Macroeconomics Report: Italy's Economic Performance Analysis 2005-2017

VerifiedAdded on 2023/03/17

|21

|4325

|89

Report

AI Summary

This report provides a detailed analysis of Italy's macroeconomic performance from 2005 to 2017, examining key economic indicators such as real GDP growth, public debt as a percentage of GDP, inflation rates, interest rates, current account balances, exchange rate trends, and unemployment rates. The analysis covers the impact of the 2007-2008 Global Financial Crisis on the Italian economy, assessing changes in these indicators over time. The report also evaluates the economic policies implemented by the Italian government during this period, offering insights into their effectiveness and the overall economic stability of the country. Furthermore, the report assesses the current economic performance indicators and provides a comprehensive understanding of Italy's economic landscape during the analyzed timeframe.

Running head: Macroeconomics

MACROECONOMICS

Name of the student

Course name

Course ID

MACROECONOMICS

Name of the student

Course name

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

Macroeconomics

Table of Contents

Introduction......................................................................................................................................2

Part A: Economic performance indicators (EPI).............................................................................3

Growth in Real Gross Domestic Product.........................................................................................3

b. Public debt as a percentage of GDP............................................................................................4

c. Rate of inflation...........................................................................................................................5

d. Interest rates.................................................................................................................................6

e. Current account surplus/deficit as a percent of GDP...................................................................7

f. Exchange rate trends....................................................................................................................8

g. Unemployment rates....................................................................................................................9

1. An evaluation of how the 2007-2008 Global Financial Crises (GFC) affected the country’s

economy.........................................................................................................................................10

2. Assessment of the economic policies that has been implemented by government...................11

3. Description and evaluates changes in key economic performance indicators...........................12

4. Assessment of economic performances indicator......................................................................16

Conclusion.....................................................................................................................................17

Macroeconomics

Table of Contents

Introduction......................................................................................................................................2

Part A: Economic performance indicators (EPI).............................................................................3

Growth in Real Gross Domestic Product.........................................................................................3

b. Public debt as a percentage of GDP............................................................................................4

c. Rate of inflation...........................................................................................................................5

d. Interest rates.................................................................................................................................6

e. Current account surplus/deficit as a percent of GDP...................................................................7

f. Exchange rate trends....................................................................................................................8

g. Unemployment rates....................................................................................................................9

1. An evaluation of how the 2007-2008 Global Financial Crises (GFC) affected the country’s

economy.........................................................................................................................................10

2. Assessment of the economic policies that has been implemented by government...................11

3. Description and evaluates changes in key economic performance indicators...........................12

4. Assessment of economic performances indicator......................................................................16

Conclusion.....................................................................................................................................17

2

Macroeconomics

Introduction

The study is going to identify the economic performances indicator of Italy for 12 years.

The economic performances indicators of Italy will include the factors like growth in real

domestic product, public debt as percentage of GDP, rate of inflation, rate of interest, current

account surplus or deficit as percentage of GDP, exchange rate trends and unemployment rate.

Through the analysis of the economic performances indicators of Italy, the overall scenario of

the country will be clear and decisions regarding investment can be easily made. Deep analysis

of this decision will automatically increase the overall efficiency of Italy regarding the

improvement in trade and commerce. The deep analysis will automatically increase the

development of various government regulations that will help Italy in doing the better trade and

commerce. Through the development of the economic analysis, the improvement in the policy is

also closely linked with growth in EPI.

Macroeconomics

Introduction

The study is going to identify the economic performances indicator of Italy for 12 years.

The economic performances indicators of Italy will include the factors like growth in real

domestic product, public debt as percentage of GDP, rate of inflation, rate of interest, current

account surplus or deficit as percentage of GDP, exchange rate trends and unemployment rate.

Through the analysis of the economic performances indicators of Italy, the overall scenario of

the country will be clear and decisions regarding investment can be easily made. Deep analysis

of this decision will automatically increase the overall efficiency of Italy regarding the

improvement in trade and commerce. The deep analysis will automatically increase the

development of various government regulations that will help Italy in doing the better trade and

commerce. Through the development of the economic analysis, the improvement in the policy is

also closely linked with growth in EPI.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

Macroeconomics

Part A: Economic performance indicators (EPI)

Economic performance indicators will be helpful for the development of fiscal and

monetary policies that will not only increase the development of economy but will also increase

the development of trade and commerce.

Growth in Real Gross Domestic Product

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

-6

-5

-4

-3

-2

-1

0

1

2

3

Real GDP of Italy

Values

Figure 1: Real GDP of Italy

(Source: Data.worldbank.org, 2019)

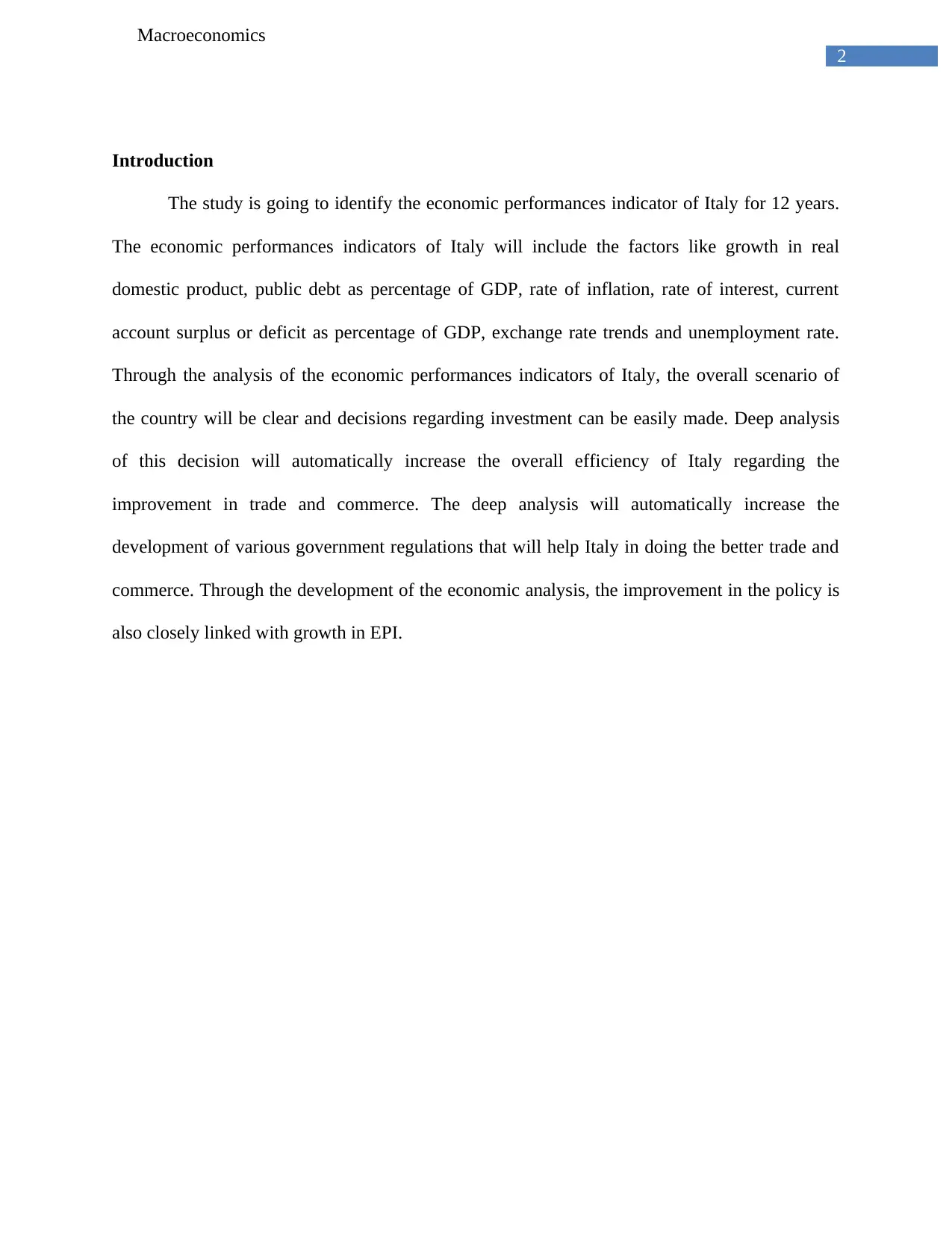

The above diagram is showing the fact that real GDP has shown an upward trend until

2007 and after that it started to fall deeply in 2009 and again started to increase. This may be the

reason due to the global financial crisis in 2008-2009. However, the improvement in the real

GDP will develop the growth of economy. Now the economy of Italy is growing in the sense that

in the European counterpart the Italian economy is having huge potentiality in the economic

Macroeconomics

Part A: Economic performance indicators (EPI)

Economic performance indicators will be helpful for the development of fiscal and

monetary policies that will not only increase the development of economy but will also increase

the development of trade and commerce.

Growth in Real Gross Domestic Product

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

-6

-5

-4

-3

-2

-1

0

1

2

3

Real GDP of Italy

Values

Figure 1: Real GDP of Italy

(Source: Data.worldbank.org, 2019)

The above diagram is showing the fact that real GDP has shown an upward trend until

2007 and after that it started to fall deeply in 2009 and again started to increase. This may be the

reason due to the global financial crisis in 2008-2009. However, the improvement in the real

GDP will develop the growth of economy. Now the economy of Italy is growing in the sense that

in the European counterpart the Italian economy is having huge potentiality in the economic

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

Macroeconomics

performances indicators. The performances of Euro are highly significant behind the stagnant

growth of the economy of Italy. Introduction of Euro has led to the lowering of real interest rates

that has a deep impact on the productivity of Italy. Many economists have also claimed that

presence of tight monetary policy within the economy is also responsible for the stagnating

growth of Italian economy (Papadia, 2019).

b. Public debt as a percentage of GDP

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

0

20

40

60

80

100

120

140

public debt as % of GDP in Italy

values

Figure 2: Public debt as percentage of GDP in Italy

(Source: Ceicdata.com, 2019)

Macroeconomics

performances indicators. The performances of Euro are highly significant behind the stagnant

growth of the economy of Italy. Introduction of Euro has led to the lowering of real interest rates

that has a deep impact on the productivity of Italy. Many economists have also claimed that

presence of tight monetary policy within the economy is also responsible for the stagnating

growth of Italian economy (Papadia, 2019).

b. Public debt as a percentage of GDP

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

0

20

40

60

80

100

120

140

public debt as % of GDP in Italy

values

Figure 2: Public debt as percentage of GDP in Italy

(Source: Ceicdata.com, 2019)

5

Macroeconomics

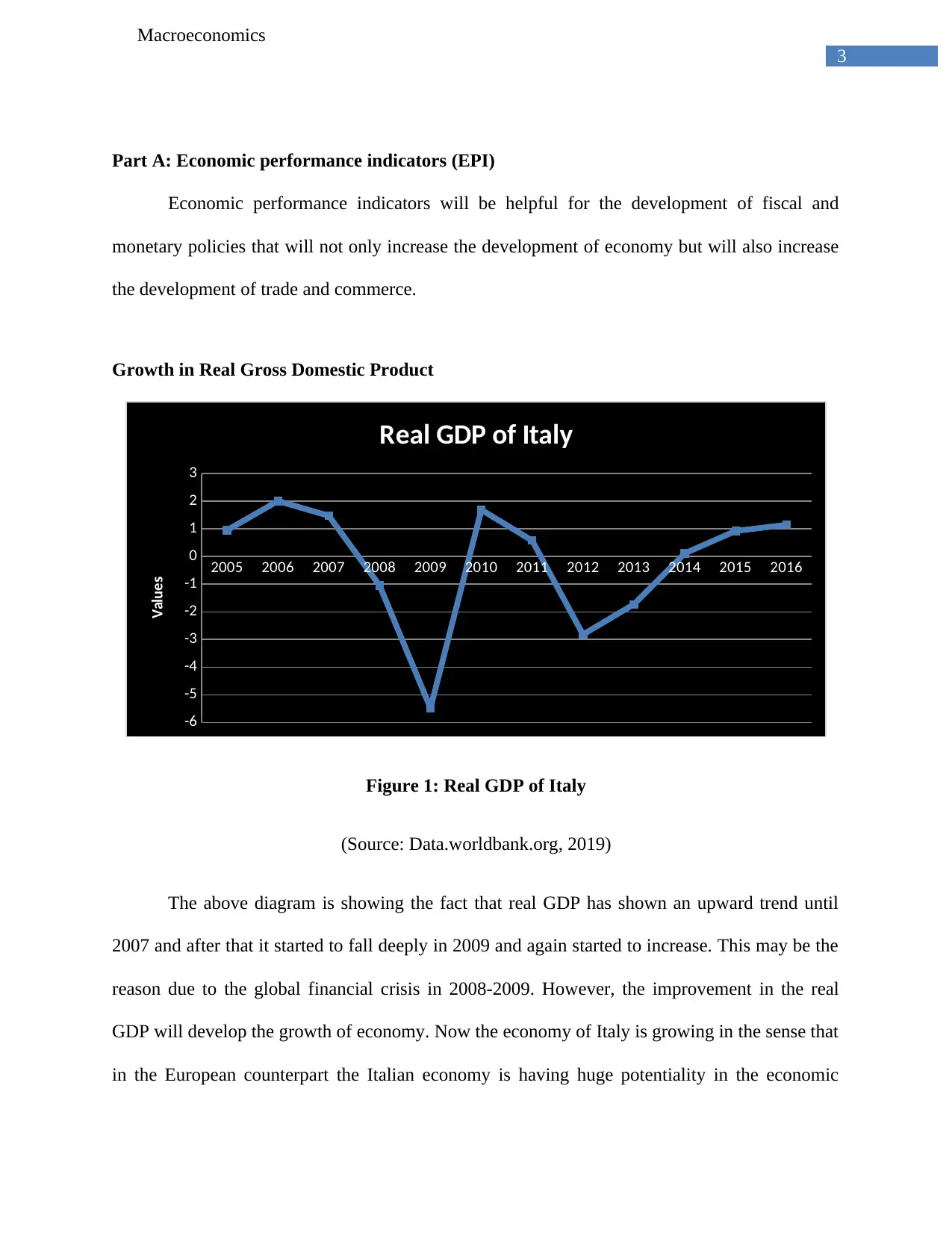

The High growth of public debt as percentage of GDP in Italy is increasing and this is not

at all good scenario for a developing nation like Italy. This is because, the government incurs the

public debt and increasing amount of public demand is actually going to incorporate pressure on

the development of the economy of Italy. Through the increase in the public debt, the economy

will not be able to increase production, as huge increased level of public debt will put pressure

on the current account balance of Italy. Due to increased amount of the public debt within the

economy, the government of Italy has faced huge deficit primarily in order to finance large

investments projects that were mainly designed for the welfare of state. On the other hand, long-

term bonds whose maturity has been over by 1 year mainly compose 75% of the government

debt. Some particular banks and insurance companies are holding almost 75% of the government

debts that are being hold by residents (Focus Economics, 2019). Even the performances of

domestic banks and financial institutions played a significant role during the Euro crisis.

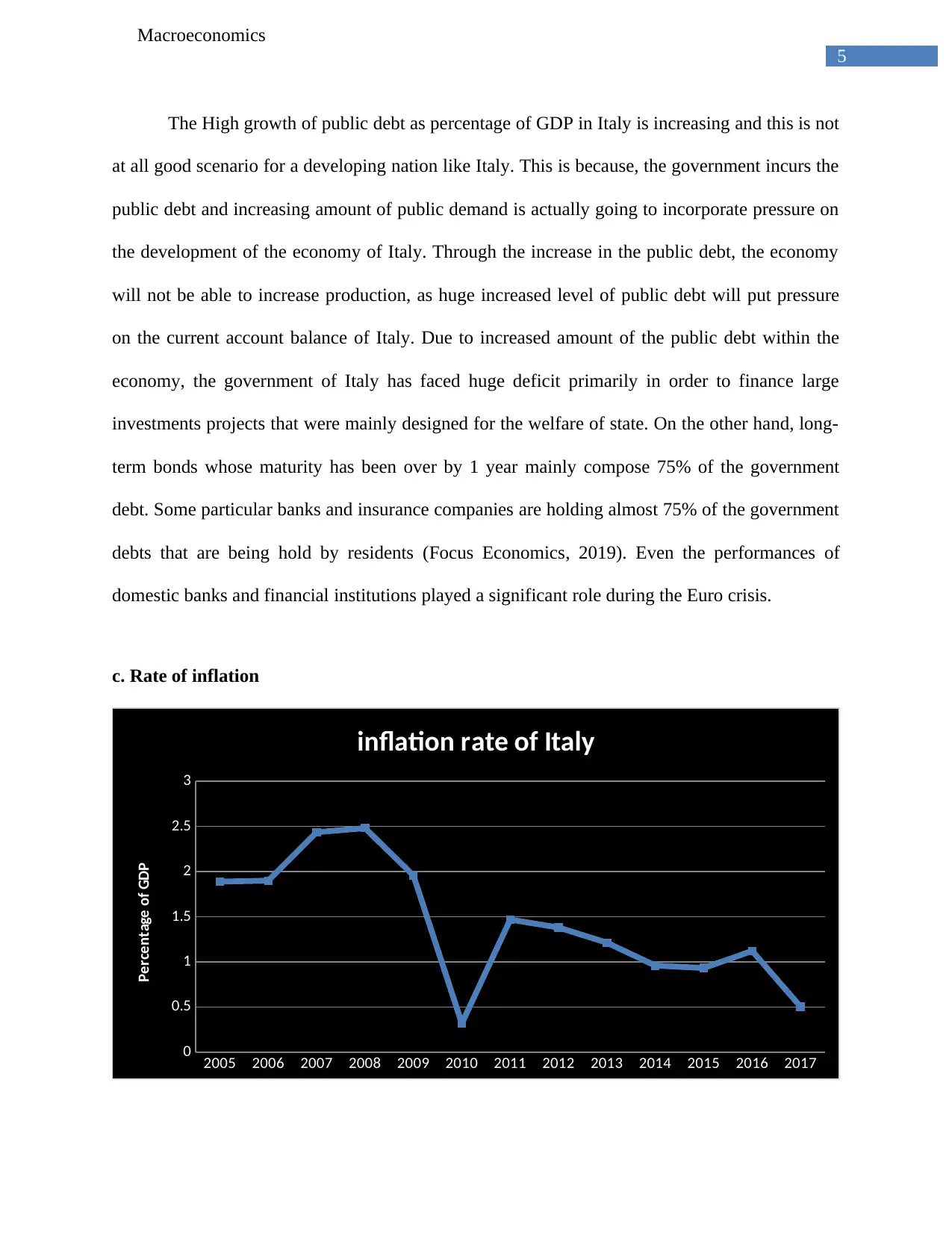

c. Rate of inflation

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

0.5

1

1.5

2

2.5

3

inflation rate of Italy

Percentage of GDP

Macroeconomics

The High growth of public debt as percentage of GDP in Italy is increasing and this is not

at all good scenario for a developing nation like Italy. This is because, the government incurs the

public debt and increasing amount of public demand is actually going to incorporate pressure on

the development of the economy of Italy. Through the increase in the public debt, the economy

will not be able to increase production, as huge increased level of public debt will put pressure

on the current account balance of Italy. Due to increased amount of the public debt within the

economy, the government of Italy has faced huge deficit primarily in order to finance large

investments projects that were mainly designed for the welfare of state. On the other hand, long-

term bonds whose maturity has been over by 1 year mainly compose 75% of the government

debt. Some particular banks and insurance companies are holding almost 75% of the government

debts that are being hold by residents (Focus Economics, 2019). Even the performances of

domestic banks and financial institutions played a significant role during the Euro crisis.

c. Rate of inflation

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

0.5

1

1.5

2

2.5

3

inflation rate of Italy

Percentage of GDP

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

Macroeconomics

Figure 3: Rate of Inflation in Italy

(Source: Data.worldbank.org, 2019)

The rate of inflation rate in Italy has witnessed deep fall in the year 2010 and before that

economy was having high rate of inflation growth to 2008 from 2006. After the great financial

crisis, the inflation rate is showing decreasing trend in growth of the inflation rate. The high rise

of the inflation rate is not a good sign for the economy, as the rate of high inflation will

obviously erode away the purchasing power of the money of the consumer. Previously Italy was

experiencing deflation within their economy and the economy had made a sharp rebound in the

inflation rate and started to increase their efficiency in the consumer price. The energy price

within the country witnessed a jump of about 5.7% in their basket price and about 3.3% rise in

the transport cost and witnessed a jump of 1.8% in the price of goods (Financial Times, 2019).

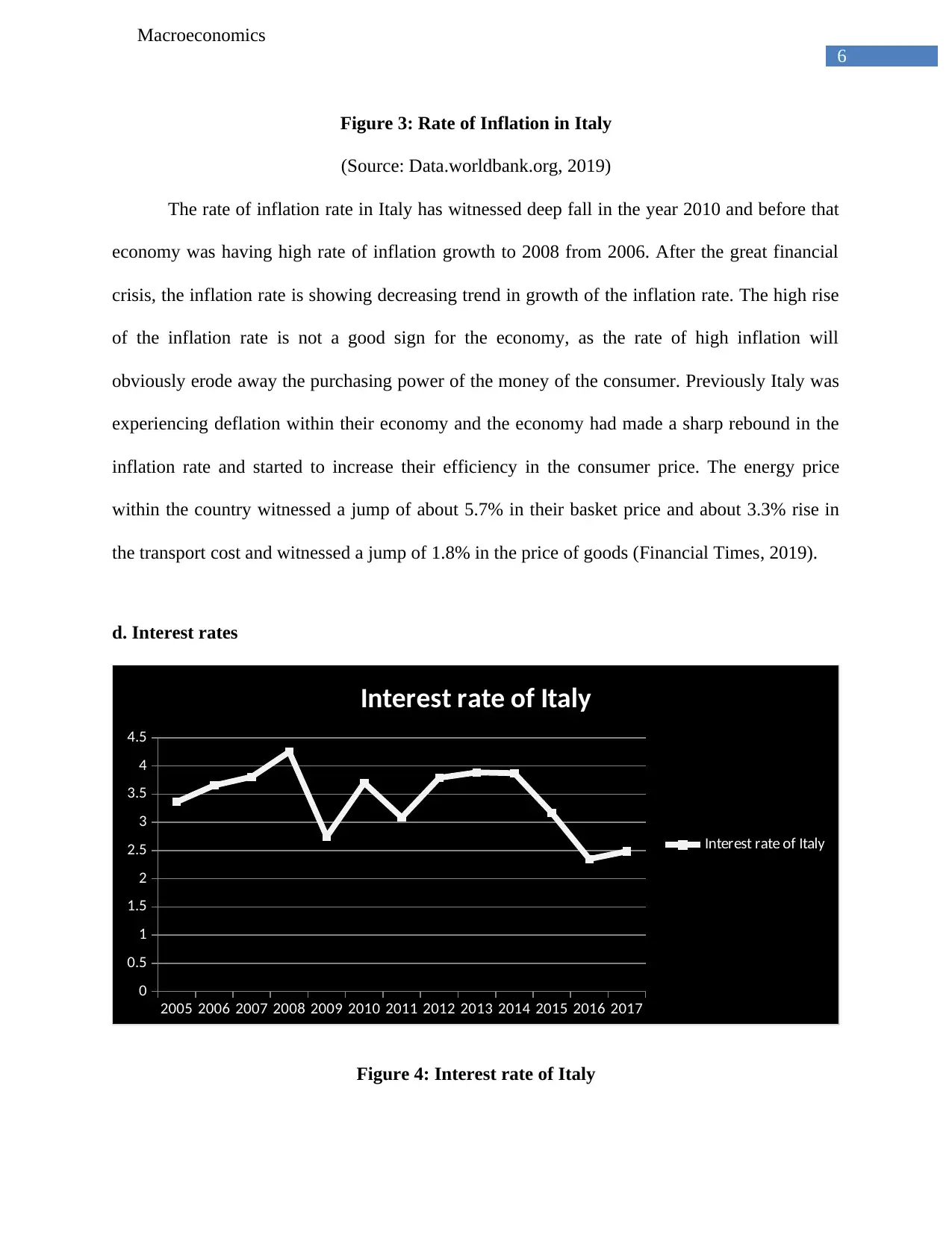

d. Interest rates

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

0.5

1

1.5

2

2.5

3

3.5

4

4.5

Interest rate of Italy

Interest rate of Italy

Figure 4: Interest rate of Italy

Macroeconomics

Figure 3: Rate of Inflation in Italy

(Source: Data.worldbank.org, 2019)

The rate of inflation rate in Italy has witnessed deep fall in the year 2010 and before that

economy was having high rate of inflation growth to 2008 from 2006. After the great financial

crisis, the inflation rate is showing decreasing trend in growth of the inflation rate. The high rise

of the inflation rate is not a good sign for the economy, as the rate of high inflation will

obviously erode away the purchasing power of the money of the consumer. Previously Italy was

experiencing deflation within their economy and the economy had made a sharp rebound in the

inflation rate and started to increase their efficiency in the consumer price. The energy price

within the country witnessed a jump of about 5.7% in their basket price and about 3.3% rise in

the transport cost and witnessed a jump of 1.8% in the price of goods (Financial Times, 2019).

d. Interest rates

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

0.5

1

1.5

2

2.5

3

3.5

4

4.5

Interest rate of Italy

Interest rate of Italy

Figure 4: Interest rate of Italy

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

Macroeconomics

(Source: Data.worldbank.org, 2019)

The rate of interest is also showing similar pattern of growth like inflation rate. The

growth in the interest rate is going to decrease the loan able ability of the economy. The interest

rate is rebounded by 6.6% in Italy is going to increase the ability of the loans within the economy

(Voxeu.org, 2019). The rate of interest is facing a stagnant growth from the year 2012-2015. The

development of the interest rate in Italy is important in the sense that with the increased rate of

interest rate the demand of the loans will decrease that will decrease the economic growth of the

development of Italy. This is important in the sense that through the development of the

economy Italy is going to increase the investment that will increase the situation in the

economy.

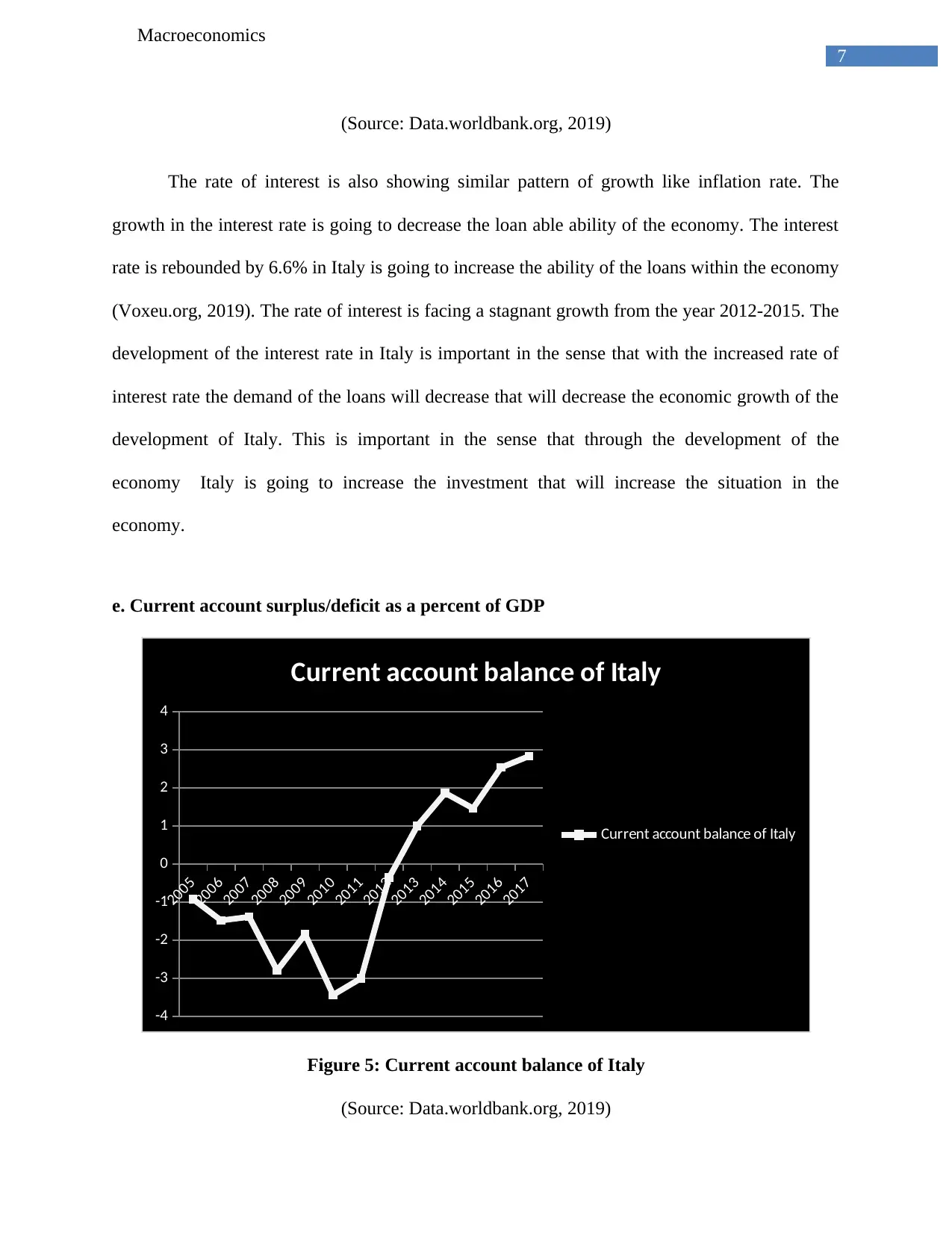

e. Current account surplus/deficit as a percent of GDP

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

-4

-3

-2

-1

0

1

2

3

4

Current account balance of Italy

Current account balance of Italy

Figure 5: Current account balance of Italy

(Source: Data.worldbank.org, 2019)

Macroeconomics

(Source: Data.worldbank.org, 2019)

The rate of interest is also showing similar pattern of growth like inflation rate. The

growth in the interest rate is going to decrease the loan able ability of the economy. The interest

rate is rebounded by 6.6% in Italy is going to increase the ability of the loans within the economy

(Voxeu.org, 2019). The rate of interest is facing a stagnant growth from the year 2012-2015. The

development of the interest rate in Italy is important in the sense that with the increased rate of

interest rate the demand of the loans will decrease that will decrease the economic growth of the

development of Italy. This is important in the sense that through the development of the

economy Italy is going to increase the investment that will increase the situation in the

economy.

e. Current account surplus/deficit as a percent of GDP

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

-4

-3

-2

-1

0

1

2

3

4

Current account balance of Italy

Current account balance of Italy

Figure 5: Current account balance of Italy

(Source: Data.worldbank.org, 2019)

8

Macroeconomics

The current account is showing huge rate of deficiency until the year 2012 and after that

the economy has been seen an upsurge in their current account balance. Economy of Italy has

witnessed 40% increase in the unit labour cost compared to Germany and it happened mainly

due to the tight monetary policy and strong incorporation of the labour unions. The divergence in

the economy has decreased steadily in manufacturing units and the service sectors are the main

reasons behind the high growth of economic variables and through the development of trade and

commerce, Italian economy witnessed surplus in the current account balance and the amount of

€47bn was the largest among the whole European unions. Seven years ago the Italian economy

witnessed current account deficit of €45-50bn and after that government spending increased by

huge margin (Financial Times, 2019). Through the development of the resource utilization,

economy is going to help in increasing the government spending.

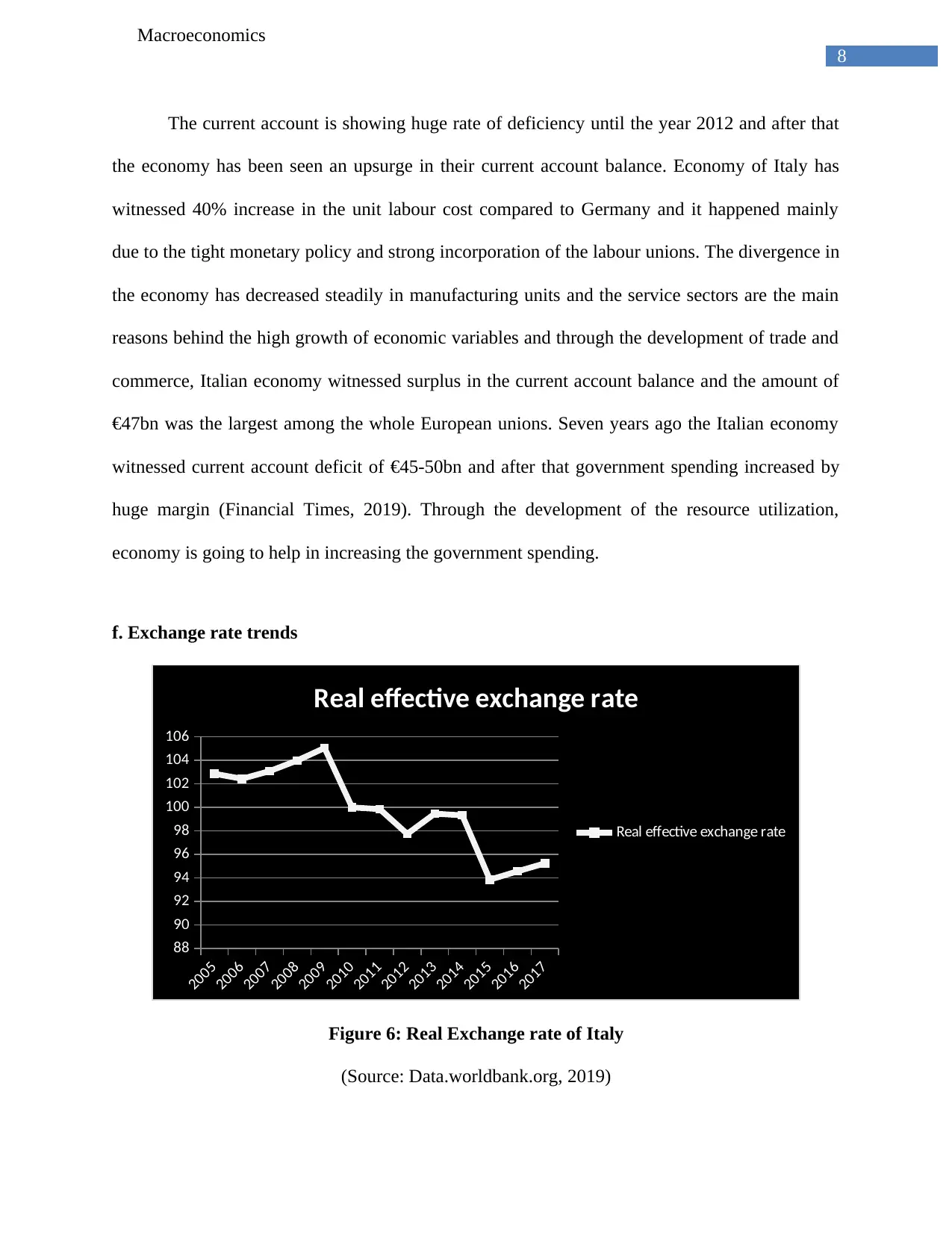

f. Exchange rate trends

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

88

90

92

94

96

98

100

102

104

106

Real effective exchange rate

Real effective exchange rate

Figure 6: Real Exchange rate of Italy

(Source: Data.worldbank.org, 2019)

Macroeconomics

The current account is showing huge rate of deficiency until the year 2012 and after that

the economy has been seen an upsurge in their current account balance. Economy of Italy has

witnessed 40% increase in the unit labour cost compared to Germany and it happened mainly

due to the tight monetary policy and strong incorporation of the labour unions. The divergence in

the economy has decreased steadily in manufacturing units and the service sectors are the main

reasons behind the high growth of economic variables and through the development of trade and

commerce, Italian economy witnessed surplus in the current account balance and the amount of

€47bn was the largest among the whole European unions. Seven years ago the Italian economy

witnessed current account deficit of €45-50bn and after that government spending increased by

huge margin (Financial Times, 2019). Through the development of the resource utilization,

economy is going to help in increasing the government spending.

f. Exchange rate trends

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

88

90

92

94

96

98

100

102

104

106

Real effective exchange rate

Real effective exchange rate

Figure 6: Real Exchange rate of Italy

(Source: Data.worldbank.org, 2019)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

Macroeconomics

The real exchange rate is not having that level of performances throughout the period of

2005-2017. The development of Libra and other currency is one of the important aspects in the

sense that the real exchange rate is going to increase the improvement of flow of the currency

and it will order the development of the economy will increase the resource utilization. On the

other hand, through the innovation in real exchange rate will determine the improvement in the

economy (Fuchs-Schündeln & Hassan, 2016).

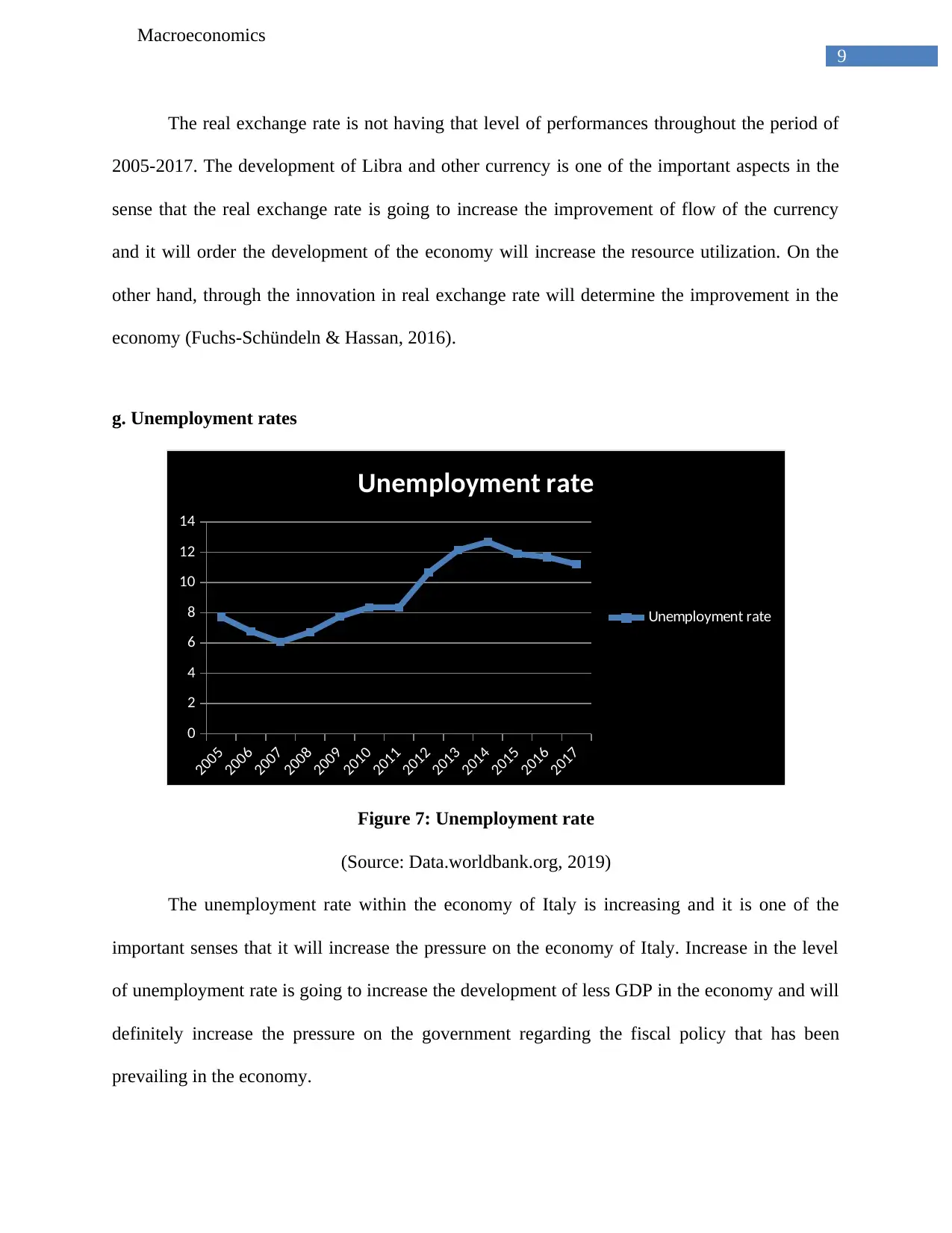

g. Unemployment rates

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

0

2

4

6

8

10

12

14

Unemployment rate

Unemployment rate

Figure 7: Unemployment rate

(Source: Data.worldbank.org, 2019)

The unemployment rate within the economy of Italy is increasing and it is one of the

important senses that it will increase the pressure on the economy of Italy. Increase in the level

of unemployment rate is going to increase the development of less GDP in the economy and will

definitely increase the pressure on the government regarding the fiscal policy that has been

prevailing in the economy.

Macroeconomics

The real exchange rate is not having that level of performances throughout the period of

2005-2017. The development of Libra and other currency is one of the important aspects in the

sense that the real exchange rate is going to increase the improvement of flow of the currency

and it will order the development of the economy will increase the resource utilization. On the

other hand, through the innovation in real exchange rate will determine the improvement in the

economy (Fuchs-Schündeln & Hassan, 2016).

g. Unemployment rates

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

0

2

4

6

8

10

12

14

Unemployment rate

Unemployment rate

Figure 7: Unemployment rate

(Source: Data.worldbank.org, 2019)

The unemployment rate within the economy of Italy is increasing and it is one of the

important senses that it will increase the pressure on the economy of Italy. Increase in the level

of unemployment rate is going to increase the development of less GDP in the economy and will

definitely increase the pressure on the government regarding the fiscal policy that has been

prevailing in the economy.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

Macroeconomics

Part B Report on Macroeconomic stability and policy

1. An evaluation of how the 2007-2008 Global Financial Crises (GFC) affected the

country’s economy

In 2008, before the collapse of Prod’s government led to the development of Berlusconi

and the Right regained power and they are aiming to increase the policies that have been taken

by the government and during that time, global economic crisis was just kicking in. The

government is aiming to increase the austerity and stability within the economy and the situation

that was prevailing within the economy was not suitable for coalition. Since 1990, the left

government supported the view of the reducing public debt and budget deficit so that they can

solve the problems that are related with the tax and tax evasion (Gla.ac.uk, 2019). The economic

crisis that was growing in 2008 has damaged the hope for the economic growth in the subsequent

years.

In the first decade of new millennium coalitions of both left and right government, was

not able to solve the problems that were popping up in the economy in the end. The economy of

Italy was making the growth of their economy stagnant in nature. Employment policies that had

been taken by the government mainly highlight the results that were in previous era. The

economy of Italy was witnessing low wage and restrictions in the rights of workers and it has

been seen mainly among young professionals (Gla.ac.uk, 2019). Long-term family investment

decreased in the economy and that made decision of building house slower and forced the

employees of the economy to refrain them from doing marriage and child bearing. Not only the

economy was having low quality of standard of living but the quality of education was also

degrading due to cut in tax and many unsuccessful reforms were mainly responsible for this.

Macroeconomics

Part B Report on Macroeconomic stability and policy

1. An evaluation of how the 2007-2008 Global Financial Crises (GFC) affected the

country’s economy

In 2008, before the collapse of Prod’s government led to the development of Berlusconi

and the Right regained power and they are aiming to increase the policies that have been taken

by the government and during that time, global economic crisis was just kicking in. The

government is aiming to increase the austerity and stability within the economy and the situation

that was prevailing within the economy was not suitable for coalition. Since 1990, the left

government supported the view of the reducing public debt and budget deficit so that they can

solve the problems that are related with the tax and tax evasion (Gla.ac.uk, 2019). The economic

crisis that was growing in 2008 has damaged the hope for the economic growth in the subsequent

years.

In the first decade of new millennium coalitions of both left and right government, was

not able to solve the problems that were popping up in the economy in the end. The economy of

Italy was making the growth of their economy stagnant in nature. Employment policies that had

been taken by the government mainly highlight the results that were in previous era. The

economy of Italy was witnessing low wage and restrictions in the rights of workers and it has

been seen mainly among young professionals (Gla.ac.uk, 2019). Long-term family investment

decreased in the economy and that made decision of building house slower and forced the

employees of the economy to refrain them from doing marriage and child bearing. Not only the

economy was having low quality of standard of living but the quality of education was also

degrading due to cut in tax and many unsuccessful reforms were mainly responsible for this.

11

Macroeconomics

During the period of 2008, Lehman Brother collapsed and it brought a contraction in the

interbank loan market. Most of the banks refused to give loans to each other due to lack of

liquidity and uncertainty in the financial conditions of borrowers. The Liquidity crisis forced the

government to support national banks with loans and on the other hand, European Central Banks

cut the discount rate (Gla.ac.uk, 2019). On the other hand, the banks also made a restriction in

the availability of credit to clients to regain the liquidity within the economy. Another factor that

popped up during this crisis is that in Italy there are many small and medium sized banks are

operating on regional scale and this is important in the sense that few of the large banks were out

of cash mainly due to collapse of Lehman Brother and their assets were devalued by the collapse

of stock market. The economy stopped offering full time payment for jobs during the period of

2008-2009. Decrease in the economic activities reduced the tax revenue and increased the anti-

crisis policies and expenditure.

2. Assessment of the economic policies that has been implemented by government

Tackling the economic crisis by taking effective policies will automatically increase the

development and different governments take different policies. However, in Italy, Berlusconi’s

government dealt with the economic crisis in two main ways. One of the ways was supporting

the large firms, business house, and the second way that has been taken by the government is

cutting public spending (Gla.ac.uk, 2019). Support of the government for the big firms will help

in the development of employment retention programe that will benefit the big firms to increase

their employment rates. Cutting public spending instead of increase in tax has been proven

successful in avoiding negative impact on the investment and consumers expenditure.

On the other hand, cuts in tax is not being able to be distributed among the different

social groups and the government mainly focused on the development of public sectors and

Macroeconomics

During the period of 2008, Lehman Brother collapsed and it brought a contraction in the

interbank loan market. Most of the banks refused to give loans to each other due to lack of

liquidity and uncertainty in the financial conditions of borrowers. The Liquidity crisis forced the

government to support national banks with loans and on the other hand, European Central Banks

cut the discount rate (Gla.ac.uk, 2019). On the other hand, the banks also made a restriction in

the availability of credit to clients to regain the liquidity within the economy. Another factor that

popped up during this crisis is that in Italy there are many small and medium sized banks are

operating on regional scale and this is important in the sense that few of the large banks were out

of cash mainly due to collapse of Lehman Brother and their assets were devalued by the collapse

of stock market. The economy stopped offering full time payment for jobs during the period of

2008-2009. Decrease in the economic activities reduced the tax revenue and increased the anti-

crisis policies and expenditure.

2. Assessment of the economic policies that has been implemented by government

Tackling the economic crisis by taking effective policies will automatically increase the

development and different governments take different policies. However, in Italy, Berlusconi’s

government dealt with the economic crisis in two main ways. One of the ways was supporting

the large firms, business house, and the second way that has been taken by the government is

cutting public spending (Gla.ac.uk, 2019). Support of the government for the big firms will help

in the development of employment retention programe that will benefit the big firms to increase

their employment rates. Cutting public spending instead of increase in tax has been proven

successful in avoiding negative impact on the investment and consumers expenditure.

On the other hand, cuts in tax is not being able to be distributed among the different

social groups and the government mainly focused on the development of public sectors and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.