Management Accounting Report: UCK Furniture Performance Analysis

VerifiedAdded on 2020/11/23

|12

|2724

|55

Report

AI Summary

This report provides a comprehensive analysis of management accounting practices applied to UCK Furniture. It begins with an introduction to the importance of managerial aspects in improving business operations, followed by an in-depth examination of costing methods, including absorption and marginal costing, along with their respective advantages and disadvantages. The report then explores various management accounting techniques, such as cash flow statements and cost variance analysis, highlighting their significance in enhancing financial health. The report also delves into budgetary control, discussing the advantages and disadvantages of planning tools like net present value, payback period, and internal rate of return. Furthermore, it includes the application of the high-low method for estimating expenses, the purpose of budget preparation, and the creation of cash budgets. Finally, the report calculates and interprets financial ratios to assess UCK Furniture's financial performance and discusses how management accounting can improve a business's financial standing, concluding with a discussion of planning tools to mitigate financial challenges and achieve success. The report is a valuable resource for students studying management accounting, providing practical insights into real-world business scenarios.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 A) Preparing cost card of absorption and marginal costing .................................................1

1.2 Range of management accounting techniques......................................................................3

1.3 Interpretation of both absorption and marginal costing and merits and demerits................4

TASK 2............................................................................................................................................5

2.1 Ascertaining the advantages and disadvantages of planning tools used in budgetary control

.....................................................................................................................................................5

2.2 Using High-low methods in estimating the expenses...........................................................7

2.3 Analysing the purpose of budget and preparing the cash budgets........................................7

TASK 3............................................................................................................................................8

3.1 Calculation of ratios .............................................................................................................8

3.2 Management accounting can improve financial performance of business...........................8

3.3 Discuss planning tools to reduce financial problems to achieve success..............................9

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 A) Preparing cost card of absorption and marginal costing .................................................1

1.2 Range of management accounting techniques......................................................................3

1.3 Interpretation of both absorption and marginal costing and merits and demerits................4

TASK 2............................................................................................................................................5

2.1 Ascertaining the advantages and disadvantages of planning tools used in budgetary control

.....................................................................................................................................................5

2.2 Using High-low methods in estimating the expenses...........................................................7

2.3 Analysing the purpose of budget and preparing the cash budgets........................................7

TASK 3............................................................................................................................................8

3.1 Calculation of ratios .............................................................................................................8

3.2 Management accounting can improve financial performance of business...........................8

3.3 Discuss planning tools to reduce financial problems to achieve success..............................9

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION

The managerial aspects of any business entity in the recent times is to bring the

appropriate execution and administration of the internal environment which in turn will be

helpful in making satisfactory improvements in the operational activities of the business. In the

present report there will be discussion based on various analysis made on operational practices of

UCK furniture on the basis of cash flows, income statement and ratio analysis.

TASK 1

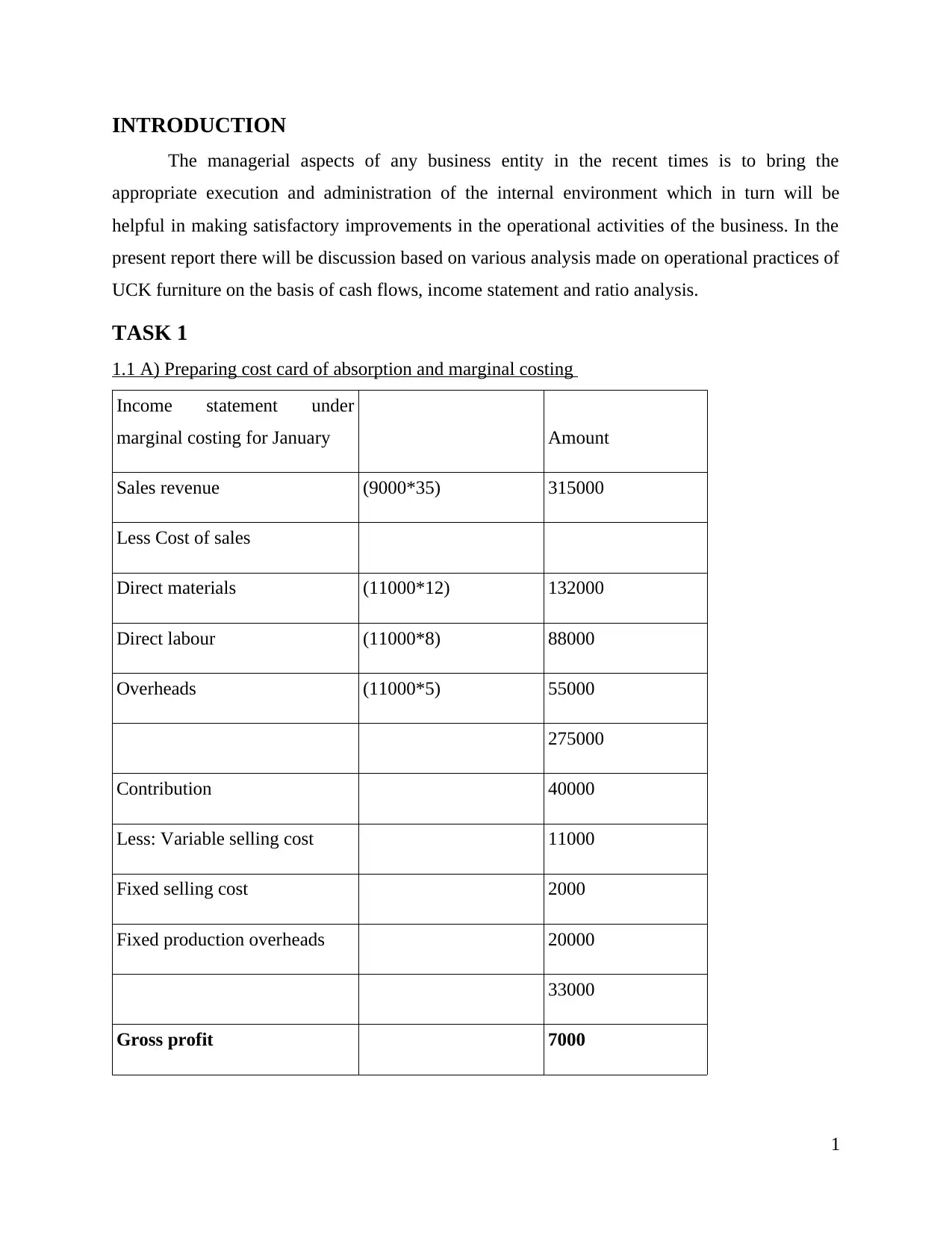

1.1 A) Preparing cost card of absorption and marginal costing

Income statement under

marginal costing for January Amount

Sales revenue (9000*35) 315000

Less Cost of sales

Direct materials (11000*12) 132000

Direct labour (11000*8) 88000

Overheads (11000*5) 55000

275000

Contribution 40000

Less: Variable selling cost 11000

Fixed selling cost 2000

Fixed production overheads 20000

33000

Gross profit 7000

1

The managerial aspects of any business entity in the recent times is to bring the

appropriate execution and administration of the internal environment which in turn will be

helpful in making satisfactory improvements in the operational activities of the business. In the

present report there will be discussion based on various analysis made on operational practices of

UCK furniture on the basis of cash flows, income statement and ratio analysis.

TASK 1

1.1 A) Preparing cost card of absorption and marginal costing

Income statement under

marginal costing for January Amount

Sales revenue (9000*35) 315000

Less Cost of sales

Direct materials (11000*12) 132000

Direct labour (11000*8) 88000

Overheads (11000*5) 55000

275000

Contribution 40000

Less: Variable selling cost 11000

Fixed selling cost 2000

Fixed production overheads 20000

33000

Gross profit 7000

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

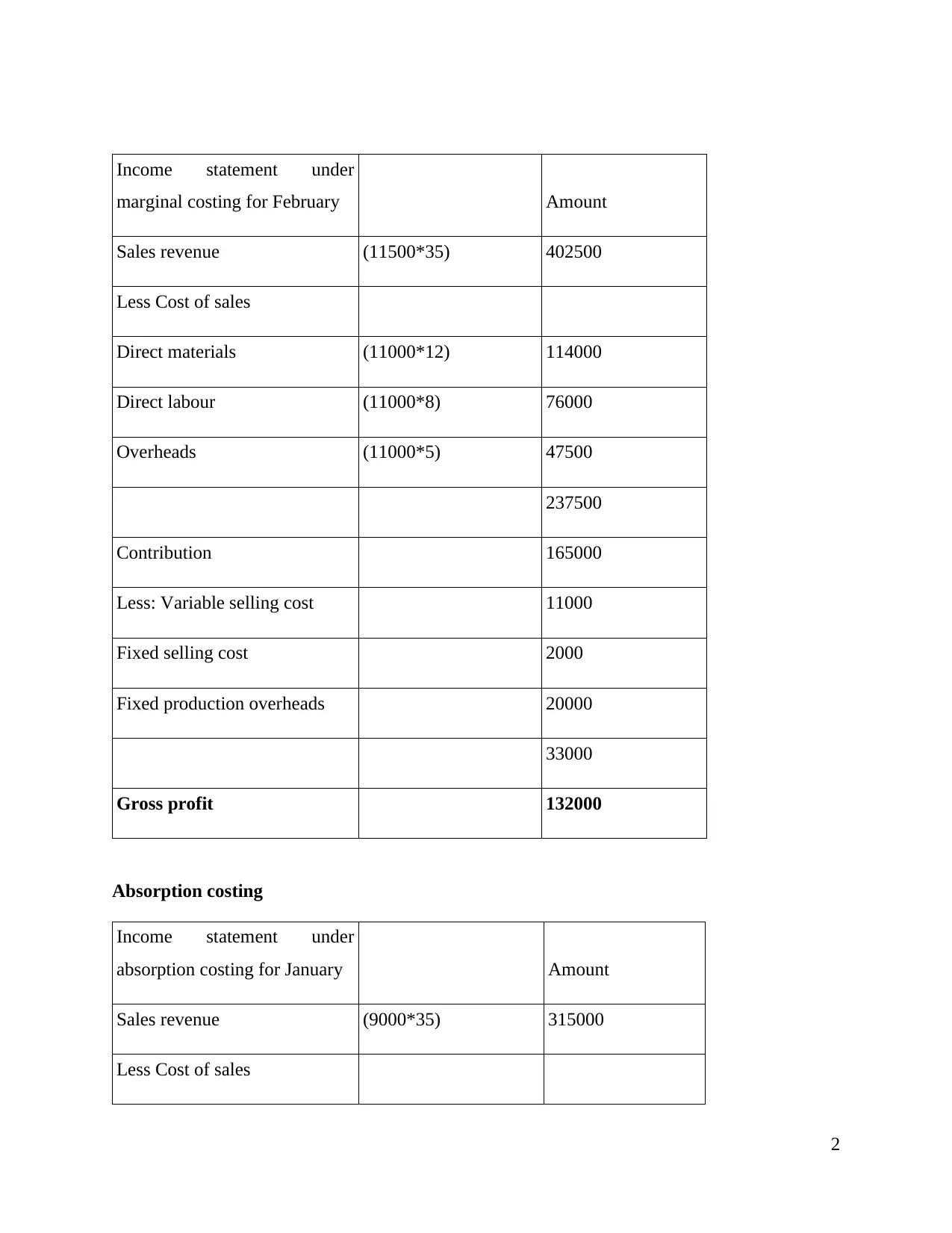

Income statement under

marginal costing for February Amount

Sales revenue (11500*35) 402500

Less Cost of sales

Direct materials (11000*12) 114000

Direct labour (11000*8) 76000

Overheads (11000*5) 47500

237500

Contribution 165000

Less: Variable selling cost 11000

Fixed selling cost 2000

Fixed production overheads 20000

33000

Gross profit 132000

Absorption costing

Income statement under

absorption costing for January Amount

Sales revenue (9000*35) 315000

Less Cost of sales

2

marginal costing for February Amount

Sales revenue (11500*35) 402500

Less Cost of sales

Direct materials (11000*12) 114000

Direct labour (11000*8) 76000

Overheads (11000*5) 47500

237500

Contribution 165000

Less: Variable selling cost 11000

Fixed selling cost 2000

Fixed production overheads 20000

33000

Gross profit 132000

Absorption costing

Income statement under

absorption costing for January Amount

Sales revenue (9000*35) 315000

Less Cost of sales

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Direct materials (11000*12) 132000

Direct labour (11000*8) 88000

Overheads (11000*5) 55000

275000

Contribution 40000

Less: Variable selling cost 11000

Fixed selling cost 2000

Fixed production overheads 22000

35000

Gross profit 5000

Income statement under

absorption costing for February Amount

Sales revenue (11500*35) 402500

Less Cost of sales

Direct materials (11000*12) 114000

Direct labour (11000*8) 76000

Overheads (11000*5) 47500

237500

3

Direct labour (11000*8) 88000

Overheads (11000*5) 55000

275000

Contribution 40000

Less: Variable selling cost 11000

Fixed selling cost 2000

Fixed production overheads 22000

35000

Gross profit 5000

Income statement under

absorption costing for February Amount

Sales revenue (11500*35) 402500

Less Cost of sales

Direct materials (11000*12) 114000

Direct labour (11000*8) 76000

Overheads (11000*5) 47500

237500

3

Contribution 165000

Less: Variable selling cost 11000

Fixed selling cost 2000

Fixed production overheads 22000

35000

Gross profit 130000

1.2 Range of management accounting techniques

There are various techniques of management accounting which are helpful in carrying out

to enhance overall financial position. Cash flow statement is one of the main technique by which

business is able to analyse cash position in the best possible manner. Moreover, there are various

activties such as operating, investing and financing activities which outlines whether adequate

cash balance is available or not (Cooper, Ezzamel and Qu, 2017). Another technique is cost

variance which is used to analyse difference between budgeted and actual costs. Thus, it is an

essential technique in generating financial reporting documents. On the other hand, revaluation

accounting is helpful in order to adjust current market and book value of asset in effectual

manner. Hence, this management accounting techniques are helpful for UCK Furniture to

enhance financial health in effective way.

1.3 Interpretation of both absorption and marginal costing and merits and demerits

Marginal costing

Marginal costing is a technique of management accounting wherein data related to cost

such as variable and fixed costs are provided to personnels for effective decision-making. The

effect on profit can be judged when there is change in volume of output. In marginal costing,

firm may be able to analyse cost of production and as a result, higher production can be achieved

by reducing unnecessary costs.

Advantages

4

Less: Variable selling cost 11000

Fixed selling cost 2000

Fixed production overheads 22000

35000

Gross profit 130000

1.2 Range of management accounting techniques

There are various techniques of management accounting which are helpful in carrying out

to enhance overall financial position. Cash flow statement is one of the main technique by which

business is able to analyse cash position in the best possible manner. Moreover, there are various

activties such as operating, investing and financing activities which outlines whether adequate

cash balance is available or not (Cooper, Ezzamel and Qu, 2017). Another technique is cost

variance which is used to analyse difference between budgeted and actual costs. Thus, it is an

essential technique in generating financial reporting documents. On the other hand, revaluation

accounting is helpful in order to adjust current market and book value of asset in effectual

manner. Hence, this management accounting techniques are helpful for UCK Furniture to

enhance financial health in effective way.

1.3 Interpretation of both absorption and marginal costing and merits and demerits

Marginal costing

Marginal costing is a technique of management accounting wherein data related to cost

such as variable and fixed costs are provided to personnels for effective decision-making. The

effect on profit can be judged when there is change in volume of output. In marginal costing,

firm may be able to analyse cost of production and as a result, higher production can be achieved

by reducing unnecessary costs.

Advantages

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

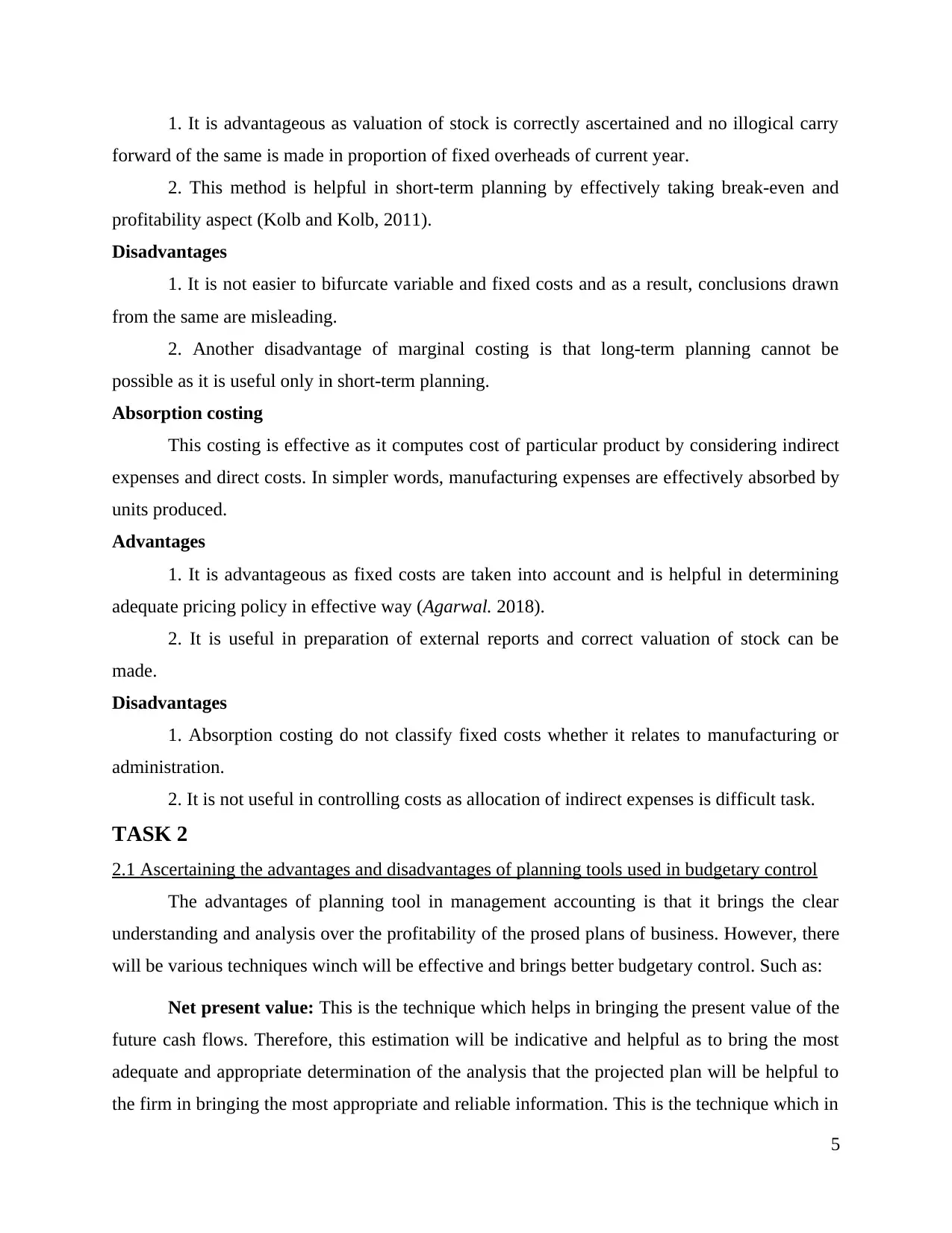

1. It is advantageous as valuation of stock is correctly ascertained and no illogical carry

forward of the same is made in proportion of fixed overheads of current year.

2. This method is helpful in short-term planning by effectively taking break-even and

profitability aspect (Kolb and Kolb, 2011).

Disadvantages

1. It is not easier to bifurcate variable and fixed costs and as a result, conclusions drawn

from the same are misleading.

2. Another disadvantage of marginal costing is that long-term planning cannot be

possible as it is useful only in short-term planning.

Absorption costing

This costing is effective as it computes cost of particular product by considering indirect

expenses and direct costs. In simpler words, manufacturing expenses are effectively absorbed by

units produced.

Advantages

1. It is advantageous as fixed costs are taken into account and is helpful in determining

adequate pricing policy in effective way (Agarwal. 2018).

2. It is useful in preparation of external reports and correct valuation of stock can be

made.

Disadvantages

1. Absorption costing do not classify fixed costs whether it relates to manufacturing or

administration.

2. It is not useful in controlling costs as allocation of indirect expenses is difficult task.

TASK 2

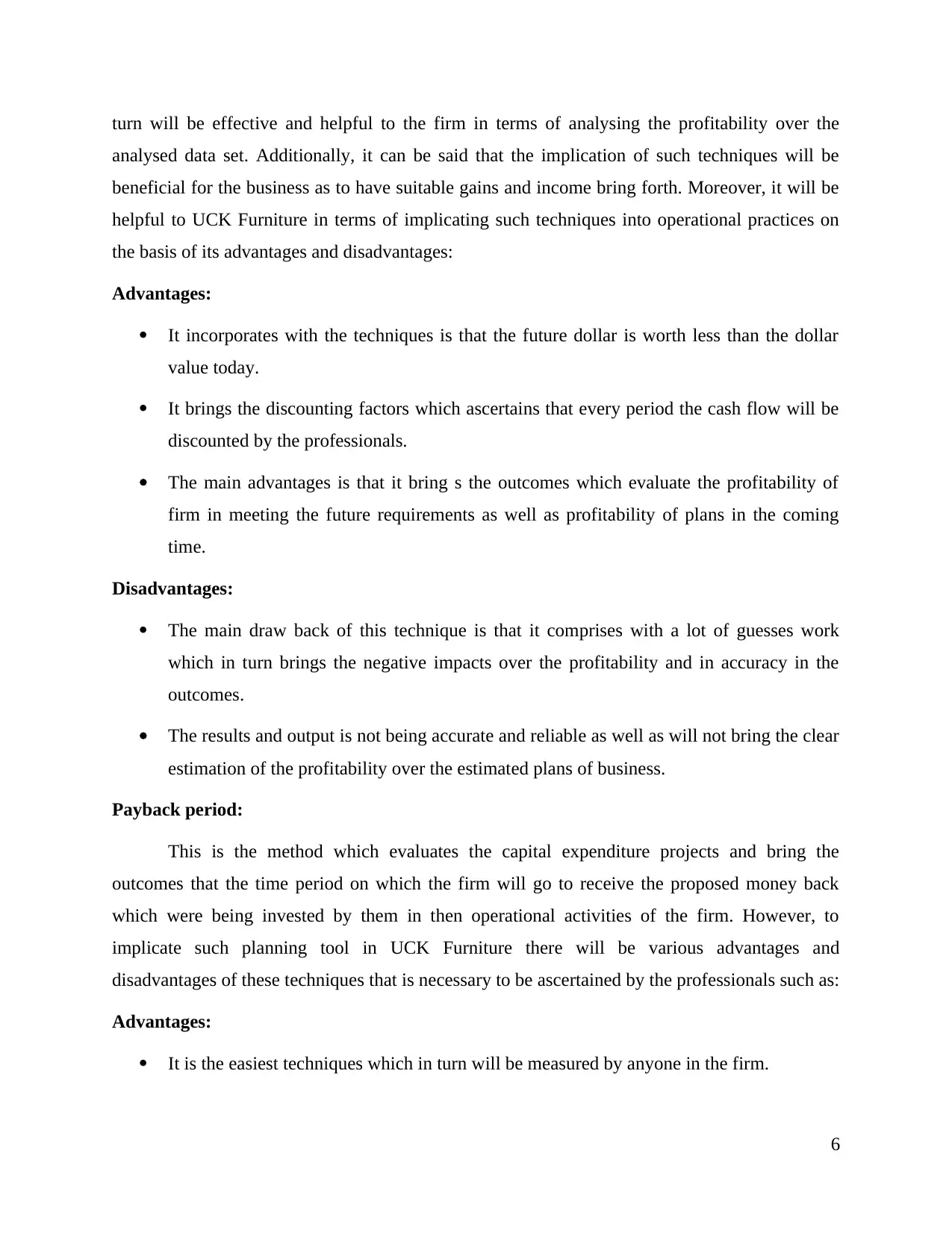

2.1 Ascertaining the advantages and disadvantages of planning tools used in budgetary control

The advantages of planning tool in management accounting is that it brings the clear

understanding and analysis over the profitability of the prosed plans of business. However, there

will be various techniques winch will be effective and brings better budgetary control. Such as:

Net present value: This is the technique which helps in bringing the present value of the

future cash flows. Therefore, this estimation will be indicative and helpful as to bring the most

adequate and appropriate determination of the analysis that the projected plan will be helpful to

the firm in bringing the most appropriate and reliable information. This is the technique which in

5

forward of the same is made in proportion of fixed overheads of current year.

2. This method is helpful in short-term planning by effectively taking break-even and

profitability aspect (Kolb and Kolb, 2011).

Disadvantages

1. It is not easier to bifurcate variable and fixed costs and as a result, conclusions drawn

from the same are misleading.

2. Another disadvantage of marginal costing is that long-term planning cannot be

possible as it is useful only in short-term planning.

Absorption costing

This costing is effective as it computes cost of particular product by considering indirect

expenses and direct costs. In simpler words, manufacturing expenses are effectively absorbed by

units produced.

Advantages

1. It is advantageous as fixed costs are taken into account and is helpful in determining

adequate pricing policy in effective way (Agarwal. 2018).

2. It is useful in preparation of external reports and correct valuation of stock can be

made.

Disadvantages

1. Absorption costing do not classify fixed costs whether it relates to manufacturing or

administration.

2. It is not useful in controlling costs as allocation of indirect expenses is difficult task.

TASK 2

2.1 Ascertaining the advantages and disadvantages of planning tools used in budgetary control

The advantages of planning tool in management accounting is that it brings the clear

understanding and analysis over the profitability of the prosed plans of business. However, there

will be various techniques winch will be effective and brings better budgetary control. Such as:

Net present value: This is the technique which helps in bringing the present value of the

future cash flows. Therefore, this estimation will be indicative and helpful as to bring the most

adequate and appropriate determination of the analysis that the projected plan will be helpful to

the firm in bringing the most appropriate and reliable information. This is the technique which in

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

turn will be effective and helpful to the firm in terms of analysing the profitability over the

analysed data set. Additionally, it can be said that the implication of such techniques will be

beneficial for the business as to have suitable gains and income bring forth. Moreover, it will be

helpful to UCK Furniture in terms of implicating such techniques into operational practices on

the basis of its advantages and disadvantages:

Advantages:

It incorporates with the techniques is that the future dollar is worth less than the dollar

value today.

It brings the discounting factors which ascertains that every period the cash flow will be

discounted by the professionals.

The main advantages is that it bring s the outcomes which evaluate the profitability of

firm in meeting the future requirements as well as profitability of plans in the coming

time.

Disadvantages:

The main draw back of this technique is that it comprises with a lot of guesses work

which in turn brings the negative impacts over the profitability and in accuracy in the

outcomes.

The results and output is not being accurate and reliable as well as will not bring the clear

estimation of the profitability over the estimated plans of business.

Payback period:

This is the method which evaluates the capital expenditure projects and bring the

outcomes that the time period on which the firm will go to receive the proposed money back

which were being invested by them in then operational activities of the firm. However, to

implicate such planning tool in UCK Furniture there will be various advantages and

disadvantages of these techniques that is necessary to be ascertained by the professionals such as:

Advantages:

It is the easiest techniques which in turn will be measured by anyone in the firm.

6

analysed data set. Additionally, it can be said that the implication of such techniques will be

beneficial for the business as to have suitable gains and income bring forth. Moreover, it will be

helpful to UCK Furniture in terms of implicating such techniques into operational practices on

the basis of its advantages and disadvantages:

Advantages:

It incorporates with the techniques is that the future dollar is worth less than the dollar

value today.

It brings the discounting factors which ascertains that every period the cash flow will be

discounted by the professionals.

The main advantages is that it bring s the outcomes which evaluate the profitability of

firm in meeting the future requirements as well as profitability of plans in the coming

time.

Disadvantages:

The main draw back of this technique is that it comprises with a lot of guesses work

which in turn brings the negative impacts over the profitability and in accuracy in the

outcomes.

The results and output is not being accurate and reliable as well as will not bring the clear

estimation of the profitability over the estimated plans of business.

Payback period:

This is the method which evaluates the capital expenditure projects and bring the

outcomes that the time period on which the firm will go to receive the proposed money back

which were being invested by them in then operational activities of the firm. However, to

implicate such planning tool in UCK Furniture there will be various advantages and

disadvantages of these techniques that is necessary to be ascertained by the professionals such as:

Advantages:

It is the easiest techniques which in turn will be measured by anyone in the firm.

6

It brings the information related with obtaining the investment amount of funds will be

recovered by a firm in the coming period.

Disadvantages:

The main disadvantage of these techniques is that it ignores the time value of money also

neglects the cash flows generated by firm after the payback.

It does not comprise with the profitability of the business

Internal rate of return:

This is the rate of return which insists that these is the discount rate which in turn will be

helpful and represents the future cash flow as zero. However, it will be a helpful tool which

brings the clear analysis to the managerial professionals that the rate or return firm will go to

have in the future over estimated operational activities or cash flows. Similarly, to implicate such

techniques into business operations of UCK Furniture there is need to ascertain several

advantages and disadvantages of this planning tool such as:

Advantages:

It comprises with the time value of money which brings appropriate results that the firm

is able to gather the most satisfactory analysis over the business operations.

Disadvantages:

The main disadvantage is that the formula used in to analyse the IRR does not bring the

clear algebraic proof. Moreover, it will not be reliable and trustworthy for the entity to

have appropriate analysis over the facts.

2.2 Using High-low methods in estimating the expenses

This is the technique which will be helpful as to analyse the fixed and variable elements

from the historical and past data such as:

Variable costs/ units High cost- Low cost 750- 650 0.0415

High unit- Low unit 9820- 7410

7

recovered by a firm in the coming period.

Disadvantages:

The main disadvantage of these techniques is that it ignores the time value of money also

neglects the cash flows generated by firm after the payback.

It does not comprise with the profitability of the business

Internal rate of return:

This is the rate of return which insists that these is the discount rate which in turn will be

helpful and represents the future cash flow as zero. However, it will be a helpful tool which

brings the clear analysis to the managerial professionals that the rate or return firm will go to

have in the future over estimated operational activities or cash flows. Similarly, to implicate such

techniques into business operations of UCK Furniture there is need to ascertain several

advantages and disadvantages of this planning tool such as:

Advantages:

It comprises with the time value of money which brings appropriate results that the firm

is able to gather the most satisfactory analysis over the business operations.

Disadvantages:

The main disadvantage is that the formula used in to analyse the IRR does not bring the

clear algebraic proof. Moreover, it will not be reliable and trustworthy for the entity to

have appropriate analysis over the facts.

2.2 Using High-low methods in estimating the expenses

This is the technique which will be helpful as to analyse the fixed and variable elements

from the historical and past data such as:

Variable costs/ units High cost- Low cost 750- 650 0.0415

High unit- Low unit 9820- 7410

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Fixed costs Hight cost- (variable cost hight unit) 342.47

2.3 Analysing the purpose of budget and preparing the cash budgets

The preparation of budgets are incorporated with the past records over the transactional

activities made by firm in the period. There will be appropriate analysis over the costs incurred

in such tasks which bounds the managerial professionals in making effective forecasts. It will be

the most helpful and beneficial techniques that will be effective and helpful as to have

satisfactory control over the gains and losses.

Particulars Initial investment July August September

cash sales 19000 29000 39000

sales on account 5600 5520 8400

Sales on account collected 560 4480 392

Revenue collected 25160 39000 47792

Inventory purchased 4800 19200 24000

Accounts payable 0 0 15000

Selling and Administration 0 0 13000

Depreciation 0 0 4000

Equipment 0 0 18000

Dividends 3000 3000 3000

Total outflows 7800 22200 77000

Net cash flow 17360 16800 -29208

Opening balance 5000 5000 22360 39160

Closing balance 5000 22360 39160 9952

TASK 3

3.1 Calculation of ratios

UCK UCK

8

2.3 Analysing the purpose of budget and preparing the cash budgets

The preparation of budgets are incorporated with the past records over the transactional

activities made by firm in the period. There will be appropriate analysis over the costs incurred

in such tasks which bounds the managerial professionals in making effective forecasts. It will be

the most helpful and beneficial techniques that will be effective and helpful as to have

satisfactory control over the gains and losses.

Particulars Initial investment July August September

cash sales 19000 29000 39000

sales on account 5600 5520 8400

Sales on account collected 560 4480 392

Revenue collected 25160 39000 47792

Inventory purchased 4800 19200 24000

Accounts payable 0 0 15000

Selling and Administration 0 0 13000

Depreciation 0 0 4000

Equipment 0 0 18000

Dividends 3000 3000 3000

Total outflows 7800 22200 77000

Net cash flow 17360 16800 -29208

Opening balance 5000 5000 22360 39160

Closing balance 5000 22360 39160 9952

TASK 3

3.1 Calculation of ratios

UCK UCK

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Furniture Woodworks

Particulars Formula

Design

Division

Gear box

Division

Operating profit margin

Operating income /

sales * 100 45.31% 14.46% 44.64%

Return on Capital Employed

(ROCE)

EBIT (Earnings

Before Interest and

Taxes) / Capital

Employed 25.50% 11.27% 8.56%

Asset turnover ratio

Revenue / Average

total assets 56.28% 77.98% 19.18%

It can be analysed from the above calculation of ratios that UCK Furniture's divisions are

performing well. This is evident from operating profit margin that division one is 45.31 % and

other division is 14.46 %. UCK Woodworks has 44.64 % of ratio. Moreover, ROCE and asset

turnover ratio both are more. Thus, it can be said that performance of divisions are far better than

UCK Woodworks.

3.2 Management accounting can improve financial performance of business

Management accounting is useful to improve financial performance of UCK Woodworks.

The managerial personnels should take into account operating expenditures and should reduce

upon the same. It will increase operating profits (Collier, 2015). Moreover, organisation should

be made internally strong to carry on operations and earn profits. Thus, it can be said that

9

Particulars Formula

Design

Division

Gear box

Division

Operating profit margin

Operating income /

sales * 100 45.31% 14.46% 44.64%

Return on Capital Employed

(ROCE)

EBIT (Earnings

Before Interest and

Taxes) / Capital

Employed 25.50% 11.27% 8.56%

Asset turnover ratio

Revenue / Average

total assets 56.28% 77.98% 19.18%

It can be analysed from the above calculation of ratios that UCK Furniture's divisions are

performing well. This is evident from operating profit margin that division one is 45.31 % and

other division is 14.46 %. UCK Woodworks has 44.64 % of ratio. Moreover, ROCE and asset

turnover ratio both are more. Thus, it can be said that performance of divisions are far better than

UCK Woodworks.

3.2 Management accounting can improve financial performance of business

Management accounting is useful to improve financial performance of UCK Woodworks.

The managerial personnels should take into account operating expenditures and should reduce

upon the same. It will increase operating profits (Collier, 2015). Moreover, organisation should

be made internally strong to carry on operations and earn profits. Thus, it can be said that

9

management accounting is quite beneficial for the organisation in order to improve upon

financial condition in effective manner.

3.3 Discuss planning tools to reduce financial problems to achieve success

Ratio analysis- It is important analysis as profitability and overall financial performance

is evaluated with the help of conducting ratio analysis. Historic data from financial

statements are utilised for carrying out ratios.

Budgeting- It is termed as a financial goal for coming period which consists of income to

be earned and expenses to be incurred (Ax and Greve, 2017).

Project evaluation- It is used to easily determine level of achievement of objectives of

project so that effective accomplishment of project can be done.

Standard costing- It is used to show variances between actual and expected expenses in

effective way.

Analysis of cost variances- Planned and actual expenditures are analysed and necessary

steps are taken to eradicate increased costs if any.

Budgetary control- It is done to analyse whether actual performance is as per planned one

and deviations are exists, then corrective action are taken to improve upon the same.

CONCLUSION

On the basis of above study it can be said that there are various operations which in turn

will be helpful and beneficial to be analysed by the business professionals. There has been

various discussion based on planning tolls and budgetary system on which cash flow statement

and income statement has been presented by the business professionals.

10

financial condition in effective manner.

3.3 Discuss planning tools to reduce financial problems to achieve success

Ratio analysis- It is important analysis as profitability and overall financial performance

is evaluated with the help of conducting ratio analysis. Historic data from financial

statements are utilised for carrying out ratios.

Budgeting- It is termed as a financial goal for coming period which consists of income to

be earned and expenses to be incurred (Ax and Greve, 2017).

Project evaluation- It is used to easily determine level of achievement of objectives of

project so that effective accomplishment of project can be done.

Standard costing- It is used to show variances between actual and expected expenses in

effective way.

Analysis of cost variances- Planned and actual expenditures are analysed and necessary

steps are taken to eradicate increased costs if any.

Budgetary control- It is done to analyse whether actual performance is as per planned one

and deviations are exists, then corrective action are taken to improve upon the same.

CONCLUSION

On the basis of above study it can be said that there are various operations which in turn

will be helpful and beneficial to be analysed by the business professionals. There has been

various discussion based on planning tolls and budgetary system on which cash flow statement

and income statement has been presented by the business professionals.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.