ECO2103 Macroeconomics: Analysis of GDP, Inflation, Unemployment

VerifiedAdded on 2023/06/09

|14

|2458

|266

Report

AI Summary

This report provides a macroeconomic analysis based on current articles, examining GDP growth in the USA, inflation in Japan, unemployment trends in the USA, interest rate policies in Indonesia, and business cycle indicators in South Africa. The analysis uses economic models such as AD-AS, demand-supply dynamics in the labor market, and investment-interest rate relationships to explain the observed phenomena. It concludes that despite economic tensions, the US economy shows growth due to fiscal stimuli and global development, while Japan's inflation is aggravated by oil prices and monetary policies. Furthermore, job growth in the US isn't raising wages due to low-wage jobs, Indonesia is holding interest rates to stimulate growth, and South Africa shows positive growth trends with potential for future boom. Desklib offers more solved assignments and study resources for students.

Running head: MACROECONOMIC ASSIGNMENT

Macroeconomic Assignment

Name of the Student

Name of the University

Author Note

Date of Report: 20.07.2018

Macroeconomic Assignment

Name of the Student

Name of the University

Author Note

Date of Report: 20.07.2018

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MACROECONOMIC ASSIGNMENT

Table of Contents

Chapter 1: Macroeconomics, GDP and Economic Growth.......................................................2

Chapter 2: Inflation and rise in price levels...............................................................................3

Chapter 3: Unemployment and Wages......................................................................................5

Chapter 4: Financial Markets, Capital Formation and Savings.................................................6

Chapter 5: Business Cycle, Short-term Economic Fluctuations and Aggregate Expenditure...8

Conclusion................................................................................................................................10

References................................................................................................................................12

Table of Contents

Chapter 1: Macroeconomics, GDP and Economic Growth.......................................................2

Chapter 2: Inflation and rise in price levels...............................................................................3

Chapter 3: Unemployment and Wages......................................................................................5

Chapter 4: Financial Markets, Capital Formation and Savings.................................................6

Chapter 5: Business Cycle, Short-term Economic Fluctuations and Aggregate Expenditure...8

Conclusion................................................................................................................................10

References................................................................................................................................12

2MACROECONOMIC ASSIGNMENT

Chapter 1: Macroeconomics, GDP and Economic Growth

a. Article Title: “Amid massive Trump-induced chaos, GDP growth continues. Why?”

(Dallasnews.com 2018)

Article Source: https://www.dallasnews.com/opinion/commentary/2018/07/19/amid-

massive-trump-induced-chaos-gdp-growth-continues

b. Article Summary

According to the article, on one hand, the country can be seen to be struggling with a

possible trade war, fallacies on part of the government and political tensions and on the other

hand the GDP of the country can be seen to be showing positive and impressive growth rates

(nearly 4.5%) (Dallasnews.com 2018). The article attributes this growth in GDP to the

aspects like the increase in the development and economic activities of the economies with

which the USA enjoys economic linkages, fiscal stimuli on part of the government in the

forms of tax cuts and increased government expenditures (Jorgenson, Gollop and Fraumeni

2016).

c. Analysis:

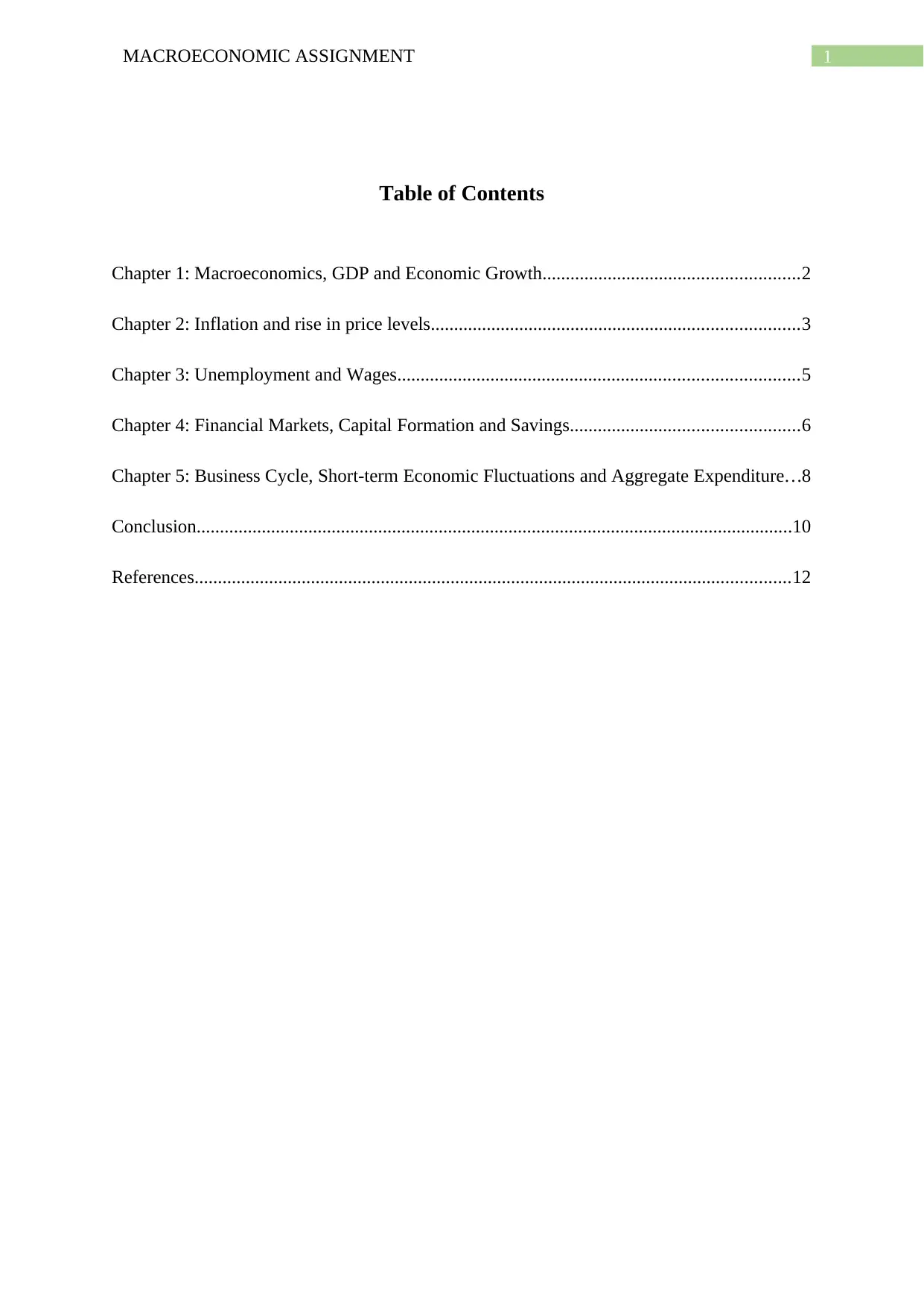

The above phenomenon can be explained with the help of the AD-AS model. The

components of AD include consumption, investment, government expenditures and net

exports:

AD = C+I+G+NX

Due to the fiscal stimuli, G can be seen to be increasing and due to a highly profitable

financial market and robust development of partner economies, investment is also rising. The

growth of the partner nations is also contributing in higher exports, thereby increasing NX.

Along with the same, with the tax cuts, especially in the domain of businesses and corporate

Chapter 1: Macroeconomics, GDP and Economic Growth

a. Article Title: “Amid massive Trump-induced chaos, GDP growth continues. Why?”

(Dallasnews.com 2018)

Article Source: https://www.dallasnews.com/opinion/commentary/2018/07/19/amid-

massive-trump-induced-chaos-gdp-growth-continues

b. Article Summary

According to the article, on one hand, the country can be seen to be struggling with a

possible trade war, fallacies on part of the government and political tensions and on the other

hand the GDP of the country can be seen to be showing positive and impressive growth rates

(nearly 4.5%) (Dallasnews.com 2018). The article attributes this growth in GDP to the

aspects like the increase in the development and economic activities of the economies with

which the USA enjoys economic linkages, fiscal stimuli on part of the government in the

forms of tax cuts and increased government expenditures (Jorgenson, Gollop and Fraumeni

2016).

c. Analysis:

The above phenomenon can be explained with the help of the AD-AS model. The

components of AD include consumption, investment, government expenditures and net

exports:

AD = C+I+G+NX

Due to the fiscal stimuli, G can be seen to be increasing and due to a highly profitable

financial market and robust development of partner economies, investment is also rising. The

growth of the partner nations is also contributing in higher exports, thereby increasing NX.

Along with the same, with the tax cuts, especially in the domain of businesses and corporate

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MACROECONOMIC ASSIGNMENT

expansions, the investment can also be seen to be increasing in the country, which, in turn,

can also be seen to be contributing to the increase in the AD of the country.

Figure 1: Increase in the Aggregate Demand and increase in GDP

(Source: As created by the author)

This increase in the AD, can be seen to be increasing the GDP of the country (Heijdra

2017), as with the increase in the AD, the producers are encouraged to produce more, thereby

increasing the economic productivity of the country, which is reflected in the GDP dynamics

of the country.

Chapter 2: Inflation and rise in price levels

a. Article Title: “Japan's core inflation rate rises to 0.8% in June on energy boost”

(Asia.nikkei.com 2018)

Article Source: https://asia.nikkei.com/Economy/Japan-s-core-inflation-rate-rises-to-0.8-in-

June-on-energy-boost

expansions, the investment can also be seen to be increasing in the country, which, in turn,

can also be seen to be contributing to the increase in the AD of the country.

Figure 1: Increase in the Aggregate Demand and increase in GDP

(Source: As created by the author)

This increase in the AD, can be seen to be increasing the GDP of the country (Heijdra

2017), as with the increase in the AD, the producers are encouraged to produce more, thereby

increasing the economic productivity of the country, which is reflected in the GDP dynamics

of the country.

Chapter 2: Inflation and rise in price levels

a. Article Title: “Japan's core inflation rate rises to 0.8% in June on energy boost”

(Asia.nikkei.com 2018)

Article Source: https://asia.nikkei.com/Economy/Japan-s-core-inflation-rate-rises-to-0.8-in-

June-on-energy-boost

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4MACROECONOMIC ASSIGNMENT

b. Article Summary:

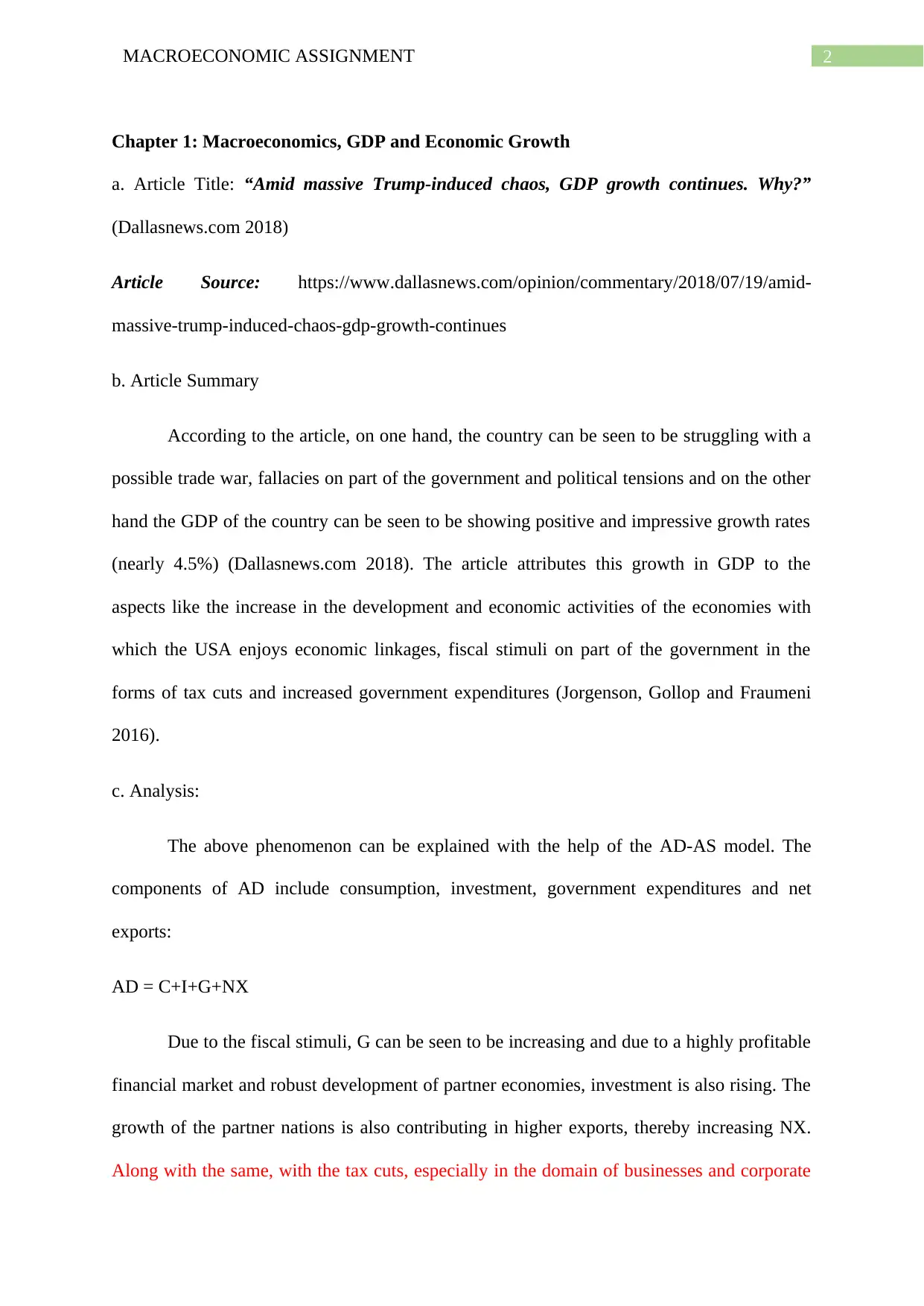

As per the assertions of the article, in the quarter of June, the CPI of Japan, rose by

nearly 0.8% (Asia.nikkei.com 2018). The main reasons behind the rise in the inflation, as per

the arguments put forward by the article, are that of increase in the price of oil and gasoline

and also on the aspects of loose monetary policies which include the policy of monetary

easing (Abhyankar, Xu and Wang 2013).

c. Analysis:

The situation prevailing in the country, in terms of the price level scenarios can be

explained with the help of the concepts of demand and supply dynamics and the same can be

expressed with the help of the diagram as follows:

Figure 2: Effects of rise in oil price and monetary easing in Japan

(Source: As created by the author)

b. Article Summary:

As per the assertions of the article, in the quarter of June, the CPI of Japan, rose by

nearly 0.8% (Asia.nikkei.com 2018). The main reasons behind the rise in the inflation, as per

the arguments put forward by the article, are that of increase in the price of oil and gasoline

and also on the aspects of loose monetary policies which include the policy of monetary

easing (Abhyankar, Xu and Wang 2013).

c. Analysis:

The situation prevailing in the country, in terms of the price level scenarios can be

explained with the help of the concepts of demand and supply dynamics and the same can be

expressed with the help of the diagram as follows:

Figure 2: Effects of rise in oil price and monetary easing in Japan

(Source: As created by the author)

5MACROECONOMIC ASSIGNMENT

As the above figure shows, due to the rise in oil price, the overall production level can

be seen to be falling, mainly due to the increase in the cost of production, which compels the

producers to reduce their production (Bernanke et al. 2018). However, due to the monetary

easing and loose monetary policy on part of the Japanese Government, the demand does not

seem to be negatively affected, to that extent, which in turn can be seen to have aggravated

the inflation to a greater extent, since a fall in the supply with the demand patterns remaining

the same, tend to draw the average price levels of the country upwards.

Chapter 3: Unemployment and Wages

a. Article Title: “Why Wages Won't Rise When Unemployment Falls” (Forbes.com 2018)

Article Source: https://www.forbes.com/sites/teresaghilarducci/2018/07/18/why-wages-

wont-rise-when-unemployment-falls/#56b42e635d9d

b. Article Summary:

The article contradicts the general assertion of Phillips Curve, citing the case of the

contemporary economy of the USA, where the wages are not seen to be rising with the fall in

the rate of unemployment. The primary reason attributed to the same, by the article, is that of

the rising importance of capital over labour and productivity running ahead of wages

(Coibion and Gorodnichenko 2015). The other reason pointed out by the article, is that of the

increase in the demand as well as the supply of low wage employment scopes, in the face of

the increase in the labour force in the country and the loss of the bargaining power of the

workers due to the weakening of the labour unions (Forbes.com 2018).

c. Analysis

The relation between the wage and the level of employment of labour, in the

contemporary economy of the USA, can be elaborated with economic concepts of demand-

As the above figure shows, due to the rise in oil price, the overall production level can

be seen to be falling, mainly due to the increase in the cost of production, which compels the

producers to reduce their production (Bernanke et al. 2018). However, due to the monetary

easing and loose monetary policy on part of the Japanese Government, the demand does not

seem to be negatively affected, to that extent, which in turn can be seen to have aggravated

the inflation to a greater extent, since a fall in the supply with the demand patterns remaining

the same, tend to draw the average price levels of the country upwards.

Chapter 3: Unemployment and Wages

a. Article Title: “Why Wages Won't Rise When Unemployment Falls” (Forbes.com 2018)

Article Source: https://www.forbes.com/sites/teresaghilarducci/2018/07/18/why-wages-

wont-rise-when-unemployment-falls/#56b42e635d9d

b. Article Summary:

The article contradicts the general assertion of Phillips Curve, citing the case of the

contemporary economy of the USA, where the wages are not seen to be rising with the fall in

the rate of unemployment. The primary reason attributed to the same, by the article, is that of

the rising importance of capital over labour and productivity running ahead of wages

(Coibion and Gorodnichenko 2015). The other reason pointed out by the article, is that of the

increase in the demand as well as the supply of low wage employment scopes, in the face of

the increase in the labour force in the country and the loss of the bargaining power of the

workers due to the weakening of the labour unions (Forbes.com 2018).

c. Analysis

The relation between the wage and the level of employment of labour, in the

contemporary economy of the USA, can be elaborated with economic concepts of demand-

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6MACROECONOMIC ASSIGNMENT

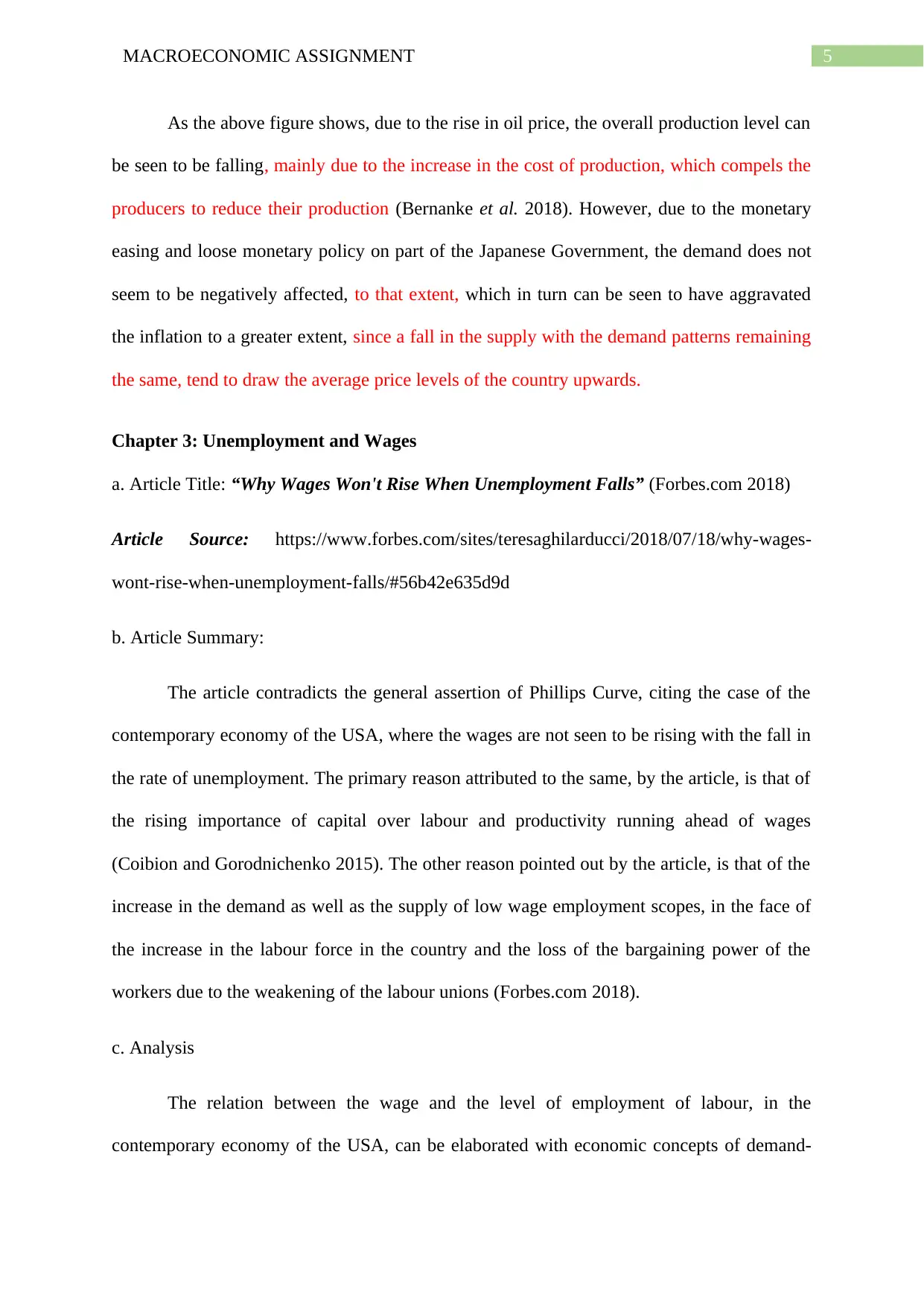

supply situations in the labour market (Coibion and Gorodnichenko 2015). The wage being

the price of the labours, an increase in the supply of labours leads to fall in thee wages and

vice versa, which is shown as follows:

Figure 3: Demand-Supply dynamics in the USA labour market

(Source: As created by the author)

In the concerned case, due to the presence of huge labour supply in the economy of

the USA, new jobs are created which are mostly of low-wage types and the labours, in the

face of high competitions, are accepting the same, which in turn can be seen to be

contributing in sluggish growth in the wage levels in the country. The aspects of presence of

higher importance of capital over labour and the chances of substitutability of the latter by the

former also make the labours more vulnerable, thereby compelling them to resort to low paid

jobs.

Chapter 4: Financial Markets, Capital Formation and Savings

a. Article Title: “Bank Indonesia keeps interest rate on hold” (Businesstimes.com.sg 2018)

supply situations in the labour market (Coibion and Gorodnichenko 2015). The wage being

the price of the labours, an increase in the supply of labours leads to fall in thee wages and

vice versa, which is shown as follows:

Figure 3: Demand-Supply dynamics in the USA labour market

(Source: As created by the author)

In the concerned case, due to the presence of huge labour supply in the economy of

the USA, new jobs are created which are mostly of low-wage types and the labours, in the

face of high competitions, are accepting the same, which in turn can be seen to be

contributing in sluggish growth in the wage levels in the country. The aspects of presence of

higher importance of capital over labour and the chances of substitutability of the latter by the

former also make the labours more vulnerable, thereby compelling them to resort to low paid

jobs.

Chapter 4: Financial Markets, Capital Formation and Savings

a. Article Title: “Bank Indonesia keeps interest rate on hold” (Businesstimes.com.sg 2018)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7MACROECONOMIC ASSIGNMENT

Article Source: https://www.businesstimes.com.sg/banking-finance/bank-indonesia-keeps-

interest-rate-on-hold

b. Article Summary:

According to the assertions of the concerned article, in spite of the presence of room

for increase in the rate of interest, the government of Indonesia, has resorted to keep it

constant rate of 5.25% in the current period (Rosser 2013). The primary reasons behind the

same, as highlighted by the article are the presence of harmless dynamics in the inflation

scenario of the country as well as the stagnation in the economic growth of the country to

boost which the rate of interest is not hiked further by the government.

c. Analysis:

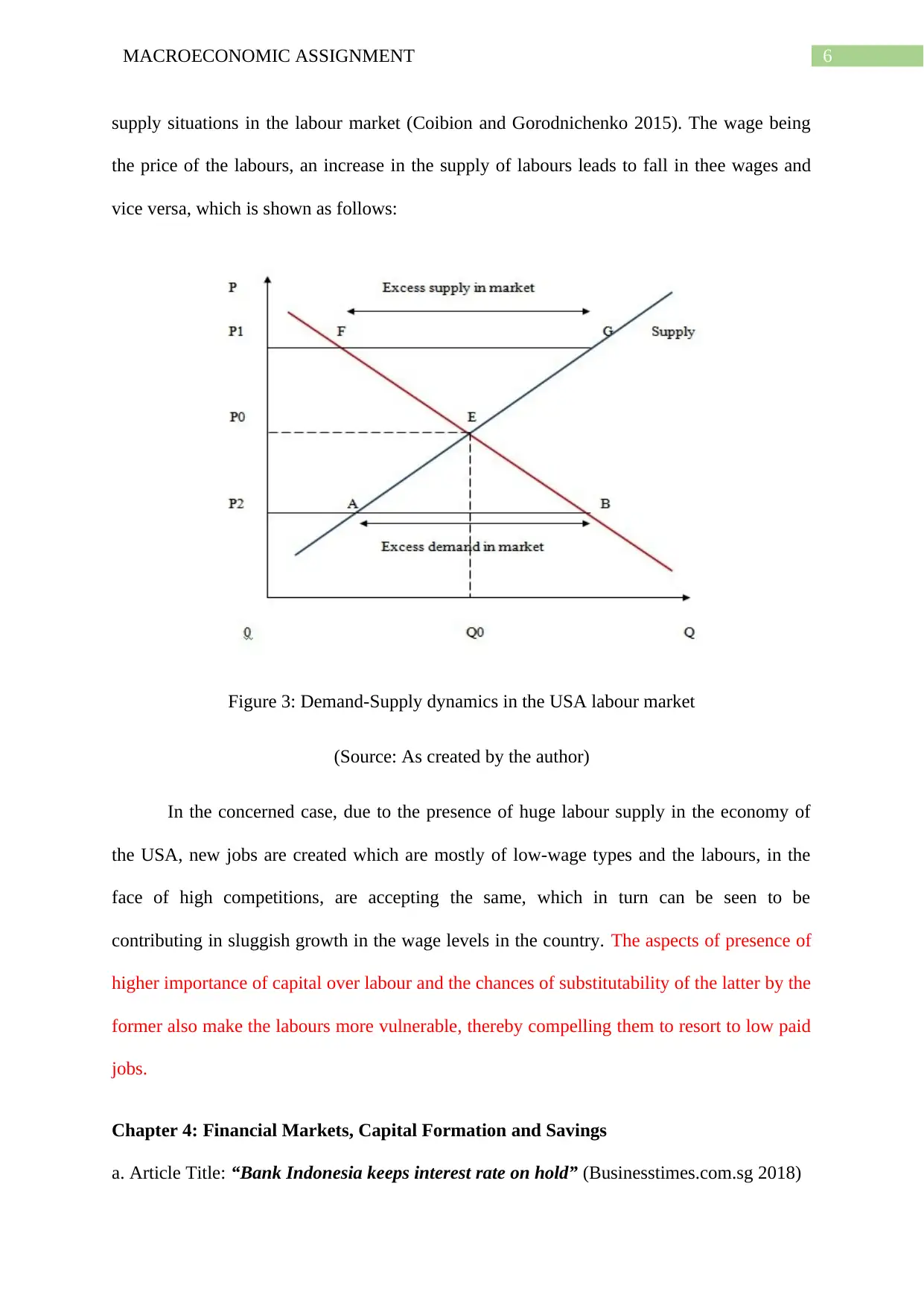

The rate of interest in a country is inversely related to the investment volumes of the

same, as with the increase in the rate of interest, people become less eager to borrow money

for the purpose of investing, as can be seen from the following figure:

Figure 4: Investment and Rate of Interest

Article Source: https://www.businesstimes.com.sg/banking-finance/bank-indonesia-keeps-

interest-rate-on-hold

b. Article Summary:

According to the assertions of the concerned article, in spite of the presence of room

for increase in the rate of interest, the government of Indonesia, has resorted to keep it

constant rate of 5.25% in the current period (Rosser 2013). The primary reasons behind the

same, as highlighted by the article are the presence of harmless dynamics in the inflation

scenario of the country as well as the stagnation in the economic growth of the country to

boost which the rate of interest is not hiked further by the government.

c. Analysis:

The rate of interest in a country is inversely related to the investment volumes of the

same, as with the increase in the rate of interest, people become less eager to borrow money

for the purpose of investing, as can be seen from the following figure:

Figure 4: Investment and Rate of Interest

8MACROECONOMIC ASSIGNMENT

(Source: As created by the author)

Due to the successive rise in the rate of interest, the investments and economic

productivity of Indonesia could be seen to be hampered, as can be seen from their sluggish

economic growth. Investment being a part of the AD, the fall in the former effects the latter

negatively which in turn is expected to lead to an economic stagnating situation in the

country. To combat the same and to increase the level of investments, the rate of interest can

be seen to be keep at a constant level in the recent period (Arrow and Kruz 2013).

Chapter 5: Business Cycle, Short-term Economic Fluctuations and Aggregate

Expenditure

a. Article Title: “EXPLAINER: The business cycle and GDP” (Fin24.com 2018)

Article Source: https://www.fin24.com/Economy/explainer-the-business-cycle-and-gdp-

20180703

b. Article Summary:

Explaining the aspects of GDP and its components like consumption, government

spending, investments and also the net exports, the article asserts that in spite of the

difficulties of predicting the future situation of the economy of South Africa, the current

situation can be seen from the Business Cycle Indicator of the country, which is as follows:

(Source: As created by the author)

Due to the successive rise in the rate of interest, the investments and economic

productivity of Indonesia could be seen to be hampered, as can be seen from their sluggish

economic growth. Investment being a part of the AD, the fall in the former effects the latter

negatively which in turn is expected to lead to an economic stagnating situation in the

country. To combat the same and to increase the level of investments, the rate of interest can

be seen to be keep at a constant level in the recent period (Arrow and Kruz 2013).

Chapter 5: Business Cycle, Short-term Economic Fluctuations and Aggregate

Expenditure

a. Article Title: “EXPLAINER: The business cycle and GDP” (Fin24.com 2018)

Article Source: https://www.fin24.com/Economy/explainer-the-business-cycle-and-gdp-

20180703

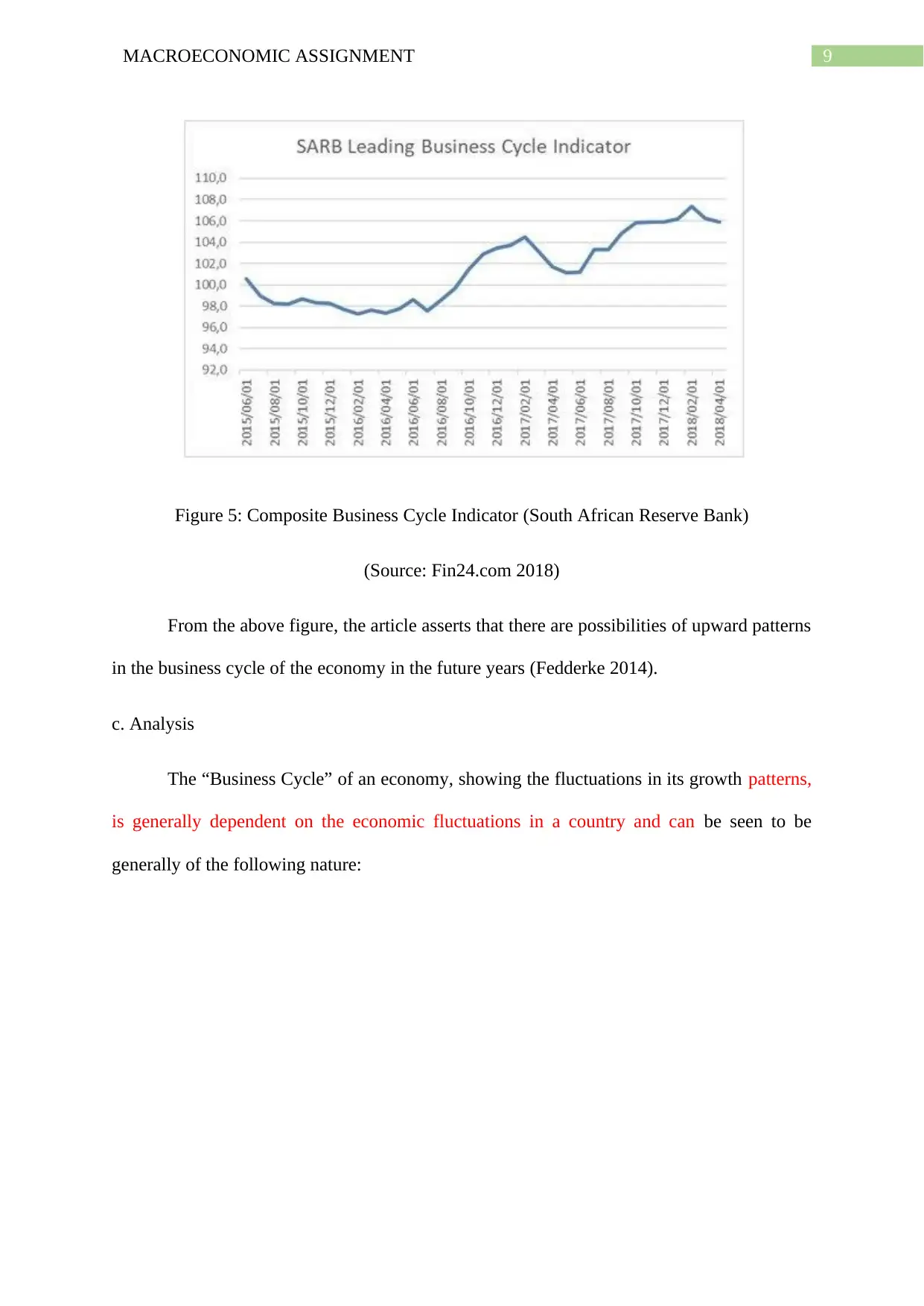

b. Article Summary:

Explaining the aspects of GDP and its components like consumption, government

spending, investments and also the net exports, the article asserts that in spite of the

difficulties of predicting the future situation of the economy of South Africa, the current

situation can be seen from the Business Cycle Indicator of the country, which is as follows:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9MACROECONOMIC ASSIGNMENT

Figure 5: Composite Business Cycle Indicator (South African Reserve Bank)

(Source: Fin24.com 2018)

From the above figure, the article asserts that there are possibilities of upward patterns

in the business cycle of the economy in the future years (Fedderke 2014).

c. Analysis

The “Business Cycle” of an economy, showing the fluctuations in its growth patterns,

is generally dependent on the economic fluctuations in a country and can be seen to be

generally of the following nature:

Figure 5: Composite Business Cycle Indicator (South African Reserve Bank)

(Source: Fin24.com 2018)

From the above figure, the article asserts that there are possibilities of upward patterns

in the business cycle of the economy in the future years (Fedderke 2014).

c. Analysis

The “Business Cycle” of an economy, showing the fluctuations in its growth patterns,

is generally dependent on the economic fluctuations in a country and can be seen to be

generally of the following nature:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10MACROECONOMIC ASSIGNMENT

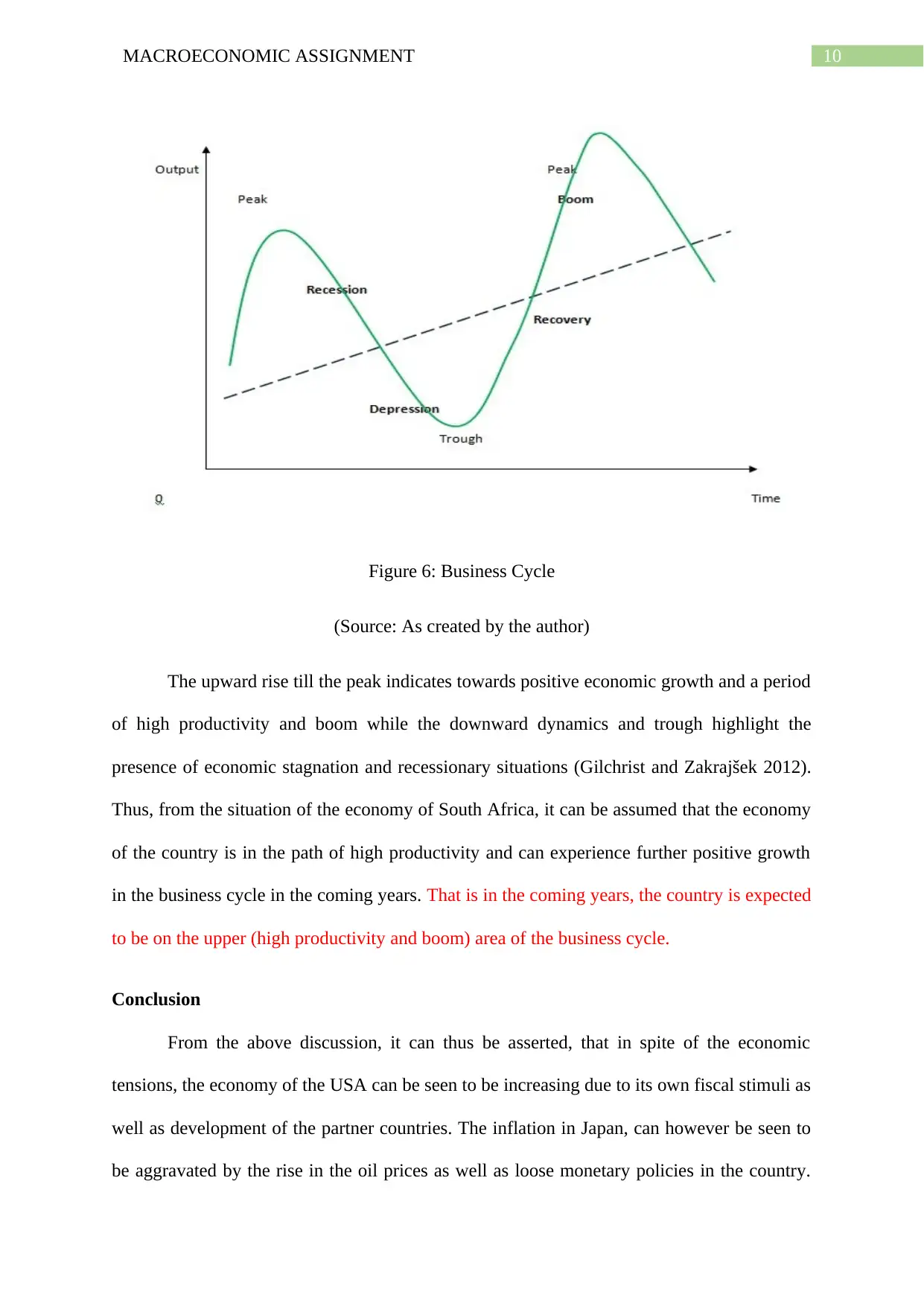

Figure 6: Business Cycle

(Source: As created by the author)

The upward rise till the peak indicates towards positive economic growth and a period

of high productivity and boom while the downward dynamics and trough highlight the

presence of economic stagnation and recessionary situations (Gilchrist and Zakrajšek 2012).

Thus, from the situation of the economy of South Africa, it can be assumed that the economy

of the country is in the path of high productivity and can experience further positive growth

in the business cycle in the coming years. That is in the coming years, the country is expected

to be on the upper (high productivity and boom) area of the business cycle.

Conclusion

From the above discussion, it can thus be asserted, that in spite of the economic

tensions, the economy of the USA can be seen to be increasing due to its own fiscal stimuli as

well as development of the partner countries. The inflation in Japan, can however be seen to

be aggravated by the rise in the oil prices as well as loose monetary policies in the country.

Figure 6: Business Cycle

(Source: As created by the author)

The upward rise till the peak indicates towards positive economic growth and a period

of high productivity and boom while the downward dynamics and trough highlight the

presence of economic stagnation and recessionary situations (Gilchrist and Zakrajšek 2012).

Thus, from the situation of the economy of South Africa, it can be assumed that the economy

of the country is in the path of high productivity and can experience further positive growth

in the business cycle in the coming years. That is in the coming years, the country is expected

to be on the upper (high productivity and boom) area of the business cycle.

Conclusion

From the above discussion, it can thus be asserted, that in spite of the economic

tensions, the economy of the USA can be seen to be increasing due to its own fiscal stimuli as

well as development of the partner countries. The inflation in Japan, can however be seen to

be aggravated by the rise in the oil prices as well as loose monetary policies in the country.

11MACROECONOMIC ASSIGNMENT

The increase in the employment in the USA, however, cannot be seen to be rising the wages

as most of the jobs created are of low-wage types. To stimulate the stagnated economic

growth of Indonesia, the Central Bank can be seen to stall the hike in the rate of interest in the

recent periods. South African economy, however, can be seen to be showing positive growth

trends, with future prospects of boom in its business cycle if the trend of economic growth

continues.

The increase in the employment in the USA, however, cannot be seen to be rising the wages

as most of the jobs created are of low-wage types. To stimulate the stagnated economic

growth of Indonesia, the Central Bank can be seen to stall the hike in the rate of interest in the

recent periods. South African economy, however, can be seen to be showing positive growth

trends, with future prospects of boom in its business cycle if the trend of economic growth

continues.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.