Governance and Stewardship

VerifiedAdded on 2023/03/30

|13

|3023

|399

AI Summary

This report discusses the concept and theories of governance and stewardship in organizations, including corporate governance, agency theory, stakeholder theory, and resource dependency theory. It also explores the role of leaders in effective governance and the application of stewardship theory in profit and non-profit organizations.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running Head: MANAGEMENT

0

Governance and Stewardship

6/5/2019

0

Governance and Stewardship

6/5/2019

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

MANAGEMENT

1

Contents

Introduction...........................................................................................................................................2

Corporate governance in Organisations.................................................................................................2

1. Agency theory...........................................................................................................................2

2. Stakeholder theory.....................................................................................................................3

3. Resource dependency theory.....................................................................................................4

Stewardship theory in organisations (Profit and non-profit)..................................................................5

Leader’s value and contribution to governance in organizations...........................................................7

Conclusion.............................................................................................................................................9

References...........................................................................................................................................10

1

Contents

Introduction...........................................................................................................................................2

Corporate governance in Organisations.................................................................................................2

1. Agency theory...........................................................................................................................2

2. Stakeholder theory.....................................................................................................................3

3. Resource dependency theory.....................................................................................................4

Stewardship theory in organisations (Profit and non-profit)..................................................................5

Leader’s value and contribution to governance in organizations...........................................................7

Conclusion.............................................................................................................................................9

References...........................................................................................................................................10

MANAGEMENT

2

Introduction

The report brings about the discussion on the concept and theories of governance and

stewardship that considers the concept of effective leadership in the organisations. The

organisations here include both, profit and not-for profit organisations. The concept of

corporate governance refers to the set of policies and business practices, which determines

the functioning of the organisation. The other concept of stewardship refers to the aspect of

showing willingness for being accountable for the functioning of the organisation through

operating in service, rather exercising the control (Kim, Eisenberger & Baik, 2016).

Therefore, the discussion will carry out the assessment of the theories of corporate

governance and contribution of stewardship. The theory of stewardship involves the role of

stewards to attain objectives. Besides, the discussion will also involve the leader’s values and

their beliefs leading or determining effective governance in organisations. Thus, the readers

will gain an understanding of the concept of effective governance in businesses, affecting

their performance in longer period.

Corporate governance in Organisations

The concept of corporate governance refers to the process of decision-making,

including the practices determining implementation in business organisations. A number of

theories have been found relevant that describes the relationship between different

stakeholders while carrying out the business activities. In business organisations, managers

apply various theories of corporate governance such as stewardship theory, agency theory,

stakeholder theory, transaction theory, political theory, and others. Discussing in general,

three major theories of corporate governance contribute to effectiveness of the organisation.

These theories include agency theory, stewardship theory, and the stakeholder theory that

facilitates attainment of objectives and determining compliance to the ethical and legal

standards of doing business (Tricker & Tricker, 2015).

1. Agency theory

The concept of ‘agency theory’ is described as the relationship between the principals and

agents, i.e. shareholders and managers or company executives. Under this theory, the

shareholders are the principals or owners of the company and they hire agents to perform

2

Introduction

The report brings about the discussion on the concept and theories of governance and

stewardship that considers the concept of effective leadership in the organisations. The

organisations here include both, profit and not-for profit organisations. The concept of

corporate governance refers to the set of policies and business practices, which determines

the functioning of the organisation. The other concept of stewardship refers to the aspect of

showing willingness for being accountable for the functioning of the organisation through

operating in service, rather exercising the control (Kim, Eisenberger & Baik, 2016).

Therefore, the discussion will carry out the assessment of the theories of corporate

governance and contribution of stewardship. The theory of stewardship involves the role of

stewards to attain objectives. Besides, the discussion will also involve the leader’s values and

their beliefs leading or determining effective governance in organisations. Thus, the readers

will gain an understanding of the concept of effective governance in businesses, affecting

their performance in longer period.

Corporate governance in Organisations

The concept of corporate governance refers to the process of decision-making,

including the practices determining implementation in business organisations. A number of

theories have been found relevant that describes the relationship between different

stakeholders while carrying out the business activities. In business organisations, managers

apply various theories of corporate governance such as stewardship theory, agency theory,

stakeholder theory, transaction theory, political theory, and others. Discussing in general,

three major theories of corporate governance contribute to effectiveness of the organisation.

These theories include agency theory, stewardship theory, and the stakeholder theory that

facilitates attainment of objectives and determining compliance to the ethical and legal

standards of doing business (Tricker & Tricker, 2015).

1. Agency theory

The concept of ‘agency theory’ is described as the relationship between the principals and

agents, i.e. shareholders and managers or company executives. Under this theory, the

shareholders are the principals or owners of the company and they hire agents to perform

MANAGEMENT

3

the work. The role of the principals , here shareholders is to delegate the responsibilities or

work to the managers or directors, i.e. agents of the firm (Nikula & Kivistö, 2018).

One of the key characteristics of agency theory includes ‘ownership and control, therefore

employees are held accountable for their tasks and responsibilities. The use of rewards and

punishments is considered important for correcting the priorities of the agents. In this theory,

the agent may become self-centred or opportunistic behaviour, and may fall short of

maintaining effective balance between the principal aspirations and the duties of agents. An

aspect of the positive approach has been used in the theory, stating that principals control or

enforce the rules to be followed by the agents, aiming to maximize shareholders value. The

increase in shareholder value lead to better management and governance of the organisation.

Hence, it can be stated that a more individualistic approach has been implemented in this

theory. The implementation of agency theory determines good corporate governance and

determines effective compliance to the orders, leading to organisational effectiveness (Bosse

& Phillips, 2016).

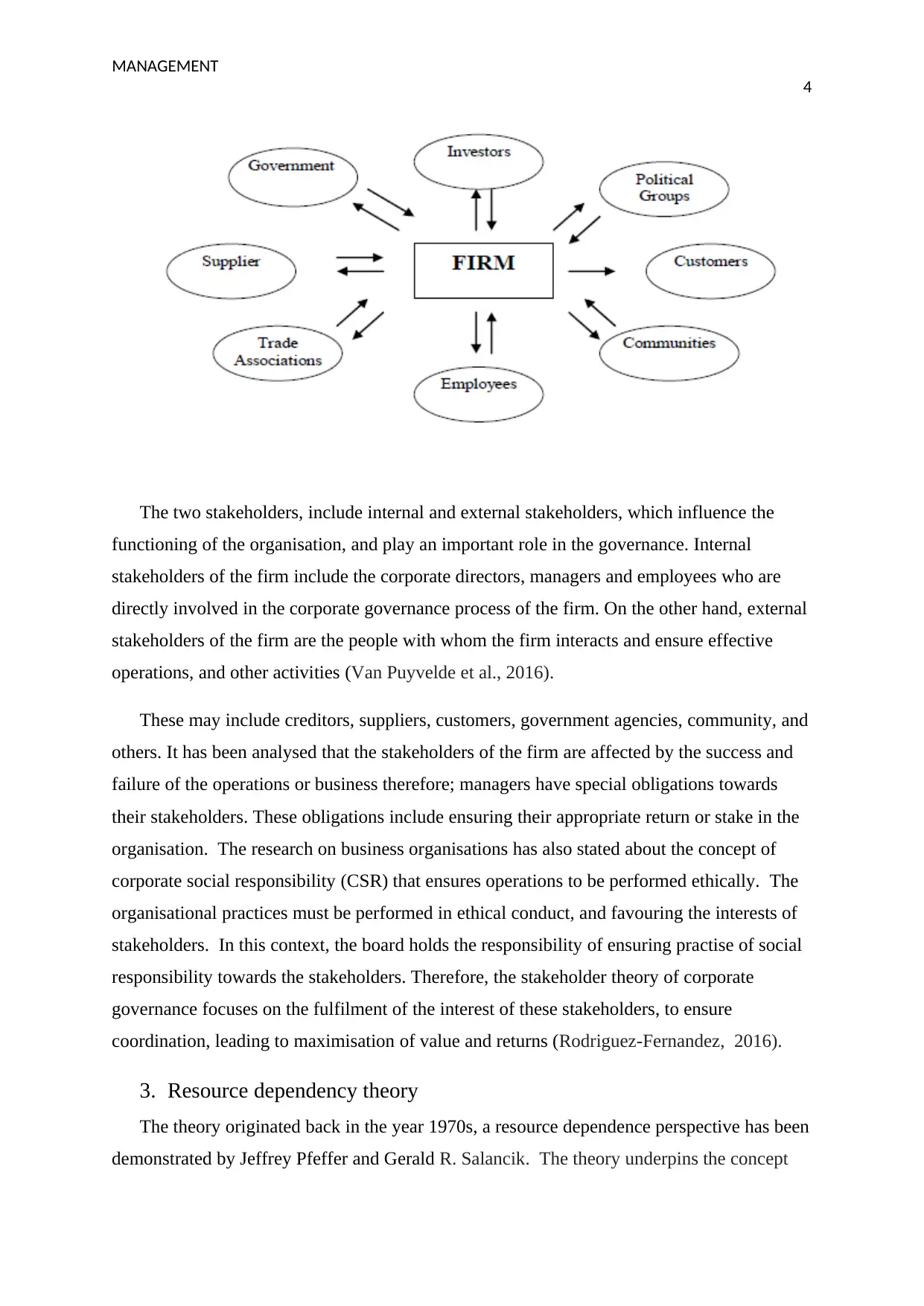

2. Stakeholder theory

The concept of stakeholder theory, explains the accountability of the organisation towards

their stakeholders i.e. customers, suppliers, investors, shareholder, and community. The

aspect of relationship of the managers with these people is considered vital, determining their

role in decision-making. Therefore, stakeholder theory explains the fulfilment of the interests

of the stakeholders, enhancing their satisfaction. Here, the managers emphasize the effect of

the corporate activity on the stakeholders associated with the firm. The managers consider

the interest and expectations of the key stakeholders, in the process of governance

maintaining effectiveness of the firm (Abdallah & Ismail, 2017).

3

the work. The role of the principals , here shareholders is to delegate the responsibilities or

work to the managers or directors, i.e. agents of the firm (Nikula & Kivistö, 2018).

One of the key characteristics of agency theory includes ‘ownership and control, therefore

employees are held accountable for their tasks and responsibilities. The use of rewards and

punishments is considered important for correcting the priorities of the agents. In this theory,

the agent may become self-centred or opportunistic behaviour, and may fall short of

maintaining effective balance between the principal aspirations and the duties of agents. An

aspect of the positive approach has been used in the theory, stating that principals control or

enforce the rules to be followed by the agents, aiming to maximize shareholders value. The

increase in shareholder value lead to better management and governance of the organisation.

Hence, it can be stated that a more individualistic approach has been implemented in this

theory. The implementation of agency theory determines good corporate governance and

determines effective compliance to the orders, leading to organisational effectiveness (Bosse

& Phillips, 2016).

2. Stakeholder theory

The concept of stakeholder theory, explains the accountability of the organisation towards

their stakeholders i.e. customers, suppliers, investors, shareholder, and community. The

aspect of relationship of the managers with these people is considered vital, determining their

role in decision-making. Therefore, stakeholder theory explains the fulfilment of the interests

of the stakeholders, enhancing their satisfaction. Here, the managers emphasize the effect of

the corporate activity on the stakeholders associated with the firm. The managers consider

the interest and expectations of the key stakeholders, in the process of governance

maintaining effectiveness of the firm (Abdallah & Ismail, 2017).

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

MANAGEMENT

4

The two stakeholders, include internal and external stakeholders, which influence the

functioning of the organisation, and play an important role in the governance. Internal

stakeholders of the firm include the corporate directors, managers and employees who are

directly involved in the corporate governance process of the firm. On the other hand, external

stakeholders of the firm are the people with whom the firm interacts and ensure effective

operations, and other activities (Van Puyvelde et al., 2016).

These may include creditors, suppliers, customers, government agencies, community, and

others. It has been analysed that the stakeholders of the firm are affected by the success and

failure of the operations or business therefore; managers have special obligations towards

their stakeholders. These obligations include ensuring their appropriate return or stake in the

organisation. The research on business organisations has also stated about the concept of

corporate social responsibility (CSR) that ensures operations to be performed ethically. The

organisational practices must be performed in ethical conduct, and favouring the interests of

stakeholders. In this context, the board holds the responsibility of ensuring practise of social

responsibility towards the stakeholders. Therefore, the stakeholder theory of corporate

governance focuses on the fulfilment of the interest of these stakeholders, to ensure

coordination, leading to maximisation of value and returns (Rodriguez-Fernandez, 2016).

3. Resource dependency theory

The theory originated back in the year 1970s, a resource dependence perspective has been

demonstrated by Jeffrey Pfeffer and Gerald R. Salancik. The theory underpins the concept

4

The two stakeholders, include internal and external stakeholders, which influence the

functioning of the organisation, and play an important role in the governance. Internal

stakeholders of the firm include the corporate directors, managers and employees who are

directly involved in the corporate governance process of the firm. On the other hand, external

stakeholders of the firm are the people with whom the firm interacts and ensure effective

operations, and other activities (Van Puyvelde et al., 2016).

These may include creditors, suppliers, customers, government agencies, community, and

others. It has been analysed that the stakeholders of the firm are affected by the success and

failure of the operations or business therefore; managers have special obligations towards

their stakeholders. These obligations include ensuring their appropriate return or stake in the

organisation. The research on business organisations has also stated about the concept of

corporate social responsibility (CSR) that ensures operations to be performed ethically. The

organisational practices must be performed in ethical conduct, and favouring the interests of

stakeholders. In this context, the board holds the responsibility of ensuring practise of social

responsibility towards the stakeholders. Therefore, the stakeholder theory of corporate

governance focuses on the fulfilment of the interest of these stakeholders, to ensure

coordination, leading to maximisation of value and returns (Rodriguez-Fernandez, 2016).

3. Resource dependency theory

The theory originated back in the year 1970s, a resource dependence perspective has been

demonstrated by Jeffrey Pfeffer and Gerald R. Salancik. The theory underpins the concept

MANAGEMENT

5

that resources are central to the growth and success of the organisation, and access or control

determines base of power. It explains the effect of external resources of the organisation on

the behavioural aspects of the organisation (Jeavons, 2016).

Here, the theory stated an important role of directors, and owners in securing and

allowing access to the resources, through their interaction with external environment. The

provision of resources ensures effective functioning of the organisation, leading to increased

profits. The major resources, which are brought about the owners of the organisation, include

information, skills along with the approach to suppliers, investors, buyers, and social

workers. Resource is linked to power, and firms are dependent on multiple resources, such

as labour, capital, and raw material and they enable managers exercise control over their

operations. The aspect of resource dependency is linked with the concept of organisational

behaviour, helps in making a correct choice or decision related to actions or activities to be

undertaken. Therefore, in organisations, the use of resource dependency theory enhances

governance and efficiency in longer period (Knutsen, 2017).

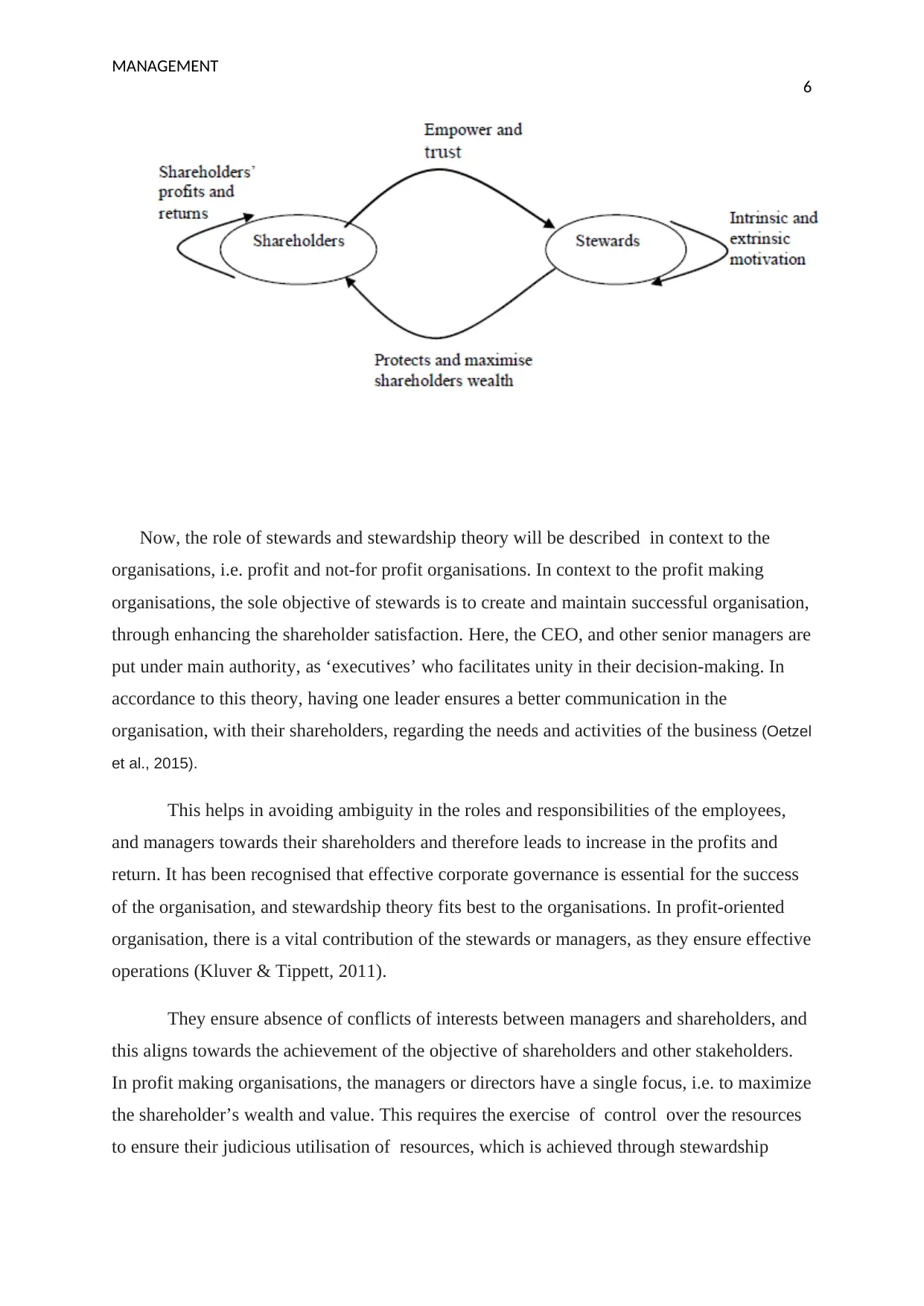

Stewardship theory in organisations (Profit and non-profit)

According to stewardship theory, a steward plays a vital role in organisations to protect

and enhance the wealth of shareholders in the firm. To determine the stewards these refer to

the managers, senior executives of the firm, working for shareholders focusing on

maximisation of profits. Motivated or satisfied stewards in the firm put stress on the

employees, to perform their work diligently, and increase the returns to the shareholders

(Bosse & Phillips, 2016). The concept and interrelatedness of the factors, of shareholders

profits and returns, and the contribution of the stewards has been illustrated through the

diagram given below:

5

that resources are central to the growth and success of the organisation, and access or control

determines base of power. It explains the effect of external resources of the organisation on

the behavioural aspects of the organisation (Jeavons, 2016).

Here, the theory stated an important role of directors, and owners in securing and

allowing access to the resources, through their interaction with external environment. The

provision of resources ensures effective functioning of the organisation, leading to increased

profits. The major resources, which are brought about the owners of the organisation, include

information, skills along with the approach to suppliers, investors, buyers, and social

workers. Resource is linked to power, and firms are dependent on multiple resources, such

as labour, capital, and raw material and they enable managers exercise control over their

operations. The aspect of resource dependency is linked with the concept of organisational

behaviour, helps in making a correct choice or decision related to actions or activities to be

undertaken. Therefore, in organisations, the use of resource dependency theory enhances

governance and efficiency in longer period (Knutsen, 2017).

Stewardship theory in organisations (Profit and non-profit)

According to stewardship theory, a steward plays a vital role in organisations to protect

and enhance the wealth of shareholders in the firm. To determine the stewards these refer to

the managers, senior executives of the firm, working for shareholders focusing on

maximisation of profits. Motivated or satisfied stewards in the firm put stress on the

employees, to perform their work diligently, and increase the returns to the shareholders

(Bosse & Phillips, 2016). The concept and interrelatedness of the factors, of shareholders

profits and returns, and the contribution of the stewards has been illustrated through the

diagram given below:

MANAGEMENT

6

Now, the role of stewards and stewardship theory will be described in context to the

organisations, i.e. profit and not-for profit organisations. In context to the profit making

organisations, the sole objective of stewards is to create and maintain successful organisation,

through enhancing the shareholder satisfaction. Here, the CEO, and other senior managers are

put under main authority, as ‘executives’ who facilitates unity in their decision-making. In

accordance to this theory, having one leader ensures a better communication in the

organisation, with their shareholders, regarding the needs and activities of the business (Oetzel

et al., 2015).

This helps in avoiding ambiguity in the roles and responsibilities of the employees,

and managers towards their shareholders and therefore leads to increase in the profits and

return. It has been recognised that effective corporate governance is essential for the success

of the organisation, and stewardship theory fits best to the organisations. In profit-oriented

organisation, there is a vital contribution of the stewards or managers, as they ensure effective

operations (Kluver & Tippett, 2011).

They ensure absence of conflicts of interests between managers and shareholders, and

this aligns towards the achievement of the objective of shareholders and other stakeholders.

In profit making organisations, the managers or directors have a single focus, i.e. to maximize

the shareholder’s wealth and value. This requires the exercise of control over the resources

to ensure their judicious utilisation of resources, which is achieved through stewardship

6

Now, the role of stewards and stewardship theory will be described in context to the

organisations, i.e. profit and not-for profit organisations. In context to the profit making

organisations, the sole objective of stewards is to create and maintain successful organisation,

through enhancing the shareholder satisfaction. Here, the CEO, and other senior managers are

put under main authority, as ‘executives’ who facilitates unity in their decision-making. In

accordance to this theory, having one leader ensures a better communication in the

organisation, with their shareholders, regarding the needs and activities of the business (Oetzel

et al., 2015).

This helps in avoiding ambiguity in the roles and responsibilities of the employees,

and managers towards their shareholders and therefore leads to increase in the profits and

return. It has been recognised that effective corporate governance is essential for the success

of the organisation, and stewardship theory fits best to the organisations. In profit-oriented

organisation, there is a vital contribution of the stewards or managers, as they ensure effective

operations (Kluver & Tippett, 2011).

They ensure absence of conflicts of interests between managers and shareholders, and

this aligns towards the achievement of the objective of shareholders and other stakeholders.

In profit making organisations, the managers or directors have a single focus, i.e. to maximize

the shareholder’s wealth and value. This requires the exercise of control over the resources

to ensure their judicious utilisation of resources, which is achieved through stewardship

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGEMENT

7

theory. This aspect further leads to the attainment of increased revenues and profits in the

long-run (Miles, 2017).

For the not-for-profit organisations, the implementation of stewardship theory,

organisations is motivated to act in respect to the interests of their donors. Four different

strategies are found relevant for the non-profit organisations, to establish good relations with

their donors. These strategies include reciprocity, responsibility, reporting, and the

relationship nurturing. In not for profit organisations, the use of trust, reputation, and

monitoring is considered important for maintaining the corporate relationships. This is a vital

factor in context to the not-for profit organisations, determining the effectiveness of

governance exercised by the directors. It has been analysed that through the positivist

approach of stewardship theory, employees are more encouraged or have high levels of

intrinsic motivation (Jeavons, 2016).

This facilitates their high commitment towards complying with the organisational

goals. This is essential to ensure effective corporate governance in the organisations. Not-

for-profit organisations have other motives or objectives, other than increasing the profits of

the firm. This includes the managers or directors contributing through providing help or

resources to the target audience or people in a community. They usually focus on serving a

public purpose, like enriching the lives of people, and saving the burden of tax on them. This

is assumed a part of the corporate governance, which enhances the organisational

effectiveness. The role of stewards should be emphasized more than the profit making

organisations, as they deal with the public (Abdallah & Ismail, 2017).

In a well-governed organisation, the power to control and ensuring effective

management of affairs of the organisation, is a major concern for the non-profit

organisation, like profit organisations. The state law in every country allows these

organisations to direct allocation of power and resources and ensure effective corporate

governance. The governing body of the non-profit organisations must practice effective

theories of corporate governance to be able to attain the wealth through establishing a

strategic direction of the organisation. Therefore, profit and non-profit organisations both

need to practise effective corporate governance to lead high profits and performance in the

long-run (Jeavons, 2016).

7

theory. This aspect further leads to the attainment of increased revenues and profits in the

long-run (Miles, 2017).

For the not-for-profit organisations, the implementation of stewardship theory,

organisations is motivated to act in respect to the interests of their donors. Four different

strategies are found relevant for the non-profit organisations, to establish good relations with

their donors. These strategies include reciprocity, responsibility, reporting, and the

relationship nurturing. In not for profit organisations, the use of trust, reputation, and

monitoring is considered important for maintaining the corporate relationships. This is a vital

factor in context to the not-for profit organisations, determining the effectiveness of

governance exercised by the directors. It has been analysed that through the positivist

approach of stewardship theory, employees are more encouraged or have high levels of

intrinsic motivation (Jeavons, 2016).

This facilitates their high commitment towards complying with the organisational

goals. This is essential to ensure effective corporate governance in the organisations. Not-

for-profit organisations have other motives or objectives, other than increasing the profits of

the firm. This includes the managers or directors contributing through providing help or

resources to the target audience or people in a community. They usually focus on serving a

public purpose, like enriching the lives of people, and saving the burden of tax on them. This

is assumed a part of the corporate governance, which enhances the organisational

effectiveness. The role of stewards should be emphasized more than the profit making

organisations, as they deal with the public (Abdallah & Ismail, 2017).

In a well-governed organisation, the power to control and ensuring effective

management of affairs of the organisation, is a major concern for the non-profit

organisation, like profit organisations. The state law in every country allows these

organisations to direct allocation of power and resources and ensure effective corporate

governance. The governing body of the non-profit organisations must practice effective

theories of corporate governance to be able to attain the wealth through establishing a

strategic direction of the organisation. Therefore, profit and non-profit organisations both

need to practise effective corporate governance to lead high profits and performance in the

long-run (Jeavons, 2016).

MANAGEMENT

8

Leader’s value and contribution to governance in organizations

In organisation, the role of a leader is vital to the effective functioning and growth of

the organisation. Effective leadership practices influences the values of the organisation such

as honesty, respect, autonomy, ethics, and others, through demonstrating an ideal behaviour

of individuals. Some of the key values of a leader consist of decision-making skills,

accountability, creativity and innovation, and integrity, which lead to effective governance.

In general, it has been analysed that leadership is concerned with the relationships.

Moreover, it states the aspect of guiding and inspiring people towards new goals, through

establishing trust, integrity and attaining a positive interaction between the leaders and other

stakeholders. An effective leader will determine rational or ethical decision-making, and will

ensure maintaining the confidentiality of the information in the organisation. This will further

lead to corporate governance and bring effectiveness in the overall performance (Black,

2015).

A number of characteristics or elements, such as accountability, openness/integrity,

values, and relationships are vital in effective leadership, also form a part of governance. A

leader, who shows the essential quality of being accountable for his actions in the

organisation, is able to ensure better governance in the firm. In positive leadership roles, the

term ‘accountability’ is assumed as the responsibility for their actions, products, decisions,

policies inclusive of administration, and governance in the organisation. Through ensuring

accountability, a leader develops a trust in the people, and it further fosters integrity and

power in the organisation. Power is another important value of the leader, as through

exercising power and position, they influence behaviour towards attaining mission and vision

of the organisation (Coule, 2015).

Besides, this leader has certain beliefs of ensuring and maintaining equity and

inclusiveness within society, ensuring all the members or people are given equal respect and

opportunities. An important factor establishes the foundation of good corporate governance.

Leaders in an organisation do not only focus upon their followers or employees, they serve

the public, which is an important element determining effectiveness of governance in the

organisations (Shi, Connelly & Hoskisson, 2015).

Consensus-oriented is one major characteristics or values of leader, which is vital for

leading governance in the organisation. The leader in an organisation, play the role of an

organisational entrepreneur facing the structure of corporate governance. It is because a

8

Leader’s value and contribution to governance in organizations

In organisation, the role of a leader is vital to the effective functioning and growth of

the organisation. Effective leadership practices influences the values of the organisation such

as honesty, respect, autonomy, ethics, and others, through demonstrating an ideal behaviour

of individuals. Some of the key values of a leader consist of decision-making skills,

accountability, creativity and innovation, and integrity, which lead to effective governance.

In general, it has been analysed that leadership is concerned with the relationships.

Moreover, it states the aspect of guiding and inspiring people towards new goals, through

establishing trust, integrity and attaining a positive interaction between the leaders and other

stakeholders. An effective leader will determine rational or ethical decision-making, and will

ensure maintaining the confidentiality of the information in the organisation. This will further

lead to corporate governance and bring effectiveness in the overall performance (Black,

2015).

A number of characteristics or elements, such as accountability, openness/integrity,

values, and relationships are vital in effective leadership, also form a part of governance. A

leader, who shows the essential quality of being accountable for his actions in the

organisation, is able to ensure better governance in the firm. In positive leadership roles, the

term ‘accountability’ is assumed as the responsibility for their actions, products, decisions,

policies inclusive of administration, and governance in the organisation. Through ensuring

accountability, a leader develops a trust in the people, and it further fosters integrity and

power in the organisation. Power is another important value of the leader, as through

exercising power and position, they influence behaviour towards attaining mission and vision

of the organisation (Coule, 2015).

Besides, this leader has certain beliefs of ensuring and maintaining equity and

inclusiveness within society, ensuring all the members or people are given equal respect and

opportunities. An important factor establishes the foundation of good corporate governance.

Leaders in an organisation do not only focus upon their followers or employees, they serve

the public, which is an important element determining effectiveness of governance in the

organisations (Shi, Connelly & Hoskisson, 2015).

Consensus-oriented is one major characteristics or values of leader, which is vital for

leading governance in the organisation. The leader in an organisation, play the role of an

organisational entrepreneur facing the structure of corporate governance. It is because a

MANAGEMENT

9

strong leader becomes able to attract competent labour in the market, for the attainment of

goals and objectives. The organisations with good leadership are able to sustain positive work

culture, achieve goals and sustain quality, and deliver effective services This helps in

establishing collaboration, and coordination of the activities and enhance performance

(McCahery, Sautner & Starks, 2016).

The quality or element of the competency acts as another major characteristic of the

leader, determining the way a leader understands different responsibilities and approaches of

leadership in the organisation. A direct link has been found in context to the leadership

values, and beliefs of effective governance in the organisations. Furthermore, the research, it

has been understood that a positive or effective leader is able to attain the values, of the

governance through communicating the vision to the people. This is another aspect

determining the interrelatedness of the leader’s values and governance in organisations.

Leadership approaches or styles such as participative, democratic, transformational,

transactional are used by the leaders or managers to attain strong relationships at the

workplace. This further develops or facilitates in the effective communication of the ideas

or issues of the employees or workers in the organisation. Therefore, from the above analysis,

the relationship between a leader’s values and beliefs to corporate governance has been

understood in context to business organisations (Sethibe & Steyn, 2015).

Conclusion

To conclude the above discussion it has been analysed that the concept of effective

governance and leadership practices determine organisational effectiveness. Governance is

the key to ethical decision-making and consists of the processes that exercise rule or control

over the organisation. The discussion included the analysis of three vital theories of corporate

governance, used by the managers in business firms. In addition, the concept of stewardship

theory has been also described in the report, with respect to profit, and non-profit

organisations. This is attained by the specific contribution of the managers or leaders and

their values or contribution in the organisation. The role of a leader has been demonstrated

well in this assignment, as trust, honesty, integrity, and other aspects that lead to effective

administration of the organisation. The report has mentioned all these aspects or concepts, in

the above discussion in respect to the organisational effectiveness. The managers must

9

strong leader becomes able to attract competent labour in the market, for the attainment of

goals and objectives. The organisations with good leadership are able to sustain positive work

culture, achieve goals and sustain quality, and deliver effective services This helps in

establishing collaboration, and coordination of the activities and enhance performance

(McCahery, Sautner & Starks, 2016).

The quality or element of the competency acts as another major characteristic of the

leader, determining the way a leader understands different responsibilities and approaches of

leadership in the organisation. A direct link has been found in context to the leadership

values, and beliefs of effective governance in the organisations. Furthermore, the research, it

has been understood that a positive or effective leader is able to attain the values, of the

governance through communicating the vision to the people. This is another aspect

determining the interrelatedness of the leader’s values and governance in organisations.

Leadership approaches or styles such as participative, democratic, transformational,

transactional are used by the leaders or managers to attain strong relationships at the

workplace. This further develops or facilitates in the effective communication of the ideas

or issues of the employees or workers in the organisation. Therefore, from the above analysis,

the relationship between a leader’s values and beliefs to corporate governance has been

understood in context to business organisations (Sethibe & Steyn, 2015).

Conclusion

To conclude the above discussion it has been analysed that the concept of effective

governance and leadership practices determine organisational effectiveness. Governance is

the key to ethical decision-making and consists of the processes that exercise rule or control

over the organisation. The discussion included the analysis of three vital theories of corporate

governance, used by the managers in business firms. In addition, the concept of stewardship

theory has been also described in the report, with respect to profit, and non-profit

organisations. This is attained by the specific contribution of the managers or leaders and

their values or contribution in the organisation. The role of a leader has been demonstrated

well in this assignment, as trust, honesty, integrity, and other aspects that lead to effective

administration of the organisation. The report has mentioned all these aspects or concepts, in

the above discussion in respect to the organisational effectiveness. The managers must

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

MANAGEMENT

10

consider and aim to fulfil the interests of stakeholders, as they determine the profitability and

success of the organisation. Hence, it has been analysed that managers can attain effective

corporate governance through practising leadership values, and other aspects within

organisations.

10

consider and aim to fulfil the interests of stakeholders, as they determine the profitability and

success of the organisation. Hence, it has been analysed that managers can attain effective

corporate governance through practising leadership values, and other aspects within

organisations.

MANAGEMENT

11

References

Abdallah, A. A. N. & Ismail, A. K. (2017). Corporate governance practices, ownership

structure, and corporate performance in the GCC countries. Journal of International

Financial Markets, Institutions and Money, 46, 98-115.

Black, S. A. (2015). Qualities of effective leadership in higher education. Open Journal of

Leadership, 4(02), 54.

Bosse, D. A., & Phillips, R. A. (2016). Agency theory and bounded self-interest. Academy of

Management Review, 41(2), 276-297.

Coule, T. M. (2015). Non-profit governance and accountability: Broadening the theoretical

perspective. Non-profit and Voluntary Sector Quarterly, 44(1), 75-97.

Jeavons, T. H. (2016). Ethical non-profit management: Core values and key practices. The

Jossey‐Bass Handbook of Non-profit Leadership and Management, 188-216.

Kim, K. Y., Eisenberger, R. & Baik, K. (2016). Perceived organizational support and

affective organizational commitment: Moderating influence of perceived

organizational competence. Journal of Organizational Behaviour, 37(4), 558-583.

Kluvers, R. & Tippett, J. (2011, December). An exploration of stewardship theory in a Not-

for-Profit organisation. In Accounting Forum (Vol. 35, No. 4, pp. 275-284). United

Kingdom: Taylor & Francis.

Knutsen, W. L. (2017). Retaining the Benefits of Government–Nonprofit Contracting

Relationship: Opposites Attract or Clash?. VOLUNTAS: International Journal of

Voluntary and Non-profit Organizations, 28(4), 1373-1398.

McCahery, J. A., Sautner, Z. & Starks, L. T. (2016). Behind the scenes: The corporate

governance preferences of institutional investors. The Journal of Finance, 71(6),

2905-2932.

Miles, S. (2017). Stakeholder theory classification: A theoretical and empirical evaluation of

definitions. Journal of Business Ethics, 142(3), 437-459.

11

References

Abdallah, A. A. N. & Ismail, A. K. (2017). Corporate governance practices, ownership

structure, and corporate performance in the GCC countries. Journal of International

Financial Markets, Institutions and Money, 46, 98-115.

Black, S. A. (2015). Qualities of effective leadership in higher education. Open Journal of

Leadership, 4(02), 54.

Bosse, D. A., & Phillips, R. A. (2016). Agency theory and bounded self-interest. Academy of

Management Review, 41(2), 276-297.

Coule, T. M. (2015). Non-profit governance and accountability: Broadening the theoretical

perspective. Non-profit and Voluntary Sector Quarterly, 44(1), 75-97.

Jeavons, T. H. (2016). Ethical non-profit management: Core values and key practices. The

Jossey‐Bass Handbook of Non-profit Leadership and Management, 188-216.

Kim, K. Y., Eisenberger, R. & Baik, K. (2016). Perceived organizational support and

affective organizational commitment: Moderating influence of perceived

organizational competence. Journal of Organizational Behaviour, 37(4), 558-583.

Kluvers, R. & Tippett, J. (2011, December). An exploration of stewardship theory in a Not-

for-Profit organisation. In Accounting Forum (Vol. 35, No. 4, pp. 275-284). United

Kingdom: Taylor & Francis.

Knutsen, W. L. (2017). Retaining the Benefits of Government–Nonprofit Contracting

Relationship: Opposites Attract or Clash?. VOLUNTAS: International Journal of

Voluntary and Non-profit Organizations, 28(4), 1373-1398.

McCahery, J. A., Sautner, Z. & Starks, L. T. (2016). Behind the scenes: The corporate

governance preferences of institutional investors. The Journal of Finance, 71(6),

2905-2932.

Miles, S. (2017). Stakeholder theory classification: A theoretical and empirical evaluation of

definitions. Journal of Business Ethics, 142(3), 437-459.

MANAGEMENT

12

Nikula, P. T. & Kivistö, J. (2018). Hiring education agents for international student

recruitment: Perspectives from agency theory. Higher Education Policy, 1-23.

Oetzel, J. G., Villegas, M., Zenone, H., White Hat, E. R., Wallerstein, N. & Duran, B. (2015).

Enhancing stewardship of community-engaged research through

governance. American Journal of Public Health, 105(6), 1161-1167.

Rodriguez-Fernandez, M. (2016). Social responsibility and financial performance: The role

of good corporate governance. BRQ Business Research Quarterly, 19(2), 137-151.

Schillemans, T. (2016). Combining Agency and Stewardship: Welfare reforms and

accountability. In The Routledge Handbook to Accountability and Welfare State

Reforms in Europe (pp. 59-72). United Kingdom: Routledge.

Sethibe, T. & Steyn, R. (2015). The relationship between leadership styles, innovation, and

organisational performance: A systematic review. South African Journal of Economic

and Management Sciences, 18(3), 325-337.

Shi, W., Connelly, B. L. & Hoskisson, R. E. (2017). External corporate governance and

financial fraud: Cognitive evaluation theory insights on agency theory

prescriptions. Strategic Management Journal, 38(6), 1268-1286.

Tricker, R. B. & Tricker, R. I. (2015). Corporate governance: Principles, policies, and

practices. United States: Oxford University Press.

Van Puyvelde, S., Caers, R., Du Bois, C. & Jegers, M. (2016). Managerial objectives and the

governance of public and non-profit organizations. Public management review, 18(2),

221-237.

12

Nikula, P. T. & Kivistö, J. (2018). Hiring education agents for international student

recruitment: Perspectives from agency theory. Higher Education Policy, 1-23.

Oetzel, J. G., Villegas, M., Zenone, H., White Hat, E. R., Wallerstein, N. & Duran, B. (2015).

Enhancing stewardship of community-engaged research through

governance. American Journal of Public Health, 105(6), 1161-1167.

Rodriguez-Fernandez, M. (2016). Social responsibility and financial performance: The role

of good corporate governance. BRQ Business Research Quarterly, 19(2), 137-151.

Schillemans, T. (2016). Combining Agency and Stewardship: Welfare reforms and

accountability. In The Routledge Handbook to Accountability and Welfare State

Reforms in Europe (pp. 59-72). United Kingdom: Routledge.

Sethibe, T. & Steyn, R. (2015). The relationship between leadership styles, innovation, and

organisational performance: A systematic review. South African Journal of Economic

and Management Sciences, 18(3), 325-337.

Shi, W., Connelly, B. L. & Hoskisson, R. E. (2017). External corporate governance and

financial fraud: Cognitive evaluation theory insights on agency theory

prescriptions. Strategic Management Journal, 38(6), 1268-1286.

Tricker, R. B. & Tricker, R. I. (2015). Corporate governance: Principles, policies, and

practices. United States: Oxford University Press.

Van Puyvelde, S., Caers, R., Du Bois, C. & Jegers, M. (2016). Managerial objectives and the

governance of public and non-profit organizations. Public management review, 18(2),

221-237.

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.