Detailed Report: JD Sports' Financials, Strategy, and Performance

VerifiedAdded on 2021/09/10

|11

|2842

|332

Report

AI Summary

This report provides an in-depth analysis of JD Sports, a leading retailer of sports and casual wear. It begins by outlining the company's history, from its founding in 1981 to its current status as a publicly listed company on the London Stock Exchange. The report details JD Sports' objectives, including sustaining its market position through retail investments, brand acquisitions, and strong supplier relationships. It examines the company's director remuneration policies, significant shareholdings, and financial performance, highlighting revenue growth, gross margins, and operating profits. The analysis also covers JD Sports' financing strategies, key investments, and acquisitions, such as Size?, Footpatrol, and Chausport. Furthermore, the report discusses share price changes, total shareholder return, performance against the FTSE 250, and dividend history, providing a comprehensive overview of the company's financial health and strategic direction.

JD SPORTS 1

JD SPORTS

Student’s Name:

Lecture’s Name:

Institution:

Course:

Date:

Word Count:

JD SPORTS

Student’s Name:

Lecture’s Name:

Institution:

Course:

Date:

Word Count:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

JD SPORTS 2

Background & History of the Company

JD Sports is a retailer and distributor of sports and casual wear and is the leading

brand in UK in this market space. JD Sports was founded in 1981 by John Wardle & David

Makin (JD) from a single shop in Bury, Great Manchester, England which has now grown into

many branches throughout England and Europe. As the company continued to row, the founders

opened a new branch in 1983 at Arndale Centre, Manchester. The growth of the company

continued and by 1989, the company opened its first store in Oxford Street, London. Through

continuous growth since it was founded, the company was finally listed on the London Stock

Exchange in 1996 (JD Sports Fashion, PLC; Annual Report).

By December 2001, JD had acquired 200 more stores throughout England. The

company did this by first acquiring stores from Blacks Leisure Group called First Sport. JD then

acquired 70 more stores in October 2005 from Allsports administrators. In May 2005, John and

David who were the founders of JD Sports and the company’s largest shareholders sold their

shares for £44.6 Million to the Pentland Group. After the purchase, the founders resigned from

JD’s board of directors. The company continued to grow and in December 2007, it purchased

Bank Store a fashion clothing retail outlet for £19M. Bank Store sold fashion brands such as Alu,

Firetrap, Adidas Originals and Henleys (JD Sports Fashion, PLC; Annual Report).

JD Sports currently supplies and sponsors a large number of athletes, football teams

and sports associations; these include: Blackpool, Bournemouth, Luton Town, Dundee United

and Oldham Athletic. The sponsorship deals with these clubs allow them to us the Carbini brand.

JD Sports then expanded to France and acquired 75 small stores in May 2009 all which were

under the Chausport brand. JD also increased its acquisition by buying Champion Sports in

Background & History of the Company

JD Sports is a retailer and distributor of sports and casual wear and is the leading

brand in UK in this market space. JD Sports was founded in 1981 by John Wardle & David

Makin (JD) from a single shop in Bury, Great Manchester, England which has now grown into

many branches throughout England and Europe. As the company continued to row, the founders

opened a new branch in 1983 at Arndale Centre, Manchester. The growth of the company

continued and by 1989, the company opened its first store in Oxford Street, London. Through

continuous growth since it was founded, the company was finally listed on the London Stock

Exchange in 1996 (JD Sports Fashion, PLC; Annual Report).

By December 2001, JD had acquired 200 more stores throughout England. The

company did this by first acquiring stores from Blacks Leisure Group called First Sport. JD then

acquired 70 more stores in October 2005 from Allsports administrators. In May 2005, John and

David who were the founders of JD Sports and the company’s largest shareholders sold their

shares for £44.6 Million to the Pentland Group. After the purchase, the founders resigned from

JD’s board of directors. The company continued to grow and in December 2007, it purchased

Bank Store a fashion clothing retail outlet for £19M. Bank Store sold fashion brands such as Alu,

Firetrap, Adidas Originals and Henleys (JD Sports Fashion, PLC; Annual Report).

JD Sports currently supplies and sponsors a large number of athletes, football teams

and sports associations; these include: Blackpool, Bournemouth, Luton Town, Dundee United

and Oldham Athletic. The sponsorship deals with these clubs allow them to us the Carbini brand.

JD Sports then expanded to France and acquired 75 small stores in May 2009 all which were

under the Chausport brand. JD also increased its acquisition by buying Champion Sports in

JD SPORTS 3

January 2011 for £19.6M. JD also bought a conflicted Blacks Leisure Group in January 2012 for

an amounted that totaled to £20M. The company also acquired Streetwear which is also a

clothing brand in February 2012 for an undisclosed amount. JD also bought Cloggs, in February

2013 which was an established brand in shoe retailing. Finally, JD sports acquired Go Outdoors

in 2016 for £112M. JD Sports faces significant competition in its environment from

organizations such as Auto Trader Group Plc, Inchcape Plc, Sports Direct International Plc, BCA

Marketplace Plc, Card Factory Plc and WH Smith Plc (JD Sports Fashion, PLC; Annual Report).

Objectives of the company

Throughout the years, JD Sports has established itself as the top retailer of own

brand and branded sports fashion apparel, casualwear and footwear in both the United Kingdom

and Ireland. The objectives of the company is to sustain their strong market position in coming

years even as the competition grows stronger. This will be done by the continued investment in

retail stores, nurturing of good relationships with global brand suppliers and acquisition of

different brands and retail stores throughout Europe and overseas which have the potential to be

developed and exploited for the benefit of the group’s brand which is known to offer and

appealing products in stores with vibrant atmospheres (JD Sports Fashion, PLC; Annual Report).

JD Sports fundamental business strength is their consumers who are either Outdoor

or Sport Fashion oriented. To retain their leading position, JD Sports main objective is therefore

to provide a wide variety of brands to select from. This is achieved by the introduction of own

brands to act as complementary brands to the existing global brands and also working

consistently to be the partner of choice with various international brands. The Group seeks to

record profits in all the businesses they acquired as their medium term goals. For their ultimate

January 2011 for £19.6M. JD also bought a conflicted Blacks Leisure Group in January 2012 for

an amounted that totaled to £20M. The company also acquired Streetwear which is also a

clothing brand in February 2012 for an undisclosed amount. JD also bought Cloggs, in February

2013 which was an established brand in shoe retailing. Finally, JD sports acquired Go Outdoors

in 2016 for £112M. JD Sports faces significant competition in its environment from

organizations such as Auto Trader Group Plc, Inchcape Plc, Sports Direct International Plc, BCA

Marketplace Plc, Card Factory Plc and WH Smith Plc (JD Sports Fashion, PLC; Annual Report).

Objectives of the company

Throughout the years, JD Sports has established itself as the top retailer of own

brand and branded sports fashion apparel, casualwear and footwear in both the United Kingdom

and Ireland. The objectives of the company is to sustain their strong market position in coming

years even as the competition grows stronger. This will be done by the continued investment in

retail stores, nurturing of good relationships with global brand suppliers and acquisition of

different brands and retail stores throughout Europe and overseas which have the potential to be

developed and exploited for the benefit of the group’s brand which is known to offer and

appealing products in stores with vibrant atmospheres (JD Sports Fashion, PLC; Annual Report).

JD Sports fundamental business strength is their consumers who are either Outdoor

or Sport Fashion oriented. To retain their leading position, JD Sports main objective is therefore

to provide a wide variety of brands to select from. This is achieved by the introduction of own

brands to act as complementary brands to the existing global brands and also working

consistently to be the partner of choice with various international brands. The Group seeks to

record profits in all the businesses they acquired as their medium term goals. For their ultimate

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

JD SPORTS 4

objectives, JD Sports seeks to sustain a long-term growth in their earnings to ensure a growth I in

Total Shareholder Returns (TSR) through dividends and the overall performance of the share

price. The Group seeks to achieve this objective whilst maintaining their financial ability to

invest towards the growth of the business (JD Sports Fashion, PLC; Annual Report).

Directors’ interests and remuneration

On June 26, 2014, JD Sports shareholders held their AGM and approved the Director’s

remuneration policy. This policy acknowledges that JD Sports operates at a very competitive

retail space and therefore the acquisition of a high caliber Executive Director is critical to the

company’s success. Therefore, it was necessary for the Group to come up with a remuneration

policy that is appropriate to attract, motivate and retain an individual of such caliber.

Remuneration should be consistent to the performance of the group over its medium and long

term existence, to ensure both the shareholders and the business experience growth in their

earnings (JD Sports Fashion, PLC; Annual Report).

Due to these factors, JD Sports has created a Remuneration Committee. This committee is

made up of three independent Non-Executive Directors and its duties include determining the

company’s remuneration policy and determining the remuneration packages for both the senior

management and the Executive Directors. The committee also determines the terms and

conditions for service contracts signed by Executive directors among other duties such as

managing the terms of performance-oriented schemes run by the business and their

remunerations (JD Sports Fashion, PLC; Annual Report).

objectives, JD Sports seeks to sustain a long-term growth in their earnings to ensure a growth I in

Total Shareholder Returns (TSR) through dividends and the overall performance of the share

price. The Group seeks to achieve this objective whilst maintaining their financial ability to

invest towards the growth of the business (JD Sports Fashion, PLC; Annual Report).

Directors’ interests and remuneration

On June 26, 2014, JD Sports shareholders held their AGM and approved the Director’s

remuneration policy. This policy acknowledges that JD Sports operates at a very competitive

retail space and therefore the acquisition of a high caliber Executive Director is critical to the

company’s success. Therefore, it was necessary for the Group to come up with a remuneration

policy that is appropriate to attract, motivate and retain an individual of such caliber.

Remuneration should be consistent to the performance of the group over its medium and long

term existence, to ensure both the shareholders and the business experience growth in their

earnings (JD Sports Fashion, PLC; Annual Report).

Due to these factors, JD Sports has created a Remuneration Committee. This committee is

made up of three independent Non-Executive Directors and its duties include determining the

company’s remuneration policy and determining the remuneration packages for both the senior

management and the Executive Directors. The committee also determines the terms and

conditions for service contracts signed by Executive directors among other duties such as

managing the terms of performance-oriented schemes run by the business and their

remunerations (JD Sports Fashion, PLC; Annual Report).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

JD SPORTS 5

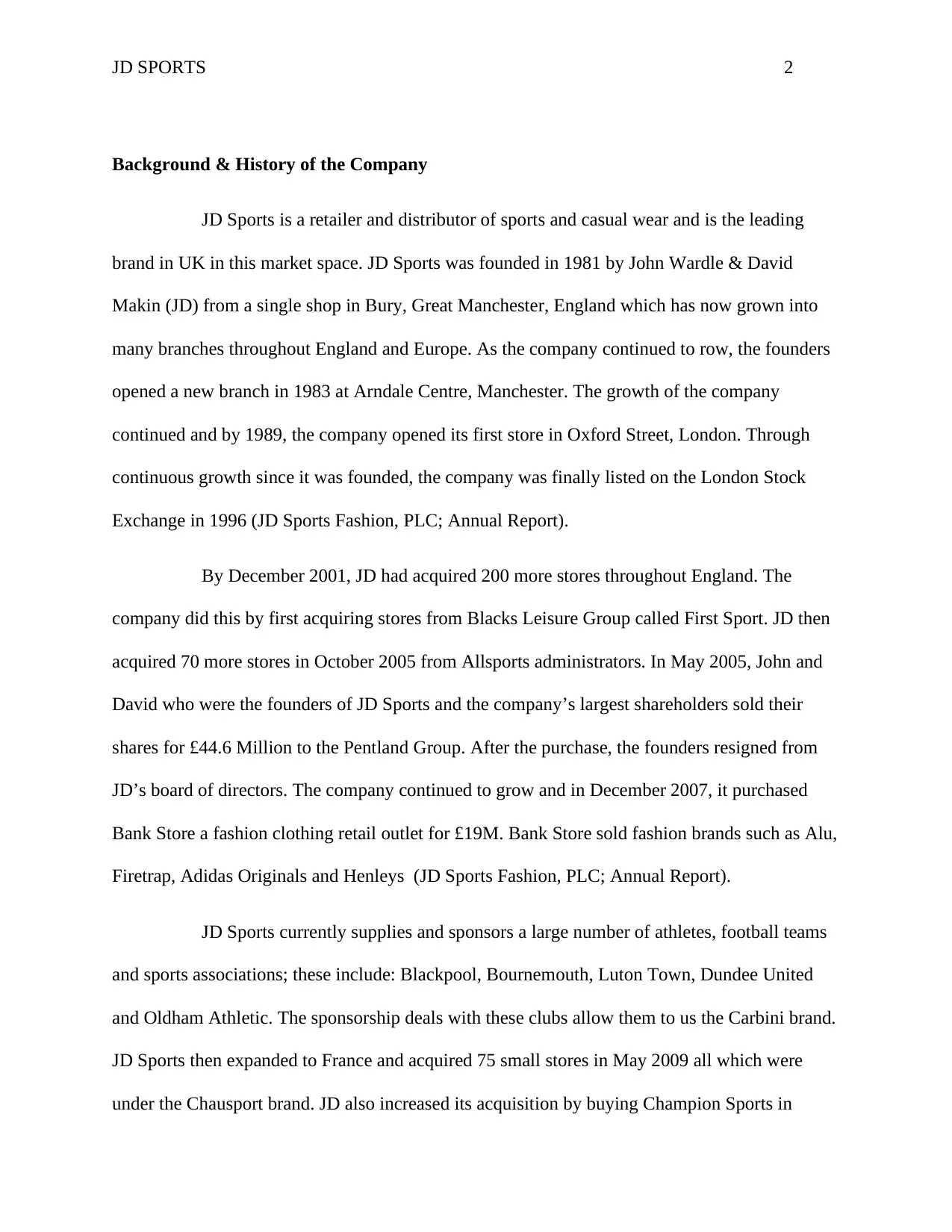

Significant shareholdings

JD Sports is listed in the London Stocks Exchange. Its top shareholders own 18.69%

of the company (JD Sports Fashion, PLC; Annual Report). These shareholders include;

Institutional Shareholders Shares %Held

BlackRock Advisors Ltd. (UK) 4.52M 0.46%

BlackRock Investment Management Ltd. (UK) 5.01M 0.52%

Legal & General Investment Management Ltd. 7.80M 0.80%

The Vanguard Group Inc. 8.34M 0.86%

Hargreave Hale Ltd. 9.58M 0.98%

Norges Bank Investment Management 15.74M 1.62%

JPMorgan Asset Management (UK) Ltd. 15.99M 1.64%

Standard Life Investments Ltd. 18.02M 1.85%

Old Mutual Global Investors (UK) Ltd. 48.30M 4.96%

Fidelity Management & Research Co. 48.56M 4.99%

Financial Analysis of recent performance

In 2016, JD Sports increased its total revenue by a 20% margin. 2016 saw the business

record an all-time high in the revenue collected by making £1,821.7M which was a 20%

improvement compared to the £1,522.3M collected in 205 as total revenues. An 11.6%

increment for like for like sales in 2016 for the 52 week long year was experienced across or

Group fascias owned by JD Sports including those outside Europe. JD Sports also recorded a

48.5% gross margin which was highly consistent to the numbers recorded in 2015 (JD Sports

Fashion, PLC; Annual Report).

JD Sports divides its business into two categories. The Sports Fashion and the Outdoor

fascias. In 2016, Sports Fashion performed exemplary with their operating profits increasing

from £109.3 M recorded in 2015, to £162.9M in 2016 a 49% jump. This is an indication that

Significant shareholdings

JD Sports is listed in the London Stocks Exchange. Its top shareholders own 18.69%

of the company (JD Sports Fashion, PLC; Annual Report). These shareholders include;

Institutional Shareholders Shares %Held

BlackRock Advisors Ltd. (UK) 4.52M 0.46%

BlackRock Investment Management Ltd. (UK) 5.01M 0.52%

Legal & General Investment Management Ltd. 7.80M 0.80%

The Vanguard Group Inc. 8.34M 0.86%

Hargreave Hale Ltd. 9.58M 0.98%

Norges Bank Investment Management 15.74M 1.62%

JPMorgan Asset Management (UK) Ltd. 15.99M 1.64%

Standard Life Investments Ltd. 18.02M 1.85%

Old Mutual Global Investors (UK) Ltd. 48.30M 4.96%

Fidelity Management & Research Co. 48.56M 4.99%

Financial Analysis of recent performance

In 2016, JD Sports increased its total revenue by a 20% margin. 2016 saw the business

record an all-time high in the revenue collected by making £1,821.7M which was a 20%

improvement compared to the £1,522.3M collected in 205 as total revenues. An 11.6%

increment for like for like sales in 2016 for the 52 week long year was experienced across or

Group fascias owned by JD Sports including those outside Europe. JD Sports also recorded a

48.5% gross margin which was highly consistent to the numbers recorded in 2015 (JD Sports

Fashion, PLC; Annual Report).

JD Sports divides its business into two categories. The Sports Fashion and the Outdoor

fascias. In 2016, Sports Fashion performed exemplary with their operating profits increasing

from £109.3 M recorded in 2015, to £162.9M in 2016 a 49% jump. This is an indication that

JD SPORTS 6

JD Sports was performing well in both its international and core markets. The overall gross

margins were slightly lower in 2016 as compared to 2015 a reflection of the impacts of a

weaker Euro throughout the year. JD Sports largely sources and distributes its products in the

United Kingdom. Though the Euro strengthened towards the end of 2016, the company is

still working out ways to mitigate or minimize the huge currency impacts on its global

brands. Finally, a pleasing progress was experienced when the net operating loss of the

Outdoor fascias reduced to £4.0M in 2016 as compared to the £7.1M net operating loss in

2015. Outdoor fascia stores which still remain at their trial stages showed much potential

with the Millets and Blacks fascia stores breaking even in 2016 (JD Sports Fashion, PLC;

Annual Report).

The financing of the company

JD Sports generated much of its cash from ongoing trading activities in their core retail

stores which was also supplemented by improving stock management. These factors

contributed to a balance £200M in excess cash. In this position, the Group is provided with

strong financing adequate to support the retail developments that are in progress in UK and

international markets. With this financial foundation, JD Sports was given the ability to

acquire new investments and acquisitions to improve the company’s strategic development

plan (JD Sports Fashion, PLC; Annual Report).

Significant investments/purchases by the company

Below is an insight of JD most recognizable brands, Investments and acquisitions;

JD Sports was performing well in both its international and core markets. The overall gross

margins were slightly lower in 2016 as compared to 2015 a reflection of the impacts of a

weaker Euro throughout the year. JD Sports largely sources and distributes its products in the

United Kingdom. Though the Euro strengthened towards the end of 2016, the company is

still working out ways to mitigate or minimize the huge currency impacts on its global

brands. Finally, a pleasing progress was experienced when the net operating loss of the

Outdoor fascias reduced to £4.0M in 2016 as compared to the £7.1M net operating loss in

2015. Outdoor fascia stores which still remain at their trial stages showed much potential

with the Millets and Blacks fascia stores breaking even in 2016 (JD Sports Fashion, PLC;

Annual Report).

The financing of the company

JD Sports generated much of its cash from ongoing trading activities in their core retail

stores which was also supplemented by improving stock management. These factors

contributed to a balance £200M in excess cash. In this position, the Group is provided with

strong financing adequate to support the retail developments that are in progress in UK and

international markets. With this financial foundation, JD Sports was given the ability to

acquire new investments and acquisitions to improve the company’s strategic development

plan (JD Sports Fashion, PLC; Annual Report).

Significant investments/purchases by the company

Below is an insight of JD most recognizable brands, Investments and acquisitions;

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

JD SPORTS 7

JD- JD has been acknowledged as the top brand and a lead specialists in the retail of trending

and fashionable branded and own brand for both sports apparel and casual wear throughout

the United Kingdom and the Republic of Ireland. JD retails globally recognized brands such

as Nike, Under Amour, Adidas and The North Face. JD also has strong own brands such as

Carbini, Mckenzie, the Duffer of St George and Supply & Demand. JD first venture outside

the European territory is the newly acquired store in Kuala Lumpur, Malaysia.

Size? - Size? Was established in 2000 and its specialty is in the supply and retail of most

fashionable brands in footwear, accessories and apparel. Size? Has stores in Germany, Italy,

France, Netherlands and Denmark and prides itself in the retail of highly sought out

exclusive footwear products released throughout the world.

Footpatrol- Footpatrol has grown to be recognized as one of the most popular sneaker retail

outlet and specialize in supplying the most exclusive sneakers in the global market.

Footpatrol specializes in limited edition sneakers, classic sneakers, rare dead stock and

Japanese exclusive sneakers. It’s located in Berwick Street, Soho.

Chausport- Chausport is one of JD’s acquisitions which operated in France and retails

globally leading footwear brands such as Adidas and Nike while also specializing in locally

appealing and specific brands such as Redskins.

Sprinter- Sprinter which was acquired in Spain specializes in the retail of footwear apparel,

sporting equipment, children’s wear and casual lifestyle wear for both own and international

brands.

JD- JD has been acknowledged as the top brand and a lead specialists in the retail of trending

and fashionable branded and own brand for both sports apparel and casual wear throughout

the United Kingdom and the Republic of Ireland. JD retails globally recognized brands such

as Nike, Under Amour, Adidas and The North Face. JD also has strong own brands such as

Carbini, Mckenzie, the Duffer of St George and Supply & Demand. JD first venture outside

the European territory is the newly acquired store in Kuala Lumpur, Malaysia.

Size? - Size? Was established in 2000 and its specialty is in the supply and retail of most

fashionable brands in footwear, accessories and apparel. Size? Has stores in Germany, Italy,

France, Netherlands and Denmark and prides itself in the retail of highly sought out

exclusive footwear products released throughout the world.

Footpatrol- Footpatrol has grown to be recognized as one of the most popular sneaker retail

outlet and specialize in supplying the most exclusive sneakers in the global market.

Footpatrol specializes in limited edition sneakers, classic sneakers, rare dead stock and

Japanese exclusive sneakers. It’s located in Berwick Street, Soho.

Chausport- Chausport is one of JD’s acquisitions which operated in France and retails

globally leading footwear brands such as Adidas and Nike while also specializing in locally

appealing and specific brands such as Redskins.

Sprinter- Sprinter which was acquired in Spain specializes in the retail of footwear apparel,

sporting equipment, children’s wear and casual lifestyle wear for both own and international

brands.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

JD SPORTS 8

Scotts- Scotts is a retail outlet which is more oriented to sports brands which appeal more to

older and affluent male consumers above school age. This store stock brands such as Pretty

Green, Adidas Originals, Fred Perry, Lacoste and EA7

Tessuti- Tessuti is a men’s fashion outlet that specialized in branded premium menswear.

Their stores offer a wide variety of brands which include Hugo Boss, Stone Island and Ralph

Lauren Polo.

JD Gyms- These are modern hi-tech gym and fitness facilities located in prime city center

locations throughout United Kingdom.

Blacks- Blacks has been established as retail store which specializes in footwear, outdoor

apparel and equipment. The chain has over sixty outlets and an online store.

Other mentionable investments and acquisitions of JD include; Mainline a menswear online

retailer, GetTheLabel- Online store retailing branded fashion wear, Kooga Design- retail and

wholesale store for rugby apparel, Focus, Kukri, Millets, Ultimate Outdoors, Source Lab,

Tiso and Nicholas Deakins.

Share price changes and calculations of total shareholder return and performance against

the FTSE 250 in the last 12 months.

The FTSE 250 Index is a capitalization-weighted index is made up of the 101st to the

350th largest companies which have been listed in the LSE. Calculation and the publication of

this list is done every minute and companies are promoted or demoted in the index on

quarterly basis throughout the year. In the financial year of 2016, JD Sports shareholders

Scotts- Scotts is a retail outlet which is more oriented to sports brands which appeal more to

older and affluent male consumers above school age. This store stock brands such as Pretty

Green, Adidas Originals, Fred Perry, Lacoste and EA7

Tessuti- Tessuti is a men’s fashion outlet that specialized in branded premium menswear.

Their stores offer a wide variety of brands which include Hugo Boss, Stone Island and Ralph

Lauren Polo.

JD Gyms- These are modern hi-tech gym and fitness facilities located in prime city center

locations throughout United Kingdom.

Blacks- Blacks has been established as retail store which specializes in footwear, outdoor

apparel and equipment. The chain has over sixty outlets and an online store.

Other mentionable investments and acquisitions of JD include; Mainline a menswear online

retailer, GetTheLabel- Online store retailing branded fashion wear, Kooga Design- retail and

wholesale store for rugby apparel, Focus, Kukri, Millets, Ultimate Outdoors, Source Lab,

Tiso and Nicholas Deakins.

Share price changes and calculations of total shareholder return and performance against

the FTSE 250 in the last 12 months.

The FTSE 250 Index is a capitalization-weighted index is made up of the 101st to the

350th largest companies which have been listed in the LSE. Calculation and the publication of

this list is done every minute and companies are promoted or demoted in the index on

quarterly basis throughout the year. In the financial year of 2016, JD Sports shareholders

JD SPORTS 9

enjoyed an increase in the basic earnings for every share from 36.17p in 2015 to 42.6% jump

into 2016 which translates to 50.16p (JD Sports Fashion, PLC; Annual Report).

Dividend history

For 2016, JD Sports Board of directors proposed paying 6.20p as the final dividend of the

year which shows a slight improvement from the 5.90p paid as dividends in 2015. Therefore

the overall dividend amount paid in 2016 was 7.40p which is a 5% improvement compared to

the overall 7.05p paid in dividends in 2015. These dividends were proposed to be paid by

August 1st 2016. The dividends given to JD Sports shareholders have increased with 64%

since 2010. JD Sports board of director believed that by paying that amount for dividends

created a win-win situation for the company’s shareholders who had invested in the company

and to the company because these investments allowed it to grow. This is an approach that

would increase the benefits of the shareholders in the long run. In 2016, the basics earnings

per share increased 50.16p, which is a 43% jump from 35.17p recorded in 2015. In addition

to this, in 2016, the adjusted earnings in each and every share before exceptional products

increase to 61.34p, a 58% jump from the 38.89p recorded in 2015 (JD Sports Fashion, PLC;

Annual Report).

Any other issues – ethics, audit comment, regulation, legislative changes, risks

JD Sports conducts independent audits to give opinions, comments and conclusions

on the company’s financial statements, tax reports, and annual reports among other internal

organization affairs. The Group also identifies several risk factors such as seasonality of the

enjoyed an increase in the basic earnings for every share from 36.17p in 2015 to 42.6% jump

into 2016 which translates to 50.16p (JD Sports Fashion, PLC; Annual Report).

Dividend history

For 2016, JD Sports Board of directors proposed paying 6.20p as the final dividend of the

year which shows a slight improvement from the 5.90p paid as dividends in 2015. Therefore

the overall dividend amount paid in 2016 was 7.40p which is a 5% improvement compared to

the overall 7.05p paid in dividends in 2015. These dividends were proposed to be paid by

August 1st 2016. The dividends given to JD Sports shareholders have increased with 64%

since 2010. JD Sports board of director believed that by paying that amount for dividends

created a win-win situation for the company’s shareholders who had invested in the company

and to the company because these investments allowed it to grow. This is an approach that

would increase the benefits of the shareholders in the long run. In 2016, the basics earnings

per share increased 50.16p, which is a 43% jump from 35.17p recorded in 2015. In addition

to this, in 2016, the adjusted earnings in each and every share before exceptional products

increase to 61.34p, a 58% jump from the 38.89p recorded in 2015 (JD Sports Fashion, PLC;

Annual Report).

Any other issues – ethics, audit comment, regulation, legislative changes, risks

JD Sports conducts independent audits to give opinions, comments and conclusions

on the company’s financial statements, tax reports, and annual reports among other internal

organization affairs. The Group also identifies several risk factors such as seasonality of the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

JD SPORTS 10

consumer trends, economic factors such as the Euro performing weakly, reliance on

manufacturers based outside the UK, Personnel risks, health and safety risks to both their clients

and their staff and compliance with all regulatory requirements among others. These risk pose

great threats to the business but the group has taken important steps to mitigate the possibility of

risk occurrence as seen in their annual report. JD Sports also involves itself corporate and social

activities such as promoting diversity and equality among its staff, preservation of the

environment by reducing the company’s carbon footprint, ethical sourcing of merchandise/

branded products, and involvement in community through funding, donating and contributing to

community projects such as the Teenage Cancer Trust (JD Sports Fashion, PLC; Annual Report).

Recommendation and reasons

The purpose of this report was for presentation to a potential investor. Currently JD

Sports is at the top of its market environment and shows no signs of slowing down. Though the

Group has improved year in year out since it was founded, it is difficult to predict the economic

status especially of the global market in the near future. However, JD Sports has taken the

initiative to expand its business territories into markets outside Europe to countries such as

Malaysia. Venturing in new markets at the global provides a wide range of economic

opportunities for JD Sports as a brand which most likely turn into economic growth. The

company is an already established brand in the UK and is making the right steps to become a

household name throughout Europe. The current returns per share as seen in the above report

indicate a significant return per share making JD Sports a very sound investment for any investor

who wishes to grow their wealth while also fulfilling their social responsibility.

consumer trends, economic factors such as the Euro performing weakly, reliance on

manufacturers based outside the UK, Personnel risks, health and safety risks to both their clients

and their staff and compliance with all regulatory requirements among others. These risk pose

great threats to the business but the group has taken important steps to mitigate the possibility of

risk occurrence as seen in their annual report. JD Sports also involves itself corporate and social

activities such as promoting diversity and equality among its staff, preservation of the

environment by reducing the company’s carbon footprint, ethical sourcing of merchandise/

branded products, and involvement in community through funding, donating and contributing to

community projects such as the Teenage Cancer Trust (JD Sports Fashion, PLC; Annual Report).

Recommendation and reasons

The purpose of this report was for presentation to a potential investor. Currently JD

Sports is at the top of its market environment and shows no signs of slowing down. Though the

Group has improved year in year out since it was founded, it is difficult to predict the economic

status especially of the global market in the near future. However, JD Sports has taken the

initiative to expand its business territories into markets outside Europe to countries such as

Malaysia. Venturing in new markets at the global provides a wide range of economic

opportunities for JD Sports as a brand which most likely turn into economic growth. The

company is an already established brand in the UK and is making the right steps to become a

household name throughout Europe. The current returns per share as seen in the above report

indicate a significant return per share making JD Sports a very sound investment for any investor

who wishes to grow their wealth while also fulfilling their social responsibility.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

JD SPORTS 11

References

"JD Sports Fashion PLC." JD Sports Fashion PLC, JD: LSE Summary - FT.com. N.p., n.d. Web.

05 June 2017. https://markets.ft.com/data/equities/tearsheet/summary?s=JD.:LSE (JD

Sports Fashion, PLC; Annual Report)

References

"JD Sports Fashion PLC." JD Sports Fashion PLC, JD: LSE Summary - FT.com. N.p., n.d. Web.

05 June 2017. https://markets.ft.com/data/equities/tearsheet/summary?s=JD.:LSE (JD

Sports Fashion, PLC; Annual Report)

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.