Sunway University: ECON2023 Macroeconomic Report on Greece

VerifiedAdded on 2023/06/10

|15

|6025

|343

Report

AI Summary

This report provides a comprehensive macroeconomic analysis of Greece, focusing on the challenges of unemployment and slow economic growth. The report begins with a summary of the macroeconomic problems faced by Greece, highlighting the high unemployment rate and the impact of the debt crisis. It then explores the concepts of unemployment and economic growth, examining their relationship and impact on the country's economy. The analysis includes economic data, such as growth rates, debt-to-GDP ratios, and unemployment figures, to illustrate trends and fluctuations. The report further investigates the impact of unemployment on Greece, including social and economic costs, and proposes fiscal and monetary policy measures to address these issues. Finally, it concludes with a reflection on the macroeconomic topics covered and their relevance to the real-world economic performance of Greece. The report adheres to the guidelines provided in the assignment brief, including the use of relevant economic data and the proposal of policy recommendations. The report effectively addresses the assignment's objectives by linking macroeconomic variables to Greece's economic performance and critically evaluating the application of macroeconomic theories.

Running head: MACROECONOMICS

Macroeconomics

Name of the student

Name of the university

Author Note

Macroeconomics

Name of the student

Name of the university

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MACROECONOMICS

Table of Contents

Summary of the report:..............................................................................................................2

Macroeconomic problem:..........................................................................................................2

Concept of unemployment and its impact:.............................................................................2

Economic growth:..................................................................................................................3

Relation between unemployment and economic growth:......................................................3

Economic data relating to the macroeconomic problem of Greece:..........................................3

Economic growth rate of Greece:..........................................................................................3

Debt-crisis of Greece:............................................................................................................4

Unemployment in Greece:.....................................................................................................5

Impact of unemployment on Greece:.........................................................................................6

Policies taken by the Greece government to reduce unemployment:....................................7

Proposed measurement to overcome problems:.........................................................................8

Fiscal policy:..........................................................................................................................8

Monetary policy:....................................................................................................................8

Policies to reduce unemployment in Greece:.........................................................................9

Conclusion:..............................................................................................................................10

References:...............................................................................................................................11

Table of Contents

Summary of the report:..............................................................................................................2

Macroeconomic problem:..........................................................................................................2

Concept of unemployment and its impact:.............................................................................2

Economic growth:..................................................................................................................3

Relation between unemployment and economic growth:......................................................3

Economic data relating to the macroeconomic problem of Greece:..........................................3

Economic growth rate of Greece:..........................................................................................3

Debt-crisis of Greece:............................................................................................................4

Unemployment in Greece:.....................................................................................................5

Impact of unemployment on Greece:.........................................................................................6

Policies taken by the Greece government to reduce unemployment:....................................7

Proposed measurement to overcome problems:.........................................................................8

Fiscal policy:..........................................................................................................................8

Monetary policy:....................................................................................................................8

Policies to reduce unemployment in Greece:.........................................................................9

Conclusion:..............................................................................................................................10

References:...............................................................................................................................11

2MACROECONOMICS

Summary of the report:

At the end of 2016, economic growth and unemployment have remained high in

Greece though other countries of euro zone have recovered their position. At the end of this

year, unemployment rate of Greece has become 23.1 %, which has remained the highest rate

in euro zone. Labor market of this country has not been influenced instead of the broader

improvements in job sectors while in other countries of Europe the average number of

unemployment has reduced to 9.8 %, which has become the lowest over the last four years

(Giannakis & Bruggeman, 2017). The debt burden of this economy has remained very high

with 180% and consequently the growth of Greece has declined since the last three months in

2017 by 1.2 % (Financial Times., 2018). During 2015, this country has performed the worst

due to higher debt crisis and has reflected uncertainty. As a result, average GDP of the euro

zone has increased by 0.4% during the fourth quarter of 2016. However, the economic fall

supports the claims of Syriza government regarding the imposition of more austerity

(Fountas, Karatasi & Tzika, 2018). The International Monetary Fund has claimed that due to

slow growth, the country cannot achieve its determined budgetary targets and consequently

the country needs other structural reform for its pension and tax system.

Macroeconomic problem:

Hence, the chief problem of Greece is unemployment and slow growth of GDP.

Unemployment is considered as an economic obstacle that each country experiences. For any

developed or developing country, higher rate of unemployment is not desirable. This

economic phenomenon occurs when a person searches for an employment actively but cannot

find a job (Bulow & Geanakoplos, 2017). Thus, unemployment sometimes is used as an

indicator to represent health of an economy and for this unemployment rate is used. The

unemployment rate is represented by the number of unemployed people of a country divided

by the number of people in the total work force. Based on the definition of unemployment,

economists have divided it into two parts, which are, involuntary and voluntary

unemployment. According to the concept of involuntary unemployment, a person intends to

find a job at existing wages but remains unable to find. On the contrary, voluntary

unemployment indicates that a person leaves his or her job willingly or does not want to do

job at existing wages. In this context, it is essential to mention that involuntary

unemployment is a serious issue for an economy while voluntary unemployment is not.

Concept of unemployment and its impact:

Due to unemployment, an economy bears both social and economic costs that include

costs of government, personal costs and costs of the country in general. Costs to government

indicates as the lost of tax revenue while personal costs means loss of income. In addition to

this, costs to society means loss of national income or GDP. Thus, unemployment can

increase poverty level of a country and this in turn can lead households into debt, which

further can increase relative poverty rates (Christiano, Eichenbaum & Trabandt, 2016).

Moreover, unemployment can also reduce the amount of human capital of a country. Due to

lack of job, people cannot receive proper job training and consequently they cannot improve

their skills. On the other side, higher unemployment decreases tax revenue of the

government, as number of taxpaying people decreases due to their no income. Moreover,

people also reduce their consumption for which the amount of indirect tax also decreases. As

Summary of the report:

At the end of 2016, economic growth and unemployment have remained high in

Greece though other countries of euro zone have recovered their position. At the end of this

year, unemployment rate of Greece has become 23.1 %, which has remained the highest rate

in euro zone. Labor market of this country has not been influenced instead of the broader

improvements in job sectors while in other countries of Europe the average number of

unemployment has reduced to 9.8 %, which has become the lowest over the last four years

(Giannakis & Bruggeman, 2017). The debt burden of this economy has remained very high

with 180% and consequently the growth of Greece has declined since the last three months in

2017 by 1.2 % (Financial Times., 2018). During 2015, this country has performed the worst

due to higher debt crisis and has reflected uncertainty. As a result, average GDP of the euro

zone has increased by 0.4% during the fourth quarter of 2016. However, the economic fall

supports the claims of Syriza government regarding the imposition of more austerity

(Fountas, Karatasi & Tzika, 2018). The International Monetary Fund has claimed that due to

slow growth, the country cannot achieve its determined budgetary targets and consequently

the country needs other structural reform for its pension and tax system.

Macroeconomic problem:

Hence, the chief problem of Greece is unemployment and slow growth of GDP.

Unemployment is considered as an economic obstacle that each country experiences. For any

developed or developing country, higher rate of unemployment is not desirable. This

economic phenomenon occurs when a person searches for an employment actively but cannot

find a job (Bulow & Geanakoplos, 2017). Thus, unemployment sometimes is used as an

indicator to represent health of an economy and for this unemployment rate is used. The

unemployment rate is represented by the number of unemployed people of a country divided

by the number of people in the total work force. Based on the definition of unemployment,

economists have divided it into two parts, which are, involuntary and voluntary

unemployment. According to the concept of involuntary unemployment, a person intends to

find a job at existing wages but remains unable to find. On the contrary, voluntary

unemployment indicates that a person leaves his or her job willingly or does not want to do

job at existing wages. In this context, it is essential to mention that involuntary

unemployment is a serious issue for an economy while voluntary unemployment is not.

Concept of unemployment and its impact:

Due to unemployment, an economy bears both social and economic costs that include

costs of government, personal costs and costs of the country in general. Costs to government

indicates as the lost of tax revenue while personal costs means loss of income. In addition to

this, costs to society means loss of national income or GDP. Thus, unemployment can

increase poverty level of a country and this in turn can lead households into debt, which

further can increase relative poverty rates (Christiano, Eichenbaum & Trabandt, 2016).

Moreover, unemployment can also reduce the amount of human capital of a country. Due to

lack of job, people cannot receive proper job training and consequently they cannot improve

their skills. On the other side, higher unemployment decreases tax revenue of the

government, as number of taxpaying people decreases due to their no income. Moreover,

people also reduce their consumption for which the amount of indirect tax also decreases. As

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MACROECONOMICS

a result, government is forced to borrow money from other internal or external sources which

in turn increases burden of public debt. In addition to this, economic growth of a country can

be decreased due to lower GDP. Higher level of unemployment indicates that an economy is

not performing efficiently with its full capacity. As a result, total amount of output and

national income for the country decreases significantly. Furthermore, unemployed person

cannot purchase large number of products and for this consumption level of that person along

with the country decreases.

Economic growth:

Economic growth is other macroeconomic concept, which represents capacity of an

economy to produce large number of goods and services over the year. Economic growth can

be obtained from both nominal and real terms while the second one is obtained as inflation

adjusted. For a country, economic growth is measured with the help of gross domestic

product (GDP) and gross national product (GNP) (Herndon, Ash & Pollin, 2014). Through

increasing aggregate productivity, a country can achieve economic growth.

Relation between unemployment and economic growth:

However, unemployment can lead economic growth of a country towards negative

direction. Firstly, unemployment exploits workers, as they are forced to accept low wages

and to work within an unfavorable environment. Secondly, this economic phenomenon can

generate a negative relation between employers and employees and consequently industrial

disputes can be occurred (De Neve et al., 2018). In this context, it can be mentioned that this

industrial dispute again increases unemployment to a large extend. Thirdly, unemployment

along with industrial disputes brings political instability within the country. Government

implements various policies to control this negative economic phenomenon. However, some

these of policies may generate conflicts among citizens and the government or can generate

conflicts among various political parties, which further generates instability. Fourthly,

unemployment generates social problems as poverty level increases. To meet basic needs,

those unemployed people involve themselves in some illegal activities that cause gambling,

dishonesty and immortality.

Hence, for any country, unemployment is not desirable as it reduces economic growth

and hampers socio-political and economical condition of it. For this, the government can take

various initiatives to reduce unemployment rate and to promote economic growth with the

help of monetary or fiscal policy or both. This economic phenomenon is also true for Greece

as discussed above. Hence, with the help of economic data related to this country, these

macroeconomic problems can be described. Moreover, this statistical data can also describe

trends and fluctuation of the country’s economy that can further measure the impact of

macroeconomic problem on Greece (Dritsakis & Stamatiou, 2017). After discussing these, it

can be suggested that what type of measure the government can take to reduce unemployment

level and to promote economic growth in this country.

Economic data relating to the macroeconomic problem of Greece:

Economic growth rate of Greece:

Greece is located in Southern Europe and ranks as 48th largest country all over the

world. In 2017, Greece has remained 7th largest economy among the 28 member of European

a result, government is forced to borrow money from other internal or external sources which

in turn increases burden of public debt. In addition to this, economic growth of a country can

be decreased due to lower GDP. Higher level of unemployment indicates that an economy is

not performing efficiently with its full capacity. As a result, total amount of output and

national income for the country decreases significantly. Furthermore, unemployed person

cannot purchase large number of products and for this consumption level of that person along

with the country decreases.

Economic growth:

Economic growth is other macroeconomic concept, which represents capacity of an

economy to produce large number of goods and services over the year. Economic growth can

be obtained from both nominal and real terms while the second one is obtained as inflation

adjusted. For a country, economic growth is measured with the help of gross domestic

product (GDP) and gross national product (GNP) (Herndon, Ash & Pollin, 2014). Through

increasing aggregate productivity, a country can achieve economic growth.

Relation between unemployment and economic growth:

However, unemployment can lead economic growth of a country towards negative

direction. Firstly, unemployment exploits workers, as they are forced to accept low wages

and to work within an unfavorable environment. Secondly, this economic phenomenon can

generate a negative relation between employers and employees and consequently industrial

disputes can be occurred (De Neve et al., 2018). In this context, it can be mentioned that this

industrial dispute again increases unemployment to a large extend. Thirdly, unemployment

along with industrial disputes brings political instability within the country. Government

implements various policies to control this negative economic phenomenon. However, some

these of policies may generate conflicts among citizens and the government or can generate

conflicts among various political parties, which further generates instability. Fourthly,

unemployment generates social problems as poverty level increases. To meet basic needs,

those unemployed people involve themselves in some illegal activities that cause gambling,

dishonesty and immortality.

Hence, for any country, unemployment is not desirable as it reduces economic growth

and hampers socio-political and economical condition of it. For this, the government can take

various initiatives to reduce unemployment rate and to promote economic growth with the

help of monetary or fiscal policy or both. This economic phenomenon is also true for Greece

as discussed above. Hence, with the help of economic data related to this country, these

macroeconomic problems can be described. Moreover, this statistical data can also describe

trends and fluctuation of the country’s economy that can further measure the impact of

macroeconomic problem on Greece (Dritsakis & Stamatiou, 2017). After discussing these, it

can be suggested that what type of measure the government can take to reduce unemployment

level and to promote economic growth in this country.

Economic data relating to the macroeconomic problem of Greece:

Economic growth rate of Greece:

Greece is located in Southern Europe and ranks as 48th largest country all over the

world. In 2017, Greece has remained 7th largest economy among the 28 member of European

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4MACROECONOMICS

Union. According to the report of IMF, Greece has ranked 49th and 39th for per capital

purchasing power parity and per capita nominal GDP across the world, respectively

(Drydakis, 2015). The economy of this developed country is chiefly based on service and

industrial sectors while agricultural sector contributes small portion to the country’s total

GDP. The chief industries of this country are tourism and shipping and consequently it has

become the 7th most visited country of the European Union and also 16th worldwide

(Papanikolaou, 2018). Within the EU, Greece has become an important producer of

agricultural product. However, due to Great recession and debt-crisis of the Greek

government along with debt crisis of Europe, economy of this country has decreased sharply

and consequently GDP growth rate of this country has entered in the negative phase

(Granados & Rodriguez, 2015). On the other side, public debt of this country has increased

significantly though after 2012, Greece has reduced its sovereign debt burden significantly

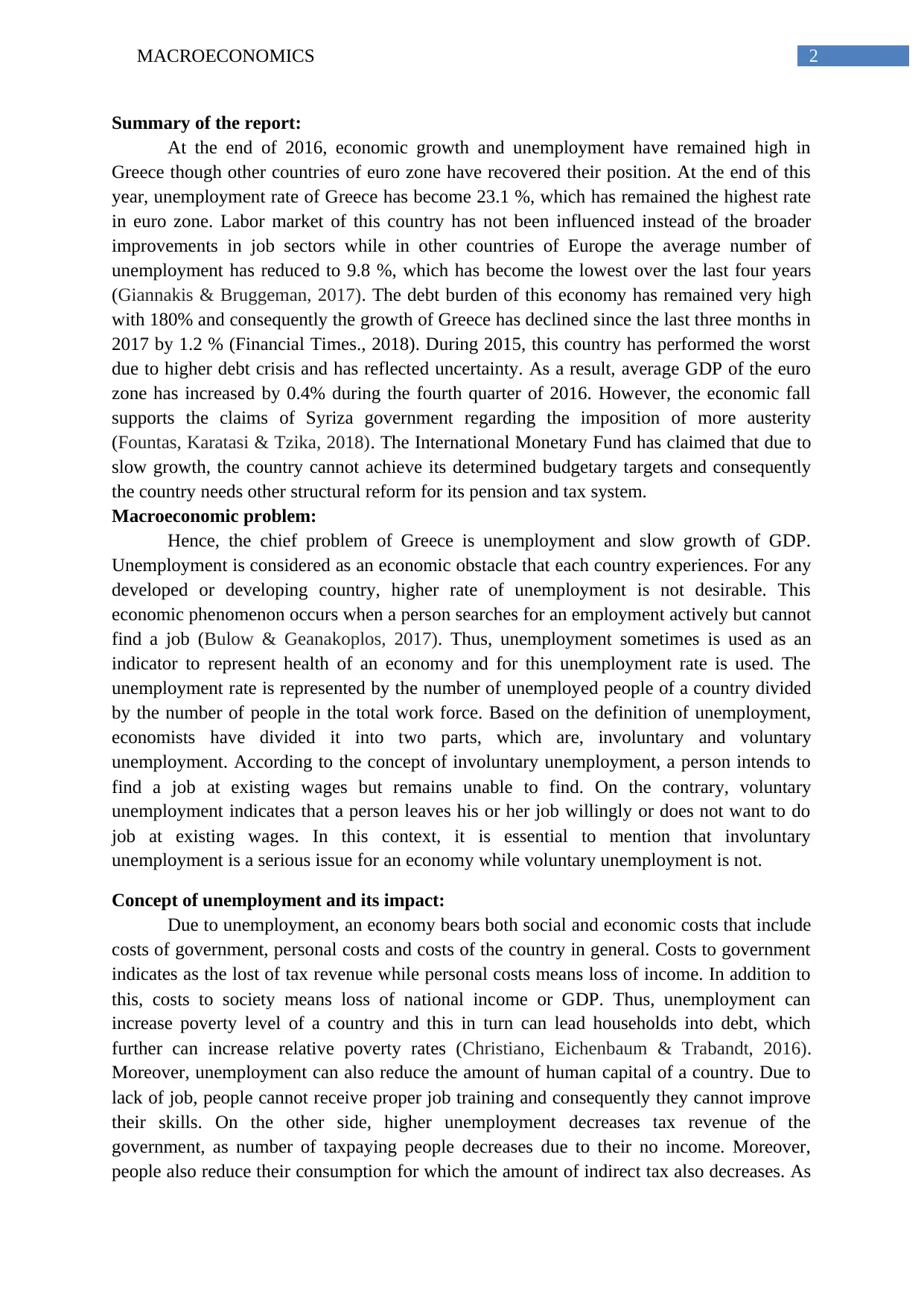

after negotiating the biggest debt restructure with private sector. Economic growth of Greece

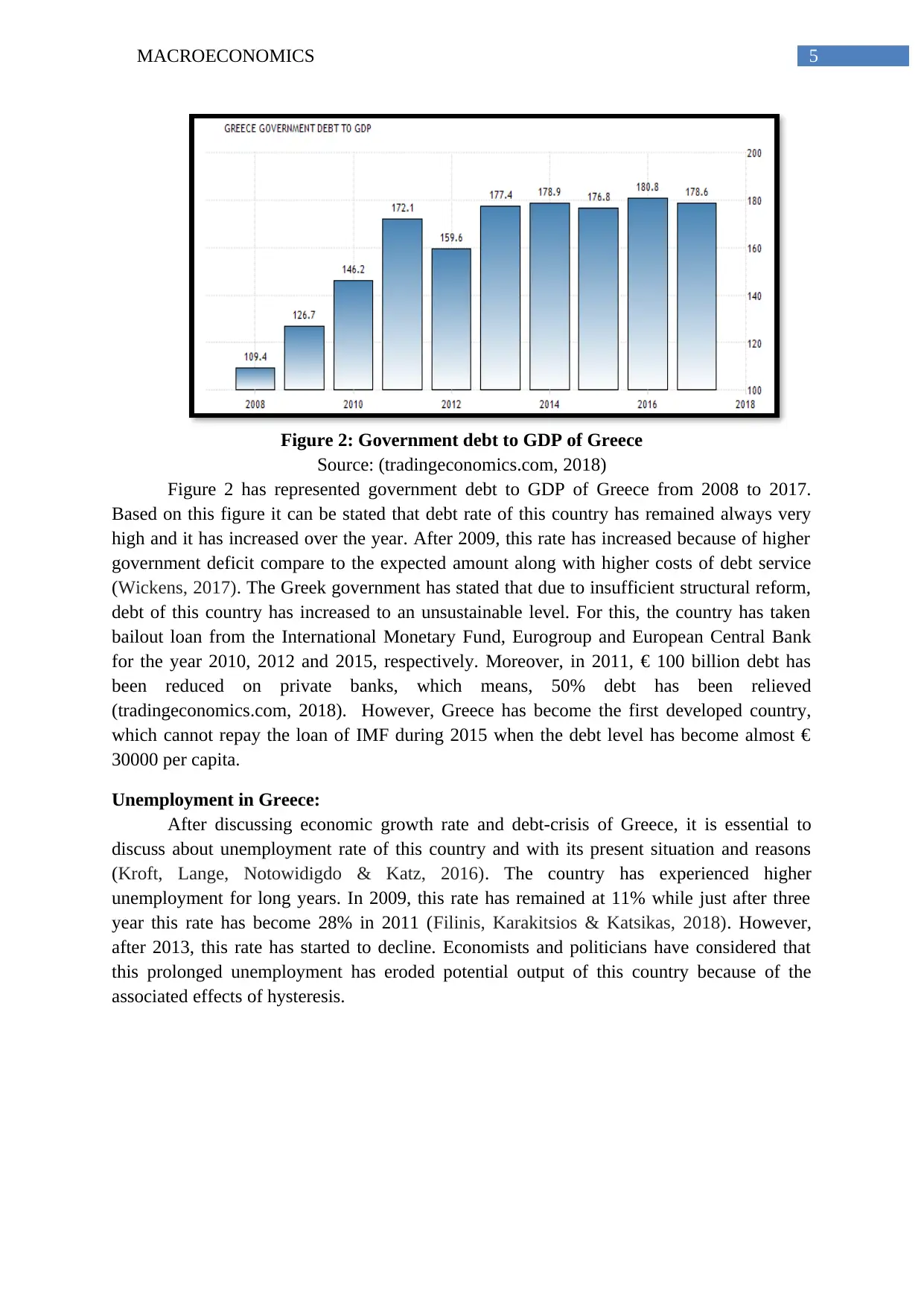

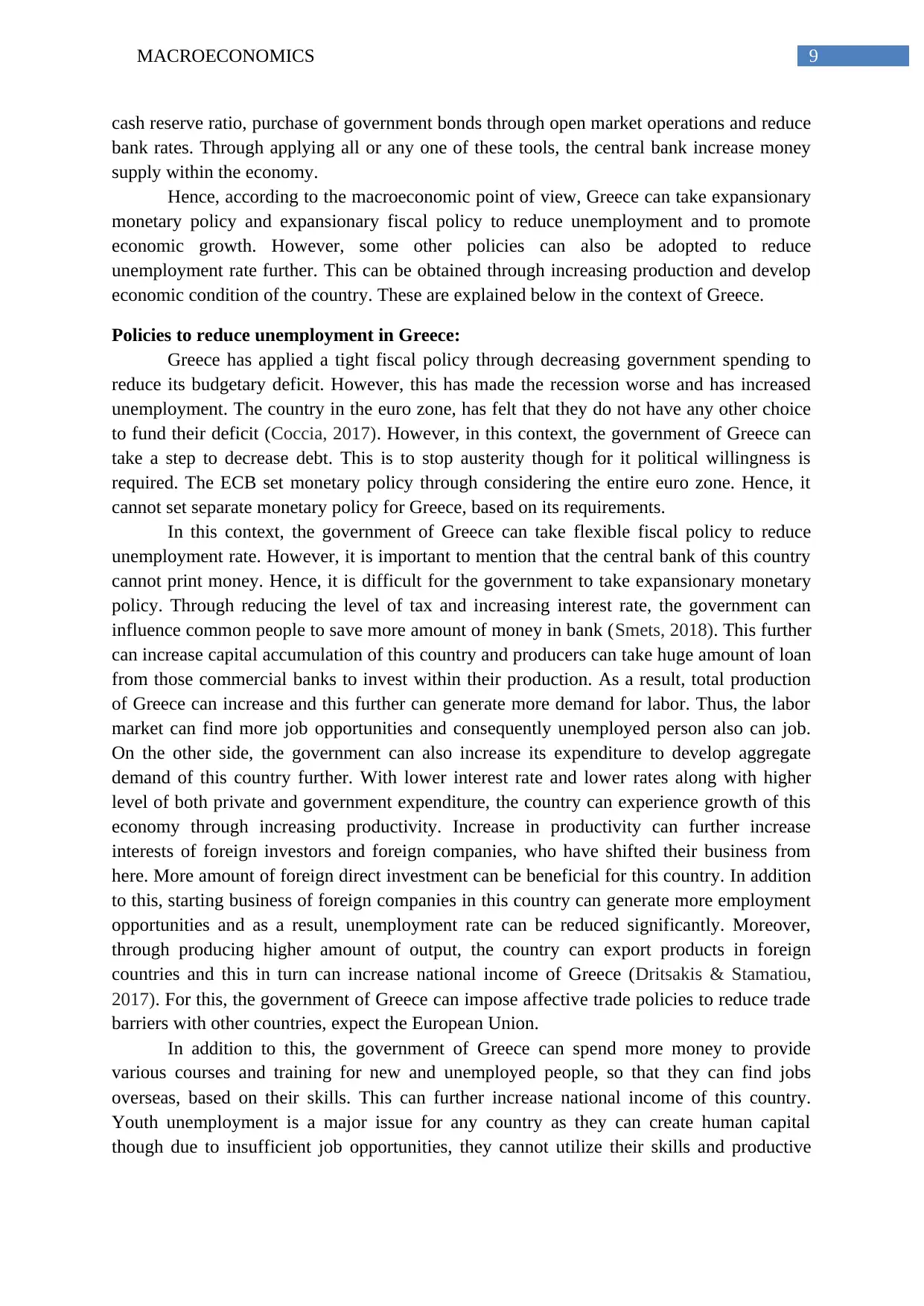

can be described with the help of following diagram.

Figure 1: Economic growth of Greece

Source: (tradingeconomics.com, 2018)

Figure 1 has represented economic growth of Greece since 2008. According to this

diagram, it can be said that the growth rate of this country has entered into a negative phase

after 2008 and has fluctuated drastically. After global financial crisis of 2008, economic

growth of Greece has decreased significantly though this rate has touched its minimum point

during 2011 and 2012 and has become -10%. However, after 2012, economic growth has

started to improve again and in 2018 this growth rate of Greece has become 2%

(tradingeconomics.com, 2018).

Debt-crisis of Greece:

As a result, debt-crisis of this country has also increased significantly after 2007-

2008. After great recession, the Greek crisis has started and the country has become

structurally weak. This phenomenon has further generated crisis of confidence within other

countries of European Union, especially Germany. The government of Greek has increased

tax through 12 rounds, decreased spending and reformed from 2010 to 2016, which have

generated local riots and protests across the country (Ehrmann & Fratzscher, 2017).

Union. According to the report of IMF, Greece has ranked 49th and 39th for per capital

purchasing power parity and per capita nominal GDP across the world, respectively

(Drydakis, 2015). The economy of this developed country is chiefly based on service and

industrial sectors while agricultural sector contributes small portion to the country’s total

GDP. The chief industries of this country are tourism and shipping and consequently it has

become the 7th most visited country of the European Union and also 16th worldwide

(Papanikolaou, 2018). Within the EU, Greece has become an important producer of

agricultural product. However, due to Great recession and debt-crisis of the Greek

government along with debt crisis of Europe, economy of this country has decreased sharply

and consequently GDP growth rate of this country has entered in the negative phase

(Granados & Rodriguez, 2015). On the other side, public debt of this country has increased

significantly though after 2012, Greece has reduced its sovereign debt burden significantly

after negotiating the biggest debt restructure with private sector. Economic growth of Greece

can be described with the help of following diagram.

Figure 1: Economic growth of Greece

Source: (tradingeconomics.com, 2018)

Figure 1 has represented economic growth of Greece since 2008. According to this

diagram, it can be said that the growth rate of this country has entered into a negative phase

after 2008 and has fluctuated drastically. After global financial crisis of 2008, economic

growth of Greece has decreased significantly though this rate has touched its minimum point

during 2011 and 2012 and has become -10%. However, after 2012, economic growth has

started to improve again and in 2018 this growth rate of Greece has become 2%

(tradingeconomics.com, 2018).

Debt-crisis of Greece:

As a result, debt-crisis of this country has also increased significantly after 2007-

2008. After great recession, the Greek crisis has started and the country has become

structurally weak. This phenomenon has further generated crisis of confidence within other

countries of European Union, especially Germany. The government of Greek has increased

tax through 12 rounds, decreased spending and reformed from 2010 to 2016, which have

generated local riots and protests across the country (Ehrmann & Fratzscher, 2017).

5MACROECONOMICS

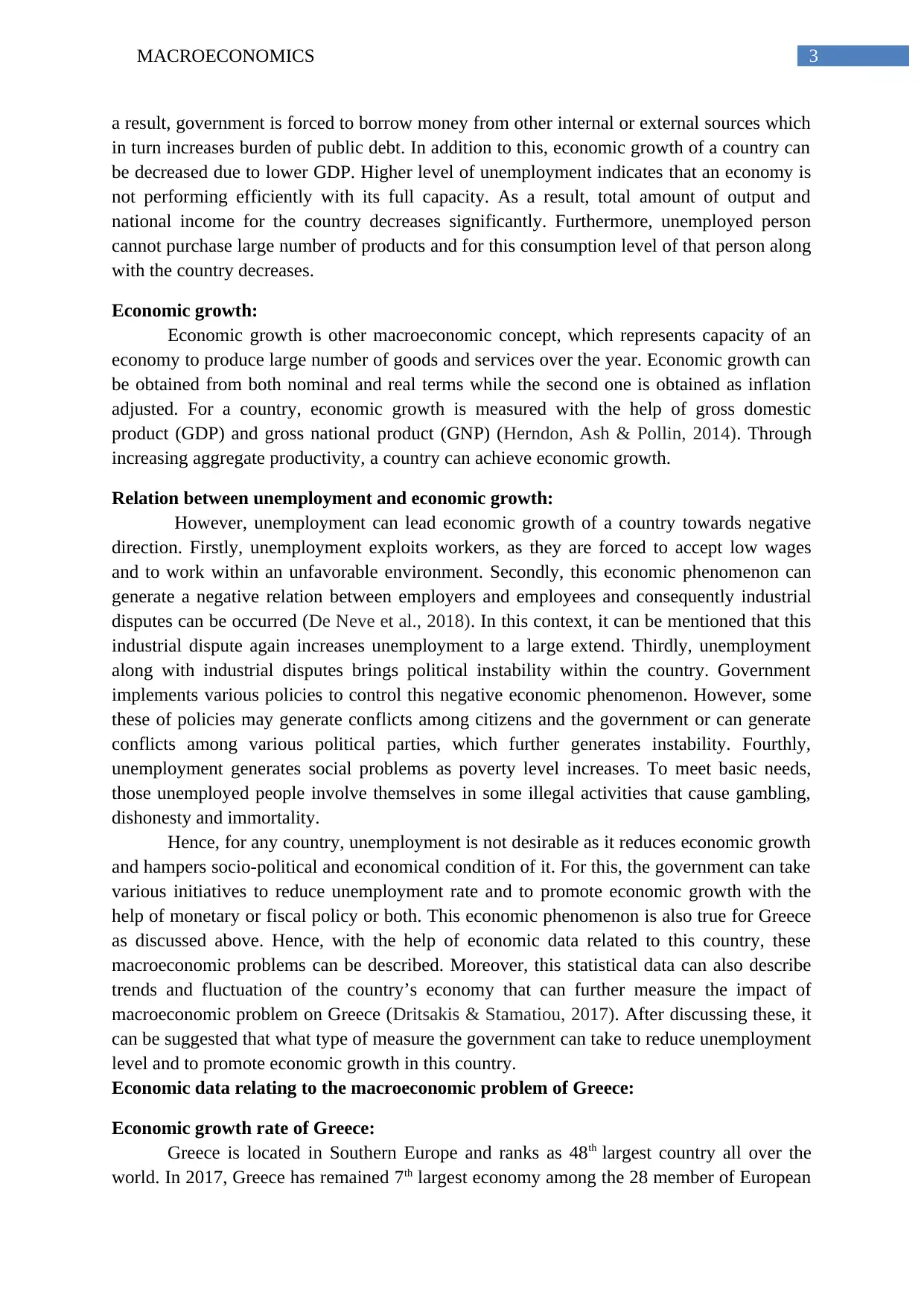

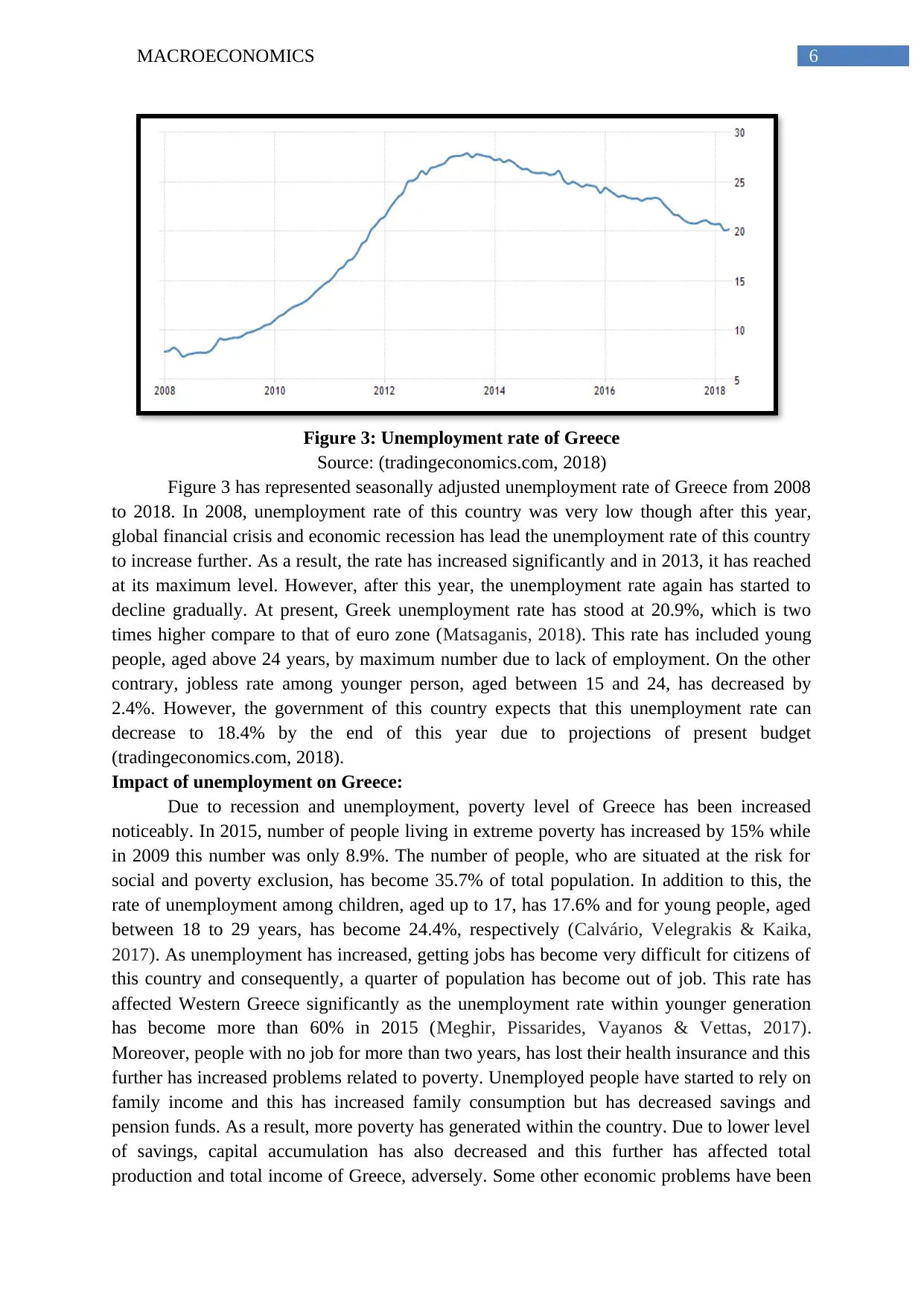

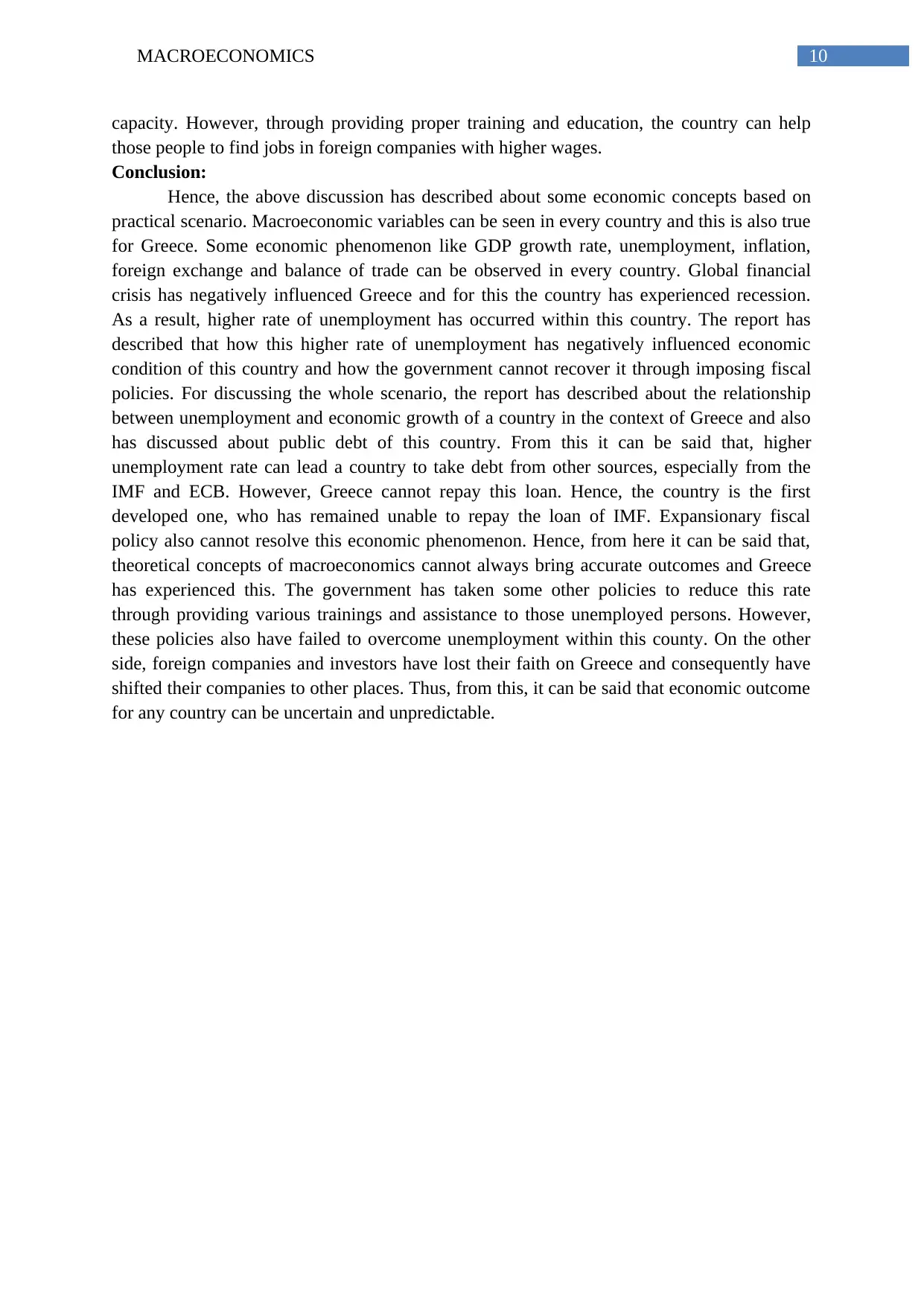

Figure 2: Government debt to GDP of Greece

Source: (tradingeconomics.com, 2018)

Figure 2 has represented government debt to GDP of Greece from 2008 to 2017.

Based on this figure it can be stated that debt rate of this country has remained always very

high and it has increased over the year. After 2009, this rate has increased because of higher

government deficit compare to the expected amount along with higher costs of debt service

(Wickens, 2017). The Greek government has stated that due to insufficient structural reform,

debt of this country has increased to an unsustainable level. For this, the country has taken

bailout loan from the International Monetary Fund, Eurogroup and European Central Bank

for the year 2010, 2012 and 2015, respectively. Moreover, in 2011, € 100 billion debt has

been reduced on private banks, which means, 50% debt has been relieved

(tradingeconomics.com, 2018). However, Greece has become the first developed country,

which cannot repay the loan of IMF during 2015 when the debt level has become almost €

30000 per capita.

Unemployment in Greece:

After discussing economic growth rate and debt-crisis of Greece, it is essential to

discuss about unemployment rate of this country and with its present situation and reasons

(Kroft, Lange, Notowidigdo & Katz, 2016). The country has experienced higher

unemployment for long years. In 2009, this rate has remained at 11% while just after three

year this rate has become 28% in 2011 (Filinis, Karakitsios & Katsikas, 2018). However,

after 2013, this rate has started to decline. Economists and politicians have considered that

this prolonged unemployment has eroded potential output of this country because of the

associated effects of hysteresis.

Figure 2: Government debt to GDP of Greece

Source: (tradingeconomics.com, 2018)

Figure 2 has represented government debt to GDP of Greece from 2008 to 2017.

Based on this figure it can be stated that debt rate of this country has remained always very

high and it has increased over the year. After 2009, this rate has increased because of higher

government deficit compare to the expected amount along with higher costs of debt service

(Wickens, 2017). The Greek government has stated that due to insufficient structural reform,

debt of this country has increased to an unsustainable level. For this, the country has taken

bailout loan from the International Monetary Fund, Eurogroup and European Central Bank

for the year 2010, 2012 and 2015, respectively. Moreover, in 2011, € 100 billion debt has

been reduced on private banks, which means, 50% debt has been relieved

(tradingeconomics.com, 2018). However, Greece has become the first developed country,

which cannot repay the loan of IMF during 2015 when the debt level has become almost €

30000 per capita.

Unemployment in Greece:

After discussing economic growth rate and debt-crisis of Greece, it is essential to

discuss about unemployment rate of this country and with its present situation and reasons

(Kroft, Lange, Notowidigdo & Katz, 2016). The country has experienced higher

unemployment for long years. In 2009, this rate has remained at 11% while just after three

year this rate has become 28% in 2011 (Filinis, Karakitsios & Katsikas, 2018). However,

after 2013, this rate has started to decline. Economists and politicians have considered that

this prolonged unemployment has eroded potential output of this country because of the

associated effects of hysteresis.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6MACROECONOMICS

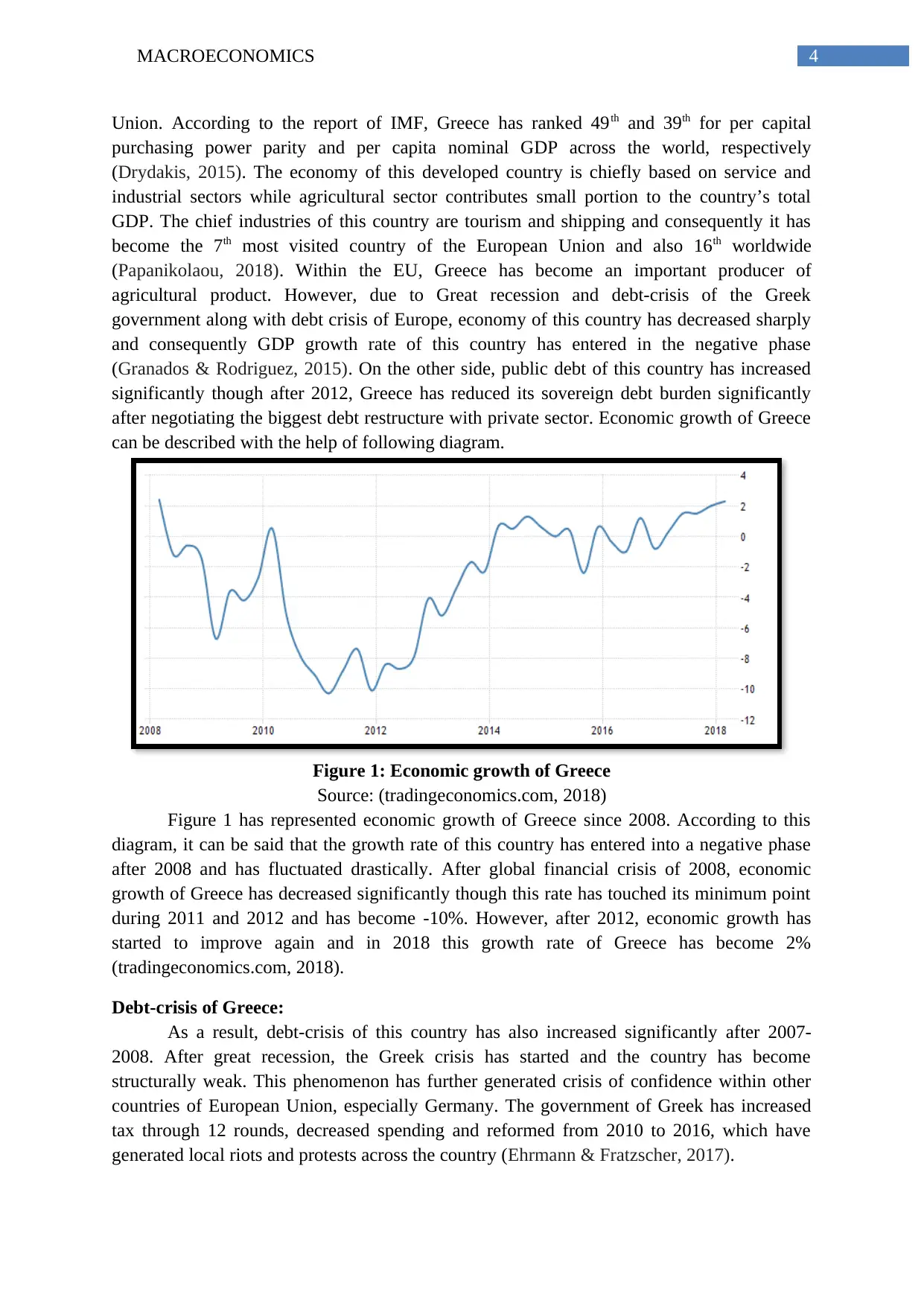

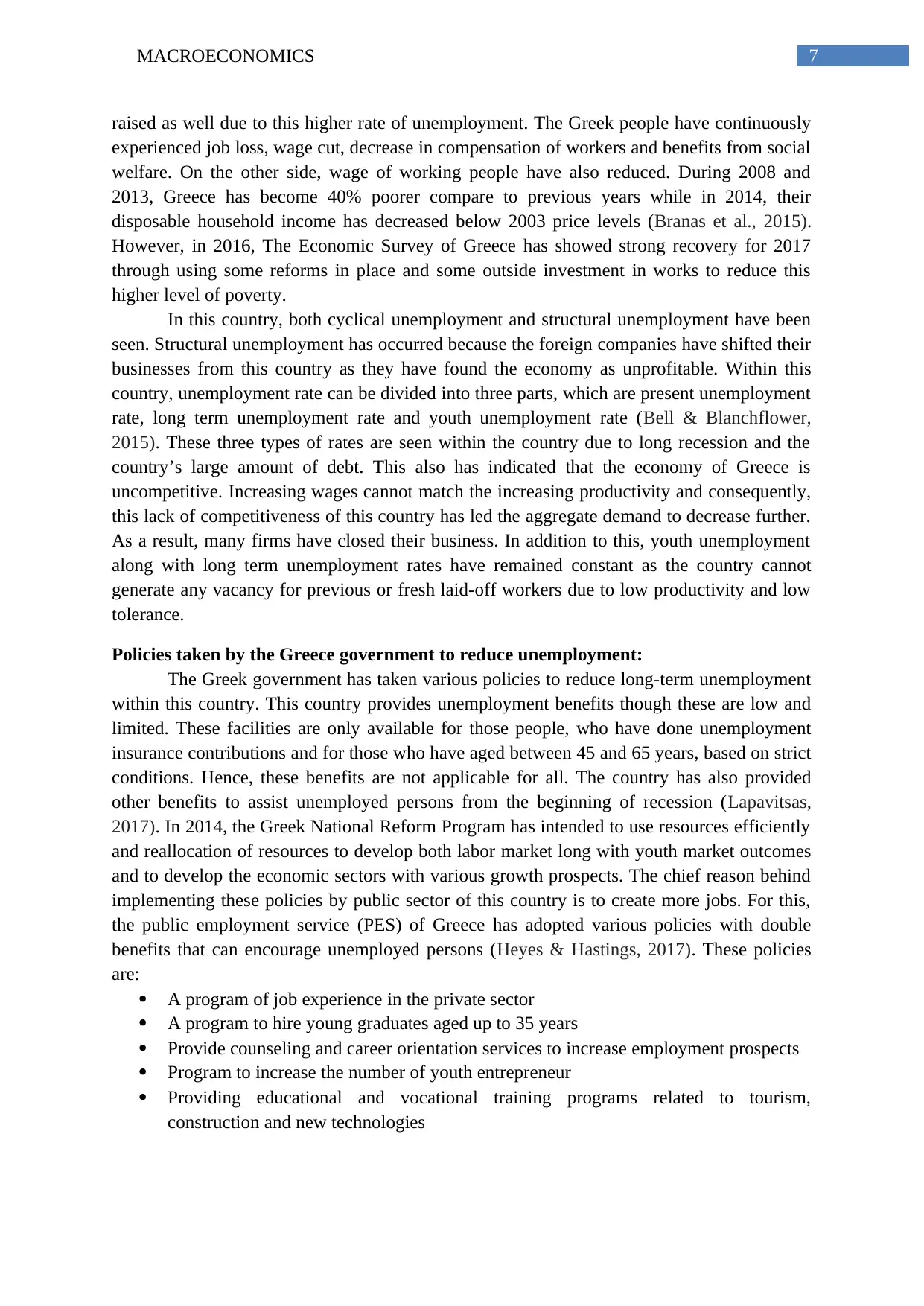

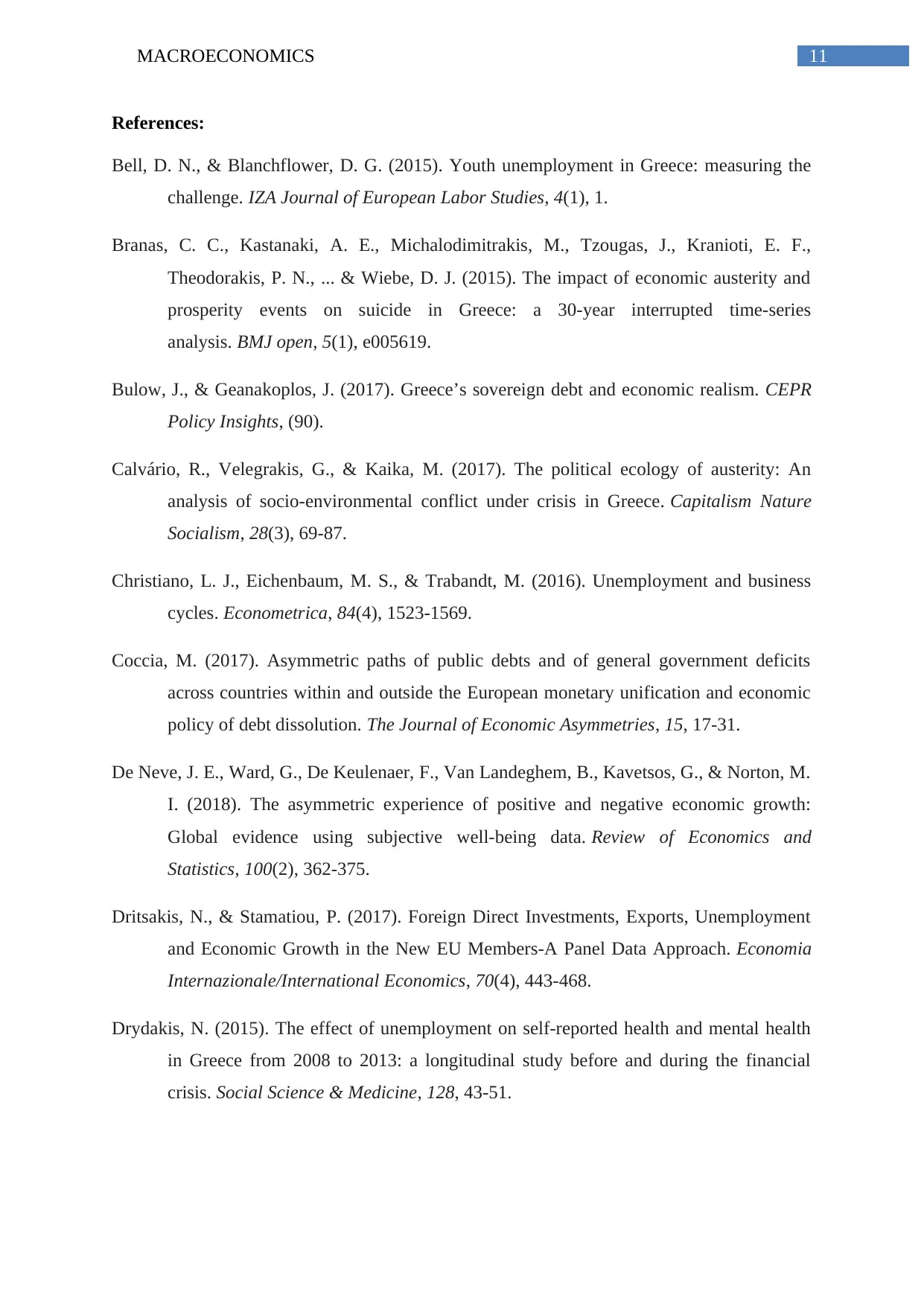

Figure 3: Unemployment rate of Greece

Source: (tradingeconomics.com, 2018)

Figure 3 has represented seasonally adjusted unemployment rate of Greece from 2008

to 2018. In 2008, unemployment rate of this country was very low though after this year,

global financial crisis and economic recession has lead the unemployment rate of this country

to increase further. As a result, the rate has increased significantly and in 2013, it has reached

at its maximum level. However, after this year, the unemployment rate again has started to

decline gradually. At present, Greek unemployment rate has stood at 20.9%, which is two

times higher compare to that of euro zone (Matsaganis, 2018). This rate has included young

people, aged above 24 years, by maximum number due to lack of employment. On the other

contrary, jobless rate among younger person, aged between 15 and 24, has decreased by

2.4%. However, the government of this country expects that this unemployment rate can

decrease to 18.4% by the end of this year due to projections of present budget

(tradingeconomics.com, 2018).

Impact of unemployment on Greece:

Due to recession and unemployment, poverty level of Greece has been increased

noticeably. In 2015, number of people living in extreme poverty has increased by 15% while

in 2009 this number was only 8.9%. The number of people, who are situated at the risk for

social and poverty exclusion, has become 35.7% of total population. In addition to this, the

rate of unemployment among children, aged up to 17, has 17.6% and for young people, aged

between 18 to 29 years, has become 24.4%, respectively (Calvário, Velegrakis & Kaika,

2017). As unemployment has increased, getting jobs has become very difficult for citizens of

this country and consequently, a quarter of population has become out of job. This rate has

affected Western Greece significantly as the unemployment rate within younger generation

has become more than 60% in 2015 (Meghir, Pissarides, Vayanos & Vettas, 2017).

Moreover, people with no job for more than two years, has lost their health insurance and this

further has increased problems related to poverty. Unemployed people have started to rely on

family income and this has increased family consumption but has decreased savings and

pension funds. As a result, more poverty has generated within the country. Due to lower level

of savings, capital accumulation has also decreased and this further has affected total

production and total income of Greece, adversely. Some other economic problems have been

Figure 3: Unemployment rate of Greece

Source: (tradingeconomics.com, 2018)

Figure 3 has represented seasonally adjusted unemployment rate of Greece from 2008

to 2018. In 2008, unemployment rate of this country was very low though after this year,

global financial crisis and economic recession has lead the unemployment rate of this country

to increase further. As a result, the rate has increased significantly and in 2013, it has reached

at its maximum level. However, after this year, the unemployment rate again has started to

decline gradually. At present, Greek unemployment rate has stood at 20.9%, which is two

times higher compare to that of euro zone (Matsaganis, 2018). This rate has included young

people, aged above 24 years, by maximum number due to lack of employment. On the other

contrary, jobless rate among younger person, aged between 15 and 24, has decreased by

2.4%. However, the government of this country expects that this unemployment rate can

decrease to 18.4% by the end of this year due to projections of present budget

(tradingeconomics.com, 2018).

Impact of unemployment on Greece:

Due to recession and unemployment, poverty level of Greece has been increased

noticeably. In 2015, number of people living in extreme poverty has increased by 15% while

in 2009 this number was only 8.9%. The number of people, who are situated at the risk for

social and poverty exclusion, has become 35.7% of total population. In addition to this, the

rate of unemployment among children, aged up to 17, has 17.6% and for young people, aged

between 18 to 29 years, has become 24.4%, respectively (Calvário, Velegrakis & Kaika,

2017). As unemployment has increased, getting jobs has become very difficult for citizens of

this country and consequently, a quarter of population has become out of job. This rate has

affected Western Greece significantly as the unemployment rate within younger generation

has become more than 60% in 2015 (Meghir, Pissarides, Vayanos & Vettas, 2017).

Moreover, people with no job for more than two years, has lost their health insurance and this

further has increased problems related to poverty. Unemployed people have started to rely on

family income and this has increased family consumption but has decreased savings and

pension funds. As a result, more poverty has generated within the country. Due to lower level

of savings, capital accumulation has also decreased and this further has affected total

production and total income of Greece, adversely. Some other economic problems have been

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7MACROECONOMICS

raised as well due to this higher rate of unemployment. The Greek people have continuously

experienced job loss, wage cut, decrease in compensation of workers and benefits from social

welfare. On the other side, wage of working people have also reduced. During 2008 and

2013, Greece has become 40% poorer compare to previous years while in 2014, their

disposable household income has decreased below 2003 price levels (Branas et al., 2015).

However, in 2016, The Economic Survey of Greece has showed strong recovery for 2017

through using some reforms in place and some outside investment in works to reduce this

higher level of poverty.

In this country, both cyclical unemployment and structural unemployment have been

seen. Structural unemployment has occurred because the foreign companies have shifted their

businesses from this country as they have found the economy as unprofitable. Within this

country, unemployment rate can be divided into three parts, which are present unemployment

rate, long term unemployment rate and youth unemployment rate (Bell & Blanchflower,

2015). These three types of rates are seen within the country due to long recession and the

country’s large amount of debt. This also has indicated that the economy of Greece is

uncompetitive. Increasing wages cannot match the increasing productivity and consequently,

this lack of competitiveness of this country has led the aggregate demand to decrease further.

As a result, many firms have closed their business. In addition to this, youth unemployment

along with long term unemployment rates have remained constant as the country cannot

generate any vacancy for previous or fresh laid-off workers due to low productivity and low

tolerance.

Policies taken by the Greece government to reduce unemployment:

The Greek government has taken various policies to reduce long-term unemployment

within this country. This country provides unemployment benefits though these are low and

limited. These facilities are only available for those people, who have done unemployment

insurance contributions and for those who have aged between 45 and 65 years, based on strict

conditions. Hence, these benefits are not applicable for all. The country has also provided

other benefits to assist unemployed persons from the beginning of recession (Lapavitsas,

2017). In 2014, the Greek National Reform Program has intended to use resources efficiently

and reallocation of resources to develop both labor market long with youth market outcomes

and to develop the economic sectors with various growth prospects. The chief reason behind

implementing these policies by public sector of this country is to create more jobs. For this,

the public employment service (PES) of Greece has adopted various policies with double

benefits that can encourage unemployed persons (Heyes & Hastings, 2017). These policies

are:

A program of job experience in the private sector

A program to hire young graduates aged up to 35 years

Provide counseling and career orientation services to increase employment prospects

Program to increase the number of youth entrepreneur

Providing educational and vocational training programs related to tourism,

construction and new technologies

raised as well due to this higher rate of unemployment. The Greek people have continuously

experienced job loss, wage cut, decrease in compensation of workers and benefits from social

welfare. On the other side, wage of working people have also reduced. During 2008 and

2013, Greece has become 40% poorer compare to previous years while in 2014, their

disposable household income has decreased below 2003 price levels (Branas et al., 2015).

However, in 2016, The Economic Survey of Greece has showed strong recovery for 2017

through using some reforms in place and some outside investment in works to reduce this

higher level of poverty.

In this country, both cyclical unemployment and structural unemployment have been

seen. Structural unemployment has occurred because the foreign companies have shifted their

businesses from this country as they have found the economy as unprofitable. Within this

country, unemployment rate can be divided into three parts, which are present unemployment

rate, long term unemployment rate and youth unemployment rate (Bell & Blanchflower,

2015). These three types of rates are seen within the country due to long recession and the

country’s large amount of debt. This also has indicated that the economy of Greece is

uncompetitive. Increasing wages cannot match the increasing productivity and consequently,

this lack of competitiveness of this country has led the aggregate demand to decrease further.

As a result, many firms have closed their business. In addition to this, youth unemployment

along with long term unemployment rates have remained constant as the country cannot

generate any vacancy for previous or fresh laid-off workers due to low productivity and low

tolerance.

Policies taken by the Greece government to reduce unemployment:

The Greek government has taken various policies to reduce long-term unemployment

within this country. This country provides unemployment benefits though these are low and

limited. These facilities are only available for those people, who have done unemployment

insurance contributions and for those who have aged between 45 and 65 years, based on strict

conditions. Hence, these benefits are not applicable for all. The country has also provided

other benefits to assist unemployed persons from the beginning of recession (Lapavitsas,

2017). In 2014, the Greek National Reform Program has intended to use resources efficiently

and reallocation of resources to develop both labor market long with youth market outcomes

and to develop the economic sectors with various growth prospects. The chief reason behind

implementing these policies by public sector of this country is to create more jobs. For this,

the public employment service (PES) of Greece has adopted various policies with double

benefits that can encourage unemployed persons (Heyes & Hastings, 2017). These policies

are:

A program of job experience in the private sector

A program to hire young graduates aged up to 35 years

Provide counseling and career orientation services to increase employment prospects

Program to increase the number of youth entrepreneur

Providing educational and vocational training programs related to tourism,

construction and new technologies

8MACROECONOMICS

Proposed measurement to overcome problems:

In 2009, when economic crisis started in Greece, no one could realize the duration and

impact of it. However, the country has experienced higher rate unemployment as the most

tremendous outcome, occurred from this crisis and recession. The International Monetary

Fund (IMF), European Union (EU) and European Central Bank (ECB) have constituted

Troika, to experience rigidity in labor market and unemployment, with the help of some

restructured measures (Kosmidou, Kousenidis & Negakis, 2015). However, the outcome has

become unexpected. Higher rate of unemployment along with austerity measures have

adversely influenced individuals, economy and society.

It has been realized by the IMF, EU and ECB that some fundamental reforms are

required to restructure labor market of this country. However, huge goals and contractionary

fiscal policy, taken by Troika for adjusting budget, have negatively influenced the labor

market. The strict measures have led many people to lose their jobs.

Fiscal policy:

Through fiscal policy, the government can adjust its level of expenditure and tax rates

to control and influence a country’s economic condition. According to Keynes, the

government can influence a production level of a country through changing public

expenditure and tax levels (Jordà & Taylor, 2016). As a result, the inflation rate of a country

decreases while employment and value of money increase. Hence, to mange economic

condition of a country, this policy plays an important role. When a country experiences

similar condition as Greece, the government can adopt contractionary fiscal policy. By

decreasing tax rates, it can increase consumer spending. At the same time, by increasing

public expenditure, the government can increase aggregate demand of the country (Rendahl,

2016). This further can increase productivity of the nation and this in turn can increase

demand for workers. Hence, with the help of this fiscal policy, government can generate

more employment opportunity along with higher wages.

However, fiscal policy depends chiefly on goals of policymakers and political

orientations. Hence, for all countries, this policy does not affect equally. Sometimes, tax cut

can influence only a particular group of people. This is also true when the government

intends to expand total expenditure of the country. Thus, fiscal policy sometime can affect the

economy in a negative way.

Monetary policy:

The central bank of any country takes monetary policy to determine size and growth

rate of money supply that further can affect interest rates. This policy considers various

actions like interest rate modification, transaction of government bonds and changing the rate

of cash reserved kept by commercial banks. Monetary policy can be of two types, which are,

contractionary and expansionary (Wu & Xia, 2016). To reduce unemployment and to

increase consumer spending, the government takes expansionary monetary policy, which

increases money supply within economy. This in turn stimulates economic growth of the

country. After global financial crisis of 2008, central banks of many countries have applied

this type of monetary policy while interest rate has become zero or low (Ricci, 2015). To

apply this policy in an effective way, the central bank can apply various tools like decrease in

Proposed measurement to overcome problems:

In 2009, when economic crisis started in Greece, no one could realize the duration and

impact of it. However, the country has experienced higher rate unemployment as the most

tremendous outcome, occurred from this crisis and recession. The International Monetary

Fund (IMF), European Union (EU) and European Central Bank (ECB) have constituted

Troika, to experience rigidity in labor market and unemployment, with the help of some

restructured measures (Kosmidou, Kousenidis & Negakis, 2015). However, the outcome has

become unexpected. Higher rate of unemployment along with austerity measures have

adversely influenced individuals, economy and society.

It has been realized by the IMF, EU and ECB that some fundamental reforms are

required to restructure labor market of this country. However, huge goals and contractionary

fiscal policy, taken by Troika for adjusting budget, have negatively influenced the labor

market. The strict measures have led many people to lose their jobs.

Fiscal policy:

Through fiscal policy, the government can adjust its level of expenditure and tax rates

to control and influence a country’s economic condition. According to Keynes, the

government can influence a production level of a country through changing public

expenditure and tax levels (Jordà & Taylor, 2016). As a result, the inflation rate of a country

decreases while employment and value of money increase. Hence, to mange economic

condition of a country, this policy plays an important role. When a country experiences

similar condition as Greece, the government can adopt contractionary fiscal policy. By

decreasing tax rates, it can increase consumer spending. At the same time, by increasing

public expenditure, the government can increase aggregate demand of the country (Rendahl,

2016). This further can increase productivity of the nation and this in turn can increase

demand for workers. Hence, with the help of this fiscal policy, government can generate

more employment opportunity along with higher wages.

However, fiscal policy depends chiefly on goals of policymakers and political

orientations. Hence, for all countries, this policy does not affect equally. Sometimes, tax cut

can influence only a particular group of people. This is also true when the government

intends to expand total expenditure of the country. Thus, fiscal policy sometime can affect the

economy in a negative way.

Monetary policy:

The central bank of any country takes monetary policy to determine size and growth

rate of money supply that further can affect interest rates. This policy considers various

actions like interest rate modification, transaction of government bonds and changing the rate

of cash reserved kept by commercial banks. Monetary policy can be of two types, which are,

contractionary and expansionary (Wu & Xia, 2016). To reduce unemployment and to

increase consumer spending, the government takes expansionary monetary policy, which

increases money supply within economy. This in turn stimulates economic growth of the

country. After global financial crisis of 2008, central banks of many countries have applied

this type of monetary policy while interest rate has become zero or low (Ricci, 2015). To

apply this policy in an effective way, the central bank can apply various tools like decrease in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9MACROECONOMICS

cash reserve ratio, purchase of government bonds through open market operations and reduce

bank rates. Through applying all or any one of these tools, the central bank increase money

supply within the economy.

Hence, according to the macroeconomic point of view, Greece can take expansionary

monetary policy and expansionary fiscal policy to reduce unemployment and to promote

economic growth. However, some other policies can also be adopted to reduce

unemployment rate further. This can be obtained through increasing production and develop

economic condition of the country. These are explained below in the context of Greece.

Policies to reduce unemployment in Greece:

Greece has applied a tight fiscal policy through decreasing government spending to

reduce its budgetary deficit. However, this has made the recession worse and has increased

unemployment. The country in the euro zone, has felt that they do not have any other choice

to fund their deficit (Coccia, 2017). However, in this context, the government of Greece can

take a step to decrease debt. This is to stop austerity though for it political willingness is

required. The ECB set monetary policy through considering the entire euro zone. Hence, it

cannot set separate monetary policy for Greece, based on its requirements.

In this context, the government of Greece can take flexible fiscal policy to reduce

unemployment rate. However, it is important to mention that the central bank of this country

cannot print money. Hence, it is difficult for the government to take expansionary monetary

policy. Through reducing the level of tax and increasing interest rate, the government can

influence common people to save more amount of money in bank (Smets, 2018). This further

can increase capital accumulation of this country and producers can take huge amount of loan

from those commercial banks to invest within their production. As a result, total production

of Greece can increase and this further can generate more demand for labor. Thus, the labor

market can find more job opportunities and consequently unemployed person also can job.

On the other side, the government can also increase its expenditure to develop aggregate

demand of this country further. With lower interest rate and lower rates along with higher

level of both private and government expenditure, the country can experience growth of this

economy through increasing productivity. Increase in productivity can further increase

interests of foreign investors and foreign companies, who have shifted their business from

here. More amount of foreign direct investment can be beneficial for this country. In addition

to this, starting business of foreign companies in this country can generate more employment

opportunities and as a result, unemployment rate can be reduced significantly. Moreover,

through producing higher amount of output, the country can export products in foreign

countries and this in turn can increase national income of Greece (Dritsakis & Stamatiou,

2017). For this, the government of Greece can impose affective trade policies to reduce trade

barriers with other countries, expect the European Union.

In addition to this, the government of Greece can spend more money to provide

various courses and training for new and unemployed people, so that they can find jobs

overseas, based on their skills. This can further increase national income of this country.

Youth unemployment is a major issue for any country as they can create human capital

though due to insufficient job opportunities, they cannot utilize their skills and productive

cash reserve ratio, purchase of government bonds through open market operations and reduce

bank rates. Through applying all or any one of these tools, the central bank increase money

supply within the economy.

Hence, according to the macroeconomic point of view, Greece can take expansionary

monetary policy and expansionary fiscal policy to reduce unemployment and to promote

economic growth. However, some other policies can also be adopted to reduce

unemployment rate further. This can be obtained through increasing production and develop

economic condition of the country. These are explained below in the context of Greece.

Policies to reduce unemployment in Greece:

Greece has applied a tight fiscal policy through decreasing government spending to

reduce its budgetary deficit. However, this has made the recession worse and has increased

unemployment. The country in the euro zone, has felt that they do not have any other choice

to fund their deficit (Coccia, 2017). However, in this context, the government of Greece can

take a step to decrease debt. This is to stop austerity though for it political willingness is

required. The ECB set monetary policy through considering the entire euro zone. Hence, it

cannot set separate monetary policy for Greece, based on its requirements.

In this context, the government of Greece can take flexible fiscal policy to reduce

unemployment rate. However, it is important to mention that the central bank of this country

cannot print money. Hence, it is difficult for the government to take expansionary monetary

policy. Through reducing the level of tax and increasing interest rate, the government can

influence common people to save more amount of money in bank (Smets, 2018). This further

can increase capital accumulation of this country and producers can take huge amount of loan

from those commercial banks to invest within their production. As a result, total production

of Greece can increase and this further can generate more demand for labor. Thus, the labor

market can find more job opportunities and consequently unemployed person also can job.

On the other side, the government can also increase its expenditure to develop aggregate

demand of this country further. With lower interest rate and lower rates along with higher

level of both private and government expenditure, the country can experience growth of this

economy through increasing productivity. Increase in productivity can further increase

interests of foreign investors and foreign companies, who have shifted their business from

here. More amount of foreign direct investment can be beneficial for this country. In addition

to this, starting business of foreign companies in this country can generate more employment

opportunities and as a result, unemployment rate can be reduced significantly. Moreover,

through producing higher amount of output, the country can export products in foreign

countries and this in turn can increase national income of Greece (Dritsakis & Stamatiou,

2017). For this, the government of Greece can impose affective trade policies to reduce trade

barriers with other countries, expect the European Union.

In addition to this, the government of Greece can spend more money to provide

various courses and training for new and unemployed people, so that they can find jobs

overseas, based on their skills. This can further increase national income of this country.

Youth unemployment is a major issue for any country as they can create human capital

though due to insufficient job opportunities, they cannot utilize their skills and productive

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10MACROECONOMICS

capacity. However, through providing proper training and education, the country can help

those people to find jobs in foreign companies with higher wages.

Conclusion:

Hence, the above discussion has described about some economic concepts based on

practical scenario. Macroeconomic variables can be seen in every country and this is also true

for Greece. Some economic phenomenon like GDP growth rate, unemployment, inflation,

foreign exchange and balance of trade can be observed in every country. Global financial

crisis has negatively influenced Greece and for this the country has experienced recession.

As a result, higher rate of unemployment has occurred within this country. The report has

described that how this higher rate of unemployment has negatively influenced economic

condition of this country and how the government cannot recover it through imposing fiscal

policies. For discussing the whole scenario, the report has described about the relationship

between unemployment and economic growth of a country in the context of Greece and also

has discussed about public debt of this country. From this it can be said that, higher

unemployment rate can lead a country to take debt from other sources, especially from the

IMF and ECB. However, Greece cannot repay this loan. Hence, the country is the first

developed one, who has remained unable to repay the loan of IMF. Expansionary fiscal

policy also cannot resolve this economic phenomenon. Hence, from here it can be said that,

theoretical concepts of macroeconomics cannot always bring accurate outcomes and Greece

has experienced this. The government has taken some other policies to reduce this rate

through providing various trainings and assistance to those unemployed persons. However,

these policies also have failed to overcome unemployment within this county. On the other

side, foreign companies and investors have lost their faith on Greece and consequently have

shifted their companies to other places. Thus, from this, it can be said that economic outcome

for any country can be uncertain and unpredictable.

capacity. However, through providing proper training and education, the country can help

those people to find jobs in foreign companies with higher wages.

Conclusion:

Hence, the above discussion has described about some economic concepts based on

practical scenario. Macroeconomic variables can be seen in every country and this is also true

for Greece. Some economic phenomenon like GDP growth rate, unemployment, inflation,

foreign exchange and balance of trade can be observed in every country. Global financial

crisis has negatively influenced Greece and for this the country has experienced recession.

As a result, higher rate of unemployment has occurred within this country. The report has

described that how this higher rate of unemployment has negatively influenced economic

condition of this country and how the government cannot recover it through imposing fiscal

policies. For discussing the whole scenario, the report has described about the relationship

between unemployment and economic growth of a country in the context of Greece and also

has discussed about public debt of this country. From this it can be said that, higher

unemployment rate can lead a country to take debt from other sources, especially from the

IMF and ECB. However, Greece cannot repay this loan. Hence, the country is the first

developed one, who has remained unable to repay the loan of IMF. Expansionary fiscal

policy also cannot resolve this economic phenomenon. Hence, from here it can be said that,

theoretical concepts of macroeconomics cannot always bring accurate outcomes and Greece

has experienced this. The government has taken some other policies to reduce this rate

through providing various trainings and assistance to those unemployed persons. However,

these policies also have failed to overcome unemployment within this county. On the other

side, foreign companies and investors have lost their faith on Greece and consequently have

shifted their companies to other places. Thus, from this, it can be said that economic outcome

for any country can be uncertain and unpredictable.

11MACROECONOMICS

References:

Bell, D. N., & Blanchflower, D. G. (2015). Youth unemployment in Greece: measuring the

challenge. IZA Journal of European Labor Studies, 4(1), 1.

Branas, C. C., Kastanaki, A. E., Michalodimitrakis, M., Tzougas, J., Kranioti, E. F.,

Theodorakis, P. N., ... & Wiebe, D. J. (2015). The impact of economic austerity and

prosperity events on suicide in Greece: a 30-year interrupted time-series

analysis. BMJ open, 5(1), e005619.

Bulow, J., & Geanakoplos, J. (2017). Greece’s sovereign debt and economic realism. CEPR

Policy Insights, (90).

Calvário, R., Velegrakis, G., & Kaika, M. (2017). The political ecology of austerity: An

analysis of socio-environmental conflict under crisis in Greece. Capitalism Nature

Socialism, 28(3), 69-87.

Christiano, L. J., Eichenbaum, M. S., & Trabandt, M. (2016). Unemployment and business

cycles. Econometrica, 84(4), 1523-1569.

Coccia, M. (2017). Asymmetric paths of public debts and of general government deficits

across countries within and outside the European monetary unification and economic

policy of debt dissolution. The Journal of Economic Asymmetries, 15, 17-31.

De Neve, J. E., Ward, G., De Keulenaer, F., Van Landeghem, B., Kavetsos, G., & Norton, M.

I. (2018). The asymmetric experience of positive and negative economic growth:

Global evidence using subjective well-being data. Review of Economics and

Statistics, 100(2), 362-375.

Dritsakis, N., & Stamatiou, P. (2017). Foreign Direct Investments, Exports, Unemployment

and Economic Growth in the New EU Members-A Panel Data Approach. Economia

Internazionale/International Economics, 70(4), 443-468.

Drydakis, N. (2015). The effect of unemployment on self-reported health and mental health

in Greece from 2008 to 2013: a longitudinal study before and during the financial

crisis. Social Science & Medicine, 128, 43-51.

References:

Bell, D. N., & Blanchflower, D. G. (2015). Youth unemployment in Greece: measuring the

challenge. IZA Journal of European Labor Studies, 4(1), 1.

Branas, C. C., Kastanaki, A. E., Michalodimitrakis, M., Tzougas, J., Kranioti, E. F.,

Theodorakis, P. N., ... & Wiebe, D. J. (2015). The impact of economic austerity and

prosperity events on suicide in Greece: a 30-year interrupted time-series

analysis. BMJ open, 5(1), e005619.

Bulow, J., & Geanakoplos, J. (2017). Greece’s sovereign debt and economic realism. CEPR

Policy Insights, (90).

Calvário, R., Velegrakis, G., & Kaika, M. (2017). The political ecology of austerity: An

analysis of socio-environmental conflict under crisis in Greece. Capitalism Nature

Socialism, 28(3), 69-87.

Christiano, L. J., Eichenbaum, M. S., & Trabandt, M. (2016). Unemployment and business

cycles. Econometrica, 84(4), 1523-1569.

Coccia, M. (2017). Asymmetric paths of public debts and of general government deficits

across countries within and outside the European monetary unification and economic

policy of debt dissolution. The Journal of Economic Asymmetries, 15, 17-31.

De Neve, J. E., Ward, G., De Keulenaer, F., Van Landeghem, B., Kavetsos, G., & Norton, M.

I. (2018). The asymmetric experience of positive and negative economic growth:

Global evidence using subjective well-being data. Review of Economics and

Statistics, 100(2), 362-375.

Dritsakis, N., & Stamatiou, P. (2017). Foreign Direct Investments, Exports, Unemployment

and Economic Growth in the New EU Members-A Panel Data Approach. Economia

Internazionale/International Economics, 70(4), 443-468.

Drydakis, N. (2015). The effect of unemployment on self-reported health and mental health

in Greece from 2008 to 2013: a longitudinal study before and during the financial

crisis. Social Science & Medicine, 128, 43-51.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.