Management Accounting Report: Airdri's Financial Performance Analysis

VerifiedAdded on 2020/11/23

|16

|5250

|245

Report

AI Summary

This report provides a comprehensive overview of management accounting systems and their application within a business context, using Airdri, a hand dryer manufacturer, as a case study. The report begins by identifying essential management accounting systems such as cost accounting, price optimization, inventory management, and job costing, detailing their functions and benefits. It then explores various management accounting reporting methods, including performance, inventory management, accounts receivable, and job cost reports, explaining how these reports are used to monitor and improve business operations. The report delves into cost analysis, employing marginal and absorption costing techniques to prepare income statements, and discusses the merits and demerits of planning tools used in budgetary control. It also examines how management accounting systems can be used to respond to financial problems, contributing to an organization's sustainable success. Overall, the report offers practical insights into how management accounting principles can be applied to enhance financial decision-making and improve business performance.

Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1: Essential management accounting systems used in an organisation....................................1

P2: Various methods used for management accounting reporting..............................................3

M1: Benefits of management accounting systems within organisation......................................4

D1: Management accounting systems and reporting integrated in processes.............................5

TASK 2............................................................................................................................................5

P3: Cost analysis to prepare an income statement......................................................................5

M3: Management accounting technique for producing financial reporting................................7

D2: Analysis of data comes from income statements.................................................................7

TASK 3............................................................................................................................................8

P4: Merits and demerit of using planning tools used in budgetary control................................8

M3: Analysis of several planning tool and its application for forecasting.................................9

TASK 4............................................................................................................................................9

P5. Management accounting systems to respond to financial problems.....................................9

M4: Financial problems, management accounting can lead organisations to sustainable

success.......................................................................................................................................11

D3: Planning tool respond to financial problems......................................................................12

CONCLUSION..............................................................................................................................12

REFERENCES .............................................................................................................................13

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1: Essential management accounting systems used in an organisation....................................1

P2: Various methods used for management accounting reporting..............................................3

M1: Benefits of management accounting systems within organisation......................................4

D1: Management accounting systems and reporting integrated in processes.............................5

TASK 2............................................................................................................................................5

P3: Cost analysis to prepare an income statement......................................................................5

M3: Management accounting technique for producing financial reporting................................7

D2: Analysis of data comes from income statements.................................................................7

TASK 3............................................................................................................................................8

P4: Merits and demerit of using planning tools used in budgetary control................................8

M3: Analysis of several planning tool and its application for forecasting.................................9

TASK 4............................................................................................................................................9

P5. Management accounting systems to respond to financial problems.....................................9

M4: Financial problems, management accounting can lead organisations to sustainable

success.......................................................................................................................................11

D3: Planning tool respond to financial problems......................................................................12

CONCLUSION..............................................................................................................................12

REFERENCES .............................................................................................................................13

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Management accounting is a process of identifying costs that involve in business

operations. It also help in preparing accounting reports which assist in decision making process.

Its objective is to aid in planning and formulating policies of future and provide solutions to

strategic business issues. Airdri is a well established manufacturer of hand dryers located in

United Kingdom. They provide highly reliable, beautifully designed and energy efficient hand

dryers throughout the world.

In this project report, various management accounting systems are analyse and its

reporting methods are identified that are used in preparing effective reports. Cost of product and

income is determined with the use of marginal and absorption costing techniques. Different

budgetary control planning tool are evaluated that helps in preparing and forecasting budgets. At

last, several management accounting systems are used for responding company's financial

problems (Amidu, Effah and Abor, 2011).

TASK 1

P1: Essential management accounting systems used in an organisation

Management accounting refers to process of tracking company's internal cost involves in

its operations which helps individual, management and business in making decision. Its main

objective is to provide information that assist in planning, recording, organising, controlling and

directing for business activities. The management accountant of company plays an important role

in performing various tasks to ensure organisation's financial security that help in achieve overall

objectives. Airdri is a small size company and wish to expand its business in future. Company

follow management accounting for providing accounting information that help in dealing with

future course of actions. So, it use several management accounting systems in order to run its

business effectively (Carlsson-Wall, Kraus and Lind, 2015). Cost accounting, price optimisation,

inventory management, job costing systems are four different types of systems that Airdri using

for achieving its objectives on time. Various management accounting systems are explained

below:

Cost Accounting System: This approach is mainly used for cost ascertainment and

control to achieve maximum profits. It is an essential and ongoing process that provides cost

information to management and decision makers. This system deals only with cost related

1

Management accounting is a process of identifying costs that involve in business

operations. It also help in preparing accounting reports which assist in decision making process.

Its objective is to aid in planning and formulating policies of future and provide solutions to

strategic business issues. Airdri is a well established manufacturer of hand dryers located in

United Kingdom. They provide highly reliable, beautifully designed and energy efficient hand

dryers throughout the world.

In this project report, various management accounting systems are analyse and its

reporting methods are identified that are used in preparing effective reports. Cost of product and

income is determined with the use of marginal and absorption costing techniques. Different

budgetary control planning tool are evaluated that helps in preparing and forecasting budgets. At

last, several management accounting systems are used for responding company's financial

problems (Amidu, Effah and Abor, 2011).

TASK 1

P1: Essential management accounting systems used in an organisation

Management accounting refers to process of tracking company's internal cost involves in

its operations which helps individual, management and business in making decision. Its main

objective is to provide information that assist in planning, recording, organising, controlling and

directing for business activities. The management accountant of company plays an important role

in performing various tasks to ensure organisation's financial security that help in achieve overall

objectives. Airdri is a small size company and wish to expand its business in future. Company

follow management accounting for providing accounting information that help in dealing with

future course of actions. So, it use several management accounting systems in order to run its

business effectively (Carlsson-Wall, Kraus and Lind, 2015). Cost accounting, price optimisation,

inventory management, job costing systems are four different types of systems that Airdri using

for achieving its objectives on time. Various management accounting systems are explained

below:

Cost Accounting System: This approach is mainly used for cost ascertainment and

control to achieve maximum profits. It is an essential and ongoing process that provides cost

information to management and decision makers. This system deals only with cost related

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

aspects. Raw material, labour and overhead are the basic elements of cost. Actual, standard,

normal and activity based costing are the various cost accounting approaches that assist in

evaluating an appropriate cost of product. Airdri use cost accounting system for recording,

determining, analysing and evaluating costs that are associated with process or operations of

hand dryers. Company determine a suitable cost of its product on the basis of activity based

costing where it identify and assign costs that incurred during manufacturing process. By this its

product true cost is evaluated that aid in individual product profitability (Granlund, 2011).

Price Optimisation System: It is a process of identifying maximum price that customer

is willing to pay for company's product or services. This system determine variation in demand

of product or services at different price levels through various channels. It help in determining

initial, promotional and discount price of a product. It is also necessary for evaluating price of

goods or services to meet organisation's objectives. Airdri follow this system for establishing the

optimum price of its product for customer segments in order to target more buyers. Company use

initial price optimisation for creating a secure customer base of its hand dryers in achieving

desired goals such as maximisation of operating profits.

Inventory Management System: This system is important for managing flow of

inventory from manufacturer to warehouse. It helps in tracking stock at different level of

production. It is a continuous process of moving stock in or out from organisation's location.

First in first out, last in first out and weighted average are the different methods of inventory

management. Airdri use inventory management system for managing its inventory on regular

basis as they receive new orders for hand dryers and moves that order out on time. It also aid in

determining inflow and outflow of inventory and finds FIFO method is the best method for

evaluating inventory flow within manufacturing process (Johnson, 2013).

Job Costing System: In this system cost of product is determine under specific

production job. It assign manufacturing costs to a single or batches of product. Direct material,

labour and overhead used in course of job are the three types of information that are needed in

this system. This information is necessary for every job under which company's deal. Airdri is a

hand dryers manufacture and distributor, so it deals in two different jobs. It follow job costing

system to determine accumulated costs and revenues of hand dryers at each level of production

in order to estimate profit.

2

normal and activity based costing are the various cost accounting approaches that assist in

evaluating an appropriate cost of product. Airdri use cost accounting system for recording,

determining, analysing and evaluating costs that are associated with process or operations of

hand dryers. Company determine a suitable cost of its product on the basis of activity based

costing where it identify and assign costs that incurred during manufacturing process. By this its

product true cost is evaluated that aid in individual product profitability (Granlund, 2011).

Price Optimisation System: It is a process of identifying maximum price that customer

is willing to pay for company's product or services. This system determine variation in demand

of product or services at different price levels through various channels. It help in determining

initial, promotional and discount price of a product. It is also necessary for evaluating price of

goods or services to meet organisation's objectives. Airdri follow this system for establishing the

optimum price of its product for customer segments in order to target more buyers. Company use

initial price optimisation for creating a secure customer base of its hand dryers in achieving

desired goals such as maximisation of operating profits.

Inventory Management System: This system is important for managing flow of

inventory from manufacturer to warehouse. It helps in tracking stock at different level of

production. It is a continuous process of moving stock in or out from organisation's location.

First in first out, last in first out and weighted average are the different methods of inventory

management. Airdri use inventory management system for managing its inventory on regular

basis as they receive new orders for hand dryers and moves that order out on time. It also aid in

determining inflow and outflow of inventory and finds FIFO method is the best method for

evaluating inventory flow within manufacturing process (Johnson, 2013).

Job Costing System: In this system cost of product is determine under specific

production job. It assign manufacturing costs to a single or batches of product. Direct material,

labour and overhead used in course of job are the three types of information that are needed in

this system. This information is necessary for every job under which company's deal. Airdri is a

hand dryers manufacture and distributor, so it deals in two different jobs. It follow job costing

system to determine accumulated costs and revenues of hand dryers at each level of production

in order to estimate profit.

2

P2: Various methods used for management accounting reporting

Reporting is a process of providing information regarding activities that runs in an

organisation in order to aware management about its working. It also provide accurate and

current information that company use in preparing extract reports. Management reporting system

is necessary for monitoring the company's mission. This system is valuable for protecting

company by presenting a complete image of it's performance. Company create management

accounting reports on monthly, quarterly, half yearly or yearly basis according to its operations.

Airdri is a small scale company and wants to estimate their performance regularly. So they create

management accounting reports such as performance, inventory management, account receivable

and job costing on quarterly basis in order to measure its progress (JOSHI and et. al., 2011).

These reports are continuously created throughout the accounting period as per company's

requirements. These reports are described below:

Performance Report: It is created to review the organisation's performance as a whole.

Management used this reporting system for planning, measuring, regulating performance that

attained in decision making. This reports involves information regarding resource utilisation,

collection of data and its progress that assist in forecasting future success to various stakeholders.

Status, progress, forecasting and variance reports are the types of performance report. Airdri use

this reporting for comparing its actual costs or revenues with the budgeted for a period.

Performance report is a detail statement which measures outcomes of business activities in terms

of its progress over a particular period of time. By this company create an effective performance

reports which shows how efficiently it spent money on useful activities.

Inventory Management Report: This report is used to centralise information about

inventory costs, labour and overhead those are involve in manufacturing process. It also display

inventory status by its availability in an organisation. Inventory management reporting track cost

of goods sold that avoid under and overselling by creating custom reports. Airdri use this

reporting system for dealing with over or under stock situation of inventory. This report displays

an inflow and outflow of inventory that helps in maintaining a balance of inventory within

company. Inventory management report is also used for reviewing profitability and demand of its

product in future (Klychova, Faskhutdinova and Sadrieva, 2014).

Account Receivable Report: It provide detail information about unpaid customers in list

form on various date. This tool is used by collection department to determine bills which are

3

Reporting is a process of providing information regarding activities that runs in an

organisation in order to aware management about its working. It also provide accurate and

current information that company use in preparing extract reports. Management reporting system

is necessary for monitoring the company's mission. This system is valuable for protecting

company by presenting a complete image of it's performance. Company create management

accounting reports on monthly, quarterly, half yearly or yearly basis according to its operations.

Airdri is a small scale company and wants to estimate their performance regularly. So they create

management accounting reports such as performance, inventory management, account receivable

and job costing on quarterly basis in order to measure its progress (JOSHI and et. al., 2011).

These reports are continuously created throughout the accounting period as per company's

requirements. These reports are described below:

Performance Report: It is created to review the organisation's performance as a whole.

Management used this reporting system for planning, measuring, regulating performance that

attained in decision making. This reports involves information regarding resource utilisation,

collection of data and its progress that assist in forecasting future success to various stakeholders.

Status, progress, forecasting and variance reports are the types of performance report. Airdri use

this reporting for comparing its actual costs or revenues with the budgeted for a period.

Performance report is a detail statement which measures outcomes of business activities in terms

of its progress over a particular period of time. By this company create an effective performance

reports which shows how efficiently it spent money on useful activities.

Inventory Management Report: This report is used to centralise information about

inventory costs, labour and overhead those are involve in manufacturing process. It also display

inventory status by its availability in an organisation. Inventory management reporting track cost

of goods sold that avoid under and overselling by creating custom reports. Airdri use this

reporting system for dealing with over or under stock situation of inventory. This report displays

an inflow and outflow of inventory that helps in maintaining a balance of inventory within

company. Inventory management report is also used for reviewing profitability and demand of its

product in future (Klychova, Faskhutdinova and Sadrieva, 2014).

Account Receivable Report: It provide detail information about unpaid customers in list

form on various date. This tool is used by collection department to determine bills which are

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

overdue for payments. Account receivable report is important for those organisation which offer

credit to its customers. Airdri also offer credit facilities to its buyer. Therefore, it use account

receivable report for identifying the duration of collection period within operations. This report

provide a detail about its unpaid customers, outstanding balances and credit memos which

company have to recover within accounting period. By this company create appropriate aging

report which helps in establishing credit period in order to recover credit on time.

Job cost Report: This report is prepare to determine current status of cost and revenue at

each various levels of job. Job cost report create a list of every job on which company working

and listing total costs incurred on previous period job. This reporting provide a detail of total cost

of product accrued in one project compared with expected revenue generate by that project.

Airdri deal in two jobs of hand dryers like manufacturer and distributor. It use job costing system

for preparing this report where cost incurred in each jobs like manufacturing and distributing

activities are evaluated on the basis of its revenue.

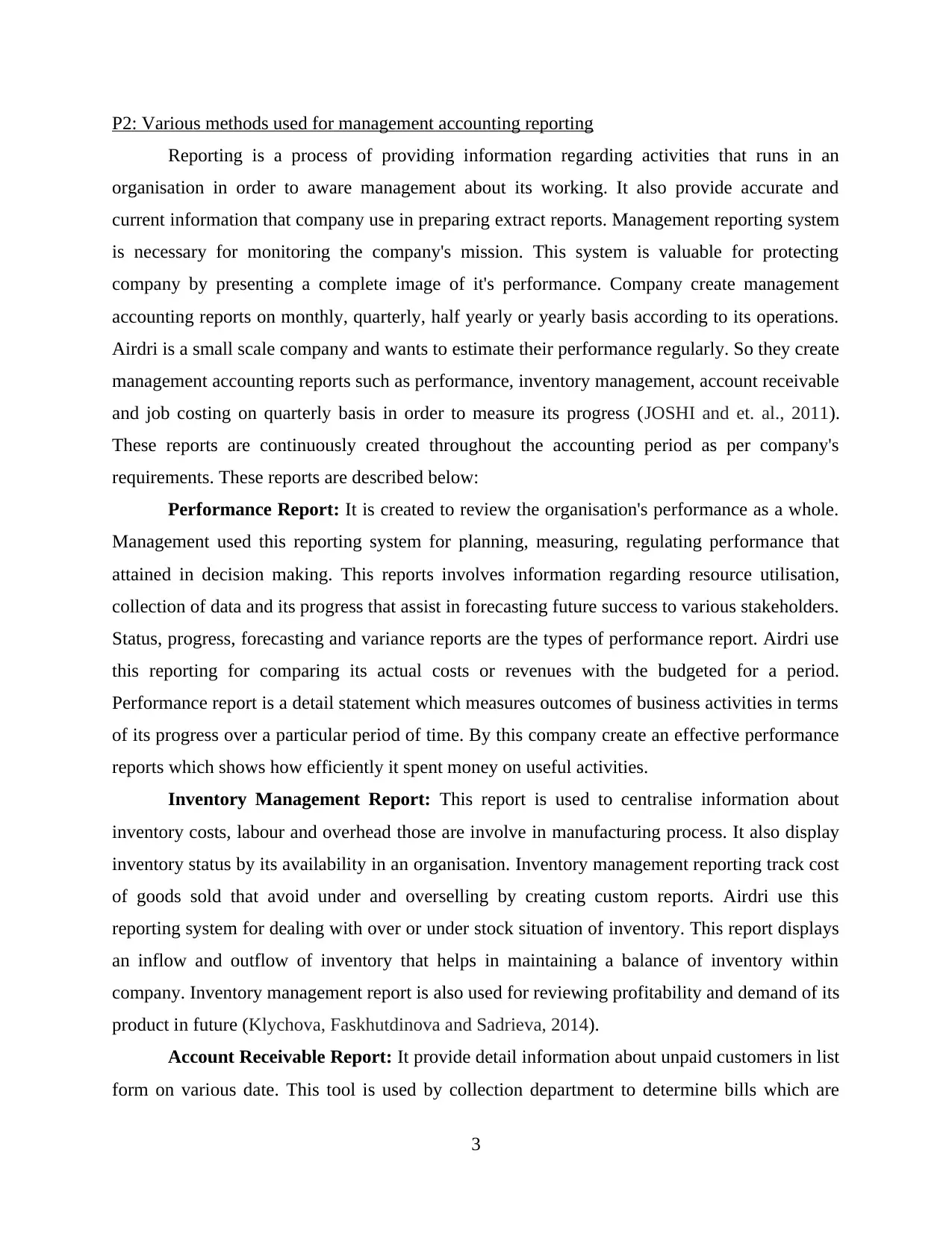

M1: Benefits of management accounting systems within organisation

Management accounting systems Benefits

Cost Accounting System It assist in controlling expenses that incurred

during manufacturing process.

Company use this system for determining its

earning on the basis of estimated cost.

Price Optimisation System It determine the exact cost of product that

customer is willingness to pay.

It aid in increasing the future demand of

product that generate more revenues.

Inventory Management System Accountant use this system to determine the

accumulating cost of inventory for accounting

reporting purposes.

It help in tracking issues like over and under

valuation of inventory in process.

Job Costing System This system helps in evaluating cost at each job

4

credit to its customers. Airdri also offer credit facilities to its buyer. Therefore, it use account

receivable report for identifying the duration of collection period within operations. This report

provide a detail about its unpaid customers, outstanding balances and credit memos which

company have to recover within accounting period. By this company create appropriate aging

report which helps in establishing credit period in order to recover credit on time.

Job cost Report: This report is prepare to determine current status of cost and revenue at

each various levels of job. Job cost report create a list of every job on which company working

and listing total costs incurred on previous period job. This reporting provide a detail of total cost

of product accrued in one project compared with expected revenue generate by that project.

Airdri deal in two jobs of hand dryers like manufacturer and distributor. It use job costing system

for preparing this report where cost incurred in each jobs like manufacturing and distributing

activities are evaluated on the basis of its revenue.

M1: Benefits of management accounting systems within organisation

Management accounting systems Benefits

Cost Accounting System It assist in controlling expenses that incurred

during manufacturing process.

Company use this system for determining its

earning on the basis of estimated cost.

Price Optimisation System It determine the exact cost of product that

customer is willingness to pay.

It aid in increasing the future demand of

product that generate more revenues.

Inventory Management System Accountant use this system to determine the

accumulating cost of inventory for accounting

reporting purposes.

It help in tracking issues like over and under

valuation of inventory in process.

Job Costing System This system helps in evaluating cost at each job

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

level that help in next process.

It assist in determining which job is more

profitable.

D1: Management accounting systems and reporting integrated in processes

Company use performance, inventory management, account receivable and job costing

systems of management accounting for creating an effective reports. Airdri use performance

reporting for identifying employees and operations performance with a specific time period. It

also follow account receivable reporting for determining its collection cycle in order to recover

due amount earlier. Company use inventory management reporting for evaluating position of

inventory in the process. At last, it use job costing reporting for estimating its total cost and

revenue at each level of jobs. These above reporting methods help in effectively working within

organisation.

TASK 2

P3: Cost analysis to prepare an income statement

Cost: It is a monetary value given up in lieu of products or services offered by an

organisation. Material, efforts, time utilised and risk incurred in manufacturing of a product is

included in the cost of that products or services. Costing is process and technique of allocating

costs. Airdri use costing technique for recording and classifying appropriate cost of its product in

order to increase its sales practices. Internal and external reporting are the purpose of using this

technique. Company follow marginal and absorption costing tool for preparing income

statement. These costing techniques are explained below:

Marginal costing: It is tool used for evaluating the maximum production quantity, where

variable cost is charged to additional unit of an item produce. It is a technique in which fixed

cost is written off against its contribution. Airdri use marginal costing for determining the extra

cost involved in producing an additional unit of output. Here the term marginal means variable

which includes the cost of direct material, labour, expenses and variable overheads in production

of goods. It helps in determining of price on the basis of variable cost and contribution that assist

in evaluating product's profitability (Mistry, Sharma and Low, 2014).

Absorption costing: In this technique where all manufacturing cost that are absorbed by

units produced. Cost of product includes direct material, labour and both fixed & variable

5

It assist in determining which job is more

profitable.

D1: Management accounting systems and reporting integrated in processes

Company use performance, inventory management, account receivable and job costing

systems of management accounting for creating an effective reports. Airdri use performance

reporting for identifying employees and operations performance with a specific time period. It

also follow account receivable reporting for determining its collection cycle in order to recover

due amount earlier. Company use inventory management reporting for evaluating position of

inventory in the process. At last, it use job costing reporting for estimating its total cost and

revenue at each level of jobs. These above reporting methods help in effectively working within

organisation.

TASK 2

P3: Cost analysis to prepare an income statement

Cost: It is a monetary value given up in lieu of products or services offered by an

organisation. Material, efforts, time utilised and risk incurred in manufacturing of a product is

included in the cost of that products or services. Costing is process and technique of allocating

costs. Airdri use costing technique for recording and classifying appropriate cost of its product in

order to increase its sales practices. Internal and external reporting are the purpose of using this

technique. Company follow marginal and absorption costing tool for preparing income

statement. These costing techniques are explained below:

Marginal costing: It is tool used for evaluating the maximum production quantity, where

variable cost is charged to additional unit of an item produce. It is a technique in which fixed

cost is written off against its contribution. Airdri use marginal costing for determining the extra

cost involved in producing an additional unit of output. Here the term marginal means variable

which includes the cost of direct material, labour, expenses and variable overheads in production

of goods. It helps in determining of price on the basis of variable cost and contribution that assist

in evaluating product's profitability (Mistry, Sharma and Low, 2014).

Absorption costing: In this technique where all manufacturing cost that are absorbed by

units produced. Cost of product includes direct material, labour and both fixed & variable

5

manufacturing overheads. It is also known as full absorption method. Airdri use absorption

costing for determining product cost which includes overall manufacturing cost. This method is

also used for accumulating the costs linked with a production process and distribute them to

individual products.

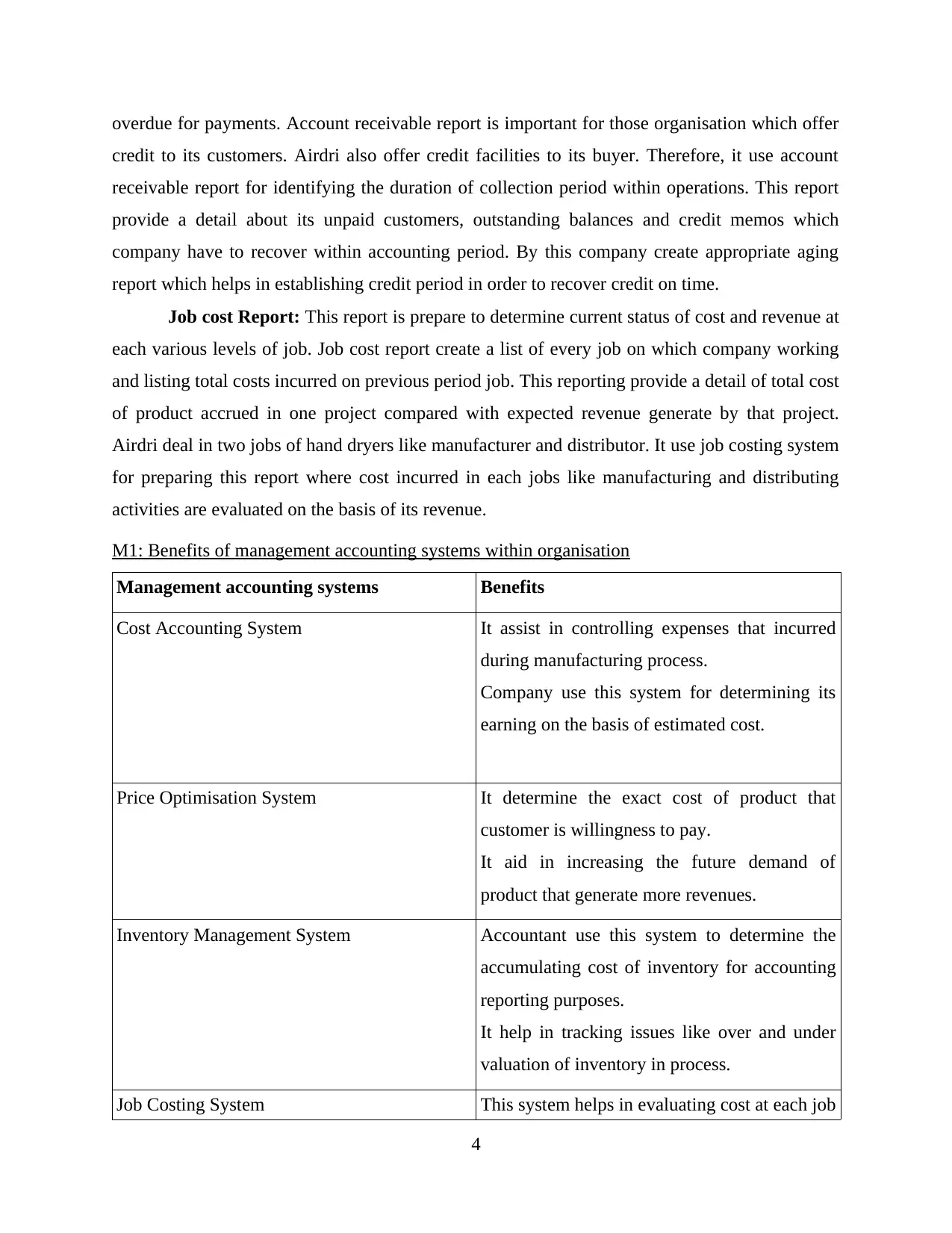

Calculation of net profit by using marginal costing method:

Particulars Amount

Sales revenue = (selling price * no. of goods sold = 55 * 600) 33000

Marginal Cost of goods sold: 9600

Production = (units produced * marginal cost per unit = 800 * 16) 12800

closing stock = (closing stock units * marginal cost per unit = 200 *

16) 3200

Contribution 23400

Fixed cost ( 3200+1200+1500 ) 5900

Net profit 17500

Computation of net income by using absorption costing method:

Particulars Amount

Sales = (selling price * no. of units sold = 55 * 600) 33000

Cost of goods sold = (total expenses per unit * actual sales = 23.375 * 600) 14025

Gross profit 18975

Selling & Administrative expenses = (variable sales overhead * actual sales +

selling and administrative cost = 1 * 600 + 2700) 3300

Net profit/ operating income 15675

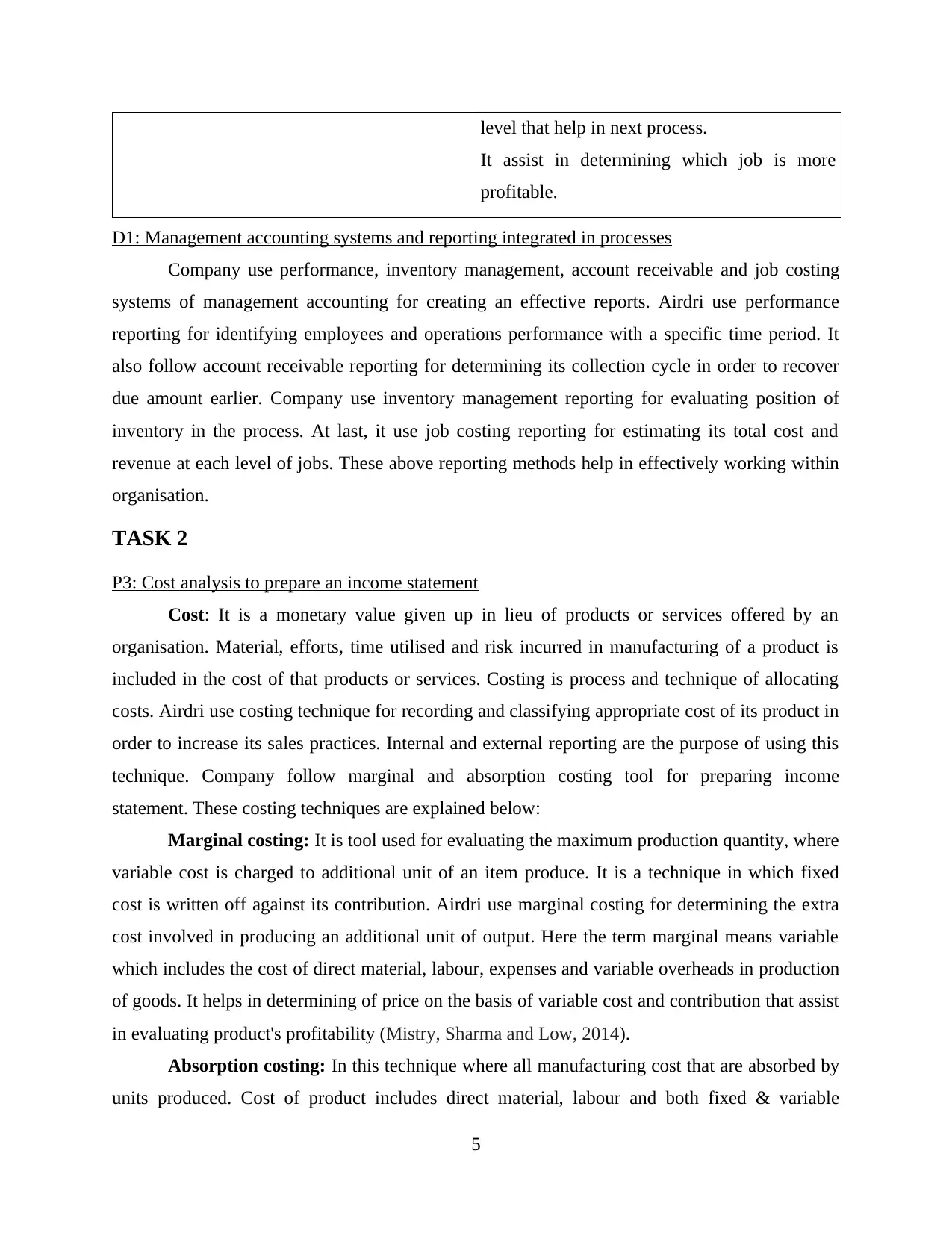

Break even analysis: It is used to determine a point where company's total cost of

product is equal to its revenue. It is based on fixed, variable costs per unit of sales and revenue

generated. Airdri use break even analysis to determine no profit – no loss situation, where

company receive revenue equals to costs associated with product.

A. Total number of product sold

Sales per unit 40

Variable costs VC = DM + DL 28

Contribution 12

Fixed costs 6000

BEP in units 500

b. Calculation of breakeven point in accordance to sales revenue

6

costing for determining product cost which includes overall manufacturing cost. This method is

also used for accumulating the costs linked with a production process and distribute them to

individual products.

Calculation of net profit by using marginal costing method:

Particulars Amount

Sales revenue = (selling price * no. of goods sold = 55 * 600) 33000

Marginal Cost of goods sold: 9600

Production = (units produced * marginal cost per unit = 800 * 16) 12800

closing stock = (closing stock units * marginal cost per unit = 200 *

16) 3200

Contribution 23400

Fixed cost ( 3200+1200+1500 ) 5900

Net profit 17500

Computation of net income by using absorption costing method:

Particulars Amount

Sales = (selling price * no. of units sold = 55 * 600) 33000

Cost of goods sold = (total expenses per unit * actual sales = 23.375 * 600) 14025

Gross profit 18975

Selling & Administrative expenses = (variable sales overhead * actual sales +

selling and administrative cost = 1 * 600 + 2700) 3300

Net profit/ operating income 15675

Break even analysis: It is used to determine a point where company's total cost of

product is equal to its revenue. It is based on fixed, variable costs per unit of sales and revenue

generated. Airdri use break even analysis to determine no profit – no loss situation, where

company receive revenue equals to costs associated with product.

A. Total number of product sold

Sales per unit 40

Variable costs VC = DM + DL 28

Contribution 12

Fixed costs 6000

BEP in units 500

b. Calculation of breakeven point in accordance to sales revenue

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

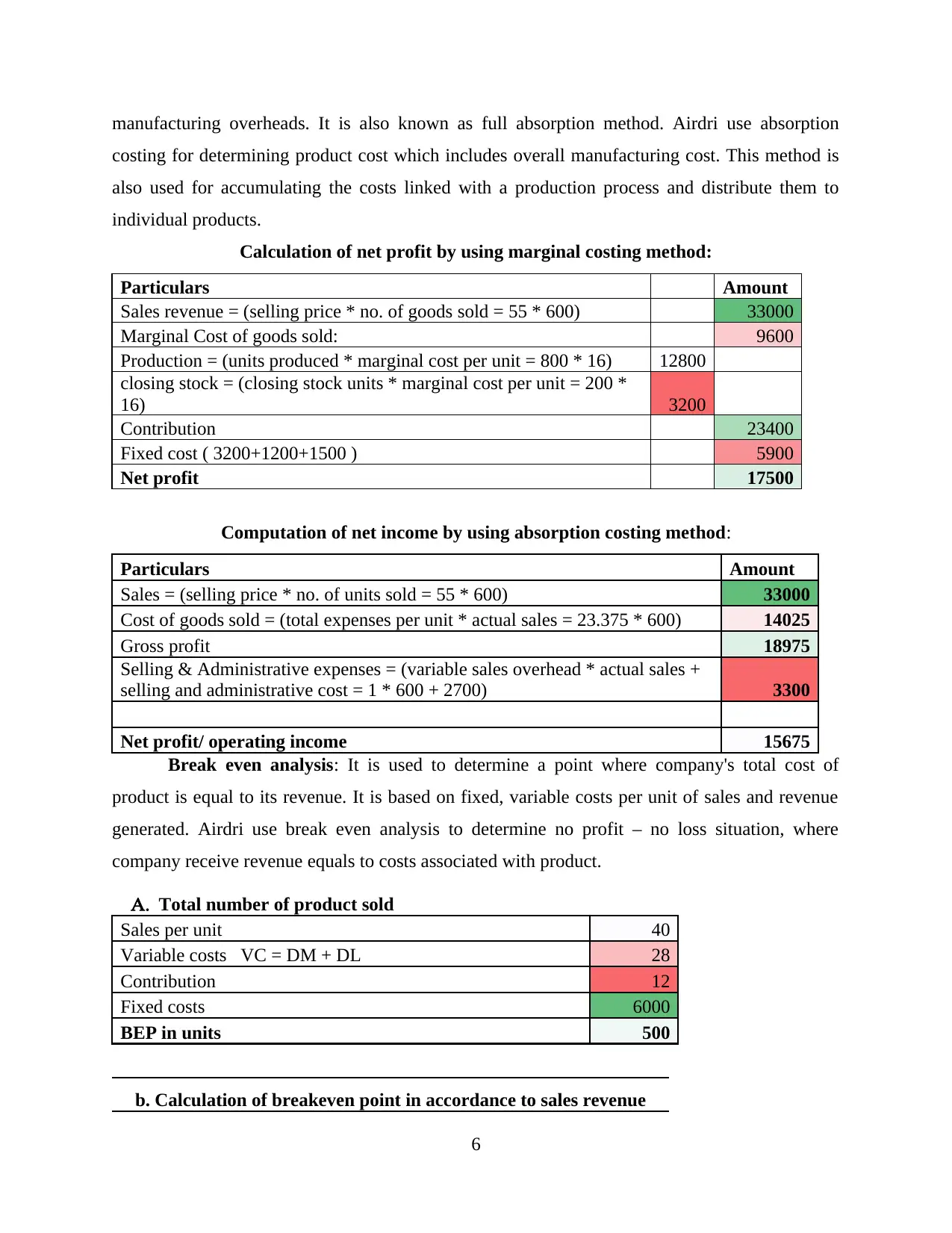

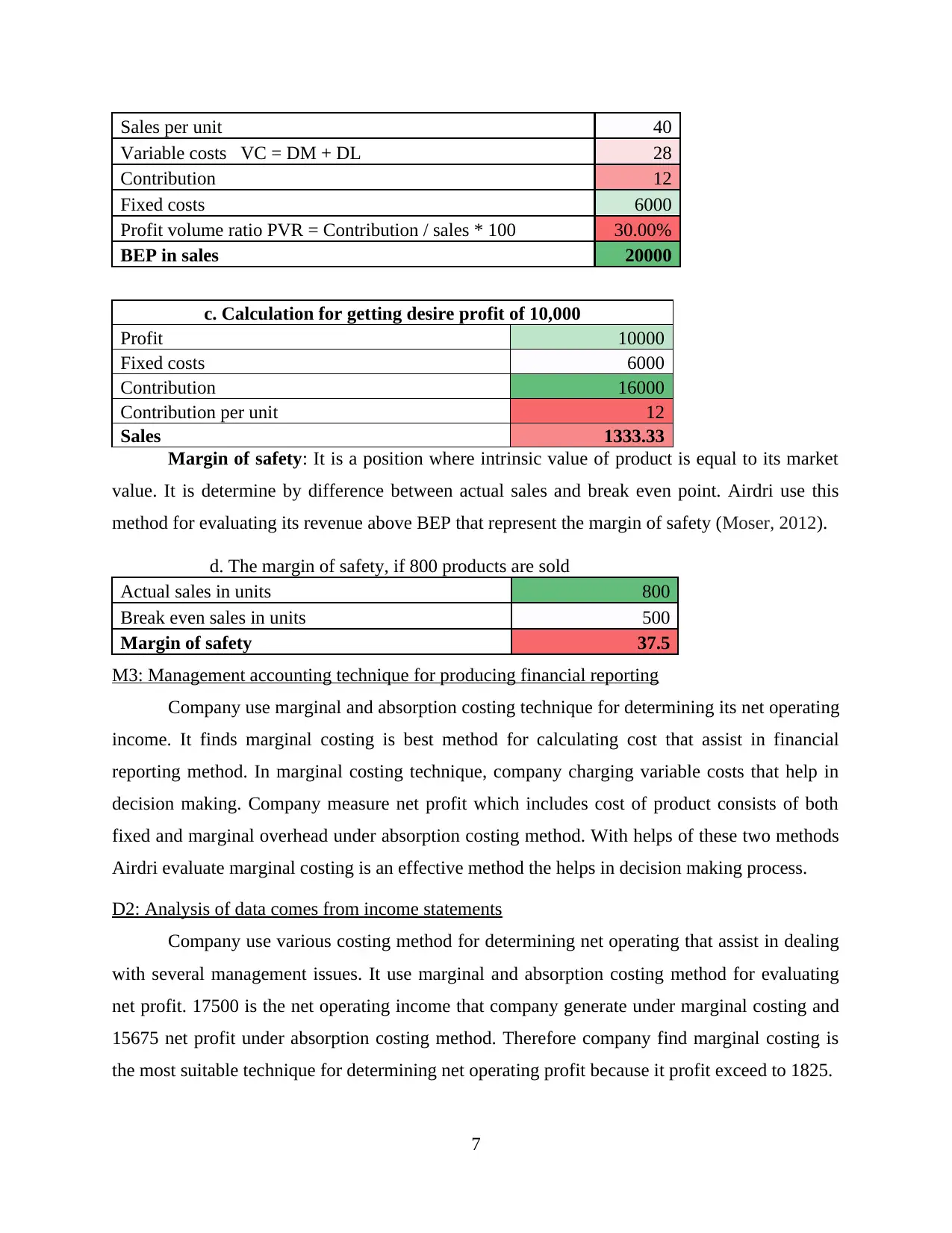

Sales per unit 40

Variable costs VC = DM + DL 28

Contribution 12

Fixed costs 6000

Profit volume ratio PVR = Contribution / sales * 100 30.00%

BEP in sales 20000

c. Calculation for getting desire profit of 10,000

Profit 10000

Fixed costs 6000

Contribution 16000

Contribution per unit 12

Sales 1333.33

Margin of safety: It is a position where intrinsic value of product is equal to its market

value. It is determine by difference between actual sales and break even point. Airdri use this

method for evaluating its revenue above BEP that represent the margin of safety (Moser, 2012).

d. The margin of safety, if 800 products are sold

Actual sales in units 800

Break even sales in units 500

Margin of safety 37.5

M3: Management accounting technique for producing financial reporting

Company use marginal and absorption costing technique for determining its net operating

income. It finds marginal costing is best method for calculating cost that assist in financial

reporting method. In marginal costing technique, company charging variable costs that help in

decision making. Company measure net profit which includes cost of product consists of both

fixed and marginal overhead under absorption costing method. With helps of these two methods

Airdri evaluate marginal costing is an effective method the helps in decision making process.

D2: Analysis of data comes from income statements

Company use various costing method for determining net operating that assist in dealing

with several management issues. It use marginal and absorption costing method for evaluating

net profit. 17500 is the net operating income that company generate under marginal costing and

15675 net profit under absorption costing method. Therefore company find marginal costing is

the most suitable technique for determining net operating profit because it profit exceed to 1825.

7

Variable costs VC = DM + DL 28

Contribution 12

Fixed costs 6000

Profit volume ratio PVR = Contribution / sales * 100 30.00%

BEP in sales 20000

c. Calculation for getting desire profit of 10,000

Profit 10000

Fixed costs 6000

Contribution 16000

Contribution per unit 12

Sales 1333.33

Margin of safety: It is a position where intrinsic value of product is equal to its market

value. It is determine by difference between actual sales and break even point. Airdri use this

method for evaluating its revenue above BEP that represent the margin of safety (Moser, 2012).

d. The margin of safety, if 800 products are sold

Actual sales in units 800

Break even sales in units 500

Margin of safety 37.5

M3: Management accounting technique for producing financial reporting

Company use marginal and absorption costing technique for determining its net operating

income. It finds marginal costing is best method for calculating cost that assist in financial

reporting method. In marginal costing technique, company charging variable costs that help in

decision making. Company measure net profit which includes cost of product consists of both

fixed and marginal overhead under absorption costing method. With helps of these two methods

Airdri evaluate marginal costing is an effective method the helps in decision making process.

D2: Analysis of data comes from income statements

Company use various costing method for determining net operating that assist in dealing

with several management issues. It use marginal and absorption costing method for evaluating

net profit. 17500 is the net operating income that company generate under marginal costing and

15675 net profit under absorption costing method. Therefore company find marginal costing is

the most suitable technique for determining net operating profit because it profit exceed to 1825.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 3

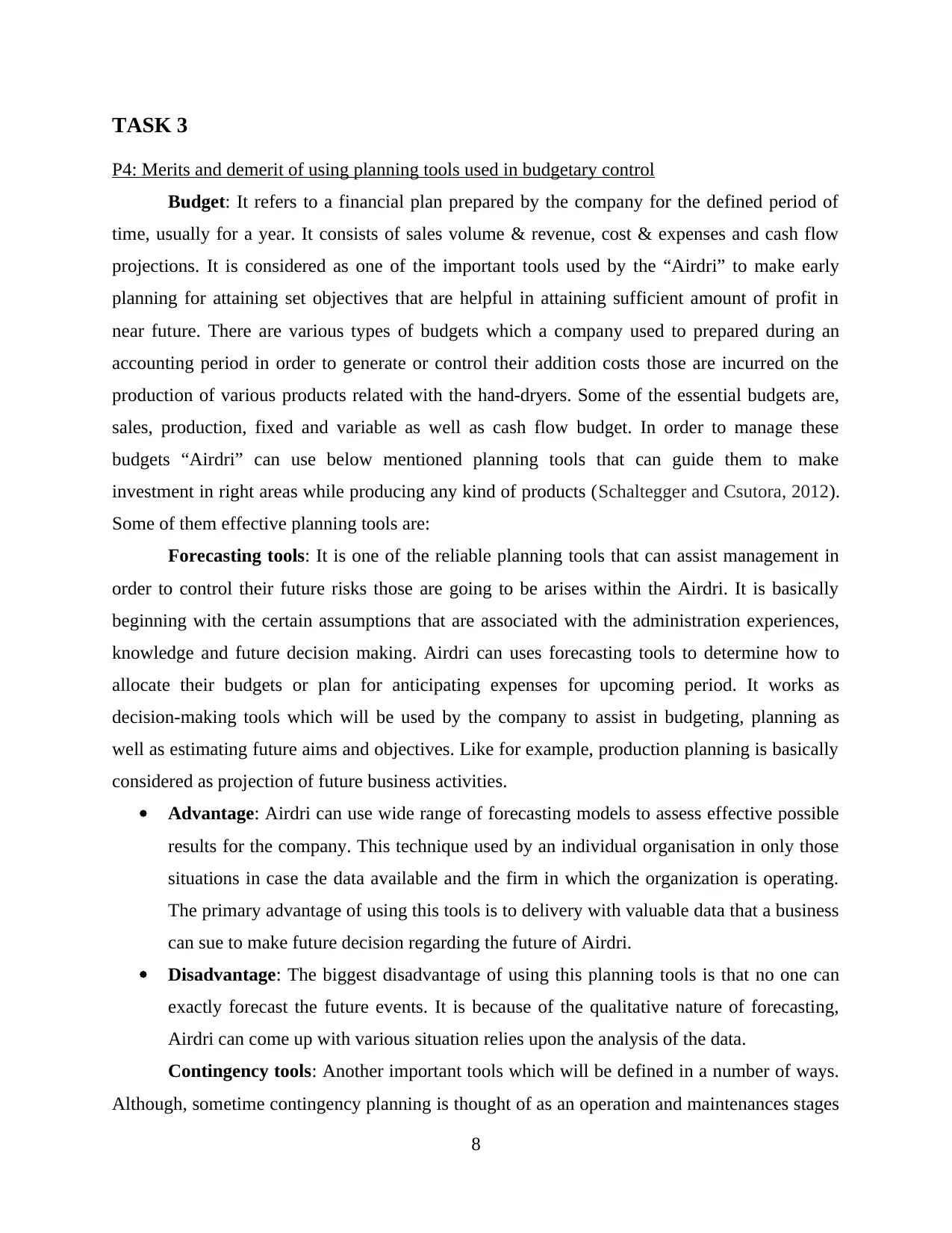

P4: Merits and demerit of using planning tools used in budgetary control

Budget: It refers to a financial plan prepared by the company for the defined period of

time, usually for a year. It consists of sales volume & revenue, cost & expenses and cash flow

projections. It is considered as one of the important tools used by the “Airdri” to make early

planning for attaining set objectives that are helpful in attaining sufficient amount of profit in

near future. There are various types of budgets which a company used to prepared during an

accounting period in order to generate or control their addition costs those are incurred on the

production of various products related with the hand-dryers. Some of the essential budgets are,

sales, production, fixed and variable as well as cash flow budget. In order to manage these

budgets “Airdri” can use below mentioned planning tools that can guide them to make

investment in right areas while producing any kind of products (Schaltegger and Csutora, 2012).

Some of them effective planning tools are:

Forecasting tools: It is one of the reliable planning tools that can assist management in

order to control their future risks those are going to be arises within the Airdri. It is basically

beginning with the certain assumptions that are associated with the administration experiences,

knowledge and future decision making. Airdri can uses forecasting tools to determine how to

allocate their budgets or plan for anticipating expenses for upcoming period. It works as

decision-making tools which will be used by the company to assist in budgeting, planning as

well as estimating future aims and objectives. Like for example, production planning is basically

considered as projection of future business activities.

Advantage: Airdri can use wide range of forecasting models to assess effective possible

results for the company. This technique used by an individual organisation in only those

situations in case the data available and the firm in which the organization is operating.

The primary advantage of using this tools is to delivery with valuable data that a business

can sue to make future decision regarding the future of Airdri.

Disadvantage: The biggest disadvantage of using this planning tools is that no one can

exactly forecast the future events. It is because of the qualitative nature of forecasting,

Airdri can come up with various situation relies upon the analysis of the data.

Contingency tools: Another important tools which will be defined in a number of ways.

Although, sometime contingency planning is thought of as an operation and maintenances stages

8

P4: Merits and demerit of using planning tools used in budgetary control

Budget: It refers to a financial plan prepared by the company for the defined period of

time, usually for a year. It consists of sales volume & revenue, cost & expenses and cash flow

projections. It is considered as one of the important tools used by the “Airdri” to make early

planning for attaining set objectives that are helpful in attaining sufficient amount of profit in

near future. There are various types of budgets which a company used to prepared during an

accounting period in order to generate or control their addition costs those are incurred on the

production of various products related with the hand-dryers. Some of the essential budgets are,

sales, production, fixed and variable as well as cash flow budget. In order to manage these

budgets “Airdri” can use below mentioned planning tools that can guide them to make

investment in right areas while producing any kind of products (Schaltegger and Csutora, 2012).

Some of them effective planning tools are:

Forecasting tools: It is one of the reliable planning tools that can assist management in

order to control their future risks those are going to be arises within the Airdri. It is basically

beginning with the certain assumptions that are associated with the administration experiences,

knowledge and future decision making. Airdri can uses forecasting tools to determine how to

allocate their budgets or plan for anticipating expenses for upcoming period. It works as

decision-making tools which will be used by the company to assist in budgeting, planning as

well as estimating future aims and objectives. Like for example, production planning is basically

considered as projection of future business activities.

Advantage: Airdri can use wide range of forecasting models to assess effective possible

results for the company. This technique used by an individual organisation in only those

situations in case the data available and the firm in which the organization is operating.

The primary advantage of using this tools is to delivery with valuable data that a business

can sue to make future decision regarding the future of Airdri.

Disadvantage: The biggest disadvantage of using this planning tools is that no one can

exactly forecast the future events. It is because of the qualitative nature of forecasting,

Airdri can come up with various situation relies upon the analysis of the data.

Contingency tools: Another important tools which will be defined in a number of ways.

Although, sometime contingency planning is thought of as an operation and maintenances stages

8

of activity. Because of this particular nature, Airdri can uses this tools to identify and integrates

at every stages of project life cycle (Ward, 2012). In order to get more successful, stakeholders

of Aridri must continuously re-examine areas of operations those are significant with an aim on

certain things such as business process and alternative analysis of the products.

Advantage: Using any kind of contingency plan which would means that, in case the

unexpected events a business can maintain the best state of operations that relies on

harshness of the disaster. An effective plan can outline all those responsibilities for which

employees are responsible for saving the time for additional cost of production.

Disadvantage: Because of inappropriate literature company can lead to suffer from any

kind of problems like fund crises and additional expenses during the time of contingency

situation.

Scenario tool – This planning tool is concerned with developing a range of possibilities

which can occur in future. This tool helps an organisation like Airdri to plan for future so that

issues and problems can be tackled (Scenario planning, 2018).

Advantages: This tool can be performed by internal staff of the company and is highly

beneficial for the company as by developing future possibilities, future contingencies can

also be handled.

Disadvantages: This tool requires a lot of skills and money which can result into a

financial burden for the organisation. Future is uncertain due to which there are high

chances of wastage of efforts.

M3: Analysis of several planning tool and its application for forecasting

Company use forecasting, contingency and scenario planning tool for controlling

organisation's budgets. In forecasting tool, company predict future events in order to effective

working in upcoming years. Uncertain and unforeseen situation that might influence future

operations are considered under contingency tool. In scenario tool help in determining short and

long term planning on the basis of past events.

TASK 4

P5. Management accounting systems to respond to financial problems

Financial problem may be described as those situation where money worries can cause

stress to an individual or an organisation. In a business approach these problems are termed as

9

at every stages of project life cycle (Ward, 2012). In order to get more successful, stakeholders

of Aridri must continuously re-examine areas of operations those are significant with an aim on

certain things such as business process and alternative analysis of the products.

Advantage: Using any kind of contingency plan which would means that, in case the

unexpected events a business can maintain the best state of operations that relies on

harshness of the disaster. An effective plan can outline all those responsibilities for which

employees are responsible for saving the time for additional cost of production.

Disadvantage: Because of inappropriate literature company can lead to suffer from any

kind of problems like fund crises and additional expenses during the time of contingency

situation.

Scenario tool – This planning tool is concerned with developing a range of possibilities

which can occur in future. This tool helps an organisation like Airdri to plan for future so that

issues and problems can be tackled (Scenario planning, 2018).

Advantages: This tool can be performed by internal staff of the company and is highly

beneficial for the company as by developing future possibilities, future contingencies can

also be handled.

Disadvantages: This tool requires a lot of skills and money which can result into a

financial burden for the organisation. Future is uncertain due to which there are high

chances of wastage of efforts.

M3: Analysis of several planning tool and its application for forecasting

Company use forecasting, contingency and scenario planning tool for controlling

organisation's budgets. In forecasting tool, company predict future events in order to effective

working in upcoming years. Uncertain and unforeseen situation that might influence future

operations are considered under contingency tool. In scenario tool help in determining short and

long term planning on the basis of past events.

TASK 4

P5. Management accounting systems to respond to financial problems

Financial problem may be described as those situation where money worries can cause

stress to an individual or an organisation. In a business approach these problems are termed as

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.