Lindl Case Study: Pre Expansion Analysis

VerifiedAdded on 2022/11/14

|19

|4377

|476

AI Summary

This report aims to analyze the international business structure in terms of expansion. The chosen organization is Lidl, a discount retail chain based in Germany. The organization desires to expand in either Norway or Mexico. For the purpose of external analysis, a comparative study of Norway and Mexico has been executed. The resultant territory for international expansion is Norway where it is suitable over Mexico in all aspects. After choosing Norway, as the country for expansion, VRIO framework is used for internal analysis. Lastly, suitable recommendations are being provided for gaining access into the Norwegian market, which will enable the company to enter the market and gain large market share very quickly.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running Head: LINDL CASE STUDY: PRE EXPANSION ANALYSIS

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Name of the Student

Name of the University

Author Note

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Name of the Student

Name of the University

Author Note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Executive Summary

This report aims to analyze the international business structure in terms of expansion. The

chosen organization is Lidl, a discount retail chain based in Germany. The organization

desires to expand in either Norway or Mexico. For the purpose of external analysis, a

comparative study of Norway and Mexico has been executed. The resultant territory for

international expansion is Norway where it is suitable over Mexico in all aspects. After

choosing Norway, as the country for expansion, VRIO framework is used for internal

analysis. Lastly, suitable recommendations are being provided for gaining access into the

Norwegian market, which will enable the company to enter the market and gain large market

share very quickly.

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Executive Summary

This report aims to analyze the international business structure in terms of expansion. The

chosen organization is Lidl, a discount retail chain based in Germany. The organization

desires to expand in either Norway or Mexico. For the purpose of external analysis, a

comparative study of Norway and Mexico has been executed. The resultant territory for

international expansion is Norway where it is suitable over Mexico in all aspects. After

choosing Norway, as the country for expansion, VRIO framework is used for internal

analysis. Lastly, suitable recommendations are being provided for gaining access into the

Norwegian market, which will enable the company to enter the market and gain large market

share very quickly.

2

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Table of Contents

Introduction................................................................................................................................3

Company Background............................................................................................................3

Discussion..................................................................................................................................4

PESTEL Analysis...................................................................................................................4

Porter’s five forces: Application on Norway.........................................................................7

VRIO Framework...................................................................................................................9

Recommended Modes of Entry............................................................................................11

Conclusion................................................................................................................................12

References................................................................................................................................14

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Table of Contents

Introduction................................................................................................................................3

Company Background............................................................................................................3

Discussion..................................................................................................................................4

PESTEL Analysis...................................................................................................................4

Porter’s five forces: Application on Norway.........................................................................7

VRIO Framework...................................................................................................................9

Recommended Modes of Entry............................................................................................11

Conclusion................................................................................................................................12

References................................................................................................................................14

3

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Introduction

International Business is defined as the process of exchange of goods and services

across the domestic territory of the country. In today’s modern world, the leading companies

are all multinational companies (Buckey, Doh and Benischke 2017). Expansion is necessary

for every business because local markets becomes saturated after sometime (Brem, Maier and

Wimschneider 2016).

Retail Chain is a form of business where an organization opens multiple outlets across

various locations offering the same type of products maintaining uniformity throughout the

chain (Diallo and Lambey-Checchin 2017).

Discount retails are defined as outlets, which stocks huge number of products and

attains economies of scale. Thus, they have the capacity to deliver huge discounts passing on

the profit to the customer (Gligor et al. 2016). Therefore, this system attracts huge number of

customers and creates a win-win situation for both the organization and the customers. This

type of business essentially has a strong distribution and logistics segment because

maintenance of uniformity in the supply of products is one crucial feature. Warehousing is

equally important this is because most of the products are perishable in nature to an extent

(Friebel et al. 2017).

The structure of the retail consists of in-house employees, distributors, stockiest,

manufacturers among others. These outlets generally covers a huge area due to the large

quantities of stocks. Almost all household raw, intermediate and finished products are

stocked in every outlet (Gómez-Lobo, Jiminez and Perdiguero 2015).

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Introduction

International Business is defined as the process of exchange of goods and services

across the domestic territory of the country. In today’s modern world, the leading companies

are all multinational companies (Buckey, Doh and Benischke 2017). Expansion is necessary

for every business because local markets becomes saturated after sometime (Brem, Maier and

Wimschneider 2016).

Retail Chain is a form of business where an organization opens multiple outlets across

various locations offering the same type of products maintaining uniformity throughout the

chain (Diallo and Lambey-Checchin 2017).

Discount retails are defined as outlets, which stocks huge number of products and

attains economies of scale. Thus, they have the capacity to deliver huge discounts passing on

the profit to the customer (Gligor et al. 2016). Therefore, this system attracts huge number of

customers and creates a win-win situation for both the organization and the customers. This

type of business essentially has a strong distribution and logistics segment because

maintenance of uniformity in the supply of products is one crucial feature. Warehousing is

equally important this is because most of the products are perishable in nature to an extent

(Friebel et al. 2017).

The structure of the retail consists of in-house employees, distributors, stockiest,

manufacturers among others. These outlets generally covers a huge area due to the large

quantities of stocks. Almost all household raw, intermediate and finished products are

stocked in every outlet (Gómez-Lobo, Jiminez and Perdiguero 2015).

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Company Background

Lidl is a Germany based discount supermarket chain commercialized itself in the year

1973 and in the year 2019 it has over 760 outlets and 13 distribution points across United

Kingdom, attaining an employee strength of 22000 units. The unique selling proposition of

this company s providing the best quality product at affordable prices. It initiated its first

store in Germany in the year 1973 employing 3 people and stocking around 500 products. In

the 1980’s it expanded largely and opened around 300 stores across Germany with more than

900 products. In the 1990’s it started expanding outside the country and opened its first

international store in France. It opened its first British store in the year 1994. Later it became

the largest retail chain in this part of the country (Craven 2018). With growing GDP in other

parts of the world, Lidl is planning to expand in untapped territories. The selected countries

are Mexico and Norway, where the present retail infrastructure is very conventional but the

potential market is very large. This report will allow the organization to receive an in depth

comparative analysis analysis before expanding in one of the either countries mentioned

above. Firstly, this report will use PESTEL analysis to examine the external environment of

the two countries.

Discussion

PESTEL Analysis

The components of PESTEL analysis are Political, Environmental, Social,

Technological, Economical and Legal. This model helps the organization to take crucial

decisions before expanding in untapped areas. Each component will take into account two

countries to make a comparative analysis (Grover et al. 2018).

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Company Background

Lidl is a Germany based discount supermarket chain commercialized itself in the year

1973 and in the year 2019 it has over 760 outlets and 13 distribution points across United

Kingdom, attaining an employee strength of 22000 units. The unique selling proposition of

this company s providing the best quality product at affordable prices. It initiated its first

store in Germany in the year 1973 employing 3 people and stocking around 500 products. In

the 1980’s it expanded largely and opened around 300 stores across Germany with more than

900 products. In the 1990’s it started expanding outside the country and opened its first

international store in France. It opened its first British store in the year 1994. Later it became

the largest retail chain in this part of the country (Craven 2018). With growing GDP in other

parts of the world, Lidl is planning to expand in untapped territories. The selected countries

are Mexico and Norway, where the present retail infrastructure is very conventional but the

potential market is very large. This report will allow the organization to receive an in depth

comparative analysis analysis before expanding in one of the either countries mentioned

above. Firstly, this report will use PESTEL analysis to examine the external environment of

the two countries.

Discussion

PESTEL Analysis

The components of PESTEL analysis are Political, Environmental, Social,

Technological, Economical and Legal. This model helps the organization to take crucial

decisions before expanding in untapped areas. Each component will take into account two

countries to make a comparative analysis (Grover et al. 2018).

5

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Political: Norway stands as one of the most politically stable countries in the world. It

follows a democracy system of authority with negligible opposition. It has one of the

Highest GDP’s of the world and corporate establishment is ideal due to its robust

political stability. Norway is an active member of European Union and European

Free Trade Association which helps organizations to export and import goods at

subsidized tariffs.

On the other hand, Mexico follows a federal system of Government.

Therefore, there exists separate laws in different parts of the country and tax rates

varies widely from one state to other. Political instability is very high and poverty

persists throughout the country (Lee and Linda 2016). The government does not

formulate enough policies to create a sustainable environment for the growing

population of the country.

Economic Factors: The economic standards of Norway are very high. The main

source of Income for this country is Oil and Fish, which is growing over the years.

These two sector employs around 2.5 million people in the country. Moreover, it has

a very stable banking sector and active stock exchange.

On the other hand, Mexico has been tagged as upper middle-income country

by World Bank, but 44% portion of the population belongs to the below poverty line

category. It has been badly hit by recession two times in history. GDP often

fluctuates over time and the export sector is very weak. It uniformly receives

remittances from United States of America. Though it has a weak export sector, it is

the second largest exporter of North America. However, it mainly exports products

such as Chemicals, Electronic Components and Vehicle Parts among others only to

the United States. It is an active member of both World Trade Organization and

National American Free Trade Agreement.

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Political: Norway stands as one of the most politically stable countries in the world. It

follows a democracy system of authority with negligible opposition. It has one of the

Highest GDP’s of the world and corporate establishment is ideal due to its robust

political stability. Norway is an active member of European Union and European

Free Trade Association which helps organizations to export and import goods at

subsidized tariffs.

On the other hand, Mexico follows a federal system of Government.

Therefore, there exists separate laws in different parts of the country and tax rates

varies widely from one state to other. Political instability is very high and poverty

persists throughout the country (Lee and Linda 2016). The government does not

formulate enough policies to create a sustainable environment for the growing

population of the country.

Economic Factors: The economic standards of Norway are very high. The main

source of Income for this country is Oil and Fish, which is growing over the years.

These two sector employs around 2.5 million people in the country. Moreover, it has

a very stable banking sector and active stock exchange.

On the other hand, Mexico has been tagged as upper middle-income country

by World Bank, but 44% portion of the population belongs to the below poverty line

category. It has been badly hit by recession two times in history. GDP often

fluctuates over time and the export sector is very weak. It uniformly receives

remittances from United States of America. Though it has a weak export sector, it is

the second largest exporter of North America. However, it mainly exports products

such as Chemicals, Electronic Components and Vehicle Parts among others only to

the United States. It is an active member of both World Trade Organization and

National American Free Trade Agreement.

6

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Social Factors: The population of Norway is 5.26 million (2017) and has been

growing at the rate of 4% annually. There exists gender equality and social justice

uniformly throughout the country. Homosexual relations is considered legally and

child adoption policy has been legal since 2009. There is a positive environment for

foreign entities and huge number of Multinational companies exist in the country.

On the other hand, Mexico has a population of over 130 million (2017) and

contains the largest Spanish speaking population in the world. Once considered an

underdeveloped country it has been improving over the years in terms of education,

employment and growth opportunities. The catch up effect of the country is positive

and estimated to attain balance over the next decade.

Technological Factors: Norway is one of the first countries to accept internet

commercially and uses internet in daily life both officially and personally. Small

businesses such as restaurants, pubs, bars and cafes have their unique webpages for

assisting the consumers of the region. Population of the country is technologically

sound and advanced than most of the countries.

On the other hand, with the advent of android and windows, Mexico is

improving over the years in terms of technology. Use of internet on commercial basis

is very limited and retails in the area rely on conventional style of doing business.

The scope for technology is very high backed by affordable labor in the country

making technology is cost effective (Keselli 2017).

Legal Factors: Norway has a sound legal system, backed by judicial bodies at every

level. It has a stable banking sector with proper constitutional regulations and strict

rules and regulations (Kremer and Symmons 2015). The crime rate in the country is

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Social Factors: The population of Norway is 5.26 million (2017) and has been

growing at the rate of 4% annually. There exists gender equality and social justice

uniformly throughout the country. Homosexual relations is considered legally and

child adoption policy has been legal since 2009. There is a positive environment for

foreign entities and huge number of Multinational companies exist in the country.

On the other hand, Mexico has a population of over 130 million (2017) and

contains the largest Spanish speaking population in the world. Once considered an

underdeveloped country it has been improving over the years in terms of education,

employment and growth opportunities. The catch up effect of the country is positive

and estimated to attain balance over the next decade.

Technological Factors: Norway is one of the first countries to accept internet

commercially and uses internet in daily life both officially and personally. Small

businesses such as restaurants, pubs, bars and cafes have their unique webpages for

assisting the consumers of the region. Population of the country is technologically

sound and advanced than most of the countries.

On the other hand, with the advent of android and windows, Mexico is

improving over the years in terms of technology. Use of internet on commercial basis

is very limited and retails in the area rely on conventional style of doing business.

The scope for technology is very high backed by affordable labor in the country

making technology is cost effective (Keselli 2017).

Legal Factors: Norway has a sound legal system, backed by judicial bodies at every

level. It has a stable banking sector with proper constitutional regulations and strict

rules and regulations (Kremer and Symmons 2015). The crime rate in the country is

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

one of the lowest in the world providing a good area for performing business

activities.

On the other hand, Mexico has high criminal rates. Though, drug cartels and

gangs have decreased over time, they have an informal hold in the country. These are

mainly due to high unemployment rates but over the years the country has stabilized

the growing instability and proceeding towards a brighter future.

Environmental Factors: Norway is situated in the upper half of the temperate zone

and lower part Frigid Zone so a significant portion of the country remains frozen and

commercially unavailable. As the country is rich in oil, pollution exists largely in the

oceanic areas. However, the non-industrial areas quite sound and pollution levels are

quite low (Djupdal and Westhead 2015).

On the other hand, Mexico has huge environmental issues especially in rural

areas mainly due to high population growth and urbanization and heavy

industrialization. Public awareness towards environmental protection is quite low.

Sanitation facilities are very conventional and directly linked to water bodies (Drago

et al. 2015).

From the above PESTLE analysis, Norway has an upper hand over Mexico

in terms of business expansion for Lidl, as the allover business environment is more

stable and uniform. Whereas Mexico being in the upper half of the list of Developing

Economies experienced many hindrances of crimes and poverty, the scope is very

positive due to extensive potential in Growth and Development.

Porter’s five forces: Application on Norway

The five forces of Porter’s Model are as follows:

1. Bargaining Power of the Buyer

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

one of the lowest in the world providing a good area for performing business

activities.

On the other hand, Mexico has high criminal rates. Though, drug cartels and

gangs have decreased over time, they have an informal hold in the country. These are

mainly due to high unemployment rates but over the years the country has stabilized

the growing instability and proceeding towards a brighter future.

Environmental Factors: Norway is situated in the upper half of the temperate zone

and lower part Frigid Zone so a significant portion of the country remains frozen and

commercially unavailable. As the country is rich in oil, pollution exists largely in the

oceanic areas. However, the non-industrial areas quite sound and pollution levels are

quite low (Djupdal and Westhead 2015).

On the other hand, Mexico has huge environmental issues especially in rural

areas mainly due to high population growth and urbanization and heavy

industrialization. Public awareness towards environmental protection is quite low.

Sanitation facilities are very conventional and directly linked to water bodies (Drago

et al. 2015).

From the above PESTLE analysis, Norway has an upper hand over Mexico

in terms of business expansion for Lidl, as the allover business environment is more

stable and uniform. Whereas Mexico being in the upper half of the list of Developing

Economies experienced many hindrances of crimes and poverty, the scope is very

positive due to extensive potential in Growth and Development.

Porter’s five forces: Application on Norway

The five forces of Porter’s Model are as follows:

1. Bargaining Power of the Buyer

8

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

2. Bargaining power of the supplier

3. Threat from New Entrants

4. Threat from Substitutes

5. Rivalry among Existing Firms

This model will help the organization to study the business environment of Norway

and provide Lidl an analytical overview

1. Bargaining Power of Buyer: The frequency of suppliers in Norway is higher than

the number of firms producing the product in the market in which Lidl operates.

Therefore, the bargaining power of the buyer is very weak. Moreover, the

heterogeneous nature of the products leaves the consumer with less alternatives.

The target customers of the organization is low-income groups and the USP of

Lidl is its price. Thus, the organization has upper hand over consumers (Hovav

2015).

2. Bargaining Power of Suppliers: The number of suppliers of Lidl is very high,

therefore making the bargaining power of suppliers weak. Moreover, due to their

high frequency makes switching cost very low and thus the company enjoys upper

hand over the suppliers. On the other hand, the suppliers are largely dependent on

Lidl as they supply huge quantities towards the organization. Therefore, the

Bargaining power of suppliers is low.

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

2. Bargaining power of the supplier

3. Threat from New Entrants

4. Threat from Substitutes

5. Rivalry among Existing Firms

This model will help the organization to study the business environment of Norway

and provide Lidl an analytical overview

1. Bargaining Power of Buyer: The frequency of suppliers in Norway is higher than

the number of firms producing the product in the market in which Lidl operates.

Therefore, the bargaining power of the buyer is very weak. Moreover, the

heterogeneous nature of the products leaves the consumer with less alternatives.

The target customers of the organization is low-income groups and the USP of

Lidl is its price. Thus, the organization has upper hand over consumers (Hovav

2015).

2. Bargaining Power of Suppliers: The number of suppliers of Lidl is very high,

therefore making the bargaining power of suppliers weak. Moreover, due to their

high frequency makes switching cost very low and thus the company enjoys upper

hand over the suppliers. On the other hand, the suppliers are largely dependent on

Lidl as they supply huge quantities towards the organization. Therefore, the

Bargaining power of suppliers is low.

9

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

3. Threat from New Entrants: Lidl exists from 1970’s and is a cash rich company. A

retail chain cannot be formulated overnight, as it requires huge amount of

investment. Moreover, achieving economies of scale requires time and new retail

cannot provide the price Lidl can provide the customers for the same product.

Lastly, accessing the distribution channel of an economy is very complex and

requires ample time. Thus, threat from New Entrants are low for the company.

4. Threat from Substitutes: Lidl stocks over 9000 product lines and all the substitutes

are available in the retail chain itself. Very few substitutes exist in the market and

either they are overpriced or of inferior quality. Therefore, threat from substitutes

is very low.

5. Rivalry among Existing Firms: The number of organizations are very few in the

market in which the company operates. Some of the companies, which exists in

Norway, are 7-Eleven, Reitan Group, Bunnpris and Coop Marked among others.

These companies are either smaller than Lidl or as Big as Lidl so any strategy

changes or cheap stunts will not go unnoticed this making the rivalry among

existing firms very weak.

From the Porter’s five forces analysis it can be inferred that bargaining power of

the buyer is pretty low because its target customers are price sensitive in nature,

where Lidl offers the lowest price for the same or similar products. Bargaining power

of the suppliers are also low because the products in which the company deals with

are found in abundance and the switching cost is very low. Threat is almost negligible

from new entrants as the company is cash rich and imitation requires money and time.

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

3. Threat from New Entrants: Lidl exists from 1970’s and is a cash rich company. A

retail chain cannot be formulated overnight, as it requires huge amount of

investment. Moreover, achieving economies of scale requires time and new retail

cannot provide the price Lidl can provide the customers for the same product.

Lastly, accessing the distribution channel of an economy is very complex and

requires ample time. Thus, threat from New Entrants are low for the company.

4. Threat from Substitutes: Lidl stocks over 9000 product lines and all the substitutes

are available in the retail chain itself. Very few substitutes exist in the market and

either they are overpriced or of inferior quality. Therefore, threat from substitutes

is very low.

5. Rivalry among Existing Firms: The number of organizations are very few in the

market in which the company operates. Some of the companies, which exists in

Norway, are 7-Eleven, Reitan Group, Bunnpris and Coop Marked among others.

These companies are either smaller than Lidl or as Big as Lidl so any strategy

changes or cheap stunts will not go unnoticed this making the rivalry among

existing firms very weak.

From the Porter’s five forces analysis it can be inferred that bargaining power of

the buyer is pretty low because its target customers are price sensitive in nature,

where Lidl offers the lowest price for the same or similar products. Bargaining power

of the suppliers are also low because the products in which the company deals with

are found in abundance and the switching cost is very low. Threat is almost negligible

from new entrants as the company is cash rich and imitation requires money and time.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Substitutes of products exist in the market but Lidl provides huge variants at low

prices. Finally, when Lidl shall expand in Norway it will face stiff competition from

existing retail chains 7-eleven and Reitan Group. The only way to stay ahead of

competitors in the new country is to stock products, which are not available in the

country. As the Norwegian population has high per capita income, they will not be

very price sensitive. As, Lidl is a German based firm it can bring German products

which are not available in Norway.

VRIO Framework

Valuable, Rare, Imitable and Organized Framework helps an organization to conduct

internal analysis to identify problematic areas and probable solutions for in the future. VRIO

framework segmentation on Lidl are as follows:

Valuable: Lidl’s financial position is very strong which helps the organization to

invest in new opportunities and helps it to fight external threats. Its main strength lies

in its local resources, which are highly heterogeneous in nature. The employees of the

organization are highly efficient leading to high productivity in output. Employee

retention is very high making them loyal. It also possesses a strong distribution

network helping the company to reach more customers. The negatives of the

company include its cost ineffectiveness because its production system is costly

directly affecting the profit of the firm. Another drawback in this section is the

Research and Development wing of the company, which is more costly when

compared to the benefits it provides. A probable solution maybe outsourcing the

research and development functions of the company to a third party entity.

Rare: The products, which Lidl offers are not unique but the way it has branded the

products makes it rare and unique enough to attract more customers. Moreover, the

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Substitutes of products exist in the market but Lidl provides huge variants at low

prices. Finally, when Lidl shall expand in Norway it will face stiff competition from

existing retail chains 7-eleven and Reitan Group. The only way to stay ahead of

competitors in the new country is to stock products, which are not available in the

country. As the Norwegian population has high per capita income, they will not be

very price sensitive. As, Lidl is a German based firm it can bring German products

which are not available in Norway.

VRIO Framework

Valuable, Rare, Imitable and Organized Framework helps an organization to conduct

internal analysis to identify problematic areas and probable solutions for in the future. VRIO

framework segmentation on Lidl are as follows:

Valuable: Lidl’s financial position is very strong which helps the organization to

invest in new opportunities and helps it to fight external threats. Its main strength lies

in its local resources, which are highly heterogeneous in nature. The employees of the

organization are highly efficient leading to high productivity in output. Employee

retention is very high making them loyal. It also possesses a strong distribution

network helping the company to reach more customers. The negatives of the

company include its cost ineffectiveness because its production system is costly

directly affecting the profit of the firm. Another drawback in this section is the

Research and Development wing of the company, which is more costly when

compared to the benefits it provides. A probable solution maybe outsourcing the

research and development functions of the company to a third party entity.

Rare: The products, which Lidl offers are not unique but the way it has branded the

products makes it rare and unique enough to attract more customers. Moreover, the

11

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

company sells products, which are mostly in-house brands, and very few retail chains

possesses this quality. The strength of the supply chain management is very rare

compared to other retail companies like Costco and Walmart.

Imitation: The imitation possibility in the market is very low because Lidl exists in

the market for a long time and contains numerous outlets gaining more brand loyalty.

On the other hand, due to the huge capital requirement in the market for retail chain,

imitation is almost impossible. However, the process in which it conducts business is

easily imitable and exists widely in other retail companies.

Organized: Lidl is one of the largest retail chain in the world. It is a typical example

of organization as it maintains uniform distribution of products across all outlets

according to the market requirement.

Recommended Modes of Entry

Direct Investment: Direct investment is a type of international expansion in which the

foreign company brings in the capital required to open a business. In this method,

there exists no third party and the firm can freely take decisions immediately. Direct

transfer of technology takes placed and there exists (De Villa, Rajwani and Lawton

2015)

Non-Controlling Interest: One of the entry strategies, which Lidl can adopt, is the

non-controlling interest method. In this process, the new organization purchases

minority stakes of an existing company to gain access into the market. The new

company does is not eligible to take any decisions in the business due to its limited

proportion of shares. New companies who wants to expand internationally generally

attain this method. This type of investment is categorized under Foreign Portfolio

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

company sells products, which are mostly in-house brands, and very few retail chains

possesses this quality. The strength of the supply chain management is very rare

compared to other retail companies like Costco and Walmart.

Imitation: The imitation possibility in the market is very low because Lidl exists in

the market for a long time and contains numerous outlets gaining more brand loyalty.

On the other hand, due to the huge capital requirement in the market for retail chain,

imitation is almost impossible. However, the process in which it conducts business is

easily imitable and exists widely in other retail companies.

Organized: Lidl is one of the largest retail chain in the world. It is a typical example

of organization as it maintains uniform distribution of products across all outlets

according to the market requirement.

Recommended Modes of Entry

Direct Investment: Direct investment is a type of international expansion in which the

foreign company brings in the capital required to open a business. In this method,

there exists no third party and the firm can freely take decisions immediately. Direct

transfer of technology takes placed and there exists (De Villa, Rajwani and Lawton

2015)

Non-Controlling Interest: One of the entry strategies, which Lidl can adopt, is the

non-controlling interest method. In this process, the new organization purchases

minority stakes of an existing company to gain access into the market. The new

company does is not eligible to take any decisions in the business due to its limited

proportion of shares. New companies who wants to expand internationally generally

attain this method. This type of investment is categorized under Foreign Portfolio

12

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Investment where the investment type is indirect buying up equity or right shares of a

company (Gollner and Turkina 2015).

International Outlets: This type of strategy is typically used by fashion brands but due

to the huge popularity of the brand among customers. If it initially opens an outlet in a

prime marketplace in Norway, say in Oslo then the awareness can be increased

initially then in the second phase after assessing the response of the new customers it

can decide on the expansionary plans. This type of investment falls under the category

of Foreign Portfolio Investment.

Merger: Merger is a process in which two parties mutually agree to sell/purchase its

major portion of shares to the other party. In this type of acquisition, both parties have

proportionate authority in decision making in all aspects such as production,

distribution, branding and procurement among others. In this case, cross border

transfer of technology takes place. Huge monetary transfers take place and this

method is executed when quick market acquisitions take place. For instance, if Lidl

can merge up with 7-Eleven it can proportionately conduct business in Norway. This

type of investment falls in the category of Foreign Portfolio Investment.

Takeover: In this method, the foreign entity purchases all the shares of the host entity.

This decisions are generally taken when the company is a loss making entity or under

huge debt. In this case, technological transfer takes place. The foreign entity is

generally cash rich in nature and due to total acquisition, the new company can launch

new brands and acquire more market share in the retail sector in the new country. This

type of acquisition falls under the category of foreign portfolio investment.

Franchise: Franchise is a form of expansion and very common in retail chain business.

In this method, a local resident purchases the rights of the company against which the

company allows the franchiser to use its trademark, brand name and products among

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Investment where the investment type is indirect buying up equity or right shares of a

company (Gollner and Turkina 2015).

International Outlets: This type of strategy is typically used by fashion brands but due

to the huge popularity of the brand among customers. If it initially opens an outlet in a

prime marketplace in Norway, say in Oslo then the awareness can be increased

initially then in the second phase after assessing the response of the new customers it

can decide on the expansionary plans. This type of investment falls under the category

of Foreign Portfolio Investment.

Merger: Merger is a process in which two parties mutually agree to sell/purchase its

major portion of shares to the other party. In this type of acquisition, both parties have

proportionate authority in decision making in all aspects such as production,

distribution, branding and procurement among others. In this case, cross border

transfer of technology takes place. Huge monetary transfers take place and this

method is executed when quick market acquisitions take place. For instance, if Lidl

can merge up with 7-Eleven it can proportionately conduct business in Norway. This

type of investment falls in the category of Foreign Portfolio Investment.

Takeover: In this method, the foreign entity purchases all the shares of the host entity.

This decisions are generally taken when the company is a loss making entity or under

huge debt. In this case, technological transfer takes place. The foreign entity is

generally cash rich in nature and due to total acquisition, the new company can launch

new brands and acquire more market share in the retail sector in the new country. This

type of acquisition falls under the category of foreign portfolio investment.

Franchise: Franchise is a form of expansion and very common in retail chain business.

In this method, a local resident purchases the rights of the company against which the

company allows the franchiser to use its trademark, brand name and products among

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

others. Against this facility, the company charges royalty. This type of investment is

categorized under foreign portfolio investment.

Joint Venture: Joint Venture is a form of international expansion when two or more

parties enter into an agreement, proportional investment and agreeing on decided

proportion of profit. Joint Venture is contractual in nature and the success of this kind

of business depends on the relation of the existing parties. In case of retail chain

business, Lidl can enter into joint venture with stockiest, distributors or wholesalers

engaged in the same business for a long period (Larimo and Nguyen 2015).

Conclusion

From the above study, it can be concluded that clearly Norway has an upper hand

over Mexico in terms of business expansion, which has been proved in the PESTEL analysis.

However, Mexico has a larger potential market but the political instability, high levels of

crime rates and rising poverty increases the probability of Business Failure. Then after

selecting Norway as the potential country for business expansion VRIO framework has been

used to identify the internal problems and their probable solutions. From the framework, it

can be inferred that very few problems exists in the firm, which can be rectified easily.

Finally, coming to the recommendations for the type of expansion it can attain greatest

market share by investing directly as Lidl is a cash rich company and it can flexibly take

decisions regarding expansion, new product launches, strategies and branding among others.

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

others. Against this facility, the company charges royalty. This type of investment is

categorized under foreign portfolio investment.

Joint Venture: Joint Venture is a form of international expansion when two or more

parties enter into an agreement, proportional investment and agreeing on decided

proportion of profit. Joint Venture is contractual in nature and the success of this kind

of business depends on the relation of the existing parties. In case of retail chain

business, Lidl can enter into joint venture with stockiest, distributors or wholesalers

engaged in the same business for a long period (Larimo and Nguyen 2015).

Conclusion

From the above study, it can be concluded that clearly Norway has an upper hand

over Mexico in terms of business expansion, which has been proved in the PESTEL analysis.

However, Mexico has a larger potential market but the political instability, high levels of

crime rates and rising poverty increases the probability of Business Failure. Then after

selecting Norway as the potential country for business expansion VRIO framework has been

used to identify the internal problems and their probable solutions. From the framework, it

can be inferred that very few problems exists in the firm, which can be rectified easily.

Finally, coming to the recommendations for the type of expansion it can attain greatest

market share by investing directly as Lidl is a cash rich company and it can flexibly take

decisions regarding expansion, new product launches, strategies and branding among others.

14

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

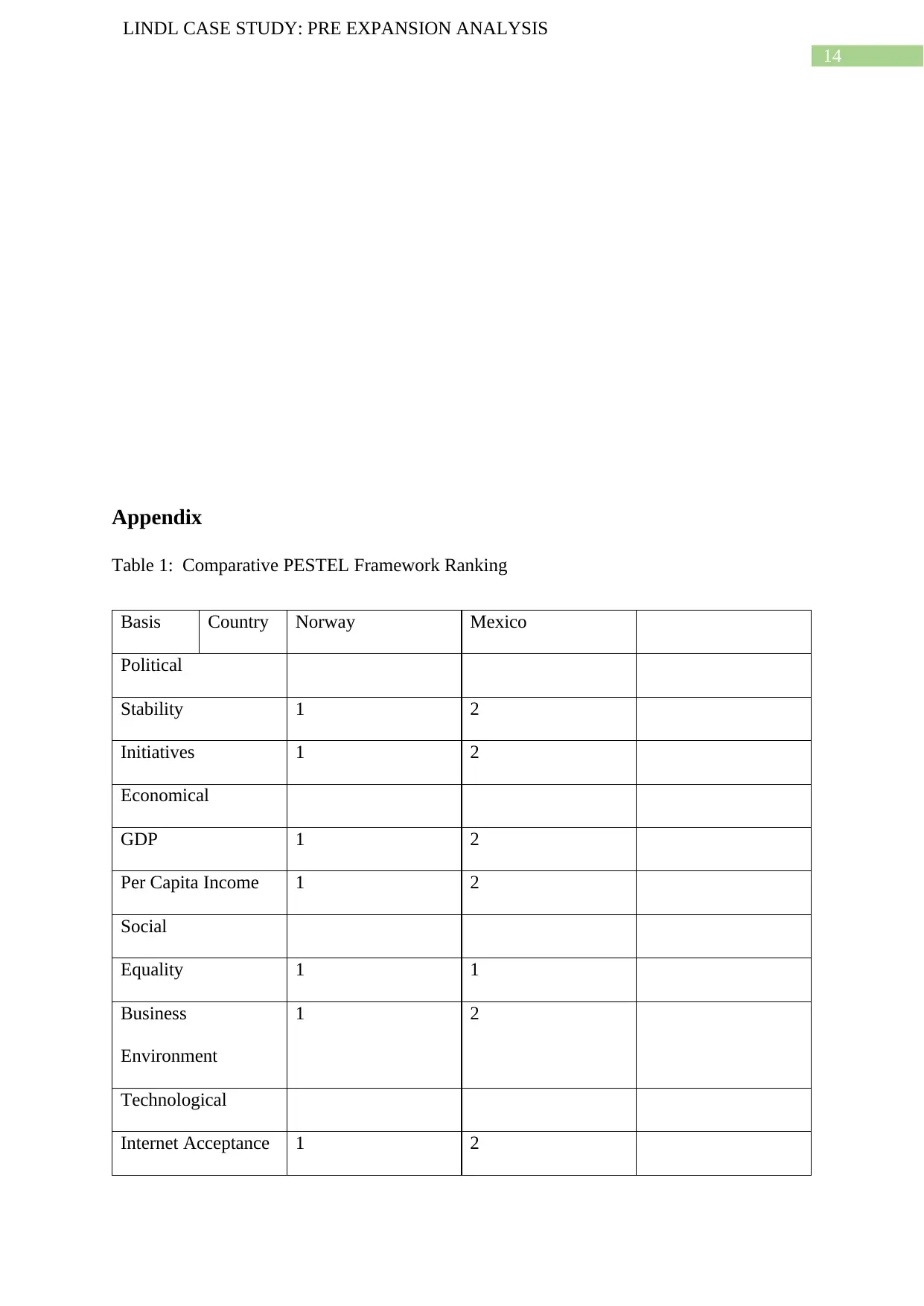

Appendix

Table 1: Comparative PESTEL Framework Ranking

Basis Country Norway Mexico

Political

Stability 1 2

Initiatives 1 2

Economical

GDP 1 2

Per Capita Income 1 2

Social

Equality 1 1

Business

Environment

1 2

Technological

Internet Acceptance 1 2

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Appendix

Table 1: Comparative PESTEL Framework Ranking

Basis Country Norway Mexico

Political

Stability 1 2

Initiatives 1 2

Economical

GDP 1 2

Per Capita Income 1 2

Social

Equality 1 1

Business

Environment

1 2

Technological

Internet Acceptance 1 2

15

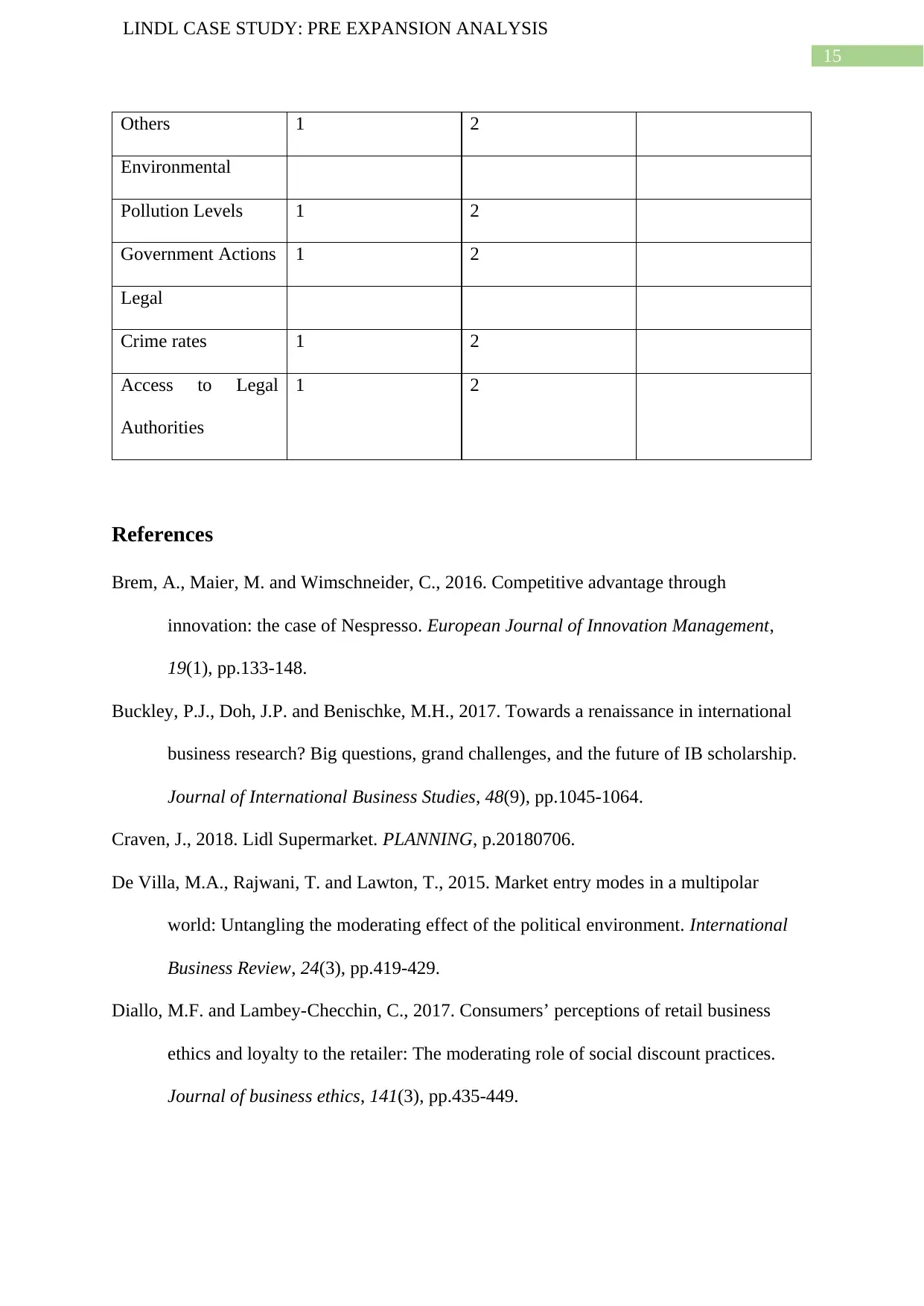

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Others 1 2

Environmental

Pollution Levels 1 2

Government Actions 1 2

Legal

Crime rates 1 2

Access to Legal

Authorities

1 2

References

Brem, A., Maier, M. and Wimschneider, C., 2016. Competitive advantage through

innovation: the case of Nespresso. European Journal of Innovation Management,

19(1), pp.133-148.

Buckley, P.J., Doh, J.P. and Benischke, M.H., 2017. Towards a renaissance in international

business research? Big questions, grand challenges, and the future of IB scholarship.

Journal of International Business Studies, 48(9), pp.1045-1064.

Craven, J., 2018. Lidl Supermarket. PLANNING, p.20180706.

De Villa, M.A., Rajwani, T. and Lawton, T., 2015. Market entry modes in a multipolar

world: Untangling the moderating effect of the political environment. International

Business Review, 24(3), pp.419-429.

Diallo, M.F. and Lambey-Checchin, C., 2017. Consumers’ perceptions of retail business

ethics and loyalty to the retailer: The moderating role of social discount practices.

Journal of business ethics, 141(3), pp.435-449.

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Others 1 2

Environmental

Pollution Levels 1 2

Government Actions 1 2

Legal

Crime rates 1 2

Access to Legal

Authorities

1 2

References

Brem, A., Maier, M. and Wimschneider, C., 2016. Competitive advantage through

innovation: the case of Nespresso. European Journal of Innovation Management,

19(1), pp.133-148.

Buckley, P.J., Doh, J.P. and Benischke, M.H., 2017. Towards a renaissance in international

business research? Big questions, grand challenges, and the future of IB scholarship.

Journal of International Business Studies, 48(9), pp.1045-1064.

Craven, J., 2018. Lidl Supermarket. PLANNING, p.20180706.

De Villa, M.A., Rajwani, T. and Lawton, T., 2015. Market entry modes in a multipolar

world: Untangling the moderating effect of the political environment. International

Business Review, 24(3), pp.419-429.

Diallo, M.F. and Lambey-Checchin, C., 2017. Consumers’ perceptions of retail business

ethics and loyalty to the retailer: The moderating role of social discount practices.

Journal of business ethics, 141(3), pp.435-449.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

16

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Djupdal, K. and Westhead, P., 2015. Environmental certification as a buffer against the

liabilities of newness and smallness: Firm performance benefits. International Small

Business Journal, 33(2), pp.148-168.

Drago, C., Millo, F., Ricciuti, R. and Santella, P., 2015. Corporate governance reforms,

interlocking directorship and company performance in Italy. International Review of

Law and Economics, 41, pp.38-49.

Friebel, Guido, et al. "Team incentives and performance: Evidence from a retail chain."

American Economic Review 107.8 (2017): 2168-2203.

Gligor, David M., Carol L. Esmark, and Ismail Gölgeci. "Building international business

theory: A grounded theory approach." Journal of International Business Studies 47.1

(2016): 93-111.

Gollnhofer, J.F. and Turkina, E., 2015. Cultural distance and entry modes: implications for

global expansion strategy. Cross cultural management, 22(1), pp.21-41.

Gómez-Lobo, A., Jiménez, J.L. and Perdiguero, J., 2015. The entry of a hard discount

supermarket: price effects.

Grover, V., Chiang, R.H., Liang, T.P. and Zhang, D., 2018. Creating strategic business value

from big data analytics: A research framework. Journal of Management Information

Systems, 35(2), pp.388-423.

Hovav, T., 2015. Business models analysis of Finnish food retailers-Case K-chain, S-chain

and Lidl-How to determine right channel to enter grocery retail market as a new

supplier with new products in Finland.

Kesseli, T., 2017. The Business Environment and Culture of Mexico from the Perspective of

Finnish Companies.

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Djupdal, K. and Westhead, P., 2015. Environmental certification as a buffer against the

liabilities of newness and smallness: Firm performance benefits. International Small

Business Journal, 33(2), pp.148-168.

Drago, C., Millo, F., Ricciuti, R. and Santella, P., 2015. Corporate governance reforms,

interlocking directorship and company performance in Italy. International Review of

Law and Economics, 41, pp.38-49.

Friebel, Guido, et al. "Team incentives and performance: Evidence from a retail chain."

American Economic Review 107.8 (2017): 2168-2203.

Gligor, David M., Carol L. Esmark, and Ismail Gölgeci. "Building international business

theory: A grounded theory approach." Journal of International Business Studies 47.1

(2016): 93-111.

Gollnhofer, J.F. and Turkina, E., 2015. Cultural distance and entry modes: implications for

global expansion strategy. Cross cultural management, 22(1), pp.21-41.

Gómez-Lobo, A., Jiménez, J.L. and Perdiguero, J., 2015. The entry of a hard discount

supermarket: price effects.

Grover, V., Chiang, R.H., Liang, T.P. and Zhang, D., 2018. Creating strategic business value

from big data analytics: A research framework. Journal of Management Information

Systems, 35(2), pp.388-423.

Hovav, T., 2015. Business models analysis of Finnish food retailers-Case K-chain, S-chain

and Lidl-How to determine right channel to enter grocery retail market as a new

supplier with new products in Finland.

Kesseli, T., 2017. The Business Environment and Culture of Mexico from the Perspective of

Finnish Companies.

17

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Kremer, P.D. and Symmons, M.A., 2015. Mass timber construction as an alternative to

concrete and steel in the Australia building industry: a PESTEL evaluation of the

potential. International Wood Products Journal, 6(3), pp.138-147.

Larimo, J.A. and Nguyen, H.L., 2015. International joint venture strategies and performance

in the Baltic States. Baltic Journal of Management, 10(1), pp.52-72.

Lee, J.G. and Linda, N., 2016. Assessing the challenges and opportunities for small and

medium enterprises (SMEs) in the Vietnamese apparel retail market.

Luna Hernandez, A.Y., 2019. Business opportunities for Finnish companies in the label

industry in emerging Mexican market.

Paulus, A.L. and Murdapa, P., 2017. The Utilization of Resource-Based View Theory on

Minimarket Retail: Its Implication toward Strategy and Competitive Advantage. In

The 1st International Conference on Economics, Education, Business, and

Accounting (ICEEBA, 2016).

Sasson, A. and Reve, T., 2015. Complementing clusters: a competitiveness rationale for

infrastructure investments. Competitiveness Review, 25(3), pp.242-257.

Solberg, S.L., Terragni, L. and Granheim, S.I., 2016. Ultra-processed food purchases in

Norway: a quantitative study on a representative sample of food retailers. Public

health nutrition, 19(11), pp.1990-2001.

Takata, H., 2016. Effects of industry forces, market orientation, and marketing capabilities on

business performance: An empirical analysis of Japanese manufacturers from 2009 to

2011. Journal of Business Research, 69(12), pp.5611-5619.

Turner, M.J., Hodari, D. and Blal, I., 2016. Entry modes: Management contract. The

Routledge handbook of hotel chain management, pp.157-170.

Wu, C.W., 2015. Antecedents of franchise strategy and performance. Journal of Business

Research, 68(7), pp.1581-1588.

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

Kremer, P.D. and Symmons, M.A., 2015. Mass timber construction as an alternative to

concrete and steel in the Australia building industry: a PESTEL evaluation of the

potential. International Wood Products Journal, 6(3), pp.138-147.

Larimo, J.A. and Nguyen, H.L., 2015. International joint venture strategies and performance

in the Baltic States. Baltic Journal of Management, 10(1), pp.52-72.

Lee, J.G. and Linda, N., 2016. Assessing the challenges and opportunities for small and

medium enterprises (SMEs) in the Vietnamese apparel retail market.

Luna Hernandez, A.Y., 2019. Business opportunities for Finnish companies in the label

industry in emerging Mexican market.

Paulus, A.L. and Murdapa, P., 2017. The Utilization of Resource-Based View Theory on

Minimarket Retail: Its Implication toward Strategy and Competitive Advantage. In

The 1st International Conference on Economics, Education, Business, and

Accounting (ICEEBA, 2016).

Sasson, A. and Reve, T., 2015. Complementing clusters: a competitiveness rationale for

infrastructure investments. Competitiveness Review, 25(3), pp.242-257.

Solberg, S.L., Terragni, L. and Granheim, S.I., 2016. Ultra-processed food purchases in

Norway: a quantitative study on a representative sample of food retailers. Public

health nutrition, 19(11), pp.1990-2001.

Takata, H., 2016. Effects of industry forces, market orientation, and marketing capabilities on

business performance: An empirical analysis of Japanese manufacturers from 2009 to

2011. Journal of Business Research, 69(12), pp.5611-5619.

Turner, M.J., Hodari, D. and Blal, I., 2016. Entry modes: Management contract. The

Routledge handbook of hotel chain management, pp.157-170.

Wu, C.W., 2015. Antecedents of franchise strategy and performance. Journal of Business

Research, 68(7), pp.1581-1588.

18

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

LINDL CASE STUDY: PRE EXPANSION ANALYSIS

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.