Johnson & Johnson: Macro-Environment and Competitive Analysis Report

VerifiedAdded on 2022/09/10

|18

|4340

|29

Report

AI Summary

This report offers a comprehensive analysis of Johnson & Johnson's competitive environment within the US pharmaceutical industry. It begins with a PESTLE analysis to assess the macro-environmental factors, including political, economic, social, technological, legal, and environmental influences. The report then applies Porter's Five Forces model to evaluate the industry's competitive landscape, examining the bargaining power of buyers and suppliers, the intensity of competitive rivalry, the threat of new entrants, and the threat of substitutes. Furthermore, the analysis delves into Johnson & Johnson's competitive advantages, strategies, and resources and capabilities, considering theories of competitive advantage and the company's strategic approach. The report concludes with a self-reflection on the skills developed through the analysis of the provided materials.

Johnson & Johnson competitive analysis

Name

Course

Name

Course

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

Executive summary

This report provides an analysis of the macro-environment of the US pharmaceutical industry by

using the PESTLE analysis. Also, it analyzes the market competitiveness by using the five forces

model to show the level of competitiveness of the market in which Johnson & Johnson operates.

In addition, the competitive advantage, strategy and resources and capabilities. The last section

provides a self-reflection of the studied materials in terms of developing self-skills.

Executive summary

This report provides an analysis of the macro-environment of the US pharmaceutical industry by

using the PESTLE analysis. Also, it analyzes the market competitiveness by using the five forces

model to show the level of competitiveness of the market in which Johnson & Johnson operates.

In addition, the competitive advantage, strategy and resources and capabilities. The last section

provides a self-reflection of the studied materials in terms of developing self-skills.

2

Table of Contents

Introduction....................................................................................................................................3

Part 1: A PESTLE analysis of the US pharmaceutical industry...............................................3

Part 2: Analysis of the industry competitiveness........................................................................5

Part 3: Johnson & Johnson competitiveness...............................................................................8

Part 4: Self reflection...................................................................................................................14

Conclusions...................................................................................................................................15

References......................................................................................................................................16

Table of Contents

Introduction....................................................................................................................................3

Part 1: A PESTLE analysis of the US pharmaceutical industry...............................................3

Part 2: Analysis of the industry competitiveness........................................................................5

Part 3: Johnson & Johnson competitiveness...............................................................................8

Part 4: Self reflection...................................................................................................................14

Conclusions...................................................................................................................................15

References......................................................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

Introduction

The US pharmaceutical industry witnesses a significant growth rate. The main aim of the public

policy is to develop the overall health of the American citizens and at the same provide drugs at

affordable prices. The industry business has sustained for decades of increasing growth and

profits. Business organizations are required to adapt to the external environment to survive

(Cognizant, 2011; IFPMA, 2017).

Johnson & Johnson is considered among the largest companies not only in the US but also across

the globe. The company has to face a highly competitive market and adapt to the external

environment changes (Johnson & Johnson, 2018a).

The following section analyses the macro environment, the market competitiveness in which

Johnson & Johnson operates and its competitive advantage and performance contribution to

value creation.

Part 1: A PESTLE analysis of the US pharmaceutical industry

The increasing prices of drugs in the US are considered to be part of the global rising skepticism.

In the US, the industry faces intense pressure that could be analyses according to PESTEL as

discussed by Miller (2019).

Political:

The pharmaceutical companies face tough global security policies due to the pressure on drug

prices. Margins used to be low for several past years and the pressure lead to losses for drug

companies including Johnson and Johnson. Political pressures are increasing in the US market,

the matter that led the manufacturers, distributors and investors to consider the risk of the

political pressure among the causes of losses.

Introduction

The US pharmaceutical industry witnesses a significant growth rate. The main aim of the public

policy is to develop the overall health of the American citizens and at the same provide drugs at

affordable prices. The industry business has sustained for decades of increasing growth and

profits. Business organizations are required to adapt to the external environment to survive

(Cognizant, 2011; IFPMA, 2017).

Johnson & Johnson is considered among the largest companies not only in the US but also across

the globe. The company has to face a highly competitive market and adapt to the external

environment changes (Johnson & Johnson, 2018a).

The following section analyses the macro environment, the market competitiveness in which

Johnson & Johnson operates and its competitive advantage and performance contribution to

value creation.

Part 1: A PESTLE analysis of the US pharmaceutical industry

The increasing prices of drugs in the US are considered to be part of the global rising skepticism.

In the US, the industry faces intense pressure that could be analyses according to PESTEL as

discussed by Miller (2019).

Political:

The pharmaceutical companies face tough global security policies due to the pressure on drug

prices. Margins used to be low for several past years and the pressure lead to losses for drug

companies including Johnson and Johnson. Political pressures are increasing in the US market,

the matter that led the manufacturers, distributors and investors to consider the risk of the

political pressure among the causes of losses.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

Economic

The increase in drug prices in the US market by 100% over the last six years. The reasons behind

this price increase are the increase in manufacturing costs and the lack of generic competition

backed by the drug companies to benefit from the price rise. The U.S. Food and Drug

Administration is unobligated to control drug costs but it can approve cheaper alternatives.

Social

The majority of the American citizens find that the drug prices are high (77%), but few of them

find that drugs have the advantage of improving their lives, which is indicated by Kaiser Health

Tracking Poll (2016), as cited in Miller (2019). Americans, in general, ask for price limits for

companies producing drugs for specific diseases, like hepatitis or cancer.

Technological:

Technology supports the Pharma sector with many opportunities and at the same time, it keeps to

be a source of expenditure. The rapid development of IT helped the companies to manage their

costs and increase their profits.

Legal

The legal framework of the US pharmaceutical industry allows companies to benefit from

releasing new drugs into the market for an exclusivity period that enables them to gain what they

invested in the research and innovation. Then, drugs are supposed to become generic that allows

competition to decrease the price.

Environmental:

The pharmaceutical sector is highly related to environmental issues due to their residues that

could be harmful to the environment. Proper storage is essential for keeping the environment

safe. The big size of the Pharma industry results in a big responsibility for the environment.

Economic

The increase in drug prices in the US market by 100% over the last six years. The reasons behind

this price increase are the increase in manufacturing costs and the lack of generic competition

backed by the drug companies to benefit from the price rise. The U.S. Food and Drug

Administration is unobligated to control drug costs but it can approve cheaper alternatives.

Social

The majority of the American citizens find that the drug prices are high (77%), but few of them

find that drugs have the advantage of improving their lives, which is indicated by Kaiser Health

Tracking Poll (2016), as cited in Miller (2019). Americans, in general, ask for price limits for

companies producing drugs for specific diseases, like hepatitis or cancer.

Technological:

Technology supports the Pharma sector with many opportunities and at the same time, it keeps to

be a source of expenditure. The rapid development of IT helped the companies to manage their

costs and increase their profits.

Legal

The legal framework of the US pharmaceutical industry allows companies to benefit from

releasing new drugs into the market for an exclusivity period that enables them to gain what they

invested in the research and innovation. Then, drugs are supposed to become generic that allows

competition to decrease the price.

Environmental:

The pharmaceutical sector is highly related to environmental issues due to their residues that

could be harmful to the environment. Proper storage is essential for keeping the environment

safe. The big size of the Pharma industry results in a big responsibility for the environment.

5

Part 2: Analysis of the industry competitiveness

2.1 Pharmaceutical industry competitive forces

Porter's five forces model will be applied to the pharmaceutical industry within the US to analyze

the competitiveness of the industry and the way that different factors can impact the industry.

The following section provides an analysis of the pharmaceutical industry in the US.

Bargaining power of buyers – Medium

The high prices of drugs in the US create problems for the buyers who are the patients that

despite their ability to access many branded and generic drugs; they are not capable of affording

co-insurance of their needed drugs. People cannot always afford the high-cost prescriptions, the

matter that might lead to facing serious health issues. Also, the manufacturing companies’ ability

to market their products directly to the end users results in over-prescribing of the advertised

drugs. This is likely to result in increased national spending for drugs concerning that these drugs

are expensive. The buyers seek control over the drug prices that will result in controlled profits

for the manufacturing companies. While the latest seek to maximize their profits. Overall, the

availability of the generic drugs and buyers’ ability to access alternatives by searching the

internet provide power to the buyers and makes the overall power of the buyers’ medium (Kasi,

2017; IQVIA, 2019).

Bargaining power of suppliers - Low

Producing a new drug requires the approval of the Food and Drug Administration (FDA) to

enable the manufacturing companies to sell it into the market to the end users. Once the

companies got the approval, the drugs become ready to move to the wholesalers or the

middlemen that represent the suppliers of the retailers according to the Pharma supply chain. The

drug manufacturers only need the raw materials to manufacture the drugs in house, where the

Part 2: Analysis of the industry competitiveness

2.1 Pharmaceutical industry competitive forces

Porter's five forces model will be applied to the pharmaceutical industry within the US to analyze

the competitiveness of the industry and the way that different factors can impact the industry.

The following section provides an analysis of the pharmaceutical industry in the US.

Bargaining power of buyers – Medium

The high prices of drugs in the US create problems for the buyers who are the patients that

despite their ability to access many branded and generic drugs; they are not capable of affording

co-insurance of their needed drugs. People cannot always afford the high-cost prescriptions, the

matter that might lead to facing serious health issues. Also, the manufacturing companies’ ability

to market their products directly to the end users results in over-prescribing of the advertised

drugs. This is likely to result in increased national spending for drugs concerning that these drugs

are expensive. The buyers seek control over the drug prices that will result in controlled profits

for the manufacturing companies. While the latest seek to maximize their profits. Overall, the

availability of the generic drugs and buyers’ ability to access alternatives by searching the

internet provide power to the buyers and makes the overall power of the buyers’ medium (Kasi,

2017; IQVIA, 2019).

Bargaining power of suppliers - Low

Producing a new drug requires the approval of the Food and Drug Administration (FDA) to

enable the manufacturing companies to sell it into the market to the end users. Once the

companies got the approval, the drugs become ready to move to the wholesalers or the

middlemen that represent the suppliers of the retailers according to the Pharma supply chain. The

drug manufacturers only need the raw materials to manufacture the drugs in house, where the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

suppliers provide only the packaging materials. The suppliers of drugs in the US market are

represented in a few companies that gain the largest market share. They do not have a pranging

power (Kasi, 2017; IQVIA, 2019).

Competitive rivalry – High

Drugs are available with different prices in the US marketenables mainly depends on who pays

the bill. Price differences are due to rebates and discounts provided to members of care programs

(Ellis, 2016). The US pharmaceutical industry is considered to be among the highest competitive

industries across the globe. Regarding the specialty drugs that are provided in limited supply to

treat special diseases are very expensive and affect the overall drug prices by driving them to

increase. The branded drugs are marketable by the pharmaceutical company or group of

companies that have the patients. These companies gain a patient from the FDA for 20 years and

gain regulatory exclusivity that enables them to sell the drug at high prices during this period.

The usage of generic drugs witnessed an increase over recent years; they are drugs that contain

the same components, dosages and strength like the branded drugs that are characterized with

low prices compared to the branded drugs. Moreover, the US market is considered to be a large

market for selling the over-the-counter (OTC) medicines; they represent easy to access drugs by

the customers that do not require a prescription by the physicians. OTC drugs are not covered by

insurance. In addition, Biotechnology companies are meant for developing new products in the

market. These companies depend on manufacturing proteins sourced from living systems, like

animals and plants. These drugs are very expensive and do not have generic products yet despite

the movement of the US in 2010 to develop regulation of biosimilar drugs that provide

equivalent medication of the original biotechnology drug. Also, the personalized medicines

represent the latest pharmaceutical development with its focus on genetics and genomics in

suppliers provide only the packaging materials. The suppliers of drugs in the US market are

represented in a few companies that gain the largest market share. They do not have a pranging

power (Kasi, 2017; IQVIA, 2019).

Competitive rivalry – High

Drugs are available with different prices in the US marketenables mainly depends on who pays

the bill. Price differences are due to rebates and discounts provided to members of care programs

(Ellis, 2016). The US pharmaceutical industry is considered to be among the highest competitive

industries across the globe. Regarding the specialty drugs that are provided in limited supply to

treat special diseases are very expensive and affect the overall drug prices by driving them to

increase. The branded drugs are marketable by the pharmaceutical company or group of

companies that have the patients. These companies gain a patient from the FDA for 20 years and

gain regulatory exclusivity that enables them to sell the drug at high prices during this period.

The usage of generic drugs witnessed an increase over recent years; they are drugs that contain

the same components, dosages and strength like the branded drugs that are characterized with

low prices compared to the branded drugs. Moreover, the US market is considered to be a large

market for selling the over-the-counter (OTC) medicines; they represent easy to access drugs by

the customers that do not require a prescription by the physicians. OTC drugs are not covered by

insurance. In addition, Biotechnology companies are meant for developing new products in the

market. These companies depend on manufacturing proteins sourced from living systems, like

animals and plants. These drugs are very expensive and do not have generic products yet despite

the movement of the US in 2010 to develop regulation of biosimilar drugs that provide

equivalent medication of the original biotechnology drug. Also, the personalized medicines

represent the latest pharmaceutical development with its focus on genetics and genomics in

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

biomedical manufacturing. It helps in better diagnoses of different diseases and personal factors

of risk that are highly potential to give hope to many patients in the future (Kasi, 2017; IQVIA,

2019).

Threat of new entrants – Low

The new entrants to the US pharmaceutical industry represent a low threat due to the high initial

costs of investment in new facilities establishments, R&D activities. Also, they are threatened

flow return on investment if the companies failed to provide the drugs on time. The current

players enjoy high economies of scale. In addition, getting approval from the regulatory

authorities is a very long process. Moreover, new entrants will find complexities to access

distribution channels (Kasi, 2017).

Threat of substitutes – Medium

Drugs in the exclusivity periods have no substitutes. Following the expiry of the exclusivity

periods, generic drugs can be produced. The matter that makes the threat of substitutes medium

level (Kasi, 2017).

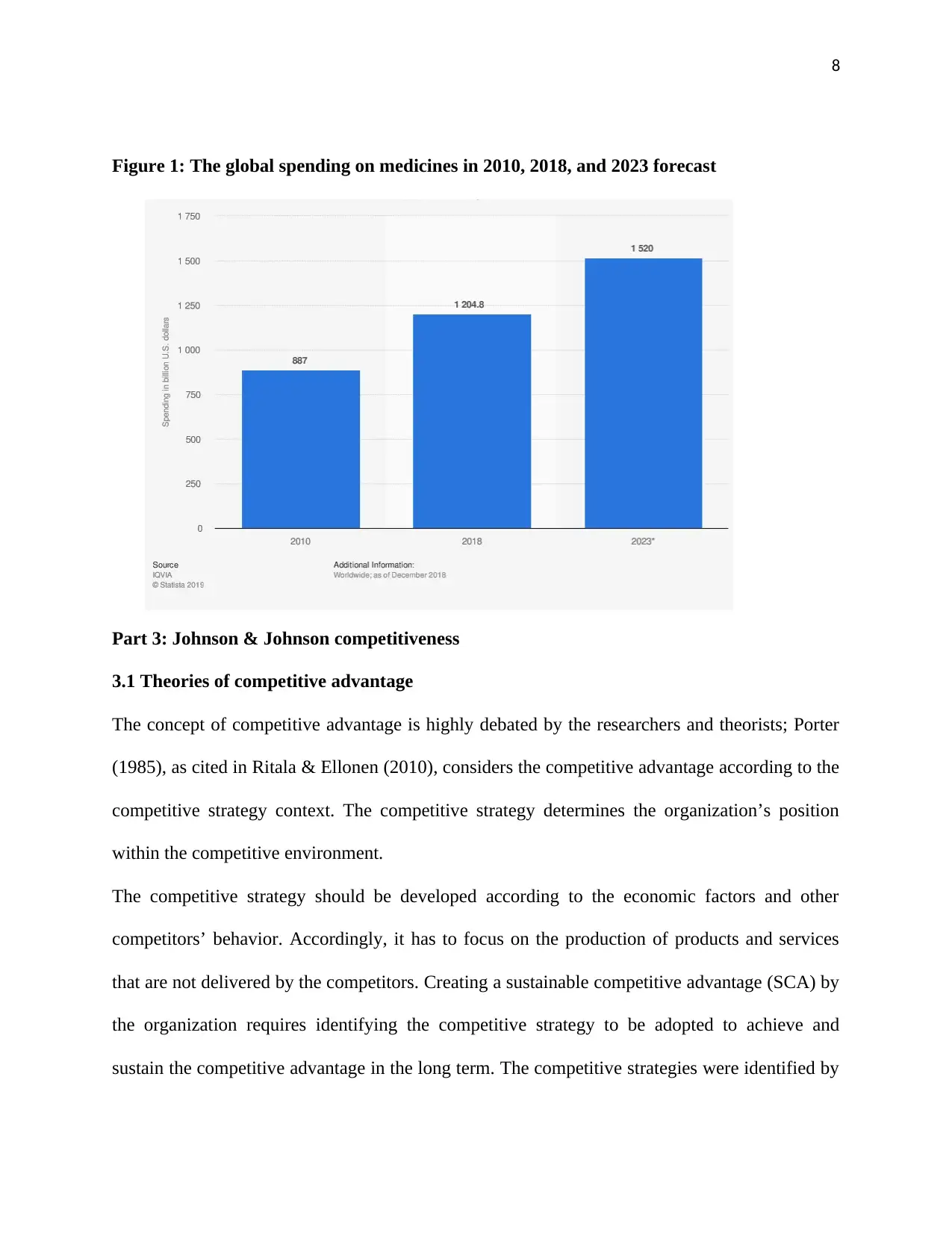

2.2 Industry attractiveness

The pharmaceutical industry is considered one of the biggest US industries. Companies

operating in the industry enjoy high-profit margins, where they could benefit from their

economies of scale by maximizing profits and minimizing costs. Also, their distribution channels

cover the whole market and extend it to cover the globe. Figure (1), shows that the global

pharmaceutical industry is expected to expand its investments from $1204.8 Bn. In 2018 to

become $1520Bn. in 2023. This means that also the US market will expand, this because the US

pharmaceutical companies operate globally (IQVIA, 2019; Mousavi, et al., 2018; PWC, 2018).

biomedical manufacturing. It helps in better diagnoses of different diseases and personal factors

of risk that are highly potential to give hope to many patients in the future (Kasi, 2017; IQVIA,

2019).

Threat of new entrants – Low

The new entrants to the US pharmaceutical industry represent a low threat due to the high initial

costs of investment in new facilities establishments, R&D activities. Also, they are threatened

flow return on investment if the companies failed to provide the drugs on time. The current

players enjoy high economies of scale. In addition, getting approval from the regulatory

authorities is a very long process. Moreover, new entrants will find complexities to access

distribution channels (Kasi, 2017).

Threat of substitutes – Medium

Drugs in the exclusivity periods have no substitutes. Following the expiry of the exclusivity

periods, generic drugs can be produced. The matter that makes the threat of substitutes medium

level (Kasi, 2017).

2.2 Industry attractiveness

The pharmaceutical industry is considered one of the biggest US industries. Companies

operating in the industry enjoy high-profit margins, where they could benefit from their

economies of scale by maximizing profits and minimizing costs. Also, their distribution channels

cover the whole market and extend it to cover the globe. Figure (1), shows that the global

pharmaceutical industry is expected to expand its investments from $1204.8 Bn. In 2018 to

become $1520Bn. in 2023. This means that also the US market will expand, this because the US

pharmaceutical companies operate globally (IQVIA, 2019; Mousavi, et al., 2018; PWC, 2018).

8

Figure 1: The global spending on medicines in 2010, 2018, and 2023 forecast

Part 3: Johnson & Johnson competitiveness

3.1 Theories of competitive advantage

The concept of competitive advantage is highly debated by the researchers and theorists; Porter

(1985), as cited in Ritala & Ellonen (2010), considers the competitive advantage according to the

competitive strategy context. The competitive strategy determines the organization’s position

within the competitive environment.

The competitive strategy should be developed according to the economic factors and other

competitors’ behavior. Accordingly, it has to focus on the production of products and services

that are not delivered by the competitors. Creating a sustainable competitive advantage (SCA) by

the organization requires identifying the competitive strategy to be adopted to achieve and

sustain the competitive advantage in the long term. The competitive strategies were identified by

Figure 1: The global spending on medicines in 2010, 2018, and 2023 forecast

Part 3: Johnson & Johnson competitiveness

3.1 Theories of competitive advantage

The concept of competitive advantage is highly debated by the researchers and theorists; Porter

(1985), as cited in Ritala & Ellonen (2010), considers the competitive advantage according to the

competitive strategy context. The competitive strategy determines the organization’s position

within the competitive environment.

The competitive strategy should be developed according to the economic factors and other

competitors’ behavior. Accordingly, it has to focus on the production of products and services

that are not delivered by the competitors. Creating a sustainable competitive advantage (SCA) by

the organization requires identifying the competitive strategy to be adopted to achieve and

sustain the competitive advantage in the long term. The competitive strategies were identified by

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

Porter, as cited in Tanwar (2013), to be cost leadership, differentiation, and focus strategies.

Then, Barney (1991), as cited in Barney (2012), defined the SCA to be a continuous process of

benefiting due to the application of unique strategies of value creation with potential competitors

who are unable to imitate or copy these benefits. Accordingly, the SCA is highly related to the

organizational efforts that are established to maintain specific advantages over the long-term.

SCA is affected by the organization's ability to access resources, the condition of the target

market, customer specifications and the restrictions to the power of the competitors. According

to Coyne Kevin (1986), as cited in Waweru (2011), creating SCA requires increasing customer

awareness about the difference between the organization’s products compared to other products.

These differences could be a result of the organizational access to specific resources not allowed

to the competitors. There special resources and skills that contribute to the SCA according to

Barney, as cited in Huang, et al. (2015), these resources should be rare, valuable, con not be

imitated and cannot be replaced. Also, Prahalad and Hamel (1990), as cited in Agha, et al.

(2012), argue that organizations combine their available resources and skills with their core

competencies in order to create SCA in a unique way that cannot be imitated by the competitors

(Hakkak & Ghodsi, 2015).

The concept of core competencies is highly relevant to the strategic resource-based view (RBV)

(Wang, 2014).

3.2 Johnson & Johnson’s strategy

Strategy refers to the objective and direction, drivers of motivation and staff who are involved in

fulfilling the organizational goals. It is important for matching the organization’s capabilities to

the stakeholders’ needs at the current time and in the future.

Porter, as cited in Tanwar (2013), to be cost leadership, differentiation, and focus strategies.

Then, Barney (1991), as cited in Barney (2012), defined the SCA to be a continuous process of

benefiting due to the application of unique strategies of value creation with potential competitors

who are unable to imitate or copy these benefits. Accordingly, the SCA is highly related to the

organizational efforts that are established to maintain specific advantages over the long-term.

SCA is affected by the organization's ability to access resources, the condition of the target

market, customer specifications and the restrictions to the power of the competitors. According

to Coyne Kevin (1986), as cited in Waweru (2011), creating SCA requires increasing customer

awareness about the difference between the organization’s products compared to other products.

These differences could be a result of the organizational access to specific resources not allowed

to the competitors. There special resources and skills that contribute to the SCA according to

Barney, as cited in Huang, et al. (2015), these resources should be rare, valuable, con not be

imitated and cannot be replaced. Also, Prahalad and Hamel (1990), as cited in Agha, et al.

(2012), argue that organizations combine their available resources and skills with their core

competencies in order to create SCA in a unique way that cannot be imitated by the competitors

(Hakkak & Ghodsi, 2015).

The concept of core competencies is highly relevant to the strategic resource-based view (RBV)

(Wang, 2014).

3.2 Johnson & Johnson’s strategy

Strategy refers to the objective and direction, drivers of motivation and staff who are involved in

fulfilling the organizational goals. It is important for matching the organization’s capabilities to

the stakeholders’ needs at the current time and in the future.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

Johnson & Johnson, is engaged in the R&D, manufacturing and selling of pharmaceutical and

health products in all of the world countries. The company is dedicated to responsibly marketing

all of its products, including brochures, direct selling to customers and online advertising.

Accordingly, the company’s business strategy focuses on specific fields and approached for

achieving a leading position. It focuses on human health care, managing business in the long

term and decentralization of management to be able to meet different customer needs and

comply with the fast-changing environment. The company seeks to be different from its

competitors by developing new products characterized by innovativeness and high quality

(Choudhuri, 2018). Johnson & Johnson strategic framework consists of four basic dimensions,

they are discussed according to Choudhuri (2018), as follows:

3. 2. 1 Broadly based in human health care

The company is considered to be a major market player that focuses on disease prevention,

diagnoses and treatment. The breadth of the market operations enables the company to capture

opportunities for growth, for example, large customers and governments.

3. 2. 2 Managed for the long term

Johnson & Johnson focuses on managing for the long term through building equity of its brands

in the long-term, gain sustainable customer loyalty and adding value to the shareholders over

time.

3. 2. 3 Decentralized management approach

Decentralized management considers the leaders to be close to the customers, which implies that

they are most knowledgeable about their needs. This resulted in locating R&D centers in

developing markets to innovate products based on the local needs of patients. Products offerings

Johnson & Johnson, is engaged in the R&D, manufacturing and selling of pharmaceutical and

health products in all of the world countries. The company is dedicated to responsibly marketing

all of its products, including brochures, direct selling to customers and online advertising.

Accordingly, the company’s business strategy focuses on specific fields and approached for

achieving a leading position. It focuses on human health care, managing business in the long

term and decentralization of management to be able to meet different customer needs and

comply with the fast-changing environment. The company seeks to be different from its

competitors by developing new products characterized by innovativeness and high quality

(Choudhuri, 2018). Johnson & Johnson strategic framework consists of four basic dimensions,

they are discussed according to Choudhuri (2018), as follows:

3. 2. 1 Broadly based in human health care

The company is considered to be a major market player that focuses on disease prevention,

diagnoses and treatment. The breadth of the market operations enables the company to capture

opportunities for growth, for example, large customers and governments.

3. 2. 2 Managed for the long term

Johnson & Johnson focuses on managing for the long term through building equity of its brands

in the long-term, gain sustainable customer loyalty and adding value to the shareholders over

time.

3. 2. 3 Decentralized management approach

Decentralized management considers the leaders to be close to the customers, which implies that

they are most knowledgeable about their needs. This resulted in locating R&D centers in

developing markets to innovate products based on the local needs of patients. Products offerings

11

are expanded to respond to the needs of the emerging markets and the increasing needs of the

middle-class population in high growth countries.

3. 3. 3 People and values

People are highly engaged in executing organizational strategies and committed to fulfilling their

goals. The company is highly committed to attract, develop and retain talents in order to foster

organizational growth.

3.3 Analysis of the resources and capabilities of Johnson & Johnson and their contribution

to sustaining its competitive advantage

Johnson & Johnson was named to be the world’s most admired company in 2018 by Fortune for

its smart and quality management, forward-thinking, financial performance, global

competitiveness and social responsibility in the pharmaceutical category for 5 consecutive years

(Johnson & Johnson, 2018b)

3.3.1 Tangible resources

The company’s performance indicators according to 2017 figures show that its total R&D

expense was $10,600 million, the number of developed pharmaceutical products was 42

products. The number of approved Pharmaceutical products and breakthrough therapy

designations by the US FDA during 2013 – 2017 was 15 products, and the number of launched

customer products was 1493 (Johnson & Johnson, 2017).

Raw materials are essential to implementing the company’s business. They are available for

Johnson & Johnson in the form of multiple sources. There are some temporarily unavailable raw

materials due to environmental protection considerations, but they are not expected to negatively

impact the company's financial performance (Johnson & Johnson, 2018a).

are expanded to respond to the needs of the emerging markets and the increasing needs of the

middle-class population in high growth countries.

3. 3. 3 People and values

People are highly engaged in executing organizational strategies and committed to fulfilling their

goals. The company is highly committed to attract, develop and retain talents in order to foster

organizational growth.

3.3 Analysis of the resources and capabilities of Johnson & Johnson and their contribution

to sustaining its competitive advantage

Johnson & Johnson was named to be the world’s most admired company in 2018 by Fortune for

its smart and quality management, forward-thinking, financial performance, global

competitiveness and social responsibility in the pharmaceutical category for 5 consecutive years

(Johnson & Johnson, 2018b)

3.3.1 Tangible resources

The company’s performance indicators according to 2017 figures show that its total R&D

expense was $10,600 million, the number of developed pharmaceutical products was 42

products. The number of approved Pharmaceutical products and breakthrough therapy

designations by the US FDA during 2013 – 2017 was 15 products, and the number of launched

customer products was 1493 (Johnson & Johnson, 2017).

Raw materials are essential to implementing the company’s business. They are available for

Johnson & Johnson in the form of multiple sources. There are some temporarily unavailable raw

materials due to environmental protection considerations, but they are not expected to negatively

impact the company's financial performance (Johnson & Johnson, 2018a).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.