Analysis of Management Accounting Practices at Creams Limited

VerifiedAdded on 2023/01/11

|18

|4766

|61

Report

AI Summary

This report examines the application of management accounting within Creams Ltd, a confectionery company. It begins by defining management accounting (MA) and its significance, highlighting its role in internal decision-making and differentiating it from financial accounting. The report then explores various MA systems, including cost accounting, job costing, inventory management, and price optimization, evaluating their benefits and applications within the company. It describes different techniques used for reporting under MA, such as budget reports, accounts receivable reports, cost accounting reports, and performance reports. The report further analyzes the advantages and applications of MA systems and computes costs and prepares income statements using absorption and marginal costing tools. Finally, the report compares and contrasts how Creams Ltd adapts MA systems to address financial challenges, offering a comprehensive overview of MA's practical implementation in a business context.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION...........................................................................................................................3

P1. Explaining MA and significance of its systems....................................................................3

P2. Describing different techniques that are been used for reporting under MA........................4

M1. Evaluating advantages and application of MA systems.......................................................5

P3. Computing cost and preparing income statement by applying different MA tools..............5

P4. Explaining benefits and limitations of different planning tools............................................5

M3. Analyzing uses and the application of different budgetary control tools.............................8

P5. Comparing and contrasting the ways in which an entity adapt MA systems in responding

towards the financial problem.....................................................................................................8

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

P1. Explaining MA and significance of its systems....................................................................3

P2. Describing different techniques that are been used for reporting under MA........................4

M1. Evaluating advantages and application of MA systems.......................................................5

P3. Computing cost and preparing income statement by applying different MA tools..............5

P4. Explaining benefits and limitations of different planning tools............................................5

M3. Analyzing uses and the application of different budgetary control tools.............................8

P5. Comparing and contrasting the ways in which an entity adapt MA systems in responding

towards the financial problem.....................................................................................................8

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION

Management accounting is concerned with the study of providing financial information

and resources to the business managers in decision making. Management accounting can be used

only by the internal members of the company as it focuses on improving the efficiency and

effectiveness of the employees of the Creams Ltd so that they can achieve the desired goals and

objectives. The major objective of management accounting is to use statistical information so

that the managers can take better decision in regard to success of the company. Creams Limited

is a confectionery company that manufactures and sells ice creams, doughnuts and waffles. The

current study will focus on the use of management accounting in the working of Creams Limited

and also various tools and techniques used by management accounting to ensure smooth working

of a company.

P1. Explaining MA and significance of its systems

MA is defined as the practice of facilitating financial information and the resources to

managers in the process of decision making. It is only been used by an internal team of the

company and it is the only things that differs MA from that of financial accounting. In this

practice, financial information and the reports like invoice, final report etc is been shared by the

finance department to management team of an entity. The main purpose of management

accenting is making use of statistical information and taking better or accurate decisions,

controlling an entity, development and the activities of the business. On the other hand financial

accounting is referred as presentation and recording of an information for the benefit of different

stakeholders of an enterprise. However, MA is seen as the presentation of the financial data and

the business activities for an internal management of the firm. There are various systems of MA

that plays a crucial role in managing the activities of an enterprise in an effective way that are as

follows-

Cost accounting system- It is the system that is used by anCreams Ltd in estimating cost

of the products for making profitability analysis, valuation of an inventory and controlling cost.

This system is critical for the company as it helps in estimating product cost for analyzing that

whether the process is generating profits or not (Ghasemiand et.al., 2016). It is very essential in

Management accounting is concerned with the study of providing financial information

and resources to the business managers in decision making. Management accounting can be used

only by the internal members of the company as it focuses on improving the efficiency and

effectiveness of the employees of the Creams Ltd so that they can achieve the desired goals and

objectives. The major objective of management accounting is to use statistical information so

that the managers can take better decision in regard to success of the company. Creams Limited

is a confectionery company that manufactures and sells ice creams, doughnuts and waffles. The

current study will focus on the use of management accounting in the working of Creams Limited

and also various tools and techniques used by management accounting to ensure smooth working

of a company.

P1. Explaining MA and significance of its systems

MA is defined as the practice of facilitating financial information and the resources to

managers in the process of decision making. It is only been used by an internal team of the

company and it is the only things that differs MA from that of financial accounting. In this

practice, financial information and the reports like invoice, final report etc is been shared by the

finance department to management team of an entity. The main purpose of management

accenting is making use of statistical information and taking better or accurate decisions,

controlling an entity, development and the activities of the business. On the other hand financial

accounting is referred as presentation and recording of an information for the benefit of different

stakeholders of an enterprise. However, MA is seen as the presentation of the financial data and

the business activities for an internal management of the firm. There are various systems of MA

that plays a crucial role in managing the activities of an enterprise in an effective way that are as

follows-

Cost accounting system- It is the system that is used by anCreams Ltd in estimating cost

of the products for making profitability analysis, valuation of an inventory and controlling cost.

This system is critical for the company as it helps in estimating product cost for analyzing that

whether the process is generating profits or not (Ghasemiand et.al., 2016). It is very essential in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

understanding cash flow along with assessing the profitable and non-profitable products for an

entity. It helps the managers in keeping a check on the raw materials at each and every stage of

the production. It enables the management of company in lowering down the cost incurred in

business operations by way of identifying or controlling the relevant items. Moreover, this

system provides detailed information with regards cost incurred by the company and helps in

keeping better control on the cost.

Job costing system- It means the system that includes process of accumulating an

information regarding costs attached with particular production or the service job. It plays an

essential role in the Creams Ltd as it submit an information in relation to cost for the customers

under the contract where cost are been reimbursed (Amran, 2020). This information is useful in

determining accuracy of an estimating system of the company that helps in quoting price which

allows for gaining a reasonable profit. The information provided by this system could also be

used for assigning inventory cost in manufacturing the goods. This system presents information

relating to the cost incurred in each and every production unit or job. It enables managers in the

reviving the cost setting up best prices so that profits can be gained.

Inventory management system- It refers to combination of the processes, technology and

the procedures which oversee maintenance and monitoring of the stock. This system helps in

managing and maintaining optimum level of stock within the business. It helps in keeping the

business more and more organized and also assists the managers in tracking the level or flow of

inventory from business premises to the customer in an entire supply chain. It prevents an

inventory in being overflowed by just keeping sufficient inventory in stock. This helps in

minimizing amount of an unused inventory along with it improves relationship with the vendors.

It represents the information relating to stock level within the premises of an entity and also

helps in making optimum use of inventory so that less cost and wastage is resulted.

Price optimization system- This MA system involves using of the mathematical analysis

in order to determine the way in which customers would respond to different prices for their

products and the services by way of different channels (Wen and Mao, 2019). This system plays

a significant role in determining prices that company would best meet its goals like maximization

of profits. It helps the managers in setting up the suitable prices that is affordable to customers as

well as profitable for anCreams Ltd. It is the system that facilitates appropriate information in

entity. It helps the managers in keeping a check on the raw materials at each and every stage of

the production. It enables the management of company in lowering down the cost incurred in

business operations by way of identifying or controlling the relevant items. Moreover, this

system provides detailed information with regards cost incurred by the company and helps in

keeping better control on the cost.

Job costing system- It means the system that includes process of accumulating an

information regarding costs attached with particular production or the service job. It plays an

essential role in the Creams Ltd as it submit an information in relation to cost for the customers

under the contract where cost are been reimbursed (Amran, 2020). This information is useful in

determining accuracy of an estimating system of the company that helps in quoting price which

allows for gaining a reasonable profit. The information provided by this system could also be

used for assigning inventory cost in manufacturing the goods. This system presents information

relating to the cost incurred in each and every production unit or job. It enables managers in the

reviving the cost setting up best prices so that profits can be gained.

Inventory management system- It refers to combination of the processes, technology and

the procedures which oversee maintenance and monitoring of the stock. This system helps in

managing and maintaining optimum level of stock within the business. It helps in keeping the

business more and more organized and also assists the managers in tracking the level or flow of

inventory from business premises to the customer in an entire supply chain. It prevents an

inventory in being overflowed by just keeping sufficient inventory in stock. This helps in

minimizing amount of an unused inventory along with it improves relationship with the vendors.

It represents the information relating to stock level within the premises of an entity and also

helps in making optimum use of inventory so that less cost and wastage is resulted.

Price optimization system- This MA system involves using of the mathematical analysis

in order to determine the way in which customers would respond to different prices for their

products and the services by way of different channels (Wen and Mao, 2019). This system plays

a significant role in determining prices that company would best meet its goals like maximization

of profits. It helps the managers in setting up the suitable prices that is affordable to customers as

well as profitable for anCreams Ltd. It is the system that facilitates appropriate information in

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

relation to setting up of the price in such a way that large profitability could be ascertained and is

affordable to the customers as well.

P2. Describing different techniques that are been used for reporting under MA

The report under MA are been used for regulating, planning, making decision and

measuring the performance. Such reports are generated on a continuous basis throughout n

accounting and the book-keeping period as per the requirements (Shevelev, Shevelevaand

Gvozdev, 2017). As many of the critical decisions depend on authenticity of such reports, they

must be crafted carefully by experts. Managers assess such reports for highlighting particular

patterns and converting it into useful information for company.

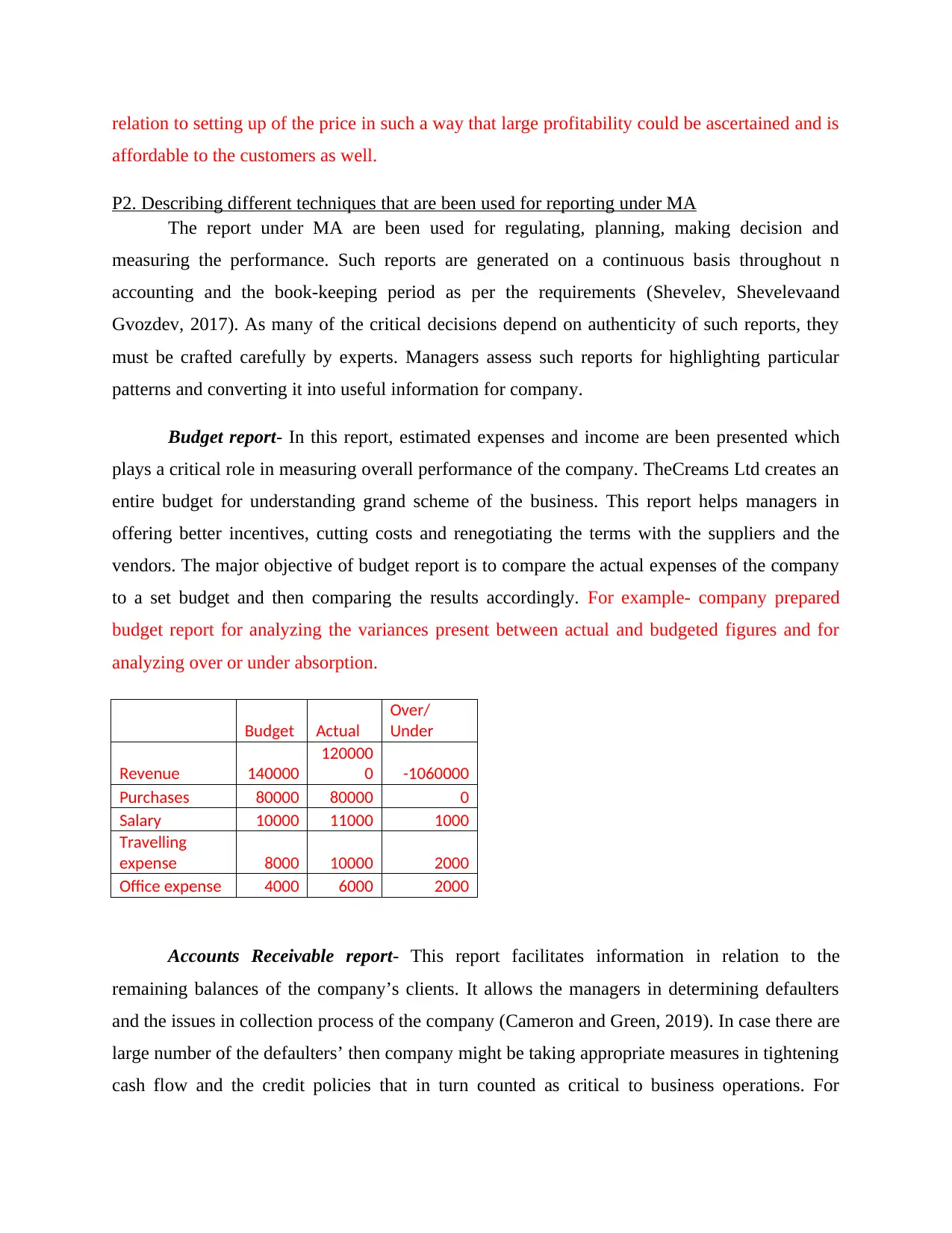

Budget report- In this report, estimated expenses and income are been presented which

plays a critical role in measuring overall performance of the company. TheCreams Ltd creates an

entire budget for understanding grand scheme of the business. This report helps managers in

offering better incentives, cutting costs and renegotiating the terms with the suppliers and the

vendors. The major objective of budget report is to compare the actual expenses of the company

to a set budget and then comparing the results accordingly. For example- company prepared

budget report for analyzing the variances present between actual and budgeted figures and for

analyzing over or under absorption.

Budget Actual

Over/

Under

Revenue 140000

120000

0 -1060000

Purchases 80000 80000 0

Salary 10000 11000 1000

Travelling

expense 8000 10000 2000

Office expense 4000 6000 2000

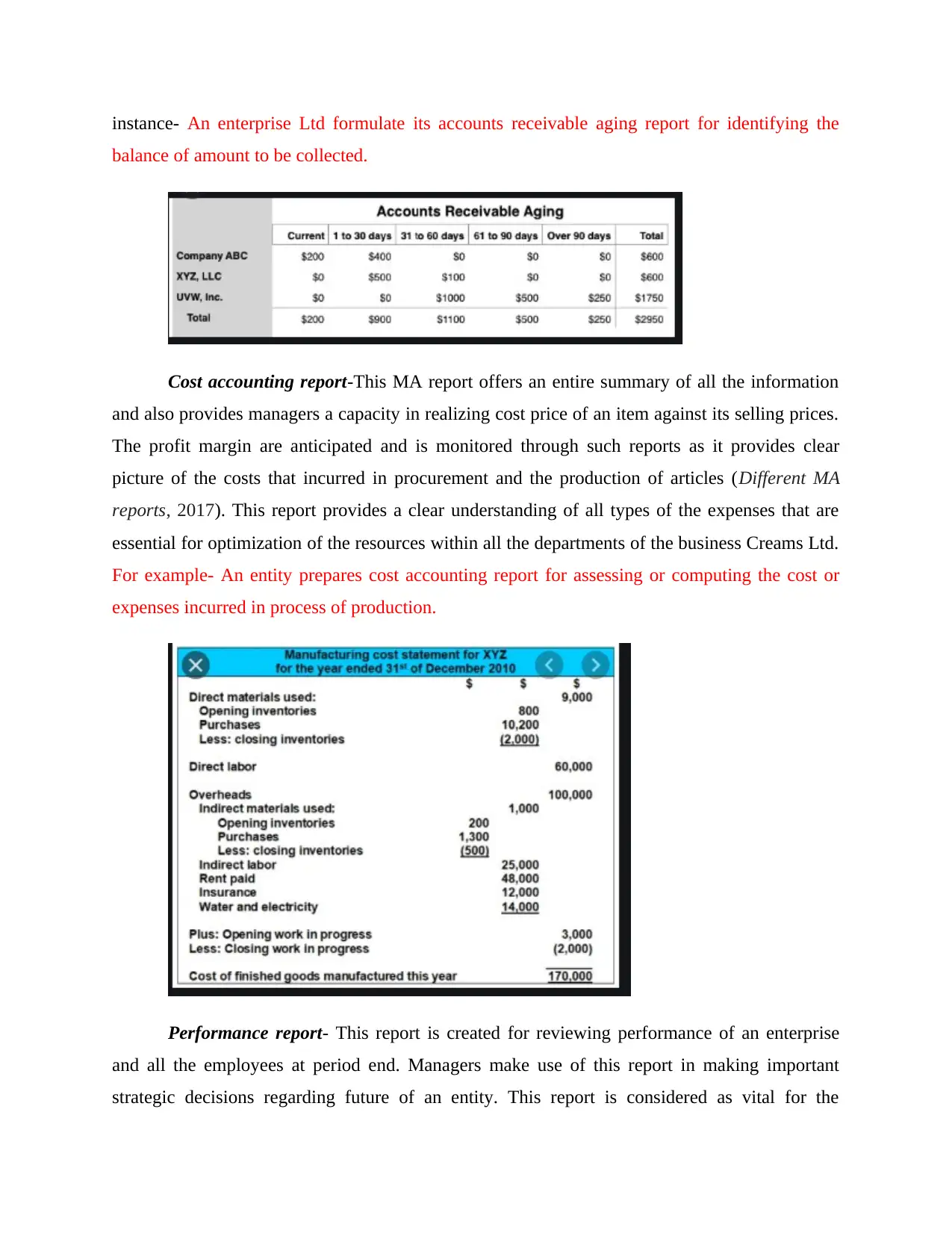

Accounts Receivable report- This report facilitates information in relation to the

remaining balances of the company’s clients. It allows the managers in determining defaulters

and the issues in collection process of the company (Cameron and Green, 2019). In case there are

large number of the defaulters’ then company might be taking appropriate measures in tightening

cash flow and the credit policies that in turn counted as critical to business operations. For

affordable to the customers as well.

P2. Describing different techniques that are been used for reporting under MA

The report under MA are been used for regulating, planning, making decision and

measuring the performance. Such reports are generated on a continuous basis throughout n

accounting and the book-keeping period as per the requirements (Shevelev, Shevelevaand

Gvozdev, 2017). As many of the critical decisions depend on authenticity of such reports, they

must be crafted carefully by experts. Managers assess such reports for highlighting particular

patterns and converting it into useful information for company.

Budget report- In this report, estimated expenses and income are been presented which

plays a critical role in measuring overall performance of the company. TheCreams Ltd creates an

entire budget for understanding grand scheme of the business. This report helps managers in

offering better incentives, cutting costs and renegotiating the terms with the suppliers and the

vendors. The major objective of budget report is to compare the actual expenses of the company

to a set budget and then comparing the results accordingly. For example- company prepared

budget report for analyzing the variances present between actual and budgeted figures and for

analyzing over or under absorption.

Budget Actual

Over/

Under

Revenue 140000

120000

0 -1060000

Purchases 80000 80000 0

Salary 10000 11000 1000

Travelling

expense 8000 10000 2000

Office expense 4000 6000 2000

Accounts Receivable report- This report facilitates information in relation to the

remaining balances of the company’s clients. It allows the managers in determining defaulters

and the issues in collection process of the company (Cameron and Green, 2019). In case there are

large number of the defaulters’ then company might be taking appropriate measures in tightening

cash flow and the credit policies that in turn counted as critical to business operations. For

instance- An enterprise Ltd formulate its accounts receivable aging report for identifying the

balance of amount to be collected.

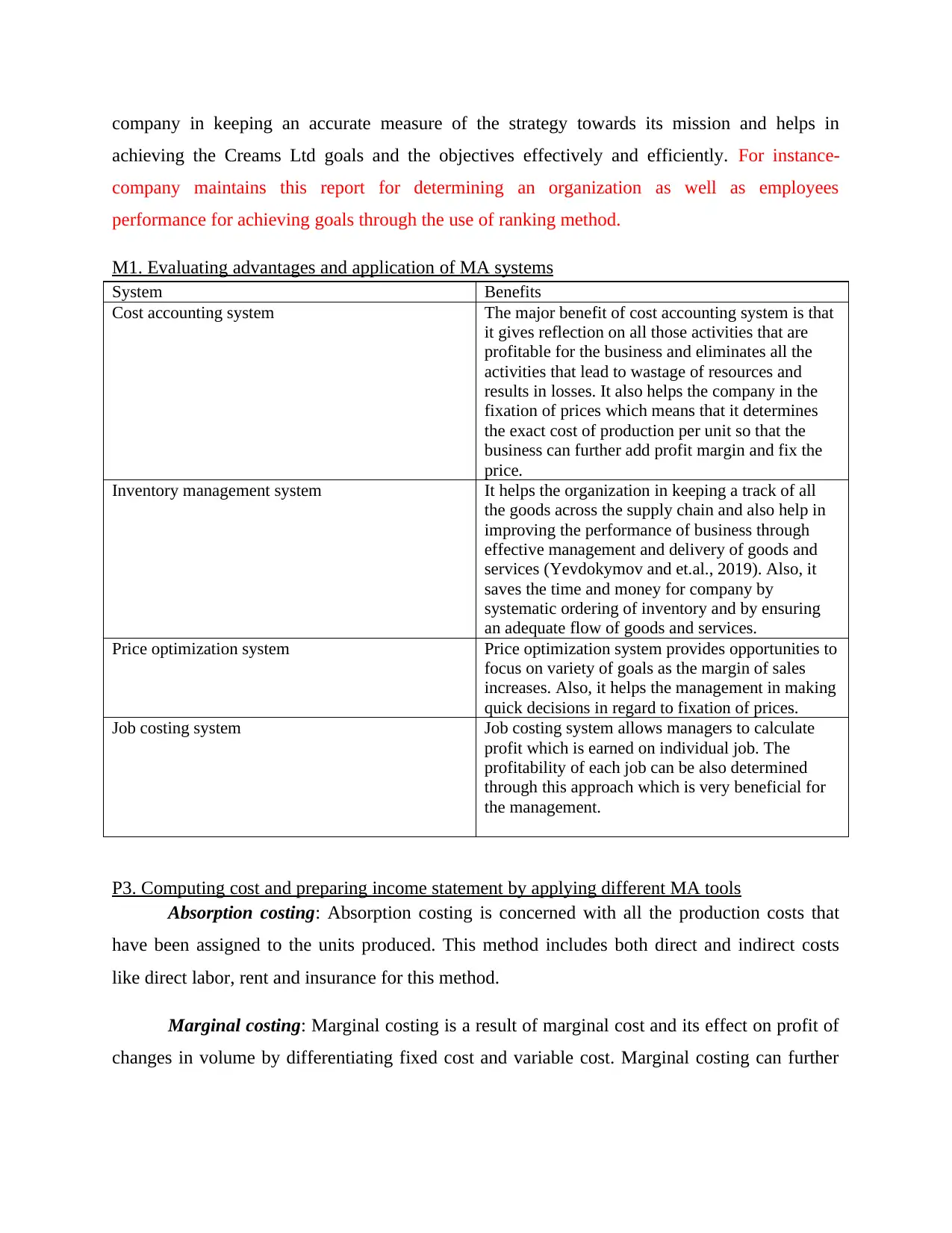

Cost accounting report-This MA report offers an entire summary of all the information

and also provides managers a capacity in realizing cost price of an item against its selling prices.

The profit margin are anticipated and is monitored through such reports as it provides clear

picture of the costs that incurred in procurement and the production of articles (Different MA

reports, 2017). This report provides a clear understanding of all types of the expenses that are

essential for optimization of the resources within all the departments of the business Creams Ltd.

For example- An entity prepares cost accounting report for assessing or computing the cost or

expenses incurred in process of production.

Performance report- This report is created for reviewing performance of an enterprise

and all the employees at period end. Managers make use of this report in making important

strategic decisions regarding future of an entity. This report is considered as vital for the

balance of amount to be collected.

Cost accounting report-This MA report offers an entire summary of all the information

and also provides managers a capacity in realizing cost price of an item against its selling prices.

The profit margin are anticipated and is monitored through such reports as it provides clear

picture of the costs that incurred in procurement and the production of articles (Different MA

reports, 2017). This report provides a clear understanding of all types of the expenses that are

essential for optimization of the resources within all the departments of the business Creams Ltd.

For example- An entity prepares cost accounting report for assessing or computing the cost or

expenses incurred in process of production.

Performance report- This report is created for reviewing performance of an enterprise

and all the employees at period end. Managers make use of this report in making important

strategic decisions regarding future of an entity. This report is considered as vital for the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

company in keeping an accurate measure of the strategy towards its mission and helps in

achieving the Creams Ltd goals and the objectives effectively and efficiently. For instance-

company maintains this report for determining an organization as well as employees

performance for achieving goals through the use of ranking method.

M1. Evaluating advantages and application of MA systems

System Benefits

Cost accounting system The major benefit of cost accounting system is that

it gives reflection on all those activities that are

profitable for the business and eliminates all the

activities that lead to wastage of resources and

results in losses. It also helps the company in the

fixation of prices which means that it determines

the exact cost of production per unit so that the

business can further add profit margin and fix the

price.

Inventory management system It helps the organization in keeping a track of all

the goods across the supply chain and also help in

improving the performance of business through

effective management and delivery of goods and

services (Yevdokymov and et.al., 2019). Also, it

saves the time and money for company by

systematic ordering of inventory and by ensuring

an adequate flow of goods and services.

Price optimization system Price optimization system provides opportunities to

focus on variety of goals as the margin of sales

increases. Also, it helps the management in making

quick decisions in regard to fixation of prices.

Job costing system Job costing system allows managers to calculate

profit which is earned on individual job. The

profitability of each job can be also determined

through this approach which is very beneficial for

the management.

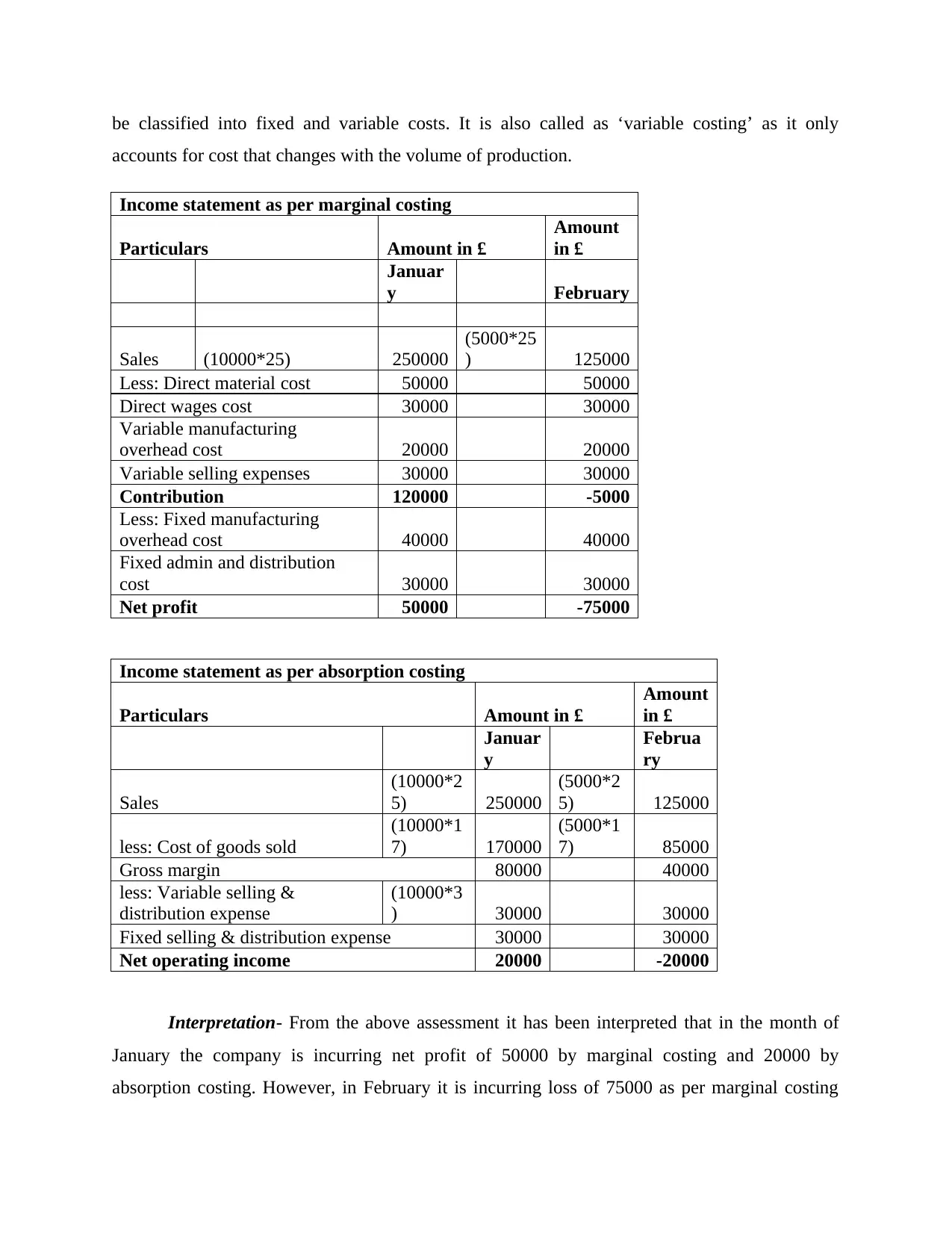

P3. Computing cost and preparing income statement by applying different MA tools

Absorption costing: Absorption costing is concerned with all the production costs that

have been assigned to the units produced. This method includes both direct and indirect costs

like direct labor, rent and insurance for this method.

Marginal costing: Marginal costing is a result of marginal cost and its effect on profit of

changes in volume by differentiating fixed cost and variable cost. Marginal costing can further

achieving the Creams Ltd goals and the objectives effectively and efficiently. For instance-

company maintains this report for determining an organization as well as employees

performance for achieving goals through the use of ranking method.

M1. Evaluating advantages and application of MA systems

System Benefits

Cost accounting system The major benefit of cost accounting system is that

it gives reflection on all those activities that are

profitable for the business and eliminates all the

activities that lead to wastage of resources and

results in losses. It also helps the company in the

fixation of prices which means that it determines

the exact cost of production per unit so that the

business can further add profit margin and fix the

price.

Inventory management system It helps the organization in keeping a track of all

the goods across the supply chain and also help in

improving the performance of business through

effective management and delivery of goods and

services (Yevdokymov and et.al., 2019). Also, it

saves the time and money for company by

systematic ordering of inventory and by ensuring

an adequate flow of goods and services.

Price optimization system Price optimization system provides opportunities to

focus on variety of goals as the margin of sales

increases. Also, it helps the management in making

quick decisions in regard to fixation of prices.

Job costing system Job costing system allows managers to calculate

profit which is earned on individual job. The

profitability of each job can be also determined

through this approach which is very beneficial for

the management.

P3. Computing cost and preparing income statement by applying different MA tools

Absorption costing: Absorption costing is concerned with all the production costs that

have been assigned to the units produced. This method includes both direct and indirect costs

like direct labor, rent and insurance for this method.

Marginal costing: Marginal costing is a result of marginal cost and its effect on profit of

changes in volume by differentiating fixed cost and variable cost. Marginal costing can further

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

be classified into fixed and variable costs. It is also called as ‘variable costing’ as it only

accounts for cost that changes with the volume of production.

Income statement as per marginal costing

Particulars Amount in £

Amount

in £

Januar

y February

Sales (10000*25) 250000

(5000*25

) 125000

Less: Direct material cost 50000 50000

Direct wages cost 30000 30000

Variable manufacturing

overhead cost 20000 20000

Variable selling expenses 30000 30000

Contribution 120000 -5000

Less: Fixed manufacturing

overhead cost 40000 40000

Fixed admin and distribution

cost 30000 30000

Net profit 50000 -75000

Income statement as per absorption costing

Particulars Amount in £

Amount

in £

Januar

y

Februa

ry

Sales

(10000*2

5) 250000

(5000*2

5) 125000

less: Cost of goods sold

(10000*1

7) 170000

(5000*1

7) 85000

Gross margin 80000 40000

less: Variable selling &

distribution expense

(10000*3

) 30000 30000

Fixed selling & distribution expense 30000 30000

Net operating income 20000 -20000

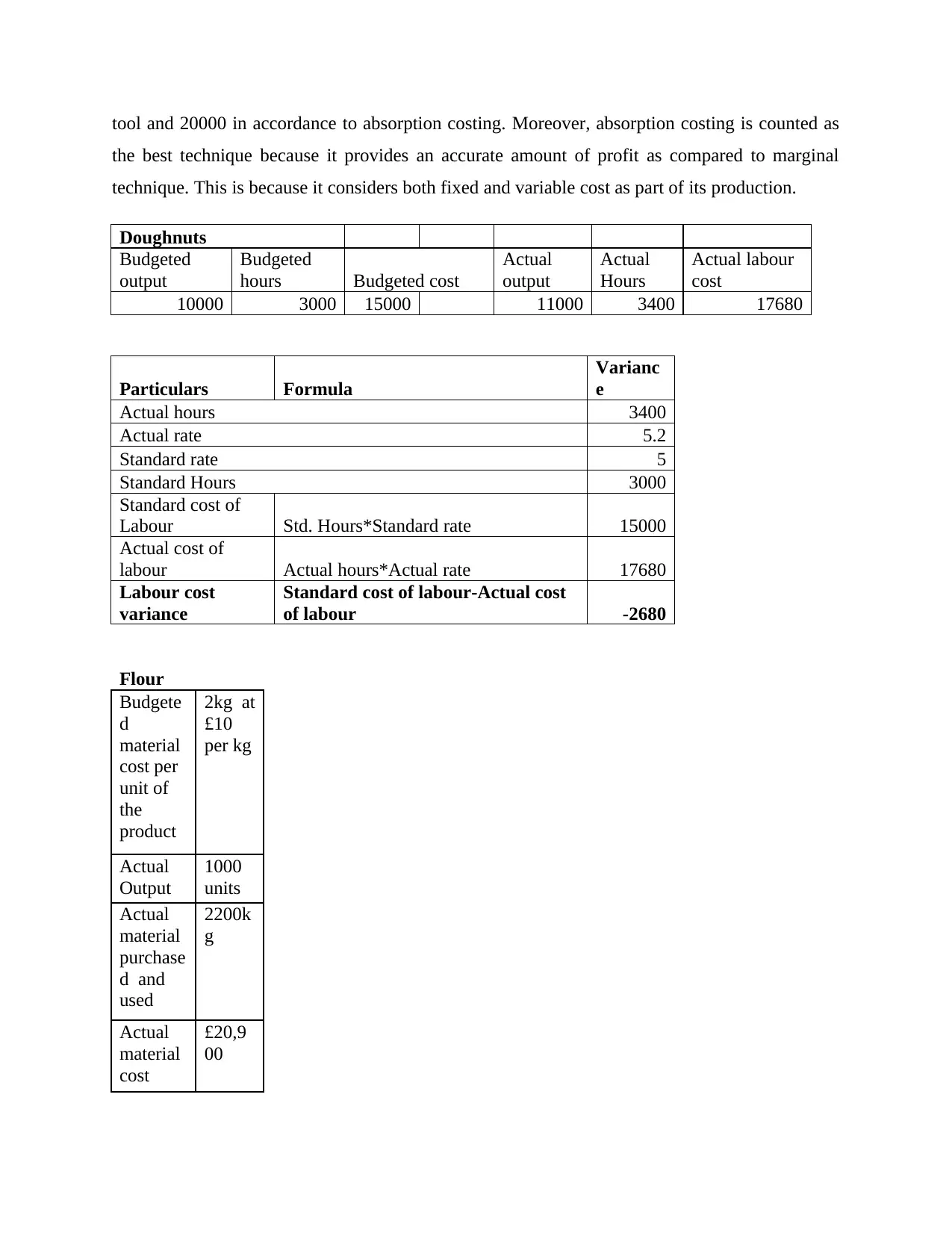

Interpretation- From the above assessment it has been interpreted that in the month of

January the company is incurring net profit of 50000 by marginal costing and 20000 by

absorption costing. However, in February it is incurring loss of 75000 as per marginal costing

accounts for cost that changes with the volume of production.

Income statement as per marginal costing

Particulars Amount in £

Amount

in £

Januar

y February

Sales (10000*25) 250000

(5000*25

) 125000

Less: Direct material cost 50000 50000

Direct wages cost 30000 30000

Variable manufacturing

overhead cost 20000 20000

Variable selling expenses 30000 30000

Contribution 120000 -5000

Less: Fixed manufacturing

overhead cost 40000 40000

Fixed admin and distribution

cost 30000 30000

Net profit 50000 -75000

Income statement as per absorption costing

Particulars Amount in £

Amount

in £

Januar

y

Februa

ry

Sales

(10000*2

5) 250000

(5000*2

5) 125000

less: Cost of goods sold

(10000*1

7) 170000

(5000*1

7) 85000

Gross margin 80000 40000

less: Variable selling &

distribution expense

(10000*3

) 30000 30000

Fixed selling & distribution expense 30000 30000

Net operating income 20000 -20000

Interpretation- From the above assessment it has been interpreted that in the month of

January the company is incurring net profit of 50000 by marginal costing and 20000 by

absorption costing. However, in February it is incurring loss of 75000 as per marginal costing

tool and 20000 in accordance to absorption costing. Moreover, absorption costing is counted as

the best technique because it provides an accurate amount of profit as compared to marginal

technique. This is because it considers both fixed and variable cost as part of its production.

Doughnuts

Budgeted

output

Budgeted

hours Budgeted cost

Actual

output

Actual

Hours

Actual labour

cost

10000 3000 15000 11000 3400 17680

Particulars Formula

Varianc

e

Actual hours 3400

Actual rate 5.2

Standard rate 5

Standard Hours 3000

Standard cost of

Labour Std. Hours*Standard rate 15000

Actual cost of

labour Actual hours*Actual rate 17680

Labour cost

variance

Standard cost of labour-Actual cost

of labour -2680

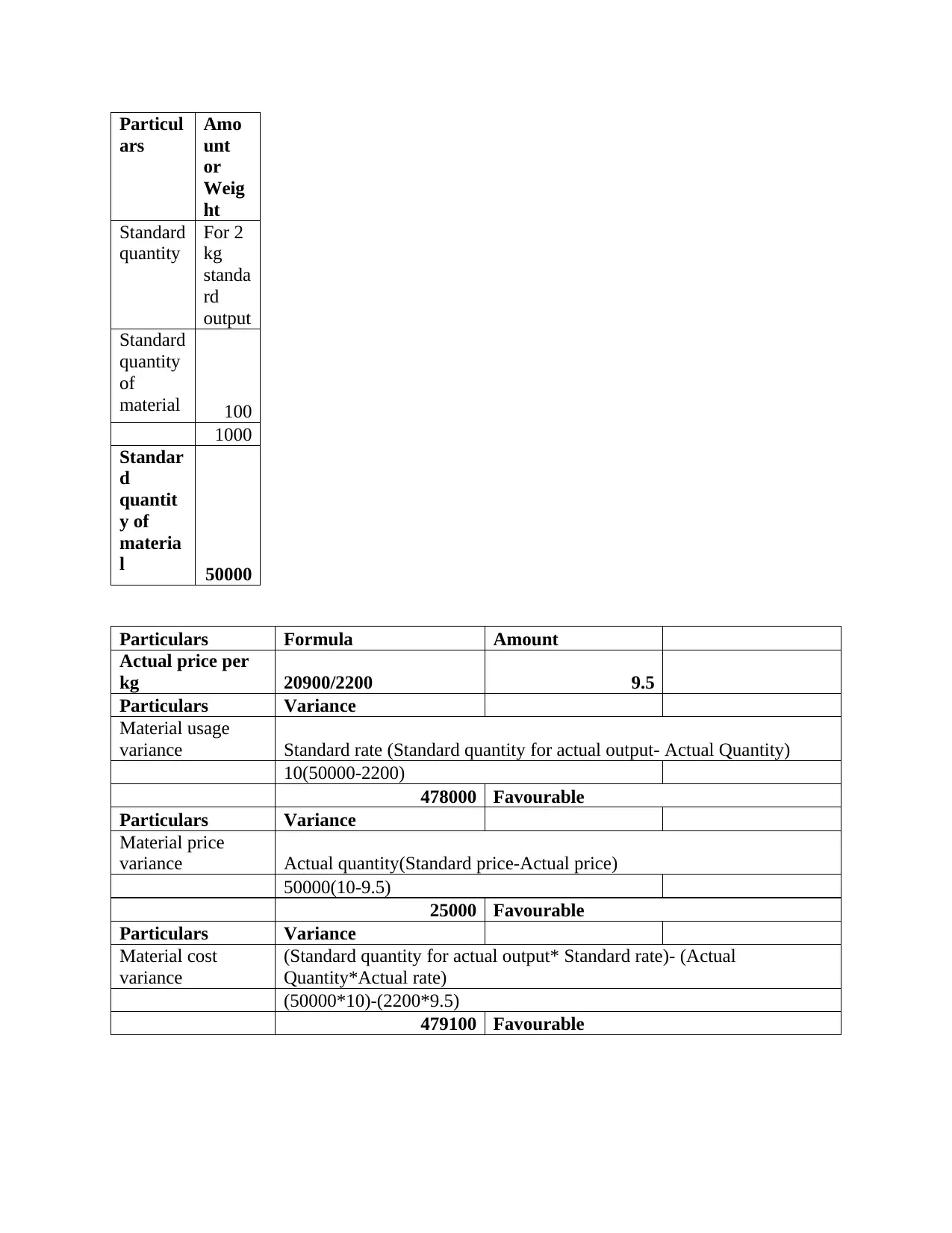

Flour

Budgete

d

material

cost per

unit of

the

product

2kg at

£10

per kg

Actual

Output

1000

units

Actual

material

purchase

d and

used

2200k

g

Actual

material

cost

£20,9

00

the best technique because it provides an accurate amount of profit as compared to marginal

technique. This is because it considers both fixed and variable cost as part of its production.

Doughnuts

Budgeted

output

Budgeted

hours Budgeted cost

Actual

output

Actual

Hours

Actual labour

cost

10000 3000 15000 11000 3400 17680

Particulars Formula

Varianc

e

Actual hours 3400

Actual rate 5.2

Standard rate 5

Standard Hours 3000

Standard cost of

Labour Std. Hours*Standard rate 15000

Actual cost of

labour Actual hours*Actual rate 17680

Labour cost

variance

Standard cost of labour-Actual cost

of labour -2680

Flour

Budgete

d

material

cost per

unit of

the

product

2kg at

£10

per kg

Actual

Output

1000

units

Actual

material

purchase

d and

used

2200k

g

Actual

material

cost

£20,9

00

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Particul

ars

Amo

unt

or

Weig

ht

Standard

quantity

For 2

kg

standa

rd

output

Standard

quantity

of

material 100

1000

Standar

d

quantit

y of

materia

l 50000

Particulars Formula Amount

Actual price per

kg 20900/2200 9.5

Particulars Variance

Material usage

variance Standard rate (Standard quantity for actual output- Actual Quantity)

10(50000-2200)

478000 Favourable

Particulars Variance

Material price

variance Actual quantity(Standard price-Actual price)

50000(10-9.5)

25000 Favourable

Particulars Variance

Material cost

variance

(Standard quantity for actual output* Standard rate)- (Actual

Quantity*Actual rate)

(50000*10)-(2200*9.5)

479100 Favourable

ars

Amo

unt

or

Weig

ht

Standard

quantity

For 2

kg

standa

rd

output

Standard

quantity

of

material 100

1000

Standar

d

quantit

y of

materia

l 50000

Particulars Formula Amount

Actual price per

kg 20900/2200 9.5

Particulars Variance

Material usage

variance Standard rate (Standard quantity for actual output- Actual Quantity)

10(50000-2200)

478000 Favourable

Particulars Variance

Material price

variance Actual quantity(Standard price-Actual price)

50000(10-9.5)

25000 Favourable

Particulars Variance

Material cost

variance

(Standard quantity for actual output* Standard rate)- (Actual

Quantity*Actual rate)

(50000*10)-(2200*9.5)

479100 Favourable

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

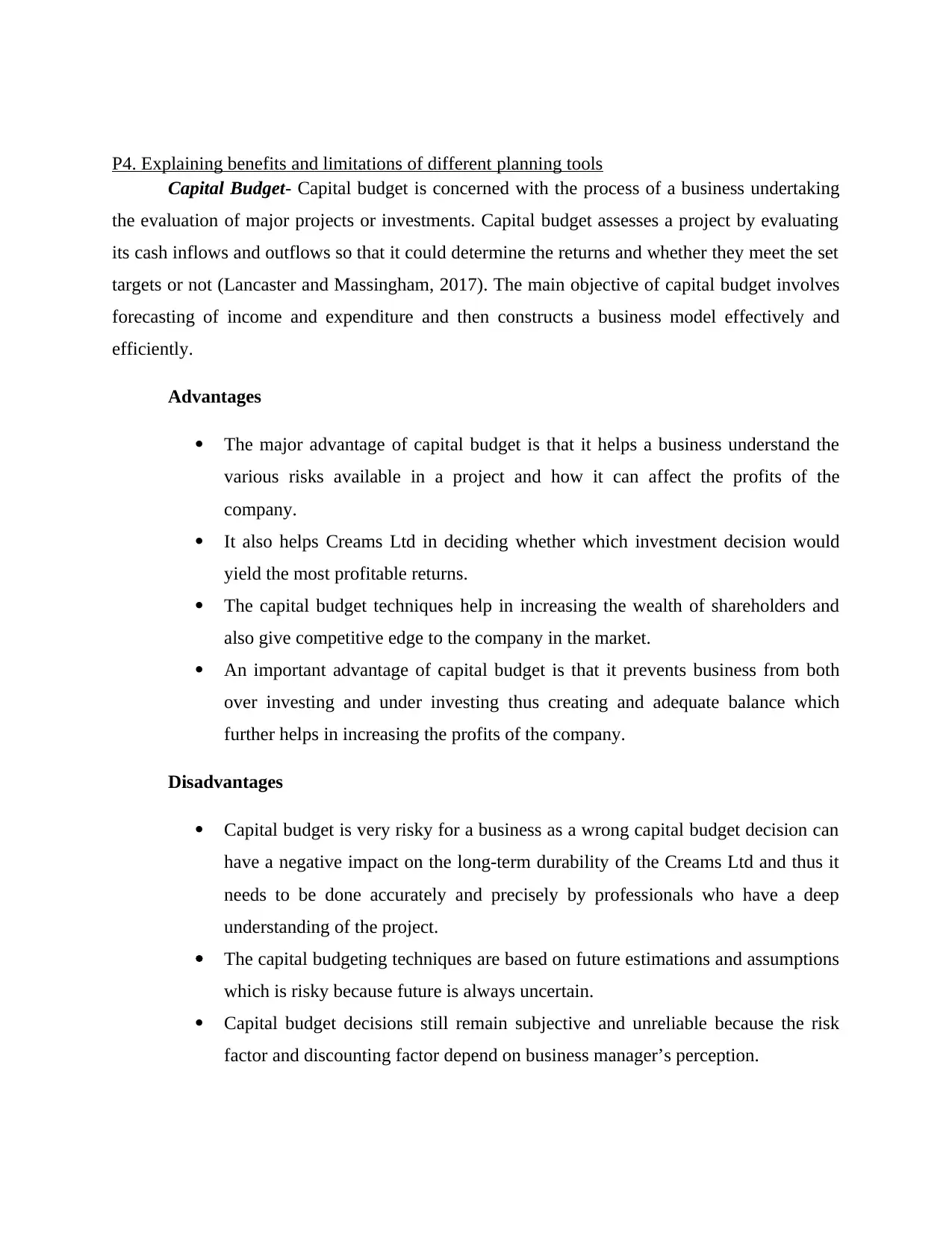

P4. Explaining benefits and limitations of different planning tools

Capital Budget- Capital budget is concerned with the process of a business undertaking

the evaluation of major projects or investments. Capital budget assesses a project by evaluating

its cash inflows and outflows so that it could determine the returns and whether they meet the set

targets or not (Lancaster and Massingham, 2017). The main objective of capital budget involves

forecasting of income and expenditure and then constructs a business model effectively and

efficiently.

Advantages

The major advantage of capital budget is that it helps a business understand the

various risks available in a project and how it can affect the profits of the

company.

It also helps Creams Ltd in deciding whether which investment decision would

yield the most profitable returns.

The capital budget techniques help in increasing the wealth of shareholders and

also give competitive edge to the company in the market.

An important advantage of capital budget is that it prevents business from both

over investing and under investing thus creating and adequate balance which

further helps in increasing the profits of the company.

Disadvantages

Capital budget is very risky for a business as a wrong capital budget decision can

have a negative impact on the long-term durability of the Creams Ltd and thus it

needs to be done accurately and precisely by professionals who have a deep

understanding of the project.

The capital budgeting techniques are based on future estimations and assumptions

which is risky because future is always uncertain.

Capital budget decisions still remain subjective and unreliable because the risk

factor and discounting factor depend on business manager’s perception.

Capital Budget- Capital budget is concerned with the process of a business undertaking

the evaluation of major projects or investments. Capital budget assesses a project by evaluating

its cash inflows and outflows so that it could determine the returns and whether they meet the set

targets or not (Lancaster and Massingham, 2017). The main objective of capital budget involves

forecasting of income and expenditure and then constructs a business model effectively and

efficiently.

Advantages

The major advantage of capital budget is that it helps a business understand the

various risks available in a project and how it can affect the profits of the

company.

It also helps Creams Ltd in deciding whether which investment decision would

yield the most profitable returns.

The capital budget techniques help in increasing the wealth of shareholders and

also give competitive edge to the company in the market.

An important advantage of capital budget is that it prevents business from both

over investing and under investing thus creating and adequate balance which

further helps in increasing the profits of the company.

Disadvantages

Capital budget is very risky for a business as a wrong capital budget decision can

have a negative impact on the long-term durability of the Creams Ltd and thus it

needs to be done accurately and precisely by professionals who have a deep

understanding of the project.

The capital budgeting techniques are based on future estimations and assumptions

which is risky because future is always uncertain.

Capital budget decisions still remain subjective and unreliable because the risk

factor and discounting factor depend on business manager’s perception.

Another limitation of capital budgeting is that the cost of operations increases

when the fixed asset investment is more than required and also abnormal

investment creates problem for the business because it makes it difficult for them

to increase their budget and capital.

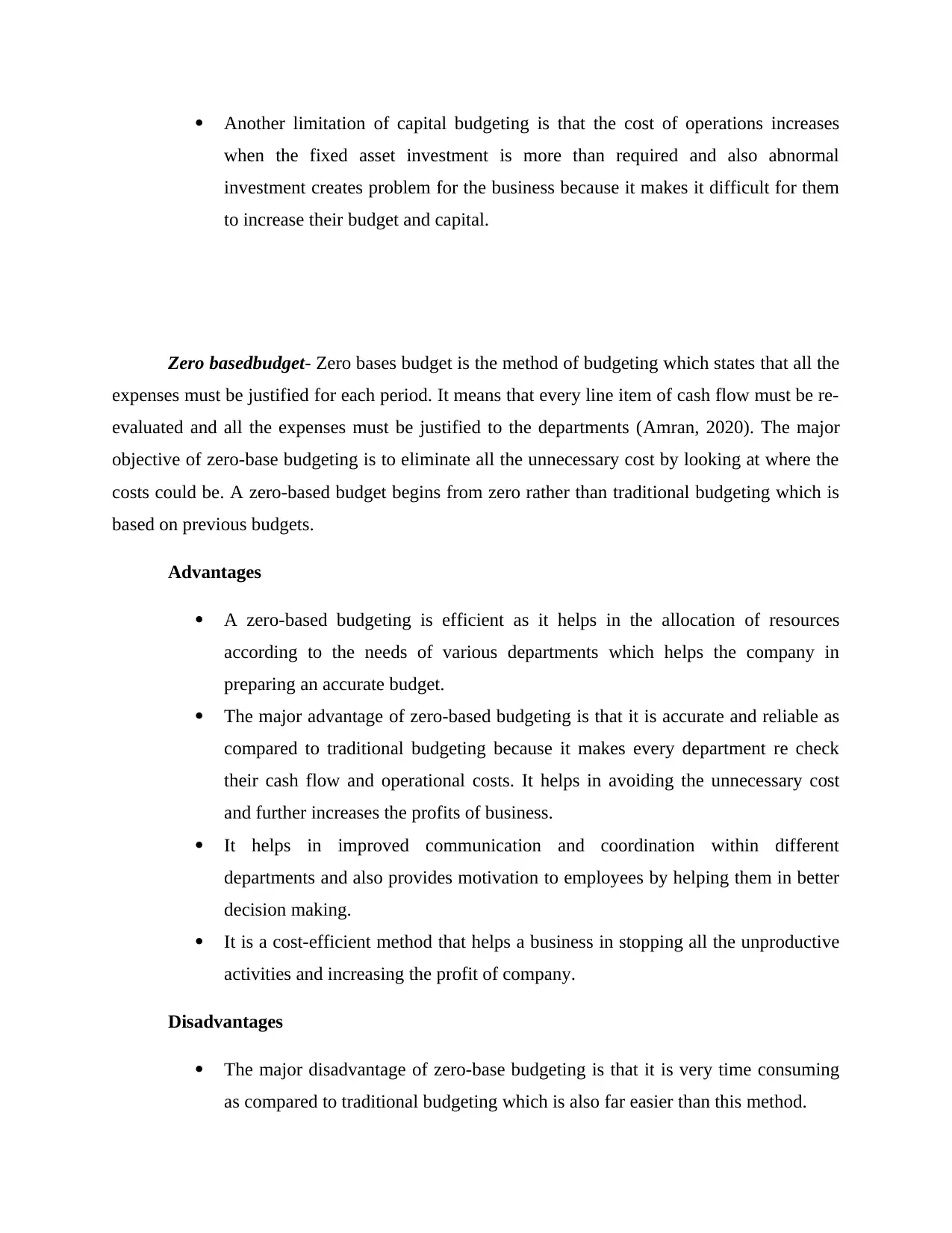

Zero basedbudget- Zero bases budget is the method of budgeting which states that all the

expenses must be justified for each period. It means that every line item of cash flow must be re-

evaluated and all the expenses must be justified to the departments (Amran, 2020). The major

objective of zero-base budgeting is to eliminate all the unnecessary cost by looking at where the

costs could be. A zero-based budget begins from zero rather than traditional budgeting which is

based on previous budgets.

Advantages

A zero-based budgeting is efficient as it helps in the allocation of resources

according to the needs of various departments which helps the company in

preparing an accurate budget.

The major advantage of zero-based budgeting is that it is accurate and reliable as

compared to traditional budgeting because it makes every department re check

their cash flow and operational costs. It helps in avoiding the unnecessary cost

and further increases the profits of business.

It helps in improved communication and coordination within different

departments and also provides motivation to employees by helping them in better

decision making.

It is a cost-efficient method that helps a business in stopping all the unproductive

activities and increasing the profit of company.

Disadvantages

The major disadvantage of zero-base budgeting is that it is very time consuming

as compared to traditional budgeting which is also far easier than this method.

when the fixed asset investment is more than required and also abnormal

investment creates problem for the business because it makes it difficult for them

to increase their budget and capital.

Zero basedbudget- Zero bases budget is the method of budgeting which states that all the

expenses must be justified for each period. It means that every line item of cash flow must be re-

evaluated and all the expenses must be justified to the departments (Amran, 2020). The major

objective of zero-base budgeting is to eliminate all the unnecessary cost by looking at where the

costs could be. A zero-based budget begins from zero rather than traditional budgeting which is

based on previous budgets.

Advantages

A zero-based budgeting is efficient as it helps in the allocation of resources

according to the needs of various departments which helps the company in

preparing an accurate budget.

The major advantage of zero-based budgeting is that it is accurate and reliable as

compared to traditional budgeting because it makes every department re check

their cash flow and operational costs. It helps in avoiding the unnecessary cost

and further increases the profits of business.

It helps in improved communication and coordination within different

departments and also provides motivation to employees by helping them in better

decision making.

It is a cost-efficient method that helps a business in stopping all the unproductive

activities and increasing the profit of company.

Disadvantages

The major disadvantage of zero-base budgeting is that it is very time consuming

as compared to traditional budgeting which is also far easier than this method.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.