Management Accounting Report: Buccaneers Ltd Cost Analysis and Budgets

VerifiedAdded on 2019/12/03

|18

|4077

|127

Report

AI Summary

This report provides a comprehensive analysis of management accounting principles within the context of Buccaneers Ltd. It begins with an introduction to management accounting and its importance in decision-making, followed by a detailed examination of cost information, including direct and indirect costs, and various costing methods such as process costing, which is applied to Buccaneers Ltd's production processes. The report then proposes methods for cost reduction and value enhancement, emphasizing the use of financial and non-financial performance indicators. Furthermore, it delves into the preparation of forecasts and budgets, outlining the budgeting process and its key purposes. Finally, the report addresses performance monitoring, covering financial statements and ratio analysis. The report concludes with a summary of the key findings and recommendations for Buccaneers Ltd.

Management accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................4

TASK1 BE ABLE TO ANALYZE COST INFORMATION WITHIN THE BUSINESS OF

BUCCANEERS LTD......................................................................................................................4

P1.1 .............................................................................................................................................4

P1.2 .............................................................................................................................................5

P1.3 .............................................................................................................................................5

P1.4..............................................................................................................................................6

TASK 2 BE ABLE TO PROPOSE METHOD TO REDUCE COSTS AND ENHANCE VALUE

WITHIN THE BUSINESS..............................................................................................................7

P2.1 .............................................................................................................................................7

P2.2 .............................................................................................................................................7

P2.3 .............................................................................................................................................8

TASK 3 BE ABLE TO PREPARE FORECASTS AND BUDGETS FOR A BUSINESS............8

P3.1 .............................................................................................................................................8

P3.2 .............................................................................................................................................9

P3.3 ...........................................................................................................................................10

P3.4 ...........................................................................................................................................10

TASK 4 BE ABLE TO MONITOR PERFORMANCE................................................................12

P4.1 ...........................................................................................................................................12

P4.2 ...........................................................................................................................................13

P4.3 ...........................................................................................................................................13

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

.......................................................................................................................................................16

INTRODUCTION...........................................................................................................................4

TASK1 BE ABLE TO ANALYZE COST INFORMATION WITHIN THE BUSINESS OF

BUCCANEERS LTD......................................................................................................................4

P1.1 .............................................................................................................................................4

P1.2 .............................................................................................................................................5

P1.3 .............................................................................................................................................5

P1.4..............................................................................................................................................6

TASK 2 BE ABLE TO PROPOSE METHOD TO REDUCE COSTS AND ENHANCE VALUE

WITHIN THE BUSINESS..............................................................................................................7

P2.1 .............................................................................................................................................7

P2.2 .............................................................................................................................................7

P2.3 .............................................................................................................................................8

TASK 3 BE ABLE TO PREPARE FORECASTS AND BUDGETS FOR A BUSINESS............8

P3.1 .............................................................................................................................................8

P3.2 .............................................................................................................................................9

P3.3 ...........................................................................................................................................10

P3.4 ...........................................................................................................................................10

TASK 4 BE ABLE TO MONITOR PERFORMANCE................................................................12

P4.1 ...........................................................................................................................................12

P4.2 ...........................................................................................................................................13

P4.3 ...........................................................................................................................................13

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

.......................................................................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

In today’s competitive and rapidly changing environment, it is essential for the organizations to

decide effective course of action. In order to effectively plan business course of action, the varied

range of management accounting information is required. The financial information tends to

support effective decision making within the organization. It is through access to wide range of

financial information that the business unit is able to decide effective course of action. The report

into consideration develops deep understanding of manner in which management accounting

information helps in decision making process. Moreover, the manner in which management

accounting techniques helps in supporting strategic management decisions. Moreover, it throws

light on manner in which budgeting and forecasting techniques is considered to be effective

decision making tool. It also helps in understanding ways through which management

accounting techniques can be used in the current competitive era of business.

TASK1 BE ABLE TO ANALYZE COST INFORMATION WITHIN THE

BUSINESS OF BUCCANEERS LTD.

P1.1

4

In today’s competitive and rapidly changing environment, it is essential for the organizations to

decide effective course of action. In order to effectively plan business course of action, the varied

range of management accounting information is required. The financial information tends to

support effective decision making within the organization. It is through access to wide range of

financial information that the business unit is able to decide effective course of action. The report

into consideration develops deep understanding of manner in which management accounting

information helps in decision making process. Moreover, the manner in which management

accounting techniques helps in supporting strategic management decisions. Moreover, it throws

light on manner in which budgeting and forecasting techniques is considered to be effective

decision making tool. It also helps in understanding ways through which management

accounting techniques can be used in the current competitive era of business.

TASK1 BE ABLE TO ANALYZE COST INFORMATION WITHIN THE

BUSINESS OF BUCCANEERS LTD.

P1.1

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

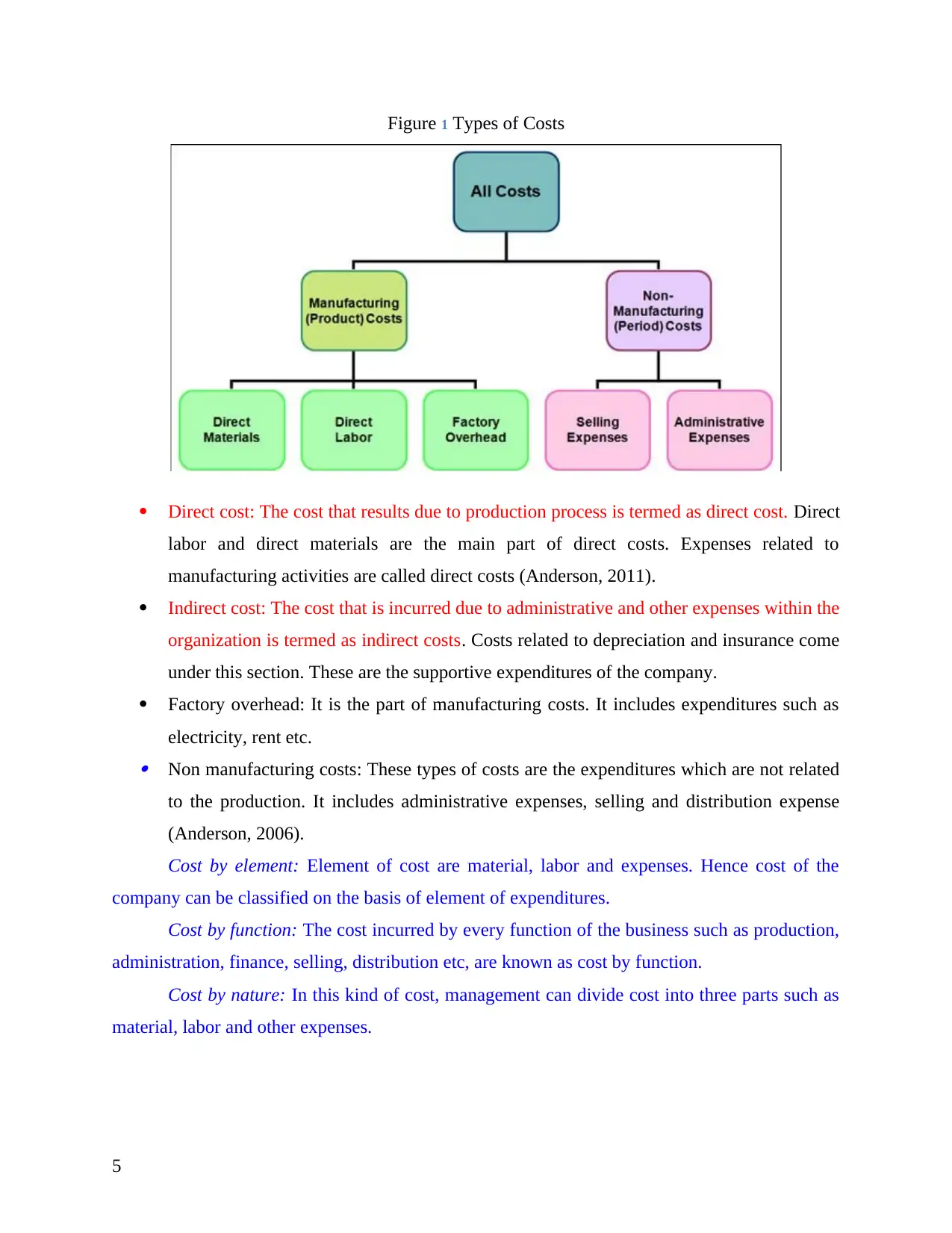

Figure 1 Types of Costs

Direct cost: The cost that results due to production process is termed as direct cost. Direct

labor and direct materials are the main part of direct costs. Expenses related to

manufacturing activities are called direct costs (Anderson, 2011).

Indirect cost: The cost that is incurred due to administrative and other expenses within the

organization is termed as indirect costs. Costs related to depreciation and insurance come

under this section. These are the supportive expenditures of the company.

Factory overhead: It is the part of manufacturing costs. It includes expenditures such as

electricity, rent etc. Non manufacturing costs: These types of costs are the expenditures which are not related

to the production. It includes administrative expenses, selling and distribution expense

(Anderson, 2006).

Cost by element: Element of cost are material, labor and expenses. Hence cost of the

company can be classified on the basis of element of expenditures.

Cost by function: The cost incurred by every function of the business such as production,

administration, finance, selling, distribution etc, are known as cost by function.

Cost by nature: In this kind of cost, management can divide cost into three parts such as

material, labor and other expenses.

5

Direct cost: The cost that results due to production process is termed as direct cost. Direct

labor and direct materials are the main part of direct costs. Expenses related to

manufacturing activities are called direct costs (Anderson, 2011).

Indirect cost: The cost that is incurred due to administrative and other expenses within the

organization is termed as indirect costs. Costs related to depreciation and insurance come

under this section. These are the supportive expenditures of the company.

Factory overhead: It is the part of manufacturing costs. It includes expenditures such as

electricity, rent etc. Non manufacturing costs: These types of costs are the expenditures which are not related

to the production. It includes administrative expenses, selling and distribution expense

(Anderson, 2006).

Cost by element: Element of cost are material, labor and expenses. Hence cost of the

company can be classified on the basis of element of expenditures.

Cost by function: The cost incurred by every function of the business such as production,

administration, finance, selling, distribution etc, are known as cost by function.

Cost by nature: In this kind of cost, management can divide cost into three parts such as

material, labor and other expenses.

5

Cost by behavior: In this part cost can be classified into fixed cost, variable cost and

mixed costs. Buccaneers Ltd is using cost classification by behavior in its business. They are

included fixed, variable and mixed costs in business operations.

P1.2

Multiple costing: The methodology emphasizes on application of minimum of two

approaches for calculation of costs for the organization. The methodology is suitable for

calculation of costs in automobile sector, telecom industry and so on.

Activity based costing: The activity based costing emphasizes on allocation of costs

within the business based on activities for optimum allocation of resources. It is useful

for the production industries (Arai, Kitada and Oura, 2013).

Batch costing: In this method, the whole process of production is divided into batches.

The expenditures are also distributed on the basis of batches. It is useful for big

companies.

Job costing: In this technique cost of the production is calculated as per the expenditure

incurred by a specific work or job.

Contract costing: The costing methodology is applicable in businesses that are

conducting operations on the basis of contracts such as construction of dams and

buildings. Expenditures are calculated on the basis of every contract.

Process costing: Many companies go through different processes to produce the

particular goods. Such companies use process costing. Costs are calculated on the basis

of the every process (Banks, 2008). In the present case study, Buccaneers Ltd is using

process costing because company has ranges of process of production such as forming,

machining, finishing etc.

P1.3

On the evaluation of case presented herewith, it is seen that Buccaneers plc evaluates the

processes of production that includes forming, machining and finishing. They can use process

costing method for cost calculation. The raw material is converted into finished goods by

entering into different process of production. It can be therefore said that the process costing is

one of the best options for the organization because it is the easiest technique and matches with

the production style of the company. The company is using process costing technique for its

6

mixed costs. Buccaneers Ltd is using cost classification by behavior in its business. They are

included fixed, variable and mixed costs in business operations.

P1.2

Multiple costing: The methodology emphasizes on application of minimum of two

approaches for calculation of costs for the organization. The methodology is suitable for

calculation of costs in automobile sector, telecom industry and so on.

Activity based costing: The activity based costing emphasizes on allocation of costs

within the business based on activities for optimum allocation of resources. It is useful

for the production industries (Arai, Kitada and Oura, 2013).

Batch costing: In this method, the whole process of production is divided into batches.

The expenditures are also distributed on the basis of batches. It is useful for big

companies.

Job costing: In this technique cost of the production is calculated as per the expenditure

incurred by a specific work or job.

Contract costing: The costing methodology is applicable in businesses that are

conducting operations on the basis of contracts such as construction of dams and

buildings. Expenditures are calculated on the basis of every contract.

Process costing: Many companies go through different processes to produce the

particular goods. Such companies use process costing. Costs are calculated on the basis

of the every process (Banks, 2008). In the present case study, Buccaneers Ltd is using

process costing because company has ranges of process of production such as forming,

machining, finishing etc.

P1.3

On the evaluation of case presented herewith, it is seen that Buccaneers plc evaluates the

processes of production that includes forming, machining and finishing. They can use process

costing method for cost calculation. The raw material is converted into finished goods by

entering into different process of production. It can be therefore said that the process costing is

one of the best options for the organization because it is the easiest technique and matches with

the production style of the company. The company is using process costing technique for its

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

business and operations (Birnberg and Sisaye, 2010). Besides, some tools of costing that can be

adopted by the organization are described underneath in detail.

Standard costing: The costing methodology emphasizes on comparison of actual

expenditure incurred to that of budgeted expenditure. This in turn helps in estimating

variances that can be minimized by taking appropriate measures. It is the most famous

classical tool of costing.

Marginal costing: In this method, marginal cost of products is computed by estimating a

difference between fixed and variable expenditure incurred on part of the organization. It

is therefore considered to be one of the easiest techniques for costing.

Uniform costing: The costing methodology emphasizes on adoption of similar costing

techniques and principles by which expenditures can be controlled and regulated in a

continuous manner (Budgetary control. 2011).

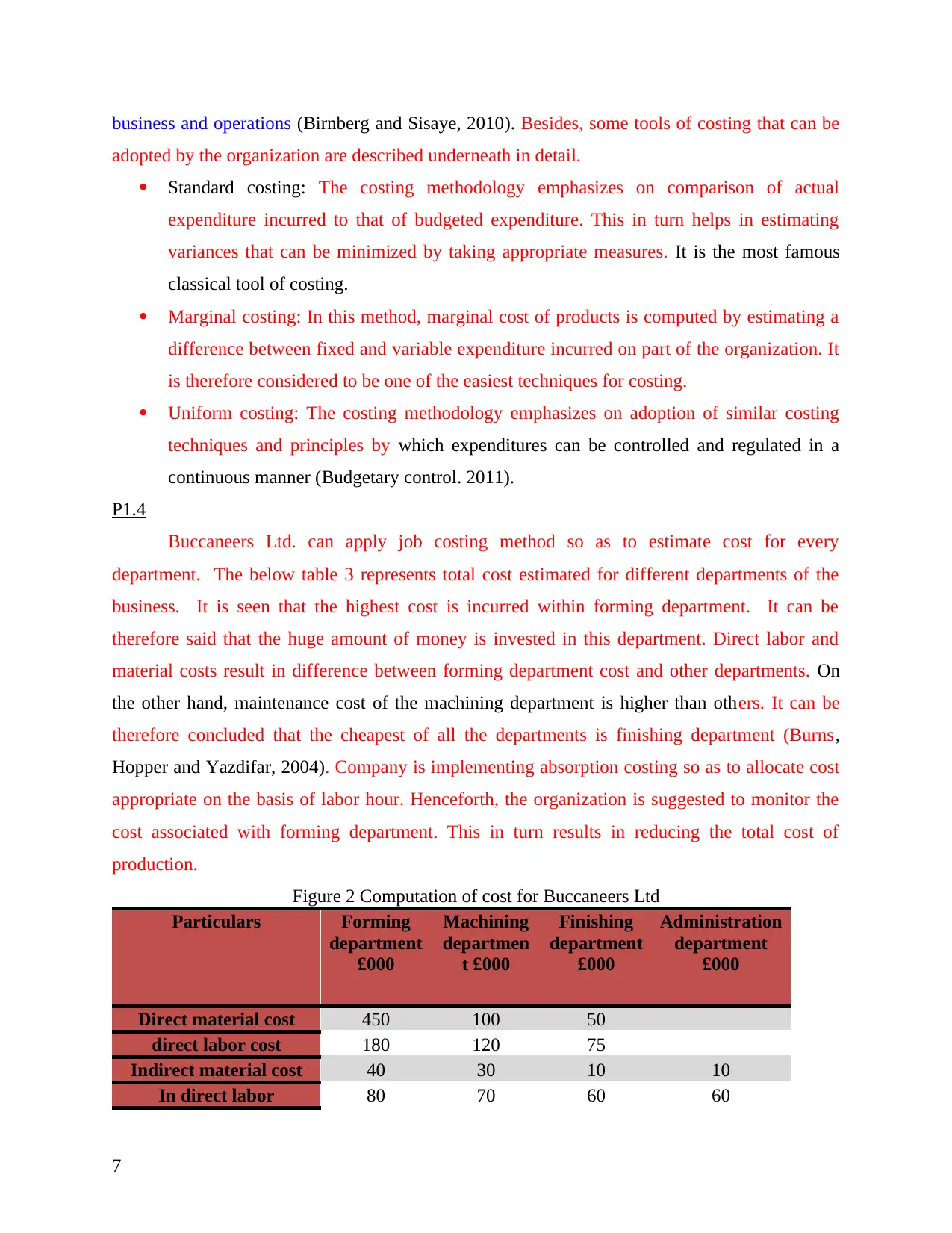

P1.4

Buccaneers Ltd. can apply job costing method so as to estimate cost for every

department. The below table 3 represents total cost estimated for different departments of the

business. It is seen that the highest cost is incurred within forming department. It can be

therefore said that the huge amount of money is invested in this department. Direct labor and

material costs result in difference between forming department cost and other departments. On

the other hand, maintenance cost of the machining department is higher than others. It can be

therefore concluded that the cheapest of all the departments is finishing department (Burns,

Hopper and Yazdifar, 2004). Company is implementing absorption costing so as to allocate cost

appropriate on the basis of labor hour. Henceforth, the organization is suggested to monitor the

cost associated with forming department. This in turn results in reducing the total cost of

production.

Figure 2 Computation of cost for Buccaneers Ltd

Particulars Forming

department

£000

Machining

departmen

t £000

Finishing

department

£000

Administration

department

£000

Direct material cost 450 100 50

direct labor cost 180 120 75

Indirect material cost 40 30 10 10

In direct labor 80 70 60 60

7

adopted by the organization are described underneath in detail.

Standard costing: The costing methodology emphasizes on comparison of actual

expenditure incurred to that of budgeted expenditure. This in turn helps in estimating

variances that can be minimized by taking appropriate measures. It is the most famous

classical tool of costing.

Marginal costing: In this method, marginal cost of products is computed by estimating a

difference between fixed and variable expenditure incurred on part of the organization. It

is therefore considered to be one of the easiest techniques for costing.

Uniform costing: The costing methodology emphasizes on adoption of similar costing

techniques and principles by which expenditures can be controlled and regulated in a

continuous manner (Budgetary control. 2011).

P1.4

Buccaneers Ltd. can apply job costing method so as to estimate cost for every

department. The below table 3 represents total cost estimated for different departments of the

business. It is seen that the highest cost is incurred within forming department. It can be

therefore said that the huge amount of money is invested in this department. Direct labor and

material costs result in difference between forming department cost and other departments. On

the other hand, maintenance cost of the machining department is higher than others. It can be

therefore concluded that the cheapest of all the departments is finishing department (Burns,

Hopper and Yazdifar, 2004). Company is implementing absorption costing so as to allocate cost

appropriate on the basis of labor hour. Henceforth, the organization is suggested to monitor the

cost associated with forming department. This in turn results in reducing the total cost of

production.

Figure 2 Computation of cost for Buccaneers Ltd

Particulars Forming

department

£000

Machining

departmen

t £000

Finishing

department

£000

Administration

department

£000

Direct material cost 450 100 50

direct labor cost 180 120 75

Indirect material cost 40 30 10 10

In direct labor 80 70 60 60

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Maintenance cost 7.5 37.5 5

rent and rates 40 30 20 10

heating and lighting 2 6 2

building insurance 4 3 2 1

Machinery insurance 2 6 2

Depreciation of

machinery

30 60 30

Total cost of administration 8

1

Allocation of

Administration cost

35.99 35.99 8.99

Total Cost 871.49 498.49 264.99

TASK 2 BE ABLE TO PROPOSE METHOD TO REDUCE COSTS AND

ENHANCE VALUE WITHIN THE BUSINESS

P2.1

Cost report of Buccaneers ltd shows the money incurred on each element of cost such as

production cost, material cost, labor cost etc. By using effective method they can reduce their

production cost. The report is prepared by using all the financial information of the business.

Information or data should be accurate and correct. It should be collected in an effective manner.

After proper collection of data, it should be organized, summarized and arranged according to

the use of this information. After compiling of all the data, reports of cost should be developed.

There are many problems which may arise during the report formulation (Hopwood, 2007).

Issues related to inadequacy, irrelevancy, nu-authenticity and shortage must be avoided by the

managers. Moreover, the organization should make appropriate estimation of facts and figures

since these decide achievement of goals and objectives of the organization. Managers must find

out the all errors of report perfectly.

P2.2

Generally, there are two types of indicators of performance of the business which are as

follows:

Financial statements: There are basically tree types of financial statements which show

the financial position and performance of the enterprise such as income statement,

balance sheet and cash flow statement. These statements help in evaluating financial

8

rent and rates 40 30 20 10

heating and lighting 2 6 2

building insurance 4 3 2 1

Machinery insurance 2 6 2

Depreciation of

machinery

30 60 30

Total cost of administration 8

1

Allocation of

Administration cost

35.99 35.99 8.99

Total Cost 871.49 498.49 264.99

TASK 2 BE ABLE TO PROPOSE METHOD TO REDUCE COSTS AND

ENHANCE VALUE WITHIN THE BUSINESS

P2.1

Cost report of Buccaneers ltd shows the money incurred on each element of cost such as

production cost, material cost, labor cost etc. By using effective method they can reduce their

production cost. The report is prepared by using all the financial information of the business.

Information or data should be accurate and correct. It should be collected in an effective manner.

After proper collection of data, it should be organized, summarized and arranged according to

the use of this information. After compiling of all the data, reports of cost should be developed.

There are many problems which may arise during the report formulation (Hopwood, 2007).

Issues related to inadequacy, irrelevancy, nu-authenticity and shortage must be avoided by the

managers. Moreover, the organization should make appropriate estimation of facts and figures

since these decide achievement of goals and objectives of the organization. Managers must find

out the all errors of report perfectly.

P2.2

Generally, there are two types of indicators of performance of the business which are as

follows:

Financial statements: There are basically tree types of financial statements which show

the financial position and performance of the enterprise such as income statement,

balance sheet and cash flow statement. These statements help in evaluating financial

8

performance and position of the business unit. It can be said that the profitability,

liquidity and efficiency position of the organization is judged through the analysis of

statements. These statements will assist in identifying the growth opportunities that exist

for the organization (Kastantin, 2005).

Ratio analysis: It is the scientific way of finding out the exact efficiency, effectiveness,

profitability, liquidity etc. of the associates. They can compare their performance with

existing years as well as with the other enterprise to find out new development, growth

and expansion opportunities for the company.

Non financial indicators: Efficiency of the labor, satisfaction level of consumer etc are

included in non financial performance indicators, and these can be found out with the

help of effective use of research tools and techniques. Company can conduct market

research in order to find out valuable and significant data regarding consumers,

employees etc.

P2.3

Cost incurred, value offered and quality delivered of the product are considered to be

interrelated elements. The approach of value enhancement emphasizes on rising level of profits

and reducing cost of production. However, the approach ensures maintenance of adequate level

of quality (Kate-Riin Kont, 2012). They can use many cost controlling techniques and value

enhancement methods so as to develop business activities. Moreover, the list of expenditures

which have high value can be prepared. This in turn helps in finding out efficient ways to reduce

the expenditure. The organization should pay wages as per the nature and quality of work

completed by distinct set of employees. The business unit can employ stock and cash controlling

techniques such as just-in-time, economic order quantity and so on. These techniques help in

reducing cost of holding, insurance and damages. They also can set the priority of different set of

expenditures according to the respective prices. Moreover, the top management is responsible to

control the high level of expenditure. The organization can adopt the latest technology so as to

produce quality products at reasonable price. Moreover, the implementation of novel and fast

machinery and equipment can make the production process faster (Kinney and Raiborn, 2012).

Cost can be reduce with by using just in time, EOQ etc method of inventory control. It is

also helpful in improving value of products and services.

9

liquidity and efficiency position of the organization is judged through the analysis of

statements. These statements will assist in identifying the growth opportunities that exist

for the organization (Kastantin, 2005).

Ratio analysis: It is the scientific way of finding out the exact efficiency, effectiveness,

profitability, liquidity etc. of the associates. They can compare their performance with

existing years as well as with the other enterprise to find out new development, growth

and expansion opportunities for the company.

Non financial indicators: Efficiency of the labor, satisfaction level of consumer etc are

included in non financial performance indicators, and these can be found out with the

help of effective use of research tools and techniques. Company can conduct market

research in order to find out valuable and significant data regarding consumers,

employees etc.

P2.3

Cost incurred, value offered and quality delivered of the product are considered to be

interrelated elements. The approach of value enhancement emphasizes on rising level of profits

and reducing cost of production. However, the approach ensures maintenance of adequate level

of quality (Kate-Riin Kont, 2012). They can use many cost controlling techniques and value

enhancement methods so as to develop business activities. Moreover, the list of expenditures

which have high value can be prepared. This in turn helps in finding out efficient ways to reduce

the expenditure. The organization should pay wages as per the nature and quality of work

completed by distinct set of employees. The business unit can employ stock and cash controlling

techniques such as just-in-time, economic order quantity and so on. These techniques help in

reducing cost of holding, insurance and damages. They also can set the priority of different set of

expenditures according to the respective prices. Moreover, the top management is responsible to

control the high level of expenditure. The organization can adopt the latest technology so as to

produce quality products at reasonable price. Moreover, the implementation of novel and fast

machinery and equipment can make the production process faster (Kinney and Raiborn, 2012).

Cost can be reduce with by using just in time, EOQ etc method of inventory control. It is

also helpful in improving value of products and services.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Effective and efficient use of human resource is helpful in improving quality or value and

reducing expenditures such as wastage etc.

Effective cash management and working capital management is also helpful in improving

efficiency of the business and finally it is helpful in value enhancement and cost

management.

TASK 3 BE ABLE TO PREPARE FORECASTS AND BUDGETS FOR A

BUSINESS

P3.1

The process of budgeting initiates with the stage of formulation whereby the future

forecast for income and expenses are made. The forecasting is done on the basis of past

performance of the organization. Once the forecasting is done and budget is prepared; the actual

performance is compared to that of budgeted values. This in turn helps in identifying variances

which are removed through adoption of appropriate measures. It can be said that the budgeting

process helps in quantifying the future performance of the organization. The key purposes of

budgeting process are as follows.

Optimum utilization of financial resources

Implementation of strict control mechanism within the organization

Motivating individuals.

Communicating.

Forecasting income and expenditure.

A tool of decision making.

Monitoring business performance.

Budgeting will help to manage limited resources effectively. It provides an appropriate

way of allocation of economic resources in an effective manner. The basic purpose of budgeting

is decision making and planning (Lillis, 2008). The main aim behind the process is to efficiently

plan financial operations of the organization. Moreover, the adequate level of co-ordination is

established in allocation of resources and cost of production. It will help to predict the outcomes

of an adjustment before action.

P3.2

Following are the key methods of budgeting which can be used in the case study.

10

reducing expenditures such as wastage etc.

Effective cash management and working capital management is also helpful in improving

efficiency of the business and finally it is helpful in value enhancement and cost

management.

TASK 3 BE ABLE TO PREPARE FORECASTS AND BUDGETS FOR A

BUSINESS

P3.1

The process of budgeting initiates with the stage of formulation whereby the future

forecast for income and expenses are made. The forecasting is done on the basis of past

performance of the organization. Once the forecasting is done and budget is prepared; the actual

performance is compared to that of budgeted values. This in turn helps in identifying variances

which are removed through adoption of appropriate measures. It can be said that the budgeting

process helps in quantifying the future performance of the organization. The key purposes of

budgeting process are as follows.

Optimum utilization of financial resources

Implementation of strict control mechanism within the organization

Motivating individuals.

Communicating.

Forecasting income and expenditure.

A tool of decision making.

Monitoring business performance.

Budgeting will help to manage limited resources effectively. It provides an appropriate

way of allocation of economic resources in an effective manner. The basic purpose of budgeting

is decision making and planning (Lillis, 2008). The main aim behind the process is to efficiently

plan financial operations of the organization. Moreover, the adequate level of co-ordination is

established in allocation of resources and cost of production. It will help to predict the outcomes

of an adjustment before action.

P3.2

Following are the key methods of budgeting which can be used in the case study.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Incremental budgeting: It is classical and one of very simple methods of budgeting.

Moreover, the budget as per incremental budgeting is prepared by continuously

increasing financial figures of past years at constant or increasing rate. It will be prepared

on consistent basis. The main limitation of this kind of budgets is considered to be its

approach to ignore the impact of changes within organization. Moreover, limited amount

of efforts are involved in development due to lack of innovation. It can be therefore said

that the approach is not considered to be valuable in present dynamic environment

(Obura and Bukenya, 2008).

Zero based budgeting: It overcomes the disadvantage of incremental budgeting. This

approach says that the managers should start their budgeting with zero bases. They

should consider the changes and make a new budget every year by starting with zero

level. It is the modern method through which they can allocate resources efficiently. This

type of budgeting may be used by the big companies because it requires trained and

expert employees.

Top down budgeting: It provides importance on the priority of work done. It says that

they should estimate the expenditure of raised level tasks introductory and use this

approximation to constrain the calculation for subordinate level. This way takes very

fewer time frames than others and appraises upper level loyalty (Standard Costs and

Variance Analysis. 2007). This is the method utilized by the company in the present case.

Hence, it can be said that it is the best way of controlling and managing variance as it

includes less involvement of low level workers of the entity.

Bottom up budgeting: In this technique, budgets are formed by incorporating the input of

subordinate level administration. The counsel and procedure are developed by strategic

level but budgets are prepared by the individual departments. It is also a good method

which can provide full information of activities easily. The company can use this kind of

budgets with experienced employees.

P3.3

Antonio Ltd. can set up their budget with the help of the following procedure.

Preparation of budget: The process outset with the preparation stage where they estimate

the income and expenses within the company (Thomas, 2009). It is the first step of the

budgeting.

11

Moreover, the budget as per incremental budgeting is prepared by continuously

increasing financial figures of past years at constant or increasing rate. It will be prepared

on consistent basis. The main limitation of this kind of budgets is considered to be its

approach to ignore the impact of changes within organization. Moreover, limited amount

of efforts are involved in development due to lack of innovation. It can be therefore said

that the approach is not considered to be valuable in present dynamic environment

(Obura and Bukenya, 2008).

Zero based budgeting: It overcomes the disadvantage of incremental budgeting. This

approach says that the managers should start their budgeting with zero bases. They

should consider the changes and make a new budget every year by starting with zero

level. It is the modern method through which they can allocate resources efficiently. This

type of budgeting may be used by the big companies because it requires trained and

expert employees.

Top down budgeting: It provides importance on the priority of work done. It says that

they should estimate the expenditure of raised level tasks introductory and use this

approximation to constrain the calculation for subordinate level. This way takes very

fewer time frames than others and appraises upper level loyalty (Standard Costs and

Variance Analysis. 2007). This is the method utilized by the company in the present case.

Hence, it can be said that it is the best way of controlling and managing variance as it

includes less involvement of low level workers of the entity.

Bottom up budgeting: In this technique, budgets are formed by incorporating the input of

subordinate level administration. The counsel and procedure are developed by strategic

level but budgets are prepared by the individual departments. It is also a good method

which can provide full information of activities easily. The company can use this kind of

budgets with experienced employees.

P3.3

Antonio Ltd. can set up their budget with the help of the following procedure.

Preparation of budget: The process outset with the preparation stage where they estimate

the income and expenses within the company (Thomas, 2009). It is the first step of the

budgeting.

11

Budget implementation: After formulation of various budgets, it's should be implemented

in the work environment for decision making and planning.

Monitoring and evaluation: It is the most important stage of this process. They must

monitor their budget’s performance from time to time for modification. The results of

budget are evaluated in this step.

Assessment and computation of variances: After finding out the result of the budget, they

will find out the variances by analyzing the budgeted amount and actual performance.

Modification for better results: Managers can modify the budgets by calculating the

variances for better results in near future (Wildavsky, 2006).

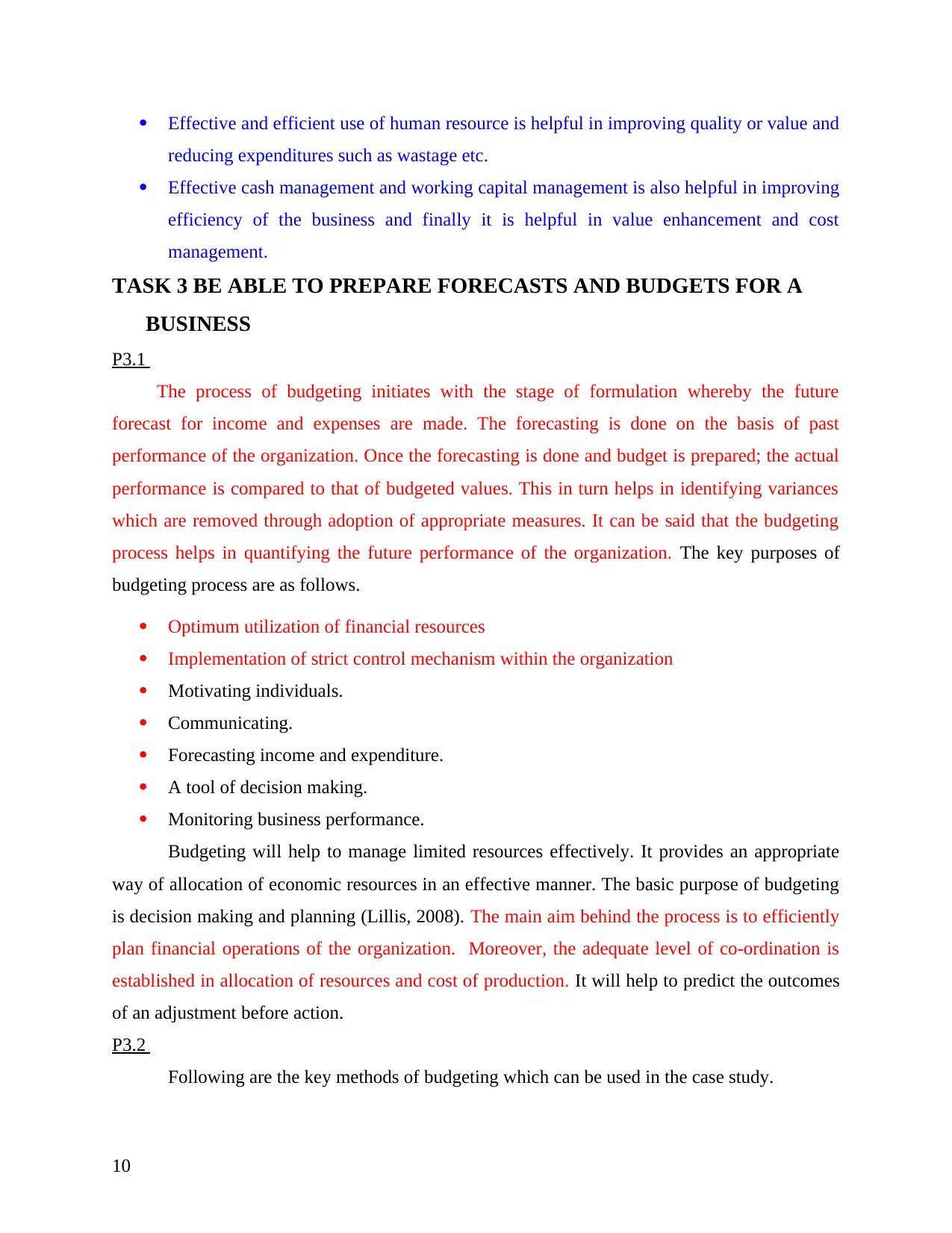

P3.4

Figure 3 Raw material budget for Antonio Ltd

Raw

material

inventor

y budget

(£)

Month Jul

y

Augus

t

Septembe

r

Octobe

r

Novembe

r

Decembe

r

Opening unit 500 650 750 750 800 850

Production

unit

500 600 600 700 750 750

Sales unit 350 500 600 650 700 800

Closing unit 650 750 750 800 850 800

Stock of Raw material budget shows the measure of raw material expected to be bought

by the enterprise. The above calculation shows that Antonia Ltd. will be purchasing

continuously. The closing units of raw materials from July to November are increasing every

month but in December, they will decrease the raw material. This budgets shows the level of raw

materials which will be bought by the company (Zawawi and Hoque, 2010).

Figure 4 Trade Payable budget for Antonio Ltd

Trade

payable

budget

12

in the work environment for decision making and planning.

Monitoring and evaluation: It is the most important stage of this process. They must

monitor their budget’s performance from time to time for modification. The results of

budget are evaluated in this step.

Assessment and computation of variances: After finding out the result of the budget, they

will find out the variances by analyzing the budgeted amount and actual performance.

Modification for better results: Managers can modify the budgets by calculating the

variances for better results in near future (Wildavsky, 2006).

P3.4

Figure 3 Raw material budget for Antonio Ltd

Raw

material

inventor

y budget

(£)

Month Jul

y

Augus

t

Septembe

r

Octobe

r

Novembe

r

Decembe

r

Opening unit 500 650 750 750 800 850

Production

unit

500 600 600 700 750 750

Sales unit 350 500 600 650 700 800

Closing unit 650 750 750 800 850 800

Stock of Raw material budget shows the measure of raw material expected to be bought

by the enterprise. The above calculation shows that Antonia Ltd. will be purchasing

continuously. The closing units of raw materials from July to November are increasing every

month but in December, they will decrease the raw material. This budgets shows the level of raw

materials which will be bought by the company (Zawawi and Hoque, 2010).

Figure 4 Trade Payable budget for Antonio Ltd

Trade

payable

budget

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.