Assignment: Manage Physical Assets (Finance) - University Name

VerifiedAdded on 2023/06/06

|37

|6268

|409

Homework Assignment

AI Summary

This assignment provides a comprehensive overview of managing physical assets within a financial framework. It begins by identifying various physical assets common in organizations, such as land, buildings, equipment, and vehicles. The assignment then explores the importance of asset registers, detailing the information they contain and the methods of depreciation applicable to different asset types. It delves into maintenance programs, comparing fix-on-fail, comprehensive, and preventive approaches, and outlines the factors to consider when establishing such programs. The assignment further examines environmental impacts, acquisition processes, and the role of financial statements in asset management decisions. It assesses the impact, effectiveness, and long-term performance of assets, along with techniques for reporting and identifying problems. The assignment also covers operational requirements, design specifications, supplier communication, and the benefits and drawbacks of asset purchases versus leasing, providing a thorough understanding of the financial aspects of physical asset management.

Running head: MANAGE PHYSICAL ASSETS (FINANCE)

Manage Physical Assets (Finance)

Name of the Student:

Name of the University:

Authors Note:

Manage Physical Assets (Finance)

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

MANAGE PHYSICAL ASSETS (FINANCE)

Contents

Section 1:.........................................................................................................................................2

Section 2:.........................................................................................................................................7

Section 3:.........................................................................................................................................9

Assessment task 3:.........................................................................................................................20

Task 1:.......................................................................................................................................20

Task 2:.......................................................................................................................................29

Task 3:.......................................................................................................................................32

References:....................................................................................................................................35

MANAGE PHYSICAL ASSETS (FINANCE)

Contents

Section 1:.........................................................................................................................................2

Section 2:.........................................................................................................................................7

Section 3:.........................................................................................................................................9

Assessment task 3:.........................................................................................................................20

Task 1:.......................................................................................................................................20

Task 2:.......................................................................................................................................29

Task 3:.......................................................................................................................................32

References:....................................................................................................................................35

2

MANAGE PHYSICAL ASSETS (FINANCE)

Section 1:

Answer 1:

In a work organization as well as in a training institute generally the following physical assets

can be identified:

I. Land.

II. Building.

III. Plant and equipment.

IV. Machinery.

V. Motor vehicles.

VI. Furniture.

VII. Computers.

VIII. Printer.

IX. Air conditioner.

X. Water purifier (Haggerty et. al. 2017).

Answer 2:

Two primary reasons to maintain asset registers are:

I. Asset register helps an organisation to keep track of its assets and thus, maintenance

of assets becomes easier.

II. To keep record of assets such as asset type, date of acquisition etc. for future

reference (Gardiner, 2014).

Answer 3:

MANAGE PHYSICAL ASSETS (FINANCE)

Section 1:

Answer 1:

In a work organization as well as in a training institute generally the following physical assets

can be identified:

I. Land.

II. Building.

III. Plant and equipment.

IV. Machinery.

V. Motor vehicles.

VI. Furniture.

VII. Computers.

VIII. Printer.

IX. Air conditioner.

X. Water purifier (Haggerty et. al. 2017).

Answer 2:

Two primary reasons to maintain asset registers are:

I. Asset register helps an organisation to keep track of its assets and thus, maintenance

of assets becomes easier.

II. To keep record of assets such as asset type, date of acquisition etc. for future

reference (Gardiner, 2014).

Answer 3:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

MANAGE PHYSICAL ASSETS (FINANCE)

Following are the eight details recorded in an asset register:

I. Asset name.

II. Asset type.

III. Asset specification.

IV. Date of acquisition of asset.

V. Identification code of the asset.

VI. Method of depreciation for the asset.

VII. Useful life of the asset.

VIII. Insurance details on the asset (Barney, 2017).

Answer 4:

In order to decide the method of depreciation applicable to each type of physical asset the most

important factor to be considered is the extent of use of such asset in the business. The useful life

of the asset is also another important consideration to be kept in mind while determining the

method of depreciation for a particular type of physical asset (Campbell, Jardine and McGlynn,

2016).

Answer 5:

The business objectives determines the extent of use of physical assets thus, the management of

such asset is very much dependant on business objectives. However, the general care and

protection of physical assets remain more or less similar irrespective of business objectives.

Answer 6:

MANAGE PHYSICAL ASSETS (FINANCE)

Following are the eight details recorded in an asset register:

I. Asset name.

II. Asset type.

III. Asset specification.

IV. Date of acquisition of asset.

V. Identification code of the asset.

VI. Method of depreciation for the asset.

VII. Useful life of the asset.

VIII. Insurance details on the asset (Barney, 2017).

Answer 4:

In order to decide the method of depreciation applicable to each type of physical asset the most

important factor to be considered is the extent of use of such asset in the business. The useful life

of the asset is also another important consideration to be kept in mind while determining the

method of depreciation for a particular type of physical asset (Campbell, Jardine and McGlynn,

2016).

Answer 5:

The business objectives determines the extent of use of physical assets thus, the management of

such asset is very much dependant on business objectives. However, the general care and

protection of physical assets remain more or less similar irrespective of business objectives.

Answer 6:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

MANAGE PHYSICAL ASSETS (FINANCE)

Fix on fail:

This is the maintenance program where the physical assets are used extensively without much

maintenance. The physical assets are only repaired and fixed when the assets failed to perform

the required services (Kahn and Lemmon, 2016).

Comprehensive:

In comprehensive maintenance program an organization makes a comprehensive maintenance

plan for physical assets to enhance the life of these assets. Regular maintenance and repairing

work is conducted in physical asset under the program. Thus, the amount of expenditures is

relatively higher under the program. However, the expected lives of physical assets increased

significantly as a result of such maintenance program.

Preventive maintenance program:

In preventive program extensive amount of expenditures is incurred on maintenance of physical

assets with the objective of preventing the break-down of physical assets (Gârleanu and

Pedersen, 2015).

Answer 7:

The list to be followed to establish a maintenance program:

I. The type of physical asset and its specification.

II. The type of work for which the asset is to be used.

III. The number of hours that the asset will be in use each day.

IV. The replacement available for the asset in the organization in case of any break-down.

V. The importance of the asset for the day to day operations in an organization.

MANAGE PHYSICAL ASSETS (FINANCE)

Fix on fail:

This is the maintenance program where the physical assets are used extensively without much

maintenance. The physical assets are only repaired and fixed when the assets failed to perform

the required services (Kahn and Lemmon, 2016).

Comprehensive:

In comprehensive maintenance program an organization makes a comprehensive maintenance

plan for physical assets to enhance the life of these assets. Regular maintenance and repairing

work is conducted in physical asset under the program. Thus, the amount of expenditures is

relatively higher under the program. However, the expected lives of physical assets increased

significantly as a result of such maintenance program.

Preventive maintenance program:

In preventive program extensive amount of expenditures is incurred on maintenance of physical

assets with the objective of preventing the break-down of physical assets (Gârleanu and

Pedersen, 2015).

Answer 7:

The list to be followed to establish a maintenance program:

I. The type of physical asset and its specification.

II. The type of work for which the asset is to be used.

III. The number of hours that the asset will be in use each day.

IV. The replacement available for the asset in the organization in case of any break-down.

V. The importance of the asset for the day to day operations in an organization.

5

MANAGE PHYSICAL ASSETS (FINANCE)

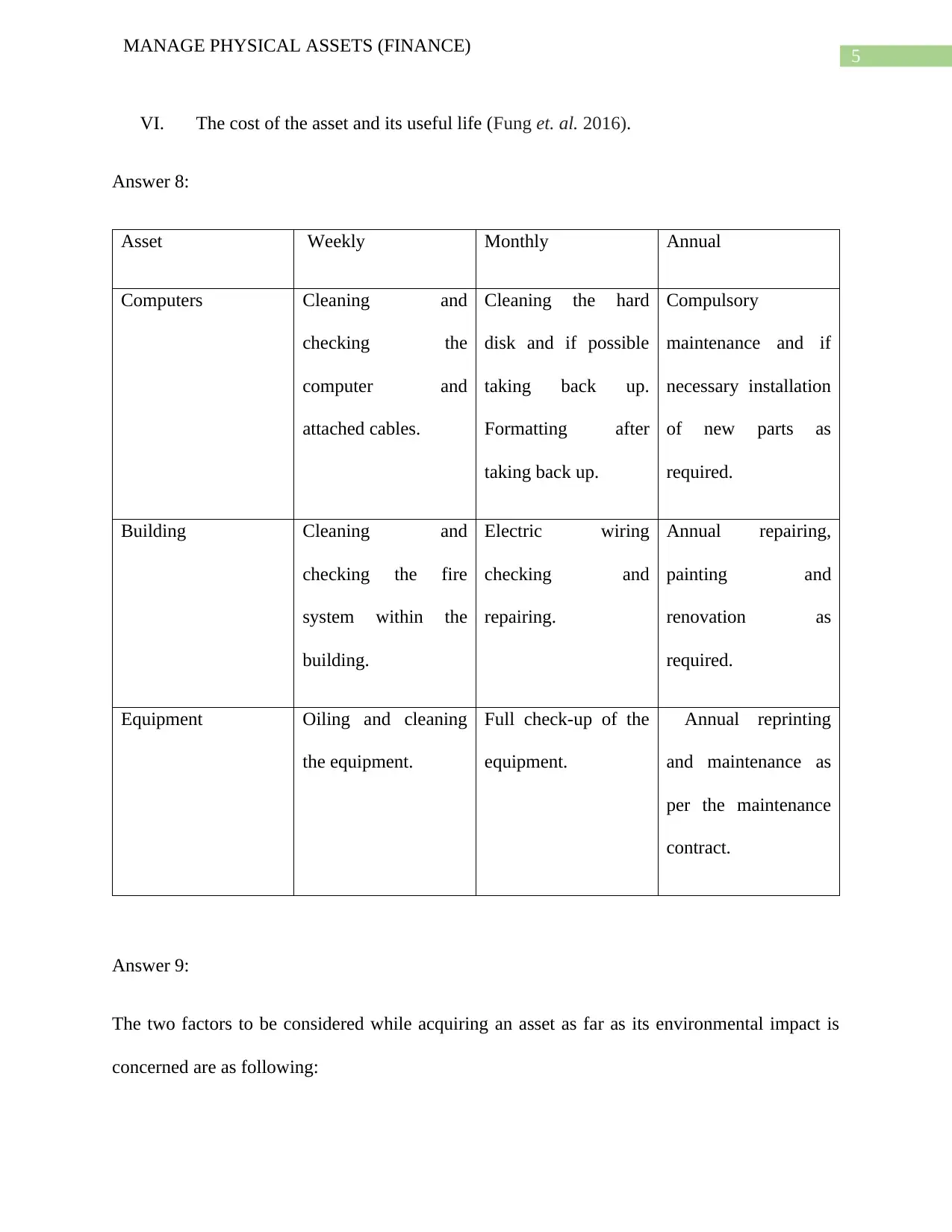

VI. The cost of the asset and its useful life (Fung et. al. 2016).

Answer 8:

Asset Weekly Monthly Annual

Computers Cleaning and

checking the

computer and

attached cables.

Cleaning the hard

disk and if possible

taking back up.

Formatting after

taking back up.

Compulsory

maintenance and if

necessary installation

of new parts as

required.

Building Cleaning and

checking the fire

system within the

building.

Electric wiring

checking and

repairing.

Annual repairing,

painting and

renovation as

required.

Equipment Oiling and cleaning

the equipment.

Full check-up of the

equipment.

Annual reprinting

and maintenance as

per the maintenance

contract.

Answer 9:

The two factors to be considered while acquiring an asset as far as its environmental impact is

concerned are as following:

MANAGE PHYSICAL ASSETS (FINANCE)

VI. The cost of the asset and its useful life (Fung et. al. 2016).

Answer 8:

Asset Weekly Monthly Annual

Computers Cleaning and

checking the

computer and

attached cables.

Cleaning the hard

disk and if possible

taking back up.

Formatting after

taking back up.

Compulsory

maintenance and if

necessary installation

of new parts as

required.

Building Cleaning and

checking the fire

system within the

building.

Electric wiring

checking and

repairing.

Annual repairing,

painting and

renovation as

required.

Equipment Oiling and cleaning

the equipment.

Full check-up of the

equipment.

Annual reprinting

and maintenance as

per the maintenance

contract.

Answer 9:

The two factors to be considered while acquiring an asset as far as its environmental impact is

concerned are as following:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

MANAGE PHYSICAL ASSETS (FINANCE)

I. Whether the use of the asset would contribute to the pollution in the environment.

II. The noise and heat to be generated due to the use of the asset in the working place.

Answer 10:

The business objectives have to be evaluated at the beginning. After the evaluation of the

objectives of the business a clear evaluation of the physical asset shall be conducted to determine

how the asset will contribute to the fulfilment of the business objectives. The financial

implications of acquiring the asset is to be determined by evaluating the proposal of acquiring

the asset. Investment appraisal techniques such as Net present value analysis would help the

business to determine whether the asset would be beneficial for the business or not (Campbell,

Jardine and McGlynn, 2016).

Answer 11:

The financial statements of a business shows the financial performance and position of the

business as on a particular period. The ability of a business to acquire an asset at present or in the

future can be very much evaluated from the financial position of the business. The amount of

retained earnings and the liquidity position of a business will very much reflect its ability to

acquire an asset or assets as on a particular date. Also the solvency position of an organization

helps such organization to take loan from banks to acquire assets for business. Thus, both current

as well as future ability of a business to acquire a particular can be evaluated from the

assessment of its financial position. In addition the ability of an organization to make optimum

use of its assets in the future is another factor that will contribute to the decision of an

organization to acquire an asset (Ma, Zhou and Sheng, 2014).

MANAGE PHYSICAL ASSETS (FINANCE)

I. Whether the use of the asset would contribute to the pollution in the environment.

II. The noise and heat to be generated due to the use of the asset in the working place.

Answer 10:

The business objectives have to be evaluated at the beginning. After the evaluation of the

objectives of the business a clear evaluation of the physical asset shall be conducted to determine

how the asset will contribute to the fulfilment of the business objectives. The financial

implications of acquiring the asset is to be determined by evaluating the proposal of acquiring

the asset. Investment appraisal techniques such as Net present value analysis would help the

business to determine whether the asset would be beneficial for the business or not (Campbell,

Jardine and McGlynn, 2016).

Answer 11:

The financial statements of a business shows the financial performance and position of the

business as on a particular period. The ability of a business to acquire an asset at present or in the

future can be very much evaluated from the financial position of the business. The amount of

retained earnings and the liquidity position of a business will very much reflect its ability to

acquire an asset or assets as on a particular date. Also the solvency position of an organization

helps such organization to take loan from banks to acquire assets for business. Thus, both current

as well as future ability of a business to acquire a particular can be evaluated from the

assessment of its financial position. In addition the ability of an organization to make optimum

use of its assets in the future is another factor that will contribute to the decision of an

organization to acquire an asset (Ma, Zhou and Sheng, 2014).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

MANAGE PHYSICAL ASSETS (FINANCE)

Section 2:

Answer 12:

Impact:

In order to assess the impact of a physical asset on the performance of an organization the

following shall be evaluated:

I. The quantum of production.

II. The quality of production.

III. Production costs (Shah, McMann and Borthwick, 2017).

Effectiveness:

In order to assess the effectiveness of a physical asset on the performance of an organization the

following shall be evaluated:

I. How the production processes have changed.

II. The improvement in the goods and services.

III. Use of other resources in production of goods and proving services.

Long-term performance:

In order to assess the impact of physical asset on the long-term performance of an organization

the following shall be evaluated:

I. The profit from business operations.

II. The quality of goods and services whether improved or not.

MANAGE PHYSICAL ASSETS (FINANCE)

Section 2:

Answer 12:

Impact:

In order to assess the impact of a physical asset on the performance of an organization the

following shall be evaluated:

I. The quantum of production.

II. The quality of production.

III. Production costs (Shah, McMann and Borthwick, 2017).

Effectiveness:

In order to assess the effectiveness of a physical asset on the performance of an organization the

following shall be evaluated:

I. How the production processes have changed.

II. The improvement in the goods and services.

III. Use of other resources in production of goods and proving services.

Long-term performance:

In order to assess the impact of physical asset on the long-term performance of an organization

the following shall be evaluated:

I. The profit from business operations.

II. The quality of goods and services whether improved or not.

8

MANAGE PHYSICAL ASSETS (FINANCE)

III. Customer satisfaction level subsequent to the use of long-term performance (Green

et. al. 2016).

Answer 13:

Once the analysis of performance monitor is complete the business will be able to take a final

decision as to whether the asset is to be acquired or not. If the performance monitoring indicates

that the acquisition of asset would benefit the business then the asset should be purchased

otherwise the asset should not be purchased (Trappey et. al. 2015).

Answer 14:

Three techniques to be used to establish and implement regular reporting practices on the assets

performance are as following:

I. The efficiency with which the asset is performing.

II. The quality and quantity of goods and services subsequent to the use of the asset.

III. The financial performance of the entity as a result of using the asset (Toepke et. al.

2018).

Answer 15:

Three methods to identify problems with physical assets are:

I. Efficiency method

II. Performance method.

III. Testing method.

Answer 16:

MANAGE PHYSICAL ASSETS (FINANCE)

III. Customer satisfaction level subsequent to the use of long-term performance (Green

et. al. 2016).

Answer 13:

Once the analysis of performance monitor is complete the business will be able to take a final

decision as to whether the asset is to be acquired or not. If the performance monitoring indicates

that the acquisition of asset would benefit the business then the asset should be purchased

otherwise the asset should not be purchased (Trappey et. al. 2015).

Answer 14:

Three techniques to be used to establish and implement regular reporting practices on the assets

performance are as following:

I. The efficiency with which the asset is performing.

II. The quality and quantity of goods and services subsequent to the use of the asset.

III. The financial performance of the entity as a result of using the asset (Toepke et. al.

2018).

Answer 15:

Three methods to identify problems with physical assets are:

I. Efficiency method

II. Performance method.

III. Testing method.

Answer 16:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

MANAGE PHYSICAL ASSETS (FINANCE)

The meetings and discussion forums can be used to discuss the condition and deficiencies os

assets with employee and staffs. It is important that the meeting and discussion allow the staff

and employees to put forward their point of views freely (McCabe and Donahue, Raymond Corp,

2017).

Answer 17:

Following three types of specialist assistance may be taken to maintain, repair and deal with

performance issues of physical assets:

I. The expert assistance.

II. The quality appraisal assistance of the asset.

III. Regular maintenance assistance of the asset.

Section 3:

Answer 18:

Three examples of operational requirements and design features provided are as following:

Operational requirements:

I. The refrigerator has anti-mist function.

II. It has a minimum capacity of 1,000 litre.

III. The temperature of the refrigerator can be controlled +1 degree to +10 degree Celsius

(Coffman et. al. 2017).

Design specification:

I. The refrigerator has double glazed door.

MANAGE PHYSICAL ASSETS (FINANCE)

The meetings and discussion forums can be used to discuss the condition and deficiencies os

assets with employee and staffs. It is important that the meeting and discussion allow the staff

and employees to put forward their point of views freely (McCabe and Donahue, Raymond Corp,

2017).

Answer 17:

Following three types of specialist assistance may be taken to maintain, repair and deal with

performance issues of physical assets:

I. The expert assistance.

II. The quality appraisal assistance of the asset.

III. Regular maintenance assistance of the asset.

Section 3:

Answer 18:

Three examples of operational requirements and design features provided are as following:

Operational requirements:

I. The refrigerator has anti-mist function.

II. It has a minimum capacity of 1,000 litre.

III. The temperature of the refrigerator can be controlled +1 degree to +10 degree Celsius

(Coffman et. al. 2017).

Design specification:

I. The refrigerator has double glazed door.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

MANAGE PHYSICAL ASSETS (FINANCE)

II. It has both black as well as black and silver exterior.

III. The refrigerator has casters with adjustable shelves.

Answer 19:

Design, operational requirements and budgets are the three types of requirements and parameters

that guide the type of information to be disclosed in an equipment specification.

Design: Design provides significant details such as the colour and exterior of an equipment.

Operational requirements: Operational specification provides capacity of an equipment as well as

it technical parameters of operations.

Budget: Budget generally provides the cost and price of an equipment in the market (Bishop and

Cardozo, Landis+ Gyr Innovations Inc, 2016).

Answer 20:

While writing specifications about a physical asset generally the following two guidelines must

be followed:

I. The operational requirements must be given very clearly to ensure that the

prospective buyers are aware of complete operational and technical specifications

about a physical asset to buy such asset.

II. Ensuring disclosure of all important qualitative characteristics of the physical asset in

the specification to attract buyers.

Answer 21:

MANAGE PHYSICAL ASSETS (FINANCE)

II. It has both black as well as black and silver exterior.

III. The refrigerator has casters with adjustable shelves.

Answer 19:

Design, operational requirements and budgets are the three types of requirements and parameters

that guide the type of information to be disclosed in an equipment specification.

Design: Design provides significant details such as the colour and exterior of an equipment.

Operational requirements: Operational specification provides capacity of an equipment as well as

it technical parameters of operations.

Budget: Budget generally provides the cost and price of an equipment in the market (Bishop and

Cardozo, Landis+ Gyr Innovations Inc, 2016).

Answer 20:

While writing specifications about a physical asset generally the following two guidelines must

be followed:

I. The operational requirements must be given very clearly to ensure that the

prospective buyers are aware of complete operational and technical specifications

about a physical asset to buy such asset.

II. Ensuring disclosure of all important qualitative characteristics of the physical asset in

the specification to attract buyers.

Answer 21:

11

MANAGE PHYSICAL ASSETS (FINANCE)

In order to estimate the cost of acquiring an asset correctly the information about a physical asset

can generally be found on the official website of the company producing such assets. Apart from

that the commodity markets and manufacturing units can be visited to get important information

before taking a final decision.

Answer 22:

In order to communicate with the supplier any one of the following methods can be used:

I. Directly approaching the suppliers by using telecommunication of personal visits to

the supplier premises.

II. Tenders can be invited from suppliers.

III. Confirmations can be requested from the suppliers for different quantity of orders.

Answer 23:

The existing physical assets and their performances must be tested at first. If the performance of

existing physical assets are of not up-to the mark then obviously the business should consider

replacing the existing assets. The replacement decision also depends on the financial viability of

acquiring new asset. If acquisition of new asset is not expected to benefit the business financially

then the decision of acquisition of new asset and replacement of the existing assert should be

postponed.

Answer 24:

Since the responsibility of operations in a new asset is on the shoulder of the workers and

employees thus, it is important to discuss the potential acquisition of new asset with the team that

would operate in the new asset. Without discussion the team and the staffs might feel disgruntled

MANAGE PHYSICAL ASSETS (FINANCE)

In order to estimate the cost of acquiring an asset correctly the information about a physical asset

can generally be found on the official website of the company producing such assets. Apart from

that the commodity markets and manufacturing units can be visited to get important information

before taking a final decision.

Answer 22:

In order to communicate with the supplier any one of the following methods can be used:

I. Directly approaching the suppliers by using telecommunication of personal visits to

the supplier premises.

II. Tenders can be invited from suppliers.

III. Confirmations can be requested from the suppliers for different quantity of orders.

Answer 23:

The existing physical assets and their performances must be tested at first. If the performance of

existing physical assets are of not up-to the mark then obviously the business should consider

replacing the existing assets. The replacement decision also depends on the financial viability of

acquiring new asset. If acquisition of new asset is not expected to benefit the business financially

then the decision of acquisition of new asset and replacement of the existing assert should be

postponed.

Answer 24:

Since the responsibility of operations in a new asset is on the shoulder of the workers and

employees thus, it is important to discuss the potential acquisition of new asset with the team that

would operate in the new asset. Without discussion the team and the staffs might feel disgruntled

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 37

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.