The Impact of Interest Rate Changes and Brexit on the UK Economy

VerifiedAdded on 2023/04/21

|7

|1472

|453

Essay

AI Summary

This essay provides a comprehensive analysis of several key macroeconomic factors, primarily focusing on the impact of interest rate changes and Brexit on the UK economy. It begins by examining how decreasing interest rates influence macroeconomic variables such as household spending, investment levels, exchange rates, and inflation rates. The essay further discusses the concept of the zero lower bound interest rate, highlighting the challenges it poses for central banks in stimulating economic activity, particularly during crises. Lastly, it explores the multifaceted effects of Brexit on the UK's macroeconomy, including its potential impact on trade, foreign investment, labor mobility, and currency valuation. The analysis draws upon various economic theories and empirical evidence to provide a nuanced understanding of these complex macroeconomic relationships.

Running head: MACROECONOMICS

Macroeconomics

Name of the Student

Name of the University

Course ID

Macroeconomics

Name of the Student

Name of the University

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MACROECONOMICS

Table of Contents

Answer 7....................................................................................................................................2

Effect of decreased interest rate on the macro economy........................................................2

Answer 9....................................................................................................................................3

Zero lower bound interest......................................................................................................3

Answer 10..................................................................................................................................4

Effect of Brexit on UK macro economy................................................................................4

References..................................................................................................................................6

Table of Contents

Answer 7....................................................................................................................................2

Effect of decreased interest rate on the macro economy........................................................2

Answer 9....................................................................................................................................3

Zero lower bound interest......................................................................................................3

Answer 10..................................................................................................................................4

Effect of Brexit on UK macro economy................................................................................4

References..................................................................................................................................6

2MACROECONOMICS

Answer 7

Effect of decreased interest rate on the macro economy

Interest rate is one of the important macroeconomic variables reflecting the borrowing

cost of money in the form of cash, credit, stocks, bonds, mortgage and government

borrowing. As change in interest affects different macroeconomic variables, it is used as an

important instrument to influence economic growth of a nation (Goodwin et al. 2015).

Change in interest rate affects macro-economic variable such as spending, investment,

exchange rate, inflation rate, housing and asset market.

Spending of household depends on level of income. Households do not spend their

entire income for making purchase of different things in the economy. Part of the income is

saved. The tendency to save depends on the prevailing interest rate. As household earns

interest on saving, they tend to save more when interest rate is high. When there is a decrease

in interest rate, the opportunity cost of holding money reduces. This in in turn encourages

people to save less and spend more. A decline in interest rate thus increases household

spending, which in turn has a positive impact on aggregate demand and economic growth.

Interest rate also influence the level of investment. As interest rate is the cost of

borrowing, decrease in interest rate means a cheaper cost of borrowing. This encourages

firms and investors to borrow more in order to make purchase of large equipment (Agenor

and Montiel 2015). With increase in the level of investment, production expands contributing

to economic growth of the nation.

Another important macro variable gets affected from a decrease in interest rate is

exchange rate. A lower interest rate makes it less attractive to save money in the concerned

currency denomination. This reduce demand domestic currency causing a decline in relative

Answer 7

Effect of decreased interest rate on the macro economy

Interest rate is one of the important macroeconomic variables reflecting the borrowing

cost of money in the form of cash, credit, stocks, bonds, mortgage and government

borrowing. As change in interest affects different macroeconomic variables, it is used as an

important instrument to influence economic growth of a nation (Goodwin et al. 2015).

Change in interest rate affects macro-economic variable such as spending, investment,

exchange rate, inflation rate, housing and asset market.

Spending of household depends on level of income. Households do not spend their

entire income for making purchase of different things in the economy. Part of the income is

saved. The tendency to save depends on the prevailing interest rate. As household earns

interest on saving, they tend to save more when interest rate is high. When there is a decrease

in interest rate, the opportunity cost of holding money reduces. This in in turn encourages

people to save less and spend more. A decline in interest rate thus increases household

spending, which in turn has a positive impact on aggregate demand and economic growth.

Interest rate also influence the level of investment. As interest rate is the cost of

borrowing, decrease in interest rate means a cheaper cost of borrowing. This encourages

firms and investors to borrow more in order to make purchase of large equipment (Agenor

and Montiel 2015). With increase in the level of investment, production expands contributing

to economic growth of the nation.

Another important macro variable gets affected from a decrease in interest rate is

exchange rate. A lower interest rate makes it less attractive to save money in the concerned

currency denomination. This reduce demand domestic currency causing a decline in relative

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MACROECONOMICS

price of currency. A depreciated currency makes export more competitive while making

imports more expensive.

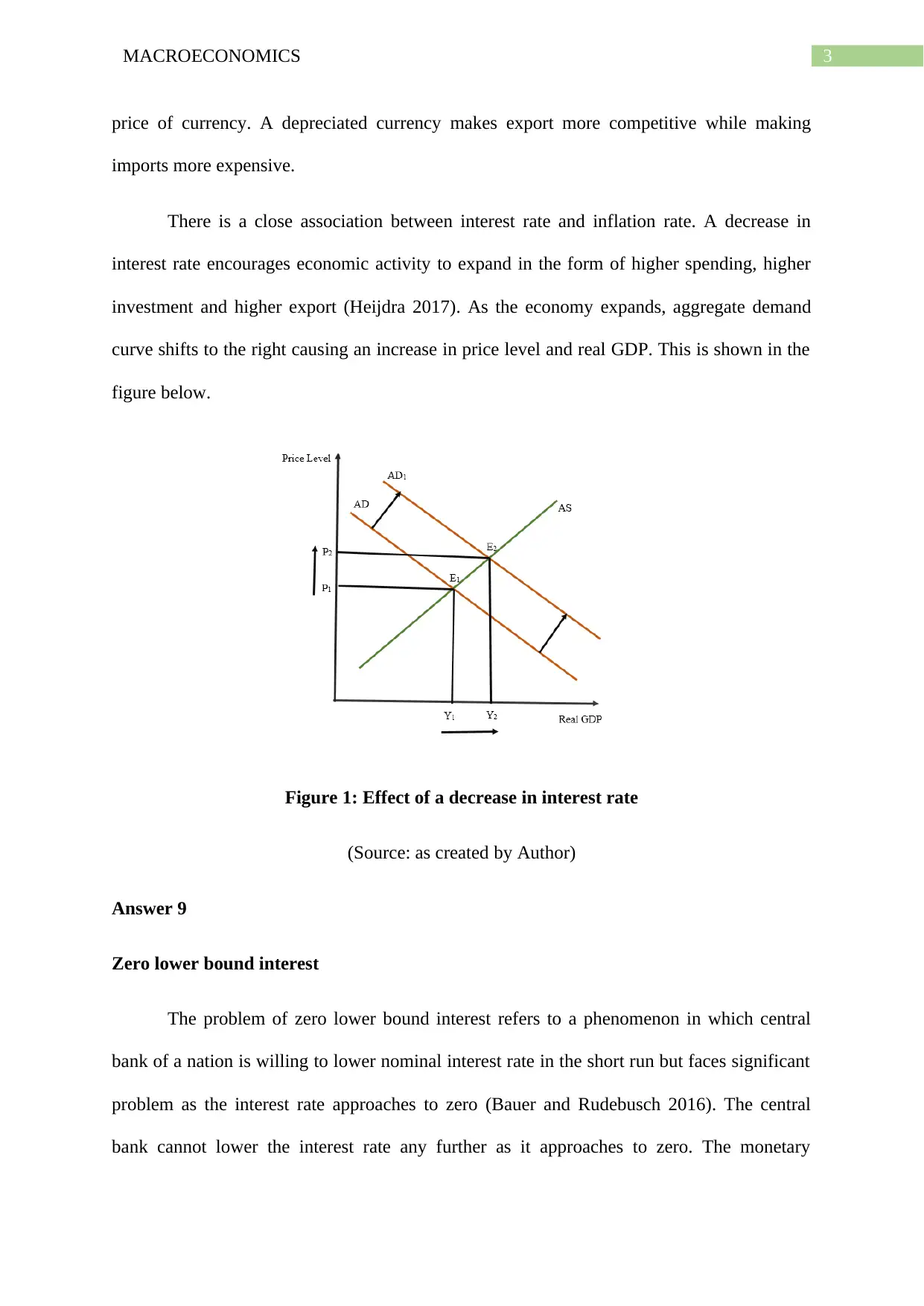

There is a close association between interest rate and inflation rate. A decrease in

interest rate encourages economic activity to expand in the form of higher spending, higher

investment and higher export (Heijdra 2017). As the economy expands, aggregate demand

curve shifts to the right causing an increase in price level and real GDP. This is shown in the

figure below.

Figure 1: Effect of a decrease in interest rate

(Source: as created by Author)

Answer 9

Zero lower bound interest

The problem of zero lower bound interest refers to a phenomenon in which central

bank of a nation is willing to lower nominal interest rate in the short run but faces significant

problem as the interest rate approaches to zero (Bauer and Rudebusch 2016). The central

bank cannot lower the interest rate any further as it approaches to zero. The monetary

price of currency. A depreciated currency makes export more competitive while making

imports more expensive.

There is a close association between interest rate and inflation rate. A decrease in

interest rate encourages economic activity to expand in the form of higher spending, higher

investment and higher export (Heijdra 2017). As the economy expands, aggregate demand

curve shifts to the right causing an increase in price level and real GDP. This is shown in the

figure below.

Figure 1: Effect of a decrease in interest rate

(Source: as created by Author)

Answer 9

Zero lower bound interest

The problem of zero lower bound interest refers to a phenomenon in which central

bank of a nation is willing to lower nominal interest rate in the short run but faces significant

problem as the interest rate approaches to zero (Bauer and Rudebusch 2016). The central

bank cannot lower the interest rate any further as it approaches to zero. The monetary

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4MACROECONOMICS

authority though would prefer to lower interest rate further to stabilize the economy but

cannot do so as interest rate cannot go below zero. There are several reasons for which

interest rate cannot be set below zero. Firstly, once the interest rate approaches to zero or

even below that, the situation would induce people to withdraw money from the commercial

banks and hold it in the form of cash as it would give zero nominal return instead of negative

return that they would receive otherwise (Fernandez-Villaverde et al. 2015). People

withdraws their money from the accounts as the negative returns that the deposited money

incurs leads to a deduction of funds instead of adding a positive interest amount. The zero

lower bound interest actually limit the power of central bank to boost economic condition in

the desired direction.

The zero lower bound interest is a feared condition for the economy. This is because

of unfavorable events such as increase in cash holding, deflation, a decrease in commercial

banks’ return and other associated consequences. The problem of zero lower bound interest

was first realized in Japan during 1990s and more recently in the subprime mortgage crisis

held in 2008. The objective of central bank to lower interest rate is to increase inflationary

pressure (Nakata 2017). The advent of zero lower bound interest however does the reverse by

triggering deflation in the economy. Zero interest rate or rate closer to zero creates a

condition of liquidity trap. Under such a situation, the central bank’s policy to lower interest

rate become completely ineffective.

Answer 10

Effect of Brexit on UK macro economy

UK holds the membership in European Union since 1973. The membership in EU

gives several benefits to the UK economy. Now the proposal to leave European Union termed

as “Brexit” likely to affect the economy in several ways.

authority though would prefer to lower interest rate further to stabilize the economy but

cannot do so as interest rate cannot go below zero. There are several reasons for which

interest rate cannot be set below zero. Firstly, once the interest rate approaches to zero or

even below that, the situation would induce people to withdraw money from the commercial

banks and hold it in the form of cash as it would give zero nominal return instead of negative

return that they would receive otherwise (Fernandez-Villaverde et al. 2015). People

withdraws their money from the accounts as the negative returns that the deposited money

incurs leads to a deduction of funds instead of adding a positive interest amount. The zero

lower bound interest actually limit the power of central bank to boost economic condition in

the desired direction.

The zero lower bound interest is a feared condition for the economy. This is because

of unfavorable events such as increase in cash holding, deflation, a decrease in commercial

banks’ return and other associated consequences. The problem of zero lower bound interest

was first realized in Japan during 1990s and more recently in the subprime mortgage crisis

held in 2008. The objective of central bank to lower interest rate is to increase inflationary

pressure (Nakata 2017). The advent of zero lower bound interest however does the reverse by

triggering deflation in the economy. Zero interest rate or rate closer to zero creates a

condition of liquidity trap. Under such a situation, the central bank’s policy to lower interest

rate become completely ineffective.

Answer 10

Effect of Brexit on UK macro economy

UK holds the membership in European Union since 1973. The membership in EU

gives several benefits to the UK economy. Now the proposal to leave European Union termed

as “Brexit” likely to affect the economy in several ways.

5MACROECONOMICS

The first direct channel through which Brexit can affect UK economy is through

trade. UK currently enjoys a free trade with 28 European member countries exchanging a

large volume of export and import. UK’s export and import with EU countries account

respective share of 44.6 percent and 53.2 percent respectively (Dhingra et al. 2016). It UK

leaves EU, and then the nation may not be in a place to negotiate free trade deals with rest of

the EU nations. This ultimately leads to a trade diversion having an adverse effect on export

of UK.

Brexit would likely to interrupt the flow of fund between UK and EU. Many large

companies of Europe invest in UK. UK also earns large revenue from its investment in EU.

After Brexit, it would be less attractive for foreign investors to investors to invest. Many of

the foreign firms then could leave UK and return to EU border. The lower investment means

a contraction in economic activity causing economic growth to decline. Brexit would likely to

lower the relative price of pound causing the currency to depreciate.

An important issue related to Brexit is its impact on free movement of labor. Net

migration in UK is mostly from European countries. From an economic point of view,

immigration mostly has a positive impact as migrants are generally of working age and help

to fill the labor shortage in different areas of the economy such as cleaning, teaching, nursing

and plumbing. The Brexit is likely to make labor market less flexible (Gudgin et al. 2018). It

would give UK greater freedom to limit net immigration. Brexit would also make difficult for

UK nationals to work abroad.

The first direct channel through which Brexit can affect UK economy is through

trade. UK currently enjoys a free trade with 28 European member countries exchanging a

large volume of export and import. UK’s export and import with EU countries account

respective share of 44.6 percent and 53.2 percent respectively (Dhingra et al. 2016). It UK

leaves EU, and then the nation may not be in a place to negotiate free trade deals with rest of

the EU nations. This ultimately leads to a trade diversion having an adverse effect on export

of UK.

Brexit would likely to interrupt the flow of fund between UK and EU. Many large

companies of Europe invest in UK. UK also earns large revenue from its investment in EU.

After Brexit, it would be less attractive for foreign investors to investors to invest. Many of

the foreign firms then could leave UK and return to EU border. The lower investment means

a contraction in economic activity causing economic growth to decline. Brexit would likely to

lower the relative price of pound causing the currency to depreciate.

An important issue related to Brexit is its impact on free movement of labor. Net

migration in UK is mostly from European countries. From an economic point of view,

immigration mostly has a positive impact as migrants are generally of working age and help

to fill the labor shortage in different areas of the economy such as cleaning, teaching, nursing

and plumbing. The Brexit is likely to make labor market less flexible (Gudgin et al. 2018). It

would give UK greater freedom to limit net immigration. Brexit would also make difficult for

UK nationals to work abroad.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6MACROECONOMICS

References

Agenor, P.R. and Montiel, P.J., 2015. Development macroeconomics. Princeton University

Press.

Bauer, M.D. and Rudebusch, G.D., 2016. Monetary policy expectations at the zero lower

bound. Journal of Money, Credit and Banking, 48(7), pp.1439-1465.

Dhingra, S., Ottaviano, G., Sampson, T. and Van Reenen, J., 2016. The impact of Brexit on

foreign investment in the UK. BREXIT 2016, 24, p.2.

Fernandez-Villaverde, J., Gordon, G., Guerrón-Quintana, P. and Rubio-Ramirez, J.F., 2015.

Nonlinear adventures at the zero lower bound. Journal of Economic Dynamics and

Control, 57, pp.182-204.

Goodwin, N., Harris, J.M., Nelson, J.A., Roach, B. and Torras, M., 2015. Macroeconomics in

context. Routledge.

Gudgin, G., Coutts, K., Gibson, N. and Buchanan, J., 2018. The macro-economic impact of

Brexit: using the CBR macro-economic model of the UK economy (UKMOD). Journal of

Self-Governance and Management Economics, 6(2), pp.7-49.

Heijdra, B.J., 2017. Foundations of modern macroeconomics. Oxford university press.

Nakata, T., 2017. Uncertainty at the zero lower bound. American Economic Journal:

Macroeconomics, 9(3), pp.186-221.

References

Agenor, P.R. and Montiel, P.J., 2015. Development macroeconomics. Princeton University

Press.

Bauer, M.D. and Rudebusch, G.D., 2016. Monetary policy expectations at the zero lower

bound. Journal of Money, Credit and Banking, 48(7), pp.1439-1465.

Dhingra, S., Ottaviano, G., Sampson, T. and Van Reenen, J., 2016. The impact of Brexit on

foreign investment in the UK. BREXIT 2016, 24, p.2.

Fernandez-Villaverde, J., Gordon, G., Guerrón-Quintana, P. and Rubio-Ramirez, J.F., 2015.

Nonlinear adventures at the zero lower bound. Journal of Economic Dynamics and

Control, 57, pp.182-204.

Goodwin, N., Harris, J.M., Nelson, J.A., Roach, B. and Torras, M., 2015. Macroeconomics in

context. Routledge.

Gudgin, G., Coutts, K., Gibson, N. and Buchanan, J., 2018. The macro-economic impact of

Brexit: using the CBR macro-economic model of the UK economy (UKMOD). Journal of

Self-Governance and Management Economics, 6(2), pp.7-49.

Heijdra, B.J., 2017. Foundations of modern macroeconomics. Oxford university press.

Nakata, T., 2017. Uncertainty at the zero lower bound. American Economic Journal:

Macroeconomics, 9(3), pp.186-221.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.