Management Accounting 2 Report - Amana Ltd

VerifiedAdded on 2023/06/18

|12

|3199

|233

AI Summary

This report provides a detailed analysis of the monthly control report for Amana Ltd, including original budget, flexed budget, and variances. It also includes recommendations for areas of improvement and a discussion on switching to online business. The report highlights the importance of management accounting in attaining financial operational efficiency. The subject is Management Accounting 2 and the course code is not mentioned. The report is relevant for students studying management accounting and finance. The college/university is not mentioned.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Management

Accounting 2 Report

Accounting 2 Report

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

Introduction....................................................................................................................................3

Part - A............................................................................................................................................4

(i) Prepare the monthly control report showing original budget, flexed budget, and

variances................................................................................................................................4

Statement of Original Budget................................................................................................4

Statement of Flexed Budget..................................................................................................4

Statement of Variances..........................................................................................................5

(ii) Using your control report prepared in (i) above, prepare a report on Amana’s

performance during the year 2020......................................................................................5

(iii) Provide recommendations to Amana’s CEO on areas of improvement..................7

Part – B...........................................................................................................................................8

Conclusion....................................................................................................................................10

References.....................................................................................................................................11

Books & Journals...............................................................................................................11

Introduction....................................................................................................................................3

Part - A............................................................................................................................................4

(i) Prepare the monthly control report showing original budget, flexed budget, and

variances................................................................................................................................4

Statement of Original Budget................................................................................................4

Statement of Flexed Budget..................................................................................................4

Statement of Variances..........................................................................................................5

(ii) Using your control report prepared in (i) above, prepare a report on Amana’s

performance during the year 2020......................................................................................5

(iii) Provide recommendations to Amana’s CEO on areas of improvement..................7

Part – B...........................................................................................................................................8

Conclusion....................................................................................................................................10

References.....................................................................................................................................11

Books & Journals...............................................................................................................11

Introduction

Management accounting can be defined as an important tool that helps in attaining the end

objectives of the business organization in the most effective manner. It helps an organization in

recognizing, breaking down and translating to make the organizational structure stronger so that

it can achieve higher level of financial operational efficiency effectively. It is basically a type of

accounting that helps in the financial book keeping. In order to make various managerial

decisions it is highly important that the financial information of the company is made in an

efficient manner. In context to this report, different practical tools of management accounting are

used in order to prepare a budget for the organization namely Amana Ltd. So that the proper

management of the finances can be done effectively. Along with this, a critical discussion on

switching to the online business is performed so that the respective business can attain higher

level of profitability.

Management accounting can be defined as an important tool that helps in attaining the end

objectives of the business organization in the most effective manner. It helps an organization in

recognizing, breaking down and translating to make the organizational structure stronger so that

it can achieve higher level of financial operational efficiency effectively. It is basically a type of

accounting that helps in the financial book keeping. In order to make various managerial

decisions it is highly important that the financial information of the company is made in an

efficient manner. In context to this report, different practical tools of management accounting are

used in order to prepare a budget for the organization namely Amana Ltd. So that the proper

management of the finances can be done effectively. Along with this, a critical discussion on

switching to the online business is performed so that the respective business can attain higher

level of profitability.

Part - A

(i) Prepare the monthly control report showing original budget, flexed budget, and variances.

A flexible budget can be defined as the budget which is majorly used by the organization when

the business organization is dealing with the shifting expenses as well as the incomes. For the

preparation of such kind of budget it is important to extract all the costs which includes the

incomes and the expenditures into the account (Ciftci and Salama, 2018). This helps in having

certain amount of projection that assists the business organization to deal with the financial

responsibilities effectively. For a longer duration, flexed budget is often used by many of the

organization because it is more effective as compared to the static budget. Except the fixed costs,

all the costs keeps on changing throughout the financial period.

Statement of Original Budget

Particulars Original Budget

Production 100,000

Variable costs:

Materials

Labours

Overhead

250,000

400,000

150,000

Fixed overheads:

Warehouse rental

Insurance

Fulltime warehouse supervisor salary

200,000

100,000

50,000

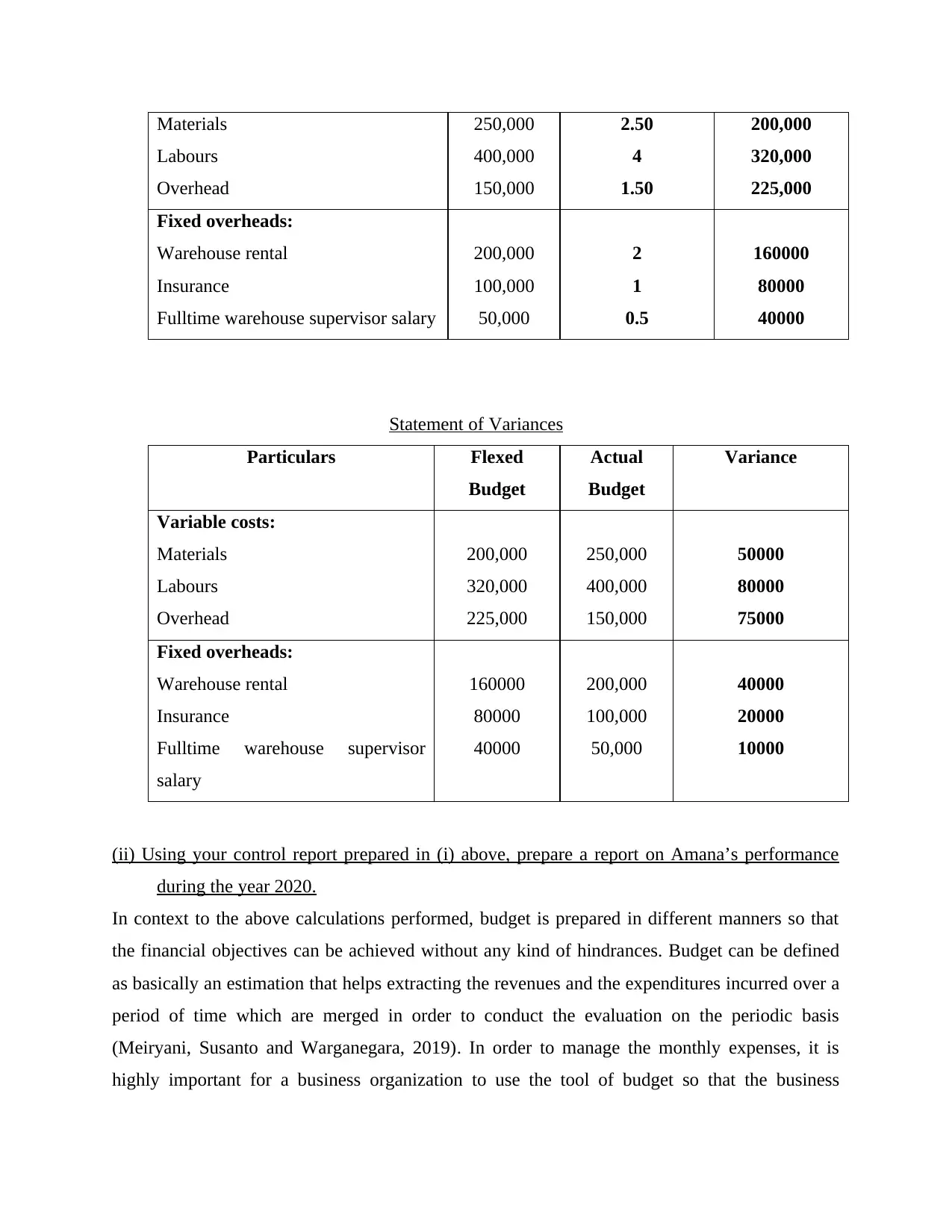

Statement of Flexed Budget

Particulars Original

Budget

Variable Cost

per unit

Flexed Budget

Production 100,000 Original Budget/

100,000

Average cost *

80,000

Variable costs:

(i) Prepare the monthly control report showing original budget, flexed budget, and variances.

A flexible budget can be defined as the budget which is majorly used by the organization when

the business organization is dealing with the shifting expenses as well as the incomes. For the

preparation of such kind of budget it is important to extract all the costs which includes the

incomes and the expenditures into the account (Ciftci and Salama, 2018). This helps in having

certain amount of projection that assists the business organization to deal with the financial

responsibilities effectively. For a longer duration, flexed budget is often used by many of the

organization because it is more effective as compared to the static budget. Except the fixed costs,

all the costs keeps on changing throughout the financial period.

Statement of Original Budget

Particulars Original Budget

Production 100,000

Variable costs:

Materials

Labours

Overhead

250,000

400,000

150,000

Fixed overheads:

Warehouse rental

Insurance

Fulltime warehouse supervisor salary

200,000

100,000

50,000

Statement of Flexed Budget

Particulars Original

Budget

Variable Cost

per unit

Flexed Budget

Production 100,000 Original Budget/

100,000

Average cost *

80,000

Variable costs:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Materials

Labours

Overhead

250,000

400,000

150,000

2.50

4

1.50

200,000

320,000

225,000

Fixed overheads:

Warehouse rental

Insurance

Fulltime warehouse supervisor salary

200,000

100,000

50,000

2

1

0.5

160000

80000

40000

Statement of Variances

Particulars Flexed

Budget

Actual

Budget

Variance

Variable costs:

Materials

Labours

Overhead

200,000

320,000

225,000

250,000

400,000

150,000

50000

80000

75000

Fixed overheads:

Warehouse rental

Insurance

Fulltime warehouse supervisor

salary

160000

80000

40000

200,000

100,000

50,000

40000

20000

10000

(ii) Using your control report prepared in (i) above, prepare a report on Amana’s performance

during the year 2020.

In context to the above calculations performed, budget is prepared in different manners so that

the financial objectives can be achieved without any kind of hindrances. Budget can be defined

as basically an estimation that helps extracting the revenues and the expenditures incurred over a

period of time which are merged in order to conduct the evaluation on the periodic basis

(Meiryani, Susanto and Warganegara, 2019). In order to manage the monthly expenses, it is

highly important for a business organization to use the tool of budget so that the business

Labours

Overhead

250,000

400,000

150,000

2.50

4

1.50

200,000

320,000

225,000

Fixed overheads:

Warehouse rental

Insurance

Fulltime warehouse supervisor salary

200,000

100,000

50,000

2

1

0.5

160000

80000

40000

Statement of Variances

Particulars Flexed

Budget

Actual

Budget

Variance

Variable costs:

Materials

Labours

Overhead

200,000

320,000

225,000

250,000

400,000

150,000

50000

80000

75000

Fixed overheads:

Warehouse rental

Insurance

Fulltime warehouse supervisor

salary

160000

80000

40000

200,000

100,000

50,000

40000

20000

10000

(ii) Using your control report prepared in (i) above, prepare a report on Amana’s performance

during the year 2020.

In context to the above calculations performed, budget is prepared in different manners so that

the financial objectives can be achieved without any kind of hindrances. Budget can be defined

as basically an estimation that helps extracting the revenues and the expenditures incurred over a

period of time which are merged in order to conduct the evaluation on the periodic basis

(Meiryani, Susanto and Warganegara, 2019). In order to manage the monthly expenses, it is

highly important for a business organization to use the tool of budget so that the business

organiza6tion can run effectively. From the above calculation, it can be seen that the firm has

incurred more amount in the fixed and variable expenses of the company as compared to the

flexed budget. A flexed budget is basically a type of budget with various fluctuations in the

actual revenue gained by the company. This kind of budgeting is often followed in many of the

business organization because it helps in evaluating the comparability of the actual results with

that of the budgeted results. Also, the actual expenses have been higher as compared to the

amount of expenses that have projected through the budgeted amount. The variance have shown

the unfavourable results from the budgeting of the company which have disclosed that the

business organization namely, Amana Ltd faced certain level of inefficiency in developing the

projected budget because the results have been showing an excess of fixed and variable

expenditures (Freidank and Sassen, 2020). Considering all the variances mentioned above, the

variable costs including materials, labours, overhead have increased by 50000, 80000 and

75000 respectively. In addition to this, the fixed costs which includes warehouse rental,

insurance, fulltime warehouse supervisor salary costs have increased by 40000, 20000 and 10000

respectively. In addition to this, it must also be considered that the company was operating on the

basis of physical stores stating that the costs were higher in that case. Offline operations are

considered as very high as compared to the online operations. Therefore, it can be considered

that these variances have shown that the amount have disclosed a considerable amount of

imbalances.

Management accounting systems hence, plays an significant role in dealing with the

financial complications in effective and efficient manner. It benefits to accomplish the results

with the application of resources and with the utilization of funds and least costs that helps in

attaining highest level of efficiency.

There are different ways which can be used by Amana Ltd in order to manage with the financial

cost management problems:

Good Financial management: The chances of financial cost inefficiency gets

reduced when the financial data of the business is carefully assessed. It helps in

undertaking the financial difficulties and improvising the reports of financial

management. It is the most appropriate method that ensures that all the data related to

the cost is relevant.

incurred more amount in the fixed and variable expenses of the company as compared to the

flexed budget. A flexed budget is basically a type of budget with various fluctuations in the

actual revenue gained by the company. This kind of budgeting is often followed in many of the

business organization because it helps in evaluating the comparability of the actual results with

that of the budgeted results. Also, the actual expenses have been higher as compared to the

amount of expenses that have projected through the budgeted amount. The variance have shown

the unfavourable results from the budgeting of the company which have disclosed that the

business organization namely, Amana Ltd faced certain level of inefficiency in developing the

projected budget because the results have been showing an excess of fixed and variable

expenditures (Freidank and Sassen, 2020). Considering all the variances mentioned above, the

variable costs including materials, labours, overhead have increased by 50000, 80000 and

75000 respectively. In addition to this, the fixed costs which includes warehouse rental,

insurance, fulltime warehouse supervisor salary costs have increased by 40000, 20000 and 10000

respectively. In addition to this, it must also be considered that the company was operating on the

basis of physical stores stating that the costs were higher in that case. Offline operations are

considered as very high as compared to the online operations. Therefore, it can be considered

that these variances have shown that the amount have disclosed a considerable amount of

imbalances.

Management accounting systems hence, plays an significant role in dealing with the

financial complications in effective and efficient manner. It benefits to accomplish the results

with the application of resources and with the utilization of funds and least costs that helps in

attaining highest level of efficiency.

There are different ways which can be used by Amana Ltd in order to manage with the financial

cost management problems:

Good Financial management: The chances of financial cost inefficiency gets

reduced when the financial data of the business is carefully assessed. It helps in

undertaking the financial difficulties and improvising the reports of financial

management. It is the most appropriate method that ensures that all the data related to

the cost is relevant.

Balance Scorecard: It can be used by the company so that the management and

identification of various different outcomes and various business functions can be

done effectively. It helps the company in order to accomplish objectives and growth

in long run (Ferramosca and Ghio, 2018). It is a strategic tool that assists for a well-

structured report that includes execution of operations to control costs. It is used for

the purpose of planning in a better & a strategic way.

Benchmarking: It helps in establishing the standard and must be used with an

objective to evaluate the risks. It is the method that helps the company to stay updated

with the trends related to the costs in the business organization and helps the company

to achieve higher level of standards with high level of efficiency while dealing with

the costs.

Adaptability: The organization must have the capability to adapt latest trend and

fluctuations according to the dynamic business environment. There are various

variations which can arise due to guidelines or policy and all the activities in the

organization that are conducted on the basis of these policies.

Conducting adequate research: An extensive research helps an organization to

indicate and identify the advantages and disadvantages of the specific decisions

which are related to the business. It is highly important to conduct certain adequate

research that can be highly important for the business decisions in relation to the cost

management that are directly related to the financial objectives.

In the present scenario, the organizations have adopted various concepts in order to manage the

financial working as well taking various decisions related to management of financial working.

Management accounting tools helps in attaining sustainable success and inculcates essence of

efficiency. In relation to Amana Ltd, the organization should go for focus on sustainable success

and development in longer run as it helps in resolving various financial problems which will

eventually help the company to achieve long term success through achieving high level of

financial efficiencies.

(iii) Provide recommendations to Amana’s CEO on areas of improvement.

In every organization, it sometimes happens that an organization faces certain issues in relation

to the management of the costs (Kroos, Schabus and Verbeeten, 2021). It can be challenging for

identification of various different outcomes and various business functions can be

done effectively. It helps the company in order to accomplish objectives and growth

in long run (Ferramosca and Ghio, 2018). It is a strategic tool that assists for a well-

structured report that includes execution of operations to control costs. It is used for

the purpose of planning in a better & a strategic way.

Benchmarking: It helps in establishing the standard and must be used with an

objective to evaluate the risks. It is the method that helps the company to stay updated

with the trends related to the costs in the business organization and helps the company

to achieve higher level of standards with high level of efficiency while dealing with

the costs.

Adaptability: The organization must have the capability to adapt latest trend and

fluctuations according to the dynamic business environment. There are various

variations which can arise due to guidelines or policy and all the activities in the

organization that are conducted on the basis of these policies.

Conducting adequate research: An extensive research helps an organization to

indicate and identify the advantages and disadvantages of the specific decisions

which are related to the business. It is highly important to conduct certain adequate

research that can be highly important for the business decisions in relation to the cost

management that are directly related to the financial objectives.

In the present scenario, the organizations have adopted various concepts in order to manage the

financial working as well taking various decisions related to management of financial working.

Management accounting tools helps in attaining sustainable success and inculcates essence of

efficiency. In relation to Amana Ltd, the organization should go for focus on sustainable success

and development in longer run as it helps in resolving various financial problems which will

eventually help the company to achieve long term success through achieving high level of

financial efficiencies.

(iii) Provide recommendations to Amana’s CEO on areas of improvement.

In every organization, it sometimes happens that an organization faces certain issues in relation

to the management of the costs (Kroos, Schabus and Verbeeten, 2021). It can be challenging for

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

any organization to handle the challenges integrated with the most effective ways. For the

business organization Amana Ltd, cost control can be one of the major and the best ways through

which the business can perform well in consideration to keep a control on the economic

environments. It is highly important for the Amana Ltd to lower down the overhead costs and

achieve the optimum level of costs. Also, it is highly recommended to the CEO of the company

to not only concentrate on the cost control but also the cost management in order to achieve

higher level of financial efficiency. Cost control measures the actual amount of expenses as

compared to the estimated, or budgeted, expenses so that the business organization proactively

address variances. Cost control establish various corrective actions that will ultimately help in

enabling the business organization to lower down the unexpected costs. Along with this, Amana

Ltd need to maintain the inventory management in a better way so that the company do not

spend higher amount of funds on the inventories or the stock of the company. This will help in

maintaining the optimum level of inventory in order to avoid the situation of excessive and

deficit of the stock or inventory.

Part – B

In the current scenario, online businesses are giving a tough competition to the traditional offline

businesses. This is helping them to earn a greater amount of revenue along with a higher level of

profitability (Bourmistrov, Grossi and Haldma, 2019). An online business is basically any type

of business that is executed over the digital platforms by utilizing the internet. It will basically

involve the buying and selling of the goods and services on the various platforms virtually. In

context to the report, Mr. Amana’s decision to move its 50% of sales towards the online selling

is significantly profitable. While considering the selection of the type of online method to run the

business, it is considered that selling on the online platform of Amazon will be a good idea to

execute. Establishing a self own online business platform and incurring a huge amount of cost on

it may also result into various hindrances which are explained below:

Copyright infringement: This can occur often because there is a huge of content and

ideas which are already existing on virtual marketplace. This can result into different

legal cases against the company harming the overall reputation considerably.

Data Privacy & Security: There is also a risk of data privacy and the security which can

result in affecting the image of the brand value of the company.

business organization Amana Ltd, cost control can be one of the major and the best ways through

which the business can perform well in consideration to keep a control on the economic

environments. It is highly important for the Amana Ltd to lower down the overhead costs and

achieve the optimum level of costs. Also, it is highly recommended to the CEO of the company

to not only concentrate on the cost control but also the cost management in order to achieve

higher level of financial efficiency. Cost control measures the actual amount of expenses as

compared to the estimated, or budgeted, expenses so that the business organization proactively

address variances. Cost control establish various corrective actions that will ultimately help in

enabling the business organization to lower down the unexpected costs. Along with this, Amana

Ltd need to maintain the inventory management in a better way so that the company do not

spend higher amount of funds on the inventories or the stock of the company. This will help in

maintaining the optimum level of inventory in order to avoid the situation of excessive and

deficit of the stock or inventory.

Part – B

In the current scenario, online businesses are giving a tough competition to the traditional offline

businesses. This is helping them to earn a greater amount of revenue along with a higher level of

profitability (Bourmistrov, Grossi and Haldma, 2019). An online business is basically any type

of business that is executed over the digital platforms by utilizing the internet. It will basically

involve the buying and selling of the goods and services on the various platforms virtually. In

context to the report, Mr. Amana’s decision to move its 50% of sales towards the online selling

is significantly profitable. While considering the selection of the type of online method to run the

business, it is considered that selling on the online platform of Amazon will be a good idea to

execute. Establishing a self own online business platform and incurring a huge amount of cost on

it may also result into various hindrances which are explained below:

Copyright infringement: This can occur often because there is a huge of content and

ideas which are already existing on virtual marketplace. This can result into different

legal cases against the company harming the overall reputation considerably.

Data Privacy & Security: There is also a risk of data privacy and the security which can

result in affecting the image of the brand value of the company.

The above mentioned hindrances which can affect the working of the business organization.

Also, it can be considered that Amazon plays a major role in protecting the copyright, frauds,

data privacy and security related issues in a very efficient manner (Tucker, 2019). The major

reason behind that is that Amazon is following strict terms and policies in its trade policies so

that it can provide an efficient, transparent and safe platform for the various business

organization to run its business operations effectively.

The major reason behind choosing this way to execute the business is that the amount required

for investment in order to switch towards online sale through Amazon are comparatively lower

than the amount that is required to set up a separate online shop. Also, selling through Amazon

will result into calculative risk taking which will make this move to shift from offline to online

more profitable. The various advantages that Mr. Amana can get by having its business on

Amazon which are mentioned underneath:

Amazon provides an already well-established and organized market to the buy and sell

the goods and services on the digital platform.

The cost of setting up the business on Amazon is involving a lower of cost as compared

to costs of establishing the whole business by own. The cost to list the products on

Amazon is just £50,000 while on the other hand the cost of setting the own business is

almost, £235,000 which is considered as huge.

Amazon is also providing guaranteed sale of approx. 65000 units on yearly basis.

Amazon provides performance based incentive programmes that help in providing the

recommendations so that the growth can be accelerated on customized basis.

Amazon plays an important role in empowering the business organization so that the

performance can be improved consistently.

Amazon also provides more reach of the potential customers towards the products and

the services of the respective business organization.

The above mentioned advantages can be highly profitable for the Amana Ltd. Although, it can be

seen that the amount of returns in the forms of unit sold per year are higher by 35000 units in the

self-established online business but it involves only the element of risk which can somehow

affect the profitability of the business organization (Alam, 2020). While on the other hand,

Amazon is incurring less amount of costs but it is providing guaranteed sales. In addition to this,

a self-established online business will also take a longer time period to get established that to

Also, it can be considered that Amazon plays a major role in protecting the copyright, frauds,

data privacy and security related issues in a very efficient manner (Tucker, 2019). The major

reason behind that is that Amazon is following strict terms and policies in its trade policies so

that it can provide an efficient, transparent and safe platform for the various business

organization to run its business operations effectively.

The major reason behind choosing this way to execute the business is that the amount required

for investment in order to switch towards online sale through Amazon are comparatively lower

than the amount that is required to set up a separate online shop. Also, selling through Amazon

will result into calculative risk taking which will make this move to shift from offline to online

more profitable. The various advantages that Mr. Amana can get by having its business on

Amazon which are mentioned underneath:

Amazon provides an already well-established and organized market to the buy and sell

the goods and services on the digital platform.

The cost of setting up the business on Amazon is involving a lower of cost as compared

to costs of establishing the whole business by own. The cost to list the products on

Amazon is just £50,000 while on the other hand the cost of setting the own business is

almost, £235,000 which is considered as huge.

Amazon is also providing guaranteed sale of approx. 65000 units on yearly basis.

Amazon provides performance based incentive programmes that help in providing the

recommendations so that the growth can be accelerated on customized basis.

Amazon plays an important role in empowering the business organization so that the

performance can be improved consistently.

Amazon also provides more reach of the potential customers towards the products and

the services of the respective business organization.

The above mentioned advantages can be highly profitable for the Amana Ltd. Although, it can be

seen that the amount of returns in the forms of unit sold per year are higher by 35000 units in the

self-established online business but it involves only the element of risk which can somehow

affect the profitability of the business organization (Alam, 2020). While on the other hand,

Amazon is incurring less amount of costs but it is providing guaranteed sales. In addition to this,

a self-established online business will also take a longer time period to get established that to

with a lot of efforts. That’s how considering all types of relevant costs mentioned above gives

the insights that if Mr. Amana wants to take a risk for attaining a higher amount profits, he can

go for self-established online business while if he wish to go for a calculative risk taking then he

can go with Amazon.

Therefore, it is highly recommended to Mr. Amana and his company that it will be better if it

select the option of Amazon to run the business. It will help the respective business organization

to run its business operations in an easier and suitable manner. Also, the element of safety and

compliance with the legal rules can be effectively dealt with (Maranjory and Alikhani, 2020).

The one of the major and the best advantage Mr Amana will receive is that everything related to

the business operations will be closely handled and monitored by Amazon. This will result into

effective controlling of the business operations assisting the respective business entity to deal

with the deviation which may or may not hamper the overall performance of the business

organization. With the involvement of customized recommendation from the end of Amazon will

also help Amana Ltd to implement and execute the corrective measures to attain highest level of

efficiency consistently.

Conclusion

From the above report it can be concluded that for every business organization it is highly

important to apply the tool of management accounting to attain the end objectives of the business

organization in a longer run. Preparing budgets is considered as one of the major and the

important element that helps in maintaining all the costs related to the business organization. In

relation to Amana Ltd, the original, flexed and variance budget is prepared to ascertain the

financial position of the business organization effectively. It could be seen that the respective

business organization have seen a considerable increase in the amount of the actual budget as

compared to the original budget. In the second part of the report, it was recommended to the

CEO of Amana Ltd that shifting the 50% sales on the online platform must be done through

Amazon, which will help in enhancing the profitability and productivity to a higher level.

the insights that if Mr. Amana wants to take a risk for attaining a higher amount profits, he can

go for self-established online business while if he wish to go for a calculative risk taking then he

can go with Amazon.

Therefore, it is highly recommended to Mr. Amana and his company that it will be better if it

select the option of Amazon to run the business. It will help the respective business organization

to run its business operations in an easier and suitable manner. Also, the element of safety and

compliance with the legal rules can be effectively dealt with (Maranjory and Alikhani, 2020).

The one of the major and the best advantage Mr Amana will receive is that everything related to

the business operations will be closely handled and monitored by Amazon. This will result into

effective controlling of the business operations assisting the respective business entity to deal

with the deviation which may or may not hamper the overall performance of the business

organization. With the involvement of customized recommendation from the end of Amazon will

also help Amana Ltd to implement and execute the corrective measures to attain highest level of

efficiency consistently.

Conclusion

From the above report it can be concluded that for every business organization it is highly

important to apply the tool of management accounting to attain the end objectives of the business

organization in a longer run. Preparing budgets is considered as one of the major and the

important element that helps in maintaining all the costs related to the business organization. In

relation to Amana Ltd, the original, flexed and variance budget is prepared to ascertain the

financial position of the business organization effectively. It could be seen that the respective

business organization have seen a considerable increase in the amount of the actual budget as

compared to the original budget. In the second part of the report, it was recommended to the

CEO of Amana Ltd that shifting the 50% sales on the online platform must be done through

Amazon, which will help in enhancing the profitability and productivity to a higher level.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

References

Books & Journals

Ciftci, M. and Salama, F. M., 2018. Stickiness in costs and voluntary disclosures: Evidence from

management earnings forecasts. Journal of Management Accounting Research, 30(3).

pp.211-234.

Meiryani, M., Susanto, A. and Warganegara, D.L., 2019. The issues influencing of

environmental accounting information systems: an empirical investigation of SMEs in

Indonesia. International Journal of Energy Economics and Policy, 9(1). p.282.

Freidank, C. C. and Sassen, R., 2020. Kostenrechnung: Grundlagen des Management

Accounting, Konzepte des Kostenmanagements und zentrale Schnittstellen. Walter de

Gruyter GmbH & Co KG.

Ferramosca, S. and Ghio, A., 2018. Accounting choices in family firms: An analysis of influences

and implications. Springer.

Kroos, P., Schabus, M. and Verbeeten, F., 2021. The Relation between Internal Forecasting

Sophistication and Accounting Misreporting. Journal of Management Accounting

Research.

Bourmistrov, A., Grossi, G. and Haldma, T., 2019. Special issue on accounting and performance

management innovations in public sector organizations. Baltic Journal of Management.

Tucker, B. P., 2019. Heard it through the grapevine: conceptualizing informal control through

the lens of social network theory. Journal of Management Accounting Research, 31(1).

pp.219-245.

Alam, M., 2020. Organisational processes and COVID-19 pandemic: implications for job

design. Journal of Accounting & Organizational Change.

Maranjory, M. and Alikhani, R., 2020. The moderating role of manager's narcissism on the

relationship between environmental uncertainty and CSR. Journal of Management

Accounting and Auditing Knowledge, 9(35). pp.263-272.

Hutaibat, K., 2019. Accounting for strategic management, strategising and power structures in

the Jordanian higher education sector. Journal of Accounting & Organizational Change.

Stein, S.E., 2019. Auditor industry specialization and accounting estimates: Evidence from asset

impairments. Auditing: A Journal of Practice & Theory, 38(2). pp.207-234.

Books & Journals

Ciftci, M. and Salama, F. M., 2018. Stickiness in costs and voluntary disclosures: Evidence from

management earnings forecasts. Journal of Management Accounting Research, 30(3).

pp.211-234.

Meiryani, M., Susanto, A. and Warganegara, D.L., 2019. The issues influencing of

environmental accounting information systems: an empirical investigation of SMEs in

Indonesia. International Journal of Energy Economics and Policy, 9(1). p.282.

Freidank, C. C. and Sassen, R., 2020. Kostenrechnung: Grundlagen des Management

Accounting, Konzepte des Kostenmanagements und zentrale Schnittstellen. Walter de

Gruyter GmbH & Co KG.

Ferramosca, S. and Ghio, A., 2018. Accounting choices in family firms: An analysis of influences

and implications. Springer.

Kroos, P., Schabus, M. and Verbeeten, F., 2021. The Relation between Internal Forecasting

Sophistication and Accounting Misreporting. Journal of Management Accounting

Research.

Bourmistrov, A., Grossi, G. and Haldma, T., 2019. Special issue on accounting and performance

management innovations in public sector organizations. Baltic Journal of Management.

Tucker, B. P., 2019. Heard it through the grapevine: conceptualizing informal control through

the lens of social network theory. Journal of Management Accounting Research, 31(1).

pp.219-245.

Alam, M., 2020. Organisational processes and COVID-19 pandemic: implications for job

design. Journal of Accounting & Organizational Change.

Maranjory, M. and Alikhani, R., 2020. The moderating role of manager's narcissism on the

relationship between environmental uncertainty and CSR. Journal of Management

Accounting and Auditing Knowledge, 9(35). pp.263-272.

Hutaibat, K., 2019. Accounting for strategic management, strategising and power structures in

the Jordanian higher education sector. Journal of Accounting & Organizational Change.

Stein, S.E., 2019. Auditor industry specialization and accounting estimates: Evidence from asset

impairments. Auditing: A Journal of Practice & Theory, 38(2). pp.207-234.

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.