Management Accounting and Reporting Methods

VerifiedAdded on 2023/01/13

|17

|4685

|55

AI Summary

This document provides an overview of management accounting and reporting methods used in organizations. It discusses the requirements of management accounting systems, cost calculation techniques, and the benefits of different management accounting systems. The document also covers budget reports, performance reports, cost accounting reports, and other managerial accounting reports. It is based on the case study of Tesco.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

LO1..................................................................................................................................................1

P1 Management accounting and the requirements of management accounting systems. .........1

P2 Management accounting reporting methods...........................................................................3

P3 Cost calculation using the appropriate cost analysis techniques. ..........................................4

P4 Types of budgetary planning tools used in organisation. ......................................................6

P5 Comparison of organisations adapting the management accounting methods for responding

to the financial problems..............................................................................................................8

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION...........................................................................................................................1

LO1..................................................................................................................................................1

P1 Management accounting and the requirements of management accounting systems. .........1

P2 Management accounting reporting methods...........................................................................3

P3 Cost calculation using the appropriate cost analysis techniques. ..........................................4

P4 Types of budgetary planning tools used in organisation. ......................................................6

P5 Comparison of organisations adapting the management accounting methods for responding

to the financial problems..............................................................................................................8

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION

Management accounting is defined as the practice of identifying, analysing, measuring,

interpreting and for communicating the financial information’s to the managers for pursuing the

organisational goals. It is different from that of financial accounting as it is for the internal use to

managers where the financial reports are for outside parties. Present report is based on Tesco in

in which management accounting will be discussed such as management accounting systems

their benefit to organisation and how it can be applied in the organisation. It will also be

providing understanding on management accounting reporting methods and different costing

techniques used for reporting. Study will further cover the planning tools used in management

accounting and the methods for solving the financial problems of company.

LO1

P1 Management accounting and the requirements of management accounting systems.

Management Accounting

It is also referred as managerial accounting. Management accounting deals with

providing information related to financial and other resources that help the company in process

of decision making. The management accounting provides information that is important for the

internal management for controlling the costs effective management of resources. Objective of

management accounting is to deal effectively with statistical data for making accurate and better

decisions for developing the business by effectively managing the resources.

Functions of MA

Assists in making forecast about future.

Helps in forecasting cash flows.

Provides assistance in analysing returns and setting strategic direction.

Helps in understanding performance variances effectually and taking strategic action

within suitable time frame.

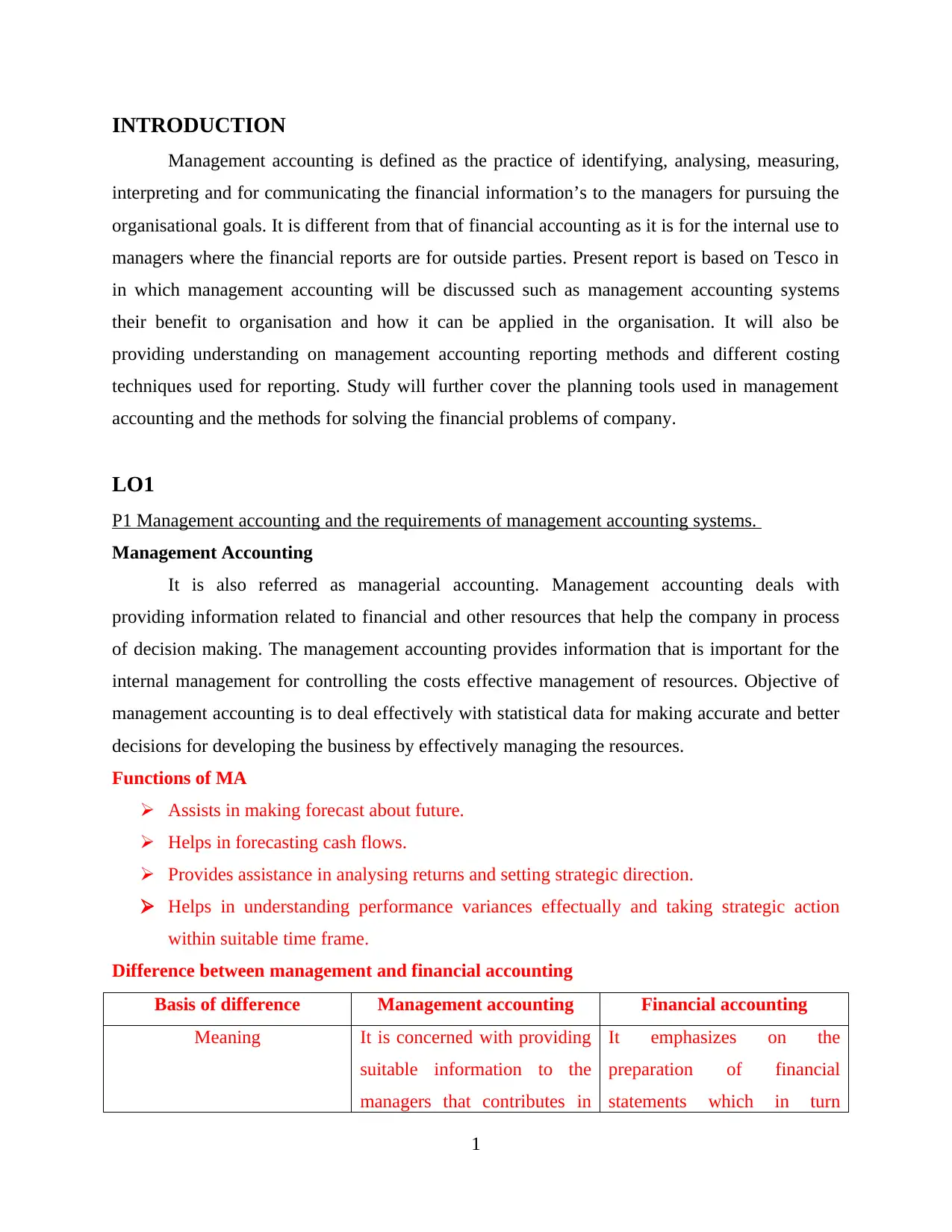

Difference between management and financial accounting

Basis of difference Management accounting Financial accounting

Meaning It is concerned with providing

suitable information to the

managers that contributes in

It emphasizes on the

preparation of financial

statements which in turn

1

Management accounting is defined as the practice of identifying, analysing, measuring,

interpreting and for communicating the financial information’s to the managers for pursuing the

organisational goals. It is different from that of financial accounting as it is for the internal use to

managers where the financial reports are for outside parties. Present report is based on Tesco in

in which management accounting will be discussed such as management accounting systems

their benefit to organisation and how it can be applied in the organisation. It will also be

providing understanding on management accounting reporting methods and different costing

techniques used for reporting. Study will further cover the planning tools used in management

accounting and the methods for solving the financial problems of company.

LO1

P1 Management accounting and the requirements of management accounting systems.

Management Accounting

It is also referred as managerial accounting. Management accounting deals with

providing information related to financial and other resources that help the company in process

of decision making. The management accounting provides information that is important for the

internal management for controlling the costs effective management of resources. Objective of

management accounting is to deal effectively with statistical data for making accurate and better

decisions for developing the business by effectively managing the resources.

Functions of MA

Assists in making forecast about future.

Helps in forecasting cash flows.

Provides assistance in analysing returns and setting strategic direction.

Helps in understanding performance variances effectually and taking strategic action

within suitable time frame.

Difference between management and financial accounting

Basis of difference Management accounting Financial accounting

Meaning It is concerned with providing

suitable information to the

managers that contributes in

It emphasizes on the

preparation of financial

statements which in turn

1

developing plans, policies and

strategies for the near future.

assists interested parties in

decision making.

Stakeholders Only internal management

team undertakes MA reports

for strategic decision making.

For the purpose of decision

making both internal and

external parties use financial

reports.

Time period Reports are prepared as per

the requirements weekly,

monthly, fortnightly etc.

Accounting reports are

prepared and presented

annually.

Format No specific format followed

for managerial reports.

Companies are obliged to

prepare financial referring

specific rules and format such

as IFRS, GAAP.

Information Includes both monetary and

non-monetary information

Furnishes only monetary

information for evaluation.

Management accounting systems

Management accounting systems helps Tesco to manage its business operations

effectively achieving the growth of business.

Inventory Management System

Inventory management systems refers to the system where inventory is required to be

ordered, stored and its use in the processes. It includes management of raw material,

components, finished products and the assets of company. It is very useful for Tesco as it is

having complex supply chains process as it deals with number of products. Inventory

management systems helps company to deal effectively with the inventory of company. Tesco is

using technology and software systems for managing its stocks (Maas, Schaltegger and Crutzen,

2016). It has established the method in warehouse its stores to keep proper record of its

movement within and outside the organisation. Inventory management has helped management

in taking steps related to the effective management of all the company stocks. Using the

inventory management makes forecast about its future requirement of the production based on

2

strategies for the near future.

assists interested parties in

decision making.

Stakeholders Only internal management

team undertakes MA reports

for strategic decision making.

For the purpose of decision

making both internal and

external parties use financial

reports.

Time period Reports are prepared as per

the requirements weekly,

monthly, fortnightly etc.

Accounting reports are

prepared and presented

annually.

Format No specific format followed

for managerial reports.

Companies are obliged to

prepare financial referring

specific rules and format such

as IFRS, GAAP.

Information Includes both monetary and

non-monetary information

Furnishes only monetary

information for evaluation.

Management accounting systems

Management accounting systems helps Tesco to manage its business operations

effectively achieving the growth of business.

Inventory Management System

Inventory management systems refers to the system where inventory is required to be

ordered, stored and its use in the processes. It includes management of raw material,

components, finished products and the assets of company. It is very useful for Tesco as it is

having complex supply chains process as it deals with number of products. Inventory

management systems helps company to deal effectively with the inventory of company. Tesco is

using technology and software systems for managing its stocks (Maas, Schaltegger and Crutzen,

2016). It has established the method in warehouse its stores to keep proper record of its

movement within and outside the organisation. Inventory management has helped management

in taking steps related to the effective management of all the company stocks. Using the

inventory management makes forecast about its future requirement of the production based on

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

the frequency of movements. This helps the business in keeping proper stock of all the material

of the business and prevent it from going out of stock.

Benefits

The inventory management systems help Tesco to have proper record of its inventory

level. It helps company to make order on time of required stocks that have been sold. It enables

the management to identify the time within which inventory is moving to identify the peak sales

time.

Job Costing Systems

The job costing system accumulates the costs incurred on individual jobs. The job costing

systems bis used by company for identifying the cost of jobs separately. This is widely used by

organisation having various activities. It helps company to identify cost of special orders

separately. Teco uses this system for determining the accuracy of the estimating systems of

company to quote the prices that will enable the company to earn reasonable profits (Otley,

2016). In this costing system cost of sales are identified including all the cost like direct costs of

materials, labour overhead and other costs.

Benefits

It allows Tesco to measure profits that is earned on every job. This enables company to

make decisions regarding the profitability of special job. The system helps in costing each

product separately by the information of costs obtained.

Cost accounting Systems

It is an another management accounting system used by organisation to measure the cost

of products or services. The costing method provides the variable and fixed costs separately to

the management for business decision making. It provides the information about the costs that

are incurred for manufacturing a product or providing of services. Tesco is able to cost the

products and services being produced by company (Messner, 2016). It includes different types of

costing methods like activity based costing, direct costing and standard costing. They provide

important information to management for making decisions related to pricing of product. The

cost accounting is used by organisation for pricing the products appropriately. Cost accounting is

required for having proper record of all the cost transactions for management decision-making. It

is used by the enterprise for pricing its goods or services and for determining the profit margins

3

of the business and prevent it from going out of stock.

Benefits

The inventory management systems help Tesco to have proper record of its inventory

level. It helps company to make order on time of required stocks that have been sold. It enables

the management to identify the time within which inventory is moving to identify the peak sales

time.

Job Costing Systems

The job costing system accumulates the costs incurred on individual jobs. The job costing

systems bis used by company for identifying the cost of jobs separately. This is widely used by

organisation having various activities. It helps company to identify cost of special orders

separately. Teco uses this system for determining the accuracy of the estimating systems of

company to quote the prices that will enable the company to earn reasonable profits (Otley,

2016). In this costing system cost of sales are identified including all the cost like direct costs of

materials, labour overhead and other costs.

Benefits

It allows Tesco to measure profits that is earned on every job. This enables company to

make decisions regarding the profitability of special job. The system helps in costing each

product separately by the information of costs obtained.

Cost accounting Systems

It is an another management accounting system used by organisation to measure the cost

of products or services. The costing method provides the variable and fixed costs separately to

the management for business decision making. It provides the information about the costs that

are incurred for manufacturing a product or providing of services. Tesco is able to cost the

products and services being produced by company (Messner, 2016). It includes different types of

costing methods like activity based costing, direct costing and standard costing. They provide

important information to management for making decisions related to pricing of product. The

cost accounting is used by organisation for pricing the products appropriately. Cost accounting is

required for having proper record of all the cost transactions for management decision-making. It

is used by the enterprise for pricing its goods or services and for determining the profit margins

3

associated with each product. It helps in controlling the cost and expenditures using variance

analysis.

Benefits

The cost accounting helps management in identifying the cost of products and services.

Cost accounting helps Tesco in deciding the profits margins of company. It allows company to

make comparison of costs of two products.

Activity Based Costing

It refers to a methodology used for more precisely allocating the costs of overheads

through assignment to separate activities. After the costs have been assigned to the activities,

costs could be allocated to cost objects using those activities. This system is employed by Tesco

for reducing the overhead costs of company. As company is having a complex environment

dealing with multiple products and activities the system is very beneficial to have proper

allocation of the overhead costs to products and activities (Cooper, Ezzamel and Qu, 2017). It is

applied in the business process for allocation of overhead cost to the products and services

separately.

Benefits

It helps Tesco in identifying the profitability of company related to different activities. It

helps in distribution of cost among different product separately and accurately. When the

overhead costs are properly allocated minimum prices of the products could be more accurately

identified.

Price optimization system

This system of management accounting is highly significant which helps in ascertaining

the extent to which demand varies as per the price level. Thus, by applying this model Tesco can

set suitable prices that customers willing to pay for the concerned products or services. Through

this, firm would become able to enhance customer base and thereby productivity & profitability

as well.

Benefits

Helps in taking appropriate pricing decisions

Maximizes profitability as it helps in enhancing customer base

Helps in gaining competitive advantage over others

4

analysis.

Benefits

The cost accounting helps management in identifying the cost of products and services.

Cost accounting helps Tesco in deciding the profits margins of company. It allows company to

make comparison of costs of two products.

Activity Based Costing

It refers to a methodology used for more precisely allocating the costs of overheads

through assignment to separate activities. After the costs have been assigned to the activities,

costs could be allocated to cost objects using those activities. This system is employed by Tesco

for reducing the overhead costs of company. As company is having a complex environment

dealing with multiple products and activities the system is very beneficial to have proper

allocation of the overhead costs to products and activities (Cooper, Ezzamel and Qu, 2017). It is

applied in the business process for allocation of overhead cost to the products and services

separately.

Benefits

It helps Tesco in identifying the profitability of company related to different activities. It

helps in distribution of cost among different product separately and accurately. When the

overhead costs are properly allocated minimum prices of the products could be more accurately

identified.

Price optimization system

This system of management accounting is highly significant which helps in ascertaining

the extent to which demand varies as per the price level. Thus, by applying this model Tesco can

set suitable prices that customers willing to pay for the concerned products or services. Through

this, firm would become able to enhance customer base and thereby productivity & profitability

as well.

Benefits

Helps in taking appropriate pricing decisions

Maximizes profitability as it helps in enhancing customer base

Helps in gaining competitive advantage over others

4

P2 Management accounting reporting methods.

The management accounting report helps the company to recognise the performance of

company. The management reporting methods provide all the important information that are

essential for enhancing the performance of company. The management accounting reports

includes following:

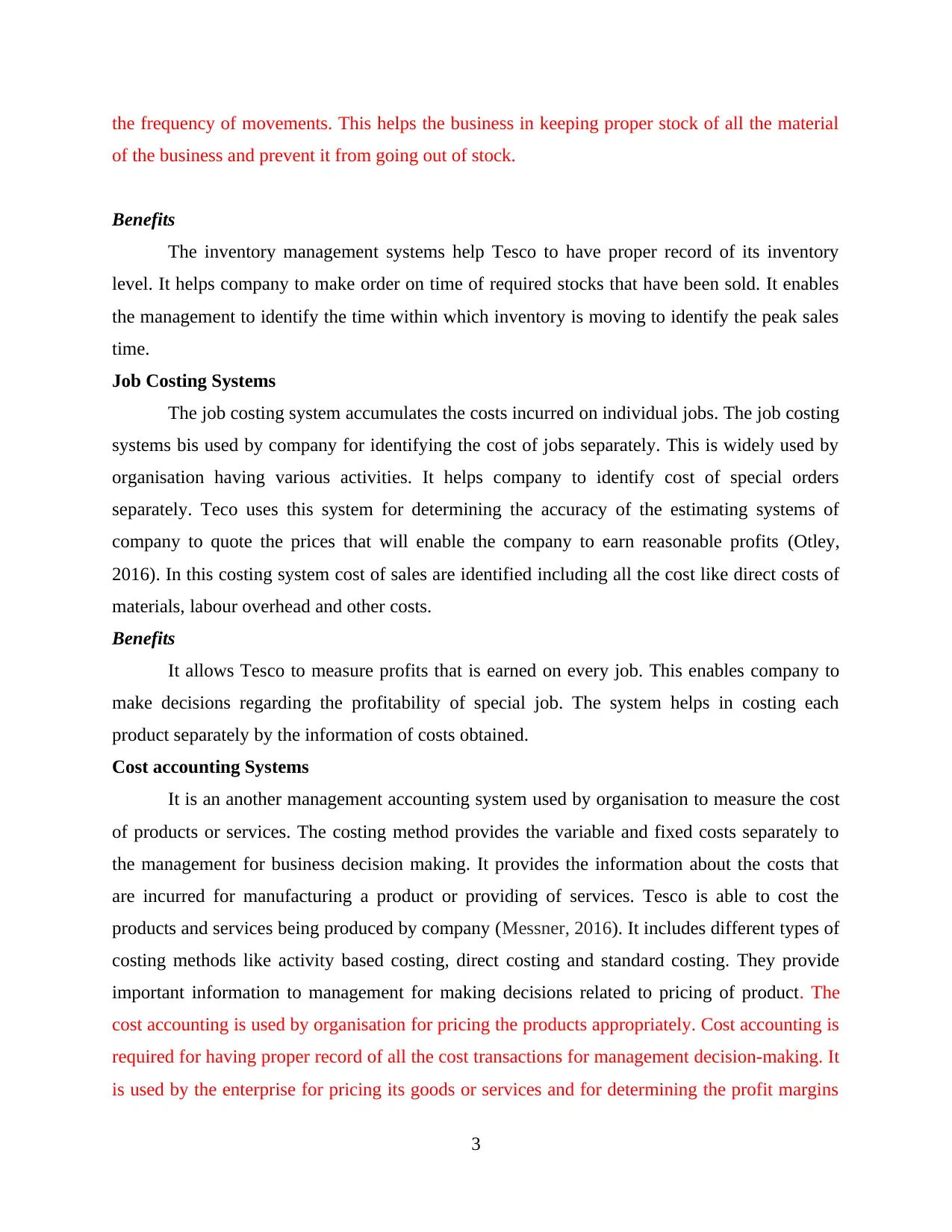

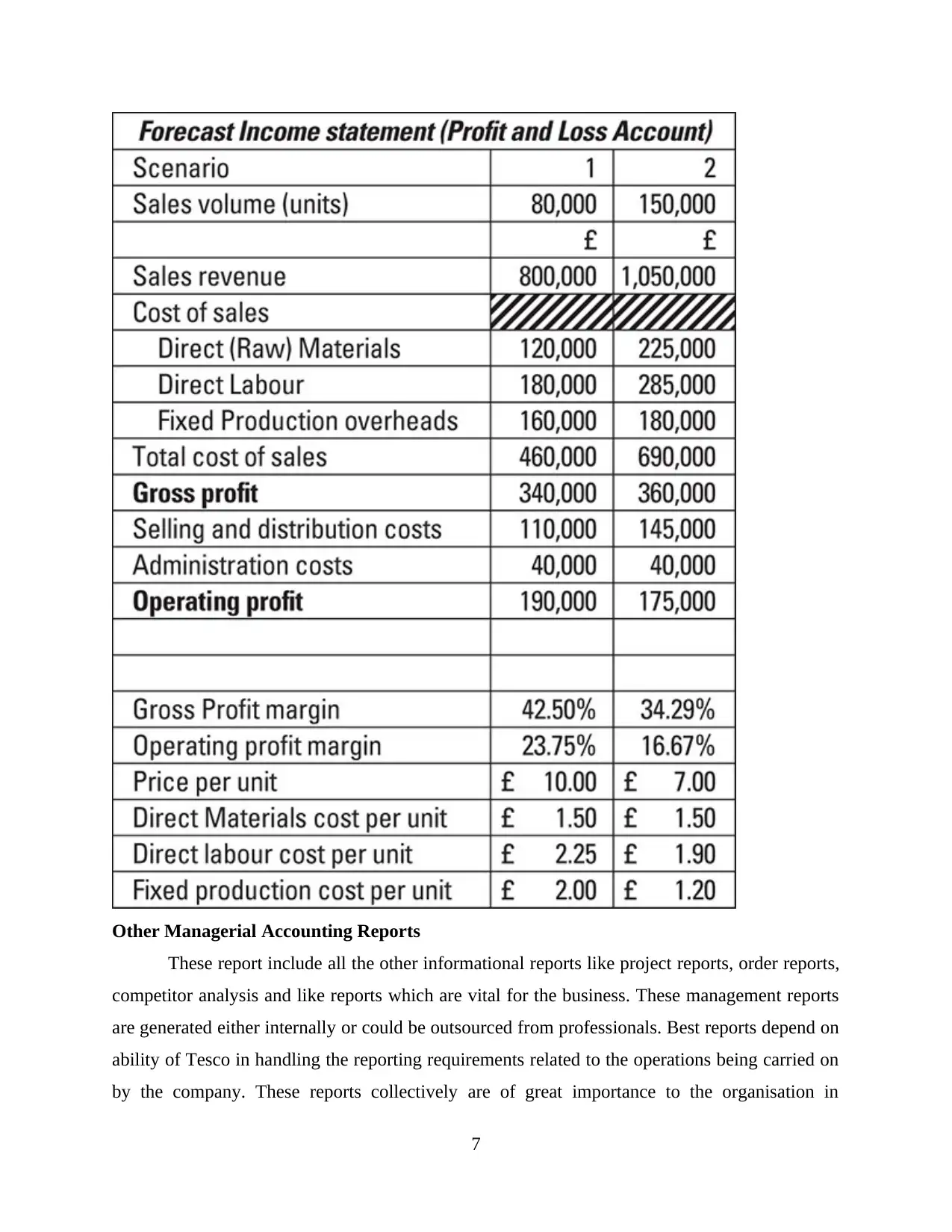

Budget Reports

Budget reports provide information about the cost and expenditures of company. The

budget reports are prepared on the estimates. Every company prepares a budget for

understanding their business portfolio or plans. It involves forecasting the future incomes and

expenditures and preparing the budget based on previous trends followed by business. The

budget reports help Tesco in making proper allocation of resources between department and

different activities (Bromwich and Scapens, 2016). They are very important for the organisation

as they help them to keep the expenses under control. Specimen of budget report is enumerated

below:

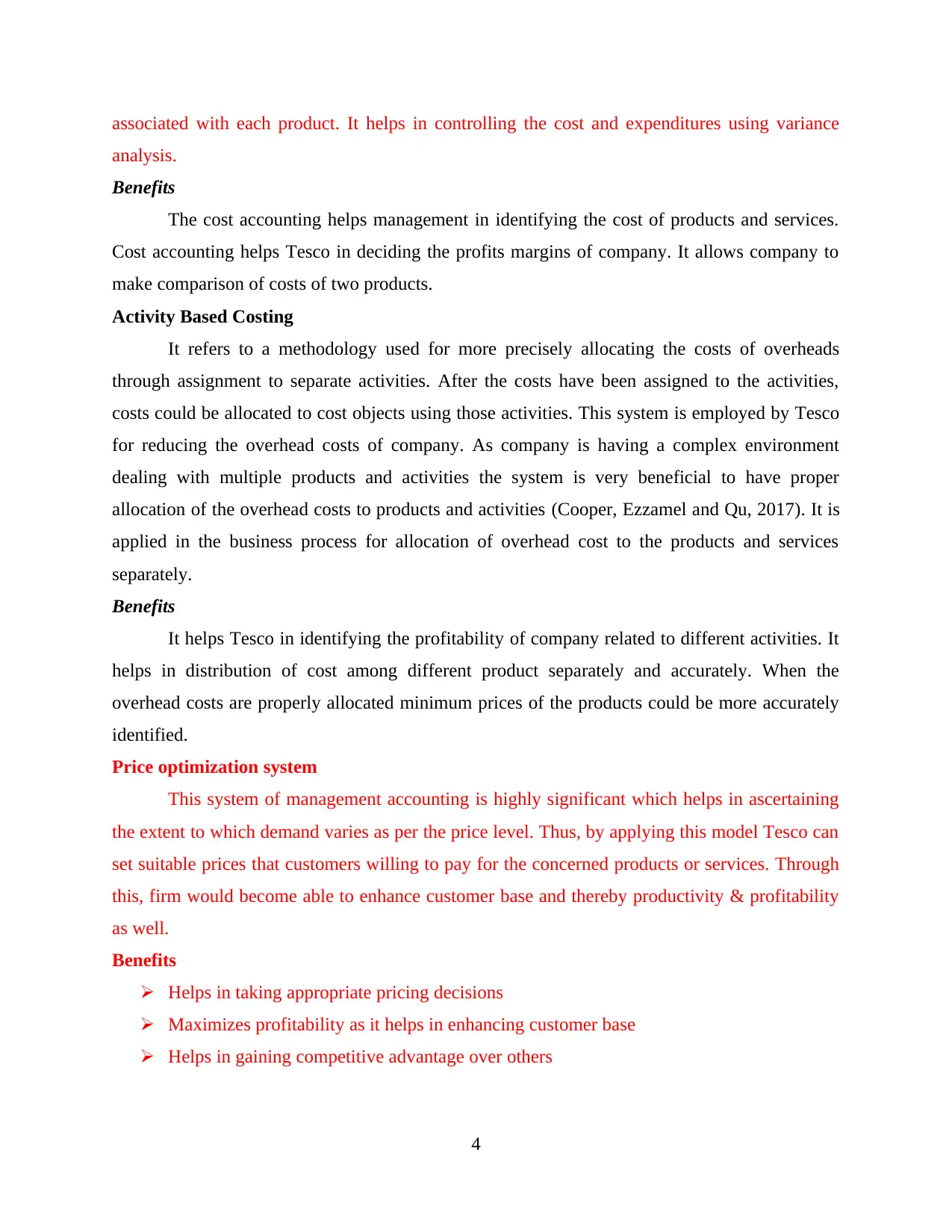

Performance Reports

The performance reports involve evaluation of the performance of company and the

various activities performed by company. The performance reports are prepared for identifying

whether the set targets have been achieved or not. If the targeted levels are not achieved by

company than it takes effective measures for improving its performance. The performance

reports also include information of employee performances that is essential for identifying the

efficient employees and motivating them through rewards and incentives (Weetman, 2019).

Performance reports is used by management in the strategic decision-making process for

increasing the efficiency and productivity of Tesco. These reports provide a deeper insight about

the working of company. Example of performance report.

5

The management accounting report helps the company to recognise the performance of

company. The management reporting methods provide all the important information that are

essential for enhancing the performance of company. The management accounting reports

includes following:

Budget Reports

Budget reports provide information about the cost and expenditures of company. The

budget reports are prepared on the estimates. Every company prepares a budget for

understanding their business portfolio or plans. It involves forecasting the future incomes and

expenditures and preparing the budget based on previous trends followed by business. The

budget reports help Tesco in making proper allocation of resources between department and

different activities (Bromwich and Scapens, 2016). They are very important for the organisation

as they help them to keep the expenses under control. Specimen of budget report is enumerated

below:

Performance Reports

The performance reports involve evaluation of the performance of company and the

various activities performed by company. The performance reports are prepared for identifying

whether the set targets have been achieved or not. If the targeted levels are not achieved by

company than it takes effective measures for improving its performance. The performance

reports also include information of employee performances that is essential for identifying the

efficient employees and motivating them through rewards and incentives (Weetman, 2019).

Performance reports is used by management in the strategic decision-making process for

increasing the efficiency and productivity of Tesco. These reports provide a deeper insight about

the working of company. Example of performance report.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cost Accounting Reports

The cost reports include the information about the costs of carrying out any activity or

service. These reports are of great importance to the management as it involves all the

information about cash movements. It contains information regarding the sources of income and

application of funds within the organisation (Granlund and Lukka, 2017). These reports also

enable Tesco to compare its actual results with the budgeted levels. The deviations are identified

and then management takes corrective steps for minimising the deviations. This is essential for

company to achieve the success and growth. This also helps company in keeping the costs under

control by applying cost effective strategies within the organisation.

Example of cost report is as follows:

6

The cost reports include the information about the costs of carrying out any activity or

service. These reports are of great importance to the management as it involves all the

information about cash movements. It contains information regarding the sources of income and

application of funds within the organisation (Granlund and Lukka, 2017). These reports also

enable Tesco to compare its actual results with the budgeted levels. The deviations are identified

and then management takes corrective steps for minimising the deviations. This is essential for

company to achieve the success and growth. This also helps company in keeping the costs under

control by applying cost effective strategies within the organisation.

Example of cost report is as follows:

6

Other Managerial Accounting Reports

These report include all the other informational reports like project reports, order reports,

competitor analysis and like reports which are vital for the business. These management reports

are generated either internally or could be outsourced from professionals. Best reports depend on

ability of Tesco in handling the reporting requirements related to the operations being carried on

by the company. These reports collectively are of great importance to the organisation in

7

These report include all the other informational reports like project reports, order reports,

competitor analysis and like reports which are vital for the business. These management reports

are generated either internally or could be outsourced from professionals. Best reports depend on

ability of Tesco in handling the reporting requirements related to the operations being carried on

by the company. These reports collectively are of great importance to the organisation in

7

decision-making process. For example, the reports about competitor give the company about the

trend being followed and price levels to remain competitive and deciding the price of their

product accordingly.

P3 Cost calculation using the appropriate cost analysis techniques.

Marginal Costing

It is an costing principle where the variable costs of products are charged to the cost units

& fixed costs are allocated to the period in which they are occurred. The fixed costs associated

are written off against contribution margin of the period. It refers to ascertainment of marginal

costs and effects of profit over the change in output type or volume by differentiation between

variable and fixed costs (Christ and Burritt, 2017). Marginal costing concept is based over h

behaviour of cost varying with volume of outputs. The costing method is also called variable

costing where only variable cost is accumulated and the per unit cost is also measured on

variable cost for each unit. In some cases, direct and marginal costing are regarded as

interchangeable terms. There is a difference between the two as marginal cost only covers

expenses that are variable in nature while the direct costs can also include costs that are beside

fixed in nature with the cost objectives.

Benefits

It is an easy and understandable method. The costing method could be combined with

both the budgetary control and standard costing for making the control mechanisms much

effective. It eliminates fixed costs from production costs that prevents effect of the varying

charges on per unit basis. It also helps in preventing the fixed costs to be carried forward to

subsequent period. It does not involve complex calculations of under and over absorption (Nitzl,

2016). The marginal costing system helps in profit planning with the help of break even and

profit graphs which it makes it easier for assessing the profitability of project.

Limitation

With the benefits it has limitations too. It is difficult to segregate the cost between

variable & fixed in practical. In marginal costing greater attention is paid to sales function. The

concept of eliminating the fixed cost from production cost is not logical as production cannot be

carried out without incurring fixed costs. This method undervalues the inventory that is neither

cost nor market price.

8

trend being followed and price levels to remain competitive and deciding the price of their

product accordingly.

P3 Cost calculation using the appropriate cost analysis techniques.

Marginal Costing

It is an costing principle where the variable costs of products are charged to the cost units

& fixed costs are allocated to the period in which they are occurred. The fixed costs associated

are written off against contribution margin of the period. It refers to ascertainment of marginal

costs and effects of profit over the change in output type or volume by differentiation between

variable and fixed costs (Christ and Burritt, 2017). Marginal costing concept is based over h

behaviour of cost varying with volume of outputs. The costing method is also called variable

costing where only variable cost is accumulated and the per unit cost is also measured on

variable cost for each unit. In some cases, direct and marginal costing are regarded as

interchangeable terms. There is a difference between the two as marginal cost only covers

expenses that are variable in nature while the direct costs can also include costs that are beside

fixed in nature with the cost objectives.

Benefits

It is an easy and understandable method. The costing method could be combined with

both the budgetary control and standard costing for making the control mechanisms much

effective. It eliminates fixed costs from production costs that prevents effect of the varying

charges on per unit basis. It also helps in preventing the fixed costs to be carried forward to

subsequent period. It does not involve complex calculations of under and over absorption (Nitzl,

2016). The marginal costing system helps in profit planning with the help of break even and

profit graphs which it makes it easier for assessing the profitability of project.

Limitation

With the benefits it has limitations too. It is difficult to segregate the cost between

variable & fixed in practical. In marginal costing greater attention is paid to sales function. The

concept of eliminating the fixed cost from production cost is not logical as production cannot be

carried out without incurring fixed costs. This method undervalues the inventory that is neither

cost nor market price.

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Absorption Costing

It is a costing technique that is used by companies for calculation of cost of product or for

inventory valuation in company where all expenses carried out by business are taken into

consideration. The costing method includes both direct as well as indirect costs incurred for the

product. Absorption costings defines as a method where all the cost associated with production

process are considered and these involves allocation of these costs to products or services

separately. The method is named as absorption as it involves absorbing manufacturing costs both

variable & fixed. In simple terms, this method does not present the fixed costs as the period costs

but are included in the costing of the product. The absorption costing gives Tesco an increased

comprehensive and an accurate view related to the costing of inventory. The costing is

considered more reliable and accurate for the business as it involves various activities and

products.

Benefits

This costing technique considers both fixed and variable in costing the product. It

considers he overhead costs incurred by company in manufacturing that makes it more realistic.

The costing method recognises inventory at more accurate levels. The absorption costing method

is acceptable by accounting standards for inventory valuation (Malmi, 2016). The proper

allocation of overhead cost to products or services separately makes pricing of product more

accurate which helps company in determining the profit margins. This method is suitable for

Tesco as it is having constant demand of its products.

Limitations

Costing technique unlike the marginal costing method is not used as effective tool for

evaluating the profitability of company. The decisions cannot be drawn accurately as the fixed

cost will be remaining fixed irrespective of the output levels. Therefore, marginal costing is used

in decision-making. This method does not provide relevant information for forecasting future. It

is difficult to carry out cost volume profit analysis in company.

Pricing strategies

There are different pricing strategies company promote its product in th market to

increase its market share.

9

It is a costing technique that is used by companies for calculation of cost of product or for

inventory valuation in company where all expenses carried out by business are taken into

consideration. The costing method includes both direct as well as indirect costs incurred for the

product. Absorption costings defines as a method where all the cost associated with production

process are considered and these involves allocation of these costs to products or services

separately. The method is named as absorption as it involves absorbing manufacturing costs both

variable & fixed. In simple terms, this method does not present the fixed costs as the period costs

but are included in the costing of the product. The absorption costing gives Tesco an increased

comprehensive and an accurate view related to the costing of inventory. The costing is

considered more reliable and accurate for the business as it involves various activities and

products.

Benefits

This costing technique considers both fixed and variable in costing the product. It

considers he overhead costs incurred by company in manufacturing that makes it more realistic.

The costing method recognises inventory at more accurate levels. The absorption costing method

is acceptable by accounting standards for inventory valuation (Malmi, 2016). The proper

allocation of overhead cost to products or services separately makes pricing of product more

accurate which helps company in determining the profit margins. This method is suitable for

Tesco as it is having constant demand of its products.

Limitations

Costing technique unlike the marginal costing method is not used as effective tool for

evaluating the profitability of company. The decisions cannot be drawn accurately as the fixed

cost will be remaining fixed irrespective of the output levels. Therefore, marginal costing is used

in decision-making. This method does not provide relevant information for forecasting future. It

is difficult to carry out cost volume profit analysis in company.

Pricing strategies

There are different pricing strategies company promote its product in th market to

increase its market share.

9

Penetration – It is the pricing strategy where the company keeps prices of its products to the

minimum and also the quality of goods lower. Quality is kept lower to maintain some amount of

profit margin essential for the survival of business enterprise.

Skimming – This is the pricing strategy where the prices of goods are kept higher and also the

quality of goods and services are higher. In this strategy cost is kept higher initially and is

decreased gradually with the increase of the customer base

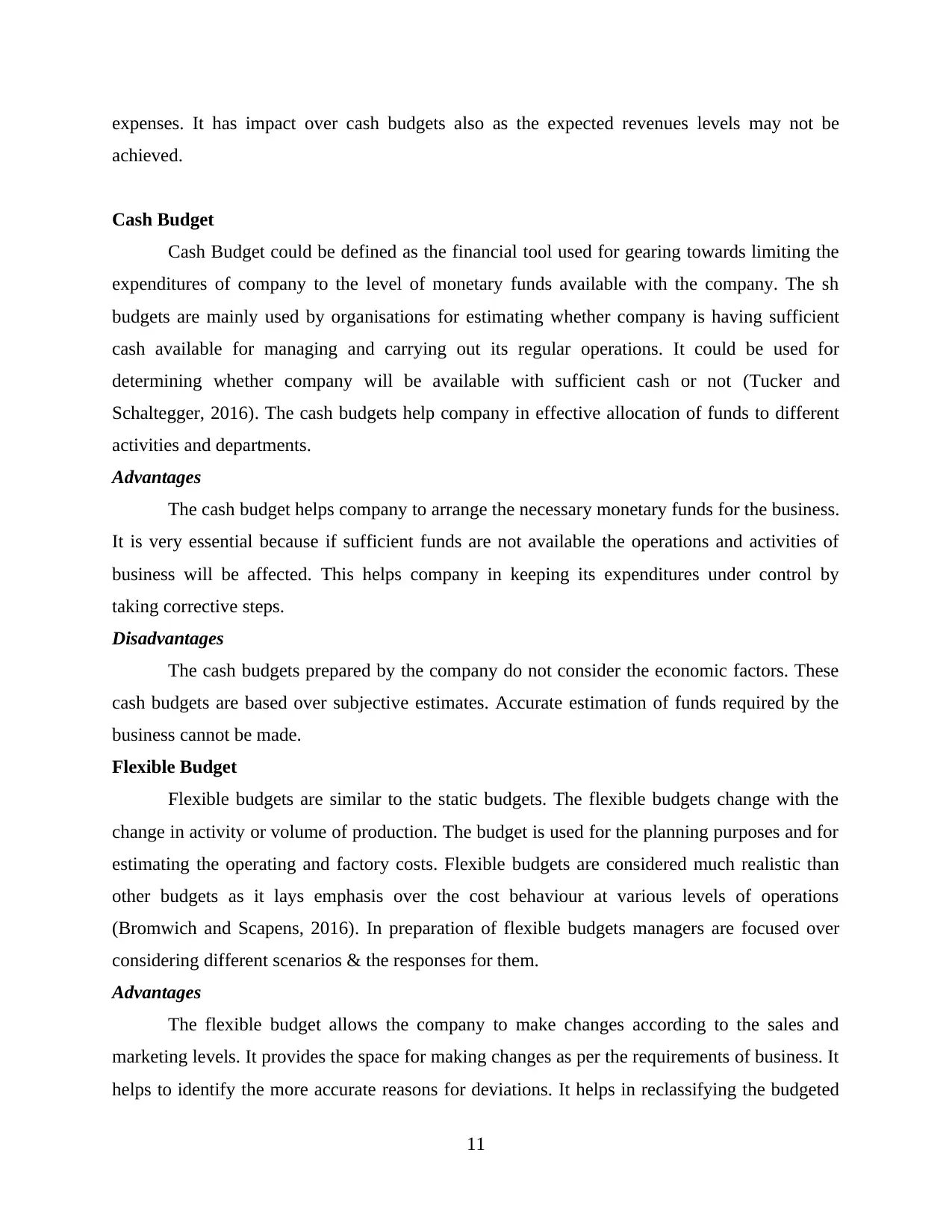

P4 Types of budgetary planning tools used in organisation.

There are different types of planning tools used by company for managing it business and

having proper control. These planning tools in budgetary control help Tesco to achieve its

organisational goals and objectives.

Sales Budget

Sales budget are prepared for determining the estimated average earnings after a pre-

determined period. These budgets are prepared by company after effectively analysing the

economic conditions, production capacities competition and the expenditures to be carried out.

The factors have an important role for the future performance of company. Sales budget defines

the goals of business by determining the sales level for generating business. Sales budgets

involves forecasting about the future sales level (Hall, 2016). This refers to predicting the sales

level by analysing the market conditions, growth rate and other factors. It is very important for

the business enterprise to forecasts properly about the sales levels as it will have impact over the

other budgets.

Advantages

The sales budget helps Tesco in proper planning about the future sales level. This helps company

in managing its activities and operations according to the forecasted sales level. The company

keeps a check over all the expenses and other forecasted sales level. Sales budget helps company

to identify whether the required sales level have been achieved or not by making comparison

between the actual and budgeted levels. This requires company to changes its strategies for

achieving the sales level.

Disadvantages

It is not possible for company to make accurate forecasts about future as it is multiple

dynamic factors. The sales level that are carried out by the business may not be realistic. Wrong

estimates of revenues by sales would be leading to wrong estimates related to costs and

10

minimum and also the quality of goods lower. Quality is kept lower to maintain some amount of

profit margin essential for the survival of business enterprise.

Skimming – This is the pricing strategy where the prices of goods are kept higher and also the

quality of goods and services are higher. In this strategy cost is kept higher initially and is

decreased gradually with the increase of the customer base

P4 Types of budgetary planning tools used in organisation.

There are different types of planning tools used by company for managing it business and

having proper control. These planning tools in budgetary control help Tesco to achieve its

organisational goals and objectives.

Sales Budget

Sales budget are prepared for determining the estimated average earnings after a pre-

determined period. These budgets are prepared by company after effectively analysing the

economic conditions, production capacities competition and the expenditures to be carried out.

The factors have an important role for the future performance of company. Sales budget defines

the goals of business by determining the sales level for generating business. Sales budgets

involves forecasting about the future sales level (Hall, 2016). This refers to predicting the sales

level by analysing the market conditions, growth rate and other factors. It is very important for

the business enterprise to forecasts properly about the sales levels as it will have impact over the

other budgets.

Advantages

The sales budget helps Tesco in proper planning about the future sales level. This helps company

in managing its activities and operations according to the forecasted sales level. The company

keeps a check over all the expenses and other forecasted sales level. Sales budget helps company

to identify whether the required sales level have been achieved or not by making comparison

between the actual and budgeted levels. This requires company to changes its strategies for

achieving the sales level.

Disadvantages

It is not possible for company to make accurate forecasts about future as it is multiple

dynamic factors. The sales level that are carried out by the business may not be realistic. Wrong

estimates of revenues by sales would be leading to wrong estimates related to costs and

10

expenses. It has impact over cash budgets also as the expected revenues levels may not be

achieved.

Cash Budget

Cash Budget could be defined as the financial tool used for gearing towards limiting the

expenditures of company to the level of monetary funds available with the company. The sh

budgets are mainly used by organisations for estimating whether company is having sufficient

cash available for managing and carrying out its regular operations. It could be used for

determining whether company will be available with sufficient cash or not (Tucker and

Schaltegger, 2016). The cash budgets help company in effective allocation of funds to different

activities and departments.

Advantages

The cash budget helps company to arrange the necessary monetary funds for the business.

It is very essential because if sufficient funds are not available the operations and activities of

business will be affected. This helps company in keeping its expenditures under control by

taking corrective steps.

Disadvantages

The cash budgets prepared by the company do not consider the economic factors. These

cash budgets are based over subjective estimates. Accurate estimation of funds required by the

business cannot be made.

Flexible Budget

Flexible budgets are similar to the static budgets. The flexible budgets change with the

change in activity or volume of production. The budget is used for the planning purposes and for

estimating the operating and factory costs. Flexible budgets are considered much realistic than

other budgets as it lays emphasis over the cost behaviour at various levels of operations

(Bromwich and Scapens, 2016). In preparation of flexible budgets managers are focused over

considering different scenarios & the responses for them.

Advantages

The flexible budget allows the company to make changes according to the sales and

marketing levels. It provides the space for making changes as per the requirements of business. It

helps to identify the more accurate reasons for deviations. It helps in reclassifying the budgeted

11

achieved.

Cash Budget

Cash Budget could be defined as the financial tool used for gearing towards limiting the

expenditures of company to the level of monetary funds available with the company. The sh

budgets are mainly used by organisations for estimating whether company is having sufficient

cash available for managing and carrying out its regular operations. It could be used for

determining whether company will be available with sufficient cash or not (Tucker and

Schaltegger, 2016). The cash budgets help company in effective allocation of funds to different

activities and departments.

Advantages

The cash budget helps company to arrange the necessary monetary funds for the business.

It is very essential because if sufficient funds are not available the operations and activities of

business will be affected. This helps company in keeping its expenditures under control by

taking corrective steps.

Disadvantages

The cash budgets prepared by the company do not consider the economic factors. These

cash budgets are based over subjective estimates. Accurate estimation of funds required by the

business cannot be made.

Flexible Budget

Flexible budgets are similar to the static budgets. The flexible budgets change with the

change in activity or volume of production. The budget is used for the planning purposes and for

estimating the operating and factory costs. Flexible budgets are considered much realistic than

other budgets as it lays emphasis over the cost behaviour at various levels of operations

(Bromwich and Scapens, 2016). In preparation of flexible budgets managers are focused over

considering different scenarios & the responses for them.

Advantages

The flexible budget allows the company to make changes according to the sales and

marketing levels. It provides the space for making changes as per the requirements of business. It

helps to identify the more accurate reasons for deviations. It helps in reclassifying the budgeted

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

cost suffered by the organisation. The budget is not like static budget where the changes cannot

be made once defined.

Disadvantages

The budget requires more skilled professionals to make the estimates for the business

activities. Whole budget is required to be changed for adjusting small changes in volumes. The

effects of changes are also seen in cost controls measures. The deviations between the budgeted

and actual levels go high.

Zero Based Budgeting

Zero-based budgeting is referred to as an effective measure which in turn is considered to

be very useful in justifying each expenses of the organization. The process of the ZBB tends to

start with the zero base or from the scratch. Each function within the organization is usually

analysed for the cost and needs associated with each function. The process of the zero based

budgeting in turn tends to start from the zero base where all the budget in turn tends to start from

the scratch without taking into consideration past data associated with the specific activity.

Advantage

Every budget is prepared from the fresh without taking the budgets of previous years as

the base for preparation of current budgets. This is beneficial for organisation with products

having high influence of external factors.

Disadvantage

It takes considerable time of management to prepare the budgets as the budget is prepared

after analysing all the associated factors. This is very expensive as involve more resources

compared with other budgets.

P5 Comparison of organisations adapting the management accounting methods for responding to

the financial problems.

The business operates in an environment that is continuously changing due to various

factors. These influences affect the business and its performance. The management accounting

methods help the company in responding to the financial problems

Financial issues

Tesco – It is facing financial issue regarding the collection of funds from debtors. The

financial issue creates problem for the company as it is not able to carry out its financial

operations according to the budgets prepared.

12

be made once defined.

Disadvantages

The budget requires more skilled professionals to make the estimates for the business

activities. Whole budget is required to be changed for adjusting small changes in volumes. The

effects of changes are also seen in cost controls measures. The deviations between the budgeted

and actual levels go high.

Zero Based Budgeting

Zero-based budgeting is referred to as an effective measure which in turn is considered to

be very useful in justifying each expenses of the organization. The process of the ZBB tends to

start with the zero base or from the scratch. Each function within the organization is usually

analysed for the cost and needs associated with each function. The process of the zero based

budgeting in turn tends to start from the zero base where all the budget in turn tends to start from

the scratch without taking into consideration past data associated with the specific activity.

Advantage

Every budget is prepared from the fresh without taking the budgets of previous years as

the base for preparation of current budgets. This is beneficial for organisation with products

having high influence of external factors.

Disadvantage

It takes considerable time of management to prepare the budgets as the budget is prepared

after analysing all the associated factors. This is very expensive as involve more resources

compared with other budgets.

P5 Comparison of organisations adapting the management accounting methods for responding to

the financial problems.

The business operates in an environment that is continuously changing due to various

factors. These influences affect the business and its performance. The management accounting

methods help the company in responding to the financial problems

Financial issues

Tesco – It is facing financial issue regarding the collection of funds from debtors. The

financial issue creates problem for the company as it is not able to carry out its financial

operations according to the budgets prepared.

12

Unilever – It is a Competitor company facing the problem of scarce resource. Company

is notr able to meet the demands with the available resources. This is essential for company to

keep its cost under control.

Comparisons of Tesco adapting to various financial issues.

Financial tools Benchmarking – It refers to process where the management is required to set the target

levels for activities and operations. It enables company to gain valuable data and

information that is essential for making future decisions. For example setting target of

departments and analysing their performance after completion of production.

Corporate Governance – It refers to rules, regulation and the processes on which

business are operating, controlled or regulated. It encompasses internal & external factors

affecting the interests of stakeholders.

Key performance indicators - It is measure used by the organization to reflect progress in

relation to specific goals. It helps in monitoring the performance of the organization

based on certain criteria. The financial KPIs are based on income statement and balance

sheet of the organization which includes reports on changes in sales growth, expenses etc.

It helps in improving the strategy as per the requirement.

MA in resolving financial issues.

Tesco uses benchmarking in it company for identifying the sales level achieved by it. The

deviations are recognised which helps company to take corrective measures. When the required

collections are not made as per the set targets company charges extra interests on delayed

payments.

Corporate governance is applied by Unilever in the organisation for dealing with the

problem of scarce resources (Christ and Burritt, 2017). Corporate governance involves keeping

proper monitoring and control over the operations. It ensures that the resources are not wasted

and the activities that are not productive are eliminated. It ensures that the available resources are

best utilised by the company

Tesco used Cost accounting systems for issues related to the effective utilisation of

resources and increasing costs. It incorporated cost accounting methods through which costs

13

is notr able to meet the demands with the available resources. This is essential for company to

keep its cost under control.

Comparisons of Tesco adapting to various financial issues.

Financial tools Benchmarking – It refers to process where the management is required to set the target

levels for activities and operations. It enables company to gain valuable data and

information that is essential for making future decisions. For example setting target of

departments and analysing their performance after completion of production.

Corporate Governance – It refers to rules, regulation and the processes on which

business are operating, controlled or regulated. It encompasses internal & external factors

affecting the interests of stakeholders.

Key performance indicators - It is measure used by the organization to reflect progress in

relation to specific goals. It helps in monitoring the performance of the organization

based on certain criteria. The financial KPIs are based on income statement and balance

sheet of the organization which includes reports on changes in sales growth, expenses etc.

It helps in improving the strategy as per the requirement.

MA in resolving financial issues.

Tesco uses benchmarking in it company for identifying the sales level achieved by it. The

deviations are recognised which helps company to take corrective measures. When the required

collections are not made as per the set targets company charges extra interests on delayed

payments.

Corporate governance is applied by Unilever in the organisation for dealing with the

problem of scarce resources (Christ and Burritt, 2017). Corporate governance involves keeping

proper monitoring and control over the operations. It ensures that the resources are not wasted

and the activities that are not productive are eliminated. It ensures that the available resources are

best utilised by the company

Tesco used Cost accounting systems for issues related to the effective utilisation of

resources and increasing costs. It incorporated cost accounting methods through which costs

13

were controlled and the resources were effectively used by organisation. The accounting system

helped company to achieve the required sales levels keeping the cost under control.

The Unilever used inventory management systems with technological advancements.

Inventory management helps in making accurate forecasts about the future demands of

inventories in the production process. This made the company to place purchase orders on time

as before companies was facing issues related to availability of inventory on time of

productions. Also sometimes high stocks increased the carrying cost of organisation.

CONCLUSION

From the above research it could be concluded that management accounting is helping

organisation to perform as per the required levels. Management accounting is helping

organisations to achieve the goals and objectives of business. It ensures that the business

maintain it performance by adapting the management accounting systems. The reports methods

of management accounting help to identify the loopholes of business so that necessary corrective

steps can be taken by the management. Planning tools helps management in making more

accurate forecast about the future income and expenses. The management accounting method

also helps company to respond positively with the financial issues. MA is used by Unilever for

the better performance of the management of the business operations of the business. This is

used for keeping its costs and expenditures under control of the business operations. Business is

achieving success of the goals and objectives of the business.

14

helped company to achieve the required sales levels keeping the cost under control.

The Unilever used inventory management systems with technological advancements.

Inventory management helps in making accurate forecasts about the future demands of

inventories in the production process. This made the company to place purchase orders on time

as before companies was facing issues related to availability of inventory on time of

productions. Also sometimes high stocks increased the carrying cost of organisation.

CONCLUSION

From the above research it could be concluded that management accounting is helping

organisation to perform as per the required levels. Management accounting is helping

organisations to achieve the goals and objectives of business. It ensures that the business

maintain it performance by adapting the management accounting systems. The reports methods

of management accounting help to identify the loopholes of business so that necessary corrective

steps can be taken by the management. Planning tools helps management in making more

accurate forecast about the future income and expenses. The management accounting method

also helps company to respond positively with the financial issues. MA is used by Unilever for

the better performance of the management of the business operations of the business. This is

used for keeping its costs and expenditures under control of the business operations. Business is

achieving success of the goals and objectives of the business.

14

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REFERENCES

Books and Journals

Bromwich, M. and Scapens, R.W., 2016. Management accounting research: 25 years

on. Management Accounting Research.31. pp.1-9.

Christ, K.L. and Burritt, R.L., 2017. Water management accounting: A framework for corporate

practice. Journal of cleaner production, 152, pp.379-386.

Cooper, D.J., Ezzamel, M. and Qu, S.Q., 2017. Popularizing a management accounting idea: The

case of the balanced scorecard. Contemporary Accounting Research.34(2).pp.991-1025.

Granlund, M. and Lukka, K., 2017. Investigating highly established research paradigms:

Reviving contextuality in contingency theory based management accounting

research. Critical Perspectives on Accounting.45.pp.63-80.

Hall, M., 2016. Realising the richness of psychology theory in contingency-based management

accounting research. Management Accounting Research. 31.pp.63-74.

Maas, K., Schaltegger, S. and Crutzen, N., 2016. Integrating corporate sustainability assessment,

management accounting, control, and reporting. Journal of Cleaner Production. 136.

pp.237-248.

Malmi, T., 2016. Managerialist studies in management accounting: 1990–2014. Management

Accounting Research.31.pp.31-44.

Messner, M., 2016. Does industry matter? How industry context shapes management accounting

practice. Management Accounting Research. 31. pp.103-111.

Nitzl, C., 2016. The use of partial least squares structural equation modelling (PLS-SEM) in

management accounting research: Directions for future theory development. Journal of

Accounting Literature. 37.pp.19-35.

Otley, D., 2016. The contingency theory of management accounting and control: 1980–

2014. Management accounting research.31.pp.45-62.

Quattrone, P., 2016. Management accounting goes digital: Will the move make it

wiser?. Management Accounting Research.31.pp.118-122.

Tucker, B.P. and Schaltegger, S., 2016. Comparing the research-practice gap in management

accounting. Accounting, Auditing & Accountability Journal.

Weetman, P., 2019. Financial and management accounting. Pearson UK.

15

Books and Journals

Bromwich, M. and Scapens, R.W., 2016. Management accounting research: 25 years

on. Management Accounting Research.31. pp.1-9.

Christ, K.L. and Burritt, R.L., 2017. Water management accounting: A framework for corporate

practice. Journal of cleaner production, 152, pp.379-386.

Cooper, D.J., Ezzamel, M. and Qu, S.Q., 2017. Popularizing a management accounting idea: The

case of the balanced scorecard. Contemporary Accounting Research.34(2).pp.991-1025.

Granlund, M. and Lukka, K., 2017. Investigating highly established research paradigms:

Reviving contextuality in contingency theory based management accounting

research. Critical Perspectives on Accounting.45.pp.63-80.

Hall, M., 2016. Realising the richness of psychology theory in contingency-based management

accounting research. Management Accounting Research. 31.pp.63-74.

Maas, K., Schaltegger, S. and Crutzen, N., 2016. Integrating corporate sustainability assessment,

management accounting, control, and reporting. Journal of Cleaner Production. 136.

pp.237-248.

Malmi, T., 2016. Managerialist studies in management accounting: 1990–2014. Management

Accounting Research.31.pp.31-44.

Messner, M., 2016. Does industry matter? How industry context shapes management accounting

practice. Management Accounting Research. 31. pp.103-111.

Nitzl, C., 2016. The use of partial least squares structural equation modelling (PLS-SEM) in

management accounting research: Directions for future theory development. Journal of

Accounting Literature. 37.pp.19-35.

Otley, D., 2016. The contingency theory of management accounting and control: 1980–

2014. Management accounting research.31.pp.45-62.

Quattrone, P., 2016. Management accounting goes digital: Will the move make it

wiser?. Management Accounting Research.31.pp.118-122.

Tucker, B.P. and Schaltegger, S., 2016. Comparing the research-practice gap in management

accounting. Accounting, Auditing & Accountability Journal.

Weetman, P., 2019. Financial and management accounting. Pearson UK.

15

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.