Importance of Budget Planning in Management

VerifiedAdded on 2020/05/28

|13

|3041

|81

AI Summary

This assignment delves into the crucial role of budget planning in successful management practices. It highlights the benefits of budgeting, emphasizing its ability to enhance decision-making processes and facilitate continuous improvements within organizations. The document also explores how a well-structured budget provides essential financial information that supports informed decision-making, ultimately leading to increased confidence and organizational effectiveness.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: MANAGEMENT ACCOUNTING

Management accounting

Name of the student

Name of the university

Author note

Management accounting

Name of the student

Name of the university

Author note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1MANAGEMENT ACCOUNTING

Table of Contents

Assessment task – Part A – Activity based costing...................................................................2

a. Computation of the per unit cost for listed activities based on activity drivers..............4

b. Determining the per unit cost for Lamington and preparation of activity bill................5

c. Other costs.......................................................................................................................5

Assessment task – Part B – Budgeting.......................................................................................6

a. Impact of the sales revenue.............................................................................................7

b. Analysis of the new fee structure and membership plan for rejecting it or adopting it. .9

Reference..................................................................................................................................11

Table of Contents

Assessment task – Part A – Activity based costing...................................................................2

a. Computation of the per unit cost for listed activities based on activity drivers..............4

b. Determining the per unit cost for Lamington and preparation of activity bill................5

c. Other costs.......................................................................................................................5

Assessment task – Part B – Budgeting.......................................................................................6

a. Impact of the sales revenue.............................................................................................7

b. Analysis of the new fee structure and membership plan for rejecting it or adopting it. .9

Reference..................................................................................................................................11

2MANAGEMENT ACCOUNTING

Assessment task – Part A – Activity based costing

Activity based costing is the methodology for allocating the overheads more precisely

over those items actually used by the process. This method can be used for achieving target

deduction in the overhead expenses (Bhimani 2012). It works best in the complex

circumstance where many products and machines are there, processes are tangled and not

easy for sorting out. On the contrary, it is not of much importance where the process of

production is simple. ABC identifies the special training, machine set up, special engineering

and other activities that generate costs and lead the company to the consumer resources. As

per ABC the company computes the resource cost used under the activities (Bunn and Sapio

2015). Thereafter, cost of each activity is assigned only over the products that require the

activities. ABC has become important in past few years as the manufacturing costs increased

significantly, diversity with regard to the demands of the customer as well as the product has

been increased significantly, the costs of manufacturing overheads do not correlate with the

direct labour hours and productive machine hours anymore and few products are produced

under large batches while other products are produced under small batches. Various

advantages are there with regard to usages of ABC. These are –

Make or buy – it provides the comprehensive view regarding each cost that is

associated with in-house manufacturing of any product so that the company can

precisely analyse which cost shall be eliminated if the product is outsourced and

which cost can be carried on.

Minimum price – pricing is done for the product in such way that the market will be

ready to pay and the marketing manager shall know the product cost before deciding

the price of the product. It will assist the company to avoid the situation where the

company will lose money due to high pricing of product. ABC helps to determine

Assessment task – Part A – Activity based costing

Activity based costing is the methodology for allocating the overheads more precisely

over those items actually used by the process. This method can be used for achieving target

deduction in the overhead expenses (Bhimani 2012). It works best in the complex

circumstance where many products and machines are there, processes are tangled and not

easy for sorting out. On the contrary, it is not of much importance where the process of

production is simple. ABC identifies the special training, machine set up, special engineering

and other activities that generate costs and lead the company to the consumer resources. As

per ABC the company computes the resource cost used under the activities (Bunn and Sapio

2015). Thereafter, cost of each activity is assigned only over the products that require the

activities. ABC has become important in past few years as the manufacturing costs increased

significantly, diversity with regard to the demands of the customer as well as the product has

been increased significantly, the costs of manufacturing overheads do not correlate with the

direct labour hours and productive machine hours anymore and few products are produced

under large batches while other products are produced under small batches. Various

advantages are there with regard to usages of ABC. These are –

Make or buy – it provides the comprehensive view regarding each cost that is

associated with in-house manufacturing of any product so that the company can

precisely analyse which cost shall be eliminated if the product is outsourced and

which cost can be carried on.

Minimum price – pricing is done for the product in such way that the market will be

ready to pay and the marketing manager shall know the product cost before deciding

the price of the product. It will assist the company to avoid the situation where the

company will lose money due to high pricing of product. ABC helps to determine

3MANAGEMENT ACCOUNTING

which cost is to be included under this minimum product price based on the

circumstances under which the product is to be sold (Guerrero-Baena, Gómez-Limón

and Fruet Cardozo 2013).

Cost for production facility – it becomes easy to differentiate the overhead cost at the

level of production plant which in turn enables the manager to compare the

production cost among various facilities (Linassi, Alberton and Marinho 2016).

Customer’s profitability – mostly the costs incurred by individual customers are

product cost that includes the overhead expenses and other costs like handling of

product return, high level of customer service and agreements for cooperative

marketing. ABC method can sort through the additional overhead costs and may assist

in determining which customer is earning the reasonable profit (Drury 2013).

However, some issues must be taken into consideration before implementing the ABC

system. These are –

Volume for cost pool – though the ABC system produces information of high quality,

it comes with the cost of various cost pools and cost of managing system increases

with additional cost pools. For reducing these costs, ongoing analysis of cost shall be

carried out with comparing the utility of each cost pool.

Time for installation – the ABC system is quite difficult to install as it may require

multi-year installations where the company try to install this across all the facilities

and products. Further, it is difficult to manage the high level budgetary support as

time wasted without the completion of installations (Fathi and Elham 2015).

Project basis – generally the ABC projects are allowed on basis of the project so that

the information is collected only once. Further, the information can be useful for the

current operational situation of the company. Therefore, management may not

authorize the funding for future ABC project.

which cost is to be included under this minimum product price based on the

circumstances under which the product is to be sold (Guerrero-Baena, Gómez-Limón

and Fruet Cardozo 2013).

Cost for production facility – it becomes easy to differentiate the overhead cost at the

level of production plant which in turn enables the manager to compare the

production cost among various facilities (Linassi, Alberton and Marinho 2016).

Customer’s profitability – mostly the costs incurred by individual customers are

product cost that includes the overhead expenses and other costs like handling of

product return, high level of customer service and agreements for cooperative

marketing. ABC method can sort through the additional overhead costs and may assist

in determining which customer is earning the reasonable profit (Drury 2013).

However, some issues must be taken into consideration before implementing the ABC

system. These are –

Volume for cost pool – though the ABC system produces information of high quality,

it comes with the cost of various cost pools and cost of managing system increases

with additional cost pools. For reducing these costs, ongoing analysis of cost shall be

carried out with comparing the utility of each cost pool.

Time for installation – the ABC system is quite difficult to install as it may require

multi-year installations where the company try to install this across all the facilities

and products. Further, it is difficult to manage the high level budgetary support as

time wasted without the completion of installations (Fathi and Elham 2015).

Project basis – generally the ABC projects are allowed on basis of the project so that

the information is collected only once. Further, the information can be useful for the

current operational situation of the company. Therefore, management may not

authorize the funding for future ABC project.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4MANAGEMENT ACCOUNTING

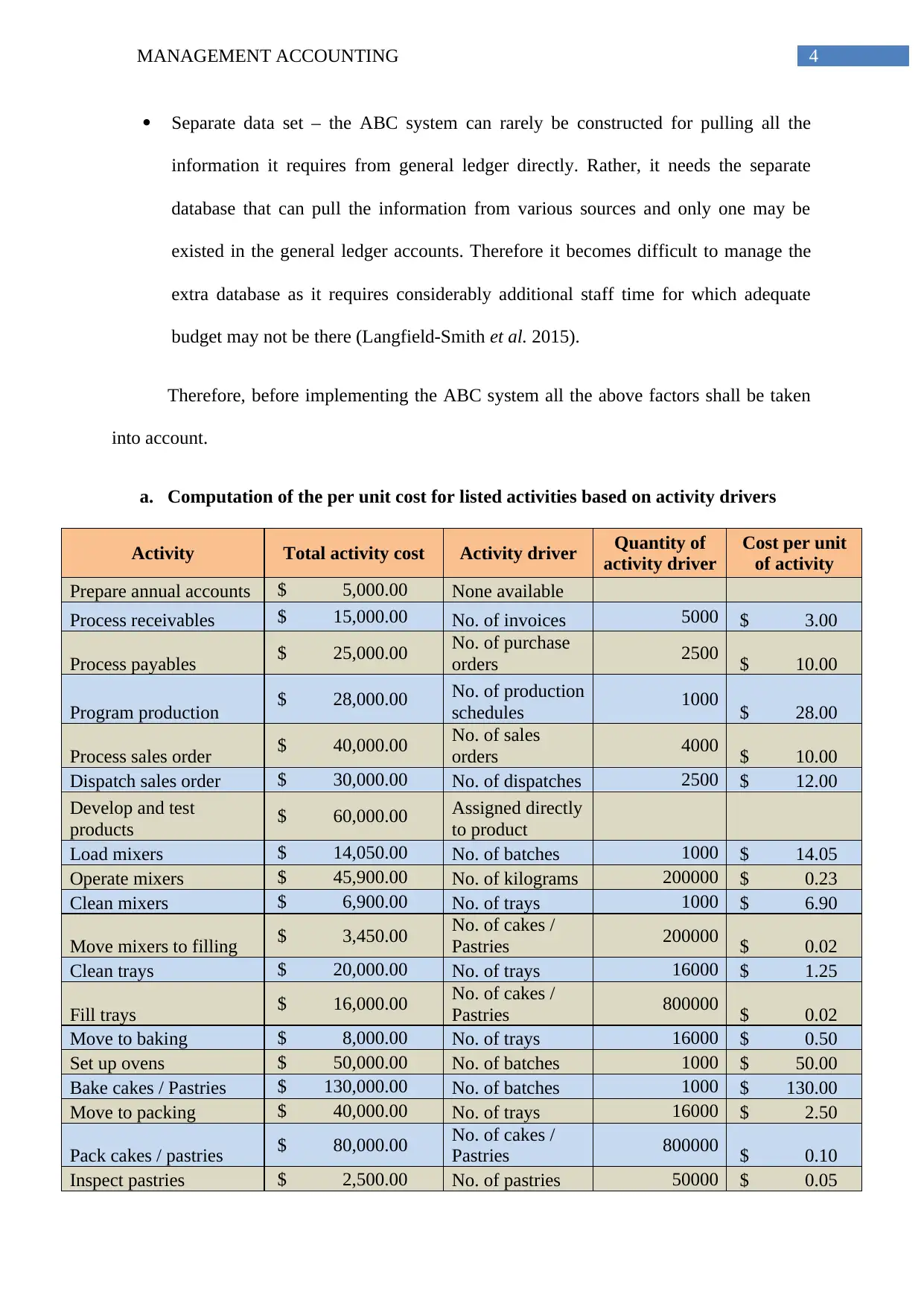

Separate data set – the ABC system can rarely be constructed for pulling all the

information it requires from general ledger directly. Rather, it needs the separate

database that can pull the information from various sources and only one may be

existed in the general ledger accounts. Therefore it becomes difficult to manage the

extra database as it requires considerably additional staff time for which adequate

budget may not be there (Langfield-Smith et al. 2015).

Therefore, before implementing the ABC system all the above factors shall be taken

into account.

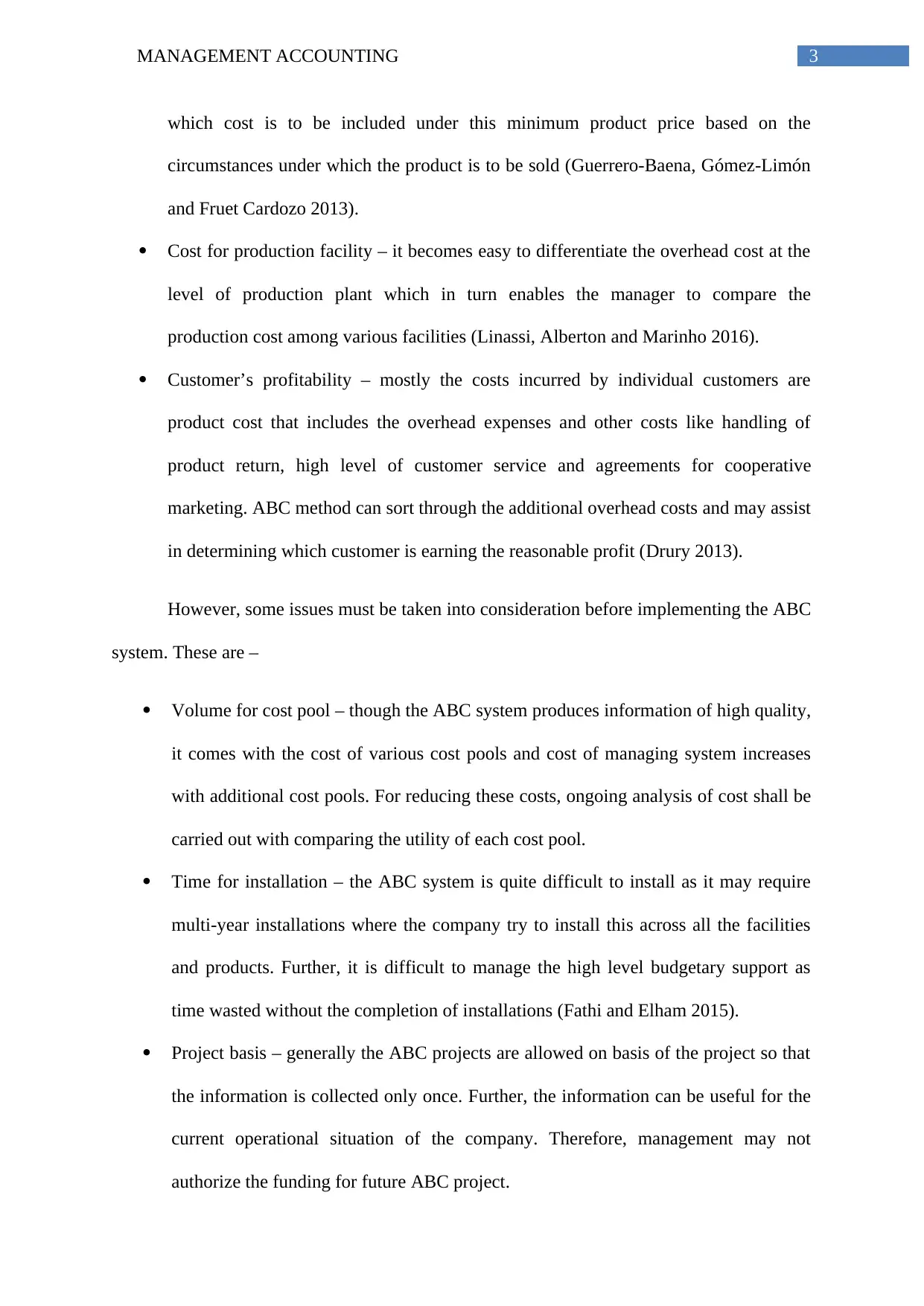

a. Computation of the per unit cost for listed activities based on activity drivers

Activity Total activity cost Activity driver Quantity of

activity driver

Cost per unit

of activity

Prepare annual accounts $ 5,000.00 None available

Process receivables $ 15,000.00 No. of invoices 5000 $ 3.00

Process payables $ 25,000.00 No. of purchase

orders 2500 $ 10.00

Program production $ 28,000.00 No. of production

schedules 1000 $ 28.00

Process sales order $ 40,000.00 No. of sales

orders 4000 $ 10.00

Dispatch sales order $ 30,000.00 No. of dispatches 2500 $ 12.00

Develop and test

products $ 60,000.00 Assigned directly

to product

Load mixers $ 14,050.00 No. of batches 1000 $ 14.05

Operate mixers $ 45,900.00 No. of kilograms 200000 $ 0.23

Clean mixers $ 6,900.00 No. of trays 1000 $ 6.90

Move mixers to filling $ 3,450.00 No. of cakes /

Pastries 200000 $ 0.02

Clean trays $ 20,000.00 No. of trays 16000 $ 1.25

Fill trays $ 16,000.00 No. of cakes /

Pastries 800000 $ 0.02

Move to baking $ 8,000.00 No. of trays 16000 $ 0.50

Set up ovens $ 50,000.00 No. of batches 1000 $ 50.00

Bake cakes / Pastries $ 130,000.00 No. of batches 1000 $ 130.00

Move to packing $ 40,000.00 No. of trays 16000 $ 2.50

Pack cakes / pastries $ 80,000.00 No. of cakes /

Pastries 800000 $ 0.10

Inspect pastries $ 2,500.00 No. of pastries 50000 $ 0.05

Separate data set – the ABC system can rarely be constructed for pulling all the

information it requires from general ledger directly. Rather, it needs the separate

database that can pull the information from various sources and only one may be

existed in the general ledger accounts. Therefore it becomes difficult to manage the

extra database as it requires considerably additional staff time for which adequate

budget may not be there (Langfield-Smith et al. 2015).

Therefore, before implementing the ABC system all the above factors shall be taken

into account.

a. Computation of the per unit cost for listed activities based on activity drivers

Activity Total activity cost Activity driver Quantity of

activity driver

Cost per unit

of activity

Prepare annual accounts $ 5,000.00 None available

Process receivables $ 15,000.00 No. of invoices 5000 $ 3.00

Process payables $ 25,000.00 No. of purchase

orders 2500 $ 10.00

Program production $ 28,000.00 No. of production

schedules 1000 $ 28.00

Process sales order $ 40,000.00 No. of sales

orders 4000 $ 10.00

Dispatch sales order $ 30,000.00 No. of dispatches 2500 $ 12.00

Develop and test

products $ 60,000.00 Assigned directly

to product

Load mixers $ 14,050.00 No. of batches 1000 $ 14.05

Operate mixers $ 45,900.00 No. of kilograms 200000 $ 0.23

Clean mixers $ 6,900.00 No. of trays 1000 $ 6.90

Move mixers to filling $ 3,450.00 No. of cakes /

Pastries 200000 $ 0.02

Clean trays $ 20,000.00 No. of trays 16000 $ 1.25

Fill trays $ 16,000.00 No. of cakes /

Pastries 800000 $ 0.02

Move to baking $ 8,000.00 No. of trays 16000 $ 0.50

Set up ovens $ 50,000.00 No. of batches 1000 $ 50.00

Bake cakes / Pastries $ 130,000.00 No. of batches 1000 $ 130.00

Move to packing $ 40,000.00 No. of trays 16000 $ 2.50

Pack cakes / pastries $ 80,000.00 No. of cakes /

Pastries 800000 $ 0.10

Inspect pastries $ 2,500.00 No. of pastries 50000 $ 0.05

5MANAGEMENT ACCOUNTING

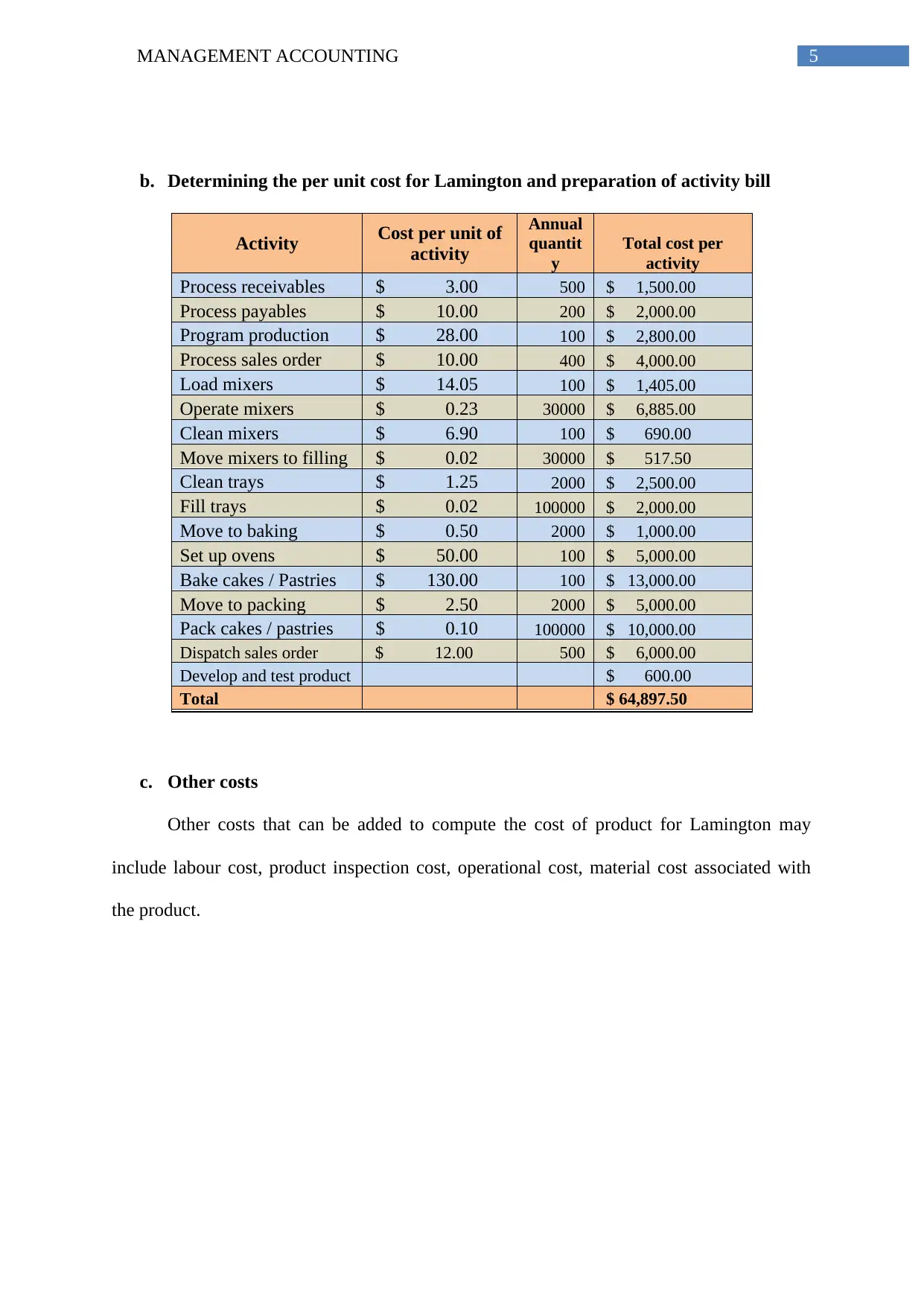

b. Determining the per unit cost for Lamington and preparation of activity bill

Activity Cost per unit of

activity

Annual

quantit

y

Total cost per

activity

Process receivables $ 3.00 500 $ 1,500.00

Process payables $ 10.00 200 $ 2,000.00

Program production $ 28.00 100 $ 2,800.00

Process sales order $ 10.00 400 $ 4,000.00

Load mixers $ 14.05 100 $ 1,405.00

Operate mixers $ 0.23 30000 $ 6,885.00

Clean mixers $ 6.90 100 $ 690.00

Move mixers to filling $ 0.02 30000 $ 517.50

Clean trays $ 1.25 2000 $ 2,500.00

Fill trays $ 0.02 100000 $ 2,000.00

Move to baking $ 0.50 2000 $ 1,000.00

Set up ovens $ 50.00 100 $ 5,000.00

Bake cakes / Pastries $ 130.00 100 $ 13,000.00

Move to packing $ 2.50 2000 $ 5,000.00

Pack cakes / pastries $ 0.10 100000 $ 10,000.00

Dispatch sales order $ 12.00 500 $ 6,000.00

Develop and test product $ 600.00

Total $ 64,897.50

c. Other costs

Other costs that can be added to compute the cost of product for Lamington may

include labour cost, product inspection cost, operational cost, material cost associated with

the product.

b. Determining the per unit cost for Lamington and preparation of activity bill

Activity Cost per unit of

activity

Annual

quantit

y

Total cost per

activity

Process receivables $ 3.00 500 $ 1,500.00

Process payables $ 10.00 200 $ 2,000.00

Program production $ 28.00 100 $ 2,800.00

Process sales order $ 10.00 400 $ 4,000.00

Load mixers $ 14.05 100 $ 1,405.00

Operate mixers $ 0.23 30000 $ 6,885.00

Clean mixers $ 6.90 100 $ 690.00

Move mixers to filling $ 0.02 30000 $ 517.50

Clean trays $ 1.25 2000 $ 2,500.00

Fill trays $ 0.02 100000 $ 2,000.00

Move to baking $ 0.50 2000 $ 1,000.00

Set up ovens $ 50.00 100 $ 5,000.00

Bake cakes / Pastries $ 130.00 100 $ 13,000.00

Move to packing $ 2.50 2000 $ 5,000.00

Pack cakes / pastries $ 0.10 100000 $ 10,000.00

Dispatch sales order $ 12.00 500 $ 6,000.00

Develop and test product $ 600.00

Total $ 64,897.50

c. Other costs

Other costs that can be added to compute the cost of product for Lamington may

include labour cost, product inspection cost, operational cost, material cost associated with

the product.

6MANAGEMENT ACCOUNTING

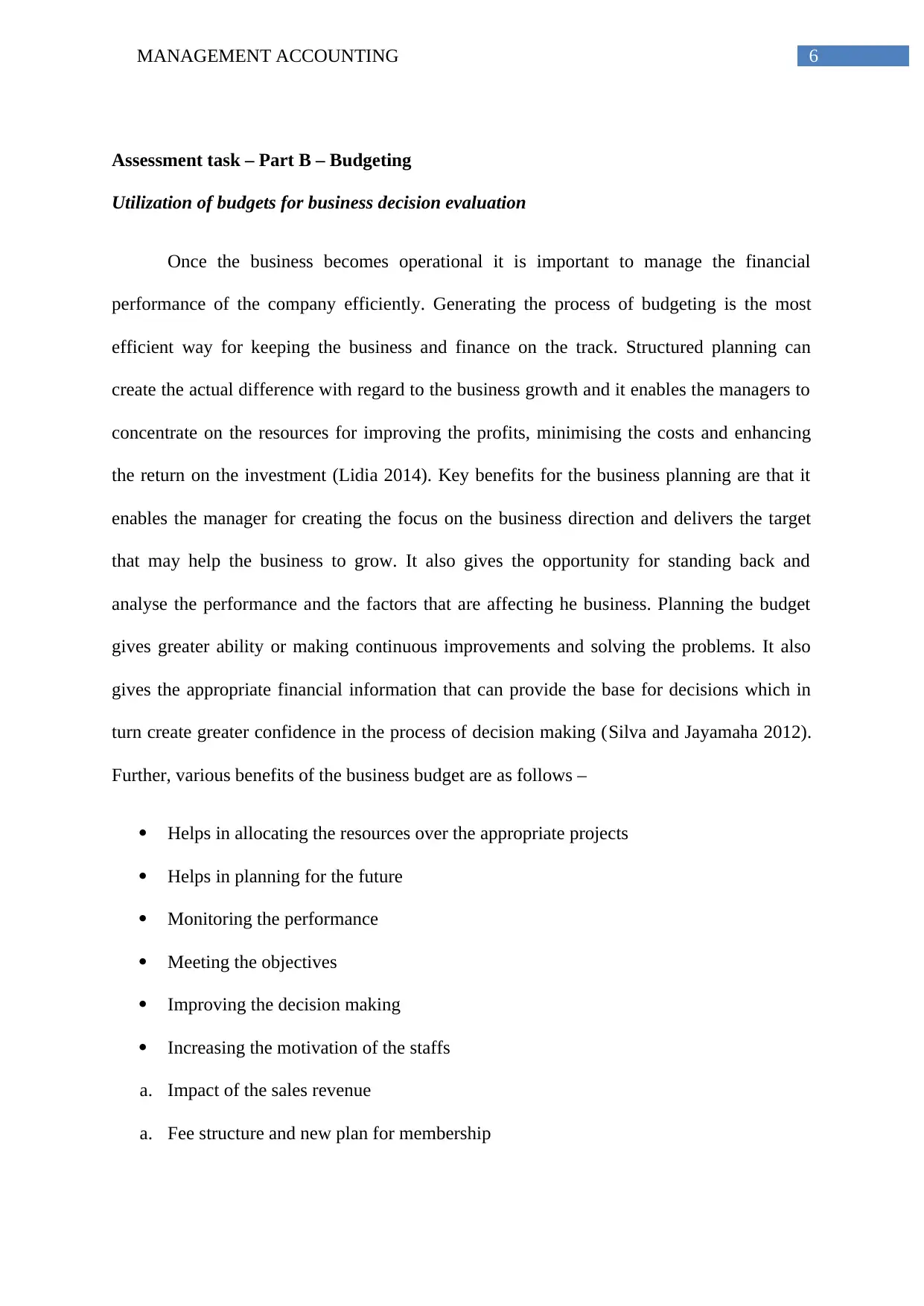

Assessment task – Part B – Budgeting

Utilization of budgets for business decision evaluation

Once the business becomes operational it is important to manage the financial

performance of the company efficiently. Generating the process of budgeting is the most

efficient way for keeping the business and finance on the track. Structured planning can

create the actual difference with regard to the business growth and it enables the managers to

concentrate on the resources for improving the profits, minimising the costs and enhancing

the return on the investment (Lidia 2014). Key benefits for the business planning are that it

enables the manager for creating the focus on the business direction and delivers the target

that may help the business to grow. It also gives the opportunity for standing back and

analyse the performance and the factors that are affecting he business. Planning the budget

gives greater ability or making continuous improvements and solving the problems. It also

gives the appropriate financial information that can provide the base for decisions which in

turn create greater confidence in the process of decision making (Silva and Jayamaha 2012).

Further, various benefits of the business budget are as follows –

Helps in allocating the resources over the appropriate projects

Helps in planning for the future

Monitoring the performance

Meeting the objectives

Improving the decision making

Increasing the motivation of the staffs

a. Impact of the sales revenue

a. Fee structure and new plan for membership

Assessment task – Part B – Budgeting

Utilization of budgets for business decision evaluation

Once the business becomes operational it is important to manage the financial

performance of the company efficiently. Generating the process of budgeting is the most

efficient way for keeping the business and finance on the track. Structured planning can

create the actual difference with regard to the business growth and it enables the managers to

concentrate on the resources for improving the profits, minimising the costs and enhancing

the return on the investment (Lidia 2014). Key benefits for the business planning are that it

enables the manager for creating the focus on the business direction and delivers the target

that may help the business to grow. It also gives the opportunity for standing back and

analyse the performance and the factors that are affecting he business. Planning the budget

gives greater ability or making continuous improvements and solving the problems. It also

gives the appropriate financial information that can provide the base for decisions which in

turn create greater confidence in the process of decision making (Silva and Jayamaha 2012).

Further, various benefits of the business budget are as follows –

Helps in allocating the resources over the appropriate projects

Helps in planning for the future

Monitoring the performance

Meeting the objectives

Improving the decision making

Increasing the motivation of the staffs

a. Impact of the sales revenue

a. Fee structure and new plan for membership

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7MANAGEMENT ACCOUNTING

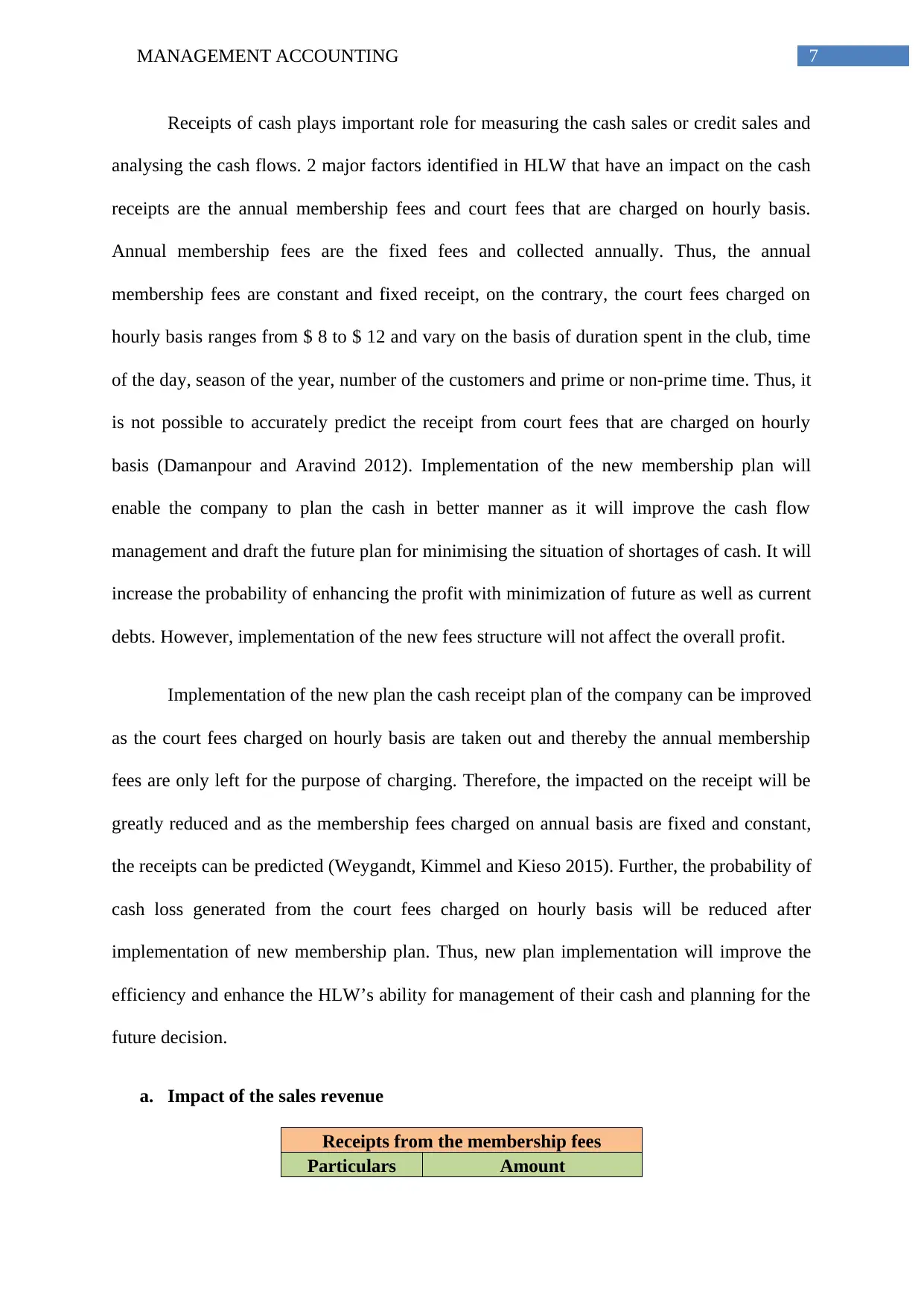

Receipts of cash plays important role for measuring the cash sales or credit sales and

analysing the cash flows. 2 major factors identified in HLW that have an impact on the cash

receipts are the annual membership fees and court fees that are charged on hourly basis.

Annual membership fees are the fixed fees and collected annually. Thus, the annual

membership fees are constant and fixed receipt, on the contrary, the court fees charged on

hourly basis ranges from $ 8 to $ 12 and vary on the basis of duration spent in the club, time

of the day, season of the year, number of the customers and prime or non-prime time. Thus, it

is not possible to accurately predict the receipt from court fees that are charged on hourly

basis (Damanpour and Aravind 2012). Implementation of the new membership plan will

enable the company to plan the cash in better manner as it will improve the cash flow

management and draft the future plan for minimising the situation of shortages of cash. It will

increase the probability of enhancing the profit with minimization of future as well as current

debts. However, implementation of the new fees structure will not affect the overall profit.

Implementation of the new plan the cash receipt plan of the company can be improved

as the court fees charged on hourly basis are taken out and thereby the annual membership

fees are only left for the purpose of charging. Therefore, the impacted on the receipt will be

greatly reduced and as the membership fees charged on annual basis are fixed and constant,

the receipts can be predicted (Weygandt, Kimmel and Kieso 2015). Further, the probability of

cash loss generated from the court fees charged on hourly basis will be reduced after

implementation of new membership plan. Thus, new plan implementation will improve the

efficiency and enhance the HLW’s ability for management of their cash and planning for the

future decision.

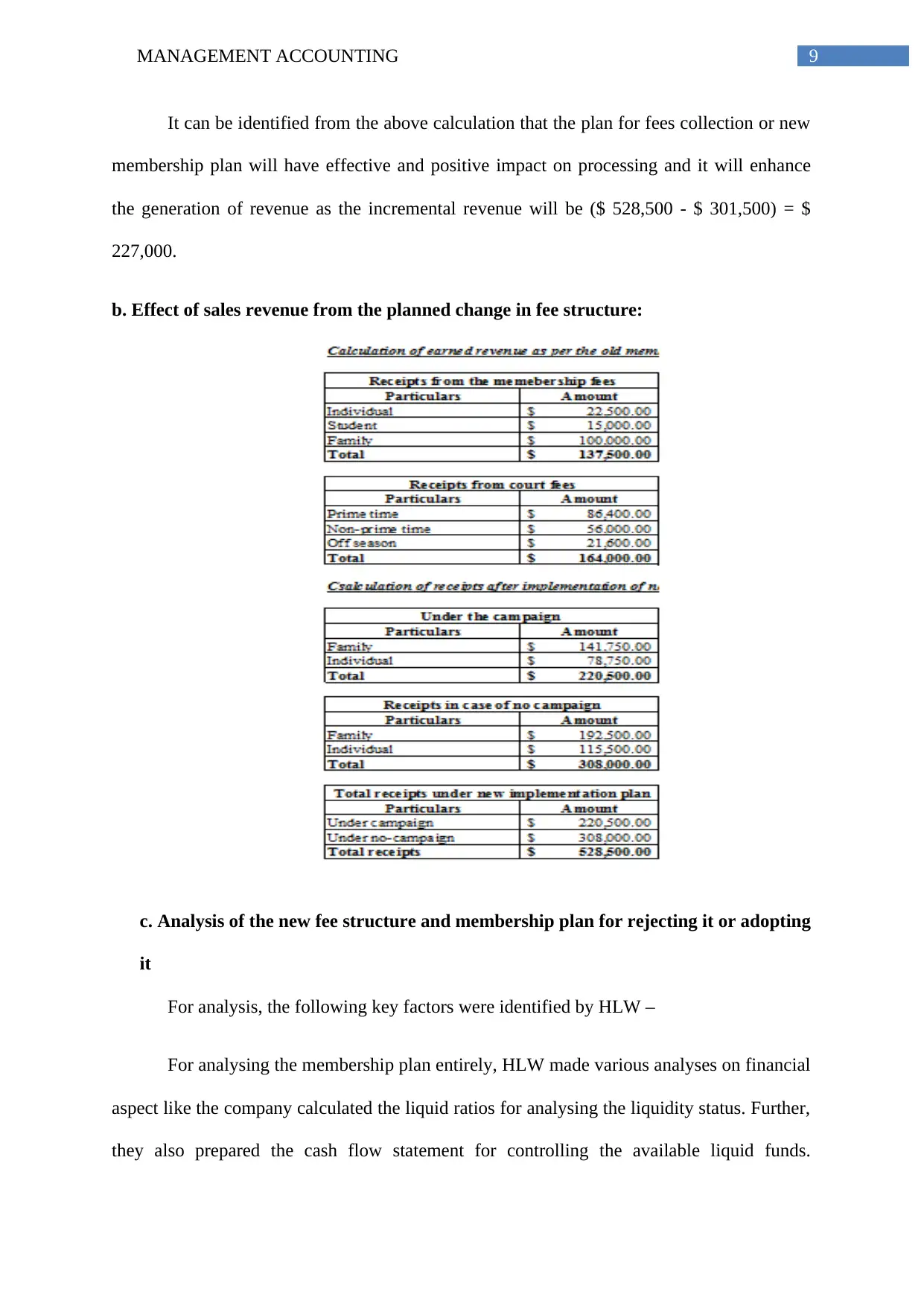

a. Impact of the sales revenue

Receipts from the membership fees

Particulars Amount

Receipts of cash plays important role for measuring the cash sales or credit sales and

analysing the cash flows. 2 major factors identified in HLW that have an impact on the cash

receipts are the annual membership fees and court fees that are charged on hourly basis.

Annual membership fees are the fixed fees and collected annually. Thus, the annual

membership fees are constant and fixed receipt, on the contrary, the court fees charged on

hourly basis ranges from $ 8 to $ 12 and vary on the basis of duration spent in the club, time

of the day, season of the year, number of the customers and prime or non-prime time. Thus, it

is not possible to accurately predict the receipt from court fees that are charged on hourly

basis (Damanpour and Aravind 2012). Implementation of the new membership plan will

enable the company to plan the cash in better manner as it will improve the cash flow

management and draft the future plan for minimising the situation of shortages of cash. It will

increase the probability of enhancing the profit with minimization of future as well as current

debts. However, implementation of the new fees structure will not affect the overall profit.

Implementation of the new plan the cash receipt plan of the company can be improved

as the court fees charged on hourly basis are taken out and thereby the annual membership

fees are only left for the purpose of charging. Therefore, the impacted on the receipt will be

greatly reduced and as the membership fees charged on annual basis are fixed and constant,

the receipts can be predicted (Weygandt, Kimmel and Kieso 2015). Further, the probability of

cash loss generated from the court fees charged on hourly basis will be reduced after

implementation of new membership plan. Thus, new plan implementation will improve the

efficiency and enhance the HLW’s ability for management of their cash and planning for the

future decision.

a. Impact of the sales revenue

Receipts from the membership fees

Particulars Amount

8MANAGEMENT ACCOUNTING

Individual $ 22,500.00

Student $ 15,000.00

Family $ 100,000.00

Total $ 137,500.00

Receipts from court fees

Particulars Amount

Prime time $ 86,400.00

Non-prime time $ 56,000.00

Off season $ 21,600.00

Total $ 164,000.00

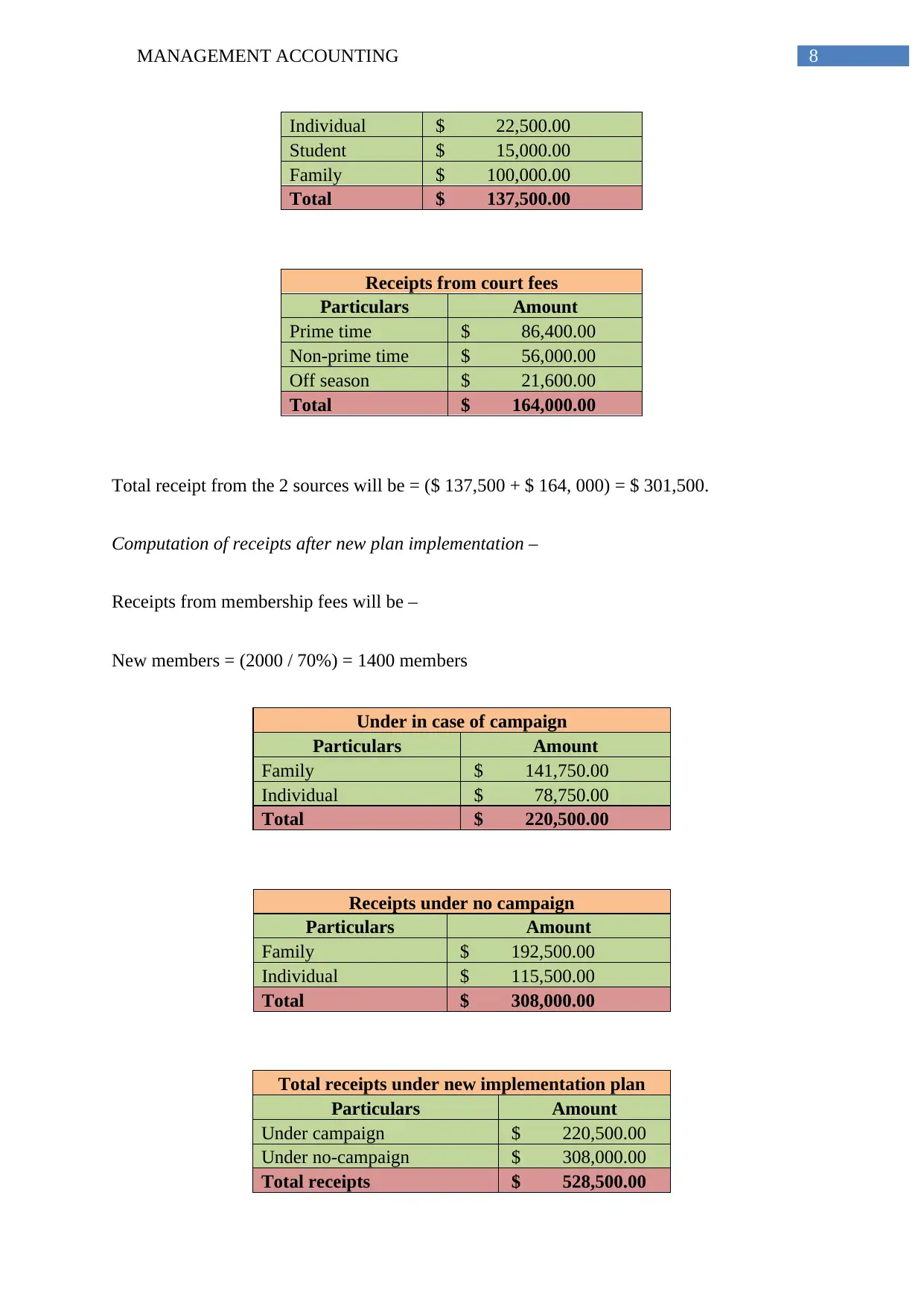

Total receipt from the 2 sources will be = ($ 137,500 + $ 164, 000) = $ 301,500.

Computation of receipts after new plan implementation –

Receipts from membership fees will be –

New members = (2000 / 70%) = 1400 members

Under in case of campaign

Particulars Amount

Family $ 141,750.00

Individual $ 78,750.00

Total $ 220,500.00

Receipts under no campaign

Particulars Amount

Family $ 192,500.00

Individual $ 115,500.00

Total $ 308,000.00

Total receipts under new implementation plan

Particulars Amount

Under campaign $ 220,500.00

Under no-campaign $ 308,000.00

Total receipts $ 528,500.00

Individual $ 22,500.00

Student $ 15,000.00

Family $ 100,000.00

Total $ 137,500.00

Receipts from court fees

Particulars Amount

Prime time $ 86,400.00

Non-prime time $ 56,000.00

Off season $ 21,600.00

Total $ 164,000.00

Total receipt from the 2 sources will be = ($ 137,500 + $ 164, 000) = $ 301,500.

Computation of receipts after new plan implementation –

Receipts from membership fees will be –

New members = (2000 / 70%) = 1400 members

Under in case of campaign

Particulars Amount

Family $ 141,750.00

Individual $ 78,750.00

Total $ 220,500.00

Receipts under no campaign

Particulars Amount

Family $ 192,500.00

Individual $ 115,500.00

Total $ 308,000.00

Total receipts under new implementation plan

Particulars Amount

Under campaign $ 220,500.00

Under no-campaign $ 308,000.00

Total receipts $ 528,500.00

9MANAGEMENT ACCOUNTING

It can be identified from the above calculation that the plan for fees collection or new

membership plan will have effective and positive impact on processing and it will enhance

the generation of revenue as the incremental revenue will be ($ 528,500 - $ 301,500) = $

227,000.

b. Effect of sales revenue from the planned change in fee structure:

c. Analysis of the new fee structure and membership plan for rejecting it or adopting

it

For analysis, the following key factors were identified by HLW –

For analysing the membership plan entirely, HLW made various analyses on financial

aspect like the company calculated the liquid ratios for analysing the liquidity status. Further,

they also prepared the cash flow statement for controlling the available liquid funds.

It can be identified from the above calculation that the plan for fees collection or new

membership plan will have effective and positive impact on processing and it will enhance

the generation of revenue as the incremental revenue will be ($ 528,500 - $ 301,500) = $

227,000.

b. Effect of sales revenue from the planned change in fee structure:

c. Analysis of the new fee structure and membership plan for rejecting it or adopting

it

For analysis, the following key factors were identified by HLW –

For analysing the membership plan entirely, HLW made various analyses on financial

aspect like the company calculated the liquid ratios for analysing the liquidity status. Further,

they also prepared the cash flow statement for controlling the available liquid funds.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10MANAGEMENT ACCOUNTING

Moreover, they tried to maintain sufficient balance between the amount of cash inflows and

outflows. For the purpose of achieving the target they also prepared the flexible budget and

the statement for estimation of cash flows (McVay 2015). The HLW management recognized

that the minimization of the administration cost after new membership plan implementation

as the club will no more be required to prepare the revenue collection data on regular basis

(Burns and Walker 2015). However, initially the plan may get adverse opinion from the

management as they will face problem in collecting the membership fees. Moreover, the

onetime fees may seem to be a burden for the members which in turn may reduce the number

of members considerably. Further, as per the new membership plan the members required to

pay the payment for entire year as the advance payment (Estampe et al. 2013). Therefore, as

per the new policy onetime cash budgets is required to be prepared as the payment will be

made once in the year. However, to execute the plan successfully effective cash management

is required to be in place that includes controlling and managing the cash efficiently.

It has been concluded from the above analysis that Activity based costing can be used

for achieving target deduction in the overhead expenses. It works best in the complex

circumstance where many products and machines are there, processes are tangled and not

easy for sorting out. ABC identifies the special training, machine set up, special engineering

and other activities that generate costs and lead the company to the consumer resources.

However, it is not of much importance where the process of production is simple. On the

other hand, planning the budget gives greater ability or making continuous improvements and

solving the problems. It also gives the appropriate financial information that can provide the

base for decisions which in turn create greater confidence in the process of decision making.

Moreover, they tried to maintain sufficient balance between the amount of cash inflows and

outflows. For the purpose of achieving the target they also prepared the flexible budget and

the statement for estimation of cash flows (McVay 2015). The HLW management recognized

that the minimization of the administration cost after new membership plan implementation

as the club will no more be required to prepare the revenue collection data on regular basis

(Burns and Walker 2015). However, initially the plan may get adverse opinion from the

management as they will face problem in collecting the membership fees. Moreover, the

onetime fees may seem to be a burden for the members which in turn may reduce the number

of members considerably. Further, as per the new membership plan the members required to

pay the payment for entire year as the advance payment (Estampe et al. 2013). Therefore, as

per the new policy onetime cash budgets is required to be prepared as the payment will be

made once in the year. However, to execute the plan successfully effective cash management

is required to be in place that includes controlling and managing the cash efficiently.

It has been concluded from the above analysis that Activity based costing can be used

for achieving target deduction in the overhead expenses. It works best in the complex

circumstance where many products and machines are there, processes are tangled and not

easy for sorting out. ABC identifies the special training, machine set up, special engineering

and other activities that generate costs and lead the company to the consumer resources.

However, it is not of much importance where the process of production is simple. On the

other hand, planning the budget gives greater ability or making continuous improvements and

solving the problems. It also gives the appropriate financial information that can provide the

base for decisions which in turn create greater confidence in the process of decision making.

11MANAGEMENT ACCOUNTING

Reference

Bhimani, A. 2012, Introduction to management accounting,Financial Times Prentice Hall,

Harlow.

Bunn, D., Koc, V. and Sapio, A. 2015, "Resource externalities and the persistence of

heterogeneous pricing behavior in an energy commodity market", Energy Economics, vol.

48, pp. 265-275.

Burns, R. and Walker, J., 2015. Capital budgeting surveys: the future is now.

Damanpour, F. and Aravind, D., 2012. Managerial innovation: Conceptions, processes, and

antecedents. Management and Organization Review, 8(2), pp.423-454.

Drury, C.M., 2013. Management and cost accounting. Springer.

Estampe, D., Lamouri, S., Paris, J.L. and Brahim-Djelloul, S., 2013. A framework for

analysing supply chain performance evaluation models. International Journal of Production

Economics, 142(2), pp.247-258.

Fathi, Z. and Elham, M.D., 2015, A survey of activity-based costing in hotel industry,

Management Science Letters, vol. 5, no. 9, pp. 855-860.

Guerrero-Baena, M.D., Gómez-Limón, J.A. and Fruet Cardozo, J.V. 2013, "The capital

budgeting process: A methodological approach based on financial and intellectual value

creation", Intangible Capital, vol. 9, no. 4.

Langfield-Smith, K., Thorne, H., Smith, D.A. and Hilton, R.W. 2015, Management

accounting: information for creating and managing value, 7e [] edn, McGraw-Hill Education,

North Ryde, N.S.W.

Reference

Bhimani, A. 2012, Introduction to management accounting,Financial Times Prentice Hall,

Harlow.

Bunn, D., Koc, V. and Sapio, A. 2015, "Resource externalities and the persistence of

heterogeneous pricing behavior in an energy commodity market", Energy Economics, vol.

48, pp. 265-275.

Burns, R. and Walker, J., 2015. Capital budgeting surveys: the future is now.

Damanpour, F. and Aravind, D., 2012. Managerial innovation: Conceptions, processes, and

antecedents. Management and Organization Review, 8(2), pp.423-454.

Drury, C.M., 2013. Management and cost accounting. Springer.

Estampe, D., Lamouri, S., Paris, J.L. and Brahim-Djelloul, S., 2013. A framework for

analysing supply chain performance evaluation models. International Journal of Production

Economics, 142(2), pp.247-258.

Fathi, Z. and Elham, M.D., 2015, A survey of activity-based costing in hotel industry,

Management Science Letters, vol. 5, no. 9, pp. 855-860.

Guerrero-Baena, M.D., Gómez-Limón, J.A. and Fruet Cardozo, J.V. 2013, "The capital

budgeting process: A methodological approach based on financial and intellectual value

creation", Intangible Capital, vol. 9, no. 4.

Langfield-Smith, K., Thorne, H., Smith, D.A. and Hilton, R.W. 2015, Management

accounting: information for creating and managing value, 7e [] edn, McGraw-Hill Education,

North Ryde, N.S.W.

12MANAGEMENT ACCOUNTING

Lidia, T.G. 2014, Difficulties of the Budgeting Process and Factors Leading to the Decision

to Implement this Management Tool, Procedia Economics and Finance, vol. 15, pp. 466-473.

Linassi, R., Alberton, A. and Marinho, S.V. 2016, "Menu engineering and activity-based

costing: An improved method of menu planning", International Journal of Contemporary

Hospitality Management, vol. 28, no. 7, pp. 1417-1440.

McVay, G.J. 2015, "The effects of compensation scheme, source credibility, and receiver

involvement on the organizational budgeting process", Academy of Accounting and Financial

Studies Journal, vol. 19, no. 3, pp. 217.

Silva, L.M.D. and Jayamaha, A., 2012. Budgetary process and organizational performance of

apparel industry in Sri Lanka. Journal of Emerging Trends in Economics and Management

Sciences, 3(4), p.354.

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2015. Financial & Managerial Accounting.

John Wiley & Sons.

Lidia, T.G. 2014, Difficulties of the Budgeting Process and Factors Leading to the Decision

to Implement this Management Tool, Procedia Economics and Finance, vol. 15, pp. 466-473.

Linassi, R., Alberton, A. and Marinho, S.V. 2016, "Menu engineering and activity-based

costing: An improved method of menu planning", International Journal of Contemporary

Hospitality Management, vol. 28, no. 7, pp. 1417-1440.

McVay, G.J. 2015, "The effects of compensation scheme, source credibility, and receiver

involvement on the organizational budgeting process", Academy of Accounting and Financial

Studies Journal, vol. 19, no. 3, pp. 217.

Silva, L.M.D. and Jayamaha, A., 2012. Budgetary process and organizational performance of

apparel industry in Sri Lanka. Journal of Emerging Trends in Economics and Management

Sciences, 3(4), p.354.

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2015. Financial & Managerial Accounting.

John Wiley & Sons.

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.