Analyzing Australia's Macroeconomic Condition using AE Model Approach

VerifiedAdded on 2023/06/14

|13

|2403

|346

Report

AI Summary

This report provides a comprehensive analysis of Australia's macroeconomic condition using the aggregate expenditure model, examining components such as consumption, investment, government expenditure, and net exports. It details the trends in these components over the past decade and ...

Running Head: ECONOMIC ASSIGNMENT

Economic Assignment

Name of the Student

Name of the University

Author note

Economic Assignment

Name of the Student

Name of the University

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMIC ASSIGNMENT

Table of Contents

Introduction................................................................................................................................2

Aggregate Expenditure Model...................................................................................................2

Trend analysis of different components of AE model in Australia...........................................3

Consumption..........................................................................................................................3

Investment..............................................................................................................................4

Government expenditure........................................................................................................5

Net Export..............................................................................................................................6

Macroeconomic performances and forecast of Australia...........................................................7

GDP Growth of Australia.......................................................................................................7

Unemployment.......................................................................................................................8

Rate of Inflation.....................................................................................................................9

Cash Rate Movement...............................................................................................................10

Conclusion................................................................................................................................10

References................................................................................................................................11

Table of Contents

Introduction................................................................................................................................2

Aggregate Expenditure Model...................................................................................................2

Trend analysis of different components of AE model in Australia...........................................3

Consumption..........................................................................................................................3

Investment..............................................................................................................................4

Government expenditure........................................................................................................5

Net Export..............................................................................................................................6

Macroeconomic performances and forecast of Australia...........................................................7

GDP Growth of Australia.......................................................................................................7

Unemployment.......................................................................................................................8

Rate of Inflation.....................................................................................................................9

Cash Rate Movement...............................................................................................................10

Conclusion................................................................................................................................10

References................................................................................................................................11

2ECONOMIC ASSIGNMENT

Introduction

Fiscal and monetary policy are the two major tools used by government to stabilize

the economy. The Reserve Bank of Australia designs monetary policy using the instrument of

cash rate. Depending on the state of macroeconomic condition, RBA takes decision regarding

whether to increase or decrease the cash rate. Growth and inflation targeting of RBA

influences cash rate. The report analyzes the macroeconomic condition of Australia in

reference to basic aggregate expenditure model. Depending on current condition, prediction

has been made about future movement of the cash rate.

Aggregate Expenditure Model

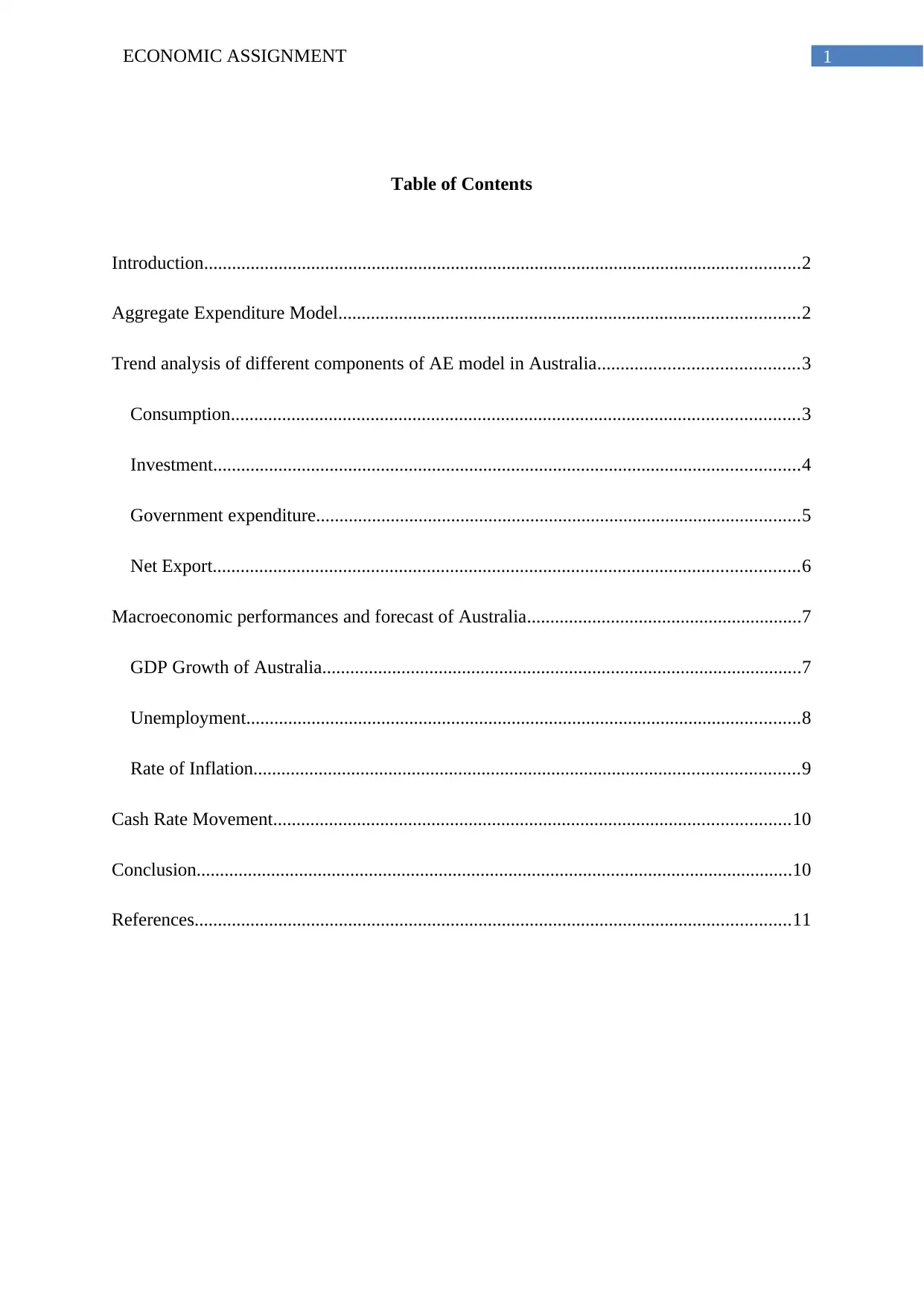

The aggregate expenditure mode comprises all the expenditure incurred in the

economy (Johnson 2017). The four major components of aggregate expenditure model are

consumption expenditure, investment expenditure, Government expenditure and net export

(Export less import).

AE ( Y ) =C+ I +G+( X−M )

C: Consumption

I: Investment

G: Government

X: Export

I: Import

Introduction

Fiscal and monetary policy are the two major tools used by government to stabilize

the economy. The Reserve Bank of Australia designs monetary policy using the instrument of

cash rate. Depending on the state of macroeconomic condition, RBA takes decision regarding

whether to increase or decrease the cash rate. Growth and inflation targeting of RBA

influences cash rate. The report analyzes the macroeconomic condition of Australia in

reference to basic aggregate expenditure model. Depending on current condition, prediction

has been made about future movement of the cash rate.

Aggregate Expenditure Model

The aggregate expenditure mode comprises all the expenditure incurred in the

economy (Johnson 2017). The four major components of aggregate expenditure model are

consumption expenditure, investment expenditure, Government expenditure and net export

(Export less import).

AE ( Y ) =C+ I +G+( X−M )

C: Consumption

I: Investment

G: Government

X: Export

I: Import

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMIC ASSIGNMENT

Figure 1: Aggregate expenditure

(Source: Johnson 2017)

Trend analysis of different components of AE model in Australia

Consumption

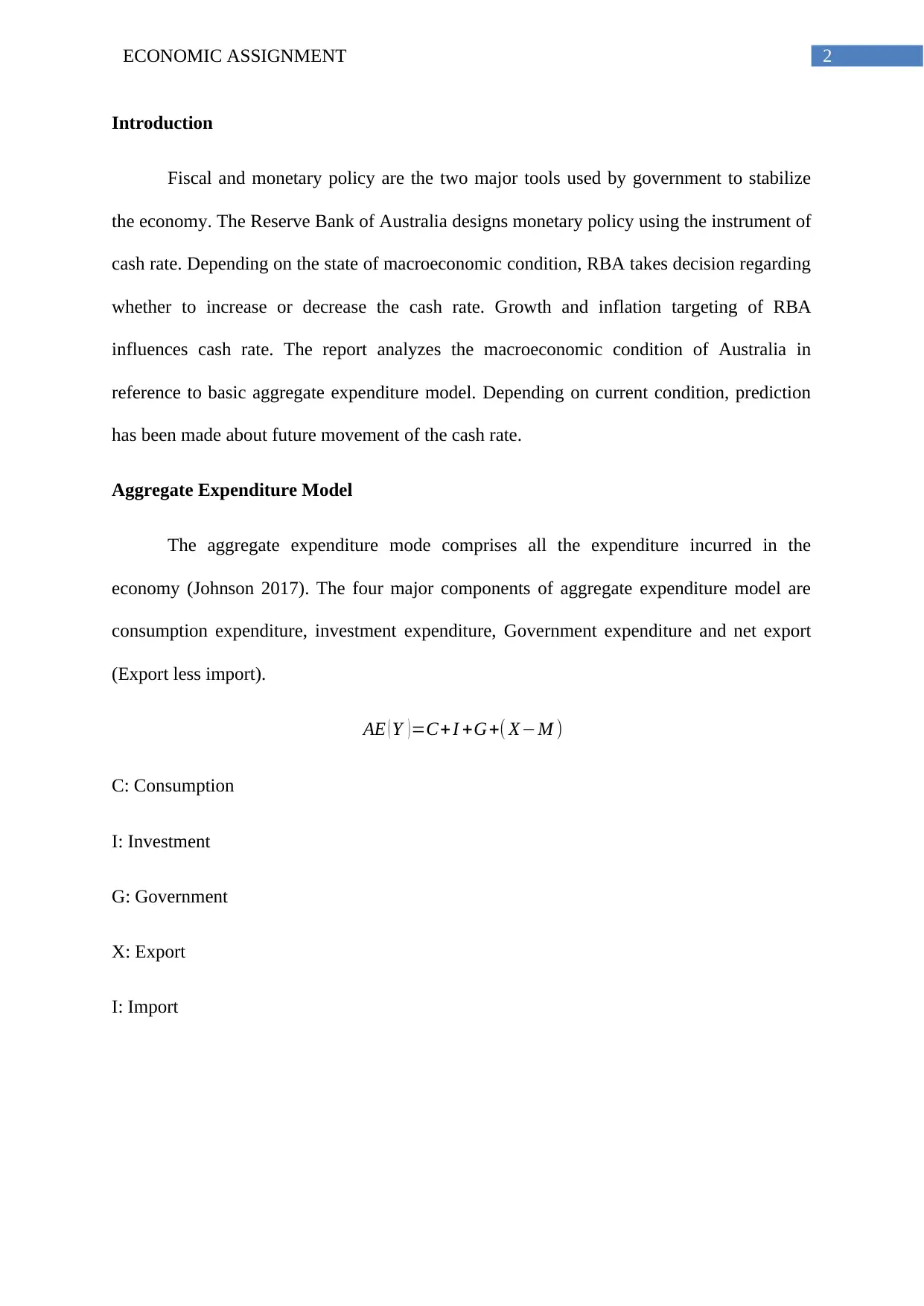

In the AE model, consumption expenditure indicates consumption of household over

a particular point time. Different factors that influence consumption expenditure include

income, tax, interest rate, confidence of consumer, wealth level, access to credit and debit

level (Mankiw 2014).

Figure 2: Trend in consumption expenditure

Figure 1: Aggregate expenditure

(Source: Johnson 2017)

Trend analysis of different components of AE model in Australia

Consumption

In the AE model, consumption expenditure indicates consumption of household over

a particular point time. Different factors that influence consumption expenditure include

income, tax, interest rate, confidence of consumer, wealth level, access to credit and debit

level (Mankiw 2014).

Figure 2: Trend in consumption expenditure

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMIC ASSIGNMENT

(Source: tradingeconomics.com 2018)

The consumption expenditure in Australia has constituted an upward trend in the last

ten years. Household consumption has increased from AUD 252489 Million in third quarter

of 2017 to AUD 254902 Million in the fourth quarter. Consumption expenditure include

spending on durable goods like motor vehicles, the imputed rent of owner occupied houses,

salary ad wage payment and values of backyard production.

The rising consumption spending is driving up economic growth in Australia. Despite

low wage and income growth, the three driving factors for consumption growth are more

people, a low price and decline in saving. In Australia, more and more people are now going

to shop. Arrival of tourist provide additional strength to Australian buyers (abc.net.au 2018).

The declining value of AUD below the parity has made consumption more attractive. A low

inflation targeting policy has helped Australia to keep prices at a relatively low level

encouraging more consumption. The sliding saving rate in Australia is another contributor to

rising household consumption.

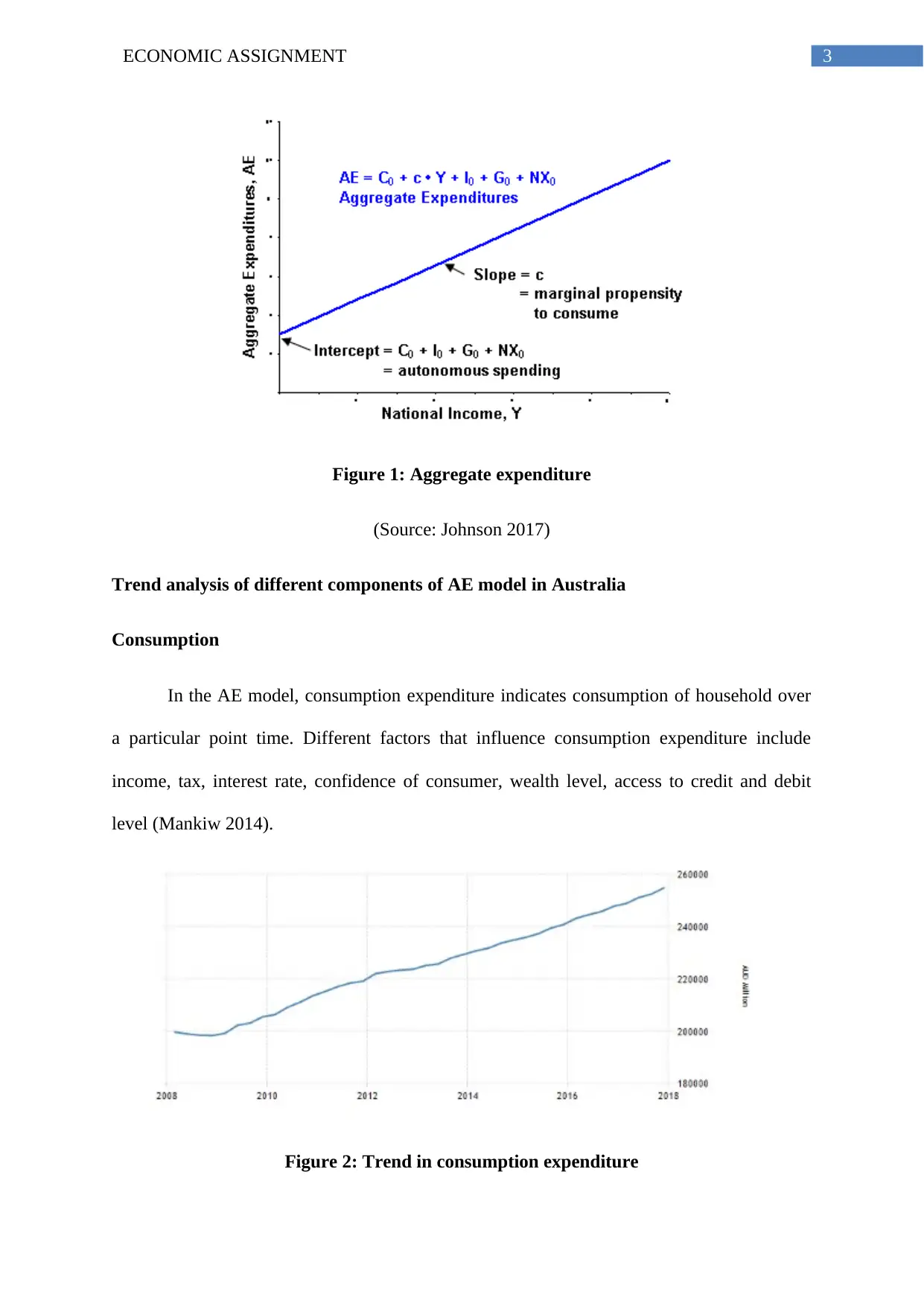

Investment

Investment in the economy refers to the expenditure made on capital goods (Kleinert

2016). Interest rate is the main determinants of investment.

(Source: tradingeconomics.com 2018)

The consumption expenditure in Australia has constituted an upward trend in the last

ten years. Household consumption has increased from AUD 252489 Million in third quarter

of 2017 to AUD 254902 Million in the fourth quarter. Consumption expenditure include

spending on durable goods like motor vehicles, the imputed rent of owner occupied houses,

salary ad wage payment and values of backyard production.

The rising consumption spending is driving up economic growth in Australia. Despite

low wage and income growth, the three driving factors for consumption growth are more

people, a low price and decline in saving. In Australia, more and more people are now going

to shop. Arrival of tourist provide additional strength to Australian buyers (abc.net.au 2018).

The declining value of AUD below the parity has made consumption more attractive. A low

inflation targeting policy has helped Australia to keep prices at a relatively low level

encouraging more consumption. The sliding saving rate in Australia is another contributor to

rising household consumption.

Investment

Investment in the economy refers to the expenditure made on capital goods (Kleinert

2016). Interest rate is the main determinants of investment.

5ECONOMIC ASSIGNMENT

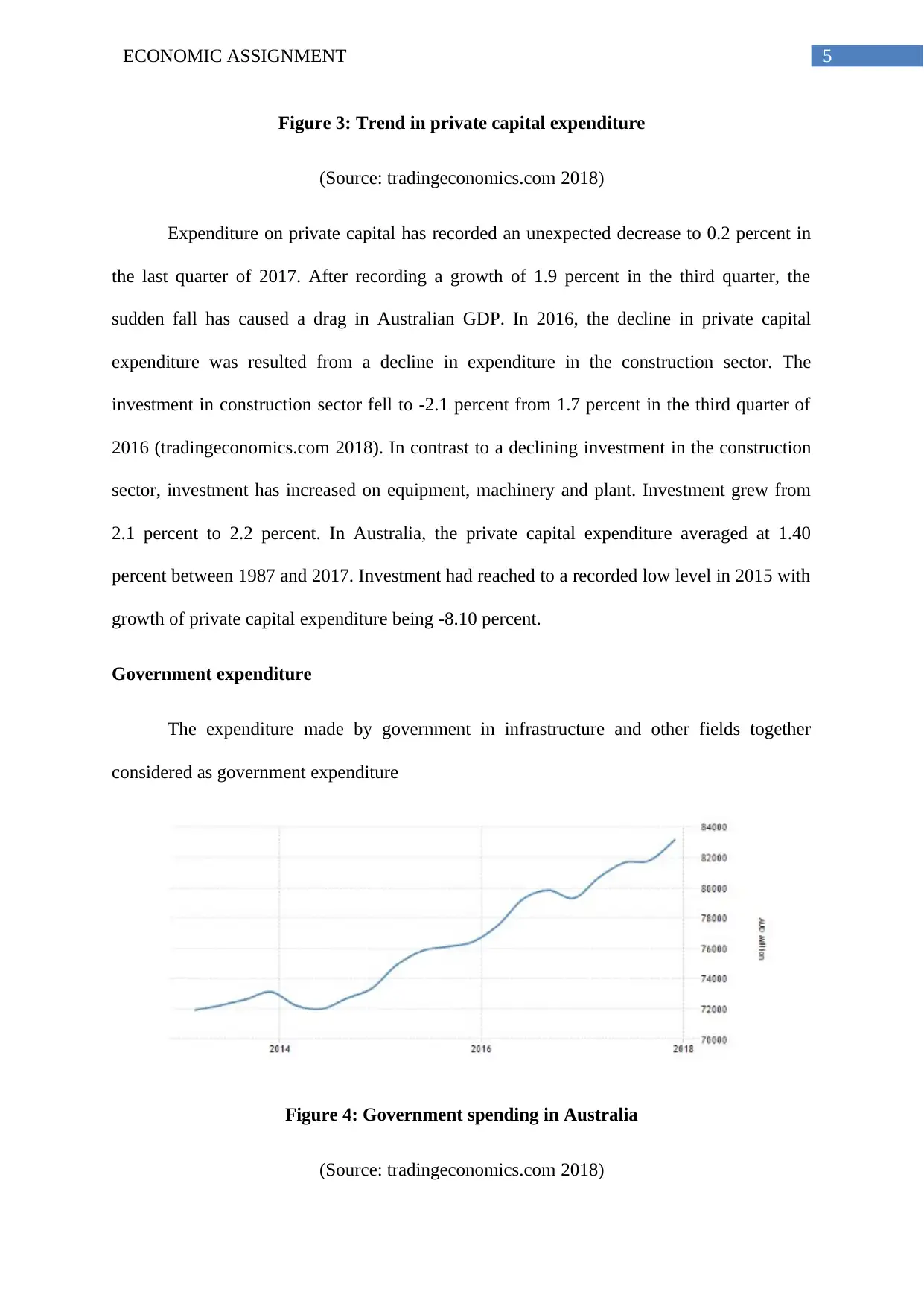

Figure 3: Trend in private capital expenditure

(Source: tradingeconomics.com 2018)

Expenditure on private capital has recorded an unexpected decrease to 0.2 percent in

the last quarter of 2017. After recording a growth of 1.9 percent in the third quarter, the

sudden fall has caused a drag in Australian GDP. In 2016, the decline in private capital

expenditure was resulted from a decline in expenditure in the construction sector. The

investment in construction sector fell to -2.1 percent from 1.7 percent in the third quarter of

2016 (tradingeconomics.com 2018). In contrast to a declining investment in the construction

sector, investment has increased on equipment, machinery and plant. Investment grew from

2.1 percent to 2.2 percent. In Australia, the private capital expenditure averaged at 1.40

percent between 1987 and 2017. Investment had reached to a recorded low level in 2015 with

growth of private capital expenditure being -8.10 percent.

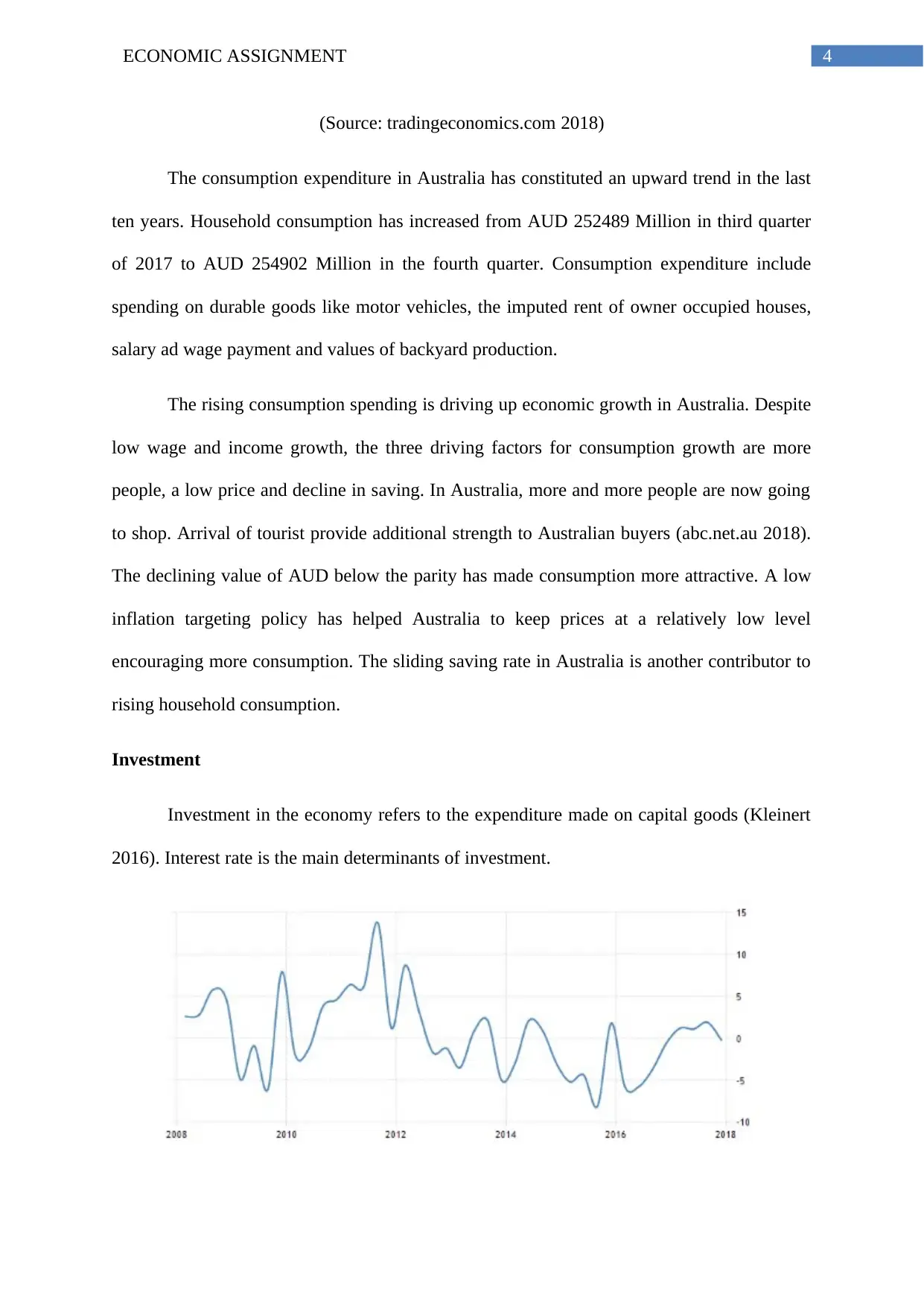

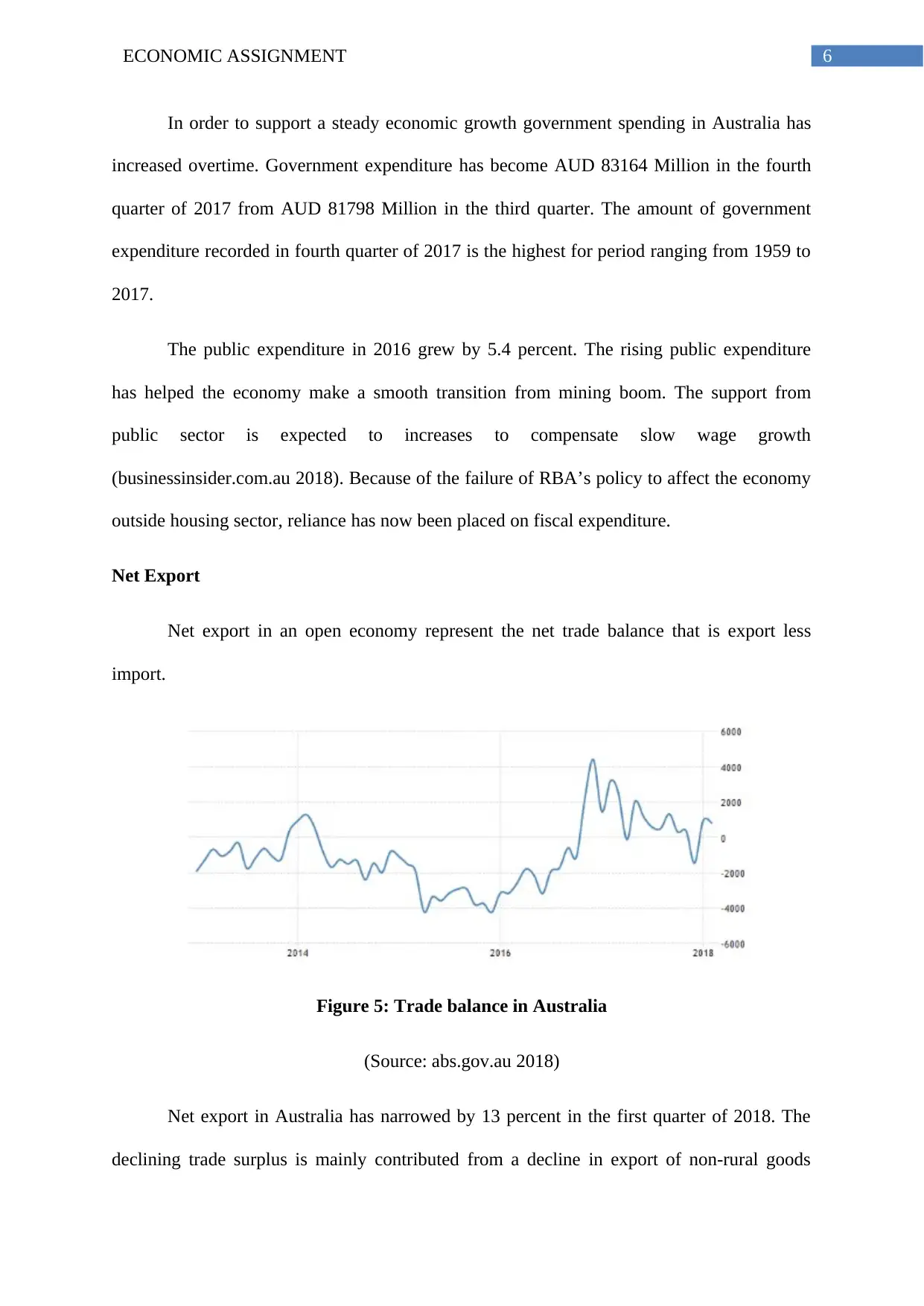

Government expenditure

The expenditure made by government in infrastructure and other fields together

considered as government expenditure

Figure 4: Government spending in Australia

(Source: tradingeconomics.com 2018)

Figure 3: Trend in private capital expenditure

(Source: tradingeconomics.com 2018)

Expenditure on private capital has recorded an unexpected decrease to 0.2 percent in

the last quarter of 2017. After recording a growth of 1.9 percent in the third quarter, the

sudden fall has caused a drag in Australian GDP. In 2016, the decline in private capital

expenditure was resulted from a decline in expenditure in the construction sector. The

investment in construction sector fell to -2.1 percent from 1.7 percent in the third quarter of

2016 (tradingeconomics.com 2018). In contrast to a declining investment in the construction

sector, investment has increased on equipment, machinery and plant. Investment grew from

2.1 percent to 2.2 percent. In Australia, the private capital expenditure averaged at 1.40

percent between 1987 and 2017. Investment had reached to a recorded low level in 2015 with

growth of private capital expenditure being -8.10 percent.

Government expenditure

The expenditure made by government in infrastructure and other fields together

considered as government expenditure

Figure 4: Government spending in Australia

(Source: tradingeconomics.com 2018)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMIC ASSIGNMENT

In order to support a steady economic growth government spending in Australia has

increased overtime. Government expenditure has become AUD 83164 Million in the fourth

quarter of 2017 from AUD 81798 Million in the third quarter. The amount of government

expenditure recorded in fourth quarter of 2017 is the highest for period ranging from 1959 to

2017.

The public expenditure in 2016 grew by 5.4 percent. The rising public expenditure

has helped the economy make a smooth transition from mining boom. The support from

public sector is expected to increases to compensate slow wage growth

(businessinsider.com.au 2018). Because of the failure of RBA’s policy to affect the economy

outside housing sector, reliance has now been placed on fiscal expenditure.

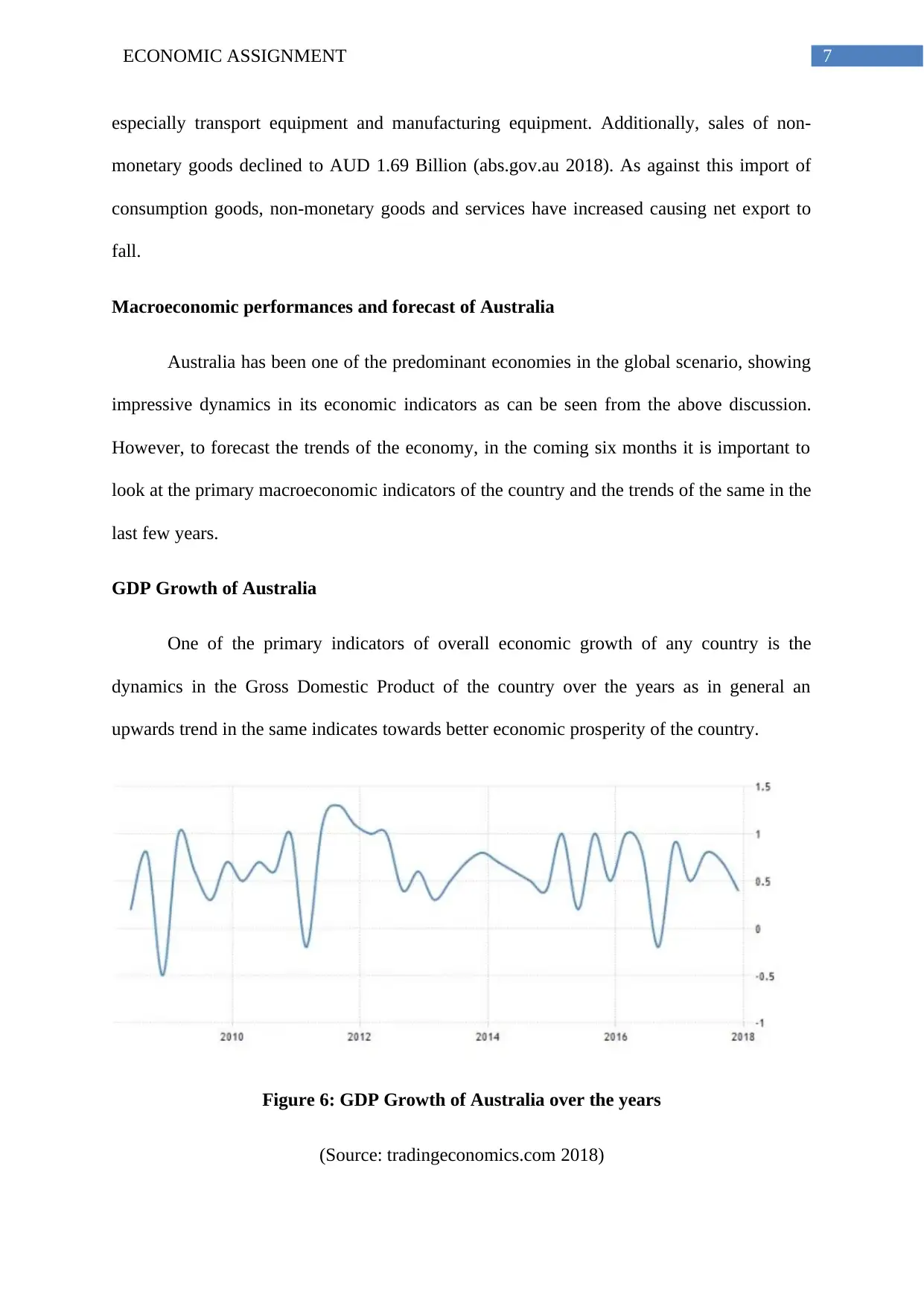

Net Export

Net export in an open economy represent the net trade balance that is export less

import.

Figure 5: Trade balance in Australia

(Source: abs.gov.au 2018)

Net export in Australia has narrowed by 13 percent in the first quarter of 2018. The

declining trade surplus is mainly contributed from a decline in export of non-rural goods

In order to support a steady economic growth government spending in Australia has

increased overtime. Government expenditure has become AUD 83164 Million in the fourth

quarter of 2017 from AUD 81798 Million in the third quarter. The amount of government

expenditure recorded in fourth quarter of 2017 is the highest for period ranging from 1959 to

2017.

The public expenditure in 2016 grew by 5.4 percent. The rising public expenditure

has helped the economy make a smooth transition from mining boom. The support from

public sector is expected to increases to compensate slow wage growth

(businessinsider.com.au 2018). Because of the failure of RBA’s policy to affect the economy

outside housing sector, reliance has now been placed on fiscal expenditure.

Net Export

Net export in an open economy represent the net trade balance that is export less

import.

Figure 5: Trade balance in Australia

(Source: abs.gov.au 2018)

Net export in Australia has narrowed by 13 percent in the first quarter of 2018. The

declining trade surplus is mainly contributed from a decline in export of non-rural goods

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMIC ASSIGNMENT

especially transport equipment and manufacturing equipment. Additionally, sales of non-

monetary goods declined to AUD 1.69 Billion (abs.gov.au 2018). As against this import of

consumption goods, non-monetary goods and services have increased causing net export to

fall.

Macroeconomic performances and forecast of Australia

Australia has been one of the predominant economies in the global scenario, showing

impressive dynamics in its economic indicators as can be seen from the above discussion.

However, to forecast the trends of the economy, in the coming six months it is important to

look at the primary macroeconomic indicators of the country and the trends of the same in the

last few years.

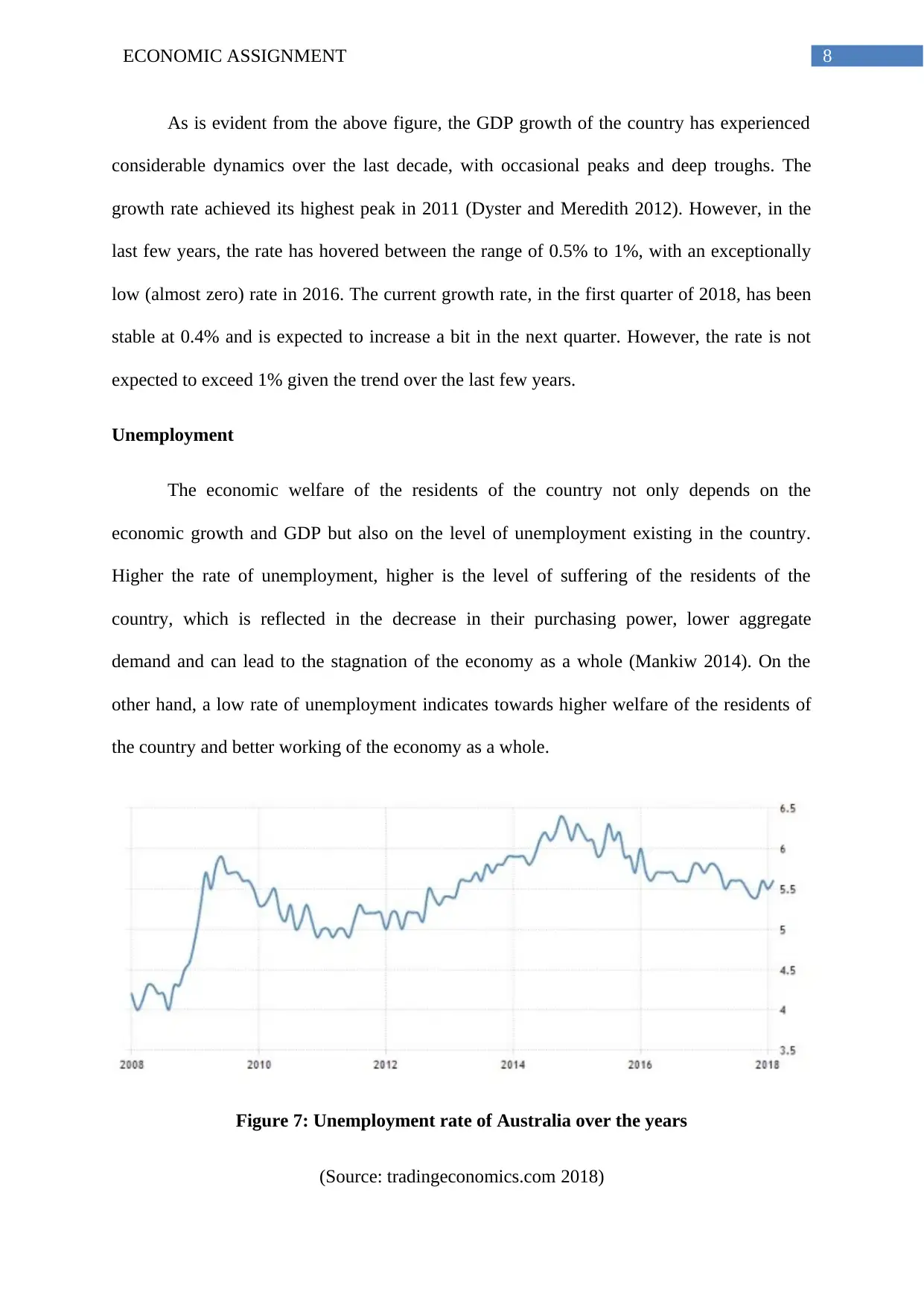

GDP Growth of Australia

One of the primary indicators of overall economic growth of any country is the

dynamics in the Gross Domestic Product of the country over the years as in general an

upwards trend in the same indicates towards better economic prosperity of the country.

Figure 6: GDP Growth of Australia over the years

(Source: tradingeconomics.com 2018)

especially transport equipment and manufacturing equipment. Additionally, sales of non-

monetary goods declined to AUD 1.69 Billion (abs.gov.au 2018). As against this import of

consumption goods, non-monetary goods and services have increased causing net export to

fall.

Macroeconomic performances and forecast of Australia

Australia has been one of the predominant economies in the global scenario, showing

impressive dynamics in its economic indicators as can be seen from the above discussion.

However, to forecast the trends of the economy, in the coming six months it is important to

look at the primary macroeconomic indicators of the country and the trends of the same in the

last few years.

GDP Growth of Australia

One of the primary indicators of overall economic growth of any country is the

dynamics in the Gross Domestic Product of the country over the years as in general an

upwards trend in the same indicates towards better economic prosperity of the country.

Figure 6: GDP Growth of Australia over the years

(Source: tradingeconomics.com 2018)

8ECONOMIC ASSIGNMENT

As is evident from the above figure, the GDP growth of the country has experienced

considerable dynamics over the last decade, with occasional peaks and deep troughs. The

growth rate achieved its highest peak in 2011 (Dyster and Meredith 2012). However, in the

last few years, the rate has hovered between the range of 0.5% to 1%, with an exceptionally

low (almost zero) rate in 2016. The current growth rate, in the first quarter of 2018, has been

stable at 0.4% and is expected to increase a bit in the next quarter. However, the rate is not

expected to exceed 1% given the trend over the last few years.

Unemployment

The economic welfare of the residents of the country not only depends on the

economic growth and GDP but also on the level of unemployment existing in the country.

Higher the rate of unemployment, higher is the level of suffering of the residents of the

country, which is reflected in the decrease in their purchasing power, lower aggregate

demand and can lead to the stagnation of the economy as a whole (Mankiw 2014). On the

other hand, a low rate of unemployment indicates towards higher welfare of the residents of

the country and better working of the economy as a whole.

Figure 7: Unemployment rate of Australia over the years

(Source: tradingeconomics.com 2018)

As is evident from the above figure, the GDP growth of the country has experienced

considerable dynamics over the last decade, with occasional peaks and deep troughs. The

growth rate achieved its highest peak in 2011 (Dyster and Meredith 2012). However, in the

last few years, the rate has hovered between the range of 0.5% to 1%, with an exceptionally

low (almost zero) rate in 2016. The current growth rate, in the first quarter of 2018, has been

stable at 0.4% and is expected to increase a bit in the next quarter. However, the rate is not

expected to exceed 1% given the trend over the last few years.

Unemployment

The economic welfare of the residents of the country not only depends on the

economic growth and GDP but also on the level of unemployment existing in the country.

Higher the rate of unemployment, higher is the level of suffering of the residents of the

country, which is reflected in the decrease in their purchasing power, lower aggregate

demand and can lead to the stagnation of the economy as a whole (Mankiw 2014). On the

other hand, a low rate of unemployment indicates towards higher welfare of the residents of

the country and better working of the economy as a whole.

Figure 7: Unemployment rate of Australia over the years

(Source: tradingeconomics.com 2018)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ECONOMIC ASSIGNMENT

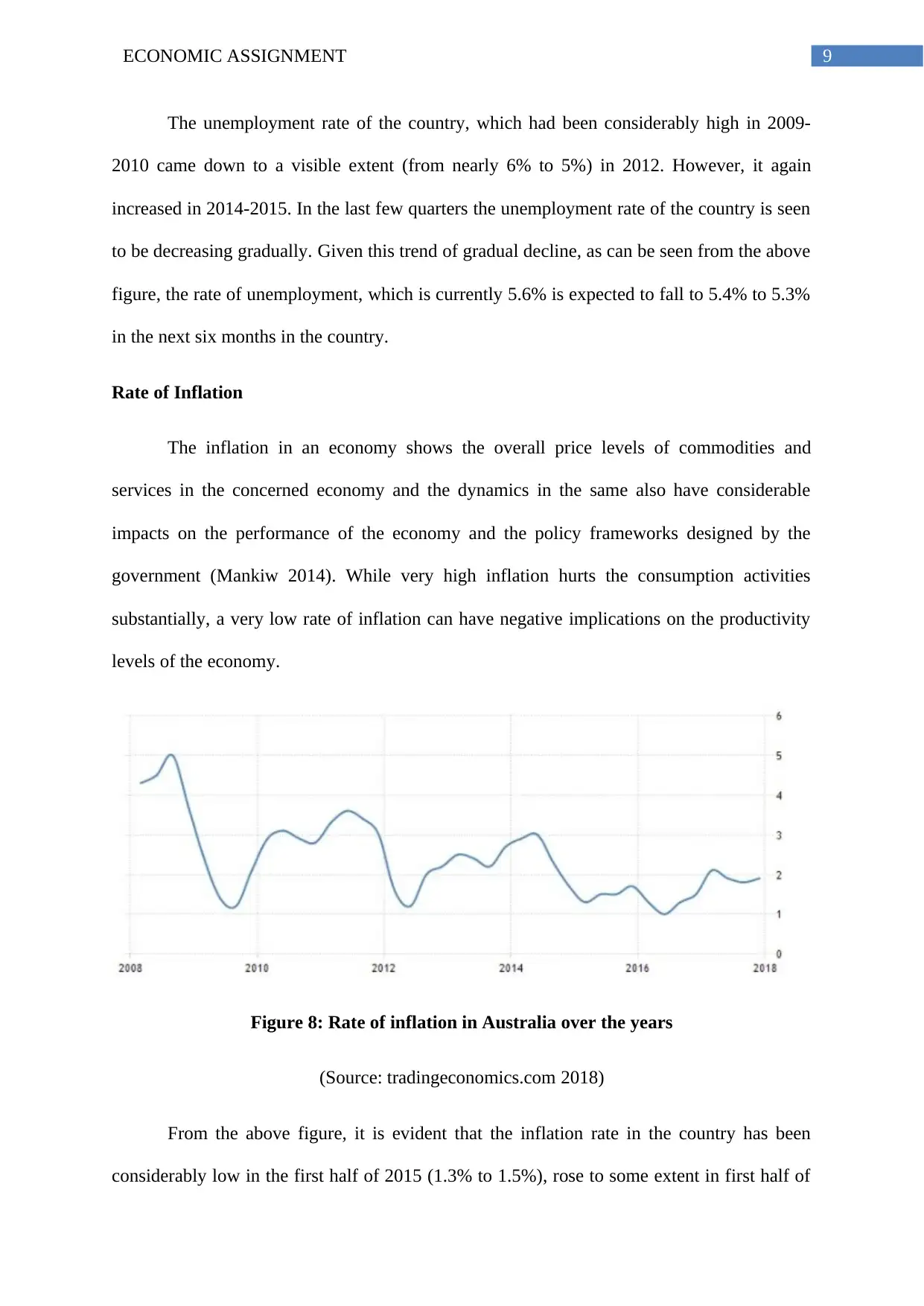

The unemployment rate of the country, which had been considerably high in 2009-

2010 came down to a visible extent (from nearly 6% to 5%) in 2012. However, it again

increased in 2014-2015. In the last few quarters the unemployment rate of the country is seen

to be decreasing gradually. Given this trend of gradual decline, as can be seen from the above

figure, the rate of unemployment, which is currently 5.6% is expected to fall to 5.4% to 5.3%

in the next six months in the country.

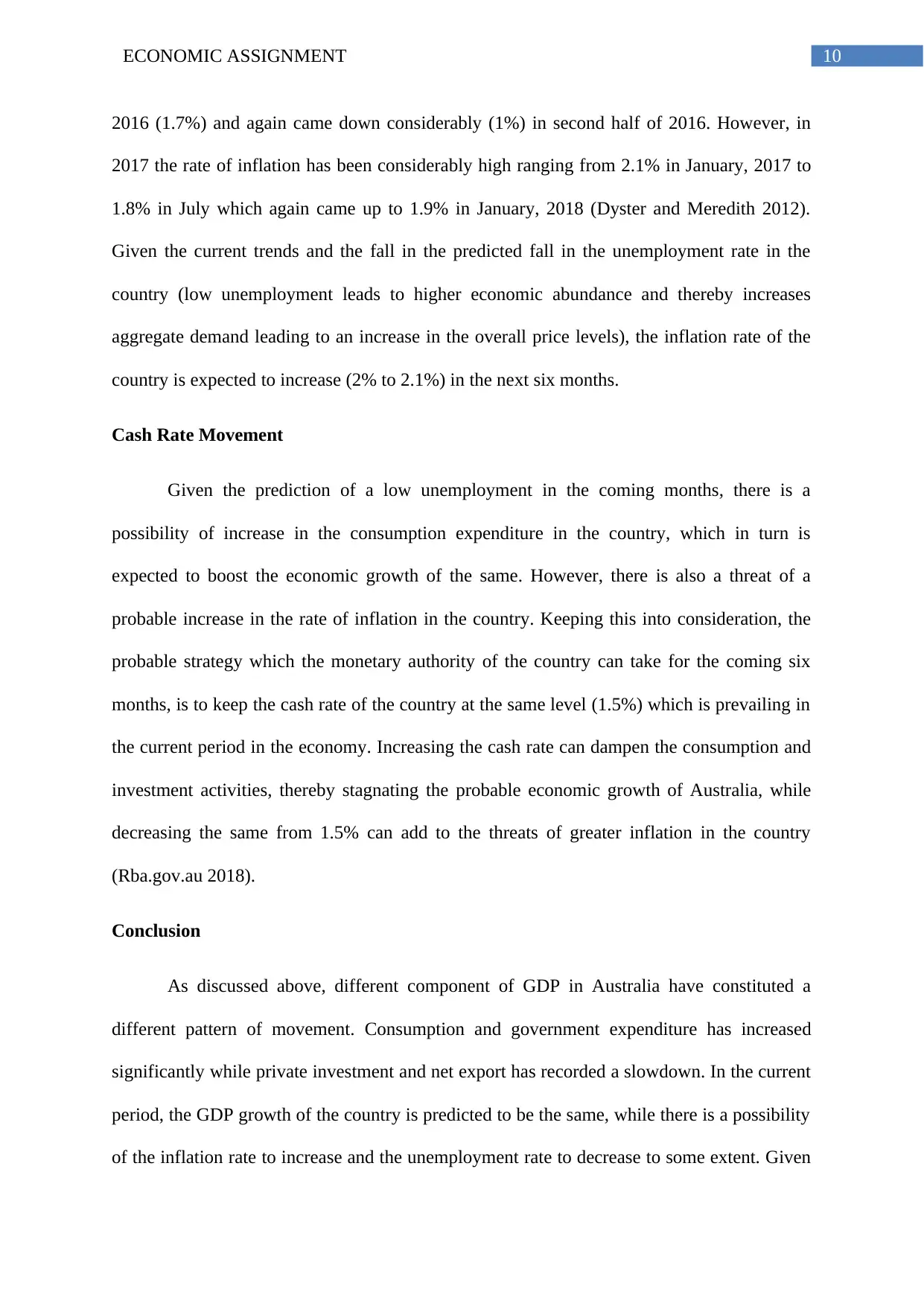

Rate of Inflation

The inflation in an economy shows the overall price levels of commodities and

services in the concerned economy and the dynamics in the same also have considerable

impacts on the performance of the economy and the policy frameworks designed by the

government (Mankiw 2014). While very high inflation hurts the consumption activities

substantially, a very low rate of inflation can have negative implications on the productivity

levels of the economy.

Figure 8: Rate of inflation in Australia over the years

(Source: tradingeconomics.com 2018)

From the above figure, it is evident that the inflation rate in the country has been

considerably low in the first half of 2015 (1.3% to 1.5%), rose to some extent in first half of

The unemployment rate of the country, which had been considerably high in 2009-

2010 came down to a visible extent (from nearly 6% to 5%) in 2012. However, it again

increased in 2014-2015. In the last few quarters the unemployment rate of the country is seen

to be decreasing gradually. Given this trend of gradual decline, as can be seen from the above

figure, the rate of unemployment, which is currently 5.6% is expected to fall to 5.4% to 5.3%

in the next six months in the country.

Rate of Inflation

The inflation in an economy shows the overall price levels of commodities and

services in the concerned economy and the dynamics in the same also have considerable

impacts on the performance of the economy and the policy frameworks designed by the

government (Mankiw 2014). While very high inflation hurts the consumption activities

substantially, a very low rate of inflation can have negative implications on the productivity

levels of the economy.

Figure 8: Rate of inflation in Australia over the years

(Source: tradingeconomics.com 2018)

From the above figure, it is evident that the inflation rate in the country has been

considerably low in the first half of 2015 (1.3% to 1.5%), rose to some extent in first half of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ECONOMIC ASSIGNMENT

2016 (1.7%) and again came down considerably (1%) in second half of 2016. However, in

2017 the rate of inflation has been considerably high ranging from 2.1% in January, 2017 to

1.8% in July which again came up to 1.9% in January, 2018 (Dyster and Meredith 2012).

Given the current trends and the fall in the predicted fall in the unemployment rate in the

country (low unemployment leads to higher economic abundance and thereby increases

aggregate demand leading to an increase in the overall price levels), the inflation rate of the

country is expected to increase (2% to 2.1%) in the next six months.

Cash Rate Movement

Given the prediction of a low unemployment in the coming months, there is a

possibility of increase in the consumption expenditure in the country, which in turn is

expected to boost the economic growth of the same. However, there is also a threat of a

probable increase in the rate of inflation in the country. Keeping this into consideration, the

probable strategy which the monetary authority of the country can take for the coming six

months, is to keep the cash rate of the country at the same level (1.5%) which is prevailing in

the current period in the economy. Increasing the cash rate can dampen the consumption and

investment activities, thereby stagnating the probable economic growth of Australia, while

decreasing the same from 1.5% can add to the threats of greater inflation in the country

(Rba.gov.au 2018).

Conclusion

As discussed above, different component of GDP in Australia have constituted a

different pattern of movement. Consumption and government expenditure has increased

significantly while private investment and net export has recorded a slowdown. In the current

period, the GDP growth of the country is predicted to be the same, while there is a possibility

of the inflation rate to increase and the unemployment rate to decrease to some extent. Given

2016 (1.7%) and again came down considerably (1%) in second half of 2016. However, in

2017 the rate of inflation has been considerably high ranging from 2.1% in January, 2017 to

1.8% in July which again came up to 1.9% in January, 2018 (Dyster and Meredith 2012).

Given the current trends and the fall in the predicted fall in the unemployment rate in the

country (low unemployment leads to higher economic abundance and thereby increases

aggregate demand leading to an increase in the overall price levels), the inflation rate of the

country is expected to increase (2% to 2.1%) in the next six months.

Cash Rate Movement

Given the prediction of a low unemployment in the coming months, there is a

possibility of increase in the consumption expenditure in the country, which in turn is

expected to boost the economic growth of the same. However, there is also a threat of a

probable increase in the rate of inflation in the country. Keeping this into consideration, the

probable strategy which the monetary authority of the country can take for the coming six

months, is to keep the cash rate of the country at the same level (1.5%) which is prevailing in

the current period in the economy. Increasing the cash rate can dampen the consumption and

investment activities, thereby stagnating the probable economic growth of Australia, while

decreasing the same from 1.5% can add to the threats of greater inflation in the country

(Rba.gov.au 2018).

Conclusion

As discussed above, different component of GDP in Australia have constituted a

different pattern of movement. Consumption and government expenditure has increased

significantly while private investment and net export has recorded a slowdown. In the current

period, the GDP growth of the country is predicted to be the same, while there is a possibility

of the inflation rate to increase and the unemployment rate to decrease to some extent. Given

11ECONOMIC ASSIGNMENT

this scenario, it will be optimal for the governing authority of the country to keep the cash

rate at the current level of 1.5% to keep the economy buoyant and growing.

References

ABC News. (2018). Australia's economic growth jumps, but is it sustainable?. [online]

Available at: http://www.abc.net.au/news/2017-09-06/gdp-economic-growth-abs-data-june-

quarter-2017/8877618 [Accessed 5 Apr. 2018].

Abs.gov.au. (2018). 5368.0 - International Trade in Goods and Services, Australia, Feb

2018. [online] Available at: http://www.abs.gov.au/ausstats/abs@.nsf/mf/5368.0 [Accessed 5

Apr. 2018].

Dyster, B. and Meredith, D., 2012. Australia in the global economy: continuity and change.

Cambridge University Press.

Jacobs, S. (2018). Australia's economy is being cushioned by a big increase in government

spending. [online] Business Insider Australia. Available at:

https://www.businessinsider.com.au/australias-economy-is-being-cushioned-by-a-big-

increase-in-government-spending-2017-6 [Accessed 5 Apr. 2018].

Johnson, H.G., 2017. Macroeconomics and monetary theory. Routledge.

Kleinert, J., 2016. Open economy macroeconomics. Chapters, pp.427-435.

Mankiw, N.G., 2014. Principles of macroeconomics. Cengage Learning.

Rba.gov.au (2018). About Monetary Policy | RBA. [online] Reserve Bank of Australia.

Available at: https://www.rba.gov.au/monetary-policy/about.html [Accessed 5 Apr. 2018].

this scenario, it will be optimal for the governing authority of the country to keep the cash

rate at the current level of 1.5% to keep the economy buoyant and growing.

References

ABC News. (2018). Australia's economic growth jumps, but is it sustainable?. [online]

Available at: http://www.abc.net.au/news/2017-09-06/gdp-economic-growth-abs-data-june-

quarter-2017/8877618 [Accessed 5 Apr. 2018].

Abs.gov.au. (2018). 5368.0 - International Trade in Goods and Services, Australia, Feb

2018. [online] Available at: http://www.abs.gov.au/ausstats/abs@.nsf/mf/5368.0 [Accessed 5

Apr. 2018].

Dyster, B. and Meredith, D., 2012. Australia in the global economy: continuity and change.

Cambridge University Press.

Jacobs, S. (2018). Australia's economy is being cushioned by a big increase in government

spending. [online] Business Insider Australia. Available at:

https://www.businessinsider.com.au/australias-economy-is-being-cushioned-by-a-big-

increase-in-government-spending-2017-6 [Accessed 5 Apr. 2018].

Johnson, H.G., 2017. Macroeconomics and monetary theory. Routledge.

Kleinert, J., 2016. Open economy macroeconomics. Chapters, pp.427-435.

Mankiw, N.G., 2014. Principles of macroeconomics. Cengage Learning.

Rba.gov.au (2018). About Monetary Policy | RBA. [online] Reserve Bank of Australia.

Available at: https://www.rba.gov.au/monetary-policy/about.html [Accessed 5 Apr. 2018].

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

12ECONOMIC ASSIGNMENT

Tradingeconomics.com (2018). Australia GDP Growth Rate | 1959-2018 | Data | Chart |

Calendar | Forecast. [online] Tradingeconomics.com. Available at:

https://tradingeconomics.com/australia/gdp-growth [Accessed 5 Apr. 2018].

Tradingeconomics.com (2018). Australia Inflation Rate - Forecast. [online]

Tradingeconomics.com. Available at:

https://tradingeconomics.com/australia/inflation-cpi/forecast [Accessed 5 Apr. 2018].

Tradingeconomics.com (2018). Australia Unemployment Rate | 1978-2018 | Data | Chart |

Calendar. [online] Tradingeconomics.com. Available at:

https://tradingeconomics.com/australia/unemployment-rate [Accessed 5 Apr. 2018].

Tradingeconomics.com. (2018). Australia Private Capital Expenditure | 1987-2018 | Data |

Chart | Calendar. [online] Available at: https://tradingeconomics.com/australia/private-

investment [Accessed 5 Apr. 2018].

Tradingeconomics.com (2018). Australia GDP Growth Rate | 1959-2018 | Data | Chart |

Calendar | Forecast. [online] Tradingeconomics.com. Available at:

https://tradingeconomics.com/australia/gdp-growth [Accessed 5 Apr. 2018].

Tradingeconomics.com (2018). Australia Inflation Rate - Forecast. [online]

Tradingeconomics.com. Available at:

https://tradingeconomics.com/australia/inflation-cpi/forecast [Accessed 5 Apr. 2018].

Tradingeconomics.com (2018). Australia Unemployment Rate | 1978-2018 | Data | Chart |

Calendar. [online] Tradingeconomics.com. Available at:

https://tradingeconomics.com/australia/unemployment-rate [Accessed 5 Apr. 2018].

Tradingeconomics.com. (2018). Australia Private Capital Expenditure | 1987-2018 | Data |

Chart | Calendar. [online] Available at: https://tradingeconomics.com/australia/private-

investment [Accessed 5 Apr. 2018].

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.