Econ 212 Homework: Macroeconomic Analysis of GDP, Labor Market

VerifiedAdded on 2023/06/13

|16

|2256

|98

Homework Assignment

AI Summary

This assignment provides detailed solutions to various macroeconomics questions, covering topics such as GDP calculation, inflation rate analysis, labor market indicators, and fiscal policy implications. It includes calculations for nominal and real GDP growth, unemployment rate, labor force participation rate, and the impact of government surplus or deficit on loanable funds. The assignment also delves into exchange rate determination, aggregate demand and supply analysis, and the use of fiscal policy to address output gaps. Furthermore, it explores monetary policy tools, such as open market operations and overnight interest rates, to influence economic equilibrium. The document includes graphical representations to illustrate key concepts and provides numerical examples to demonstrate the application of macroeconomic principles. Desklib offers a platform where students can find similar solved assignments and study resources to enhance their understanding of economics.

Running head: MACROECONOMICS

Macroeconomics

Name of the Student:

Name of the University:

Author’s Note:

Macroeconomics

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MACROECONOMICS 1

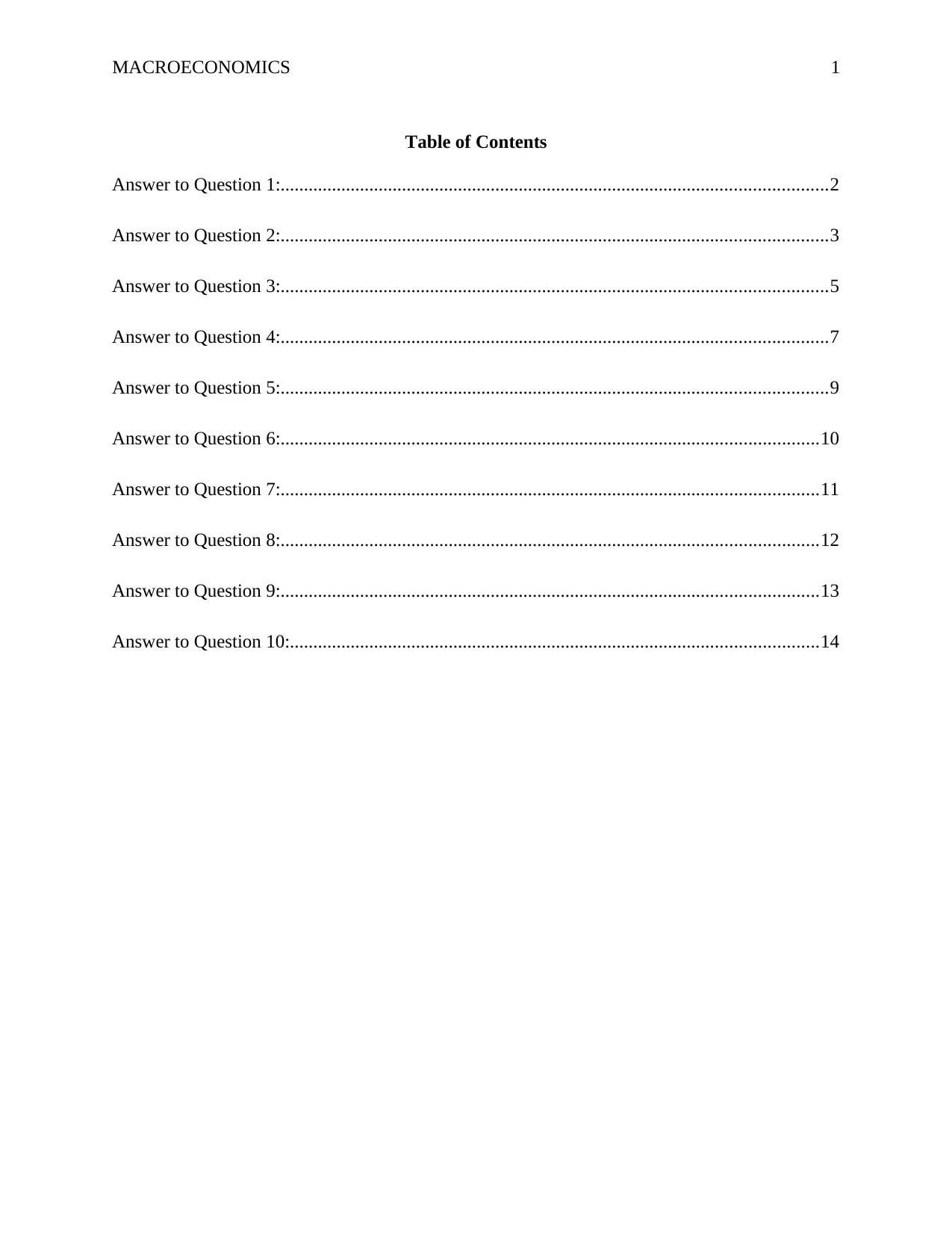

Table of Contents

Answer to Question 1:.....................................................................................................................2

Answer to Question 2:.....................................................................................................................3

Answer to Question 3:.....................................................................................................................5

Answer to Question 4:.....................................................................................................................7

Answer to Question 5:.....................................................................................................................9

Answer to Question 6:...................................................................................................................10

Answer to Question 7:...................................................................................................................11

Answer to Question 8:...................................................................................................................12

Answer to Question 9:...................................................................................................................13

Answer to Question 10:.................................................................................................................14

Table of Contents

Answer to Question 1:.....................................................................................................................2

Answer to Question 2:.....................................................................................................................3

Answer to Question 3:.....................................................................................................................5

Answer to Question 4:.....................................................................................................................7

Answer to Question 5:.....................................................................................................................9

Answer to Question 6:...................................................................................................................10

Answer to Question 7:...................................................................................................................11

Answer to Question 8:...................................................................................................................12

Answer to Question 9:...................................................................................................................13

Answer to Question 10:.................................................................................................................14

MACROECONOMICS 2

Answer to Question 1:

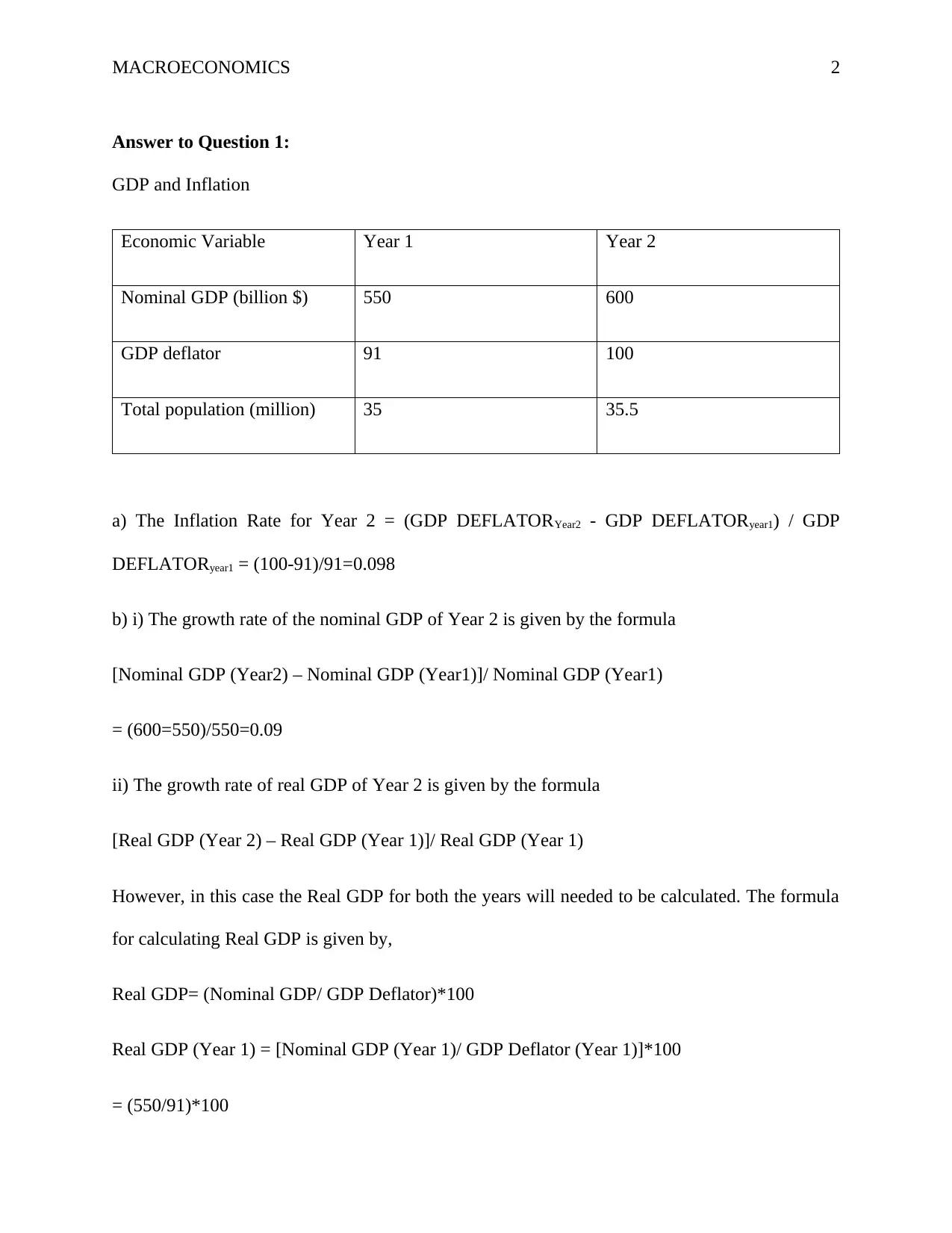

GDP and Inflation

Economic Variable Year 1 Year 2

Nominal GDP (billion $) 550 600

GDP deflator 91 100

Total population (million) 35 35.5

a) The Inflation Rate for Year 2 = (GDP DEFLATORYear2 - GDP DEFLATORyear1) / GDP

DEFLATORyear1 = (100-91)/91=0.098

b) i) The growth rate of the nominal GDP of Year 2 is given by the formula

[Nominal GDP (Year2) – Nominal GDP (Year1)]/ Nominal GDP (Year1)

= (600=550)/550=0.09

ii) The growth rate of real GDP of Year 2 is given by the formula

[Real GDP (Year 2) – Real GDP (Year 1)]/ Real GDP (Year 1)

However, in this case the Real GDP for both the years will needed to be calculated. The formula

for calculating Real GDP is given by,

Real GDP= (Nominal GDP/ GDP Deflator)*100

Real GDP (Year 1) = [Nominal GDP (Year 1)/ GDP Deflator (Year 1)]*100

= (550/91)*100

Answer to Question 1:

GDP and Inflation

Economic Variable Year 1 Year 2

Nominal GDP (billion $) 550 600

GDP deflator 91 100

Total population (million) 35 35.5

a) The Inflation Rate for Year 2 = (GDP DEFLATORYear2 - GDP DEFLATORyear1) / GDP

DEFLATORyear1 = (100-91)/91=0.098

b) i) The growth rate of the nominal GDP of Year 2 is given by the formula

[Nominal GDP (Year2) – Nominal GDP (Year1)]/ Nominal GDP (Year1)

= (600=550)/550=0.09

ii) The growth rate of real GDP of Year 2 is given by the formula

[Real GDP (Year 2) – Real GDP (Year 1)]/ Real GDP (Year 1)

However, in this case the Real GDP for both the years will needed to be calculated. The formula

for calculating Real GDP is given by,

Real GDP= (Nominal GDP/ GDP Deflator)*100

Real GDP (Year 1) = [Nominal GDP (Year 1)/ GDP Deflator (Year 1)]*100

= (550/91)*100

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MACROECONOMICS 3

= 604

Real GDP (Year 2) = [Nominal GDP (Year 2)/ GDP Deflator (Year 2)]*100

= (600/100)*100

=600

The Growth Rate of real GDP = (600-604)/604

= - 0.0066

iii) The real GDP per capita can be obtained by the formula

Real GDP per Capita (Year 1) = Real GDP (Year 1) / Population (Year 1)

= 604/35= 17.25

Real GDP per Capita (Year 2) = Real GDP (Year 2) / Population (Year 2)

=600/35.5= 16.9

Growth rate of Real GDP per Capita =

[Real GDP per Capita (Year 2) - Real GDP per Capita (Year 1)]/ Real GDP per Capita (Year 1)

= (16.9-17.25)/17.25

= - 0.02

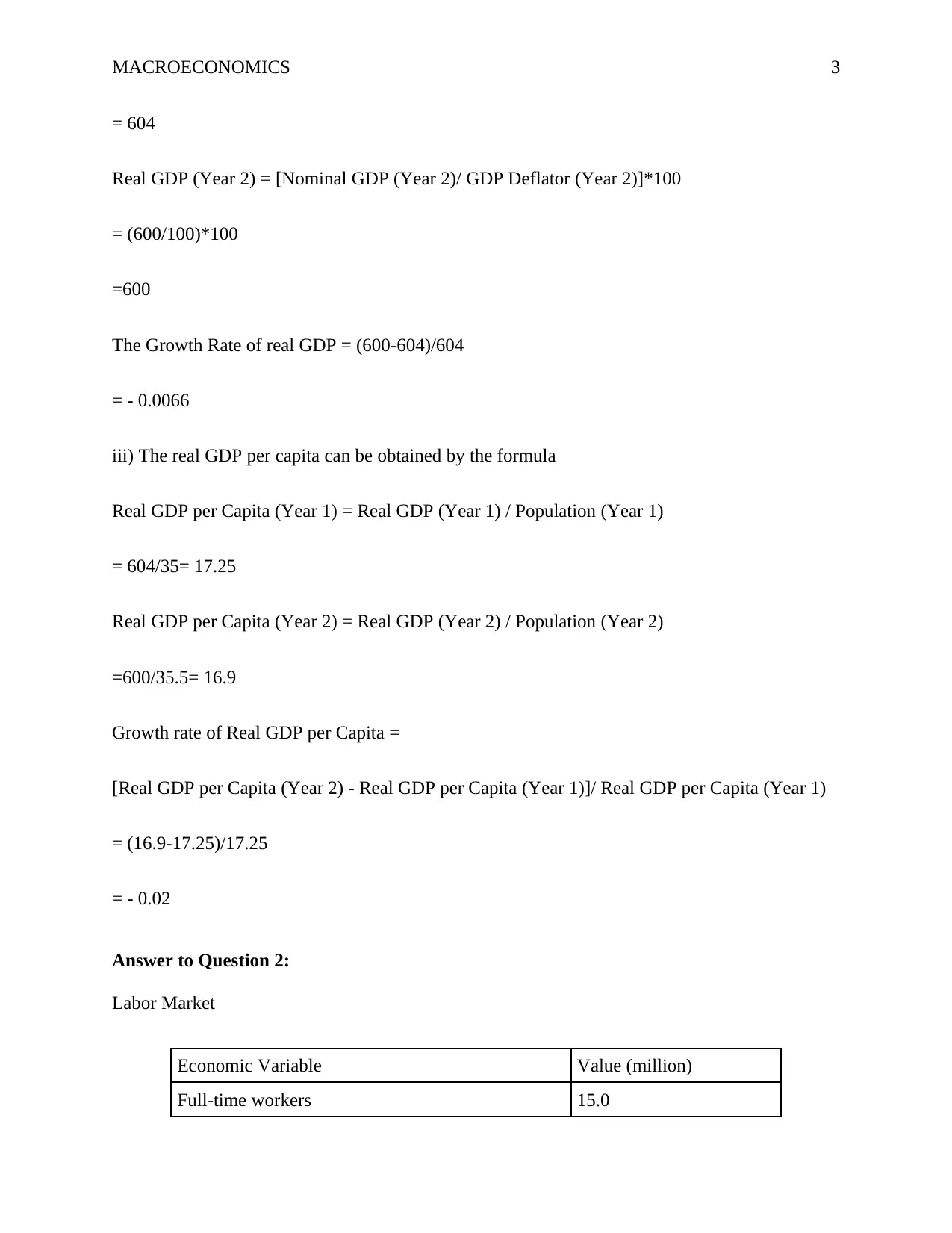

Answer to Question 2:

Labor Market

Economic Variable Value (million)

Full-time workers 15.0

= 604

Real GDP (Year 2) = [Nominal GDP (Year 2)/ GDP Deflator (Year 2)]*100

= (600/100)*100

=600

The Growth Rate of real GDP = (600-604)/604

= - 0.0066

iii) The real GDP per capita can be obtained by the formula

Real GDP per Capita (Year 1) = Real GDP (Year 1) / Population (Year 1)

= 604/35= 17.25

Real GDP per Capita (Year 2) = Real GDP (Year 2) / Population (Year 2)

=600/35.5= 16.9

Growth rate of Real GDP per Capita =

[Real GDP per Capita (Year 2) - Real GDP per Capita (Year 1)]/ Real GDP per Capita (Year 1)

= (16.9-17.25)/17.25

= - 0.02

Answer to Question 2:

Labor Market

Economic Variable Value (million)

Full-time workers 15.0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MACROECONOMICS 4

Part-time workers 5.0

Involuntary part-time workers 1.0

Unemployed 2.5

Discouraged workers 1.0

Working-age population 30.5

Total population 35.5

a. Unemployment Rate = (Unemployed/ Labor Force)

In the given scenario, Labor Force =Full-time workers + Part-time workers + Involuntary part-

time workers + Unemployed

=15.0 + 5.0 + 1.0 + 2.5

= 19.5

Hence Unemployment Rate = (2.5/19.5)= 0.12

Labor force participation rate = (Labor Force/ Total Working-age Population)*100

= (19.5/30.5)*100= 63.9

Involuntary part-time rate= (Number of involuntary part-time workers/ Labor force)*100

= (1.0/19.5)*100=5.12

Employment-to-population ratio= (Employed / Civilian Population)*100 = (21/35.5)*100=

59.1%

An economy is said to be in full employment level when there is no involuntary unemployment.

In the given scenario the economy has involuntary part time worker which means there are

Part-time workers 5.0

Involuntary part-time workers 1.0

Unemployed 2.5

Discouraged workers 1.0

Working-age population 30.5

Total population 35.5

a. Unemployment Rate = (Unemployed/ Labor Force)

In the given scenario, Labor Force =Full-time workers + Part-time workers + Involuntary part-

time workers + Unemployed

=15.0 + 5.0 + 1.0 + 2.5

= 19.5

Hence Unemployment Rate = (2.5/19.5)= 0.12

Labor force participation rate = (Labor Force/ Total Working-age Population)*100

= (19.5/30.5)*100= 63.9

Involuntary part-time rate= (Number of involuntary part-time workers/ Labor force)*100

= (1.0/19.5)*100=5.12

Employment-to-population ratio= (Employed / Civilian Population)*100 = (21/35.5)*100=

59.1%

An economy is said to be in full employment level when there is no involuntary unemployment.

In the given scenario the economy has involuntary part time worker which means there are

MACROECONOMICS 5

people who are willing to work full time at the existing wage rate but are working part time. This

means that the economy is not at full employment level.

b. If the discouraged workers are considered the New Unemployment Rate = (2.5/20.5)= 0.12

The labor force participation rate= (20.5/30.5)*100= 67%

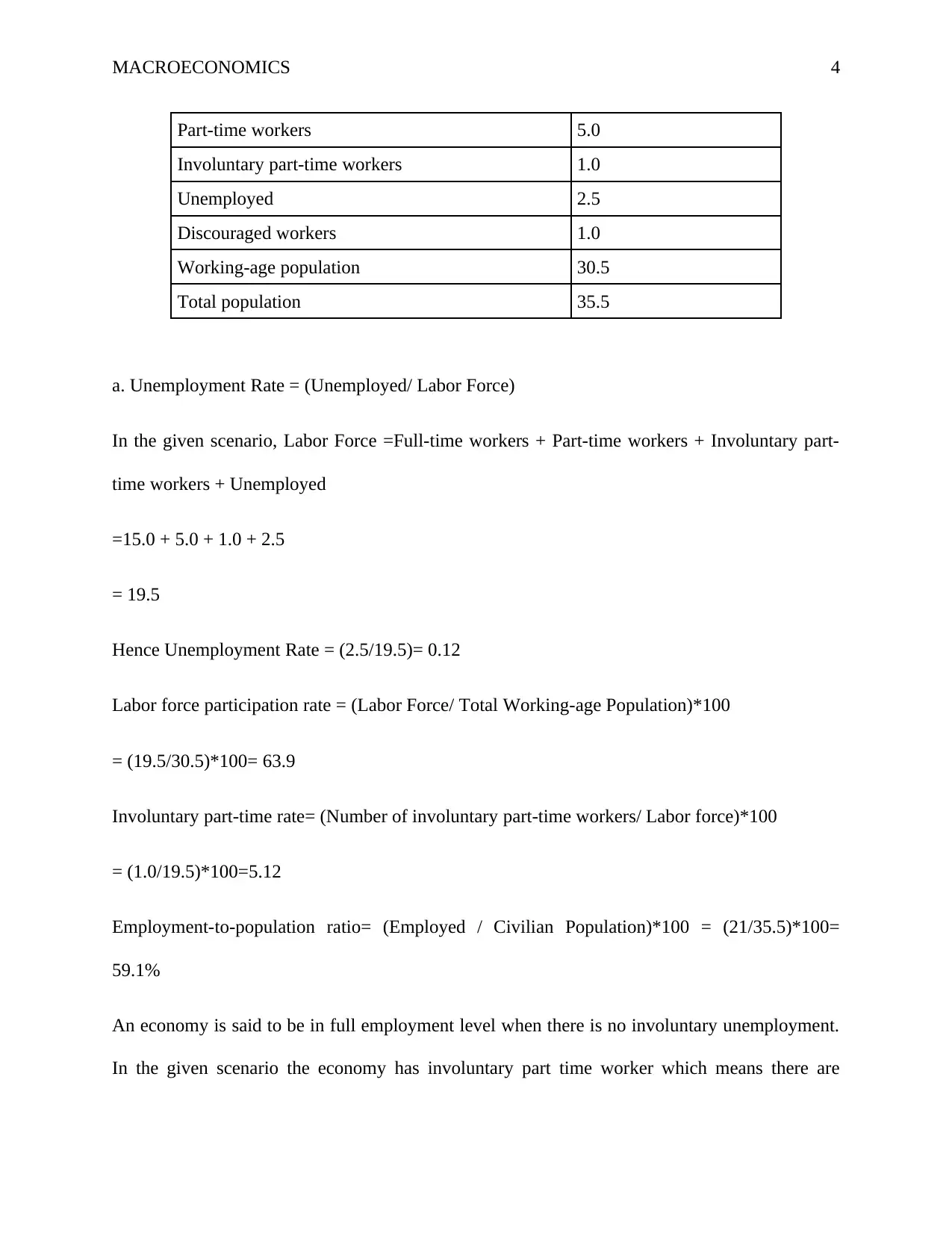

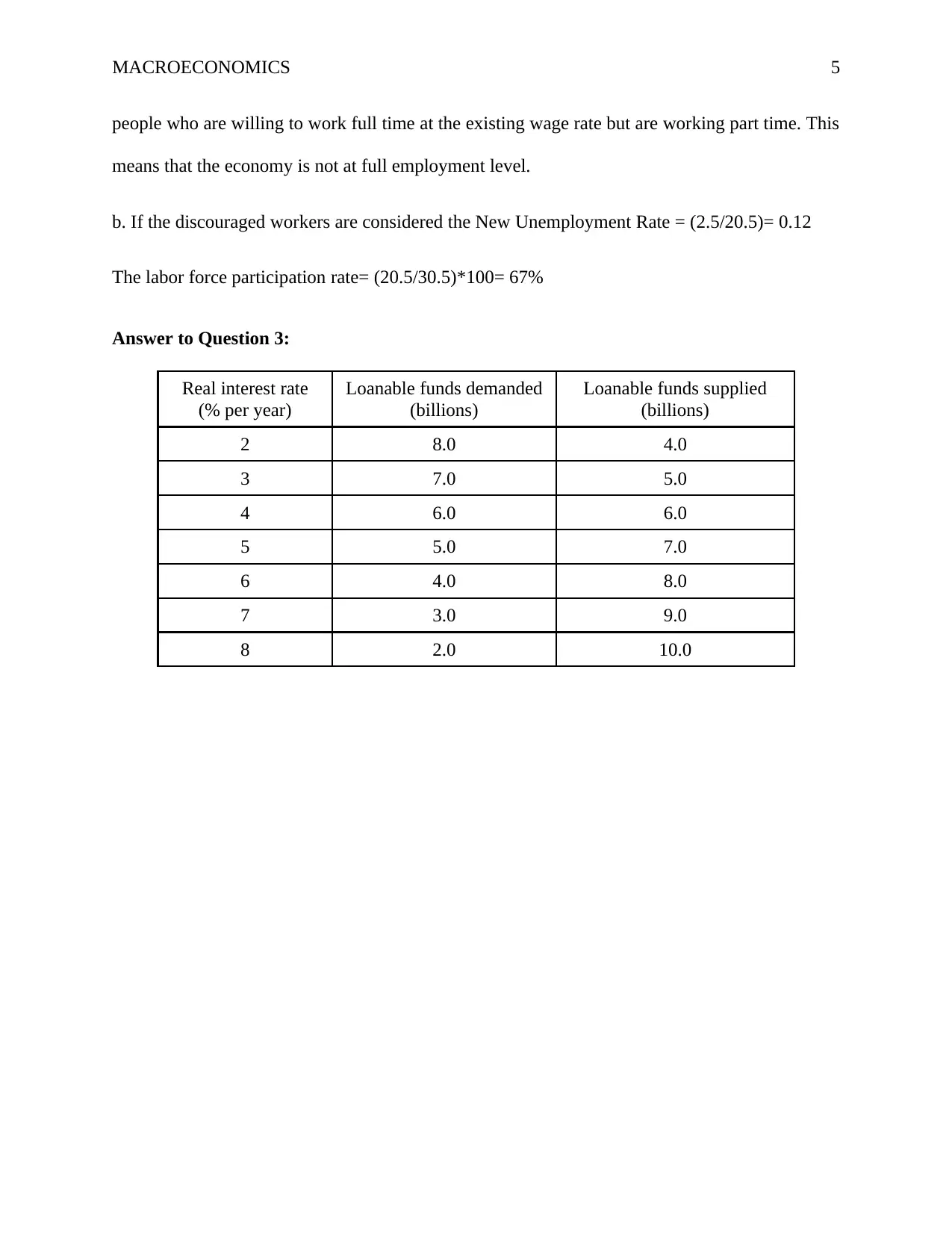

Answer to Question 3:

Real interest rate

(% per year)

Loanable funds demanded

(billions)

Loanable funds supplied

(billions)

2 8.0 4.0

3 7.0 5.0

4 6.0 6.0

5 5.0 7.0

6 4.0 8.0

7 3.0 9.0

8 2.0 10.0

people who are willing to work full time at the existing wage rate but are working part time. This

means that the economy is not at full employment level.

b. If the discouraged workers are considered the New Unemployment Rate = (2.5/20.5)= 0.12

The labor force participation rate= (20.5/30.5)*100= 67%

Answer to Question 3:

Real interest rate

(% per year)

Loanable funds demanded

(billions)

Loanable funds supplied

(billions)

2 8.0 4.0

3 7.0 5.0

4 6.0 6.0

5 5.0 7.0

6 4.0 8.0

7 3.0 9.0

8 2.0 10.0

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Demand

Supply

r=4

Q Quantity

Real

interest

rate

MACROECONOMICS 6

Figure 1: Demand Supply framework of Loanable Funds

(Source: Created by Author)

At equilibrium point that is at the point of intersection between the demand and supply curve for

loanable funds the real interest rate will be determined. In the given scenario the rate of interest

will be 6. At equilibrium if it is assumed that the entire loanable funds are used for investment

then the level of investment is 6.

On an added notion, demand for loanable fund=I

On the other hand, private savings=r

It is known that demand for loanable funds=private savings

Private savings is also 6.

Supply

r=4

Q Quantity

Real

interest

rate

MACROECONOMICS 6

Figure 1: Demand Supply framework of Loanable Funds

(Source: Created by Author)

At equilibrium point that is at the point of intersection between the demand and supply curve for

loanable funds the real interest rate will be determined. In the given scenario the rate of interest

will be 6. At equilibrium if it is assumed that the entire loanable funds are used for investment

then the level of investment is 6.

On an added notion, demand for loanable fund=I

On the other hand, private savings=r

It is known that demand for loanable funds=private savings

Private savings is also 6.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MACROECONOMICS 7

b) When there is a government surplus it will increase the supply of loanable funds and thereby

reduce the level of savings and increases the level of investment. This also reduces the rate of

interest.

c) A deficit on the part of the government will reduce the level of national savings as a result of

which the supply of loanable funds shifts to the left and thereby increases the rate of interest and

decreases the level of investment.

Answer to Question 4:

a)

Assets Amount (in $) Liabilities Amount (in $)

Reserves 2,000 Deposits 2,000

In this case, the bank reserves would increase by $2,000. As an amount of $2,000 is

deposited in the bank, the liabilities of the bank would rise by $2,000 as well.

b)

There is absence of additional reserves in BMO Bank and the reserve ratio is provided as

20%. This implies that with the rise in checking amount by $2,000, the bank needs to keep 20%

of the amount as reserves and the rest could be lent.

Particulars Units

Deposited amount $ 2,000

Reserve ratio 20%

Maximum amount to be $ 1,600

b) When there is a government surplus it will increase the supply of loanable funds and thereby

reduce the level of savings and increases the level of investment. This also reduces the rate of

interest.

c) A deficit on the part of the government will reduce the level of national savings as a result of

which the supply of loanable funds shifts to the left and thereby increases the rate of interest and

decreases the level of investment.

Answer to Question 4:

a)

Assets Amount (in $) Liabilities Amount (in $)

Reserves 2,000 Deposits 2,000

In this case, the bank reserves would increase by $2,000. As an amount of $2,000 is

deposited in the bank, the liabilities of the bank would rise by $2,000 as well.

b)

There is absence of additional reserves in BMO Bank and the reserve ratio is provided as

20%. This implies that with the rise in checking amount by $2,000, the bank needs to keep 20%

of the amount as reserves and the rest could be lent.

Particulars Units

Deposited amount $ 2,000

Reserve ratio 20%

Maximum amount to be $ 1,600

MACROECONOMICS 8

lent

Assets Amount (in $) Liabilities Amount (in $)

Reserves 2,000 Deposits 2,000

Loans 1,600 Deposits 1,600

c)

BMO

Assets Amount (in $) Liabilities Amount (in $)

Reserves 2,000 Deposits 2,000

Loans 1,600

CIBC Bank

Assets Amount (in $) Liabilities Amount (in $)

Reserves 1,600 Deposits 1,600

d)

Particulars Units

Bank reserves $ 2,000

Reserve ratio 20%

Checking deposits $ 10,000

Increase in money supply $ 8,000

lent

Assets Amount (in $) Liabilities Amount (in $)

Reserves 2,000 Deposits 2,000

Loans 1,600 Deposits 1,600

c)

BMO

Assets Amount (in $) Liabilities Amount (in $)

Reserves 2,000 Deposits 2,000

Loans 1,600

CIBC Bank

Assets Amount (in $) Liabilities Amount (in $)

Reserves 1,600 Deposits 1,600

d)

Particulars Units

Bank reserves $ 2,000

Reserve ratio 20%

Checking deposits $ 10,000

Increase in money supply $ 8,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

D1

Exchange Rate

EX1

Q1QO Quantity

EX

E1

E

D

MACROECONOMICS 9

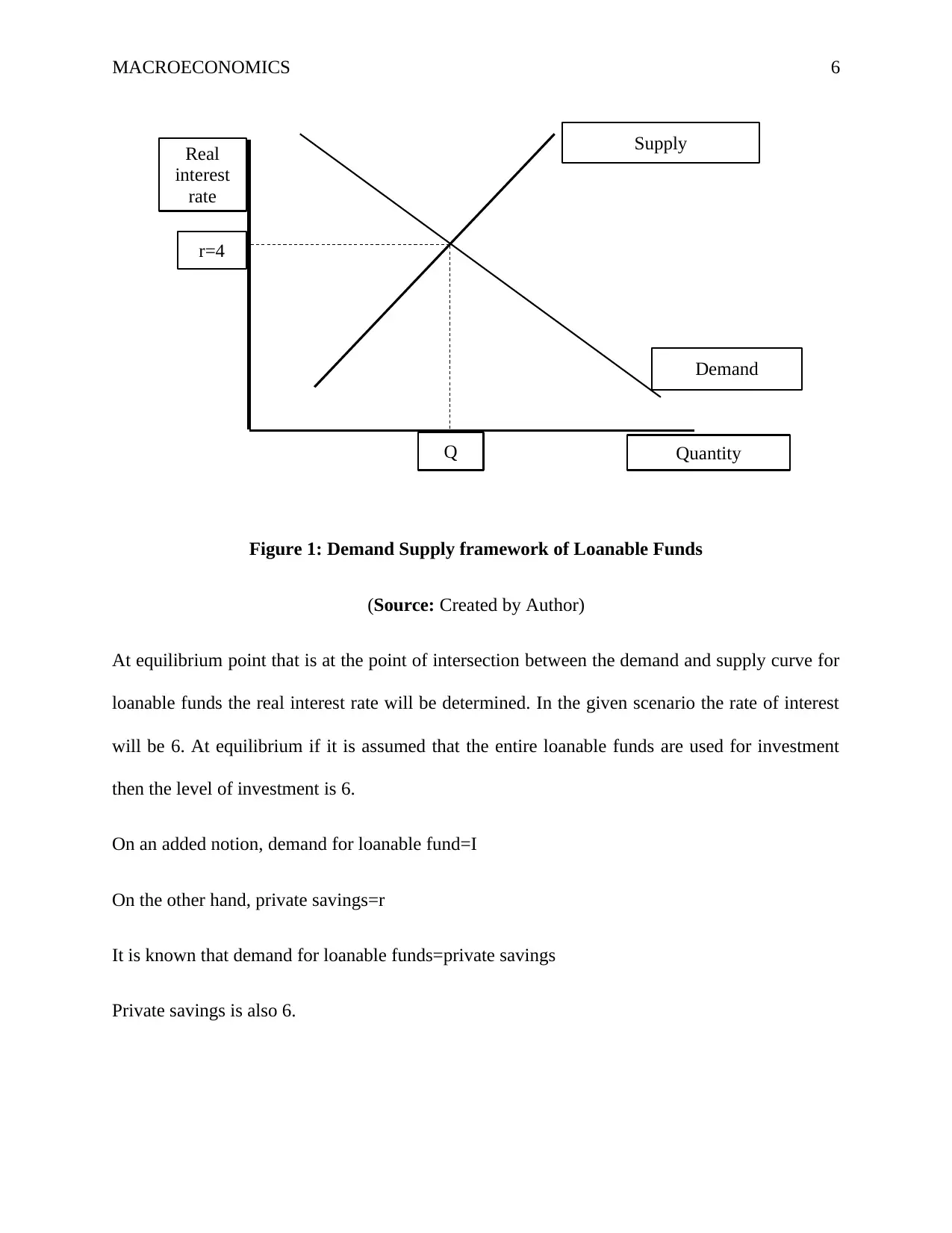

Answer to Question 5:

a)

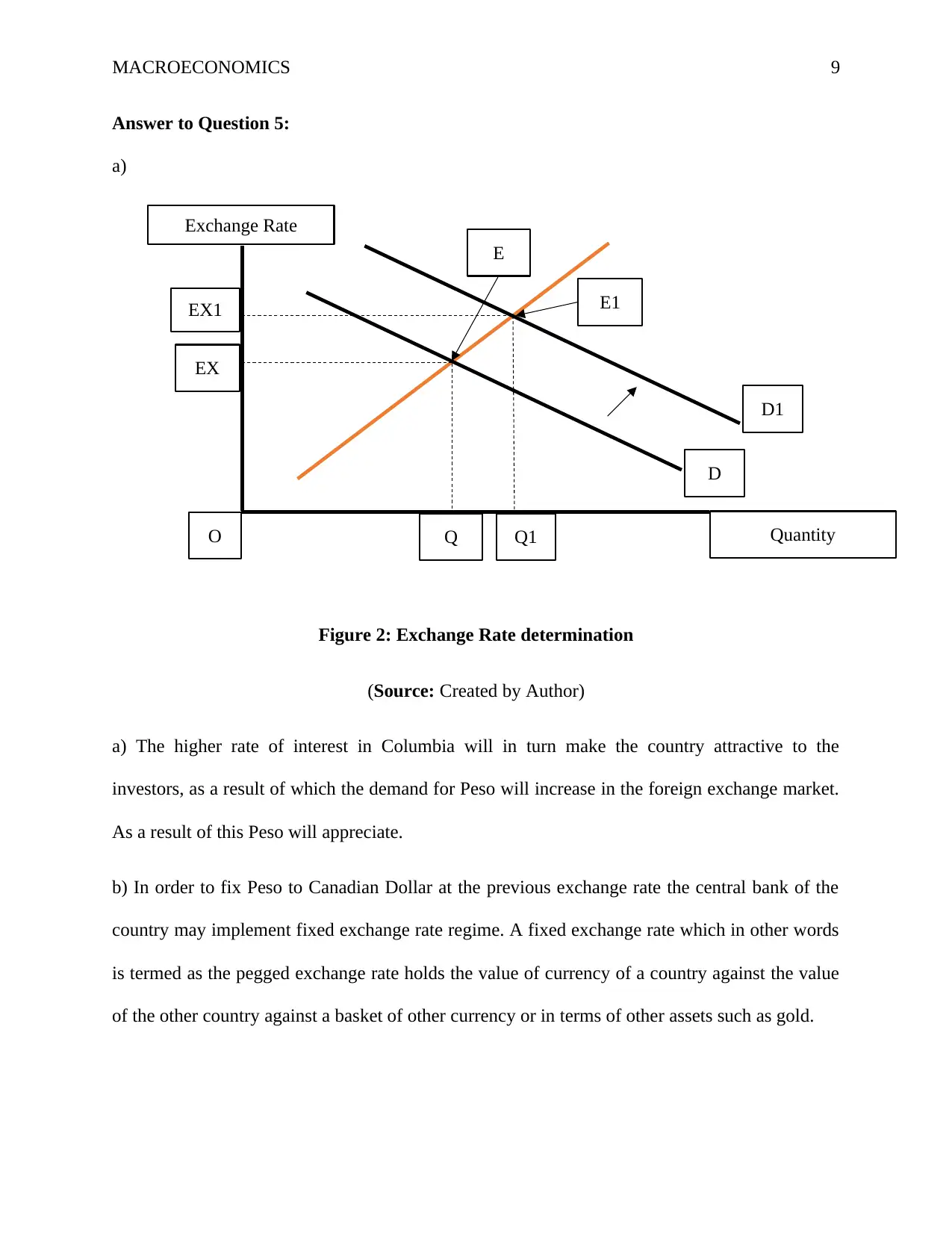

Figure 2: Exchange Rate determination

(Source: Created by Author)

a) The higher rate of interest in Columbia will in turn make the country attractive to the

investors, as a result of which the demand for Peso will increase in the foreign exchange market.

As a result of this Peso will appreciate.

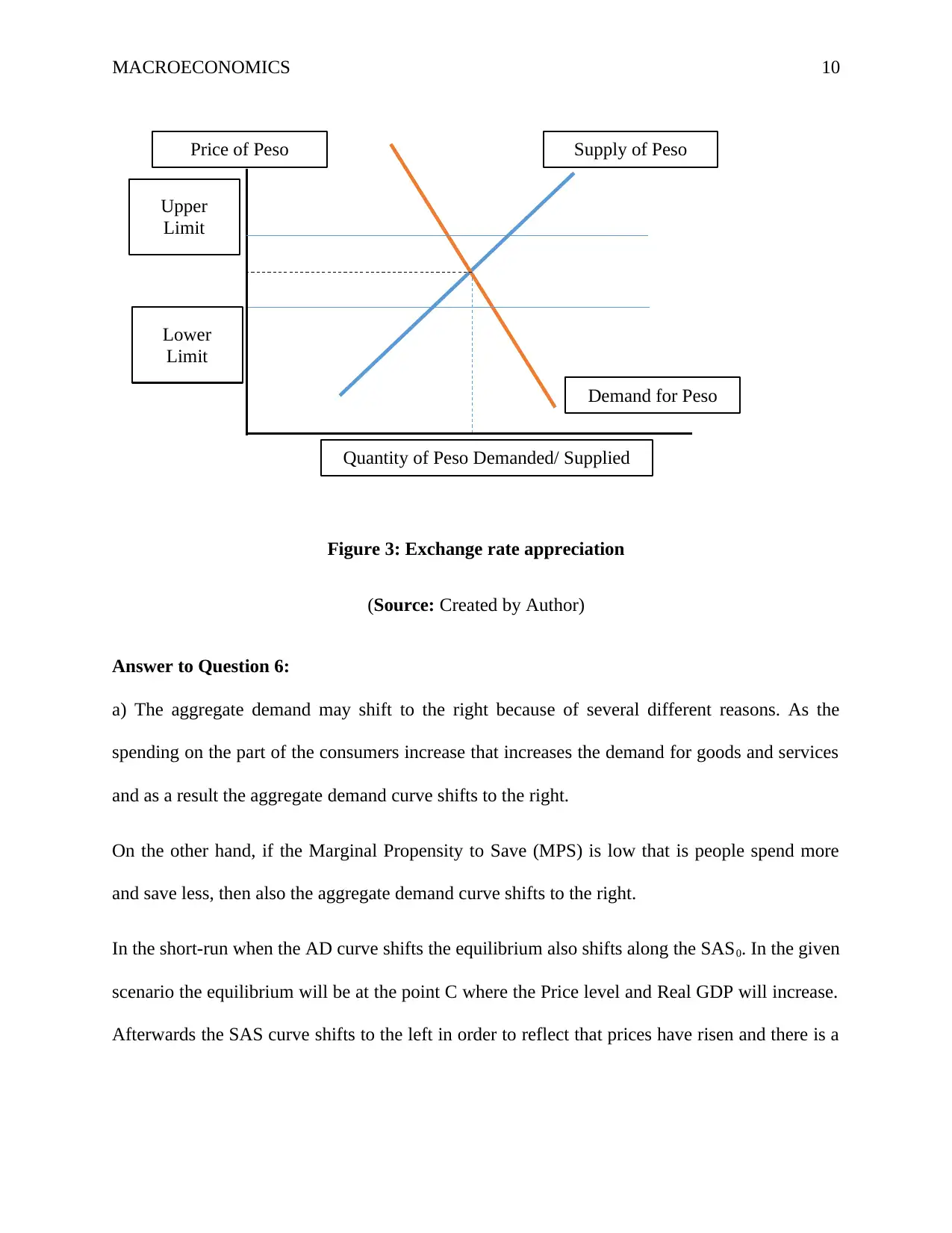

b) In order to fix Peso to Canadian Dollar at the previous exchange rate the central bank of the

country may implement fixed exchange rate regime. A fixed exchange rate which in other words

is termed as the pegged exchange rate holds the value of currency of a country against the value

of the other country against a basket of other currency or in terms of other assets such as gold.

Exchange Rate

EX1

Q1QO Quantity

EX

E1

E

D

MACROECONOMICS 9

Answer to Question 5:

a)

Figure 2: Exchange Rate determination

(Source: Created by Author)

a) The higher rate of interest in Columbia will in turn make the country attractive to the

investors, as a result of which the demand for Peso will increase in the foreign exchange market.

As a result of this Peso will appreciate.

b) In order to fix Peso to Canadian Dollar at the previous exchange rate the central bank of the

country may implement fixed exchange rate regime. A fixed exchange rate which in other words

is termed as the pegged exchange rate holds the value of currency of a country against the value

of the other country against a basket of other currency or in terms of other assets such as gold.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Upper

Limit

Lower

Limit

Price of Peso

Quantity of Peso Demanded/ Supplied

Demand for Peso

Supply of Peso

MACROECONOMICS 10

Figure 3: Exchange rate appreciation

(Source: Created by Author)

Answer to Question 6:

a) The aggregate demand may shift to the right because of several different reasons. As the

spending on the part of the consumers increase that increases the demand for goods and services

and as a result the aggregate demand curve shifts to the right.

On the other hand, if the Marginal Propensity to Save (MPS) is low that is people spend more

and save less, then also the aggregate demand curve shifts to the right.

In the short-run when the AD curve shifts the equilibrium also shifts along the SAS0. In the given

scenario the equilibrium will be at the point C where the Price level and Real GDP will increase.

Afterwards the SAS curve shifts to the left in order to reflect that prices have risen and there is a

Limit

Lower

Limit

Price of Peso

Quantity of Peso Demanded/ Supplied

Demand for Peso

Supply of Peso

MACROECONOMICS 10

Figure 3: Exchange rate appreciation

(Source: Created by Author)

Answer to Question 6:

a) The aggregate demand may shift to the right because of several different reasons. As the

spending on the part of the consumers increase that increases the demand for goods and services

and as a result the aggregate demand curve shifts to the right.

On the other hand, if the Marginal Propensity to Save (MPS) is low that is people spend more

and save less, then also the aggregate demand curve shifts to the right.

In the short-run when the AD curve shifts the equilibrium also shifts along the SAS0. In the given

scenario the equilibrium will be at the point C where the Price level and Real GDP will increase.

Afterwards the SAS curve shifts to the left in order to reflect that prices have risen and there is a

MACROECONOMICS 11

decrease in the amount of real GDP. Hence the new equilibrium is achieved at the point D. The

economy can be regarded at a full employment equilibrium.

b) The SAS curve also may shift to the left because of different reasons. Which may include,

A rise in the level of nominal wage rate shifts the SAS curve to the left as the cost of production

rises and the level of profit lowers.

Rise in the process of the other input factors may shift the SAS curve to the left as this increases

the cost of production.

In the given context when the SAS curve shifts to the left in the short run the new equilibrium

will be achieved at point A, where real GDP will decrease and price level will increase. In this

context it can be stated that the country possesses an inflationary gap.

c) The new equilibrium will be achieved at the point D where the SAS and AD curve will

intersect.

Answer to Question 7:

a)

decrease in the amount of real GDP. Hence the new equilibrium is achieved at the point D. The

economy can be regarded at a full employment equilibrium.

b) The SAS curve also may shift to the left because of different reasons. Which may include,

A rise in the level of nominal wage rate shifts the SAS curve to the left as the cost of production

rises and the level of profit lowers.

Rise in the process of the other input factors may shift the SAS curve to the left as this increases

the cost of production.

In the given context when the SAS curve shifts to the left in the short run the new equilibrium

will be achieved at point A, where real GDP will decrease and price level will increase. In this

context it can be stated that the country possesses an inflationary gap.

c) The new equilibrium will be achieved at the point D where the SAS and AD curve will

intersect.

Answer to Question 7:

a)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MACROECONOMICS 12

250 300 350 400 450 500 550 600 650 700 750

0

20

40

60

80

100

120

140

160

Equilibrium of Japanese Economy

Demand Curve Supply Curve

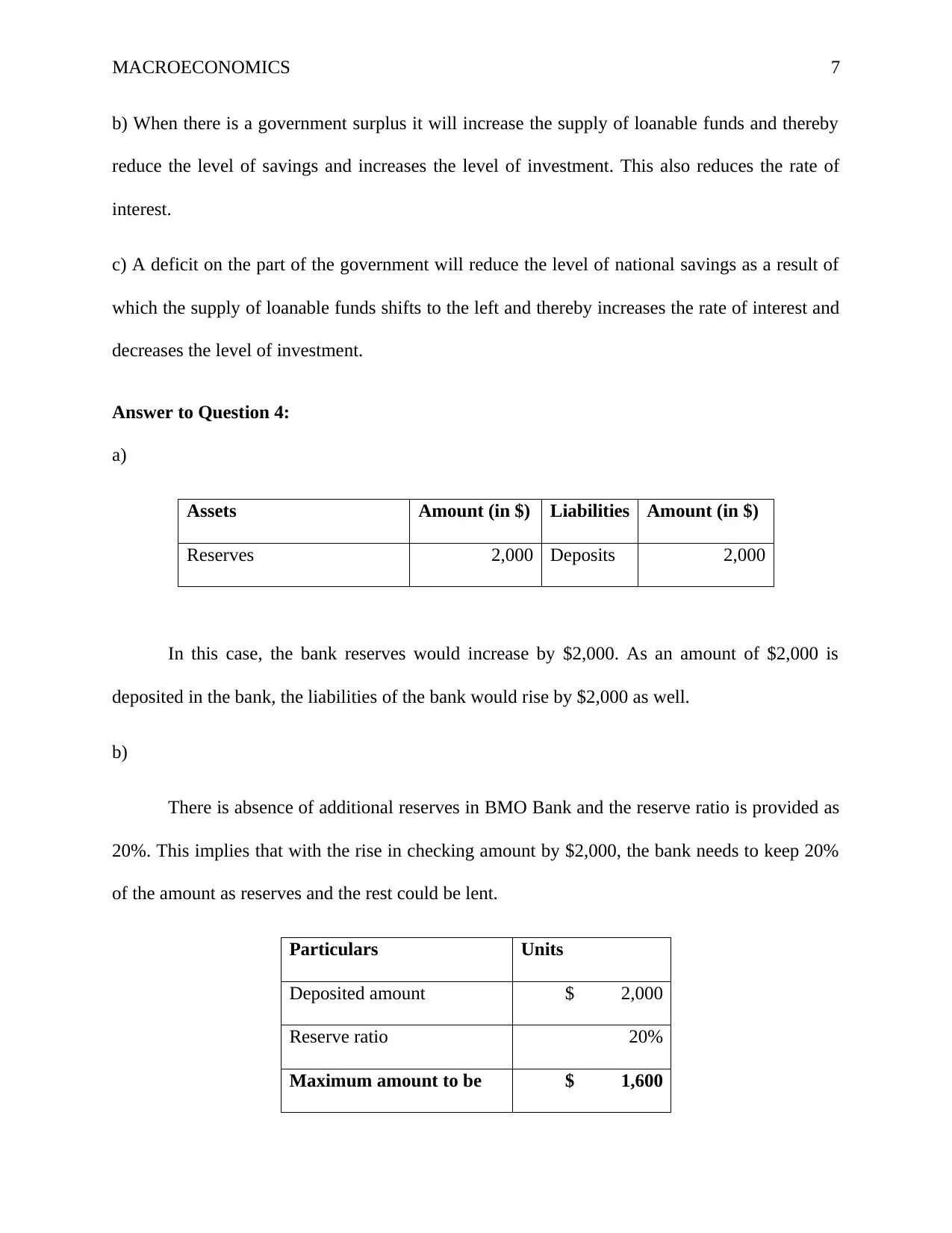

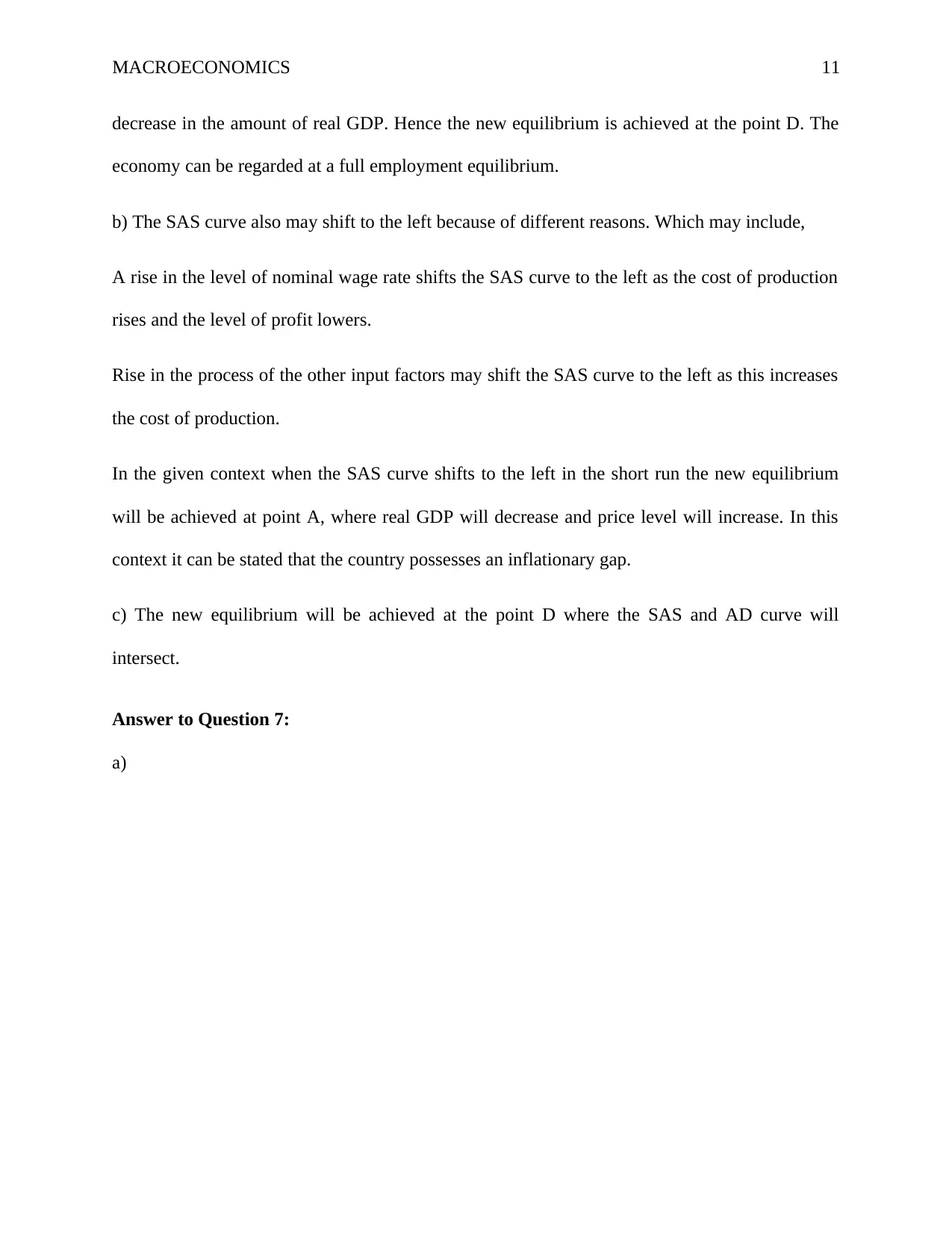

Figure 4: Aggregate Demand and Aggregate Supply Model

(Source: Created by Author)

The equilibrium Price is 95 and the equilibrium level of real GDP is 500.

b) The country is facing an recessionary gap which is 600-500=100

c) MPS=1-MPC=1-.75=.25

Multiplier=1/.25=4

Hence the G should be increased by 25 Billions of Yen to mitigate the gap.

The multiplier is 4 and hence the tax multiplier is 3. Therefore, the second round consumer

spending should be 33.33 Billions of Yen.

The third round of consumer spending would be .25*33.33= 8.33 Billion

The fourth round would be savings equal to the tax cut.

Total= 66.66

250 300 350 400 450 500 550 600 650 700 750

0

20

40

60

80

100

120

140

160

Equilibrium of Japanese Economy

Demand Curve Supply Curve

Figure 4: Aggregate Demand and Aggregate Supply Model

(Source: Created by Author)

The equilibrium Price is 95 and the equilibrium level of real GDP is 500.

b) The country is facing an recessionary gap which is 600-500=100

c) MPS=1-MPC=1-.75=.25

Multiplier=1/.25=4

Hence the G should be increased by 25 Billions of Yen to mitigate the gap.

The multiplier is 4 and hence the tax multiplier is 3. Therefore, the second round consumer

spending should be 33.33 Billions of Yen.

The third round of consumer spending would be .25*33.33= 8.33 Billion

The fourth round would be savings equal to the tax cut.

Total= 66.66

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Price

LRAS

SRAS

AD2

AD1

Y Output

P

Y1

P1

2014

2015

MACROECONOMICS 13

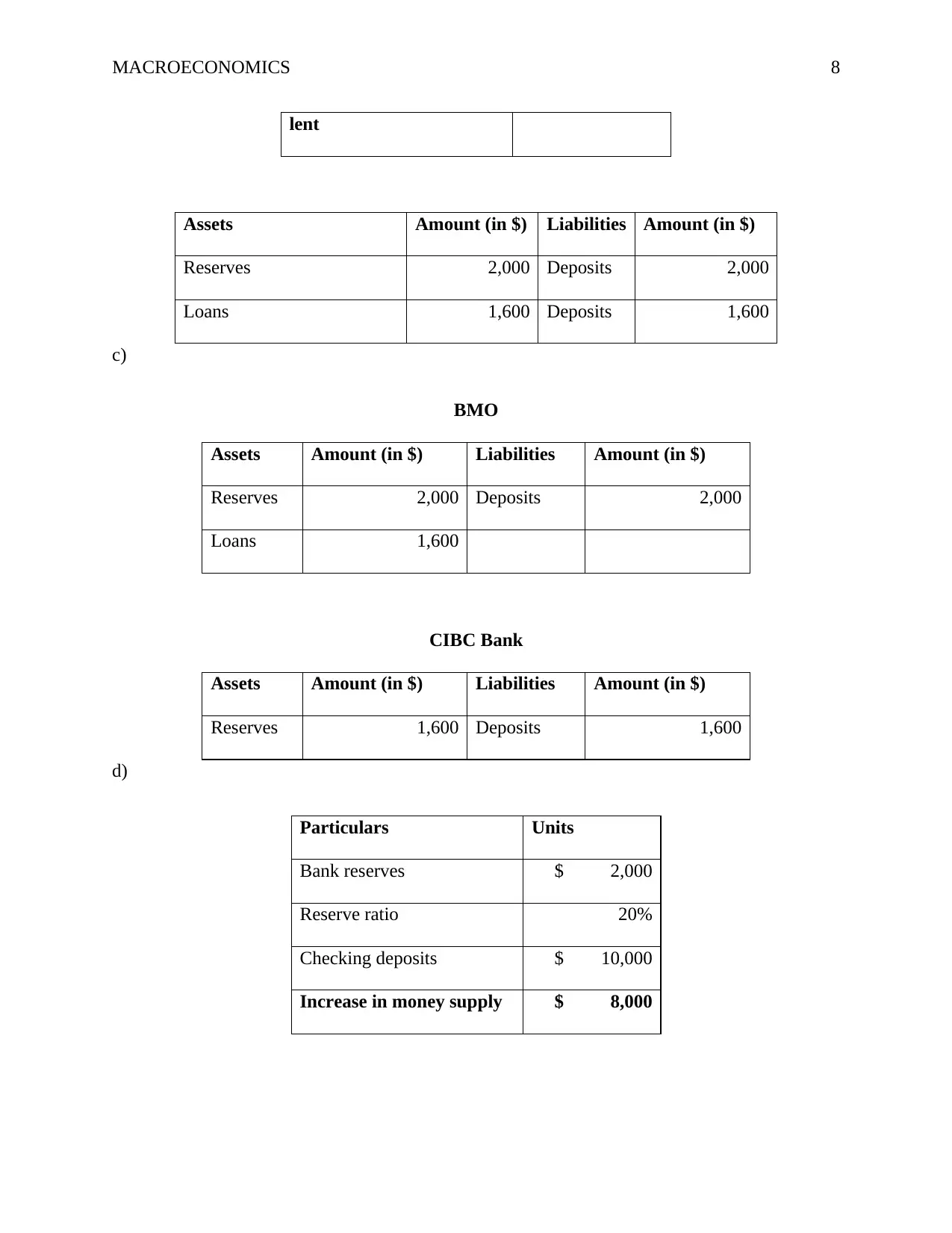

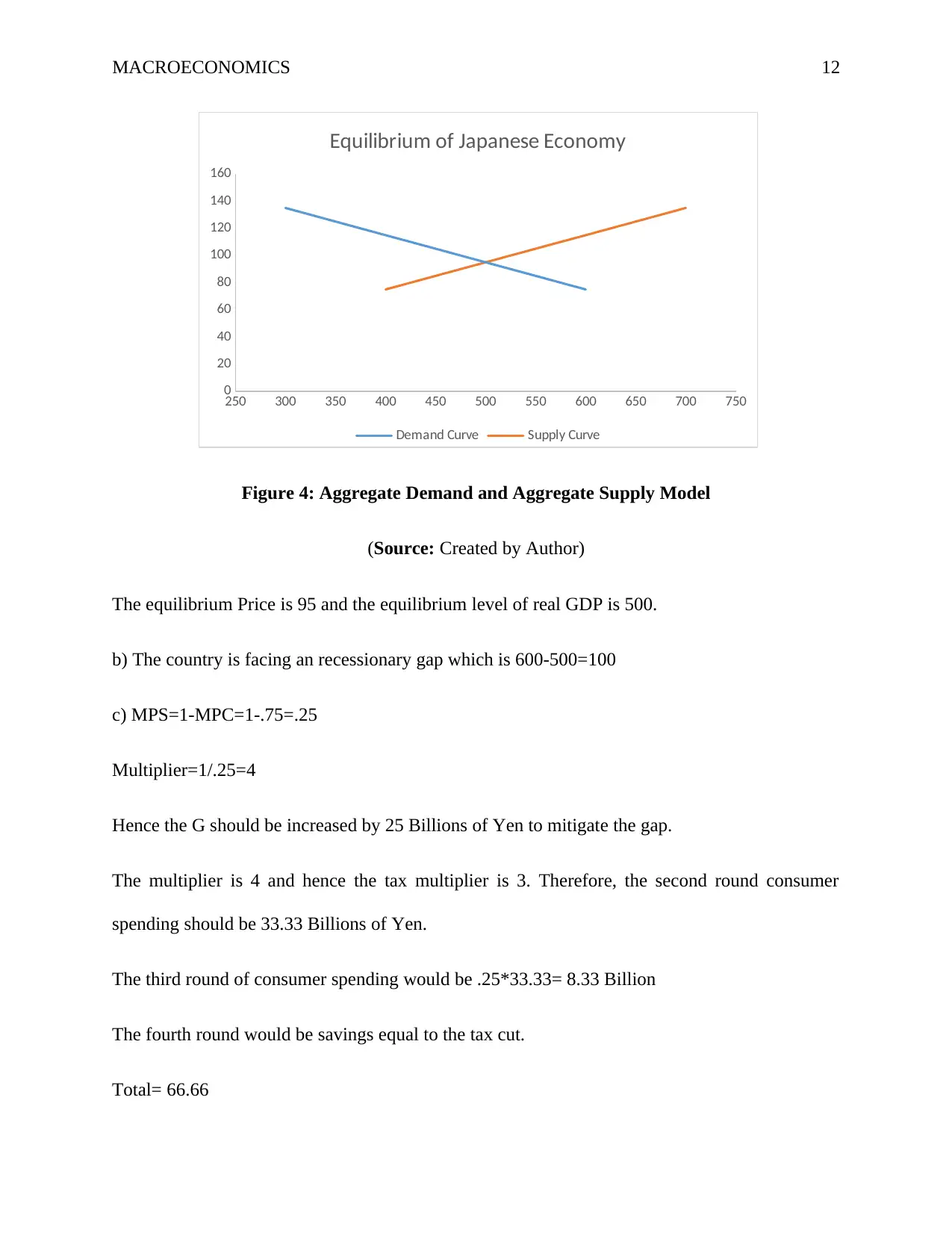

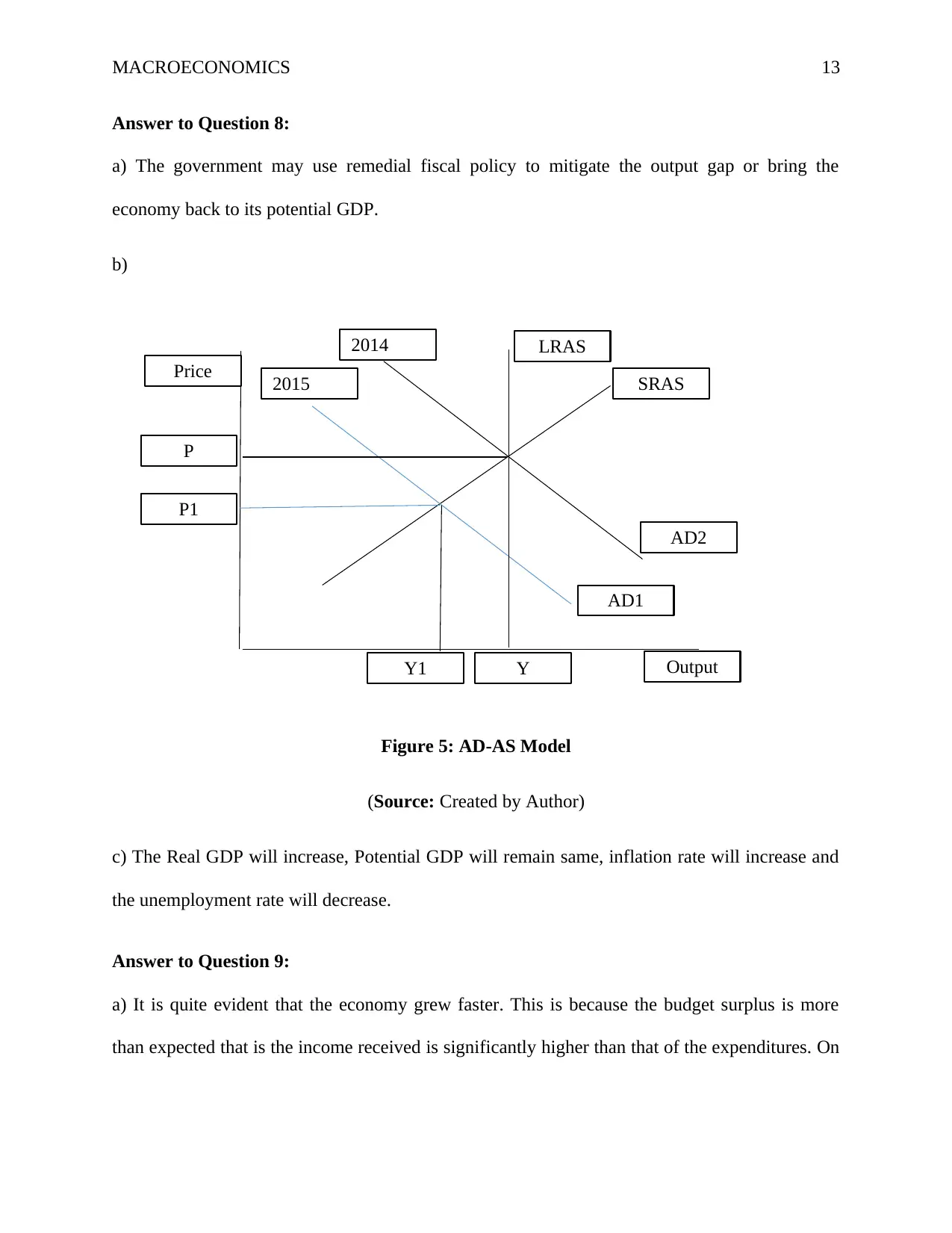

Answer to Question 8:

a) The government may use remedial fiscal policy to mitigate the output gap or bring the

economy back to its potential GDP.

b)

Figure 5: AD-AS Model

(Source: Created by Author)

c) The Real GDP will increase, Potential GDP will remain same, inflation rate will increase and

the unemployment rate will decrease.

Answer to Question 9:

a) It is quite evident that the economy grew faster. This is because the budget surplus is more

than expected that is the income received is significantly higher than that of the expenditures. On

LRAS

SRAS

AD2

AD1

Y Output

P

Y1

P1

2014

2015

MACROECONOMICS 13

Answer to Question 8:

a) The government may use remedial fiscal policy to mitigate the output gap or bring the

economy back to its potential GDP.

b)

Figure 5: AD-AS Model

(Source: Created by Author)

c) The Real GDP will increase, Potential GDP will remain same, inflation rate will increase and

the unemployment rate will decrease.

Answer to Question 9:

a) It is quite evident that the economy grew faster. This is because the budget surplus is more

than expected that is the income received is significantly higher than that of the expenditures. On

SRAS

Price

P1

P0

Y0 Y1 Real GDP

SRAS0

SRAS1

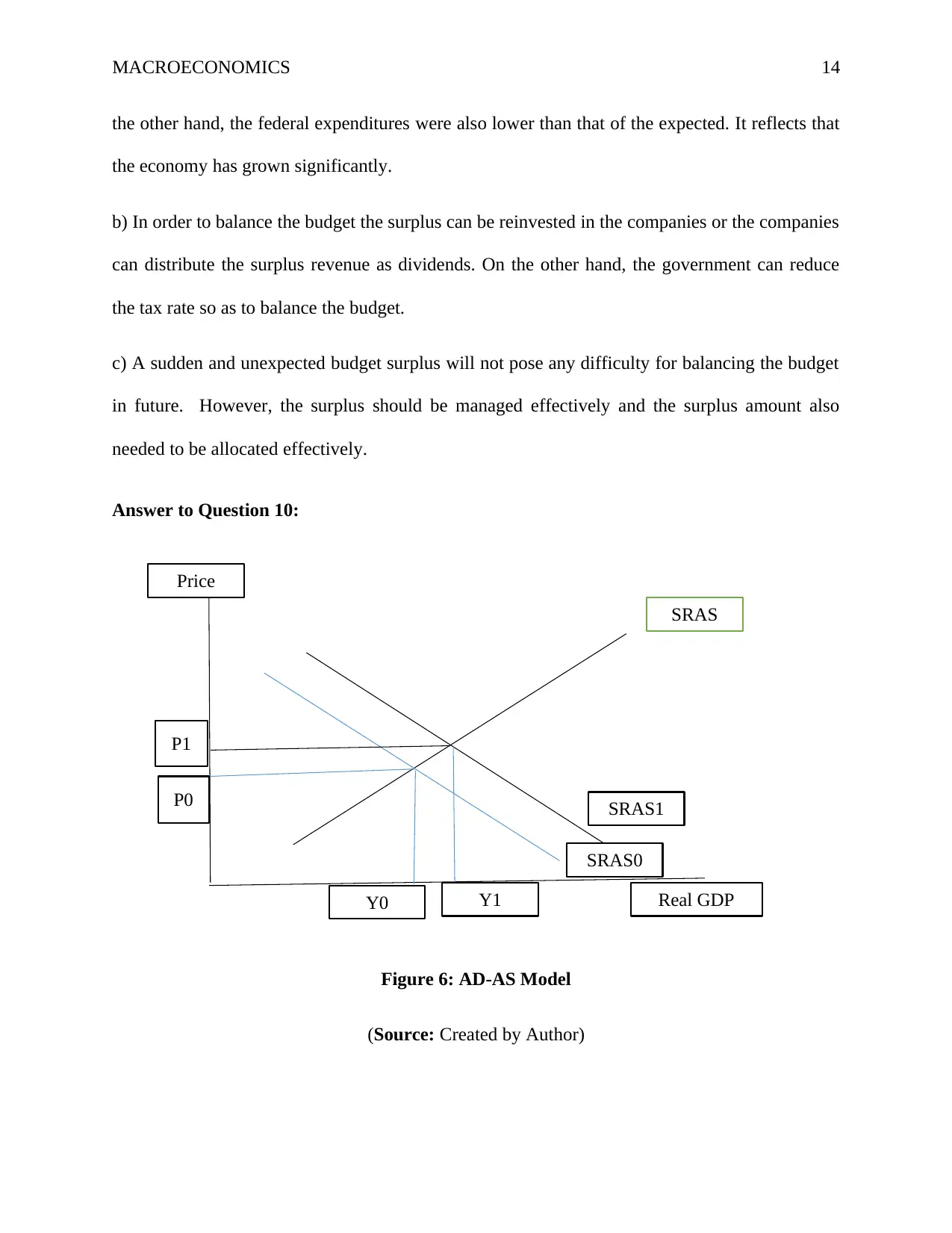

MACROECONOMICS 14

the other hand, the federal expenditures were also lower than that of the expected. It reflects that

the economy has grown significantly.

b) In order to balance the budget the surplus can be reinvested in the companies or the companies

can distribute the surplus revenue as dividends. On the other hand, the government can reduce

the tax rate so as to balance the budget.

c) A sudden and unexpected budget surplus will not pose any difficulty for balancing the budget

in future. However, the surplus should be managed effectively and the surplus amount also

needed to be allocated effectively.

Answer to Question 10:

Figure 6: AD-AS Model

(Source: Created by Author)

Price

P1

P0

Y0 Y1 Real GDP

SRAS0

SRAS1

MACROECONOMICS 14

the other hand, the federal expenditures were also lower than that of the expected. It reflects that

the economy has grown significantly.

b) In order to balance the budget the surplus can be reinvested in the companies or the companies

can distribute the surplus revenue as dividends. On the other hand, the government can reduce

the tax rate so as to balance the budget.

c) A sudden and unexpected budget surplus will not pose any difficulty for balancing the budget

in future. However, the surplus should be managed effectively and the surplus amount also

needed to be allocated effectively.

Answer to Question 10:

Figure 6: AD-AS Model

(Source: Created by Author)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

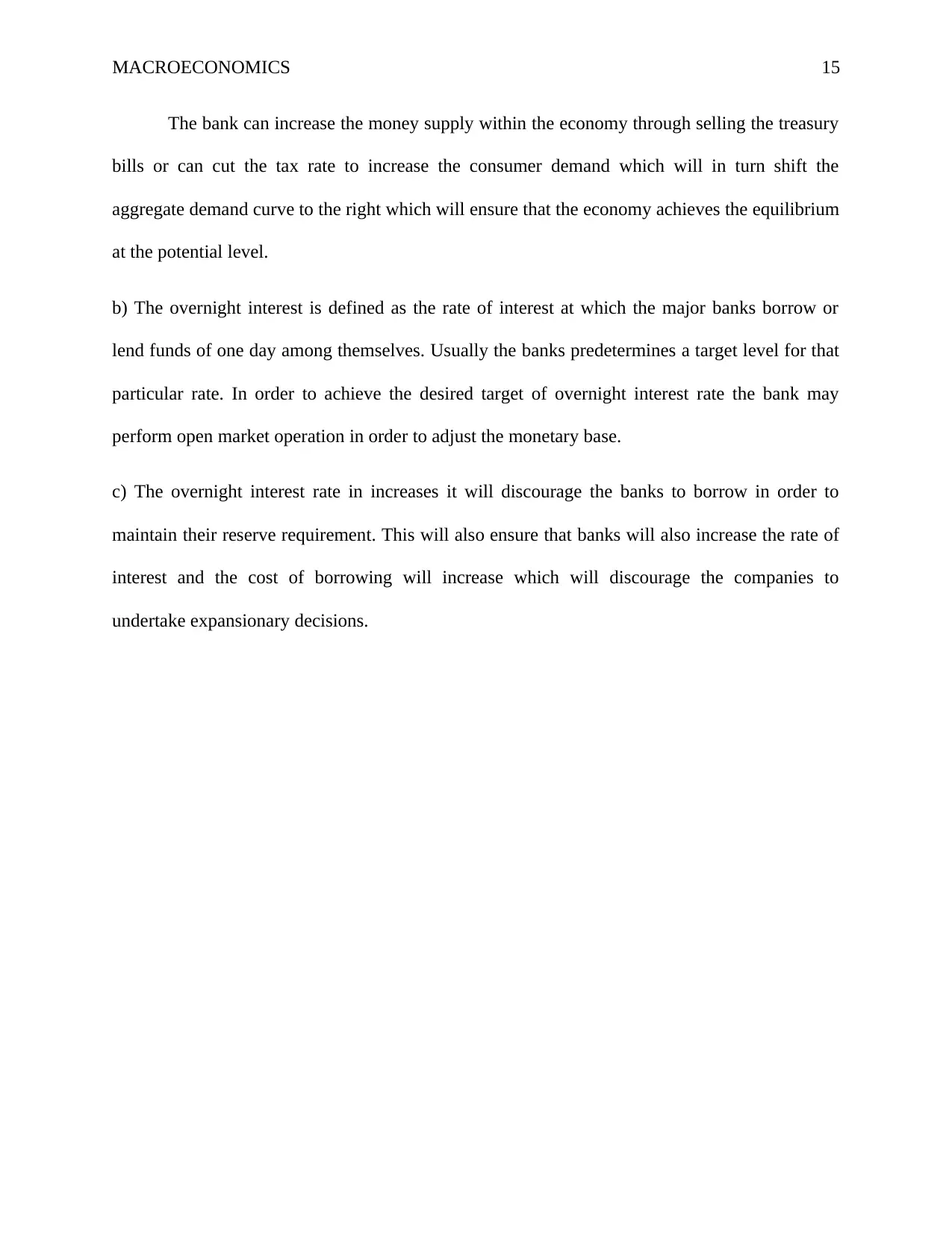

MACROECONOMICS 15

The bank can increase the money supply within the economy through selling the treasury

bills or can cut the tax rate to increase the consumer demand which will in turn shift the

aggregate demand curve to the right which will ensure that the economy achieves the equilibrium

at the potential level.

b) The overnight interest is defined as the rate of interest at which the major banks borrow or

lend funds of one day among themselves. Usually the banks predetermines a target level for that

particular rate. In order to achieve the desired target of overnight interest rate the bank may

perform open market operation in order to adjust the monetary base.

c) The overnight interest rate in increases it will discourage the banks to borrow in order to

maintain their reserve requirement. This will also ensure that banks will also increase the rate of

interest and the cost of borrowing will increase which will discourage the companies to

undertake expansionary decisions.

The bank can increase the money supply within the economy through selling the treasury

bills or can cut the tax rate to increase the consumer demand which will in turn shift the

aggregate demand curve to the right which will ensure that the economy achieves the equilibrium

at the potential level.

b) The overnight interest is defined as the rate of interest at which the major banks borrow or

lend funds of one day among themselves. Usually the banks predetermines a target level for that

particular rate. In order to achieve the desired target of overnight interest rate the bank may

perform open market operation in order to adjust the monetary base.

c) The overnight interest rate in increases it will discourage the banks to borrow in order to

maintain their reserve requirement. This will also ensure that banks will also increase the rate of

interest and the cost of borrowing will increase which will discourage the companies to

undertake expansionary decisions.

1 out of 16

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.