Management Accounting and its Role in Organizational Processes

VerifiedAdded on 2023/01/19

|20

|4140

|100

AI Summary

This assignment discusses the concept of management accounting and its importance in organizational processes. It covers different management accounting systems and reports, as well as various cost analysis techniques. The advantages and disadvantages of using planning tools for budget control are also discussed.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

INTRODUCTION

Management accounting is a field of accounts which benefits in preparation of multiple

reports and accounts so that organisation can attain reliability and productivity while performing

business operations. This will allow a firm to take strategic decisions so that high outcomes can

be achieved (Abdelmoneim Mohamed and Jones, 2014). This assignment is written for KEF Ltd

which is a medium sized manufacturing company which is operating in UK. This report is given

to cover about multiple kind of management accounting systems and reports and their role in

performing organisational processes. Also, different kind of costs will be used to prepare

financial and income statements. With the help of budgetary tools, appropriate budget for firm

will be prepared and forecasted. At last, different techniques will be adopted so that financial

issues of an organisation can be resolved in an efficient manner.

TASK 1

P1 Mention about management accounting and need of different management accounting

systems in an organisation

Management accounting is termed as an activity of analysing, summarizing and

interpreting final statements prepared on annual basis by an organization. These accounts include

income statement, cash flow statement, balance sheet etc. It makes easy for the manager to

identify actual financial position of an organization which motivates them to make corrective

actions for future improvement (AlMaryani and Sadik, 2012).

Price optimization system: It is a system which bring out the information about the actual

perception of customers towards the pricing decisions taken by an organization for their products

and services. Using of such system by KEF Ltd facilitates their manager to recognize the aspects

on the basis of which willingness to buy depends. It makes easy for them to frame an effective

pricing strategies which can bring profitable return to both customers and an organization. Hiring

a researcher to identify the actual satisfaction level of customers will be the most effective

decision of KEF Ltd as it estimates an organization about the effectiveness of their current

pricing policy for their offerings (Bennett and James, 2017).

Inventory management system: This type of system emphasize on maintaining and

managing inventories in a firm so that cost of inventories can be optimised desirably. This

system can be used by organisations to increase their efficiency of inventory management. In

1

Management accounting is a field of accounts which benefits in preparation of multiple

reports and accounts so that organisation can attain reliability and productivity while performing

business operations. This will allow a firm to take strategic decisions so that high outcomes can

be achieved (Abdelmoneim Mohamed and Jones, 2014). This assignment is written for KEF Ltd

which is a medium sized manufacturing company which is operating in UK. This report is given

to cover about multiple kind of management accounting systems and reports and their role in

performing organisational processes. Also, different kind of costs will be used to prepare

financial and income statements. With the help of budgetary tools, appropriate budget for firm

will be prepared and forecasted. At last, different techniques will be adopted so that financial

issues of an organisation can be resolved in an efficient manner.

TASK 1

P1 Mention about management accounting and need of different management accounting

systems in an organisation

Management accounting is termed as an activity of analysing, summarizing and

interpreting final statements prepared on annual basis by an organization. These accounts include

income statement, cash flow statement, balance sheet etc. It makes easy for the manager to

identify actual financial position of an organization which motivates them to make corrective

actions for future improvement (AlMaryani and Sadik, 2012).

Price optimization system: It is a system which bring out the information about the actual

perception of customers towards the pricing decisions taken by an organization for their products

and services. Using of such system by KEF Ltd facilitates their manager to recognize the aspects

on the basis of which willingness to buy depends. It makes easy for them to frame an effective

pricing strategies which can bring profitable return to both customers and an organization. Hiring

a researcher to identify the actual satisfaction level of customers will be the most effective

decision of KEF Ltd as it estimates an organization about the effectiveness of their current

pricing policy for their offerings (Bennett and James, 2017).

Inventory management system: This type of system emphasize on maintaining and

managing inventories in a firm so that cost of inventories can be optimised desirably. This

system can be used by organisations to increase their efficiency of inventory management. In

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

case of KEF Ltd, inventories involves raw material, finished goods, spare tools, processed goods,

WIP etc. To manage all the record of inventories, this tool can be used efficiently. By this,

manager of company will be able to identify which stock is required and available to company

for manufacturing purpose.

Cost Accounting System: This system emphasize on the profitability analysis by

projection and estimation of cost associated with multiple services and products. This system

involves activities of summarising, recording, analysing and classifying various expenditures and

costs which are concerned with the manufacturing of products. In case of KEF Ltd, this system

can be used by manufacturing manager to optimise their costs so that high revenues can be

earned (Bloomfield, 2015).

P2 Different methods used for management accounting reporting

Management accounting reporting: It refers to an activity of recording, summarising

and storing financial data of an organisation with a purpose of using at the time of making an

effective decision for achievement of organisational goals and objectives thus important for KEF

Ltd to prepare the same on timely basis. There are various kind of reporting system which

includes the following:

Performance report: It is the report prepared by an organisation with a purpose of

maintaining track record of performance of different business functions. It can be used by KEF

Ltd to compare and analyse the performance level of employee’s as well as business so that an

effective decision could be made relating to providing bonus and incentives to employees on the

basis of their contribution towards achievement of organisational goals and objectives (Wood,

2016).

Budget report: It is another kind of report which is also necessary to prepare by an

organisation with the purpose of allocating budget to different departments according to their

requirements based on given objectives. Such kind of report is prepared by KEF Ltd to measure

the performance level of different functions. It gives direction to departments to spend money

according to the given budget so that wastage of funds could be minimised (Demski, 2013).

Account receivable report: This is the report containing information related with list of

debtors whose payments to an organisation are still due. It is prepared by such organisation who

avails option to provide credit to others. Thus, KEF Ltd can use this report for making decision

2

WIP etc. To manage all the record of inventories, this tool can be used efficiently. By this,

manager of company will be able to identify which stock is required and available to company

for manufacturing purpose.

Cost Accounting System: This system emphasize on the profitability analysis by

projection and estimation of cost associated with multiple services and products. This system

involves activities of summarising, recording, analysing and classifying various expenditures and

costs which are concerned with the manufacturing of products. In case of KEF Ltd, this system

can be used by manufacturing manager to optimise their costs so that high revenues can be

earned (Bloomfield, 2015).

P2 Different methods used for management accounting reporting

Management accounting reporting: It refers to an activity of recording, summarising

and storing financial data of an organisation with a purpose of using at the time of making an

effective decision for achievement of organisational goals and objectives thus important for KEF

Ltd to prepare the same on timely basis. There are various kind of reporting system which

includes the following:

Performance report: It is the report prepared by an organisation with a purpose of

maintaining track record of performance of different business functions. It can be used by KEF

Ltd to compare and analyse the performance level of employee’s as well as business so that an

effective decision could be made relating to providing bonus and incentives to employees on the

basis of their contribution towards achievement of organisational goals and objectives (Wood,

2016).

Budget report: It is another kind of report which is also necessary to prepare by an

organisation with the purpose of allocating budget to different departments according to their

requirements based on given objectives. Such kind of report is prepared by KEF Ltd to measure

the performance level of different functions. It gives direction to departments to spend money

according to the given budget so that wastage of funds could be minimised (Demski, 2013).

Account receivable report: This is the report containing information related with list of

debtors whose payments to an organisation are still due. It is prepared by such organisation who

avails option to provide credit to others. Thus, KEF Ltd can use this report for making decision

2

to recover the due amount of debtors either by changing existing credit policies or ending up

their loyalty cards so that an organisation can be protected from any financial losses.

Inventory management report: This is the report which contains information related with

current inventory level an organisation has at present to meet customers’ requirements. It is more

beneficial for KEF Ltd to prepare such kind of report as it enables their manager to keep track

record of material used to manufacture products and services for targeted customers. It makes

easy for management to make decision regarding ordering further inventory if faces shortage in

warehouses which help them to retain loyal customers by supplying ordered products on time.

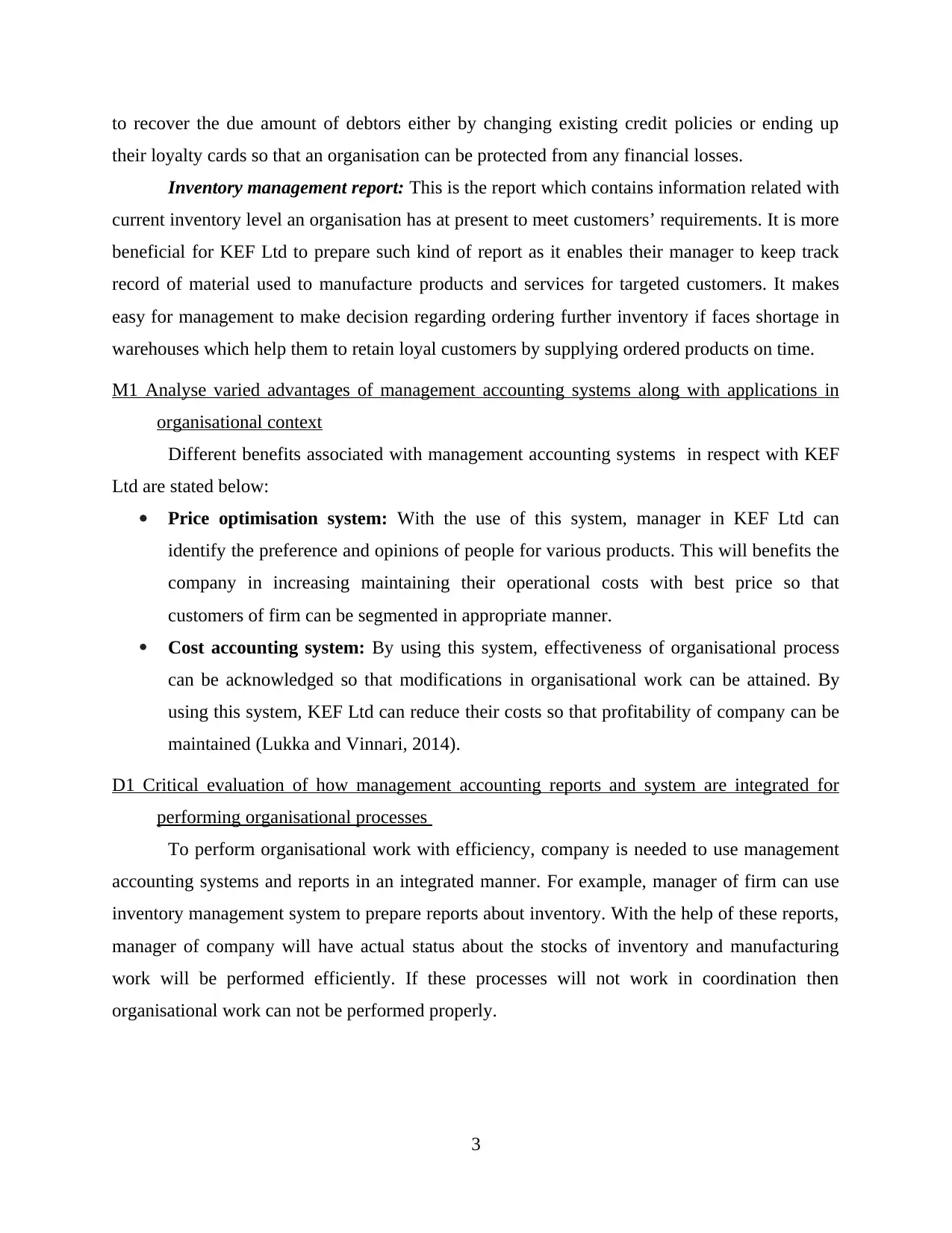

M1 Analyse varied advantages of management accounting systems along with applications in

organisational context

Different benefits associated with management accounting systems in respect with KEF

Ltd are stated below:

Price optimisation system: With the use of this system, manager in KEF Ltd can

identify the preference and opinions of people for various products. This will benefits the

company in increasing maintaining their operational costs with best price so that

customers of firm can be segmented in appropriate manner.

Cost accounting system: By using this system, effectiveness of organisational process

can be acknowledged so that modifications in organisational work can be attained. By

using this system, KEF Ltd can reduce their costs so that profitability of company can be

maintained (Lukka and Vinnari, 2014).

D1 Critical evaluation of how management accounting reports and system are integrated for

performing organisational processes

To perform organisational work with efficiency, company is needed to use management

accounting systems and reports in an integrated manner. For example, manager of firm can use

inventory management system to prepare reports about inventory. With the help of these reports,

manager of company will have actual status about the stocks of inventory and manufacturing

work will be performed efficiently. If these processes will not work in coordination then

organisational work can not be performed properly.

3

their loyalty cards so that an organisation can be protected from any financial losses.

Inventory management report: This is the report which contains information related with

current inventory level an organisation has at present to meet customers’ requirements. It is more

beneficial for KEF Ltd to prepare such kind of report as it enables their manager to keep track

record of material used to manufacture products and services for targeted customers. It makes

easy for management to make decision regarding ordering further inventory if faces shortage in

warehouses which help them to retain loyal customers by supplying ordered products on time.

M1 Analyse varied advantages of management accounting systems along with applications in

organisational context

Different benefits associated with management accounting systems in respect with KEF

Ltd are stated below:

Price optimisation system: With the use of this system, manager in KEF Ltd can

identify the preference and opinions of people for various products. This will benefits the

company in increasing maintaining their operational costs with best price so that

customers of firm can be segmented in appropriate manner.

Cost accounting system: By using this system, effectiveness of organisational process

can be acknowledged so that modifications in organisational work can be attained. By

using this system, KEF Ltd can reduce their costs so that profitability of company can be

maintained (Lukka and Vinnari, 2014).

D1 Critical evaluation of how management accounting reports and system are integrated for

performing organisational processes

To perform organisational work with efficiency, company is needed to use management

accounting systems and reports in an integrated manner. For example, manager of firm can use

inventory management system to prepare reports about inventory. With the help of these reports,

manager of company will have actual status about the stocks of inventory and manufacturing

work will be performed efficiently. If these processes will not work in coordination then

organisational work can not be performed properly.

3

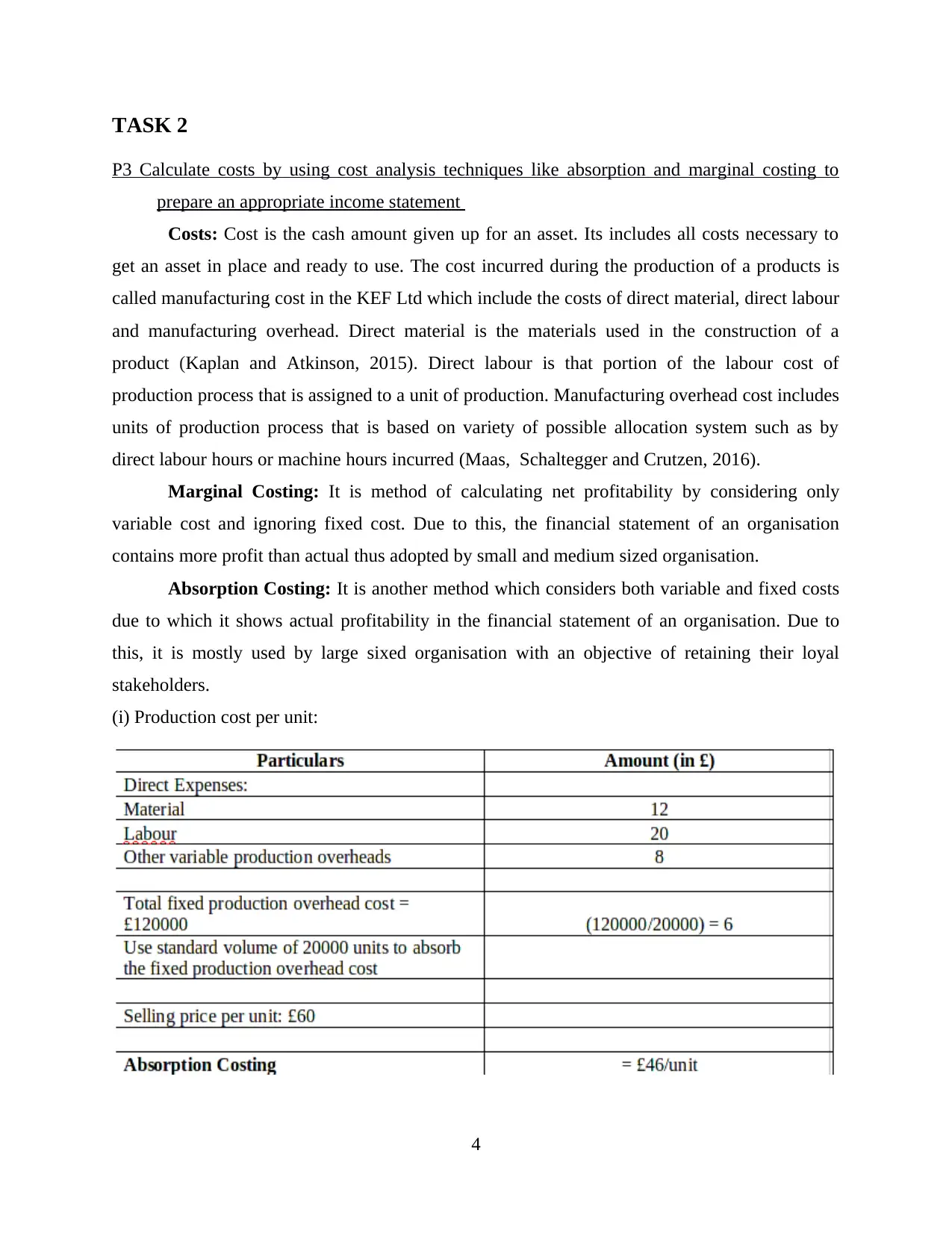

TASK 2

P3 Calculate costs by using cost analysis techniques like absorption and marginal costing to

prepare an appropriate income statement

Costs: Cost is the cash amount given up for an asset. Its includes all costs necessary to

get an asset in place and ready to use. The cost incurred during the production of a products is

called manufacturing cost in the KEF Ltd which include the costs of direct material, direct labour

and manufacturing overhead. Direct material is the materials used in the construction of a

product (Kaplan and Atkinson, 2015). Direct labour is that portion of the labour cost of

production process that is assigned to a unit of production. Manufacturing overhead cost includes

units of production process that is based on variety of possible allocation system such as by

direct labour hours or machine hours incurred (Maas, Schaltegger and Crutzen, 2016).

Marginal Costing: It is method of calculating net profitability by considering only

variable cost and ignoring fixed cost. Due to this, the financial statement of an organisation

contains more profit than actual thus adopted by small and medium sized organisation.

Absorption Costing: It is another method which considers both variable and fixed costs

due to which it shows actual profitability in the financial statement of an organisation. Due to

this, it is mostly used by large sixed organisation with an objective of retaining their loyal

stakeholders.

(i) Production cost per unit:

4

P3 Calculate costs by using cost analysis techniques like absorption and marginal costing to

prepare an appropriate income statement

Costs: Cost is the cash amount given up for an asset. Its includes all costs necessary to

get an asset in place and ready to use. The cost incurred during the production of a products is

called manufacturing cost in the KEF Ltd which include the costs of direct material, direct labour

and manufacturing overhead. Direct material is the materials used in the construction of a

product (Kaplan and Atkinson, 2015). Direct labour is that portion of the labour cost of

production process that is assigned to a unit of production. Manufacturing overhead cost includes

units of production process that is based on variety of possible allocation system such as by

direct labour hours or machine hours incurred (Maas, Schaltegger and Crutzen, 2016).

Marginal Costing: It is method of calculating net profitability by considering only

variable cost and ignoring fixed cost. Due to this, the financial statement of an organisation

contains more profit than actual thus adopted by small and medium sized organisation.

Absorption Costing: It is another method which considers both variable and fixed costs

due to which it shows actual profitability in the financial statement of an organisation. Due to

this, it is mostly used by large sixed organisation with an objective of retaining their loyal

stakeholders.

(i) Production cost per unit:

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

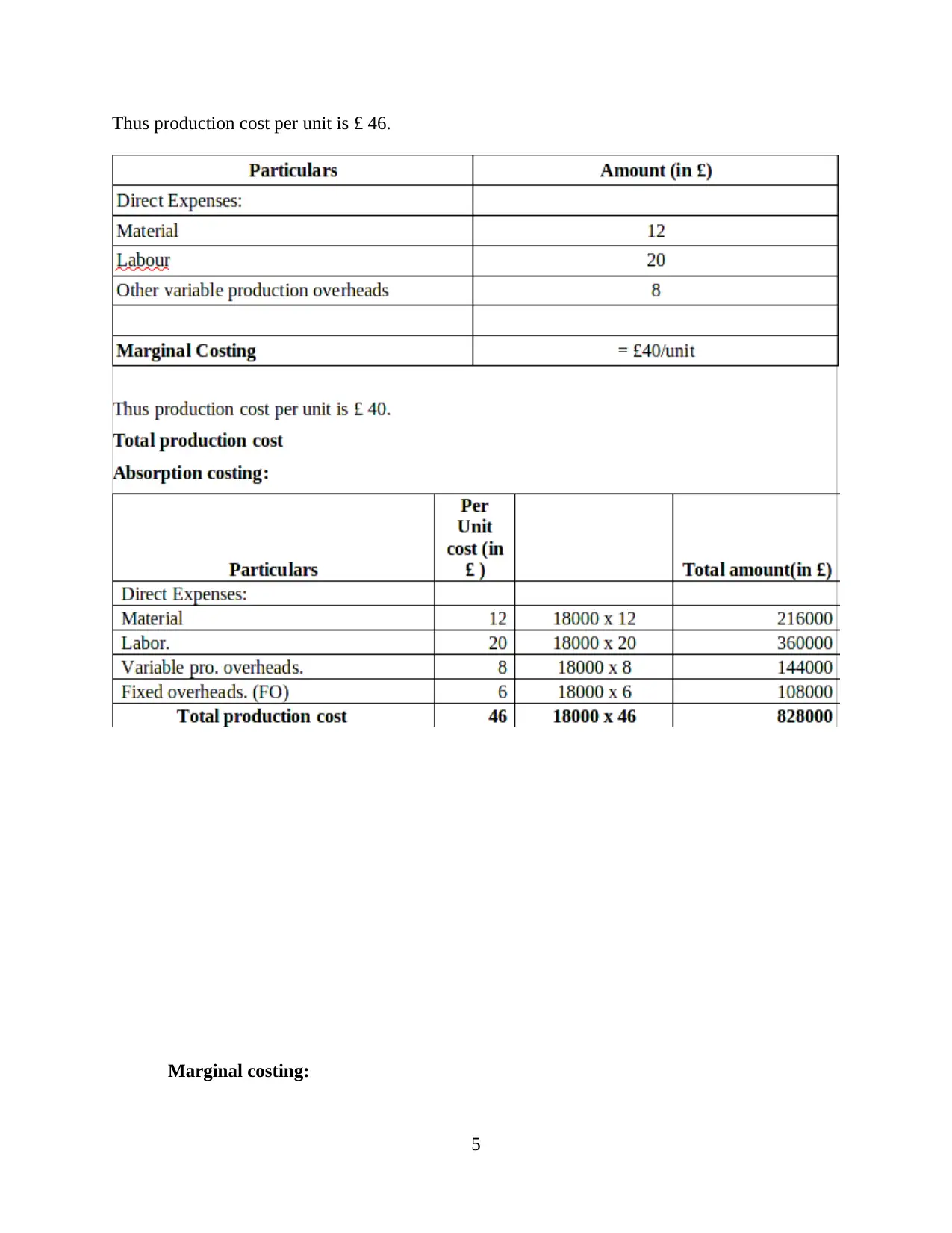

Thus production cost per unit is £ 46.

Marginal costing:

5

Marginal costing:

5

Particulars Per Unit

cost (in

£ )

Total amount(in £)

Direct Expenses:

Material 12 18000 x 12 216000

Labor. 20 18000 x 20 360000

Variable pro. overheads. 8 18000 x 8 144000

Total production cost 40 18000 x 40 720000

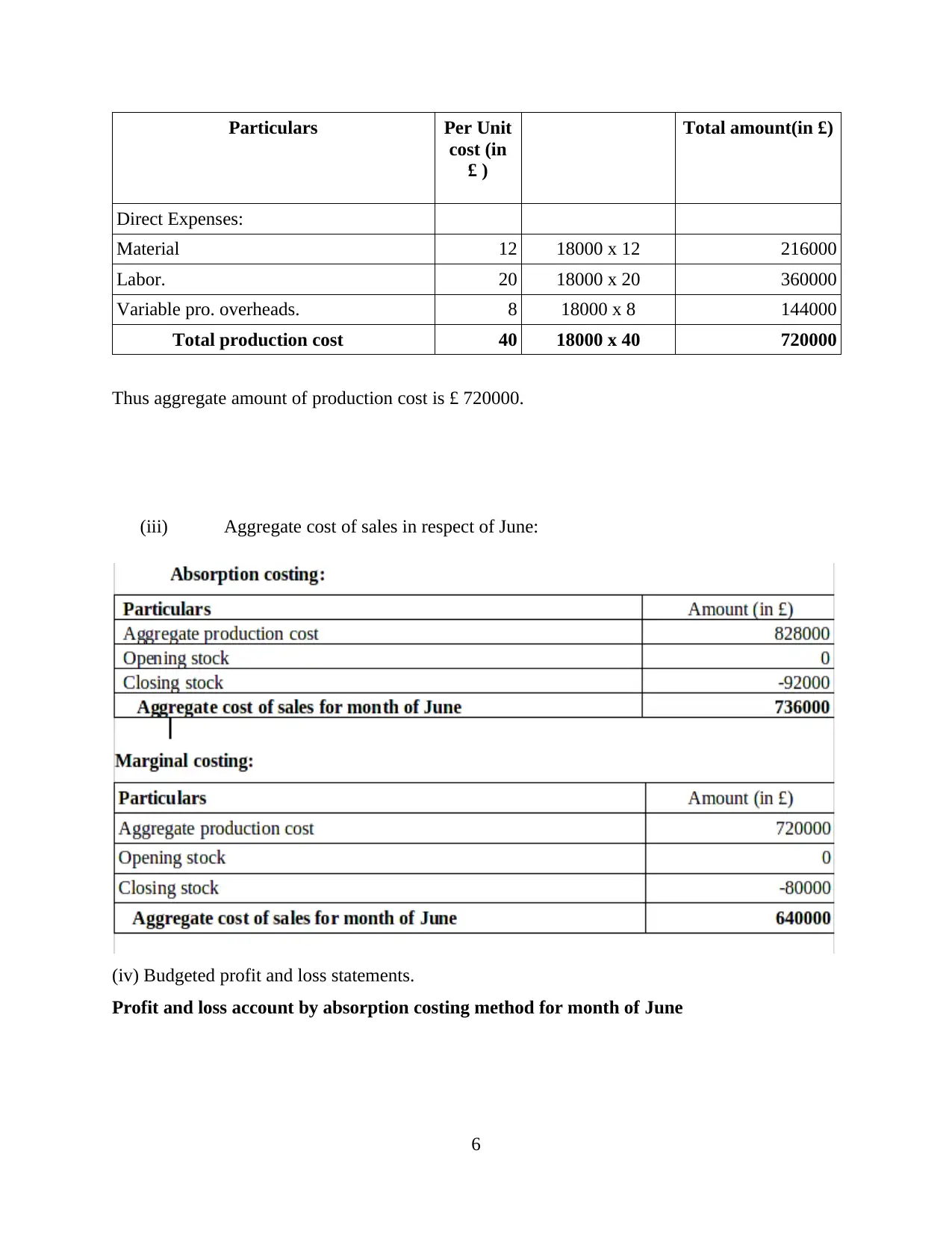

Thus aggregate amount of production cost is £ 720000.

(iii) Aggregate cost of sales in respect of June:

(iv) Budgeted profit and loss statements.

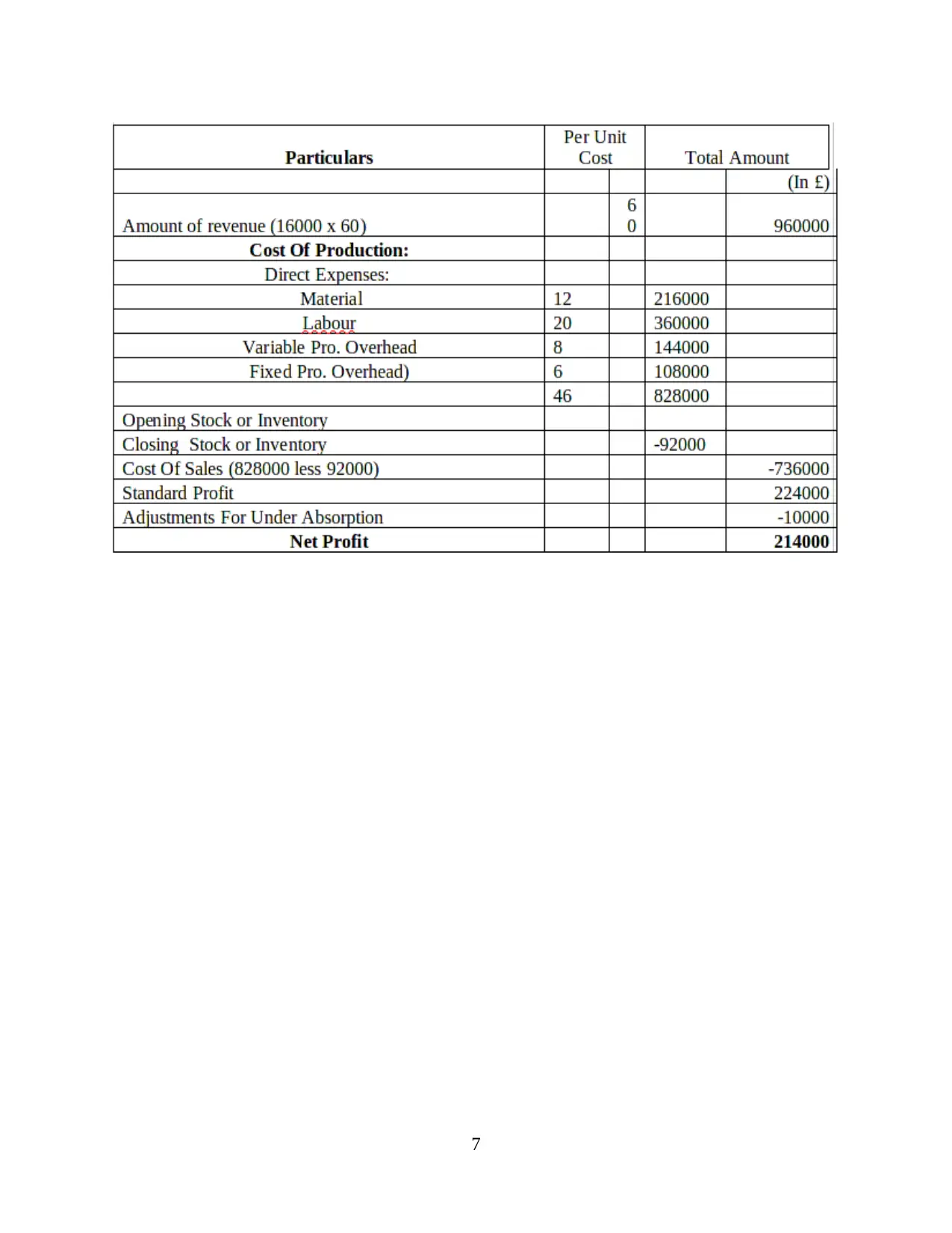

Profit and loss account by absorption costing method for month of June

6

cost (in

£ )

Total amount(in £)

Direct Expenses:

Material 12 18000 x 12 216000

Labor. 20 18000 x 20 360000

Variable pro. overheads. 8 18000 x 8 144000

Total production cost 40 18000 x 40 720000

Thus aggregate amount of production cost is £ 720000.

(iii) Aggregate cost of sales in respect of June:

(iv) Budgeted profit and loss statements.

Profit and loss account by absorption costing method for month of June

6

7

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

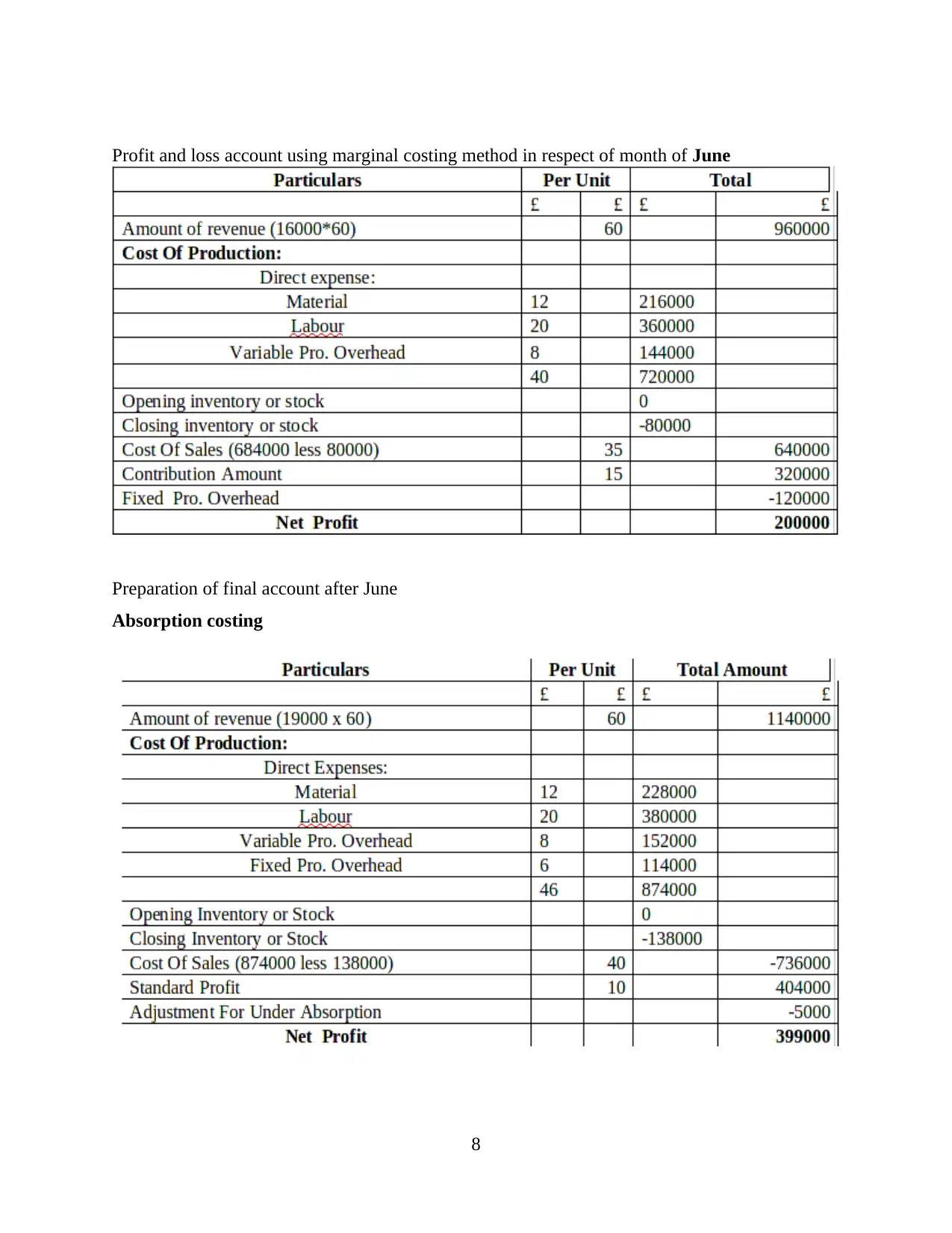

Profit and loss account using marginal costing method in respect of month of June

Preparation of final account after June

Absorption costing

8

Preparation of final account after June

Absorption costing

8

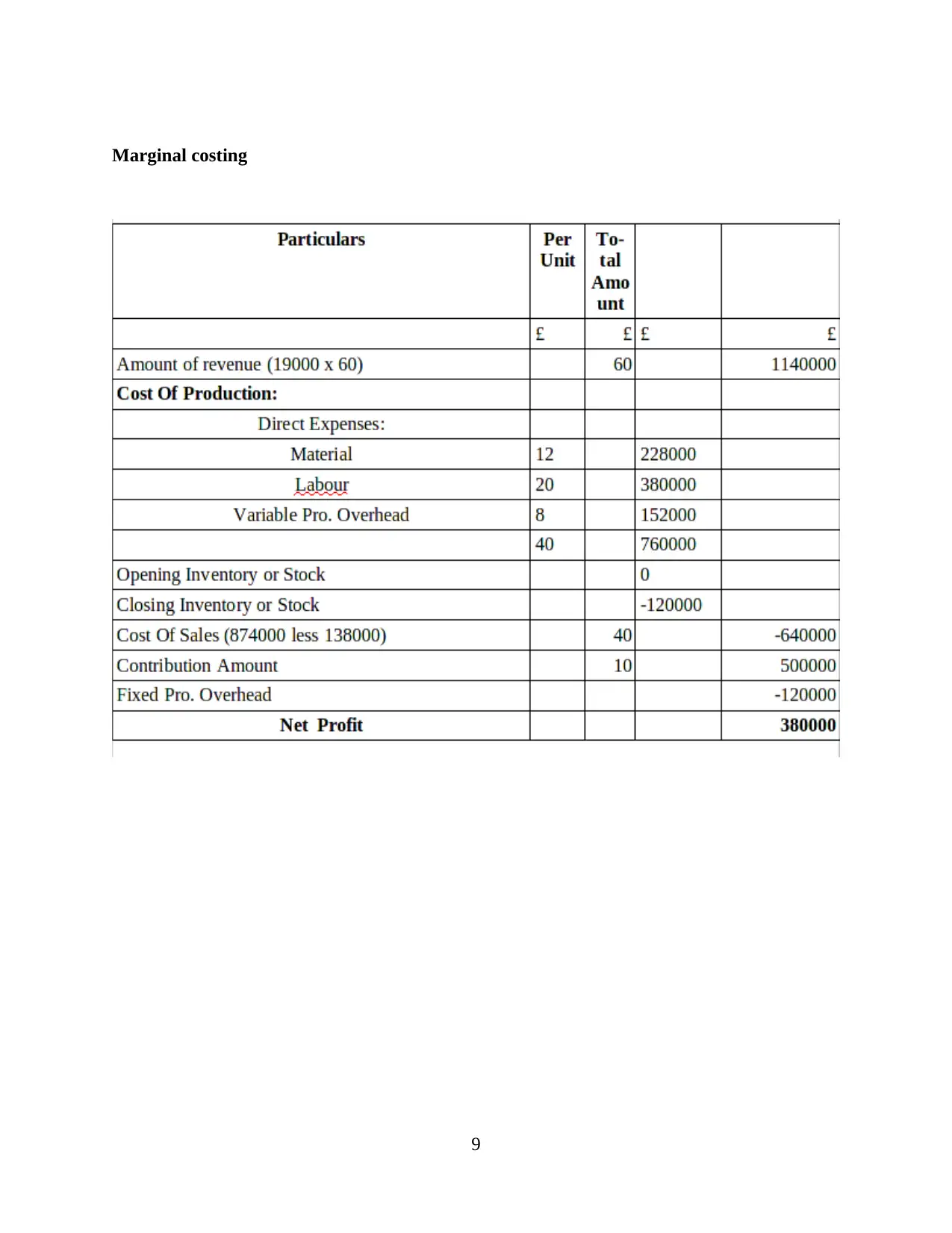

Marginal costing

9

9

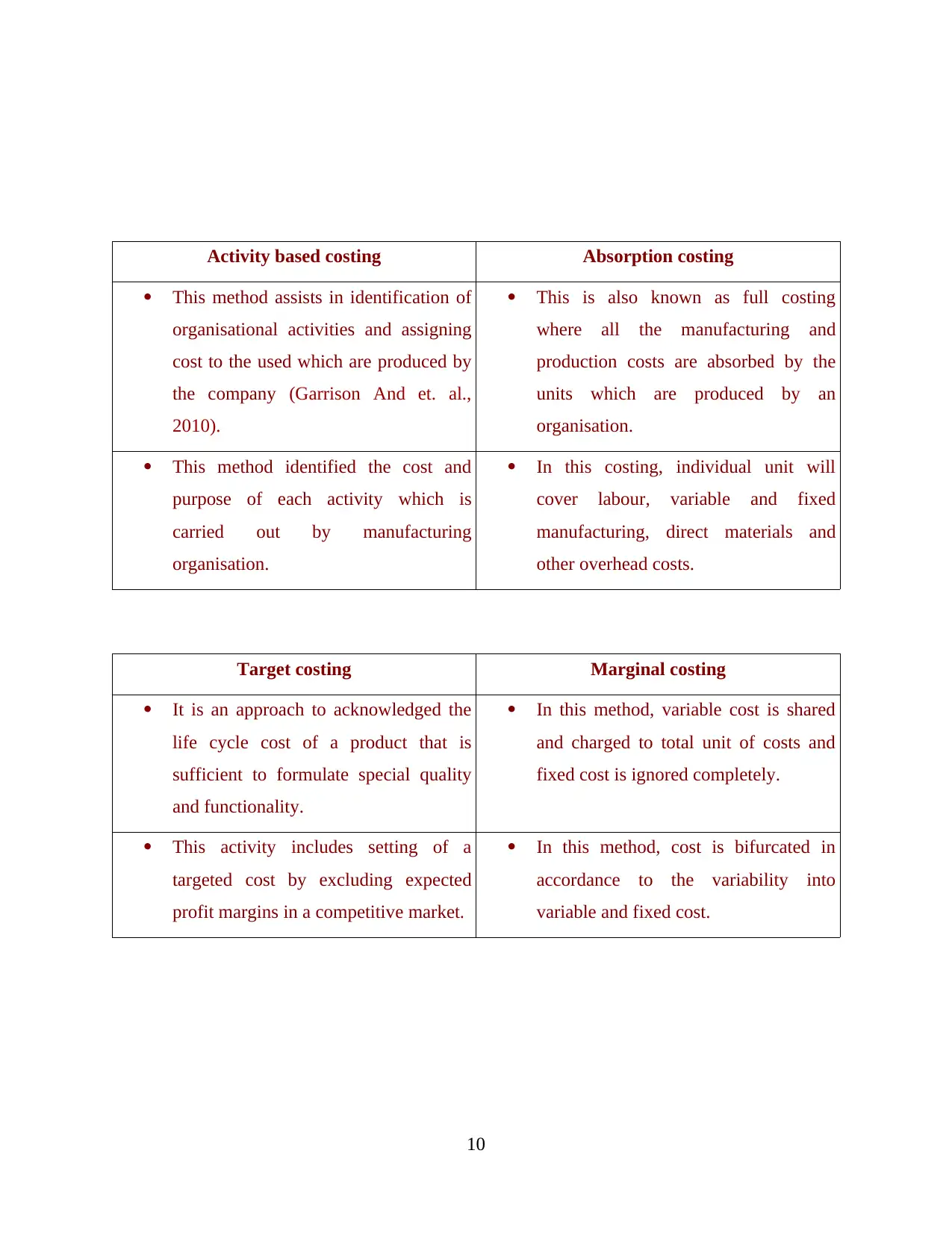

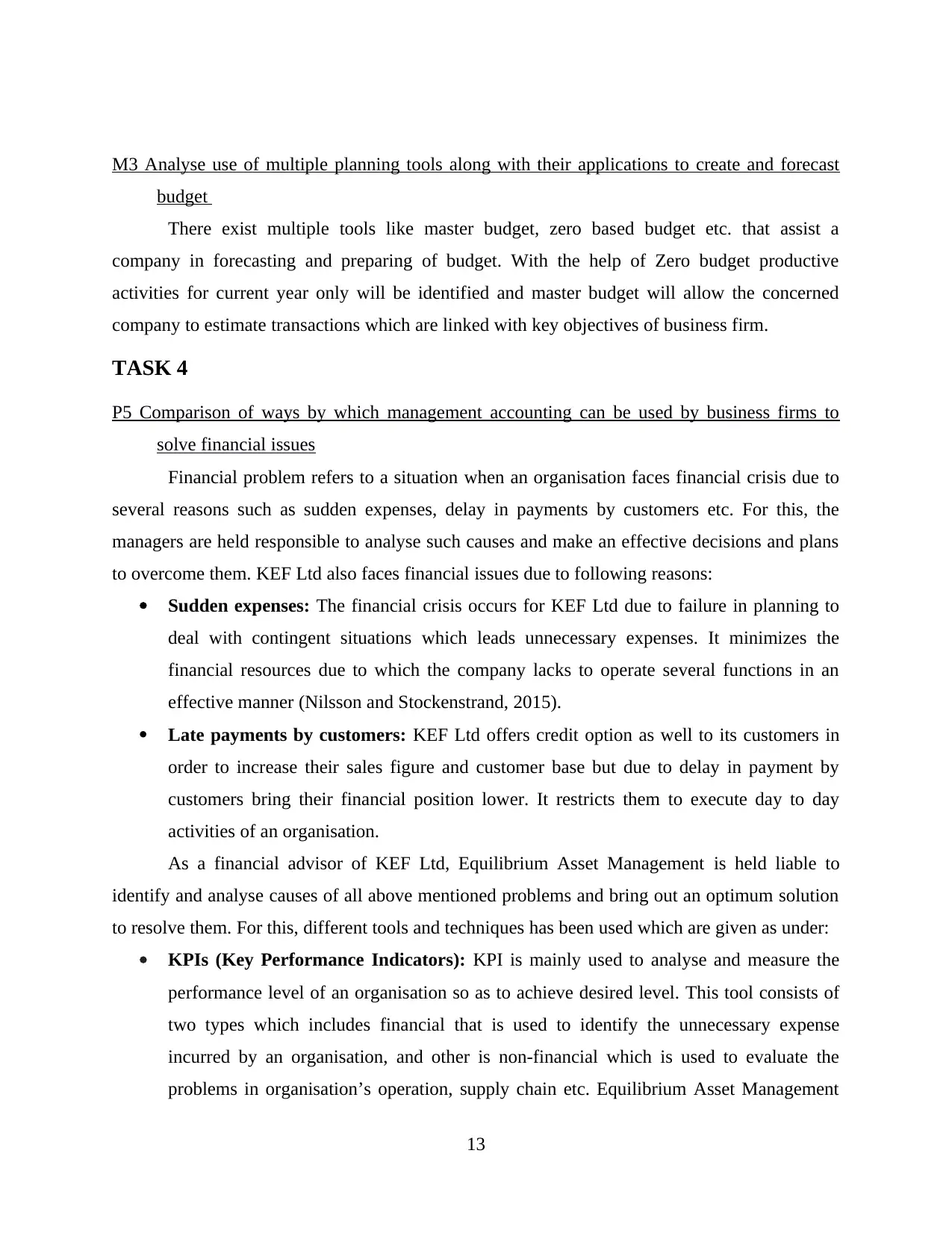

Activity based costing Absorption costing

This method assists in identification of

organisational activities and assigning

cost to the used which are produced by

the company (Garrison And et. al.,

2010).

This is also known as full costing

where all the manufacturing and

production costs are absorbed by the

units which are produced by an

organisation.

This method identified the cost and

purpose of each activity which is

carried out by manufacturing

organisation.

In this costing, individual unit will

cover labour, variable and fixed

manufacturing, direct materials and

other overhead costs.

Target costing Marginal costing

It is an approach to acknowledged the

life cycle cost of a product that is

sufficient to formulate special quality

and functionality.

In this method, variable cost is shared

and charged to total unit of costs and

fixed cost is ignored completely.

This activity includes setting of a

targeted cost by excluding expected

profit margins in a competitive market.

In this method, cost is bifurcated in

accordance to the variability into

variable and fixed cost.

10

This method assists in identification of

organisational activities and assigning

cost to the used which are produced by

the company (Garrison And et. al.,

2010).

This is also known as full costing

where all the manufacturing and

production costs are absorbed by the

units which are produced by an

organisation.

This method identified the cost and

purpose of each activity which is

carried out by manufacturing

organisation.

In this costing, individual unit will

cover labour, variable and fixed

manufacturing, direct materials and

other overhead costs.

Target costing Marginal costing

It is an approach to acknowledged the

life cycle cost of a product that is

sufficient to formulate special quality

and functionality.

In this method, variable cost is shared

and charged to total unit of costs and

fixed cost is ignored completely.

This activity includes setting of a

targeted cost by excluding expected

profit margins in a competitive market.

In this method, cost is bifurcated in

accordance to the variability into

variable and fixed cost.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

M2 Discuss a range of management accounting techniques and formulate reporting documents of

finance

There exist multiple techniques which are concerned with management accounting like

cash flows, profits and loss statements, balance sheets etc. that allows a company to prepare

accurate financial reports and documents. Without using these tools, company will never identify

their financial position within marketplace in respect with competitors.

D2 Prepare a financial report which appropriately applies and interpret data to perform complex

business operations

It is important for KEF Ltd to interpret their transactions and income statements so that

employees of company can identify which method of calculating cost will be beneficial for them.

In July net profits via absorption cost is 399000 and net profits earned in case of marginal cost is

380000. hence, company can calculate cost via absorption costing as it considers both fixed cost

and variable cost.

TASK 3

P4 Mention advantages and disadvantages of using varied kind of planning tools in context with

budget control

Budget is referred as the forecasting tool that can be used by an business organisation to

predict their future expenses and incomes for a particular time, mainly 1 year. An organisation

formulates different budgets so that all of their activities and operations can be performed in

expected costs (McLaren, Appleyard and Mitchell, 2016). With the help of Budget, an

organisation can decide about the activities which they wish to perform to achieve their goals.

Those activities which do not provide value to the company and are very expensive can be

ignored by preparing an appropriate budget.

There are different kind of planning tools which can be used by the manager in KEF Ltd

for budgetary control. Advantages and disadvantages for these tools are stated below:

Zero based budget: It is main element for budget control where budget for business

activities and operations initiate from zero base. Every year manager in KEF Ltd prepare

a zero budget base due to which transactions of previous years are ignored.

Advantage: This budget brings accuracy and transparency in finance of company.

11

finance

There exist multiple techniques which are concerned with management accounting like

cash flows, profits and loss statements, balance sheets etc. that allows a company to prepare

accurate financial reports and documents. Without using these tools, company will never identify

their financial position within marketplace in respect with competitors.

D2 Prepare a financial report which appropriately applies and interpret data to perform complex

business operations

It is important for KEF Ltd to interpret their transactions and income statements so that

employees of company can identify which method of calculating cost will be beneficial for them.

In July net profits via absorption cost is 399000 and net profits earned in case of marginal cost is

380000. hence, company can calculate cost via absorption costing as it considers both fixed cost

and variable cost.

TASK 3

P4 Mention advantages and disadvantages of using varied kind of planning tools in context with

budget control

Budget is referred as the forecasting tool that can be used by an business organisation to

predict their future expenses and incomes for a particular time, mainly 1 year. An organisation

formulates different budgets so that all of their activities and operations can be performed in

expected costs (McLaren, Appleyard and Mitchell, 2016). With the help of Budget, an

organisation can decide about the activities which they wish to perform to achieve their goals.

Those activities which do not provide value to the company and are very expensive can be

ignored by preparing an appropriate budget.

There are different kind of planning tools which can be used by the manager in KEF Ltd

for budgetary control. Advantages and disadvantages for these tools are stated below:

Zero based budget: It is main element for budget control where budget for business

activities and operations initiate from zero base. Every year manager in KEF Ltd prepare

a zero budget base due to which transactions of previous years are ignored.

Advantage: This budget brings accuracy and transparency in finance of company.

11

Disadvantage: It ignores data and finances of previous year due to which employees find

difficulty in analysing previous data.

Master budget: Each department creates a budget so that their work can be performed

without shortage of money. All the budgets related with a company are part of master

budget. This budget will help KEF Ltd in summarising all of their financial activities at

single place.

Advantage: This budget offers different financial statements and budgets in a single document.

Disadvantage: Due to integration of multiple budgets, finding requirement information takes a

lot of time.

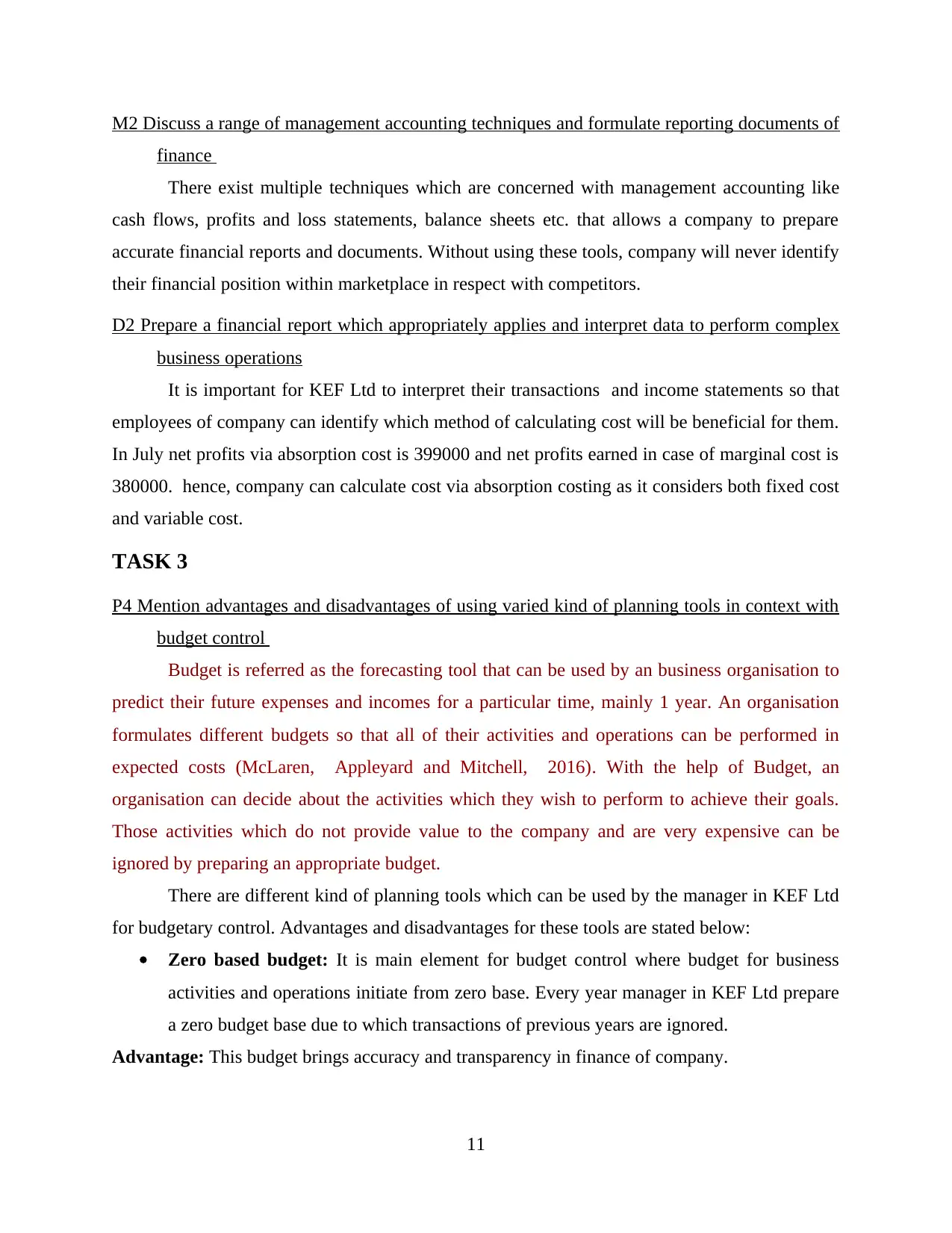

SWOT

Strengths Weaknesses

Market image of KEF Ltd is very good

due to which brand image of company

is high. This will help the firm in

earning high revenues.

This company spends less amount in

performing their marketing, research &

development activities due to which

organisation lacks in identifying

customer preferences.

Opportunities Threats

This company can expand their

business in near by regions and areas

which will help them in increasing their

sales and market shares (Maher,

Stickney and Weil, 2012).

There exist different organisation which

are operating in manufacturing sector

and giving tough competition in

market. This can be a big threat to the

revenues of company.

Balance scorecard

This is defined as a performance management tool that can be used by the manager in

KEF Ltd so that their activities can be analysed and evaluated in a proper manner. Also, this

scorecard will helps in observing the performance of staff members due to which required

modifications will be carried on time. This will help the organisation in earning high sales.

12

difficulty in analysing previous data.

Master budget: Each department creates a budget so that their work can be performed

without shortage of money. All the budgets related with a company are part of master

budget. This budget will help KEF Ltd in summarising all of their financial activities at

single place.

Advantage: This budget offers different financial statements and budgets in a single document.

Disadvantage: Due to integration of multiple budgets, finding requirement information takes a

lot of time.

SWOT

Strengths Weaknesses

Market image of KEF Ltd is very good

due to which brand image of company

is high. This will help the firm in

earning high revenues.

This company spends less amount in

performing their marketing, research &

development activities due to which

organisation lacks in identifying

customer preferences.

Opportunities Threats

This company can expand their

business in near by regions and areas

which will help them in increasing their

sales and market shares (Maher,

Stickney and Weil, 2012).

There exist different organisation which

are operating in manufacturing sector

and giving tough competition in

market. This can be a big threat to the

revenues of company.

Balance scorecard

This is defined as a performance management tool that can be used by the manager in

KEF Ltd so that their activities can be analysed and evaluated in a proper manner. Also, this

scorecard will helps in observing the performance of staff members due to which required

modifications will be carried on time. This will help the organisation in earning high sales.

12

M3 Analyse use of multiple planning tools along with their applications to create and forecast

budget

There exist multiple tools like master budget, zero based budget etc. that assist a

company in forecasting and preparing of budget. With the help of Zero budget productive

activities for current year only will be identified and master budget will allow the concerned

company to estimate transactions which are linked with key objectives of business firm.

TASK 4

P5 Comparison of ways by which management accounting can be used by business firms to

solve financial issues

Financial problem refers to a situation when an organisation faces financial crisis due to

several reasons such as sudden expenses, delay in payments by customers etc. For this, the

managers are held responsible to analyse such causes and make an effective decisions and plans

to overcome them. KEF Ltd also faces financial issues due to following reasons:

Sudden expenses: The financial crisis occurs for KEF Ltd due to failure in planning to

deal with contingent situations which leads unnecessary expenses. It minimizes the

financial resources due to which the company lacks to operate several functions in an

effective manner (Nilsson and Stockenstrand, 2015).

Late payments by customers: KEF Ltd offers credit option as well to its customers in

order to increase their sales figure and customer base but due to delay in payment by

customers bring their financial position lower. It restricts them to execute day to day

activities of an organisation.

As a financial advisor of KEF Ltd, Equilibrium Asset Management is held liable to

identify and analyse causes of all above mentioned problems and bring out an optimum solution

to resolve them. For this, different tools and techniques has been used which are given as under:

KPIs (Key Performance Indicators): KPI is mainly used to analyse and measure the

performance level of an organisation so as to achieve desired level. This tool consists of

two types which includes financial that is used to identify the unnecessary expense

incurred by an organisation, and other is non-financial which is used to evaluate the

problems in organisation’s operation, supply chain etc. Equilibrium Asset Management

13

budget

There exist multiple tools like master budget, zero based budget etc. that assist a

company in forecasting and preparing of budget. With the help of Zero budget productive

activities for current year only will be identified and master budget will allow the concerned

company to estimate transactions which are linked with key objectives of business firm.

TASK 4

P5 Comparison of ways by which management accounting can be used by business firms to

solve financial issues

Financial problem refers to a situation when an organisation faces financial crisis due to

several reasons such as sudden expenses, delay in payments by customers etc. For this, the

managers are held responsible to analyse such causes and make an effective decisions and plans

to overcome them. KEF Ltd also faces financial issues due to following reasons:

Sudden expenses: The financial crisis occurs for KEF Ltd due to failure in planning to

deal with contingent situations which leads unnecessary expenses. It minimizes the

financial resources due to which the company lacks to operate several functions in an

effective manner (Nilsson and Stockenstrand, 2015).

Late payments by customers: KEF Ltd offers credit option as well to its customers in

order to increase their sales figure and customer base but due to delay in payment by

customers bring their financial position lower. It restricts them to execute day to day

activities of an organisation.

As a financial advisor of KEF Ltd, Equilibrium Asset Management is held liable to

identify and analyse causes of all above mentioned problems and bring out an optimum solution

to resolve them. For this, different tools and techniques has been used which are given as under:

KPIs (Key Performance Indicators): KPI is mainly used to analyse and measure the

performance level of an organisation so as to achieve desired level. This tool consists of

two types which includes financial that is used to identify the unnecessary expense

incurred by an organisation, and other is non-financial which is used to evaluate the

problems in organisation’s operation, supply chain etc. Equilibrium Asset Management

13

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

uses financial KPI in order to address problem of sudden expenses for KEF Ltd as it

makes easy for their managers to determine unplanned or unnecessary expenses

(Quattrone, 2016).

Benchmarking: It is a technique which is used to motivate their employees to increase

their contribution towards enhancing financial position of company by setting target or

benchmark after analyzing their rival’s strategies. This tool is used by KEF Ltd which

enforces them to update their credit policies so that delay in payments by customers can

be minimized or eliminated.

Financial governance: It refers to a set of different financial principles that are required

to be comply by an organisation with a motive to deal with fund related problems. Using

such technique facilitate KEF Ltd to resolve financial issues by directing their employees

to perform in systematic way following all guidelines provided by an organisation (Renz,

2016).

Characteristics of an effective management accountant and the way in which it can

be used to prevent problems:

An effective accounting manager have sufficient amount of skills to analyse the financial

statements and make corrective decisions to strengthen their financial position by

forecasting situations and implement plans accordingly.

Decision making skill is also one of an effective characteristic that an accounting

manager have as it help them in identifying the issues behind arising financial problems

and make an effective decision accordingly (Ruch and Taylor, 2015).

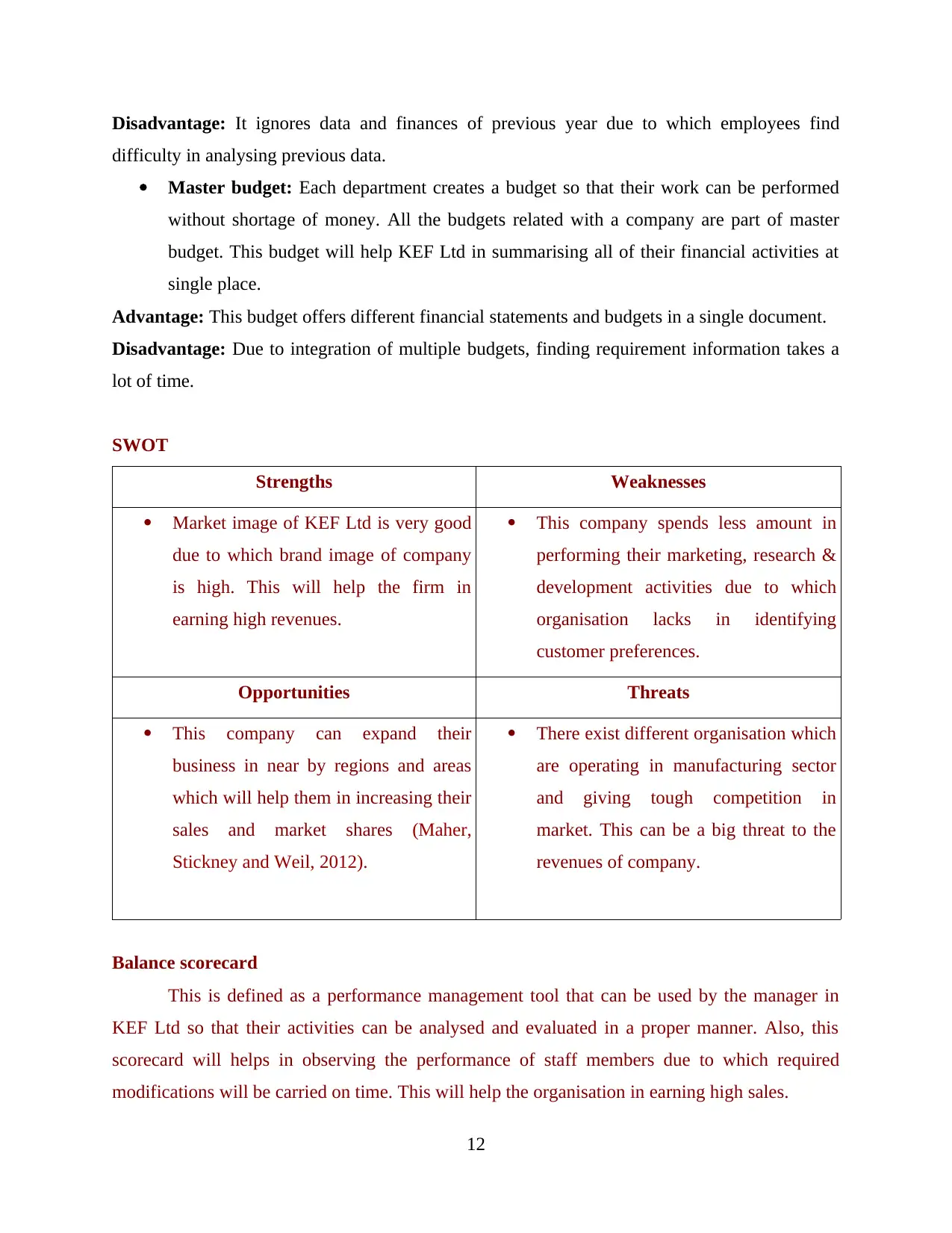

COMPARISON

KEF Ltd Galway Plc.

Cost accounting system is adopted by

this organisation to evaluate the cost of

material used to construct building and

other projects so that the sudden or

unplanned expenses cannot be

occurred.

Inventory management system is used

in order to maintain sufficient amount

of stock so as to meet customers’ needs

and requirements on time.

14

makes easy for their managers to determine unplanned or unnecessary expenses

(Quattrone, 2016).

Benchmarking: It is a technique which is used to motivate their employees to increase

their contribution towards enhancing financial position of company by setting target or

benchmark after analyzing their rival’s strategies. This tool is used by KEF Ltd which

enforces them to update their credit policies so that delay in payments by customers can

be minimized or eliminated.

Financial governance: It refers to a set of different financial principles that are required

to be comply by an organisation with a motive to deal with fund related problems. Using

such technique facilitate KEF Ltd to resolve financial issues by directing their employees

to perform in systematic way following all guidelines provided by an organisation (Renz,

2016).

Characteristics of an effective management accountant and the way in which it can

be used to prevent problems:

An effective accounting manager have sufficient amount of skills to analyse the financial

statements and make corrective decisions to strengthen their financial position by

forecasting situations and implement plans accordingly.

Decision making skill is also one of an effective characteristic that an accounting

manager have as it help them in identifying the issues behind arising financial problems

and make an effective decision accordingly (Ruch and Taylor, 2015).

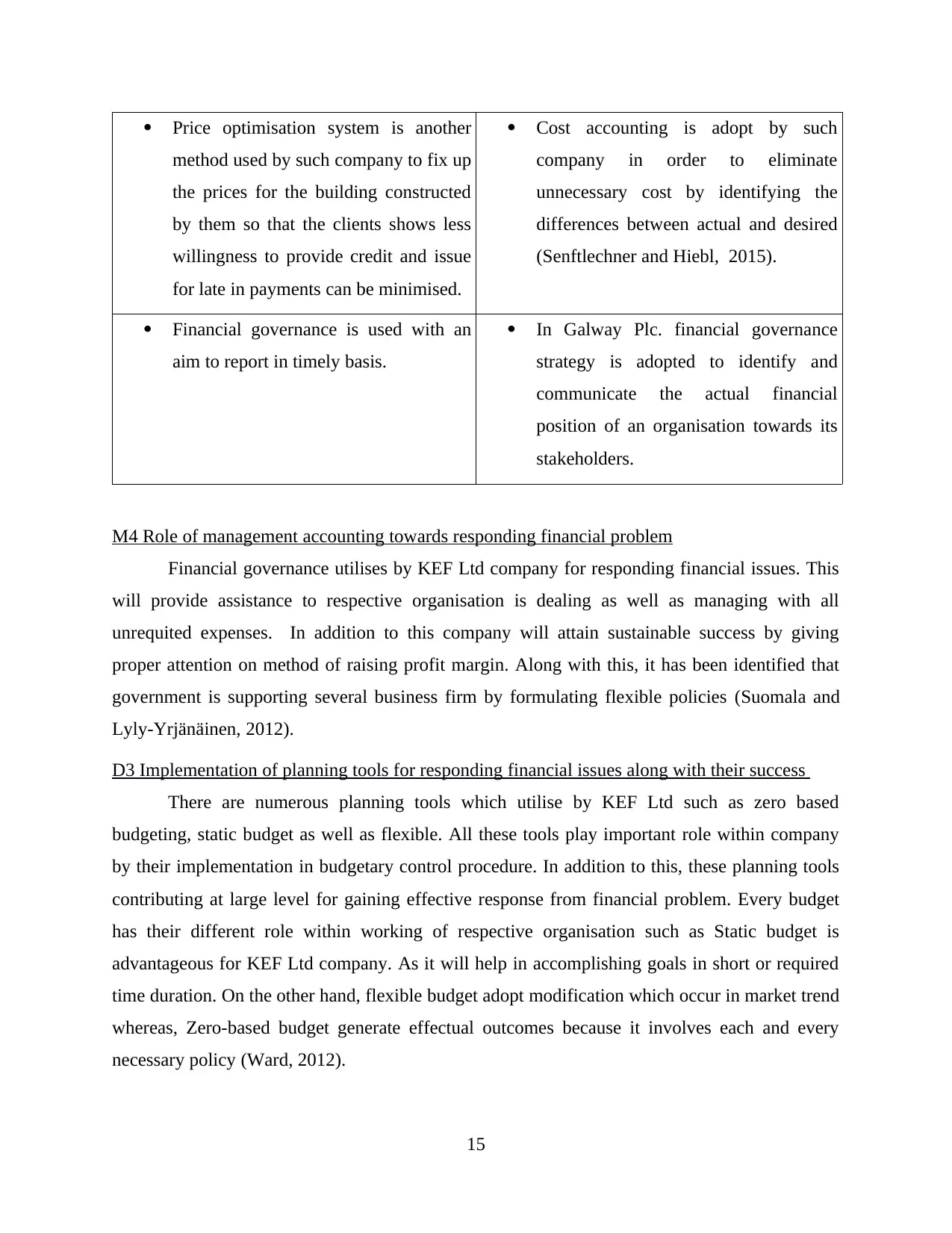

COMPARISON

KEF Ltd Galway Plc.

Cost accounting system is adopted by

this organisation to evaluate the cost of

material used to construct building and

other projects so that the sudden or

unplanned expenses cannot be

occurred.

Inventory management system is used

in order to maintain sufficient amount

of stock so as to meet customers’ needs

and requirements on time.

14

Price optimisation system is another

method used by such company to fix up

the prices for the building constructed

by them so that the clients shows less

willingness to provide credit and issue

for late in payments can be minimised.

Cost accounting is adopt by such

company in order to eliminate

unnecessary cost by identifying the

differences between actual and desired

(Senftlechner and Hiebl, 2015).

Financial governance is used with an

aim to report in timely basis.

In Galway Plc. financial governance

strategy is adopted to identify and

communicate the actual financial

position of an organisation towards its

stakeholders.

M4 Role of management accounting towards responding financial problem

Financial governance utilises by KEF Ltd company for responding financial issues. This

will provide assistance to respective organisation is dealing as well as managing with all

unrequited expenses. In addition to this company will attain sustainable success by giving

proper attention on method of raising profit margin. Along with this, it has been identified that

government is supporting several business firm by formulating flexible policies (Suomala and

Lyly-Yrjänäinen, 2012).

D3 Implementation of planning tools for responding financial issues along with their success

There are numerous planning tools which utilise by KEF Ltd such as zero based

budgeting, static budget as well as flexible. All these tools play important role within company

by their implementation in budgetary control procedure. In addition to this, these planning tools

contributing at large level for gaining effective response from financial problem. Every budget

has their different role within working of respective organisation such as Static budget is

advantageous for KEF Ltd company. As it will help in accomplishing goals in short or required

time duration. On the other hand, flexible budget adopt modification which occur in market trend

whereas, Zero-based budget generate effectual outcomes because it involves each and every

necessary policy (Ward, 2012).

15

method used by such company to fix up

the prices for the building constructed

by them so that the clients shows less

willingness to provide credit and issue

for late in payments can be minimised.

Cost accounting is adopt by such

company in order to eliminate

unnecessary cost by identifying the

differences between actual and desired

(Senftlechner and Hiebl, 2015).

Financial governance is used with an

aim to report in timely basis.

In Galway Plc. financial governance

strategy is adopted to identify and

communicate the actual financial

position of an organisation towards its

stakeholders.

M4 Role of management accounting towards responding financial problem

Financial governance utilises by KEF Ltd company for responding financial issues. This

will provide assistance to respective organisation is dealing as well as managing with all

unrequited expenses. In addition to this company will attain sustainable success by giving

proper attention on method of raising profit margin. Along with this, it has been identified that

government is supporting several business firm by formulating flexible policies (Suomala and

Lyly-Yrjänäinen, 2012).

D3 Implementation of planning tools for responding financial issues along with their success

There are numerous planning tools which utilise by KEF Ltd such as zero based

budgeting, static budget as well as flexible. All these tools play important role within company

by their implementation in budgetary control procedure. In addition to this, these planning tools

contributing at large level for gaining effective response from financial problem. Every budget

has their different role within working of respective organisation such as Static budget is

advantageous for KEF Ltd company. As it will help in accomplishing goals in short or required

time duration. On the other hand, flexible budget adopt modification which occur in market trend

whereas, Zero-based budget generate effectual outcomes because it involves each and every

necessary policy (Ward, 2012).

15

CONCLUSION

As per this given report, it can be summarised that systems of management accounting

helps a company to manage their work related with accounts and income reports so that

organisational targets can be attained efficiently. There are various types of accounting systems

like price optimisation, inventory systems etc. which helps in performing complex organisational

work in simplified manner. Different reports of management accounting like Account receivable,

inventory report helps in maintaining accounts of a firm. Different costs helps in preparing

financial statement. Budgetary tools like master budget, zero budget etc. assists in budget

forecasting and with the help of techniques like Benchmarking and KPI, financial issues of a

company can be resolved appropriately. By this, attainment of organisational goals became easy.

16

As per this given report, it can be summarised that systems of management accounting

helps a company to manage their work related with accounts and income reports so that

organisational targets can be attained efficiently. There are various types of accounting systems

like price optimisation, inventory systems etc. which helps in performing complex organisational

work in simplified manner. Different reports of management accounting like Account receivable,

inventory report helps in maintaining accounts of a firm. Different costs helps in preparing

financial statement. Budgetary tools like master budget, zero budget etc. assists in budget

forecasting and with the help of techniques like Benchmarking and KPI, financial issues of a

company can be resolved appropriately. By this, attainment of organisational goals became easy.

16

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journal

Abdelmoneim Mohamed, A. and Jones, T., 2014. Relationship between strategic management

accounting techniques and profitability–a proposed model. Measuring Business

Excellence. 18(3). pp.1-22.

Bennett, M. and James, P., 2017. The Green bottom line: environmental accounting for

management: current practice and future trends. Routledge.

Bloomfield, R. J., 2015. Rethinking managerial reporting. Journal of Management Accounting

Research. 27(1). pp.139-150.

Demski, J., 2013. Managerial uses of accounting information. Springer Science & Business

Media.

Garrison, R. H. And et. al., 2010. Managerial accounting. Issues in Accounting Education. 25(4).

pp.792-793.

Lukka, K. and Vinnari, E., 2014. Domain theory and method theory in management accounting

research. Accounting, Auditing & Accountability Journal. 27(8). pp.1308-1338.

Maas, K., Schaltegger, S. and Crutzen, N., 2016. Integrating corporate sustainability assessment,

management accounting, control, and reporting. Journal of Cleaner Production, 136,

pp.237-248.

Maher, M. W., Stickney, C. P. and Weil, R. L., 2012. Managerial accounting: An introduction to

concepts, methods and uses. Cengage Learning.

McLaren, J., Appleyard, T. and Mitchell, F., 2016. The rise and fall of management accounting

systems: A case study investigation of EVA™. The British Accounting Review. 48(3).

pp.341-358.

Nilsson, F. and Stockenstrand, A. K., 2015. Financial accounting and management control. The

tensions and conflicts between uniformity and uniqueness. Springer, Cham.

Quattrone, P., 2016. Management accounting goes digital: Will the move make it wiser?.

Management Accounting Research. 31. pp.118-122.

Renz, D. O., 2016. The Jossey-Bass handbook of nonprofit leadership and management. John

Wiley & Sons.

Ruch, G. W. and Taylor, G., 2015. Accounting conservatism: A review of the literature. Journal

of Accounting Literature. 34. pp.17-38.

Senftlechner, D. and Hiebl, M. R., 2015. Management accounting and management control in

family businesses: Past accomplishments and future opportunities. Journal of

Accounting & Organizational Change. 11(4). pp.573-606.

Suomala, P. and Lyly-Yrjänäinen, J., 2012. Management accounting research in practice:

Lessons learned from an interventionist approach. Routledge.

Ward, K., 2012.Strategic management accounting. Routledge.

Wood, D. A., 2016. Comparing the publication process in accounting, economics, finance,

management, marketing, psychology, and the natural sciences. Accounting Horizons.

30(3). pp.341-361.

17

Books and Journal

Abdelmoneim Mohamed, A. and Jones, T., 2014. Relationship between strategic management

accounting techniques and profitability–a proposed model. Measuring Business

Excellence. 18(3). pp.1-22.

Bennett, M. and James, P., 2017. The Green bottom line: environmental accounting for

management: current practice and future trends. Routledge.

Bloomfield, R. J., 2015. Rethinking managerial reporting. Journal of Management Accounting

Research. 27(1). pp.139-150.

Demski, J., 2013. Managerial uses of accounting information. Springer Science & Business

Media.

Garrison, R. H. And et. al., 2010. Managerial accounting. Issues in Accounting Education. 25(4).

pp.792-793.

Lukka, K. and Vinnari, E., 2014. Domain theory and method theory in management accounting

research. Accounting, Auditing & Accountability Journal. 27(8). pp.1308-1338.

Maas, K., Schaltegger, S. and Crutzen, N., 2016. Integrating corporate sustainability assessment,

management accounting, control, and reporting. Journal of Cleaner Production, 136,

pp.237-248.

Maher, M. W., Stickney, C. P. and Weil, R. L., 2012. Managerial accounting: An introduction to

concepts, methods and uses. Cengage Learning.

McLaren, J., Appleyard, T. and Mitchell, F., 2016. The rise and fall of management accounting

systems: A case study investigation of EVA™. The British Accounting Review. 48(3).

pp.341-358.

Nilsson, F. and Stockenstrand, A. K., 2015. Financial accounting and management control. The

tensions and conflicts between uniformity and uniqueness. Springer, Cham.

Quattrone, P., 2016. Management accounting goes digital: Will the move make it wiser?.

Management Accounting Research. 31. pp.118-122.

Renz, D. O., 2016. The Jossey-Bass handbook of nonprofit leadership and management. John

Wiley & Sons.

Ruch, G. W. and Taylor, G., 2015. Accounting conservatism: A review of the literature. Journal

of Accounting Literature. 34. pp.17-38.

Senftlechner, D. and Hiebl, M. R., 2015. Management accounting and management control in

family businesses: Past accomplishments and future opportunities. Journal of

Accounting & Organizational Change. 11(4). pp.573-606.

Suomala, P. and Lyly-Yrjänäinen, J., 2012. Management accounting research in practice:

Lessons learned from an interventionist approach. Routledge.

Ward, K., 2012.Strategic management accounting. Routledge.

Wood, D. A., 2016. Comparing the publication process in accounting, economics, finance,

management, marketing, psychology, and the natural sciences. Accounting Horizons.

30(3). pp.341-361.

17

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.