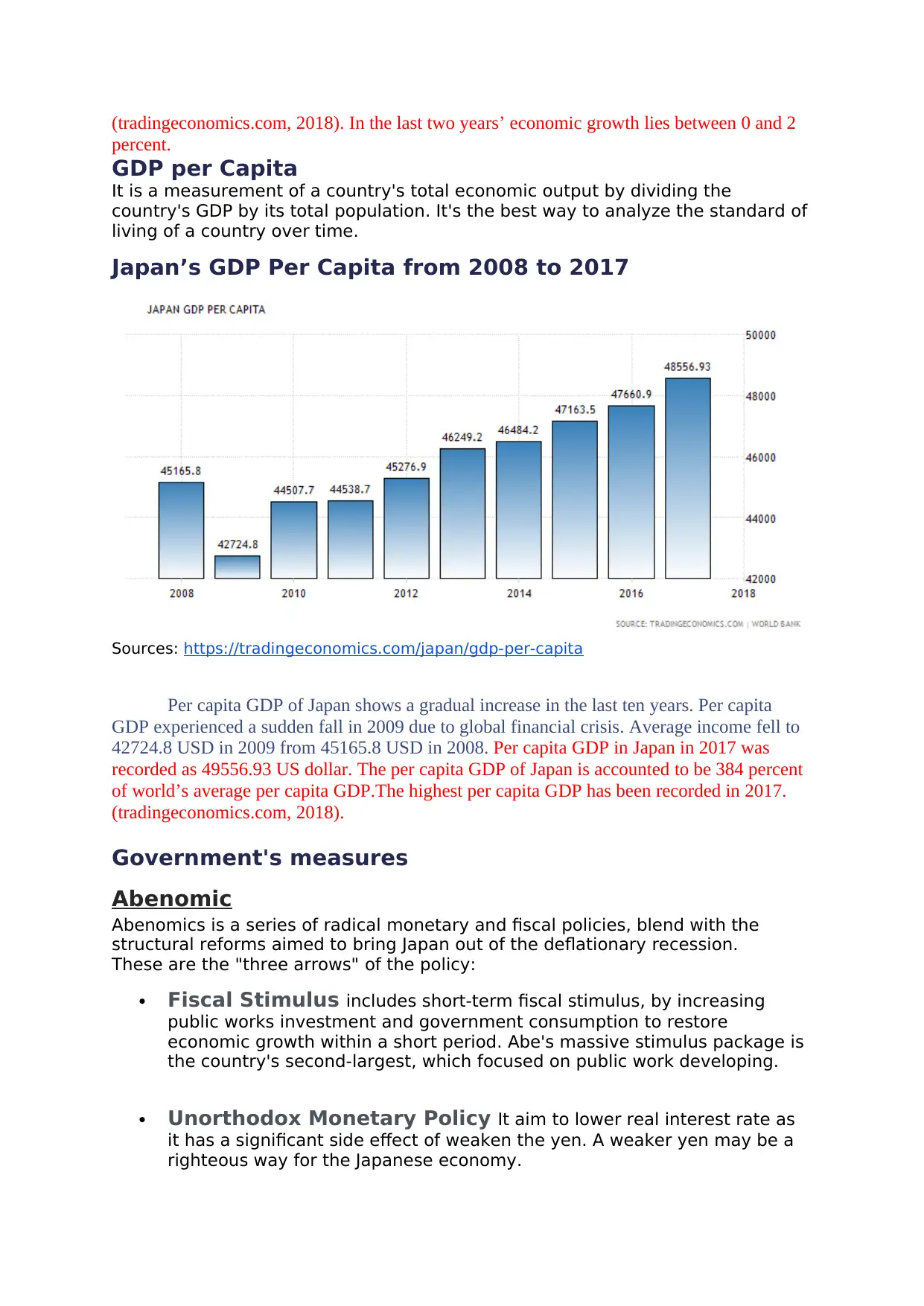

GDP per Capita

It is a measurement of a country's total economic output by dividing the

country's GDP by its total population. It's the best way to analyze the standard of

living of a country over time.

Japan’s GDP Per Capita from 2008 to 2017

Sources: https://tradingeconomics.com/japan/gdp-per-capita

Per capita GDP of Japan shows a gradual increase in the last ten years. Per capita

GDP experienced a sudden fall in 2009 due to global financial crisis. Average income fell to

42724.8 USD in 2009 from 45165.8 USD in 2008. Per capita GDP in Japan in 2017 was

recorded as 49556.93 US dollar. The per capita GDP of Japan is accounted to be 384 percent

of world’s average per capita GDP.The highest per capita GDP has been recorded in 2017.

(tradingeconomics.com, 2018).

Government's measures

Abenomic

Abenomics is a series of radical monetary and fiscal policies, blend with the

structural reforms aimed to bring Japan out of the deflationary recession.

These are the "three arrows" of the policy:

Fiscal Stimulus includes short-term fiscal stimulus, by increasing

public works investment and government consumption to restore

economic growth within a short period. Abe's massive stimulus package is

the country's second-largest, which focused on public work developing.

Unorthodox Monetary Policy It aim to lower real interest rate as

it has a significant side effect of weaken the yen. A weaker yen may be a

righteous way for the Japanese economy.

percent.

GDP per Capita

It is a measurement of a country's total economic output by dividing the

country's GDP by its total population. It's the best way to analyze the standard of

living of a country over time.

Japan’s GDP Per Capita from 2008 to 2017

Sources: https://tradingeconomics.com/japan/gdp-per-capita

Per capita GDP of Japan shows a gradual increase in the last ten years. Per capita

GDP experienced a sudden fall in 2009 due to global financial crisis. Average income fell to

42724.8 USD in 2009 from 45165.8 USD in 2008. Per capita GDP in Japan in 2017 was

recorded as 49556.93 US dollar. The per capita GDP of Japan is accounted to be 384 percent

of world’s average per capita GDP.The highest per capita GDP has been recorded in 2017.

(tradingeconomics.com, 2018).

Government's measures

Abenomic

Abenomics is a series of radical monetary and fiscal policies, blend with the

structural reforms aimed to bring Japan out of the deflationary recession.

These are the "three arrows" of the policy:

Fiscal Stimulus includes short-term fiscal stimulus, by increasing

public works investment and government consumption to restore

economic growth within a short period. Abe's massive stimulus package is

the country's second-largest, which focused on public work developing.

Unorthodox Monetary Policy It aim to lower real interest rate as

it has a significant side effect of weaken the yen. A weaker yen may be a

righteous way for the Japanese economy.

First and foremost, it encourages exports as other currencies can afford

more Japanese-produce products which will boost corporate earnings and

increased business investment. A weaker yen also provides fuel for stocks

in the same time.

Furthermore, with higher share prices, Companies are easier to raise fund

and more likely to invest in businesses expansion

For households, by increasing the value of shareholding and indicate the

health of the economy will boost the enthusiasm of spending

Lastly, the Structural Reform plans- including cutting business

regulations, expanding labor market and agricultural sector, reduce

companies’ taxes and increase labor diversity to bring back Japan's

competitiveness.

"The key to improving medium-term growth potential," economists Nomura

said.

It will be hard for Japan to expand the economy in the medium term just

through fiscal spending due to the government debs are extended to more

than 200% of GDP, unless economic growth can be enhanced by the

governments' growth strategy otherwise any resultant move of deflation is

short-lived. As the outcomes of bold monetary easing are mainly relaid by

the expectations of the financial and capital market. (Boesler 2013)

Government's measures

During the year 2016, Shinō Abe launched a new ¥4.6tn ($45bn) stimulus to

drive up the struggling Japanese economy to shift Japan from the front of global

austerity to the looser fiscal policy. It combines monetary and fiscal stimulus, as

Japan had been struggled with weak consumption and impediment exports from

stronger yen, which return to the basics of the Abenomics. The core of the

package is to help low-income pensioners and use eight years of soft

government loans to bring up the completion of the maglev train line from Tokyo

to Osaka (Harding, 2016).

The Japanese government is also try to improve their economy and stop their

white-collar worker from working themselves to death by using a single phase-

Hatarakikata kaikaku or “work style reform”. It's promoted as a keyword to

reduce overtime, enhanced work-life balance and make better use of the skills of

female and elderly workers.

On the instruction of the government, many businesses are implementing

hatarakikata kaikaku to reduce overtime by force employees to leave earlier,

they even turn off the lights at specific times or require overtime permits. Yet

they also allow employees to telework, promoting ‘womenomics’ and offer

support to working parents such as reduce working hours. (Kopp, 2017).

Labour Market Analysis

Unemployment Rates

It is the percentage of the labor force that are unemployed by dividing the

number of people unemployed by labor force.

more Japanese-produce products which will boost corporate earnings and

increased business investment. A weaker yen also provides fuel for stocks

in the same time.

Furthermore, with higher share prices, Companies are easier to raise fund

and more likely to invest in businesses expansion

For households, by increasing the value of shareholding and indicate the

health of the economy will boost the enthusiasm of spending

Lastly, the Structural Reform plans- including cutting business

regulations, expanding labor market and agricultural sector, reduce

companies’ taxes and increase labor diversity to bring back Japan's

competitiveness.

"The key to improving medium-term growth potential," economists Nomura

said.

It will be hard for Japan to expand the economy in the medium term just

through fiscal spending due to the government debs are extended to more

than 200% of GDP, unless economic growth can be enhanced by the

governments' growth strategy otherwise any resultant move of deflation is

short-lived. As the outcomes of bold monetary easing are mainly relaid by

the expectations of the financial and capital market. (Boesler 2013)

Government's measures

During the year 2016, Shinō Abe launched a new ¥4.6tn ($45bn) stimulus to

drive up the struggling Japanese economy to shift Japan from the front of global

austerity to the looser fiscal policy. It combines monetary and fiscal stimulus, as

Japan had been struggled with weak consumption and impediment exports from

stronger yen, which return to the basics of the Abenomics. The core of the

package is to help low-income pensioners and use eight years of soft

government loans to bring up the completion of the maglev train line from Tokyo

to Osaka (Harding, 2016).

The Japanese government is also try to improve their economy and stop their

white-collar worker from working themselves to death by using a single phase-

Hatarakikata kaikaku or “work style reform”. It's promoted as a keyword to

reduce overtime, enhanced work-life balance and make better use of the skills of

female and elderly workers.

On the instruction of the government, many businesses are implementing

hatarakikata kaikaku to reduce overtime by force employees to leave earlier,

they even turn off the lights at specific times or require overtime permits. Yet

they also allow employees to telework, promoting ‘womenomics’ and offer

support to working parents such as reduce working hours. (Kopp, 2017).

Labour Market Analysis

Unemployment Rates

It is the percentage of the labor force that are unemployed by dividing the

number of people unemployed by labor force.

Type of Unemployment:

1. Frictional Unemployment

Unemployment that arises because of workers who are search for a new

job.

2. Structural Unemployment

Happened when demand increases for some skill while another skill are no

longer in demand.

3. Cyclical Unemployment

Emerge due to the downturn in the overall of business cycle

Types of Unemployment in Japan

Structural unemployment

The manufacturing industry in Japan experienced a contraction in

employment opportunity due to shift of production units to overseas and

increasing dependency on imported items from other Asian countries. In contrast

to job losses in manufacturing sector, nursing industry suffers from a shortage of

labour. This kind of mismatch results in structural unemployment (Lin &

Miyamoto, 2012).

Cyclical Unemployment

The cyclical unemployment in Japan caused from the hit of global

recession and different natural disaster like Tsunami and others. During this

time, large number of people become unemployed as employer seeks to reduce

their work force to cut down wage costs.

Frictional Unemployment

Frictional unemployment is not a major problem in Japan because of

different government measures. Government provides opportunities for job

recruitment to new graduates (Chen et al., 2012). In Japan, people hardly have any

attitude towards shifting their jobs which help to minimize frictional

unemployment in the economy.

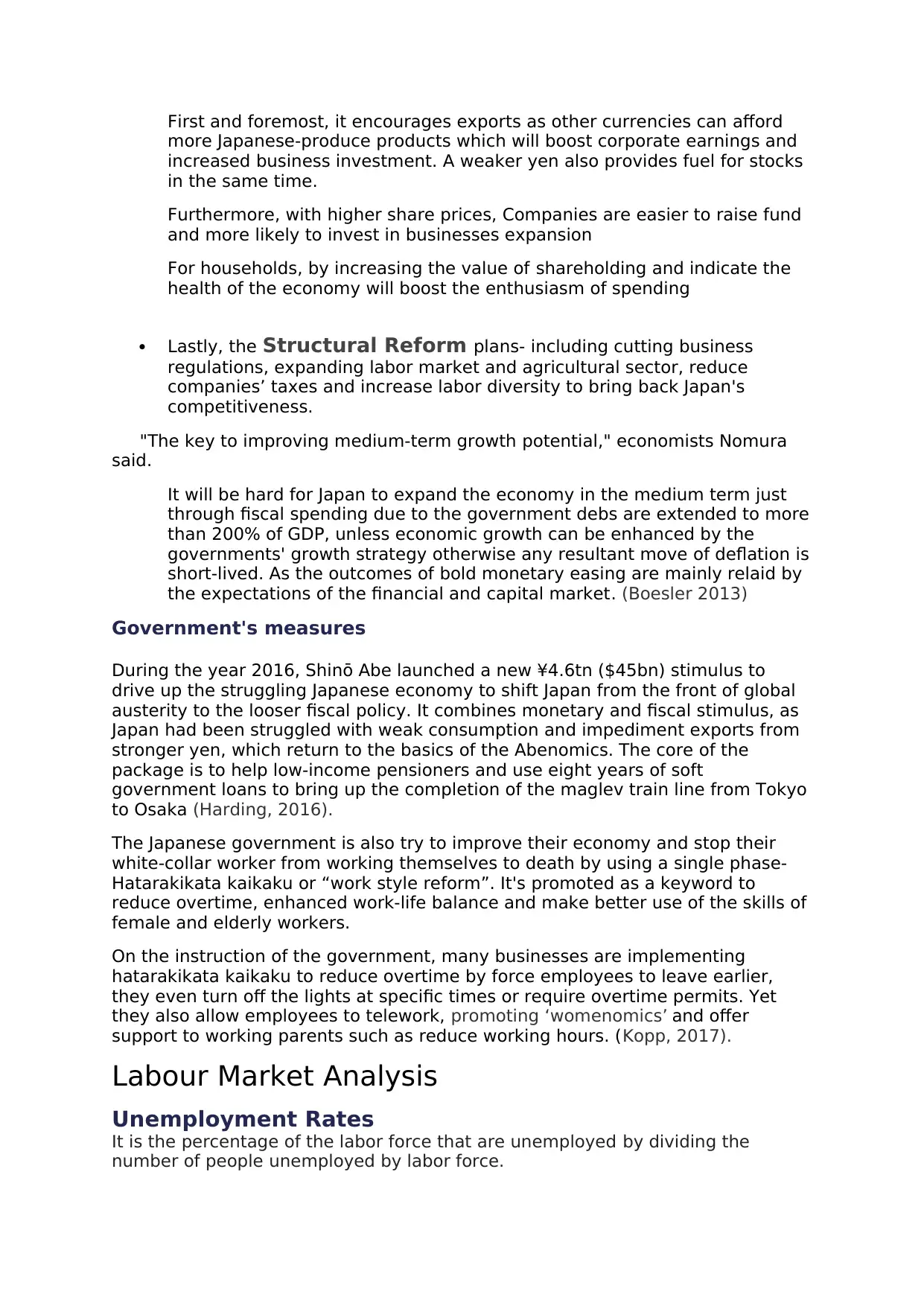

Japan’s Unemployment Rates from 2008 to 2017

Sources: https://tradingeconomics.com/japan/unemployment-rate

1. Frictional Unemployment

Unemployment that arises because of workers who are search for a new

job.

2. Structural Unemployment

Happened when demand increases for some skill while another skill are no

longer in demand.

3. Cyclical Unemployment

Emerge due to the downturn in the overall of business cycle

Types of Unemployment in Japan

Structural unemployment

The manufacturing industry in Japan experienced a contraction in

employment opportunity due to shift of production units to overseas and

increasing dependency on imported items from other Asian countries. In contrast

to job losses in manufacturing sector, nursing industry suffers from a shortage of

labour. This kind of mismatch results in structural unemployment (Lin &

Miyamoto, 2012).

Cyclical Unemployment

The cyclical unemployment in Japan caused from the hit of global

recession and different natural disaster like Tsunami and others. During this

time, large number of people become unemployed as employer seeks to reduce

their work force to cut down wage costs.

Frictional Unemployment

Frictional unemployment is not a major problem in Japan because of

different government measures. Government provides opportunities for job

recruitment to new graduates (Chen et al., 2012). In Japan, people hardly have any

attitude towards shifting their jobs which help to minimize frictional

unemployment in the economy.

Japan’s Unemployment Rates from 2008 to 2017

Sources: https://tradingeconomics.com/japan/unemployment-rate

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

As indicated from the trend unemployment rate Japan experienced an

overtime decline in the unemployment rate. The hit of global recession

aggravated unemployment problem in Japan with rate of unemployment

increased to 5.05 percent in the year 2009 and 2010. The recorded

unemployment rate again declined from 2010. Unemployment varied between

5.05 to 4.07 between 2010 and 2013. Lowest unemployment is in the year 2018

and unemployment rate reached to the level close to 2 percent (Kakinaka &

Miyamoto, 2012).

Government's measures

Before 2008, Japan hold the position of one of the largest economy in the world.

During global financial crisis, the export sector of Japan experienced a break down. Export

being one of the major support of the economy, slow-down in export sector resulted in an

economy wide recession and cyclical unemployment. In order to improve labour market

condition government provided different job training courses to those searching for jobs with

special attention given on students in colleges and universities (Campbell, 2014). In order to

counter unemployment caused from the hit of recession, the labour ministry held conference

to promote employment through job support program to victim of the disaster. Government

also has created temporary job opportunities in the field of medical service, welfare,

reconstruction of public facilities and water supply.

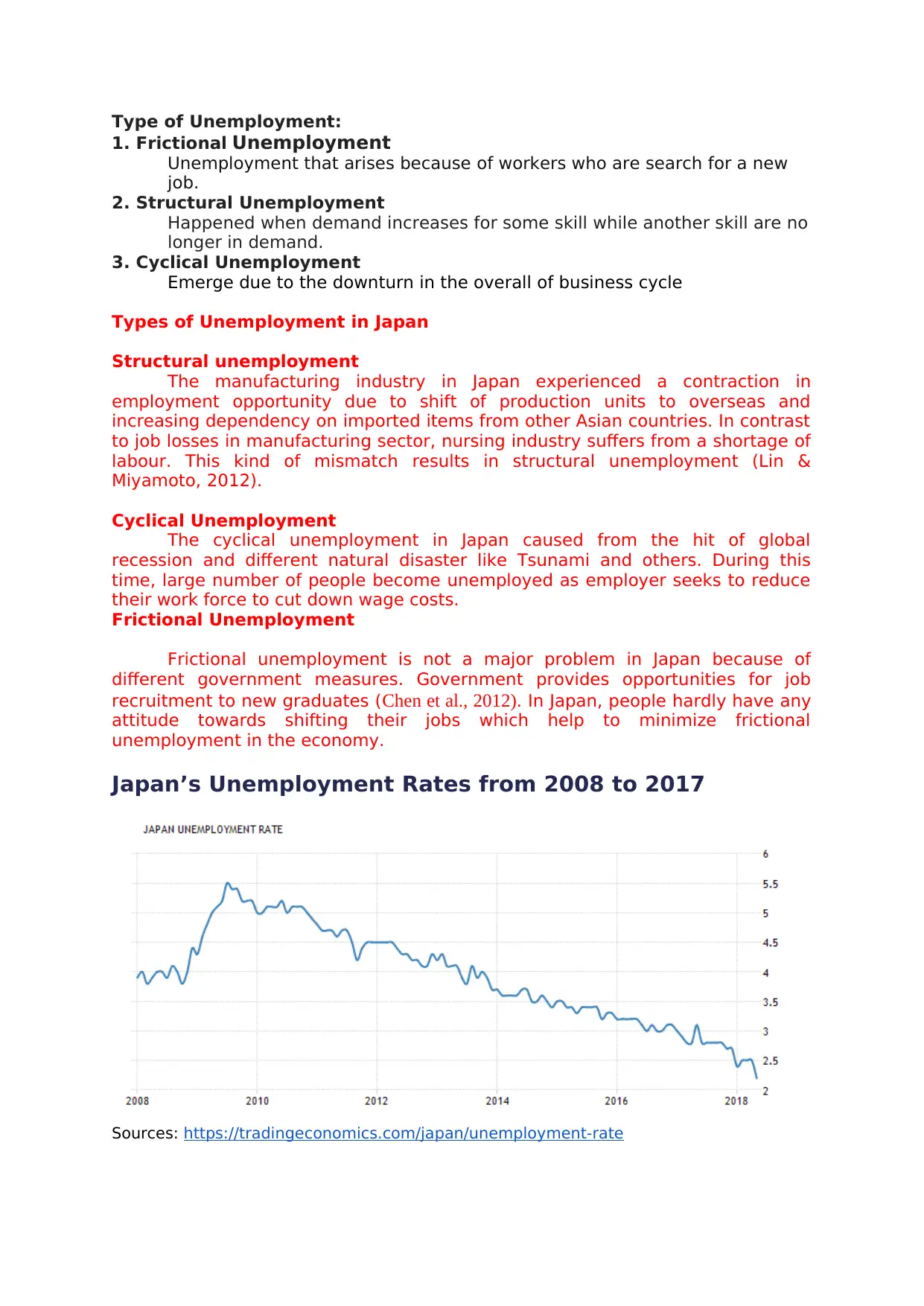

Price Level Analysis

Inflation Rates

Japan’s Inflation Rates from 2008 to 2017

Sources: https://tradingeconomics.com/japan/inflation-cpi

The above figure demonstrates the trend inflation rate in Japan from 2008

to 2017. The inflation rate was negative between 2009 and 2010 as the country

experienced a recession during this time. The price level gradually recovered

from 2011 onwards. The price level strengthened mainly due to Yen depreciation

and higher price of gasoline. Inflation during this time reached close to 4%.

Inflation then began to fall due to decrease in prices of major categories in

affecting the measured consumer price index. The food price grew at a much

overtime decline in the unemployment rate. The hit of global recession

aggravated unemployment problem in Japan with rate of unemployment

increased to 5.05 percent in the year 2009 and 2010. The recorded

unemployment rate again declined from 2010. Unemployment varied between

5.05 to 4.07 between 2010 and 2013. Lowest unemployment is in the year 2018

and unemployment rate reached to the level close to 2 percent (Kakinaka &

Miyamoto, 2012).

Government's measures

Before 2008, Japan hold the position of one of the largest economy in the world.

During global financial crisis, the export sector of Japan experienced a break down. Export

being one of the major support of the economy, slow-down in export sector resulted in an

economy wide recession and cyclical unemployment. In order to improve labour market

condition government provided different job training courses to those searching for jobs with

special attention given on students in colleges and universities (Campbell, 2014). In order to

counter unemployment caused from the hit of recession, the labour ministry held conference

to promote employment through job support program to victim of the disaster. Government

also has created temporary job opportunities in the field of medical service, welfare,

reconstruction of public facilities and water supply.

Price Level Analysis

Inflation Rates

Japan’s Inflation Rates from 2008 to 2017

Sources: https://tradingeconomics.com/japan/inflation-cpi

The above figure demonstrates the trend inflation rate in Japan from 2008

to 2017. The inflation rate was negative between 2009 and 2010 as the country

experienced a recession during this time. The price level gradually recovered

from 2011 onwards. The price level strengthened mainly due to Yen depreciation

and higher price of gasoline. Inflation during this time reached close to 4%.

Inflation then began to fall due to decrease in prices of major categories in

affecting the measured consumer price index. The food price grew at a much

slower pace due to decline in cost of cost of fish, seafood, eggs and other dairy

products, fresh food and fresh fruits. Cost increases at a relatively faster pace for

transport, communication, culture and recreation, medical care, health care and

education. In contrast, the cost of footwear and clothes remain almost flat (De

Michelis & Iacoviello, 2016). Following the inflation targeting policy of Bank of

Japan inflation in recent years has fluctuated between 0 to 2 percent.

Cause of inflation

The two primary cause of inflation include demand pull and cost push. The former is

caused due to an increase in aggregate demand while the latter is caused by an increase in

cost. Japan has experienced a long period of deflation, a situation where price level declines

gradually. The deflationary state of Japan is explained by the decrease in the supply of

money, excess supply of goods in combination with a decline in demand and a fall in money

demand. Deflation is again of two types Benign deflation and Malign deflation (Fuhrer,

Olivei & Tootell, 2012). The first is when price declines due to increase in productive

efficiency that result in an increase in aggregate supply. The malign deflation is caused due to

deficiency of aggregate demand. Japan experienced Malign inflation due to ageing population

causing decline in work force and decrease in money spent on goods and services.

Government's measures

Attaining a stable price level is one of the major goal of Bank of Japan. Stability in

the price level is important as it builds the foundation of economic activity of a nation. Bank

of Japan undertakes several measures to maintain a stable price. At September 2016, BOJ

conducted an assessment on monetary policy framework made of quantitative and qualitative

monetary easing. After that, bank introduced a new measure of which combines both

Quantity and Qualitative Monetary Easing and yield curve control. BOJ introduced the policy

of QQE in 2013 which made an improvement in price level through a decline in the real

interest rate (boj.or.jp, 2018). The policy of yield control curve causes a decline in real

interest rate through controlling the short term and long term interest rate in the economy.

Bank designs a policy of inflation overtook under which it continues to increase the monetary

base until the yearly inflation rate reached to the targeted level of 2%.

Conclusion

The paper briefly discusses economic performance of Japan in the past ten years.

Output performances are evaluated on the basis of real GDP, growth in real GDP and per

capita real GDP. The economy of Japan has experienced several years of recessionary

pressure. Economic growth though recovered after global financial crisis but the economy

grew at a moderate rate in the last few years. Under the framework of Abenomics policies

favourable to economic growth has been undertaken. Coming to labour market performance,

the economy mainly suffered from structural and cyclical unemployment. Because of

government’s supportive programs to new graduates, frictional unemployment is not a major

problem for Japan. After years of deflationary pressure, the economy is now in a path of [rice

stability due to correct design of monetary policy by Bank of Japan.

products, fresh food and fresh fruits. Cost increases at a relatively faster pace for

transport, communication, culture and recreation, medical care, health care and

education. In contrast, the cost of footwear and clothes remain almost flat (De

Michelis & Iacoviello, 2016). Following the inflation targeting policy of Bank of

Japan inflation in recent years has fluctuated between 0 to 2 percent.

Cause of inflation

The two primary cause of inflation include demand pull and cost push. The former is

caused due to an increase in aggregate demand while the latter is caused by an increase in

cost. Japan has experienced a long period of deflation, a situation where price level declines

gradually. The deflationary state of Japan is explained by the decrease in the supply of

money, excess supply of goods in combination with a decline in demand and a fall in money

demand. Deflation is again of two types Benign deflation and Malign deflation (Fuhrer,

Olivei & Tootell, 2012). The first is when price declines due to increase in productive

efficiency that result in an increase in aggregate supply. The malign deflation is caused due to

deficiency of aggregate demand. Japan experienced Malign inflation due to ageing population

causing decline in work force and decrease in money spent on goods and services.

Government's measures

Attaining a stable price level is one of the major goal of Bank of Japan. Stability in

the price level is important as it builds the foundation of economic activity of a nation. Bank

of Japan undertakes several measures to maintain a stable price. At September 2016, BOJ

conducted an assessment on monetary policy framework made of quantitative and qualitative

monetary easing. After that, bank introduced a new measure of which combines both

Quantity and Qualitative Monetary Easing and yield curve control. BOJ introduced the policy

of QQE in 2013 which made an improvement in price level through a decline in the real

interest rate (boj.or.jp, 2018). The policy of yield control curve causes a decline in real

interest rate through controlling the short term and long term interest rate in the economy.

Bank designs a policy of inflation overtook under which it continues to increase the monetary

base until the yearly inflation rate reached to the targeted level of 2%.

Conclusion

The paper briefly discusses economic performance of Japan in the past ten years.

Output performances are evaluated on the basis of real GDP, growth in real GDP and per

capita real GDP. The economy of Japan has experienced several years of recessionary

pressure. Economic growth though recovered after global financial crisis but the economy

grew at a moderate rate in the last few years. Under the framework of Abenomics policies

favourable to economic growth has been undertaken. Coming to labour market performance,

the economy mainly suffered from structural and cyclical unemployment. Because of

government’s supportive programs to new graduates, frictional unemployment is not a major

problem for Japan. After years of deflationary pressure, the economy is now in a path of [rice

stability due to correct design of monetary policy by Bank of Japan.

References

Campbell, J. C. (2014). How policies change: The Japanese government and the aging

society (Vol. 138). Princeton University Press.

Chen, J., Choi, Y. C., Mori, K., Sawada, Y., & Sugano, S. (2012). Recession, unemployment,

and suicide in Japan. Japan Labor Review, 9(2), 75-92.

De Michelis, A., & Iacoviello, M. (2016). Raising an inflation target: The Japanese

experience with Abenomics. European Economic Review, 88, 67-87.

Fuhrer, J. C., Olivei, G. P., & Tootell, G. M. (2012). Inflation dynamics when inflation is

near zero. Journal of Money, Credit and Banking, 44, 83-122.

Japan GDP Annual Growth Rate | 1981-2018 | Data | Chart | Calendar. (2018). Retrieved

from https://tradingeconomics.com/japan/gdp-growth-annual

Kakinaka, M., & Miyamoto, H. (2012). Unemployment and labour force participation in

Japan. Applied Economics Letters, 19(11), 1039-1043.

Lin, C. Y., & Miyamoto, H. (2012). Gross worker flows and unemployment dynamics in

Japan. Journal of the Japanese and International Economies, 26(1), 44-61.

"Price Stability Target" of 2 Percent and "Quantitative and Qualitative Monetary Easing with

Yield Curve Control": Bank of Japan. (2018). Retrieved from

https://www.boj.or.jp/en/mopo/outline/qqe.htm/

Campbell, J. C. (2014). How policies change: The Japanese government and the aging

society (Vol. 138). Princeton University Press.

Chen, J., Choi, Y. C., Mori, K., Sawada, Y., & Sugano, S. (2012). Recession, unemployment,

and suicide in Japan. Japan Labor Review, 9(2), 75-92.

De Michelis, A., & Iacoviello, M. (2016). Raising an inflation target: The Japanese

experience with Abenomics. European Economic Review, 88, 67-87.

Fuhrer, J. C., Olivei, G. P., & Tootell, G. M. (2012). Inflation dynamics when inflation is

near zero. Journal of Money, Credit and Banking, 44, 83-122.

Japan GDP Annual Growth Rate | 1981-2018 | Data | Chart | Calendar. (2018). Retrieved

from https://tradingeconomics.com/japan/gdp-growth-annual

Kakinaka, M., & Miyamoto, H. (2012). Unemployment and labour force participation in

Japan. Applied Economics Letters, 19(11), 1039-1043.

Lin, C. Y., & Miyamoto, H. (2012). Gross worker flows and unemployment dynamics in

Japan. Journal of the Japanese and International Economies, 26(1), 44-61.

"Price Stability Target" of 2 Percent and "Quantitative and Qualitative Monetary Easing with

Yield Curve Control": Bank of Japan. (2018). Retrieved from

https://www.boj.or.jp/en/mopo/outline/qqe.htm/

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.