In-depth Analysis of Australia's Macroeconomic Performance (1990-2016)

VerifiedAdded on 2023/06/11

|13

|3860

|298

Report

AI Summary

This report analyzes Australia's macroeconomic performance between 1990 and 2016, focusing on key indicators such as real GDP growth, inflation, cash rate, export, import, and unemployment rate. It examines the relationships between GDP growth, inflation, and unemployment, noting the volatility of inflation in the 1990s and its subsequent stabilization. A positive association is found between the US-Australia exchange rate and net exports. The report also explores the correlation between cash rate and fund rate, suggesting domestic economic conditions primarily influence cash rate decisions. The analysis covers business cycles, trade dynamics, and the impact of global events like the Asian financial crisis and the global financial crisis on Australia's economy.

Running Head: MACROECONOMIC PERFORMANCE OF AUSTRALIA

Macroeconomic Performance of Australia

Name of the Student

Name of the University

Author note

Macroeconomic Performance of Australia

Name of the Student

Name of the University

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MACROECONOMIC PERFORMANCE OF AUSTRALIA

Executive Summary

The paper visited Australian economic performance for period ranging from 1990 to 2016. The main

performance indicators considered here include real GDP growth, inflation., cash rate, export, import,

and unemployment rate. The analysis also involves pairwise evaluation of GDP growth, inflation and

unemployment to look into interrelationship between these indicative measures. GDP growth through

expansion of employment reduces unemployment. Inflation is recorded to be highly volatile during the

decade of 1990s. Price level gradually stabilized thereafter. A positive association has found between

exchange rate between USA and Australia and that of net export. The paper finally incorporates

simultaneous movement of cash rate and fund rate to find whether any association exists between the

two. Data though find a strong positive association between cash rate and fund rate but it is more of the

status of domestic economy that influence cash rate decision.

Executive Summary

The paper visited Australian economic performance for period ranging from 1990 to 2016. The main

performance indicators considered here include real GDP growth, inflation., cash rate, export, import,

and unemployment rate. The analysis also involves pairwise evaluation of GDP growth, inflation and

unemployment to look into interrelationship between these indicative measures. GDP growth through

expansion of employment reduces unemployment. Inflation is recorded to be highly volatile during the

decade of 1990s. Price level gradually stabilized thereafter. A positive association has found between

exchange rate between USA and Australia and that of net export. The paper finally incorporates

simultaneous movement of cash rate and fund rate to find whether any association exists between the

two. Data though find a strong positive association between cash rate and fund rate but it is more of the

status of domestic economy that influence cash rate decision.

2MACROECONOMIC PERFORMANCE OF AUSTRALIA

Table of Contents

Introduction.................................................................................................................................................3

Real GDP growth, inflation and unemployment..........................................................................................3

Growth history and Business cycle..............................................................................................................5

Trade and exchange rate.............................................................................................................................6

Cash rate, fund rate and policy implication.................................................................................................8

Australian economic outlook.....................................................................................................................10

Conclusion.................................................................................................................................................10

References list...........................................................................................................................................11

Table of Contents

Introduction.................................................................................................................................................3

Real GDP growth, inflation and unemployment..........................................................................................3

Growth history and Business cycle..............................................................................................................5

Trade and exchange rate.............................................................................................................................6

Cash rate, fund rate and policy implication.................................................................................................8

Australian economic outlook.....................................................................................................................10

Conclusion.................................................................................................................................................10

References list...........................................................................................................................................11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MACROECONOMIC PERFORMANCE OF AUSTRALIA

Introduction

Analysis of economic performance requires evaluation in several dimension. Long term growth

of a is represented by the trend growth in real GDP. The economic growth is again related with

unemployment and price level movement. Evaluation of external account involves analysis of net export

and exchange rate. Strong interdependence exists between volume of trade and exchange rate.

Government policy intervention contributes to improve growth performance of the economy

(Williamson, 2014). RBA uses cash rate to control credit supply and hence, economic growth. Cash rate

decision is often influenced by fund rate in USA. Evaluation of all these indicators together provides an

understanding of economic performance of Australia in the over a considerably long period.

Real GDP growth, inflation and unemployment

GDP growth, inflation and unemployment are three vital indicators of performance of an

economy. GDP growth reflects the overall growth of the economy. Inflation and unemployment on the

hand other hand are related with dynamic movement of price level and labor market performance. GDP

growth generally fosters production opportunity (Mankiw,2014). The goods market expansion has a

direct effect on factor market. The increased demand for labor reduces hurdles of finding jobs in the

labor market. This contributes to a significant reduction in unemployment level. Additionally, economic

growth usually comes with an increased demand through boosting average income and reduction in

unemployment. The demand side pressure transforms to a higher price level or inflation (Cioran, 2014).

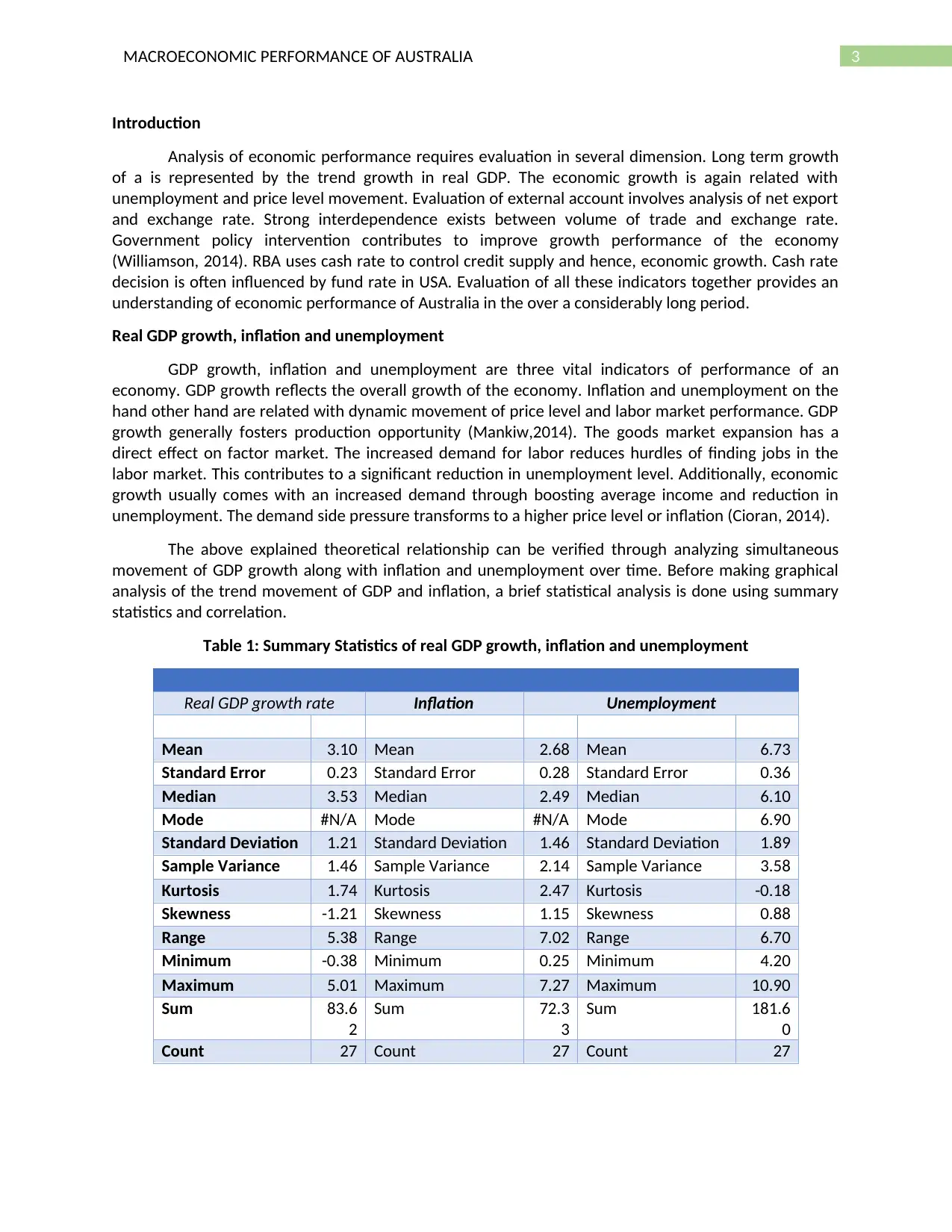

The above explained theoretical relationship can be verified through analyzing simultaneous

movement of GDP growth along with inflation and unemployment over time. Before making graphical

analysis of the trend movement of GDP and inflation, a brief statistical analysis is done using summary

statistics and correlation.

Table 1: Summary Statistics of real GDP growth, inflation and unemployment

Real GDP growth rate Inflation Unemployment

Mean 3.10 Mean 2.68 Mean 6.73

Standard Error 0.23 Standard Error 0.28 Standard Error 0.36

Median 3.53 Median 2.49 Median 6.10

Mode #N/A Mode #N/A Mode 6.90

Standard Deviation 1.21 Standard Deviation 1.46 Standard Deviation 1.89

Sample Variance 1.46 Sample Variance 2.14 Sample Variance 3.58

Kurtosis 1.74 Kurtosis 2.47 Kurtosis -0.18

Skewness -1.21 Skewness 1.15 Skewness 0.88

Range 5.38 Range 7.02 Range 6.70

Minimum -0.38 Minimum 0.25 Minimum 4.20

Maximum 5.01 Maximum 7.27 Maximum 10.90

Sum 83.6

2

Sum 72.3

3

Sum 181.6

0

Count 27 Count 27 Count 27

Introduction

Analysis of economic performance requires evaluation in several dimension. Long term growth

of a is represented by the trend growth in real GDP. The economic growth is again related with

unemployment and price level movement. Evaluation of external account involves analysis of net export

and exchange rate. Strong interdependence exists between volume of trade and exchange rate.

Government policy intervention contributes to improve growth performance of the economy

(Williamson, 2014). RBA uses cash rate to control credit supply and hence, economic growth. Cash rate

decision is often influenced by fund rate in USA. Evaluation of all these indicators together provides an

understanding of economic performance of Australia in the over a considerably long period.

Real GDP growth, inflation and unemployment

GDP growth, inflation and unemployment are three vital indicators of performance of an

economy. GDP growth reflects the overall growth of the economy. Inflation and unemployment on the

hand other hand are related with dynamic movement of price level and labor market performance. GDP

growth generally fosters production opportunity (Mankiw,2014). The goods market expansion has a

direct effect on factor market. The increased demand for labor reduces hurdles of finding jobs in the

labor market. This contributes to a significant reduction in unemployment level. Additionally, economic

growth usually comes with an increased demand through boosting average income and reduction in

unemployment. The demand side pressure transforms to a higher price level or inflation (Cioran, 2014).

The above explained theoretical relationship can be verified through analyzing simultaneous

movement of GDP growth along with inflation and unemployment over time. Before making graphical

analysis of the trend movement of GDP and inflation, a brief statistical analysis is done using summary

statistics and correlation.

Table 1: Summary Statistics of real GDP growth, inflation and unemployment

Real GDP growth rate Inflation Unemployment

Mean 3.10 Mean 2.68 Mean 6.73

Standard Error 0.23 Standard Error 0.28 Standard Error 0.36

Median 3.53 Median 2.49 Median 6.10

Mode #N/A Mode #N/A Mode 6.90

Standard Deviation 1.21 Standard Deviation 1.46 Standard Deviation 1.89

Sample Variance 1.46 Sample Variance 2.14 Sample Variance 3.58

Kurtosis 1.74 Kurtosis 2.47 Kurtosis -0.18

Skewness -1.21 Skewness 1.15 Skewness 0.88

Range 5.38 Range 7.02 Range 6.70

Minimum -0.38 Minimum 0.25 Minimum 4.20

Maximum 5.01 Maximum 7.27 Maximum 10.90

Sum 83.6

2

Sum 72.3

3

Sum 181.6

0

Count 27 Count 27 Count 27

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4MACROECONOMIC PERFORMANCE OF AUSTRALIA

From the summary statistics insights are obtained regarding average movement of the concerned

variables, range within which the indicators vary and finally stability of the distribution for the given

period. Growth rate in Australia for the time period wad averaged at 3.10%. Economic growth of

Australia varied between the rate of -0.38% to 5.10%. Distribution of real GDP growth is less volatile as

reflected from the lower standard deviation. Price level is Australia average at 2.68%. The inflation rate

varied between the 0.25 percent and 7.27. The small standard deviation indicates that the economy has

attained a price level stability over time. Average growth and price level in Australia is though at the

satisfactory level but the average unemployment rate is comparatively high. The average estimate for

unemployment is 6.73. Rate of unemployment moved in the range from 4.20 to 10.90.

Table 2: Correlation between GDP growth and inflation

Real GDP growth

rate

Inflation

Real GDP growth rate 1

Inflation -0.019661645 1

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

2012

2014

2016

-1.00

0.00

1.00

2.00

3.00

4.00

5.00

6.00

7.00

8.00

Real GDP growth and inflation

Year

GDP growth and inflation

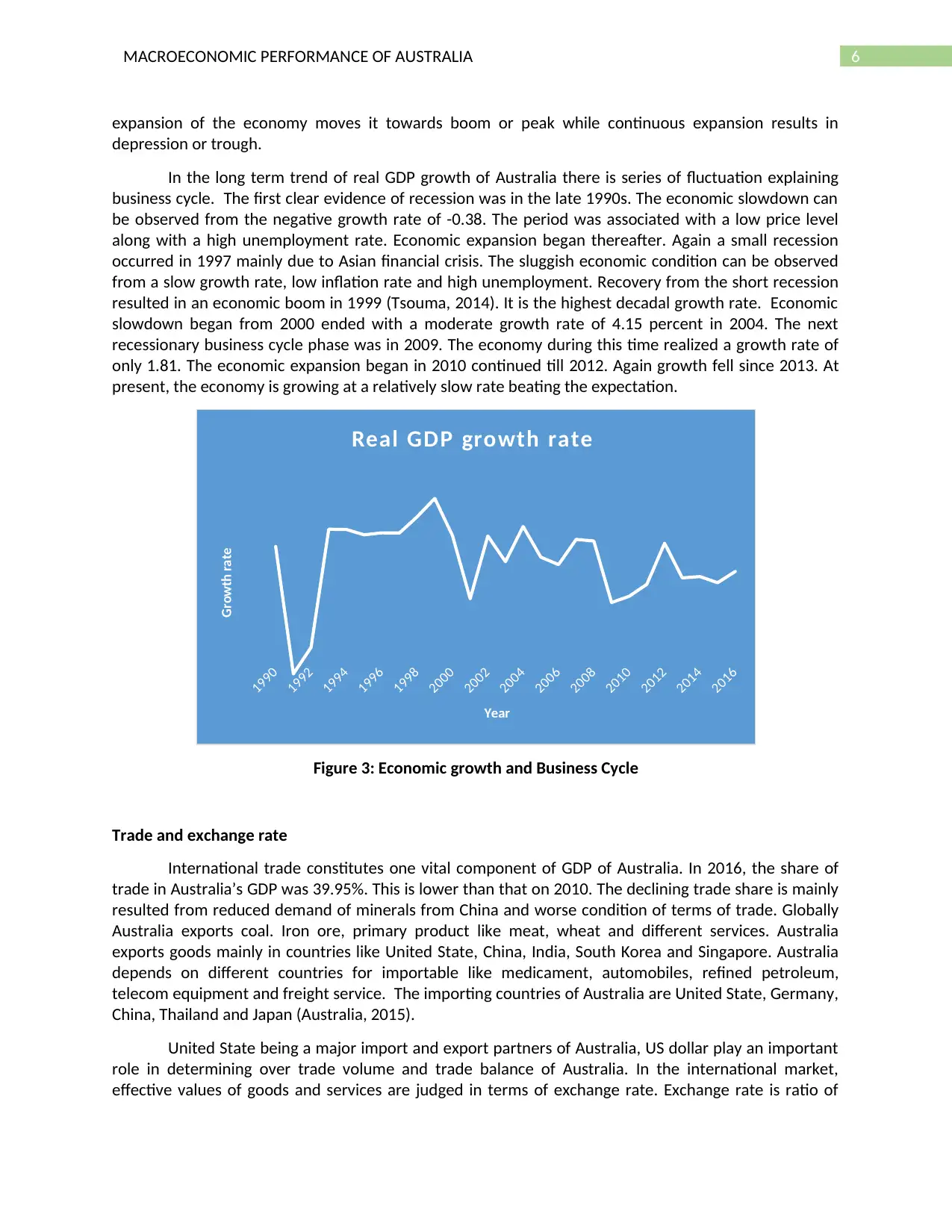

Figure 1: Real GDP growth VS inflation

Starting from 1990, GDP growth rate in the year was accounted as 3.53. The corresponding inflation rate

was 7.27 percent. From the late 1990s, the economy began to slow down with growth rate became

negative. The accounted growth rate during this period was -0.38. Associated with the negative growth

rate, inflation rate fell to 3.2 supporting the theoretical assertion (Ffrench-Davis, 2016). After that

economy though grew at a moderate to stable rate price level remain highly volatile. The period of 1997

was the period of Asian financial crisis. Australia being actively involved in trade with some vital Asian

countries (Malaysia, South Korea, Indonesia, Thailand) had realized a recessionary shock during this

time. Price level reached to its lowest level mainly to shocks in the exchange rate. Growth and price both

recovered. The decade ended with the maximum growth rate of 5.01% while the inflation rate was 1.47

percent. The decade of 2000s, is a phase of almost stable growth rate except in two years -2001 and

2008. The growth rate fell to 1.93 in 2001 with an associated fall in inflation rate to 1.93. The decline in

the growth rate during 2009 was largely due to occurrence of global financial crisis (Sarva, 2013). Price

From the summary statistics insights are obtained regarding average movement of the concerned

variables, range within which the indicators vary and finally stability of the distribution for the given

period. Growth rate in Australia for the time period wad averaged at 3.10%. Economic growth of

Australia varied between the rate of -0.38% to 5.10%. Distribution of real GDP growth is less volatile as

reflected from the lower standard deviation. Price level is Australia average at 2.68%. The inflation rate

varied between the 0.25 percent and 7.27. The small standard deviation indicates that the economy has

attained a price level stability over time. Average growth and price level in Australia is though at the

satisfactory level but the average unemployment rate is comparatively high. The average estimate for

unemployment is 6.73. Rate of unemployment moved in the range from 4.20 to 10.90.

Table 2: Correlation between GDP growth and inflation

Real GDP growth

rate

Inflation

Real GDP growth rate 1

Inflation -0.019661645 1

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

2012

2014

2016

-1.00

0.00

1.00

2.00

3.00

4.00

5.00

6.00

7.00

8.00

Real GDP growth and inflation

Year

GDP growth and inflation

Figure 1: Real GDP growth VS inflation

Starting from 1990, GDP growth rate in the year was accounted as 3.53. The corresponding inflation rate

was 7.27 percent. From the late 1990s, the economy began to slow down with growth rate became

negative. The accounted growth rate during this period was -0.38. Associated with the negative growth

rate, inflation rate fell to 3.2 supporting the theoretical assertion (Ffrench-Davis, 2016). After that

economy though grew at a moderate to stable rate price level remain highly volatile. The period of 1997

was the period of Asian financial crisis. Australia being actively involved in trade with some vital Asian

countries (Malaysia, South Korea, Indonesia, Thailand) had realized a recessionary shock during this

time. Price level reached to its lowest level mainly to shocks in the exchange rate. Growth and price both

recovered. The decade ended with the maximum growth rate of 5.01% while the inflation rate was 1.47

percent. The decade of 2000s, is a phase of almost stable growth rate except in two years -2001 and

2008. The growth rate fell to 1.93 in 2001 with an associated fall in inflation rate to 1.93. The decline in

the growth rate during 2009 was largely due to occurrence of global financial crisis (Sarva, 2013). Price

5MACROECONOMIC PERFORMANCE OF AUSTRALIA

level low grew at a very slow rate during this time with inflation rate being 1.82. Since 210, economic

growth though has increased but price level remains at a stable rate of 1-2%. The price level stability is

mainly attributed from monetary policy of Reserve Bank of Australia.

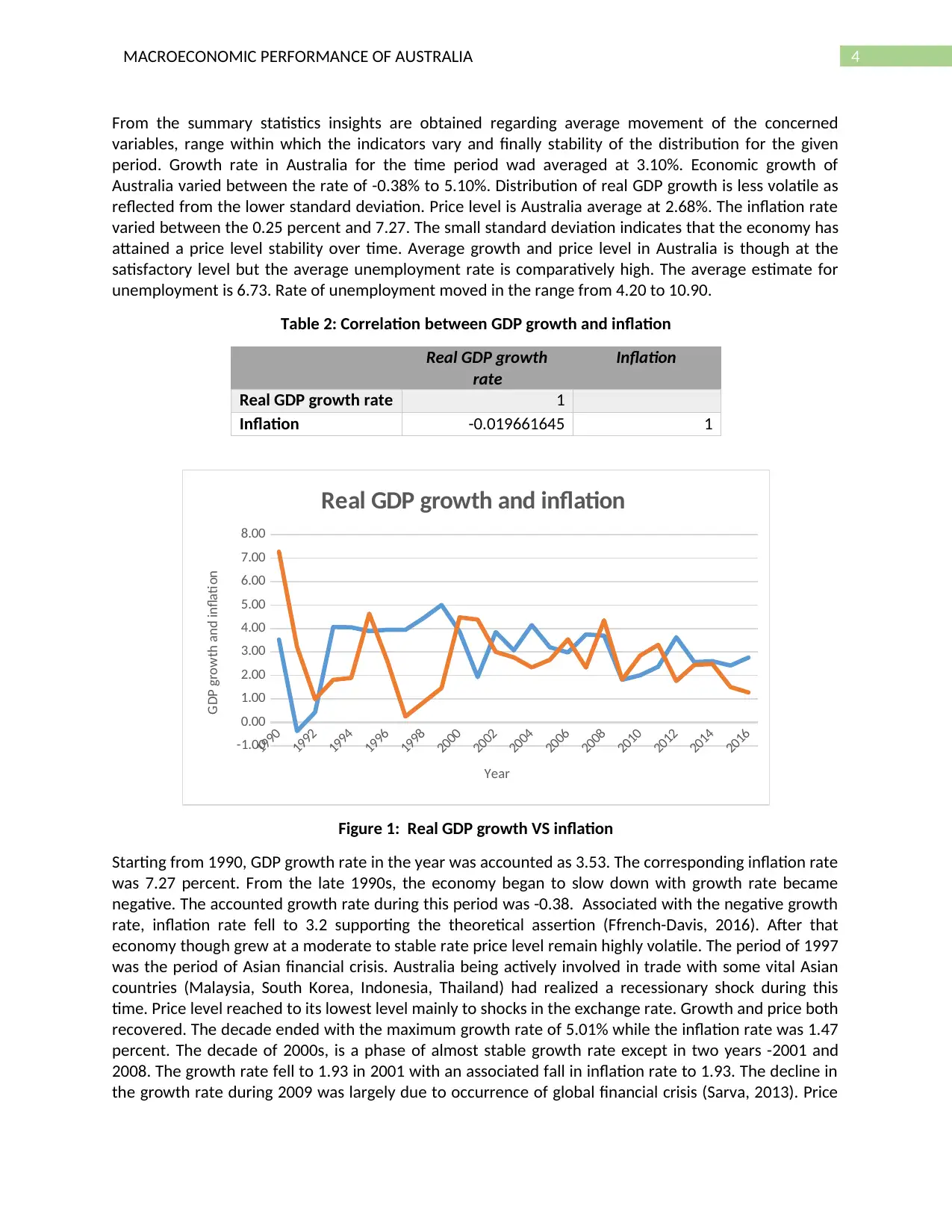

Table 3: Correlation between GDP growth and unemployment

Real GDP growth

rate

Unemployment

Real GDP growth rate 1

Unemployment -0.125528172 1

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

-2.00

0.00

2.00

4.00

6.00

8.00

10.00

12.00

Real GDP growth and unemployment

Real GDP growth rate Unemployment

Year

Unemployment and GDP growth rate

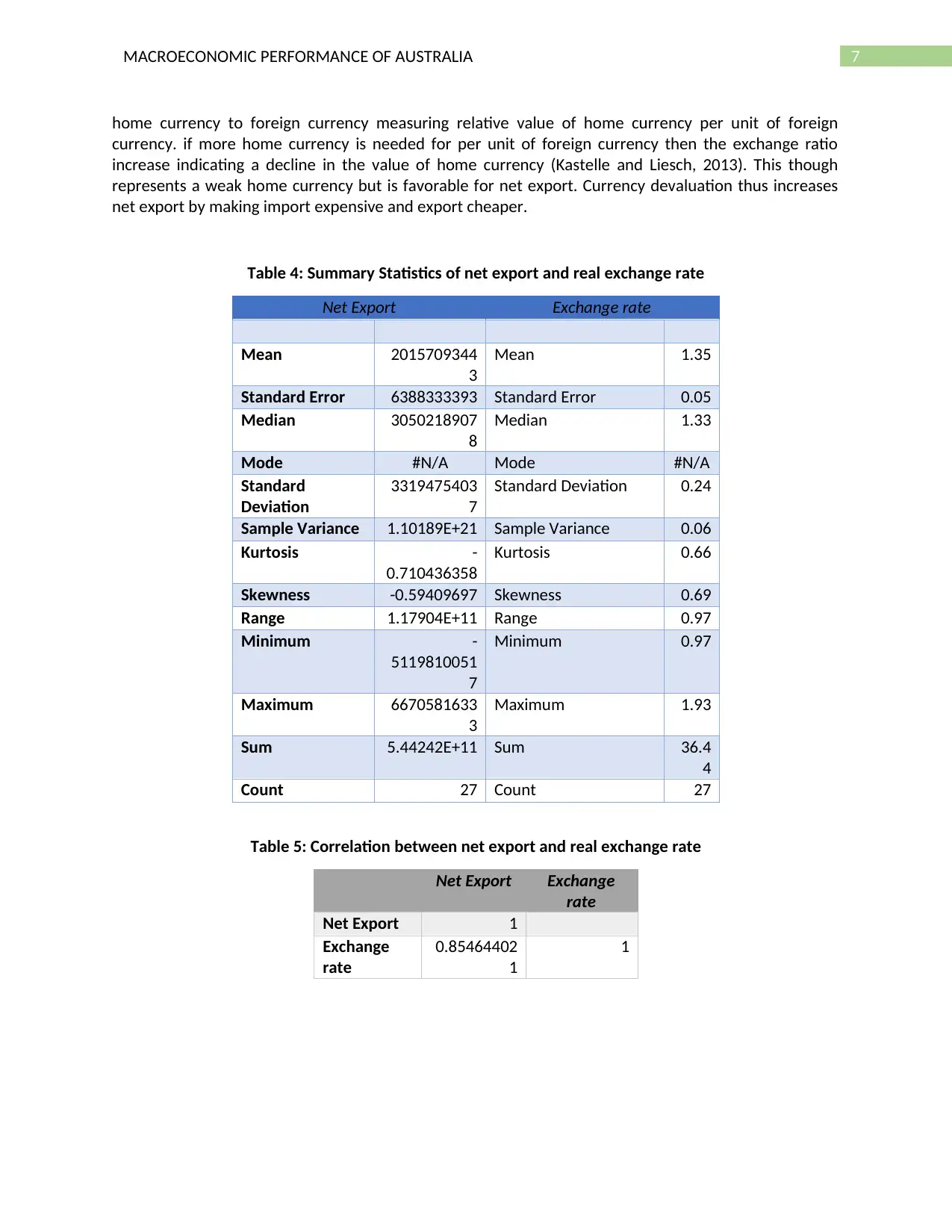

Figure 2: Real GDP growth VS unemployment

Figure 2 represents periodic movement of real GDP growth and unemployment rate. There is an

indication of clear adverse relation between GDP growth and unemployment. The negative GDP growth

rate of -0.38 percent was associated with a very high unemployment rate of 9.60. With gradual

improvement in the GDP growth rate unemployment rate declines. The decadal unemployment rate in

2000s is much lower than that 1990s. The negative correlation between unemployment and GDP growth

is supported by the periodic movement of unemployment and Australia. From the graph s convergence

is observed between GDP growth and unemployment rate overtime. Mining sector is the main engine

of economic growth. Mining industry is a labor intensive sector. Economic growth driven by labor

intensive sector indicates a lower unemployment with economic growth (Robinson, Tsiaplias and

Nguyen, 2015).

Growth history and Business cycle

Business cycle also termed as economic or trade cycle explicates upward and downward

movement in the long term tend of real gross domestic product. The business cycle contains a point if

economic boom and series of contraction in a continuous sequence (Stock and Watson, 2016). Gradual

level low grew at a very slow rate during this time with inflation rate being 1.82. Since 210, economic

growth though has increased but price level remains at a stable rate of 1-2%. The price level stability is

mainly attributed from monetary policy of Reserve Bank of Australia.

Table 3: Correlation between GDP growth and unemployment

Real GDP growth

rate

Unemployment

Real GDP growth rate 1

Unemployment -0.125528172 1

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

-2.00

0.00

2.00

4.00

6.00

8.00

10.00

12.00

Real GDP growth and unemployment

Real GDP growth rate Unemployment

Year

Unemployment and GDP growth rate

Figure 2: Real GDP growth VS unemployment

Figure 2 represents periodic movement of real GDP growth and unemployment rate. There is an

indication of clear adverse relation between GDP growth and unemployment. The negative GDP growth

rate of -0.38 percent was associated with a very high unemployment rate of 9.60. With gradual

improvement in the GDP growth rate unemployment rate declines. The decadal unemployment rate in

2000s is much lower than that 1990s. The negative correlation between unemployment and GDP growth

is supported by the periodic movement of unemployment and Australia. From the graph s convergence

is observed between GDP growth and unemployment rate overtime. Mining sector is the main engine

of economic growth. Mining industry is a labor intensive sector. Economic growth driven by labor

intensive sector indicates a lower unemployment with economic growth (Robinson, Tsiaplias and

Nguyen, 2015).

Growth history and Business cycle

Business cycle also termed as economic or trade cycle explicates upward and downward

movement in the long term tend of real gross domestic product. The business cycle contains a point if

economic boom and series of contraction in a continuous sequence (Stock and Watson, 2016). Gradual

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6MACROECONOMIC PERFORMANCE OF AUSTRALIA

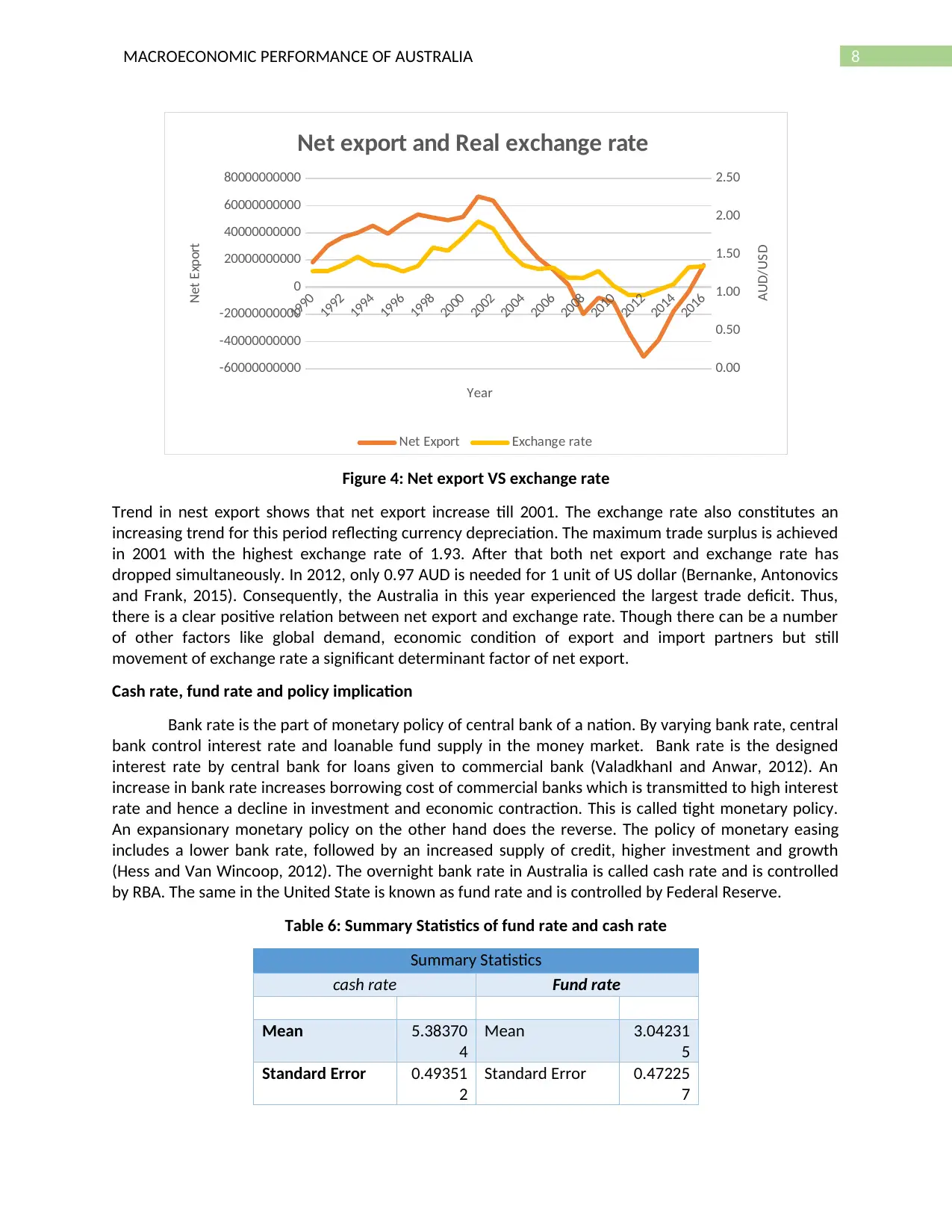

expansion of the economy moves it towards boom or peak while continuous expansion results in

depression or trough.

In the long term trend of real GDP growth of Australia there is series of fluctuation explaining

business cycle. The first clear evidence of recession was in the late 1990s. The economic slowdown can

be observed from the negative growth rate of -0.38. The period was associated with a low price level

along with a high unemployment rate. Economic expansion began thereafter. Again a small recession

occurred in 1997 mainly due to Asian financial crisis. The sluggish economic condition can be observed

from a slow growth rate, low inflation rate and high unemployment. Recovery from the short recession

resulted in an economic boom in 1999 (Tsouma, 2014). It is the highest decadal growth rate. Economic

slowdown began from 2000 ended with a moderate growth rate of 4.15 percent in 2004. The next

recessionary business cycle phase was in 2009. The economy during this time realized a growth rate of

only 1.81. The economic expansion began in 2010 continued till 2012. Again growth fell since 2013. At

present, the economy is growing at a relatively slow rate beating the expectation.

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

2012

2014

2016

Real GDP growth rate

Year

Growth rate

Figure 3: Economic growth and Business Cycle

Trade and exchange rate

International trade constitutes one vital component of GDP of Australia. In 2016, the share of

trade in Australia’s GDP was 39.95%. This is lower than that on 2010. The declining trade share is mainly

resulted from reduced demand of minerals from China and worse condition of terms of trade. Globally

Australia exports coal. Iron ore, primary product like meat, wheat and different services. Australia

exports goods mainly in countries like United State, China, India, South Korea and Singapore. Australia

depends on different countries for importable like medicament, automobiles, refined petroleum,

telecom equipment and freight service. The importing countries of Australia are United State, Germany,

China, Thailand and Japan (Australia, 2015).

United State being a major import and export partners of Australia, US dollar play an important

role in determining over trade volume and trade balance of Australia. In the international market,

effective values of goods and services are judged in terms of exchange rate. Exchange rate is ratio of

expansion of the economy moves it towards boom or peak while continuous expansion results in

depression or trough.

In the long term trend of real GDP growth of Australia there is series of fluctuation explaining

business cycle. The first clear evidence of recession was in the late 1990s. The economic slowdown can

be observed from the negative growth rate of -0.38. The period was associated with a low price level

along with a high unemployment rate. Economic expansion began thereafter. Again a small recession

occurred in 1997 mainly due to Asian financial crisis. The sluggish economic condition can be observed

from a slow growth rate, low inflation rate and high unemployment. Recovery from the short recession

resulted in an economic boom in 1999 (Tsouma, 2014). It is the highest decadal growth rate. Economic

slowdown began from 2000 ended with a moderate growth rate of 4.15 percent in 2004. The next

recessionary business cycle phase was in 2009. The economy during this time realized a growth rate of

only 1.81. The economic expansion began in 2010 continued till 2012. Again growth fell since 2013. At

present, the economy is growing at a relatively slow rate beating the expectation.

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

2012

2014

2016

Real GDP growth rate

Year

Growth rate

Figure 3: Economic growth and Business Cycle

Trade and exchange rate

International trade constitutes one vital component of GDP of Australia. In 2016, the share of

trade in Australia’s GDP was 39.95%. This is lower than that on 2010. The declining trade share is mainly

resulted from reduced demand of minerals from China and worse condition of terms of trade. Globally

Australia exports coal. Iron ore, primary product like meat, wheat and different services. Australia

exports goods mainly in countries like United State, China, India, South Korea and Singapore. Australia

depends on different countries for importable like medicament, automobiles, refined petroleum,

telecom equipment and freight service. The importing countries of Australia are United State, Germany,

China, Thailand and Japan (Australia, 2015).

United State being a major import and export partners of Australia, US dollar play an important

role in determining over trade volume and trade balance of Australia. In the international market,

effective values of goods and services are judged in terms of exchange rate. Exchange rate is ratio of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7MACROECONOMIC PERFORMANCE OF AUSTRALIA

home currency to foreign currency measuring relative value of home currency per unit of foreign

currency. if more home currency is needed for per unit of foreign currency then the exchange ratio

increase indicating a decline in the value of home currency (Kastelle and Liesch, 2013). This though

represents a weak home currency but is favorable for net export. Currency devaluation thus increases

net export by making import expensive and export cheaper.

Table 4: Summary Statistics of net export and real exchange rate

Net Export Exchange rate

Mean 2015709344

3

Mean 1.35

Standard Error 6388333393 Standard Error 0.05

Median 3050218907

8

Median 1.33

Mode #N/A Mode #N/A

Standard

Deviation

3319475403

7

Standard Deviation 0.24

Sample Variance 1.10189E+21 Sample Variance 0.06

Kurtosis -

0.710436358

Kurtosis 0.66

Skewness -0.59409697 Skewness 0.69

Range 1.17904E+11 Range 0.97

Minimum -

5119810051

7

Minimum 0.97

Maximum 6670581633

3

Maximum 1.93

Sum 5.44242E+11 Sum 36.4

4

Count 27 Count 27

Table 5: Correlation between net export and real exchange rate

Net Export Exchange

rate

Net Export 1

Exchange

rate

0.85464402

1

1

home currency to foreign currency measuring relative value of home currency per unit of foreign

currency. if more home currency is needed for per unit of foreign currency then the exchange ratio

increase indicating a decline in the value of home currency (Kastelle and Liesch, 2013). This though

represents a weak home currency but is favorable for net export. Currency devaluation thus increases

net export by making import expensive and export cheaper.

Table 4: Summary Statistics of net export and real exchange rate

Net Export Exchange rate

Mean 2015709344

3

Mean 1.35

Standard Error 6388333393 Standard Error 0.05

Median 3050218907

8

Median 1.33

Mode #N/A Mode #N/A

Standard

Deviation

3319475403

7

Standard Deviation 0.24

Sample Variance 1.10189E+21 Sample Variance 0.06

Kurtosis -

0.710436358

Kurtosis 0.66

Skewness -0.59409697 Skewness 0.69

Range 1.17904E+11 Range 0.97

Minimum -

5119810051

7

Minimum 0.97

Maximum 6670581633

3

Maximum 1.93

Sum 5.44242E+11 Sum 36.4

4

Count 27 Count 27

Table 5: Correlation between net export and real exchange rate

Net Export Exchange

rate

Net Export 1

Exchange

rate

0.85464402

1

1

8MACROECONOMIC PERFORMANCE OF AUSTRALIA

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

2012

2014

2016

-60000000000

-40000000000

-20000000000

0

20000000000

40000000000

60000000000

80000000000

0.00

0.50

1.00

1.50

2.00

2.50

Net export and Real exchange rate

Net Export Exchange rate

Year

Net Export

AUD/USD

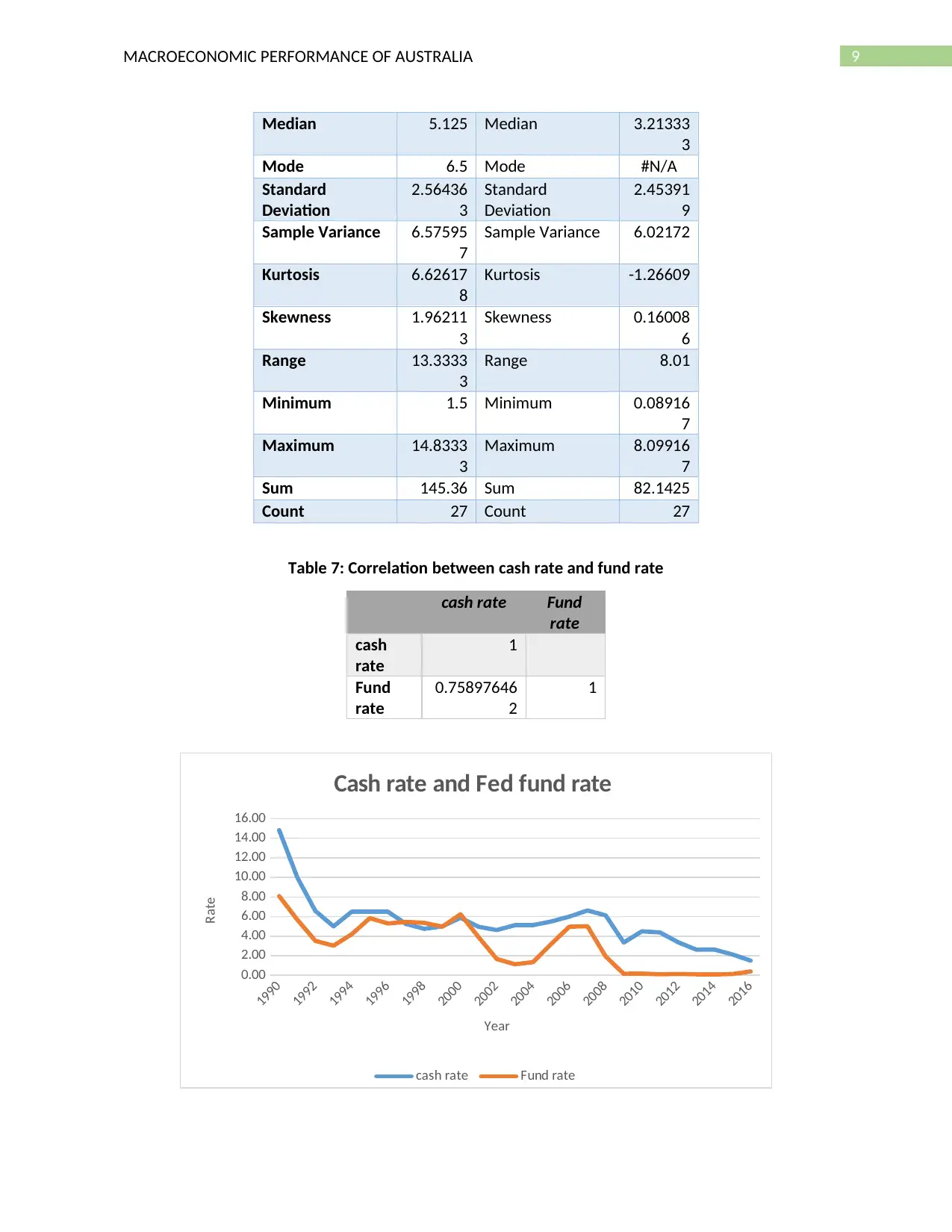

Figure 4: Net export VS exchange rate

Trend in nest export shows that net export increase till 2001. The exchange rate also constitutes an

increasing trend for this period reflecting currency depreciation. The maximum trade surplus is achieved

in 2001 with the highest exchange rate of 1.93. After that both net export and exchange rate has

dropped simultaneously. In 2012, only 0.97 AUD is needed for 1 unit of US dollar (Bernanke, Antonovics

and Frank, 2015). Consequently, the Australia in this year experienced the largest trade deficit. Thus,

there is a clear positive relation between net export and exchange rate. Though there can be a number

of other factors like global demand, economic condition of export and import partners but still

movement of exchange rate a significant determinant factor of net export.

Cash rate, fund rate and policy implication

Bank rate is the part of monetary policy of central bank of a nation. By varying bank rate, central

bank control interest rate and loanable fund supply in the money market. Bank rate is the designed

interest rate by central bank for loans given to commercial bank (ValadkhanI and Anwar, 2012). An

increase in bank rate increases borrowing cost of commercial banks which is transmitted to high interest

rate and hence a decline in investment and economic contraction. This is called tight monetary policy.

An expansionary monetary policy on the other hand does the reverse. The policy of monetary easing

includes a lower bank rate, followed by an increased supply of credit, higher investment and growth

(Hess and Van Wincoop, 2012). The overnight bank rate in Australia is called cash rate and is controlled

by RBA. The same in the United State is known as fund rate and is controlled by Federal Reserve.

Table 6: Summary Statistics of fund rate and cash rate

Summary Statistics

cash rate Fund rate

Mean 5.38370

4

Mean 3.04231

5

Standard Error 0.49351

2

Standard Error 0.47225

7

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

2012

2014

2016

-60000000000

-40000000000

-20000000000

0

20000000000

40000000000

60000000000

80000000000

0.00

0.50

1.00

1.50

2.00

2.50

Net export and Real exchange rate

Net Export Exchange rate

Year

Net Export

AUD/USD

Figure 4: Net export VS exchange rate

Trend in nest export shows that net export increase till 2001. The exchange rate also constitutes an

increasing trend for this period reflecting currency depreciation. The maximum trade surplus is achieved

in 2001 with the highest exchange rate of 1.93. After that both net export and exchange rate has

dropped simultaneously. In 2012, only 0.97 AUD is needed for 1 unit of US dollar (Bernanke, Antonovics

and Frank, 2015). Consequently, the Australia in this year experienced the largest trade deficit. Thus,

there is a clear positive relation between net export and exchange rate. Though there can be a number

of other factors like global demand, economic condition of export and import partners but still

movement of exchange rate a significant determinant factor of net export.

Cash rate, fund rate and policy implication

Bank rate is the part of monetary policy of central bank of a nation. By varying bank rate, central

bank control interest rate and loanable fund supply in the money market. Bank rate is the designed

interest rate by central bank for loans given to commercial bank (ValadkhanI and Anwar, 2012). An

increase in bank rate increases borrowing cost of commercial banks which is transmitted to high interest

rate and hence a decline in investment and economic contraction. This is called tight monetary policy.

An expansionary monetary policy on the other hand does the reverse. The policy of monetary easing

includes a lower bank rate, followed by an increased supply of credit, higher investment and growth

(Hess and Van Wincoop, 2012). The overnight bank rate in Australia is called cash rate and is controlled

by RBA. The same in the United State is known as fund rate and is controlled by Federal Reserve.

Table 6: Summary Statistics of fund rate and cash rate

Summary Statistics

cash rate Fund rate

Mean 5.38370

4

Mean 3.04231

5

Standard Error 0.49351

2

Standard Error 0.47225

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9MACROECONOMIC PERFORMANCE OF AUSTRALIA

Median 5.125 Median 3.21333

3

Mode 6.5 Mode #N/A

Standard

Deviation

2.56436

3

Standard

Deviation

2.45391

9

Sample Variance 6.57595

7

Sample Variance 6.02172

Kurtosis 6.62617

8

Kurtosis -1.26609

Skewness 1.96211

3

Skewness 0.16008

6

Range 13.3333

3

Range 8.01

Minimum 1.5 Minimum 0.08916

7

Maximum 14.8333

3

Maximum 8.09916

7

Sum 145.36 Sum 82.1425

Count 27 Count 27

Table 7: Correlation between cash rate and fund rate

cash rate Fund

rate

cash

rate

1

Fund

rate

0.75897646

2

1

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

2012

2014

2016

0.00

2.00

4.00

6.00

8.00

10.00

12.00

14.00

16.00

Cash rate and Fed fund rate

cash rate Fund rate

Year

Rate

Median 5.125 Median 3.21333

3

Mode 6.5 Mode #N/A

Standard

Deviation

2.56436

3

Standard

Deviation

2.45391

9

Sample Variance 6.57595

7

Sample Variance 6.02172

Kurtosis 6.62617

8

Kurtosis -1.26609

Skewness 1.96211

3

Skewness 0.16008

6

Range 13.3333

3

Range 8.01

Minimum 1.5 Minimum 0.08916

7

Maximum 14.8333

3

Maximum 8.09916

7

Sum 145.36 Sum 82.1425

Count 27 Count 27

Table 7: Correlation between cash rate and fund rate

cash rate Fund

rate

cash

rate

1

Fund

rate

0.75897646

2

1

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

2012

2014

2016

0.00

2.00

4.00

6.00

8.00

10.00

12.00

14.00

16.00

Cash rate and Fed fund rate

cash rate Fund rate

Year

Rate

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10MACROECONOMIC PERFORMANCE OF AUSTRALIA

Figure 5: Fund rate VS Cash rate

The periodic movement of cash rate and fund rate reflects that starting with a very high level they are

settled at a very low rate. Following a close economic interdependence, a change in fund rate can cause

a change in cash rate. In Fed decides to reduce rate, then it results in a weak currency for US. Weak US

dollar on the other hand indicates strong Australian dollar which might hurt Australia export. The RBA

then might make a downward revision in cash rate for devaluation of the currency. This indicates a

positive association between cash rate and fund rate. Fed reduced the fund rate almost to zero bound

after financial crisis in 2008 (Bhuiyan, 2014). The effect of financial crisis also disseminated to Australian

economy but with a lower intensity. RBA reduced the cash rate to 3% during this time. The movement of

fund rate thus not solely drive cash rate but some relation might be observed because of economic

interconnectedness.

Australian economic outlook

Long term trend of Australian economic growth revealed a gradual slowdown of economic

growth since 2013. The growth rate by beating expectation of the policymaker might have expected to

bring a recession for Australia. The gloomy outlook however offset by economic expansion realized

outside the traditional sector. The phase of decline in mining investment will be finished soon (The

Oxford Economics Forecast, 2016). This along with slow growth on mining export will contribute to pick

up GDP growth. The ongoing decline in the mining investment will be recovered with potential growth

opportunities in the sector. Increased LNG production has opened up a new door for export and growth.

Recent impetus to non-mining investment will expand further supporting the future growth prospect.

The weak consumption growth will be recovered following a growth in wage rate. The job opportunities

outside mining will expand consumption demand and economic growth (Robinson and Wang, 2018).

The fear of economic recession thus overcome by economic expansion in several dimension of the

economy.

Conclusion

In conclusion, it can be said that Australian economy has been recorded a stable performance

over a long period with a stable rate of economic growth, inflation and unemployment. The average

growth and inflation is stable as compare to global standard. The unemployment rate on the other hand

recorded a comparatively higher average unemployment rate. The economy realized a recessionary

pressure in 1997 and in 2009. The former is caused by Asian financial crisis while the latter followed

from global financial crisis. A devaluation of Australian dollar is associated with an increase in net export.

The policy of monetary easing is more dominating both for Australia showing interdependence in

economic policy framework of both the nation. The recent recovery of domestic economy along with

improvement in global activity indicates an awaited economic expansion in next few years.

Figure 5: Fund rate VS Cash rate

The periodic movement of cash rate and fund rate reflects that starting with a very high level they are

settled at a very low rate. Following a close economic interdependence, a change in fund rate can cause

a change in cash rate. In Fed decides to reduce rate, then it results in a weak currency for US. Weak US

dollar on the other hand indicates strong Australian dollar which might hurt Australia export. The RBA

then might make a downward revision in cash rate for devaluation of the currency. This indicates a

positive association between cash rate and fund rate. Fed reduced the fund rate almost to zero bound

after financial crisis in 2008 (Bhuiyan, 2014). The effect of financial crisis also disseminated to Australian

economy but with a lower intensity. RBA reduced the cash rate to 3% during this time. The movement of

fund rate thus not solely drive cash rate but some relation might be observed because of economic

interconnectedness.

Australian economic outlook

Long term trend of Australian economic growth revealed a gradual slowdown of economic

growth since 2013. The growth rate by beating expectation of the policymaker might have expected to

bring a recession for Australia. The gloomy outlook however offset by economic expansion realized

outside the traditional sector. The phase of decline in mining investment will be finished soon (The

Oxford Economics Forecast, 2016). This along with slow growth on mining export will contribute to pick

up GDP growth. The ongoing decline in the mining investment will be recovered with potential growth

opportunities in the sector. Increased LNG production has opened up a new door for export and growth.

Recent impetus to non-mining investment will expand further supporting the future growth prospect.

The weak consumption growth will be recovered following a growth in wage rate. The job opportunities

outside mining will expand consumption demand and economic growth (Robinson and Wang, 2018).

The fear of economic recession thus overcome by economic expansion in several dimension of the

economy.

Conclusion

In conclusion, it can be said that Australian economy has been recorded a stable performance

over a long period with a stable rate of economic growth, inflation and unemployment. The average

growth and inflation is stable as compare to global standard. The unemployment rate on the other hand

recorded a comparatively higher average unemployment rate. The economy realized a recessionary

pressure in 1997 and in 2009. The former is caused by Asian financial crisis while the latter followed

from global financial crisis. A devaluation of Australian dollar is associated with an increase in net export.

The policy of monetary easing is more dominating both for Australia showing interdependence in

economic policy framework of both the nation. The recent recovery of domestic economy along with

improvement in global activity indicates an awaited economic expansion in next few years.

11MACROECONOMIC PERFORMANCE OF AUSTRALIA

References list

Bernanke, B., Antonovics, K. and Frank, R., 2015. Principles of macroeconomics. McGraw-Hill Higher

Education.

Bhuiyan, R., 2014. The Effects of Monetary Policy Shocks in the USA: A Forecast-Augmented VAR

Approach. Australian Economic Papers, 53(3-4), pp.139-152.

Cioran, Z., 2014. Monetary Policy, Inflation and the Causal Relation between the Inflation Rate and Some

of the Macroeconomic Variables. Procedia Economics and Finance, 16, pp.391-401.

Economic Outlook, 2016. The Oxford Economics Forecast. 40(2), pp.2-2.

Ffrench-Davis, R., 2016. Neostructuralism and macroeconomics for development. Neostructuralism and

heterodox thinking in Latin America and the Caribbean in the early twenty-first century. Santiago: ECLAC,

2016. LC/G. 2633-P. p. 117-138.

Hess, G. and Van Wincoop, E., 2012. Intranational Macroeconomics. Cambridge: Cambridge University

Press.

International Trade by Commodity Statistics, 2015. Australia. 2015(1), pp.6-79.

Kastelle, T. and Liesch, P., 2013. The Importance of Trade in Economic Development. International

Studies of Management and Organization, 43(2), pp.6-29.

Mankiw, N.G., 2014. Principles of macroeconomics. Cengage Learning.

Robinson, T. and Wang, J., 2018. The Australian Economy in 2017-2018: The Importance of Stronger

Non-Mining Business Investment Growth. Australian Economic Review, 51(1), pp.5-20.

Robinson, T., Tsiaplias, S. and Nguyen, V., 2015. The Australian Economy in 2014-15: An Economy in

Transition. Australian Economic Review, 48(1), pp.1-14.

Sarva, S., 2013. Global Financial Crisis and Australian Economy. SSRN Electronic Journal,.

Stock, J.H. and Watson, M.W., 2016. Dynamic factor models, factor-augmented vector autoregressions,

and structural vector autoregressions in macroeconomics. In Handbook of macroeconomics (Vol. 2, pp.

415-525). Elsevier.

Tsouma, E., 2014. Dating business cycle turning points. OECD Journal: Journal of Business Cycle

Measurement and Analysis, 2014(1), pp.1-24.

ValadkhanI, A. and Anwar, S., 2012. Interest Rate Pass-Through and the Asymmetric Relationship

between the Cash Rate and the Mortgage Rate. Economic Record, 88(282), pp.341-350.

Williamson, S., 2014. Macroeconomics. Boston, Mass.: Pearson.

Sources of Data

Abs.gov.au. (2018). 6401.0 - Consumer Price Index, Australia, Mar 2018. [online] Available at:

<http://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/6401.0Mar%202018?OpenDocument>

[Accessed 25 May 2018].

References list

Bernanke, B., Antonovics, K. and Frank, R., 2015. Principles of macroeconomics. McGraw-Hill Higher

Education.

Bhuiyan, R., 2014. The Effects of Monetary Policy Shocks in the USA: A Forecast-Augmented VAR

Approach. Australian Economic Papers, 53(3-4), pp.139-152.

Cioran, Z., 2014. Monetary Policy, Inflation and the Causal Relation between the Inflation Rate and Some

of the Macroeconomic Variables. Procedia Economics and Finance, 16, pp.391-401.

Economic Outlook, 2016. The Oxford Economics Forecast. 40(2), pp.2-2.

Ffrench-Davis, R., 2016. Neostructuralism and macroeconomics for development. Neostructuralism and

heterodox thinking in Latin America and the Caribbean in the early twenty-first century. Santiago: ECLAC,

2016. LC/G. 2633-P. p. 117-138.

Hess, G. and Van Wincoop, E., 2012. Intranational Macroeconomics. Cambridge: Cambridge University

Press.

International Trade by Commodity Statistics, 2015. Australia. 2015(1), pp.6-79.

Kastelle, T. and Liesch, P., 2013. The Importance of Trade in Economic Development. International

Studies of Management and Organization, 43(2), pp.6-29.

Mankiw, N.G., 2014. Principles of macroeconomics. Cengage Learning.

Robinson, T. and Wang, J., 2018. The Australian Economy in 2017-2018: The Importance of Stronger

Non-Mining Business Investment Growth. Australian Economic Review, 51(1), pp.5-20.

Robinson, T., Tsiaplias, S. and Nguyen, V., 2015. The Australian Economy in 2014-15: An Economy in

Transition. Australian Economic Review, 48(1), pp.1-14.

Sarva, S., 2013. Global Financial Crisis and Australian Economy. SSRN Electronic Journal,.

Stock, J.H. and Watson, M.W., 2016. Dynamic factor models, factor-augmented vector autoregressions,

and structural vector autoregressions in macroeconomics. In Handbook of macroeconomics (Vol. 2, pp.

415-525). Elsevier.

Tsouma, E., 2014. Dating business cycle turning points. OECD Journal: Journal of Business Cycle

Measurement and Analysis, 2014(1), pp.1-24.

ValadkhanI, A. and Anwar, S., 2012. Interest Rate Pass-Through and the Asymmetric Relationship

between the Cash Rate and the Mortgage Rate. Economic Record, 88(282), pp.341-350.

Williamson, S., 2014. Macroeconomics. Boston, Mass.: Pearson.

Sources of Data

Abs.gov.au. (2018). 6401.0 - Consumer Price Index, Australia, Mar 2018. [online] Available at:

<http://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/6401.0Mar%202018?OpenDocument>

[Accessed 25 May 2018].

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.