Management Accounting Case Studies and Accounting System - Assignment

VerifiedAdded on 2021/02/19

|24

|5930

|86

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Management Accounting

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................2

TASK 1............................................................................................................................................2

P1. Management accounting........................................................................................................2

P2. Management accounting reporting........................................................................................5

TASK 2............................................................................................................................................7

P3. Calculation of costs for the preparation of income statement. .............................................7

TASK 3..........................................................................................................................................14

P4. Planning tools used for budgetary control...........................................................................14

TASK 4..........................................................................................................................................19

P5. Comparison of organisations to solve the financial problem by using management

accounting system......................................................................................................................19

CONCLUSION..............................................................................................................................22

REFERENCES..............................................................................................................................23

1

INTRODUCTION...........................................................................................................................2

TASK 1............................................................................................................................................2

P1. Management accounting........................................................................................................2

P2. Management accounting reporting........................................................................................5

TASK 2............................................................................................................................................7

P3. Calculation of costs for the preparation of income statement. .............................................7

TASK 3..........................................................................................................................................14

P4. Planning tools used for budgetary control...........................................................................14

TASK 4..........................................................................................................................................19

P5. Comparison of organisations to solve the financial problem by using management

accounting system......................................................................................................................19

CONCLUSION..............................................................................................................................22

REFERENCES..............................................................................................................................23

1

INTRODUCTION

Management accounting is a concept which involves preparation of management reports

along with accounts in order to provide financial information to managers for the purpose of

making strategic decisions for the organisation (Basu, 2012). It helps in identification, collection,

reporting, measurement, analysing and communicating the same information in such manner that

benefits in pursuing towards goals of company. To understand the concept of management

accounting, Burlington Associates Limited is selected which is a medium sized organisation that

provides financial consultancy services to numerous clients. One of its clients is Murrill

Construction Limited which performs its operations in construction industry. This report covers

management accounting systems and their essential requirement. It further discusses about

methods used for management accounting reporting along with usage of costing techniques to

prepare income statements. It further includes various planning tools and the ways adopted by

management of two companies to resolve financial problems that helps in leading towards

sustainable success.

TASK 1

P1. Management accounting.

Accounting is a practice as well as applied aspects of knowledge which includes

recording as per the well-defined principles and rules of the operations related with the sourcing

and usage of resources to accomplish the business strategy.

Management accounting is a process in which accounting reports are prepared as well

as provided to top level management on accurate time period. Managers of Murrill Construction

Limited uses management accounting to facilitate financial planning, making decisions and

keeping records in effective manner (Bellassen and Stephan, 2015).

Management accounting origin, role along with principles

Management accounting was first emerged during early industry revolution in 19 century.

It was arose after financial management which has traced its origins towards stewardship role at

the time of European trading ventures. Other than this, books are balanced which is also part of it

and used from long ago such as 300 years. From that time, management accounting was emerged

as a recognizable field.

2

Management accounting is a concept which involves preparation of management reports

along with accounts in order to provide financial information to managers for the purpose of

making strategic decisions for the organisation (Basu, 2012). It helps in identification, collection,

reporting, measurement, analysing and communicating the same information in such manner that

benefits in pursuing towards goals of company. To understand the concept of management

accounting, Burlington Associates Limited is selected which is a medium sized organisation that

provides financial consultancy services to numerous clients. One of its clients is Murrill

Construction Limited which performs its operations in construction industry. This report covers

management accounting systems and their essential requirement. It further discusses about

methods used for management accounting reporting along with usage of costing techniques to

prepare income statements. It further includes various planning tools and the ways adopted by

management of two companies to resolve financial problems that helps in leading towards

sustainable success.

TASK 1

P1. Management accounting.

Accounting is a practice as well as applied aspects of knowledge which includes

recording as per the well-defined principles and rules of the operations related with the sourcing

and usage of resources to accomplish the business strategy.

Management accounting is a process in which accounting reports are prepared as well

as provided to top level management on accurate time period. Managers of Murrill Construction

Limited uses management accounting to facilitate financial planning, making decisions and

keeping records in effective manner (Bellassen and Stephan, 2015).

Management accounting origin, role along with principles

Management accounting was first emerged during early industry revolution in 19 century.

It was arose after financial management which has traced its origins towards stewardship role at

the time of European trading ventures. Other than this, books are balanced which is also part of it

and used from long ago such as 300 years. From that time, management accounting was emerged

as a recognizable field.

2

The role of management accounting is different at workplace based on its requirements as

it is a internal part that performs functions related to financial security, handling taxes,

developing accounting systems, maintaining capital structure, fund flow analysis, decision

making on investment appraisal, financing of projects and hence forth.

Principles of management accounting includes the following:

Influence which says communication must be in such manner that provides insight which

are persuaded.

Relevance that is providing information in adequate manner.

Value shows impact on belief that are analysed.

Trust that is stewardship builds belongings.

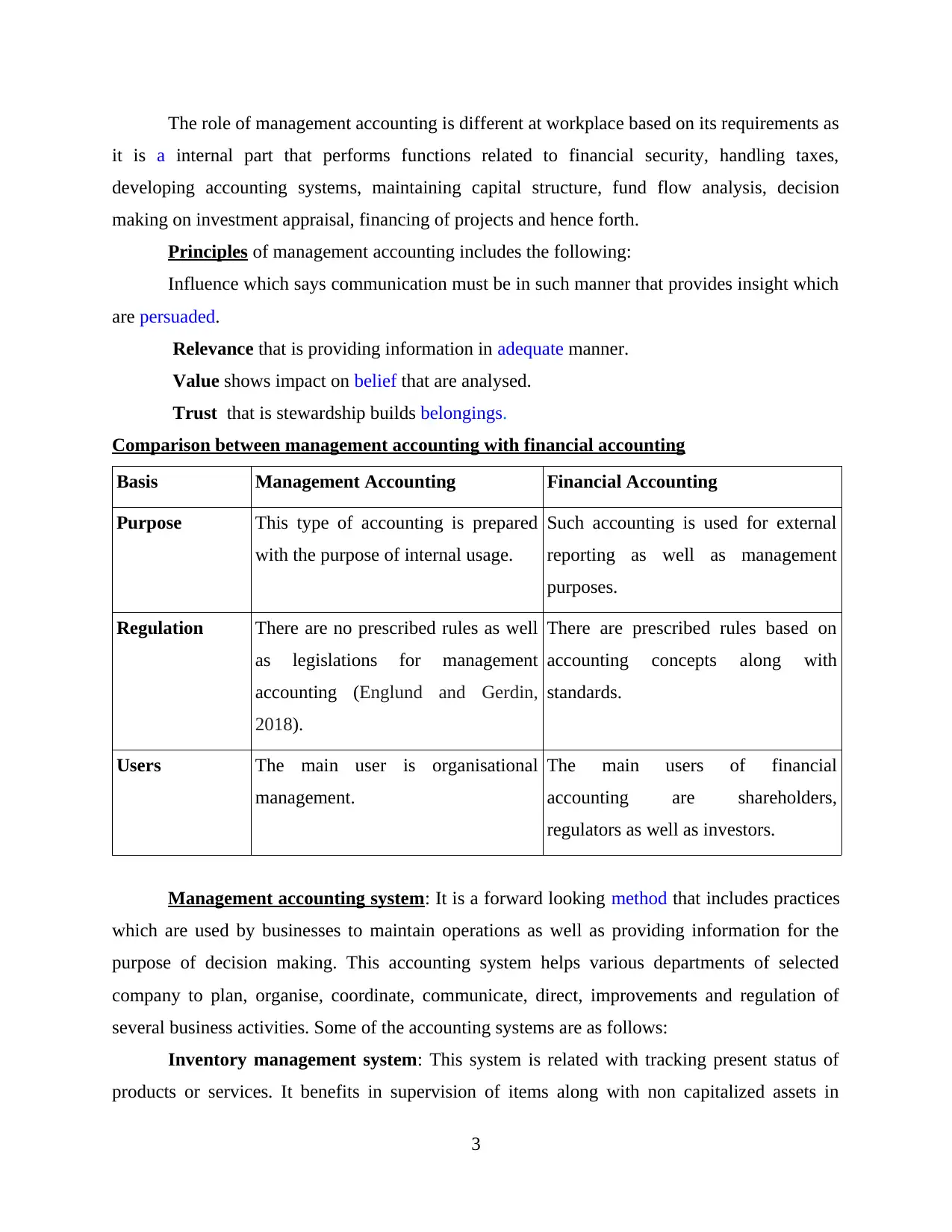

Comparison between management accounting with financial accounting

Basis Management Accounting Financial Accounting

Purpose This type of accounting is prepared

with the purpose of internal usage.

Such accounting is used for external

reporting as well as management

purposes.

Regulation There are no prescribed rules as well

as legislations for management

accounting (Englund and Gerdin,

2018).

There are prescribed rules based on

accounting concepts along with

standards.

Users The main user is organisational

management.

The main users of financial

accounting are shareholders,

regulators as well as investors.

Management accounting system: It is a forward looking method that includes practices

which are used by businesses to maintain operations as well as providing information for the

purpose of decision making. This accounting system helps various departments of selected

company to plan, organise, coordinate, communicate, direct, improvements and regulation of

several business activities. Some of the accounting systems are as follows:

Inventory management system: This system is related with tracking present status of

products or services. It benefits in supervision of items along with non capitalized assets in

3

it is a internal part that performs functions related to financial security, handling taxes,

developing accounting systems, maintaining capital structure, fund flow analysis, decision

making on investment appraisal, financing of projects and hence forth.

Principles of management accounting includes the following:

Influence which says communication must be in such manner that provides insight which

are persuaded.

Relevance that is providing information in adequate manner.

Value shows impact on belief that are analysed.

Trust that is stewardship builds belongings.

Comparison between management accounting with financial accounting

Basis Management Accounting Financial Accounting

Purpose This type of accounting is prepared

with the purpose of internal usage.

Such accounting is used for external

reporting as well as management

purposes.

Regulation There are no prescribed rules as well

as legislations for management

accounting (Englund and Gerdin,

2018).

There are prescribed rules based on

accounting concepts along with

standards.

Users The main user is organisational

management.

The main users of financial

accounting are shareholders,

regulators as well as investors.

Management accounting system: It is a forward looking method that includes practices

which are used by businesses to maintain operations as well as providing information for the

purpose of decision making. This accounting system helps various departments of selected

company to plan, organise, coordinate, communicate, direct, improvements and regulation of

several business activities. Some of the accounting systems are as follows:

Inventory management system: This system is related with tracking present status of

products or services. It benefits in supervision of items along with non capitalized assets in

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

effective manner that results in preventing shortages of material at workplace. This system can

benefit Murril Construction Limited by properly tracking and keeping record of incoming as well

as outgoing materials along with finished products. Using this system, managers can get

information related with current inventory level that results in minimising circumstances related

to over stock or under stock of materials which adds values to keep track of record which adds

value to organisation by keeping detailed record and using them at the time required for analysis.

The essential requirement of inventory management system is to track and maintain records in

systematic manner based on existing or new stock that enters or leaves warehouses or

construction sites at some point of sale.

Cost accounting system: It is another type of accounting system that helps in analysing

product costs such as fixed or variable costs. Its main functionality is to ascertain value of

inventory, controlling costs as well as profitability analysis (Fayol, 2016). Managers of Murril

Construction Limited uses this system to estimate cost of products or services in accurate manner

that that results in profitable operations. It adds value to company by estimating cost of products

or services in order to predicting profits or losses in accurate format. The essential requirement

of such system is to fix standards, determining costs as well as classification of costs such as

factory cost, direct cost, prime cost and so on.

Price optimisation system: A mathematical program which calculates demand

variations at different pricing levels is price optimising system. It performs functions related to

combining data with relevant information based on inventory and cost level to provide

recommendations to change prices for the purpose of improving profits. Such system adds value

to business by understanding perception of clients towards prices of products or services which

are rendered by organisational members and formulating prices accordingly. Price optimisation

system is used by managers of Murril Construction Limited to determine prices of constructional

projects as well as discovering pricing structures as per customer willingness related with

making payment decisions. The essential requirement of price optimising system is to determine

prices of various constructional projects that helps in maximising profits.

Job costing system- Job costing system can be defined as calculating total cost of

particular products and services. Murrill construction limited adopts this system to accumulate

information based on direct material, overhead costs as well as direct labour and it can be

tailored as per the requirements of customers. Functionality of job costing system is to determine

4

benefit Murril Construction Limited by properly tracking and keeping record of incoming as well

as outgoing materials along with finished products. Using this system, managers can get

information related with current inventory level that results in minimising circumstances related

to over stock or under stock of materials which adds values to keep track of record which adds

value to organisation by keeping detailed record and using them at the time required for analysis.

The essential requirement of inventory management system is to track and maintain records in

systematic manner based on existing or new stock that enters or leaves warehouses or

construction sites at some point of sale.

Cost accounting system: It is another type of accounting system that helps in analysing

product costs such as fixed or variable costs. Its main functionality is to ascertain value of

inventory, controlling costs as well as profitability analysis (Fayol, 2016). Managers of Murril

Construction Limited uses this system to estimate cost of products or services in accurate manner

that that results in profitable operations. It adds value to company by estimating cost of products

or services in order to predicting profits or losses in accurate format. The essential requirement

of such system is to fix standards, determining costs as well as classification of costs such as

factory cost, direct cost, prime cost and so on.

Price optimisation system: A mathematical program which calculates demand

variations at different pricing levels is price optimising system. It performs functions related to

combining data with relevant information based on inventory and cost level to provide

recommendations to change prices for the purpose of improving profits. Such system adds value

to business by understanding perception of clients towards prices of products or services which

are rendered by organisational members and formulating prices accordingly. Price optimisation

system is used by managers of Murril Construction Limited to determine prices of constructional

projects as well as discovering pricing structures as per customer willingness related with

making payment decisions. The essential requirement of price optimising system is to determine

prices of various constructional projects that helps in maximising profits.

Job costing system- Job costing system can be defined as calculating total cost of

particular products and services. Murrill construction limited adopts this system to accumulate

information based on direct material, overhead costs as well as direct labour and it can be

tailored as per the requirements of customers. Functionality of job costing system is to determine

4

material cost, factory overhead and labour overhead related with particular job or project. This

system adds value to enterprise by setting standard targets as well as tracking all revenues

pertaining to different jobs in discrete batches. The essential requirement of job costing system is

to ensure that product or job price covers all actual costs and at the same time provide profits.

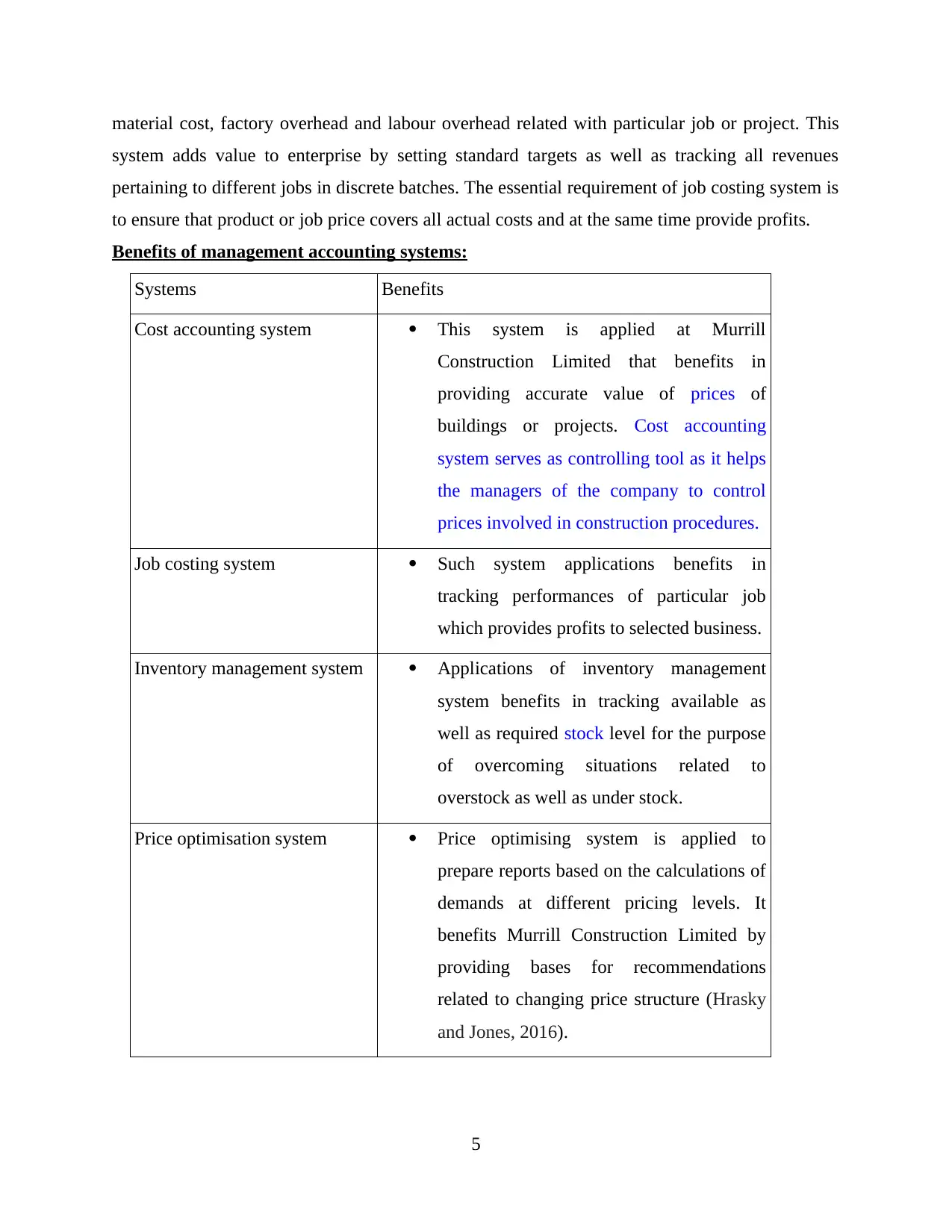

Benefits of management accounting systems:

Systems Benefits

Cost accounting system This system is applied at Murrill

Construction Limited that benefits in

providing accurate value of prices of

buildings or projects. Cost accounting

system serves as controlling tool as it helps

the managers of the company to control

prices involved in construction procedures.

Job costing system Such system applications benefits in

tracking performances of particular job

which provides profits to selected business.

Inventory management system Applications of inventory management

system benefits in tracking available as

well as required stock level for the purpose

of overcoming situations related to

overstock as well as under stock.

Price optimisation system Price optimising system is applied to

prepare reports based on the calculations of

demands at different pricing levels. It

benefits Murrill Construction Limited by

providing bases for recommendations

related to changing price structure (Hrasky

and Jones, 2016).

5

system adds value to enterprise by setting standard targets as well as tracking all revenues

pertaining to different jobs in discrete batches. The essential requirement of job costing system is

to ensure that product or job price covers all actual costs and at the same time provide profits.

Benefits of management accounting systems:

Systems Benefits

Cost accounting system This system is applied at Murrill

Construction Limited that benefits in

providing accurate value of prices of

buildings or projects. Cost accounting

system serves as controlling tool as it helps

the managers of the company to control

prices involved in construction procedures.

Job costing system Such system applications benefits in

tracking performances of particular job

which provides profits to selected business.

Inventory management system Applications of inventory management

system benefits in tracking available as

well as required stock level for the purpose

of overcoming situations related to

overstock as well as under stock.

Price optimisation system Price optimising system is applied to

prepare reports based on the calculations of

demands at different pricing levels. It

benefits Murrill Construction Limited by

providing bases for recommendations

related to changing price structure (Hrasky

and Jones, 2016).

5

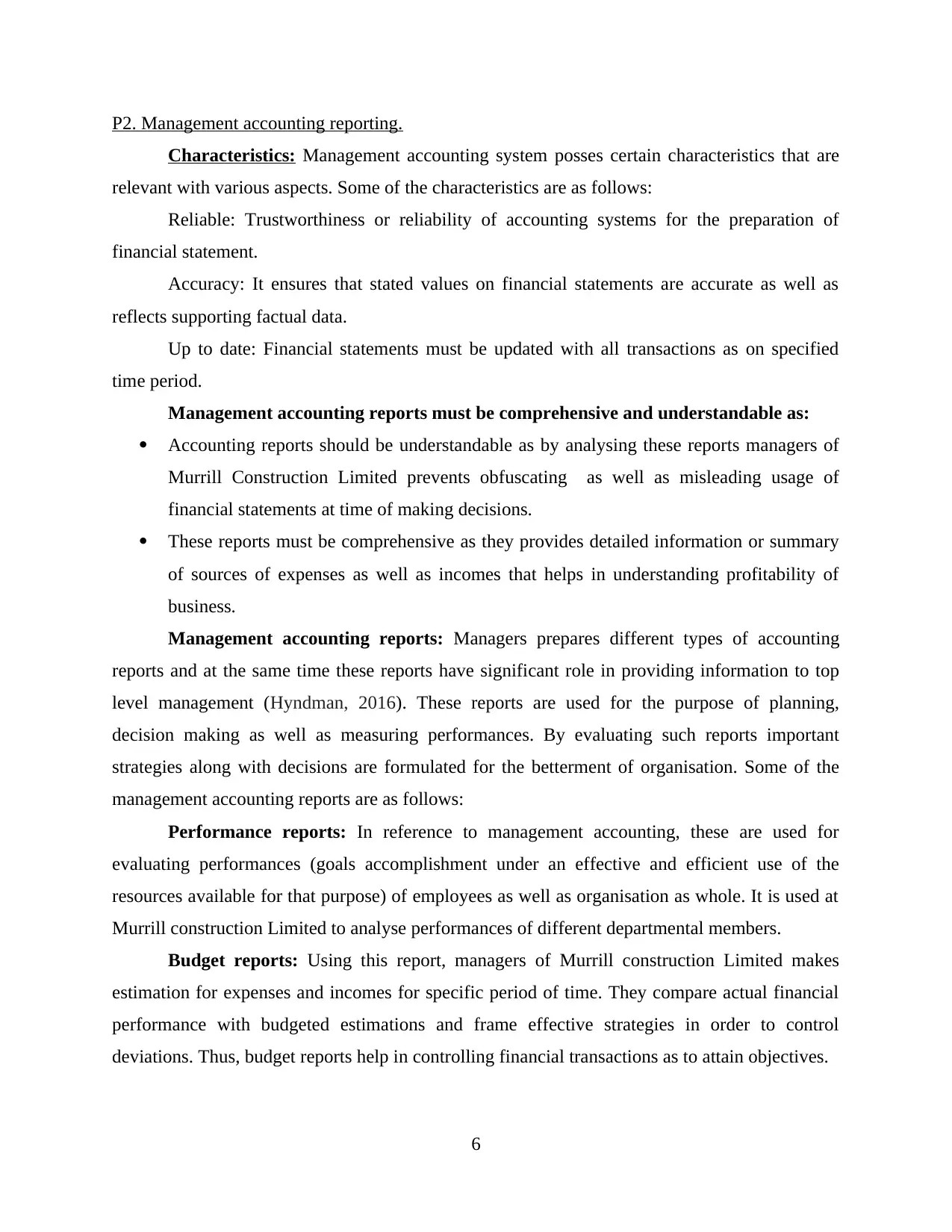

P2. Management accounting reporting.

Characteristics: Management accounting system posses certain characteristics that are

relevant with various aspects. Some of the characteristics are as follows:

Reliable: Trustworthiness or reliability of accounting systems for the preparation of

financial statement.

Accuracy: It ensures that stated values on financial statements are accurate as well as

reflects supporting factual data.

Up to date: Financial statements must be updated with all transactions as on specified

time period.

Management accounting reports must be comprehensive and understandable as:

Accounting reports should be understandable as by analysing these reports managers of

Murrill Construction Limited prevents obfuscating as well as misleading usage of

financial statements at time of making decisions.

These reports must be comprehensive as they provides detailed information or summary

of sources of expenses as well as incomes that helps in understanding profitability of

business.

Management accounting reports: Managers prepares different types of accounting

reports and at the same time these reports have significant role in providing information to top

level management (Hyndman, 2016). These reports are used for the purpose of planning,

decision making as well as measuring performances. By evaluating such reports important

strategies along with decisions are formulated for the betterment of organisation. Some of the

management accounting reports are as follows:

Performance reports: In reference to management accounting, these are used for

evaluating performances (goals accomplishment under an effective and efficient use of the

resources available for that purpose) of employees as well as organisation as whole. It is used at

Murrill construction Limited to analyse performances of different departmental members.

Budget reports: Using this report, managers of Murrill construction Limited makes

estimation for expenses and incomes for specific period of time. They compare actual financial

performance with budgeted estimations and frame effective strategies in order to control

deviations. Thus, budget reports help in controlling financial transactions as to attain objectives.

6

Characteristics: Management accounting system posses certain characteristics that are

relevant with various aspects. Some of the characteristics are as follows:

Reliable: Trustworthiness or reliability of accounting systems for the preparation of

financial statement.

Accuracy: It ensures that stated values on financial statements are accurate as well as

reflects supporting factual data.

Up to date: Financial statements must be updated with all transactions as on specified

time period.

Management accounting reports must be comprehensive and understandable as:

Accounting reports should be understandable as by analysing these reports managers of

Murrill Construction Limited prevents obfuscating as well as misleading usage of

financial statements at time of making decisions.

These reports must be comprehensive as they provides detailed information or summary

of sources of expenses as well as incomes that helps in understanding profitability of

business.

Management accounting reports: Managers prepares different types of accounting

reports and at the same time these reports have significant role in providing information to top

level management (Hyndman, 2016). These reports are used for the purpose of planning,

decision making as well as measuring performances. By evaluating such reports important

strategies along with decisions are formulated for the betterment of organisation. Some of the

management accounting reports are as follows:

Performance reports: In reference to management accounting, these are used for

evaluating performances (goals accomplishment under an effective and efficient use of the

resources available for that purpose) of employees as well as organisation as whole. It is used at

Murrill construction Limited to analyse performances of different departmental members.

Budget reports: Using this report, managers of Murrill construction Limited makes

estimation for expenses and incomes for specific period of time. They compare actual financial

performance with budgeted estimations and frame effective strategies in order to control

deviations. Thus, budget reports help in controlling financial transactions as to attain objectives.

6

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Account receivable reports: This report is used to make list of unpaid customer invoice

along with credit memos which are unused by date ranges. It categorises account receivables

according to time outstanding for invoice. Using this report, Murrill construction Limited

managers identify defaulters along with financial health of potential clients. It is prepared in

systematic manner which provides detailed information related to transactions such as date, time,

particulars, amount and so on which reduces complexities to calculate credit values which brings

transparency in collection of credit from various creditors.

Cost management accounting reports: This report helps in computing cost of products

by taking into consideration other costs such as raw material costs, overhead costs, labour costs

and so on that adds costs to products. Financial manager of Murrill Construction Limited uses

this report to provide information related with cost price along with selling price of construction

projects or buildings in order to estimate margin of profits. Inventory wastages, hourly labour

costs and over costs are involved in such report.

Integration of management accounting system and accounting reports: For the

preparation of management accounting reports managers uses accounting systems. These

systems provide necessary information on accurate time period at the time of preparing reports

which are further used by top managers of Murrill construction Limited to make decisions to

achieve results.

TASK 2

P3. Calculation of costs for the preparation of income statement.

Cost: The total amount that is paid by the customer in order to buy the product. For the

purpose of attracting customers, managers of Murrill Construction Limited sets appropriate costs

pertaining with different buildings or projects (Ionescu, 2016).

Fixed Cost: A type of value that does not changes with changes in particular activity is

termed as fixed cost. It remains fixed during accounting year.

Variable Cost: A worth which varies when changes are seen in different level of activity

are known as variable cost. This type of cost is related with direct material cost.

Semi variable Cost: A cost that has features of fixed cost as well as variable cost.

Cost analysis: The breaking down into constituents of cost summary along with

understanding as studying each factors is defined as cost analysis. It is used to make comparisons

7

along with credit memos which are unused by date ranges. It categorises account receivables

according to time outstanding for invoice. Using this report, Murrill construction Limited

managers identify defaulters along with financial health of potential clients. It is prepared in

systematic manner which provides detailed information related to transactions such as date, time,

particulars, amount and so on which reduces complexities to calculate credit values which brings

transparency in collection of credit from various creditors.

Cost management accounting reports: This report helps in computing cost of products

by taking into consideration other costs such as raw material costs, overhead costs, labour costs

and so on that adds costs to products. Financial manager of Murrill Construction Limited uses

this report to provide information related with cost price along with selling price of construction

projects or buildings in order to estimate margin of profits. Inventory wastages, hourly labour

costs and over costs are involved in such report.

Integration of management accounting system and accounting reports: For the

preparation of management accounting reports managers uses accounting systems. These

systems provide necessary information on accurate time period at the time of preparing reports

which are further used by top managers of Murrill construction Limited to make decisions to

achieve results.

TASK 2

P3. Calculation of costs for the preparation of income statement.

Cost: The total amount that is paid by the customer in order to buy the product. For the

purpose of attracting customers, managers of Murrill Construction Limited sets appropriate costs

pertaining with different buildings or projects (Ionescu, 2016).

Fixed Cost: A type of value that does not changes with changes in particular activity is

termed as fixed cost. It remains fixed during accounting year.

Variable Cost: A worth which varies when changes are seen in different level of activity

are known as variable cost. This type of cost is related with direct material cost.

Semi variable Cost: A cost that has features of fixed cost as well as variable cost.

Cost analysis: The breaking down into constituents of cost summary along with

understanding as studying each factors is defined as cost analysis. It is used to make comparisons

7

of standard costs with actual costs during a specified time period and disclosing the same for

further improvements.

Cost volume profit: It a type of cost analysis in which changes in costs as well as

volume are determined that affects operating income of any business.

Flexible budgeting: It is analysed and adjusted as per changes in activity at the time of

completion of projects.

Absorption costing: It is a costing technique that helps in evaluation of costs during an

accounting period. Herein, to sell single product in competitive market place, Galway Plc

calculates cost of product by using such costing technique (Ionescu, 2016).

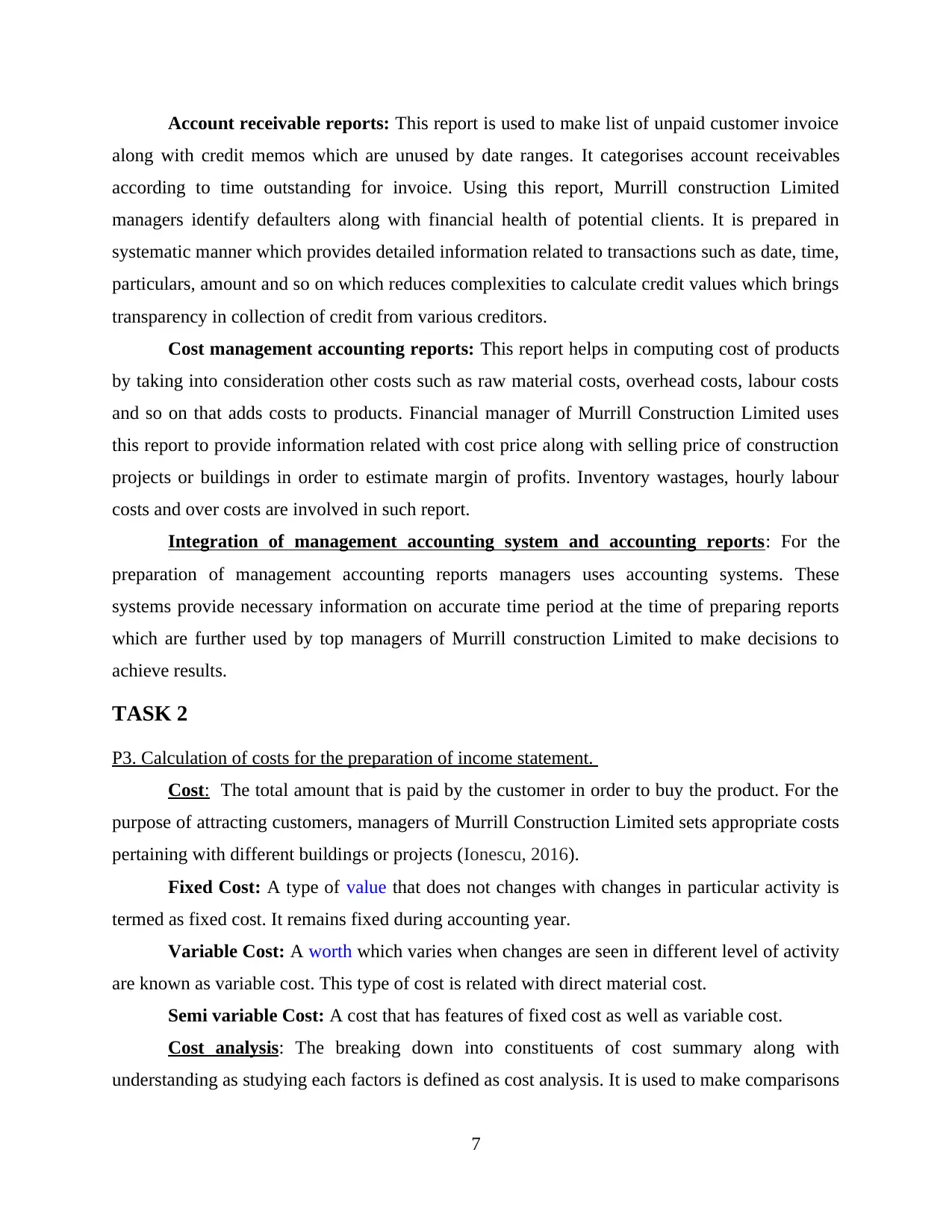

Marginal costing: It is a costing method that emphasis towards classification of all

expenses in terms of variable as well as fixed costs (Jones, 2014). On other hand all fixed cost

are charged as per period costs. Calculations based on marginal costing technique are as follows:

Income statement under Marginal costing method for month of May & June

8

further improvements.

Cost volume profit: It a type of cost analysis in which changes in costs as well as

volume are determined that affects operating income of any business.

Flexible budgeting: It is analysed and adjusted as per changes in activity at the time of

completion of projects.

Absorption costing: It is a costing technique that helps in evaluation of costs during an

accounting period. Herein, to sell single product in competitive market place, Galway Plc

calculates cost of product by using such costing technique (Ionescu, 2016).

Marginal costing: It is a costing method that emphasis towards classification of all

expenses in terms of variable as well as fixed costs (Jones, 2014). On other hand all fixed cost

are charged as per period costs. Calculations based on marginal costing technique are as follows:

Income statement under Marginal costing method for month of May & June

8

Working note:

9

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

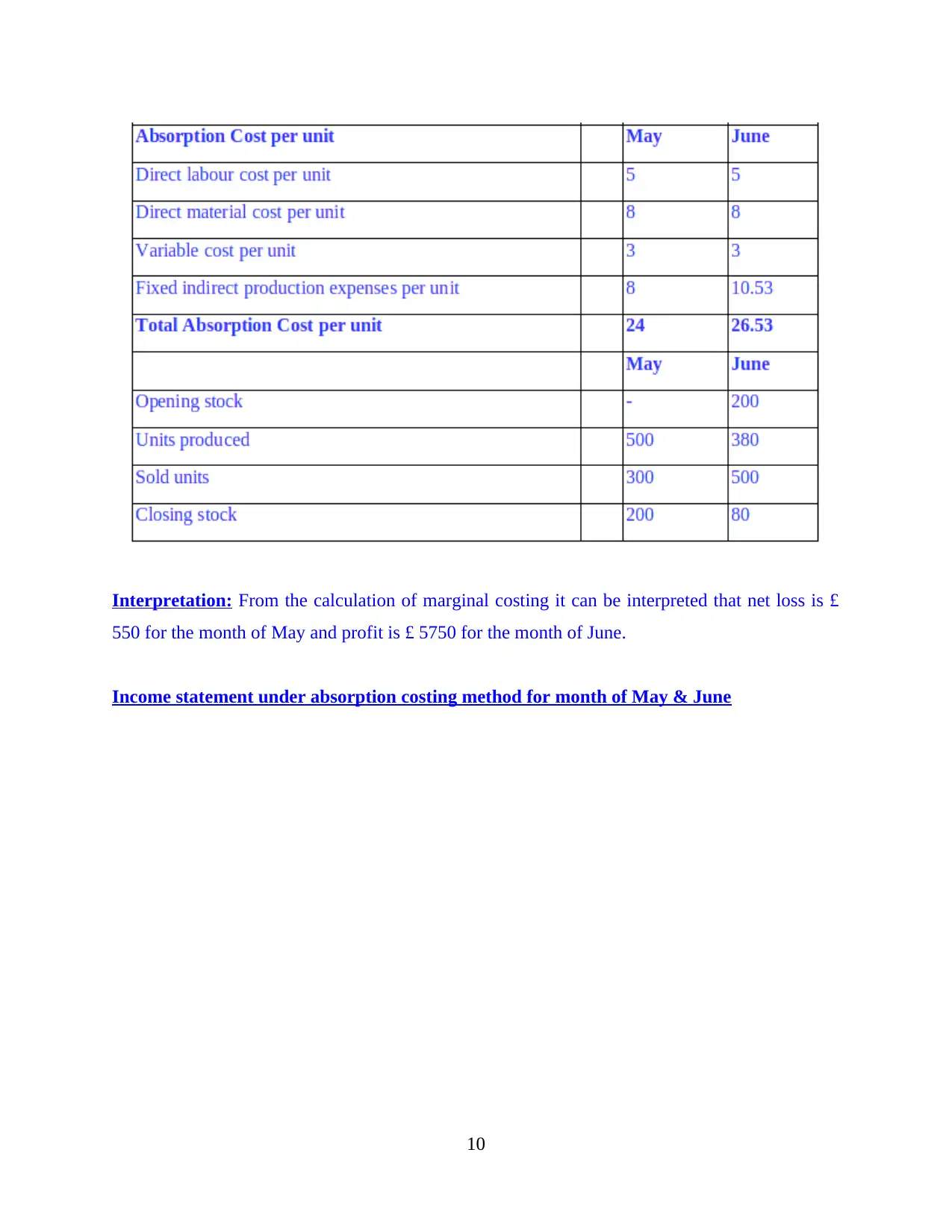

Interpretation: From the calculation of marginal costing it can be interpreted that net loss is £

550 for the month of May and profit is £ 5750 for the month of June.

Income statement under absorption costing method for month of May & June

10

550 for the month of May and profit is £ 5750 for the month of June.

Income statement under absorption costing method for month of May & June

10

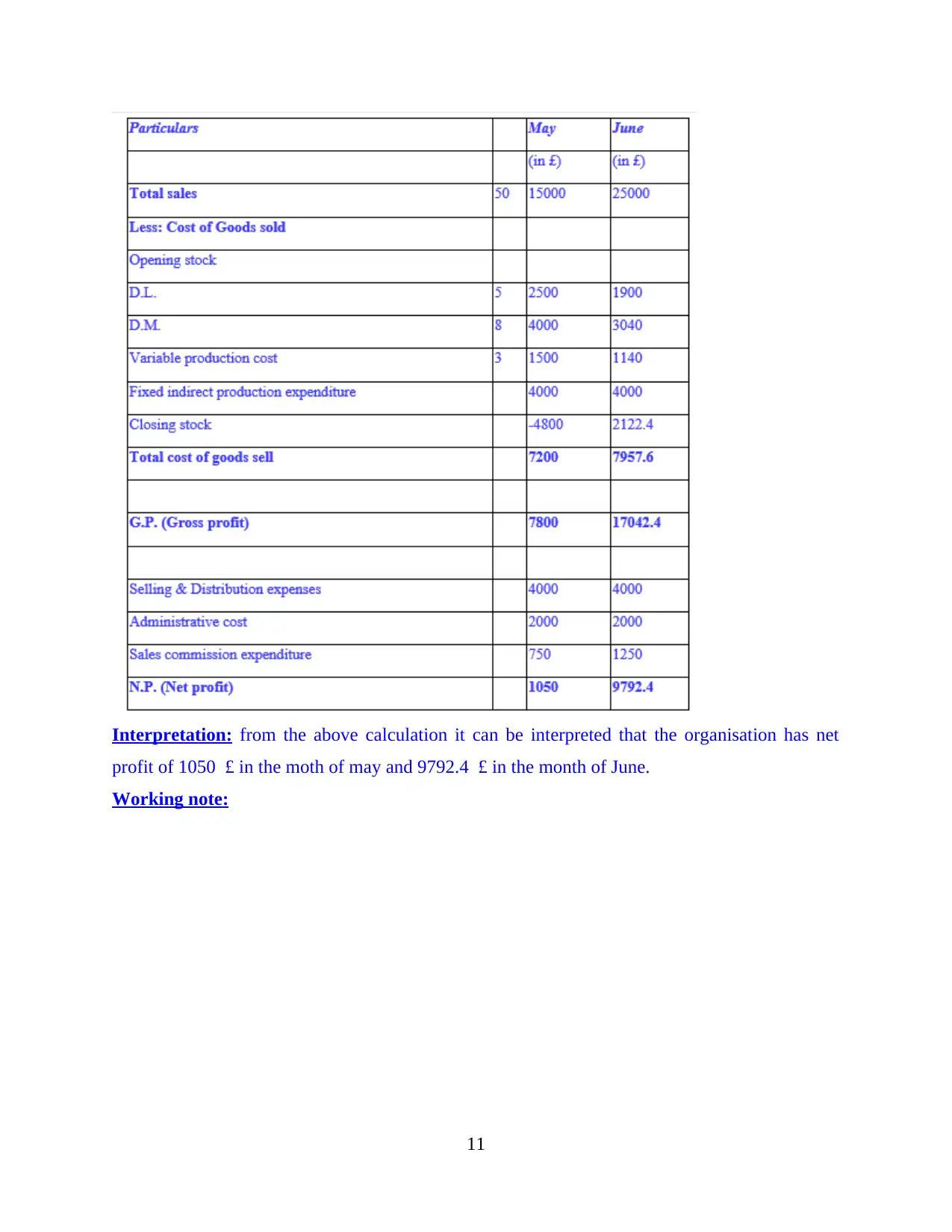

Interpretation: from the above calculation it can be interpreted that the organisation has net

profit of 1050 £ in the moth of may and 9792.4 £ in the month of June.

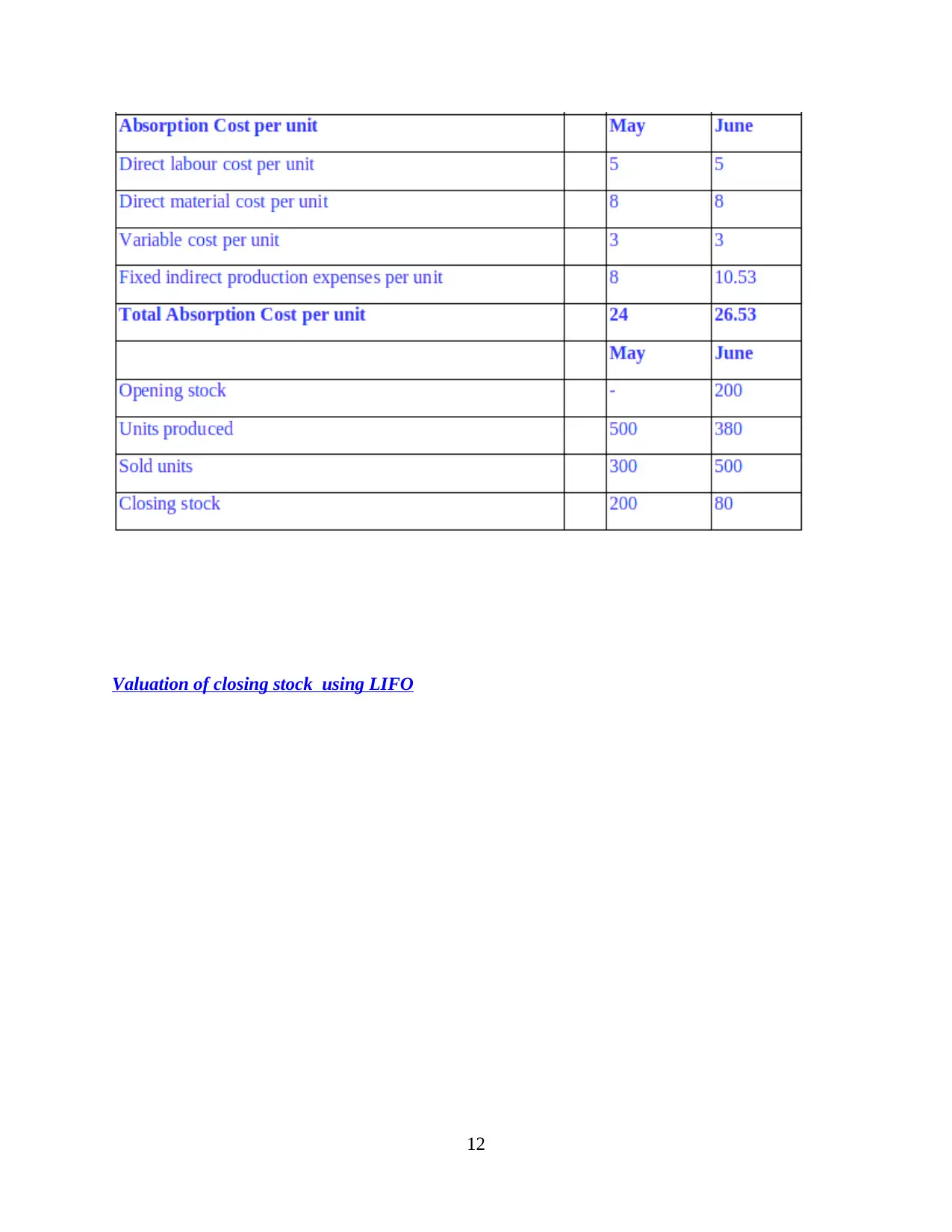

Working note:

11

profit of 1050 £ in the moth of may and 9792.4 £ in the month of June.

Working note:

11

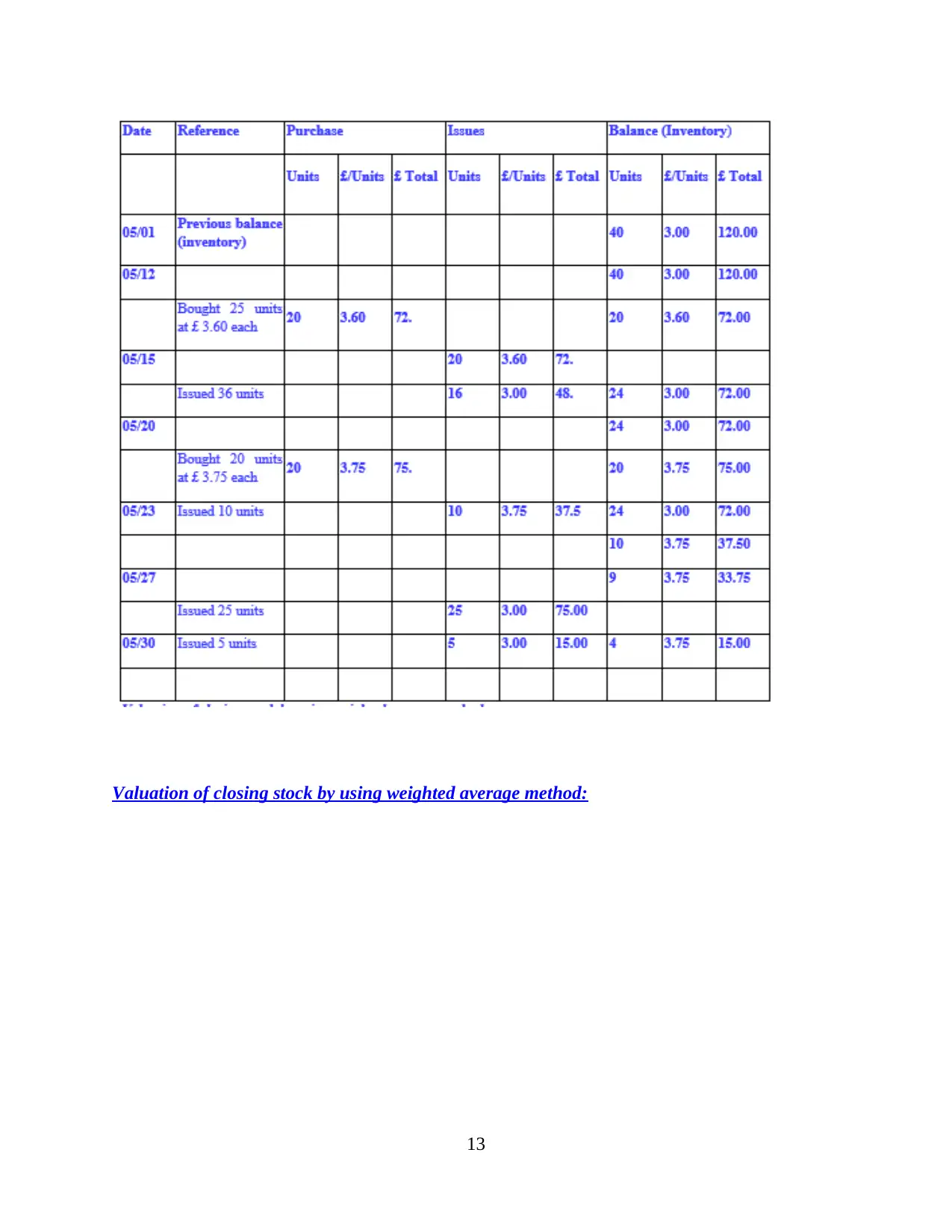

Valuation of closing stock using LIFO

12

12

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Valuation of closing stock by using weighted average method:

13

13

Cost allocation: Procedures based on identification, recording, aggregation as well as

assigning costs to different items, products or services. Such procedures are termed as cost

allocation. Methods of cost allocation are as follows:

Normal costing: Costing method which is used by managers at the time of deriving costs

to different projects at Galway Plc. Managers considers actual costs of labour, material along

with standard overhead rates for the purpose of allocation.

Standard costing: This type of cost is used to compare standard targets with actual costs

under normal conditions. Managers considers historical data to allocate standard costs.

Activity based costing: An accounting method that is used for identification as well as

assigning costs to activities based on overheads. Further, costs to different products are assigned

Role of costs: Costs plays role at Galway Plc to estimate unit cost of projects as well as

evaluating performances and removing unnecessary transactions at the time of allocating costs to

different products (Kaplan and Atkinson, 2015).

14

assigning costs to different items, products or services. Such procedures are termed as cost

allocation. Methods of cost allocation are as follows:

Normal costing: Costing method which is used by managers at the time of deriving costs

to different projects at Galway Plc. Managers considers actual costs of labour, material along

with standard overhead rates for the purpose of allocation.

Standard costing: This type of cost is used to compare standard targets with actual costs

under normal conditions. Managers considers historical data to allocate standard costs.

Activity based costing: An accounting method that is used for identification as well as

assigning costs to activities based on overheads. Further, costs to different products are assigned

Role of costs: Costs plays role at Galway Plc to estimate unit cost of projects as well as

evaluating performances and removing unnecessary transactions at the time of allocating costs to

different products (Kaplan and Atkinson, 2015).

14

Inventory costs: The cost which is associated with storage, management as well as

procurement of inventory is inventory cost. Types of inventory costs are:

Ordering cost: It includes procurement as well as logistics costs.

Carrying cost: It is related with inventory storage cost along with capital cost.

Benefits to reduce inventory costs: By reducing inventory costs, managers of Galway

Plc are benefits with reducing wastages, consolidating supplier base, forecasting demand and

improves management of supply chain.

Valuation methods: Methods that provides specific ways that helps in determining value

of intangible assets, security and estimation of business worth are valuation methods.

LIFO method: This is used for providing accounting values to inventory on the basis of

last in first out.

FIFO method: Another method which is used for valuation of inventory as per first in

first out at constructional project sites.

Managers of Murrill construction Limited uses FIFO method for constructional purposes

(Khlif and Chalmers, 2015).

Cost variances: Difference between budgeted amount and actual incurred cost is known

as cost variance.

Overhead costs: Such cost is considered as necessary business expense which includes

all costs related with administration salaries, insurance, rent, utilities and so on.

TASK 3

P4. Planning tools used for budgetary control

Budgetary planning and control: It is characterised as tool that is used for preparation

of budgets along with used for controlling purposes. It is a process that is followed by managers

to set financial as well as performance goals with the help of budget. This is the comparison

between actual results and budgeted figures of an entity for the future. Murrill Construction

Limited follows budgetary control measures adopted such as, master, operating and zero-based

budget.

Preparing a budget: The process of budget includes setting a plan of action with goals,

identification of income and expenses of the company, forming expectations by reconciling the

data, monitoring actual data with budgeted figures to get an estimation of what is to be made,

15

procurement of inventory is inventory cost. Types of inventory costs are:

Ordering cost: It includes procurement as well as logistics costs.

Carrying cost: It is related with inventory storage cost along with capital cost.

Benefits to reduce inventory costs: By reducing inventory costs, managers of Galway

Plc are benefits with reducing wastages, consolidating supplier base, forecasting demand and

improves management of supply chain.

Valuation methods: Methods that provides specific ways that helps in determining value

of intangible assets, security and estimation of business worth are valuation methods.

LIFO method: This is used for providing accounting values to inventory on the basis of

last in first out.

FIFO method: Another method which is used for valuation of inventory as per first in

first out at constructional project sites.

Managers of Murrill construction Limited uses FIFO method for constructional purposes

(Khlif and Chalmers, 2015).

Cost variances: Difference between budgeted amount and actual incurred cost is known

as cost variance.

Overhead costs: Such cost is considered as necessary business expense which includes

all costs related with administration salaries, insurance, rent, utilities and so on.

TASK 3

P4. Planning tools used for budgetary control

Budgetary planning and control: It is characterised as tool that is used for preparation

of budgets along with used for controlling purposes. It is a process that is followed by managers

to set financial as well as performance goals with the help of budget. This is the comparison

between actual results and budgeted figures of an entity for the future. Murrill Construction

Limited follows budgetary control measures adopted such as, master, operating and zero-based

budget.

Preparing a budget: The process of budget includes setting a plan of action with goals,

identification of income and expenses of the company, forming expectations by reconciling the

data, monitoring actual data with budgeted figures to get an estimation of what is to be made,

15

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

adjusting the requirement as per the projected income as well as expenditure, making a draft to

get it checked by a senior personnel, preparing the budget.

Different types of budgets: Murrill Construction Limited uses various types of budgets

such as:

Capital budgets: This type of budget which deals with the planning of the long term

investments that are associated with expensive assets, and other resources needed to run properly

the business. It helps Murrill Construction Limited to allocate all funds in order to acquiring as

well as maintain organisational fixed assets.

Operating budgets: It is considered as annual plan that is prepared monthly, quarterly or

annually which is used for projecting incomes as well as expenses related to daily activities. This

type of financial estimate which is used by selected organisation with the aim to determine

necessary funds required to carry daily expenses in effective manner which results in smooth

functioning of operations by eliminating hurdles.

Alternate methods of budgeting: Murrill Construction Limited also uses alternate

methods of budgeting with the objective of planning long with controlling various other costs

(Lampe, Hilgers and Ihl, 2015). Some budgets with advantages as well as disadvantages are as

described:

Zero-based budget: It involves preparing a forecasting plan for each cost centre or

activity from zero base. This requires justification of all expenses within an accounting

year. It is required to be built around what is needed for the upcoming year. Murrill

Construction Limited plans new budget every year with no reference to the prior records

(Khlif and Chalmers, 2015).

Advantages: It can increase the motivation among staff by promoting a culture of

efficiency. This responses to changes in business environment.

Disadvantages: Short term benefits might be emphasised. This is a time extensive process

as it is prepared from scratch.

Master budget: It is an aggregation of all the low level prediction of revenue into one

that are produced by a company's various functional areas. Murrill Construction Limited

makes master budget for estimation of its sale, production as well as manufacturing

activities.

16

get it checked by a senior personnel, preparing the budget.

Different types of budgets: Murrill Construction Limited uses various types of budgets

such as:

Capital budgets: This type of budget which deals with the planning of the long term

investments that are associated with expensive assets, and other resources needed to run properly

the business. It helps Murrill Construction Limited to allocate all funds in order to acquiring as

well as maintain organisational fixed assets.

Operating budgets: It is considered as annual plan that is prepared monthly, quarterly or

annually which is used for projecting incomes as well as expenses related to daily activities. This

type of financial estimate which is used by selected organisation with the aim to determine

necessary funds required to carry daily expenses in effective manner which results in smooth

functioning of operations by eliminating hurdles.

Alternate methods of budgeting: Murrill Construction Limited also uses alternate

methods of budgeting with the objective of planning long with controlling various other costs

(Lampe, Hilgers and Ihl, 2015). Some budgets with advantages as well as disadvantages are as

described:

Zero-based budget: It involves preparing a forecasting plan for each cost centre or

activity from zero base. This requires justification of all expenses within an accounting

year. It is required to be built around what is needed for the upcoming year. Murrill

Construction Limited plans new budget every year with no reference to the prior records

(Khlif and Chalmers, 2015).

Advantages: It can increase the motivation among staff by promoting a culture of

efficiency. This responses to changes in business environment.

Disadvantages: Short term benefits might be emphasised. This is a time extensive process

as it is prepared from scratch.

Master budget: It is an aggregation of all the low level prediction of revenue into one

that are produced by a company's various functional areas. Murrill Construction Limited

makes master budget for estimation of its sale, production as well as manufacturing

activities.

16

Advantages: Such budget helps managers of Murrill construction Limited to identify

problems in current time period for the purpose of planning future activities. Master budget helps

in identifying which department is spending more that cause problems to achieve profitability.

Disadvantages: This budget lacks specificity and at the same time it is very difficult to

update uncertain transactions in less time period.

Cash budget: In this financial estimation, all cash related transactions are recorded in

systematic manner such as all received amount are recorded in receipts side where as all

paid amounts are recorded in payment side. Murrill construction Limited also prepares

this budget to understand nature of transactions (Parker and Fleischman, 2017).

Advantages: By breaking down accounting period in different time form, this budget

provides easily monitoring of cash transactions. The changes are easily understandable by

managers through this budget.

Disadvantages: Such budget causes distortion as well as does not provide accurate results

as credit transactions are not part of it.

Behavioural implications: Budgets are important as they play essential role in Murrill

Construction Limited for the purpose of planning, organising, managing, directing as well as

controlling variances. There are different types of budgets that facilitate controlling

organisational resources at various stages within different departments to provide appropriate

and accurate information.

Pricing strategies: Such strategies are set after considering market conditions, trade

margins, segmentation, competitors actions, ability of clients to pay and so on aspects. Some of

the pricing strategies adopted by Murrill construction Limited are as follows:

Penetrating pricing: Under such strategy, lowers prices are set my managers of chosen

business for the buildings or projects in order to attract as many buyers as possible.

Premium pricing: Using premium pricing strategy, higher costs are set for specific

buildings whose interior is unique and not been used by competitors.

Competitors determine prices: Competitors determine prices on the basis of direct as

well as indirect competition along with markup pricing strategy.

Supply and demand consideration: Such consideration encompasses time series,

adequate resources, income level of buyers, software tools, consumer preferences, statistical

forecasting and other factors (Raj, Walters and Rashid, 2017).

17

problems in current time period for the purpose of planning future activities. Master budget helps

in identifying which department is spending more that cause problems to achieve profitability.

Disadvantages: This budget lacks specificity and at the same time it is very difficult to

update uncertain transactions in less time period.

Cash budget: In this financial estimation, all cash related transactions are recorded in

systematic manner such as all received amount are recorded in receipts side where as all

paid amounts are recorded in payment side. Murrill construction Limited also prepares

this budget to understand nature of transactions (Parker and Fleischman, 2017).

Advantages: By breaking down accounting period in different time form, this budget

provides easily monitoring of cash transactions. The changes are easily understandable by

managers through this budget.

Disadvantages: Such budget causes distortion as well as does not provide accurate results

as credit transactions are not part of it.

Behavioural implications: Budgets are important as they play essential role in Murrill

Construction Limited for the purpose of planning, organising, managing, directing as well as

controlling variances. There are different types of budgets that facilitate controlling

organisational resources at various stages within different departments to provide appropriate

and accurate information.

Pricing strategies: Such strategies are set after considering market conditions, trade

margins, segmentation, competitors actions, ability of clients to pay and so on aspects. Some of

the pricing strategies adopted by Murrill construction Limited are as follows:

Penetrating pricing: Under such strategy, lowers prices are set my managers of chosen

business for the buildings or projects in order to attract as many buyers as possible.

Premium pricing: Using premium pricing strategy, higher costs are set for specific

buildings whose interior is unique and not been used by competitors.

Competitors determine prices: Competitors determine prices on the basis of direct as

well as indirect competition along with markup pricing strategy.

Supply and demand consideration: Such consideration encompasses time series,

adequate resources, income level of buyers, software tools, consumer preferences, statistical

forecasting and other factors (Raj, Walters and Rashid, 2017).

17

Strategic planning: Written guidelines which involves actions, plans, strategies and so

on for the purpose of attaining business goals. Some of the strategic planning adopted by

managers of Murrill construction Limited are as follows:

PEST Analysis:

Political factors Economic factors

Changes in political systems as well as

political decisions related to taxation

policies, restrictions, findings impacts

on financial position of any business as

managers have to change their

strategies as per the new provisions of

political system.

When there are changes in inflation

rates, interest rates or bank rates that

results in hindrances to achieve

objectives of Murrill Construction

Limited which results in affecting

financial position in competitive market

(Shette, Kuntluru and Korivi, 2016).

Social factors Technological factors

Such factors includes status, income,

perceptions, beliefs and other factors. If

perception of clients shifts towards

competitor buildings then it impacts on

financial position of selected business.

Adoption of new technological

advancements such as construction

machines, artificial intelligence

improves working status of company

and enhances financial position of

Murrill Construction Limited.

SWOT analysis:

Strength Weaknesses Opportunities Threats

Murrill

Construction

Limited

executes their

operations at

high speed and

Selected

construction

company has

limited global

presence.

The company

has opportunity

to expand its

operations in

internal market

(Shi, Zhang,

The biggest

threat for

Murrill

Construction

Limited is

strong

18

on for the purpose of attaining business goals. Some of the strategic planning adopted by

managers of Murrill construction Limited are as follows:

PEST Analysis:

Political factors Economic factors

Changes in political systems as well as

political decisions related to taxation

policies, restrictions, findings impacts

on financial position of any business as

managers have to change their

strategies as per the new provisions of

political system.

When there are changes in inflation

rates, interest rates or bank rates that

results in hindrances to achieve

objectives of Murrill Construction

Limited which results in affecting

financial position in competitive market

(Shette, Kuntluru and Korivi, 2016).

Social factors Technological factors

Such factors includes status, income,

perceptions, beliefs and other factors. If

perception of clients shifts towards

competitor buildings then it impacts on

financial position of selected business.

Adoption of new technological

advancements such as construction

machines, artificial intelligence

improves working status of company

and enhances financial position of

Murrill Construction Limited.

SWOT analysis:

Strength Weaknesses Opportunities Threats

Murrill

Construction

Limited

executes their

operations at

high speed and

Selected

construction

company has

limited global

presence.

The company

has opportunity

to expand its

operations in

internal market

(Shi, Zhang,

The biggest

threat for

Murrill

Construction

Limited is

strong

18

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

has made a

market image

which is the

strength.

and Guo,

2010).

competition

level in

construction

industry. The

competitors are

Asseal

Architecture

Limited and

BSE

Construction

Ltd.

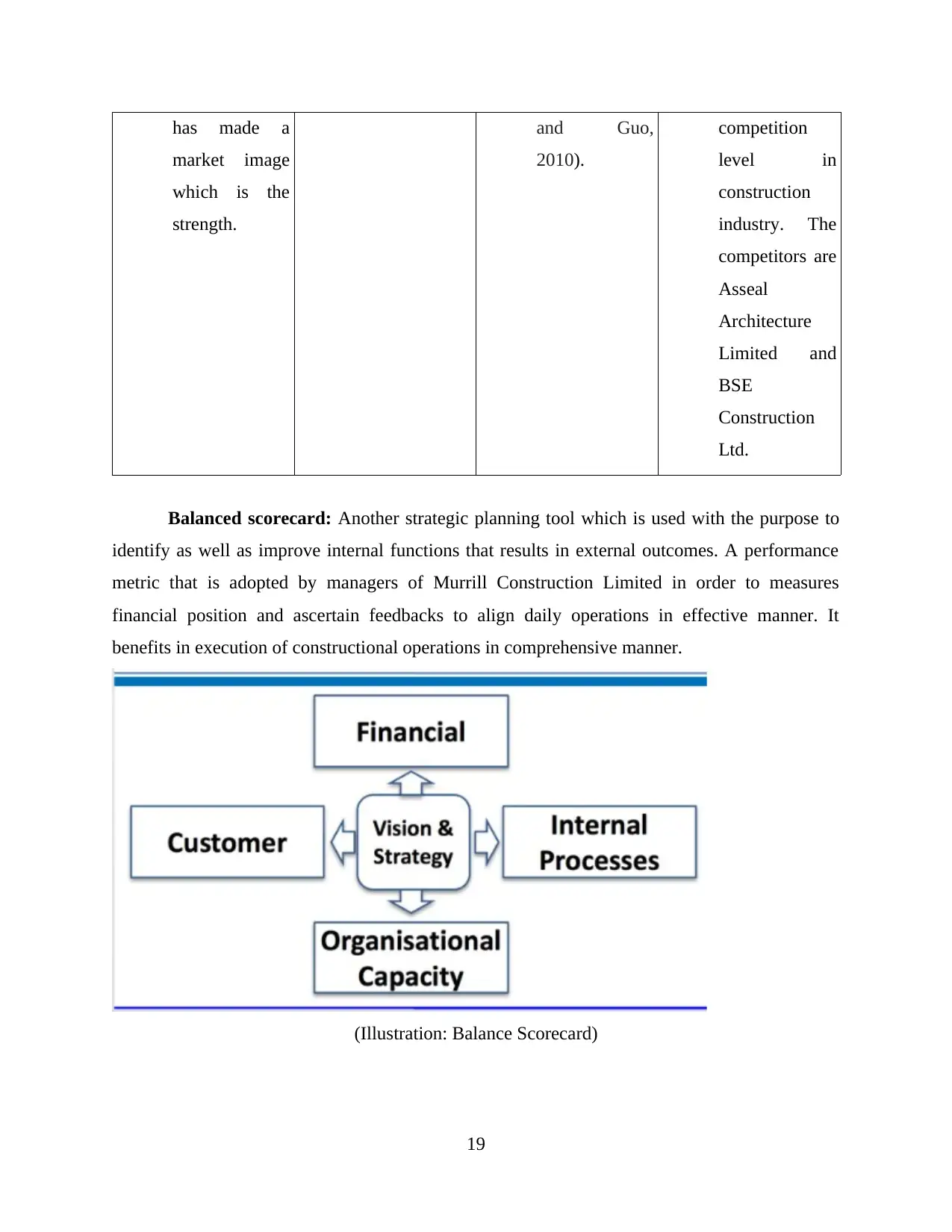

Balanced scorecard: Another strategic planning tool which is used with the purpose to

identify as well as improve internal functions that results in external outcomes. A performance

metric that is adopted by managers of Murrill Construction Limited in order to measures

financial position and ascertain feedbacks to align daily operations in effective manner. It

benefits in execution of constructional operations in comprehensive manner.

(Illustration: Balance Scorecard)

19

market image

which is the

strength.

and Guo,

2010).

competition

level in

construction

industry. The

competitors are

Asseal

Architecture

Limited and

BSE

Construction

Ltd.

Balanced scorecard: Another strategic planning tool which is used with the purpose to

identify as well as improve internal functions that results in external outcomes. A performance

metric that is adopted by managers of Murrill Construction Limited in order to measures

financial position and ascertain feedbacks to align daily operations in effective manner. It

benefits in execution of constructional operations in comprehensive manner.

(Illustration: Balance Scorecard)

19

TASK 4

P5. Comparison of organisations to solve the financial problem by using management accounting

system

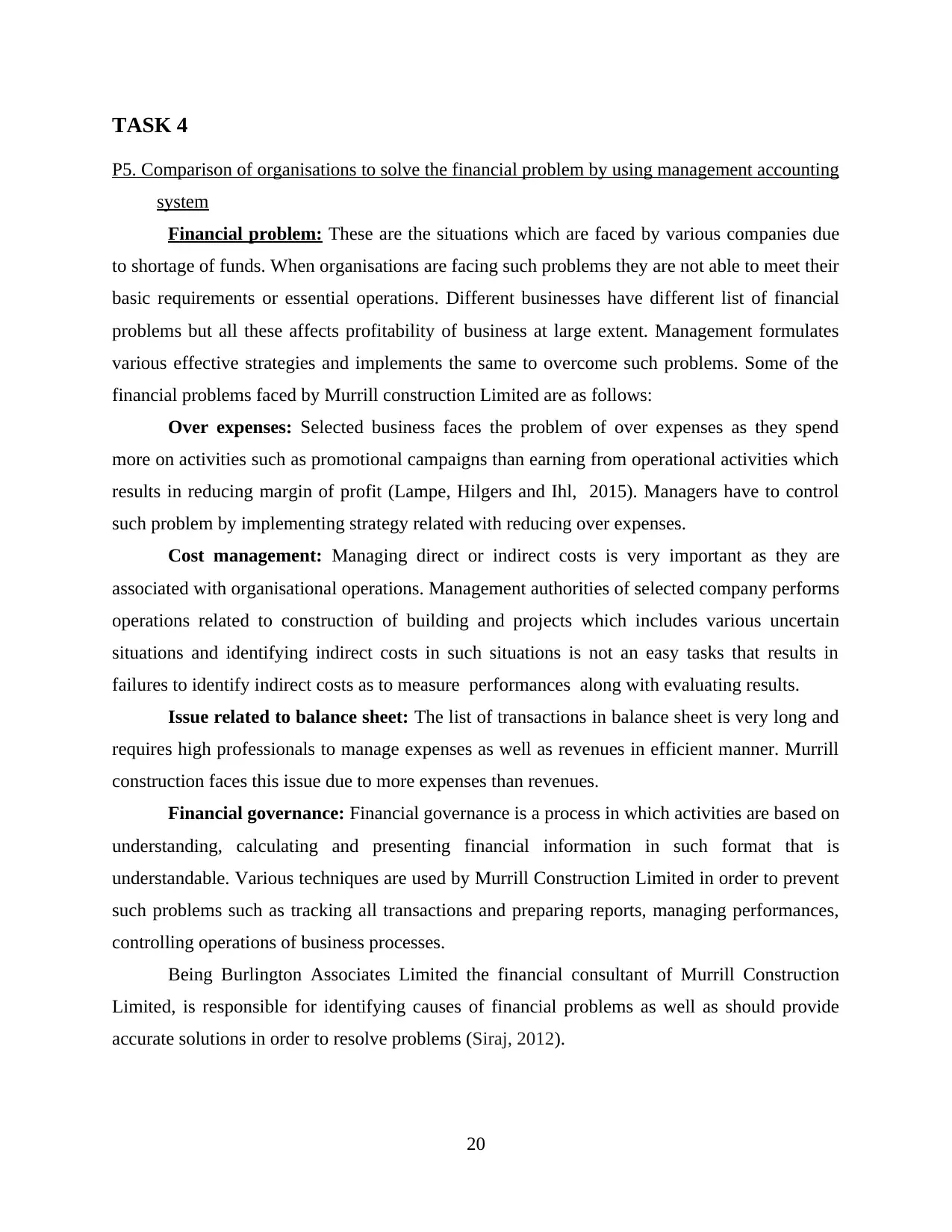

Financial problem: These are the situations which are faced by various companies due

to shortage of funds. When organisations are facing such problems they are not able to meet their

basic requirements or essential operations. Different businesses have different list of financial

problems but all these affects profitability of business at large extent. Management formulates

various effective strategies and implements the same to overcome such problems. Some of the

financial problems faced by Murrill construction Limited are as follows:

Over expenses: Selected business faces the problem of over expenses as they spend

more on activities such as promotional campaigns than earning from operational activities which

results in reducing margin of profit (Lampe, Hilgers and Ihl, 2015). Managers have to control

such problem by implementing strategy related with reducing over expenses.

Cost management: Managing direct or indirect costs is very important as they are

associated with organisational operations. Management authorities of selected company performs

operations related to construction of building and projects which includes various uncertain

situations and identifying indirect costs in such situations is not an easy tasks that results in

failures to identify indirect costs as to measure performances along with evaluating results.

Issue related to balance sheet: The list of transactions in balance sheet is very long and

requires high professionals to manage expenses as well as revenues in efficient manner. Murrill

construction faces this issue due to more expenses than revenues.

Financial governance: Financial governance is a process in which activities are based on

understanding, calculating and presenting financial information in such format that is

understandable. Various techniques are used by Murrill Construction Limited in order to prevent

such problems such as tracking all transactions and preparing reports, managing performances,

controlling operations of business processes.

Being Burlington Associates Limited the financial consultant of Murrill Construction

Limited, is responsible for identifying causes of financial problems as well as should provide

accurate solutions in order to resolve problems (Siraj, 2012).

20

P5. Comparison of organisations to solve the financial problem by using management accounting

system

Financial problem: These are the situations which are faced by various companies due

to shortage of funds. When organisations are facing such problems they are not able to meet their

basic requirements or essential operations. Different businesses have different list of financial

problems but all these affects profitability of business at large extent. Management formulates

various effective strategies and implements the same to overcome such problems. Some of the

financial problems faced by Murrill construction Limited are as follows:

Over expenses: Selected business faces the problem of over expenses as they spend

more on activities such as promotional campaigns than earning from operational activities which

results in reducing margin of profit (Lampe, Hilgers and Ihl, 2015). Managers have to control

such problem by implementing strategy related with reducing over expenses.

Cost management: Managing direct or indirect costs is very important as they are

associated with organisational operations. Management authorities of selected company performs

operations related to construction of building and projects which includes various uncertain

situations and identifying indirect costs in such situations is not an easy tasks that results in

failures to identify indirect costs as to measure performances along with evaluating results.

Issue related to balance sheet: The list of transactions in balance sheet is very long and

requires high professionals to manage expenses as well as revenues in efficient manner. Murrill

construction faces this issue due to more expenses than revenues.

Financial governance: Financial governance is a process in which activities are based on

understanding, calculating and presenting financial information in such format that is

understandable. Various techniques are used by Murrill Construction Limited in order to prevent

such problems such as tracking all transactions and preparing reports, managing performances,

controlling operations of business processes.

Being Burlington Associates Limited the financial consultant of Murrill Construction

Limited, is responsible for identifying causes of financial problems as well as should provide

accurate solutions in order to resolve problems (Siraj, 2012).

20

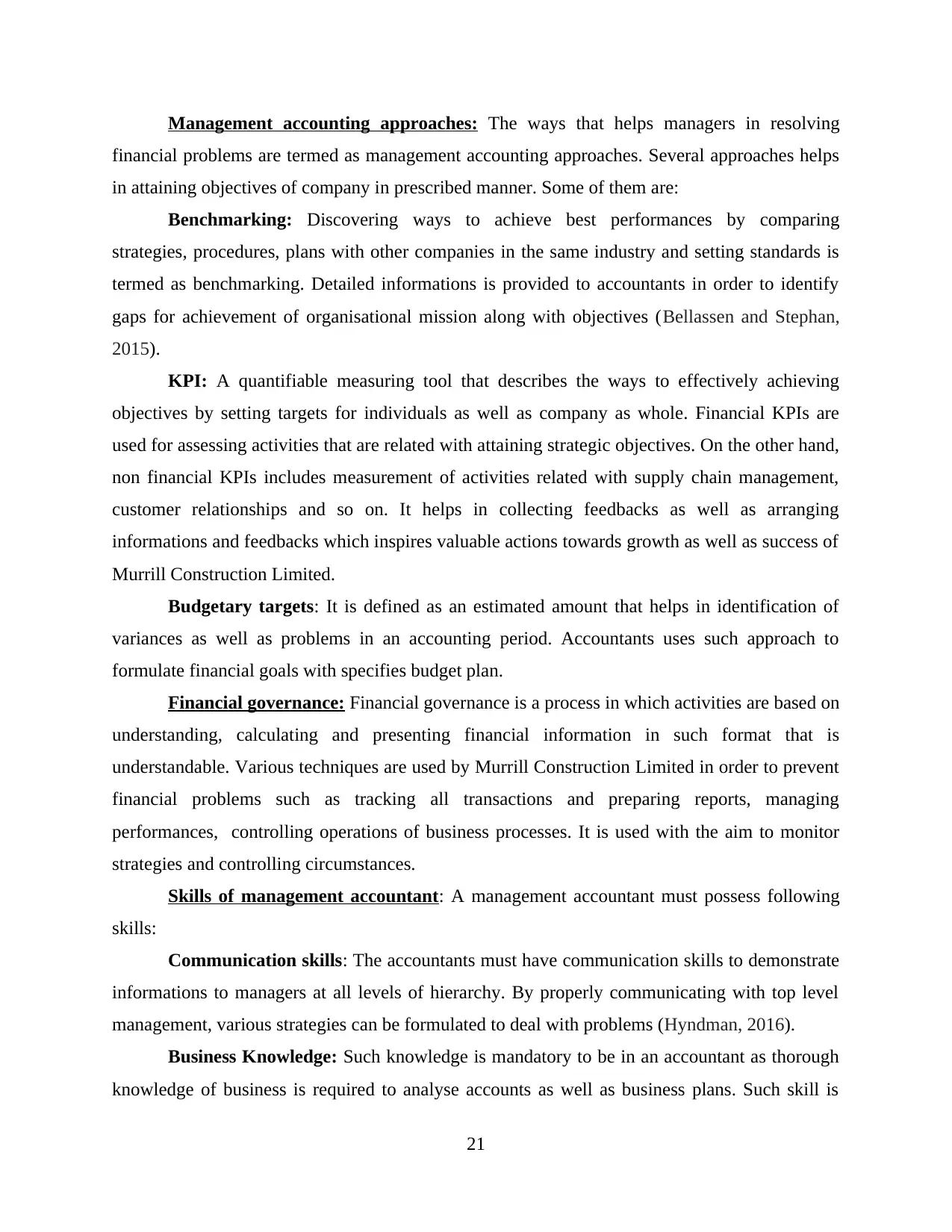

Management accounting approaches: The ways that helps managers in resolving

financial problems are termed as management accounting approaches. Several approaches helps

in attaining objectives of company in prescribed manner. Some of them are:

Benchmarking: Discovering ways to achieve best performances by comparing

strategies, procedures, plans with other companies in the same industry and setting standards is

termed as benchmarking. Detailed informations is provided to accountants in order to identify

gaps for achievement of organisational mission along with objectives (Bellassen and Stephan,

2015).

KPI: A quantifiable measuring tool that describes the ways to effectively achieving

objectives by setting targets for individuals as well as company as whole. Financial KPIs are

used for assessing activities that are related with attaining strategic objectives. On the other hand,

non financial KPIs includes measurement of activities related with supply chain management,

customer relationships and so on. It helps in collecting feedbacks as well as arranging

informations and feedbacks which inspires valuable actions towards growth as well as success of

Murrill Construction Limited.

Budgetary targets: It is defined as an estimated amount that helps in identification of

variances as well as problems in an accounting period. Accountants uses such approach to

formulate financial goals with specifies budget plan.

Financial governance: Financial governance is a process in which activities are based on

understanding, calculating and presenting financial information in such format that is

understandable. Various techniques are used by Murrill Construction Limited in order to prevent

financial problems such as tracking all transactions and preparing reports, managing

performances, controlling operations of business processes. It is used with the aim to monitor

strategies and controlling circumstances.

Skills of management accountant: A management accountant must possess following

skills:

Communication skills: The accountants must have communication skills to demonstrate

informations to managers at all levels of hierarchy. By properly communicating with top level

management, various strategies can be formulated to deal with problems (Hyndman, 2016).

Business Knowledge: Such knowledge is mandatory to be in an accountant as thorough

knowledge of business is required to analyse accounts as well as business plans. Such skill is

21

financial problems are termed as management accounting approaches. Several approaches helps

in attaining objectives of company in prescribed manner. Some of them are:

Benchmarking: Discovering ways to achieve best performances by comparing

strategies, procedures, plans with other companies in the same industry and setting standards is

termed as benchmarking. Detailed informations is provided to accountants in order to identify

gaps for achievement of organisational mission along with objectives (Bellassen and Stephan,

2015).

KPI: A quantifiable measuring tool that describes the ways to effectively achieving

objectives by setting targets for individuals as well as company as whole. Financial KPIs are

used for assessing activities that are related with attaining strategic objectives. On the other hand,

non financial KPIs includes measurement of activities related with supply chain management,

customer relationships and so on. It helps in collecting feedbacks as well as arranging

informations and feedbacks which inspires valuable actions towards growth as well as success of

Murrill Construction Limited.

Budgetary targets: It is defined as an estimated amount that helps in identification of

variances as well as problems in an accounting period. Accountants uses such approach to

formulate financial goals with specifies budget plan.

Financial governance: Financial governance is a process in which activities are based on

understanding, calculating and presenting financial information in such format that is

understandable. Various techniques are used by Murrill Construction Limited in order to prevent

financial problems such as tracking all transactions and preparing reports, managing

performances, controlling operations of business processes. It is used with the aim to monitor

strategies and controlling circumstances.

Skills of management accountant: A management accountant must possess following

skills:

Communication skills: The accountants must have communication skills to demonstrate

informations to managers at all levels of hierarchy. By properly communicating with top level

management, various strategies can be formulated to deal with problems (Hyndman, 2016).

Business Knowledge: Such knowledge is mandatory to be in an accountant as thorough

knowledge of business is required to analyse accounts as well as business plans. Such skill is

21

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

required for making innumerable business decisions that helps in preventing financial problems

before the time they occur.

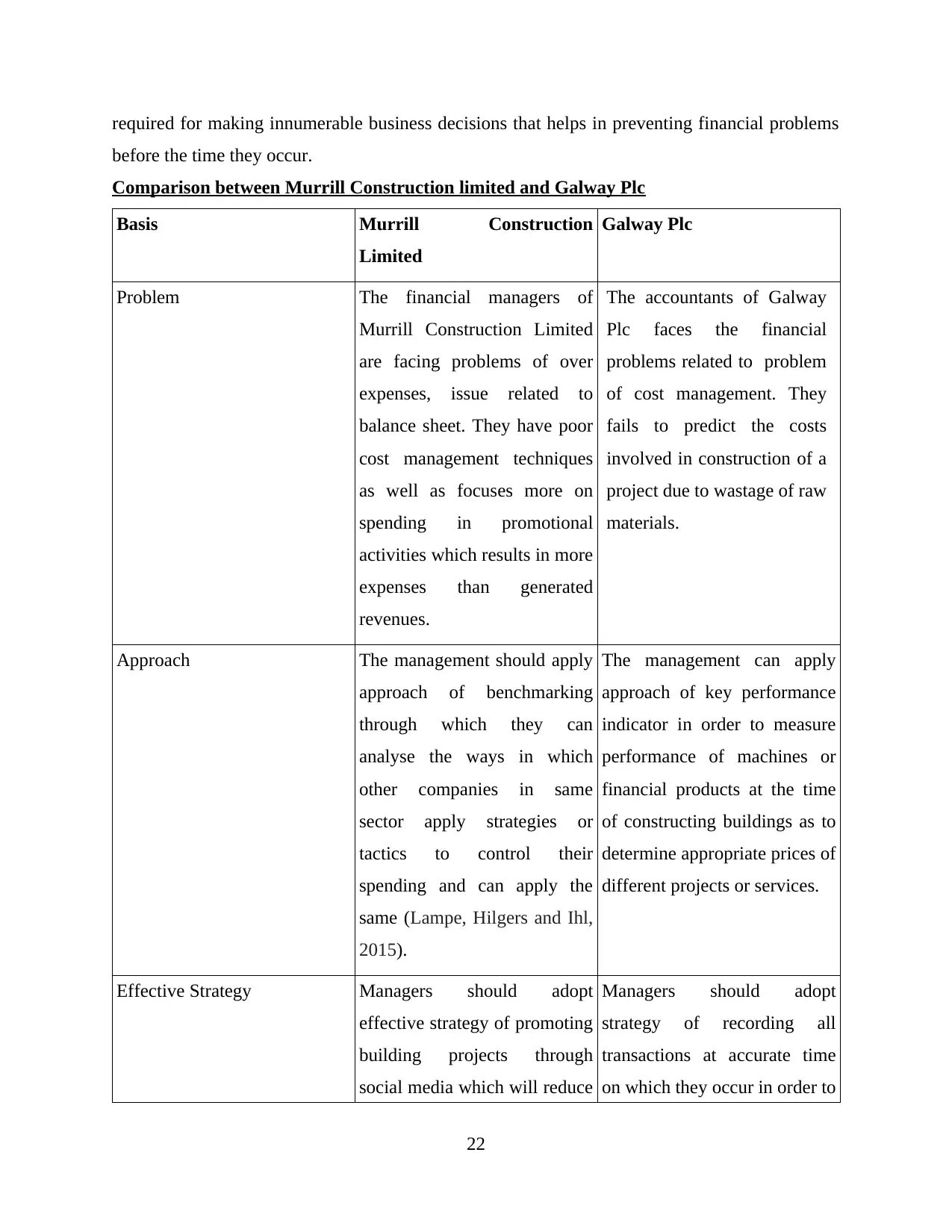

Comparison between Murrill Construction limited and Galway Plc

Basis Murrill Construction

Limited

Galway Plc

Problem The financial managers of

Murrill Construction Limited

are facing problems of over

expenses, issue related to

balance sheet. They have poor

cost management techniques

as well as focuses more on

spending in promotional

activities which results in more

expenses than generated

revenues.

The accountants of Galway

Plc faces the financial

problems related to problem

of cost management. They

fails to predict the costs

involved in construction of a

project due to wastage of raw

materials.

Approach The management should apply

approach of benchmarking

through which they can

analyse the ways in which

other companies in same

sector apply strategies or

tactics to control their

spending and can apply the

same (Lampe, Hilgers and Ihl,

2015).

The management can apply

approach of key performance

indicator in order to measure

performance of machines or

financial products at the time

of constructing buildings as to

determine appropriate prices of

different projects or services.

Effective Strategy Managers should adopt

effective strategy of promoting

building projects through

social media which will reduce

Managers should adopt

strategy of recording all

transactions at accurate time

on which they occur in order to

22

before the time they occur.

Comparison between Murrill Construction limited and Galway Plc

Basis Murrill Construction

Limited

Galway Plc

Problem The financial managers of

Murrill Construction Limited

are facing problems of over

expenses, issue related to

balance sheet. They have poor

cost management techniques

as well as focuses more on

spending in promotional

activities which results in more

expenses than generated

revenues.

The accountants of Galway

Plc faces the financial

problems related to problem

of cost management. They

fails to predict the costs

involved in construction of a

project due to wastage of raw

materials.

Approach The management should apply

approach of benchmarking

through which they can

analyse the ways in which

other companies in same

sector apply strategies or

tactics to control their

spending and can apply the

same (Lampe, Hilgers and Ihl,

2015).

The management can apply

approach of key performance

indicator in order to measure

performance of machines or

financial products at the time

of constructing buildings as to

determine appropriate prices of

different projects or services.

Effective Strategy Managers should adopt

effective strategy of promoting

building projects through

social media which will reduce

Managers should adopt

strategy of recording all

transactions at accurate time

on which they occur in order to

22

the spendings and helps in

overcoming from over expense

issue.

reduce wastage of materials.

Organisations uses management accounting tools in order to overcome from financial issues and

implementing effective strategies. Murrill Construction Limited and Galway Plc uses cost

accounting system to control prices of construction projects and to predict prices for future time

as to overcome the problem of over expense.

CONCLUSION

From the present report it can be concluded that recording and maintaining financial

statements is very important. Management accounting and financial accounting plays important

function of providing financial information to managers for taking critical decisions.

Management accounting systems includes price optimisation system, inventory management

system, cost accounting system, and job costing system. There are various management

accounting reports that are classified as performance reports,, account receivable reports, budget

reports as well as cost management accounting report. Absorption cost and marginal costing

techniques are used for preparing income statements. Planning tools includes budgets which are

capital, operating, zero-based, master budget that are used by managers. Financial problems

faced by company are over expenses, cost management and issues related to balance sheet.

Organisations adopt approach of benchmarking, key performance indicators to resolve problems

and to lead towards success.

23

overcoming from over expense

issue.

reduce wastage of materials.

Organisations uses management accounting tools in order to overcome from financial issues and

implementing effective strategies. Murrill Construction Limited and Galway Plc uses cost

accounting system to control prices of construction projects and to predict prices for future time

as to overcome the problem of over expense.

CONCLUSION

From the present report it can be concluded that recording and maintaining financial

statements is very important. Management accounting and financial accounting plays important

function of providing financial information to managers for taking critical decisions.

Management accounting systems includes price optimisation system, inventory management

system, cost accounting system, and job costing system. There are various management

accounting reports that are classified as performance reports,, account receivable reports, budget

reports as well as cost management accounting report. Absorption cost and marginal costing

techniques are used for preparing income statements. Planning tools includes budgets which are

capital, operating, zero-based, master budget that are used by managers. Financial problems

faced by company are over expenses, cost management and issues related to balance sheet.

Organisations adopt approach of benchmarking, key performance indicators to resolve problems

and to lead towards success.

23

1 out of 24

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.