Critical Analysis: Key Audit Matters in Independent Auditor's Report

VerifiedAdded on 2023/03/21

|13

|3550

|40

Report

AI Summary

This report critically analyzes key audit matters within the context of independent auditor's reports, focusing on the implications of Auditing Standard ASA 701. It examines the rationale for the standard's introduction, particularly in light of the global financial crisis and the Lehman Brothers' collapse. The analysis includes a review of Westpac Bank's financial statements, emphasizing the accuracy of liabilities related to Australian banknotes and the valuation of foreign currencies and Australian dollar investments. It discusses the auditor's responsibilities, the basis for opinions, and the procedures used to address key audit matters, such as testing key controls and assessing banknote movements. Furthermore, the report evaluates the company's going concern status and other relevant financial information, concluding that the financial statements comply with auditing guidelines set by the AASB.

Key Audit Matters 1

KEY AUDIT MATTERS IN INDEPENDENT AUDITOR’S REPORT

By Student’s Name

Course Code and Name

Professor’s Name

Institution Affiliation

Date

KEY AUDIT MATTERS IN INDEPENDENT AUDITOR’S REPORT

By Student’s Name

Course Code and Name

Professor’s Name

Institution Affiliation

Date

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Key Audit Matters 2

Introduction

The Audit Report Standard, currently referred as the ASA 701 is concerning with critically

evaluating the key audit matters in an independent auditor’s reports. This standard is used by

financial entities to evaluate the key issues that arise especially when an auditor

communicates key matters during the evaluation of an entity’s financial statements. In that

regard, this paper presents and evaluates key audit matters, including the rationale of

introducing the key audit matters in an independent auditor’s report. The analyses are based

on the differentiation of financial position of an ASX-listed company, the Westpac Bank, in

the Banking industry, among others companies i.e. the AMP, ANZ, Bank of Queensland and

Australian National Bank

The auditor’s analysis of key audit matters in this report evaluates the intervening

financial statement of the Westpac Group. To effectively present the rationale of this

research, the new accounting standard in Australia (ASA 701) will be applied to represent

key audit matters. As such, the associated balanced sheet as ended on 30th June 2018. Among

the key audit matters to be considered is the evaluation of key issues from the Lehman

Brothers. This Audit Report is fundamental for the ASX-listed to forecast their financial

position and health in the future. This Lehman Brothers, dated on 15th Sep 2008, were listed

bankrupt will an approximated debt of about $600 billion in assets and liabilities of the same

amount. In this evaluation, key accounting issues the evaluation of relevant liabilities, and the

accuracy of the Australian banknote as stated in the financial policy page introduced by the

Australian Government.

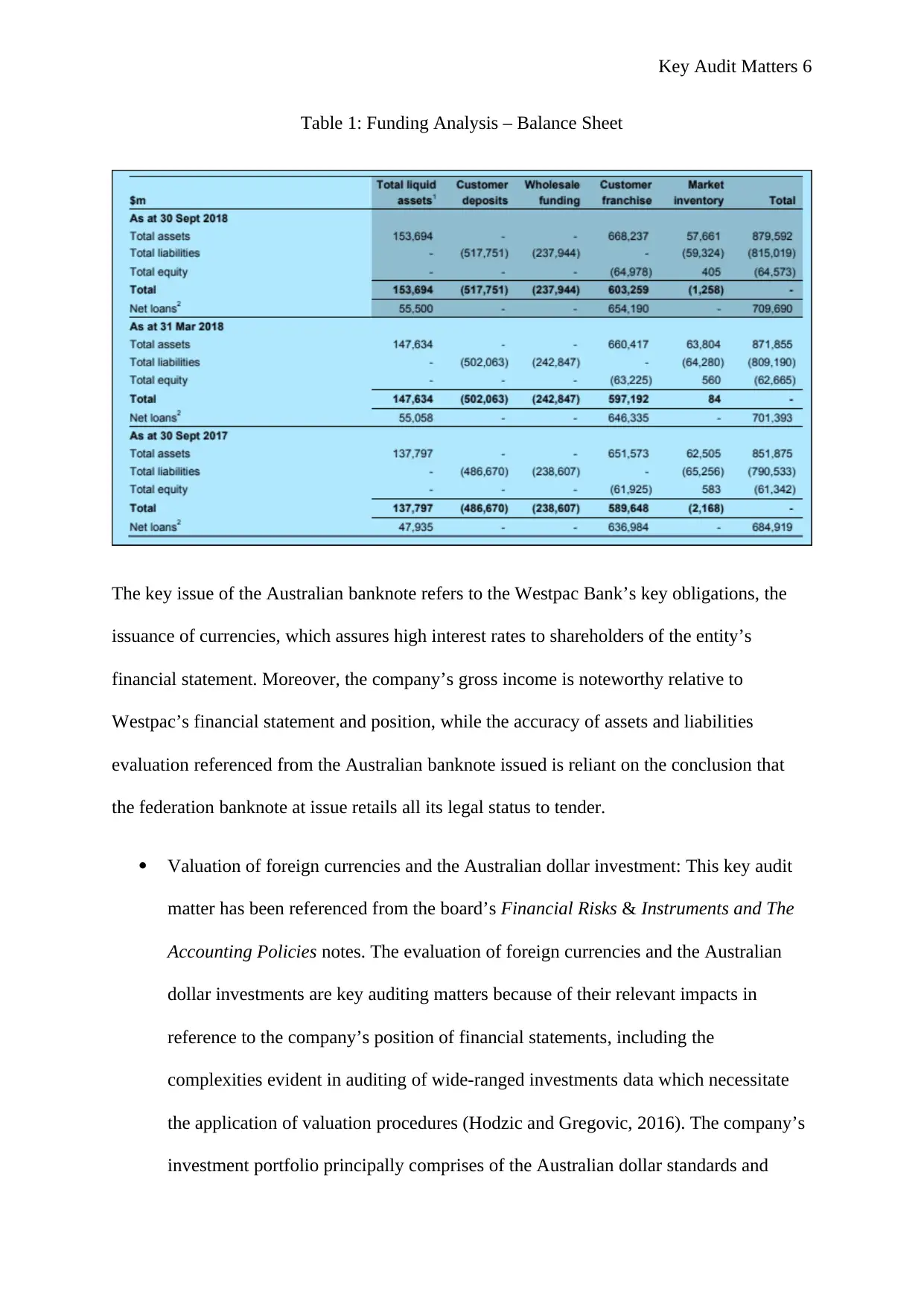

The evaluation and balance of the Australian banknote delivered to financial institutions

indicates the assessment of fundamental banknotes concerning assets and liabilities calculated

to about $879,592 in assets and about $815,000 in gross liabilities (Qiao, Vo and Zhu, 2019).

Introduction

The Audit Report Standard, currently referred as the ASA 701 is concerning with critically

evaluating the key audit matters in an independent auditor’s reports. This standard is used by

financial entities to evaluate the key issues that arise especially when an auditor

communicates key matters during the evaluation of an entity’s financial statements. In that

regard, this paper presents and evaluates key audit matters, including the rationale of

introducing the key audit matters in an independent auditor’s report. The analyses are based

on the differentiation of financial position of an ASX-listed company, the Westpac Bank, in

the Banking industry, among others companies i.e. the AMP, ANZ, Bank of Queensland and

Australian National Bank

The auditor’s analysis of key audit matters in this report evaluates the intervening

financial statement of the Westpac Group. To effectively present the rationale of this

research, the new accounting standard in Australia (ASA 701) will be applied to represent

key audit matters. As such, the associated balanced sheet as ended on 30th June 2018. Among

the key audit matters to be considered is the evaluation of key issues from the Lehman

Brothers. This Audit Report is fundamental for the ASX-listed to forecast their financial

position and health in the future. This Lehman Brothers, dated on 15th Sep 2008, were listed

bankrupt will an approximated debt of about $600 billion in assets and liabilities of the same

amount. In this evaluation, key accounting issues the evaluation of relevant liabilities, and the

accuracy of the Australian banknote as stated in the financial policy page introduced by the

Australian Government.

The evaluation and balance of the Australian banknote delivered to financial institutions

indicates the assessment of fundamental banknotes concerning assets and liabilities calculated

to about $879,592 in assets and about $815,000 in gross liabilities (Qiao, Vo and Zhu, 2019).

Key Audit Matters 3

The estimations were drawn based on the consideration of the comparative Australian

banknote provided marginal banknotes were eliminated from the currency exchange rates.

Another key audit matters is the evaluation of foreign currencies, in consideration to the

investment of the Australian dollar. This key auditing concern is considered based on the

firm’s Accounting Policy and Financial Risks & Instruments notes. The consideration of

foreign currency and the dollar investments are considered to be key auditing concerns due to

its fundamental implication on Westpac’s position and value of its financial statements.

These fiscal data are an inclusive of issues apparent in auditing wide-range stock information

that necessitate the consideration of fiscal evaluation procedures.

Rationale of New Auditing Standard ASA 701

The ASA 701 presented the Auditing and Assurance Standard Board (AASB), which

analyses and communicates key auditing concerns in an independent auditor’s reports. This

standard deals with the pertinent necessities and issues of entity’s and legal requirements,

including the relevant strategic guidelines. The accounting board denotes the independent

statutory grouping under the Australian federation, under the accounting section 227A,

known as the Australian Security and Investments Commission Act of 2001. In that regard,

the governing body evaluates key auditing standards, in reference to the entities’ legal actions

as argued by Xu, Jiang, Fargher and Carson (2011). The new accounting standard, the ASA

701, illustrates the communication of key auditing matters in the Westpac’s audit report. In

addition to that, the report enables the relevant auditors in top ASX-listed firms to evaluate

and implement key decisions on how audit matters should be included in an auditor’s report.

The AMP’s profitability indicates a significant drop of its finances from 35% to 680M

in 2018. Considering the costs tabulated from the board of the royal commission, the AMP’s

portfolio account has presented a chance for the company being subjected to profitability. In

reference to the evaluation done by the company in 2018, the funds evaluated on 14th Feb

The estimations were drawn based on the consideration of the comparative Australian

banknote provided marginal banknotes were eliminated from the currency exchange rates.

Another key audit matters is the evaluation of foreign currencies, in consideration to the

investment of the Australian dollar. This key auditing concern is considered based on the

firm’s Accounting Policy and Financial Risks & Instruments notes. The consideration of

foreign currency and the dollar investments are considered to be key auditing concerns due to

its fundamental implication on Westpac’s position and value of its financial statements.

These fiscal data are an inclusive of issues apparent in auditing wide-range stock information

that necessitate the consideration of fiscal evaluation procedures.

Rationale of New Auditing Standard ASA 701

The ASA 701 presented the Auditing and Assurance Standard Board (AASB), which

analyses and communicates key auditing concerns in an independent auditor’s reports. This

standard deals with the pertinent necessities and issues of entity’s and legal requirements,

including the relevant strategic guidelines. The accounting board denotes the independent

statutory grouping under the Australian federation, under the accounting section 227A,

known as the Australian Security and Investments Commission Act of 2001. In that regard,

the governing body evaluates key auditing standards, in reference to the entities’ legal actions

as argued by Xu, Jiang, Fargher and Carson (2011). The new accounting standard, the ASA

701, illustrates the communication of key auditing matters in the Westpac’s audit report. In

addition to that, the report enables the relevant auditors in top ASX-listed firms to evaluate

and implement key decisions on how audit matters should be included in an auditor’s report.

The AMP’s profitability indicates a significant drop of its finances from 35% to 680M

in 2018. Considering the costs tabulated from the board of the royal commission, the AMP’s

portfolio account has presented a chance for the company being subjected to profitability. In

reference to the evaluation done by the company in 2018, the funds evaluated on 14th Feb

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Key Audit Matters 4

deliver fundamental updates to the relevant stakeholders regarding the company’s earnings

and dividends dated on 31st December 2018. The ANZ is another financial institution

included in the analysis of firms’ key audit matters. According the taxation period ended 30th

Sep 2018, the company audit profitability approximated to about $6.4 billion, which related

to cash profitability of approximately $6 billion. The Bank of Queensland reported an overall

profit of about $336 ended in Dec, 2018. On the other hand, the Westpac reported a gross

annual profitability, which has edged about 1% considerably to about $8 B. The firm’s

preferred profit margin was relatively flat and at the same level compared to other banks. The

National Australia Bank has its financial income reading A$5.7 B for a financial year ended

on 30th Sep in reference to the book-keeping of about A$b.6B in profits over the fiscal year.

Independent Auditor’s Report

Basic Opinion

As for my personal opinion, the financial statements of the Westpac Bank and consolidated

entity for the evaluation of fiscal statements ended on 30th June 2018 comply with the

necessary auditing guidelines introduced by the AASB and significantly the ASA 701.

Additionally, the Westpac Bank maintains it accounting positions strategically pertinent to its

consolidated firms as recorded on 30th June 2018. During the same period, financial

performance of the company’s cash flow were evaluated and audited, including the

evaluation of balanced sheet, cash flow statements, operation incomes, overall interest rates,

among other fundamental accounting statements.

Basis for Opinion

The completed auditing report has been completed considering the new accounting standards

launched by the federal board of accounting in Australia with consideration to the AASB. In

reference to the legal frameworks, the auditor is tasked with an obligation to correctly

evaluate key accounting statements as outlined by the AASB concerning the responsibilities

deliver fundamental updates to the relevant stakeholders regarding the company’s earnings

and dividends dated on 31st December 2018. The ANZ is another financial institution

included in the analysis of firms’ key audit matters. According the taxation period ended 30th

Sep 2018, the company audit profitability approximated to about $6.4 billion, which related

to cash profitability of approximately $6 billion. The Bank of Queensland reported an overall

profit of about $336 ended in Dec, 2018. On the other hand, the Westpac reported a gross

annual profitability, which has edged about 1% considerably to about $8 B. The firm’s

preferred profit margin was relatively flat and at the same level compared to other banks. The

National Australia Bank has its financial income reading A$5.7 B for a financial year ended

on 30th Sep in reference to the book-keeping of about A$b.6B in profits over the fiscal year.

Independent Auditor’s Report

Basic Opinion

As for my personal opinion, the financial statements of the Westpac Bank and consolidated

entity for the evaluation of fiscal statements ended on 30th June 2018 comply with the

necessary auditing guidelines introduced by the AASB and significantly the ASA 701.

Additionally, the Westpac Bank maintains it accounting positions strategically pertinent to its

consolidated firms as recorded on 30th June 2018. During the same period, financial

performance of the company’s cash flow were evaluated and audited, including the

evaluation of balanced sheet, cash flow statements, operation incomes, overall interest rates,

among other fundamental accounting statements.

Basis for Opinion

The completed auditing report has been completed considering the new accounting standards

launched by the federal board of accounting in Australia with consideration to the AASB. In

reference to the legal frameworks, the auditor is tasked with an obligation to correctly

evaluate key accounting statements as outlined by the AASB concerning the responsibilities

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Key Audit Matters 5

of Auditors. In that regard, I am independently considering the company’s financial statement

of the consolidated entity according to the ethical standards and financial principles set by the

financial professional board (The Code of Ethics for a professional Auditor) in the country.

The included opinions are pertinent to ensuring the financial statements are correctly

analysed to avoid unnecessary conflicts with certain standards like the Auditor General Act

1997. Additionally, this evaluation has attained all the pertinent obligations assigned to the

code of conduct.

Key Audit Matters

When analysing the key auditing matters, it is fundamental for accountants to

contemplate, in professional judgement, the vital audit matters since they are relevant to the

company’s fiscal statements recorded within a certain timeframe (Ratzinger-Sakel and Theis,

2017). The problems faced by the Lehman Brothers draws the relevance of evaluating an

entity’s financial statements to determine its health and future consideration to mitigate any

potential issues that may arise. This group, on 15th September 2008, was filed for bankruptcy

recording an approximated debt of $600 billion and the same amount in assets.

However, the key audit matters to be addressed from the company’s financial

statements are:

Liabilities accuracy in accordance to the Australian Banknote: This key matter has

been referenced from the accounting policies whereby the balance of the Australia

banknote issued signifies the valuation of all the relevant banknotes on liability and

assets calculated to be $879,592 in total assets and $815,019 in total liabilities as

indicated in Table 1 below. This valuation is analysed in consideration to the relative

Australian banknotes provided minimal banknotes deducted from exchange (Qiao, Vo

and Zhu, 2019).

of Auditors. In that regard, I am independently considering the company’s financial statement

of the consolidated entity according to the ethical standards and financial principles set by the

financial professional board (The Code of Ethics for a professional Auditor) in the country.

The included opinions are pertinent to ensuring the financial statements are correctly

analysed to avoid unnecessary conflicts with certain standards like the Auditor General Act

1997. Additionally, this evaluation has attained all the pertinent obligations assigned to the

code of conduct.

Key Audit Matters

When analysing the key auditing matters, it is fundamental for accountants to

contemplate, in professional judgement, the vital audit matters since they are relevant to the

company’s fiscal statements recorded within a certain timeframe (Ratzinger-Sakel and Theis,

2017). The problems faced by the Lehman Brothers draws the relevance of evaluating an

entity’s financial statements to determine its health and future consideration to mitigate any

potential issues that may arise. This group, on 15th September 2008, was filed for bankruptcy

recording an approximated debt of $600 billion and the same amount in assets.

However, the key audit matters to be addressed from the company’s financial

statements are:

Liabilities accuracy in accordance to the Australian Banknote: This key matter has

been referenced from the accounting policies whereby the balance of the Australia

banknote issued signifies the valuation of all the relevant banknotes on liability and

assets calculated to be $879,592 in total assets and $815,019 in total liabilities as

indicated in Table 1 below. This valuation is analysed in consideration to the relative

Australian banknotes provided minimal banknotes deducted from exchange (Qiao, Vo

and Zhu, 2019).

Key Audit Matters 6

Table 1: Funding Analysis – Balance Sheet

The key issue of the Australian banknote refers to the Westpac Bank’s key obligations, the

issuance of currencies, which assures high interest rates to shareholders of the entity’s

financial statement. Moreover, the company’s gross income is noteworthy relative to

Westpac’s financial statement and position, while the accuracy of assets and liabilities

evaluation referenced from the Australian banknote issued is reliant on the conclusion that

the federation banknote at issue retails all its legal status to tender.

Valuation of foreign currencies and the Australian dollar investment: This key audit

matter has been referenced from the board’s Financial Risks & Instruments and The

Accounting Policies notes. The evaluation of foreign currencies and the Australian

dollar investments are key auditing matters because of their relevant impacts in

reference to the company’s position of financial statements, including the

complexities evident in auditing of wide-ranged investments data which necessitate

the application of valuation procedures (Hodzic and Gregovic, 2016). The company’s

investment portfolio principally comprises of the Australian dollar standards and

Table 1: Funding Analysis – Balance Sheet

The key issue of the Australian banknote refers to the Westpac Bank’s key obligations, the

issuance of currencies, which assures high interest rates to shareholders of the entity’s

financial statement. Moreover, the company’s gross income is noteworthy relative to

Westpac’s financial statement and position, while the accuracy of assets and liabilities

evaluation referenced from the Australian banknote issued is reliant on the conclusion that

the federation banknote at issue retails all its legal status to tender.

Valuation of foreign currencies and the Australian dollar investment: This key audit

matter has been referenced from the board’s Financial Risks & Instruments and The

Accounting Policies notes. The evaluation of foreign currencies and the Australian

dollar investments are key auditing matters because of their relevant impacts in

reference to the company’s position of financial statements, including the

complexities evident in auditing of wide-ranged investments data which necessitate

the application of valuation procedures (Hodzic and Gregovic, 2016). The company’s

investment portfolio principally comprises of the Australian dollar standards and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Key Audit Matters 7

securities, repurchasing agreement, foreign currencies securities, deposition with

other ASX top 100 listed financial companies and foreign currencies swapping

contract. All these investments have been assessed at a fair worth except for its

repurchasing agreement and depositions which are evaluated based on amortised

costs.

How the audit addressed the matter

Considering the Australia banknote at issue, the following procedures were used to perform

and address the key matter.

Undertaking a test of key controls: These controls are relevant to facilitate precise

recording of returns on banknotes and its issuance, which include General IT Control

using the notes controlling systems.

Agreement to Liabilities: This procedure reflects on the Australian banknote at issues,

which is recorded according to an entity’s financial statements over balanced

evaluated according to the notes controlling systems as at 30th June 2018.

Assessment of the Australian banknote movement: The banknotes at issue should be

assessed over recorded comparative trends. The demanding aspect of the banknotes

are retrieved, in fragment by fundamental economic activities, particularly the entity’s

overall assumptions expenditures provided by the Australian Bureau of Statistics

measuring the expenditure in a household.

Performance of movement comparison: It is relevant to compare the present year of

banknote movement over earlier years patterns before launching an investigation

concerning fundamental variances.

securities, repurchasing agreement, foreign currencies securities, deposition with

other ASX top 100 listed financial companies and foreign currencies swapping

contract. All these investments have been assessed at a fair worth except for its

repurchasing agreement and depositions which are evaluated based on amortised

costs.

How the audit addressed the matter

Considering the Australia banknote at issue, the following procedures were used to perform

and address the key matter.

Undertaking a test of key controls: These controls are relevant to facilitate precise

recording of returns on banknotes and its issuance, which include General IT Control

using the notes controlling systems.

Agreement to Liabilities: This procedure reflects on the Australian banknote at issues,

which is recorded according to an entity’s financial statements over balanced

evaluated according to the notes controlling systems as at 30th June 2018.

Assessment of the Australian banknote movement: The banknotes at issue should be

assessed over recorded comparative trends. The demanding aspect of the banknotes

are retrieved, in fragment by fundamental economic activities, particularly the entity’s

overall assumptions expenditures provided by the Australian Bureau of Statistics

measuring the expenditure in a household.

Performance of movement comparison: It is relevant to compare the present year of

banknote movement over earlier years patterns before launching an investigation

concerning fundamental variances.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Key Audit Matters 8

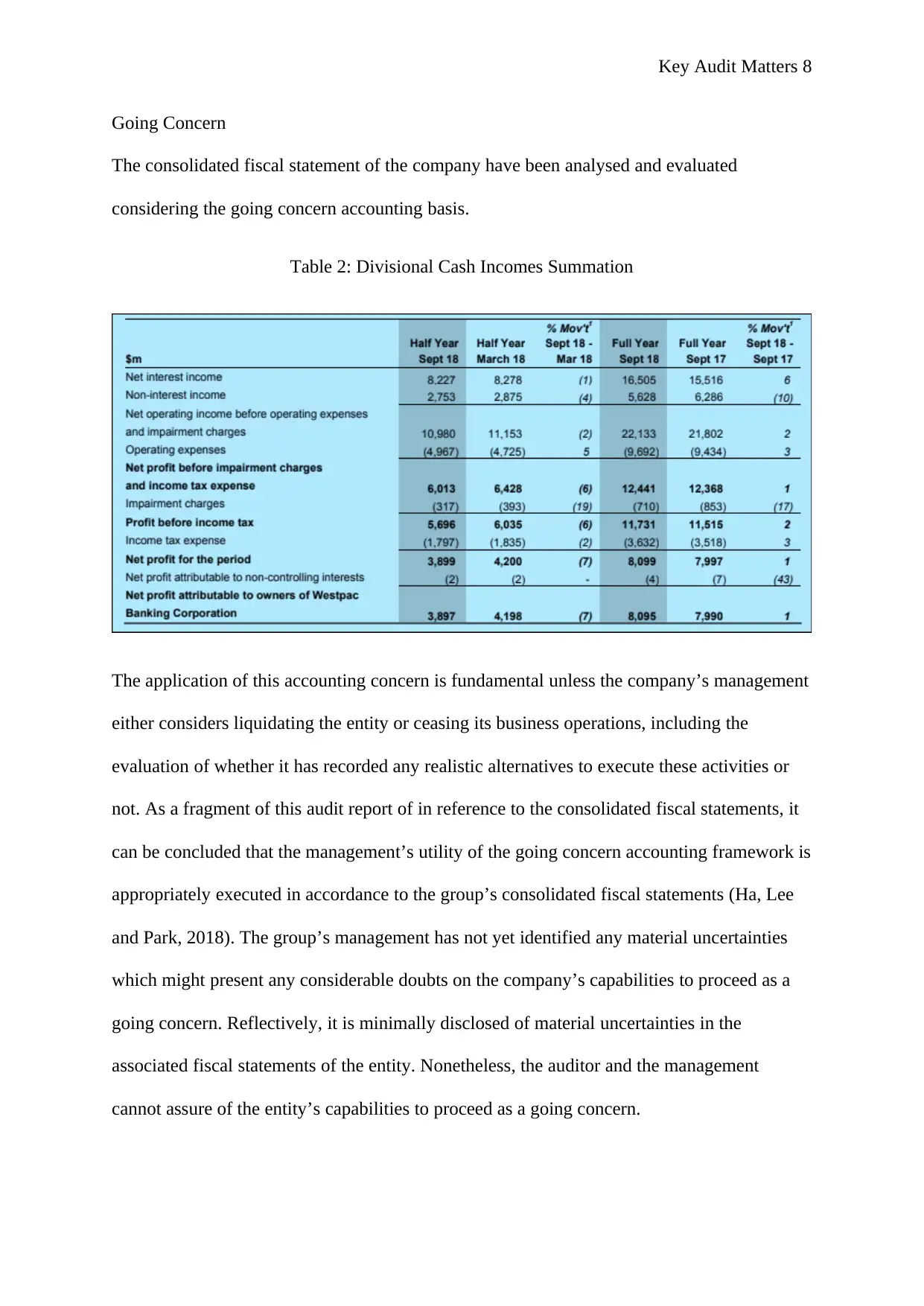

Going Concern

The consolidated fiscal statement of the company have been analysed and evaluated

considering the going concern accounting basis.

Table 2: Divisional Cash Incomes Summation

The application of this accounting concern is fundamental unless the company’s management

either considers liquidating the entity or ceasing its business operations, including the

evaluation of whether it has recorded any realistic alternatives to execute these activities or

not. As a fragment of this audit report of in reference to the consolidated fiscal statements, it

can be concluded that the management’s utility of the going concern accounting framework is

appropriately executed in accordance to the group’s consolidated fiscal statements (Ha, Lee

and Park, 2018). The group’s management has not yet identified any material uncertainties

which might present any considerable doubts on the company’s capabilities to proceed as a

going concern. Reflectively, it is minimally disclosed of material uncertainties in the

associated fiscal statements of the entity. Nonetheless, the auditor and the management

cannot assure of the entity’s capabilities to proceed as a going concern.

Going Concern

The consolidated fiscal statement of the company have been analysed and evaluated

considering the going concern accounting basis.

Table 2: Divisional Cash Incomes Summation

The application of this accounting concern is fundamental unless the company’s management

either considers liquidating the entity or ceasing its business operations, including the

evaluation of whether it has recorded any realistic alternatives to execute these activities or

not. As a fragment of this audit report of in reference to the consolidated fiscal statements, it

can be concluded that the management’s utility of the going concern accounting framework is

appropriately executed in accordance to the group’s consolidated fiscal statements (Ha, Lee

and Park, 2018). The group’s management has not yet identified any material uncertainties

which might present any considerable doubts on the company’s capabilities to proceed as a

going concern. Reflectively, it is minimally disclosed of material uncertainties in the

associated fiscal statements of the entity. Nonetheless, the auditor and the management

cannot assure of the entity’s capabilities to proceed as a going concern.

Key Audit Matters 9

Other Information

The financial authorities are obliged for other information, which are retrieved on the day of

the audit. This information includes incomes, capital management, voluntary remunerations

disclosure and distributions for the period ended 30th June 2018. However, the information

excludes financial statement and this audit thereon. Other financial statement information

includes:

The entity’s statutory gross profits of $8,095 million recorded up 1%

Cash income of $8,065 million, which is minimally transited

Cash income in a share, approximately 236 cents down 1%

Income return on equity of a about 13% at a minimal level that the entity seeks to

attain

Untarnished, conclusive, and completely franked dividends of about 94 cents in every

share and;

Financial levy of pre-tax about $378 million and effective taxation rate including the

entity’s levy of about 33%.

Accountable Authority's Responsibility for the Financial Statements

The accounting authority and the governor in Australia are obliged, under the Public

Governance, Performance and Accountability Act 2013, to prepare and present fairly all the

annual reports on entities’ finances. These reports should be drafted according to the

Australian financial standards and guidelines presented in the Act (Kuziev, 2011). The

federal government is mandated for these internal controls of fiscal statements, which are free

from materiality misstatements that might be due to possible errors or fraud. In the

preparation of fiscal statements, the government is obliged to asset the combine company’s

capabilities to proceed as a going concern considering whether its operations will possibly

cease due to management restructuring or other possible reasons.

Other Information

The financial authorities are obliged for other information, which are retrieved on the day of

the audit. This information includes incomes, capital management, voluntary remunerations

disclosure and distributions for the period ended 30th June 2018. However, the information

excludes financial statement and this audit thereon. Other financial statement information

includes:

The entity’s statutory gross profits of $8,095 million recorded up 1%

Cash income of $8,065 million, which is minimally transited

Cash income in a share, approximately 236 cents down 1%

Income return on equity of a about 13% at a minimal level that the entity seeks to

attain

Untarnished, conclusive, and completely franked dividends of about 94 cents in every

share and;

Financial levy of pre-tax about $378 million and effective taxation rate including the

entity’s levy of about 33%.

Accountable Authority's Responsibility for the Financial Statements

The accounting authority and the governor in Australia are obliged, under the Public

Governance, Performance and Accountability Act 2013, to prepare and present fairly all the

annual reports on entities’ finances. These reports should be drafted according to the

Australian financial standards and guidelines presented in the Act (Kuziev, 2011). The

federal government is mandated for these internal controls of fiscal statements, which are free

from materiality misstatements that might be due to possible errors or fraud. In the

preparation of fiscal statements, the government is obliged to asset the combine company’s

capabilities to proceed as a going concern considering whether its operations will possibly

cease due to management restructuring or other possible reasons.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Key Audit Matters 10

Auditor's Responsibilities for the Audit of the Financial Statements

As an auditor, it is vital to obtain considerable guarantee concerning whether the relevant

financial statements collectively will be permitted from materiality uncertainties, if due to

possible errors or fraud, and present an auditor’s evaluation, which includes auditing opinion.

Considerable guarantee is a vital and high-level assurance, but does not entirely guarantee

that the completed audit in reference to the Australian National Auditing Office completely

detects materiality uncertainties whenever it occurs. These misstatements may be evident

from possible errors or fraud and deliberated to be material if aggregated individually, which

might considerably be speculated to stimulated financial decision of relevant shareholders

based on the available fiscal statements.

As a fragment of auditing referenced from the Auditing office and its standard, it is vital to

present expert judgement, while maintaining professional cynicism throughout this audit

report. Thus, it is relevant to:

Assess the identified hazards of materiality uncertainties of the overall financial

statements, that are evident due to possible errors or fraud before designing and

performing auditing procedures approachable using these threats to obtain sufficient

auditing evidence appropriate to presenting professional opinion. The problem of not

identifying these uncertainties resultant from fraud is greater compared to risks

realized from errors; this is due to the assumption that fraud involve forgery,

collusion, data misinterpretation, intentional deduction and overriding the entity’s

internal control (Zalata, Tauringana and Tingbani, 2018).

Attain full understanding of the entity’s internal control, which is fundamental for the

overall audit that is meant to design an acceptable auditing procedure. These

procedures are relevant in various financial conditions, but not intended to present

audit opinions on the efficacy of integrated company’s internal controls.

Auditor's Responsibilities for the Audit of the Financial Statements

As an auditor, it is vital to obtain considerable guarantee concerning whether the relevant

financial statements collectively will be permitted from materiality uncertainties, if due to

possible errors or fraud, and present an auditor’s evaluation, which includes auditing opinion.

Considerable guarantee is a vital and high-level assurance, but does not entirely guarantee

that the completed audit in reference to the Australian National Auditing Office completely

detects materiality uncertainties whenever it occurs. These misstatements may be evident

from possible errors or fraud and deliberated to be material if aggregated individually, which

might considerably be speculated to stimulated financial decision of relevant shareholders

based on the available fiscal statements.

As a fragment of auditing referenced from the Auditing office and its standard, it is vital to

present expert judgement, while maintaining professional cynicism throughout this audit

report. Thus, it is relevant to:

Assess the identified hazards of materiality uncertainties of the overall financial

statements, that are evident due to possible errors or fraud before designing and

performing auditing procedures approachable using these threats to obtain sufficient

auditing evidence appropriate to presenting professional opinion. The problem of not

identifying these uncertainties resultant from fraud is greater compared to risks

realized from errors; this is due to the assumption that fraud involve forgery,

collusion, data misinterpretation, intentional deduction and overriding the entity’s

internal control (Zalata, Tauringana and Tingbani, 2018).

Attain full understanding of the entity’s internal control, which is fundamental for the

overall audit that is meant to design an acceptable auditing procedure. These

procedures are relevant in various financial conditions, but not intended to present

audit opinions on the efficacy of integrated company’s internal controls.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Key Audit Matters 11

Considering the evaluation of financial policy efficacy applied, including the

rationality of the relevant financial approximations and correlated disclosures by the

relevant accounting authorities.

Complete on the correctness of accounting authorities’ relevance based on the going

concern accounting framework, including the basis of auditing indication provided.

This includes an evaluation of whether the materiality uncertainty occurs correlated to

conditions and events casting fundamental suspicion on the integrated company’s

capabilities to proceed as a going concern. Concluding that the materiality

uncertainties prevail, it is relevant to draw significant responsiveness in this auditor’s

analysis to correlated disclosures in the fiscal statements or, whether these disclosures

are insufficient to transform this audit opinion. The findings are centred on auditing

evidence until the date of this audit analysis. Nonetheless, future conditions and evens

may possibly affect the integrated entity to terminate its continuity to proceed as a

going concern (Fakhfakh, 2015).

Evaluating the collective structure and presentation of the statement’s context, which

includes financial disclosures, and if the accounting statements signify principal

events and transactions designed to attain fair data presentation, and

Obtaining effective audit evidence concerning the relevant financial data of various

top 100 entities listed by ASX within the banking industry to provide expert opinion

on fiscal reports. Thus, this audit entails a presentation of future directions,

performance and supervisions purposed on consolidated company audit, which draws

the relevance of remaining completely responsible for opinions presented in the audit.

Moreover, maintaining communication with the authorities tasked with governance of

key matters, premediated timing and audit scope is fundamental for presenting

Considering the evaluation of financial policy efficacy applied, including the

rationality of the relevant financial approximations and correlated disclosures by the

relevant accounting authorities.

Complete on the correctness of accounting authorities’ relevance based on the going

concern accounting framework, including the basis of auditing indication provided.

This includes an evaluation of whether the materiality uncertainty occurs correlated to

conditions and events casting fundamental suspicion on the integrated company’s

capabilities to proceed as a going concern. Concluding that the materiality

uncertainties prevail, it is relevant to draw significant responsiveness in this auditor’s

analysis to correlated disclosures in the fiscal statements or, whether these disclosures

are insufficient to transform this audit opinion. The findings are centred on auditing

evidence until the date of this audit analysis. Nonetheless, future conditions and evens

may possibly affect the integrated entity to terminate its continuity to proceed as a

going concern (Fakhfakh, 2015).

Evaluating the collective structure and presentation of the statement’s context, which

includes financial disclosures, and if the accounting statements signify principal

events and transactions designed to attain fair data presentation, and

Obtaining effective audit evidence concerning the relevant financial data of various

top 100 entities listed by ASX within the banking industry to provide expert opinion

on fiscal reports. Thus, this audit entails a presentation of future directions,

performance and supervisions purposed on consolidated company audit, which draws

the relevance of remaining completely responsible for opinions presented in the audit.

Moreover, maintaining communication with the authorities tasked with governance of

key matters, premediated timing and audit scope is fundamental for presenting

Key Audit Matters 12

professional audit conclusions as presented by Alali and Romero (2013), which

entails any relevant uncertainties in the entity’s internal control identified in this audit.

Conclusion

The key audit matters illustrated in this paper represents how to communicate financial

statements in an independent auditor’s report. This report has presented the matters that were

of utmost implication in the exercise of auditing the company’s financial reports as at 30th

June 2018. Thus, these key matters should be communicated due the current issues, which

might have a significant impact on the entity’s financial performance, evident in the banking

industry.

Recommendations

Companies should consider communicating with the relevant accounting authorities, include

those charged with entities’ governance concerning key matters, audit schedules scope and

the timing for the presentation of fundamental audit conclusion. Moreover, companies are

recommended to consider evaluating possible uncertainties in their intern controls, which

have been ascertained in this analysis. It is vital to provide (the authorities obliged with

governance) with statements signifying that all the ethical considerations concerning

independent are followed. These considerations, including key matters which may rationally

be considered to be of significant independence, should also be communicated to relevant

authorities where pertinent.

References

Alali, F. and Romero, S., 2013. Benford's Law: Analyzing a Decade of Financial

Data. Journal of Emerging Technologies in Accounting, 10(1), pp.1-39.

professional audit conclusions as presented by Alali and Romero (2013), which

entails any relevant uncertainties in the entity’s internal control identified in this audit.

Conclusion

The key audit matters illustrated in this paper represents how to communicate financial

statements in an independent auditor’s report. This report has presented the matters that were

of utmost implication in the exercise of auditing the company’s financial reports as at 30th

June 2018. Thus, these key matters should be communicated due the current issues, which

might have a significant impact on the entity’s financial performance, evident in the banking

industry.

Recommendations

Companies should consider communicating with the relevant accounting authorities, include

those charged with entities’ governance concerning key matters, audit schedules scope and

the timing for the presentation of fundamental audit conclusion. Moreover, companies are

recommended to consider evaluating possible uncertainties in their intern controls, which

have been ascertained in this analysis. It is vital to provide (the authorities obliged with

governance) with statements signifying that all the ethical considerations concerning

independent are followed. These considerations, including key matters which may rationally

be considered to be of significant independence, should also be communicated to relevant

authorities where pertinent.

References

Alali, F. and Romero, S., 2013. Benford's Law: Analyzing a Decade of Financial

Data. Journal of Emerging Technologies in Accounting, 10(1), pp.1-39.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.