HI6026: Auditor Reporting & Compliance in Australia - Assurance Report

VerifiedAdded on 2023/06/07

|13

|2914

|264

Report

AI Summary

This report analyzes Macquarie Media Limited's annual report, focusing on mandatory disclosure requirements and auditor responsibilities. It examines the audit committee's structure, functions, and responsibilities, as well as the external auditor's (Ernst & Young) independence declaration, services provided, and audit opinion. The report also discusses key audit matters, differences in responsibilities between directors/management and auditors, and any material subsequent events. The analysis reveals that the company adheres to all necessary requirements, and the auditors have fulfilled their responsibilities without any observed issues in declarations, remunerations, or expressed opinions. The report concludes with a summary of findings and a list of references, providing a comprehensive overview of the audit and assurance process for Macquarie Media Limited. Desklib provides access to similar solved assignments and past papers for students.

Audit and assurance

Assurance

Assurance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY

The current report deals with the certain disclosure requirements that are mandatory in

any kind of annual report published by a listed company. The sample company dealt in the

report is Macquarie Media Limited. The ultimate result observed is the follow up of all the

requirements by the board of the company. The auditors, Ernst & Young have also observed

all their responsibilities. No problems have been observed in the declarations provided,

remunerations paid and the opinion expressed.

The current report deals with the certain disclosure requirements that are mandatory in

any kind of annual report published by a listed company. The sample company dealt in the

report is Macquarie Media Limited. The ultimate result observed is the follow up of all the

requirements by the board of the company. The auditors, Ernst & Young have also observed

all their responsibilities. No problems have been observed in the declarations provided,

remunerations paid and the opinion expressed.

Table of Contents

EXECUTIVE SUMMARY...................................................................................................................1

INTRODUCTION.................................................................................................................................2

ABOUT THE COMPANY AND AUDIT COMMITTEE.....................................................................3

COMPANY DETAILS......................................................................................................................3

AUDIT COMMITTEE......................................................................................................................3

STRUCTURE OF THE COMMITTEE.........................................................................................3

FUNCTION AND RESPONSIBILITIES OF AUDIT COMMITTEE..............................................3

ALL ABOUT EXTERNAL AUDITORS..............................................................................................4

WHO ARE THE EXTERNAL AUDITORS?...................................................................................4

HAVE THEY GIVEN DECLARATION FOR INDEPENDENCE?.................................................4

HAVE ANY NON AUDIT SERVICES BEING PROVIDED?........................................................4

WHAT ARE THE CHANGES IN REMUNERATION?...................................................................5

WHAT KIND OF AUDIT OPINION IS EXPRESSED BY THE AUDITORS?...............................5

ARE THERE ANY KEY AUDIT MATTERS MENTIONED?........................................................6

DIFFERENCE IN RESPONSIBILITIES IN REALTION TO FINANCIAL REPORTING.................8

RESPONSIBILITY OF DIRECTORS AND MANAGEMENT........................................................8

RESPONSIBILITY OF THE AUDITORS........................................................................................8

ARE THERE ANY MATERIAL SUBSEQUENT EVENTS?..............................................................9

CONCLUSION.....................................................................................................................................9

REFERENCES......................................................................................................................................9

EXECUTIVE SUMMARY...................................................................................................................1

INTRODUCTION.................................................................................................................................2

ABOUT THE COMPANY AND AUDIT COMMITTEE.....................................................................3

COMPANY DETAILS......................................................................................................................3

AUDIT COMMITTEE......................................................................................................................3

STRUCTURE OF THE COMMITTEE.........................................................................................3

FUNCTION AND RESPONSIBILITIES OF AUDIT COMMITTEE..............................................3

ALL ABOUT EXTERNAL AUDITORS..............................................................................................4

WHO ARE THE EXTERNAL AUDITORS?...................................................................................4

HAVE THEY GIVEN DECLARATION FOR INDEPENDENCE?.................................................4

HAVE ANY NON AUDIT SERVICES BEING PROVIDED?........................................................4

WHAT ARE THE CHANGES IN REMUNERATION?...................................................................5

WHAT KIND OF AUDIT OPINION IS EXPRESSED BY THE AUDITORS?...............................5

ARE THERE ANY KEY AUDIT MATTERS MENTIONED?........................................................6

DIFFERENCE IN RESPONSIBILITIES IN REALTION TO FINANCIAL REPORTING.................8

RESPONSIBILITY OF DIRECTORS AND MANAGEMENT........................................................8

RESPONSIBILITY OF THE AUDITORS........................................................................................8

ARE THERE ANY MATERIAL SUBSEQUENT EVENTS?..............................................................9

CONCLUSION.....................................................................................................................................9

REFERENCES......................................................................................................................................9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

In this report, audit and assurance program on the Macquarie Media Limited has been

chosen for analysing the auditor’s responsibilities and other programs. Whenever any company

carries on the audit function, it has to follow up with a number of compliances. These

compliances relate both to the auditor and the directors. These are required to make the

operations of the entity as well as the audit function transparent. To evolve transparency, the

topics required to be covered include the declaration related to auditor independence, and the

matters highlighted by the auditor in his audit report. For developing a real time idea, a

company is chosen for the purpose of the report. The name of the company is Macquarie

Media Limited. It is considered that a well maintained audit committee along with audit

charter is present in the company’s governance model.

ABOUT THE COMPANY AND AUDIT COMMITTEE

COMPANY DETAILS

Macquarie Media Limited is engaged in the operation of radio stations at the national level. It

is a company listed on Australian stock exchange. The operation of the radio stations is in the

capital cities of Perth, Brisbane, Melbourne, Sydney and in some of the regions of

Queensland. The operation of this company had gained widespread success in Australia and

is considered trustworthy (Macquarie Media Limited., 2018).

AUDIT COMMITTEE

STRUCTURE OF THE COMMITTEE

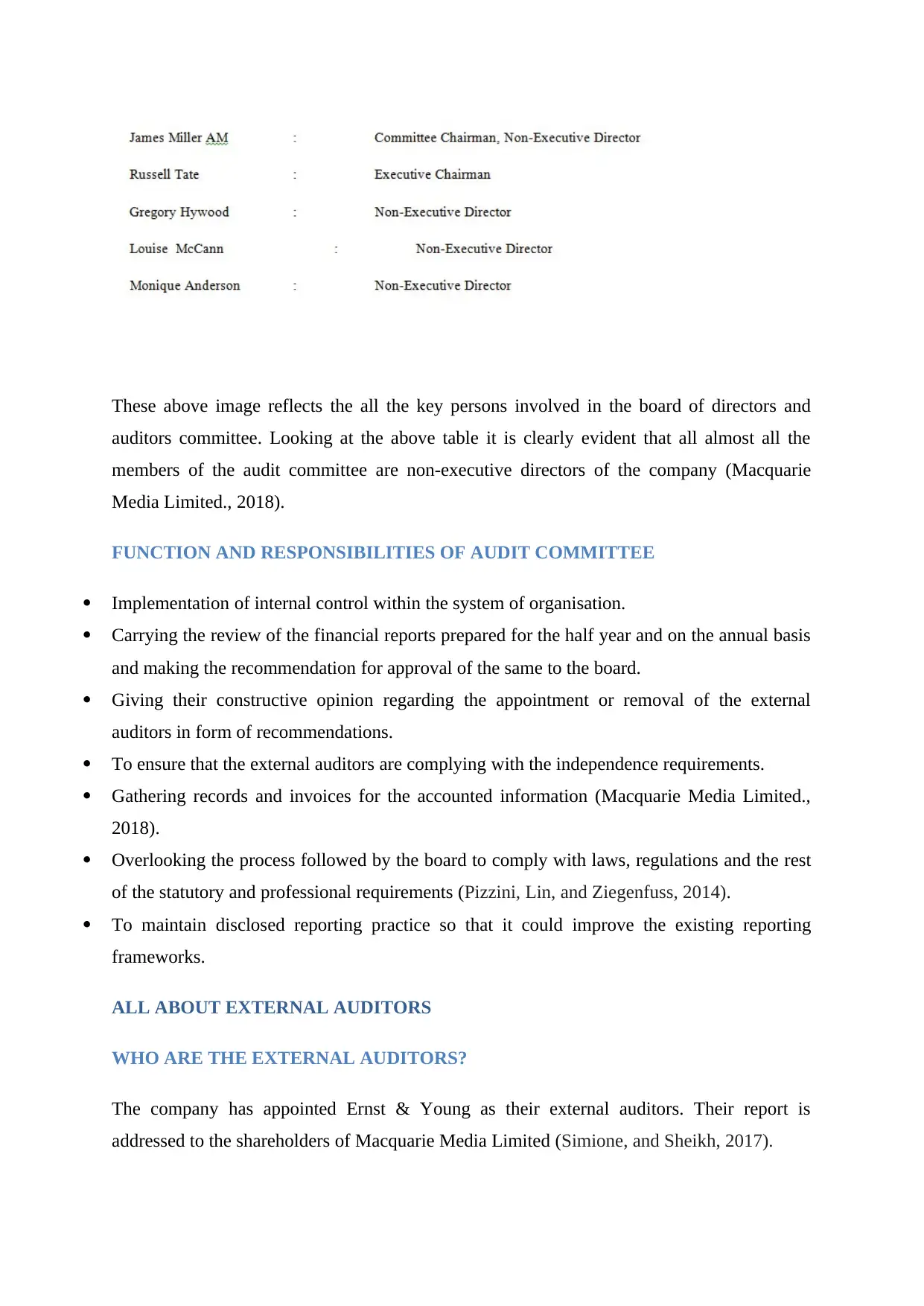

The audit committee charter is laid by the management of the company. Audit committee is

constituted out of the members of the board and comprises of following members as on

current date (Goddard,. and Malagila, 2015). The Audit committee is set up to implement the

control check-up program in the audit and assurance program. It assists in keeping the

business more transparent towards the stakeholders. They work for the stakeholders so that

they could get right amount of information.

In this report, audit and assurance program on the Macquarie Media Limited has been

chosen for analysing the auditor’s responsibilities and other programs. Whenever any company

carries on the audit function, it has to follow up with a number of compliances. These

compliances relate both to the auditor and the directors. These are required to make the

operations of the entity as well as the audit function transparent. To evolve transparency, the

topics required to be covered include the declaration related to auditor independence, and the

matters highlighted by the auditor in his audit report. For developing a real time idea, a

company is chosen for the purpose of the report. The name of the company is Macquarie

Media Limited. It is considered that a well maintained audit committee along with audit

charter is present in the company’s governance model.

ABOUT THE COMPANY AND AUDIT COMMITTEE

COMPANY DETAILS

Macquarie Media Limited is engaged in the operation of radio stations at the national level. It

is a company listed on Australian stock exchange. The operation of the radio stations is in the

capital cities of Perth, Brisbane, Melbourne, Sydney and in some of the regions of

Queensland. The operation of this company had gained widespread success in Australia and

is considered trustworthy (Macquarie Media Limited., 2018).

AUDIT COMMITTEE

STRUCTURE OF THE COMMITTEE

The audit committee charter is laid by the management of the company. Audit committee is

constituted out of the members of the board and comprises of following members as on

current date (Goddard,. and Malagila, 2015). The Audit committee is set up to implement the

control check-up program in the audit and assurance program. It assists in keeping the

business more transparent towards the stakeholders. They work for the stakeholders so that

they could get right amount of information.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

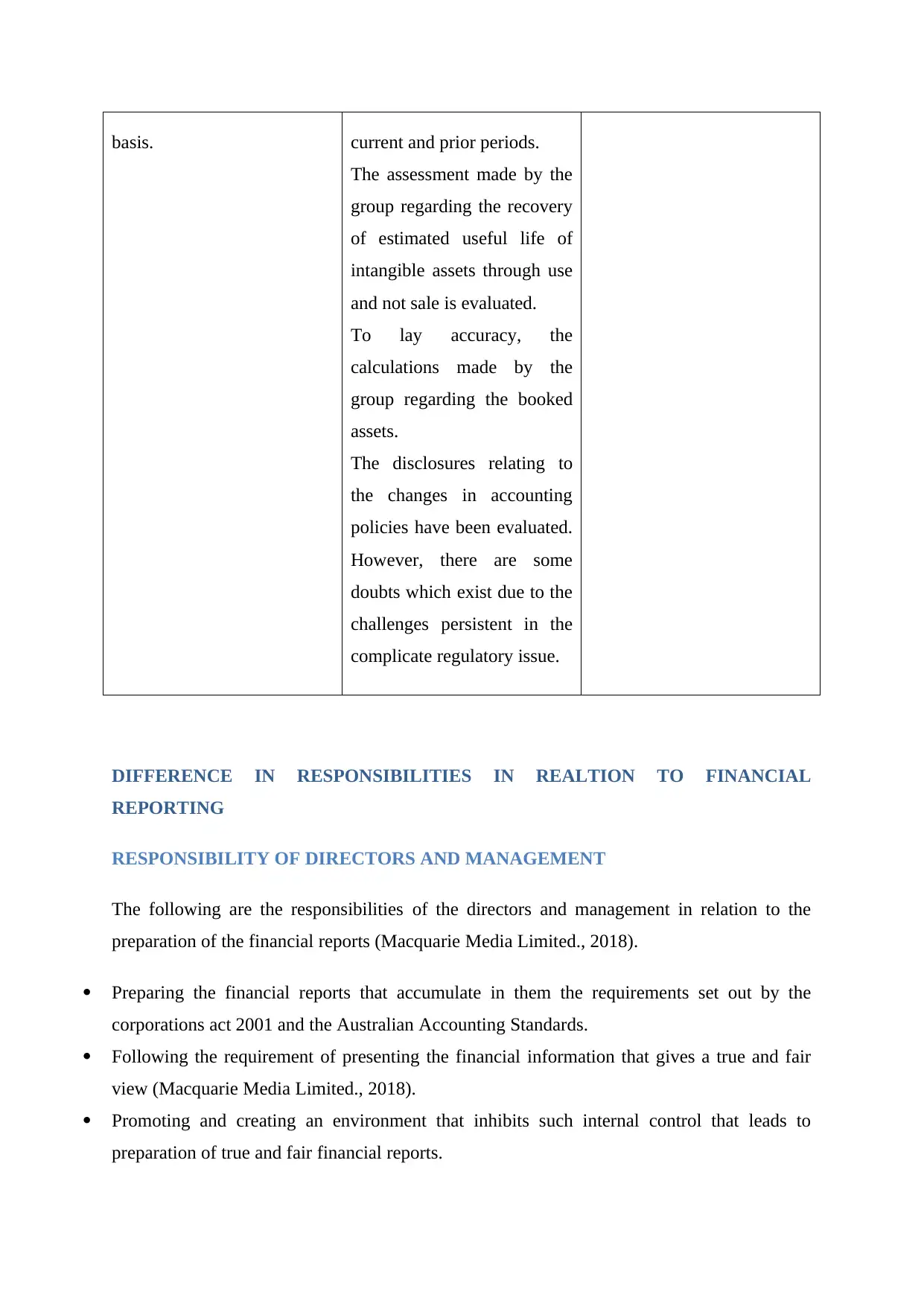

These above image reflects the all the key persons involved in the board of directors and

auditors committee. Looking at the above table it is clearly evident that all almost all the

members of the audit committee are non-executive directors of the company (Macquarie

Media Limited., 2018).

FUNCTION AND RESPONSIBILITIES OF AUDIT COMMITTEE

Implementation of internal control within the system of organisation.

Carrying the review of the financial reports prepared for the half year and on the annual basis

and making the recommendation for approval of the same to the board.

Giving their constructive opinion regarding the appointment or removal of the external

auditors in form of recommendations.

To ensure that the external auditors are complying with the independence requirements.

Gathering records and invoices for the accounted information (Macquarie Media Limited.,

2018).

Overlooking the process followed by the board to comply with laws, regulations and the rest

of the statutory and professional requirements (Pizzini, Lin, and Ziegenfuss, 2014).

To maintain disclosed reporting practice so that it could improve the existing reporting

frameworks.

ALL ABOUT EXTERNAL AUDITORS

WHO ARE THE EXTERNAL AUDITORS?

The company has appointed Ernst & Young as their external auditors. Their report is

addressed to the shareholders of Macquarie Media Limited (Simione, and Sheikh, 2017).

auditors committee. Looking at the above table it is clearly evident that all almost all the

members of the audit committee are non-executive directors of the company (Macquarie

Media Limited., 2018).

FUNCTION AND RESPONSIBILITIES OF AUDIT COMMITTEE

Implementation of internal control within the system of organisation.

Carrying the review of the financial reports prepared for the half year and on the annual basis

and making the recommendation for approval of the same to the board.

Giving their constructive opinion regarding the appointment or removal of the external

auditors in form of recommendations.

To ensure that the external auditors are complying with the independence requirements.

Gathering records and invoices for the accounted information (Macquarie Media Limited.,

2018).

Overlooking the process followed by the board to comply with laws, regulations and the rest

of the statutory and professional requirements (Pizzini, Lin, and Ziegenfuss, 2014).

To maintain disclosed reporting practice so that it could improve the existing reporting

frameworks.

ALL ABOUT EXTERNAL AUDITORS

WHO ARE THE EXTERNAL AUDITORS?

The company has appointed Ernst & Young as their external auditors. Their report is

addressed to the shareholders of Macquarie Media Limited (Simione, and Sheikh, 2017).

HAVE THEY GIVEN DECLARATION FOR INDEPENDENCE?

It is a statutory requirement for all the external auditors to provide an exclusive declaration

for their independent functioning. Likewise, the auditors of Macquarie Media Limited have

also extended their independence declaration. The same is listed in the annual report also.

The independence declaration is given for the entity as well as all the consolidated entities

audited along with (Tepalagul, and Lin, 2015). The declaration is provided by the lead

auditor of Ernst & Young on behalf of the whole audit team and specifically states the

following (Böhm, Bollen, and Hassink, 2016).

The whole audit team has done no contraventions in respect of the independence expected as

per the requirements of corporation act 2001.

Further, the requirements relating to independence expected as per the applicable professional

code has also been complied with (Macquarie Media Limited., 2018).

HAVE ANY NON AUDIT SERVICES BEING PROVIDED?

As far as it gets evident from the declarations given by the auditors, the report presented by

the entity and the remuneration table provided for the auditors, it is certain that there are no

non-audit services being provisioned by the auditor. However, even if the auditors would

have provided any non-audit services, the entity has to explicitly mention the same under a

separate heading in the annual report (Wu, Hsu, and Haslam, 2016).

There are certain services that are clearly ineligible to be provisioned by the auditors to their

client. But in the case of given company, no additional services other than audit appraisal are

being provided by Ernst & Young. There are several auditors who are indulged in keeping the

business more transparent.

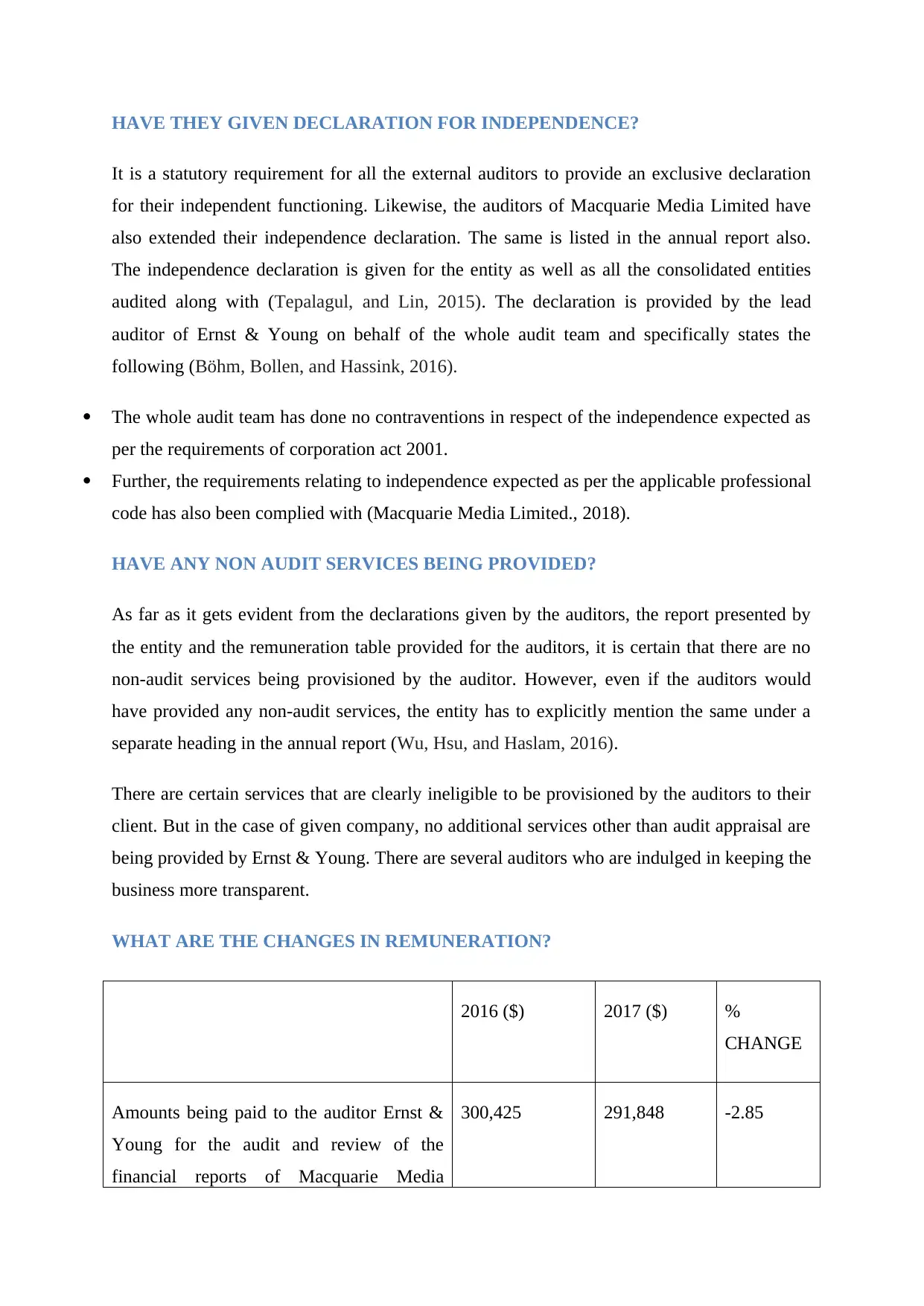

WHAT ARE THE CHANGES IN REMUNERATION?

2016 ($) 2017 ($) %

CHANGE

Amounts being paid to the auditor Ernst &

Young for the audit and review of the

financial reports of Macquarie Media

300,425 291,848 -2.85

It is a statutory requirement for all the external auditors to provide an exclusive declaration

for their independent functioning. Likewise, the auditors of Macquarie Media Limited have

also extended their independence declaration. The same is listed in the annual report also.

The independence declaration is given for the entity as well as all the consolidated entities

audited along with (Tepalagul, and Lin, 2015). The declaration is provided by the lead

auditor of Ernst & Young on behalf of the whole audit team and specifically states the

following (Böhm, Bollen, and Hassink, 2016).

The whole audit team has done no contraventions in respect of the independence expected as

per the requirements of corporation act 2001.

Further, the requirements relating to independence expected as per the applicable professional

code has also been complied with (Macquarie Media Limited., 2018).

HAVE ANY NON AUDIT SERVICES BEING PROVIDED?

As far as it gets evident from the declarations given by the auditors, the report presented by

the entity and the remuneration table provided for the auditors, it is certain that there are no

non-audit services being provisioned by the auditor. However, even if the auditors would

have provided any non-audit services, the entity has to explicitly mention the same under a

separate heading in the annual report (Wu, Hsu, and Haslam, 2016).

There are certain services that are clearly ineligible to be provisioned by the auditors to their

client. But in the case of given company, no additional services other than audit appraisal are

being provided by Ernst & Young. There are several auditors who are indulged in keeping the

business more transparent.

WHAT ARE THE CHANGES IN REMUNERATION?

2016 ($) 2017 ($) %

CHANGE

Amounts being paid to the auditor Ernst &

Young for the audit and review of the

financial reports of Macquarie Media

300,425 291,848 -2.85

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Limited (Yahoo finance, 2018).

The table presented above is showing the remuneration that is paid to the auditors for the

assurance services extended by them to the entity. These services are being remunerated as

the assurance services. The table is showing that the remuneration paid to the auditors have

declined in the year 2017 as compared to year 2016. There is a percentage decline of around

2.85 %.

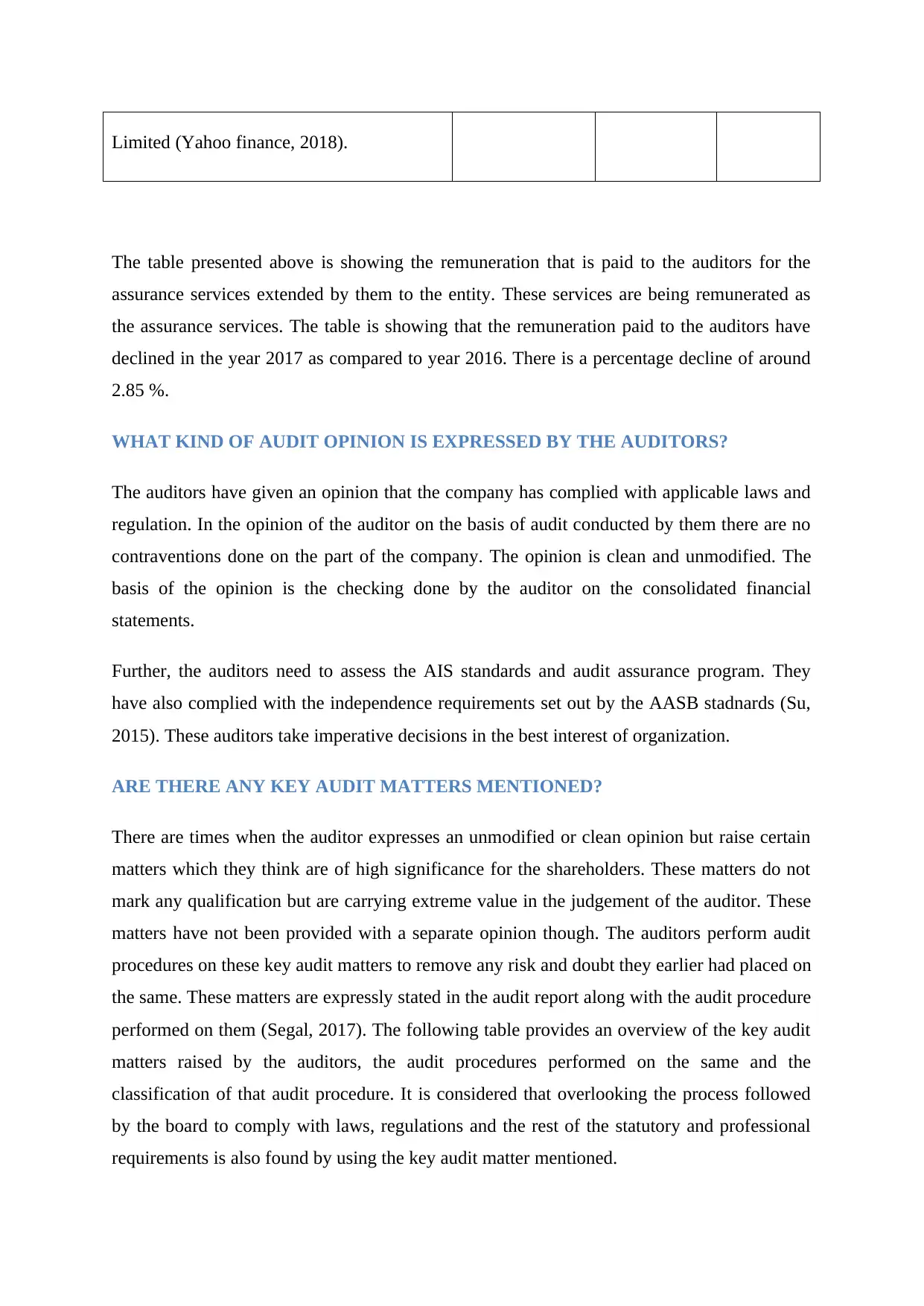

WHAT KIND OF AUDIT OPINION IS EXPRESSED BY THE AUDITORS?

The auditors have given an opinion that the company has complied with applicable laws and

regulation. In the opinion of the auditor on the basis of audit conducted by them there are no

contraventions done on the part of the company. The opinion is clean and unmodified. The

basis of the opinion is the checking done by the auditor on the consolidated financial

statements.

Further, the auditors need to assess the AIS standards and audit assurance program. They

have also complied with the independence requirements set out by the AASB stadnards (Su,

2015). These auditors take imperative decisions in the best interest of organization.

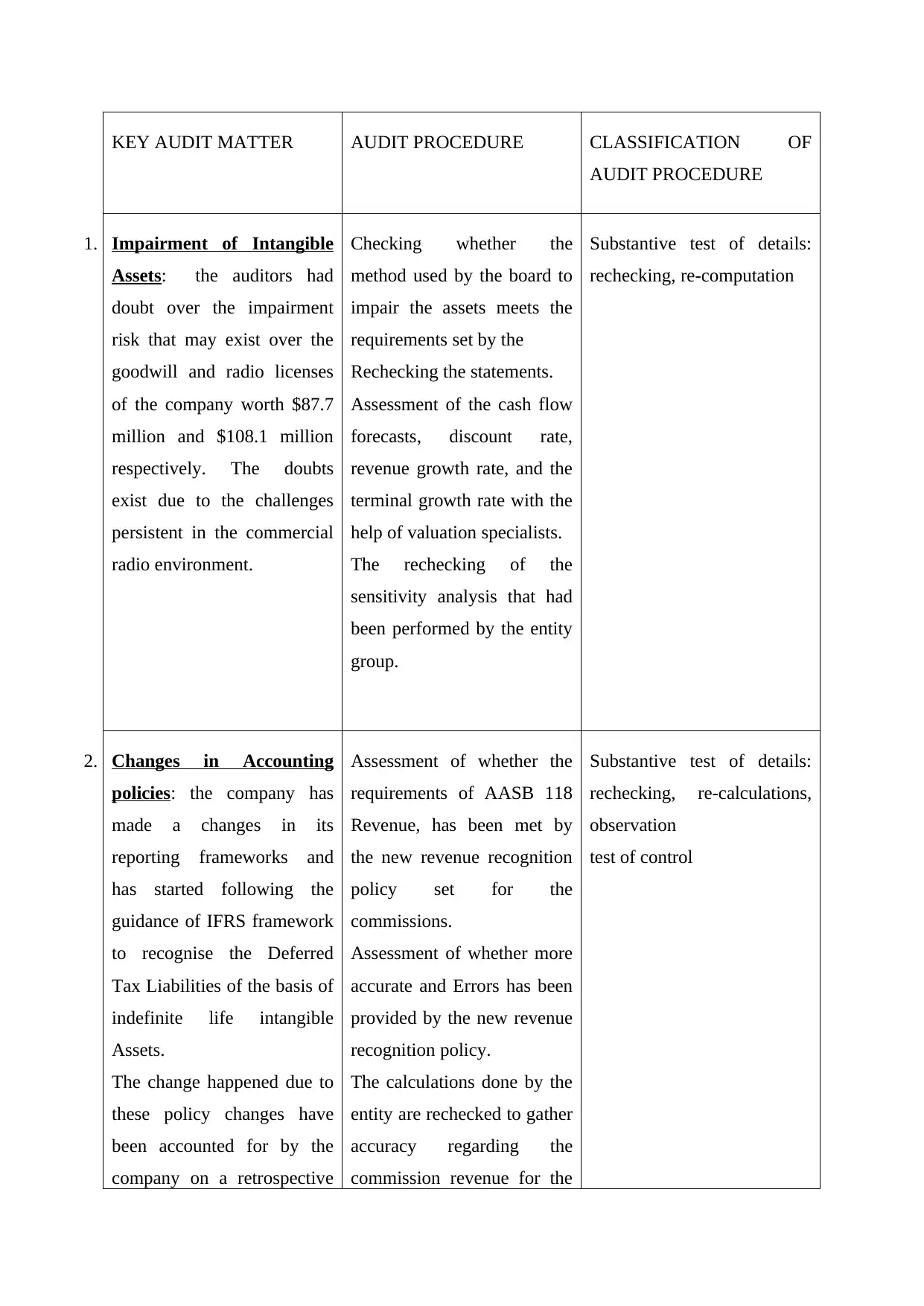

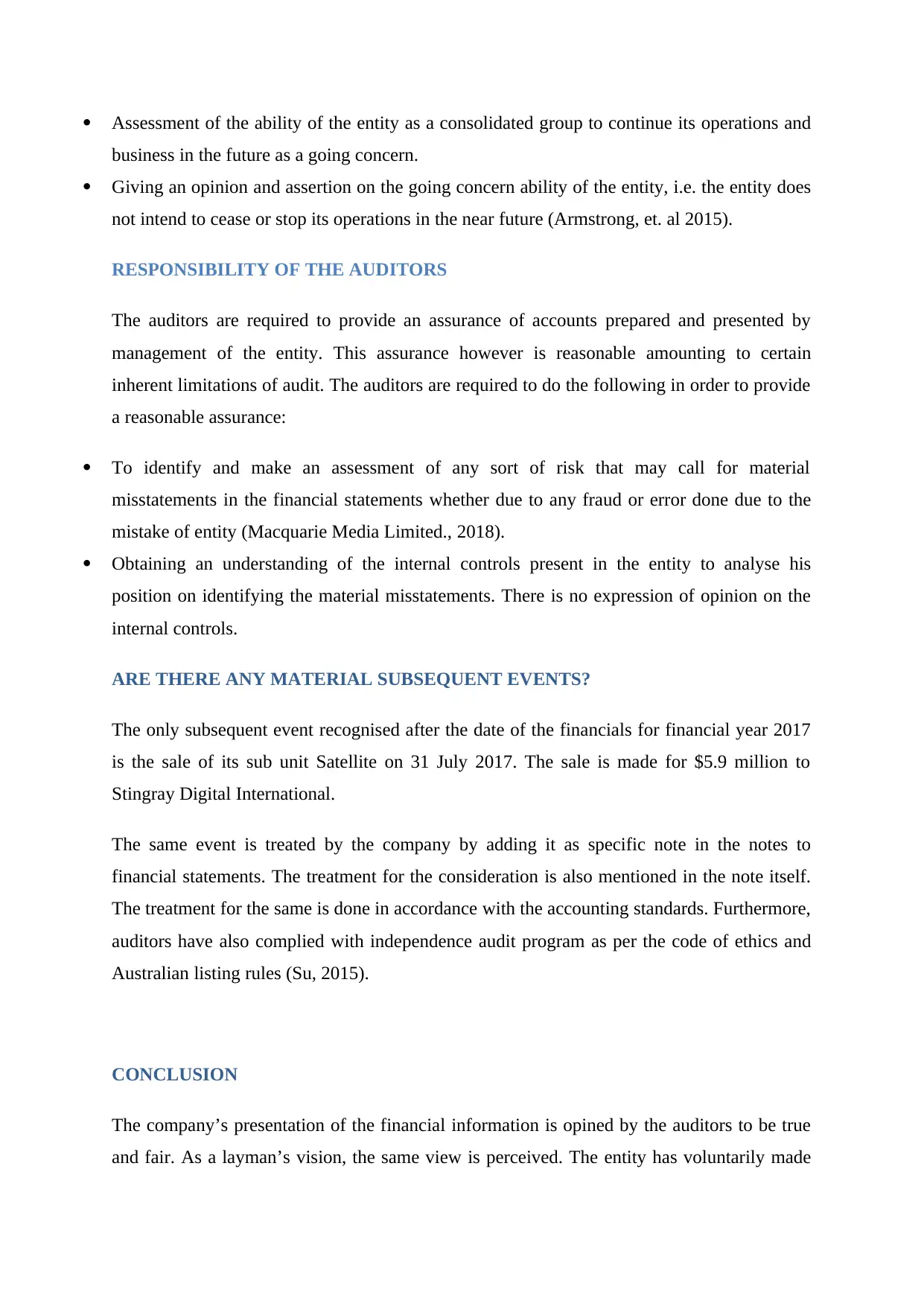

ARE THERE ANY KEY AUDIT MATTERS MENTIONED?

There are times when the auditor expresses an unmodified or clean opinion but raise certain

matters which they think are of high significance for the shareholders. These matters do not

mark any qualification but are carrying extreme value in the judgement of the auditor. These

matters have not been provided with a separate opinion though. The auditors perform audit

procedures on these key audit matters to remove any risk and doubt they earlier had placed on

the same. These matters are expressly stated in the audit report along with the audit procedure

performed on them (Segal, 2017). The following table provides an overview of the key audit

matters raised by the auditors, the audit procedures performed on the same and the

classification of that audit procedure. It is considered that overlooking the process followed

by the board to comply with laws, regulations and the rest of the statutory and professional

requirements is also found by using the key audit matter mentioned.

The table presented above is showing the remuneration that is paid to the auditors for the

assurance services extended by them to the entity. These services are being remunerated as

the assurance services. The table is showing that the remuneration paid to the auditors have

declined in the year 2017 as compared to year 2016. There is a percentage decline of around

2.85 %.

WHAT KIND OF AUDIT OPINION IS EXPRESSED BY THE AUDITORS?

The auditors have given an opinion that the company has complied with applicable laws and

regulation. In the opinion of the auditor on the basis of audit conducted by them there are no

contraventions done on the part of the company. The opinion is clean and unmodified. The

basis of the opinion is the checking done by the auditor on the consolidated financial

statements.

Further, the auditors need to assess the AIS standards and audit assurance program. They

have also complied with the independence requirements set out by the AASB stadnards (Su,

2015). These auditors take imperative decisions in the best interest of organization.

ARE THERE ANY KEY AUDIT MATTERS MENTIONED?

There are times when the auditor expresses an unmodified or clean opinion but raise certain

matters which they think are of high significance for the shareholders. These matters do not

mark any qualification but are carrying extreme value in the judgement of the auditor. These

matters have not been provided with a separate opinion though. The auditors perform audit

procedures on these key audit matters to remove any risk and doubt they earlier had placed on

the same. These matters are expressly stated in the audit report along with the audit procedure

performed on them (Segal, 2017). The following table provides an overview of the key audit

matters raised by the auditors, the audit procedures performed on the same and the

classification of that audit procedure. It is considered that overlooking the process followed

by the board to comply with laws, regulations and the rest of the statutory and professional

requirements is also found by using the key audit matter mentioned.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

KEY AUDIT MATTER AUDIT PROCEDURE CLASSIFICATION OF

AUDIT PROCEDURE

1. Impairment of Intangible

Assets: the auditors had

doubt over the impairment

risk that may exist over the

goodwill and radio licenses

of the company worth $87.7

million and $108.1 million

respectively. The doubts

exist due to the challenges

persistent in the commercial

radio environment.

Checking whether the

method used by the board to

impair the assets meets the

requirements set by the

Rechecking the statements.

Assessment of the cash flow

forecasts, discount rate,

revenue growth rate, and the

terminal growth rate with the

help of valuation specialists.

The rechecking of the

sensitivity analysis that had

been performed by the entity

group.

Substantive test of details:

rechecking, re-computation

2. Changes in Accounting

policies: the company has

made a changes in its

reporting frameworks and

has started following the

guidance of IFRS framework

to recognise the Deferred

Tax Liabilities of the basis of

indefinite life intangible

Assets.

The change happened due to

these policy changes have

been accounted for by the

company on a retrospective

Assessment of whether the

requirements of AASB 118

Revenue, has been met by

the new revenue recognition

policy set for the

commissions.

Assessment of whether more

accurate and Errors has been

provided by the new revenue

recognition policy.

The calculations done by the

entity are rechecked to gather

accuracy regarding the

commission revenue for the

Substantive test of details:

rechecking, re-calculations,

observation

test of control

AUDIT PROCEDURE

1. Impairment of Intangible

Assets: the auditors had

doubt over the impairment

risk that may exist over the

goodwill and radio licenses

of the company worth $87.7

million and $108.1 million

respectively. The doubts

exist due to the challenges

persistent in the commercial

radio environment.

Checking whether the

method used by the board to

impair the assets meets the

requirements set by the

Rechecking the statements.

Assessment of the cash flow

forecasts, discount rate,

revenue growth rate, and the

terminal growth rate with the

help of valuation specialists.

The rechecking of the

sensitivity analysis that had

been performed by the entity

group.

Substantive test of details:

rechecking, re-computation

2. Changes in Accounting

policies: the company has

made a changes in its

reporting frameworks and

has started following the

guidance of IFRS framework

to recognise the Deferred

Tax Liabilities of the basis of

indefinite life intangible

Assets.

The change happened due to

these policy changes have

been accounted for by the

company on a retrospective

Assessment of whether the

requirements of AASB 118

Revenue, has been met by

the new revenue recognition

policy set for the

commissions.

Assessment of whether more

accurate and Errors has been

provided by the new revenue

recognition policy.

The calculations done by the

entity are rechecked to gather

accuracy regarding the

commission revenue for the

Substantive test of details:

rechecking, re-calculations,

observation

test of control

basis. current and prior periods.

The assessment made by the

group regarding the recovery

of estimated useful life of

intangible assets through use

and not sale is evaluated.

To lay accuracy, the

calculations made by the

group regarding the booked

assets.

The disclosures relating to

the changes in accounting

policies have been evaluated.

However, there are some

doubts which exist due to the

challenges persistent in the

complicate regulatory issue.

DIFFERENCE IN RESPONSIBILITIES IN REALTION TO FINANCIAL

REPORTING

RESPONSIBILITY OF DIRECTORS AND MANAGEMENT

The following are the responsibilities of the directors and management in relation to the

preparation of the financial reports (Macquarie Media Limited., 2018).

Preparing the financial reports that accumulate in them the requirements set out by the

corporations act 2001 and the Australian Accounting Standards.

Following the requirement of presenting the financial information that gives a true and fair

view (Macquarie Media Limited., 2018).

Promoting and creating an environment that inhibits such internal control that leads to

preparation of true and fair financial reports.

The assessment made by the

group regarding the recovery

of estimated useful life of

intangible assets through use

and not sale is evaluated.

To lay accuracy, the

calculations made by the

group regarding the booked

assets.

The disclosures relating to

the changes in accounting

policies have been evaluated.

However, there are some

doubts which exist due to the

challenges persistent in the

complicate regulatory issue.

DIFFERENCE IN RESPONSIBILITIES IN REALTION TO FINANCIAL

REPORTING

RESPONSIBILITY OF DIRECTORS AND MANAGEMENT

The following are the responsibilities of the directors and management in relation to the

preparation of the financial reports (Macquarie Media Limited., 2018).

Preparing the financial reports that accumulate in them the requirements set out by the

corporations act 2001 and the Australian Accounting Standards.

Following the requirement of presenting the financial information that gives a true and fair

view (Macquarie Media Limited., 2018).

Promoting and creating an environment that inhibits such internal control that leads to

preparation of true and fair financial reports.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Assessment of the ability of the entity as a consolidated group to continue its operations and

business in the future as a going concern.

Giving an opinion and assertion on the going concern ability of the entity, i.e. the entity does

not intend to cease or stop its operations in the near future (Armstrong, et. al 2015).

RESPONSIBILITY OF THE AUDITORS

The auditors are required to provide an assurance of accounts prepared and presented by

management of the entity. This assurance however is reasonable amounting to certain

inherent limitations of audit. The auditors are required to do the following in order to provide

a reasonable assurance:

To identify and make an assessment of any sort of risk that may call for material

misstatements in the financial statements whether due to any fraud or error done due to the

mistake of entity (Macquarie Media Limited., 2018).

Obtaining an understanding of the internal controls present in the entity to analyse his

position on identifying the material misstatements. There is no expression of opinion on the

internal controls.

ARE THERE ANY MATERIAL SUBSEQUENT EVENTS?

The only subsequent event recognised after the date of the financials for financial year 2017

is the sale of its sub unit Satellite on 31 July 2017. The sale is made for $5.9 million to

Stingray Digital International.

The same event is treated by the company by adding it as specific note in the notes to

financial statements. The treatment for the consideration is also mentioned in the note itself.

The treatment for the same is done in accordance with the accounting standards. Furthermore,

auditors have also complied with independence audit program as per the code of ethics and

Australian listing rules (Su, 2015).

CONCLUSION

The company’s presentation of the financial information is opined by the auditors to be true

and fair. As a layman’s vision, the same view is perceived. The entity has voluntarily made

business in the future as a going concern.

Giving an opinion and assertion on the going concern ability of the entity, i.e. the entity does

not intend to cease or stop its operations in the near future (Armstrong, et. al 2015).

RESPONSIBILITY OF THE AUDITORS

The auditors are required to provide an assurance of accounts prepared and presented by

management of the entity. This assurance however is reasonable amounting to certain

inherent limitations of audit. The auditors are required to do the following in order to provide

a reasonable assurance:

To identify and make an assessment of any sort of risk that may call for material

misstatements in the financial statements whether due to any fraud or error done due to the

mistake of entity (Macquarie Media Limited., 2018).

Obtaining an understanding of the internal controls present in the entity to analyse his

position on identifying the material misstatements. There is no expression of opinion on the

internal controls.

ARE THERE ANY MATERIAL SUBSEQUENT EVENTS?

The only subsequent event recognised after the date of the financials for financial year 2017

is the sale of its sub unit Satellite on 31 July 2017. The sale is made for $5.9 million to

Stingray Digital International.

The same event is treated by the company by adding it as specific note in the notes to

financial statements. The treatment for the consideration is also mentioned in the note itself.

The treatment for the same is done in accordance with the accounting standards. Furthermore,

auditors have also complied with independence audit program as per the code of ethics and

Australian listing rules (Su, 2015).

CONCLUSION

The company’s presentation of the financial information is opined by the auditors to be true

and fair. As a layman’s vision, the same view is perceived. The entity has voluntarily made

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

disclosure of all required data. Further, there is no visible intention on part of the entity

wanting to have hidden any material information. All the requirements of the Corporations

Act 2001, Corporation Regulations 2001, and Australian Accounting Standards have been

followed. Auditors need to give their constructive opinion, appointment, or removal of the

external auditors in form of recommendations so that company could keep the business more

transparent and easily comply with the applicable laws and regulations. The auditors needs to

analysis whether the company is disclosing the proper details to stakeholders. They have to

take best efforts for the benefits of the stakeholders not organization.

wanting to have hidden any material information. All the requirements of the Corporations

Act 2001, Corporation Regulations 2001, and Australian Accounting Standards have been

followed. Auditors need to give their constructive opinion, appointment, or removal of the

external auditors in form of recommendations so that company could keep the business more

transparent and easily comply with the applicable laws and regulations. The auditors needs to

analysis whether the company is disclosing the proper details to stakeholders. They have to

take best efforts for the benefits of the stakeholders not organization.

REFERENCES

Armstrong, C., Guay, W.R., Mehran, H. and Weber, J., (2015). The role of information and

financial reporting in corporate governance: A review of the evidence and the implications

for banking firms and the financial services industry, 20(2), pp.19-22.

Böhm, F., Bollen, L.H. and Hassink, H.F., (2016). Audit committee charter scope:

Determinants and effects on audit committee effort. International Journal of Auditing, 20(2),

pp.119-132.

Goddard, A. and Malagila, J., (2015). Public sector external auditing in Tanzania: a theory of

managing colonising tendencies. In The Public Sector Accounting, Accountability and

Auditing in Emerging Economies, 2nd Ed, USA: Emerald Group Publishing Limited.

Macquarie Media Limited., (2018) Available at

http://quicktake.morningstar.com/stocknet/secdocuments.aspx?

symbol=mrn&country=ausAccessed, on 17th September 2018

Pizzini, M., Lin, S. and Ziegenfuss, D.E., (2014). The impact of internal audit function

quality and contribution on audit delay. Auditing: A Journal of Practice & Theory, 34(1),

pp.25-58.

Segal, M., (2017). ISA 701: Key Audit Matters-An exploration of the rationale and possible

unintended consequences in a South African. Journal of Economic and Financial

Sciences, 10(2), pp.376-391.

Simione, K.A. and Sheikh, A., (2017). REVIEW OF AMG's QUARTERLY FINANCAL

STATEMENTS: A SHORT CASE ABOUT AUDITOR RESPONSIBILITIES AND

REQUIREMENTS. Journal of the International Academy for Case Studies, 23(4), pp.1-13.

Su, L., (2015). Do the auditors bear the consequences of corporate failures? The case of

failed New Zealand finance companies (Doctoral dissertation, Auckland University of

Technology). 20(2), pp.119-132.

Tepalagul, N. and Lin, L., (2015). Auditor independence and audit quality: A literature

review. Journal of Accounting, Auditing & Finance, 30(1), pp.101-121.

Armstrong, C., Guay, W.R., Mehran, H. and Weber, J., (2015). The role of information and

financial reporting in corporate governance: A review of the evidence and the implications

for banking firms and the financial services industry, 20(2), pp.19-22.

Böhm, F., Bollen, L.H. and Hassink, H.F., (2016). Audit committee charter scope:

Determinants and effects on audit committee effort. International Journal of Auditing, 20(2),

pp.119-132.

Goddard, A. and Malagila, J., (2015). Public sector external auditing in Tanzania: a theory of

managing colonising tendencies. In The Public Sector Accounting, Accountability and

Auditing in Emerging Economies, 2nd Ed, USA: Emerald Group Publishing Limited.

Macquarie Media Limited., (2018) Available at

http://quicktake.morningstar.com/stocknet/secdocuments.aspx?

symbol=mrn&country=ausAccessed, on 17th September 2018

Pizzini, M., Lin, S. and Ziegenfuss, D.E., (2014). The impact of internal audit function

quality and contribution on audit delay. Auditing: A Journal of Practice & Theory, 34(1),

pp.25-58.

Segal, M., (2017). ISA 701: Key Audit Matters-An exploration of the rationale and possible

unintended consequences in a South African. Journal of Economic and Financial

Sciences, 10(2), pp.376-391.

Simione, K.A. and Sheikh, A., (2017). REVIEW OF AMG's QUARTERLY FINANCAL

STATEMENTS: A SHORT CASE ABOUT AUDITOR RESPONSIBILITIES AND

REQUIREMENTS. Journal of the International Academy for Case Studies, 23(4), pp.1-13.

Su, L., (2015). Do the auditors bear the consequences of corporate failures? The case of

failed New Zealand finance companies (Doctoral dissertation, Auckland University of

Technology). 20(2), pp.119-132.

Tepalagul, N. and Lin, L., (2015). Auditor independence and audit quality: A literature

review. Journal of Accounting, Auditing & Finance, 30(1), pp.101-121.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.